EUROLIFE FFH

NAVIGATING CLIMATE CHANGES: RESILIENCE THROUGH INSURANCE, MARKETS AND PUBLIC POLICY

The entire discussion at

The entire discussion at

and the Dean of the Climate School, Alexis Abramson, which took place on Monday, September 22, 2025

At the opening of “Navigating Climate Changes: Resilience Through Insurance, Markets and Public Policy,” the deans of Columbia’s Business, Climate, and Engineering Schools highlighted the central role of climate change as an economic and business challenge.

Dean Costis Maglaras emphasized New York’s position as a global climate hub and the need to integrate climate risks into business strategy, financial markets, and education, while noting the complex relationship between AI, energy consumption, and climate.

Dean Shih-Fu Chang underscored the Schools’ collaboration during Climate Week and outlined Engineering’s focus on sustainable materials, clean technologies, fusion, AI-driven climate solutions, and energy storage. He introduced the Fireside Chat featuring Climate School Dean Alexis Abramson and Alexandros Sarrigeorgiou, CEO of Eurolife and a leading figure in the European insurance sector. Their discussion centers on how insurance, markets, and public policy can drive resilience and financially viable climate solutions.

Alexis Abramson, Dean, Columbia Climate School

Thank you for being here, thank you all for joining us this morning. I do want to say that I was thrilled to join in January and be so welcomed by these two Deans here, in partnership. As we all know, Climate Change is a complex challenge that is increasing globally and it really does take a multi-disciplinarian approach. We are trying to grow a new paradigm in higher education at the Climate School that really focuses a lot on impact and also partnerships. And I am so thrilled to be hjere today, to talk with you,

because the Industry that you represent is absolutely… has to be part not only of the global solution, but also to what we are working on at Climate School, in order to have that impact. So this partnership is critical. Since we are both engineers, I am going to start with that. You trained, as a Civil Engineer at Columbia, before moving into the Insurance Sector. So, we can start talking about your career path, you know, what did Columbia prepared you for and then how your perspective and interest in Climate and Risk come into what you have decided to pursue.

Alexander Sarrigeorgiou, Chairman & CEO, Eurolife FFH Insurance Group, Vice-President of Insurance Europe

First of all, when I was a kid, I wanted to be an astronaut, not an insurance guy. So, first of all, Dean Abramson, Dean Maglaras and Dean Shih Fu, thank you so much for the honor of hosting me here today. And it is really an honor, because I landed here on September 1st, 1976. A wide-eyed freshman, 18 years old. You can do the math, I am 67, ok? I was convinced back then, for various, shall we say, socioeconomic reasons of Greece back in the day, that I wanted to be a Civil Engineer. I was 100% convinced. I wasn’t 100% sure of what it was, but I had seen some people in Athens and I loved the idea. By the time I got my Bachelor’s and then my Master’s Degree, I knew a lot of math, which I loved, I wish I could still remember the level of math that I could solve back then. I had met a lot of people, I had met friends, I had seen professors, I had seen people around the city and I decided to do an MBA at that other School. Which I did and when I graduated, I was convinced that I wanted to be an Asset Manager. So, I got a job

with an Insurance Company in New York, always saying that insurance companies… the only reason I am with the insurance companies is that insurers have a lot of money, otherwise I want nothing to do with them, I will have nothing to do with Insurance. But I wanted to be an Asset Manager, so I got through this into the Asset Management and then, through a series of lucky circumstances, I got a beat into Management and gradually fell in love with Insurance. It can happen to you too!

Fast forward, I now run an Insurance Company in Greece, one of the largest. I am the longest serving chairman of the Hellenic Insurance Association, which is 120 years old and I’ve been Chairman for 12 years. And I am Vice-Chairman of Insurance Europe, which is the lobby instrument of the European Insurance Industry, which is a trillion Euros industry. Sorry to digress, but since most of you are students here, just have an open mind, if you allow me to give you some advice. Enjoy who you meet, what you learn. Yes, learn a basis somewhere and then let life lead you where it’s going to lead you, because as we know now with A.I., things are changing so fast. Professions are changing, I guess. You are in a wonderful University, a truly wonderful University. I’ve always been in love, with Columbia, don’t tell the other School! In an amazing city. So, an open mind will lead you where is going to lead you.

ABRAMSON: That’s a great lesson for us all to take forward. Let’s talk a little more about the Insurance Industry and Climate Change, since we are in the Climate Week, here in New York city. So, you’ve been in that Industry for a while and seen some of the impacts of Climate Change, which have really already started to influence the Insurance business model. So, can you talk about that a little bit more? How does Climate Change perhaps presents an opportunity for the Insurance Industry, bit also obstacle for the Insurance Industry. Talk about that.

SARRIGEORGOU: If you allow me, I would like to start by saying that represents a huge challenge to societies, not only economies, but societies and challenges to insurers, and obviously opportunities for the insurers. The opportunities exist because there is such a huge protection gap. And if you give me 30 seconds, the protection gap is the elephant in the room, but actually, there are three elephants, because the protection gap that the society is facing, ends up with natural catastrophes and Climate change, but there is a huge protection gap, as baby boomers become pensioners and you guys are not enough to work and pay for our pensions, with the pay-as-you-go system. And if you are not enough in the U.S., in Greece they are not enough by a factor of 10 and so on, so forth. So, it’s the pension protection gap that is huge. The health protection gap is extremely… You know, longevity and health span, I am sure you’re familiar with the term, health span is expensive and longevity is

expensive, so there is not enough money, neither in the U.S. system, nor in the European system, that I know, on the health side, to cover that protection gap. And then we come to Climate. There is no doubt, regardless of what anybody may say, in my Industry we see Climate Change, we see it in numbers, but also in concepts. Bear with me for a second. Insurers reinsure, right? So, this is when an Insurance Company insures itself. And by the way, if you want something even more exotic, there is also a retrocession, the reinsurers insure themselves. So, there is a chain, where capital goes to sit on the side and wait for some disasters. We reinsure, we but reinsurance for natural catastrophes. We buy reinsurance using some models and models deal with primary risks. Primary risks are earthquakes, which are very relevant in Greece, hurricanes and cyclones. In order to buy reinsurance, the models that’s all they look at. You don’t need to worry about convection storms, you don’t need to worry about wildfires, you don’t need to worry about floods. Guess what’s happening. I had my colleague who runs the Reinsurance Department at Eurolife to a little servery. First of all, the pricing of Reinsurance is going up, you have to neutralize it for hard and soft markets, I am not going to get into that, but there is a secular growth in the pricing, which means that Climate Change is causing more natural catastrophes, perils and so on, so forth. But number 2, there is a factor into the pricing, not only for primary perils, but also for secondary perils. In other words, convection storms, fires etc., which we didn’t use to look at, because they were insignificant, they are not very significant. There are even new terms. For examples, the Medi-Clones, the Mediterranean Cyclones, because there are mini events that look like a hurricane, smaller but sure enough they cause a lot of damage.

So, let me share a few numbers here. In Europe, between 1980 and 2022, when the Climate Change has started and grew exponentially, 19,5% of economic losses were insured. That means that 80% of the losses were borne by society, by tax payers, by business people. Well, guess what’s happening now. Only 25% of perils are insured for natural catastrophes, so yes, it has gone up from 20% to 25%, but 75% of economic risks are still uninsured.

ABRAMSON: Is that because they can’t get Insurance or they can’t afford it?

SARRIGEORGIOU: Ok, thank you for the question. First of all, let me back up and say the following. Usually, you say you are insured or you are uninsured. Your home, whatever. The reality is, the way you should look at it is whether you are insured or you are selfinsured. And if you are self-insured, you better be rich, speaking loosely here. You know the economically vulnerable societies, countries, or people within a country, are the ones who are usually least well insured or totally self-insured and they don’t realize that they are bearing the risk. To give you an example, in Greece we had an 1 in 200 years event, two or three years ago, the Daniel Storm, which hit the bread-basket of Greece. Insurance was very low. Estimates are that the economic cost of Daniel was 2,5 billion Euros. The Insurance Industry paid 370 million to the insured. Out of the 370 million, 320 million went to large and medium size companies. So, the “man on the street” got 50 million out of 2,5 billion loss. That is extremely difficult to recover from. And then we get to the point. For example in Greece… I don’t want to be specific only for Greece, but you can extrapolate to various degrees, to various countries. Any KPI you look at how much recovered, you know, how much insurance we have, is about a quarter of the European

average. The European average is not enough. We are a quarter of that. And people use to say that well, this is because Greeks are Zorba like, they don’t care and whatever. The sun and the sea. In fact, and this is indicative that it is not only for Greece, it’s global, in Insurance there is a term, international term, for the reason, which is called “Charity Hazard”. Charity Hazard means that my local politicians… Politicians, when he or she is campaigning, tells me don’t worry my friend, I am here, ok? And you tend to believe him, depending also on the culture of the country. Also, that costs nothing, insurance costs something. Which may go up or down, bit is costs something. So you leave yourself to the mercy of the politician. To me, is one of the biggest pain points. There are other pain points: affordability, models, I guess we can talk about that.

ABRAMSON: But the delta between the millions and the billions basically that you’ve mentioned, is being covered by the Government in your example in Greece, or is it people no longer have homes?

SARRIGEORGIOU: In my work with Insurance Association in Greece, I had the chance to work closely with the Government and in my estimation, we have a good, business-friendly government, who know their stuff, they are not traditional politicians. So, while they are aware from the top of what this thing is costing and while, in the case of this particular government, they have finally instituted some incentives for people to get insured, on real estate taxes, you get a break to insure your home, you see that in the implementation the government, that is now fairly modern and digitalized and all that, there is a lot of friction, there are a lot of obstacles. By the time fiscal space gets allocated to prevention, so infrastructure works for prevention, which is another big thing, to incentives for people to

get insured, which doesn’t have an immediate political… it doesn’t pay an immediate political dividend, ok? And this gives me the chance, as I am rumbling on, to mention the following. You know, there is the political cycle. We have elections in a year, or mid-term elections here in the U.S. in a year or whatever. So, the political cycle is important. There is the economic cycle, GDP growth, interest rates, which affect the capital markets and returns in the Insurance Market, which makes the Market hard or soft. If I am an investor, I can invest in an insurance company and therefore make capital available, or I can invest in CocaCola, so… So all of these cycles happen and they affect the season. If a I have elections, maybe I don’t give incentives to insure your home, because I want to give an extra hand out or whatever, so I can get elected, right? If elections just happened, maybe I can legislate an incentive. So the protection gap gets covered. But, and you know better than me, Climate Change is on its own cycle that doesn’t care if there are elections or not. And that exaggerates the problem.

ABRAMSON: Well, I think what’s interesting is that bridges the social science, behavior piece into it and I think the Climate School and the Business School and Engineering School are acknowledging that is going to be a lot more politics in the way, this is a lot more complex problem. We want people to have insurance but getting to that, is going to continue to be a challenge. You also mentioned that Climate Change is impacting obviously extreme weather events, in ways that were not significant, at least a couple of decades ago, so the Insurance Industry relies on modeling, in order to price and to price risk and of course modeling is changing, we are able to model things in ways we could not before, we heard about the competitional power, the speed and that have a great impact, helping us get an insight and then there is also A.I. and bringing A.I. into the insurance sector certainly is changing things, reshaping how risks are priced and manage. So, maybe we could talk about those advantages a bit, what excites you about opportunities that are provided in the Insurance Sector and maybe some concerns you might have about it.

SARRIGEORGIOU: Let me start by saying that I am a CEO at a medium size, at global scale, Insurance Company. We do about 750 million dollars of premiums per year. So, not a company with infinite resources, not a very small company. I am most excited because A.I. is sort of democratizing access to high end technology. In the past you needed specialized departments to have access. My company is already using A.I. for the past year for the Customer Service area, on center calls and so forth, but I am not going to talk about that. However, the most important thing is pricing the risk accurately. And in order to price the risk accurately, obviously the better modeling you can do, the better you can work on your data, the better you can work of bigger

sets of data, the more accurate the model, the lower the price, because you need less risk premium. Which, however, opens up another kind of worms, which is access to data. I am not going to elaborate here, we don’t have to time. You know there was an issue, I thought of something, I asked my guy and said how exciting this is not sold with A.I., except GDPR. GDPR in Europe is the data protection thing, which is good, but we didn’t have access to data. So then you have to work with the lawyers and try to find solutions. There are always lawyers, there are not only engineers and business people! So, again, models. Buying reinsurance has a big cost for an Insurance Company. Natural Catastrophes Reinsurance. The NatCat models that are used… As I said before, initially they dealt with earthquakes and hurricanes, but now they are dealing increasingly with secondary risks, storms etc. We are working, my company, but also globally, the big Reinsurance Brokers, EON, etc., are refining their models, so to allow us to buy just the reinsurance we need and not too much. Therefore, the products become cheaper, therefore you who are not insured or you are self-insured, are able to buy the product. So, there is a chain, that allows more accurate underwriting, allows us to give credit, to price credit appropriately to the guy who has done work with is risk, with the thing he is insuring, so I am going to give him credit and his insurance will be cheaper.

ABRAMSON: So, does that help bridge that protection gap you talked about before?

SARRIGEORGIOU: Yes, it definitely does. We are at the initial stages of this project. I have a feeling that we just started. Larger companies, different markets. Two more side-notes. Not exactly side-notes, they are very important. The other thing A.I. is helping. We always had machine learning and expert models, dealing

with fraud insurance, because in insurance you have a 3% to 5% fraud, that we pay for. Now, fraud detection becomes much better. Therefore, the pricing and all this. But you have to super impose all this to regulation. And this is another elephant, in all rooms. Regulation in insurance is a fiduciary business. I give you a piece of paper, I give you promise. So we need to have a regulatory framework, properly supervised. In the U.S., you need 30% less capital to start an insurance company, than you need in Europe. Obviously in Europe we have something called Solvency II, which is a risk-based solvency system. Great, I mean I don’t want to elaborate on that, that’s really good, but they tend to be… One is the capital aspect and the other is an information aspect. Information aspect, not because of A.I., but because of technology, now allows us to sell you a contract of X, Y, Z. There are hundreds of digital pages that you will never read but, however, we need to produce. There is cost. So, regulation is a big stuff, but let me move especially to regulation regarding Climate. There is a new acronym, which I don’t want to waste time to find, I can never remember it, that started in Europe. It is the regulatory… So, we are a medium size Insurance Company, we need to report on how we deal with Climate, underwriting etc. Investments insurers are the largest institutional investors. This regulation comes from Brussels and let me speak personally, I am all for it, I am aware of what is going on, and I sit through this presentation, which tells me basically that I have to hire 5 people, to create a report, that is hundreds of pages, is based on taxonomy of investments that are green investments, there is a lot of debate on taxonomy and what is green and what is green washing. I mean there is a lot of subjects here. And then we are going to hire an accounting firm to audit this, separately of

our big four Audits on financial state. So, what naturally will happen, not only in Greece, this is European, is black-lash, so this standard is on hold and they are studying it, there is a simplification omnibus in Brussels, to simplify the regulation, etc. It’s postponed. Long story short to say, that yes, you should supervise regulate also regarding Climate Change etc. But when, from a political stand point, as a politician, you don’t quite understand the thing, you let the bureaucrats build hundreds of pages of regulation and then the Industry reacts. And what we have? We have a gap, we do have a gap regarding regulating Climate Change.

ABRAMSON: It sounds like having these partnerships with Government and Regulators is really important, because you know, we want o protect the consumers but we don’t want to go so far in costing so much more money. Circling back a little bit, to the fact that you mentioned, that there is such a high percentage of people that are –I will use your term– self-insured rather than uninsured and we need those public-private partnerships for the reasons you mentioned, but regulation must also help support people who end up self-insured, but need that kind of help. Are there public-private funds available, that are emerging? Is that changing? How are public-private partnership and funds changing the insurance landscape?

SARRIGEORGIOU: Let me give you two examples. I mentioned that Daniel Storm in Greece and we paid 370 million out of 2,5 billion. A year or two years ago, there was a much bigger thing. You may have seen it on TV. In Valencia, in Spain, where there was this river that went through the city. That caused 15 billion of damage, of which 4,8 billion have already been paid, from a Consortium of public-private insurance. I will come to that. It was paid immediately. I don’t want to quote

right now the exact numbers. The gap is still very significant. Five billion out of 15. But it has been paid very quickly. It’s a big amount and the reason this worked, is the model they have in Spain. In Spain they have something called the Consortio something…, which is basically on every property and motor insurance. When you insure your home or your car, there is a mandatory surcharge that sets aside money, so that when there is a natural catastrophe, that thing pays out. One thing we have to remember is that Insurance is not only about money. Insurance is also about what you do when catastrophe happens. In other words, if you just have money, you need engineers, surveyors, adjustors, to go out and understand what goes on and if I pay you X, or I pay you 2xX, or I don’t pay you. Also, I have to tell you there is a lot of fraud going on. There is a flood, that floods my basement and I need to rebuild the entire building from the insurance money. So, the Insurance Industry in Spain had the money set aside on behalf of the Government, through this keen, and they had the knowhow and they were out there on day one. Which then translates into a very fundamental concept, which is if I am a politician or if I am in a society, do I want to set aside money in X, Y or Z way, for the bad day that for sure will come through Climate Change, we know what is happening? Or do I want sort of scramble after the event?

ABRAMSON: Right. I think this is a debate happening in this country was well, so yes.

SARRIGEORGIOU: If I may add one more thing. In Greece, the Government mandated mandatory insurance for business that has sales over half a million Euros. In our discussions with the Government and in fact this came directly from the Prime Minister, he said: I don’t want anybody to be left uninsured. Because there are uninsurable risks. You know, the gut that built his little factory in the in the dry bed of a creek right? So, we looked into this and it’s an interesting lesson. We went into the International Reinsurance Markets, because the numbers become very significant, because you know these risks will burn or will flood or whatever, and there are many thousands of them, in the millions of total risks, and a solution was found. For that solution to work, meaning we will commit to insure everybody, regardless of the risk. For that you pay insurance. You pay a lot of money. You need the Government to take a slice of that risk. When you get then to the political decision of getting this done, I think it will eventually get done. But the technicalities, the legal department…, you know, because… When I was in school, first of all there were no discussions on the environment but nobody… You find the solution, but you don’t realize that to turn it into law, or to turn it into action, you need legal work, you need all kinds of other things and the devil is there, ok? You may say we found the solution, it’s done.

ABRAMSON: It might take, unfortunately, more crisis, more extreme weather events,

more urgent responses, to move us forward. I would like to open it up. I could ask a few more questions, but I really want to make sure we have to audience to have the opportunity to ask any questions. So, if we can open it up, I think we have got a microphone here, which would be great to capture you on…

PERSON 1: Thank you for joining us this morning. You mentioned financial gaps in Insurance Market. The catastrophe bond market has gone very quickly the recent years, but still is quite small. Does moving reinsurance risks to the capital market is this a way of helping to close one of these gaps? Or do you expect the market will always be very small?

SARRIGEORGIOU: The technical answer to your very good question, is that it should… Technically there should be some sort of arbitrage if it makes sense to catastrophe bonds, you do catastrophe bonds, if it’s more efficient the other way. For some reason, catastrophe bonds have not taken off as I would have expected. I suspect, based also a little bit on my experience with the Government in Greece…In traditional reinsurance, you have reinsurance brokers, you have people behind it, who talk insurance, understand risks, and give you solutions. The other one works just as well, but it’s sort of a financial thing and you don’t have someone to bridge the gap and tell you who would do what if something happens. You know, how the money is going to flow. So, I suspect that is why. But it has ebbs and flows.

PERSON 2: I don’t really want to ask a political question, but we did talk earlier about the politicization of Climate Change. Americans and the President has called it a hoax many times and has downplayed a number of natural disasters that we have seen. I am curious to people who are skeptical of Climate

Change and who aren’t believers in it, a lot of them still make business leaders and have to deal with insurance cost, the real world implications of whether they want to believe or not. What is that like in the Insurance Market and dealing with a business leader who might not understand or believe or trust why their premiums are going up, or why maybe their new building in a flatable area is not going to get the insurance. Is that waking up some leaders, what’s that like?

SARRIGEORGIOU: I think there are two things happening here. Public opinion is becoming more aware, regardless of the politics or what they may think or believe, because you see it on TV, you see things happening. And also in business, in insurance, every September in Greece we anticipate some major flood. And every summer we anticipate fires that are such, that will cause insurance damage, in a country that is largely not very insured. This thing used to be the case, so you want to call it Climate Change or not Climate Change, it’s there. Also, from a Government standing point, and I know that from our talks with the Government around the table, they have the guy, the government guy, who knows what the bill is. So, if you see the bill… Like I said, I don’t care about the politics, I don’t care whether you believe in this or that, the bills are rising. And I think that it’s working to change the reactions or executers or of people vis-à-vis.

ABRAMSON: I think what’s important there, is that in many ways, the insurance sector is, I hope, the voice of reason here, the voice of reality, of what really is going on in the world and you know, it’s one thing from a professor of the Climate School to talk about Climate Change and it’s another thing for the Insurance Industry to say here is the data, here is actually what has happened in our Industry and in certain geographic locations in

particular and how we have had to pay out a lot more compared to 20 years ago. We are paying out a lot more, not because more people are insured, but because more disasters are happening.

SARRIGEORGIOU: We have frequence and sovereignty going up. Let me quote a couple of numbers here. The most frequent and costly natural peril is flood. In the EU, a single major flood costs 10 billion in damages. We have several examples of those. In the U.S., hurricane Ian in 2022 cost 112 billion in losses. Wildfires in 2022, in Europe, 2 billion in losses. These are not fires, like they are burning Canada, you have a fire and it burns a neighborhood in a city, that kind of thing. And over 18 billion wildfire in payments in the U.S. One other thing I have the chance to comment here. When you have government intervention on prices, you are intervening in a market and you can cause severe damage. Severe damage meaning, and I think that’s what happened in California recently, capital is mobile basically, if you regulate prices, companies will leave, because capital will leave. Insurance companies. Because my shareholder will leave, and therefore, you know, it’s gone. And then the protection gap increases and then the risk comes. Like I said, these are not political, ideological, it’s there, it’s happening. If capital was not so mobile, you know, 50 years ago, maybe to change, to take the money from Industry X and move it to Industry Y, would have been very difficult and very expensive. Now it’s not. One more. Heat waves in Europe in 2022, led to over 61.000 deaths. Droughts. Europe faces annual drought losses of 9 billion. The U.S> agricultural sector lost over 20 billion to the drought of 2022-2023. And so one and so forth. It’s a big list.

ABRAMSON: Do you have any other questions?

PERSON 3: Hello, thank you very much for coming here. You mentioned about implementing AI as a way to get access to high end quality for analyzing data. I am curious to know first if you use AI to build tools to analyze this data or do you directly feed into AI the data that you have. And in that case, how do you manage trusting the results that AI gives you?

SARRIGEORGIOU: Good question. As I said, we are at the start. My company has invested in AI in the last year, a year and a half. We are using it on Customer Service and we are no redoing the model that detects fraud that was… machine learning or the other term, it doesn’t come to me now, but to use AI for fraud detection. My company is not there yet in what you alluded to, in underwriting etc. It’s coming and like I said I am excited because it is affordable for a company of our size, which is not small, but it’s not a giant. The thing that we are currently studying, is programming. How AI enables programming by factors of 10 or 100 to do much faster, to program things. But we are at the start.

PERSON 4: Thank you for your excellent presentation. I enjoyed your chorobiographical background. I am probably the only one in the room who has a few years on you, …and ended up an environmental attorney. With some government positions in the middle. One question that I had is, you obviously use, you spoke about using AI and the efficiency in administering the insurance. But the risk, the Climate Risk Model, who develops this? Are they shared among insurance companies or are these propriatory models? Who is doing this?

SARRIGEORGIOU: The short answer is Reinsurance Brokers, who are huge companies, EON, GUY CARPENTER, these are really huge multi-national companies. They work for us, because they are brokers, so they work for the customer, in buying reinsurance from the reinsurers. So it’s in their interest to develop a model on earthquakes, on hurricanes and now on secondary risks, that will more accurately price the risk. It used to be that these models were, they are very complex, but they were so labor-intensive that… So, for example earthquake, Greece is in a big seismic zone, so this is by far the largest and more expensive risk to reinsure for. The earthquake model for Greece was part of an earthquake model for Europe and we knew that in Greece we could buy, you know, we needed less reinsurance, we could make it more specific and we could but less reinsurance. But the bigger companies were not doing it. I had excellent researchers from Universities in Athens to tell me look, here is my model. It’s so much more accurate, than the big European model of X, Y, Z company. Now, I get to something else. As an executive though –and touch wood– of a company that makes 100-150 million per year profits, if I adopt this model, I will same a million Euros, right? If I get it wrong, I may lose half a billion Euros, if the earthquake is wrong or right. So, I wouldn’t

touch it. Now, it’s the big guys that are doing it, because it’s cheap, it’s easier. So, this one sort of the dynamics that are changing the way the industry works. I hope I answered your question.

ABRAMSON: Are there collaborations of academics or experts in the field?

SARRIGEORGIOU: Yes. The big international models are doing it, I don’t have details on that. I can give you an example, that is not related to Climate, but it’s interesting though, that has to do with AI. We work with the University of Piraeus in Greece, which has developed a model, a team of professors, which is spinning off a company, which helps us in auditing health claims. So, when you have a hospital, you have hundreds of thousands of customers and you go to the hospital, you know, they charge X, Y, Z, then we have doctors and companies that we pay to check the bill, right? Well, now AI can check the bill and do it much easier, much cheaper. Which also means that some of these guys are going to be out of work or out of this work, ok? But it’s more productive and better.

ABRAMSON: That’s where we are heading.

PERSON 5: I really appreciate that. Eric Gilbert, I am the CEO of Now City support them, focused on resilience. So, what I think about the latest, the data in insurance, in forming what we build. I am just curious if you have any thoughts or if there is already a process for that, pulling data out to inform what we design, so it’s deeply insurable and more resilient over the long term.

SARRIGEORGIOU: I wish I could answer to you that we are already doing it. We are not doing it. That’s why I said I am so excited. Because these projects for a company… If I look at my priorities as CEO, you know, this is extremely important, but it costs a lot of money, you wouldn’t do it. Now, it may not be the next one, it will be the one after the next, because building resilience, then allows me to price cheaper, right? The question is how to…, you know, and cooperating with you If I understand getting the data. It should be easy, ok? I think it may be 3 years away. Like I said,

at Eurolife we built a small AI Research Center, which is five people, five very good people. We had done amazing things, with nothing, resources that… I mean projects we would have paid millions and we would have to wait years, say a year to do, it’s done and I cannot believe it. So, naturally we are investing more and more and that’s why I think exponentially it’s going to grow. And that’s why I am giving you this forecast. In the very near future.

ABRAMSON: It was mentioned that… I work in building energy efficiency, it’s one of the areas I look at and I was working with a company that was maybe about 5 to 7 years ago, and they were building homes, buildings in Florida, in a whole different way, to withstand hurricanes. And they had all the data to demonstrate that in a hurricane, their house, that particular house, built in this particular way, will withstand, you know, 99% of the hurricane. But they were having trouble getting traction, because of course it’s more expensive, the upfront cost is more expensive and, you know, this, how do I have a partnership with the insurance companies to then show that my insurance is very lowers as a result.

SARRIGEORGIOU: The backend of this, sorry to interrupt, is that the insurance guy had a reinsurance model that they wouldn’t pay a visit to account. You see? So, if my reinsurance cost does not get lower by taking this into account, it makes no difference to me.

ABRAMSON: But this has to be an easy part of the model for sure. Good! So, I think we are near our end. I am going to give you the last word on this, so, because we are all sort of sitting at the edge or our seats, wondering what is going to happen next, we have talked about AI, we have talked about the impacts, particularly in parts of the world where they are going to feel the effects of Climate Change significantly the very near future, so as you think about it, looking ahead about 20 years lets’ say, what role do you envision the Insurance Industry will play in building this more sustainable and resilient global

SARRIGEORGIOU: I have a mixed forecast for insurers, because I think insurance, starting with retail, because you know, this is personalized, this is the key. Big industrial risks will always be insured the way they are insured, in more sophisticated ways I hope. The billions of people will be better covered, I don’t think that will be better covered with companies such as mine, or even larger companies, because I think the ability to buy insurance on your phone, through Apple, Google, Facebook, whatever, is coming. So, the capital behind the insurance will still be there, with some big reinsurers or some very large insurers or some reinsurance bonds, but I think with the help of AI and other technologies that may come, risks will be very individualized. If the risk is more individualized, well individualized, it will be cheaper and I will have incentive to get insured. So, I am optimistic about the protection gap. I think the industry is going to change. But may I have the last word? So, the last word is not about damages. The last word is about the insurance and, you know, I see a lot of young people here and I want to leave you with one message: “Insurance is sexy”. It doesn’t sound sexy, but it is sexy. It is a sector that has this grey feeling, but you sell something and you find out the cost of a good sold a few years later, which is kind of interesting. Yes, you can be an underwriter, a claims person. You know, we are the largest investors in the world, that’s how I was sacked into this Industry. Asset Management. But then there is Digital Marketing, there is all kind of things, plus AI. There is a lot of exciting things that one can do in an insurance company and this is one of the things that I always leave young audiences with, because it is a sector that I think deserves better.

ABRAMSON: I completely agree. I think for a lot of reasons we have talked about, that the Insurance Industry is really changing, so students often want to go and work with Google and Apple. I think you should consider the Insurance Industry for sure.

EUROLIFE FFH

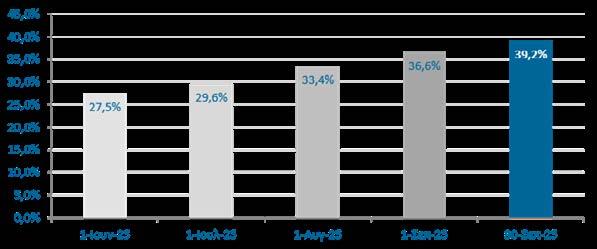

30/6/2025

31/3/2025

31/12/2024

30/9/2024

30/6/2024

31/3/2024

31/12/2023

30/9/2023

Howden Hellas

Παύλος Μπουζιάνης, πρόεδρος Δ.Σ. ΣΥΦΑΝΟΠΠΕ, Ηλίας Γουζούασης, αντιπρόεδρος Β΄ ΕΟΦ, Απόστολος Βαλτάς, πρόεδρος Δ.Σ. ΠΦΣ, και Βασίλης Μπιρλιράκης, πρόεδρος Δ.Σ. ΟΣΦΕ.

Το μέλλον της Ύγείας στην Έλλάδα

Σκιαγραφώντας το αύριο της Υγείας, ο Άδ. Γεωργιάδης ανέφερε πως το 2026 θα είναι μία

CHIESI HELLAS

Jana Russo, Manager of Regulatory Affairs, MedTech Europe,

Life Sciences Lawyer & Managing Partner, Michalopoulou & Associates,

de Créditos Inmobiliarios S.A.

CrediaBank.

Fairfax), κ. Sanjay Tugnait.

Ο Global Financial Services

Leader της ΕΥ, κ. Omar Ali, σχολίασε:

πλέον στην απλοποίηση διαδικασιών. Συνιστά

αποφάσεων σε μεγάλη κλίμακα. Η Agentic AI αποτελεί κρίσιμο μοχλό

Manager, Banking Services & Representative Offices, International Business Banking,

«India & Cyprus – Building Bridges in Alternative Investments»,

Strategic Dialogue: The India Dimension.

CFA SOCIETY CYPRUS

ALPHA

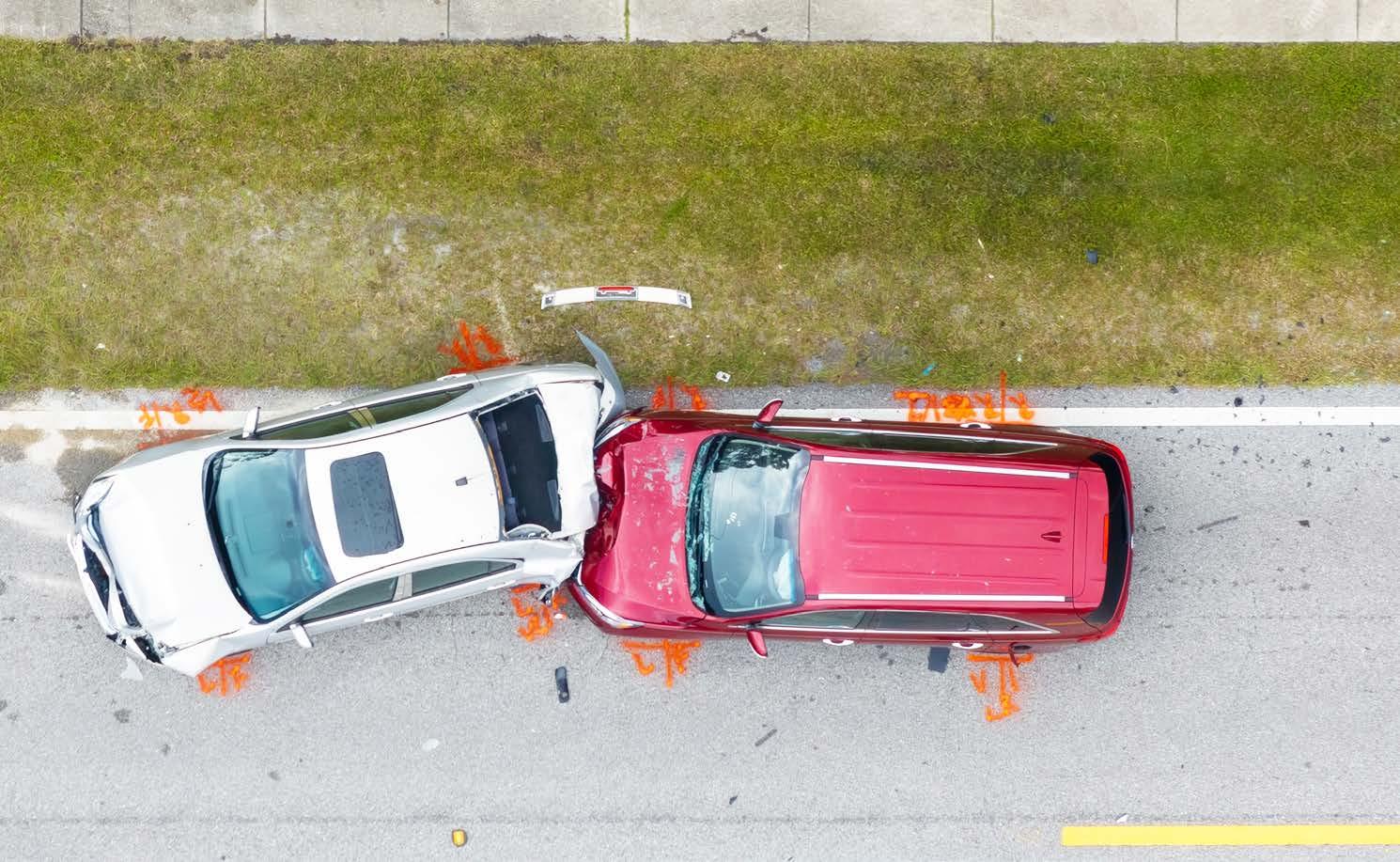

των φωτιστικών των

οχημάτων των πελατών τους.

Τι είναι καλό να κάνουν οι

ασφαλιστές; Οι ασφαλιστές οφείλουν να εντάξουν στους ελέγχους τους τον έλεγχο κατάστασης και τεχνολογίας των

φωτιστικών σωμάτων κατά την

πραγματογνωμοσύνη και τη διαδι-

κασία underwriting. Η ενημέρωση

και καθοδήγηση των πελατών για τη

σημασία της συντήρησης οδηγεί στη μείωση των κινδύνων και ενισχύει την ασφάλεια των πελατών σας. Παράλληλα, οι ασφαλιστικές εταιρείες

να αξιοποιήσουν big data

τηλεματική για να υπολογίζουν