Last month, I ran my 33rd marathon. My running partner and I had trained for months through the thickest Virginia humidity, grinding through endless pre-dawn miles. When race day came, we both crushed our previous times and even outpaced several younger, faster friends tackling their first. They learned, as I have over the years, that success in a marathon is not just about speed. It is about endurance, patience, and knowing when to push. SubTel Forum has taken that same approach for nearly a quarter century. Twenty-four years of steady progress, of adapting and refining, of outlasting trends and short sprints. Like the seasoned marathoner, we have learned that staying power and the discipline to keep moving forward, mile after mile, are what truly define longevity in this industry.

This month, SubTel Forum introduces a new department, Fault Lines, by Kristian Nielsen, CRO of WFN Strategies. As submarine cables move to the forefront of geopolitics, from contested waters to questions of sovereignty and security, Fault Lines examines how power, policy, and connectivity now meet beneath the sea. Read Kristian’s first column in this issue to see why geopolitics and subsea infrastructure are now inseparable.

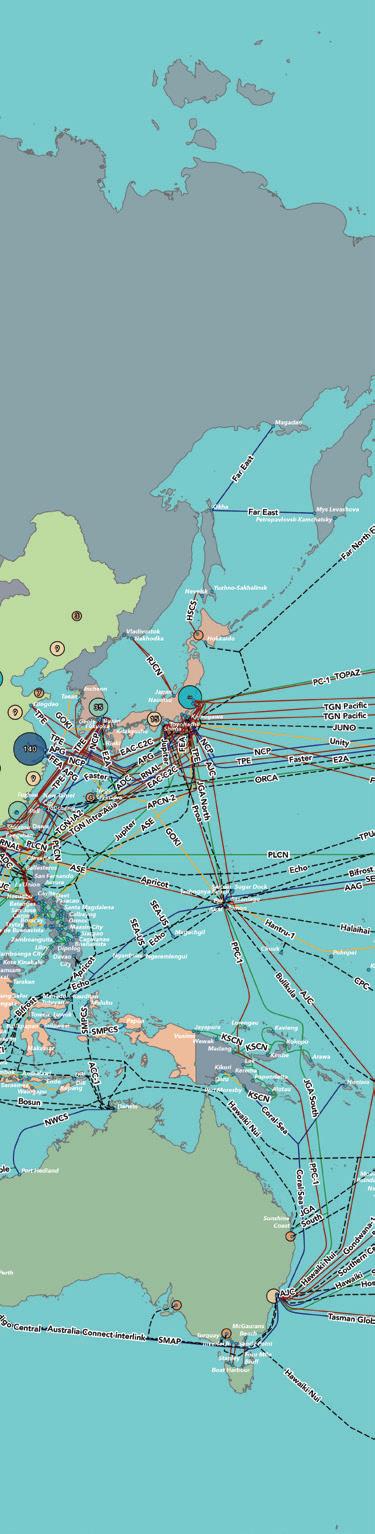

We are hard at work on the 2026 Submarine Cables of

the World wall map, scheduled for release early next year. The map will be distributed at major industry conferences including PTC 2026, Submarine Networks EMEA, and Submarine Networks World, keeping your brand visible on walls across the globe. Click here to secure your spot!

I had the pleasure of first meeting Charlie Bussmann, the original publisher of Sea Technology, in the 1980s, and later his son, Amos. I was saddened to learn that the magazine has recently ceased publication. For decades, Sea Technology delivered thoughtful, insightful content and stood as a respected voice across the marine and subsea industries. Thank you, Sea Technology, for your many years of contribution, education, and inspiration.

When Ted Breeze and I launched SubTel Forum in 2001, the industry was in a dark period. With little more than a severance package, some borrowed software, and a lot of determination, we took a leap of faith. Our first issue

featured eight articles and seven complimentary ads, a humble beginning during uncertain times.

Now, 24 years later, we have grown beyond anything we could have imagined. We have embraced new approaches, redefined our mission, and reaffirmed our commitment to the principles that started it all:

1. To provide a wide range of ideas and issues.

2. To incite, entertain, and provoke in a positive manner.

As we celebrate this milestone, our purpose remains clear. Education and communication are the foundation of our industry, and they continue to drive everything we do at SubTel Forum

To our more than 750 authors and sponsors, thank you for helping us reach this milestone. A special thanks to this issue’s advertisers: APTelecom, Fígoli Consulting, PTC 2026, Southern Cross, Telcables Europe, Undersea Fiber Communication Systems, and WFN Strategies. And of course, do not miss our fan favorite feature, Where in the World Are All Those Pesky Cableships? We hope SubTel Forum continues to be your trusted source for submarine cable industry news and analysis. As always, our mission remains to illuminate, educate, and inspire.

Good reading, Slava Ukraini , and save me a seat at the Mai Tai Bar. STF

Wayne Nielsen, Publisher

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324 subtelforum.com/advertise-with-us

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Andrés Fígoli, Brian Moon, Camila de Moraes, Iago Bojczuk, John Maguire, Kieran Clark, Nicola Tate, Nicole Starosielski, Phillip Pilgrim, and Wayne Nielsen

FEATURE WRITERS: Alex Vaxmonsky, Derek Cassidy, Doug Recker, Giorgio Grasso, Herve Fevrier, Joel Ogren, José Amaro, Kristian Nielsen, Olivier Côté, Richard Dobbie, Samia Bahsoun, Samuel Carvalho, Jayne Stowell and Omer Wilson

NEXT ISSUE: January 2026 – Global Outlook featuring Submarine Networks EMEA ’26 Preview

AUTHORS INDEX: https://subtelforum.com/authors-index

MAGAZINE ARCHIVE: subtelforum.com/magazine-archive

INDUSTRY DIRECTORY: directory.subtelforum.com

ONLINE CABLE MAP: subtelforum.com/submarine-cable-map

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers cannot be held responsible for the accuracy of the information

herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address 19471 Youngs Cliff Road, Suite 100, Sterling, Virginia 20165, USA, or call [+1] (703) 861-3647, or visit www.subtelforum.com.

Copyright © 2025 Submarine Telecoms Forum, Inc.

Samuel Carvalho

Alex Vaxmonsky

Joel Ogren

Derek Cassidy

By Fernando Borges Azevedo and Jayne Stowell

By José Amaro

Richard Dobbie

By Olivier Côté

Doug Recker

The most popular articles, Q&As of 2019. Find out what you missed!

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

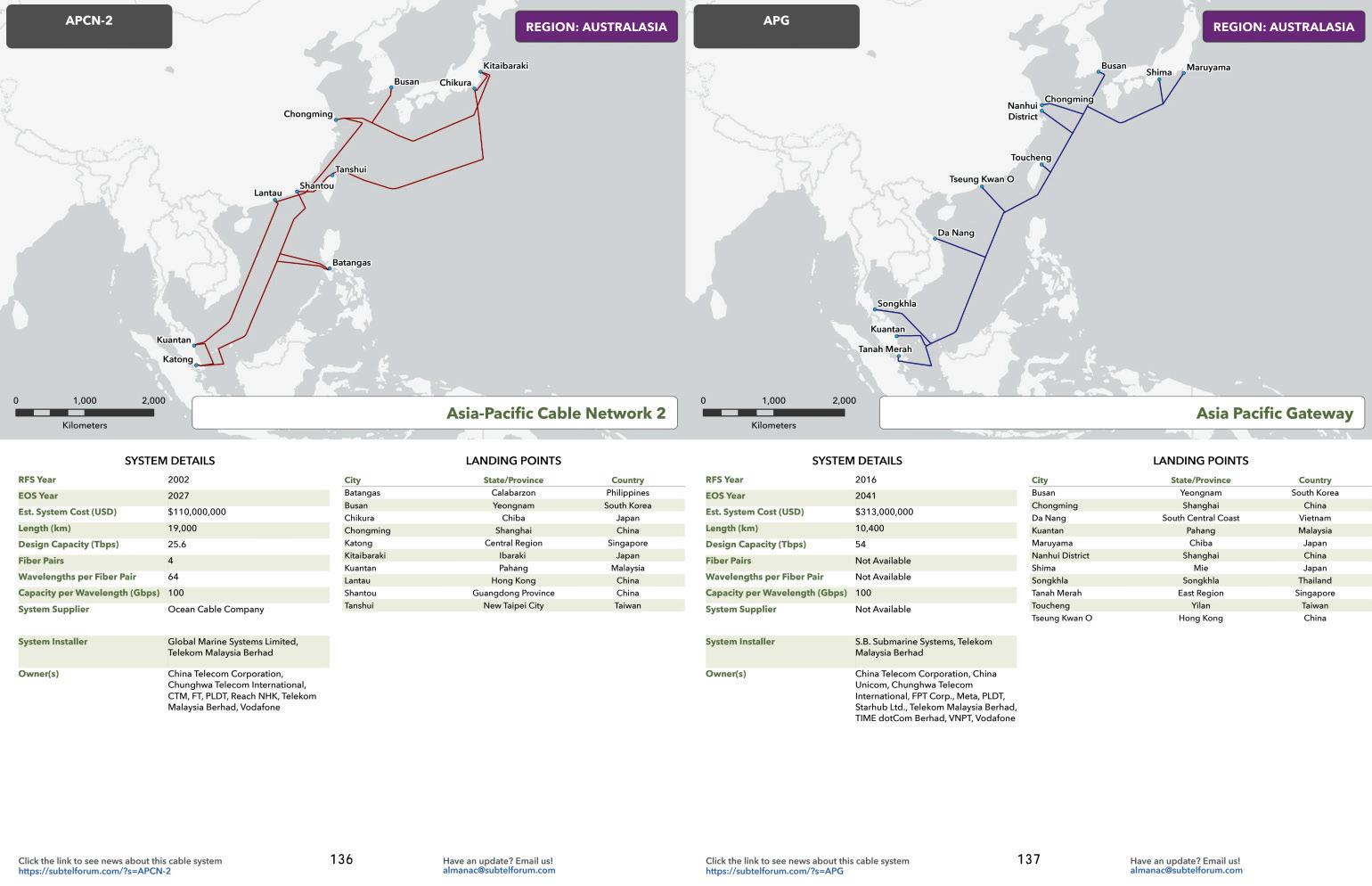

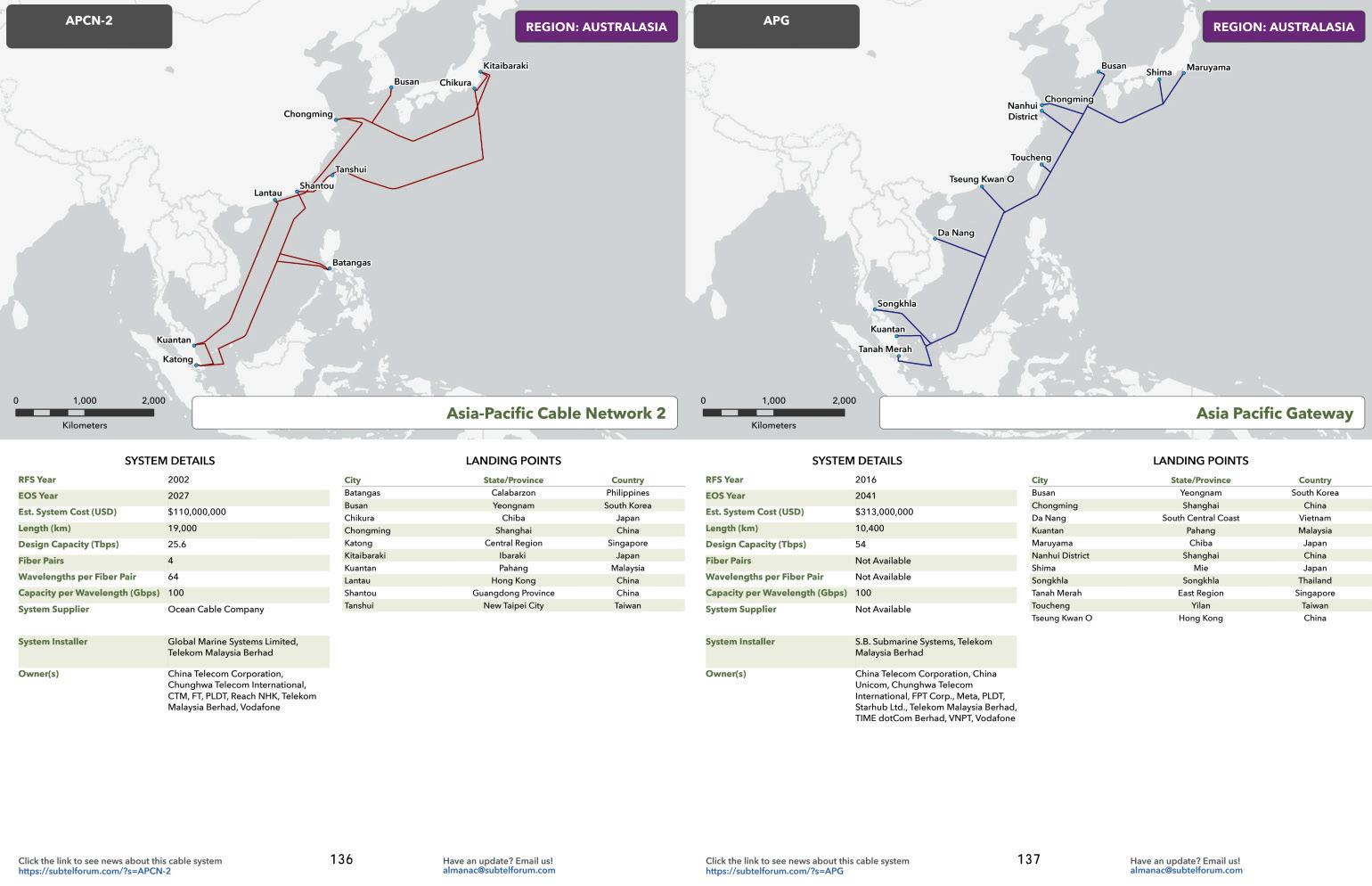

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

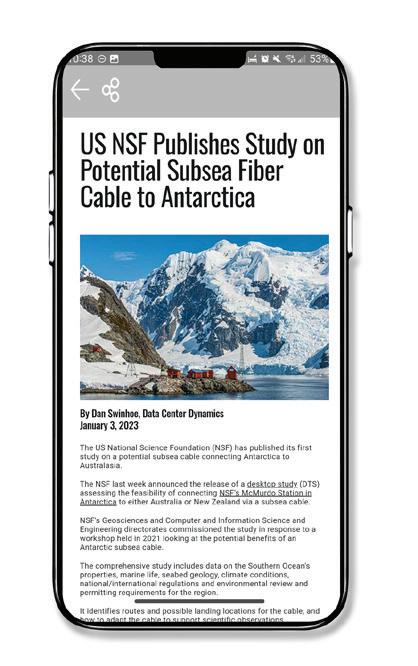

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

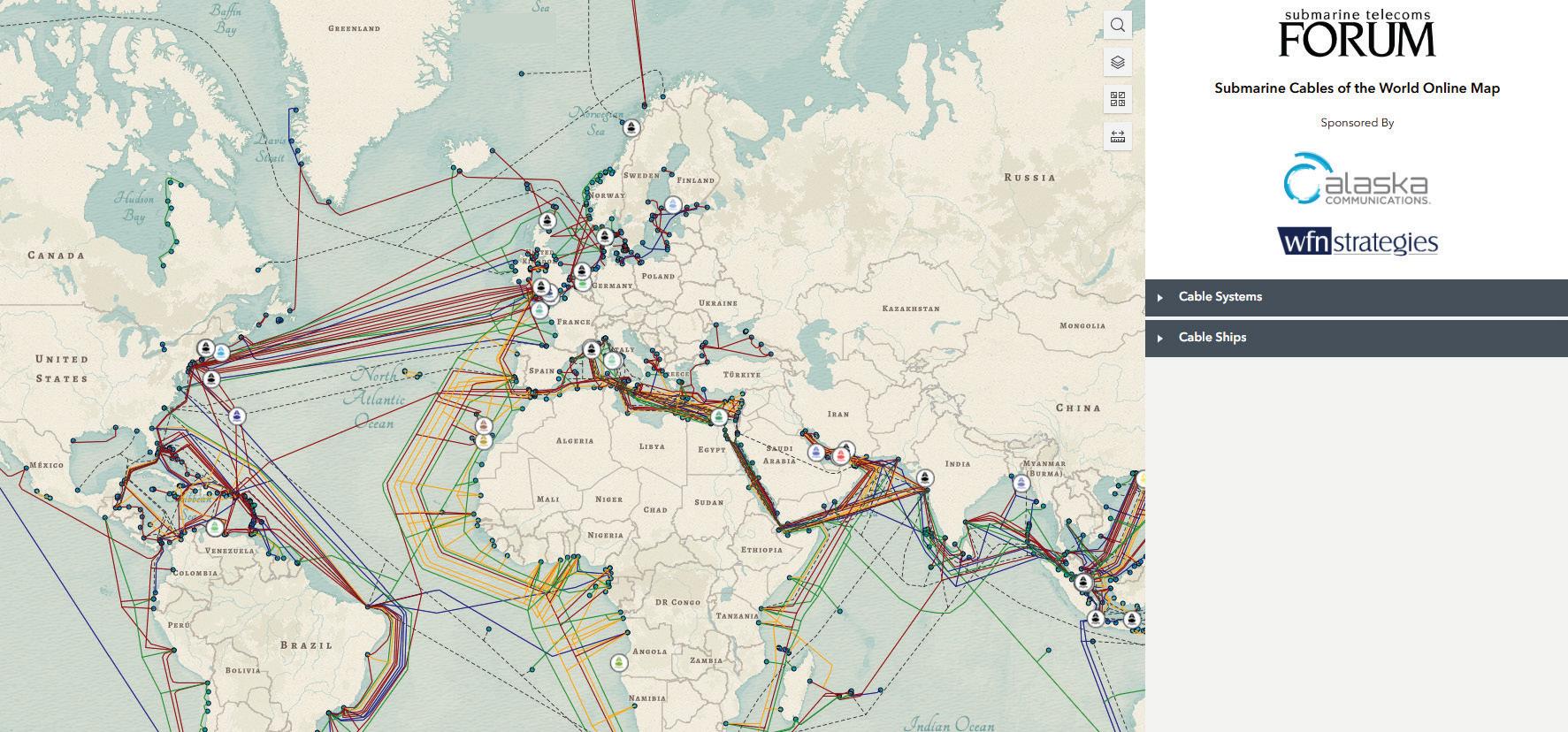

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

Explore the Submarine Telecoms Forum Magazine Archive, a comprehensive collection of past issues spanning 23+ years of submarine telecommunications. This essential resource offers insights into project updates, market trends, technological advancements, and regulatory changes. Whether researching industry developments or seeking

expert analysis, the archive provides valuable perspectives on the technologies and trends shaping global connectivity.

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

BY KIERAN CLARK

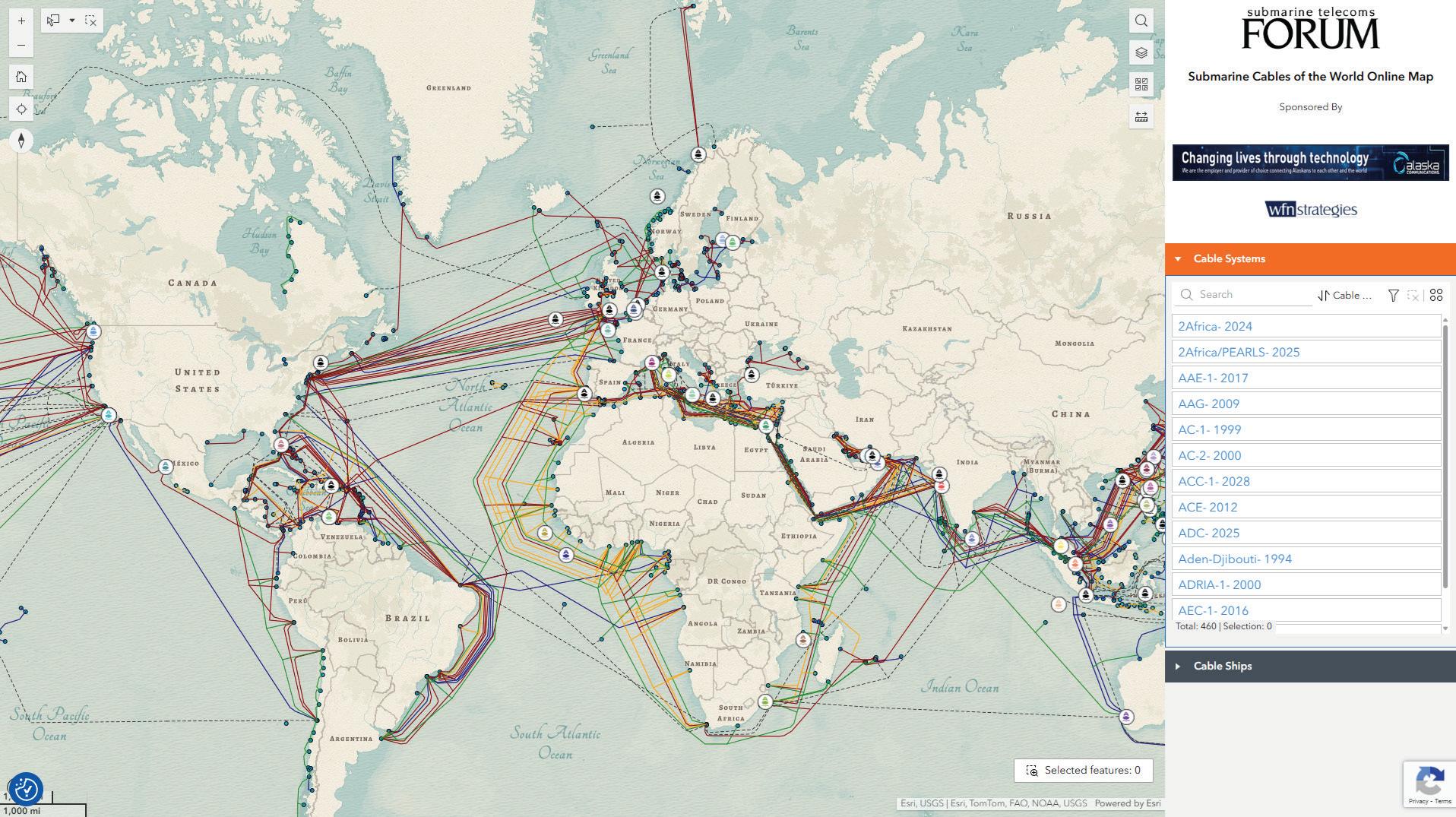

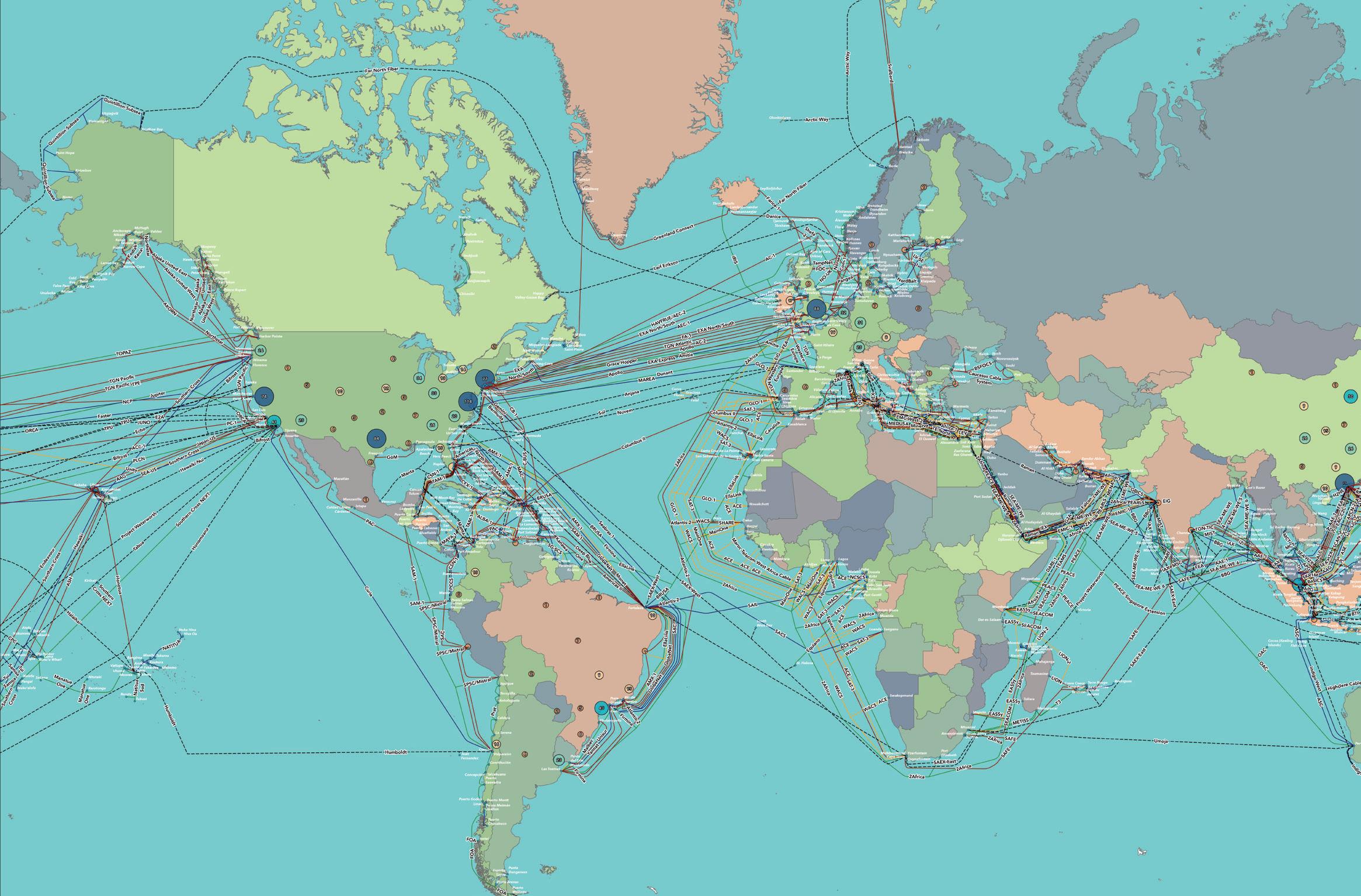

The SubTel Cable Map— powered by Esri’s ArcGIS platform—offers an interactive and detailed way to explore the global network of submarine cables. This indispensable resource provides information on over 440 existing and planned systems, more than 50 cable ships, and upwards of 1,000 landing points. Connected directly to the SubTel Forum Submarine Cable Database and integrated with our News Now Feed, the map enables real-time tracking of industry activity and cable-specific news coverage.

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations. Without them, modern, high-speed global communication simply wouldn’t be feasible. Our analysts continually update the map using verified data from the Submarine Cable Almanac and valuable input from industry contributors. This ensures a timely and accurate picture of the subsea cable landscape, spotlighting the latest deployments and developments. As we approach the end of the year, map updates may slow during the holiday season, but our commitment to delivering reliable insights remains unchanged.

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations.

We’re proud to feature Alaska Communications Systems and WFN Strategies as the current sponsors of the SubTel Cable Map. Additional sponsorship opportunities are available—offering high-visibility placement for your logo and

a direct link to your organization. It’s a great way to align your brand with global connectivity and the future of the submarine cable industry.

We invite you to explore the SubTel Cable Map and gain a deeper understanding of the vital role submarine cable systems play in our interconnected world. As always, if you are a point of contact for a system or company that requires updates, please email kclark@subtelforum.com.

We hope the SubTel Cable Map proves to be a valuable

Here’s the list of systems updated since our last issue:

NOVEMBER 17, 2025

resource for you, offering insight into the continually evolving submarine cable industry. Dive into the intricate network that powers our global communications today. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

NEWLY ADDED SYSTEMS:

• Asia United Gateway East (AUG East)

• Sol

• Sweden-Finland

• Updated Systems:

• BlueMed

• Bulikula

• Carnival Submarine Network-1 (CSN-1)

• Medusa

• Oman Emirates Gateway (OEG)

• Sydney-Melbourne-Adelaide-Perth (SMAP)

• Tabua

• Tikal-AMX-3

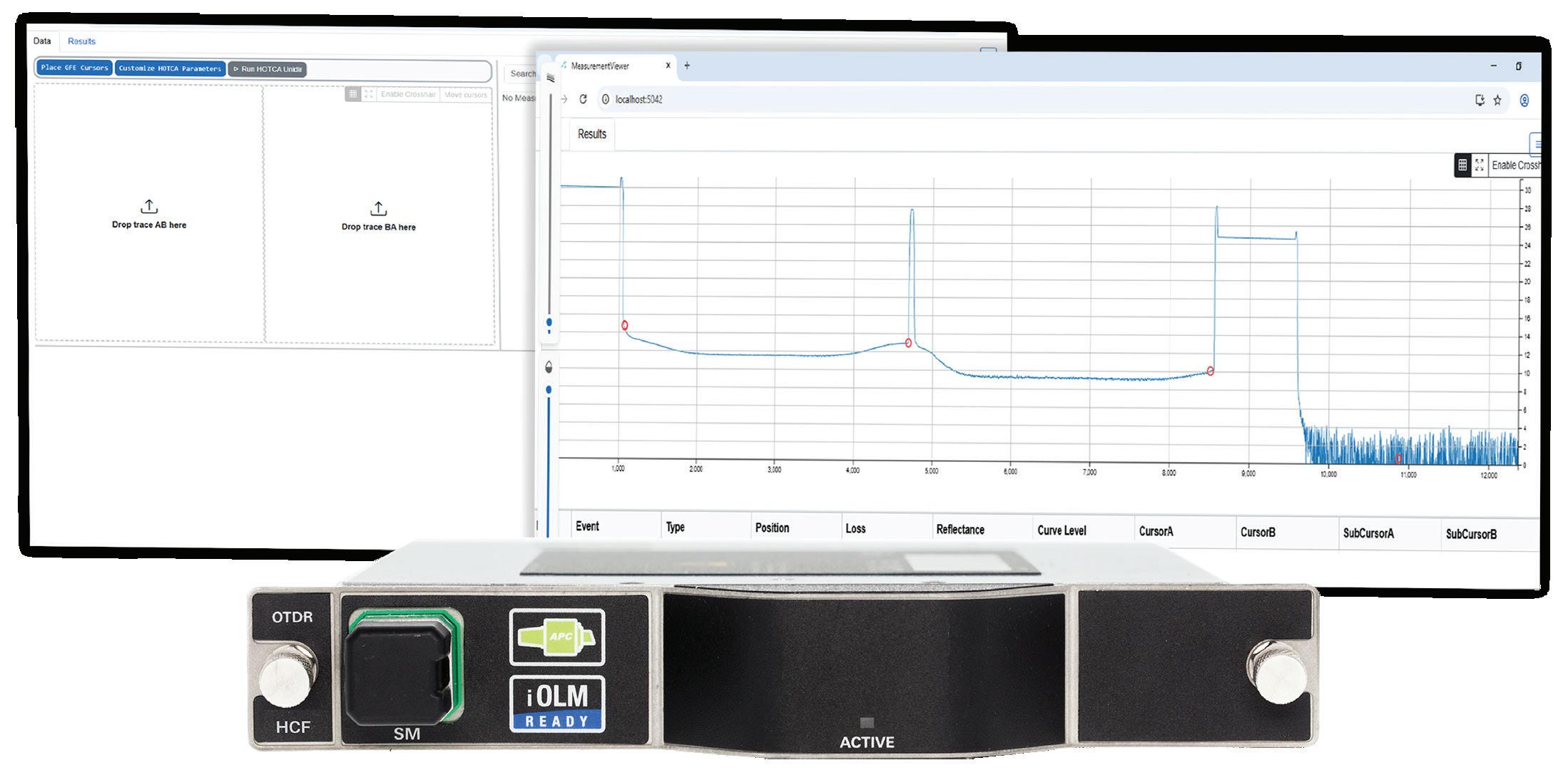

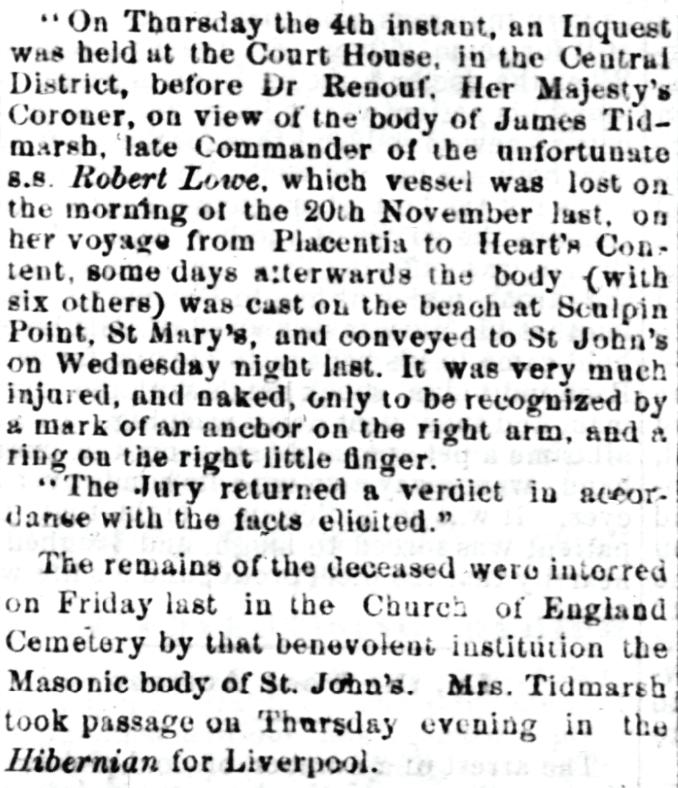

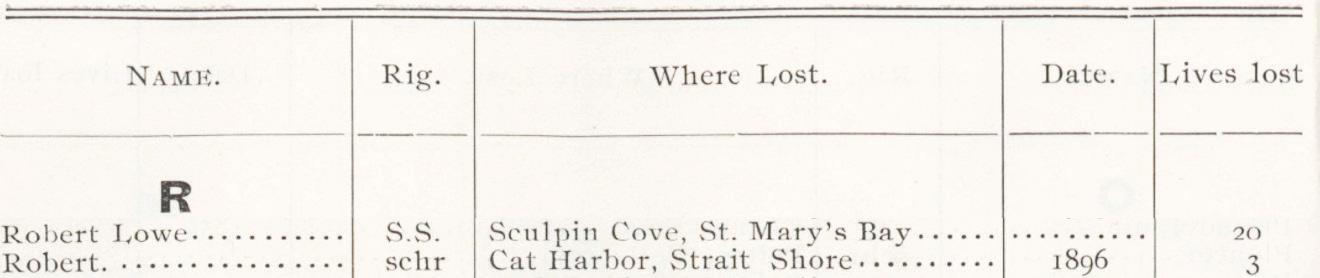

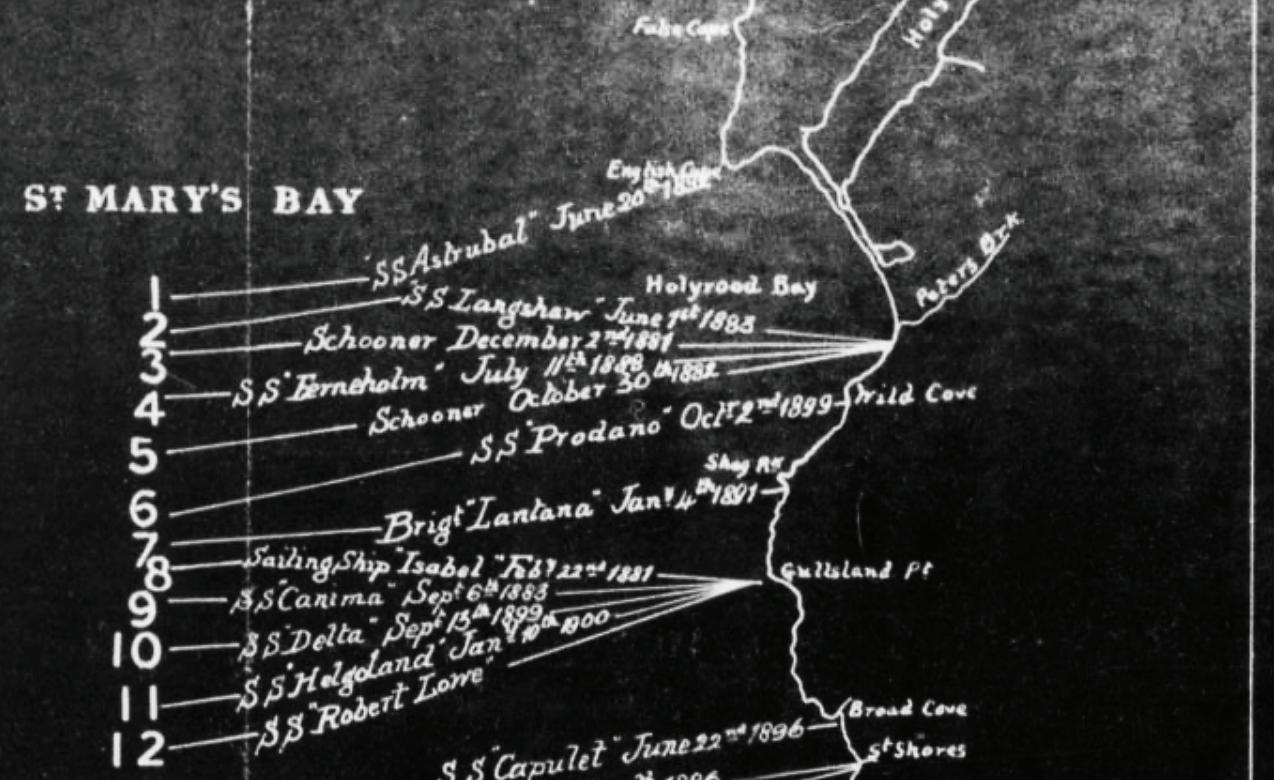

[Reprinted

Excerpts from SubTel Forum’s 2025/26

Submarine Industry Report]

Since 2016, the ownership and development of submarine cable systems have steadily shifted toward Hyperscalers such as Google, Amazon, Microsoft, and Meta. These companies have increasingly prioritized building or co-owning infrastructure to support the global distribution of cloud services, content delivery, and interconnection of massive data center campuses. Where telecom operators once dominated as primary builders and owners, Hyperscalers now represent one of the most consistent sources of demand for new cable projects.

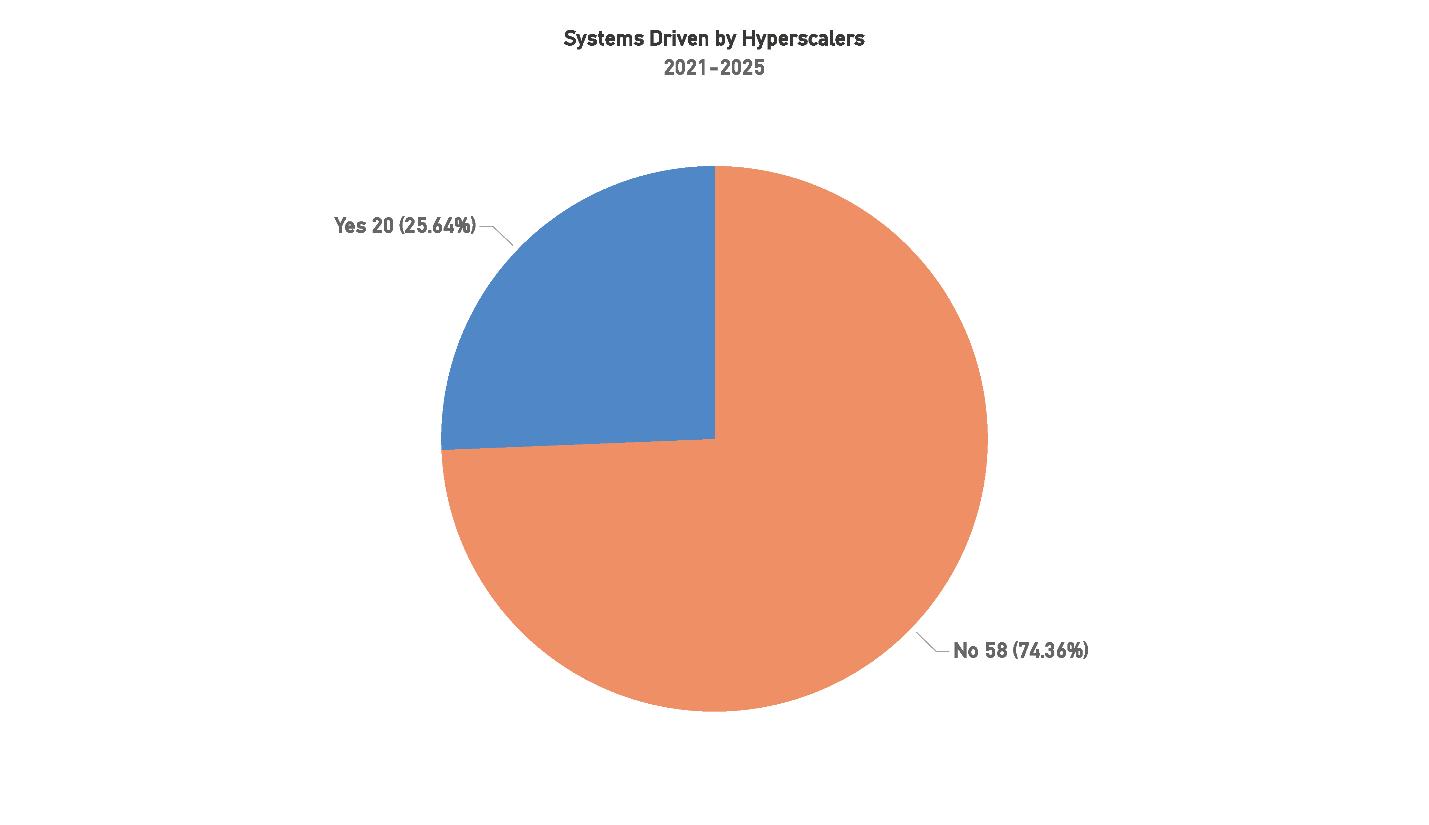

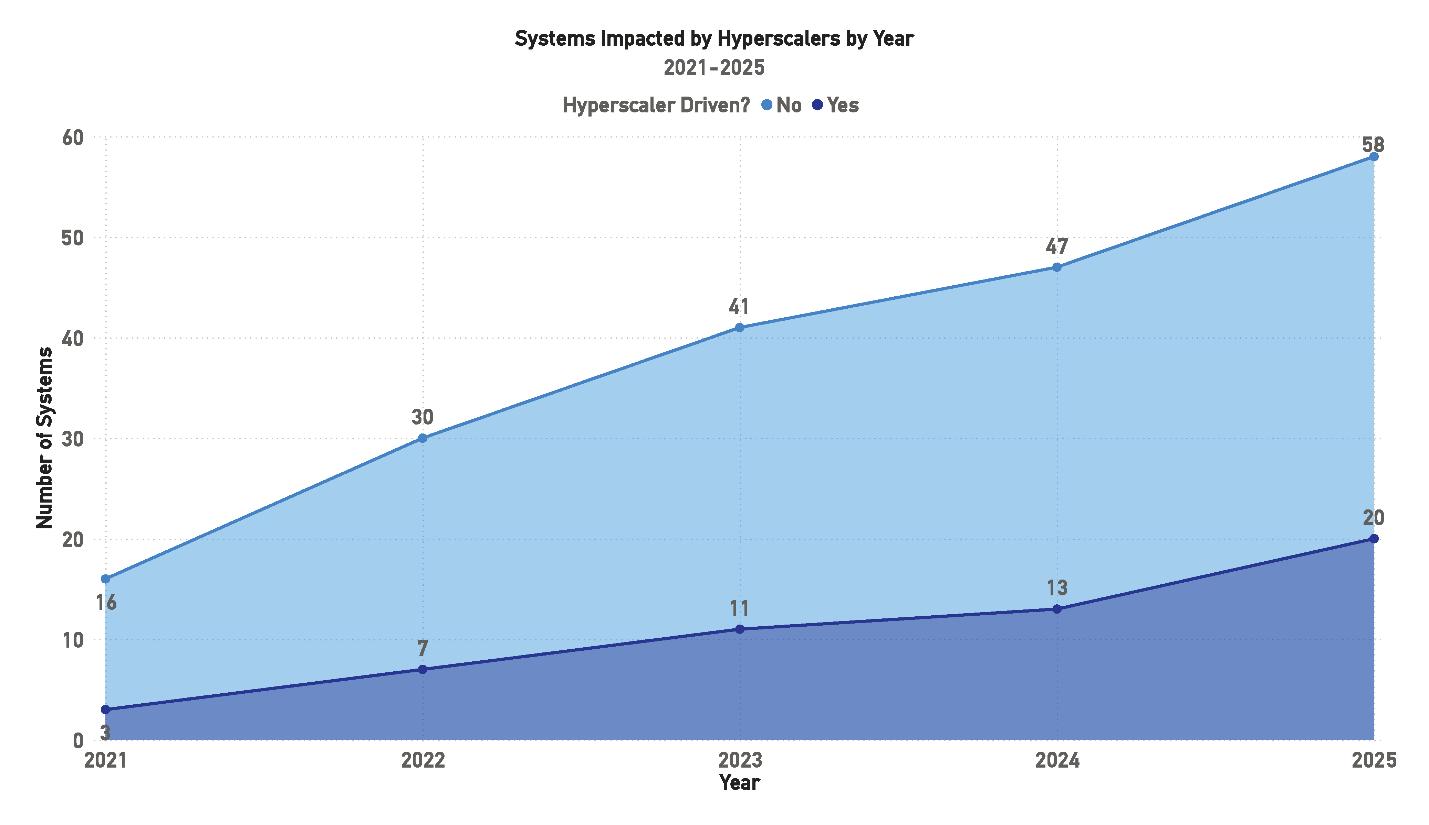

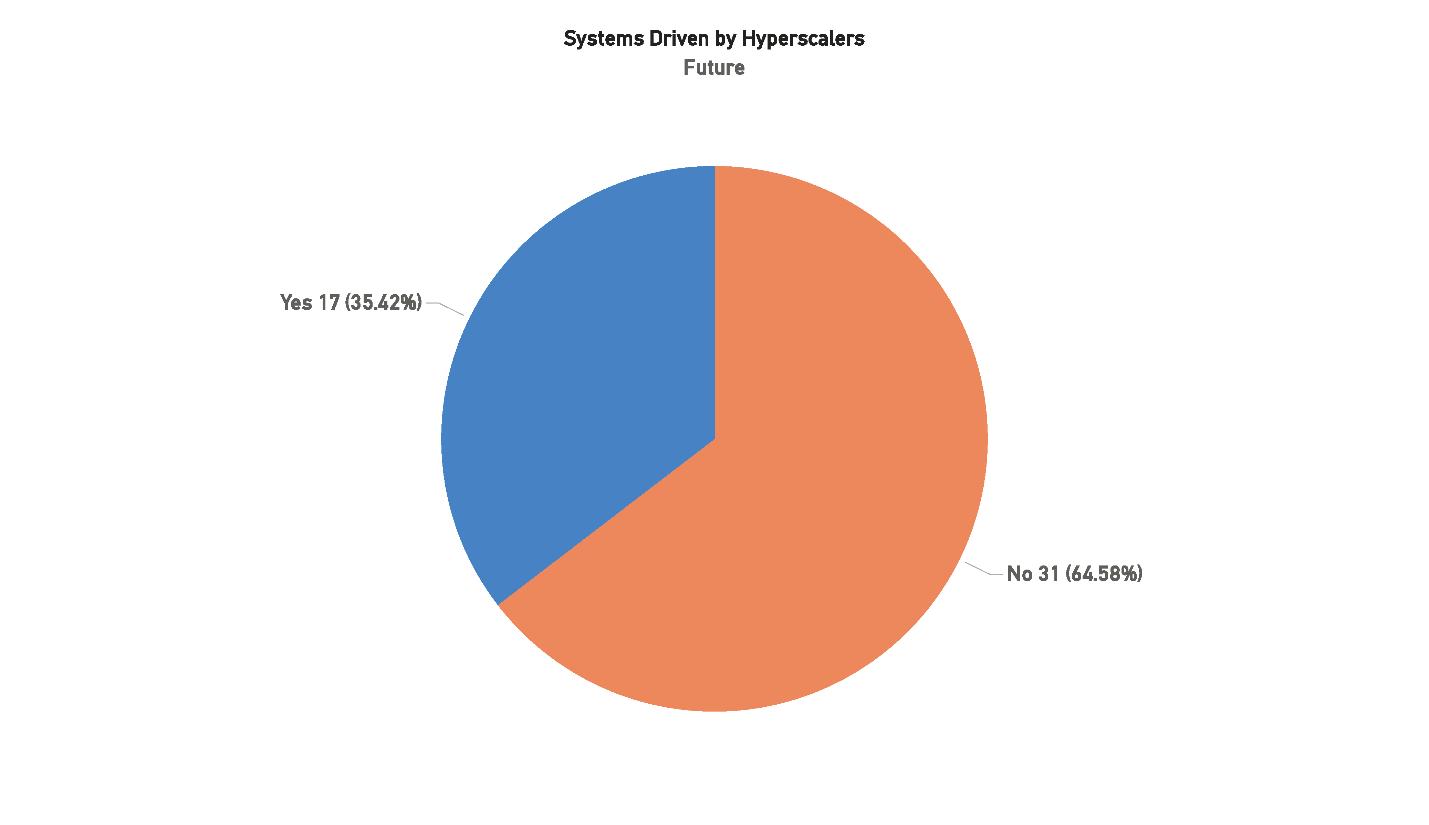

Figure 52: Systems Driven by Hyperscalers, 2021-2025

Between 2020 and 2024, Hyperscalers were responsible for driving 20 submarine cable systems, accounting for 25.64% of the 78 total systems during this period. While traditional telecom operators still account for the majority of builds, this share demonstrates the steady and growing influence of large-scale cloud and content companies in shaping global connectivity. In the 2019–2023 period, Hyperscalers ac-

counted for 24 out of 102 systems, or 23.5%. Although the absolute number is slightly lower in the most recent period, their proportional influence is higher, underscoring that Hyperscalers remain consistent participants even as overall project volumes fluctuate.

When examining year-by-year trends, the growth in Hyperscaler-driven systems is more pronounced. In 2021, only 3 such systems entered service, compared to 16 projects led by other actors. By 2022, the number of Hyperscaler-driven systems more than doubled to 7, increasing again to 11 in 2023, and reaching 13 in 2024. This reflects not just a rising number of projects, but also a growing consistency of participation: Hyperscalers are now involved every year, whereas in earlier periods their investments appeared more episodic.

This trend illustrates how Hyperscalers have become long-term strategic players rather than opportunistic participants. The increasing number of systems they sponsor, or co-sponsor is tied directly to demand for interconnection across global cloud regions, streaming platforms, and enterprise data ecosystems. Control over infrastructure offers several advantages: (1) the ability to design routes and landing points aligned with their data center footprints; (2) the capacity to allocate bandwidth flexibly without competing for limited leased circuits; and (3) resilience against supply constraints or geopolitical restrictions affecting vendor choice and route design.

The financial implications are also notable. Although constructing transoceanic cables typically requires investments exceeding $100 million per system, Hyperscalers view these expenditures as cost-saving over time. By internalizing connectivity rather than relying on leased capacity, they reduce long-term operational costs and gain scalability to match exponential growth in cloud usage. This shift also alters industry dynamics: traditional carriers increasingly act as partners or minority consortium members, while Hyperscalers assume the lead role in funding and technical design.

While Hyperscalers’ share of total systems remains around one-quarter, their influence on pricing, route development, and technical specifications far outweighs this percentage. For example, decisions made by Hyperscalers often dictate whether a project is viable, which suppliers are selected, and how capacity is marketed. This growing strategic role highlights the extent to which submarine cables are no longer simply

telecom infrastructure, but critical digital arteries tailored to the needs of the world’s largest data-centric enterprises.

Looking forward, Hyperscalers are expected to account for a significantly larger share of upcoming submarine cable systems compared to earlier projections. Out of 48 systems currently planned, 17 are identified as Hyperscaler-driven, representing 35.42% of the total. This marks a clear increase over last year’s forecast, which anticipated Hyperscalers would drive only 26.47% of planned builds, and a more than doubling compared to the 14% projection made two years ago.

This upward trend underscores the sustained commitment of companies such as Google, Amazon, Microsoft, and Meta to investing directly in critical connectivity infrastructure. While overall market conditions have become more complex — with pressures from inflation, supply chain challenges, and shifts in global regulatory frameworks — Hyperscalers continue to deploy capital strategically to secure the global bandwidth required by their core businesses. Importantly, Hyperscaler-backed projects are more likely to move from planning into service than projects led by traditional carriers, due to the financial stability, large-scale demand, and internal financing structures these companies bring.

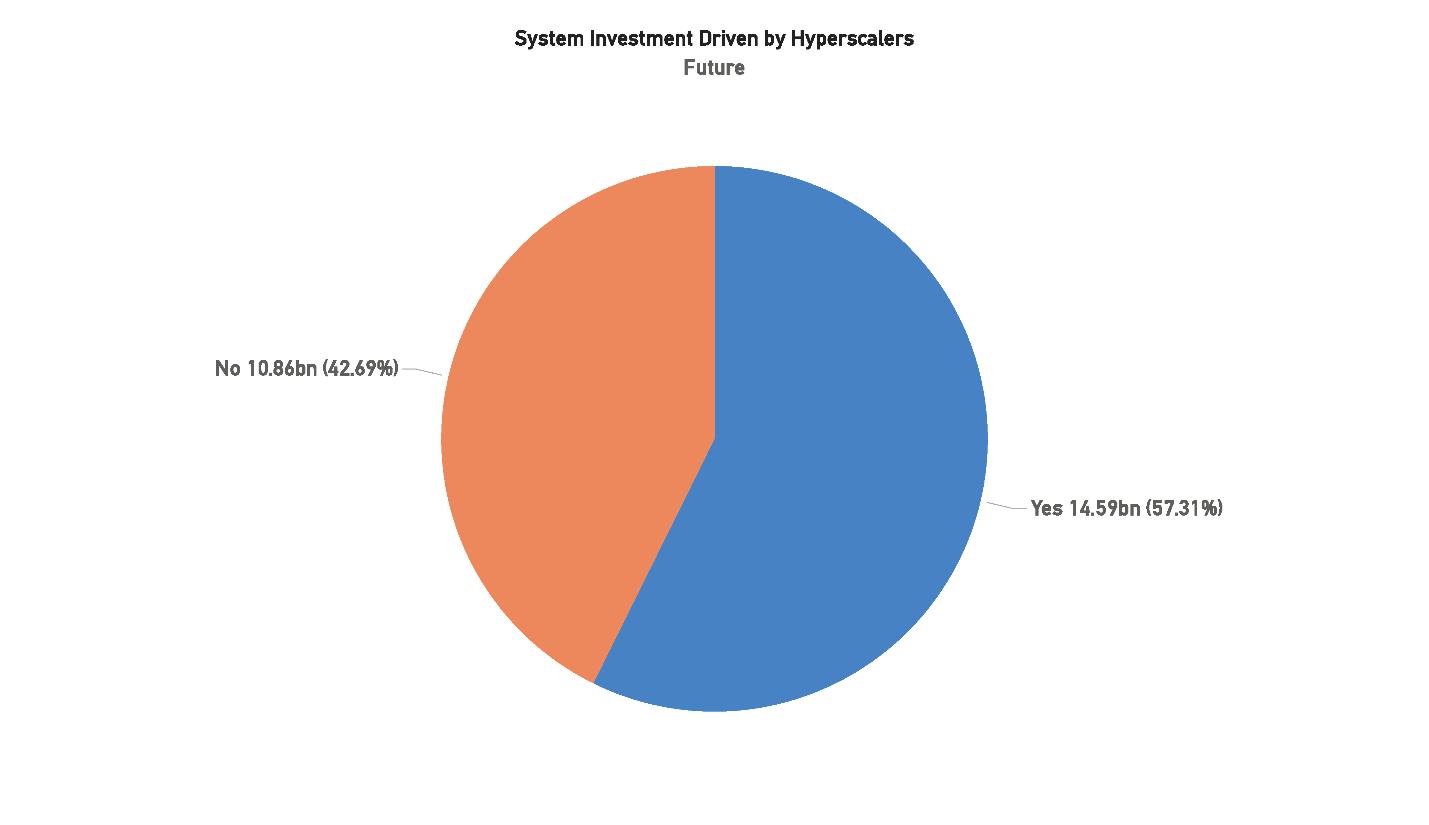

In terms of investment volume, Hyperscalers are projected to contribute approximately $14.59 billion to future cable systems, equating to 57.31% of the total projected $25.45 billion. This marks a major shift in the balance of industry financing: while Hyperscalers are responsible for just over a third of systems in number, their funding accounts for the majority of global investment. By contrast, non-Hyperscaler systems, though more numerous, represent only $10.86 billion or 42.69% of the total spend.

Hyperscalers are not only increasing system counts but reshaping the financial base of the global cable industry. Their funding minimizes project risk by securing financing early and speeds deployment by avoiding the long sales cycles traditional carriers face.

Historically, only about half of announced cable systems reach readiness for service. Hyperscaler-backed

projects, by contrast, typically move forward once the Contract in Force (CIF) milestone is met, resulting in far higher completion rates and reinforcing their position as the industry’s most reliable project drivers.

Their growing investment ensures that key cloud and content routes — especially transoceanic and inter–data center links — continue to expand. Meanwhile, carrier-led systems may increasingly require Hyperscaler or government backing as funding gaps widen. This marks a structural shift: Hyperscalers have evolved from major customers to central architects of global connectivity.

Google, Amazon, and Microsoft remain the leading investors, with Meta maintaining selective but strategic involvement. While no new entrants are expected soon, their ongoing capital commitments ensure that Hyperscalers will define future priorities — focusing on route diversity, redundancy, and avoidance of geopolitical chokepoints.

In short, Hyperscalers will shape the next era of submarine networks more than ever before. Though they represent just over one-third of planned systems, their nearly 60% share of total investment highlights their dominance — accelerating timelines, setting new reliability standards, and consolidating influence over global network infrastructure.

“More than 400 submarine cables manage 99% of global internet traffic, with private investors and major technology companies controlling over 40% of the market; Lower Earth Orbit satellites provide fast services in underserved regions and can complement cables to reduce infrastructure risks.”

John

Hibbard & Paul McCann Hibbard Consulting and McCann Consulting (STF Issue 143)

[Reprinted

Excerpts from SubTel Forum’s 2025/26

Submarine Industry Report]

Data center providers have become increasingly integral to the submarine telecommunications ecosystem in recent years. A major trend has been the strategic positioning of data centers and colocation facilities directly adjacent to submarine cable landing stations to enhance interconnection and optimize network performance. Placing data centers at cable landings is driven by the need for ultra-low latency and highspeed data transmission – closer proximity to where subsea cables come ashore can dramatically reduce network hops and latency. In practice, modern subsea cables are now often terminated inside carrier-neutral data centers at these hubs (rather than at remote beach manholes), effectively drawing cables “from data center to data center” across oceans. This configuration simplifies network architecture and improves reliability by aggregating international bandwidth in one place. It is especially advantageous at landing sites where multiple submarine cables converge, as a co-located data center can tap into all of them and provide customers with extensive interconnection options across many networks.

One prominent example is Marseille, France, which has solidified its role as a key global interconnection hub due to its strategic cable landing facilities. Marseille’s proximity to three continents has made it a gateway city for high-speed connectivity spanning Europe, Africa, the Middle East, and Asia. As of 2024, Marseille hosts around 16 international submarine cables (including the 45,000 km 2Africa cable that landed in late 2022), up from 13 cables just a few years prior. Data centers in Marseille – such as those operated by Digital Realty (Interxion) – directly house the termination equipment for these cables, giving them immediate access to enormous international capacity. This has attracted a large community of carriers, content providers, and cloud services to cluster in Marseille’s facilities. By one account, over 120 international and regional network operators and several Internet Exchanges are present at Interxion’s campus there, leveraging the city’s status as Europe’s telecommunications gateway to Asia, Africa and the Middle East. Customers benefit because from these landing-station data centers they can “land and expand” their traffic – receiving incoming intercontinental data and then instantly relaying it via low-latency backhaul to inland digital hubs like Paris, Frankfurt or London. In essence, locating data centers at cable landings creates a one-stop interconnection point, reducing transit costs and latency for international data flows.

This trend of pairing data centers with submarine cables is not limited to Marseille. Around the world, data center investment is clustering in coastal “gateway” markets. In North America, for instance, hubs like Virginia Beach (U.S.) and Hillsboro, Oregon (U.S.) have grown as they receive new Pacific and Transatlantic cables, and similar dynamics are seen in Asia (e.g., Singapore and Mumbai) and Africa (e.g., Mombasa). Data center developers and carriers are proactively expanding near these strategic landing points. Industry leaders Equinix and Digital Realty have continued to grow their portfolios in such locations, providing high-density interconnection platforms at the subsea edge of the network. Equinix in particular has opened new International Business Exchange (IBX) centers in Mediterranean markets like Lisbon, Genoa, and Barcelona to complement Marseille and offer alternative landing hubs. By establishing facilities at multiple cable endpoints, they can attract a broader customer base seeking resilient, low-latency connec-

tivity to global networks. The business case justifies the heavy capital outlay: despite the substantial cost of building and powering data centers (typically around $7–12 million per megawatt of capacity for new construction), proximity to undersea cables unlocks access to massive bandwidth and customers willing to pay for fast, direct connections. These factors have incentivized carriers and colocation providers – including smaller non-hyperscalers – to invest in markets close to cable landing stations, enhancing their competitiveness by becoming essential interconnection hubs in the international data chain.

Globally, data center capacity continues to expand at a record pace, underscoring the interdependence of the data center and submarine cable industries. 2024 saw an unprecedented boom in data center construction, and 2025 is on track to set new highs. Real estate firm JLL estimates that 10 GW of new data center capacity will break ground worldwide in 2025, with another 7 GW of capacity reaching completion during the year. This represents roughly a 15–20% annual growth rate in total installed capacity – a rate that is straining power grids and outpacing many earlier projections. Such growth is fueled by surging demand for cloud services, streaming, and AI applications, which in turn drives new submarine cable deployments to carry the traffic. The symbiosis between cables and data centers is tighter than ever: new cables require robust data centers at the landing points, and conversely, data centers flourish when fed by multiple high-capacity cables. This virtuous cycle is expected to continue, with each side spurring further investment in the other. By the end of 2025, analysts anticipate over 500 additional hyperscale and large colocation data center projects in the global pipeline (up from 440 a year earlier), many of them positioned in key landing station markets. In short, the submarine cable and data center industries are set to grow even more interdependent, jointly underpinning the next generation of global connectivity.

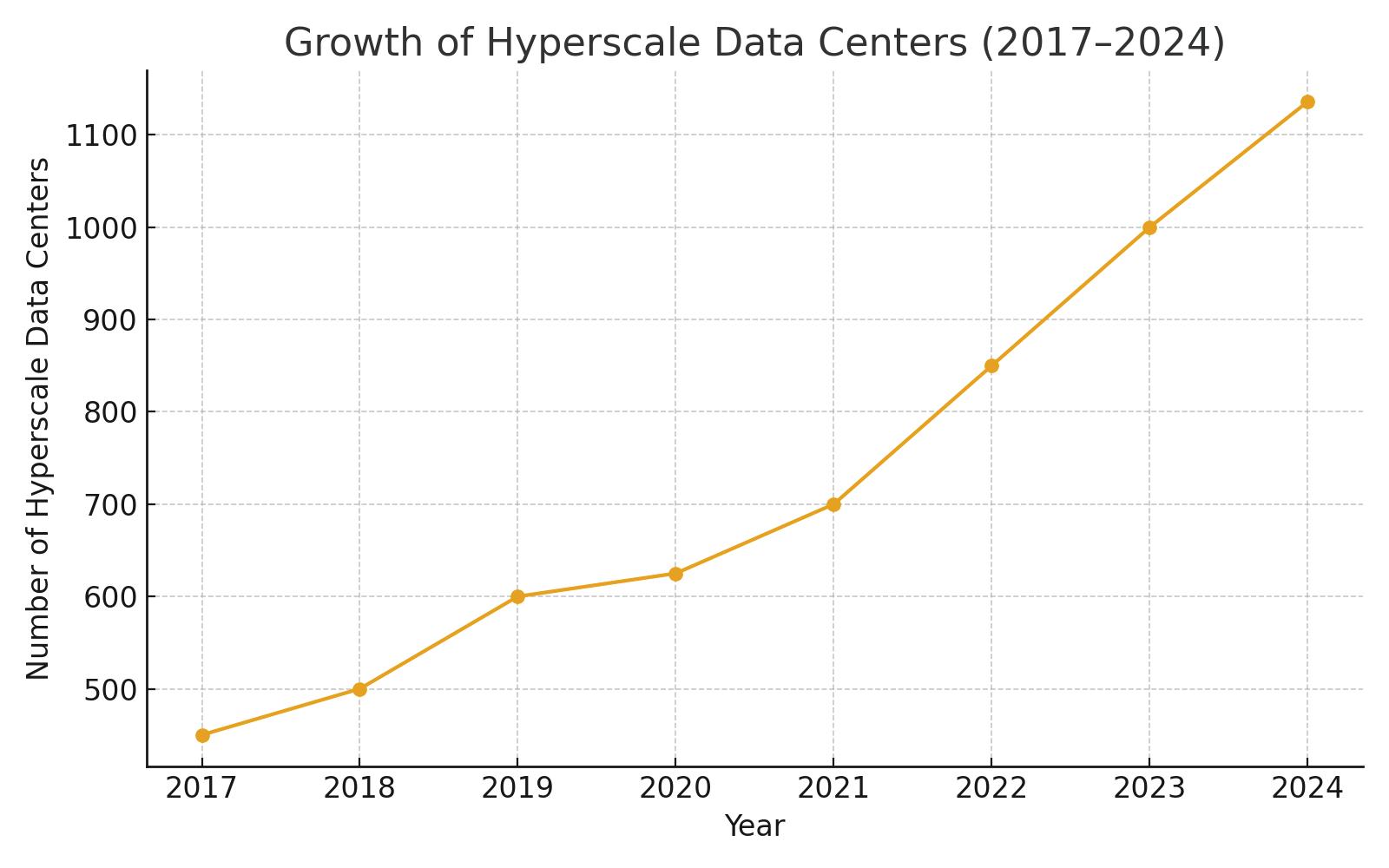

The global data center market is indeed experiencing remarkable growth, with hyperscale data centers driving much of the expansion. Hyperscale facilities – massive cloud and internet data centers owned by the likes of Amazon (AWS), Microsoft, Google, Meta, and Alibaba – crossed an important threshold in early 2024, surpassing 1,000 total sites in operation worldwide. By the end of 2024, the count of large hyperscale data centers had reached 1,136, and it continues to rise rapidly in 2025. This is more than double

the number of hyperscale sites just five years ago. Correspondingly, the aggregate capacity of hyperscale data centers (measured in megawatts of critical IT load) has doubled in under four years and is on track to double again in roughly the next four years according to Synergy Research. Each year is seeing on the order of 130–140 new hyperscale data centers come online – in 2024 alone, 137 new hyperscale facilities were activated. Crucially, not only are there more sites, but the average size of each new data center is increasing. The build-out of energy-hungry AI infrastructure is a prime reason: companies are deploying much larger server clusters (with thousands of GPUs) for training generative AI models, which require greater power and space. This has “supercharged” the scale of hyperscale campuses coming online in the past year.

The increasing reliance on AI is reshaping data center design and investment. Hyperscale operators are now routinely planning facilities exceeding 100 MW each to accommodate AI supercomputing needs – a stark jump from typical facilities a few years ago. These AI-focused builds feature higher rack densities and novel cooling systems to handle the heat output. NVIDIA’s latest AI chips, for example, consume up to 300% more power than their predecessors, driving the adoption of liquid cooling and other advanced thermal management in data centers. Many cloud providers have begun segmenting their infrastructure into AI-specific “training” data centers (sited near abundant power sources) versus more conventional “inference” or general-purpose data centers closer to end-users. Still, as core hyperscale campuses grow ever bigger, operators are also deploying an increasing number of smaller, distributed data centers to push services closer to customers at the edge. This bifurcation – mega-scale central facilities paired with satellite edge nodes – has become more pronounced in the last few years. The smaller facilities, often located in secondary cities or emerging markets, cache content and handle local traffic to further reduce latency for users, complementing the giant regional hubs.

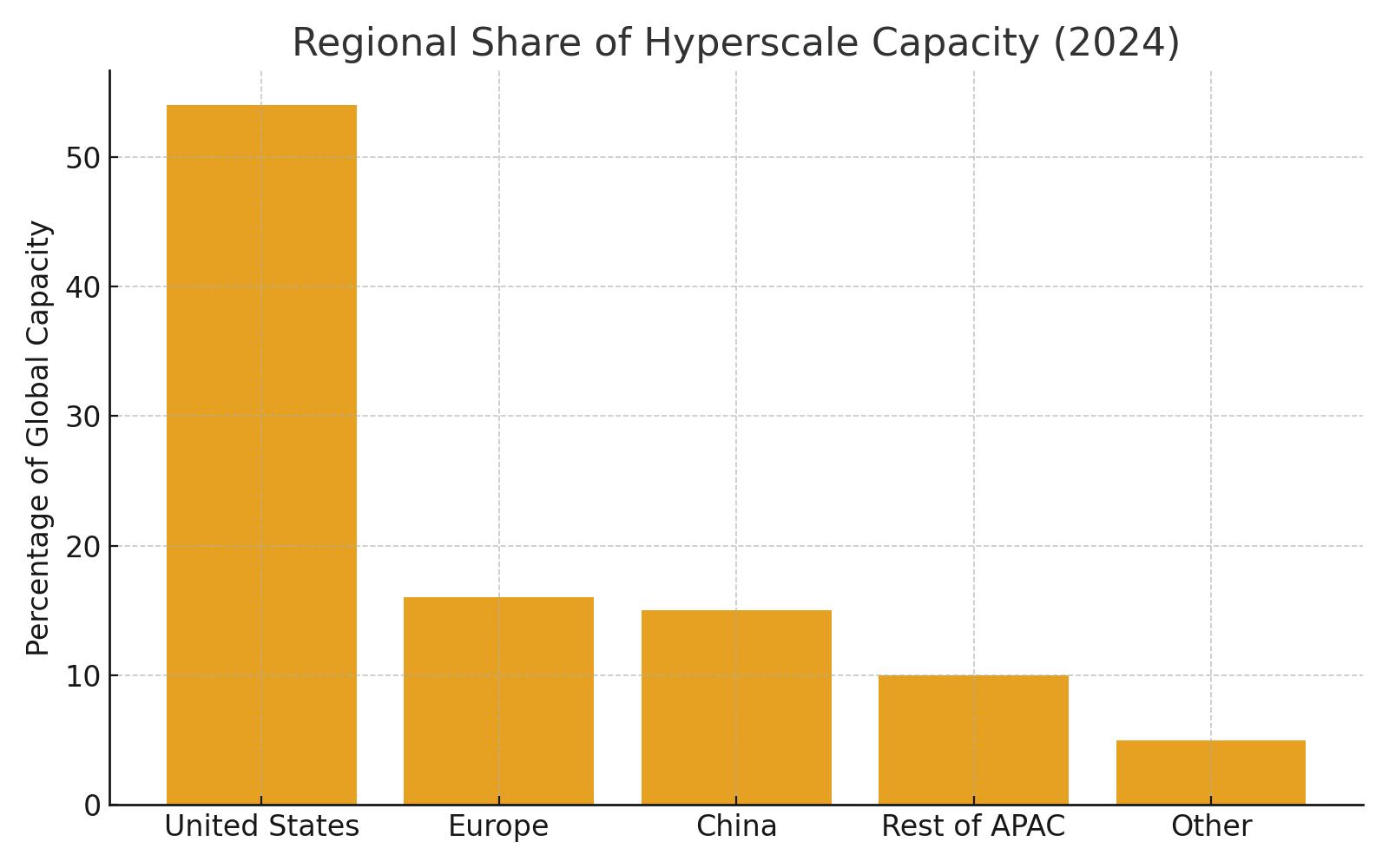

Geographically, the distribution of hyperscale capacity remains uneven and highly concentrated in a few countries. The United States is by far the dominant home of hyperscale infrastructure – as of late 2024, the U.S. alone accounts for roughly 54% of the world’s total hyperscale data center capacity. This is more capacity than Europe, China, and the rest of Asia-Pacific combined. China and Europe each account for only about 15–16% of global hyperscale capacity (with the remainder in other regions). Within the U.S., Northern Virginia (specifically Loudoun County’s “Data Center Alley” and adjacent areas) remains the single largest hyperscale cluster on the planet – so much so that Northern Virginia along with the Greater Beijing area in China together make up around 20% of all global hyperscale capacity. According to Synergy’s latest rankings, just 20 metropolitan areas or states host 62% of the world’s hyperscale capacity, and 14 of those top 20 locations are in the U.S. Besides Northern Virginia, other leading hyperscale markets include Oregon and Iowa (ranked #3 and #4 globally, thanks to huge cloud campuses with access to cheap power), the Dallas/Fort Worth metro in Texas, and Ohio – as well as Dublin, Ireland (the one European market in the top ten), and Shanghai, China. In fact, Dublin is currently the only market in all of Europe to crack the top 20 list for hyperscale capacity – Frankfurt and Amsterdam, historically big colocation hubs, have slipped just outside the top 20 as their growth has been outpaced by faster-expanding U.S. and APAC markets.

“Content and cloud providers now account for more than 70% of international bandwidth usage…global demand has nearly tripled since 2019.”

Martin Reilly - MOFN feature (STF Issue 144)

Looking ahead, new hyperscale growth markets are beginning to emerge, which could gradually shift the global landscape. Within the U.S., the “center of gravity” for hyperscale development is expected to broaden beyond Northern Virginia to include more sites in southern and midwestern states that offer abundant land and power. Industry analysts note that factors like power availability, cost of energy, land prices, and tax incentives have become pivotal in site selection – sometimes outweighing proximity to traditional tech hubs. This favors certain less densely populated areas: for example, states such as Oregon, Iowa, Nebraska, and Georgia (each of which appears in the top 20 list) have attracted massive projects due to lower costs or utility incentives.

By contrast, some major world cities face constraints: London, Frankfurt, Tokyo, and others are grappling with grid congestion, scarce real estate, and permitting challenges, which temper their hyperscale growth. Outside the U.S. and China, countries poised for greater hyperscale investment include India, which has a booming cloud user base; Malaysia and other Southeast Asian nations; Spain (leveraging new cables and strategic location for Europe/Africa connectivity); and Saudi Arabia in the Middle East. These up-and-coming markets are expected to claim a bigger share of hyperscale deployments over the next 3–5 years, as the global cloud giants extend their footprint to reach new users. In 2024, hyperscalers already ramped up their capital expenditures to accelerate expansion into new regions – collectively spending over $200 billion on data center builds (a jump from roughly $150 billion per year in 2022–2023). Colocation providers are following suit by investing in those geographies, often in partnership with hyperscalers or to provide regional capacity for enterprises. This robust investment pipeline (with 535 future hyperscale sites reportedly in planning or construction worldwide as of mid-2025) suggests that double-digit annual growth in capacity will continue in the near term. In fact, Synergy Research projects that all regions will see at least 10%+ yearly growth in total data center capacity through 2030, with hyperscale cloud infrastructure growing on the order of 20% YoY globally.

Notably, hyperscale operators are capturing an ever-larger share of the overall data center market. As cloud adoption accelerates, the industry is witnessing a shift away from traditional enterprise-owned data centers toward concentration in big cloud and colocation facilities. As of early 2025, hyperscale data cen-

ters (cloud and internet giants) account for about 44% of all installed data center capacity worldwide, up from roughly one-third just a few years ago. Correspondingly, the share of on-premises enterprise data centers has fallen to around 34% of total capacity and continues to decline. By 2030, current projections suggest hyperscalers will command nearly 60% of global data center capacity, while the enterprise onprem share may shrink to only 22%. (The remaining balance is capacity in multi-tenant colocation facilities, which is growing in absolute terms but will likely form a smaller percentage of the total pie.) In short, cloud giants and their hyperscale campuses are becoming the predominant form of data center infrastructure worldwide. Even enterprise IT workloads are increasingly being shifted to either cloud or edge colocation sites, except for certain niches requiring on-premises due to latency or data governance. One interesting nuance: after years of decline, enterprise-owned capacity saw a slight uptick in 2023–24 driven by AI and high-performance computing labs (some companies built private GPU clusters), but this does not alter the overall trend – hyperscale and cloud providers are expected to dominate new capacity additions through the end of the decade.

The breakneck expansion of data centers has heightened the industry’s focus on energy efficiency and sustainability. Power consumption by data centers is soaring as larger facilities and AI hardware come online – global data center power demand is forecast to double by the end of the decade if current trends continue. The need to balance this growth with environmental responsibility is driving a wave of innovation in how data centers are powered and cooled. Operators are investing heavily in renewable energy: hyperscale cloud firms have become some of the world’s largest corporate buyers of wind and solar power purchase agreements (PPAs), aiming to run their servers on carbon-free energy. For example, Nordic countries have become prime locations for new data center projects in part due to their abundant cheap renewable electricity (hydropower, wind) and naturally cold climate. The Nordics are “gearing up for a data centre gold rush” over the next five years, thanks to advantages like low-cost green power and investor-friendly regulations. Major operators such as Microsoft, Google, and Amazon have announced or opened large facilities in Sweden, Finland, and Denmark, leveraging those nations’ cooler temperatures for free cooling and their robust grids for clean energy. Regions like Scandinavia and the Pacific Northwest in the U.S. (e.g., Oregon) not only offer renewable-rich power grids (hydroelectric, wind, etc.) but also benefit from climate conditions that reduce cooling costs – making them attractive for sustainable expansion.

At the same time, data center engineering is increasingly oriented toward high efficiency. Almost all new hyperscale builds feature state-of-the-art cooling designs – including widespread adoption of liquid cooling for racks hosting AI chips – and advanced energy management systems. In many new facilities, liquid coolant circulation has become the default instead of traditional air cooling, because modern AI servers dissipate heat at levels that air cooling cannot handle efficiently. This allows operators to maintain higher densities with less energy overhead for cooling, thereby improving PUE (Power Usage Effectiveness) even as compute loads intensify. Operators are also exploring innovative power solutions to meet growing demand. There is rising interest in nuclear energy, for instance – both conventional nuclear and small modular reactors (SMRs) – as a potential long-term clean power source for energy-hungry data center campuses. In 2024 several hyperscale companies signed agreements tied to nuclear power supply, and more such deals are expected in 2025 as companies look to lock in reliable, carbon-free power for future facilities. (Notably, some U.S. data center operators even inquired about placing SMRs directly next to their data centers, though utilities note that practical deployment of on-site mini-reactors is still many years away.) Finally, governments and industry coalitions in places like the European Union are putting pressure on data centers to improve energy reuse – for example, by capturing waste heat from servers to warm nearby buildings – and to minimize water use in cooling.

In summary, the data center sector’s growth is showing no signs of slowing – if anything, it is entering an even more ambitious phase driven by cloud, AI, and ever-increasing digitalization. Analysts forecast a continued double-digit annual increase in global data center capacity for the next several years, along with a massive pipeline of projects across all regions. Hyperscale data centers will remain at the forefront of this build-out, enabling new technologies and services but also concentrating much of the world’s compute power in their facilities. This will further entwine the fate of submarine cables and data centers: as

hyperscale platforms expand to every corner of the globe, they will rely on high-bandwidth submarine links between regions, and those cables will in turn land in proximity to large data centers.

The next generation of digital infrastructure will thus be defined by strategic convergence – cables, cloud data centers, and terrestrial networks all coming together to deliver seamless global connectivity. The challenge ahead lies in managing this growth sustainably, through smart site selection (favoring low-impact locations), renewable energy, and innovation in cooling and power technology, so that the digital ecosystem can scale responsibly over the coming decade.

“A few key insights emerged: coastal redundancy was overserved; inland diversity undersupplied; competitors had superior scale but lacked route resilience; and new data centers under development in two interior cities presented emerging demand hotspots”

Nielsen – WFN Strategies (STF Issue 142)

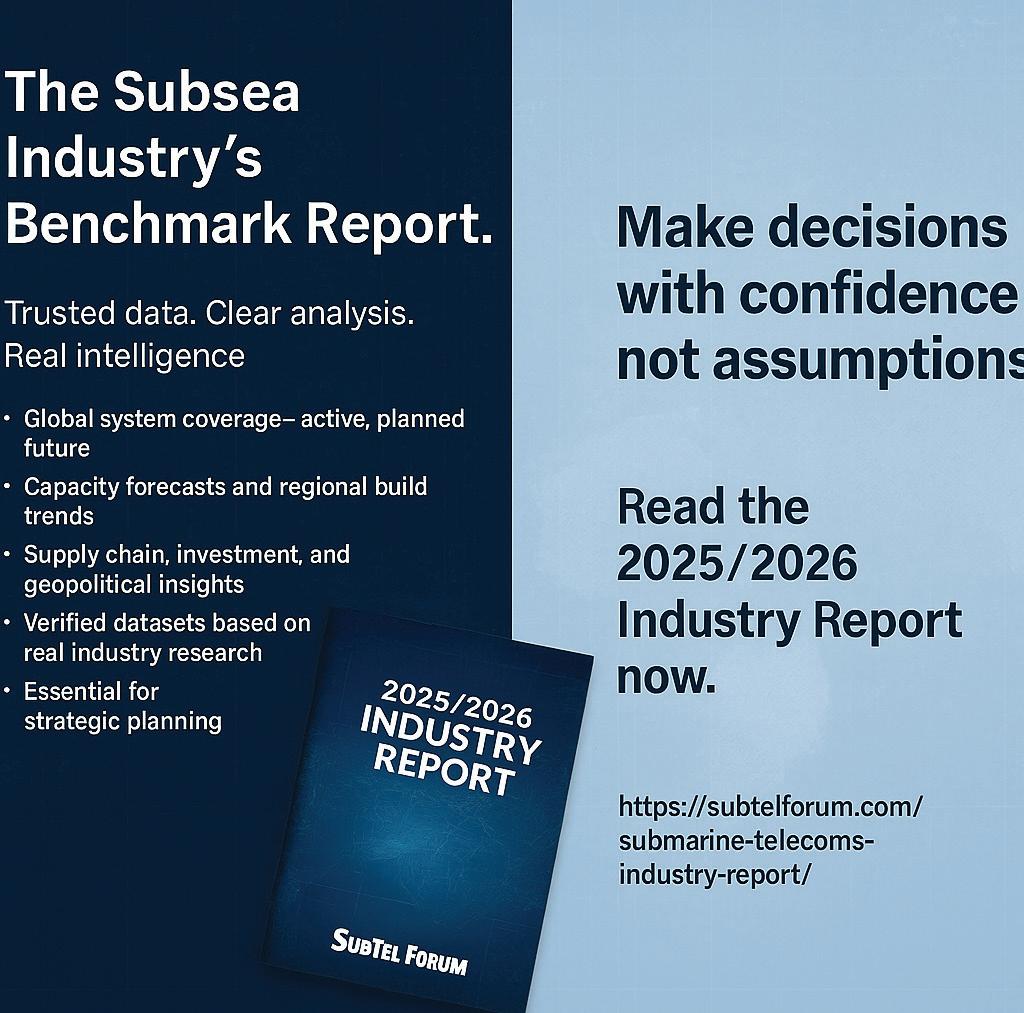

• Global system coverage—active, planned, future

• Capacity forecasts and regional build trends

• Supply chain, investment, and geopolitical insights

• Verified datasets based on real industry research

• Essential for strategic planning

BY CAMILA DE MORAES, IAGO BOJCZUK, AND NICOLE STAROSIELSKI

Cable landing stations (CLSs) and data centers share very similar energy and operational requirements. Both facilities require continuous cooling, electrical redundancy, highly sensitive equipment, and very high availability targets. Both are mission-critical infrastructures on which most digital services depend today. A failure can cause outages with significant financial implications for clients and, ultimately, negative impacts on end-users.

However, while there has been research and the development of sustainable standards and regulations for data centers over the past decade, very little is known about the CLS. Prior to the SubOptic Foundation’s Report on Best Practices in CLS Sustainability, there have been no industry-wide publications specifically on CLS sustainability.

This is in part due to the general lack of information circulated about the CLS, as well as the significant variation between CLSs around the world. According to John Tibbles of the SubOptic Foundation, CLSs have been conceived in ways that fit “their local environment and onward domestic links, or with future subsea developments in mind.” He notes the difference between examples of facilities he knew: stations in New Jersey and Bermuda built in the 1960s that could withstand a nuclear attack were substantially different from a CLS in the United Kingdom that resembled

a typical farmhouse. CLSs are less standardized than many contemporary data centers, and vary depending on coastal conditions, permitting frameworks, and commercial drivers.

In recent years, data traffic, workloads, and the number of internet users continue to rise. As a result, sustainability has become a much more significant issue. According to the European Commission, since 2010, the number of internet users has more than doubled, and global traffic has increased 25-fold. Although rapid advances in energy efficiency have moderated growth in consumption, data centres and transmission networks each account for about 1–1.5% of global electricity use (IEA, 2024). This raises questions about the sus-

tainable future of CLS architecture and global distribution.

In this column, we extend last month’s piece on the launch of the Report on Best Practices in CLS Sustainability and assess how sustainability considerations might be applied to CLS, especially as higher-capacity cable systems are deployed, new regions are connected, and new forms of convergence emerge.

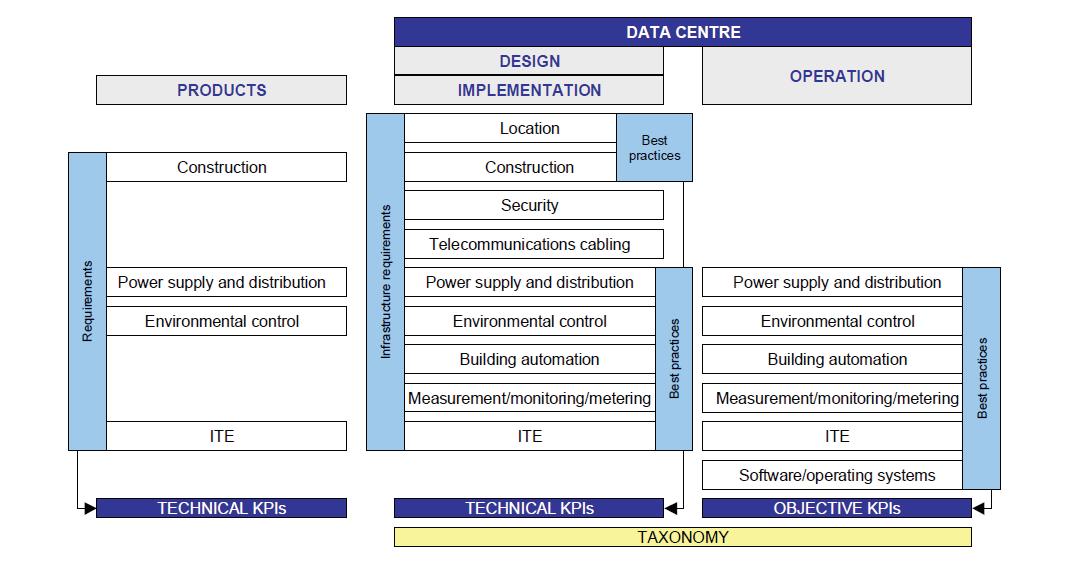

We suggest that relevant sets of standards, metrics, and best practices—already mature and widely tested across the data center sector—can be adapted and applied to CLSs. In particular, we explore how the EU Code of Conduct for Energy Efficiency in Data Centres (EUCoC) and the European Technical Standard

EN 50600-5-1 can serve as tools to enhance the sustainability of CLSs.

We explain how these frameworks can help operators to assess their current position, set priorities for improvement, and demonstrate progress internally and externally. As the findings of the report on Best Practices in CLS Sustainability highlighted, the monitoring of performance data remains a key element of potential improvement, which is a necessary precursor to implementing sustainability improvement programs. Since metrics are essential for measurement and monitoring, these tools offer a clear view of the present state of the art.

The EU Code of Conduct for Energy Efficiency in Data Centres (EUCoC)—launched in 2007, developed by the European Commission’s Joint Research Centre, and last updated in 2025—emerged in response to concerns about the rapid growth in energy use in data centres. It is a voluntary, industry-collaborative scheme that provides a standardised method of assessment and reporting, built around Power Usage Effectiveness (PUE) and an evolving set of more than 100 best-practice actions that are reviewed annually.

In several countries, public procurement now requires alignment with the EUCoC, which has helped drive participation. To date, around 600 data

centers have reported under the programme (UNEP Copenhagen Climate Centre, 2024). In a context where clients and partners demand tangible sustainability metrics, the EUCoC has become the go-to reference for operators seeking to benchmark and improve energy performance, align operations and procurement with best

A core feature of the EUCoC is its voluntary nature; that is, it does not replace regional or local legislation. In legal terms, it is a non-binding document. Therefore, adherence to the Code and compliance with its recommendations are not

facilities. While the EUCoC outlines what to do (practices and processes), EN 50600-5-1 specifies how to measure (criteria and indicators). Together, they enable organisations to assess their baseline and develop a roadmap for continuous improvement, prioritising investments according to each site’s maturity level.

Table 1 summarises the best practices and standards applicable to CLS facilities—whether integrated into a data centre or operating independently—with a focus on universally relevant actions, such as asset auditing and decommissioning unused services and equipment.

Because some CLSs are single-system sites while others are planned as multi-system hubs—with distinct marine-access and room configuration needs—metrics and practices should be right-sized to the site’s role and future expansion path.

practice, and demonstrate credible, transparent compliance with recognised efficiency targets.

Operationally, the EUCoC complements the European standard EN 50600-5-1, which establishes maturity levels for data centers and related

A core feature of the EUCoC is its voluntary nature; that is, it does not replace regional or local legislation. In legal terms, it is a non-binding document. Therefore, adherence to the Code and compliance with its recommendations are not mandated by law. For many years, the Code has functioned as an instrument of industry self-regulation without binding force.

In many instances, operators joined on their own initiative, motivated by reducing energy costs, strengthening environmental reputation, and anticipating future sustainability requirements. This voluntary nature has encouraged flexibility and open collaboration, although results have depended on each participant’s level of commitment. The list of “best practices” provides a common terminology and a reference framework for describing energy-efficiency measures, helping Participants and Endorsers avoid ambiguities and align their expectations.

For operators—whether companies with their own data centers, colocation providers, or cloud service providers—adherence to the EUCoC

Physical building

Mechanical and electrical plant

Data floor

Cabinets

IT equipment

Operating System / Virtualisation

Software

Business Practices

In many instances, operators joined on their own initiative, motivated by reducing energy costs, strengthening environmental reputation, and anticipating future sustainability requirements.

offers a structured pathway to improve efficiency and reduce costs (Table 2 outlines the operator’s responsibilities). By adopting best practices, it is possible to optimize energy consumption through more efficient cooling, eliminating inefficiencies, and fine-tuning infrastructure, leading to significant medium-term financial savings. Continuous monitoring of metrics, such as PUE, enables operators to identify and correct energy

The building, including security, location and maintenance.

waste quickly. In addition, operators benefit from access to specialized knowledge and the exchange of experiences within the EUCoC community, which fosters the discussion of innovative solutions and the dissemination of successful practices.

Following the Code also strengthens a company’s environmental credibility, signaling to clients and the public that the organization takes climate responsibility seriously. Data

The selection, installation, configuration, maintenance and management of the mechanical and electrical plant.

The installation, configuration, maintenance and management of the main data floor where IT equipment is installed. This includes the floor (raised in some cases), positioning of CRAC / CRAH units and basic layout of cabling systems (under floor or overhead).

The installation, configuration, maintenance and management of the cabinets into which rack-mount IT equipment is installed.

The selection, installation, configuration, maintenance and management of the physical IT equipment.

The selection, installation, configuration, maintenance and management of the Operating System and virtualisation (both client and hypervisor) software installed on the IT equipment. This includes monitoring clients, hardware management agents etc.

The selection, installation, configuration, maintenance and management of the application software installed on the IT equipment.

The determination and communication of the business requirements for the data centre including the importance of systems, reliability availability and maintainability specifications and data management processes.

Table 2. Operators’ areas of responsibility. They refer to the entire data centre from the physical building through to the consumption of the IT services delivered. Source: European Commission, 2025.

centers that excel at applying best practices and reducing consumption may receive awards or be mentioned in JRC reports, gaining public recognition at the European level. In summary, operators use the Code both as an energy management tool, to guide investments and operations, and as a benchmarking reference, comparing their performance against European standards and driving continuous improvement.

The development of EN 50600-5-1 marked a decisive step in consolidating sustainability as a measurable and operational discipline within the European data center and digital infrastructure industries. Based on the broader EN 50600 framework, this

part introduces a Maturity Model for Energy Management and Environmental Sustainability to assess the degree to which sustainable practices are integrated throughout the lifecycle

of an ICT site —from design and construction to operation and end-of-life.

From an industry perspective, EN 506005-1 shifts the focus from generic “green” ambitions to engineeringdriven sustainability, a transition that could also be deployed across the subsea cable industry.

More than a simple compliance checklist, EN 50600-5-1 functions as a technical governance architecture: it connects layers of infrastructure (electrical distribution, environmental control, telecommunications cabling, and building automation) to measurable indicators such as PUE, ERF (Energy Reuse Factor), REF (Renewable Energy Factor), and CER (Cooling Efficiency Ratio). These metrics enable operators to quantify efficiency gains, resilience levels, and resource circularity according to unified European KPI definitions.

From an industry perspective, EN 50600-5-1 shifts the focus from generic “green” ambitions to engineering-driven sustainability, a transition that could also be deployed across

the subsea cable industry. It requires systematic measurement and verification infrastructures, precise metering points, telemetry integration, and management systems aligned with ISO 50001 and ISO 14001 standards, ensuring data quality in energy management reporting.

The model explicitly links operational efficiency to resilience optimi-

zation, recognizing that sustainability cannot compromise service availability. Thus, redundancy (N+1, 2N) is now assessed not only for reliability but also for its energy overhead and carbon intensity. The adoption of the standard drives designers to implement modular UPS topologies, variable-speed cooling circuits, and pathways for renewable energy inte-

gration; meanwhile, facility managers must institutionalize continuous improvement cycles based on objective, comparable KPIs. This dual responsibility between design and operation produces traceable, auditable evidence of sustainability performance across colocation, enterprise, and hyperscale environments.

In practice, applying EN 506005-1 to data centers and cable landing stations enables maturity progression based on benchmarks. Operators can position each facility across defined levels—from basic compliance to proactive innovation —quantifying energy reuse, the integration of renewable sources, and water and carbon efficiencies against European benchmarks. The standard is harmonized with ETSI EN 305 174 and ISO/IEC 30134, ensuring interoperability with international frameworks while maintaining the European emphasis on environmental viability and lifecycle accountability. Thus, EN 50600-5-1 serves simultaneously as a technical backbone and a market instrument: it standardizes sustainability assessment across the sector, supports ESG disclosure and alignment with the EU Taxonomy, and steers investment toward low-carbon, high-resilience infrastructures that meet future regulatory and commercial expectations.

The combined application of the EU Code of Conduct (EUCoC) and the EN 50600-5-1 standard establishes a comprehensive sustainability framework for the design, operation, and continuous improvement of digital infrastructures, guiding both energy efficiency and the reduction

of climate impacts throughout their lifecycles.

At the operational level, the EUCoC provides a set of best-practice references covering energy management (ISO 50001), environmental management (ISO 14001), and asset management (ISO 55000), ensuring that efficiency is integrated not only into equipment procurement but also into long-term governance. EN 50600-5-1, in turn, operationalizes these principles through quantifiable KPIs such as PUE, WUE (Water Usage Effectiveness), CUE (Carbon Usage Effectiveness), and REF. Together, these metrics enable data-driven verification of sustainability claims and compliance with the reporting obligations of the EU Energy Efficiency Directive (EED). From a technical perspective, both frameworks encourage modular provisioning, the integration of free cooling, and the adoption of renewable energy sources, aligning infrastructure design with principles of climate resilience and cost efficiency.

EN 50600-5-1 explicitly links environmental sustainability to the traceability of energy sources, through guarantees of origin, and to life cycle assessments (LCA) in accordance with ISO 14040/44. The EUCoC reinforces these objectives by encouraging holistic site management, periodic and real-time monitoring of energy flows, and the creation of multifunctional roles, such as environmental or energy managers, responsible for strategic oversight.

For CLS operators, these two frameworks could serve as valuable tools as companies look for rigorous and tested approaches to sustainability improvements. If these frameworks were adopted across the subsea cable

industry, this could prompt a similar shift as in the data center sector toward a performance-oriented sustainability paradigm (see Figure 2).

As such frameworks have done for the data center industry, they might also serve for the subsea industry as a technical backbone and a market instrument, standardizing sustainability assessment across the sector and potentially steering investment toward low-carbon, high-resilience infrastructures that anticipate the future regulatory and economic environment. In addition, applying these frameworks to CLSs can also help inform design choices and strengthen approval processes that have historically been handled on an ad-hoc basis.

We encourage CLS operators who are interested in exploring this opportunity to consult SubOptic’s Report on Best Practices in CLS Sustainability as well as the ENCoC and EN 50600-5-1. STF

This article is an output from a SubOptic Foundation project, Sustainable Subsea Networks, funded by the Internet Society Foundation.

CAMILA PAULINO is a Master’s student at NOVA University Lisbon. Her research focuses on health and development, particularly in the context of climate resilience and adaptation.

IAGO BOJCZUK is a Ph.D. candidate in the Department of Sociology at the University of Cambridge, UK, and the Student and Young Professional Coordinator for the SubOptic 2025 conference. His research focuses on the sustainability and governance of digital infrastructures, including subsea cables, data centers, and satellites.

NICOLE STAROSIELSKI is Professor of Film and Media at the University of California, Berkeley. Dr. Starosielski’s research focuses on the history of the cable industry and the social aspects of submarine cable construction and maintenance. She is author of The Undersea Network (2015), which examines the cultural and environmental dimensions of transoceanic cable systems, beginning with the telegraph cables that formed the first global communications network and extending to the fiber-optic infrastructure. Starosielski has published over forty essays and is author or editor of five books on media, communications technology, and the environment. She is co-convener of SubOptic’s Global Citizen Working Group and a principal investigator on the SubOptic Foundation’s Sustainable Subsea Networks research initiative.

Works Cited

CEN/CENELEC/ETSI Coordination Group on Green Data Centres. 2024. Review of Standardisation Activities: Energy Management and Environmental Viability of Data Centres—Based on the Edition 11 Report of the CEN/CENELEC/ETSI Coordination Group on Green Data Centres. Brussels: CEN and CENELEC. Available at: https://www.cencenelec.eu/media/CEN-CENELEC/ AreasOfWork/CEN%20sectors/Digital%20Society/ Green%20Data%20Centres/2024/brochuredatacentre-_ standardizationedition11_2024.pdf.

European Commission. 2025. ‘European Code of Conduct for Energy Efficiency in Data Centres’, The Joint Research Centre: EU Science Hub. [Online]. Available at: https://publications.jrc.ec.europa.eu/repository/handle/ JRC141521?utm_source=chatgpt.com

International Energy Agency. 2024. Data Centres and Data Transmission Networks. IEA. Available at: https:// www.iea.org/energy-system/buildings/data-centres-anddata-transmission-networks

Joint Research Centre (European Commission). 2023. The EU Code of Conduct for Data Centres – Towards More Innovative, Sustainable and Secure Data Centre Facilities. European Commission. Available at: https://joint-researchcentre.ec.europa.eu/jrc-news-and-updates/eu-codeconduct-data-centres-towards-more-innovative-sustainableand-secure-data-centre-facilities-2023-09-05_en

SubOptic Foundation (2025) Report on best practices in cable landing station sustainability. London: SubOptic. [Online]. Available at: https://www.suboptic.org/paperspresentations/report-on-best-practices-in-cable-landingstation-sustainability

UNEP Copenhagen Climate Centre. 2024. “Enhancing Energy Efficiency in Data Centres: Key Strategies and Innovations.” YouTube, November 18, 2024. https://www. youtube.com/watch?v=-SEoBtVtP1Y

BY KIERAN CLARK

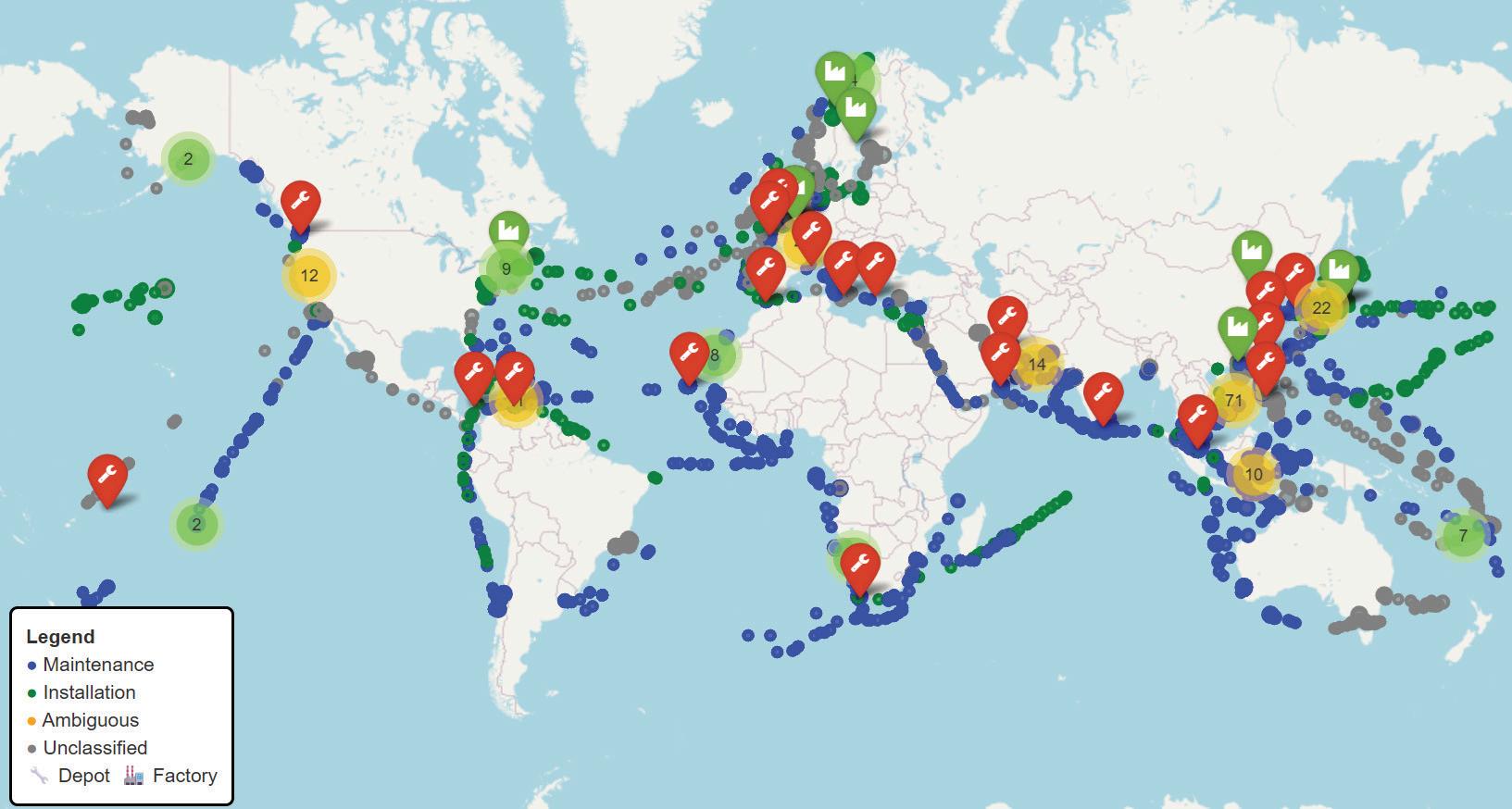

The global subsea cable network depends on a small, highly specialized fleet of installation and repair vessels whose work typically remains out of public view. AIS (Automatic Identification System) signals provide the only globally consistent window into this fleet’s behavior—but AIS reveals position, not purpose. Inferring mission profiles requires combining AIS tracks with known infrastructure locations, observed clustering patterns, and a model that interprets idle behavior in context.

This updated analysis presents the latest geospatial results for November 2025, incorporating more than 9,200 AIS-derived idle points logged at sixhour intervals throughout the month.

Compared to the September dataset, the November results show clear shifts: stronger clustering around East and Southeast Asia, noticeable increases in depot-linked maintenance signatures, and a continued surge in unclassified idle behavior. These shifts align with both seasonal repair cycles and the ongoing expansion of new-build activity across Asia.

As in previous reporting, idle points—instances where vessels remained slow-moving or stationary long enough to indicate operations—were classified using a proximity-based model:

• Installation when idling occurred near a cable factory

• Maintenance when id ling occurred near a cable depot

• Unc lassified when no facility proximity or vessel movement patterns provided sufficient context

A 50 km threshold was used to associate vessels with facilities, with installation prioritized when both factory and

depot fell within range. This mirrors behaviors observed in factory-adjacent staging zones, where vessels routinely load cable before deployment.

This methodology continues to parallel approaches used in other mobility-driven industries—logistics, offshore energy, and fisheries—where positional dwell time and clustering are used to infer mission purpose. The goal remains the same: turning raw geographic data into operational insight when direct reporting is unavailable.

Figure 1 presents an updated geospatial view of cable-ship idling for November 2025, incorporating several thousand AIS-derived idle points across all major cable-serving

regions. Each point on the map is color-coded according to the model’s projected activity classification:

• Blue: Maintenance

• Green: Installation

• Orange: Ambiguous (newly introduced transitional category)

• Gray: Unclassified

Infrastructure locations are marked with standard symbols:

• Wrench: Cable Depot

• Factory: Cable Manufacturing Facility

The November dataset reinforces long-standing geographic patterns while revealing several notable shifts. East Asia and Southeast Asia continue to dominate global vessel presence, with particularly dense clusters around Shanghai, Busan, Kitakyushu, Hong Kong, Singapore, and Manila. These regions host multiple depots and factories, explaining the heavy mix of maintenance, installation, and ambiguous staging events.

The North Atlantic and North Sea corridors again display intense concentrations, especially around Calais, Brest, Lowestoft, and the Norwegian/UK coast, highlighting Europe’s role as the world’s most mature repair and logistics hub. High volumes of unclassified and maintenance signals appear along trans-Atlantic trunk routes, matching seasonal fault-response patterns.

In the Indian Ocean, the Bay of Bengal and Arabian Sea show increasingly prominent clusters, combining

depot-linked maintenance with large pockets of unclassified idling. This reflects both active regional buildouts and sparse reporting around fault activity.

Across the Pacific, vessel presence remains thinner but persistent. Tracks are visible throughout Papua New Guinea, Eastern Australia, Hawaii, and Polynesia, where sparse infrastructure leads to higher proportions of unclassified behavior.

A new feature visible in this dataset is the clearer separation of installation corridors, with green installation points forming identifiable chains along long-haul deployment routes—particularly between East Asia, Southeast Asia, and the central Pacific.

Overall, the November map highlights the strong correlation between vessel clustering and the global distribution of depots and factories, while also underscoring the scale of operations occurring far from infrastructure— where classification remains opaque. These spatial patterns provide the foundation for the deeper activity-type, regional, and facility-influence analysis that follows.

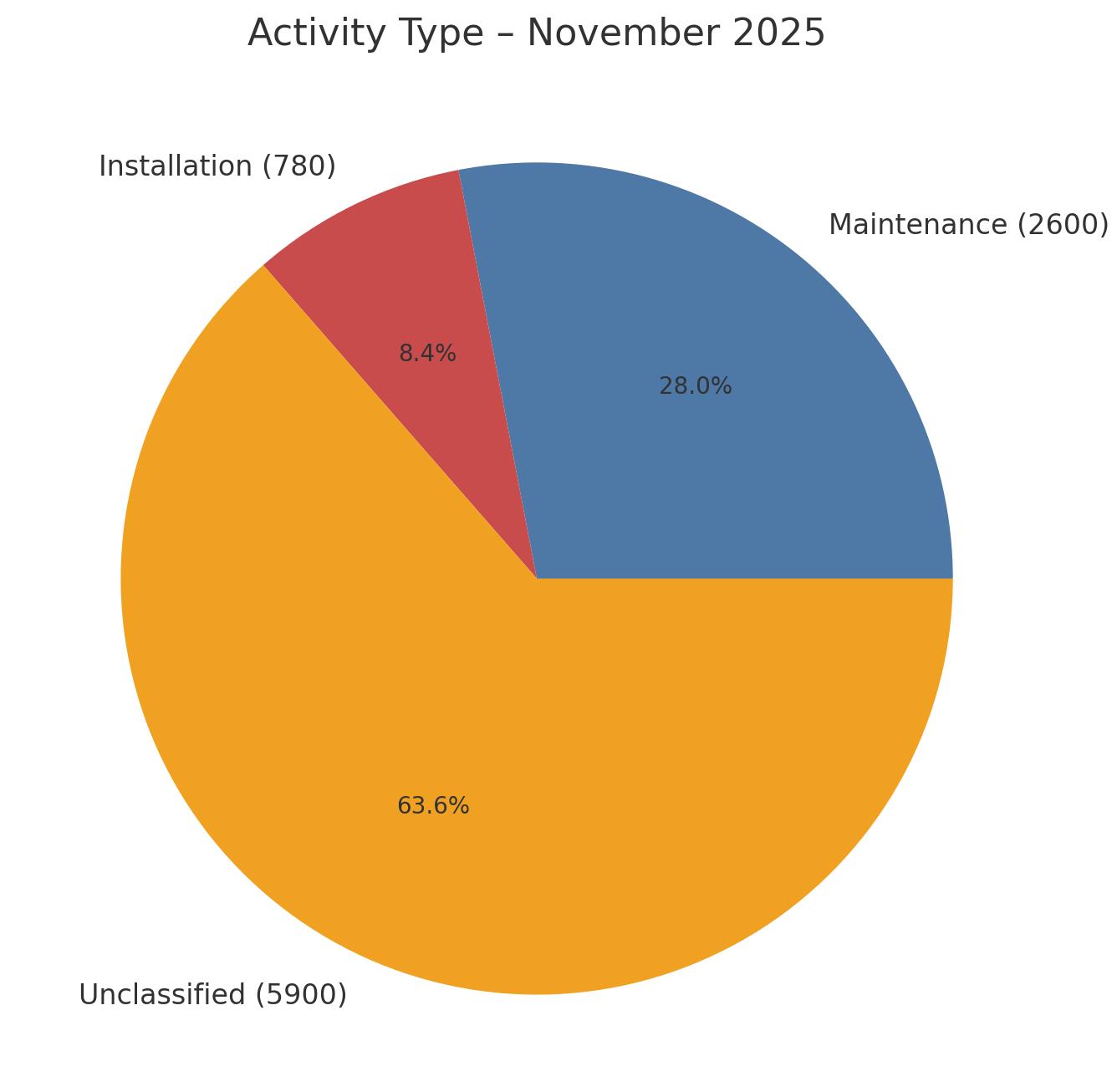

With the global footprint established, the next step is to interpret the underlying purpose of cable-ship idle behavior. Each AIS-derived idle point was again assigned to one of three categories—Maintenance, Installation, or Unclassified—based on proximity to known cable depots and factories, as well as post-idle movement patterns. Figure 2 shows the resulting classification breakdown for November 2025.

Classification results:

• Maintenance: 2,600 data points (28.0%)

• Installation: 780 data points (8.4%)

• Unclassified: 5,900 data points (63.6%)

Maintenance-linked idling continues to form the backbone of identifiable activity. Vessels associated with these points typically remained near depots or in established repair corridors, reflecting patterns tied to fault response readiness, short-range repositioning, and routine staging behavior. As seen in prior datasets, these signatures cluster most strongly in regions with dense depot coverage—East Asia, Southeast Asia, and the North Atlantic.

Installation activity, while smaller in volume, remains operationally significant. The 780 points attributed to factory-adjacent or deployment-linked behavior align with long-haul system builds underway in Asia and the Pacific. These events remain episodic rather than continuous, occurring in discrete bursts when new systems enter their deployment phase.

The most striking element of the November dataset is the continued growth of unclassified behavior, which now accounts for nearly two-thirds of all idle points. This increase mirrors the expanding geographic range of cable-ship operations and the limited visibility offered by AIS alone. Many of these unclassified events occur far from infrastructure or along transit routes where vessel intentions cannot be confidently inferred.

Taken together, the November classification picture shows a fleet whose identifiable behavior is still dominated by depot-linked maintenance, supplemented by a smaller but critical layer of installation activity. The persistently large share of unclassified points highlights both the operational complexity of global cable deployment and the industry’s ongoing lack of transparent activity reporting.

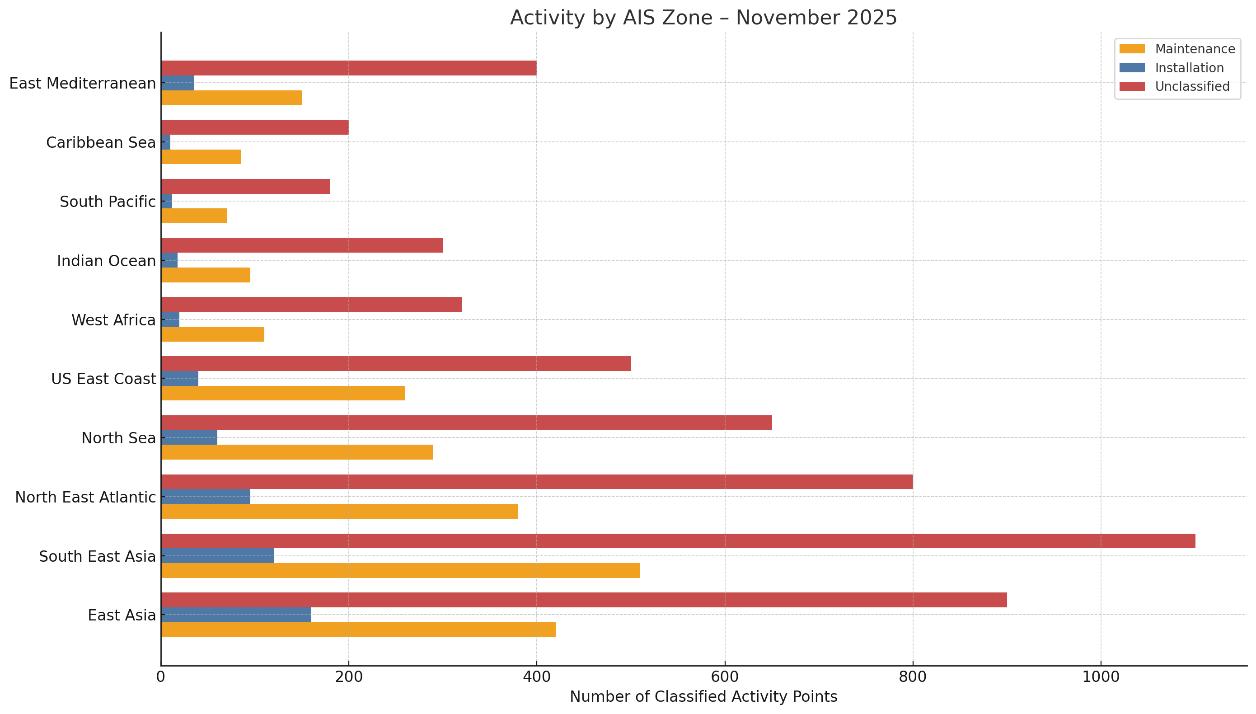

After establishing a global classification framework, the analysis turns to how activity varies across geographic regions. Grouping idle points by AIS Zone highlights how maintenance, installation, and unclassified behaviors distribute across the world’s primary cable-serving basins. Figure 3 presents the November 2025 breakdown.

The November dataset again shows pronounced regional contrasts, with clear dominance from East Asia and Southeast Asia. These two regions remain the largest global centers of cable-ship activity, each registering substantial volumes of maintenance, installation, and unclassified idle points. Their scale reflects the concentration of both cable depots and cable factories across Japan, Korea, and China—along with heavy fault-response demand and ongoing

long-haul system builds. The extremely high unclassified shares in both regions also underscore how dense vessel traffic complicates AIS-based inference.

The North East Atlantic and North Sea zones continue to stand out as Europe’s repair backbone. Dense clusters around Calais, Brest, Lowestoft, and the Norwegian–UK corridor confirm Europe’s role as the most mature depot-supported repair environment globally. Both zones show high maintenance volumes and substantial unclassified activity, consistent with intense year-round operations on transatlantic and pan-European systems.

On the US East Coast and in the Caribbean Sea, activity levels remain moderate but strategically important. These regions balance legacy-system maintenance with staging for emerging deployments in South America and the mid-Atlantic. Their maintenance signatures remain strong relative to their installation footprint, matching the known distribution of regional depots.

Elsewhere, patterns vary more widely. The Indian Ocean shows a notable mix of maintenance and unclassified behavior, reflecting both new capacity projects in the Bay of Bengal and sporadic regional repair mobilizations. The South Pacific and East Australia zones exhibit modest but steady activity dominated by unclassified points—unsurprising for a region with sparse depot and factory coverage and long transit distances between operational hubs. West Africa also remains heavily unclassified, highlighting the ongoing data and infrastructure gaps that make behavioral interpretation difficult.

Two key takeaways emerge from the zonal analysis:

1. Maintenance activity continues to cluster around depot-rich regions, particularly East Asia, the North East Atlantic, and the North Sea—areas where dense infrastructure enables rapid repair mobilization and short vessel repositioning cycles.

2. Installation activity remains geographically selective and episodic, concentrated in zones with active factory staging, most prominently East Asia and Southeast Asia.

Overall, the November zonal distribution reinforces how regional infrastructure, cable age, and route density combine to shape global vessel behavior—while also highlighting where AIS-only inference remains most constrained by unclassified activity.

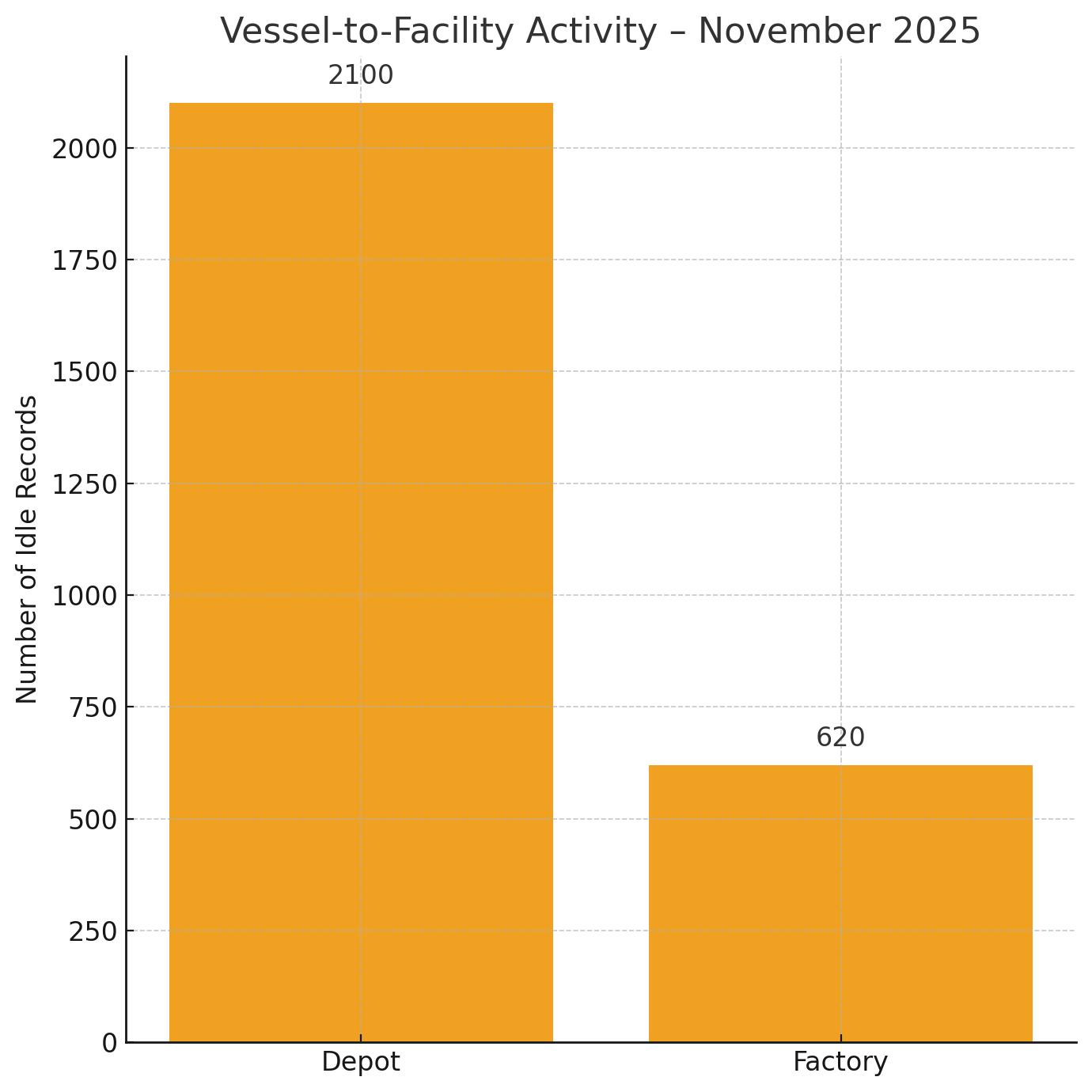

Beyond geographic distribution, cable-ship behavior is strongly shaped by proximity to infrastructure—specifically depots and cable factories. Depots serve as operational anchors for fault response, maintenance preparation, and resupply cycles, while factories support cable loading and the initiation of system deployments. Figure 4 presents the facility-linked breakdown for November 2025.

The November dataset records 2,100 depot-associated idle points compared to 620 factory-associated idle points, indicating that vessels were more than three times as likely to idle near depots as factories. This ratio closely mirrors the activity-type distribution: maintenance continues to dominate identifiable vessel behavior, while installation— though operationally significant—remains episodic and tied to specific project windows.

The operational rhythms of the two facility types remain distinct:

• Depot-linked presence is continuous and cyclical. Vessels repeatedly return to depots between repair operations for resupply, crew changes, certification work, or to

await tasking. This produces a steady baseline of maintenance-associated dwell time, especially in depot-dense regions such as the North Atlantic and East Asia.

• Factory-linked presence spikes around deployment campaigns. Ships cluster at factories for cable loading prior to long-haul installations, then rapidly disperse once deployment begins. This explains the smaller but sharply defined factory-associated footprint in November’s dataset.

The contrast between depot- and factory-linked behavior emphasizes the structural importance of global depot coverage. Regions with strong depot networks—Europe, Japan, Korea, and parts of China—benefit from faster repair mobilization and lower transit downtime. In underserved regions such as the South Pacific, West Africa, and the central Indian Ocean, vessels frequently idle in unclassified fallback zones, reflecting both long transit distances and the absence of nearby support infrastructure.

In summary, the November facility analysis reinforces depot availability as a primary driver of identifiable vessel behavior, while highlighting the episodic but strategically important role of factory adjacency in supporting system deployments.

The November 2025 dataset provides the clearest illustration yet of how global cable-ship behavior is evolving—and where visibility continues to erode. With more than 9,200 idle points analyzed across all major basins, several themes emerge with increasing clarity.

The model attributes 2,600 idle points (28%) to de-

pot-linked maintenance behavior, reinforcing the dominant role of repair readiness across East Asia, Southeast Asia, and the North Atlantic. These regions continue to function as the operational core of the global repair network, benefiting from dense depot infrastructure and short repositioning cycles.

Only 780 idle points (8.4%) were installation-linked—lower in both share and volume than earlier 2025 datasets. The identifiable events that do appear cluster tightly around factory hubs in Japan, Korea, and China, aligning with new-build launches and ongoing long-haul deployments.

At 5,900 idle points (63.6%), unclassified activity has expanded significantly. Much of this growth stems from dense AIS activity in East and Southeast Asia, where overlapping transit, staging, and operational patterns obscure vessel intent. Sparse infrastructure in the South Pacific, West Africa, and the central Indian Ocean further amplifies classification uncertainty. This rising opacity underscores the core challenge of AIS-only analysis: high data volume does not translate to operational transparency.

With 2,100 depot-associated and 620 factory-associated idle points, the November dataset mirrors long-standing fleet behavior: vessels are consistently more likely to cycle through depots than factories. Depots remain the backbone of fault response logistics, while factories serve as short-duration staging points for discrete deployment campaigns.

Comparing the September results (July–August data) with November’s dataset highlights several shifts:

• Maintenance volume increased, but its proportional share held steady (≈28%), signaling sustained repair demand.

• Installation activity declined in both absolute and relative terms, reflecting a pause or slowdown in new-build launches.

• Unclassified activity climbed sharply, from ~63% to nearly 64%, continuing a multi-month trend of decreasing interpretability.

• Depot vs. factory ratios remain stable, reaffirming the structural dominance of the maintenance cycle.

These patterns collectively point to a fleet that is increasingly active, increasingly dispersed, and increasingly difficult to classify without additional operational context.

LOOKING FORWARD

The November analysis reinforces a consistent message: the global fleet’s operational heartbeat is maintenance, while installation appears in narrow, project-specific bursts. Yet the accelerating rise in unclassified activity suggests that AIS—while invaluable—is no longer sufficient to capture the full complexity of cable-ship operations.

More structured transparency from vessel operators and system owners—whether through enhanced AIS metadata, voluntary port-call reporting, or anonymized mission declarations—would dramatically improve situational awareness. Better data would support faster fault coordination, more accurate capacity forecasting, and a clearer understanding of where the global fleet is truly deployed.

In an era of growing geopolitical tension, rising data-traffic dependency, and expanding subsea infrastructure, understanding cable-ship behavior is not merely analytical—it is strategic. STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Your Premier Portal to Locate Companies for Submarine Telecoms Collaboration

Content Highlights:

• All-Encompassing Listings: Dive into a world-class directory of submarine telecom product and service providers.

• Intuitive Search: Effortlessly navigate to the services and solutions tailored to your mission.

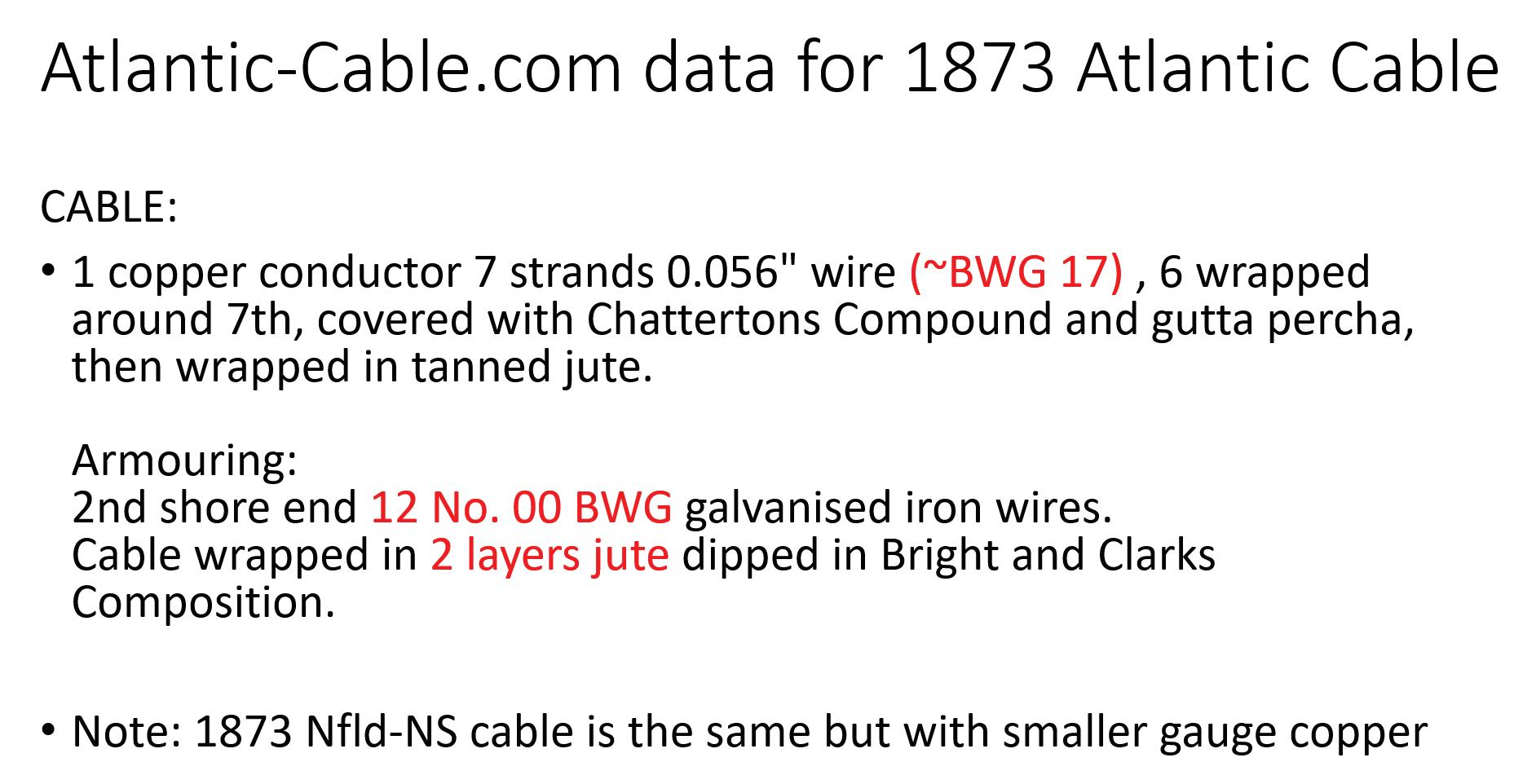

• Spotlight on Innovation: Engage with the leaders driving the industry forward through technological advancements.