FARMERS across Australia, particularly in disaster-impacted regions, are strongly encouraged to register with Rural Aid now, as ongoing natural disasters and worsening weather conditions continue to threaten rural communities.

Large areas of Victoria recently battled bushfires, while North Queensland continues to experience flooding and cyclone impacts, and parts of New South Wales face storms, heavy rainfall and damaging winds.

With further bad weather forecast for the weekend, conditions are expected to deteriorate in many regions, placing additional strain on farmers already under pressure.

Rural Aid is now urging farmers to register immediately to ensure support can be delivered as quickly as possible when it is needed most.

Rural Aid Chief Executive Officer John Warlters said disasters don’t wait, and neither should farmers.

“Registering with Rural Aid now means we can act fast when conditions worsen, whether that’s financial relief, counselling, or delivering hay and water to farmers who need it most,” he said.

Rural Aid is already responding in disasteraffected regions, providing direct financial assistance to farmers in north-west Queensland and Victoria to help cover urgent and unexpected expenses as they recover from floods, fires and severe weather events.

“Our teams are already working in disaster zones, supporting farmers who are exhausted, overwhelmed and facing enormous uncertainty,” Mr Warlters said.

“By registering early, farmers ensure critical

support can be delivered as quickly as possible when disasters strike.”

Rural Aid provides free support to registered farmers and their families, including financial assistance for urgent and unexpected expenses, professional counselling and wellbeing support, hay deliveries to feed livestock, water deliveries for household needs and volunteer assistance through Farm Army and Farm Recovery Event programs.

With severe weather forecast across multiple states this weekend - including dangerous fire conditions in Victoria and Western Australia and heavy rainfall and consequent flooding in parts of Queensland and New South Wales –Rural Aid is reinforcing the importance of early registration.

“Farmers are incredibly resilient, but they shouldn’t have to face disasters alone,” Mr Warlters said.

“We strongly encourage every farmer, especially those in high-risk areas, to register now so help can be mobilised immediately when it’s needed.”

Farmers should register for free immediately at faa.ruralaid.org.au or by calling 1300 327 624.

Registering now ensures Rural Aid can act fast and deliver critical support as fires, floods and severe weather continue to impact rural Australia.

A new discovery by researchers from Adelaide University, in collaboration with Denmark’s Carlsberg Research Laboratory, will allow barley growers to optimise seed dormancy for their crops and improve growing efficiency.

The researchers employed a multidisciplinary approach to construct the barley mitogen-activated protein kinase (MAPK) enzyme-substrate complex, which plays a crucial role in seed dormancy.

Co-author Professor Maria Hrmova, from Adelaide University said it was exciting to construct the MKK3/MAPK enzyme-substrate complexes using the tools of chemistry, biochemistry, biophysics, structural biology, genetics, and bioinformatics.

“This structural model we’ve identified could impact plant breeding and food pro-

duction, such as by plant breeders optimising the period of grain dormancy while avoiding undesirable pre-harvest sprouting, where the

grain germinates before harvest.”

The discovery, which was published in the International Journal of Molecular Sciences, builds on existing knowledge of the genetic underpinnings of seed dormancy in barley.

“Genetic analyses have previously revealed two dormancy loci in barley that encode an alanine aminotransferase enzyme and a MAPK kinase, MKK3, which forms one part of a three-component MAPK module or cascade,” said Professor Hrmova.

Professor Hrmova said the discovery could have impacts for a range of other crops, such as rice.

“Our work will impact pangenome-informed plant pre-breeding using resources associated with multiple genetic variants to define combinational effects of variations on protein structure and function,” she said.

“This will facilitate future manipulations of plant dormancy length in different environments.”

Study co-author Professor Geoff Fincher, also from Adelaide University, said the research has facilitated several advances in knowledge about seed dormancy.

“We discovered the mechanisms through computational protein-protein docking, and defined the hydrolysis of the ATP substrate, and the transfer of a phosphate group to the downstream MAPK enzyme that resulted in its activation,” he said.

“The work also clarified evolutionary aspects of natural and anthropogenic selection that have regulated the seed dormancy to germination transition under different environmental and commercial conditions.”

“MERCOSUR” is one of those terms which sound distant and abstract.

However, it is underway and will become of greater importance to Australia later this year. Mercosur is a trade alliance between four countries, Brazil, Argentina, Uruguay and Paraguay. Thus it bundles four very large agricultural exporters into one negotiating bloc.

There are some minor hurdles to be overcome within the EU administration and the member states’ parliaments but the trade agreements are likely to be in place before year’s end. [4]

Before going further, it helps to deflate one common misunderstanding. Mercosur is not “another EU” . The European Union is a deep political and economic union: it has a Parliament, EU-wide law-making institutions, a single market built on the “four freedoms” (movement of goods, services, capital and people), and for many members a shared currency (the euro) and largely open internal borders.[12]

Mercosur is much looser: it functions mainly as a customs union/free-trade arrangement with ambitions, but it has not developed the same level of integrated institutions or singlemarket reality as the EU.[10][11]

This distinction matters, because it helps readers interpret “Mercosur” headlines at the right scale: Mercosur is powerful in trade because of the size of its production base, not because it operates like a fully integrated continental union. It’s far looser than that.

What Mercosur means (literally) and who it is Mercosur is the Southern Common Market.

The name is a glorified acronym which comes from Spanish: Mercado Común del Sur — literally “Common Market of the South” , commonly rendered as “Southern Common Market”.[2] In Portuguese (Brazil’s language), the equivalent is Mercado Comum do Sul, and you’ll often see “Mercosul” used in Brazilian contexts.[1]

In trade discussion, Mercosur refers to its long-standing core members: Argentina, Brazil, Paraguay and Uruguay.[1] It is not a synonym for “South America” . It’s a defined bloc negotiating as one — and in agriculture, that “one voice” can represent very large export volumes.

Why the EU wants a deal with Mercosur It’s easy to assume the EU–Mercosur agreement is purely about beef, because beef is where the political noise is loudest inside Europe. But the arrangement is also about Europe selling more into Mercosur — especially manufactured and higher-value goods.

EU material repeatedly points to the kinds of exports which it expects to benefit from tariff reductions: cars and car parts, machinery, chemicals and pharmaceuticals.[4][5] It also notes that some EU agri-food exports face high tariffs in Mercosur, with examples such as wine

and spirits, chocolate and olive oil.[3]

So the trade logic is fairly straightforward. Mercosur (the South Americans) wants improved access for farm exports into Europe; Europe wants improved access for manufactured exports (and some branded foods) into Mercosur.[3][4][5]

Why beef is sensitive in Europe

Even though Europe’s export aims are central, the political heat inside Europe often concentrates on farm imports — especially beef. The

EU’s published agriculture factsheet stresses that this is not unlimited access. It is quotalimited access under preferential conditions, with a headline figure of 99,000 tonnes at 7.5 percent; duty, split between fresh/chilled and frozen categories.[6]

That’s why beef becomes the lightning rod for European farmers: a quota number is tangible, and cattle producers read it as competition (which it is). For Australians, the calmer approach is to hold two ideas at once: • European farm politics can be intense even

when access is controlled by quotas; and Australia’s exposure depends on where Australia actually sells, and where global demand is pulling product.

At this point, it’s prudent to look at the numbers.

Let’s consider three tables covering world beef exports, world beef imports and, finally, Australia’s beef exports. We’ll stick to 2024 figures as 2025 data is not yet to hand.

Continued Page 4

Table 1: Main Beef & Veal Exporting Nations 2024

Source: https://apps.fas.usda.gov/psdonline/circulars/livestock_poultry.pdf

FROM PAGE 3

Table 1: the main beef exporting nations (2024)

Read this table for scale rather than trivia.

The standout point is simple: Brazil is a global heavyweight, and Mercosur contains multiple exporters that matter. Australia is also clearly in the leading group. It’s also important to note that the table flags India’s exports as mostly carabeef (buffalo), because it reminds us that “beef” tables sometimes include different product categories.[7]

Table 2: where the world’s import demand sits (2024)

This is often something of a “lightbulb” table. The political debate may be loudest in Europe, but the strongest gravitational pull in global beef imports is China, followed by the United States, and then major Asian markets. The top four importing nations account for fully 62.5 percent of global beef imports.[7]

This matters for Australians because it shifts the issue from being whether the Mercosur-EU agreement takes our European markets to whether the change in global beef trade flows will cause a change in competition for Australia’s leading beef export markets notably China, the United States, Japan and Korea.

Table 3: where Australia actually sends beef (2024)

This table is the anchor for the whole “how much should we care?” question. By volume, Australia’s beef exports are mainly a US and Asia story—US, Japan, Korea, China, then a spread into South-East Asia.[7] In that context, EU27 is a small destination in 2024, accounting for only 0.5 percent of our beef exports.

This doesn’t mean Europe is irrelevant. It does mean the dramatic version of the story — “Mercosur will wipe out Australia’s EU trade” — doesn’t match Australia’s export geography. Australia simply doesn’t ship large volumes into EU27 in the first place. What changes for Australia — and what probably doesn’t What probably doesn’t change quickly Australia’s export “centre of gravity” is unlikely to flip because of an EU–Mercosur agreement.

The big demand centres pulling global beef are the US and Asia, and that’s where Australia already sells most of its volume.[7] Europe is a niche outlet for Australia by tonnage.

What could change-two issues

Where EU–Mercosur could matter to Australia is through second-order effects — how

large exporters adjust where they send marginal volumes.

The first issue is if Europe becomes a slightly more attractive option for Mercosur exporters because of improved access terms (even within a quota), other, non-Australian, exporters may rebalance what they send to Europe versus what they send elsewhere.[6]

That “elsewhere” includes markets Australians care about, particularly China.[7] Commodity markets can move on marginal shifts and expectations rather than dramatic flood events.

A second issue is standards. Europe’s debate over Mercosur isn’t only about volume; it often involves standards and enforcement. Over time, Europe’s approach to standards can influence what other markets start asking exporters to demonstrate, even if the EU itself is not a major destination for Australia by volume.[12]. This could be a drag on Mercosur at first but, in time and with improved compliance, Mercosur beef could become more attractive to discerning markets such as South Korea and Japan, a concern for Australia.

None of that is a judgement about whether the agreement is “good” or “bad”. It’s simply how trade systems tend to behave: change the incentives, and flows can shift at the margin.

Change is inevitable but for the time being, it seems unlikely that Mercosur will be a major headache for Australian agriculture.

A simple takeaway

• Mercosur means the Southern Common Market: Mercado Común del Sur (Spanish) / Mercado Comum do Sul (Portuguese).[1][2]

• Mercosur is not an EU-style deep union; it is a looser trade bloc compared with the EU’s single market and institutions.[10][12]

• The EU’s interest is not only farm imports; it is also improved access for manufactured exports into Mercosur.[4][5]

The beef issue inside Europe is politically hot, but the EU’s own description frames Mercosur beef access as quota-limited, with a headline figure of 99,000 tonnes under preferential terms.[6]

• Australia’s export reality is that beef volume goes mainly to the US and Asia, with Europe a small share by tonnage in 2024.[7]

With that mental map, “Mercosur” headlines become much easier to interpret. Europe may be where the political argument plays out, but Australia’s commercial exposure sits mainly where we ship volume — and where Mercosur exporters already compete.

Table 2: Top Beef Importers, 2024

Source: USDA FAS (Dec 2025), 2024 imports (CWE). “Other” = World total − sum of listed importers.

Ref Source

[1] MERCOSUR official site, “What is MERCOSUR?”

[2] Bodleian Libraries (Oxford), MERCOSUR guide

[3] European Commission, EU–Mercosur trade agreement page

[4] European Commission Q&A on EU–Mercosur partnership

[5] EU trade factsheet / EU materials on tariff reductions (cars, machinery, chemicals, pharma)

[6] European Commission agriculture factsheet (PDF): quota-limited beef access

[7] Uploaded file: Three tables for chat GPT. docx

[10] AS/COA explainer on Mercosur (customs union/free trade area; EU comparison)

[11] CFR backgrounder on Mercosur institutions (incl. Parlasur advisory role)

[12] EU single market explainer (four freedoms; internal market concept)

BY CONNOR BURNS

THE Western District weaner sales - held over a week in Hamilton - provided an excellent reflection on improving conditions.

Hamilton Regional Livestock Exchange (HRLX) played host to the Western District weaner sales in January, and produced amazing returns with more than $22 million worth of cattle sold over the course of the week.

In an almost record-breaking sale that attracted buyers from all across the country, there were significant increases compared to last year’s sale, which produced $15 million from roughly 18,000 cattle sold.

The sale started very strongly returning $5.32 per kilogram for black angus steers with a weight of 332kgs on average, while sales peaked at $5.90/kg for the lighter-end calves.

Agents didn’t look back after that with selling prices for all types of cattle remaining very consistent across the week, surprising LMB Livestock and Land stock agent Bernie Grant.

“It (weaner sales) did exceed our expectations a little bit with the weights in the cattle being so good,” he said.

“Everything is supply and demand driven really and there was demand this year from locals and people in the south-east and Gippsland areas more than other years.

“It is one of the bigger jumps year-to-year that we have seen, and it is on the back of coming out of that dry spell.”

Nutrien-Savin Livestock Marketing’s Managing Director Sam Savin said he was astounded at the weights of the cattle after feed shortages last year.

petition, with buyers now having plenty of feed for their cattle.

“They were nearly the heaviest calves we’ve had considering back in August we didn’t know where the next load of grain was coming from.

“It was a very good week and everybody went away happy with the prices.”

Mr Savin said another major factor in cattle prices soaring was due to the strong local com-

“In regard to the season turnaround it was quite incredible with the weights in the calves,” he said.

“We saw more local competition than we ever have, we have previously been heavily reliant on northern competition,” he said.

“People have an abundance of feed now which we never thought would be the case back in August.

So clients saw an opportunity to buy cattle

and there was good southern and local competition, while the south-west of South Australia was strong again.

Southern Grampians Shire Mayor Dennis Heslin said it was a great result after plenty of tough times in the farming industry last year.

“After the season we’ve come through, these results really put a smile on the faces of a lot of farmers,” Cr Heslin said.

A unique wellbeing program for farmers across SA has officially launched in Naracoorte.

ifarmwell, In collaboration with South Australian farming groups, has launched the next phase of its Weather it together campaign, taking its wellbeing messages into pubs and clubs across regional South Australia.

The rollout was officially launched last week at the Bushman’s Arms Hotel in Naracoorte, marking a new chapter for the farmer-led campaign designed to support rural communities through challenging seasons.

Built with farmers, for farmers, Weather it together focuses on four simple, practical behaviours proven to support wellbeing: Keep Connected, Focus on what you cancontrol, Get Active and Ask for Help.

This next phase will see posters, flyers and drink coasters distributed to hotels and clubs across the state including Bordertown and Robe, recognising pubs and clubs as places where farming families naturally come together.

Weather it together Campaign Coordinator, Annabelle Ottens says connection is at the heart of the campaign.

“Keeping connected is one of our key behaviours, and research shows it genuinely makes a difference when times are tough,” she said.

Adelaide University Associate Professor and Founder of ifarmwell Kate Gunn and Enterprise Fellow (Rural Health) said being connected with others not only makes life more enjoyable, but research shows it can even help you live longer.

“The problem is, that when things get hard, it’s often tempting to withdraw, which is why these reminders to connect at this stage of the campaign is so important.”

Ms Ottens said the response from hotels had been overwhelmingly positive and thanked the Bushman’s Arms for its ongoing support,

including fundraising for ifarmwell through its public purse initiative in September 2025.”

Hotel manager Ben Bryant said pubs play a vital role in regional communities.

“Pubs are places where people come to catch up and check in on each other,” he said.

“Supporting an initiative like ifarmwell, that

looks after farmers, just made sense.”

Ms Ottens said ifarmwell’s Weather it together campaign carries one clear messageyou’re not alone.

“Whatever the season brings, we’ll weather it together,” she said.

“Next time you’re at your local, keep an eye

out for the Weather it together materials - and don’t be afraid to ask someone the simple question: what have you done for your wellbeing today?”

For more information and tips on how to strengthen your wellbeing, visit weatherittogether.org.au

A CONFERENCE to show Australian cattle breeders how new technologies and innovations can shape the future of their herds and businesses, will be held next month

The Today, Tomorrow and Beyond conference hosted by Genetics Australia on 17 to 18 March will feature local and international speakers, farmers and dairy and beef industry leaders.

The conference at GMHBA Stadium, Geelong, follows a similar event in 2024 and retains the same focus on the use of genetics and other cutting-edge technologies to advance farming businesses.

It will feature segments on future technology and sustainable farming, the road to new markets, tomorrow’s agriculture and securing the future.

Keynote speakers will include co-founder of Audacious Agriculture Stuart Austin on harnessing artificial intelligence to transform agriculture, Midfield Group general manager Dean McKenna on how technology shapes a modern meat business, and Distinguished Professor of Cooperative Extension in Animal Biotechnology and Genomics, University of California, Professor Alison Van Eenennaam, on Advances in Gene Editing Techniques for Cattle.

International speakers from Europe, USA and South Africa will feature on the program.

Farmers from around Australia will showcase their business innovations, herd improvements and their thoughts on the future of farming as part of a panel discussion.

There will also be presentations from DataGene leaders on reproductive innovation.

Genetics Australia CEO Anthony Shelly said the GA 2026 Today, Tomorrow and Beyond conference would bring together like-minded farmers and industry people to network and hear about how new research and innovation is creating more sustainable and profitable farming systems.

ing. Mr Shelly said the conference would people a glimpse into the future.

“Agriculture is evolving at a fast pace and being aware of new and emerging technologies is essential for farmers to stay progressive and profitable,” he said.

The program features a cross section of speakers covering both dairy and beef farm-

“We’ve retained the same the theme as 2024,Today, Tomorrow and Beyond, because the conference will have something to help farmers and service providers today and give them many new ideas for the future.”

The conference will be at GMHBA Stadium 370 Moorabool Street South Geelong. People can visit trybooking.com/events/landing/1511339 for ticketing information and the full program.

DANIHER Bale Feeders are a 4-in-1 feed out system that can save time and effort in feeding stock with round or large square bales of hay or loose fodder such as cotton seed, or loose or whole bales of hay, safely from the comfort and safety of the vehicles cabin.

The continuous conveyor belt moves the bales from the Ute tray or trailer, and the hay falls off the back of the feeder using a remote to

move forward, or in reverse.

Eliminating the need to climb on the back of a moving vehicle to throw hay off manually.

The bale strings are held in place by the slots at the back and all moving parts are covered to eliminate the risk of injury to stock or operator.

The whole operation can be done safely by one person so there is no need for two work-

ers to feed out hay and can be done by anyone who is still able to drive a vehicle.

There is a single bale feeder for one large square bale or 2 round bales and also a double length feeder for 2 large square bales at once, or 4 round bales which can be dropped off from the back.

Optional extras are a round bale attachment, to unroll round bales, as well as sides

that can hold loose fodder like cotton seed or straw or anything else for use around the farm, orchard or stables or around the property.

Look us up on our website at www.daniherbalefeeder.com.au or on our Facebook page to see our video of how the Daniher Bale Feeders work and how they can make feeding hay to stock safer and easier for your family or farm workers.

supportive environments.

PARENTING disputes are never easy, particularly in close-knit regional communities where families, farms and futures are deeply intertwined.

When these matters come before the Federal Circuit and Family Court of Australia, one guiding principle sits above all else: the best interests of the child.

While every family’s circumstances are different, the Court consistently looks at a few key factors- a child’s safety, their emotional and developmental needs, and the benefit of maintaining meaningful relationships with parents and other important people in their lives.

Importantly, the Court is not there to punish parents. Its focus is on managing risk and ensuring children grow up in safe, stable and

Issues such as alcohol or substance use, mental health concerns, conflict between parents, or questions about parenting capacity can raise red flags if not handled carefully. Even historical or occasional issues may attract attention if they affect a parent’s ability to care for their child.

What often makes the difference is how parents respond. Proactive, transparent steps, such as voluntary drug or alcohol testing, engaging in counselling or rehabilitation, or completing a recognised parenting course, can significantly reduce concerns.

These actions show insight, responsibility and a genuine commitment to putting children first.

In regional areas where access to services can sometimes be more limited, taking early steps is especially important.

Courts place weight on objective evi-

dence, attendance records and reports from qualified professionals.

Conversely, avoiding issues, refusing to engage with support services, or reacting defensively can do more harm than the issue itself.

No parent is expected to be perfect. What the Court looks for is honesty, insight and a willingness to improve.

Seeking specialist family law advice early, complying with court orders, and keeping communication respectful and child-focused can all help prevent matters from escalating.

Ultimately, minimising risk in parenting proceedings isn’t about “winning” . It’s about showing the Court and your child that their wellbeing comes first.

For further support or tailored advice, contact Mellor Olsson’s Family Law team on 08 8414 3400 or visit molawyers.com.au.

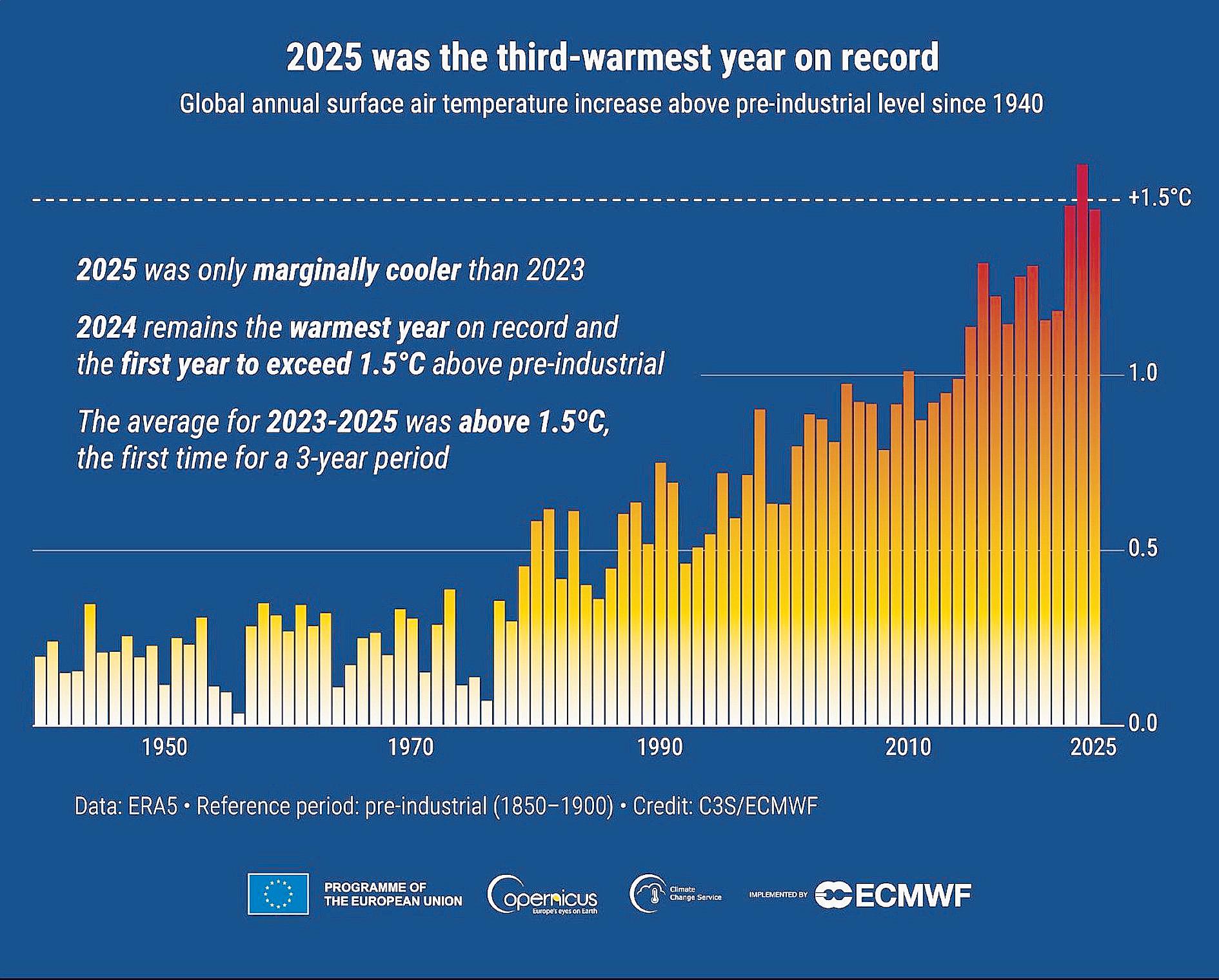

NEW data from Europe’s leading climate agency shows 2025 was just 0.13°C away from being the hottest year on record, underscoring a stark truth: global heating fuelled by climate pollution is harming Australians right now.

The Copernicus annual global climate summary showed 2025 was the third hottest year on record, and that the past 11 years have been the 11 hottest years ever documented.

For the first time, Earth’s average temperature over three consecutive years (2023-2025) rose above 1.5°C of global warming - a threshold scientists warn dramatically increases the risk of extreme weather and human harm.

Climate Councillor and leading scientist, Professor Lesley Hughes, said: “This latest climate data reveals what Australians are already experiencing: Pollution from coal, oil and gas is heating our atmosphere and oceans, driving worsening extreme weather and battering Australian communities and ecosystems.

“This report shows again that fossil fuels are the primary driver of the volatile and dangerous weather we are experiencing. Already, just a few weeks into 2026, Australians have been pummelled in the same week by devastating bushfires and heatwaves in Southern Australia, and floods and a tropical cyclone in Queensland.

“All signs point to the need to act right now, not tomorrow. Every action to cut climate pollution helps secure a safer future for ourselves and our families.

“Australia is reducing pollution in our energy sector but we need to go harder and faster right across our economy. Our leaders can’t keep talking about this crisis and also rubber stamp new coal and gas approvals.’’

Climate Councillor and leading economist, Nicki Hutley, said: “Climate pollution is driving more dangerous and costly disasters today, and Australians are footing the bill. In 2025, the world’s third hottest year, we saw floods in Queensland, NSW, and storm damage from Cyclone Alfred that cost more than $2 billion in insured losses. “Even Australians who avoided flood, storm or fire damage will still pay ever

higher insurance premiums.

“We also know that the cost of climate-fuelled disasters is wide ranging. Our research with PropTrack shows homes in flood zones are collectively worth about $42 billion less due to the risk of floods. We are also paying through lost farm production and higher food prices, lost productivity in sectors such as construction, and higher health costs.

“As an economist, the cost/benefit equation of climate action is a no-brainer. Letting climate change rip is far more expensive than the investment needed in renewable energy and storage, cleaner transport, and other sectors. We just need to get on with it and fast.”

Copernicus’ key climate records from 2025: In 2025, half of the global land area experienced more days than average with strong heat stress (days of 32? or above), the leading cause of global weather-related deaths;

The Antarctic experienced its hottest annual temperature on record and the Arctic its second hottest;

In February 2025, the combined sea ice cover from both poles fell to its lowest value since at least the start of satellite observations in the late 1970s;

January 2025 was globally the hottest January on record.

Locally Australia’s Bureau of Meteorology Data also showed:

Australia endured its fourth-hottest year in 2025 since national records began in 1910, with large regions experiencing extreme heatwave conditions between January and March, and October to December;

Australia’s average maximum temperature was 1.48°C above the 1961–1990 average, the equal fourth-hottest on record.;

Our nation has experienced nine of its 10 hottest years on record since 2013.

The Climate Council is independent, evidence-led Australian organisation that was founded in in 2013 as an independent climate organisation. Red more: https://www.climatecouncil.org.au/

GEOPOLITICS remains the “dominant risk factor” for Australian agriculture in the year ahead, Rabobank says in its newly-released annual outlook, with the prospect that fastchanging global trade rules and volatile commodity prices are set to continue.

However, the global agribusiness banking specialist says in its flagship Australia Agribusiness Outlook 2026, Australia’s agricultural sector remains “well positioned” to navigate these global challenges, with the country’s agricultural exports expected to continue their strong performance in 2026 and major commodity sectors entering the year “from a position of strength”

Report lead author, RaboResearch general manager Stefan Vogel said the recently-harvested Australian winter grain crop was “the second largest on record, around 10 per cent above last year’s” , while Australia’s meat exports – including beef and sheepmeat – remain resilient despite geopolitical tensions and tariffs.

“Livestock product prices are forecast to hold up well,” he said, “although grain prices are likely to stay subdued, given abundant global grain supply and growing inventory.”

Commodity price ‘divergence’

Thereport says agri commodity prices are forecast to remain “divided” in 2026, with prices for grains, oilseeds, pulses, cotton and sugar set to stay subdued, while meat, wool and dairy are expected to perform relatively well (albeit dairy prices are coming under increasing pressure from strong global supply).

“That said, there is an anticipation of small price improvements for most crops, while livestock produce prices might marginally weaken from the relatively strong values seen in the second half of 2025,” Mr Vogel said.

Overall, the RaboResearch Australia Commodity Price Index – which tracks local prices of all key Australian agricultural commodities – is forecast to sit near its strong five-year average, he said.

EU-MERCOSUR bloc (Argentina, Brazil, Paraguay, and Uruguay) deal. “Other trade deals, such as the EU-Australia FTA, remain distant,” Mr Vogel said.

cally results in drier conditions in Australia – is not off the cards, as several models are seeing chances of an El Niño pattern emerging in the second half of the year.”

The report says Murray-Darling Basin water storage is sitting below levels seen a year ago.

Subdued economic outlook

Australia’sagricultural sector faces a somewhat subdued global economic outlook for 2026, the report says, with GDP growth forecast to slow in the US, China and the Eurozone, compared with last year.

Australia may be an exception, with RaboResearch forecasting a modest improvement in GDP growth to 2.3 per cent in 2026 (up from 1.9 per cent in 2025).

“However domestic consumer confidence faces renewed pressure, with further interest rate cuts now relatively unlikely. Based on sticky inflation, markets are even pricing in RBA rate hikes,” Mr Vogel said.

Rabobank is forecasting the Australian dollar to remain at stronger levels than last year – to sit around USD 0.69 by late 2026 – supporting import purchasing power for Australia’s agricultural sector, but softening export returns in AUD terms.

On the topic of currency, the report also notes that the key role of the US dollar in agricultural trade is under challenge, with China increasingly pursuing commodity purchases in Chinese renminbi, while cryptocurrency stablecoins are also gaining traction in international commodity trade.

“Exporters may need to prepare for shifts in global practice payments in the coming years,” Mr Vogel said.

The Border Watch

Address: Level 1 / 1 Commercial Street East, Mt Gambier SA 5290

Telephone: 08 8741 8170

Website: www.borderwatch.com.au

Hamilton Spectator

Address: 84 Gray Street, Hamilton, Vic 3300

Telephone: 03 5572 1011

Website: www.hamiltonspectator.com.au

Portland Observer

Address: 92 Percy Street, Portland, VIC 3305

Telephone: 03 5522 3000

Website: www.portlandobserver.com.au

CONTACT US

Editorial:

Email: editorial@agtoday.com.au

EDITORS:

Elisabeth Champion

E: elisabethchampion@tbwtoday.com.au

Marlene Punton

E: marlene.punton@portlandobserver.com.au

Advertising:

Email: advertising@agtoday.com.au

ADVERTISING CONSULTANTS

Leesa Cook

E: leesa.cook@portlandobserver.com.au

Sierra Laird

E: sierra.laird@portlandobserver.com.au

Campbell Robinson

E: campbell.robinson@hamiltonspectator.com.au

Christine Cock

E: christine.cock@tbwtoday.com.au

Christine Black

E: christine.black@tbwtoday.com.au

Josh Phelan

E: josh.phelan@tbwtoday.com.au

Published by SA Today Pty Ltd. ACN 644 311 937

Geopolitical concerns

Geopoliticsand shipping remain “major areas of concern” , the RaboResearch report says.

“With President Trump not slowing down in the second year of his second term, further geopolitical surprises are likely this year. Commodity markets – from energy to fertilisers to agri goods – may feel the effects,” Mr Vogel said.

The report says Australia had benefited from strong US demand for beef in 2025, despite tariffs. And, with most US tariffs on beef now removed, competition from South American beef in the US market may intensify, Mr Vogel said.

“Meanwhile, China’s newly-introduced beef import quotas present additional challenges for both Australian and Brazilian beef importers,” he said.

The report noted tariffs continue to be used actively by key trading partners, even as some trade agreements progress, most notably the

“Military actions and threats – including Russia’s ongoing war in Ukraine and new military signals from the US – add further uncertainty.”

Maritime shipping in 2026 also remains clouded by macro-economic and geopolitical volatility.

Weather risk

Climateand weather risks continue to be significant for Australia’s ag sector, the report says.

Soil moisture remains insufficient across much of the country, except northern Australia, RaboResearch says, making timely rainfall critical for grain planting and pasture growth in drier areas.

“The prospects for agriculture will depend heavily on how weather conditions evolve,” Mr Vogel said. “The Bureau of Meteorology’s longrange forecast points to warmer-than-average temperatures and near-to-below-normal rainfall through into May for much of the country except the north. And El Niño – which typi-

Input prices “rangebound but elevated” Whenit comes to agricultural inputs, the report says, prices for farm fertiliser and crop protection products are expected to remain “rangebound, but elevated” through 2026.

“While still above pre-COVID levels, prices for farm inputs may be contained by slightly reduced demand due to tight global grain production margins,” Mr Vogel said. “However, geopolitical developments continue to pose upside risk to input prices.”

Energy markets appear oversupplied, RaboResearch says, leading to expectations Brent crude oil prices may trade below USD 60 a barrel in 2026, “although geopolitical risk remains a wildcard”

Diesel costs, however, due to limited refining capacity, are expected to stay comparatively expensive – both globally and in Australia, which relies heavily on imports.

WANGOOM sisters Abbey and Ella Titmus are helping to fill a growing void across regional Australia for large animal and mixed practice vets.

Australia is struggling through an ongoing veterinary workforce shortage, particularly in regional areas and in large animal practice, with many regions unable to meet demand for services and many job vacancies remaining open for more than a year.

But Ella and Abbey are keen to play their part in addressing the problem.

Ella has completed her five-year veterinary science studies at James Cook University in Townsville and is starting her first job in Moss Vale, NSW, while Abbey is set to start the second year of her veterinary course at Charles Sturt University in Wagga Wagga.

The pair who come from a beef farm are being supported by DemoDAIRY Foundation scholarships to complete their studies.

Ella, 23, will be working with five other vets at Southern Highlands Veterinary Hospital, one of the few large animal clinics in an area that serves 50,000 people and many large and hobby farms.

“There’s a bit of dairy and a lot of hobby farms so I will get really good at my cattle medicine skills,” she said.

In the long-term, Ella hopes to return to south-west Victoria and concentrate on dairy.

“I’ve done placement with three or four clinics in the south-west, which has been fantastic, but wanted to get experience in another area,” she said.

“I’ll be doing a good mix of large and small animals so I’m pretty excited to get into it. There’s a big push for rural mixed vets at the moment which is good because that’s what I want to do.”

Ella will be the sixth vet working in the practice. “I’ve met them and I’m confident it’s going to be a very supportive workplace,” she said.

She described the DemoDAIRY Foundation scholarship as a game-changer.

“We don’t get paid for placements and have to fund them ourselves so the support has been invaluable.

“I cannot express enough the difference the foundation is making to regional students and creating such a positive impact on our future,” Ella said.

Ella was drawn to the Townsville course because of its focus on large animal skills.

“We had a farm on-site which gave us amazing opportunities, such as preg testing, and now I’m really keen to go out and put that in practice.”

She’s happy her younger sister is following in her footsteps. “We both wanted to do it,” she said.

Coming from a farming property had a big impact on both of us. We had lambs and calves to rear as we were growing up and that cemented what we wanted to do.

Abbey, 20, returns to study on March 1 and says she was inspired by Ella’s experiences.

“I was watching the cool things she was doing and her placements and it really convinced me it was what I wanted to do,” she said.

The sisters grew up on a hobby farm which was expanded to include about 100 beef cattle in 2020.

“I was spending more time on the farm and saw what Ella was doing and the pieces all fit together,” Abbey said.

“Those couple of years on the farm before I finished Year 12 really made me aware of the industry and I found out there was a shortage of large animal vets.

“I have a passion for animals and can’t imagine myself doing anything else.”

Her first year of study has laid the ground-

work and Abbey is looking forward to more vet-related subjects in her second year.

The DemoDAIRY Foundation scholarship has been immensely helpful, she said.

“Because I’m living on campus, most of it went on rent which took a load of pressure off

and meant I could spend more on groceries and text books and other learning resources.”

After her course, Abbey expects to follow Ella into a mixed practice and also has long-term plans to work with large animals in south-west Victoria.

TWO of the Limestone Coast region’s saleyard canteens have been named some of the top saleyard canteens in the country.

Mount Gambier and District Saleyards as well as Naracoorte Regional Livestock Exchange canteens were shortlisted in the top 10 of Saleyard Australia’s canteen competition.

Mount Gambier and District Saleyards canteen owner and operator Liz Beames has been running the canteen for 18 years, only missing a single sale.

She took over the business after her friend suggested she would suit the role with her favourite part of the job being the people who walk through the doors.

“They are salt of the earth people, farmers, stock agents, meat buyers, they are just salt of the earth,” Ms Beames said.

“I come from a family farm so I understand the dynamic of how farming is and I worked in hospitality for a fair bit of my life too so I think it comes through that.”

Keeping the menu “pretty much the same” , Ms Beames continues to provide hungry farmers, stock agents and more with homemade cakes, meat and vegetables as well as the popular rissole sandwiches.

“I also make corned beef fresh so everything is homemade,” she said.

“Previously it was not open on a Thursday night so I started opening then and the boys would come in and have tea together while they are lining up their cattle but the camaraderie between all the agents is great.”

Ms Beames said she still loved working in the business with her family growing up around the canteen.

As well as enjoying the comradery of those who used the saleyards, she said highlights also included the general banter and relationships formed over the years.

“I love it, it is my business so I have got to be here but if something happened and I had to go away I would get somebody else to come in and work,” she said.

“It is good to see what people do out here at the saleyards with the cattle and sheep, it is good to see that and support what goes on because a lot of people do not realise what goes on out here.”

She said during her time, she had seen many come and go through the saleyards and watched many children grow up in the industry.

“Over the years I have seen a lot of people pass on which has been really sad, there were a lot of farmers who would come and sit on certain tables but there is probably only one of those left now which is really sad,” Ms Beames said.

“I have seen some of the stock agents start from scratch, some of the young stock agents

and it has been a highlight to watch them grow and see them come out here and not know much about it but get in there.

“One particular young boy works alongside his father and his grandfather was out here and then there are a few other companies which have got older people still in the business but then there are those older generations who are wise.”

Ms Beames said she had also watched stock agents and meat buyers band together over the years with a large amount of banter between them when they come together on a Wednesday morning.

“That is really great to see them all in here and working together and when they go out

on the sales, they are buying for their individual companies but they all band together,” she said.

Naracoorte Lucindale Council mayor Patrick Ross said the Naracoorte Saleyards was also a highlight of the community as it continued to be one the district’s most significant economic assets.

“It plays a pivotal role in supporting our farmers, agents, transport operators, and the many local businesses that rely on a strong livestock industry,” Mr Ross said.

“Our saleyards connect primary producers with national markets, helping to ensure local livestock achieves fair value while strengthening the broader supply chain.

“Their ongoing performance reflects the professionalism and dedication of our rural community.”

Mr Ross said beyond the economic contribution, the saleyards were a hub of knowledgesharing and connection.

“They bring people together, support regional employment, and reinforce our position as a key livestock centre in South Australia,” he said.

“Council remains committed to maintaining a safe, efficient and modern facility that supports the long-term future of agriculture in our region.

“The success of the saleyards is a success shared by our entire community.”

WITH the grain harvest wrapping up across the region, sheep producers are considering the benefits of grazing their flocks on stubble.

The nutritional value of the stubble depends on the amount of residual grain and green plant growth from sprouted grain and summer weeds.

In drier years, the stems and leaves can be quite nutritious as less energy and protein has ended up in the grain. Windy weather can also cause grain to drop to the ground.

When making this decision, it’s important to consider factors such as paddock size, stocking density, how much grain and green shoots remain and whether the sheep are maintaining their weight.

Stubble is low in calcium, but this can be corrected by providing licks, supplements, or a simple limestone and 5% salt mix.

Adding trace elements, vitamins, and urea, along with pellets or grains such as lupins to boost protein intake, will help address nutritional gaps.

When grazing sheep on stubble, it’s important to keep an eye out for animal health issues,including:

• water belly

• grain poisoning

• Polioencephalomalacia or thiamine deficiency

nitrate and nitrite poisoning from oilseed crops like canola

• Lupinosis from a fungus in lupins that produces a toxin.

Be careful not to overgraze the paddock and leave at least 50% ground cover to prevent wind erosion and help retain moisture in the paddock.

For further information on grazing sheep on stubble see the following resources or contact your consultant nutritionist or veterinarian. There is more information available on our website: https://go.vic.gov.au/4aJaU5W

AN event that recognises the finest Jersey cows in Australia is being relaunched with a new name and format.

Jersey Australia has changed the make-up of its on-farm challenge which has been consolidated into a national competition.

The former Great Southern and Great Northern events have ended with club and regional winners now going directly to the national title.

The event will be known as the Genetics Australia Great Australian Challenge with Genetics Australia becoming naming rights sponsor for the next three years.

Jersey Australia general manager Glen Barrett said winners of the Genetics Australia Great Australian Challenge will be announced at the Jersey Australia annual awards night at Noosa on May 28, 2026. The Challenge is expected to attract 20002500 entries from across Australia.

The on-farm challenge is one of the most popular events for Jersey farmers and has been running for about 25 years.

“Everything is done on farm so judges see the cows in their natural working environment,” Mr Barrett said.

“It’s straight out of the paddock and into the competition.”

You can also find out more in the Sheep Drought Feeding Guide.

For specific drought management support, visit https://agriculture.vic.gov.au/farm-management/drought-support or call 136 186.

Cathy Bunter, is a district veterinary officer, Ballarat, for Agriculture Victoria.

MILLICENT consultant, facilitator and coach Toni Duka has received an AgriFutures Australia grant to assist in the design of her positive-psychology based program, focused on supporting farmers as they navigate the transition to retirement.

Seven women across rural Australia received the 2026 AgriFutures Rural Women’s Acceleration Grant of up to a $7,000 bursary for professional learning and development, empowering them to transform their ideas into real-world impact and become leaders in rural Australia.

Still in its early stages, Ms Duka’s program will feature workshops, peer groups and reflective coaching to support farmers to reconnect with purpose, redefine their identity and build meaningful roles beyond the farm gate.

Excited by the grant funding, Ms Duka looked forward to further planning and executing her proposed program.

“I’ve had this program idea brewing for a little while…there’s lots of notes on butcher’s paper and in books, so it will be wonderful to have the opportunity to bring it all together,” she said.

“My vision is to create a program that supports farmers plan and navigate a transition to retirement and I really want to embed that in the principles of positive psychology and wellbeing.

“I want it to be a positive thing, I want it to be embedded in and I want to create some really useful tools and resources that are really practical, but are embedded in good science.”

Ms Duka plans to use the funding to study a positive psychology and wellbeing course at the end of February.

“I’m really excited about that, I want to embed it in those principals and approaches and look at building positive recognition and an identity beyond the farm, and base that using people’s strengths and their meanings and values,” she said.

The idea of the program was born from Ms Duka’s experience as consultant, facilitator and coach, after spending time in workshop rooms hearing the stories of members of the community - particularly those in farming - at this stage of life.

“My focus is in rural and farming communities - I grew up on a farm, it’s a unique set of circumstances,” she said.

“In other lives, people work a job and they come back to their home.

“In farming, all of that is wrapped up together and it can be very complex and involve a lot of emotion and who you are 24 hours a day, is a farmer.

“So when you are trying to transition out of that, people can find it really challenging because there’s that big question of ‘If I’m not the farmer and I’ve handed that to somebody else.. Who am I now?’

“Why would we want to lose that knowledge and passion and wisdom from those people in our community?

“They need to think about ways that they can still contribute to our community and stay connected - that really is positive for everybody’s wellbeing and for us as a rural community.”

Reflecting on her journey into motherhood, Ms Duka said she could understand and relate to the shift in identity.

“It can be a really tough time and so watching other people do that in retirement is a very similar thing, it’s actually related to a loss of identity,” she said.

“They’re complex situations - I’m not going to lie about that and this will never fix everything by any stretch of the imagination, but I think it could be one piece in the puzzle for some people.

“What to go to next and wanting to be excited about that next phase of life so you’ve got something great to look forward to and go towards, rather than focusing on what we’re letting go of.”

While the program’s foundations are laid, Ms Duka said she was keeping an open mind about the exact structure of the program as it would be shaped by the knowledge gained during her training.

“I’m certainly not fixed about what it will look like and I’m really excited about what I’m going to learn through this opportunity to then be able to use that in designing and developing and implementing this program over the next 12 months,” she said.

Ms Duka expressed hope that the program would help keep community members active and connected, though she acknowledged it was not a quick fix solution.

“I’m hoping it will keep leveraging the greatest asset we have in our businesses, and that’s our people,” she said.

“I want to support those people and I want those people that are nearing retirement to stay connected and feel valued and purposeful in the work that they have contributed to communities and what they can do to continue to contribute.

“My absolute hope and dream is that that

support helps support some healthier and more successful transition focuses for those families, because there are people out there that have a really tough time with it.”

The program will be designed to be flexible and individually tailored to meet the needs of each participant.

“That’s the beauty of it, it has some great flexibility and AgriFutures have done an incredible job with that and I’m really grateful to AgriFutures and the grant for the opportunity,” she said.

“Not only do I get the opportunity to go off and do some learning and development that would otherwise be hard for me to access, particularly living in a region, I also get to be in a group online and meet with these other people with incredible projects and really diverse projects that are all really important to regional Australia and utilise that network and lean on that network for ideas and learnings as well, so I’m really excited about that.”

The initial phase of the program will involve a trial program with known participants for the testing period.

“My passion is rural communities and the people in those and I think they’re the greatest asset we have, so while we all need to look after ourselves, we need to look after each other as well,” Ms Duka said.

“The more we learn about managing our people, the better off we’ll be.

“We’re talking about some really big issues and big things and so it’s really unrealistic to think you’re going to solve the whole lot, and so it’s also just working out where my expertise is going to best serve one piece of this puzzle.

“I’m super grateful to AgriFutures Australia for the opportunity and I’m really excited about the wider varied and inspiring projects the six other women are coming to the table with.

“I’m really looking forward to hearing more about those too and I think importantly, this is just a great opportunity to continue supporting rural communities, which everyone that has been successful in this opportunity is really passionate about.

“It’s exciting - I’m just excited about the opportunity and the possibility.”

BENDIGO Bank’s 2026 Australian Agriculture Outlook report provides an in-depth perspective on supply, demand, and price outlooks for Australia’s major agricultural commodities for the first half of 2026.

The six months ahead for Australian agriculture will be impacted by seasonal conditions and the economic environment, two key factors which have the capacity to significantly benefit or hamper the industry moving through the first half of 2026.

With around two thirds of Australian agricultural products exported, increasingly volatile global markets will be key to growth prospects across Australia’s agribusiness sector, underscoring the importance of maintaining strong diversified trade relationships.

Bendigo Bank Agribusiness Senior Manager Industry Insights, Eliza Redfern said: “Seasonal risk and economic uncertainty remain at the forefront, but the outlook for Australian agriculture is broadly positive as we move into 2026. While higher on-farm costs will weigh on the production of vegetables and milk, the tight supply outlook for sheep and wool, in addition to strong export demand for beef and demand lifting for some crops, will help support pricing into the new year.

“Beef production is tipped to drop slightly from the high volumes seen in 2025, and strong demand especially from an export perspective is likely to keep prices firm, supported by reduced supply in the US. This factor will help keep Australia as a preferred choice in key export markets across Asia, despite the US recently removing the additional tariff imposed on Brazilian beef.

“Australia’s total winter crop production for 2025/26 is now forecast at 62.3 million tonnes, representing a 12 per cent increase from our mid-year estimate of 54.5 million tonnes. This would be the third largest crop on record, driven by an extraordinary turnaround in Western Australia, where the production forecast has jumped 26 per cent, or around 5.0 million tonnes, since June.

“Weather remains the key driver of horticultural output heading into the first half of 2026. Based on current forecasts, we should see both high quality and volumes across key production regions, with output to remain strong across the fruit and nut sectors. A major dampener continues to be input costs that continue to pressure margins with fertiliser, irrigation, chemical and labour costs showing no signs of sustained easing in coming months.

“We’re also expecting Australian lamb and mutton supply will remain lower in the first half of 2026, with prices easing from recent record highs but remaining well above the five-year average. The recent run of strong prices is expected to continue into 2026 due to firm demand and the tight supply environment, driven primarily from processors who have increased their capacity over the past two years,” Ms Redfern concluded.

Fast facts

• Cattle: Strong beef production and export demand along with stable prices indicate a favourable outlook for the cattle industry. Australia’s beef industry is set for a big 2026 with strong exports and well above average slaughter rates.

Cropping: Harvest pressure keeps wheat prices soft early, but Q2 strength should emerge as Southeast Asian feed demand lifts. Barley values are likely to find support from China and the Middle East in early 2026. Barley and canola dominate Q1 exports, allowing wheat to roll into Q2. High-protein and noodle wheat are attracting early buyer interest. Demand for feed grain is at a historical peak, driven by sustained, high-volume output across all key intensive farming sectors.

• Dairy: Expectations for milk production have improved whilst the outlook for farmgate milk prices has eased. Downside risks cloud the outlook for both. Milk production is set to drop one to two per cent to around 8.2 billion litres, while continued global milk supply growth is expected across other major dairy export competitors. High input costs continue to plague farmers and production, with indicators for fodder and fertiliser around one

third higher year-on-year, in many cases double that of five years ago, despite recent easing. Our expectation for the average southern farmgate milk price has eased, to $9.40kg MS (and $9.78kg MS nationally) for the 2025/26 season.

• Horticulture: A shift in market dynamics with uncertain export demand, strong supply forecasts and high costs environment is driving a slightly less favourable outlook compared to 2025. Output to remain high across fruit and nut sectors while vegetable production will be pressured by high irrigation costs. Input costs continue to drive significant margin pressure with fertiliser, irrigation, chemical and labour costs showing no signs of any sustained easing in the coming months. Fruit and nut prices are expected to ease slightly with elevated supply and slightly softer export demand. Looking to the supply outlook for 2026, vegetable production is anticipated to sit below the first half of 2025 as reduced water storages and significantly higher irrigation costs limit production potential.

• Sheep: The recent run of strong prices is expected to continue into 2026 due to firm demand and the tight supply environment, with lamb and mutton supply likely to remain lower in the first half of 2026. Australian lamb prices expected to ease from the recent record highs but will remain well above the five-year average. Demand to remain elevated as processors look to maintain throughput, while restocking activity will also be price supportive.

• Wool: The Australian wool industry is looking to build on its positive start to the season with constrained supplies supporting rising prices. Improving demand from China is aiding the Australian wool market, although European demand lags behind. The reduced supply from across the country has been the headline feature of the Australian wool market, driving a welcome price spike across all microns. There are also indications that flock numbers should start to build up again in the year ahead. Growers can hope the recent lift in demand will continue and help lift prices further.

States roundup

Victoria:

At time of writing, the Victorian harvest was off to a slow start, running more than 50 per cent behind the five-year average. This delay has had an immediate firming effect on nearby cash prices for feed grains. However, the outlook is constrained once harvest accelerates. Victoria is forecast to deliver a significant crop of 8.5 million tonnes, slightly exceeding the ten-year average. Once this volume comes to market, prices will be facing downward harvest pressure. This heavy flow, coupled with a globally well-supplied market, and weak international futures, is expected to reverse recent short-term gains, with many growers opting to store grain and await better post-harvest values.

Victoria’s cattle industry is set for an interesting beginning to 2026, as the latest Bureau

of Meteorology forecast shows a roughly even chance of achieving median rainfall. Export demand and processor buying will likely keep prices competitive at local markets, particularly if producers hold stock amidst supportive weather conditions. However, if seasonal conditions become unfavourable, local saleyards may see an influx of stock which would weigh prices down.

• Victorian lamb prices are forecast to come back from the recent highs as supply continues to pick up, however, prices should remain historically strong. Supply will continue to build, but the quantity of lambs available is still expected to be lower following a prolonged period of destocking. Firm processor and export demand, as well as restocking activity should conditions allow, will also be supportive for prices. Dry conditions over the past two seasons have resulted in destocking across the state, so sheep prices should remain elevated, should favourable conditions prevail.

The wool market is looking to continue its positive start to the season, with further price growth driven primarily by reduced supply.

Timely spring rainfall has eased some of the immediate pressure on Victorian dairy farmers, with improved pasture availability reducing the immediate need for scarce and expensive purchased fodder. Milk production continues to trail last season; the gap closed in the three months to September before opening up against a strong October in 2024. Continued favourable rainfall and a strong hay season will be required to support farmers and keep further year-on-year production losses to a minimum, with cost pressures, export market headwinds and smaller herds to contend with.

Table grape crops are looking promising with early industry forecasts placing national production in line with last season at around 230,000 mt. This forecast has been supported by reports of strong flowering across Sunraysia and the Riverland. For context, this forecast production total sits 14 per cent above the ten-year average. Growers are monitoring for powdery mildew following a cold and wet November, but overall vineyard health appears strong.

South Australia:

South Australia is experiencing a near record slow harvest start, creating a temporary lift in cash prices for nearby feed grain delivery. Domestic buyers are actively chasing limited immediate supply, mirroring dynamics in Victoria. However, the outlook is constrained once harvest accelerates, as the state is expected to deliver a significant crop of 8.37 million tonnes, slightly above the 10-year average. This large volume will impose downward pressure. South Australia remains a key source of near-term export coverage; this early demand should help limit downward price movements, providing a floor above the weakest international values.

Quality downgrades remain a key market risk.

Output and quality across most key fruit varieties is anticipated to sit above average in the

first half of 2026. Positive seasonal conditions throughout spring and into the new year, alongside the ongoing maturation of recent plantings underpin this optimistic supply outlook. Table grape crops are looking promising with early industry forecasts placing national production in line with last season at around 230,000 mt. This forecast has been supported by reports of strong flowering across Sunraysia and the Riverland. For context, this forecast production total sits 14 per cent above the ten-year average.

The almond supply outlook appears favourable as almond crops across Sunraysia and the Riverland are tracking strongly with yields looking similar to last year. Growers are optimistic that high grade packouts will be maintained while strong pricing has also been indicated by processors, although uncertainty surrounding the US tariff situation could see this pricing outlook shift rapidly.

Impacts of the prolonged dry period are continuing to show up in South Australian milk production, with output for the four months to October the lowest in over a decade. The current season will continue to be one of supply contraction, as farmers focus on rebuilding fodder stocks and consolidating their businesses.

South Australia’s cattle industry is forecast to see a mixed first half of 2026. Seasonal conditions do not appear to show a strong chance of above or below median rainfall, which could push producers to sell more stock. South Australia has suffered through a prolonged drought period and with limited feed available, rainfall would be welcomed post-harvest. Prices will remain supported by export demand like other states, but the key watch will be how seasonal conditions develop which will shape the direction of prices in the next six months.

Lamb prices in South Australia are forecast to come back from the recent highs as supply continues to lift, however, prices should remain historically strong. Supply will continue to build into the new year, but the quantity of lambs available is still expected to be lower following the prolonged period of destocking, while firm processor and export demand, as well as restocking activity should conditions allow, will also be supportive. Dry conditions over the past two seasons have resulted in significant destocking across the state, so sheep prices should remain elevated should we see favourable conditions.

The wool market is looking to continue its positive start to the season, with further price growth driven primarily by reduced supply. Some producers will start to look at increasing flock sizes in 2026, however, there will be a lag before wool supply starts increasing again. Improved demand from China has also helped to lift prices, however, a continued upwards trajectory remains uncertain due to political tensions. Reduced supply and improved demand should provide upwards pressure on prices, although high input costs continue to create a challenge for producers.