The Shape of Play A Pre–Toy Fair Snapshot of an Industry in Motion

As the Australian Toy, Hobby & Licensing Fair approaches, early 2026 reveals an industry focused on refinement — with learning-led, open-ended play setting the tone!

January has long served as a moment of quiet calibration for the toy industry — a pause before the pace quickens and the year’s priorities come clearly into view. As this publication launches as a new pre–Toy Fair initiative, it does so against a backdrop of steady and measurable change. With the Australian Toy, Hobby & Licensing Fair returning to the Melbourne Convention and Exhibition Centre from 1–4 March 2026, the weeks leading up to the event offer a timely opportunity to examine the forces shaping assortments, conversations and commercial decisions across the sector.

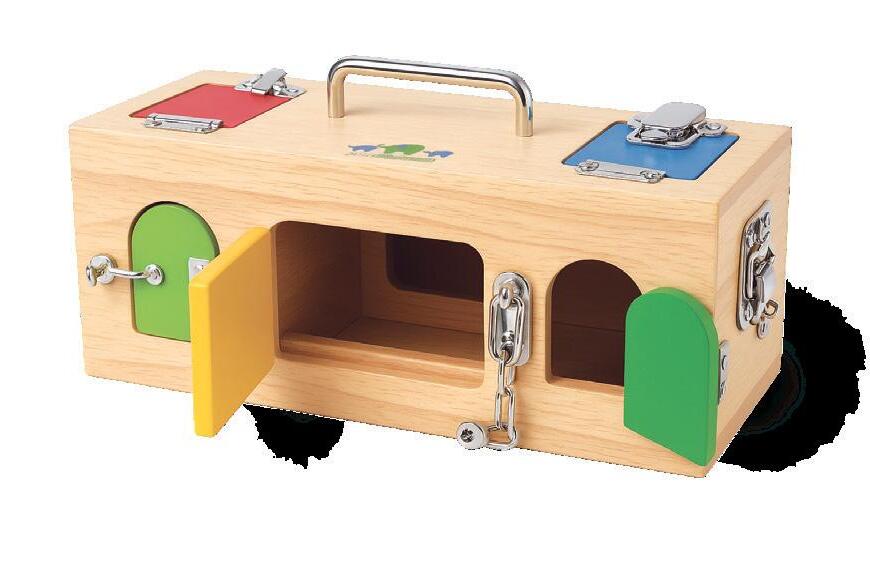

Globally, one of the most consistently reported trends is the continued growth of educational and purpose-led play. Data from Circana (formerly NPD Group) indicates sustained value growth in learning, activity and construction-based toy categories across

key international markets, driven by demand for products that support creativity, problemsolving and extended engagement.1 The Toy Association’s annual trend briefings reinforce this direction, noting a clear shift toward openended play systems that evolve with a child rather than deliver a single outcome.2

The Australian market reflects these dynamics in a distinctly confident way. Local brands are increasingly visible across export and specialty retail channels, particularly where products align with learning-through-play principles. Melbourne-founded Connetix provides a useful example, with its magnet-based construction system gaining international traction for its emphasis on imagination, spatial reasoning and collaborative play. This approach aligns with findings from OECD research linking open-ended play environments with positive cognitive and social development outcomes in early learning contexts.3

Sustainability remains an important influence on product development. Rather than functioning as a standalone category, it is increasingly embedded in design decisions around durability, modularity and material choice. The LEGO Group’s publicly reported progress toward renewable and bio-based materials reflects a broader industry effort to future-proof core product lines while

maintaining play value and commercial viability.4 For the trade, this has translated into ranges that support repeat purchase through systems and compatibility, rather than rapid replacement.

What connects these trends is not reinvention, but intent. Education and skills frameworks from the World Economic Forum continue to highlight creativity, adaptability and critical thinking as essential future capabilities — attributes now clearly reflected in the toys gaining traction across global markets.5 As such, the products expected to stand out at this year’s Australian Toy, Hobby & Licensing Fair are likely to be those that balance strong design with meaningful, repeatable play experiences.

As the industry looks ahead to March, buyers, licensors and suppliers alike enter 2026 with a shared focus on refinement, durability and long-term value as they prepare to come together at the fair.

Managing Director: Tony Bugg tony@buggsolutions.com.au

Editor & Designer: Matthew Bugg matt@buggsolutions.com.au

Published by Bugg Marketing Solutions info@buggsolutions.com.au PO BOX 491, Berwick VIC 3806

Advertising: bookings@thetoyuniverse.com.au

Feedback: editor@thetoyuniverse.com.au

Media: media@thetoyuniverse.com.au

The Toy Universe Team

Inside this Edition Welcome to Edition 19 of The Toy Universe

NEWS — NEWS UPDATES FROM THE TOY UNIVERSE

MJM AUSTRALIA — A FAMILY LEGACY REBUILT

TOY FAIR SEASON IS HERE! — BY ALICE SANDERSON

SANRIO CHARACTERS — LIFE-LONG COMPANIONS FOR KIDS AND FAMILIES

TOYS DOWN UNDER — HOW A SHARED LA SHOWROOM HELPED AUSSIE TOY BRANDS GAIN A FOOTHOLD IN US RETAIL

TOY FAIR EVENTS — MASTER THE ART OF TOYS & THE TRUE VALUE OF BRAND

FRENCH TOY MARKET — 2025 KEY RESULTS & OUTLOOK

NEW LOOK FOR LUNDBY FOR 2026 — WOODEN DOLLHOUSES TO LAUNCH IN SEPTEMBER

STORIES FROM GG'S TOY BOX — WHERE’S WALLY? YOU’RE LOOKING AT HIM...

MIZZIE THE KANGAROO — MIZZIE TEAMS UP WITH AUSTRALIAN OPEN THIS SUMMER

HONG KONG'S NEXT CHAPTER — REINVENTING THE TOY INDUSTRY HUB

OPINION PIECE — VALUE PERCEPTION (IF VALUE ISN'T INSTANT, IT WAITS FOR MARKDOWN)

EPIC DISTRIBUTION X BOOX2U — WHERE PLAY, CREATIVITY AND STORIES COME TOGETHER

News from The Toy Universe

Latest News and Updates from the Industry

2026 GALA DINNER - BOOK YOUR TICKETS NOW!

Prepare for an evening of glitz and glamour at the premier industry event of the year — the 2026 Gala Dinner, proudly sponsored by The Walt Disney Company and Diecast Distributors Australia/Oz Wheels. Presented by the ATA and hosted at the Crown Palladium, this gathering unites the entire industry, perfectly timed alongside the 2026 Australian Toy Hobby and Licensing Fair.

The event details are as follows:

Venue: Crown Palladium | Date: Sunday, 1st March

Time: 7pm - 12am | Dress: Glam Formal (strictly no denim or chinos)

Book your tickets now by clicking here!

PLASTIC IS FANTASTIC: A DYNAMIC NETWORKING EVENT IN THE TOY INDUSTRY IN HONG KONG

Hong Kong—At the heart of the toy industry, the networking event Plastic is Fantastic, hosted by entrepreneur Michael Rothling, brought together over 200 Italian and international distributors. Held at the Rosewood Hotel with stunning views of Hong Kong Harbor, attendees included leading companies such as Simba, Giocheria, Prenatal, Toys R Us, TK Maxx, Burago Maisto, and Bontempi.

Organized in partnership with Woman in Toys, Aweco, Melting Pot, and Knomocha, the event offered a valuable platform for networking, idea-sharing, and collaboration. It highlighted Hong Kong’s growing role as a strategic hub for the global toy market and the sector’s continued innovation.

The evening fostered meaningful connections and fresh perspectives, reinforcing opportunities in the ever-evolving global toy industry.

REGISTRATIONS ARE NOW OPEN

Don't miss the Australian Toy Hobby and Licensing Fair which will be held at the Melbourne Convention & Exhibition Centre this March!

We’re getting closer to the highly anticipated 2026 Toy, Hobby, and Licensing Fair, where the Melbourne Convention and Exhibition Centre will be transformed into a spectacular playground bursting with thousands of dazzling new toys, innovative gadgets, and exciting games!

This exclusive, trade-only event, taking place from Sunday, 1 March to Wednesday, 4 March, offers a one-ofa-kind opportunity to see, touch, and experience the latest and greatest products before they hit store shelves.

Don’t miss your chance to be part of this unforgettable experience!

Click here to register!

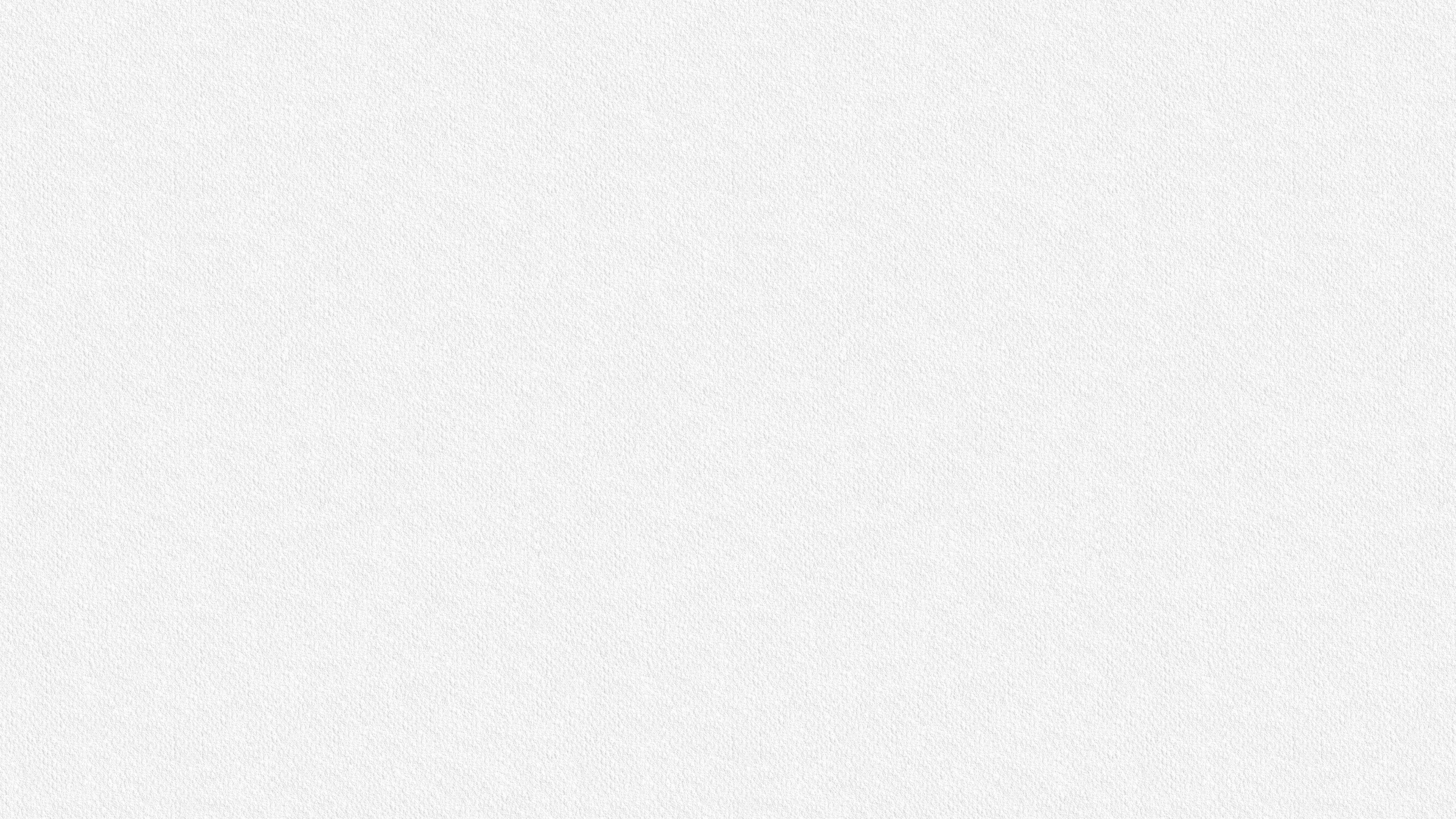

MJM Australia — A Family Legacy Rebuilt

Longevity in the Australian toy industry is rarely accidental. It is earned through resilience, reinvention, and an unwavering commitment to doing business the right way. MJM Australia stands as a powerful example of this ethos, with a family history in toys spanning more than six decades.

The story begins with the incorporation of Maurianne Trading in 1964 as a general importer in Australia. Built on entrepreneurial drive and strong customer relationships, the business evolved through the late 1960s and into the 1970s, with an increasing focus on games and puzzles, establishing its enduring connection to play.

Despite early success, the business was ultimately impacted by the challenging economic and industry conditions of the late 1980s and 1990s.

Under difficult circumstances, Maurianne Trading ceased operations — a moment that could have marked the end of the family’s involvement in the toy industry.

Instead, it became a turning point.

Refusing to step away, the family regrouped. Maurice, Marcel, and Jacques made the deliberate decision to start again, applying hard-earned lessons from the past to build a stronger and more focused enterprise. The result was MJM Australia — a business founded not just on optimism, but on experience.

Over the ensuing 30-plus years, MJM Australia steadily rebuilt its presence, carving out a clear leadership position in licensed games and puzzles. With a disciplined approach to brand partnerships, product selection, and execution, MJM differentiated itself in a category that demands both creativity and commercial rigour.

Today, MJM Australia is widely recognised as an industry leader in licensed games and puzzles, respected by licensors, retailers, and peers alike. The business has succeeded by staying true to its core strengths while adapting to a rapidly evolving marketplace.

Crucially, MJM remains a family business. Under the ongoing leadership of Jacques and Marcel, the company continues to balance tradition with modern business practices — a combination that has proven increasingly rare and increasingly valuable in the Australian toy sector.

With more than 60 years of family involvement in toys and over three decades of success under the MJM banner, this is not simply a story of survival. It is a story of reinvention, resilience, and sustained relevance — qualities that define the very best of the Australian toy industry.

MJM Australia - Family Timeline

A concise snapshot of the Maurianne family's journey through the Australian toy industry.

MAURICE AND VIVIANE LEVY, MJM'S FOUNDERS

MJM AUSTRALIA ARE A PROUDLY AUSTRALIAN OWNED FAMILY BUSINESS

Toy Fair Season Is Here!

By Alice Sanderson — Executive Manager at The Australian Toy Association

Happy New Year and a wonderful Year of the Horse to you all!

I hope the festive season brought success to your business, both in buying and selling, and that 2026 is off to a fantastic start. The toy fair season is now in full swing, kicking off with Hong Kong in early January, then moving on to London, Nuremberg, New York, and of course, our flagship event in Melbourne this March.

An unmissable opportunity to see the very best the industry has to offer!

The team is putting the final touches in place to ensure this year’s Fair is truly unmissable. For anyone in the business of toys, this is a must-attend event, bringing the industry together under one roof and offering the best opportunity to discover what’s new, what’s next, and what will shape the year ahead.

Registration is now open and mandatory for all attendees. You can find full details and access the booking form on our website here.

While you’re registering, don’t miss the chance to secure your Gala Dinner tickets. Already, around 500 guests are set to enjoy an evening of networking, mingling, and celebrating the stars of our industry. The Gala kicks off our Fair, and to close the event on a high note, we have our Women in Toys panel on Wednesday morning.

This highly anticipated session is now sold out, and it’s easy to see why! This year, four incredible women will share their inspiring stories. Hosted by the wonderful Anni Atkinson of Warner Bros. Discovery, we are thrilled to welcome Brea Brand, Danielle Lowe, Belinda Gruebner, and Kerryn McCormack to the panel.

For ATA members, Richard Hayman, our Compliance Manager, will be onsite to meet and discuss your safety and compliance matters. Spots are limited and tend to fill quickly, so if you’d like to secure some time with him, keep an eye on the ATA newsletters for updates.

We’re also excited to announce that we will be partnering with Backpacks 4 Vic Kids again. This wonderful Australian charity provides essential material aid to displaced children and their families. While onsite, there will be opportunities to support their work, both financially and through product donations.

Wishing everyone travelling abroad for the upcoming fairs a safe and successful journey! We can’t wait to welcome you back locally for our show, opening on Sunday, 1st March.

Get ready for an action-packed event showcasing the very best the industry has to offer!

Sanrio Characters: Life-Long Companions for Kids and Families

For decades, Sanrio characters have grown alongside generations of children, remaining relevant as tastes, trends, and lifestyles evolve. This enduring appeal has positioned them not only as lifestyle and cultural icons, but also as lifelong companions.

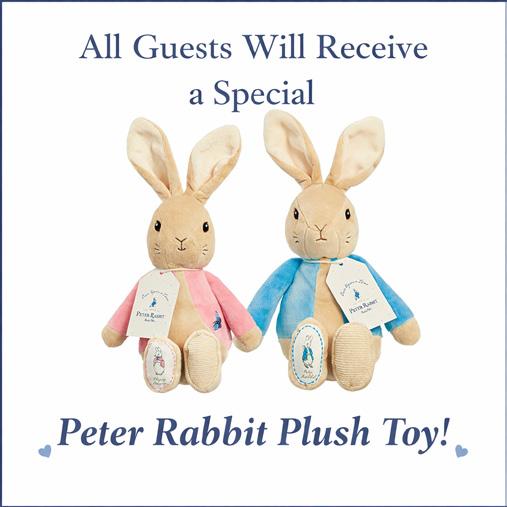

It comes as no surprise, then, that Hello Kitty, My Melody, Kuromi, and other Sanrio characters continue to drive strong retail performance, innovative toy ranges, and engaging experiences. From plush and dolls to fashion-led play and collectible items, Sanrio characters are designed to meet children—and fans of all ages—wherever they are, while leaving room to grow with them.

2025 proved to be a pivotal year for entertainment. In July, My Melody & Kuromi, a stop-motion series celebrating Kuromi’s 20th anniversary and My Melody’s 50th, debuted on Netflix. The series quickly entered the platform’s Top 10 in several countries and reached second place worldwide among non-Englishlanguage titles by viewership, underscoring the global appeal of Sanrio’s entertainment content.

The year was also marked by a major announcement. In November, Sanrio revealed that the highly anticipated Hello Kitty feature film, distributed globally by Warner Bros., is set for worldwide theatrical release on July 21, 2028. In the lead-up to the film, Sanrio is investing in a steady pipeline of entertainment content. This

strategy enables the brand to reach new markets more effectively, increase awareness, and support licensees with stronger, more relevant storytelling.

Conveying its characters’ core values is not something Sanrio leaves to entertainment content alone; the wide range of products launched across Australia and New Zealand demonstrates just how strongly the brand continues to grow.

In December 2025, Cotton On Kids showcased the strength of Hello Kitty and Friends in Australia with a high-impact front-window display. The activation went beyond product, featuring an in-store claw machine and a giveaway offering fans the chance to win a trip to Sanrio Puroland. The result reinforced the idea that Sanrio is not just something to wear or play with, but an experience to be shared.

That same sense of nostalgia and connection was central to the launch of the Frank Green Hello Kitty and Friends range, which successfully blended digital and physical retail. Released in early December, the collection featured coffee cups and water bottles starring Hello Kitty, Cinnamoroll, and Kuromi. Supported by a playful online quiz that helped fans find the bottle matching their vibe, the range quickly became a retail success.

Frank Green Hello Kitty and Friends Range

Cotton On Kids Store Window Display

Also in December, Sanrio marked another milestone with the opening of the first MEEQ Hello Kitty and Friends shop-in-shop in Sydney. Designed by Jasnor, the space offered superfans a fully immersive environment to explore the complete range. A limited-edition kangaroo plush was introduced to celebrate the opening, blending local storytelling with global character appeal.

This approach, creating compelling experiences where consumers can fully immerse themselves in the brand’s values, was clearly embodied also by the two Hello Kitty and Friends Café locations that opened in Australia in 2025.

The first café, located on the ground level of Melbourne Central, one of Australia’s key shopping and dining destinations, began welcoming guests in May. The second opened in October at Pacific Fair Shopping Centre on the Gold Coast. Designed

as immersive celebrations of the Sanrio universe, both venues feature multiple themed areas offering Japanese-inspired treats such as strawberry sandos and bento boxes, alongside coffee, pastries, and limited-edition merchandise developed in collaboration with local Australian designers.

The enormous popularity gained by the two venues mirrors the strong momentum achieved in 2025. Sanrio is set to carry this success into 2026, starting with toys and kids’ products that began reaching the market in December 2025. Kmart, a longstanding supporter of Hello Kitty, is expanding its toy offering with the launch of a new fashion doll range in January. The collection includes four collectible dolls inspired by Hello Kitty, Kuromi, My Melody, and Cinnamoroll, each featuring distinctive outfits and accessories designed to encourage imaginative play while tapping into the growing collectible doll segment.

A core strength of Sanrio’s portfolio lies in its ability to accompany fans through different life stages. In early 2026, Cotton On will introduce a new collaboration with Harvard, blending collegiate style with Hello Kitty charm across sportswear, pyjamas, and accessories. The range highlights how Sanrio characters can naturally evolve from early childhood into older kids’ and family-oriented lifestyles.

From plush toys and dolls to immersive retail activations and lifestyle collaborations, Sanrio characters continue to serve as trusted companions for children— offering comfort, creativity, and joy at every stage of growing up. Supported by a robust pipeline of toy launches and kid-focused partnerships throughout 2026, Sanrio once again demonstrates that when characters are built on emotion, storytelling, and timeless design, they do more than entertain—they evolve alongside the audiences who grow up with them.

For Licensing Information please contact: diana@havenglobal.com

Cinnamoroll Dining Room, Melbourne Central

Cotton On Harvard x Hello Kitty Collaboration

MEEQ Westfield Sydney Shop-in-Shop

MEEQ Exclusive Koala and Kangaroo Plush

Hello Kitty and Friends Merchandise Store Pacific Fair, Gold Coast

Toys Down Under — How a Shared LA Showroom

Helped Aussie Toy Brands Gain a Foothold in US Retail

Two years in, the Toys Down Under collective proves collaboration works, building momentum for Australian brands in the US.

After entering its second year at the LA Toy Preview last September, Toys Down Under has established itself as more than a shared showroom.

What began as a collaborative idea between Australian toy companies has evolved into a proven launchpad for brands entering the US market, built on community and the supportive spirit of the Australian toy industry.

Bringing together CONNETIX and My Creative Box under parent company Brave Toys, BMS Brands and Jellystone Designs, Toys Down Under offers buyers a destination to discover Australian innovation across construction, sensory and creative play, with 2026 set to introduce new innovation and space for two additional brands.

Can you share the Toys Down Under concept and how this came about?

Brea Brand, Brave Toys (CONNETIX / My Creative Box): “Toys Down Under really came from a practical starting point. CONNETIX had secured the El Segundo space, and we quickly realised there was an opportunity to make it something bigger by opening it up to other Australian brands.

There’s a genuine sense of connection and respect within the Australian toy industry, so inviting other brands in felt like a natural next step – not just sharing a space, but sharing ideas, energy and visibility as we took our next steps into the US market together.”

Alice, with years of experience supporting Australian toy brands, how did experiencing Toys Down Under in LA compare to what you’ve seen in the past?

Alice Sanderson, Australian Toy Association (Executive Manager): “We were proud to see our Australian members presenting at a standard equal to that of their international counterparts. The LA Fair has become a significant fixture on the Toy Fair calendar, and it was encouraging to see ATA members collaborating within a shared space that was professionally designed and presented to a very high standard. This collective presence clearly demonstrated the quality, innovation and commercial strength of Australian businesses in the global market.”

Toys Down Under brings together brands at different stages and across different categories. How does My Creative Box contribute to the collective?

Brea Brand, Brave Toys: “My Creative Box brings something genuinely different to Toys Down Under. While CONNETIX is known for construction and magnetic play, My Creative Box leans into creativity, hands-on activities and craft.

Since joining Brave Toys, the brand has continued to evolve, and being represented within Toys Down Under has supported its visibility in the US alongside Australian peers. It reinforces that Toys Down Under isn’t limited to one category – it’s about showcasing the breadth and quality of Australian play brands.”

After a second year at the LA Toy Preview, how has Toys Down Under supported your business growth? Has this changed since year one?

Josh Bonello, BMS Brands: “The shared presence, support and credibility have played a meaningful role in accelerating BMS Brands’ confidence establishing a US presence. Compared to year one, 2025 demonstrated a more strategic rhythm, with deeper retailer conversations and a clearer longterm vision for our brands in North America.”

Claire Behrmann, Jellystone Designs: “What's most valuable is the willingness everyone has to share their experiences from the challenges they’ve faced...and the lessons learned along the way. That level of generosity has helped extend our reach across the US in a way that wouldn’t have been possible on our own.

Beyond the commercial impact, Toys Down Under has created a beautiful, welcoming space – one that genuinely feels like a home away from home.”

2025 was a big year for CONNETIX, with new product launches and major growth in the US. How did that year feel for the brand?

Brea Brand, Brave Toys: “2025 was such an exciting year for us. We launched some very special new packs – Glitter Unicorn and Glitter Castle, Bright Portals, Light Star, and the CONNETIX PRO line for older builders. What I loved most was seeing how quickly our community embraced them.

Expanding into Target in the US was a huge milestone and one we’re incredibly proud of. That moment really reflected how far the brand has come, while still staying true to what we believe in: open-ended play that grows with the child.”

How did Toys Down Under support Good Idea Global’s early US growth, and does its move into a larger space create an opportunity for another Australian brand to join the collective?

James Hunter, Good Idea Global: “Being a part of Toys Down Under has been integral in our growth as a company…not just in the USA but all over the world. It is such a lovely group of people, and we are grateful to Brea and Dave [Brave Toys] for having us.”

Brea Brand, Brave Toys: “Absolutely. Good Idea Global’s growth is a wonderful success story. A brand outgrowing the space says a lot about how well the model works. With two showroom spaces now available, there’s a great opportunity for other Australian toy brands to step into an established, supportive presence in LA – one that’s already shown its value over multiple preview seasons.”

TOY FAIR EVENTS

Master the Art of Toys & The True Value of Brand

An Exclusive Morning of Insights at Toy Fair

Monday, March 2nd | 7:30am Arrival for Light Breakfast & Coffee

Clarendon Rooms A & B at Melbourne Convention and Exhibition Centre

Book your ticket for a morning of exclusive insights from industry leaders and earn the strategies behind the art of toys, retail and brand positioning!

Meet Our Guest Speakers

David Sprei

Commercial Director - Penguin Ventures

David leads licensing and consumer products and will open the session with insights into brand stewardship, licensing strategy, and creating enduring value.

Michael Roethling

VP - Dimian & Toyriffic-news editor

A seasoned visionary in the toy industry, Michael brings a dual perspective on Toys as a high-level executive and a leading industry journalist.

Nicole Szujda

GM - Value Chain at David Jones

With extensive experience at one of Australia's premier luxury retailers, Nicole ofiers unparalleled insight into the retail value chain and brand.

Arrival & Breakfast - 7:30am

Light breakfast served + tea and coffee

Session Commences — 8:00am

The Art of Toys & The Ture Value of Brand

Event Concludes — 8:55am

Attendees return to Toy Fair by 9am

Creative and Hands-on

Screen-free and Collaborative

No screens or interruptions, creating space for thinking and understanding. Open-ended activities that foster imagination and self-expression.

Made to Last

Quality toys designed for lasting appeal and continued play.

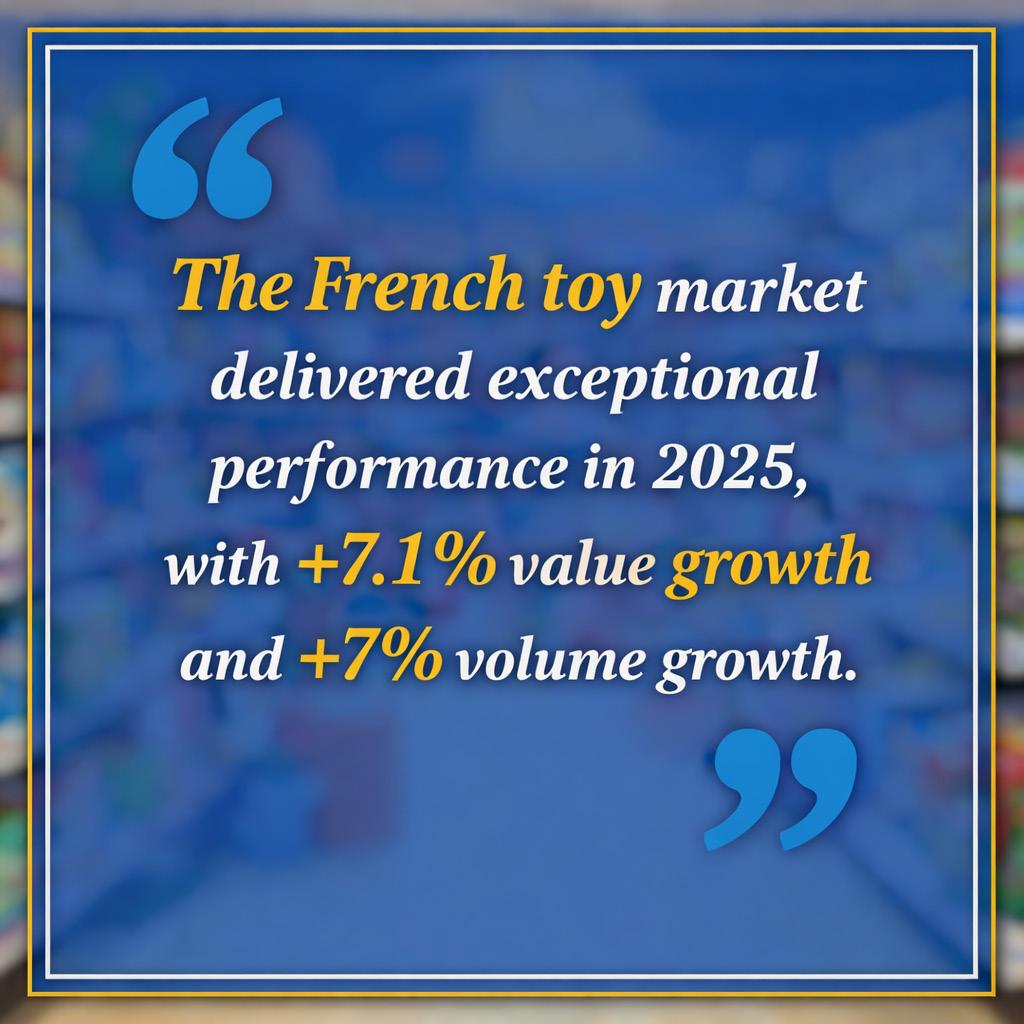

French Toy Market

2025 Key Results & Outlook

The French Toy Market Delivers a RecordBreaking Year in 2025

The French toy market delivered an exceptional performance in 2025, recording +7.1% value growth and +7% volume growth. This represents the best year in the last 25 years and marks a clear return to growth after three consecutive years of decline. Momentum was particularly strong in the first nine months of the year, with permanent sales up +9%, while Q4 maintained solid performance at +5.5%. December alone posted +4.5% growth, confirming a strong Christmas season.

As a result, the market reached a total value of €4.7 billion, positioning France among the leading toy markets in Europe, alongside Germany and the UK.

Stable Pricing Amid Easing Inflation

Despite the strong market performance, pricing remained stable. The average toy price held steady at €18 year-on-year, while the average Christmas price reached €21. Spending per child increased by +2%, demonstrating resilient consumer demand despite ongoing demographic pressure.

This performance was supported by easing inflationary conditions. Inflation slowed to +1% in 2025, down from +2% in 2024 and +4% in 2023, helping to stabilise household purchasing behaviour.

Demographic Pressure Continues

Demographic trends remain a structural challenge for the market. The number of births declined again by -2.1% in 2025, reaching 645,000 births — the lowest level since World War II. Over the past 15 years, this represents a reduction of 180,000 births, reinforcing the strategic importance of value-driven propositions and older-age segments for future growth.

Growth Driven by Innovation, Collectibles and Kidult Appeal

Market growth was driven by a strong mix of innovation, collectibles, and kidult-oriented products. Building toys recorded +35% growth, while trading cards — led by Pokémon — surged by +78%. Plush toys grew by +11%, and audio storytellers delivered particularly strong momentum with +63% growth.

The kidult segment (12+) continued to be a major growth engine, posting +16% growth in 2025. This segment now represents 33% of global toy sales, underlining its central role in reshaping the market.

Retail Performance and Channel Shifts

December’s top-performing product was SKYJO, which ranked as the #1 selling toy in value during the peak holiday period.

In retail, specialist players continued to outperform. Smyths Toys expanded its footprint with five new store openings, bringing its total to 49 stores in France. JouéClub achieved +7% growth, while La Grande Récré recorded +11% growth and now operates 110 stores, including 69 owned locations and 41 franchises. In addition, 15 stores were acquired by JouéClub members, with a further 25 acquisitions planned for 2026. King Jouet also delivered a strong performance, posting +9% growth in 2025.

Channel dynamics continued to evolve. Hypermarkets and supermarkets saw toy sales decline by -1%, as toys are no longer a strategic priority amid strong price pressure focused on food categories. E.Leclerc remains the leading hypermarket toy retailer, accounting for 33% of hypermarket toy sales. By contrast, specialist retailers now represent 42% of the total market and grew by +11%, driven largely by kidult-focused assortments. Online sales also remained dynamic, with +8% growth.

Licensed Products and Key Trends

Licensed toys enjoyed another strong year, boosted by major movie releases. Licensed products now account for 30% of global toy sales and recorded +19% growth in 2025. Pokémon led the category, with sales doubling, followed by Lilo & Stitch and Formula 1. Several key trends continued to shape the market. “Made in France” products represented 16% of total sales, showing slight growth and benefiting from stronger visibility through trade fairs, media, and Christmas catalogues. The second-hand market reached 40 million units sold, accounting for approximately 7% of total market volume. Collectibles such as cards and figurines grew by +45% and now represent 13% of total sales, driven in part by strong influence from Asian content, particularly from China, Korea, and Japan.

Regulatory Challenges and Outlook for 2026

Despite the positive momentum, regulatory and safety concerns remain significant. In 2025, 86% of toys sold by some foreign online platforms were found to be unsafe and noncompliant with EU Toy Safety regulations, highlighting an urgent need for stronger regulatory and enforcement measures.

Looking ahead, the outlook for 2026 is positive and promising. The year will mark the 30th anniversary of Pokémon, reinforcing its position as the world’s leading toy license. LEGO is set to introduce both the Pokémon license and new Smart Play System bricks, while the FIFA World Cup 2026 is expected to boost demand for sports-related toys. Supported by strong licenses, ongoing innovation, and sustained kidult demand, the French toy market enters 2026 with solid fundamentals and renewed confidence.

YANN FRESNEL, FRENCH TOY INDUSTRY EXECUTIVE

New Look for Lundby for 2026

Two New Wooden Dollhouses to Launch in September

Lundby, one of Scandinavia’s oldest and most beloved dollhouse brands, proudly announces the launch of two new wooden dollhouses for September 2026.

Star, a stylish reinterpretation of Lundby’s classic two-storey dollhouse, and Wonder, an expansive three-storey model, to elevate imaginative play with generous space for larger doll families.

Setting a new standard, Lundby blends Scandinavian design, solid wood frames, handdrawn wallpapers, and thoughtful details that spark creativity—each inspired by environments children recognise and love.

“We wanted to enhance the quality and lifelike attention to detail that has always made the brand so beloved, while also creating a more inspiring doll world,” says Anne Arvgrim, Design Manager at Lundby.

“The new product names evoke a magical miniature universe, filled with surprises and sparkling light. Rooted in Lundby’s tradition, the houses feel instantly familiar yet are refreshed with contemporary detailing reminiscent of real, stylish homes.

“Its innovation sprung from heritage – dollhouses designed to blend naturally into modern homes and interiors. But the heart of everything we do remains the same: play and imagination coming to life.”

A World of Magical Surprises

Lundby also introduces an exciting miniverse—a collection of small accessories sold as cardboard bonbon blind packs, each containing “sweet surprises,” from food and drinks to everyday gadgets that enrich life inside the dollhouse. Towards the end of 2026, Lundby will launch a Christmas calendar, offering a festive countdown filled with miniature surprises for the dollhouse world.

“This extended attention to detail makes playtime even more adventurous, engaging, and fun.”

Refinishing the Lundby Brand

Now a standalone brand within the Swedish toy house Micki, Lundby is taking the next step in a legacy built on quality and play since 1947. As part of an ambitious brand refinement and European expansion, Lundby is introducing a premium theme across its range. From product design to packaging and in-store exposure, everything has been thoughtfully updated for a modern, fresh take that remains true to Lundby’s heart.

Founded in nearly 80 years of Swedish design heritage, Lundby continues to be the dollhouse that grows with the child— now reimagined for a new generation and a global audience.

“By refreshing everything from displays to the products themselves, we strengthen our positioning and prepare to take our iconic dollhouses further into the world, finding new markets and audiences,” concludes Micki CEO Christian Nilsson.

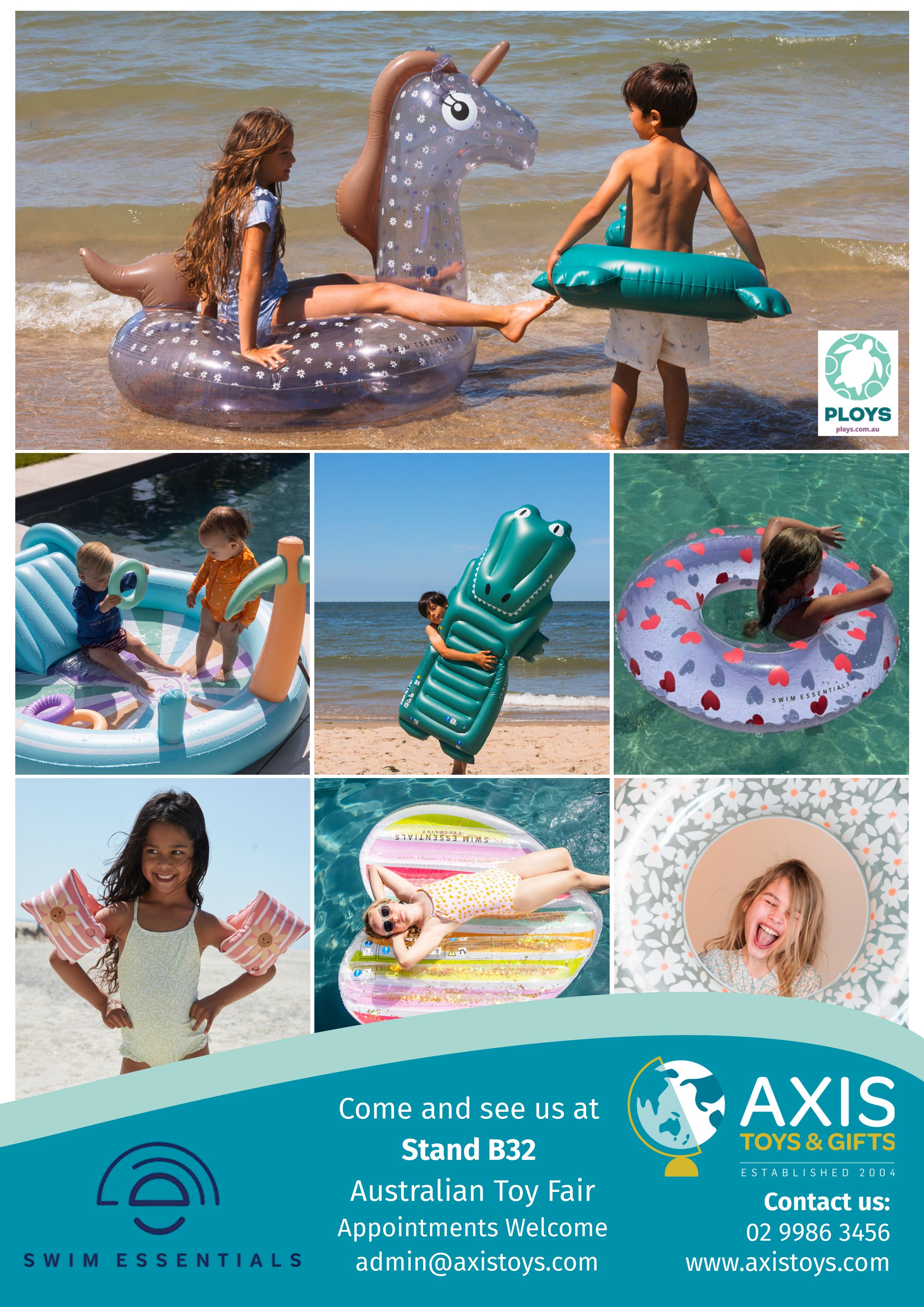

www.axistoys.com.au

Stories from GG's Toy Box

Where’s Wally? You’re Looking at Him...

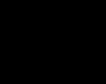

In 2011 Stella Projects was the licensing agent for Where’s Wally in Australia & New Zealand.

The Stella Projects team at that time was Claire O’Connor, Head of Marketing & Promotions, Lou Elkington, Head of Licensing, Anna Dupree, Business Manager and myself.

Claire had closed some amazing promotional deals and Lou had brought on board a core group of quality consumer product licensees, whilst Anna and I managed the day to day running of the business.

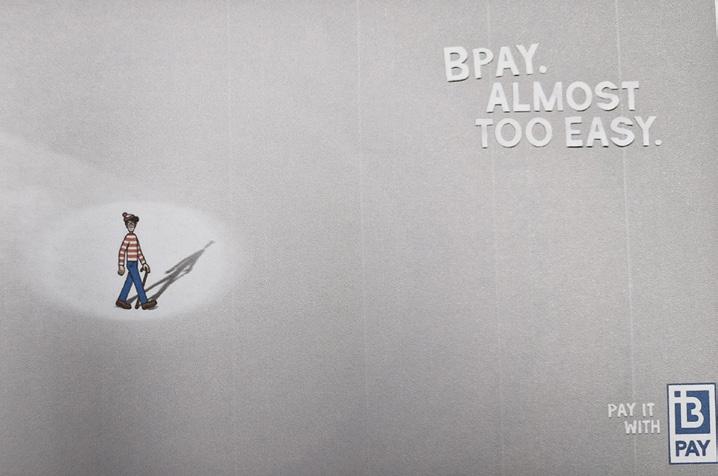

At that time, there was a national outdoor Where’s Wally B-Pay campaign running that won a number of Australian & global advertising awards, a 12 month dedicated Where’s Wally location based experience at Sydney Aquarium, a Red Rooster fast food promotion, a Telecom NZ mobile phone promotion and even a promotion to find Wally on Bondi Beach, that was covered by commercial TV and radio media across Australia.

At retail, Jay Jays was running a national window campaign in all their stores for the Playcorp t-shirt range.

Armed with a presentation deck with all of this Where’s Wally success, I went to my meeting at the Brand Licensing Show in London with the new Head of Global Licensing at Classic Media confident of being congratulated on the wonderful job the team had been doing with the Where’s Wally property Down Under.

hammer blow was delivered moments later by Classic Media’s New York based global queen of licensing.

Ha! Wrong!

The London based Where’s Wally brand manager started the meeting off by asking why certain Playcorp products had been released before final sign off had been given, with the unforgettable line “just because artwork is in the style guide doesn't mean the artwork is approved.”

At this point, my stomach began to turn as I realised I was facing a firing squad, not a cheer squad, and sure enough the

“Grahame, we are terminating your agreement”.

I pushed forward the beautiful presentation document that Anna had prepared, stuttering “but have you seen...”

“You’re not going to be foolish enough to fight this, are you Grahame?”

“No I’m not actually”.

Where’s Wally? Wonder no more, I’m Wally and I’d just been fired.

STORIES FROM GG'S TOY BOX BY GRAHAME GRASSBY

Mizzie The Kangaroo

Mizzie Teams Up with Australian Open this Summer

The Australian Open has teamed up with Aussie early childhood learning company

Mizzie The Kangaroo to launch a new limited-edition range of educational toys designed to instill a love of sport in the next generation of budding stars.

Available from today until the end of February, the collaboration combines the playful world of Mizzie and the energy and values of the much-loved grand slam, with five new items that gently teach babies and toddlers about the passion, resilience and joy of tennis.

Children can join Mizzie The Kangaroo on a day of discovery at the Australian Open in a special sound book, where she gets to experience the magic of stepping onto the famous blue court and feel the atmosphere of the cheering crowd.

A matching puzzle brings Melbourne Park to life as she hops her way through the precinct, while also encouraging problem-solving and storytelling.

For bathtime, a colour-revealing book and foam stickies promote sensory exploration, creativity and fine motor development, while the Little Ace match set pairs Mizzie The Kangaroo’s award-winning natural teething toy with the two new water-friendly items. Mizzie The Kangaroo founder Sandra Ebbott says sport plays a crucial role in the development of young minds.

“Teamwork, confidence and resilience are important for all areas of life, and they’re skills that are learned best through sport,” she says.

“This collaboration invites families and tennis fans alike to instill these values in our youngest learners, while also creating excitement around sporting activities.”

Mrs Ebbott, who started the award-winning business in 2015 but then had to rebuild in 2022 after the Brisbane floods destroyed more than 12,000 pieces of stock, says working with the Australian Open to develop the limitededition toy range is the realisation of many years of work.

“Our aim has always been to make learning through play meaningful, sustainable and accessible,” she says.

“Having Mizzie step onto the global stage of the Australian Open shows how it can connect families everywhere, from Melbourne Park to living rooms around the world.”

The limited-edition Mizzie The Kangaroo and Australian Open toys are available online now and will be available for purchase at the grand slam in Melbourne in January!

www.mizziethekangaroo.com www.australianopen.com.au

Hong Kong's Next Chapter

Reinventing the Toy Industry Hub

A HONGKONGER'S PERSPECTIVE ON INDUSTRY TRANSFORMATION

After more than 20 years living in Hong Kong, I consider myself a Hongkonger. This city moves at a completely different speed—the energy, the noise, the relentless work rhythm. Hong Kong trains you to move quicker, think on your feet, and push yourself harder. The city's unstoppable energy rewards effort, adaptability, and resilience.

For decades, this same spirit animated Mody Road in Tsim Sha Tsui East, which pulsed as the global toy industry's heartbeat. Office buildings—Houston and Peninsula Centres, New Mandarin Plaza, Tsim Sha Tsui Centre, Chinachem Golden Plaza, East Ocean Centre— housed showrooms for hundreds of toy companies, from multinational giants to small and medium-sized enterprises. Twice yearly, worldwide buyers descended to preview new products and negotiate deals.

THE PRE-COVID GLORY YEARS (2019 PEAK)

At its height, Hong Kong hosted approximately 400–500 toy company offices, including 200+ global brands and 100+ local manufacturers showcasing products during peak seasons.

The Royal Garden, Regal Hotels, and InterContinental Grand Stanford overflowed with the worldwide toy community. You couldn't walk through a lobby without encountering someone in the trade. Restaurants teemed with dealmakers, logistics hummed efficiently, and the walkable proximity between showrooms made dealclosing seamless and affordable. Hong Kong defined toy commerce itself.

"Hong Kong defined toy commerce itself."

THE COVID INFLECTION POINT (2020 ONWARDS)

Then came 2020. COVID-19 lockdowns shattered this model. Major players— anchored by Mattel's El Segundo headquarters—pivoted buyer previews to April and September in Los Angeles. By 2025, 200+ companies were showcasing products during Spring and Fall Preview events, drawing worldwide buyers to Los Angeles.

The geographic shift was swift: North American retailers are headquartered in the United States. Los Angeles offered concentrated showrooms, major brand headquarters, and synchronized preview schedules. Major brands closed Hong Kong showrooms and consolidated operations on the West Coast.

THE UNFINISHED STORY: ASIA'S TRENDS BOOM

Yet nostalgia masks opportunity. Trends increasingly originate from Asia. The AsiaPacific collectibles and blind-box boom is accelerating, driven by "kidults"—adults now accounting for 28–34% of all toy sales globally.

Pop Mart and Miniso's TopToy maintain regional headquarters in Hong Kong. The Chinese collectible toy maker 52Toys is pursuing a Hong Kong IPO. Walk through Hong Kong's retail landscape—Pop Mart at K11, Toys"R"Us experience centers, Kayou flagship stores, trading card shops, IN's Point, Mong Kok toy buildings, Tai Yuen Street—and you glimpse how trends are evolving. This is where the market's future is being shaped.

Everyone in the industry admits they miss Hong Kong's vibe—cheaper hotels, effortless showroom hopping, walkable geography. The emotional pull is genuine. But economics demand reinvention. Hong Kong is specializing where it excels: Asia-Pacific collectibles, design innovation, and supply chain orchestration.

HONG KONG'S STRATEGIC REPOSITIONING

The Hong Kong Toys & Games Fair (January 12–15, 2026) signals this pivot smartly. The "Kidult World" zone, the Asian Toys & Games Forum, and Click2Match digital tools indicate clear repositioning toward collectors, investors, and Asian-focused brands.

Hong Kong is emerging as Asia's design vanguard. The Design Centre's "Play, Pose & Pixel" exhibition fuses fashion-tech with digital collectibles—AR-enabled figures, blockchain authenticity, and NFT integration. Recent 2025 policies boosting AI development and IP safeguards provide ideal infrastructure for next-generation toys blending physical play with digital ownership.

Manufacturing coordination is another strength. Shenzhen's factories lie 30 minutes away; Vietnam and Thailand's toy sectors

need experienced coordinators. Hong Kong's English-fluent workforce, established logistics expertise, and business infrastructure position it perfectly to orchestrate diversified supply chains for brands navigating nearshoring strategies.

THE COMPLEMENTARY MARKET STRATEGY

Hong Kong's pre-2020 wholesale role has shifted to Los Angeles. Los Angeles handles centralized North American wholesale meetings, with major companies maintaining permanent headquarters there. Industry convergence in El Segundo is structural and durable.

But Hong Kong and Greater China own Asian collectors, digital innovation, manufacturing speed, and supply chain synergies. Creators, kidults, and distributors visit Hong Kong for culture, emerging trends, and cutting-edge play.

After Hong Kong comes the logical second step: factory runs through Greater China. Shantou's Chenghai District maintains permanent showrooms year-round, showcasing aggregated factories with 400,000+ toy varieties and experienced staff facilitating samples, quotes, and direct factory tours.

To sense emerging toy trends early, visit Hong Kong. To source manufacturing and coordinate supply chains, work with Hong Kong operators while executing production in South China. To understand where adult collectibles, digital integration, and Asian market dynamics are heading—you need Hong Kong.

That's the next chapter.

Francisco can be reached on LinkedIn or at francisco@toyspulse.com

Opinion Piece: Value Perception

If Value Isn't Instant, It Waits for Markdown

Let's start with an uncomfortable truth. The first thing a store buyer does when you present a product is pull out their phone and check Amazon. If the online price undercuts what they need to sell it for in their store, your pitch is over before it begins. Pricing discipline across all channels isn't some nice-to-have strategy point. It's survival.

This matters because toys are judged ruthlessly on revenue per space used. Retailers can't afford slow-moving stock tying up valuable floor space that could generate better returns. Products that don't meet sell-through targets get marked down within 8-12 weeks, creating a vicious cycle of eroded brand perception that's nearly impossible to reverse. Once a product hits the markdown table, it's done. The brand damage extends beyond that single SKU.

The challenge is that you've got roughly 3-5 seconds at shelf to communicate your value proposition before a buyer moves on to the next option. If packaging, price point and play pattern don't align immediately in the customer's mind, the product becomes invisible regardless of its actual quality. This isn't about having a good product. It's about having a product that telegraphs its value instantly, to both trade buyers and end consumers.

Strong brands and licences shortcut this entire assessment process. Buyers trust established names and proven IP because they know consumers recognise them instantly. Unknown brands without licence partnerships face scepticism at every level and need twice the evidence to justify shelf space. This isn't fair,

but it's reality. A mediocre product with a solid licence will outperform a brilliant product with no brand recognition, every single time.

Price anchoring plays a massive role in how value gets perceived. Psychological pricing thresholds vary by market, but crossing into the next price band without clear justification puts products straight into the markdown queue. Parents make instant mental calculations about what a toy should cost based on size, features and comparable products. Get it wrong by even a few pounds or dollars, and you've lost the sale.

Parents increasingly research purchases online before visiting stores, which means value perception now happens in two stages. A product might pass the digital test but fail at physical retail if the in-hand experience doesn't match expectations, creating returns and negative reviews that kill future sales. Showrooming remains a constant threat, where customers examine products in-store but purchase online for better prices, undermining brick-and-mortar retailers who invested in the display space.

Collectability and extendibility create perceived value beyond the initial purchase. Single SKU products face much harder value justification than items that belong to a broader range, theme or ecosystem that children want to complete or expand. This is why blind bags, trading cards and figure series continue to dominate. They promise ongoing engagement and create natural upsell opportunities that standalone products can't match.

Educational claims need to be instantly credible and backed by visual cues on packaging. Vague promises about "STEM learning" mean nothing if the mechanism isn't obvious, whereas a visible coding interface or engineering component telegraphs value immediately. Parents are savvy. They see through marketing waffle. If you claim educational benefits, you need to prove them at a glance.

The rise of value retailers globally has fundamentally shifted expectations across entire toy markets. Products need to justify why they cost more than budget alternatives, and "better quality" alone doesn't cut it without tangible proof points that parents and children can see and understand. This race to the bottom has squeezed mid-tier products hardest. You're either premium with clear differentiation, or you're competing on price.

Digital integration can enhance value perception but also creates new pitfalls. Apps and connectivity promise extended play value, but if the tech feels gimmicky or requires ongoing subscriptions, perceived value collapses and products end up discounted to clear space. The graveyard of app-connected toys that seemed revolutionary at Toy Fair is extensive and expensive.

Seasonal timing amplifies all these value perception issues. Toys arriving too early get overlooked, whilst late arrivals face immediate markdown pressure as retailers prioritise fast turnover during peak selling windows. Q1 arrivals in particular often go straight to clearance unless they're evergreen products with consistent demand. Getting timing right is as important as getting the product right.

The uncomfortable conclusion is this: value perception isn't about what your product actually delivers. It's about what it communicates in the first five seconds, what it costs compared to alternatives, and whether the entire channel supports the price positioning you're trying to establish. Get any part of that equation wrong, and you're not building a brand. You're filling markdown bins.

Epic Distribution x Boox2U

Where Play, Creativity and Stories Come Together

What began as a dedicated book, puzzle, and craft distribution business has undergone a transformative evolution. While these core product categories remain central to our identity, Boox2U has strategically expanded its portfolio to become a comprehensive and well-rounded supply solution for modern retailers.

STRATEGIC GROWTH AND BRAND EXPANSION

Over the past 24 months, Boox2U has significantly enhanced its offerings and market presence, demonstrating a commitment to dynamic growth and innovation:

• New Brand Launches: Successfully introducing exciting new lines, including Budeez.

• Key Brand Expansion: Deepening our commitment to high-demand existing brands such as iM.Master, KOCO, Picasso Tiles, Cubic Fun, Scrunchems, and Mystery Ballerz.

• Exclusive Licensing Success: Securing a landmark license deal with Holden, alongside releasing specialist products like the W-Class Tram and the comprehensive National Geographic range

• by Cubic Fun.

• Industry Presence: Showcasing our expanding portfolio at major industry events, including the Toy Fair, Gift Fair, Sydney Mid Year, and New Zealand Toy Fair.

THE EPIC DISTRIBUTION COMMITMENT

Our company’s long-standing philosophy has always been clear: We range Great Products at Great Prices and provide Exceptional Service

Although Boox2U has been operating successfully for over a decade, the past two years have marked an exciting new chapter. This includes the establishment of our own direct import program and, since September 2023, representing major brands across Australia and New Zealand (ANZ). This pivotal transition is driving our current evolution from Boox2U to the new identity, Epic Distribution.

We aspire to be recognized as a truly customer-focused distributor—a partner that is flexible and nimble enough to cater to the unique needs of our entire customer base, from the single-store operator to the largest national chain. We are committed to being involved and supporting your business every step of the way.

www.boox2u.com

The Toy Association

Toy Fair® New York Expands Its Role as a Global Industry Platform

As the global toy industry continues to recalibrate supply chains, retail strategies, and international partnerships, Toy Fair® New York is positioning itself as more than a traditional buying event. Entering its 120th year, the show is increasingly framed as a brand platform designed to reflect how the industry does business today with experience, responsibility, and shared purpose at its core.

One of the more visible examples of this evolution will debut at Toy Fair 2026 (14–17 February) with the introduction of the Toy Fair Store, a limited-edition retail pop-up located on the show floor.

Situated on the third level at Booth 3156 near the Toy PLAYce Lounge, the Toy Fair Store adds a new experiential element to the event, offering attendees a tangible way to engage

with the Toy Fair brand while supporting a broader social mission. One hundred percent of proceeds from the store will benefit The Toy Foundation, the philanthropic arm of The Toy Association, which delivers toys and play opportunities to children in need worldwide.

“This initiative reflects how Toy Fair is thinking more intentionally about how people experience the show,” said Kimberly Carcone, executive vice president of global experiences at The Toy Association. “As we mark 120 years, we’re focused on creating meaningful touchpoints that connect today’s industry with Toy Fair’s long-standing values.”

For Australian manufacturers, distributors, and licensors, Toy Fair New York continues to serve as a critical gateway to the North American market. The show offers direct

access to U.S. retailers, global buyers, licensing partners, and international media in a single environment, and the new Toy Fair Store complements that role by reinforcing the show’s identity as both a commercial and cultural meeting point for the industry.

The store will feature a curated range of Toy Fair-branded apparel and accessories, along with exclusive philanthropic items produced specifically for the event. This includes Toy Fair-branded beanies, caps, T-shirts, tumblers, notepads, and stickers, as well as special Toy Foundation editions of Crazy Aaron’s Thinking Putty and a first-ever Toy Fair collectible postcard series created exclusively for 2026. These limited-quantity products are designed to function as commemorative keepsakes while also supporting a charitable cause. Once sold out, items will not be restocked.

“By integrating philanthropy directly into the show floor experience, the Toy Fair Store makes giving back a visible and shared part of the event,” said Pamela Mastrota, executive director of The Toy Foundation, the philanthropic arm of The Toy Association. “Every purchase helps extend the impact of play well beyond the exhibition.”

Toy Fair® will take place February 14 to 17, 2026 at the Javits Center in New York City. Attendee registration is now open. Limited space is available to secure an exhibit space. Visit ToyFairNY.com to learn more.