Home Buyer Guide

Presented by Krystyna Tolentino

Mikhaella Tolentino & Daniil Larin,

Welcometotheexcitingjourneyofpurchasingyournewhome!

AtBerkshireHathawayHomeServicesStarckRealEstate,weunderstandthatbuyingahomeisone ofthemostsignificantdecisionsyou’llmake.Whetheryouareafirst-timehomebuyeroraseasoned investor,theprocesscanbeboththrillingandoverwhelming.Asyourdedicatedbroker,Iamhereto guideyoueverystepoftheway,ensuringasmoothandrewardingexperience.

Withover60yearsofcombinedrealestateexperience,BerkshireHathawayHomeServicesStarck RealEstatehasbuiltareputationforexcellence,integrity,andunparalleledcustomerservice. Ourcommitmenttoyoursatisfactionisunwavering,andweprideourselvesonourdeepmarket knowledge,cutting-edgetechnology,andclient-firstapproach.

Asyourbroker,Ibringdedication,attentiontodetail,andapassionforhelpingyouachieveyourreal estategoals.Ilistencarefullytoyourneedsandworktirelesslytoexceedyourexpectations.With BerkshireHathawayHomeServicesStarckRealEstate,youhaveapowerfulteamsupportingyou, ensuringasuccessfulandenjoyablehome-buyingexperience.

Thankyouforconsideringusasyourtrustedpartnerinthisexcitingjourney.Ilookforwardtoworking withyouandhelpingyoufindyourdreamhome.

Warmregards,

Krystyna Tolentino Broker

847.414.1466

KTolentino@StarckRE.com

KTolentino.StarckRE.com

“A home is one of the most important assets that most people will ever buy. Homes are also where memories are made and you want to work with someone you can trust.”

Warren Buffett

Chariman and CEO Berkshire Hathaway Inc.

LOCAL KNOWLEDGE

I have extensive knowledge of the local markets to better help you fulfill your wants and needs

NEGOTIATION EXPERTISE

I am your advocate and help you negotiate complicated contracts with experience and skill

SAVE YOU TIME

I save you time by narrowing your search and doing all the footwork to find your dream home

FINANCIAL PROTECTION

I amv legally bound to look out for your best interests

EXPERT GUIDANCE

I am trained with the entire sales process and are up to date on best (and required) practices

WHY WORK WITH A BROKER?

PAPERWORK MANAGEMENT

I will take care of all the paperwork for you

MARKET

ACCESS

I have access to homes not visible to the public and can reach out to an extensive network of other brokers

While the internet is increasingly incorporated as an important tool in the process, buyers needed the help of a real estate professional to help them find the right home, negotiate terms of sale, and help with price negotiations.

86% of buyers purchased their home through a broker*

found their real estate agent to be a very useful information source*

HOME BUYER PROCESS

Berkshire Hathaway HomeServices Starck Real Estate strives to make the home buying process seamless. Expert guidance from launch to close allows you to get where you want to go, on time.

BUYER

Buyer’s Broker Seller’s Broker

LOAN EVALUATION

Before making an offer, smart buyers apply to at least three lending sources to determine how much they can afford to spend and the best interest rate.

SALES AGREEMENT EXECUTED

OFFER PRESENTED

Buyer’s Broker presents buyer’s offer to seller’s Broker, who conveys it to the seller.

GOOD FAITH DEPOSIT

Once buyer and seller agree on terms, buyer submits a good faith deposit to cement the deal. Deposit is held in escrow to be applied toward the down payment.

LOAN APPLICATION PROCESSED

Lender conducts an extensive review of buyer’s credit report, employment, source of down payment, property appraisal, etc.

CLOSING DOCUMENTS ISSUED

Lender provides loan estimate and closing disclosure detailing all terms and costs.

SELLER

SELLER’S DISCLOSURE

Seller discloses issues that may materially affect the value of the property and which are not readily evident.

PURCHASE NEGOTIATION

Working through their Brokers, seller and buyer negotiate the sales price, sales terms and any contingencies buyer may request.

TITLE SEARCH

Concurrent with the loan process, closing agent confirms seller has a clear right to sell the property and establishes facts, such as whether there are restrictive covenants on the use of the property.

CONTINGENCIES SATISFIED

Once financing is complete and other hurdles are removed, contingencies may drop off.

FINAL WALK-THROUGH

1-2 days before closing, buyer confirms that the home is in the same condition as when purchase offer was signed and all elements that are to be conveyed are still in place.

CLOSING

Buyer and seller sign documents and complete sale.

HOMEBUYING TERMS TO KNOW

Appraisal: Professional analysis used to estimate the value of the home. A necessary step in validating the home’s worth to you and your lender to secure financing.

Closing Costs: The costs to complete the real estate transaction. Paid at closing, they include taxes, title insurance, financing costs, and items that must be prepaid or escrowed. Ask your lender for a complete list of closing cost items and an estimate of the total cost, so you are prepared in advance.

Comparative Market Analysis (CMA): A strategic pricing analysis, that is compiled by your Real Estate Agent, that looks at similar homes to determine a comparative price for your target property.

Credit Score: A number ranging from 300-850 that is based on an analysis of your credit history. Helps lenders determine the likelihood that you’ll repay future debts, like your mortgage.

Designated Buyer Agency: Designated buyer agency is when a licensed real estate broker represents the best interests of a homebuyer in a transaction. The buyer’s agent has a fiduciary duty to their client, meaning they must act with loyalty, confidentiality, obedience, reasonable care and diligence, accounting, and full disclosure while negotiating the best terms. They help buyers find suitable properties, provide market insights, arrange showings, assist with offers, and navigate the closing process. Unlike a listing agent who represents the seller, a designated buyer’s agent works

exclusively for the buyer, ensuring their needs and financial interests are prioritized throughout the home-buying journey.

Down Payment: Down payments are typically 3-20% of the purchase price of the home. Some 0% down programs are also available. Ask your lender for more information.

Earnest Money: A deposit made by the buyer to help assure the seller that the buyer has the intent to purchase the property.

MLS: The multiple listing service (MLS), is a database of homes for sale within a particular region. This database makes it much easier for real estate agents to find potential properties to show to buyers. This database contains additional information that is only available to licensed Realtors.

Mortgage Rate: The interest rate you pay to borrow money to buy your home. The lower the rate, the better.

Pre-Approval Letter: A letter from a lender indicating you qualify for a mortgage of a specific amount.

Real Estate Agent or Broker: An individual who provides services in buying and selling homes. Real estate professionals are there to help you through the confusing paperwork, find your dream home, negotiate any of the details that come up, and to help you know exactly what’s going on in the market.

WHAT IS A CMA?

A Comparative Market Analysis (CMA) is an estimate of a home’s market value based on recently sold, similar properties in the immediate area. I will use this tool to help you understand if a home you are interested in is fairly priced to the market and we can also use it to help you understand what are the pricing trends in areas you are seeking to live in.

Knowing market values can help you make better decisions and make competitive offers. The analysis considers the age, size, construction, style, bedroom and bath count as well as other factors that affect the value of a home.

WHY HIRE AN ATTORNEY

Buyers may question the need for an attorney when they close on a home. Attorneys provide substantial benefits from contract reviews and negotiations to dealing with liens and title searches. They are there as a fiduciary, to protect the buyer’s best interests.

Attorneys can assess legal issues that a real estate broker cannot. They can help make legal issues understandable by sorting through terms and providing a clear and concise contract. They will assist in making the buyer aware of their obligations under the purchase agreement and can help draft documents required for the transaction.

OUR STRATEGIC PARTNERS

Our goal is always to exceed your expectations. Berkshire Hathaway HomeServices Starck Real Estate has brought together a group of trusted strategic partners to enhance your home selling and moving experiences. Our commitment is to provide you with Double Platinum service throughout the transaction of selling your home.

ST AR CK

TITL E

Lend Local. Prosper Local.

Prosperity Home Mortgage, LLC, is a full-service mortgage banker specializing in residential and refinance loans. Prosperity Home Mortgage offers a wide range of mortgage products, including fixed and adjustable-rate mortgages, jumbo loans, Federal Housing Administration (FHA), Veterans Affairs (VA) loans, and renovation financing.

Get Peace Of Mind With Starck Title.

Title insurance protects you against risks and losses caused by flaws in title arising from events that happened in the past. Simply put, it protects you against loss due to defects that were not discovered at the time of the sale. Think of Starck Title insurance as a policy that insures your “peace of mind.” A one-time premium guards you against claims that may arise.

UNDERSTANDING THE DIFFERENCE

Mortgage Loan Prequalifications vs Pre-Approval

When you’re ready to buy a home, understanding the mortgage process is essential to making informed decisions. Two key terms you’ll encounter early on are loan prequalification and loan pre-approval. While they might seem similar, they serve different purposes and provide varying levels of insight into your home-buying journey. Let’s explore the differences between these two important steps.

LOAN PREQUALIFICATION

Prequalification is an initial assessment of your financial situation to estimate how much you might be able to borrow. It’s typically a quick and straightforward process that involves providing some basic information to your lender.

The Process

Information Provided: You’ll share your income, debts, assets, and a rough estimate of your credit score.

Lender’s Assessment: Based on this information, the lender gives you an estimate of the loan amount you might qualify for.

Timeline: The process is quick and can often be done online or over the phone in a matter of minutes.

Benefits

Ease and Speed: It’s a fast way to get an idea of your borrowing potential.

No Commitment: Since it’s an informal assessment, there’s no obligation to proceed with the lender.

Limitations

Accuracy: The estimate is based on unverified information, so it’s not a guaranteed loan amount.

Less Credibility: Sellers and real estate agents may not view prequalification as a strong indicator of your ability to secure financing.

LOAN PRE-APPROVAL

Pre-approval is a more rigorous evaluation of your financial situation. It involves a thorough review of your credit and financial background, resulting in a conditional commitment from the lender to provide you with a specific loan amount

The Process

Detailed Application: You’ll complete a detailed mortgage application and provide documentation such as pay stubs, tax returns, and bank statements.

Credit Check: The lender will conduct a hard credit inquiry to evaluate your credit history and score.

Lender’s Evaluation: After reviewing your financial documents and credit report, the lender issues a pre-approval letter stating the loan amount you are conditionally approved for.

Timeline: The process can take several days to a couple of weeks, depending on how quickly you can provide the necessary documentation and the lender’s review process.

Benefits

Accuracy: The pre-approval is based on verified information, making it a more accurate representation of your borrowing capacity.

Increased Credibility: Sellers and real estate agents view pre-approval as a strong indication that you are a serious and qualified buyer.

Negotiating Power: A pre-approval letter can give you a competitive edge in negotiations, as it shows you have the financial backing to complete the purchase.

Limitations

Time and Effort: The pre-approval process is more time-consuming and requires comprehensive financial documentation.

Credit Impact: The hard credit inquiry can temporarily affect your credit score.

WHICH SHOULD YOU GET?

While both prequalification and pre-approval have their place in the home-buying process, pre-approval is generally more advantageous if you’re serious about purchasing a home. It provides a more accurate picture of your financial standing and strengthens your position when making offers.

However, starting with prequalification can be beneficial if you’re in the early stages of house hunting and want a quick estimate of what you might afford without the commitment and detailed scrutiny of pre-approval.

PROTECT YOUR DEAL WITH CLOSINGLOCK

Wire fraud in real estate is a growing problem — buyers fall victim to fraudulent wire transfer instructions sent via email, and your client ends up losing the deal because of it. That’s why we work with Starck Title to provide ClosingLock, the most secure wire transfer environment for buyers and sellers. You get peace of mind that the funds will transfer safely and you’ll get to the closing table.

How It Works

Login information is sent via text/email.

Securely log in to the ClosingLock portal using multi factor authentication.

How is it secure?

Download verified wire instructions or upload bank information.

ClosingLock mitigates the risk of wire fraud by sending wire transfer instructions through their portal, rather than email.

On top of that, ClosingLock:

• Sends out automatic email and text notifications

• Uses multi factor authentication

• Sends out wire fraud warnings

• Integrates with over 11,000 financial institutions for easy transfers

• Doesn’t require registration, apps, or password

THE CONSUMER’S GUIDE TO REAL ESTATE AGENCY IN ILLINOIS

AGENCY

� A legal framework that allows a person to act through a representative

� Common examples include:

� An attorney representing you in a business transaction

� A stock broker buying and selling investments on your behalf

� A real estate broker assisting you in buying, selling or leasing real estate

� Under the Act, your real estate agent will owe you certain statutory duties that are similar to fiduciary agency duties

DESIGNATED AGENCY IN ILLINOIS REAL ESTATE TRANSACTIONS

� An arrangement where one or more agents from a real estate brokerage company are appointed as your legal/designated agent

� You will be presumed to be represented by the real estate agent you are working with unless you have a written agreement otherwise

� Other associates in the brokerage firm may be designated agents for other buyers or sellers and may be the legal agent of the opposite party in your transaction

� You will be asked to sign some form of written brokerage agreement to work with your agent

� Even though your brokerage agreement will be with the real estate brokerage company, you will have a designated agent(s) to act on your behalf

DESIGNATED AGENCY DUTIES UNDER THE ACT

� Perform according to the terms of your agency agreement

� Promote your best interests as follows:

� Seeking a transaction that meets the terms of your agency agreement or that is otherwise acceptable to you

� Presenting all offers to you and from you unless you direct your agent otherwise

� Disclosing material facts about the transaction that the agent actually knows about and the information is not confidential to someone else

NOTE: Material facts typically will not include information related to property that is not the subject of the transaction,that is a fact situation not related to the subject property or occurrences related to the subject property

� Accounting for all money/property received from you or for your benefit

� Obeying your lawful instructions

� Promoting your best interests above the agent’s or someone else’s best interests

� Exercise reasonable skill and care in performing brokerage services

� Keeping your confidential information confidential

� Complying with the Act and other laws that might apply, i.e. fair housing and civil rights statutes

NOT VIOLATIONS OF AGENCY DUTIES

� Showing the same or similar properties to more than one interested buyer or tenant client

� Compensation based on percentage of purchase/lease price

� Relaying false information to you (client) if agent did not know or have reason to know the information was false

REQUIRED AGENCY DISCLOSURE UNDER THE ACT

� No later than entering a brokerage agreement, you must be advised of the following from the brokerage company:

� That a designated agency relationship exists

� The name of your designated agent(s) in writing

� What the brokerage company will be paid, the company’s policy regarding payment to other brokerage companies that might be involved in your transaction and any amounts that might be authorized for

DISCLOSED DUAL AGENCY

� Sometimes a designated agent can represent both you and the opposite party in the transaction in a limited role

� Before doing so, the agent must have the informed written consent of the parties

� If your designated agent might act as a dual agent, he/she should talk to you about the potential for dual agency and give you a disclosure form entitled Disclosure and Consent to Dual Agency for your review

� You will see that the agent’s role becomes limited when you have dual agency

� You are under no obligation to consent to disclosed dual agency

� If you do consent, you must sign the disclosure form before the agent acts as a disclosed dual agent

� Sometimes, this language will be included in your written brokerage agreement

� You will be asked to sign a confirmation of your consent to dual agency no later than when you sign a purchase or lease contract

TREATMENT OF CUSTOMERS AS OPPOSED TO CLIENTS

� Sometimes someone on the opposite side of your transaction will not be represented by a real estate agent, in which case your agent will give that party a notice that tells that person the agent represents you only

� This notice might be called a Notice of No Agency Relationship

� It will allow the agent to do certain clerical type acts for that party for your benefit

� Some examples of clerical type acts might include:

w Talking to an inquiring consumer about availability and pricing of brokerage services

w Responding to phone calls from a consumer about price or location of a property

w Setting an appointment to view a property

w Completing business or factual information on a contract for the consumer but on your behalf

� If you are a customer and not a client, you should receive a Notice of No Agency Relationship

� You should not disclose anything to the agent who is treating you as a customer that would be confidential to you, i.e. anything that might hinder your bargaining position, or anything you would not want the opposing party to know and that is not otherwise published.

EXCLUSIVE BROKERAGE AGREEMENTS

� Sometimes, your agent will ask you to sign an exclusive brokerage agreement

� This means that you are agreeing to work only with the real estate brokerage company and designated agent(s) named in the agreement to the exclusion of other real estate firms and agents

� If you are the seller, the contract will likely be called an Exclusive Right to Sell or an Exclusive Agency Agreement (also sometimes called an Exclusive Seller Representation Agreement)

� If you are the buyer, the contract will likely be called an Exclusive Right to Acquire, Exclusive Right to Purchase or Exclusive Buyer Agency Agreement (sometimes called an Exclusive Buyer Representation Agreement)

� Under an exclusive brokerage agreement, the designated agent(s) is required by the Act to provide certain minimum services. These services generally include:

� Accepting and presenting offers and counter offers

� Assisting you in the preparation of offers, counteroffers etc., and

� Answering your questions related to negotiations in a real estate transaction

ITEMS YOU SHOULD RECEIVE

� If you are a client, written disclosure of your designated agent along with some form of written brokerage agreement

� If you are a customer and not a client:

� Written disclosure of Notice of No Agency

� If your agent is a disclosed dual agent:

� Written disclosure (stand-alone form or part of brokerage agreement) where you consent to dual agent’s limited role and description of limits: can’t really advise you.

� A confirmation of that consent; usually within the purchase contract but could be a standalone form.

Home Buying Simplified

THE HOME BUYING PROCESS SIMPLIFIED

Initial Consultation: I begin with a thorough discussion to understand your needs, preferences, and budget. This helps me tailor our search to homes that align with your unique criteria.

Pre-Approval: I will assist you in obtaining mortgage pre-approval, strengthening your buying position and clarifying your budget. I will leverage my mortgage lending relationships to assist you with finding the best solution.

Home Search: Leveraging our extensive network and advanced tools, I will provide a curated list of properties that match your desires. I will schedule viewings and offer insights into each home’s potential.

Making an Offer: When you find the perfect home, I will guide you in crafting a competitive offer. My expertise in negotiation ensures you will get the best possible terms and price.

Inspection and Appraisal: I will coordinate home inspections and appraisals to confirm the property’s condition and value. Any issues that arise are addressed with the seller, protecting your investment.

Closing: I will manage all the closing details, from paperwork to final walk-throughs, ensuring your seamless transition to homeownership.

PARTNERING FOR SUCCESS

We begin the homebuying process by matching your objectives and priorities with the process of finding homes that match your criteria. The buying process can be difficult and complex. Together we can set your priorities that will guide us on a smooth path. Please look at the questions below and consider how you would like the buying process to go. There is no need to write them down, we will discuss them.

1. How familiar are you with the process of buying a home? What information can I provide to help you make better decisions?

2. Have you begun your search? Have you looked online or visited any open houses?

3. Who will be purchasing the home? Who else does this decision affect? Do you require approval from anyone else to move forward?

4. Will this be your primary residence, an investment, or a vacation home?

5. What features are important to you? How many bedrooms and baths do you want? Do you want a large yard? How does your commute affect your location choices?

6. Will you need to finance your next home or will you pay cash?

7. What is your price range? Have you spoken to a mortgage lender yet?

8. Are you willing to buy a home that may need updating or do you prefer a perfect home?

9. Rate your readiness to buy on a scale of 1-10—how prepared are you to purchase your next home?

10. At the end of the process, what does a successful home purchase look like to you?

Target Budget

THE SIMPLE, STRESS-FREE

HOME BUYING WISH LIST

Target Size (SQ FT)

Style of Home Neighborhood

Walking Score School District

Must Have Like To Have Don’t Need

EXTERIOR

Garage Size (attached?)

Curb Appeal

Landscaping Views

Size of Yard

Patio/Deck/Porch

Pool/Hot Tub

Garden Space

Privacy Level

Fenced Yard

NEIGHBORHOOD

Downtown or Suburbia

Quiet or Busy Street

Near Work

Near Schools/Daycare

Near Shopping

Near Recreation Areas

Near Public Transportation

Close to Airport

Covenants/Restrictions

INTERIOR

Number of Stories

Number of Bedrooms

Number of Bathrooms

Grand Entry

Open Floor Plan

Gourmet Kitchen

Great Room

Family Room

Home Office/Work Room/Studio

Separate Laundry Area

Master Suite

Storage/Closet Space

Fire Place(s)

Type of Flooring

Attic

Finished Basement

Air Conditioning

Type of Heat

Green or Environmental Features

Energy Conservation Features

Home Security System

Home Warranty

Anything else to keep in mind?

HOME SEARCH PROCESS

In order to make sure that you don’t miss out on anything, I work by a process of elimination rather than selection. We will set up a search which will be delivered according to your preference, via email or text. You can eliminate the properties that don’t work for you, rather than have someone else reduce the selection of homes. Through a thorough diagnostic process, I will help you find the right home at the right price.

DETERMINE A HOME’S MARKET VALUE

An impartial evaluation of market activity is the most effective way to estimate a property’s potential value.

In order to make sure that you don’t pay too much, I will provide a Comparative Market Analysis which considers similar properties that:

• Have recently sold. This shows us what buyers in this market have paid for similar properties.

• Are currently on the market. This shows us what kind of properties are competing for the attention of available buyers

• Failed to sell. Understanding why these properties did not sell can help us avoid disappointment.

• Market Conditions. Understanding supply and demand in your search area to help set realistic expectations.

NEGOTIATING

My goal is to get you where you want, on time. Together, we’ll explore the five key areas of negotiation and craft a strategy that empowers you to negotiate with confidence. I believe in a positive, competitive approach—clearly showcasing the strengths and benefits of accepting your offer. The five basic areas of negotition are:

• Price

• Terms

• Dates & Deadlines

• Inclusions & Exclusions

• Contingencies

MOVING CHECKLIST

1-4 Weeks Before The Move

Make arrangements with moving company well in advance of move date.

Packing Tips:

Gather moving supplies (boxes, packing tape, newspaper, etc.)

Begin packing non-essentials and mark on outside of the box what it contains and what room it belongs in Keep essential items together and mark these boxes “OPEN FIRST”

Notify forwarding address & move date to:

___ Post office

___ Subscriptions & Online Shopping Accounts

___ Credit cards

Insurance providers-find out when your homeowner’ s insurance should be terminated

___ Mobile phone service

Cancel (or transfer) these services:

___ Bank accounts

___ Utilities-gas/electric/cable/internet

___ Water, garbage

___ Lawn service/snow removal service

___ Security system

Obtain records:

___ Medical/dental records

___ Retrieve contents of safe deposit box

___ School records

___ Legal records (such os birth certificates)

Gather for new owners:

Manuals/warranties for appliances, equipment & systems

___ Keys (labeled)

___ Garage door openers/remotes

Leave It In good condition:

___ Continue to do normal property maintenance (lawn care, etc)

Empty garage, attic, basement and yard of unwanted items unless arrangements have been made with next owners

On Moving Day

Before leaving:

___ Floors swept or vacuumed

___ Kitchen & baths wiped down (os clean as you would want to find it)

___ Windows/doors closed & locked

Empty all food from refrigerator/pantry

Double check closets and drawers to be sure nothing is left behind

___ Bring house keys & garage door openers to closing

For your trip:

___ Full gas tank/recent tune-up, etc.

___ Be prepared with enough cash

___ Bring food/games for children

Program your new address into your mobile phone for quick reference

Bring prescriptions/documents/jewelry (not with moving company)

Upon Your Arrival

Getting settled:

___ Initiate utilities/garbage/internet, etc

___ Enroll children in schools

___ Watch your stress level-don’t overdo it!

___ Apply for state driver’s license

___ Obtain village sticker. if applicable

___ Register to vote

___ Designate medical services BEFORE you need them

The Starck Difference

Aaron Starck, President

Andy Starck, Chairman

BUILT ON TRUST & RELATIONSHIPS

Berkshire Hathaway HomeServices Starck Real Estate is in the top 1% of brokerages nationally and has a long tradition of delivering service excellence with 21 offices and over 650 real estate brokers in the Chicago metro area, Rockford, and Wisconsin. Started in 1960 by Robert W. Starck, the firm’s mission is to transform lives. Starck’s core values of being caring, charitable, and knowledgeable, and to act with integrity embody this mission.

Aaron Starck, President, is a third-generation family member who manages the day to day operations of the firm along with his father Andy Starck, Chairman.

At Starck, we believe in excellence and strive to achieve the ideals of producing and accepting nothing less than the best. This is the “why” of everything we do.

“We believe integrity, ‘doing the right thing’, is the key to building trust and relationships with our clients and each other.”

Andy Starck Chariman Starck Real Estate

ABOUT STARCK REAL ESTATE

Berkshire Hathaway Starck Real Estate ranks among the top 1% of brokerages nationwide, proudly serving the Chicago metro area, Rockford, and Wisconsin with 21 offices and over 650 dedicated real estate brokers.

From its inception in 1960 by Robert W. Starck, our mission has been to transform lives through the practice of real estate. This mission is grounded in our core values: caring, charity, knowledge, and integrity. Today, under the leadership of Aaron Starck, President and CEO—and a third-generation family member—Starck Real Estate continues to set a high standard for service excellence and strategic growth.

A Legacy of Success and Service

Starck Real Estate’s commitment to excellence has earned its place among the top 1% of brokerages in the United States. In 2024, we achieved record-breaking performance, closing over 4,200 transactions and generating $1.5 billion in sales. For the fourth consecutive year, we were recognized as a Top Workplace in Chicago by the Chicago Tribune.

Beyond business, we prioritize giving back to our communities. In 2024, Starck raised over $100,000 for Sunshine Kids with Cancer and collected more than 108,000 diapers during our annual diaper drive. Supporting our communities isn’t just a responsibility—it’s a privilege.

A Proud Member of the Berkshire Hathaway HomeServices Network

As part of the prestigious Berkshire Hathaway HomeServices network, Starck Real Estate benefits from the strength, trust, and stability of one of the world’s most admired companies. Led by Warren Buffett, Berkshire Hathaway was ranked #1 on the Forbes Global 2000 list and recognized as one of Fortune Magazine’s Most Admired Companies.

Starck Real Estate is honored to rank 27th in dollar volume among the more than 1,600 offices and 50,000 agents in the Berkshire Hathaway HomeServices network.

Real Estate’s Forever Brand

Berkshire Hathaway HomeServices is committed to being “Real Estate’s Forever Brand,” a network built on trust, longevity, and excellence. As Warren Buffett, President and CEO, affirms, “Berkshire Hathaway HomeServices is built to last and will be here tomorrow, next week, next month, and 100 years from now.”

At Starck Real Estate, we combine decades of local expertise with the global strength of Berkshire Hathaway to deliver an unmatched real estate experience—helping individuals, families, and communities achieve their dreams.

$200,000+

Donated To Various Charities

Highlights of our 2023-2024 Giving

$100,000+

Donated To The Sunshine Kids Foundation

108,000+

Diapers Collected In Our Annual Drive

30+ Charities We Support

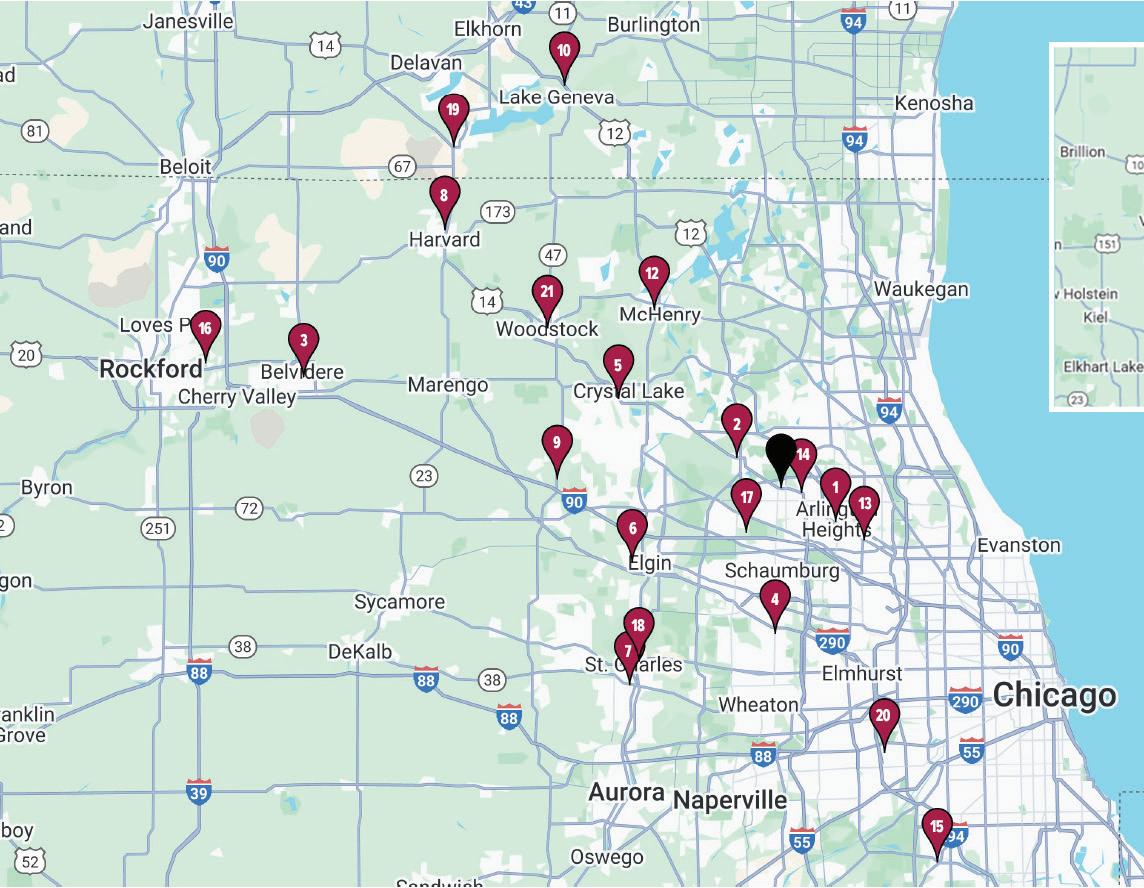

21 LOCATIONS TO SERVE YOU

21 LOCATIONS TO SERVE YOU

Arlington Heights

6 E. Miner Street

Arlington Heights, IL 60004

Arlington Heights

6 E. Miner Street

847.870.1155

Arlington Heights, IL 60004

Geneva 823 W State Street Geneva, IL 60134

630.232.0021

Mt Prospect/Des Plaines

1 W Prospect Avenue

Mount Prospect, IL 60056

823 W State Street

Geneva, IL 60134

847.255.3900

Mt Prospect/Des Plaines 1 W Prospect Avenue

1607 E. Main Street St. Charles, IL 60174

630.377.9200

Mount Prospect, IL 60056

St. Charles

1607 E. Main

St. Charles, IL

Barrington Area

847.870.1155

319 W. Northwest Highway Barrington, IL 60010

Barrington Area

847.806.8440

319 W. Northwest Highway

Barrington, IL 60010

Belvidere

847.806.8440

323 S. State Street Belvidere, IL 61008

Belvidere

815.544.1005

323 S. State Street

Bloomingdale

Belvidere, IL 61008

815.544.1005

181 S. Bloomingdale Road Bloomingdale, IL 60108 630.894.1900

Bloomingdale

181 S. Bloomingdale Road

Crystal Lake

Bloomingdale, IL 60108

330 W. Virginia Street

630.894.1900

Crystal Lake, IL 60014

815.459.5900

Crystal Lake

330 W. Virginia Street

Elgin/Algonquin

1300 Larkin Avenue

Crystal Lake, IL 60014

815.459.5900

Elgin, IL 60123

847.931.4663

Elgin/Algonquin

1300 Larkin Avenue

Elgin, IL 60123

847.931.4663

Harvard 5420 S. US Hwy. 14 Harvard, IL 60033 815.943.7911

Huntley

630.232.0021

Harvard

5420 S. US Hwy. 14

Harvard, IL 60033

815.943.7911

13300 IL Rte 47 Huntley, IL 60142 847.515.1200

Huntley

13300 IL Rte 47

Lake Geneva

Huntley, IL 60142

168 E Geneva Square Lake Geneva, WI 53147 262.273.4500

847.515.1200

Lake Geneva

Palatine

847.255.3900

240 E. Northwest Highway Palatine, IL 60067

847.359.4600

Palatine

240 E. Northwest Highway

Walworth 118 Kenosha Street Walworth, WI 53184 262.275.2185

Palatine, IL 60067

Palos/Orland Park

847.359.4600

8100 W 119th St #100 Palos Park, IL 60464

708.448.6100

Rockford

551 N. Mulford Road Rockford, IL 61107

815.397.4040

168 E Geneva Square

Manitowoc (inset)

Lake Geneva, WI 53147

907 S. 8th Street Manitowoc, WI 54220 920.663.4001

262.273.4500

McHenry

Palos/Orland Park

8100 W 119th St #100

Palos Park, IL 60464

708.448.6100

Rockford

551 N. Mulford Road

Schaumburg Area

Rockford, IL 61107

Manitowoc (inset)

907 S. 8th Street

803 N. Front Street McHenry, IL 60050 815.385.5505

2000 Center Drive, Ste C202 East Entrance Hoffman Estates, IL 60192 847.310.1886

Manitowoc, WI 54220

920.663.4001

McHenry

803 N. Front Street

McHenry, IL 60050

815.385.5505

815.397.4040

630.377.9200

Walworth

118 Kenosha Walworth, WI

Western Springs 1105 Burlington Avenue Western Springs, IL 60558 708.246.5500

262.275.2185

Western Springs

Woodstock 112 Cass Street Woodstock, IL 60098 815.338.7111

Home Office & Relocation

Schaumburg Area

2000 Center Drive, Ste C202 East Entrance

835 N. Sterling Ave, Suite 200, Palatine,IL 60067

Hoffman Estates, IL 60192

847.310.1886

Office Phone: 847.934.1153

Relocation Phone: 847.359.7000

1105 Burlington Western Springs, 708.246.5500

Woodstock

112 Cass Street Woodstock, IL

815.338.7111

WE ARE GOOD TO KNOW

Berkshire Hathaway HomeServices comes with its advantages.

• A name you can trust

• A commitment to providing great service and straightforward advice

• A network of experienced, knowledgeable agents

• Industry-leading technology and tools

• Adherence to the highest standards

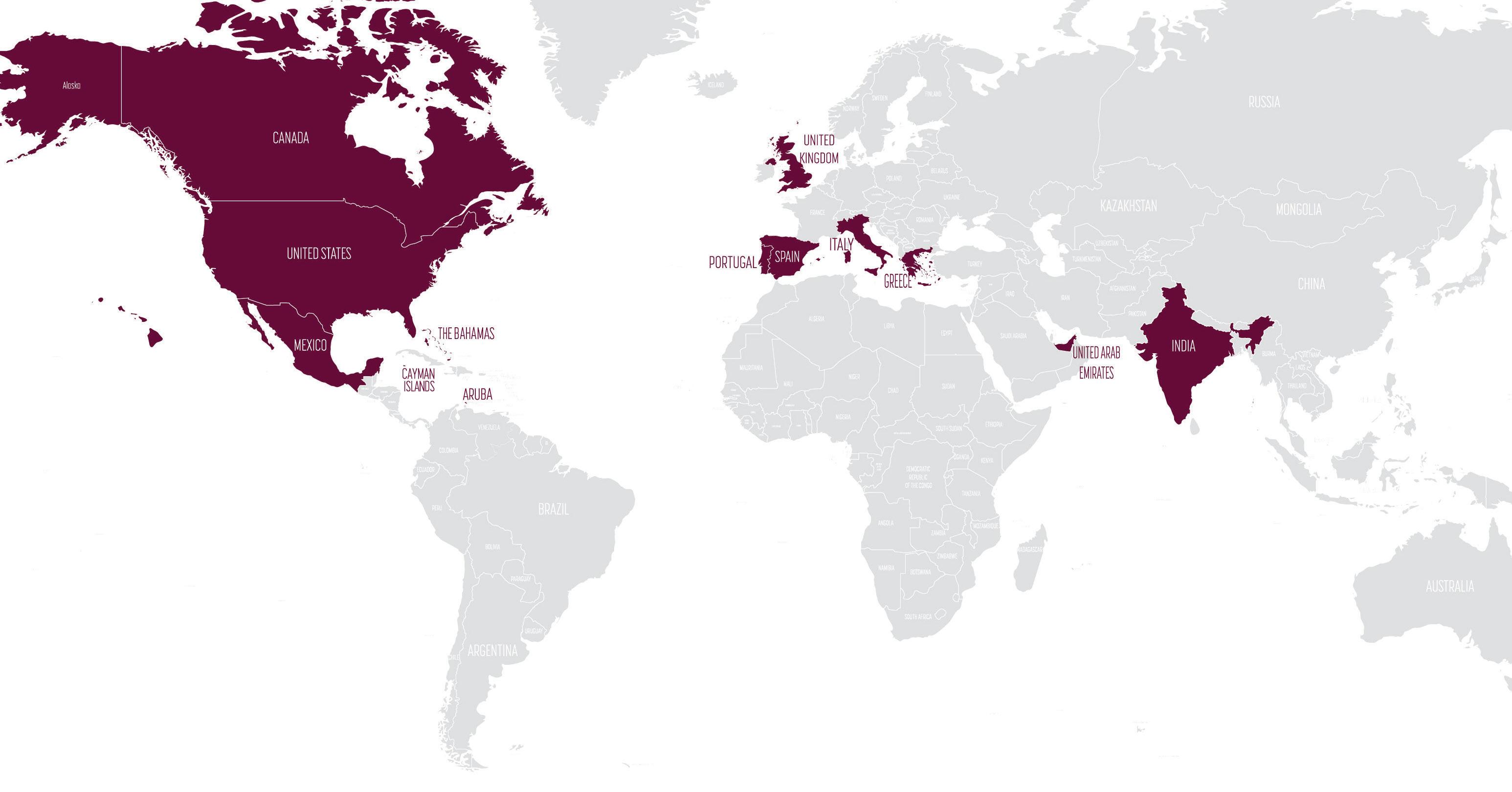

50,000

1,500 Offices

$126 BILLION in Real Estate Volume (USD)

Across 13 COUNTRIES & TERRITORIES

BHHS.COM

GLOBAL WEBSITE

Over 16 million visitors!*

With the launch of our enhanced website, Berkshire Hathaway HomeServices now offers the opportunity to search for your new home in 12 different languages, view the listing price in other currencies, and even change square footage to meters.

So, whether your prospects are visiting from abroad or simply prefer to browse in their native language, BHHS.com is good to know.

More than 26 Million Visitors*

With the launch of our enhanced website, Berkshire Hathaway HomeServices now offers the opportunity to search for your new home in 12 different languages, view the listing price in other currencies and even change square footage to meters.

*12 months ending 12/31/23

So, whether your prospects are visiting from abroad or simply prefer to browse in their

Your Strategic Partner

WHY I AM GOOD TO KNOW

The right agent can make all the difference. I will prove that to you by applying my knowledge and expertise to achieve the successful sale of your property.

You can expect that I will:

• Work with you at every stage of the home selling process

• Keep you informed at all times through an agreed-upon system of regular communication

• Give you reliable information and straightforward advice so that you can make informed, confident decisions

• Identify your needs

• Develop and implement an effective marketing plan for your property

• Help you determine an effective pricing strategy

• Recommend steps to prepare your property for market

• Represent you in negotiations with prospective buyers

• Work to protect your interests through the completion of the transaction

It is my hope that you will be so pleased with my service that you will turn to me for advice on your future real estate needs.

GET TO KNOW ME

Krystyna Tolentino Broker

847.414.1466

KTolentino@StarckRE.com

KTolentino.StarckRE.com

Buying or selling a home can feel overwhelming. Krystyna wants to help make it make sense.

She approaches real estate with patience, clarity, and care. She takes the time to listen, explain each step in plain language, and answer questions without judgment. Her focus is on preparing clients for what’s coming next, anticipating details before they become problems, and creating a steady, supportive experience from start to finish.

Krystyna understands that real estate decisions affect real lives. Homes aren’t just transactions, they’re where families live, grow, and find stability. She is especially mindful of balancing timelines, finances, and real-life needs, so clients can feel calm, supported, and confident as they make important decisions.

Krystyna serves the northwest suburbs of Illinois including:

Algonquin, Antioch, Cary, Carpentersville, Crystal Lake, Fox Lake, Grayslake, Huntley, Lake in the Hills, McHenry, Richmond, Round Lake Beach, Spring Grove, Volo, Wauconda, and Wonder Lake.

Outside of real estate, Krystyna enjoys hands-on, creative hobbies that reflect her attention to detail and thoughtful approach. She breeds dwarf shrimp and fish, designs planted aquariums, and enjoys caring for houseplants. She’s also the world’s most okayest golfer.

She is also a mom of two, which keeps her grounded in what matters most and reinforces the importance of home, stability, and careful planning.