The property sector in South Africa is changing faster than ever before.

Shaped by economic pressures, shifting tenant demands, sustainability imperatives and the rise of new technologies, the industry is being forced to innovate, adapt and reimagine how spaces are designed, nanced and managed.

In this issue, we raise the curtain on the next era of property development, investment and management – an era de ned by agility, collaboration and forward-thinking leadership.

We open with smart facilities on page 4, exploring how arti cial intelligence, the internet of things and predictive maintenance are streamlining building management.

As e-commerce continues to surge, The logistics real estate boom on page 5 unpacks how online retail growth is driving unprecedented demand for warehousing and distribution facilities – and what this means for investors and developers.

On page 6, Raising the bar in property management: skills for a new era looks at why education and continuous learning have become essential for property professionals. From tenant relations to digital asset tracking, the skills gap is widening – and training institutions, alongside industry leaders, are stepping up to bridge it.

Sustainability takes centre stage with Green assets, healthy returns on page 10, revealing how energy ef ciency, water recycling and waste optimisation are cutting costs and creating healthier, more desirable workspaces.

Investors will nd valuable insights in our nance, insurance and legal features on pages 12 and 13, unpacking funding trends, risk strategies and compliance essentials for the modern property portfolio.

For those with a global mindset, Beyond borders on page 15 examines offshore investment opportunities, highlighting emerging hotspots and practical guidance for navigating international markets.

We also explore the evolution of commercial spaces on pages 18, 20 and 22 – from hybrid of ces and adaptive reuse of vacant buildings to medical of ce developments and booming student housing. These trends are reshaping how and where South Africans work, heal and learn.

Reinventing the storefront on page 24 examines how brick-and-mortar retail is reinventing itself as an immersive, experience-driven proposition.

Finally, our residential property section starting on page 28 tackles everything from co-living and co-investing to mixed-use developments that are rede ning urban living. We also unpack residential market trends, offer practical guides for rst-time buyers and explore global property ownership opportunities for South Africans looking abroad.

From skills development to sustainability, legal insights to lifestyle shifts, this issue brings together the stories, strategies and success models shaping South Africa’s property sector in 2025 – and beyond.

Raina Julies

PUBLISHED BY

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Siya Jele, Itumeleng Mogaki, Thando Pato, Brendon Petersen, Vanessa Rogers, Anthony Sharpe, Grant Smee

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Design: Mfundo Archie Ndzo

Cover Image: Architectural render by Boogertman + Partners

SALES

Project Manager: Merryl Klein merrylk@picasso.co.za | +27 21 469 2446

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Fatima Dramat

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

Online Editor: Stacey Visser vissers@businessmediamags.co.za

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso Headline.

No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Property is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

“A Belief Economy has emerged as the Attention Economy fades. The new consumer language centres on meaningful values, sincerity and trust. The new consumer currency is emotional, human and community connection. Consumers now want something real.”

Belinda Clur – Founder & Managing Director, Clur International

Clur ConnectTM is a video series profiling South African retail property, its economic and community contribution and international leadership. The second edition features inspiring industry leaders discussing the Belief Economy.

Itumeleng Mothibeli Managing Director Southern Africa Vukile Property Fund President South African Property Owners Association (SAPOA)

Lindi Van Der Merwe National Leasing Manager Mowana Properties

Jason McCormick Chief Executive Officer Exemplar REITail

Amelia Beattie Head of Business Efficiencies, Property & Sustainable Impact Insurance and Asset Management Standard Bank Group

Vuso Majija Executive Director & Head of Retail Fortress Real Estate Investments Limited Director South African Council of Shopping Centres

Malose Kekana Group Chief Executive Officer Pareto Limited

Belinda Clur Founder & Managing Director Clur International

Clur ConnectTM is part of the Clur CollectiveTM Drive shopping centre results with the ultimate battle tools for profitability by plugging into the Clur CollectiveTM, South Africa’s leading independent early-warning performance, strategy, analysis & benchmarking platform built exclusively for shopping centres.

With extensive coverage of 5.4 million+ sqm across 130+ centres and 140+ merchandising categories in South Africa and Namibia, The Clur CollectiveTM is the endorsed industry standard and economic indicator trusted by decision makers for over a decade. It is a powerful global product built to speak retail fluently anywhere.

Clur InternationalTM is a widely recognised asset management support house with a partnership approach, which produces the Clur Shopping Centre IndexTM.

The future of building management looks nothing like the past, writes BRENDON PETERSEN

The days of waiting for equipment to fail before xing it are rapidly becoming a relic of the past. Across South Africa, facilities managers are embracing a technological revolution that transforms maintenance from a reactive cost centre into a predictive value driver.

Traditional maintenance approaches have long been characterised by inef ciency. Equipment runs until it fails, energy is wasted and compliance becomes a manual scramble. The smart facilities revolution is changing this paradigm entirely.

By embedding internet of things (IoT) sensors across critical building systems and applying arti cial intelligence (AI) algorithms to analyse data streams, facilities can now predict maintenance needs weeks before failure occurs.

Current pilots demonstrate measurable electricity savings alongside extended asset lifespans. Entire oors automatically power down when vacant, while ventilation systems adjust dynamically to CO2 levels.

South Africa’s evolving regulatory landscape presents both challenges and opportunities. As environmental standards tighten and the country aligns with global environmental, social and governance frameworks, demonstrating compliance has traditionally burdened facilities teams. Smart facilities solutions transform this burden into an automated advantage. Connected sensors continuously monitor air quality, energy consumption and occupancy levels, generating real-time dashboards and auditable records.

Conrad Steyn, leader of country digital acceleration at Cisco, explains: “By embedding IoT sensors across heating, ventilation and air conditioning, lighting and other critical assets and applying AI to detect anomalies early, we help organisations move from reactive to predictive maintenance.”

“This shifts compliance from being a manual, after-the-fact process to something embedded in daily operations,” notes Steyn. “Live data and automated records give organisations both operational ef ciency and regulatory con dence.”

The promise of smart facilities comes with cybersecurity concerns. Every connected device represents a potential entry point for threats, creating a dilemma between technological advancement and security. Leading providers address this challenge by applying enterprise-grade security frameworks directly to building systems. The approach centres on three principles: zero-trust access, network segmentation and continuous monitoring.

“For facilities managers, this approach makes the technology usable,” explains Steyn. “They can take advantage of IoT data for predictive maintenance, energy ef ciency and occupant safety, knowing that the digital layer is protected to the same standard as the rest of the business.”

Edge computing represents the most signi cant development in smart facilities technology. Processing data locally within buildings offers particular advantages in South Africa, where connectivity can be unpredictable and power supply challenges persist.

Edge computing enables buildings to respond instantly to changing conditions. Climate control adjusts immediately, maintenance alerts trigger when anomalies are detected and power consumption optimises in real-time – all without depending on external connectivity.

“AI at the edge allows facilities to optimise energy use in real-time, switching off what is not needed and keeping critical systems running,” Steyn observes. “Over time, this will lead to buildings that operate more like adaptive systems, constantly balancing comfort, ef ciency and resilience.”

Smart facilities represent a fundamental shift towards buildings that learn, adapt and optimise continuously. Rather than static structures consuming resources, the next generation functions as dynamic systems responding intelligently to environmental conditions and business needs.

This transformation is particularly relevant for South African businesses facing pressure to improve sustainability metrics while managing rising operational costs. Smart facilities technology offers a path to achieve both goals simultaneously.

As South Africa’s regulatory environment evolves and sustainability becomes increasingly critical to business success, smart facilities technology offers more than operational ef ciency – it provides a competitive advantage. The buildings of tomorrow are being built today, and they are smarter, more ef cient, and more resilient than ever before.

Follow: Conrad Steyn www.linkedin.com/in/conrad-steyn-96129740

The South African logistics real estate market is experiencing unprecedented transformation, driven by a con uence of technological innovation, evolving consumer behaviour and sophisticated supply chain optimisation strategies. As e-commerce adoption accelerates nationwide, warehousing and distribution facilities have emerged as modern commerce’s critical infrastructure backbone.

This boom’s foundation lies in South Africa’s rapid e-commerce adoption. Consumer behaviour has shifted decisively towards online shopping, creating ripple effects throughout supply chains extending beyond traditional retail models. This digital disruption has fundamentally altered how goods move from manufacturers to consumers.

Johann Nell, head of development and industrial asset management at Rede ne, observes that “markets can be disrupted overnight”, highlighting this transformation’s volatile nature. The pandemic accelerated existing trends, pushing consumers and businesses to embrace digital platforms at an unprecedented pace.

Technological innovation has become the driving force behind modern warehouse requirements. Express logistics operators are implementing automated systems that dramatically improve productivity while reducing operational errors. This evolution in parcel handling and warehouse management systems is reshaping facility design.

Older warehousing facilities face signi cant challenges. Many are constrained by congested road networks and hampered by inadequate re sprinkler systems, limited yard space and outdated building materials, creating functional obsolescence. Businesses must decide whether to retro t existing facilities or invest in purpose-built alternatives.

E-commerce has created complex, multitiered distribution networks beyond traditional warehousing. Nell explains that “mega-warehousing facilities are the rst stage of this logistics network”, but notes there exists “a network of smaller distribution hubs that are key to the last mile distribution network”.

Rede ne accommodates facilities “from large- (about 25 000m2) to midi-sized (around 1 000m2) warehousing within the e-commerce ecosystem”, according to Nell. This exibility recognises that supply chain networks are diverse, with no single approach tting all operational requirements.

The demand surge has created signi cant opportunities for investors and developers understanding modern logistics real estate nuances. However, success requires more than building large boxes.

Today’s valuable warehousing facilities must offer strategic positioning, technological compatibility and operational exibility.

Location remains paramount, with logistics parks increasingly transforming into commercial nodes. Competitive advantage often lies not just in physical space, but also in operational optimisation. Some developers provide racking and shelving as rental components, recognising that operational ef ciency extends beyond building envelopes.

“Flexibility remains key,” says Nell. “We have learned over the past ve years that markets can be disrupted overnight.” Modular warehouse design has become

essential for accommodating clients’ changing needs in unpredictable markets. Nell notes that while “some common themes exist”, such as logistics parks transforming into nodes, Rede ne’s “more than two-hundred and sixty industrial tenants hold a competitive edge within the positioning of the industrial space”. The company offers diverse industrial spaces servicing wide-ranging markets, with some facilities including racking as part of rental packages.

The logistics real estate boom represents more than a temporary market surge; it re ects fundamental shifts in commerce operations. As consumer expectations for faster, reliable delivery continue rising, demand for sophisticated warehousing will intensify.

For investors and developers, opportunities are substantial, but success requires deep understanding of technological trends, supply chain dynamics and evolving e-commerce needs. Those delivering exible, technologically advanced facilities in strategic locations will position themselves at South Africa’s logistics revolution centre.

The question is no longer whether growth continues, but how quickly industry adapts to meet digital economy demands.

Follow: Johann Nell www.linkedin.com/in/johann-nell-56543235

ITUMELENG MOGAKI speaks with property training providers to understand how modern property managers are gaining the skills they need to thrive

Property management has never been straightforward. Today, managers juggle a mix of responsibilities, from handling tenant concerns to overseeing digital property systems. With South Africa’s property sector becoming increasingly complex, education and continuous learning have become essential tools for success.

Here are some programmes and tools that equip property managers with the skills needed to thrive in today’s complex landscape.

The TUHF Programme for Property Entrepreneurship (TPPE), delivered through the University of Cape Town, celebrates its 10th anniversary in 2025. Over the past decade, TPPE has grown into one of South Africa’s leading platforms for developing property entrepreneurs, offering both TUHF clients and nonclients the chance to gain the knowledge and skills needed to run sustainable property businesses.

Structured as a twelve-day course spread over three months, TPPE blends online and in-person learning to make it accessible to working professionals nationwide. Participants engage with experts across multiple disciplines, covering property nance, valuation techniques, green building, utilities management and proptech. On completion, a digital certi cate from UCT adds credibility and industry recognition.

The programme addresses key industry gaps by equipping participants with a holistic understanding of property development and management, particularly in the affordable rental housing sector.

Henry Chitsulo, programme director for TPPE, highlights its unique value: “It is this infusion of a variety of minds in various disciplines that makes TPPE a rich learning

experience. Whether already active in the market or just starting out, our students come away feeling inspired and empowered to run their businesses successfully.”

Since 2016, the Attacq Property Point partnership has supported 55 small businesses, helping them generate over R451-million in revenue with a median annual growth rate of 40 per cent. With 56 per cent of participating enterprises being women-owned, the programme has contributed to gender equity while creating 456 full-time equivalent jobs.

pioneering listings platform into a comprehensive technology partner, providing estate agents and agencies with tools to manage clients, market listings and ensure compliance. Its agent- rst approach strengthens independence and reduces reliance on dominant property portals. Entegral’s ecosystem includes Base CRM for client and mandate management, Sync for instant listing syndication, Flex for modern agency websites and Vault for compliance and FICA management. Combined with MyProperty, these solutions give agents a connected and ef cient platform to compete in a fast-evolving market.

Entegral’s offering has expanded beyond listings into a cloud-based ecosystem embracing mobile, cloud and arti cial intelligence innovations. With a strong client base in South Africa and Namibia, and growing reach into other African countries, Entegral now supports thousands of agents while maintaining its independent, agent- rst philosophy.

The Attacq Green Programme, introduced in 2022, nurtures businesses addressing sustainability challenges in the property sector.

It has supported 10 enterprises generating R306-million in revenue, creating and sustaining 84 jobs, with half being women-led.

“Property Point has been at the forefront of empowering small and medium enterprises in South Africa’s property sector since 2008, unlocking over R2.5-billion in market opportunities,” says Shawn Theunissen, founder of Property Point. “Our Green Seeds initiative builds on this legacy by accelerating the green economy and turning entrepreneurial vision into transformative change that bene ts the entire property industry.”

For over 20 years, Entegral has been shaping the digital backbone of South Africa’s real estate industry. Founded by the CEO of Entegral, Adriaan Grové, the company has grown from a

“Our mission has always been to build technology that strengthens the independence of property professionals,” says Grové. “By connecting South African and Namibian agents through our ecosystem, we’re creating a more inclusive, innovative property market that helps agencies of all sizes thrive.”

Follow: Henry Chitsulo www.gsb.uct.ac.za/profile/1235/henry-chitsulo

Shawn Theunissen www.linkedin.com/in/shawntheunissen

Adriaan Grové www.linkedin.com/in/adriaangrove

FIND OUT HOW ENTEGRAL CAN ASSIST YOU AS A PROPERTY PROFESSIONAL

LEARN MORE TUHF PROGRAMME FOR PROPERTY ENTREPRENEURSHIP

WITS PLUS, a wholly owned subsidiary of the University of the Witwatersrand, has completed its first year in operation, marking a bold shift to ensure short learning courses are developed, managed and delivered with agility within the Wits ecosystem

Wits Plus was launched in 2024 as part of a strategic restructuring of the University of the Witwatersrand to consolidate all short courses under one independent, professionalised entity. With a strong vision to be a lifelong learning partner for individuals and organisations across South Africa, Wits Plus set out to modernise access to professional development through innovation, relevance and accessibility.

“Wits Plus is a signi cant strategic investment in skills development by the university. It is designed to be exible, agile and responsive to the needs of business, government and civil society,” says Natalie Zimmelman, chief executive of cer at Wits Plus.

Wits Plus offers a forward-thinking portfolio designed to meet the evolving needs of

individuals, institutions and industry. As it solidi es its position in the short learning landscape, it continues to:

• Disrupt traditional learning models by delivering modular, exible and digital- rst short courses that are accessible, scalable and aligned with modern learning behaviours.

• Leverage academic partnerships and intensive university quality assurance processes that draw on the depth and breadth of Wits University’s research and expertise, ensuring its offerings are high-quality and grounded in leading thought and academic integrity.

•Offer a dynamic and responsive set of short courses, designed to meet current skills demands and future workforce challenges across sectors.

•Provide streamlined access to bespoke learning solutions, making it easy for corporate clients and partners to collaborate with it in building tailored, impactful courses.

• Invest in integrated learning technologies, including advanced analytics, learning management systems and mobile-friendly platforms that enhance the learner experience and improve outcomes.

• Champion inclusive education, ensuring affordability, accessibility and meaningful transformation remain at the core of how and why it delivers education.

At Wits Plus, it is not just about planning; it is about delivering it, today.

Wits Plus offers the following short courses under the property/real estate category:

• Advanced Facilities Management.

• Commercial Property Management.

• Facilities Management.

• Retail Property and Shopping Centre Asset Management.

These courses are designed not only to upskill professionals, but also to bridge the gap between academic insight and industry application. By drawing on the depth of Wits University’s research and expertise, Wits Plus ensures its offerings are grounded in academic integrity while remaining practical and actionable.

This vision is particularly relevant to the property sector, where professionals must continuously adapt to new regulations, technologies and market dynamics. Whether a developer, estate agent, urban planner or investor, staying ahead requires more than experience; it demands continuous learning.

The property sector is undergoing transformation. Smart technologies, environmental, social and governance (ESG) compliance and shifting consumer expectations are rede ning how spaces are built, sold and managed.

Lifelong learning empowers professionals to:

• Stay relevant in a competitive and evolving market.

• Adapt to regulatory changes and industry standards.

• Innovate in areas like green building, digital marketing and data-driven property management.

• Lead transformation in urban development and infrastructure planning.

For Wits Plus, lifelong learning is about equipping individuals with the skills and insights required to navigate change, solve complex challenges and drive innovation in their sectors.

“Lifelong learning is the bridge between where we are and where we want to be,” says Yasira Cajee, digital and marketing director.

“We’re proud to be part of that journey.”

One of Wits Plus’s standout short courses is its Property and Real Estate Asset Management short course, with a special focus on shopping centre assets. This course is designed for professionals who want to deepen their understanding of South Africa’s retail property market.

The course helps learners build skills that apply across all property sectors, while also giving them a deeper understanding of the unique challenges in retail real estate. It is ideal for those looking to grow their careers in asset management or transition into the retail property space.

Key topics include:

• Ownership structures and legal frameworks.

• Financial modelling and simulations.

• ESG impacts and risk management.

• Ethical governance and King IV compliance.

• Capital markets and funding strategies.

• Asset performance monitoring and benchmarking.

The course is delivered through interactive lectures, group assignments and real-world case studies, ensuring students gain both theoretical knowledge and practical skills.

This short course is designed for a wide range of professionals, including:

• Property, leasing and facilities managers.

• Architects, engineers and town planners.

• Retail tenants and quantity surveyors.

• Professionals in banking, private equity and REITs (real estate investment trusts).

• Anyone looking to add value in retail property investment and management. Participants earn a certi cate of competence upon completion.

One of Wits Plus’s most strategic moves has been its bespoke solutions offering, which allows corporate, government and civil society clients to co-design tailored training interventions.

“Through strategic product and business development, Wits Plus is forging powerful partnerships that deliver tailored, high-impact learning solutions,” says Dr Nico Baird, product and business development director. “We’re driving workforce excellence and organisational success – now and in the future.”

This client-centric approach is already fostering deeper relationships with industry bodies, professional associations and public sector entities. It is a model that prioritises collaboration, relevance and measurable outcomes.

The property industry is changing – and so must the way we learn. Wits Plus is showing how short courses can be powerful tools for growth, transformation and impact.

Whether you are an individual looking to upskill or an organisation seeking tailored training, Wits Plus offers a smart, strategic way forward. Its commitment to lifelong learning helps professionals stay relevant, agile and empowered, not just for today, but also for the future.

“THE ULTIMATE TEST OF ANY SUSTAINABLE STRATEGY IS ITS OPERATIONAL RESULTS AND TENANT SATISFACTION AND RETENTION.” – BRYCE O’DONNELL

Sustainable infrastructure is increasingly becoming a driver for tenant attraction, operational savings and long-term resilience for commercial and retail developers.

THANDO PATO speaks with developers yielding returns

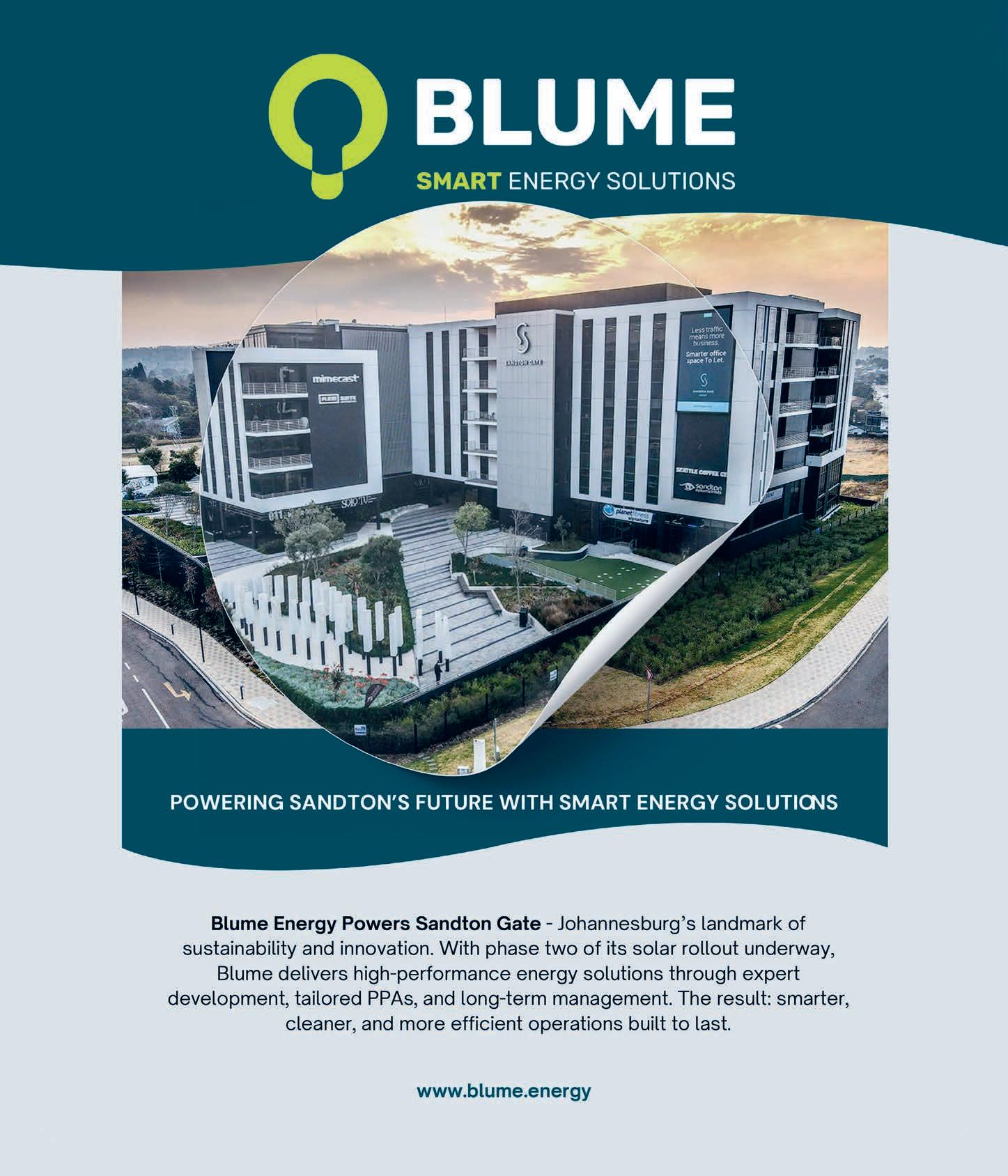

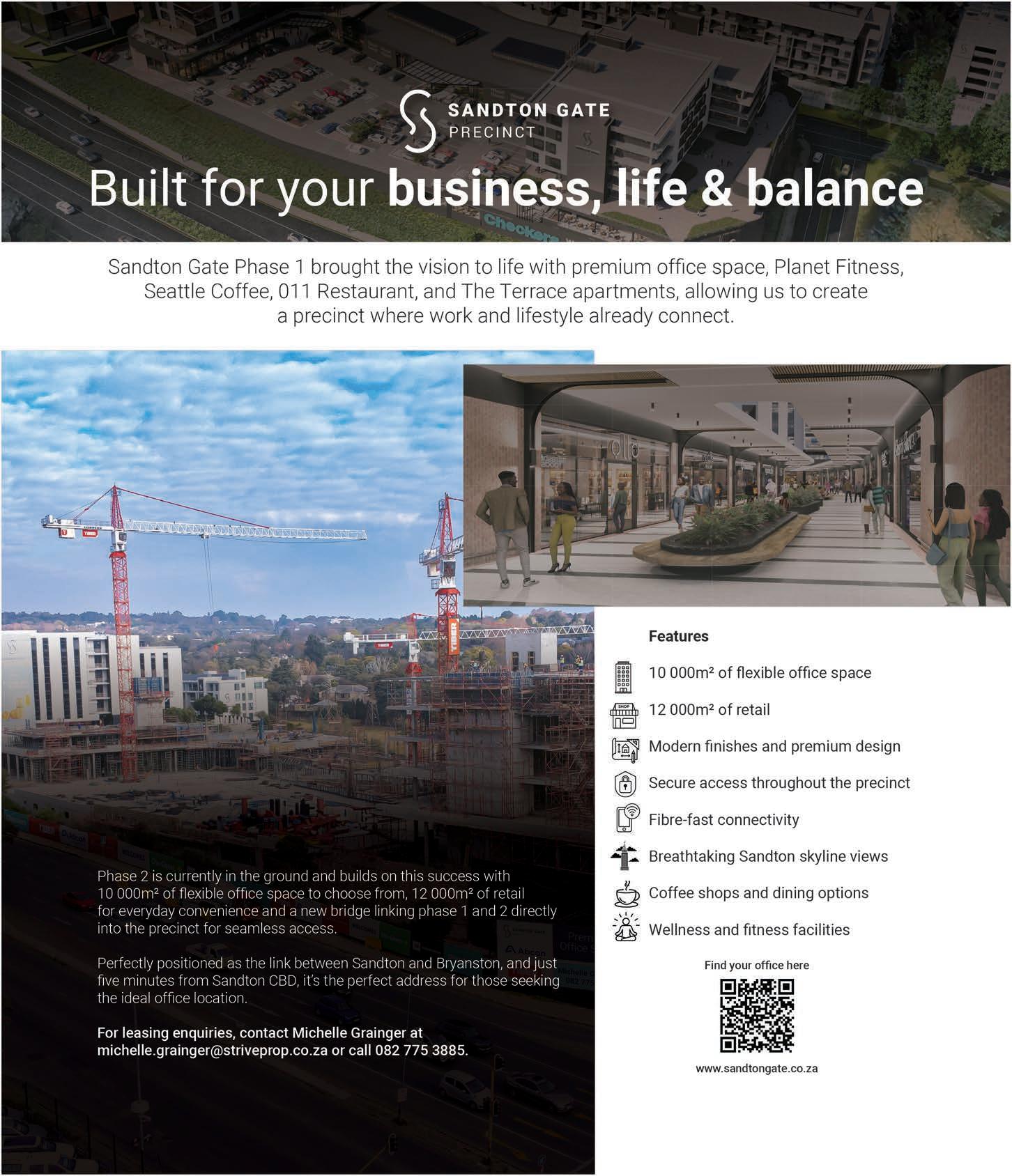

One of Sandton’s most recently erected mixed-use developments, Sandton Gate, was from conception, designed and developed around sustainable principles, says Bryce O’Donnell, MD of Abcon Developments.

“Green Star principles were used as a design and management framework from the concept stage. Credit pathways informed early choices on orientation, facade performance, water strategies, metering, commissioning and tenant guidelines. Several commercial components were registered for Green Star ratings, and base-building speci cations were set to be ‘Green Star-ready’ so that interiors can be certi ed as tenants t out,” he explains.

O’Donnell says they also worked with density and mixed tools to drive sustainability. “We clustered A-grade of ces, neighbourhood retail and apartments within a short walk and cut car dependency and internal trip lengths. We introduced shaded facades and high-performance glazing to reduce cooling loads without compromising contemporary aesthetics. We also added back-of-house systems like solar photovoltaic (PV), ef cient heating, ventilation and air conditioning (HVAC), smart metering, water reuse and on-site waste sorting.”

Cebisa Mafukuzela, sustainable building consultant at Solid Green Consulting, says the goal of the Green Star-certi ed Barloworld headquarters, situated in the Irene Link precinct – also home to several other Green Star-certi ed

commercial buildings – took direction from the Barloworld building, which Mafukuzela says was designed “to create a beacon of sustainability”.

“The entire project consisted of several commercial buildings that targeted both a Green Star Design and As Built Rating. Barloworld was the rst building constructed and certi ed,” she explains.

• Materials and health: reduced volatile organic paints or adhesives, responsible timber, preference for locally manufactured nishes with recycled content, enhanced fresh-air rates and end-of-trip facilities (showers, lockers and secure bike storage) to support active commuting.

Mafukuzela says the Irene Link development also features ef cient ttings and xtures, energy-ef cient HVAC systems and improved indoor environment quality systems to reduce impurities and increase access to fresh air.

The sustainable elements of these precincts lie in the advanced technology working behind the scenes. At Sandton Gate, a comprehensive suite of measures delivers ef ciency without compromising the tenant experience.

The green technology at Sandton Gate includes:

• Energy: rooftop and carport solar PV arrays, high-ef ciency HVAC systems, LED lighting with occupancy and daylight controls, power-factor correction and building management system-enabled demand management and electric vehicle-charging readiness.

• Water: low- ow sanitaryware, smart submetering and leak detection, rain and condensate capture for irrigation and drought-tolerant, indigenous landscaping.

The ultimate test of any sustainable strategy is its operational results and tenant satisfaction and retention.

And, the data for Sandton Gate is compelling, says O’Donnell.

“Operational data shows a materially lower electricity intensity versus comparable nonef cient of ces, with peak-demand shaving during high-stage load shedding translating into meaningful tariff savings. Potable water use per occupant is trending down thanks to metering and ttings, while waste diversion rates continue to improve as retailers and of ce tenants align on sorting.

“On the human side, tenants cite the end-of-trip facilities, walkable retail and proximity to green space as quality-of-workplace advantages that aid staff attraction and retention, factors that, in turn, support strong occupancy and lease renewals.”

He says the sustainability measures on offer at Sandton Gate have given the precinct a tangible differentiator for prospective clients, particularly businesses with environment, social and governance mandates.

“Prospective tenants increasingly ask for hard data that includes base-building energy intensity, renewable contribution, water-use metrics and indoor-environment quality. The ability to provide credible numbers, plus the convenience of bike storage, showers, EV-ready bays and a connected retail high street, has been a differentiator in lease negotiations.”

• Waste: centralised sorting areas in each building and construction waste plans that favour reuse or recycling. Follow: Bryce O’Donnell www.linkedin.com/in/bryce-o-donnell-a6628540

Cebisa Mafukuzela www.linkedin.com/in/cebisa-mafukuzela-7b633b74

Commercial properties in South Africa face a wide range of risks, some of which are universally relevant, while others are heightened by local conditions, such as the crime rate, infrastructure issues and historical examples of civil unrest, writes VANESSA

Owning commercial property is a long-term investment, but with investment comes risk. From climate change and cybercrime to theft, vandalism and the ever-present threat of re, property owners face a growing list of challenges that can erode asset value and disrupt business operations. Experts agree: understanding your risk pro le and securing appropriate insurance cover is no longer optional; it’s essential.

Dini Nondumo, head of commercial insurance at Standard Insurance Limited, notes that re remains the leading cause of catastrophic losses for commercial property owners.

“While res occur less frequently than other events, the nancial devastation they cause is unmatched,” says Nondumo.

“Our largest single claim in the past ve years involved a re at a forestry agricultural co-operative next to our client’s facility

– the gross claim reached R183-million. Thanks to structured risk-sharing, Standard Insurance absorbed only a portion of that liability.”

In addition, the rising frequency of extreme weather events, from oods to catastrophic storms, is driving up claims volumes. “Water damage, whether from burst pipes or severe ooding, often affects both the building structure and its contents. Climate change is making these events more common and more costly,” he adds.

Property owners often assume that commercial property insurance follows a standard template. In reality, cover must be tailored to the business and its risk exposure. “There’s no one-size- ts-all option,” says Nondumo. “Business owners should consult a professionally quali ed broker to conduct a comprehensive needs and risk analysis. Only then can you secure cover that addresses all major concerns – re, weather events, vandalism, cyber-risks and operational disruptions.”

As commercial properties become increasingly digitised, from automated access control to building management systems, cybersecurity

emerges as a new frontier of risk. Hackers targeting smart systems can shut down heating, ventilation, lighting or security, leading to costly operational downtime. Insurance solutions now extend to cyber liability cover, ensuring building owners are protected against data breaches and system failures.

Nondumo emphasises that insurance is only one part of risk management. Proactive maintenance signi cantly reduces the likelihood of claims. At a minimum, property owners should:

• Update electrical compliance and re suppression system certi cations annually.

• Commission structural reviews from quali ed engineers.

• Maintain gutters, drains, landscaping and other exterior features regularly.

“Day-to-day upkeep protects property value, ensures compliance and reduces the risk of catastrophic loss,” says Nondumo.

Beyond nancial protection, Nondumo believes well-managed commercial properties strengthen local communities. “Properly insured and maintained buildings safeguard jobs, support local economies and contribute to public safety,” he says. “Business continuity depends on secure, resilient infrastructure, and that bene ts everyone.”

Follow: Dini Nondumo www.linkedin.com/in/dini-nondumo-14892a8

VANESSA ROGERS looks at the latest tax amendments, conveyancing developments and property law updates affecting owners, developers and investors

South Africa’s commercial property sector continues to attract investors, with transactions often exceeding R100-million and including not only land, but also operational assets like farms and factories, according to Pieter van der Merwe, managing partner at VDMA Law.

Key tax amendments remain top of mind for developers and investors. Transfer duties, once xed at 8–10 per cent, now follow a single sliding scale of up to 13 per cent, with the rst R1.1-million exempt. Updates to the Property Practitioners Act have tightened compliance, requiring disclosure of property

defects and ensuring estate agents’ commissions are only paid upon registration – a win for buyers seeking transparency. On the conveyancing front, the deeds of ce is piloting electronic lodgement, but experts warn full digital adoption will take time due to training needs and

VANESSA ROGERS looks at market trends in property loans and bridging finance and provides expert perspective on where investors should be looking next

A25-basis point cut to the repo rate this July – down to 7 per cent – has boosted investor con dence in commercial property, particularly in South Africa’s main centres. Demand for industrial, logistics and select of ce space remains strong, driven by hybrid work models, an e-commerce boom and shifting tenant needs.

According to Ooba, there are ve main funding routes for investors:

• Traditional home loans for rst-time buyers with strong credit records.

• Home-equity nancing, using existing property equity for lower upfront costs.

• Partnership structures where investors pool resources.

• Private lending arrangements for faster turnaround times on nonstandard deals.

• Specialised nancing solutions for projects like urban renewal or green energy.

Alternative models, including bridging nance and private equity options, are gaining traction, offering quicker liquidity and exibility versus traditional lenders – often a key advantage in competitive markets.

John Jack, CEO of Galetti, says the hottest sectors right now are energy projects, light industrial property linked to logistics and select of ce spaces with strong tenant mixes. Hospitality assets also offer long-term returns if carefully researched.

ALTERNATIVE MODELS, INCLUDING BRIDGING FINANCE AND PRIVATE EQUITY OPTIONS, ARE GAINING TRACTION.

system reliability. “The existing system has strong checks and balances,” notes Hazel Jacobs, head of conveyancing at VDMA, “so digital tools will enhance rather than replace it.” With South Africa’s reputation for accurate valuations and a robust nancial sector, investors can con dently pursue long-term gains while navigating new legal frameworks with minimal disruption.

UPDATES TO THE PROPERTY PRACTITIONERS ACT HAVE TIGHTENED COMPLIANCE.

2025 PROPERTY LEGAL HIGHLIGHTS

• Transfer duties: up to 13 per cent, first R1.1-million tax-free.

• Property Practitioners Act: mandatory disclosure of defects, commission payable only upon registration.

• Conveyancing: digital lodgement pilot underway, full roll-out pending.

• Investor confidence: robust financial sector and accurate valuations boost long-term appeal.

“In energy, you can buy the land and have someone else come and build everything to run an operation. Then, out of that operation, arrange that your ‘tenant’ gives you a margin on how much fuel they pump, with 300 000 litres being the average break-even for a good business model.”

With industrials being the darling because everyone’s doing logistics, Jack adds that despite the sense that retail is going to take some pain, in South Africa, we still have a culture of “going to the shops”, plus there are easily 1 300 shopping centres in the country, ranging in size from 500m2 to 135 000m2

• Start as a broker to learn the ropes.

• Be willing to walk away from bad deals.

• Understand your market inside out.

Follow: John Jack www.linkedin.com/in/john-jack-952692a

FICA obligations require rigorous client checks, however, Hazel Jacobs, head of conveyancing at VDMA Law, insists compliance rarely disrupts deals: “Banks care about zoning, title and funding sources –the rest can be fixed post-transaction.”

Follow: Pieter van der Merwe www.linkedin.com/in/pieter-van-der-merwe-2079205 Hazel Jacobs www.linkedin.com/in/hazel-jacobs-4a503633

VANESSA ROGERS explores how South African investors are tapping into offshore property markets, maximising returns and navigating risks in a post-pandemic landscape

Speaking at a South African Property Owners Association webinar in July on global property investment trends, Eileen Andrew, vice president of MSCI, delivered encouraging news: the global property market has staged a strong rebound, shaking off two years of turbulence.

Of particular interest to South African investors, Andrew highlighted the country’s dominance on the global property investment leaderboard – 11.5 per cent total returns, led by an impressive 8.4 per cent income return. Hotels and retail properties have surged, fuelling renewed appetite for investment in these sectors.

Megan Copley, director and partner at LIO Global, notes that South African investors are particularly eyeing the United Kingdom (UK), where a low entry point of just £100 000 allows owners to generate around £10 000 per annum from light industrial, of ce, hotel or short-term rental properties.

Copley advises steering clear of markets where language barriers or regulatory restrictions create challenges. For instance:

• Spain limits Airbnb-type licences.

• Portugal frowns on short-let activity that displaces locals.

• Greek islands may offer returns, but properties do not qualify for golden visas.

• Mauritius and Seychelles have high entry points, often US$400 000-plus, with residency usually required.

Currently driving demand for short lets, is the swelling number of UK government regeneration projects aimed at revitalising urban areas,

improving infrastructure and boosting economic growth. “Engineers, contractors, builders and other support staff travel from all over the UK to work on such projects. In the interim, units can be let on a nightly basis, using a smart pricing model that’s up for adjustment to keep occupancy levels high,” says Copley. “Owners can avoid many of the pitfalls of long-term lets – delinquency, lack of rental payments and extreme damage to property over time, together with not knowing the condition of your unit for up to a year at a time.”

Short-term lets present a win-win scenario because regular inspections can be done, and owners have the bene t of commercial activity insurance, which is not the case in a long-term residential let. “There is great appeal, of course, in suddenly moving your yield from a net ve to a net ten per cent – and a

pound yield at that – and where your cost of debt is between just four and ve per cent,” Copley explains.

An interesting hotspot in the UK, aside from the obvious examples in and around the HS2 high-speed rail line and the transformation of former brown eld sites, is the holiday destination of Blackpool. “Many British nationals choose to holiday locally, rather than the expense of going abroad. They take their families on short-let stays in Blackpool to enjoy its pier, pubs, restaurants, shops, gym, horse-drawn carts, gaming arcades and the close-to-completion new theme park. While asset values are low, rental prices are booming due to the demand to accommodate holidaymakers throughout the year.”

Copley shares critical advice for commercial property investors:

• Review the contract thoroughly, ideally with an expert present.

• Con rm permitted property use and rental activities.

• Commercial leases are longer and less exible than residential leases – ensure terms favour the owner.

• Clarify maintenance responsibilities – both internal and external.

• Secure pre-arranged nancing to reduce upfront stress and costs.

“Some investors face arrangement costs of up to £7 500 on a £75 000 purchase – about ten per cent in expenses. At LIO Global, we secure private nancing agreements with vendors to provide three-to- ve-year mortgages, easing initial cash ow while commercial activity stabilises,” explains Copley.

With South Africa leading global returns and investors able to tap lucrative UK markets, commercial and short-let property remains a compelling avenue. Careful planning, legal safeguards and smart nancing are key to turning the current cautious optimism into pro table opportunity.

Follow: Megan Copley www.linkedin.com/in/megan-copley-56360143

Eileen Andrew www.linkedin.com/in/eileen-andrew-8849b440

Medical office buildings are providing essential services to the public and good returns for landlords, writes ANTHONY

SHARPE

Investing your money with the mob may not be the best of nancial-planning ideas. However, medical of ce buildings, known as MOBs for short, have emerged as resilient assets in recent years.

As opposed to hospitals, MOBs are smaller, specialised buildings that cater to specialists, independent medical practitioners and the burgeoning range of services emerging in the wake of medical technology advancements.

While South Africa may have a youthful population, these advancements are increasing longevity. Orbvest founder Hennie Bezuidenhout says technologies such as arti cial intelligence and genome sequencing are set to transform drug research, genetic therapy and diagnostics, resulting in a growing cohort of senior citizens requiring more frequent medicalcare. With local hospitals frequently overburdened, MOBs are well-positioned to provide such care.

Scott Thorburn, of ce national asset manager at Rede ne Properties, says MOBs are typically clustered around larger healthcare facilities. “You need a large hospital in the building or vicinity. However, redeveloping existing buildings to serve this purpose, even in residential areas, is typically cost-effective. That’s important, because doctors have a cap on how much they can pay for rent.”

Follow: Hennie Bezuidenhout www.linkedin.com/in/hennie-bezuidenhoudt-5a145a83

Repurposing existing commercial buildings into residential or mixed-use ones can help address housing shortages and invigorate city districts. By ANTHONY SHARPE

South Africans are no strangers to buildings being repurposed for other uses. Many of the architectural legacies of our more industrialised spaces have been reimagined, taking advantage of their unique layouts to create thriving, unique spaces. Take, for example, The Old Biscuit Mill in Cape Town, which turned the 19th-century Pyott’s biscuit factory into a lively precinct with shops, of ces, restaurants and a food court. Even more striking is Cape Town’s Zeitz Museum of Contemporary Art Africa, where old grain silos were carved out to create an extraordinary, cathedral-like atrium that practically overshadows the exhibits on display. In Johannesburg, a 1928 warehouse was adapted into Workshop17, a exible co-working and innovation hub that supports entrepreneurs, freelancers and creative professionals.

More contemporary is Braamfontein Gate, originally constructed in 1976 as the headquarters of French oil company Total Elf Fina. Four decades later, it was repurposed as part of an effort to lure people back to an area that had been left hollow by the departure of corporations and residents. Design company

Local Studio worked to retain aspects of the original building, giving it a unique character and keeping costs down. The result is 400 residential units complemented by retail spaces, a business centre, a coffee shop, a gym and swimming pool and a rooftop events space.

Developments like Braamfontein Gate are driven by a host of factors, including the economic pressure placed on landlords by low occupancy rates, demand for affordable housing close to city centres and shifting lifestyle preferences among working professionals. Adapting structures is also signi cantly more eco-friendly than building new ones, with the World Economic Forum estimating that retro tting an existing building can result in 50–75 per cent fewer carbon emissions. However, for landlords, converting their commercial spaces to residential or mixed-use often remains a last resort, says Rede ne Properties’ of ce national asset manager Scott Thorburn. “The problem is that what you can achieve from selling your building to a residential developer is a lot lower than your commercial value.”

Unsurprisingly premium of ce blocks remain resilient, while Thorburn says it is the underperforming properties that face conversion to residential. He believes such adaptive reuse is positive when it supports urban density and mixed-use living. “High-density living creates viability for shops, businesses and transport. You need people to walk down the streets, go to restaurants and shops – ultimately live, work and play in that environment.”

With more people returning to the office to work at least some days of the week, what does the hybrid workspace of today look like? By

ANTHONY SHARPE

Before the pandemic, of ce design was already shifting toward greater exibility: breakout areas, phone booths and shared spaces where employees could move between different types of work. COVID-19 merely accelerated this conversation, as remote work brie y became the default.

However, according to Scott Thorburn, of ce national asset manager at Rede ne Properties, the pendulum is swinging back – and the of ce still matters.

Thorburn says the initial embrace of working from home was partly driven by cost savings for employees.

“In South Africa, it’s almost a nancial decision,” he notes. “When you’re at home, you don’t pay for transport or childcare costs,

for example. Going back to the of ce means reabsorbing those expenses, which many had forgotten about.” That tension explains why many workers have resisted a full return.

Even so, most corporates are steadily calling staff back, often through hybrid models. In step with this, Thorburn says the trend of shrinking of ce spaces has stopped. “We’re seeing tenants like Google and nancial service providers, which take up the most space due to their large staff complements, come back.”

This return has pushed landlords and tenants to rethink space. The much-touted “activity-based workplace”, where no one has a dedicated desk, never quite took off in South Africa. “People still want a space that feels like theirs,” Thorburn argues. “They’re happy to use booths or breakout areas for certain tasks, but not to move around every day.”

What has gained traction is demand for well-located of ces near residential hubs. In Gauteng, Midrand, Bryanston, Greenstone and other suburban nodes have seen vacancies ll as smaller rms seek space close to where employees live, supported by on-site or nearby amenities such as gyms and coffee shops.

These amenities are crucial to getting staff to come back to larger of ces too, says Thorburn. “From a landlord’s perspective, you need to ensure these amenities are in the building or at least nearby. If you’re located near a shopping mall, for example, that typically takes care of these needs.”

The of ce may look different, but in Thorburn’s view, it isn’t going away. “At the end of the day, companies need space for culture. However, if you want your people to come back, you need to offer them a great working environment.”

Follow: Scott Thornburn www.linkedin.com/in/scott-thorburn-0890aa32

South Africa’s shortfall of student accommodation represents an opportunity for developers and investors, writes ANTHONY SHARPE

While many of us may recall our student digs a little warily, South Africa’s student housing sector is evolving, with purpose-built, tech-enabled residences and creative nancing

models helping to address a critical shortfall in university accommodation.

Private Student Housing Association CEO Kagisho Mamabolo, says the country has a de cit of more than 500 000 beds, with most universities seeing huge demand for purpose-built accommodation. For developers, this represents a potential goldmine. One company tapping into this potential is Growthpoint Properties, with its Thrive Student Living portfolio, which includes Peak Studios in Cape Town and Apex Studios in Johannesburg, boasting occupancy rates of 98 and 100 per cent respectively. These developments were awarded top honours at the

South African Property Owners Association Property Awards for their innovative and sustainable design.

Innovation really is key here, with tech and design features now integral to modern builds – think smart locks, high-speed internet, communal study areas and green building practices like solar energy and rainwater harvesting.

Growthpoint Investment Partners’ George Muchanya believes that while some investors may have lost interest in traditional real estate assets, the market fundamentals of student accommodation are encouraging, despite relatively low local coverage.

Follow: Kagisho Mamabolo www.linkedin.com/in/kagishomamabolo George Muchianya www.linkedin.com/in/george-muchanya-6160a040

Investing in student accommodation offers strong returns, but rising costs, high expectations and NSFAS risks demand careful planning and strategy, writes SIYA JELE, portfolio manager at TUHF

Student accommodation – or rather the lack thereof – has long been a thorn in the side of South Africa’s higher education sector. Estimates put the shortfall at nearly 500 000 beds nationwide. Protests at universities from Johannesburg to Cape Town have repeatedly highlighted the crisis, calling for affordable, decent housing within reach of campuses.

For property entrepreneurs, this shortage presents a tantalising opportunity. Yet those rushing into the market quickly learn that student housing is not just another rental property play; it comes with unique risks, costs and demands that require careful balancing.

The nancial considerations for a student accommodation project are very similar to those of any other affordable housing development. However, understanding the ancillary costs involved in meeting universities’ criteria – and students’ expectations – is crucial as these can be quite different.

Take Wi-Fi, for instance. It’s not a negotiable extra; it’s a deal-breaker. Students won’t tolerate slow or unreliable internet. If the Wi-Fi isn’t up to standard, they’ll move out, and word spreads fast.

Likewise, gone are the days of communal bathrooms and crowded dormitories. Students prefer private bathrooms and kitchenettes in smaller shared units. The old hostel model doesn’t work anymore.

Transport is another cost factor. If accommodation isn’t within walking distance of campus, operators may need to provide shuttle services, with those costs built into the rate per bed.

It’s not just about charging for the bus. You have to factor in the full cost of running the service – maintenance, drivers, fuel – and build that into your operating model.

STUDENT HOUSING IS NOT JUST ANOTHER RENTAL PROPERTY PLAY; IT COMES WITH UNIQUE RISKS, COSTS AND DEMANDS THAT REQUIRE CAREFUL BALANCING.

Unlike conventional multiresidential buildings, where operating costs might sit at 30–35 per cent of income, student accommodation can easily hit 50 per cent. In many ways, it’s closer to running a hospitality business than a residential one.

Yet the rewards can be substantial for those who get it right. You have to put a lot more in to get a lot more out. When you deliver what students want – privacy, connectivity, convenience – occupancy stays high and returns follow.

Some TUHF clients use smart building technologies to cut costs and improve ef ciency. We’ve seen clients install motion-sensor lighting in common areas or link plugs and lights in rooms to students’ access cards – much like a hotel key card system. When students leave, the power switches off automatically, keeping utility bills down.

Other examples include heat pumps instead of conventional geysers and low- ow water ttings to reduce water usage.

However, the biggest hurdle isn’t the operational side; it’s cash ow. Rent payments depend heavily on the National Student Financial Aid Scheme (NSFAS), and late or inconsistent disbursements can leave landlords struggling to service loans.

NSFAS is such a massive lever. When payments are delayed for months, it puts providers under enormous strain. Some of TUHF’s highest-risk loans are in student accommodation because of this issue.

Despite these challenges, there really is untapped potential – particularly around technical and vocational education and training colleges, which face the same shortages as universities but receive less investor attention. If NSFAS resolved its funding issues and channelled support into vocational training institutions as well, it could open up an entirely new market.

For now, the sector remains a balancing act – weighing strong demand and healthy returns against operational complexity and funding uncertainty. Well-managed, well-appointed facilities can outperform standard affordable rental housing, but the risks are higher, and you need to go in with eyes wide open.

Follow: Siya Jele www.linkedin.com/in/siya-jele-74729a19

Even as e-commerce continues its rampant growth, physical stores remain resoundingly dominant in South Africa. Nevertheless, they are evolving to reflect a new retail landscape, writes ANTHONY SHARPE

There’s no denying that South Africa is a country of brick-and-mortar shopping – especially malls. Our retail shopping centre space per capita compares favourably with similar developing countries. Despite the shocks of the COVID-19 pandemic and the concomitant shift towards online shopping, South Africans still ock in their droves to malls to mingle, browse and shop.

However, continued resilience requires a reimagining of these spaces. With e-commerce only set to grow, malls face an existential question – one that is being answered by their evolution into experiential, immersive lifestyle ecosystems.

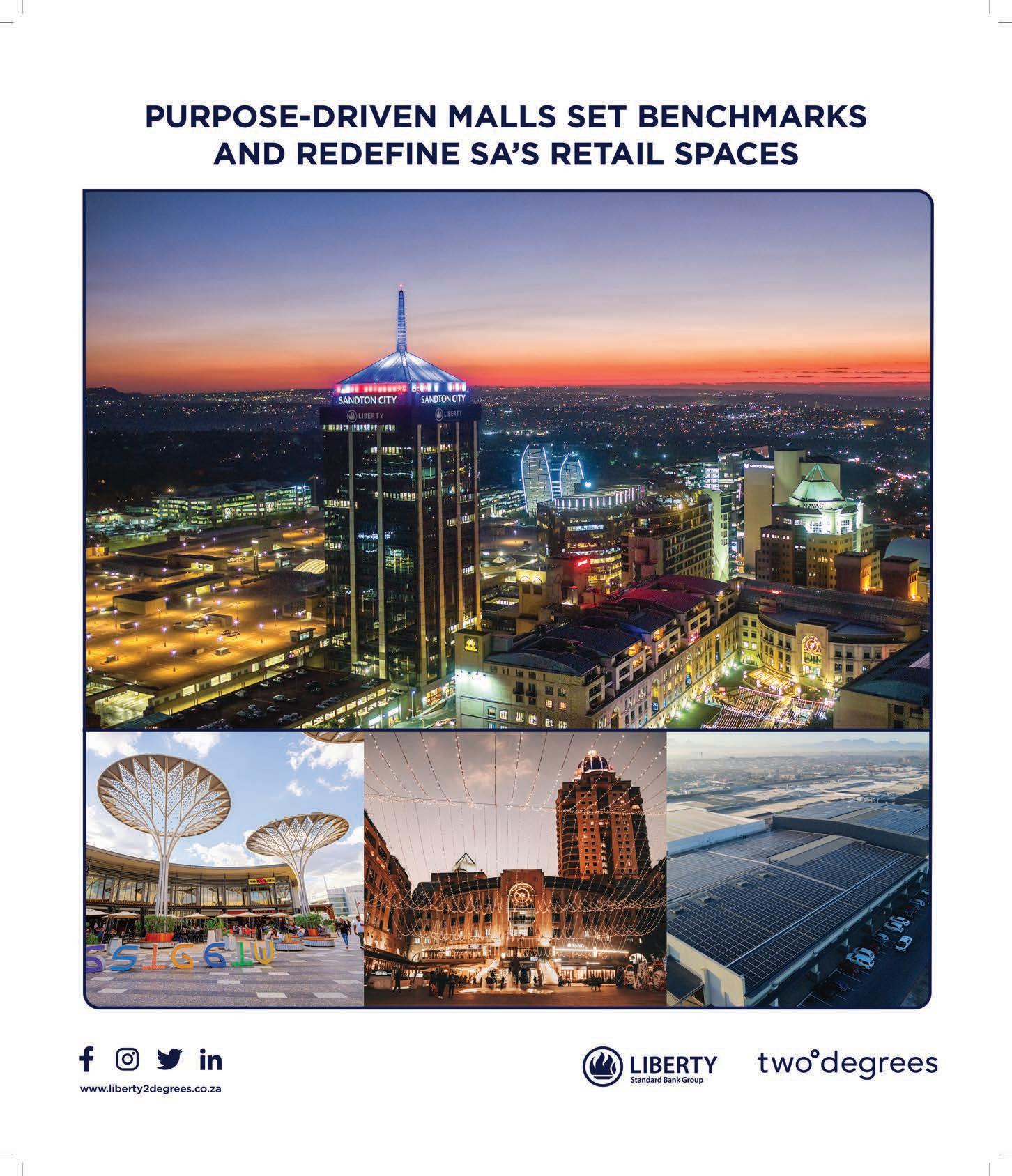

“Consumer expectations are ever-shifting, but the pace of change is increasing,” says Jonathan Sinden, property portfolio chief commercial and operations of cer at Liberty Two Degrees. “Shoppers increasingly demand more than transactions. They seek connection, community and memorable experiences.”

South Africa remains a mall-oriented country largely because malls provide safe, accessible and multifaceted environments where people can shop, socialise and be entertained, says Sinden. “Unlike markets where high-street retail dominates, malls here double as lifestyle destinations and community anchors.

Socioeconomic realities, such as inequality and constrained disposable income, mean malls must cater to a broad spectrum of needs, from aspirational luxury to essential value shopping.”

This shift is not just cosmetic. Malls are being redesigned to extend dwell time and deepen engagement. From rooftop padel courts and art installations to baby care lounges and live performances, the physical store is becoming a place to linger, not just shop.

“These elements encourage shoppers to linger, engage and return, while also contributing signi cantly to revitalising local economies and the broader nancial landscape,” explains Sinden. “This has led to the burgeoning trend of pop-up stores, interactive installations and concept shops that provide innovative and engaging retail environments.”

The South African grocery market represents a growing intersection of physical and online, with brands like Checkers and Woolworths that offer a compelling in-store and online shopping experience, outperforming competitors. This is unsurprising when you consider that, over the past year, grocery delivery from online orders has grown faster than in-store shopping.

Source: Reveal

Sinden says Liberty’s portfolio re ects this transformation. Sandton City, for example, now hosts the Standard Bank Art Lab, rooftop sports facilities and agship stores from global brands like Zara, Nike and Lego. Eastgate Shopping Centre recently refurbished its taxi rank to improve accessibility and continues to invest in sustainability, including one of South Africa’s largest rooftop solar plants. “Our portfolio achieved net-zero waste in 2024.”

Technology plays a central role in bridging the online-of ine divide. Forward-thinking malls offer mobile navigation apps, self-service kiosks and click-and-collect services, while supporting tenants’ omnichannel strategies, says Sinden. “We differentiate through activation-led marketing, placemaking and smart environments. From smart parking and energy metering systems to free Wi-Fi and digital signage, we couple convenience with engagement.”

Sinden believes online shopping is not a threat, but rather an opportunity. “It has led to a transformation, not extinction, of brick-and-mortar retail.”

Follow: Jonathan Sinden www.linkedin.com/in/jonathan-sinden-46498022

Looking ahead, the role of the storefront is poised to shift even further, from transactional space to brand-building stage.

“Retailers are spending more on their shopfronts to showcase their brands,” Sinden observes.

In this new retail landscape, the physical store isn’t just surviving; it’s thriving by becoming something more. In South Africa, the evolution of shopping spaces into places where people gather, experience and connect is well underway.

JONATHAN SINDEN, chief commercial and operations property executive at Liberty Two Degrees, part of the Standard Bank Group unpacks how experience and purpose are redefining South Africa’s malls

The rst half of 2025 has brought encouraging signs for the South African retail property sector. Subdued in ation, steady interest rates and an uptick in consumer con dence have created a more stable backdrop for discretionary spending. Against this environment, shopping centres that are adapting to the dynamic retail environment are proving resilient.

As a result, the long-held prediction that malls would decline under pressure from online shopping and economic constraints has not materialised in the way many expected. Instead, South Africa’s retail spaces are being reimagined, from transactional hubs into experience-led destinations that anchor communities culturally and socially, as much as economically. The narrative has shifted from survival to reinvention, and this is reshaping how landlords, tenants and consumers view physical retail.

Globally, shopping is no longer the sole reason people visit malls. PwC’s 2023 Global Consumer Insights Survey revealed that 59 per cent of consumers value experiences as much as products, with Millennials and Gen Z leading this trend. Locally, the same dynamic is evident. Consumers are increasingly motivated by cultural activations, social interaction and curated community moments.

South Africans are demonstrating greater selectivity in how they spend their time and money. Families seek safe, affordable entertainment. Younger shoppers crave interactive experiences that re ect global culture, but also resonate locally.

Value-conscious households prioritise destinations that offer meaning and connection beyond the purchase.

What is also becoming clear is that digital and physical channels are converging. Consumers expect the ease of e-commerce alongside the sensory appeal of physical spaces. This omnichannel expectation is pushing malls to become not only centres of commerce, but also ecosystems of engagement where digital integration enhances the physical journey.

This shift has made relevance, dwell time and engagement the new benchmarks of mall success, replacing older measures of success that relied heavily on square footage or foot traf c alone.

Malls are evolving into places of belonging and discovery. Internationally, this has given rise to “retailtainment” where immersive exhibitions, live performances and interactive experiences shape the journey. South Africa is following suit, with many centres repositioning themselves as destinations that provide both commercial and civic value.

One example is the property portfolio within the insurance and asset management

DIGITAL AND PHYSICAL CHANNELS ARE CONVERGING. CONSUMERS

EXPECT THE EASE OF E-COMMERCE ALONGSIDE THE SENSORY APPEAL OF PHYSICAL SPACES.

business unit of the Standard Bank Group, Liberty Two Degrees (L2D), which has integrated a customer- rst approach across its portfolio. At Sandton City, new store formats and digital features are being used to create more interactive shopping environments. At Liberty Promenade in Mitchells Plain, the award-winning “Unmasking Strength” campaign tackled youth mental health, demonstrating how malls can serve as safe civic spaces in addition to retail hubs.

Such initiatives highlight the growing expectation that malls contribute to social resilience and community identity, not just commerce. A mall visit is increasingly about connection, recreation and inspiration as much as it is about purchase.

Innovation in retail property is no longer about novelty; it is about resonance. South African malls are nding creative ways to deepen engagement. Examples include fashion experiences reimagined through generative arti cial intelligence, live theatre activations that make family entertainment more accessible and exhibitions showcasing local culture. These experiences extend the role of the mall from being a venue of consumption to a facilitator of discovery.

Sustainability is another vital dimension of innovation. With persistent challenges around energy supply and water security, portfolios investing in renewable energy, heating, ventilation and air conditioning upgrades and water harvesting are not only improving operational ef ciency, but also demonstrating responsible stewardship. L2D, for example, has tracked consistent progress towards its net-zero commitments, ensuring long-term resilience while enhancing tenant and consumer trust.

Globally, sustainability is becoming a decisive factor in how investors and consumers view retail real estate. South Africa’s leading malls are proving that resilience is as much about reducing environmental risk as it is about creating new experiences.

These developments point to a strategic shift. Malls are becoming cultural infrastructure, places where identity, entertainment and community converge. They are also powerful economic multipliers. A CBRE study found that shoppers who participate in experiential

A MALL VISIT IS INCREASINGLY ABOUT CONNECTION, RECREATION AND INSPIRATION AS MUCH AS IT IS ABOUT PURCHASE.

activities spend up to 40 per cent more per visit. In this way, experience is both a differentiator and a revenue driver.

Evidence from South Africa underscores this. The Liberty Property Portfolio recorded turnover growth of 4.8 per cent for the 12 months ending June 2025, ahead of the prior period. This suggests that physical spaces prioritising relevance and engagement can deliver superior performance, even in a cautious economy.

The role of malls as cultural anchors also extends to their ability to respond to societal shifts. In diverse communities, malls can provide neutral spaces where people gather, interact and share experiences. At a time when social cohesion is under strain, retail spaces that foster inclusivity and connection hold unique long-term value.

The most successful campaigns in retail today are rooted in purpose, not promotion. Deloitte’s 2024 Global Consumer Pulse survey revealed that 57 per cent of consumers remain more loyal to companies that take a stand on social or environmental issues. Malls that embrace this reality by

facilitating initiatives around social cohesion, sustainability or wellness are creating authentic bonds with their communities.

Purpose-driven strategies go beyond temporary campaigns. They involve rethinking how malls operate, how they engage with local culture and how they can amplify voices that matter within their communities. This is not a departure from retail’s core role, but an expansion of it. A mall that becomes a trusted platform for dialogue, health awareness or youth development is one that deeply embeds itself into the fabric of its society.

This requires landlords and operators to look beyond leasing and footfall. Strategies must emphasise placemaking, community engagement and the creation of memorable experiences. In many ways, property managers are evolving into custodians of community experience, with responsibility extending well beyond the walls of retail space.

The future of South Africa’s malls will not be de ned solely by size, anchor tenants or location. It will be shaped by the ability to inspire belonging, remain relevant and contribute to broader community resilience.

Examples from the local sector, including the performance of L2D’s assets, show that when malls are reimagined as experience-driven and purpose-led, they outperform nancially while strengthening their role as civic anchors.

Far from being in decline, South Africa’s malls are being rede ned. In that rede nition lies their resilience and a reminder that physical retail, when thoughtfully evolved, remains a powerful connector of people, culture and commerce.

As affordability challenges grow, South Africans are embracing co-living, co-leasing and co-investing, offering affordability, accessibility and reduced risk, writes GRANT SMEE, CEO of Only Realty Property Group

Shared property in urban settings has increased in popularity over the years. Models such as co-leasing, co-investing and co-living are gaining traction due to their affordability and accessibility to prime locations.

There is demand across all age groups who see the value and reduced risk in this particular approach.

1. Co-leasing: joint tenancy, joint accountability

A co-lease, or joint lease, is a rental agreement in which two or more individuals sign the same lease and share equal legal responsibility for the entire property. It is commonly used by roommates, friends, couples or business partners sharing a commercial space. However, it’s also typical for landlords to draft lease agreements naming only a primary leaseholder. In such cases, especially in co-living situations, all parties involved should sign a separate agreement clearly outlining each person’s responsibilities. These contracts can typically be drawn up yourself or with the help of a professional –both are legally binding once signed.

Where two or more tenants sign a lease jointly, they are

typically held jointly and severally liable. Either tenant can be held responsible for the full rental amount or any damage to the property, regardless of who caused it. If one of the tenants chooses to move out over the period of the lease agreement, a new contract must be drawn up.

The co-leasing tenants’ subagreement should contain the following details:

• Financial obligations and how payments are split.

• Responsibility for deposits and damages.

• Process for early termination.

• Replacement of departing tenants. Early termination can cause con ict, so it’s vital to include clear terms. Ensure responsibilities around deposits and replacement tenants are clearly outlined.

2. Co-investing: shared ownership, shared risk

Grant Smee

Co-investing allows buyers to share the capital and returns of property ownership. Collective buying in South Africa allows for up to 12 applicants on a single home loan by some nancial institutions. From dual-owner homes to investor syndicates in multilet properties, the bene ts include lower upfront costs and risk distribution.

Collective ownership often brings added complexity, so it’s important to establish a clear legal structure. Consider these key factors:

• Document ownership shares and capital contributions.

• Clearly outline roles and responsibilities, including who manages tenants, maintenance and accounting.

• Clarify pro t and loss sharing arrangements.

• Include exit strategies outlining how the property will be sold and how one investor may exit the partnership.

• Include the dispute resolution processes.

• A formal partnership or co-ownership agreement, ideally drafted by a legal professional, is crucial to protect everyone’s interests.

3. Co-living: shared space, shared responsibility

In a co-living situation, a residential space is shared by multiple people, typically with private bedrooms and shared common areas. All housemates should draft a written agreement covering:

• Expense breakdowns such as rent, utilities or Wi-Fi.

• House rules around communal living.

• Cleaning schedules, chores and shared responsibilities.

• Exit terms in case one party wants to leave. All agreements, payments and relevant communications should be documented and stored. Having upfront clarity will help reduce disputes.

South Africa’s rental market is booming, with average rents hitting a seven-year high of R9 132 in Q1 2025, according to PayProp. Since September 2024, rentals have outpaced in ation, rising between 1.2 and 5.4 per cent (Rode Report). This growth makes multilet properties especially appealing. By dividing a property into multiple rental units, investors enjoy higher yields and reduced risk through diversi ed tenants.

The multilet model works well with co-investing, offering steady cash ow, even if a unit is vacant. However, careful screening and planning for defaults are essential.

Shared property models are unlocking new opportunities for South Africans, whether to live, lease or invest, as they enable more people to participate in the property market. Proper planning, transparency and legal safeguards are vital to protect all parties involved.

Renting absolutely has its place, says Jacqui Savage, national rentals business development manager for the Rawson Property Group. “However, over time, as your needs and goals evolve, homeownership becomes a very appealing prospect.”

Savage notes that if you’re thinking of making the move from renting to owning, there are a few key things to know.

Step 1: Do your homework. Buying a home is one of the biggest nancial decisions you’ll ever make, so it’s worth taking the time to prepare properly. That starts with learning everything you can about the property buying process and property market, and getting a clear picture of what you want – and what you can afford.

“Spend time researching neighbourhoods, property prices and lifestyle factors that matter to you,” says David Jacobs, Rawson’s Gauteng regional manager. “Do a few show house visits, chat to local agents and compare listings online. It helps build a feel for what your money can buy and where you’re most likely to nd value.”

Step 2: Get prequalified. One of the most important – and often overlooked – steps in buying your rst home is getting prequali ed for a home loan. “Affordability is one of the biggest stumbling blocks for rst-time buyers,” says Leonard Kondowe, national manager at Rawson Finance. “We often see people falling in love with properties, only to discover they’re out of reach nancially. Prequali cation avoids that by setting realistic expectations from the start.”

Kondowe explains that the process involves assessing your income, expenses and credit history to determine what size bond you’re likely to qualify for – and at what interest rate.

RAWSON property experts share essential steps for first-time buyers, from financial preparation to partnering with professionals, for homeownership success

PRO TIP 1: “Buyers who put down a deposit – even just ten per cent – often get better interest rates,” says Leonard Kondowe, national manager at Rawson Finance. “That can lead to significant savings over the life of your bond.”

(Don’t forget to budget for the upfront costs of buying, too.)

Step 3: Partner with a professional. While it’s tempting to go it alone, especially with all the online property tools at your ngertips, having an experienced real estate professional on your side can be a game-changer. “Buying your rst home isn’t something you do every day,” says Jacobs. “It’s a process with legal, nancial and emotional layers, and it helps to have someone who’s done it all before guiding you through it.”

Step 4: Make the offer. You’ve found the one – the home that ticks the boxes and ts the budget. Now comes the exciting (and slightly nerve-wracking) part: putting in an offer. This is done through an Offer to Purchase – a legal document that outlines your price, conditions and timelines. It’s not something to rush. Your estate agent will help you get the details right, including things such as whether your offer is subject to bond approval or a satisfactory inspection.

Once the seller accepts, the ball starts rolling fast. “If you’ve already been prequali ed, the bond approval process tends to go much quicker,” notes Kondowe.

Step 5: Prepare for ownership. Once your offer has been accepted and your bond approved, you’re of cially on the home stretch – but there are still a few boxes to tick before you get the keys. The legal transfer process usually takes between eight to twelve weeks and involves attorneys handling the bond registration and property transfer. During this time, you’ll want to start prepping for the practical side of ownership: budgeting for ongoing costs, such as municipal rates, home insurance, levies (if applicable) and general maintenance.

If you’re buying in a complex or estate ensure you understand the rules, levies and shared responsibilities. If it’s a freestanding home, consider getting a basic maintenance plan in place.

However, it’s not all admin and planning; this is also the time to start dreaming. Whether choosing paint colours, planning your garden or just imagining your rst cup of coffee in your new kitchen, owning a home is a deeply personal and rewarding experience.

“IF YOU’VE ALREADY BEEN PREQUALIFIED, THE BOND APPROVAL PROCESS TENDS TO GO MUCH QUICKER.” – LEONARD KONDOWE

Follow: Jacqui Savage www.linkedin.com/in/jacqui-savage-a7083a101 David Jacobs www.linkedin.com/in/david-jacobs-706162b7 Leonard Kondowe www.linkedin.com/in/leonard-kondowe-61b18012a

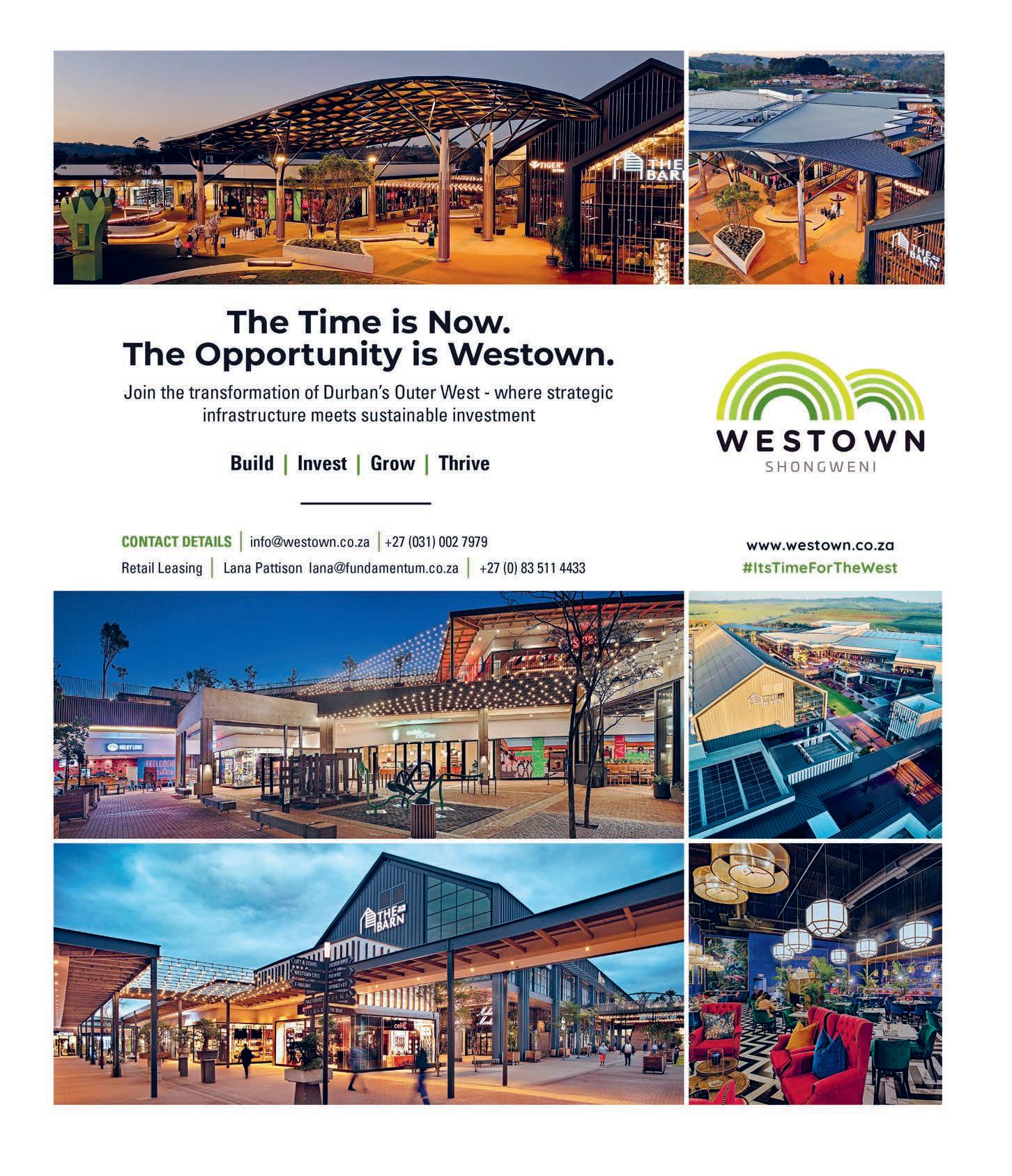

Just over six months since its official opening, WESTOWN SQUARE in Shongweni, on the outskirts of Durban, has proven to be a pivotal catalyst in the broader Westown development –the New City of the West. This transformative project is redefining Durban’s underserved Outer West region into a vibrant urban hub

As the trigger development for Westown, the Square anchors a catalytic investment that, together with strategic road and infrastructure upgrades undertaken in partnership with the eThekwini Municipality, is set to leverage a further R14-billion in investment across the precinct over the next decade.

“Like every other regional retail destination, it takes time – two to three years at least – for new spaces to become established,” says Carlos Correia, CEO of Fundamentum Property Group. “It requires a shift in shopping habits and behaviour. Expectations for a new space like Westown Square are high, especially