GREAT AIM STOCKS TO BUY NOW

05 EDITOR’S VIEW

Why straight-talking Morgan Sindall is trading at a new record high

07 Crude surges from multi-year lows on Iran-Israel tensions 08 Bellway update has helped lift the gloom towards housebuilders 09 Gaming stocks enjoy revival as Nintendo Switch 2 is launched

Renold shares jump above offer price on speculation of a rival bid 10 Recruitment firm Robert Walters falls to post-pandemic low 11 Babcock doubles in less than six months as expectations for military expenditure build 12 FedEx guidance will be under scrutiny after back-to-back profit downgrades

IDEAS

Consumer goods goliath Haleon offers growth at a reasonable price 15 Buy NextEnergy Solar for its dividend compounding potential

18 Why tricky call on Entain lands on stick, not twist

Bond vigilantes bare their teeth as US long-term yields rise

COVER STORY Great AIM stocks to buy now The best of the junior market as it turns 30

Three important things in this week’s magazine

Celebrating 30 years of AIM

London’s junior market was launched this very day in 1995 with just 10 companies. We look at how the market has evolved, its ups and downs, and what might lie ahead for this ‘growth incubator’.

Why bond investors see yields going up

US treasury yields keep edging higher, despite the market factoring in two more rate cuts from the Federal Reserve this year, which suggests investors are concerned about the deficit, inflation, or both.

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

RC Fornax shares halve as defence review delays drive revenue warning 1 3

Why takeovers are no substitute for long-term capital appreciation

UK stocks are flavour of the month at the moment – valuations are cheap, interest rates are coming down and companies are generally in good health – but the constant stream of M&A is ‘hollowing out’ the market.

Costain shares hit five-year high on new £10 million buyback

Entain shares jump 10% to top of the FTSE 100 on raised outlook

Why straight-talking Morgan Sindall is trading at a new record high

Construction group lets an increasingly attractive story speak for itself

After nearly two decades of interviewing executives from businesses across the market cap scale from minnows to FTSE 100 firms you get a sense when someone is looking to ramp up their prospects beyond any level of credibility to inflate their share price and when someone is prepared to let the story speak for itself.

There’s nothing wrong with being an enthusiastic advocate for your business but typically it is those companies whose leaders adopt an understated approach which thrive – under-promising and overdelivering being a key component of the successful management of a public company.

One interviewee I’ve found refreshingly free of any artifice is John Morgan, chief executive of construction group Morgan Sindall (MGNS). Morgan co-founded Morgan Lovell in 1977 which then merged with William Sindall in 1994 to form today’s entity.

Morgan’s answers are always short and to the point, its results are largely free from the adjustments which litter other company’s numbers, and interestingly the group almost entirely eschews M&A in favour of pursuing organic growth. Bolt-on acquisitions can be part of a firm’s toolkit but if a company can grow organically without recourse to lots of deals then its generally an encouraging sign.

Growth certainly hasn’t been a problem for Morgan Sindall, which has more than doubled its revenue over the last 10 years and delivered a seven-and-a-half-fold increase in pre-tax profit.

Apart from the fit-out business, which has relatively limited visibility, the other parts of the group benefit from long-term contractual relationships which make their revenue streams fairly predictable.

Having highlighted the shares in last week’s big feature on mid caps, it was gratifying to see Morgan Sindall serve up such a peach of a trading update on 17 June.

Source: LSEG

The stock hit new all-time highs as the firm flagged continuing strength in trading for the fit-out arm and a better-than-anticipated showing for its construction operations with profit expected to ‘significantly’ beat full-year forecasts.

It’s birthday time for the UK’s junior market AIM – which as it turns 30 seems to be enduring the relatively recently recognised phenomenon of a ‘quarter-life crisis’.

That said there are still plenty of excellent businesses to be found and Shares has identified a quartet of names worthy of your attention in our cover piece this week.

We’ve also talked to current AIM directors and a small-cap fund manager to get a broader sense of how the market’s problems might be addressed. Finally, congratulations to Chris Bromby who was first out of the hat in our competition to win a copy of The Meaningful Money Retirement Guide. Thanks to everyone who entered.

Morgan Sindall

WATCH RECENT PRESENTATIONS

Visit the Shares website for the latest company presentations, market commentary, fund manager interviews and explore our extensive video archive.

Fidelity European Trust (FEV)

Natalie Briggs, Investment Director

Fidelity European Trust (FEV) aims to be the cornerstone long-term investment of choice for those seeking European exposure across market cycles. The Trust invests predominantly in continental European equities (and their related securities) and up to 20% of gross assets may be invested in companies outside of the continent. It follows a consistent bottom-up approach, seeking to identify companies able to grow dividends over a three to five-year horizon.

abrdn Equity Income Trust (AEI)

Thomas Moore, Investment Manager

abrdn Equity Income Trust (AEI) The aim of the abrdn Equity Income Trust is to deliver equity income using an index-agnostic approach focusing on best ideas from the full UK market cap spectrum. Evaluate changing corporate situations and identify insights that are not fully recognised by the market.

North American Income Trust (NAIT)

Fran Radano, Fund Manager

North American Income Trust (NAIT) aims to invest in US companies that are either producing income today or growing for income tomorrow. Recognised for its capital growth, the North American market also generates over a third of the world’s dividends. The trust’s experienced managers seek out companies that are turning the region’s innovative ethos into real returns for investors.

Crude surges from multi-year lows on Iran-Israel tensions

Oil prices are back at levels last seen in January thanks to escalating tensions between Iran and Israel. This is an unpredictable and fast-moving situation which could have implications for the performance of the FTSE 100, inflation and much more besides.

Prior to the exchange of missiles between the two countries, oil was trading at multi-year lows thanks to concerns over global demand as tariffs threaten economic growth and amid rising production from producers’ cartel OPEC+.

These factors largely remain in place, so an easing of tensions would likely put oil on the back foot. As evidence of this truth, speculation president Donald Trump might seek to broker a ceasefire as he left a G7 meeting early on 16 June saw crude slip back before denials from the White House sent it higher again.

However, should there be a direct impact on Iran’s two million barrels of oil per day of oil and fuel exports or, more seriously, an impact on the Strait of Hormuz through which around 20% of global supplies of oil and liquefied natural gas pass, then energy prices could move yet higher. This would have a significant impact on inflation.

Fundamentally, a high oil price acts as a tax on growth through its impact on economic activity as consumers and businesses bear the financial costs. There have already been warnings from UK motoring organisations of a higher price at the pump as a result of higher wholesale energy prices.

Shore Capital analyst James Hosie says: ‘A more benign outcome for energy markets would include other OPEC+ members (notably Saudi Arabia) raising oil production to offset any disruption to Iranian exports, and non-OPEC production (notably

US shale) responding to price signals, if necessary. Such an outcome could then lead to oil markets reverting to concerns about weaker demand growth and the need to accommodate additional OPEC+ volumes.’

Another offshoot of an oil price rally could be a stock market revival for oil and gas companies.

Investment bank Berenberg comments: ‘The global energy sector has progressively derated relative to the global equity market over the last two years alongside falling oil prices. This means that energy is back to its lowest valuation levels. This valuation support has often been a good time to raise exposure to the sector.’

Oil majors BP (BP.) and Shell (SHEL) have a combined weighting of around 10% in the FTSE 100 so the index may be somewhat sheltered from wider market volatility if oil prices were to spike even higher. [TS]

Bellway update has helped lift the gloom towards housebuilders

with the second half of 2024.

After drifting steadily lower for the last five years, it looks as though the FTSE 350 Household Goods & Housebuilders index has turned the corner this year.

Admittedly, sentiment took a big hit from the MJ Gleeson (GLE) profit warning on 3 June, but it recovered a week later thanks to an upbeat report from rival builder Bellway (BWY) on 10 June.

Gleeson blamed ‘headwinds’ in the new-build market and a lack of disposal gains for lowering its full-year margin and earnings outlook, saying the pace of the recovery in sales wasn’t enough to offset increased build costs, flat selling prices and the continued need to use incentives.

As a result, the Newcastle-upon-Tyne developer lifted its annual completion forecast and its estimate of average selling prices, with chief executive Jason Honeyman assuring investors the firm was ‘on track to deliver strong volume growth in volume output and profits in the full financial year’.

In contrast, Bellway said it had enjoyed ‘robust’ trading over the Spring selling season and an increase in reservation rates this year compared

Bellway noted consumer confidence had increased, and ‘improved affordability’ was creating what it called a ‘sustainable’ rise in private reservations, while the use of incentives was stable and buildcost inflation was in the low single digits. Depending on which building society’s survey you look at, the average UK House price is either marginally lower (Halifax) or marginally higher (Nationwide) since the start of the year, while transaction levels spiked in March as buyers brought forward their purchases to avoid increased stamp duty costs.

The Nationwide says mortgage approvals data ‘suggests market activity appears to be holding up well following the end of the stamp duty holiday, and despite wider economic uncertainties in the global economy, underlying conditions for potential home buyers remains supportive’.

In turn, the Halifax says the market ‘appears to have absorbed the temporary surge in activity over spring, which was driven by the changes to stamp duty,’ and while affordability remains a challenge, with house prices still high relative to incomes, lower mortgage rates and steady wage growth ‘have helped support buyer confidence’.

Source: LSEG

The key takeaways from both societies’ recent surveys, for us, are that low unemployment, rising earnings, strong household balance sheets and the prospect of lower borrowing costs as the Bank of England cuts interest rates should mean higher prices and transaction volumes in the second half of 2025, which will be good for the new-build market as well as the existing-home market. [IC]

Gaming stocks enjoy revival as Nintendo Switch 2 is launched

Frontier Developments and Everplay shares gain 53% and 13% respectively over the past month

Aperiod in the sun during the pandemic, when alternative sources of entertainment were closed off to people, has been followed by a more difficult period for the video games industry.

However, there have been some recent signs of life in the sector, perhaps most notably with the reception for the launch of a new games console by Nintendo (7974:TYO).

Eight years after the original launch of the Switch in 2017, which saw Nintendo rake in sales of 2.7 million in the first month, Nintendo bettered this figure with 3.5 million global unit sales of Switch 2 in just the first four days after its release on 5 June showing that consumer appetite is still strong despite stretched budgets.

‘Nintendo Switch 2 is off to a strong start relative to the company’s plan to sell 15 million units in its first year,’ note analysts at investment bank Jefferies.

They add: ‘To support the launch, Nintendo worked closely with retail partners to ensure ample supply, though demand has still exceeded expectations. We note several major retailers showed the console out-of-stock online, per our checks.’

There have also been positive recent

Nintendo Switch 2 flies off shelves

Nintendo Switch 2 flies off shelves

Switch 2: Sales in four days since launch 3.5 million units

Switch 2: Sales in four days since launch 3.5 million units

Switch: Sales in first month 2.7 million units

Switch: Sales in first month 2.7 million units

Source: Nintendo, IGN

Source: Nintendo, IGN

developments at two UK-listed games developers, Frontier Developments (FDEV:AIM) reporting a robust set of results on 11 June.

Analysts at Panmure Liberum comment: ‘Cash conversion has also been stronger than anticipated and the company has circa £42.5 million at the end of May, £10 million of this will be returned to shareholders through a new buyback programme (circa 9% of market cap).’

The company also revealed the October release date for the third instalment of the critically acclaimed JWE (Jurassic World Evolution) game following the Jurassic World: Rebirth movie set for release in early July. The momentum created by these developments sent the shares more than 50% higher over the last month.

Meanwhile Everplay (EVPL:AIM) (formerly known as Team 17) has, despite the swift departure of CEO Steve Bell, chalked up double-digit gains over the same period, as it reassured investors on its full-year outlook and announced a maiden dividend.

Katie Cousins, analyst at Shore Capital observes: ‘Whilst the backdrop remains somewhat challenging with continued consumer pressures, the underlying market trends are expected to be supported by the Nintendo Switch 2 console launch as well as a healthy outlook for game launches.

‘We believe that Everplay’s long-running reputation within the gaming industry and the diversity of the portfolio model, which reduces reliance on individual title performance, leaves it well positioned for further growth.’ [SG]

Renold shares jump above offer price on speculation of a rival bid

Since 2021 the company has grown revenue by 46% and operating profit by 160%

Industrial chains maker Renold (RNO:AIM) has seen its shares more than double since early March 2025 driven by private equity interest in the business.

The company revealed it had received two separate unsolicited approaches on 29 May, pitched at 77p and 81p per share respectively, from MPE (Morganthaler Private Equity) and a consortium comprised of Buckthorn Partners and One Equity Partners, equating to a 50% premium.

Management announced an agreed deal with MPE on 13 June at 82p per share, valuing the business at £186.7 million.

The share price jumped by 11% to 85p, approximately 5% above the

agreed offer price amid huge trading volume, suggesting the market suspects a higher counterbid may be in the offing.

After all, the competing consortium only need to improve their 81p offer by 1p to match MPE, while if they increased their offer by the same magnitude, it implies a price around 85p per share.

While the shares have enjoyed a strong run and trade at their highest level in a decade, the valuation of the business is still very modest, trading on a single digit PE (price to earnings) ratio.

Recruitment firm Robert Walters falls to post-pandemic low

Second-quarter trading update seems unlikely to lift the gloom

It has been a tough start to 2025 for investors in recruitment firms, and particular for those holding Robert Walters (RWA), with the shares down exactly one third at the time of writing, at a 10-year low of 210p.

The fact the stock is trading even lower than it did during the pandemic sell-off in 2020 suggests the outlook for the staffing sector is worse than it has been for a long time.

and rival Pagegroup (PAGE) warned economic uncertainty was impacting both client and candidate confidence leading to lower net fee income and profits.

In March, both Robert Walters

In April, the firm reported another quarter of double-digit decline in net fee income for the three months to March due to the weak sentiment in 2024 extending into this year, while cautioning the increased uncertainty in global trade flows following Liberation Day would likely be ‘a further headwind to confidence, limiting visibility on the outlook for the balance of the year’.

The company is due to publish

Source: LSEG

The low valuation is one reason behind the board’s decision to recommend the acquisition to shareholders.

‘The directors believe the longterm potential of the group, as a market-leading growth business in a fragmented industry, has not been adequately reflected in the price and valuation rating,’ the company argued, adding that investor sentiment towards UK smaller companies remained ‘subdued.’ [MG]

LSEG

its second-quarter trading update in mid-July, and unless trading has improved a great deal in the interim – which at this stage seems unlikely –we suspect the shares will to continue to drift. [IC]

UK UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

23 June: One Health Group

24 June: Foresight Environmental Infrastructure, Telecom Plus

25 June: Babcock, Berkeley, Duke Capital, Liontrust, Marks Electrical, ProCook

26 June: Cake Box, Moonpig INTERIMS

24 June: LBG Media

25 June: Velocity Composites

TRADING ANNOUNCEMENTS

24 June: SThree

26 June: Time Finance

Babcock doubles in less than six months as expectations for military expenditure build

Equity investors have used defence stocks to go on the offensive in recent months as geopolitical tensions flare and governments around the world reappraise their national and international security spending.

This year, four of the 10 best performing FTSE 350 stocks come from the defence industry, while a similar story is playing out across US and European stock markets, a response to president Tump’s redrawing of the global world order.

In early June, the UK government announced its Strategic Defence Review, aimed at moving the UK to a position of ‘war fighting readiness’, perhaps a worrying toll that conflicts in Ukraine, the Middle East and elsewhere are extracting.

Even so, for a FTSE 100 stock to double in less than six months is a rarity, yet that is the case with Babcock (BAB), the British aerospace, defence and nuclear engineering services company that specialises in managing complex assets and infrastructure.

Babcock shares have surged 108% so far in 2025, and are up 60% in the

the market expects of Babcock

What the market expects of Babcock

What the market expects of Babcock

Source:

Source: LSEG

past two months.

It’s a sharp rally even by previous bolstered defence spending standards, and it now puts the stock on a 12-month rolling PE (price to earnings) of more than 20.

This puts the company under significant pressure to show tangible signs of an improved sector outlook when it reports full-year results for the 12 months to 31 March 2025 on 25 June.

While this may not show up in the numbers themselves, which largely cover a period before the big shift in US foreign policy which encouraged European countries to prioritise their own defence, it may have to be reflected in the outlook if the share price momentum is to be maintained. [SF]

Babcock International (p)

FedEx guidance will be under scrutiny after back-to-back profit downgrades

Logistic giant’s shares are down 20% this year against a 3% gain for the S&P500

The world’s largest express-parcel delivery firm FedEx (FDX:NYSE) is due to report earnings for the fourth quarter and the full year to the end of May on 24 June, and there is a lot hanging not just on the results but also the outlook.

Six months ago, the firm lowered its revenue growth forecast for the fullyear from a low single-digit increase to flat, and cut its EPS (earnings per share) guidance from around $18 to between $16.45 and $17.45 before accounting adjustments for its markto-market retirement plans.

The company also said it would spin off its FedEx Freight division, which generated around 10% of group revenue in the year to May 2024, through a separate stock market listing.

Three months ago, the firm revised its revenue growth forecast down again, from flat to ‘slightly down’, and cut its EPS guidance to a range of $15.15 to $15.75, or 14% lower at the mid-point than its original forecast.

What the market expects from FedEx

The group also lowered its capital spending target for the year to May by $300 million to $4.9 billion saying it would prioritise network optimisation and improved efficiency, including facility modernisation and automation. Unsurprisingly, brokers have lowered their price targets across the board, from the most bullish (Barclays, which cut to $330) to the most bearish (Morgan Stanley, which went to $200).

Morgan Stanley’s Ravi Shanker expects fourth-quarter EPS to disappoint at $5.33 compared with the consensus of $5.99, due to a combination of factors including rising input costs, fewer operating days, weakness in B2B volumes and the impact of tariffs on imported goods from April.

Shanker also expects margins to disappoint, especially in the Express and the Freight divisions, as lower volumes and a lack of demand offset the firm’s self-help initiatives.

Source: LSEG

With a street-low price target, the analyst argues FedEx’s risk-reward profile is firmly skewed to the downside unless management can give a clearer, more positive outlook for the core business this time around. [IC]

Consumer goods goliath Haleon offers growth at a reasonable price

The Panadol-to-Sensodyne supplier’s pricing power and structural growth opportunity remain mispriced

Haleon (HLN)

390.9p

Market cap: £35.6 billion

Geopolitical turbulence and Donald Trump’s tariffs mean uncertainties abound for investors, with the outlook for global markets and economies likely to remain unclear for some time to come.

Given this backdrop, savvy portfolio builders should increase their exposure to high-quality, cash-generative large-caps whose earnings have a defensive bent.

One shining example is Haleon (HLN), the worldleading consumer health company with a strong brand portfolio, a long trajectory of global growth and progressive dividends ahead as well as limited exposure to tariffs.

Despite delivering market share gains since its July 2022 demerger from GSK (GSK), driven by high levels of brand investment, and deploying its strong cash flows to pay down debt, Haleon’s £43.6 billion enterprise value remains some 13% below the £50 billion bid for the business from Unilever (ULVR) spurned by GSK back in 2021.

This suggests the market continues to underappreciate the resilience and growth potential of Haleon, which is better placed to win in its marketplace as a focused standalone business.

HIGH-QUALITY GROWTH

Guided by chief executive Brian McNamara and with former Tesco (TSCO) boss Dave Lewis in the chair, Haleon is the consumer health outfit behind an array of trusted headache tablet and toothpaste brands.

The £35.6 billion-cap is one of the globe’s largest providers of specialist oral health through Sensodyne, Parodontax, Polident and Aquafresh,

and manufactures respiratory products including cold and flu relief Theraflu and pain relief products including Panadol, Voltaren and Advil, not to mention its portfolio of vitamins, minerals and supplements such as Centrum.

Haleon’s attractions include earnings resilience and pricing power, reflected in gross margins north of 60%, and the company offers exposure to one of the fastest-growing segments of the wider consumer staples sector, since the outlook for the consumer health industry is underpinned by structural tailwinds including ageing populations, growing middle classes in emerging markets, overwhelmed public health systems and unaddressed consumer needs.

Highly fragmented, the global consumer health market is ripe for consolidation by companies such as Haleon with differentiated brands, and the FTSE 100 group has opportunities to tap into trends including premiumisation in emerging markets such as China, India and across Latin America.

Haleon’s supply chain optimisation programme is expected to unlock cumulative gross savings of £800 million by 2030, and should strengthen its manufacturing footprint in key emerging markets such as China and India.

HEALTHY RETURNS

Haleon is a top 10 holding in the Edinburgh

Haleon's revenue and earnings are showing robust growth

Haleon's revenue and earnings are showing robust growth

Source:

Investment Trust (EDIN) managed by Imran Sattar, who attended the company’s Capital Markets Day (1 May) and believes Haleon is ‘a lovely niche business’ and ‘far and away the best consumer goods business available for a UK investor’.

Sattar tells Shares the structural growth dynamics in over-the-counter consumer health are ‘very powerful’ and stresses Haleon is ‘long duration, which we really like, because often the market gets the growth rate right for years one and two but often fades the growth down over years three to 10, and we think Haleon has the potential to grow at very attractive rates for a very long period of time’.

When buried within GSK, Haleon ‘essentially operated a bit like a pharma company, but the products it sells are very low risk,’ explains Sattar, ‘so we think there are interesting opportunities to improve Haleon’s commercial organisation and years and years of margin growth to come.’

Analysts at Berenberg believe Haleon is entering ‘a new era of growth and increased shareholder returns’, forecasting best-in-class annual organic sales growth of 5.8% for 2025 through to 2030.

have strong market share

With the company’s leverage expected to reach management’s target of 2.5 times net debt to EBITDA (earnings before interest, tax, depreciation and amortisation) by the end of 2025, the broker now forecasts £750 million in share buybacks for 2026, rising to £1.5 billion in 2029, on top of progressive dividend payouts.

Based on Berenberg’s estimates for the next three years, Haleon’s forward price-to-earnings ratio drops from over 20 times to a more palatable 17 times on 2027 forecasts.

‘As growth in the consumer staples sector becomes scarcer, we view the stock’s multiple as undemanding for a company offering 5.8% medium-term like-for-like sales growth,’ say the analysts, who forecast net debt/EBITDA falling from 2.5 times in 2025 to 1.5 times in 2030, which will leave room for potential bolt-on acquisitions in ‘strategic growth spaces’. [JC]

Source: Berenberg

Buy NextEnergy Solar for its dividend compounding potential

This renewables trust has a strong pipeline of development projects worth more than £500 million

NextEnergy Solar (NESF) 71p

Market cap: £324 million

Specialist solar energy and energy storage fund NextEnergy Solar (NESN) is one the biggest yielders in the FTSE 350 index offering a prospective yield of nearly 12%.

Often a double-digit yield is a warning signal of a looming dividend cut but there are reasons to think that is not the case here.

Since listing on the market in 2014, the company has paid out a cumulative £395 million in dividends, an amount almost equivalent to the company’s current market capitalisation.

Over the same period the fund has delivered a total shareholder return above the FTSE All-Share total return index.

The company has met its target dividend for 11 straight years and recently (16 June) declared a target dividend for the year to the end of March 2026 of 8.43p per share, up 1% and forecast to be covered within a range of 1.1 times to 1.3 times.

Despite a successful capital recycling programme which has demonstrated consistent asset sales at prices above NAV (net asset value), as well as a share repurchase programme, the shares trade on an unwarranted 26.4% discount to NAV.

As Shares argued in a recent article on the attractions of infrastructure and renewables sector, headwinds facing the sector are dissipating while ‘self-help’ measures and increasing corporate activity could work to unlock the value on offer.

NextEnergy Solar (p)

Source: LSEG

not rise over the next five years, but the discount to NAV narrows to zero.

Merely compounding the 12.6% dividend each year gives prospective shareholders an 81% return (1.126 x 1.126 x 1.126 x 1.126 x 1.126). If the discount disappears in year five, that adds a further 26.4%, taking the total price return to 228% or a high teens percentage annualised return.

It is important to point out this an illustration only rather than a projection, but it does highlight the value of compounding dividends and the potential value on offer for patient, disciplined investors.

Just to give an idea of the value on offer and potential shareholder return for NextEnergy, let’s conservatively assume the dividend and NAV do

SELF-HELP MEASURES

The company has taken actions to narrow the discount along with other companies in the sector. The board has also indicated it is open to all strategic options to unlock value for shareholders.

Before looking at the actions taken, it might be useful to sketch a picture of the company’s assets.

NESF operates a diversified portfolio of around 100 assets and most of the cash flows from them are

inflation-linked through UK government subsidies.

The investment manager of the trust is one of the world’s biggest specialist solar investors with around £3.9 billion of assets under management worldwide.

The portfolio has a total installed capacity of 937MW (megawatts) with a remaining weighted average life of just under 25 years. Over the year to March 2025, the assets generated 830GWh (gigawatt hours), which fell around 5% short of budget, mainly due to adverse weather and outages.

Three out of the four phases of the company’s capital recycling programme have been completed, raising £72.5 million and leading to an uplift in NAV of 2.76p per share in the year to 31 March.

cost or spread over short term interest rates. Total debt stands at £490.6 million, representing gearing of 48.4%. This relatively high level of borrowing is an area of risk for prospective investors to weigh.

The £20 million share repurchase programme announced in June 2024 is 75% complete with roughly 15 million shares purchased at an average price of 74p, creating an NAV uplift of 0.5p per share.

The company consolidated its revolving credit facilities into one £205 million facility, at a reduced

Reinvesting dividends can allow you to reap the full benefits of compounding. The great thing about NextEnergy is that pays its annual targeted dividend quarterly, in the middle of February, May, August and November, each year.

The trust has an ongoing charge of 1.17% and the board are in discussions with the manager to reduce fees.

In summary, we believe the shares are attractively valued and do not reflect the company’s track record of a consistently growing, fully covered dividend. There are early signs that the wide discounts in the sector are attracting investor interest amid increasing corporate activity. [MG]

COMPOUNDING

DIVIDENDS

The sooner investors receive each cash dividend, the sooner it can be used to buy more shares in the company. Due to the effects of compounding, this means the achievable yield is even higher than the headline 12% based on the annual

How compounding can increase your yield

The calculation used is to divide the 12% annual yield into four quarters and then multiply them. (1.03 x 1.03 x 1.03 x 1.03) This equates to a yield of roughly 12.6%.

An initial investment of £10,000 would buy 14,285 shares at 70p/share

Looking for investment ideas? Register today

1 July 2025 – 18.00

The Bankers Investment Trust (BNKR) has a long history of providing growth and income returns for its shareholders through the peaks and troughs of the economy and markets. The trust aims to be a core portfolio holding for its shareholders by focusing on finding the best investment ideas globally in a bid to deliver capital growth and inflationbeating income over the long term. The trust looks for the strongest opportunities across four regions, informed by the expertise and perspectives of specialist managers.

Schroder Japan Trust

Schroder Japan Trust (SJG) aims to achieve long-term capital growth by investing in a diversified portfolio of 50-60 of the best quality but undervalued companies in Japan.

Why tricky call on Entain lands on stick, not twist

Gaming firm’s gain to date is tempting but more upside could be on the table

Entain (ENT) 848.8p

Gain to date: 34.6%

Arecent spike in Entain’s (ENT) share price sparked some interesting conversation here at Shares. Up 12% since 13 June, the jump puts paper gains at more than 33% on our original Great Idea from 5 September 2024.

There were several potential catalysts that prompted that pitch – rising pressure from activist investors, fresh leadership, possible sales of parts of the business that don’t really fit, and the possibility that, if trading didn’t improve and trigger the share price re-rating we hoped for, it could easily lead to predators circling again for an opportunistic takeover.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Judging by the recent guidance hike at BetMGM, Entain’s 50-50 joint venture with US casinos giant MGM Resorts (MGM:NYSE), a takeover may not be needed to unlock shareholder value.

In summary, the UK company told the markets

Source: LSEG

that BetMGM’s full year revenue and EBITDA (earnings before interest, tax, depreciation and amortisation) would be stronger than past expectations as encouraging business trends extended from the first quarter into the second, both from sports betting and iGaming.

Full-year revenue guidance has therefore been raised from between $2.4 billion to $2.5 billion to ‘at least $2.6 billion’, while EBITDA of ‘at least $100 million’ is projected for the joint venture, adding credibility to a medium-term $500 million target.

WHAT SHOULD INVESTORS DO NOW?

The key question facing investors now, is how much more share price upside is it reasonable to expect? On the face of it, the stock is not that much more expensive now than nine months ago, with the 12-month rolling PE (price to earnings) currently pitched at 15.8 (according to Stockopedia data) versus 13 then.

In the past, takeover offers of up to £28 per share have been rebuffed, implying what outside buyers have been willing to pay. That said, Entain has a patchy performance track record and execution risks remain in a highly competitive industry.

While it might be tempting to take profits now, we believe this is still an investment story that has plenty of scope to run. On balance, we think investors should stick with Entain. We’ll be watching closely over the coming weeks and months. [SF]

Bond vigilantes bare their teeth as US long-term yields rise

Only a downside surprise on jobs may move the Fed to lower rates, much to Trump’s disappointment

Eagle-eyed investors may have noticed something strange going on at the long end of the US treasury market, where 30year yields recently breached 5% to reach their highest level since 2007.

This may sound counter-intuitive given the Federal Reserve started cutting official interest rates in September 2024 in response to cooling inflation. After peaking at 5.5% The Fed has lowered interest rates by a full percentage point to 4.5%.

Market implied interest rates suggest the Federal Reserve will remain on hold until September 2025, then lower short-term rates by another percentage point by the end of the year, although the market remains volatile.

Yet since the Fed’s rate cutting cycle began, 10year treasury yields are roughly three quarters of a percentage point higher at 4.5% and 30-year yields are a full percentage point higher at 5%.

There are several factors which can influence longer-dated bond yields, but consensus suggests the two most important are medium-term inflation expectations and worries over persistent and rising national debts.

In other words, investors in long bonds are demanding a ‘term premium’ to compensate them for the risk inflation remains sticky and the likelihood of more bonds being issued to finance increasing government debt.

Investors looking for evidence of tariff-induced inflation in the May CPI (consumer price index) report on 11 June were disappointed after the print came in lower than expected at 0.1%, which suggests US companies are absorbing some of the impact in their margins.

On an annual basis, inflation ticked up to 2.4% from 2.3% in the prior month. Less encouraging for the Fed was an uptick in ‘super core’ inflation, which takes services inflation minus shelter (housing) costs.

With Donald Trump’s ‘Big Beautiful Bill’ making its way through Congress, potentially adding trillions to the national debt, and the government running a 6.5% budget deficit at a time of full employment, some prominent investors have sounded the alarm.

Speaking at the Bloomberg Global Credit Forum on 12 June, Doubleline Capital chief executive Jeffrey Gundlach warned of ‘a reckoning’ for US debt, which he believes has become ‘untenable’ and may lead investors to move out of dollar-based assets.

Jamie Dimon, head of JPMorgan Chase (JPM:NYSE), has also warned the bond market will ‘crack’ if the government doesn’t get a grip on the deficit.

US treasury secretary Scott Bessent, on the other hand, insists rising bond yields reflect the view the

US economy could see an acceleration in growth driven by deregulation and tariffs.

The problem is, higher long-term yields push up the cost of financing, and for the first time in its history, last year the US spent more servicing its debt ($881 billion) than on defence ($850 billion).

Martin Gamble Education Editor

GREAT AIM STO CKS TO BUY NOW

The best of the junior market as it turns 30

By Ian Conway Deputy Editor

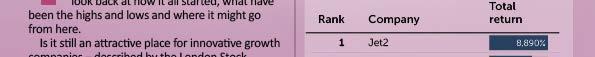

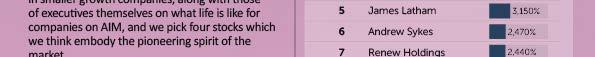

Three decades ago, the Alternative Investment Market – or AIM for short –was launched. In this article we take a look back at how it all started, what have been the highs and lows and where it might go from here.

Is it still an attractive place for innovative growth companies – described by the London Stock Exchange as ‘the lifeblood of the global economy’ –to raise vital equity capital and trade their shares?

We get the views of a fund manager who invests in smaller growth companies, along with those of executives themselves on what life is like for companies on AIM, and we pick four stocks which we think embody the pioneering spirit of the market.

ROLLING BACK THE YEARS

AIM was launched 30 years ago to the day, on 19 June 1995, as a junior market to replace the USM (Unlisted Securities Market) and attract smaller, less-developed companies than those traded on the main market.

With a ‘light-touch’ regulatory system, AIM in theory offered a more flexible way for nascent companies to raise capital and the exchange started out with 10 companies valued at a collective £82 million.

Of those 10 firms, just one is still quoted –Athelney Trust (ATY) – but it is no longer on AIM and couldn’t be described as a roaring success given its current market capitalisation of less than £5 million.

Most of the rest – Brancote, Dawson Holdings, Country Gardens, Gander Holdings, Lorien, Norholmes and Old English Pub – were taken over, while Formscan changed its name to Inspectron before leaving AIM in 2009, and Norcity II went into liquidation not long after joining the market.

That’s not to knock the market’s achievements – since its inception it has helped more than 4,000 companies raise nearly £136 billion in financing, benefitting their staff, customers, investors and local economies.

In 2024, companies on AIM raised £1.6 billion, while the average market cap was just over £100 million and the average post-IPO price performance was 47%.

A recent study by Grant Thornton calculated that in 2023, AIM companies supported over 770,000 jobs and contributed £68 billion of ‘gross value added’ to the UK economy, with the average AIM company contributing more than £87,000 of GVA per employee against a national average of just over £58,000 per employee.

WHAT IS LIFE ON AIM LIKE?

The London Stock Exchange promotes AIM as ‘built for smaller companies’, with simple requirements including no minimum free float, no minimum market cap and a minimal financial track record.

Benefits include ‘funding from a range of investors to support your organic expansion’ and the ability to ‘promote your company’s brand and story on an international scale and access new opportunities’, all within

a respected, balanced and fair regulatory environment and legal framework ‘so you can get on with running and growing the business’.

In that case, why have so many companies, this year alone, decided being on AIM doesn’t work for them and subsequently delisted their shares, leaving small investors stranded?

The three main reasons firms have given for leaving AIM are the cost of listing, the burden of regulation and the lack of liquidity in their shares.

Shares canvassed the opinions of a handful of highly placed executives at several AIMquoted firms, and the answers were extremely revealing.

The chief executive of one company, which has been on AIM for 20 years, said: ‘The annual cost of maintaining a quote, including exchange fees, is around £750,000. Over 20 years, that’s £15 million which I haven’t been able to pass on to my shareholders.’

Meanwhile, in terms of regulation, the gap between the junior market and the main market has become narrower and narrower over the last two decades, and the introduction of the QCA (Quoted Companies Alliance) code of conduct will impose even more burdens and costs on smaller companies.

For those with a small executive team, the administrative burden imposed by AIM means the idea of being free to run and grow their businesses is pie in the sky and nothing more.

As far as liquidity goes, ‘bad news gets amplified on AIM’ says another executive, leading to a vicious circle where buyers step away and trading dries up, leaving sellers and even business owners with little visibility.

Even on a good day, the bid-offer spread on many AIM stocks can be 10% to 15%, compared with fractions of a percentage point for main market stocks, which makes them unsuitable for trading.

Another executive adds ‘There are just too many mediocre companies on AIM,’ which means ‘good companies aren’t fairly valued any more’.

Finally, government changes to the IHT (inheritance tax) regime in the 2024 Budget have made it less attractive for investors to own shares in AIM-quoted stocks. IHT relief was cut by 50% and there are concerns it could be taken away altogether.

AIM ’s economic contribution to the UK (in 2023)

Source: LSEG

Source: LSEG

A FUND MANAGER VIEW

Dan Green, who manages the FTF Martin Currie UK Smaller Companies Fund (B7FFF70), draws around 30% of his portfolio from the AIM market.

He says: ‘Going back to the start of AIM it being 10 stocks and an £80 million market cap to today over 600 stocks and over £60 billion market cap then you’d say its been a massive success over the last 30 years. The last four years in particular have been tricky. The future of AIM has never looked as uncertain as it has today.

‘We’re fairly agnostic about where companies are listed but if you look at the 600 stocks on AIM today we are probably only interested in around 40 or 50. AIM has become more mature, back in the early days only around 30% of the stocks were profitable and 70% are now profitable on AIM.

‘There seems to be this vicious cycle at the moment, with companies feeling the flows are not going to AIM, which results in valuations not reflecting the qualities of the underlying businesses and businesses are being acquired or deciding to exit.’

Looking at companies which have moved from AIM to the main market in the past, Green highlights Alpha Group (ALPH) which listed on AIM in 2017 with a £67 million market cap. It

moved from AIM to the main market in May 2021 and it’s a £1.3 billion company which is now subject to a bid.

Green notes that the ease of raising money, compared with the main market is still a key selling point for AIM. Rosebank (ROSE:AIM) – a venture set up by former executives from one-time turnaround specialist Melrose (MRO) – recently raised £1.14 billion for its first deal –the largest fundraise in AIM’s history.

Green adds: ‘AIM doesn’t really attract any passive funds; they could move AIM into the AllShare and MSCI indices to get passive flows. Tax breaks could be offered on IPO costs to make sure its an attractive place to list.’

‘At the moment we go through the shareholder register and look for the percentage held by IHT funds – changes to the Budget mean flows here have slowed down or stopped. The Government could provide some certainty that the reduced IHT relief will be maintained.’

Green highlights mobile payments company Boku (BOKU:AIM) as an example of an excellent AIM company.

‘Boku is a 20% revenue growth business, it’s profitable and makes 30% operating margins, has cash on the balance sheet and is worth £500 million today. If this listed in the US it could probably be four times that.’ [TS]

OUR TOP AIM PICKS

Anpario (ANP:AIM)

Price – 425p

Market cap: £86.9 million

Growth investors seeking a quality small cap with a track record of topping analysts’ estimates, positive trading momentum at its heels and offering a progressive dividend should buy Anpario (ANP:AIM). The maker of natural sustainable feed additives for animal health, hygiene and nutrition is reassuringly diversified by geography and species, winning market share and widening its moat through investment in innovation, since competitors struggle to replicate its science-backed products.

The £86.9 million is profiting as food producers around the world transition to natural feed solutions and away from banned or toxic feed chemicals and antibiotics and the safety and sustainability of global food production increases against a backdrop of population growth. Crucially, the company is well-placed to limit US tariff impacts following the acquisition of Bio-Vet, which brought Anpario a modern US production facility from which to expand and shift UK production should the need arise; Bio-Vet’s unique technology helping dairy cows recover quicker from the impact of avian influenza is currently in big demand.

Anpario’s forecast-beating results (31 March) for the year to December 2024 revealed a 76% surge in taxable profits to £6.1 million on revenues up 23% to a record £38.2 million. Balance sheet strength is another plus at Anpario, which closed the year with £10.5 million net cash in the coffers, which should enable the company to expand its international presence, explore complementary acquisitions and enhance earnings through share buybacks.

Shore Capital forecasts a rise in pre-tax profit to £6.4 million on £44.7 million revenue this year, building to £6.8 million and £47 million respectively in 2026. Based on the broker’s 29.8p earnings estimate for the current year, and a forecast dividend hike to 11.8p, Anpario trades on a prospective p/e of 14.3, a significant discount to history, and offers a cash-backed yield approaching 3%. Shares sees scope for a significant re-rating, so long as Anpario delivers against its winning strategy and cultivates further earnings upgrades. [JC]

B.P. Marsh & Partners (BPM:AIM)

Price – 671.7p

Market cap: £248.4 million

For the uninitiated B.P. Marsh (BPM:AIM) is a specialist private equity investor in earlystage financial services businesses in the UK and internationally. Chief financial officer Dan Topping says investors should think of the company as a ‘mini-Berkshire,’ referring to the Warren Buffett backed conglomerate which takes a similar approach, and which is also heavily invested in the insurance sector.

Essentially, the company is looking to back management teams and entrepreneurs with credible plans for growth and typically invests around £5 million to take a 20% to 40% stake, with a preference for the rest to be controlled by the management team.

While prioritising high-conviction opportunities, the management is also focused on returning surplus liquidity to shareholders through dividends and share buybacks. The group has a strong track record of growth and has delivered a compound annual growth rate in NAV (net asset value) of 11.1% a year since the business floated on AIM in 2006, and 13.1% a year since inception in 1990.

NAV at the group’s financial year end on 31 January 2025 was £326.4 million, or 847.3p per diluted share. This means the shares trade at an

B.P. Marsh

Source: LSEG

unwarranted discount to NAV of just over 20%. The group delivered a strong year of growth in 2025 with NAV increasing 42.4%, an uplift on the 20.9% growth in 2024. Total return including dividends was 44.2%.

The group is debt free and had cash on the balance sheet of £74.1 million at the period end, equivalent to around 30% of the company’s market capitalisation. In addition to selling at a 20% discount to NAV, the shares trade on a lowly PE (price to earnings) ratio of 5.9 times and offer a dividend yield of 2.2%, covered twice by earnings, demonstrating great value, growth and income. [MG]

Cerillion (CER:AIM)

Price – £15.34

Market cap - £452 million

Regular Shares users will likely be familiar with the Cerillion (CER:AIM) story – we’ve been writing positive things about it since it listed stock on the London market nearly a decade ago at 76p per share with a market cap of just £22.4 million.

And how right we have been to, as the company carved out its reputation on an integrated enterprise billings and customer relationship management software platform sold to medium-sized telecommunication firms. Over the years, it has refined that reputation as a real specialist, expanding the suite to cover charging, interconnect, mediation, and provisioning solutions, moves that are starting to see bigger telecommunication companies join the fold, including Virgin Media.

And that operational progress has paid off for shareholders in spades, the stock recently standing at £19 for a rough £550 million market cap, implying 2,355% growth since. Morningstar calculates compound average growth at 45% a year over the past five (Cerillion’s time as a public company just misses the 10-year data qualification).

That was before founding chief executive Louis Hall decided to flog a chunk of his 30%-plus

stake, announced after the market closed on 11 June, at £15 per share. We imagine that most of Hall’s private wealth is tied up in Cerillion stock, and Shares recent chat with him left us in no doubt about his commitment to the firm’s growth ambitions for the foreseeable future.

‘We continue to view long-term prospects with confidence’, Hall stated alongside recent (19 May) interim results. He has also committed to sell no further shares for at least a year. But selling down his stake to about 25.5% of the company has knocked market confidence, demonstrated by the sharp share price drop on 12 June.

Since no new shares are being issued, there’s no dilution to existing holders, which we believe creates an opportunity to pick up stock at a discounted price when nothing has really changed to the investment case. Long recognised as a high-quality business it has seldom been cheap, but it does mean the 2026 (to end September) PE (price to earnings) multiple is now 27 versus 32 just days ago. Great business, great execution, great opportunity. [SF]

Chart: LSEG

Young & Co’s Brewery (YNGA:AIM)

Price – 965p

Market cap: £594.8 million

Since joining AIM in February 2008, the pubs, and hotels group Young & Co’s Brewery (YNGA:AIM) has had its fair share of ups and downs.

The Covid pandemic was an obvious low and investors have been somewhat nervous of the stock since its acquisition of junior market rival the City Pub Group in November 2023 for £162 million.

Concern about the extra debt this loaded on to the business is understandable but with the integration now complete, Shares believes this premium pub, and rooms operator has proved itself to be a cut about the rest. Essentially, its estate of pubs are smart places people want to go for a night out.

The company reported a robust set of results for the 12 months to 30 March in early June with revenue up 24.9% to £485.8 million like-for-like revenue growth of 5.7% and debt reduced by £19.5 million.

The pubs group is good at rewarding shareholders, raising its dividend per share 6% to 23.06p. This is underpinned by healthy cash generation with a 25% increase in free cash flow for the year to £54.2 million.

This cash has also allowed it to invest in the

business, completing 32 projects this year including five-bedroom upgrades at the Guinea Grill, in Mayfair London and The Libertine in Bournemouth.

Two new pubs have opened also after large investment in Tattenham Corner, Epson and Tellers Arms, Farnham.

Peel Hunt are forecasting 8% growth in pretax profit in the second half of the year (versus the first half) due to new improved drinks contracts and higher like-for-like sales of 7.8%.

Higher costs associated with the increase in the national living wage and employers’ national insurance contributions in last year’s Budget are an obvious challenge but one the group seems to be managing.

‘If the company holds back price increases, as we assume, it should benefit from rising volumes if competitors raise prices more, reduce opening hours, cut staffing and service levels, or just close,’ Peel Hunt adds. [SG] Young & Co (p)

Source: LSEG

What Disney tells us about how we draw investment conclusions

Gabriel Sacks , Co-Manager of abrdn Asia Focus plc

Walt Disney excelled in the art of fairytales. He first demonstrated a talent for them in the early 1920s, when he was still working at the humble Laugh-O-Gram studio, rattling out the likes of Little Red Riding Hood, Jack and the Beanstalk and Puss in Boots.

In the early 1930s, under the aegis of his Silly Symphony series, he produced classics such as The Ugly Duckling, Babes in the Wood and Three Little Pigs. Snow White and the Seven Dwarves, his first full-length animated feature, followed in 1937.

Yet there was one significant area in which Disney did not deal in fairytales: business. He had a vision, and he fulfilled it. He moved on from Laugh-O-Gram, kept expanding and innovating and eventually used the profits from Snow White to establish an empire that remains a major force in film and television today.

This is the stuff of which investors dream. Show us a fledgling company that has a truly compelling strategic plan for long-term growth – and, better still, which is able to successfully carry it out – and we are as happy as Mickey Mouse in a cheese factory.

Unfortunately, such instances are rare. The business world is replete with compelling stories, but many of them turn out to be better suited to a golden-age Disney script than to a golden-age Disney investor relations presentation.

As a result, separating fact from

fiction is a crucial challenge. It can be especially important when weighing up the pros and cons of smaller companies, whose narratives are almost invariably centred on longterm growth, and when surveying the opportunities in emerging markets (EMs), where competition for capital can be unusually intense.

So how does our fund, which specialises in smaller companies in Asia, go about distinguishing fact from fiction? Here are some of the tests, measures and guidelines we apply when searching for the region’s brightest investment opportunities and hidden gems.

• FAVOURING REALITY OVER HYPERBOLE

We first need to accept most Asian smaller companies are unlikely to have a tale as inherently eye-catching as, say, Apple’s or Microsoft’s. We also have to recognise they might not boast the storytelling skills of a megacap technology titan.

This being the case, our initial

attention is most likely to be grabbed by a corporate narrative that is reasonably polished, makes sense and appears grounded in reality. One that fails to “hang together” and/or is clearly couched in hyperbole tends to fall at the first hurdle.

• TAKING A CLOSER LOOK

Businesses that pass the above test must still be treated with scepticism. This might sound unkind, but it is scepticism that underpins fully informed investment decisions. Nothing should be taken for granted. A company’s financial statements are often the first port of call when scrutiny is applied in earnest. Quantitative research might show that the underlying data is vague or suspiciously selective and that the numbers simply do not add up. As we will see next, though, this level of analysis could be insufficiently revealing.

• BRINGING ON-THE-GROUND EXPERTISE TO BEAR

Wherever in the world they may be,

smaller companies are frequently under-researched. In a market such as Asia – and particularly in its EMs –many could be the subject of little or no coverage.

This is why we argue that there is huge merit in having an on-theground presence. Investment teams with local knowledge should be better positioned to differentiate between businesses that offer genuine promise and businesses whose appeal turns out to be strictly illusory.

• DIGGING DEEPER THROUGH DIRECT ENGAGEMENT

This brings us to the value of direct engagement. In our view, this is

Important information

• The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

• Past performance is not a guide to future results.

• Emerging markets tend to be more volatile than mature markets and the value of your investment could move sharply up or down.

• Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

• The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

the most powerful means of seeing beyond the surface gloss of a company’s narrative and determining whether there is an authentic prospect of long-term growth and outperformance.

Face-to-face meetings with a business’s management allow us to dig much deeper into figures, claims and projections. Ideally, we want to hear a persuasive articulation of strengths, weaknesses and the proposed way ahead. In short: we want to find out what really makes a company tick.

• SEEKING REASSURANCE IN THE FACE OF UNCERTAINTY

Of course, there will be many

instances when we choose to invest in a company and then encounter a situation in which the story we have bought into is challenged. Maybe the most obvious example is when growth expectations are not met. What matters here is how management responds. Basically, we like to see a combination of optimism and pragmatism. Is there a straightforward, sensible explanation for what has happened? Are there solid grounds for believing the situation will improve? Will guidance be adjusted accordingly? This takes us back to where we started: we are looking for clarity and rationality, not obfuscation and make-believe.

• The Company may charge expenses to capital which may erode the capital value of the investment.

• The Company invests in smaller companies which are likely to carry a higher degree of risk than larger companies.

• Movements in exchange rates will impact on both the level of income received and the capital value of your investment.

• There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

• The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

• As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

• The Company invests in emerging markets which tend to be more volatile than mature markets and the value of your investment could move sharply up or down.

• Specialist funds which invest in small markets or sectors of industry are likely to be more volatile than more diversified trusts.

• Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information:

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG. Authorised and regulated by the Financial Conduct Authority in the UK.

The abrdn Asia Focus plc Key Information Document can be obtained here

Find out more at www.Aberdeen.com/aas or by registering for updates

You can also follow us on social media: Facebook, X and LinkedIn.

Keeping your money safe from WhatsApp scams and deepfakes

The means by which fraudsters look to part you from your cash are getting more sophisticated

All investors know that putting money in the stock market comes with risk attached. Over the long term your investments will tend to rise, but along the way they’ll go up or down, and there is a chance of ultimately sustaining a loss. However there is a risk many of us don’t countenance very often, and that’s the possibility of falling prey to an investment scam.

Unfortunately scamming has become a cottage industry, to such an extent there are now several TV shows like the BBC’s Scam Interceptors which seek to raise awareness of scam tactics. Scammers stole £11.4 billion from UK individuals last year, according to the Global Anti-Scam Alliance, up £4 billion on the previous year, which puts some numbers on the growing threat. Many of us have got used to hanging up on cold calls, and ignoring annoying texts from weird email addresses which tell us a parcel is waiting for us. But there are two new digital strategies being used by scammers which are less well recognised, but which are definitely worth being aware of.

SPOTTING A WHATSAPP SCAM

WhatsApp has become a ubiquitous messaging service of choice for many people, offering a free and convenient way to stay in touch with friends and family. But scammers are increasingly using WhatsApp to try to part people from their money. These fraudsters often pose as senior members of well-known companies, including AJ Bell, contacting people with what appear to be exclusive investment opportunities.

After gaining your trust, scammers typically present high-return investment options, which are either entirely fictitious or misrepresented. You may be encouraged to act quickly, using pressure tactics that leave little time to think it through, or check any details of the scheme. Eventually, the fraudsters will request personal information or

financial transfers, claiming it’s necessary to secure the investment.

Another trick being used is to set up WhatsApp groups which recommend stocks to buy in your own investment account. This might sound harmless enough, but these are usually low value shares in small companies that are used in socalled ‘pump and dump’ schemes. Scammers artificially inflate a stock’s price through false or misleading information, or by getting other investors to buy up stock via Whatsapp, then sell off the shares they own at a profit before the price crashes. This type of scam was featured in the book and film The Wolf of Wall Street, but of course back in the 1980s and 1990s, Jordan Belfort and his team actually had to call people up one by one to get them to buy in. Modern scammers can instead target large groups of people with the same strategy through social media and Whatsapp.

DEEPFAKE SCAMS ARE ALSO RIFE

WhatsApp isn’t the only technological advancement being used by scammers to steal money and information. As artificial intelligence

PROTECTING YOURSELF

While the increasing sophistication of scam tactics is worrying, there are concrete steps you can take to protect yourself. If something feels even slightly wrong, stop and doublecheck. The key to avoiding scams is awareness and caution. These schemes are designed to catch you off guard, push you into rash decisions, and prey on your trust. Scammers often use high pressure tactics to force you to act by some fictitious deadline. Staying informed, verifying information, and taking a moment to pause can make all the difference. Scams often start with communication out of the blue offering ‘help with’ or perhaps a ‘review of’ your pensions or investments. Social media is also an increasingly lucrative hunting ground for fraudsters. If someone you don’t know contacts you about your finances, do not engage with them. If you believe someone is trying to scam you, report them to Action Fraud to help protect other investors.

Another tell-tale sign of a scam is the promise of huge, guaranteed investment returns, often over relatively short spaces of time. These investment ‘offers’ take many weird and wonderful forms, while the rise in popularity of cryptocurrencies has also been a fertile hunting ground for financial fraudsters. In addition, anyone claiming they can facilitate early access to your pension is almost certainly a fraudster.

If you’d like to know more about how to reduce the risk of falling prey to scams, or what AJ Bell does to protect its customers, please take a look at our Security Centre. The FCA’s ScamSmart website is another great resource to keep up-to-date on the latest tactics being deployed by fraudsters.

(AI) technology becomes more affordable and widely available, scammers have begun exploiting it to create increasingly sophisticated and convincing videos, known as deepfakes. These deepfakes present a likeness, sometimes along with the voice, of well-known or trusted individuals to entice others to buy into their scam. MoneySavingExpert reckons the face of its founder, Martin Lewis, is used by scammers more than any other celebrity.

AI tools like these are transforming the landscape of cybercrime, allowing scammers to create a flood of realistic, manipulative content. While the technology is not perfect and may still show signs of inconsistency, it’s improving rapidly. Of course, social media provides helpful platforms for this kind of content to proliferate and hit multiple targets at once. Even if 99% of people ignore it, with enough social media views scammers can still make money from the few who fall into the net.

DISCLAIMER: AJ Bell, referenced in this article, owns Shares magazine. The author (Laith Khalaf) and editor of this article (Tom Sieber) own shares in AJ Bell.

By Laith Khalaf AJ Bell Head of Investment Analysis

Schroder Japan Trust plc: Tariffs, turbulence and Tokyo

How US policy is reshaping the Japan investment case

Markets rarely appreciate surprises – especially the kind that land with little warning and global consequences. That’s exactly what happened on 2 April, when the US Government unveiled details of its long-trailed “Liberation Day” tariffs. These were much sharper and more punitive than expected for Japan and many other countries, compounding uncertainty and fueling fears of a trade-induced recession in the US and beyond.

The Japanese stock market declined sharply in line with the broader global reaction. A combination of policy shock and currency volatility – driven by a sharp decline in the US dollar against the yen – triggered a sell-off that weighed particularly heavily on Japanese exporters. Automotive and machinery names, already sensitive to global demand, bore the brunt of the downturn. The initial rout in early April reflected just how exposed Japan remains to swings in global trade sentiment.

Then, in a dramatic reversal just eight days later, came a partial reprieve. The US announced a 90-day suspension of the imposition of tariffs for certain countries and regions, including Japan. This news triggered a relief rally, and although sentiment remains fragile, the month as a whole ended marginally positive for Japanese equities, with performance driven almost entirely by tariff-related news flow.

A new influence on Japanese growth

What’s clear is that the new US trade stance is already influencing Japan’s economic outlook in multiple ways. Exporters face a more uncertain environment, investment decisions are being delayed and the yen’s strength is muddying the outlook for inflation. The Bank of Japan has responded by revising down its inflation forecasts and pausing the long-awaited normalisation of monetary policy. That move complicates one of the core positive narratives for Japanese equities – the country’s long path from deflation to inflation. This journey hasn’t been completely derailed, however. As indicated by

the solid wage growth secured in the recent spring wage negotiations (Shunto), domestic inflationary forces may be strong enough to offset these external deflationary pressures and sustain Japan’s inflationary cycle.

At the company level, Japanese firms have initially reacted in different ways. In the current reporting season, some have fully incorporated the expected tariff hit into earnings forecasts. Others are flagging it only as a risk scenario and a few have yet to account for it at all. This lack of consistency in assumptions has made it even harder to gauge the near-term earnings picture.

The corporate governance revolution continues

Yet amidst the uncertainty, one feature of the Japanese market stands out. The volume and scale of share buybacks announced so far this year have already exceeded last year’s record pace. That’s a striking data point, particularly given the geopolitical uncertainty. It speaks to an ongoing shift in Japanese corporate behaviour, where improving return on equity and enhancing shareholder value are now central tenets of boardroom strategy. For investors, this sustained trend in capital discipline provides a strong counterweight to short-term macro uncertainty.

While sentiment may remain vulnerable to global events, the long-term outlook continues to be underpinned by Japan’s structural progress –a reform-driven governance culture, domestic inflationary momentum supported by solid wage growth, and increasing dispersion in corporate performance.

The Schroder Japan Trust is well positioned to take advantage of these dynamics. The portfolio maintains a bias towards domestically oriented businesses and mid- and small-cap names that are benefiting from Japan’s internal growth drivers. Exposure to largecap exporters – more directly affected by trade and currency volatility – is relatively smaller. Meanwhile, the emphasis remains on companies actively pursuing governance reform, where improved capital allocation and clearer shareholder alignment can drive better returns.

One such example is the portfolio’s new position in JX Advanced Metals, which was recently spun off from ENEOS to accelerate its focus on highergrowth markets, including the production of valueadded materials used in advanced electronics and

communications infrastructure. This shift should enhance long-term returns and improve capital efficiency over time.

Many other holdings are taking similarly purposeful steps. While these company-specific improvements may be temporarily overshadowed by global developments, they are likely to be the main driver of long-term performance. This is precisely the kind of environment in which active, high-conviction portfolio managers can thrive – by identifying change where it matters and positioning accordingly.

In short, this is a stock picker’s market. And despite the headline risk, Japan continues to offer compelling opportunities for investors who remain focused on the fundamentals.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk

Before investing in an Investment Trust, the latest Key Information Document (KID) at www.schroders.co.uk/ investor or on request.

For help in understanding any terms used, please visit www.schroders.com/en-gb/uk/individual/glossary/

IMPORTANT INFORMATION

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as

amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

How Nutshell Growth is carving its own high-quality equities path

A concentrated and very actively traded option for investors to think about

To ordinary investors, it might seem like almost every investment fund under the sun is focused on high-quality companies and stocks. A long track record of superior returns, check. Deep moats and competitive advantages, check. A sustainable and long-run growth path ahead, check. High returns on investment, above average margins, pricing power, etc.

When you talk to as many fund managers as we do at Shares, a far more nuanced story emerges. There are funds whose focus lies elsewhere, sturdy income providers, low valuation opportunities, or stocks in a rut with scope for recovery, or unproven small companies.

The reality for all, is that from the vast pool of stocks on global markets (estimated at around 50,000), a small percentage of these are worth the bother, so developing a useful criterion to narrow down the

research universe fast is invaluable. Designing a bespoke way of doing so can really make a fund stand out from the crowd, if the method works.

UNIQUE MODEL

This is one way the Nutshell Growth Fund (BLP46L6) believes it offers retail investors something unique in the high-quality, large cap stocks space. If the name rings a bell, it’s probably because of the City stir kicked up in late 2023 when Nutshell’s chair, billionaire City grandee Michael Spencer, challenged formidable money man and Fundsmith Equity (B41YBW7) founder Terry Smith to a £10,000 bet that his fund would beat Smith’s during 2024.

Nutshell is outperforming Fundsmith again, although neither should be judged on six months’ worth of data”

Spencer won the bet, Nutshell’s 2024 total return (capital plus income) of 26.4% easily trumping Fundsmith Equity’s 8.9%. In retrospect, it was a safe bet, with Nutshell beating Fundsmith in all of