Pro-Pac files for bankruptcy P05

Seeks buyers for the business – or parts of

MPS Systems completes MBO P06

Relaunches itself as MPS Printing

Heidelberg partner collab P06

Solidifies partnership with MK Masterwork

Great Wrap in VA P08

Company reportedly in debt of $39 million

New site for Labelmakers P08

Expands operations with facility in Arndell Park

New digital press for Canon P09

Launches the corrPRESS iB17 industrial press

L9 World Label Award winners P09

Aussie and New Zealand companies shine

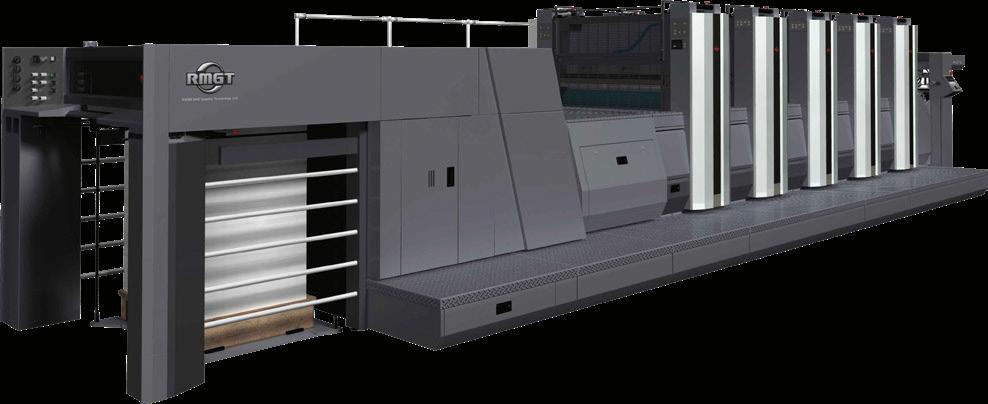

Currie Group inks new deals P10

Partners with Uteco and Bimec

New cardboard packaging trial P10

Costa, Coles, and Opal collaborate

A unified Abbe Group business P12

Insights into the company’s recent acquisition of Oji Fibre Solutions Australia

COVER STORY: Taking business to the next level with Durst P14

MD Matt Ashman addresses how Durst is always at the forefront of innovation for its customers

Reviewing the 2025 ProPack Packaging Forum P16-26

Cutting-edge technologies, sustainable solutions, and market opportunities in the evolving packaging landscape

Industry gathers at 2nd annual ProPack Packaging Forum P28

Industry executives spotted at the forum

Miraclon examines maximising ROI with modern flexo P30-31

Addresses rising brand demands and how printers can respond with modern flexo

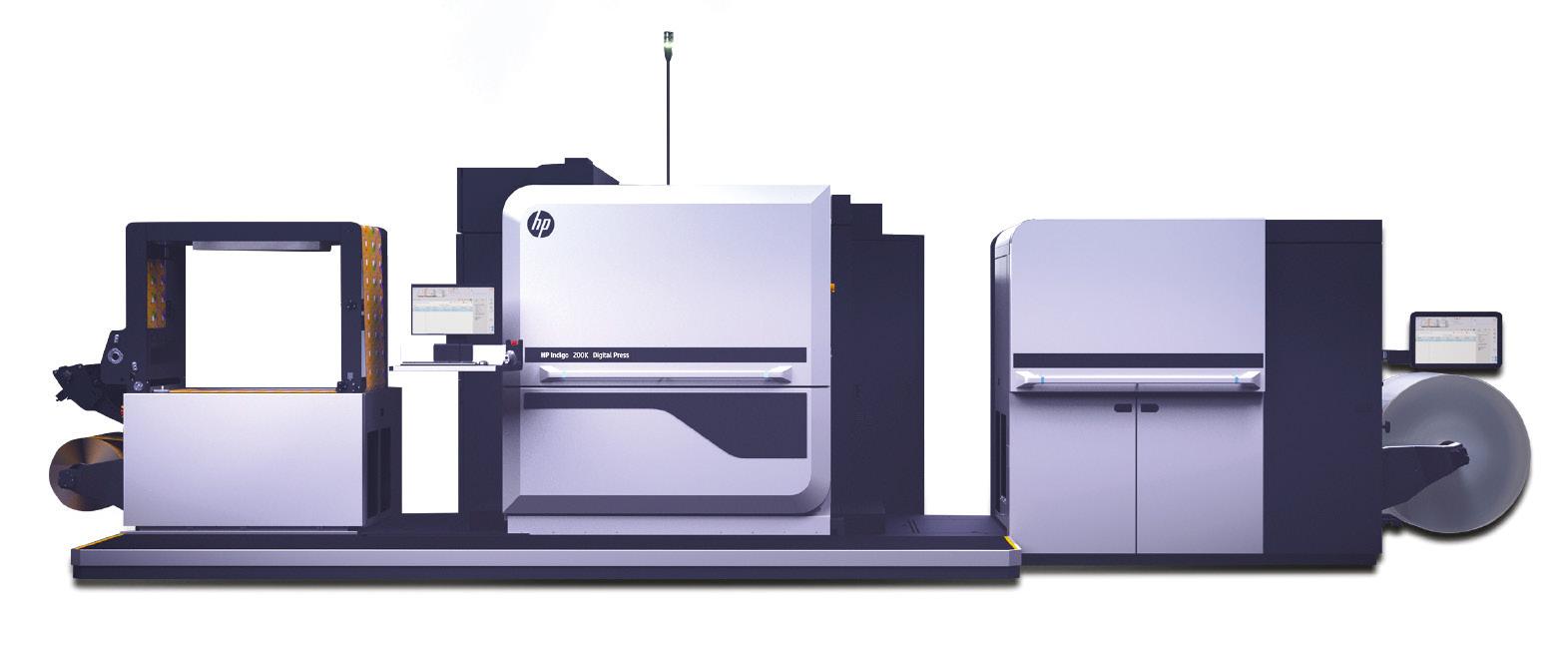

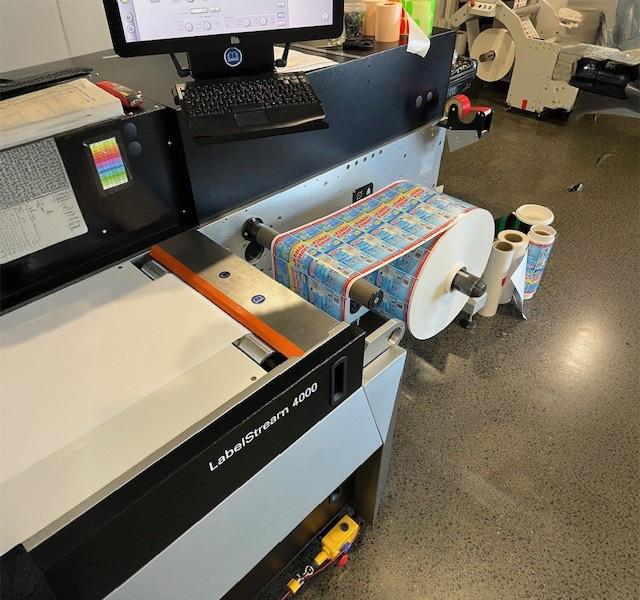

Impact expands capabilities with Canon LabelStream P32-33

Impact Labels’ new digital press has opened the doors to new markets for the business

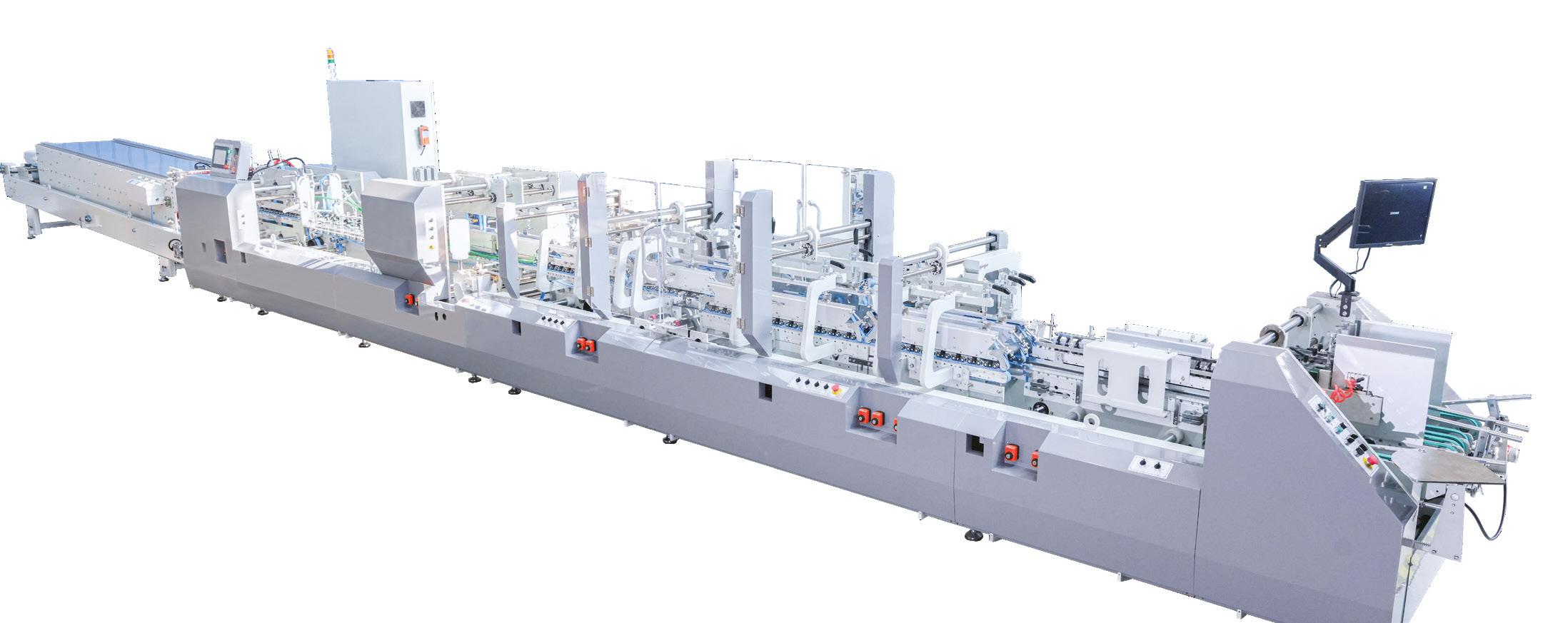

PMS Lithography installs Fengchi GW1700 laminating machine P34

Purchased through Graffica, PMS selected the machine for speed and productivity

Investing in preparation and assessment before deciding to diversify and pivot

Reflecting on the Sustainable Packaging Summit in Utrecht P37

The lens through which Australia can build a more future-ready packaging system

Trends in packaging that will be brought to light in 2026 P38

Radical transparency, fluid systems, and AR labels will define the year ahead

Sustainable innovation and re-engineering packaging P39

Re-engineering packaging requires more than just a simple redesign

Corrugated and flexible packaging to drive the

A guide to the upcoming local and international events around the world

It’s interesting to see how things have changes in just a span of 12 months. The use of AI in packaging and automation dominated conversations at the inaugural ProPack Packaging Forum last year (and was still a segment in this year’s event), but the talking points shifted more towards people in 2025 – labour shortages, changing customer demographics, and the next generation in packaging.

The message is clear: while technology remains a vital component of growth and success in packaging, people remain at the heart of what drives a business. Read more insights from the Forum in the detailed coverage inside.

As this is the last Editor’s Note for 2025, on behalf of the PMG team, I would like to wish every one of you a Merry Christmas and Happy New Year. See you in 2026.

ASX-listed Pro-Pac Packaging Limited (ASX:PPG) recently entered voluntary administration, seeking buyers for the business – or parts of.

The company appointed partners from McGrathNicol as voluntary administrators of the group, who issued a statement saying those who are “interested in recapitalising PPG or acquiring one or more of PPG’s business units are invited to register their interest with the administrators”.

McGrathNicol partner and administrator Rob Smith said, “We are urgently engaging with key stakeholders to maximise the prospect of successfully completing a sale or recapitalisation of PPG, or sales of its various business units.

“We are exploring all options that offer continued employment for PPG’s workforce and enable the business to continue producing high-quality packaging solutions for domestic and international customers.”

The administrators will also work closely with PPG’s employees, suppliers, customers, financers, and other stakeholders to stabilise operations.

In the lead up to the voluntary administration, the company’s director Ian Shannon resigned on 10 October, but remained as CEO. However, in mid-November, the administrators decided that the role of CEO would be made redundant. Shannon’s last day with Pro-Pac was 7 November.

Kathleen Forbes also resigned from her role as company secretary on 21 October.

PPG has been transparent about its liquidity position. In August, the company issued a statement saying it was conducting a strategic review, which

includes a number of transactions including the sale of assets and actions to restore profitability.

At that time, PPG was undergoing negotiations with several bidders on a number of potential transactions – but no transactions reached “an acceptable level of certainty for a specific announcement to be made”.

It also revealed its major shareholder Bennamon Pty Ltd provided an additional secured loan facility of up to $3 million, which was in addition to the $1.2 million the company drew to support its liquidity position.

In March, the company released its 1H25 financial results, reporting a decline in revenue from continued operations of 10.1 per cent across the group at $142.9 million.

The company also mentioned this included the material impact of a $13.6 million reduction in sales to its major customer in the Middle East and a three per cent reduction in other volumes in the flexibles business.

MPS Systems has completed a managementled buyout (MBO) and has relaunched as MPS Printing, entering a new phase that it says is “focused on restoring stability, rebuilding trust, and creating long-term value for customers, employees and partners”.

The move follows the announcement of MPS Systems’ bankruptcy in early November, when the Dutch developer and supplier of printing technologies for labels and flexible packaging temporarily suspended all operational activities including production, deliveries, and services.

At that time, E.R. Looijen, attorney at Stellicher advocaten N.V., was appointed as a trustee in the bankruptcies and was in discussions with several interested parties for a going concern sale of all MPS activities and assets to another party.

MPS Systems was expected to be liquidated at the end of the bankruptcy proceedings.

However, in a turn of events, the company has been bought out by its UK managing director Nick Tyrer and MPS Systems co-founder Bert van den Brink, saying an

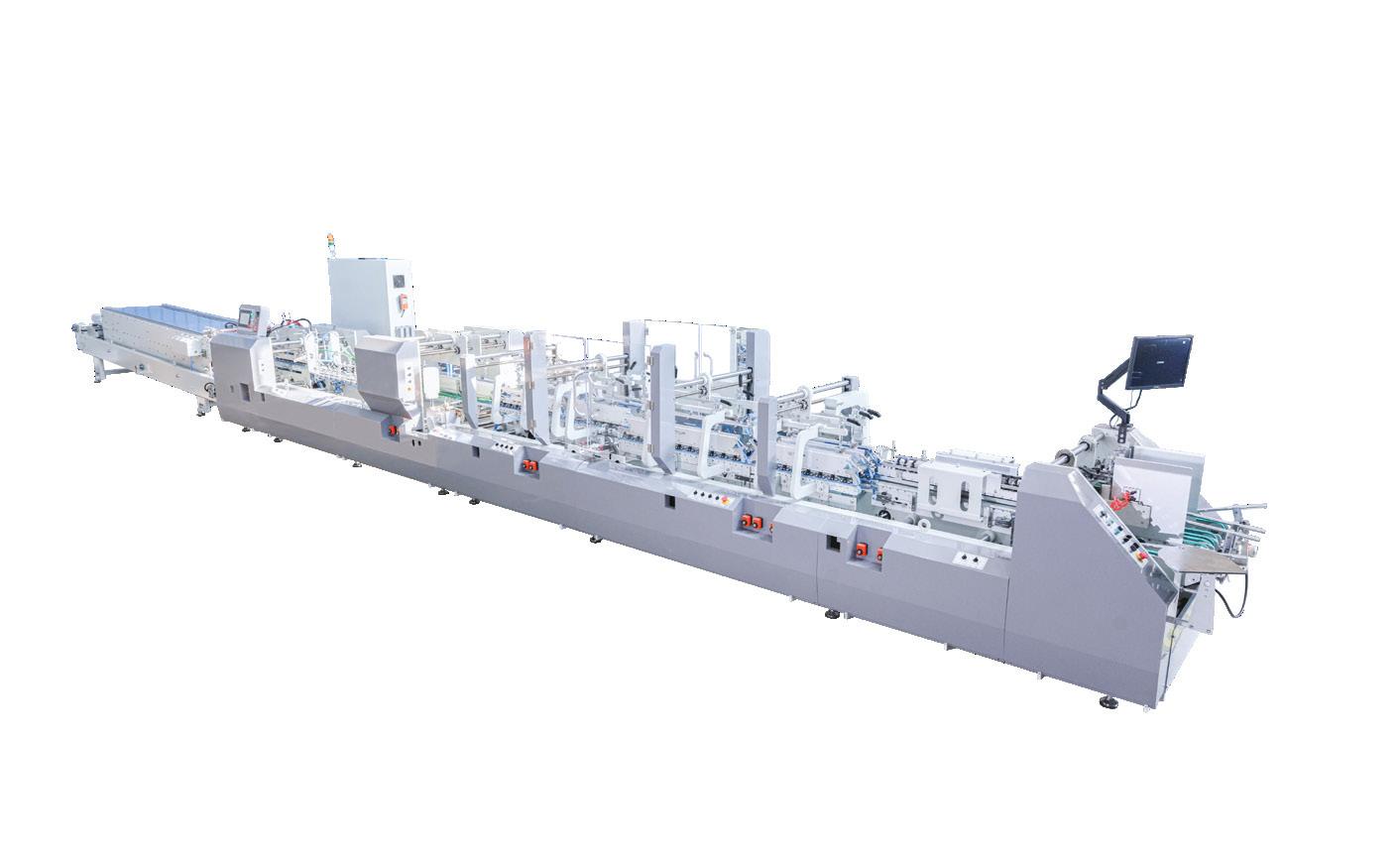

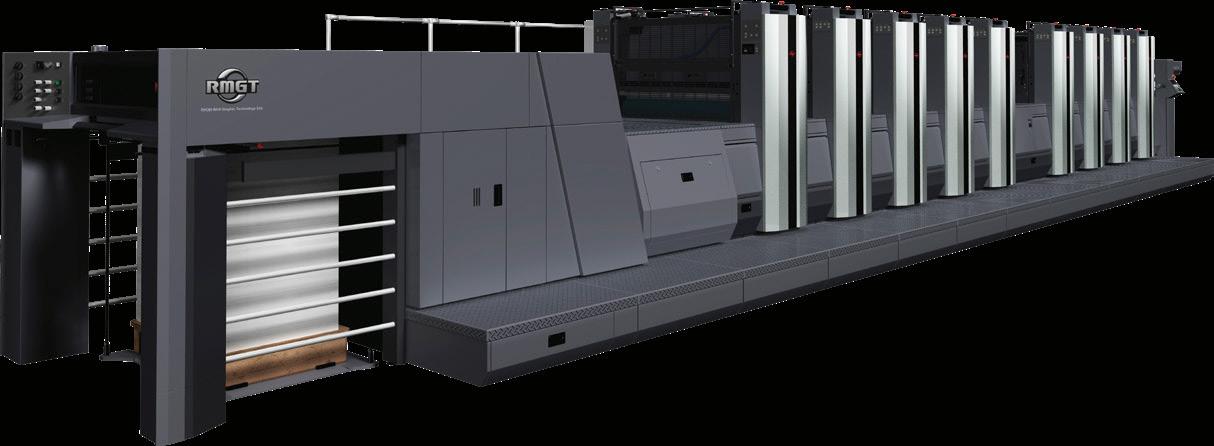

Heidelberg and MK Masterwork have celebrated 10 years of partnership and to commemorate the milestone, have inked an expanded agreement for their future.

Their collaboration now includes the field of integrated and highly automated complete solutions, which can also be developed in collaboration with customers.

This also includes the integration of MK Masterwork’s robotics systems, which Heidelberg said is becoming increasingly important for packaging manufacturers, particularly for intralogistics.

In a joint anniversary event at MK Masterwork’s headquarters in Tianjin, China, with around 100 international customers, both companies looked back on the milestones of their long-standing successful partnership.

MK Masterwork is a leading Chinese manufacturer of finishing systems for the packaging sector.

Ten years ago, both companies agreed on a strategic sales partnership where Heidelberg distributes high-performance die-cutters as well as folding carton gluers

MBO was chosen because “it offered the most stable, responsible, and continuityfocused solution”.

“By having leaders who know the company, the technology, and the customers take ownership, the new entity can rebuild quickly and effectively,” it said.

For customers, the restart means they can expect continued access to machines, parts, service, and technical support.

“Our goal is to ensure your production remains stable and that you experience as little disruption as possible. We understand that recent events may have created uncertainty, and we are committed to restoring confidence through consistent and reliable service,” MPS Printing said.

For ongoing service agreements, the company will contact each customer individually to confirm the status of

service contracts and provide clarity on coverage, scheduling, and pricing.

But payments made and invoices dated before the bankruptcy fall under the legal bankruptcy procedure and are handled by the court-appointed trustee.

The company added that the MPS management team has developed a plan to reposition the company as a healthy and sustainably operating business, with a strong focus on service, recurring revenues and selective new equipment sales.

The new direction of MPS Printing includes:

• A renewed investment in service, technical support, and customer care

• Strengthening the company’s presence with a more resilient business model

• A more efficient, and transparent organisational structure

• Lifecycle development of the product portfolio.

MPS Printing also expressed appreciation to employees, customers, suppliers, and partners who continued to engage with the company despite the uncertainty of the past period.

“We recognise the hardship this has caused for some of our stakeholders. Your continued engagement and your willingness to look ahead with us are invaluable. We are committed to earning back your trust through our actions in the months and years ahead,” it said.

and hot-foil stamping machines from MK Masterwork outside of China.

In that time, Heidelberg has installed around 1,500 systems produced by MK Masterwork at customer sites around the world.

“Packaging printing is a central component of our growth strategy for our core business,” Heidelberg chief technology and sales officer Dr. David Schmedding said.

“And our cooperation with MK Masterwork is a long-standing success story. We are now renewing and expanding this strategic partnership, thereby underlining our approach as a system integrator for end-toend packaging production. We offer our customers efficient complete solutions and at the same time tap into further potential in the attractive segment of packaging finishing.

“Thanks to our innovative and economical technologies, MK Masterwork has continued to grow dynamically in recent years and has already become the market-leading provider of packaging finishing solutions in China,”

MK Masterwork president and managing director Li Li said.

“Together with a strong partner like Heidelberg, we have succeeded in advancing to become one of the leading providers in this segment worldwide. Together, we will continue to expand our strong market position.”

MK Masterwork has been growing dynamically for years and now employs more than 1,800 people. The production site in Tianjin covers an area of around 600,000 m2. At the Print China trade fair in May this year, the company also celebrated its 30th anniversary.

Melbourne-based material science packaging company Great Wrap (registered as Plantabl Packaging on ASIC) recently entered voluntary administration, with a reported $39 million in debt.

The company, started by husband-andwife team Jordy and Julia Kay, was founded in 2019 with a mission to end the human reliance on traditional plastics.

Their former careers in winemaking and architecture led to them creating the business when they recognised the sheer impact plastic waste was having on land. As such, they started inventing compostable materials and products including compostable hand and machine pallet wraps.

Last year, the company partnered with Opal A/NZ to distribute Australian made compostable pallet wrap.

However, following years of financial losses, the company has spiralled into debts and appointed Shane Justin Cremin and Brent Leigh Morgan as administrators.

In a post, co-founder Jordy Kay said, “In light of the current circumstances and that we have arrived at the conclusion of the Great Wrap story, we wanted to share a statement and a thank you to those who supported us on this journey. We also thought it was an opportunity to put into

New South Wales-based Labelmakers Group has moved from its long-standing Northmead site to a new facility in Arndell Park.

The company said the move marks a significant milestone in its journey, reflecting its continued investment in plant, equipment, and people.

“By expanding our operations, we are reaffirming our commitment to maintaining strong local production capabilities to support our valued client base,” it said.

“Our new site has been designed to support the ever-growing needs of our folding carton and label business. With a much larger warehouse footprint, we can now house greater volumes of both finished goods and raw materials – improving efficiency, responsiveness, and service levels.”

Labelmakers Group has also made substantial investments in new capital equipment, further boosting its production

words a reflection on the path to this point in time.

“My wife, and co-founder, Julia and I made the first sale of the Great Wrap product all the way back in 2019. In 2020, we launched our direct-to-consumer brand… resulting in 30,000 orders in the first month. Customers loved the vision and impact Great Wrap could make.

“On the back of the media campaign, we received hundreds of inbound corporate enquiries. We had RFQs with the retailers and trials underway. We had the biggest FMCG companies begging for our product.

“During the building phase, we had the amazing support of our investors and team with constant introductions and opportunities. We set up a well-known brand and eventually a high-performing product that competed perfectly against decades of innovation from the petrochemical stretch wrap industry. What also began to happen in that time is that markets shifted away from

compostable packaging for stretch wrap. Retailers and FMCG companies shifted strategy from replacing fossil-fuel plastics with compostable alternatives to vertically integrating their own plastic recycling operations.

“This meant the pipeline slowly subsided and demand weakened. We pushed on and grew the business to hundreds of enterprise customers and distributors but that wasn’t enough to sustain the overheads of a plant to support a much larger vision. During this time we knew we needed to move into bigger markets, so we originated opportunities in the US market. Sadly, a combination of being unable to get the Australian plant to break even meant we ran out of time and capital to pursue the US expansion.

“Julia and I believed so strongly in this business, and I feel I have tried everything I could to make it a success. This isn’t the outcome any of our customers, team and investors wanted, and I can honestly say that I am sorry that the outcome wasn’t different. There are decisions made in hindsight that I would do differently, and I will spend a long time analysing the past six years. It has been an honour to work with our amazing team, customers and investors over the past few years and I cannot thank you enough for the support in building Great Wrap.”

Jordy added that the duo will continue to support the administrators as they go through the voluntary administration process to sell all equipment and materials, and will do their best to have all creditors repaid in full.

capacity and giving it the flexibility and space to grow into the future.

“We look forward to welcoming both new and existing clients to tour our new NSW facility in the coming months and to continuing to deliver the quality and innovation you expect from Labelmakers,” it added.

The company also announced in February that it has relocated its subsidiary Rapid Labels to a new and improved Kilsyth factory in Victoria.

Labelmakers Group acquired Rapid Labels in April 2021, with the former saying the acquisition has enabled it to move heavily into nutraceuticals with a full suite of solutions spanning labels and folding cartons.

As such, the move into a new premise that’s double the size of the previous location provides the business the space needed to continue to grow and increase its capacity. The company added that the increased space will also allow the business to expand on its already broad product/service offering.

“The new purpose-built print facility has provided Rapid Labels the opportunity to design and implement an efficient production layout to best suit the needs of the business and by extension its customers. Efficiencies from the layout have also been gained in the office space, along with improved amenities, communal spaces and meeting rooms,” it said.

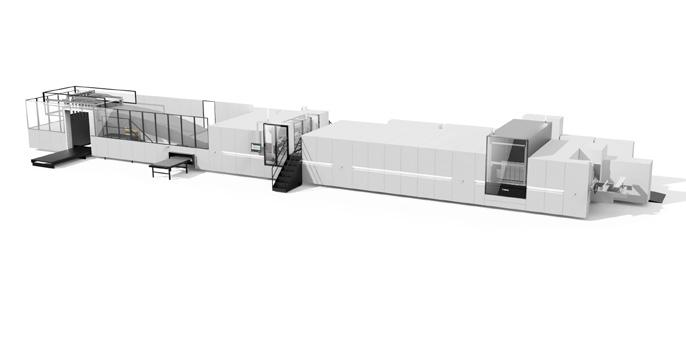

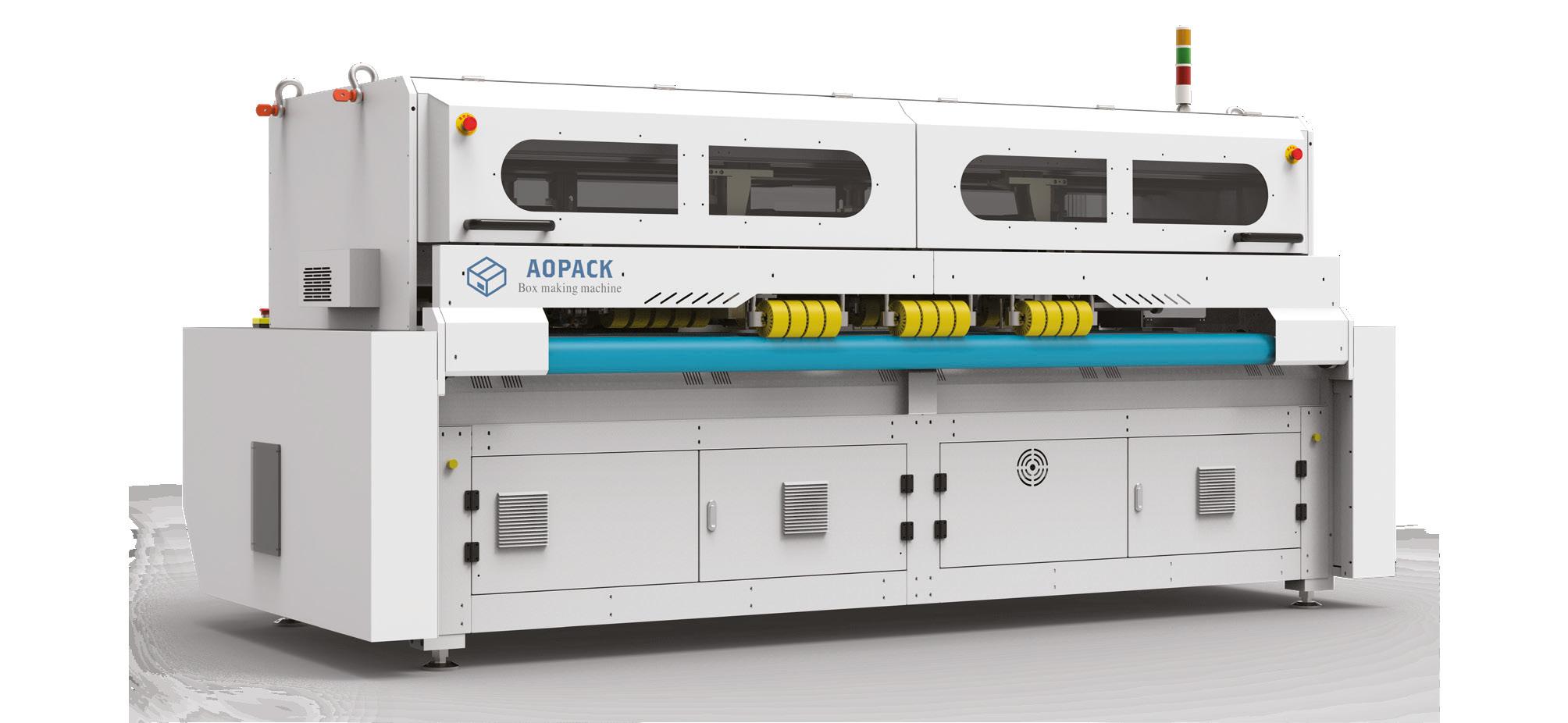

Canon launched its latest digital press for industrial-scale packaging printing, the corrPRESS iB17, at the FEFCO (European Federation of Corrugated Board Manufacturers) Technical Seminar 2025 in Rome.

Capable of digitally printing up to 8,000 m2 per hour (15 million m2 per year), the corrPRESS iB17 delivers offset-like quality directly onto corrugated boards up to 1.7m wide with water-based inks and primer for indirect food contact.

The highly automated corrPRESS iB17 enables cost-efficient short- to medium-length runs with ultra-fast turnaround times and requires fewer operators and lower skill levels.

Building on Canon’s expertise in commercial digital printing and following the development roadmap presented as a concept at drupa 2024, the Canon corrPRESS iB17 aims to address the evolving needs of corrugated converters that face increasing pressure to deliver shorter runs with more variants, faster turnaround times and premium quality, and all without compromising cost efficiency.

The corrPRESS iB17 allows converters to achieve cost-efficient production for runs up to 20,000 m2, extending digital printing viability beyond traditional shortruns. Supported by automated printhead cleaning and quality control systems, the press minimises operator intervention while maximising production efficiency.

The system’s design also reduces waste through efficient print on demand and eliminates the use of printing plates and chemicals. Unlike conventional technologies, the corrPRESS iB17 does not produce contaminated water, which then has to be filtered or released into the wastewater system.

Featuring proprietary, high-performance 1,200dpi piezo printheads and specially formulated water-based pigment inks and primer, which provide an extended colour gamut with CMYK and later OVG, the corrPRESS iB17 achieves pre-print offsetlike quality in the post-print process.

This improves production efficiency by eliminating the traditional lamination step while reproducing vibrant, accurate and consistent colours, sharp text and precise detail on both coated and uncoated topliners at rated speeds.

The system also uses an advanced spot primer that ensures optimal ink adhesion and colour reproduction across the full range of corrugated materials. The ink is jetted onto the board immediately after the primer application without any drying in between, minimising the impact of drying on the board and contributing to a highly reliable production process.

The Canon drying technology in the corrPRESS iB17 has been optimised to

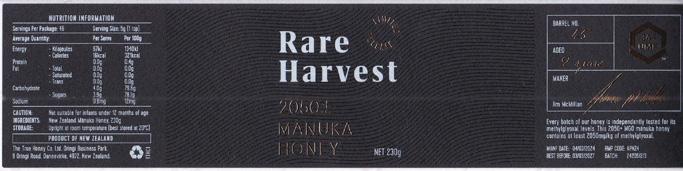

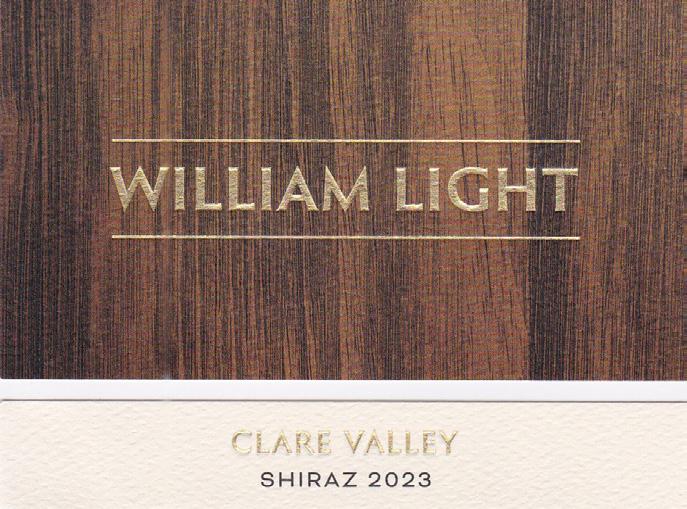

The L9 Group of international label associations recently announced the results of the 2025 L9 World Label Awards (WLA) competition, with local talent from Australia and New Zealand seeing heavy representation throughout the awards.

The corks were undoubtedly popping at MMC with three wins and three honourable mentions. MCC Premium Label Solutions, Australia was awarded a win for Class 10 –Offset Line & Screen (client: William Light). The submission was made by FINAT, which represents the European label industry.

MCC Auckland picked up a win after being nominated by New Zealand association SALMA for Class 1 – Flexo Line (client: Musashi Range).

MCC Albany, also nominated by SALMA, scored a win for Class 17 – Digital Line (client: True Honey Rare Harvest 2050+ Manuka Honey).

MCC Albany received an honourable

minimise corrugated board stress and energy consumption and to increase production efficiency. Covering approximately 80 per cent of retail packaging applications, the system supports coated and uncoated boards up to 1.7m wide and 1.3m long, and ranging from 1mm to 8mm thick, at a linear speed of 80m per minute.

Canon Production Printing chief marketing officer and senior vice-president Peter Wolff said, “By combining proven proprietary inkjet technology with an industrial board transport system, we’ve developed an innovative press that delivers offset-quality prints with outstanding productivity and digital flexibility, all developed for indirect food contact applications.

“Designed for seamless integration into existing production environments, the highly automated corrPRESS iB17 extends the economic benefits of digital printing far beyond traditional short-run applications.

“Although Canon is new to the corrugated market, we bring decades of industrial inkjet expertise which enables us to deliver a digital press that will empower converters to transform their operations while maintaining the reliability their businesses depend on.”

Canon Production Printing Oceania managing director Craig Nethercott added, “The corrPRESS iB17 is a game-changer for the Oceania market. It brings high-speed, offset-quality digital printing to corrugated packaging, helping converters meet growing demand for fast, flexible and sustainable production. We’re excited to support our customers in transforming their operations with this breakthrough technology”.

an honourable mention for Class 9 – Offset Line (client: Sparrow and Barrow Pinot Noir).

MMC’s Multi Color Adelaide scored an honourable mention for Class 4 – Flexo Wines and Spirits (client: Beenleigh Rum) following a nomination by the FPLMA, which represents the Asia-Pacific.

The FPLMA also nominated Victoria’s Label House, which received an honourable mention for Class 20 – Digital Wine & Spirits (client: Embelir).

Kiwi Labels received an honourable mention for Class 3 – Flexo Colour Process (client: Hellers Danish Eye Bacon), with a nomination by SALMA.

The awards are staged by the L9, an alliance of global associations that together formulates policies and shares global research related to the worldwide label industries. Every member association is invited to submit entries in any of the 24 classes of the competition.

mention off the back of another nomination by SALMA for Class 2 – Flexo Line & Screen (client: Terra Sancta Olive Oil). A submission by FINAT netted MCC Premium Label Solutions, Australia

Judged in Barcelona by an international panel of judges selected from each of the participating associations, the awards were timed for the annual Labelexpo Europe exhibition. It’s the 34th time that the competition has been held, with the current format in place since 2001.

The A/NZ converting industry is set to benefit from a new strategic collaboration with packaging leaders Uteco and Bimec, and the European Flex-Converting Alliance (FlexCA), which will provide greater access to a wide range of world-class products, backed by the industry’s largest service and support operation.

Through two separate distribution agreements, signed earlier this year, Currie Group has become the exclusive distributor in Australia, New Zealand and the Pacific Islands for Uteco’s wide range of high-end flexographic, rotogravure and digital printing equipment, coaters, laminators and specialty customised equipment, and for Bimec’s world-class slitter-rewinders for converting plastic films, paper and laminates.

As well as being recognised as industry leaders in their own right, Uteco and Bimec are also central players in FlexCA, a European alliance of printing and converting manufacturers which also includes CMG, ENCA, Smartjet and VISION, and these agreements will also allow Currie Group customers to access the full range of solutions offered by this market-leading alliance of companies.

Both Uteco and Bimec have been represented in the A/NZ region for many years – by Flexo Australia and Web Dynamics respectively – and Currie Group has worked closely with these agents for many months to ensure a seamless transition which will support, and add value, for customers across the region.

Reno Lauriola from Flexo Australia will join the Currie Group team, bringing his knowledge and expertise to the partnership, while Jade Gillard from Web Dynamics will hand over the Bimec agency to pursue other business interests. Currie Group already has a strong footprint in the label and flexible packaging area, particularly through their partnerships with other world-leading OEMs.

Mark Daws, Currie Group director – labels and packaging A/NZ, said this experience has

positioned the Group well to expand into the high-end, high-volume end of the market with these new partnerships.

“Flexible packaging is certainly an area where we are seeing massive growth, and these new agreements represent a significant step in expanding our offering to the highervolume converting sector by adding the unique value proposition offered by Uteco, Bimec and the wider FlexCA alliance,” Daws said.

“These new partnerships allow for a collaborative approach where we can pull in products and resources from any, or all, of the alliance members, to create solutions which are driven by each particular customer’s needs and objectives.”

Currie Group’s extensive network of technical specialists and service professionals was a key factor in these new agreements, providing customers across the region with unparalleled technical and service support. They will be backed by the full resources of Uteco, Bimec and FlexCA, who will act as strategic consultants and ‘end-to-end’ partners for all customers in the region.

Daws said these latest agreements align with the company’s commitment to provide complete, end-to-end solutions by partnering with leading brands who provide high-quality, premium products.

“Uteco, Bimec and their alliance partners, are internationally well-regarded manufacturers of quality equipment and solutions for the flexible packaging sector, and we are very pleased to be able to represent them in the South Pacific region,” he said.

In a bold move towards building a more sustainable future, Australian fresh produce grower Costa has partnered with Coles and Opal in a large-scale trial to transition packaging for Perino tomatoes from rPET plastic to recyclable cardboard packaging across Coles’ Victorian stores.

The new cardboard Costa Perino packs, designed and manufactured by Opal and made from recycled paper, are being trialled to replace Costa’s existing 80 per cent rPET punnets, with the companies saying the change is designed to reduce the industry’s reliance on plastic.

“This trial marks a major milestone in Costa’s packaging transformation journey.”

Costa Group domestic produce chief operating officer Manpreet Sidhu said.

“Costa is proud to be taking meaningful action to meet APCO’s national packaging targets, while recognising that consumers

are increasingly demanding environmentally sustainable solutions.”

The company also said the trial will provide valuable insights into packaging performance, product quality, consumer response, and supply chain integration.

A successful outcome could pave the way for a national rollout, increasing the presence of cardboard packaging alternatives in the fresh produce industry.

Coles sustainable general manager Brooke Donnelly said, “We know Perino tomatoes are a household favourite for many of our customers, and this trial is a meaningful step in reducing plastic in our stores whilst ensuring our customers who love to eat Perino tomatoes can still enjoy them at the highest quality”.

Opal said with sustainability and innovation at its core, Costa is committed to reimagining packaging for a better future and is leading the way in reducing Australia’s packaging waste, setting a powerful example for the industry.

Opal corporate business general manager David Pointer said, “Opal is excited to partner with Costa and Coles on this innovative Perino tomato punnet trial. By applying our packaging expertise, we’ve delivered a recyclable cardboard solution that is lightweight yet robust to protect fresh produce through supply chains.

“The punnet maintains product freshness and quality, and it’s an example of a clever collaboration that reduces the use of plastic”.

With the acquisition of Oji Fibre Solutions Australia by Abbe Group now complete, the company’s managing director Anthony O’Sullivan told ProPack.pro more about the origins of the deal and what the business has planned for the future.

Q: How did the acquisition of Oji Fibre Solutions (OjiFS) Australia come about?

Anthony O’Sullivan (AO): After initially being approached by representatives of OjiFS regarding the potential sale of its Packaging Australia business, Abbe’s executive leadership team immediately saw the opportunity for strategic investment, delivering clear capability and growth opportunities into the Abbe family.

The acquisition included all previous OjiFS Packaging Australia sites in Queensland, Victoria, and New South Wales, with all infrastructure and machinery at those sites being incorporated into the sale. Oji Foodservice, which has a site operating in Australia, was not part of the sale agreement.

Q: Will all OjiFS Australia staff be joining Abbe Group?

AO: Abbe understands the value of people, their knowledge and experience, and the part they play in the success of our business. We have already welcomed almost 300 former OjiFS staff into the Abbe family as part of this transition, the significant majority of former OjiFS Packaging Australia staff.

In addition, all OjiFS senior management team members have been offered roles

within Abbe and form part of the combined structure moving forward.

Q: Will OjiFS Australia be renamed under the Abbe Group banner or operate independently?

AO: All sites now operate under the Abbe banner – the former OjiFS sites were rebranded on 1 November 2025. All internal and external communications – from invoicing to emails – will fall under the Abbe brand from this date.

Q: What will the integration process of OjiFS Australia into Abbe’s existing operations look like?

AO: While complete integration plans are still being developed, we remain focussed on customer-centric outcomes, consistent with Abbe’s business strategy. Ultimately, how these integration plans look will be driven by how Abbe can better meet our customers’ product and service needs with the broader capacity and capability this acquisition brings.

Q: With multiple acquisitions under the Abbe Group banner, what does this move mean for the company?

AO: This is the largest and most complex acquisition in Abbe’s history, and we look forward to integrating the business and continuing to enhance our customers’ experience. Abbe was already the third largest corrugated cardboard packaging producer in the Australian market, and while there is no question the acquisition of OjiFS brings with it significant opportunities for growth and capability uplift, the focus on our target market and

the delivery of service, quality and exceptional value for our customers remains unchanged.

We look forward to further embedding the Abbe brand in the Queensland market with the addition of our first dedicated manufacturing site in the state. This enables us to balance production capacities and maintain consistent service year-round, despite the seasonal fluctuations in corrugated packaging demand in some sectors.

Q: As a family-run business with multiple generations having worked in the business, what values are key in building a unified company?

AO: The O’Sullivan family is fourth generation box makers, with all those generations having worked, or continuing to work, in various capacities at Abbe. We have built a business from the ground up and we are extremely proud of our achievements.

Abbe has always prioritised customer satisfaction and has refined a customercentric strategy to differentiate us in the packaging market. We focus on our values of respect, ownership, teamwork and excellence, having built an amazing team and culture founded on the values and insights of being part of a wider family.

This acquisition, of course, presented some huge challenges for both the family and our senior executive team to tackle, but we are looking forward to an exciting 12 months ahead as the Abbe family, and its offering, continues to grow.

Q: What can the industry expect from Abbe Group in the coming years?

AO: The acquisition of the OjiFS Packaging Australia business is a great fit for Abbe and its trajectory in the Australian packaging sector. In the immediate future, we are very much focussed on ensuring a seamless transition for both our existing customers and those we have welcomed from the OjiFS business, in tandem with a consolidated market presence, improved capacity and capability Australia-wide.

We continue to enjoy great support from both customers and suppliers in support of the growth of Abbe, and we are looking forward to sharing the next chapter and more exciting news in the future.

Notice of Acceptance of an Enforceable Undertaking under Part 11 of the Work Health and Safety Act 2011

On 2 July 2022, a sheeter operator had their left hand caught and drawn in-between two rollers on a sheeter machine. The worker’s hand was trapped until emergency services arrived.

SafeWork NSW investigated the incident and subsequently alleged that Westrock Oceania Pty Limited contravened section 19(1) and 32 of the Work Health and Safety Act 2011.

SafeWork NSW has accepted an enforceable undertaking from Westrock Oceania Pty Limited, ACN 000 592 745 in accordance with Part 11 of the Work Health and Safety Act 2011 in relation to the abovementioned alleged contravention. This notice has been placed under the terms of the Enforceable Undertaking and acknowledges acceptance of the Enforceable Undertaking by Westrock Oceania Pty Limited.

The undertaking requires the following actions:

• Automation of the Flat Work area to reduce the interaction between people and mobile plant items and reduce manual handling injuries to workers

• A third-party machine safety audit with a focus on fixed/removable guarding, interlock devices, electronic monitoring systems and human machine interaction

• Sharing lessons and safety successes with industry through the development and promotion of a case study.

Westrock Oceania Pty Limited is committed to ensuring, as far as reasonably practicable, the ongoing health and safety of its workers and other persons. Westrock Oceania Pty Limited sincerely regrets the alleged contravention and extends its sympathy to the injured worker and their family, Westrock Oceania Pty Limited workers and any others who have been affected by the incident.

This undertaking provides the ability to make further improvements in relation to health and safety within Westrock Oceania Pty Limited and its workforce, the industry and local community.

The full undertaking and general information about enforceable undertakings is available at safework.nsw.gov.au.

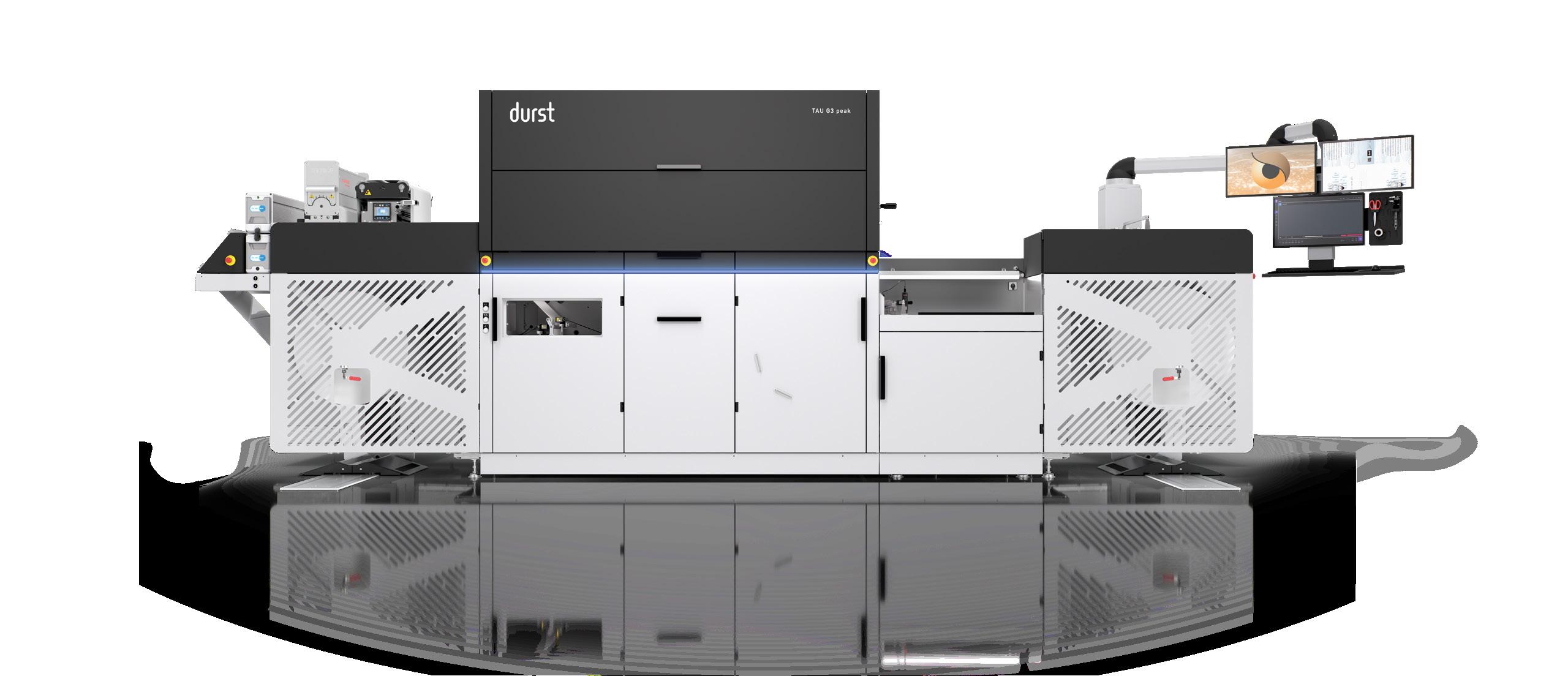

Durst Oceania MD Matt Ashman spoke at the recent ProPack Packaging Forum, where he addressed how the company is always at the forefront of innovation for its customers

Having only established itself in the Oceania market seven years ago, Durst Group, an almost 90-year-old Italian business, has significantly expanded its footprint in Australia and New Zealand in a short timeframe.

In this period, the company has installed more than 120 presses in the A/NZ region for a diverse range of businesses and has plenty more in the pipeline.

At the recent ProPack Packaging Forum, Durst Oceania managing director Matt Ashman highlighted the company’s recent achievements and shared insights on emerging technology trends and future business direction.

“It’s Durst’s 90th anniversary next year. The company has two owners, and we’ve been owned by the same family for 90 years,” he said.

“We have two production plants – one in Italy, one in Austria. Everything is made in Durst – 70 per cent to 80 per cent of the technology you see in our machines is made in our factory.

“We try and keep everything in-house at Durst.

“Two big technologies that have come out of the incubator are new trademarked technology developed by D3-AM, which is using piezo inkjet technology to print functional parts without support structure in aluminium carbide – which is stronger than steel.

“The other is Allsides, formerly Covision Media, which specialises in highperformance 3D scanning.

“That’s what you get with Durst. We always try and innovate and bring our customers new ideas to enhance their business or take their business in a different direction. But it’s always closely related to our core competence.

“For the Oceania market, we have our highly skilled technicians, sales team, and support staff within this region. We’ll also officially move into a new, bigger building soon.”

Speaking about Durst Group’s technologies, Ashman discussed AI’s role in innovation, saying it is a tool that needs to be harnessed.

“We’re all starting to use AI in our businesses and our personal lives, and we probably don’t even realise the extent to which we use it,” he said.

“When I was a child, everybody was talking about how robots were going to take people’s jobs. We’ve managed to live with robots and embrace them. They’ve made the print industry better. They’ve made automation and automotive better. And I think AI is going to go the same way. It’s something we need to embrace and use.”

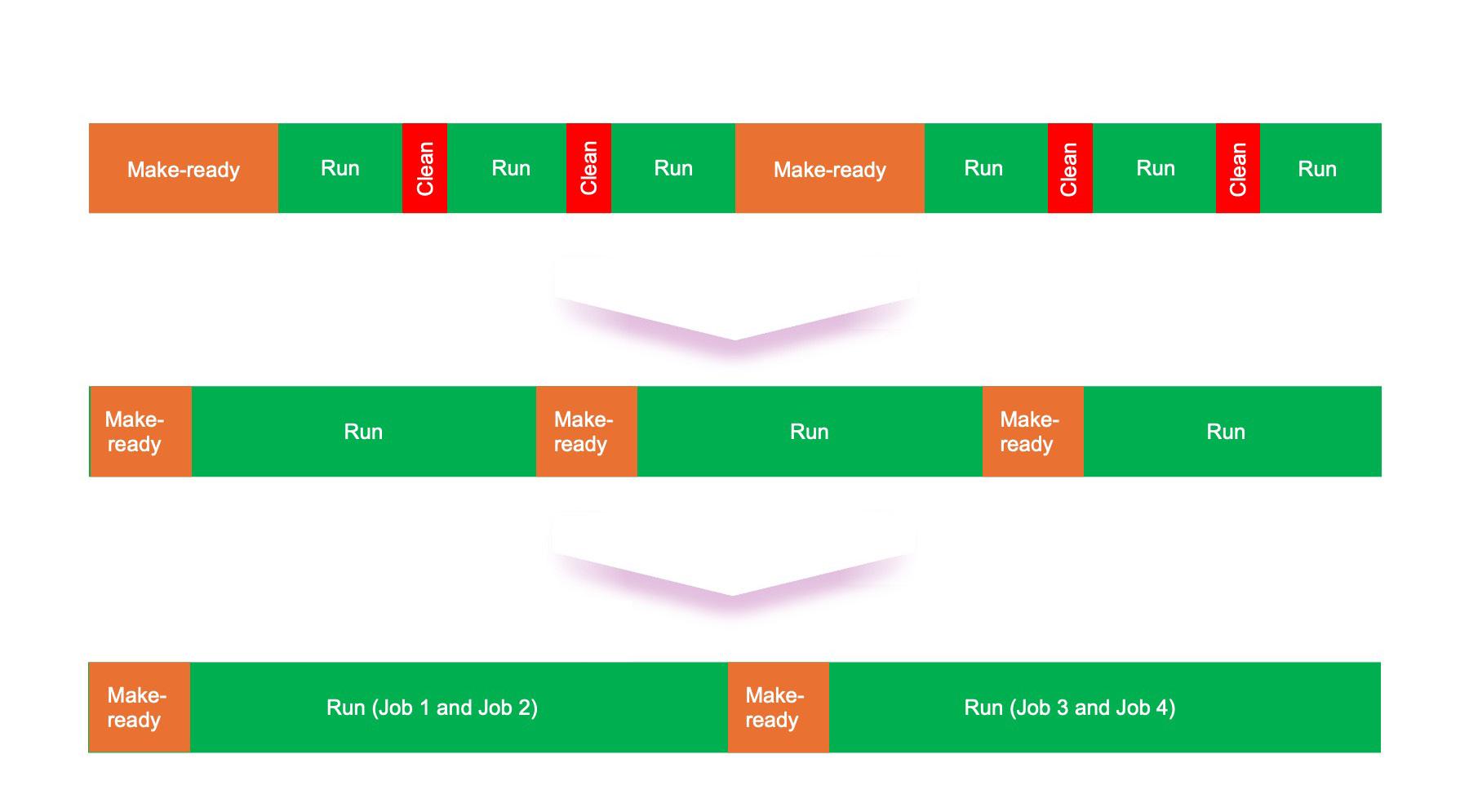

Ashman mentioned AI is now being used at Durst, including in its chat bots within its service organisation to help its engineers search service manuals to get answers quicker, and to analyse its service tickets. Ashman also discussed Durst’s label machines and their use of AI algorithms in the background.

“We’re certainly using it within our business. Durst put AI into its label

machines earlier than a lot of other companies,” he said.

“Our label machines have AI algorithms sitting in the background. For example, our machines analyse the workflow throughout the time they’re running, especially what’s being printed, and then it will take opportunities to clean the printheads when the operator is changing media or has gone on a break. So, you’re not slowing down production.”

In addition, Ashman spoke about how analogue production and digital production will run alongside each other for a long time but advised attendees to keep in mind how the packaging industry is changing.

“The label industry has been embracing digital production for some time with toner-based. Inkjet-based provides some advantages. We see those two technologies running together, even though we don’t do toner based, but only inkjet,” he said.

“The phrase that keeps coming up is ‘managing change’.”

He illustrated this with several Durst case studies, addressing how these customers achieved great results with Durst machines.

“Durst produces many different types of machines, but I think we have 11 machines that could be used for packaging alongside an analogue press, or as a complete solo production,” Ashman mentioned.

“We had an interesting business case in the US, whereby a guy decided he was going to make custom boxes. He was getting them die-cut off site, in three or four sizes. He started his business with one small printer, invested less than half a million euros, and that business grew.

“He bought a second printer, and then a third printer, all of which were low production presses. Instead of buying faster machines to speed up work, he now has 26 of the same machine with 52 operators, and he’s just sold his business to one of the biggest packaging companies in the world.”

Now in its second year, the event explored cutting-edge technologies, sustainable solutions, and market opportunities in the evolving packaging landscape

Local and international thought leaders were at the recent ProPack Packaging Forum that took place at the Shangri-La Sydney, sharing their knowledge during a day of conferencing and networking.

Headlining the conference was a keynote presentation by Time Under Tension co-founder Jason Ross, who addressed the difference between traditional AI and generative AI, and how to bring generative AI into production processes.

“Whether you know it or not, you are all using traditional AI – it sits in the background, has a profile of the user and it’s algorithmic. Generative AI is very

different – you use it to generate content. One of the obvious generative AI programs is ChatGPT. The reason it’s so good at answering anything you ask it is because it’s been trained on everything on the web,” he said.

“Text generation is probably the most mature part of generative AI. The next part of generative AI is images. We have come a long way in generative AI for images in the last year or two – they’ve now improved to the point where we are helping a lot of our clients bring these into their production processes.

“The next area of generative AI is video generation. Just three months ago, video

generation was not production ready. Today, it is. The last area of generative AI is code generation – it leverages deep learning algorithms to produce code.”

Using insights on how AI is being applied in packaging, Ross also utilised Claude, an AI language model, to review the report and use the data and findings to build an interactive HTML-based quiz which educates and informs about generative AI in packaging. This was just one of several tools he used as an example during his session.

Ross also emphasised that those using AI to reduce costs and replace workers will be out competed by those that use it to expand their capabilities, adding that generative

AI creates “a whole world of possibility”, especially in customer experience.

According to Ross, AI can be applied to all facets of business, including productivity and workflows, training, culture and people, data analysis and dissecting data, and in creating a digital twin.

“Every company is talking about implementing AI in business. There is a part of using it to reduce costs, but there’s also a world of possibility in other areas,” he said.

“There’s AI powered employee experience, where you’re boosting personal

productivity with these tools. There’s also AI augmented processes that investigates workflows that exist in the business today that could be changed or completely removed and replaced by AI workflows; and there’s AI powered customer experience, where we determine how we as consumers are changing our behaviour and relationships with computers.”

Koenig & Bauer CEO Markus Weiss urged Australian packaging converters to think in terms of “smart products” and “smart labour”, warning that the industry is at a crossroads where decisions taken now will define what gets printed in the near future.

Weiss said packaging and print were undergoing a “dual transformation”, balancing analogue and digital technologies while also responding to shifting customer expectations and labour shortages.

“Ultimately, it is a choice between two directions – a decision between smart labour and smart products,” he said.

Weiss framed today’s packaging market, alongside other industries that are wrestling with disruptive change, from automotive’s shift from petrol to electric vehicles to the move from conventional print to data-driven workflows.

He recalled his own “crossroad moment” back in 2000, when he worked for a printing company that decided to invest in digital printing to produce individualised six-page brochures for the Mercedes S-Class. The job relied on daily faxed customer codes, QuarkXPress data, and early variable-data tools, but, critically, it required a leap of faith.

According to Weiss, the return on investment for that first digital press “was not brilliant”, yet the owner chose to move anyway, based on a belief that personalisation would be part of print’s future.

“This ROI decision is the difference between followers and leaders,” he said.

To illustrate the power of “smart products”, Weiss referenced the Coca-Cola name campaign, personalised Kinder chocolate packs, and other FMCG examples where individualisation and short-run agility have turned otherwise standard products into social talking points.

“Smart products, ‘sexy products’, they make the industry attractive,” he said. “People talk about it, people will say, ‘Wow, have you seen this Coca-Cola campaign? Have you seen this Kinder chocolate block with the individualised picture of my children?’”

For Weiss, this kind of visible, consumerfacing innovation is not just good for brands – it is vital for attracting the next generation into print and packaging, especially since labour shortages are now structural.

He argued that automation, better user interfaces, and easier press operation are essential if converters want young people in the industry.

Weiss spent a significant portion of his keynote talking not about artificial intelligence as a buzzword, but to data management as a discipline. The goal, in his view, is an environment where operators stand in front of a press and receive clear recommendations based on live machine data – a stepping stone

towards highly autonomous, data-driven factories that can cope with labour constraints while maintaining productivity.

Weiss closed with a plea for printers, converters, suppliers and industry associations not to lose sight of print’s role within the broader media mix. Too often, he said, the conversation is dominated by technical specifications rather than by the relevance and creativity of the final application.

“Much more important is the application. Much more important is the content. Much more important is what you have in your hands. You have to keep print attractive in the overall media mix,” he said.

He challenged the audience to think of what they want to be printing in five to 10 years’ time and how today’s decisions on smart products, smart labour, data and connected packaging will shape that future.

Returning speaker, Peter Fotiadis, a partner at Mattingly, took a deep dive into yet another Australian packaging acquisition this year at the ProPack Packaging Forum.

He discussed the significant packaging acquisition of Oji Fibre Solutions Australia by Abbe Group, the largest independent corrugated packaging manufacturer in Australia. Abbe, led by the O’Sullivan family, focuses on medium- and small- run corrugated packaging with exceptional customer service, quality, and agility.

Following the acquisition of Oji Fibre Solutions Australia, the Abbe team has grown to more than 1,000 people, servicing around 6,500 customers annually. Abbe’s capability now extends into Queensland, having also acquired all former Oji manufacturing sites and depots up and down the east coast of Australia.

“It’s my pleasure to be able to share a few details on what has been the most significant packaging acquisition in our country this year,” Fotiadis said.

“Backed by its strength, Abbe was able, and well-positioned, to capitalise on the opportunity the acquisition of Oji presented. Australia’s corrugated industry is about a $2.5 billion industry, and was serviced by four major manufacturers –Visy, Opal, Abbe, and Oji, and supported by a raft of smaller suppliers.”

Fotiadis shared that until its New Zealand mills closed in 2025, Oji had manufactured its own paper, which had previously set it apart from Abbe. With the loss of its vertical integration, Oji’s point of difference was significantly diminished.

“Post-acquisition, Australia now has three major manufacturers, and the combined

market share of Abbe is about 16 per cent,” he said.

“A cornerstone of the transaction was Oji’s Yatala manufacturing site in Queensland. It is the newest asset in the portfolio. It was constructed in 2016, it’s well equipped, well-resourced, and positioned nicely to serve the Far North Queensland market.

“Aside from its manufacturing sites, Abbe now has specialist depots in Bundaberg, Innisfail, and Mareeba, in Far North Queensland, which is not where Abbe has traditionally played in.”

According to Fotiadis, incorporating the Oji business into the Abbe Group presents three key strategic drivers:

• Geographical expansion – Abbe’s reach now extends into Queensland, enhancing its asset base and operational efficiency.

• Strengthening of the asset base – With the flexibility of having multiple sites, Abbe can plan for best fit operations from production to supply chain.

• Synergies – Consolidating the efficiencies from sharing assets, talent, and customer bases.

“A crucial piece in this acquisition was the people and their talent, bringing together two strong, capable leadership teams,

which I experienced first-hand through the diligence program. It’s those interactions and collaboration between the two leadership teams where I witnessed the impact those people bring to the combined business,” he added.

Fotiadis also provided a roundup of the industry’s transactions this year against the backdrop of 2024 where some mega deals were announced. However, he noted that 2025 has been a lot more measured in the acquisition space, with acquisitions directly impactful in the market.

“There remains quite a hive of activity bubbling away in the background, and I expect one or two acquisitions to close before the year’s out,” he said.

“Mergers and acquisitions aren’t only for large corporates with deep pockets. There is deal activity rising around the labels and print markets for smaller businesses, mainly to enhance teams by bringing in other capabilities, to inherit a larger customer base and assets, and to expand geographically.

“The right acquisition is one way to quickly bolster your business in one fell swoop, and every business is available for the right price.”

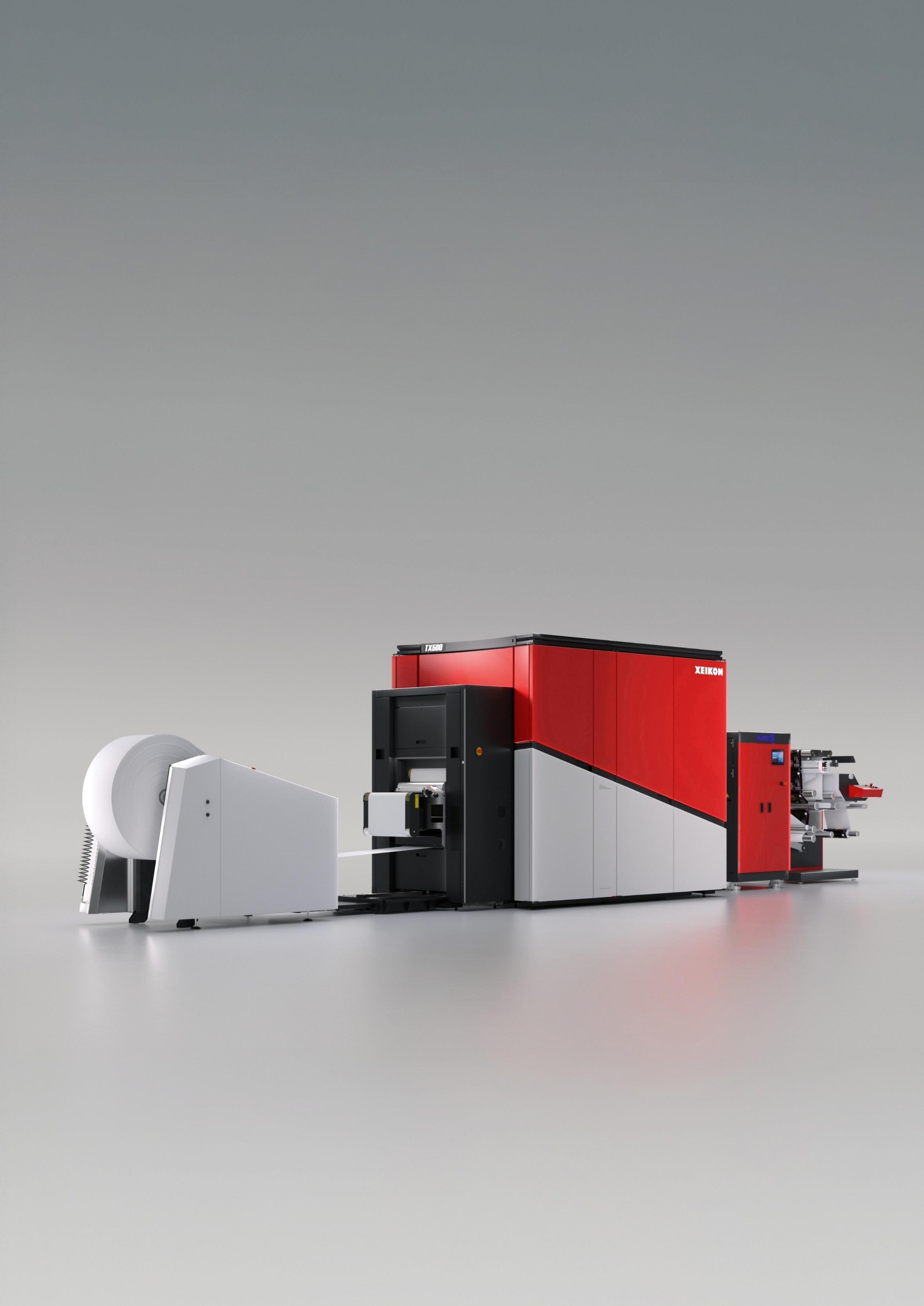

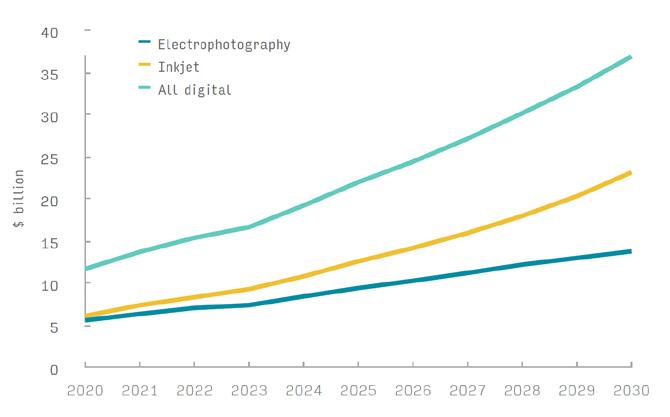

Xeikon A/NZ and North America president Robert Welford pushed back

Whether you need a versatile cutting table for creative sample-making to drive new business, or the perfect solution in automated, high-speed packaging production to empower your team to handle growing volumes of shorterrun jobs, we have the precision digital cutting tables to make it happen.

Our engineering, materials and applications experts are ready with real-world solutions to your business challenges and a long-term focus on working together to unlock your full business potential.

Let’s shape your future, together. Visit www.kongsbergsystems.com to find out more.

on industry narratives that UV inkjet will eclipse toner, arguing that toner-based digital print remains the backbone of the global market and will continue to lead in high-value applications.

Welford said 80 per cent of all digital printing is still done using toner, driven by quality, compliance and durability advantages.

“Toner is here to stay, no doubt about it,” Welford told attendees, noting its dominance in regulated categories such as pharmaceutical and food-safe packaging, where certification requirements limit the use of inkjet alternatives.

Welford positioned Xeikon as “the grandfather of digital print,” tracing its lineage back to early electro-photography. He highlighted the company’s current platforms, including the CX and LX drytoner presses, the Panther HD which is a 1200 DPI inkjet system, and Xeikon’s water-based corrugated solution priced at approximately $4.2 million.

Resolution escalation, from 600dpi to 1,200dpi, was driven not by customer need but by OEM posturing, he said.

“Everybody wants it... we want more,” Welford joked as he compared the desire for higher resolutions to his yearning for greater horsepower in his Porsche.

He described the UV inkjet sector as a “UV label bloodbath”, with too many competing OEMs discounting hardware, consumables and service.

“If you are a printer in UV digital labels, it’s a fantastic place to be,” he noted, given the ability to force vendors to compete on price.

Welford spent the latter half of his session outlining a shift he believes will reshape packaging and, by extension, digital print.

Sustainability is now embedded in Xeikon’s product design, he said, noting that its toner is manufactured using recycled water bottles. But the larger transformation will come from reusable packaging systems, akin to the milk-bottle exchange model of decades past.

Future packaging, he predicted, will favour refill models, solid-form products (such as shampoo bars), and standardised bottles or containers – with the label becoming the primary means of brand differentiation.

“If you’re printing labels, you’re in the right market,” Welford said.

Making the trip from Belgium again, Hybrid Software PACKZ product manager Pascal Wybo introduced AI-powered search engines and online editors for label and packaging design,

calling it the ‘Tinder’ application for labels and packaging.

“AI-powered search engines and online editors are the ‘Tinders’ for labels and packaging as they match using commonalities and similarities. If I were to ask to the audience what innovation in recent history has shaped how information is consumed, the answer is probably going to be search engines,” he said.

“Search engines use artificial intelligence and, in less clicks, you will learn everything about a particular topic or product. So, AI applications and models are already being used today in daily production to support processes and decisions.

“If we are looking to the label and the packaging industry today, producing print ready graphics and tooling takes a lot of effort and takes a lot of time. Reusing all this value that you are creating is tremendously important.

“But, cataloguing everything, or even locating all your assets, is going to be quite challenging. So, if we combine search engines with AI, our intellectual property will be secure and tailored to our business.”

Wybo’s presentation also featured the latest advancements in software, introducing Hybrid Software’s CloudFlow AI Matches solution – a digitalisation and automation tool in the Design2Print process that enables fast, intuitive searches for visually similar or identical image content – eliminating the need for manual keywording.

The AI image search is embedded into existing production workflows, creating new opportunities for process optimisation in prepress and packaging design.

Wybo said AI is already making its mark on the industry, adding businesses need to start to explore new ways such as the use of AI in how they are going to manage their processes. According to Wybo, this will help in making processes more efficient, reduce costs, and increase competitiveness.

“AI will help you to redesign your processes. It’s not going to replace humans but rather, will elevate what a staff member does. They will be able to work more thoroughly and explore, for instance, what more can be done with AI,” he said.

Wybo also spoke about variable data printing, saying it is the way of mass customisation and “mass uniqueness”, adding Hybrid Software’s integration with Scotty and Content.xml generates instant, print-ready output.

“There will be challenges, but don’t forget that personalisation resonates very deeply with customers. Don’t be afraid of valuable

data printing or online editing tools for your customers in making their labels and their packaging and having this ready to go to your printing press. Think possible, never think impossible,” he added.

Travelling from the UK, Kongsberg Precision Cutting Systems (PCS) APAC and EMEA vice-president David Preskett discussed industry trends and product developments.

He highlighted the need for longer run lengths in digital finishing, aiming for 400 boards, and the demand for less waste and more ecological solutions. Equally, on the other end of the spectrum, converters want it at shorter run lengths, and they want it at one board.

Productivity was also identified as a key requirement for converters – not just in terms of speed but for stack-to-stack output. Automation was also emphasised as a key theme, with companies seeking unattended production and cost reduction.

“At Kongsberg PCS, we look at all these areas of concern for customers and think about how we can maximise their productivity. We think about how we can solve their business challenges,” he said.

“We do something called customer value stream mapping. It’s a long process where we interview people extensively, and we ask them questions that allow us to analyse the quality, reject rate, costs, lead and process times, and the problems they’re facing in terms of processes and what could be done better. This ends up as a chart, and we use this analysis to help the customer.”

Preskett also said the dividing line between signage and display and packaging is getting vague as the media used is the same in many cases.

“Corrugated is being used significantly in retail display now, for ecological reasons. It’s the same media that’s being used in packaging. This line is starting to blur, and it’s driven by the application, not by the end customer,” he mentioned.

In addition, Preskett highlighted some customer stories that showcased significant productivity improvements and cost savings from using Kongsberg PCS’ products.

“The key theme across our products is automation, as this is the main requirement from customers. If some people haven’t got the volume or runlengths for that, we have other automation systems that aren’t quite as automated –they’re semi-automatic, what we call smart material handlers,” he said.

“I hope we can continue to talk to you about how we can help you be more productive,

solve some of your business challenges, find new ways forward and reveal your company potential, and how we can help you utilise the skills in your business.”

Print and Pack (representing Bobst) sales manager Miro Williams put the spotlight on how automation, digitalisation, and data-driven workflows are reshaping the packaging sector in Australia and globally.

Williams, representing the Swiss-based equipment manufacturer, emphasised the company’s long history of innovation – from inventing the automatic die cutter to its current leadership across folding carton, labels, corrugated, and flexible packaging solutions.

He also mentioned the future for Bobst is to offer more than just improved speed as it evolves its machinery. The goal going forward is to connect every machine, gather meaningful production data, and reduce human error through intelligent automation.

Williams explained the key platform for the business – ‘Bobst Connect’, a cloudbased platform designed to centralise data across the packaging workflow –from the initial brief through to delivery.

It’s all in the aim of sustainability, he explained, adding, “We want to be able to give that data to all the stakeholders from back to front, so the original customer that ordered that particular box at the end of that job. We can give them a report to state how much was wasted, how many bad sheets were found, how much waste reduction,” Williams explained.

Key trends highlighted by Williams included the shift to shorter run lengths, more complex packaging designs, and the growing need for flexibility. He pointed to the value that Bobst’s OneECG system offers.

The oneECG (Extended Colour Gamut) technology replaces custom Pantone inks with a seven-colour process, enabling

consistent colour while reducing costs and waste. According to Williams, oneECG is already being adopted in Australia, and has been rolled out by major global brands like Nivea Europe.

Williams also discussed the impact of factories seeking greater efficiencies. He pointed to the Australian investment in corrugated packaging, with several large factories upgrading decades-old equipment.

On the manufacturing side, he stressed the impact of skilled labour shortages, making automation more critical than ever.

“We need to concentrate on training young people, but if they’re not wanting to do these sorts of jobs, we have to revert to automation,” he explained.

Looking ahead, Williams predicted further factory automation over the next five years.

“We’ve seen a lot of our major following carton customers around Australia and New Zealand automate their factories, buying new equipment, adding carton pack, adding fully automated carbon pack, adding robotics to the production lines,” he said.

Kissel + Wolf Australia managing director Jamie Weller and Opal Group executive manager – packing division Rod Turnbull outlined how their partnership is enabling Opal to service fast-growing demand for local, flexible, and sustainable print solutions.

Opal recently made a major push into shortrun, high-quality fibre packaging, unveiling a Kissel + Wolf digital print and finishing investment that aims to transform how brands produce customised, sustainable packaging across A/NZ.

Turnbull said the move reflects a market that is rapidly shifting away from plastics and toward fibre-based packaging, especially among retailers and brand owners under pressure to meet sustainability targets.

“The idea is to lead Australia and New Zealand in a transition to fibre-based sustainable packaging,” he told attendees.

Customer demands are shifting, Weller explained. Retailers are seeking faster turnarounds and local supplies. Meanwhile e-commerce is driving growth in short-run packaging, with demanddriven production.

“Marketing teams… they are looking more to versioning and also seasonal design changes,” he said.

Weller said Opal had strict nonnegotiables: local distribution and service support, seamless workflow automation, and capability for both corrugated and folding carton production. He explained that they were looking for a technology partner, not only for right now, but to grow into the future.

Turnbull said partnering with Kissel + Wolf enabled the business “to do some R&D and do some work that were different”.

“We didn’t buy the basic machine – we bought a basic machine and added things to it. And that’s a big part of the process where we will learn together and grow together,” he said.

Turnbull added digital print eliminates the need to do any of the tooling, allowing Opal to turn jobs around “in days, not weeks”.

For customers, this removes the traditional pain point of minimum order quantities and introduces greater flexibility into the mix. It means that customers can avoid ordering too much product and inventory levels can be better managed.

Variable data printing is another differentiator. The system can personalise every box in a job, which is useful for limited-edition items, employee gifts, or promotional campaigns.

The new workflow also integrates Esko Automation Engine, which enables work

to be pushed through the systems without production bottlenecks. Jobs move through the factory via QR code instructions, managing product from the start of it entering the system through to the finished product.

By maximising the use of each sheet, eliminating tooling and reducing changeovers, Opal is seeing reductions in waste and greater efficiency across plants. It has four sets of machines across Australia and NZ which are calibrated identically, ensuring colour consistency.

Turnbull summed up Opal’s vision, saying, “Dream it up. We can make it for you”.

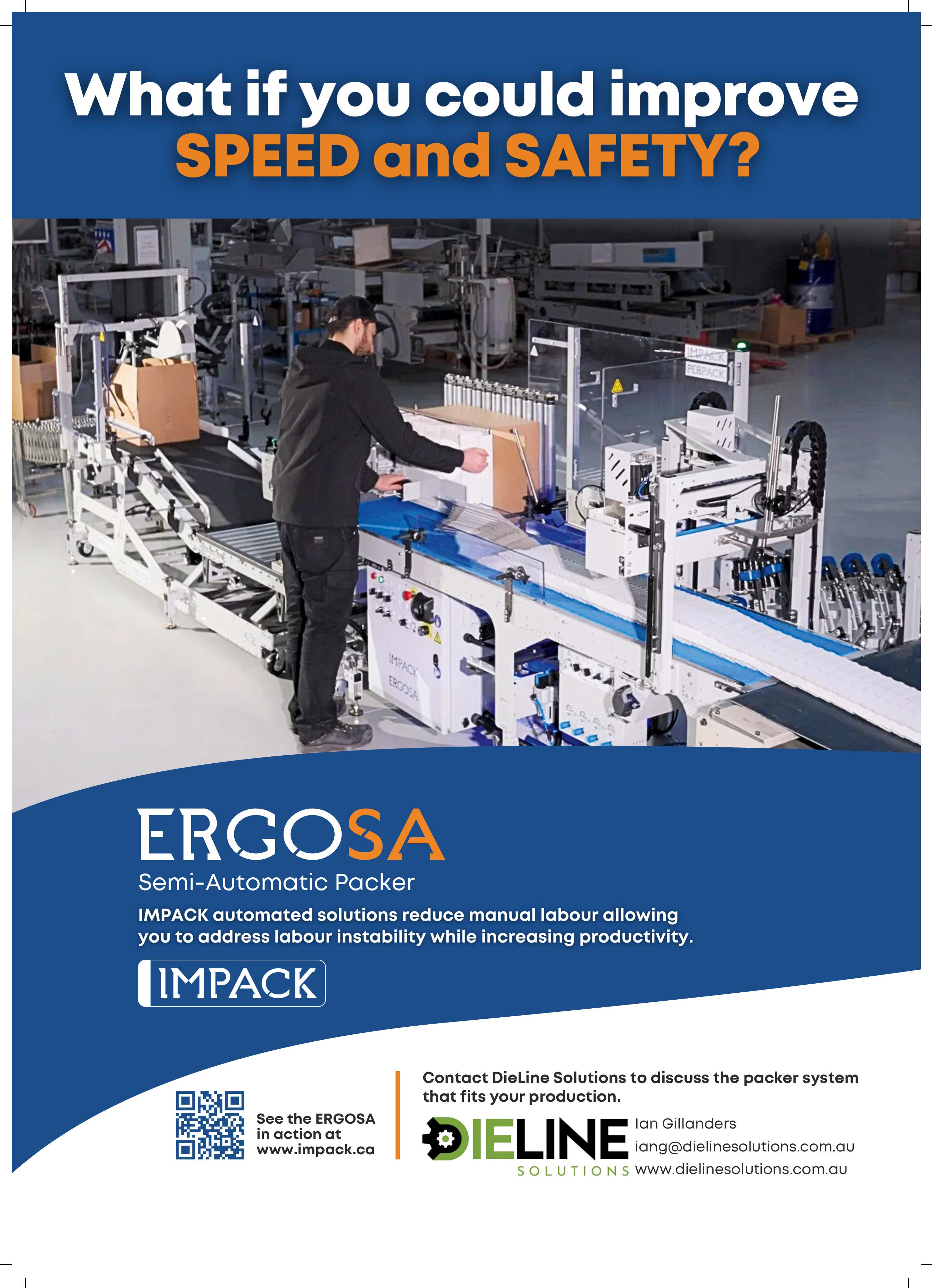

DieLine Solutions managing director Ian Gillanders and Impack sales manager Maxime Jacques addressed how rising labour costs and the ongoing skills shortage is impacting Australian converters, saying end-of-line automation is fast becoming a priority – particularly around folder-gluer lines where manual packing remains common.

Gillanders, who represents several converting and automation suppliers in Australia including Impack, said the economics of manual packing are becoming increasingly difficult to justify in the local market.

On many folder-gluers, operators at the packing end are still lifting and stacking cartons by hand, with one person handling up to nine tonnes of board in a shift. This is a recipe for repetitive strain and back injuries as well as high labour cost.

Impack positions its Ergosa semiautomatic packer as a bridge between basic collecting tables and fully automatic case packers. The system is designed to handle a wide mix of work, reducing the dependence on manual lifting and repetitive tasks.

Jacques said much of Impack’s work globally now involves designing conveyors and box-handling modules that can turn product 90 degrees, to make U-turns, or invert boxes to suit tight or awkward floorplans – effectively fitting automation around existing infrastructure rather than forcing layouts.

Above Ergosa in Impack’s range sits the Virtuo automatic packer. Jacques drew a clear distinction between “automatic” – where the loading of cartons into cases is automated – and “fully automatic”, where additional modules such as case erectors and automatic infeed remove the need for any operator at the end of the line.

Despite the strong case for full automation, Jacques cautioned against trying to jump directly from manual packing to fully automatic end-of-line systems. He argued that for very long, repeat runs of simple straight-line boxes, a fully automatic packer can be the right answer.

But for converters juggling frequent changeovers and a variety of carton styles, a semi-automatic approach can offer a more balanced mix of speed, flexibility and capital cost.

“I think we all agree that in the next months, next years, the future is automation, but it’s also to do it in the right way,” Jacques said.

Looking ahead 12 to 18 months, Gillanders predicted further consolidation across the Australian packaging sector, pointing to recent activity in both folding cartons and corrugated, including the acquisition of JacPak by IVE Group.

Against this backdrop, Jacques and Gillanders framed end-of-line automation as a practical lever converters can pull to address labour shortages, safety concerns and margin pressure – while building a more flexible platform for future growth.

For many Australian converters, their advice was simple: map the current packing process, start with semiautomatic where it makes sense, and design a clear pathway to full automation as volumes and product mix evolve.

Several panel discussions also provided engaging conversations.

Next Printing managing director

Romeo Sanuri, Carbon8 co-founder and co-director Kenneth Beck-Pedersen, Mediapoint director Jamie Xuereb, and IVE Group managing director Matt Aitken came together to discuss current challenges and business strategies.

The majority of the panel cited changing customer demographics and needs as their top obstacle.

Xuereb said Mediapoint is seeing challenges in the micro-end of its customer base, in terms of customer order sizes reducing.

“The ordering patterns from our customers are changing because they’re facing challenges as an industry. Customer demographics are also shifting – they’re now younger and the way they want to interact and place orders is completely different to what the industry has been accustomed to,” he said.

“This is the generation that has embraced AI and are using that to design their products. They expect an output that can match that level of innovation.”

Sanuri agreed, adding Next Printing worked around the reduction in customer ordering size by starting up a separate business entity for producing labels, called LabEX.

What LabEX offers is a self-service platform designed to make ordering straightforward. The system handles small, boutique runs and bigger, commercial orders. Customers can access quality materials without dealing with lengthy lead times or excessive minimum quantities as the self-service model keeps costs down whilst maintaining quality standards.

“We had to shift our thinking to address this change in market needs. We use the same printers to print the labels, but they get their short-run orders in three days at an affordable price – just by making it a self-service platform,” Sanuri said.

“We thought this strategy was going to kill us, but it has been three years and the business keeps growing.”

Beck-Pedersen said with new-age customers demanding solutions to be produced instantly, Carbon8 is challenged around being hamstrung by laws surrounding the welfare of staff, as well as competitors that are buying print from China and air freighting it in.

“It’s becoming increasingly difficult to explain to the customer why we’re unable to ‘just get it done’ within the short timeframes they expect. It is very expensive for all of us

to be competitive in Australia relative to what can come in from offshore,” he said.

“At Carbon8, we decided we want to do all these things ourselves – and that is our strength – but circumstances and changing customer needs are presenting us with challenges.”

Looking ahead, the panel mentioned building on efficiencies in businesses is going to be the focus for many companies in the coming 12 months, especially with shortages in skilled workers and the growth of AI and robotics.

When asked if IVE Group plans to build on growth through acquisition again, Aitken said, “One of the things for IVE Group is, we’re constantly looking at new markets that we can move into, or adjacencies that we should be in that we’re not in today –that makes sense for our customers or for our business and have close alignment with what we already do.

“We want to put parts of our business into growth sectors that themselves are naturally growing, and so, you can grow with and into those sectors accordingly. That’s what we did with our JacPak acquisition.

“I wouldn’t say no to an acquisition in packaging over time, but it’s not on our radar right at the moment.”

In a separate session, Colemans graphic designer Tommy Mavros, Westrock lithographic printer Robert Neale, and Harden Packaging flexo printing apprentice Jackson Young discussed the next generation in packaging.

Mavros spoke about the Colemans business in Darwin, saying that the company’s recent purchase of an HP labels machine has been a “big learning experience” for him in learning about stock, what sort of design goes into

pre-press operations, sourcing suppliers, and finding the right sustainable materials that work on it.

“There’s not only a wide market, but there’s also lots of sustainable options available today. The industry is looking to be more economic and more sustainable, which is a great growing trend,” he mentioned.

Young spoke about trends in the way packaging is being produced within Harden Packaging, saying there’s a big push towards sustainability and automation.

“Working towards automating the prepress process so you can get a photo polymer plate to market quicker is gold. We deal with packaging for fresh produce, so the move towards automation and AI enables us to get a product from farm to the shelf in half the time,” he said.

“We’ve had a brief look into AI, but it seems the best avenue to use it currently is in press inspection – using the BST and AVT systems and integrating AI into that for defects identification and press maintenance.”

Mavros agreed, adding that working in the creative and pre-press space, the use of Adobe Firefly, an AI model for creative production, has been beneficial for the business.

“It’s unbelievable what you can do if you can put in the right prompts. AI is not something to be afraid of. If we embrace it, it’s something that can help us in our work and make us more efficient,” he stated.

As someone that prefers taking a more old-school approach to work, Neale said AI will impact the future, but he prefers not to rely too heavily on it.

“I don’t really use AI in my line of work and maybe I might use some of it in the future, but I think it’s good to think for yourself. AI is only as good as what you can put into it,” he said.

Neale also said he has noticed a trend of more customers seeking higher quality work at lower costs.

“It’s unfortunately something converters have to deal with at the moment, but if customers want more sustainable, higher quality work, they need to realise that it comes at a higher cost,” he said.

All three panellists also conveyed their intent to further their careers in the companies they work for, with a view to take on leadership roles in future. They also expressed their desire to give back to the industry, by mentoring the future generations of apprentices that enter the packaging industry.

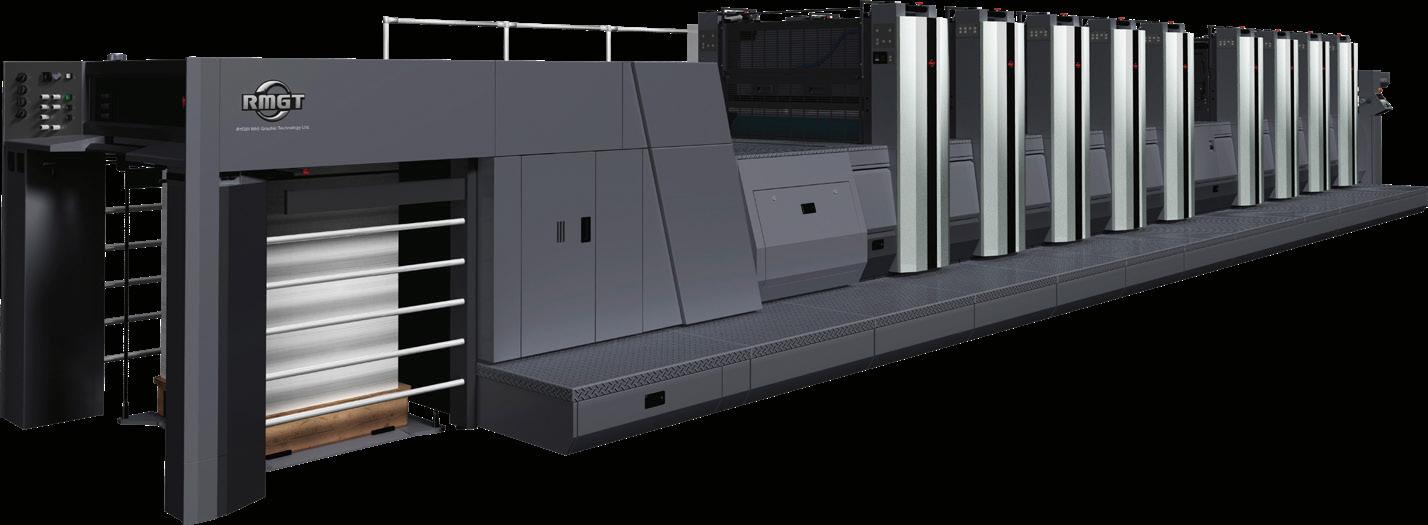

The Rapida 106 X maximizes every second for the highest productivity. Industry-leading technology ensures the fastest throughput. Print at up to 22,000 sheets per hour. Plate and substrate logistics, parallel makeready processes and digital services are among the benefits which help you always surpass your goals.

See the Rapida 106 X in action: rapida106x.koenig-bauer.com/en

Koenig & Bauer (AU)

Rayne Simpson

+61(03) 9548 7277

rayne.simpson@koenig-bauer.com.au

A large number of industry executives attended the second annual ProPack Packaging Forum for a day of conferencing and networking, prior to the 2025 ProPrint Awards

Now in its second year, the ProPack Packaging Forum recently brought together speakers, panellists, and attendees for a day of conferencing

and networking in Sydney. It explored cutting-edge technologies, sustainable solutions, and market opportunities in the evolving packaging landscape.

Here are some photos from the networking breaks during the event, where people had the opportunity to catch up with their peers.

Enterprise workflows

Native PDF editors

Color management

3D prototyping & visualization

High-speed RIPs and DFEs

Printheads electronics

Miraclon principal consultant for advanced print applications Steve Smith addresses rising brand demands and how printers can respond with modern flexo

Brands are laying a challenge at the door of packaging printers: deliver packaging with the same on-shelf appearance and improved sustainability – while driving more value from the print process. At first glance, competing requests that are difficult to deliver on.

However, flexo is evolving from its traditional capabilities, practices, and processes to a new era of modern flexo that’s consistent, highly capable, efficient, and more sustainable. Modern flexo is a standardised, sustainable manufacturing process.

Miraclon principal consultant for advanced print applications Steve Smith is an expert on modern flexo.

For Smith, re-thinking the foundations of flexo gives printers the potential they need to be more efficient, without compromising on quality – delivering packaging with optimal shelf impact.

They also need to be able to print brand designs on more sustainable packaging, often a difficult ask because of how these more textured substrates behave on press.

Smith explains how this approach allows printers to respond to what brands now want from their packaging, while becoming more efficient and more sustainable.

Q. What challenges are printers facing as a result of the priorities brands are now placing on print?

Steve Smith (SS): Brands should not have to compromise on quality, and they want to get better value from their print process while addressing sustainability. Part of the challenge comes with the higher costs of sustainable substrates too.

The focus now is often on how much value brands can get and what sustainability gains they achieve – not only through printing, but

through their other manufacturing processes – their whole supply chain.

If printers can’t find efficiencies in their process, meeting these higher demands and priorities reduces margins and puts downward pressure on profitability.

Q. How has the shift from traditional to modern flexo changed what flexo printers can achieve?

SS: Traditionally, flexo was always a whole collection of variables for a printer to juggle. The reference we often make in modern flexo to foundations is based on a paradigm shift from what people used to be doing in traditional flexo.

The whole idea is to reduce or eliminate traditional variables and, instead, control each of those foundations, from plates to inks to anilox. Colour management is a key foundational piece too.

Without control over the foundations of the print process, major inefficiencies can occur. For example, using heavier aniloxes to get the right colour on press can mean money down the drain; recently a company used 380kgs more ink during a run as a result of using heavier aniloxes to achieve the right ink laydown.

It needs to be a process where you’re not changing the inks, anilox or selecting multiple tape options – that collection of traditional flexo variables – to find tactical efficiencies in one area or get results.

When comparing different print processes, our industry also relies too much on technical perspectives – viewing packaging through a magnifying glass. Consumers don’t look at packaging that way – they just want to have packaging that looks the same on the supermarket shelf. And brands want to make sure the consumer’s perception of their brand is right.

With FLEXEL NX Plates we can provide print consistency that has the shelf impact that brands want and consumers see.

Q. How does a modern flexo approach enable printers to address brands’ demands for better value print?

SS: When we work with printers, we show them the kind of savings that are possible – identifying the biggest pain points and helping them realise the full set of possibilities that we can work towards – as well as what we can do to support the printer to achieve that. All of this is ingrained in our approach towards modern flexo.

Previously, flexo was a cheaper alternative to other print processes with compromises on shelf impact. That’s no longer the case.