THE BIG

INFRASTRUCTURE OPPORTUNITY

Discounts easing in this unloved sector

Three important things in this week’s magazine

With investment trusts under the spotlight, we take a fresh look at renewable and infrastructure funds

On next to no news and against the prevailing narrative, a group of infrastructure trusts have been making steady gains over the last month – we investigate why.

We look ahead to Nvidia’s upcoming full-year earnings report

Can the market’s favourite tech stock justify investors’ faith and its $3.4 trillion valuation by beating estimates next week?

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Why defence stocks are suddenly back on the radar despite a possible ceasefire in Ukraine

The US attempt to bring Russia ‘back into the fold’ could have major implications for European security and military spending going forward.

Saba strikes out with trusts push and the energy implications of a Ukraine peace deal

US hedge fund rebuffed by trust shareholders as we shine a light on the infrastructure space

All the meetings requisitioned by Saba at UK investment trusts are now done and dusted and the scorecard makes sobering reading for the US activist hedge fund – trusts seven, Saba nil.

That doesn’t mean there is room for complacency on the part of the investment trust industry, as Saba has shone a spotlight on issues around performance and persistent discounts to NAV (net asset value) which aren’t going away.

Given Saba still owns some significant stakes in a large number of trusts, they may well try again to push for change.

In this week’s issue we turn our attention to a separate part of the trusts universe and examine the particularly wide discounts in the infrastructure space. Martin Gamble’s excellent article shows how a takeover approach for BBGI Global Infrastructure (BBGI) at a premium to NAV has got that sector moving.

Also this week, you can read our latest My Portfolio offering, as Sarah explains why she decided to take her investment destiny into her own hands during the pandemic, and we preview a crunch set of earnings for Nvidia (NVDA:NASDAQ).

Another key development which we touch on in this issue is the start of negotiations over the Russia-Ukraine war and the implications this might have for European defence spending.

It could also have a significant bearing in another arena. Bank of America’s commodity and derivatives strategists Francisco Blanch says: ‘Negotiations to end the Russia-Ukraine war have started and, just like the war itself was a major event for global energy markets, a peace agreement, were it to occur, could also shake the world of commodities.’

Blanch notes that around half of European thermal fuel imports came from Russia before the war – encompassing 35% of the region’s coal, 35% of its crude and 77% of its natural gas.

‘As the war started, some energy was redirected away from Europe to Brazil or the Middle East, while some became stranded in Russia. Domestic production capacity also took a hit,’ Blanch says.

He goes on to observe ‘there are at least three channels from any potential sanctions relief on Russian energy that may contribute to more output and lower prices’.

‘First, trade routes may shrink, releasing operating energy storage into markets. Second, stranded energy could come back to the European market, releasing fresh supplies. And third, service companies could eventually boost Russian energy production capacity.’

If lower prices did materialise it could prove helpful in dialing down inflationary pressures, although obviously there is a long way to go in terms of a peace deal being achieved.

Can multinationals navigate trade turmoil?

Investors are asking about the impact of trade barriers. Under the rising threat of tariffs, aren’t multinational companies the most vulnerable of all?

Jody Jonsson, portfolio manager in Capital Group UK – New Perspective Fund, believes the opposite is true. Multinationals are in many ways best positioned to navigate uncertainty by developing effective solutions to disruptions.

MULTINATIONALS CAN ADAPT TO TRADE TENSIONS

There have been many twists and turns since the US-China trade war began several years ago, including onerous tariffs and other trade restrictions.

In that time, however, multinational companies have continued doing what they do best: finding ways to adapt regardless of headwinds. Some companies in the semiconductor industry, like TSMC and ASML, are expanding operations in different regions and streamlining supply chains.

EXPERIENCED MANAGEMENT TEAMS CAN HANDLE CHALLENGES

Multinational companies have risen to the global stage because, for the most part, they are run by managers who are smart, tough and experienced.

For example, pharmaceutical giant Novo Nordisk faced supply issues due to the overwhelming success of its diabetes and weight loss treatments. Its management team acted quickly to identify issues and manage resources, which shows a skill set that applies whether challenges arise from a company’s own success or external forces like regulatory change or geopolitical tension.

RESHORING SUPPLY CHAINS IS LIKELY TO BENEFIT SOME COMPANIES

Many global companies are moving away from singlesource supply chains, prioritising reliability and robustness over cost and efficiency. This has led to a rise in the construction of new manufacturing plants, logistic hubs as well as digital infrastructure closer to home or in new markets.

Multinationals like Caterpillar are well-placed to benefit from the broader build-out of infrastructure. In particular, its diesel and gas generators play a crucial role in data centre facilities, which require a constant and reliable power supply.

Capital Group UK – New Perspective Fund is an openended investment company (OEIC), structured as a company in order to invest in stocks and other securities. It focuses on identifying multinational companies we believe are best-placed to thrive in a fast-evolving world.

With strong management teams and access to resources to overcome complex problems, multinationals are often well equipped to navigate changing, even hostile, environments.

Capital Group UK – New Perspective Fund

UK and European defence stocks surge as governments mull security spending hike

Analyst calculates 2.5% to 3% GDP target could boost annual expenditure by $85 billion to $176 billion

European defence stocks are becoming hot property again as governments across the continent signal an urgent need to increase military spending. The pan-European Stoxx 600 closed the session on 17 February 0.54% higher, lifted by a 4%-plus jump in the Stoxx 600 Aerospace and Defence index.

With geopolitical tensions intensifying and European governments committing to increased military spending, analysts at investment bank Morgan Stanley re-spun their bullish thesis on the sector, identifying key players such as Germany’s Rheinmetall (RHMG:ETR), Italy’s Leonardo (LDO:BIT) and the UK’s BAE Systems (BA.) as preferred stocks.

‘Comments by secretary-general Mark Rutte that NATO members will have to boost their defence spending by ‘‘considerably more than 3%’’ of GDP put a rocket underneath defence stocks,’ said Russ Mould, investment director at AJ Bell.

All three of Morgan Stanley’s picks turned sharply higher at the start of the week, chalking up gains of between 14% and 8%, with Sweden’s Saab (SAAB-B:STO) and Thales (HO:EPA) of France also surging.

‘BAE Systems jumped to the top of the FTSE 100 risers list as investors hoped its earnings prospects would be greatly improved. Mid-cap defence player Chemring (CHG) also enjoyed a boost,’ pointed out AJ Bell’s Mould.

Shares in defence companies had already rallied hard since Russia invaded Ukraine as investors took the view rising geopolitical worries would spur governments around the world to fortify their own defences.

Rutte’s comments effectively confirm this line of thinking and have acted as another share price catalyst, even though markets had already priced in

BAE Systems

a stronger earnings environment for the sector.

The fact Donald Trump is keen for European countries to spend as much as 5% of GDP on defence adds to the narrative supporting the sector as leading NATO members haven’t spent that proportion of GDP on defence since the peak Cold War years.

In 2024, the UK’s share of GDP spent on defence was 2.33%, while France and Germany’s GDP shares were 2.06% and 2.12% respectively, behind European leader Poland (4.12%). Meanwhile, the US spent 3.37% of GDP on defence last year.

At the Munich Security Conference, the European Commission said it was considering an escape clause excluding defence-related expenditure from EU budget deficit calculations, a move which could allow governments greater financial flexibility to boost military investment.

Analysts at Stifel believe a new NATO spending target of 2.5% to 3% could result in an annual increase of between $85 billion and $176 billion in European defence expenditure alone.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Steven Frazer) and the editor (Ian Conway) own shares in AJ Bell.

Airbnb shares enjoy record day after strong Q4 and growth initiative

Travel platform Airbnb (ABNB:NASDAQ) saw its shares jump more than 14% on 14 February, the biggest one day jump since its IPO (initial public offering) in 2020.

The source of the excitement was not just that fourth quarter earnings came in ahead of Wall Street estimates, but the hosting firm’s announcement of expansion plans, stemming from improvements in its technology platform.

CEO Brian Chesky said the company will invest between $200 million and $250 million to launch a new travel-related business in May 2025, which forms part of a roadmap to launch multiple businesses over time.

‘I think that each business could take three to five years to scale. A great business could get to a billion dollars of revenue,’ said Chesky.

‘We’re going to have one app, one brand, the Airbnb app. We want the Airbnb app kind of similar to Amazon (AMZN:NASDAQ), to be one place to go for all of your traveling and living needs,’ added Chesky.

None of this would have possible without Airbnb completely overhauling its technology stack over the past several years to create a new, modernised technology platform.

Importantly, the new features give hosts the ability to offer more services in the future while making communication between hosts and guests virtually seamless.

‘With this new tech platform, we can innovate faster and expand beyond short-term rentals into an extensible platform with a range of new offerings,’ the company said in a letter to investors.

Analyst Ralph Schackart at William Blair commented: ‘Over the longer term, the company has the opportunity to add incremental growth drivers such as experiences, among others, and the stock should grow at least in line with revenue growth.’

In the fourth quarter to the end of December the number of Nights and Experiences booked accelerated to 111 million, representing 12% growth over the prior year.

The company said it also saw a ‘notable’ acceleration in first time bookings on the platform. Gross bookings for the quarter increased by 13% to $17.6 billion, above Wall Street estimates taking full year bookings up 12% year-on-year to $81.8 billion. Growth in expansion markets grew at twice the pace of the company’s core markets.

Revenue increased 12% compared to the same period in 2023 to $2.5 billion and the company turned a net profit of $461 million or $0.73 per share, surpassing analyst forecasts of $0.58 per share.

Airbnb said it expects first quarter revenue to be between $2.23 billion and $2.27 billion, representing yearly growth of between 4% to 6% in reported currencies and 7% to 9% excluding foreign exchange movements. [MG]

Market relaxed about outcome of crucial European poll for now

German election looms as DAX index makes new record highs

German election chancellor candidates

Party Candidate

CDU/CSU Friedrich Merz

AfD Alice Weidel

SPD Olaf Scholz

Greens Robert Habeck

FDP Christian Lindner

BSW Sahra Wagenknecht

Voters are set to turn out on 23 February for a general election in Germany which so far seems to have largely slipped under the market’s radar.

Despite being Europe’s most populous nation and its largest economy, US investment bank Morgan Stanley notes that, of investors who participated in a recent webcast on the election, just 52% had positioned themselves in any way for its outcome.

Meanwhile, the DAX index continues to serenely move to new record highs in the expectation we will see a coronation of the head of the centre-right CDU/CSU party, Friedrich Merz, as chancellor –despite the insurgent AfD party polling strongly in second place. Merz would replace incumbent Olaf Scholz whose SPD party is trailing in third place.

No other party wants to work with the right-wing AfD, which sits in second place in the polls at around 20%.

‘The two main options for the CDU/ CSU are thus either a coalition with the SPD (at 16%) or the Greens (at c4%). The former seems more likely because the SPD is doing a little better in the polls and because, unlike the Greens, it can currently block some legislation in the Bundesrat, the upper house of parliament.

‘According to current polls, the FDP will struggle to clear the 5% threshold to return to parliament. If it manages to do so and the leftist BSW also wins seats, Mr Merz may need the FDP as a third partner to put together a majority.’

Table: Shares magazine DAX trading around record highs ahead of German elections

The risk for markets is a more unpredictable outcome, particularly if the AfD outperforms expectations and/or Merz reverses his decision to rule out a coalition with the party.

Assuming CDU/CSU does prevail then Orgonas expects increased spending in areas like energy, defence and infrastructure. However, there are risks that a patched-up coalition might find it difficult to get things done. [TS]

Writing around a week ago, Berenberg analyst Gerhard Orgonas laid out the likely scenario and the one the market appears to be pricing in. ‘Depending on how many of the smaller parties clear the minimum requirements to gain seats, a coalition will need a total share in the popular vote between 40% and 48% for a majority.

Strong regulatory tailwinds keep XPS Pensions in the ascendency

Continuing regulatory changes, new client wins and inflation-linked contracts support growth

Pension consulting and administration group XPS Pensions (XPS) has been on a tear over the last year with the shares almost doubling, reflecting double-digit growth in the business.

An unscheduled trading update on 14 February sent the shares to yet another new all-time high as the FTSE 250 company revealed full year results will be ‘materially’ above previously ungraded expectations.

consensus estimates are pegged at the bottom end of the range.

Analysts have had a tough time keeping up with underlying growth, resulting in strong and persistent upward earnings revisions over the last year.

The board expects full year revenue growth to March 2025 of between 15% and 16% to £226 million to £229 million, while

Co-CEO Paul Cuff attributes the strong growth down to client demand for its services as they have needed support responding to market and regulatory changes. Key drivers include work around the McCloud remedy which removes age discrimination in NHS pension schemes, the guaranteed minimum

Wood Group shares hit an all-time low after review and cash flow revelation

Energy services business at new nadir after latest disappointing update

In the annals of stock market history there can be few deals as disastrous as Wood Group’s (WG.) merger with Amec Foster Wheeler.

The tie-up, which took place in 2017, has caused a plethora of problems for Wood Group in the interim and, combined with industry-wide structural pressures, has seen its market value collapse.

The shares fell to a new all-time low after a weaker-thanexpected fourth-quarter trading update on 14 February and news that an independent review had found

financial, cultural, governance and control failings.

While the company said it had taken action in response to the soft performance, including cancelling executive and employee bonuses, it is still predicting negative free cash flow of $150 million to $200 million in 2025 which means it needs to dispose of assets to help cover the outflow.

Chief executive Ken Gilmartin said: ‘While we have made progress, I am disappointed in our financial

pension and new business wins in the Risk Transfer market.

Following the trading update analysts at Canaccord Genuity increased their 2025 EPS (earnings per share) forecast by 6% implying 27% growth on the prior year. They noted the upgrade was largely the result of XPS Pensions delivering McCloud remedy work more efficiently that they previously expected. [MG]

performance. Consequently, we are taking decisive actions to ensure we can meet the opportunities we have in growing markets, principally energy.’

Wood has a huge job to rebuild its credibility with the markets to the point where it can put its problems behind it and focus on the opportunities in front of it. [TS]

UK UPDATES

OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

21 Feb: Standard Chartered

24 Feb: Me Group

International

25 Feb: Croda International, Smith & Nephew, Unite Group

26 Feb: Aston Martin Lagonda Global, Convatec, Hammerson, Hika Pharmaceuticals, Morgan Sindall, Rathbones

27 Feb: Aviva, Cairn Homes, Drax, Greencoat UK Wind, Haleon, Hiscox, Howden Joinery, Jupiter Find Management, London Stock Exchange Group, Macfarlane, Ocado, PPHE Hotel, Rolls-Royce, Serco, Shaftesbury, Taylor Wimpey, WPP

FIRST-HALF RESULTS

25 Feb: City of London Investment Trust, DotDigital, McBride

TRADING

ANNOUNCEMENTS

25 Feb: Jadestone Energy

Is the Rolls-Royce recovery complete?

Chief executive Erginbilgic has led a stunning turnaround of the aero-engine maker

Aero-engine maker Rolls-Royce (RR.) will go down as one of the greatest turnaround stories on record, with chief executive Tufan Erginbilgic injecting the sort of short, sharp, shock treatment the company needed.

Stephen Anness, manager of Invesco Global Equity Income Trust (IGET), first invested in Rolls back in 2020, since when the company has ‘gone through a remarkable transformation,’ he told Shares in December.

‘We always believed in the business’s exceptional engineering pedigree, with its strong, duopolistic position in wide body engines, but it had been mismanaged for a long period of time,’ Anness added.

Covid very nearly ended the company, and shortly after being appointed as chief executive in January 2023, Erginbilgic told the firm’s 42,000 employees they were standing atop ‘a burning platform’, but he also set out his aim to reverse the slide in profit margins and lay the groundwork for a new century of growth at the 120-year-old manufacturer.

Rolls-Royce Holdings

He's done that alright, and full year 2024 results on 27 February will show how far Rolls-Royce has come with underlying operating profit in the £2.1 billion to £2.3 billion range and free cash flow at levels not seen in years.

Rolls-Royce also expects to restart dividend payments again at a 30% payout ratio to underlying profits – the last time the firm paid a dividend was in January 2020, before the pandemic took hold.

Rolls-Royce shares were the best performers in the FTSE 100 in both 2023 and 2024, surging 207% and 96% respectively, and they have gained 9% so far this year.

Can DIY behemoth Home Depot deliver another earnings beat?

The world’s largest home improvement retailer Home Depot (HD:NYSE) has topped earnings estimates in the last two quarters, so there is well-founded optimism that the US consumer bellwether can deliver another forecast ‘beat’ when it posts fourth quarter and full-year figures on 25 February.

Home Depot’s US comparable sales were down 4% in the fourth quarter of full year 2023, which means the company has a low bar to hurdle this time around when it comes to its Stateside performance.

Truist Securities recently raised its fourth quarter US comparable sales forecast for both Home Depot and smaller rival Lowe’s (LOW:NYSE), from a 2% decline to a 0.5% rise for the former, citing strongerthan-expected sales trends based on the firm’s proprietary card data.

Shares in Atlanta-headquartered

the market expects from Home Depot

Home Depot are up almost 15% over the past year, with investors increasingly bullish about the prospects for the US housing market under Donald Trump’s presidency, though the stock has lagged the S&P 500 Index over that timeframe. And with inflation raising its head again in the US, interest rate cuts across the pond could be deferred, putting a dampener on housing sales and home improvements in the world’s biggest economy.

Led by CEO Ted Decker, Home Depot’s third quarter performance exceeded management’s expectations, with comparable sales down 1.3% and comparable US sales falling 1.2%. ‘As weather normalised, we saw better engagement across seasonal goods and certain outdoor projects as well as incremental sales related to hurricane demand,’ explained Decker on 12 November. [JC]

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS 21 Feb: Constellation Energy 24 Feb: Berkshire Hathaway, Diamondback, Domino’s Pizza, Public Storage, Realty Income 25 Feb: American Tower, Caesars, First Solar, Home Depot, Intuit, Keurig Dr Pepper, Pinnacle West, Workday 26 Feb: Crown Castle, Dollar Tree, eBay, Lowe’s, Monster Beverage, Nvidia, Paramount Global, Salesforce, TJX, Verisk 27 Feb:

Autodesk, Best Buy, Cooper, Dell Tech, Edison, Evergy, HP, Hormel Foods, JM Smucker, NRG, Solventum, Vistra Energy, Warner Bros Discovery, Zscaler

Affordable housebuilder MJ Gleeson is strongly positioned for a market recovery

There are plenty of reasons to like this wellrun business, not least an attractive valuation

MJ Gleeson (GLE) 495p

Market cap: £280 million

We originally tipped MJ Gleeson (GLE) at 438p back in May 2023, which wasn’t quite the low but was in time to catch the run all the way up to 650p last October.

Today, the shares may not be quite as cheap as they were two years ago, but the outlook is clearly a lot better, not just for Gleeson but for the whole housebuilding sector.

SOLID FOUNDATIONS

Gleeson Homes focuses on providing high-quality, genuinely affordable housing across the North of England and the Midlands, with an average threebed home selling for £170,000 or less than half

the asking price of the average property coming to market this month (£368,000) according to the latest Rightmove (RMV) survey.

For the year to June 2024, the company sold 1,772 homes, slightly more than the 1,723 sold in the previous year, with housing revenue rising 2.6% to £329 million suggesting the market has stabilised.

During the year, the group signed its first partnership agreement, with a second agreement inked in August 2024, complementing its openmarket business, reducing risk and leveraging economies of scale while helping accelerate growth. For the uninitiated, partnerships work involves teaming up with housing associations, local authorities, and private rented housing investors to advance projects that typically have a lower proportion of homes for private sale compared to traditional developments.

In the six months to December 2024, the number of homes sold reached 801, 4% more than in the prior-year period, while housing revenue rose 10% to £157 million despite a subdued newbuild market.

The homes business opened eight new build sites and 11 new sales outlets, and is on track to grow by 10 sales outlets per year in order to achieve its medium-term goal of annual sales of 3,000 units.

Gleeson

The order book currently stands at 597 plots, up from 559 in June 2024, while the pipeline of sites purchased, contracted subject to planning or with terms agreed stands at 18,731 plots across 174 sites.

Although realistically no-one in the industry expects the Labour government to fulfil its commitment to build 1.5 million new homes in its first term, the revised National Planning Policy Framework introduced in December is a big step forward for the sector and Gleeson Land has already achieved three planning consents since the start of 2025.

POSITIVE MOMENTUM

In addition, the firm saw ‘early indications of an improving selling season’ with stronger-thanexpected buyer interest in the first four weeks of this year.

Net reservation rates in January were up 45% to 0.77 per outlet per week. To put things in perspective, if the firm had 100 sales outlets open, and reservations were just 0.6 per outlet per week, it would already be meeting its target of 3,000 homes per year.

This positive start to the second half, on top of the momentum from the second half, means the firm is confident it will not only meet market expectations for the current year, but it will deliver ‘sector-leading growth underpinned by new site opening and a more stable planning environment’.

Gross margins are expected to rise as the level of incentives falls and selling price rise, and as the site mix improves with lower-margin offices closed and higher-margin ones opening.

What the market expects of MJ Gleeson

Jun25 Jun26 Jun27

Table: Shares magazine • Source: Company-compiled consensus, correct as of 20 January 2025

Chair James Thomson is on record as saying the target of 3,000 homes per year could see profitability broadly triple from the current level as Gleeson resumes its position as the fastest-growing listed housebuilder.

In addition, as the government works out a new funding settlement with housing associations, Gleeson expects the partnership business to gain traction through the end of 2025 into 2026 and beyond, increasing in scale as well as number of sites.

ATTRACTIVE VALUATION

In terms of rating, the shares are trading on a 12-month-forward PE (price to earnings) multiple of 12 times and a price to book value of less than one times.

We wouldn’t typically describe that as ‘deep value’ but interestingly with the shares trading below 500p the stock has just been added to Stockopedia’s ‘Ben Graham Bargain Screen’.

This screen looks for companies with a market cap below the value of their net current assets, meaning that even in the unlikely scenario that a company were to collapse tomorrow, investors would still generate a positive return due to its underlying asset backing.

We prefer to use a CAPE (cyclically-adjusted PE) methodology, which suggests if earnings can get back to the underlying trend and reach 50p or more by June 2027 – consistent with analysts’ forecasts – the shares should be worth around 700p or 40% more than they are at present. [IC]

AB Dynamics is well positioned to drive shareholder value

The outlook is supported by long-term structural and regulatory growth drivers

AB Dynamics (ABDP:AIM) £18.05

Market cap: £413 million

For those unfamiliar with the story, AB Dynamics (ABDP:AIM) is a leading provider of development, test and verification solutions to the global automotive market. The business was founded in Bradford-on-Avon in 1982 by Tony Best, who remains the company’s largest shareholder.

The company’s proprietary services help manufacturers develop vehicles which are safer, more efficient and more sustainable.

The shares had a flying start to life as a publicly traded company, rising from 86p at the IPO (initial public offering) in 2013 to £26 by late 2019.

These gains were supported by impressive growth in the business, with revenue and operating profit rising almost five-fold between 2013 and 2019.

The problem was investors got too far over their

AB Dynamics

Shares magazine • Source: LSEG

skis, as usual, pushing the PE (price to earnings) ratio to a nose-bleeding 50 times, so it’s not surprising the stock has trodden water since 2019 trading in a broad range between £10 and £25.

While the shares may have drifted, the business has certainly not gone sideways: sales have more than doubled and EPS have risen 76%, while new management has made the business more resilient and diversified by introducing more revenue lines.

All of which means the company has grown into its valuation, and today the shares trade on a more reasonable 24 times estimated August 2025 EPS, falling to 22 times estimated 2026 earnings of 82.6p per share.

Meanwhile, over the last year analysts have been busy revising up their earnings estimates for 2025 and 2026 by 15% and 18% respectively, according to Refinitiv data, reflecting strong momentum across the business.

We believe it’s only a matter of time before the shares regain their former glory, but this time around from a more reasonable valuation base supported by the next phase of the company’s growth trajectory.

Chart:

A HIGH-QUALITY GROWTH COMPANY

AB Dynamics possesses some attractive attributes, not least a leading position in a growing market driven by increased regulation and the transition to electrification.

To give just a flavour of the growing regulatory demands, the number of Euro NCAP (European New Car Assessment Programme) tests is expected to increase from 450 today to around 1,000 by 2030.

More complexity will drive demand for the company’s products and services together with incremental use of simulation across new geographies and vehicle categories.

Speed to market and cost efficiencies offered by simulation will drive adoption of the company’s range of services.

The company has built a diverse customer base and high-quality relationships, and the emergence of EVs (electric vehicles) is driving demand for additional development, testing and validation.

After investing for many years, the group now has a scalable platform which means it can drive higher margins through operating leverage as well as benefiting from improvements in the supply chain.

Management has increased the proportion of recurring revenue to 45% from just 8% four years ago, providing greater stability and visibility, while the business throws off lots of cash which means it can deliver shareholder value by investing in organic growth, making acquisitions or returning capital.

Management’s priorities are to invest in innovation to grow the core business, invest in ADB Solutions, make ‘bolt-on’ acquisitions and finally

AB Dynamics key financials

to return capital to shareholders via a progressive dividend policy.

To put some numbers to the capital allocation policy, free cash flow per share has grown by 35% per year since 2019 while dividends have grown by 12% per year and there is plenty of scope to increase the payout given it is covered more than eight times by earnings.

HOW IS THE BUSINESS PERFORMING?

In 2024, revenue increased by a tenth and adjusted operating profit rose by 22% to £20.3 million, meaning the operating margin on sales increased by 1.7% to 18.2% reflecting positive operating leverage and efficiency gains (positive operating leverage is the effect on profit of costs rising less than revenue).

The business achieved 115% cash conversion, in line with the three-year average, allowing it to maintain a net cash pile of around £30 million despite investing £4.8 million in the business, spending £17 million on acquisitions and paying out £1.5 million to shareholders in dividends.

The company says trading so far in the financial year to August 2025 has been strong and it expects adjusted operating profit to be slightly ahead of consensus, which it estimates to be £21.5 million.

In the medium term, the company is targeting 10% organic revenue growth and further margin expansion to 20%.

In summary, we believe AB Dynamics has been working hard under the bonnet to position the business advantageously to exploit strong industry tailwinds and increase shareholder value. [MG]

Table: Shares magazine • Source: AB Dynamics results presentation, Panmure Liberum

Why Fevertree continues to fizz with potential

We urged investors to take a taste of Fevertree Drinks (FEVR:AIM) at 698.5p on 19 December 2024, making the premium mixer drinks firm one of our key 2025 stock selections on the basis the shares were cheap and that negative sentiment towards the stock and the underlying profitability of the business had both troughed. Shares also highlighted that the brand has a significant amount of white space to grow into.

WHAT’S HAPPENED SINCE WE SAID TO BUY?

On 30 January, the shares fizzed higher after Fevertree announced a transformational strategic partnership with beer maker Molson Coors (TAP:NYSE) that represents a big endorsement of the brand Fevertree has built up across the Atlantic.

The partnership, which has seen Molson Coors

buy an 8.5% stake in the business for £71 million, will drive the next stage of Fevertree’s growth in the US and improve the tonic water-to-ginger ale seller’s earnings quality and cash generation; Fevertree has begun to returning said £71 million to shareholders via a buyback programme. Molson Coors will take over Fevertree’s US operations, while Fevertree will receive a share of the profits of the US operations as a royalty, which should materially improve over time.

WHAT SHOULD INVESTORS DO NOW?

Keep buying shares in the Madagascan cola-tomojito mixer seller, which bubbled up to £8 on the exciting news before settling back to 745p. That leaves our ‘buy’ call 6.6% in the money, but the potential is huge and we are thirsty for more upside.

The terms of the Molson Coors tie-up reduces demands on Fevertree’s capital and should power its growth in the US thanks to the beer maker’s heavyweight distribution and marketing capabilities.

Berenberg estimates that 140p per share in cash has been ‘released from working capital due to the Molson Coors partnership given the onshoring of production and the reduced inventory requirements of the US business’.

Panmure Liberum observes that the Molson Coors stake ‘provides a long-term backer and a potential eventual acquirer of the group’. [JC]

Investors brace for Nvidia’s most important earnings report so far

AI chip designer has bounced back quickly from DeepSeek scare

Chip designer Nvidia (NVDA:NASDAQ) has become the most-watched stock on the planet in recent years, having built a fastgrowing business empire in one of the most exciting investment themes ever: AI (artificial intelligence).

The date for your diary: 26 February, that’s when Nvidia will report earnings for its fourth quarter and full year for fiscal year to end January 2025.

Soaring demand for its data centre GPUs (graphics processing units) have become the gold standard for developing AI, catapulting Nvidia’s revenue, profits and cash flows higher, and adding more than $3 trillion to its market cap since the

start of 2023.

Since then, Nvidia has barely put a foot wrong, beating market expectations time and again, but the market’s confidence was given an almighty shake in recent weeks. Last month, Chinese hedge fund-backed start-up DeepSeek released R1, its open-source reasoning model that reportedly outperformed the best models from US companies, such as OpenAI.

R1’s self-reported training cost was less than $6 million, a fraction of the billions that Silicon Valley companies are spending to build their artificial intelligence models. That said, there remains healthy scepticism among analysts over those cost

Nvidia has consistently beaten estimates for two years

What the markets expects of Nvidia

claims, and the Nvidia chips that power R1.

One sceptic is Alexandr Wang, the CEO of Scale AI and the world’s youngest self-made billionaire, who claimed that DeepSeek and other Chinese labs have gotten their hands on more cutting-edge Nvidia H100 chips, which it can’t admit to because of US trade embargos on advance tech kit. Wang’s view has been backed by Elon Musk and Ted Mortonson, a managing director and tech strategist at Baird, who also doubts DeepSeek could have built its model with reduced-capacity H800 chips.

‘Pegging R1’s price tag at $6 million is wildly misleading,’ said Gavin Baker, managing partner and CIO at Boston hedge fund Atreides Management.

Crucially for investors, Nvidia’s comments in response to R1’s launch indicate that it sees DeepSeek’s breakthrough as creating more demand for its GPUs.

‘Inference requires significant numbers of Nvidia GPUs and highperformance networking,’ the company has said. ‘We now have three scaling laws: pre-training and post-training, which continue, and new test-time scaling.’

How all of this plays out will surely keep investors on the edge of their seats through 2025 and beyond, but analysts have so far not indicated any meaningful change to rampant growth forecasts. Consensus data from Koyfin for the upcoming results indicate Nvidia quarterly and full year EPS (earnings per share) of $0.84 and $2.95, on revenue of $38.08 billion and $129.19 billion.

Estimates for 2026 and 2027 put sales growth at above 50% and 20%, implying EPS of $4.44 and $5.60 over the next two years. This apparent analyst confidence that Nvidia can hang on to AI chip design leadership and keep the cash flows flowing thick and fast also seems to be returning for investors, given how quickly the stock has recovered from the sharp sell-off straight after R1’s release.

Nvidia shares lost 17% on 24 January, a $600 billion capital value loss, the biggest on record. The stock, at $138.85, is now less than $4 below the $142 close before the DeepSeek release, and less than $10 off the all-time $149.43 high set in early January 2025.

By Steven Frazer News Editor

Which? rate no other investment platform higher than us for ease of use. Explore our ISA account today.

Learn more

Feel good, investing.

Capital at risk. ISA rules apply.

THE BIG

INFRASTRUCTURE OPPORTUNITY

Discounts easing in this unloved sector

Listed infrastructure and renewable trusts have had a torrid time over the last three years with average discounts to NAV (net asset value) drifting out to between 30% and 40%.

In our view the gloom and doom gone too far, with the headwinds impacting NAVs have starting to dissipate, opening the prospect of a strong recovery.

We have noticed some green shoots of broad share price strength since the start of the year, suggesting increasing investor interest.

On 6 February BBGI Global Infrastructure (BBGI) agreed to be taken over by Canadian group British Columbia Investment Management for a cash consideration of 147.5p per share.

BCI is one of the largest investors in Canada, managing a $250 billion portfolio of diversified public and private market investments on behalf of the British Columbia public pension fund and its institutional clients.

The key takeaway from the proposed transaction is the price agreed is not just a 21% premium to the prior closing price but, more significantly, a 3.4% premium to BBGI’s NAV.

This immediately dispelled investor scepticism and general uncertainty over the credibility of the quoted NAV and sent BBGI shares up 18% on the day, with a noticeable knock-on effect on share prices across the sector.

It is not just Shares which believes this represents a potential turnaround in fortunes and inflection point.

Panmure Liberum described the deal as: ‘A bolt from the blue which will reverberate around the industry. We go as far as to say that this is the most significant single news item in several years within renewable and infrastructure funds.’

Peel Hunt added; ‘We think this should reverberate positively across the wider infrastructure peer group, with core infrastructure

trading on a weighted average discount of 25% and yield of 7.4%, core-plus infrastructure on a 20% discount and 4.1% yield, renewables on a 30% discount and 9.4% yield. We continue to see value across these sectors.’

In 2022, BBGI regularly traded at a premium to NAV, but the rapid rise in interest rates pushed up the cost of capital across the sector, and rising gilt yields provided an alternative income source for investors, draining capital from the sector.

A QUESTION OF SCALE

Another factor driving the widening of NAV discounts has been increasing consolidation within the fund and wealth management industry.

These larger pools of capital have bigger minimum investment allocations and liquidity requirements which means smaller trusts can fall out of the investable universe, encouraging the selling-down of existing positions which do not satisfy the investment size criteria.

A 2025 industry survey by broker Winterflood shines a light on this effect, showing a greater proportion of respondents preferring to invest in larger trusts.

In 2013, nearly all the clients surveyed were willing to invest in trusts with a market capitalisation below £200 million whereas today that proportion has fallen to just 46% of respondents.

Further, around two-thirds of respondents said they had a negative view on liquidity trends, up from just two fifths in 2022.

Another finding of the study is a ‘notable’ proportion of respondents think more trusts should actively pursue consolidation.

To be fair, there has been an uptick in corporate activity across the wider trust space, with Janus Henderson recently agreeing to merge Henderson International Income (HINT) into JPMorgan Global Growth & Income (JGGI)

Expected to conclude by July 2025, the transaction will create a company with net assets of roughly £3.4 billion, cementing JGGI’s position as the biggest beast by far in the Association of Investment Companies’ (AIC) Global Equity Income sector.

JPMorgan Asset Management will continue to manage the enlarged JGGI, whose shareholders will benefit from a significant fall in ongoing charges to 0.42% versus the current 0.77% on HINT.

The REIT sector has also seen consolidation

activity, but the renewable and infrastructure players have thus far seemed either reluctant or unable to engage with each other to benefit from increased scale.

The huge variety of different structures operating across the sector may have created barriers which mean it is often impractical to merge funds.

Stifel summed up the situation as follows: ‘We think key issues for bidders assessing whether to make a “go” or “no-go” decision include shareholder bases, portfolio mix between PFI (Private Finance Initiative) /PPP (Public-Private Partnerships) & Utilities/Economic assets, debt structures and management termination terms.’

CAN HEADWINDS TURN INTO TAILWINDS?

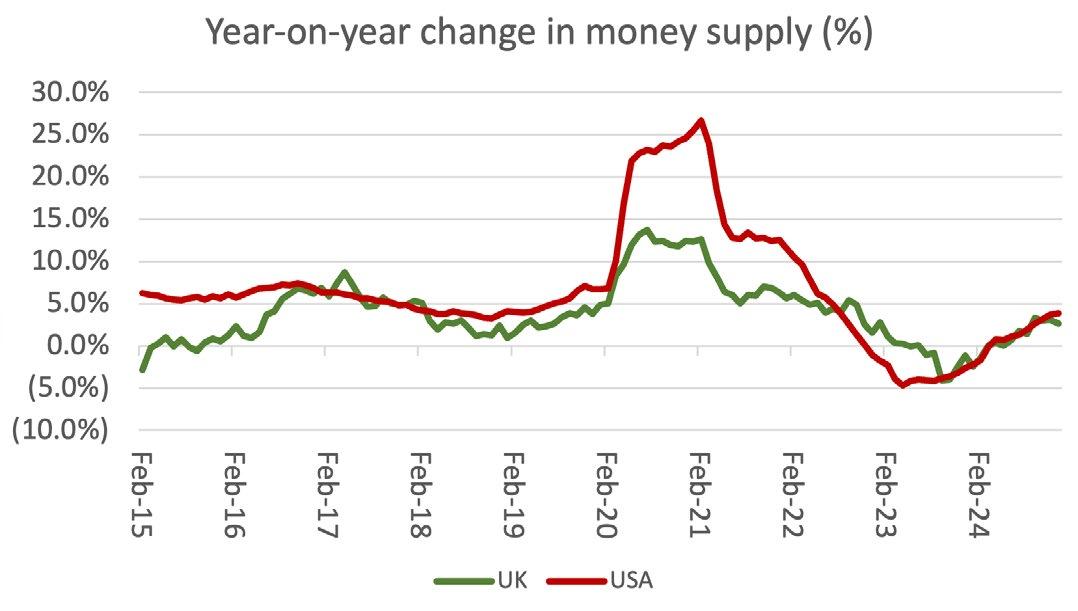

With inflation heading lower and the Bank of England recently voting to cut rates further, the headwind from rising discount rates (which made the current value of longterm infrastructure assets lower) may finally be abating while the demand picture for infrastructure remains buoyant.

Philip Kent, lead adviser of GCP Infrastructure Investments (GCP) told investors at a recent AIC webinar: ‘The biggest challenge for our sector has been the macro environment, and we’re optimistic that it will turn in our favour in 2025.

‘We’re expecting more interest rate cuts in the UK, which will make the income characteristics of infrastructure more attractive versus traditional income assets.’

One of the attractive features of infrastructure

THESE STOCKS ARE ALREADY MOVING

funds is they possess stable, predictable cash flows which stretch decades into the future and are often linked to inflation, giving investors some protection from rising inflation.

It isn’t a perfect hedge, with BBGI for example estimating its inflation sensitivity is 0.43% per 1% increase in inflation, but on the other hand the longer cash flows stretch into the future the more the upside from lower interest rates.

Falling interest rates reduce the cost of capital, which in turn increases the theoretical value of assets held by infrastructure funds, boosting net asset value.

While inflation is expected to fall, it may prove sticky, or not reach the Bank of England’s 2% target as quickly as expected, a scenario which plays to the strengths of infrastructure funds with their inflation-linked contracts.

MORE INVESTMENT IS NEEDED

Infrastructure and renewable companies benefit from strong structural growth drivers such as increasingly urbanisation, the transition to net zero emissions and the digital revolution.

Many countries around the world need to upgrade their infrastructure: the OECD

(Organisation for Economic Cooperation and Development) estimates £5 trillion of investment is required every year from now to 2030 to develop and support the world’s infrastructure needs.

Randall Sandstrom, chief executive and chief investment officer of Sequoia Economic Infrastructure Income (SEQI), comments: ‘There is currently a significant requirement for infrastructure developments, particularly in our core geographies of the US, UK and Europe.

‘However, there is a shortfall between the capital that traditional lenders can provide and the requirements of many infrastructure projects. SEQI fills this real and persistent funding gap.’

With regards to the UK’s green revolution, the government has promised to make Britain a clean energy superpower by 2030.

Michael Bonte-Friedheim, CEO and Founder of NextEnergy Group, which manages NextEnergy Solar Fund (NESF) explains what this means for the solar industry.

‘The UK government has mandated the delivery of 50 gigawatts by 2030 in its Clean Power 2030 plan. This is a threefold increase from current levels, driving the demand and necessity for strong operating portfolios such as NESF, which investors can leverage.’

ENHANCING RETURNS

Before the BBGI deal, the average discount to NAV across the infrastructure sector was 30% and across renewables the discount was closer to 40%.

The potential returns provided by the discount narrowing during a time when

NAV is rising can result in significantly enhanced returns.

For example, a 30% discount which narrows to zero on a trust which grows NAV by 7% per year, provides a price return of 75% before reinvested dividend income is factored in.

An NAV of 100p and price at 70p = a 30% discount. 7% growth over three years = 1.07 x 1.07 x 1.07 = 1.2225 x 100p NAV = 122.5p.

So, if the price increases from 70p to 122.5p, the return is 122.5/70-1x100 = 75%

THESE ONES HAVEN’T STARTED MOVING

SELF-HELP MEASURES

Investment trust managers have not been idle during the storm of the last three years: many have been proactively reshaping their balance sheets in the face of higher funding costs by paying down revolving credit facilities and recycling assets to prove net asset values they believe are conservatively struck.

For example, NextEnergy Solar has actively introduced a capital recycling programme, which has repeatedly proven the NAV is robust. By reducing leverage and using the proceeds to buy back shares, it is also boosting NAV per share in the process.

David Bird, fund manager at Octopus Renewables Infrastructure (ORIT), has followed a similar strategy: ‘Since launching our capital recycling programme in 2023, ORIT has generated £161 million through three accretive investment exits, all of which have been realised at an uplift to carrying value.

‘So, while the shares trade at a discount to the value of the assets, these transactions provide validation of the underlying value, and this may be seen as an attractive entry point for those looking to invest in this asset class and make a positive impact with their capital too.’

Meanwhile, the board of Foresight Solar Fund (FSFL) has been buying back its own shares but admits buybacks alone won’t lead to a re-rating.

Given what it calls ‘the unprecedented market challenges’ facing the listed renewable infrastructure sector, it is ‘engaging with shareholders on a range of strategic options while continuing to deliver on our near-term objectives’.

WHICH TRUSTS COULD BE M&A TARGETS?

The obvious question to ask is whether there any

aspects of the BBGI takeover which provide clues to other potential targets?

While acknowledging it is something of a ‘mugs game’ to predict which funds could be taken over or taken private, Stifel identifies fund size, mix of assets, complexity of debt and management termination terms as key variables.

‘We think smaller funds may take the view they will be unable to grow though equity issuance for the foreseeable future and going private may offer scope for growth ─ one of BBGI’s rationales for delisting,’ observes Stifel.

Trusts in this category include Pantheon Infrastructure (PIN), Foresight Environmental (FGEN), Octopus Renewables, and Downing Renewables and Infrastructure (DORE).

Interestingly, these trusts are among those which are up the least since 6 February, when the BBGI deal was announced, showing just how difficult it is to identify the next winner.

The second category identified by Stifel is those trusts which have large portfolios of operational assets and would be attractive to pension funds or institutions like BCI seeking ‘ready-made’ cash generative assets.

These include HICL Infrastructure (HICL), International Public Partnerships (INPP), Renewables Infrastructure (TRIG), Greencoat UK Wind (UKW) and Greencoat Renewables (GRP)

Investors appear to have found greater affinity with HICL and INPP, which are among the best performing trusts in recent weeks. Others gainers include Gore Street Energy (GSF) and GCP Infrastructure.

Interestingly, even though not all trusts have received a boost from the BBGI news, as a group renewables and infrastructure listed in the table have performed better than the mid-cap FTSE 250 index in recent weeks.

It still feels like early days in the recovery, and

The majority of renewable and infrastructure trusts are up over the last month

Data correct as of close 14 February 2025

Table: Shares magazine • Source: Stockopedia, the Association of Investment Companies

average discounts to NAVs remain historically wide, but with growing signs of stabilisation and doubledigit dividend yields on offer, the potential rewards look more than interesting.

The fact many trusts are seeing positive share price move suggests the factors driving recent buying may have legs. It also means the current laggards may play catch-up, so this could be a lucrative hunting ground to consider.

Greencoat UK Wind and Sequoia Economic Infrastructure sit in this category, with the former identified by Stifel as a good fit for pension funds and corporates seeking cash generative assets.

Finally, we find it interesting that despite all the gloom surrounding the sector, UK asset manager Legal & General (LGEN) has just launched (13

February) a new infrastructure fund for institutional investors, to satisfy increased demand.

Ben Cherrington, Head of UK wholesale asset management at L&G, says: ‘With concentration risk challenges for equity portfolios and pressures on inflation and bond yields, we have seen demand increase for more tailored exposures to both equity and credit markets. We have also witnessed an increasing investor interest in listed infrastructure, given the desire for better diversification and liquidity.’

SHARES PICK

real value of the portfolio by reinvesting excess cashflow.

In its recent fourth-quarter update (29 January), the company said it would increase its target dividend for 2025 to 10.35p per share, in line with the 3.5% December 2024 RPI.

This FTSE 250 company was one of the first to target renewable assets and is led by an experienced team of senior executives from Schroders Greencoat LLP, a leading European renewable investment manager.

The company is solely invested in operating offshore and onshore UK wind farms. The aim is to provide investors with a sustainable annual dividend per share that increases in line with the RPI (retail price index), while preserving the

Net asset value total return has increased by nearly 80% since 2020, comfortably outperforming the FTSE All-Share index.

The company believes there is a significant market to grow into over the next few years and estimates the total value of UK assets in operation is around £100 billion.

Disclaimer: The editor of this story (Ian Conway) owns shares in NextEnergy Solar Fund and Sequoia Economic Income.

Martin Gamble Education Editor

Fidelity European Trust PLC

Chosen by AJ Bell for its Select List

Fidelity European Trust PLC aims to be the cornerstone long-term investment of choice for those seeking European exposure across market cycles.

Aiming to capture the diversity of Europe across a range of countries and sectors, this Trust looks beyond the noise of market sentiment and concentrates on the real-life progress of European businesses. It researches and selects stocks that can grow their dividends consistently, irrespective of the economic environment.

Holding a steady course throughout market cycles

It is an uncertain time for the world and Europe is no exception. It is however vitally important for investors not to be blown off course. Good companies are still good companies and finding them remains the ‘secret sauce’ of any effective investment strategy.

We will remain focused on the companies in which we have invested and, in particular, on their ability to continue to grow their dividends. As always, we will ask ourselves if that rate of dividend growth is already discounted in the share price.

Performance over five years

We continue to seek new opportunities to add to the portfolio at the right price and remain confident in those names we currently hold. This approach has historically served the portfolio well - including through the recent volatility of the last few months - and we see no reason to change course.

Past performance is not a reliable indicator of future returns.

Source: Morningstar as at 31.01.2025, bid-bid, net income reinvested. ©2025 Morningstar Inc. All rights reserved. The FTSE World Europe ex-UK Total Return Index is a comparative index of the investment trust.

Important information

The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. This trust can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser.

The latest annual reports, key information documents (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment

(UK) Limited. Issued by FIL Investment Services (UK) Ltd, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and

UKM0225/399910/SSO/0525

How ‘all-weather’ global trust Brunner can get back on track

Performance lagged the benchmark last year, but this should prove a blip for this ‘rainy day’ dividend hero with a balanced approach

With more than half a century of unbroken dividend hikes under its belt, Brunner (BUT) aims to provide long-term growth in capital and dividends by investing in global and UK equities with an ‘all-weather’ approach designed to adapt to different market conditions.

To achieve this resilience, co-managers Julian Bishop and Christian Schneider of Allianz Global Investors focus on structurally-growing, cashgenerative companies operating in high barrierto-entry industries and diversify the £660 million of assets portfolio across market factors including quality, growth and value.

Over time, Brunner’s strategy has proved highly rewarding for shareholders. AIC data shows Brunner is the Global sector’s fifth best 10-year share price total return performer, bested only by the likes of Baillie Gifford-steered growth trusts Scottish Mortgage (SMT) and Monks (MNKS), the tech-focused Manchester & London (MNL) and Alliance Witan (ALW), although Brunner is the second best performer on a five-year view, sitting above Alliance Witan, AVI Global (AGT) and ultradiversified duo F&C (FCIT) and Bankers (BNKR) in the rankings.

Brunner

net asset value total returns

Table: Shares magazine • Source: AIC, Morningstar, data as at

Reassuringly balanced, Brunner is differentiated by having a higher allocation to UK equities compared to its Global sector peers; almost 25% of the book at last count versus 9.3% for F&C and a mere 5.9% for Alliance Witan due to Brunner’s composite benchmark consisting of 70% FTSE World ex-UK and 30% FTSE All-Share.

Schneider and Bishop believe owing UK equities brings diversification to the table, since the domestic stock market leans more toward the ‘old

Brunner vs the peer group

Five-year share price total return

Scottish Mortgage Brunner

Alliance Witan

AVI Global F&C

Manchester & London

Mid Wynd International

Bankers

Monks

Martin Currie Global Portfolio

Lindsell Train

Keystone Positive Change

Chart: Shares magazine • Source: AIC, Mmorningstar, data as at 12 February 2025

economy’ and UK valuations remain undemanding, particularly in comparison to those in the exuberantly-valued US market.

PURSUIT OF CONSISTENT PERFORMANCE

Frustratingly, against a volatile backdrop and in a cyclical rally, Brunner was unable to extend its previous five-year record of outperformance in the year to 30 November 2024, with the trust’s NAV total return of 17.9% trailing the 23.6% for the composite benchmark. However, by virtue of a strongly narrowing NAV discount, the year’s share price return was some measure ahead at 39.3%.

As chair Carolan Dobson outlined in her statement accompanying the final results (13 February), Brunner’s ‘all-weather’ approach ‘does not mean chasing some kind of absolute return or constant outperformance of the benchmark - rather it means the pursuit of consistent performance, delivered with a strong focus on risk management, finding companies with dominant market positions that the portfolio managers believe should provide steady long-term returns for shareholders.’

BALANCED APPROACH

‘It was the first year in six we didn’t outperform and I think it was because the only factor that mattered last year was growth,’ Bishop informs Shares. ‘We have plenty of growth, but we balance that with income and quality. Our balanced approach didn’t quite keep up, but January for us was a lot better. Some of what we perceive as being froth in US markets moderated slightly and European stocks fared a bit better for the first time in a long time. At a high level that helpful to us.’

But Bishop is sticking to his knitting: ‘We know what our shareholders want, which is a balanced 50 stock portfolio of good quality companies which generate cash, are sensibly valued and should compound over time, where you get a reasonable portion of the total return from the dividends. And that’s what we do.’

QUALITY STREET

Described as ‘literally a rainy day fund’ by Bishop in the promo video on the website, Brunner’s portfolio is a reassuringly diversified selection of handpicked gems from around the world. Top 20 names span tech titans such as chip manufacturer

TSMC (TSM:NYSE), Google-parent Alphabet (GOOG:NASDAQ) and Microsoft (MSFT:NASDAQ) to the likes of InterContinental Hotels (IHG), Accenture (CAN:NYSE), energy giant Shell (SHEL) and UnitedHealth (UNH:NYSE).

Bishop and Schneider put a lot of emphasis on quality, which they define as businesses with sustainable competitive advantages of some sort. ‘That quite often translates into good returns on invested capital, which is how companies can create value over the long term,’ explains Bishop. ‘If you look at all the world’s great equities, they’ve combined growth and good returns on invested capital and high returns on invested capital are normally an outcome of a business being able to do something that other businesses can’t.’

Quality names called out by Bishop include major holding Microsoft. ‘Think about Office 365, which to all intents and purposes has got no competition. Office 365 is probably the world’s stickiest business, as in it is recurring revenues for Microsoft, people pay every month and I’m pretty sure when my kids have office jobs they’ll probably be using it too.’

Another high-quality holding is payment card services colossus Visa (V:NYSE), which takes a small percentage fee every time someone uses their card and crucially, leaves the credit risk with the banks. ‘Often, we find there’s some sort of network effect that acts as a barrier to entry,’ continues Bishop. ‘In Visa’s case there’s around four billion Visa cards in circulation issued by 10,000 banks and other financial institutions and accepted at millions of retailers and websites worldwide. So it is just impossible to replicate that network, essentially

Brunner – geographic breakdown

ONE OF THE WORLD’S GREATEST BUSINESSES

A recent addition to the portfolio is Auto Trader (AUTO), the FTSE 100 automotive online marketplace Bishop believes is ‘one of the world’s greatest businesses’. Asset-light Auto Trader’s margins are an ‘extraordinary 70%. Well over 75% of all the time that people spend online looking at car websites in the UK is taken up on Auto Trader, it is the go-to destination for anyone who wants to buy a second hand car,’ explains Bishop.

it’s a duopoly with Mastercard (MA:NYSE). Incredibly profitable and new entrants are virtually unthinkable.’

Also benefiting from a network effect is Brambles (BXB:ASX), the Aussie-listed pallets, crates and containers play whose main business is actually in the US. The A$28 billion cap operates the networks of wooden pallets that goods are delivered on. ‘Brambles veers towards a monopoly because it is all to do with operational efficiency and scale. It has this nicely profitable, slightly dull but decent business on the back of that.

STRETCHING THE ELASTIC

When pressed on the broader market outlook for 2025, Bishop observes that the emergence of open-source Chinese AI chatbot DeepSeek has brought some focus to the eye-popping amounts of money companies are spending on artificial intelligence (AI) infrastructure.

‘Microsoft is spending $75 billion on capex in 2025,’ notes Bishop. ‘At some point as shareholders, we need to see a good return on that. One of the key things to look at in 2025 is evidence of people who develop AI models or use AI models turning a good profit. The evidence isn’t there yet.’

He also cautions that US valuations are ‘high and that implications for future returns. At the same time he notes valuations are more modest in the US and Europe.’ For us the key question, because we are always trying to balance these different factors of quality, value and growth, is how much of a premium does the US deserve? American businesses are superior to most European and UK-listed businesses at the aggregate level, the

‘That means that with virtually no exception, every second hand car dealer in the UK lists their inventory on Auto Trader and they pay to do so, they absolutely have to do that just to reach consumers. Really, Auto Trader is a network of buyers and sellers and businesses like this just become incredibly resistant to competition, and competition is what undermines profitability for most businesses.’

US is a better market, more profitable, and has displayed better growth in the past, but how far do you stretch that piece of elastic? If I were to bet, the next 10 years would be a lot closer between Europe and the US in terms of stock market performance and we like to have a more balanced approach.’

One attractively-valued UK-listed stock which Brunner recently purchased is automotive distributor Inchcape (INCH). ‘It is an unfashionable UK-listed name, nice double-digit free cash flow yield, pretty good returns on invested capital and an opportunity to roll-up a fragmented market’, enthuses Bishop.

OVER FIVE DECADES OF RISING DIVIDENDS

With a track record spanning more than five decades of increasing dividends, Brunner’s total dividend for 2024 will be 23.75p, an increase of 4.6% over the 2023 dividend which means the trust has now reached 53 years of consecutive dividend increases and remains in place near the top of the AIC Dividend Heroes list.

Even after paying out the proposed final dividend, Brunner’s revenue reserves will remain strong at 32.6p. ‘We’ve got well over a year in reserve and we can absolutely afford to consider increasing that again next year,’ beams Bishop. ‘That’s a record the trust is very proud of and not one we would expect to break. Not on my watch.’

By James Crux Funds and Investment Trusts Editor

WATCH RECENT PRESENTATIONS

Hercules Site Services (HERC)

Brusk Korkmaz, CEO & Paul Wheatcroft, CFO

Hercules Site Services (HERC) provides labour and construction services to blue-chip clients in the UK infrastructure sector. Reportable segments include: Labour supply, civil projects and other activities. It generates maximum revenue from Labour supply segment being its core business. Supplying skilled and qualified labour to construction companies. Deliver key infrastructure, civil engineering, utilities, groundworks, highway, and railway projects.

Shepherd Neame (SHEP)

Jonathan Neame, CEO & Mark Rider, CFO

Shepherd Neame is Britain’s Oldest Brewer, based in Kent since 1698. The Company brews, markets and distributes its own beers to national and export customers under a range of highly successful brand names including Spitfire, Bishops Finger, Whitstable Bay and Bear Island.

Strix Group (KETL)

Mark Bartlett, CEO

Strix Group manufactures and markets kettle controls for appliances. The company is engaged in the business of design, manufacture, and supply of kettle safety controls and other components and devices involving water heating and temperature control, steam management, and water filtration. Its revenue is generated by the sale of thermostatic controls, cordless interfaces, and other products such as water jugs and filters.

Find out why Sarah turned to tackling the financial markets herself during the pandemic

This investor is hoping to help her daughter with her financial goals and keep herself active in retirement

There are plenty of options these days when it comes to investing your hardearned cash. Now in her mid-60s, Sarah first started putting her money to work in the markets in 2003 through a wealth management firm and stockbroker, however it was not until the pandemic that ‘she got the investing bug’ and began trading through a stocks and shares ISA.

the process really interesting and feels much happier being able to control her own money. In the process of retiring, she sees controlling her investment journey as a means of staying busy and also helping her daughter financially.

During the pandemic she became increasingly frustrated that her existing accounts were expensive to run and the advice that she was given was inconsistent.

‘I accumulated losses of 30%, after that [I thought I could do a better job] managing my own portfolio. Even if I didn’t make any money at least I was saving on fees.

‘My wealth management account wasn’t losing any money; in fact, it made a 25% gain over 20 years. however, the dealing charges and fees were increasing over time. The account was small, and I was investing in 37 different types of funds, bonds and other financial instruments.

‘At least half the funds I didn’t understand and in the year-end reports there seemed to be a lot of transactions for no apparent reason.’

Sarah explains she was frustrated that she was made to feel uncomfortable when she questioned the advice and performance she was getting.

GOING DOWN THE DIY ROUTE

Having now become a DIY investor, Sarah finds

‘However, the question I ask myself whenever I go to anything financial; whether it be AGM’s trade shows or investor evenings or days is how few women are present,’ she says.

Sarah’s investments are in three distinct baskets, a dividend-focused collection of shares, a dealing account containing investment trusts and an ISA for growth shares.

Sarah says this latter account is ‘more experimental’ and where she does the majority of her trading. I have found the only way to really understand the markets is to buy and sell shares yourself. There is nothing more real than looking at a [trading] screen,’ she says.

Sarah readily admits that her biggest source of [stock market and financial] information is her husband. ‘He is better at reading a balance sheet than me. In fact, he was the inspiration behind me taking responsibility of my own money.

‘I think secretly he would just like me to hand it over to him but I am an independent woman and I was having none of that. Also, we trade completely differently.’

Sarah's three baskets of investments

Dividend-paying shares

City of London IT

Equinor

Growth stocks in an ISA

Treasury 4.5% t42

B&M European Value Retail

IBM Bodycote

Kyndryl Holdings

Lloyds Banking Group

LandSec

QinetiQ

Legal&General

Shell

Mountview Estates

AG Barr

BAE Systems

JP Morgan China Growth

European Asset Trust

Vodafone

M&G

CMC

Concurrent Technologies

Orsted

Morgan Advance Materials

Helium One

Ferrexpo

Investec

Ninety One

Mercadolibre

Glencore

Investment trust portfolio Table: Shares magazine • Source: Investor's own records

SOURCES OF INFORMATION

Sarah also gets financial information and ideas from AJ Bell investor evenings, from Shares and other titles targeted at private investors, Bloomberg, national newspapers and AGMs (annual general meetings). She also follows highprofile investors Ian Cowie and John Lee, Baron Lee of Trafford.

Sarah says she has had both good and bad experiences with investing. Prior to managing her own money, she was invested in a commercial property REIT (real estate investment trust) which was trading at all-time-high but has subsequently

JP Morgan Claverhouse

JP Morgan US Smaller Companies

WS Blue Whale

Stewart Inv

JPM Emerging Markets

iShare Physical Gold

iShare Core S&P ETF

iShare Core FTSE 100 ETF

HSBC Japan Index

Fidelity US Quality Income ETF

Fidelity Asian Smaller Comms

Y Acc

BNY Mellon Asian Income

BlackRock European Dynamic

fell by 45%.

‘Fortunately, the REIT pays a good dividend. I refuse to sell it until the share price goes up. This purchase is an example of a REIT being bought at the wrong time, and without my knowledge.’

There have been success stories too, as Sarah explains: ‘I recently bought Concurrent Technologies (CNC:AIM) after reading an article in the Financial Times and the shares have gained more than 100% over the past year.’

LONG-TERM GOALS

Sarah would like to grow the value of her ISA,

retain a steady income, reduce her holdings and concentrate on fewer shares. She also has some advice which she tries to follow herself and which believes could be helpful for others. ‘Don’t be frightened to sell a stock when it falls in value, or to take a profit. Don’t be frightened of sitting on cash. Never invest in a company that you don’t understand. Never buy a stock tip without doing your research and, finally, keep it simple,’ she concludes.

DISCLAIMER: Please note, we do not provide financial advice in My Portfolio articles, and we are unable to comment on the suitability of the subject’s investments. Individuals who are unsure about the suitability of investments should

consult a suitably qualified financial adviser. Past performance is not a guide to future performance and some investments need to be held for the long term. Tax treatment depends on your individual circumstances and rules may change. ISA and pension rules apply.

AJ Bell referenced in this article owns Shares magazine. The author (Sabuhi Gard) and editor (Tom Sieber) of this article own shares in AJ Bell.

By Sabuhi Gard Investment Writer

WE WANT TO HEAR FROM YOU

We are looking for individuals or couples to share their experiences of managing their own investment portfolios.

If you would like to take part, we want to know why you chose certain stocks, funds or bonds, why you might have subsequently sold some of them, and what you hope to achieve from investing.

We will pay £50 in John Lewis vouchers as a thank you to anyone whose story is published in the digital magazine.

Drop us a line with your name and two lines describing your investment experience. For those picked to feature in the magazine, we’ll be in touch to get the full story.

CONTACT: shareseditorial@ajbell.co.uk with the words My Portfolio

DISCLAIMER: Shares/ AJ Bell does not provide advice or personal recommendations. The My Portfolio articles are for information only. You must do own research and consider your own personal circumstances before making investment decisions.

My Financial Life – why thinking about your financial goals in your 20s is a smart move

It’s important to enjoy your first full decade of adulthood but starting early with saving and investing can really pay off

AJBell‘s Money Matters campaign aims to help all women feel good about their financial futures whatever their age and this is one of a series of articles targeted to help women at different points in their lives.

Your 20s is a time of discovery, of freedom and of huge change. It’s also a decade that comes with a slew of new demands on your finances which is why many of you may think that even the thought of investing for anything beyond the next few years is frankly unrealistic.

BIG CHANGES OVER THE LAST THREE DECADES

But the fact you are even reading this is testament to how much has changed for women over the past 30 years or so, and how attitudes to finance have evolved.

I’m thinking 30 years because I’m writing this from the perspective of a 50-something woman and remembering what my finances looked like in my 20s and wishing someone had shared a few tips that could have made a huge difference in the years

ahead.

First, let’s talk about good habits because I had more than my fair share of not so good ones. I grabbed hold of every opportunity, I travelled, I lived in six different cities in the space of eight years and if I didn’t have the cash to make any of those things work, I stuck it all on a credit card, figuring that my future self would have it together enough to deal with all that debt.

Making the most of opportunities is something I will never regret but I wish I’d been more thoughtful about how I made my money work because it would have made my 30s a lot less financially fraught.

Creating a savings cushion would have been a smart way to start as would paying off debt rather than letting it build. Back then those clever bank budgeting tools didn’t exist, but using tech to help you keep track of your day-to-day spending can be an eyeopener, and paying attention to all those subscriptions can also help you pare back those you can do without.

When I got my first proper job auto-enrolment

didn’t exist, so I didn’t start paying into a workplace pension until I was almost 30. That’s almost a decade of lost opportunity.

SMALL AMOUNTS EARLY ON MAKE A BIG DIFFERENCE

Even small amounts invested in your early 20s will make a huge difference to your pot because of the amount of time those funds will have in the market, so try and squirrel away as much as you can as early as you can, even boosting your contribution by 1% is a massive boon in your 20s, especially if your employer will match it.

And this is the time you can stand to be more adventurous with your investment choices, but perversely you’ll probably feel you don’t know enough to be adventurous, and many women miss out on this opportunity to supercharge their savings and investments.

Women in particular say they don’t want to risk losing money so they’d rather keep their pot in cash, even if over time the value of that cash might be eroded by inflation especially as interest rates fall.

Investing often feels like a completely alien concept so maybe try to think of it in terms of something that does compute – like a boat trip. If you’re on a short ferry hop and the sea is rough, you’re probably going to reach your destination feeling a bit queasy, but if you’re on a monthlong cruise and one day in the middle of the 30 is choppy you’re probably not going to dwell on it.

MAKING THE MOST OF COMPOUNDING