RACE TO RECOVERY AT ROLLS-ROYCE

The inside track on the UK stock which beat Nvidia

Money & Markets podcast

Weekly discussions on everything investing from the teams at AJ Bell, all available on your favourite streaming platforms.

The easy way to stay up to speed with the investing world with new episodes each week from Dan Coatsworth, Laura Suter, Charlene Young, Laith Khalaf and Danni Hewson.

LISTEN NOW

04

A spring clean not New Year’s resolution might be the best bet for your investing

05 INCOME INVESTING

Dividend taxes are going up from April: here’s how to beat them

07 MONTH AHEAD

What to expect from big tech as AI fever subsides

09 UNDER THE BONNET

What next for Rolls-Royce after a 14-fold return in three years?

12 RETIREMENT IN FOCUS

Why hitting 75 still matters when it comes to your pensions

14 FEATURE

How to screen for the very best companies

18 MY PORTFOLIO

How I invest: from being paralysed by indecision to passing on the investing habit

20 SECTOR REPORT

Why UK bank shares have soared in recent years

24 ASK LAURA

I’m a cash lover, what do the Budget Cash ISA changes mean for me?

26 FUNDS

How do private equity trusts shape up as an investment?

28 ASK RUSS

What do sky-high government debt and records for equities and gold mean for investors?

30 DEEP DIVE

Three ways to protect your investments from a stock market crash

33 ASK RACHEL

What will happen with my pension if I go into a care home?

Shares magazine is published by AJ Bell, authorised and regulated by the Financial Conduct Authority. It’s here to inform, not to give personal advice. Please don’t base your investment decisions on it alone. If you’re unsure, speak to an independent adviser. And remember: past performance isn’t a guide to the future. Tax benefits depend on your circumstances and tax rules may change.

A spring clean not New Year’s resolution might be the best bet for your investing

At this time of year investors are frequently bombarded with messages about New Year’s resolutions for their money.

This is often well-intentioned and useful advice but it would be understandable if some people responded with an internal groan and why on a broader basis adopted at this time of year resolutions often fail.

It’s dark, it’s cold, there’s an inevitable comedown after the heightened emotions around Christmas and New Year, that cough your cousin gave you as an unwelcome present might still be lingering.

Added to this, people are often feeling hard up having splurged over the festive period as well as having been paid earlier in the month than they would normally in December and, for those for whom the 31 January tax return deadline is relevant, there is yet another distraction and potential hit to the pocket.

It’s also been a noisy start to 2026 for markets, so, all in all, these are hardly the ideal conditions to make any grand plans for your investing. For some, the idea of a fresh start at the beginning of a year is a powerful motivator but, if that’s not you, there is no reason to worry or beat yourself up.

Successful investing is typically about small actions anyway. Continuing to invest regularly over the long term is what really benefits your wealth. If you’re already doing that, then that’s great and, if not, then it’s certainly worth considering making a start.

As discussed, consistency is what matters here, so it pays not to be overly ambitious. Start with a sum you’re confident you can commit to and you can always build it up over time as circumstances allow.

As motivation, using AJ Bell’s Stocks & Shares calculator you can discover

how even relatively modest monthly contributions could provide you with a meaningful sum of money in the long term.

If you put in £100 over 10 years then, assuming a 6% rate of return (which is relatively conservative based on historical stock market performance) you would have a pot worth £15,793, with £3,793 accounted for by investment returns. (Note this encompasses fees of 0.6%.)

An added benefit of regular investing is it can smooth out your returns when markets are volatile as your fixed monthly investment buys more when prices are lower and less when they’re higher.

It’s not a case of setting up your direct debit and forgetting about your investments entirely. We do all need to take stock and make sure we’re on track with our goals and chosen asset allocation, probably at least once a year.

Continuing to invest regularly over the long term is what really benefits your wealth”

However, maybe waiting to give your portfolio a spring clean in March when the days are a getting longer, the birds are singing and the flowers are blooming might be a better bet than attempting a similar exercise in the depths of winter.

Dividend taxes are going up from April: here’s how to beat them

An extra two percentage points on dividend tax could have a meaningful impact on investors from April.

It might not sound a lot, but the extra tax could add up for someone with a fair-sized portfolio. Fortunately, there are way to minimise the impact as we now discuss.

What’s the current system?

Brits can earn up to £12,570 a year without paying tax, known as the Personal Allowance (although you start to lose this once you have income above £100,000). After you exceed this threshold, you’re taxed at between 20% and 45% depending on your taxpayer status.

There is a separate Dividend Allowance on top of the Personal Allowance, where you only pay tax on any dividend income above £500. The dividend tax rates start at 8.75% for basic rate taxpayers, 33.75% at the higher rate, and 39.35% at the additional rate.

An example of how it works in practice:

Let’s say Billy gets £20,000 in dividends and earns £30,000 in wages in the 2025 to 2026 tax year. This gives him a total income of £50,000.

Billy has a Personal Allowance of £12,570. Deducting this amount from his total income leaves a taxable income of £37,430. He is a basic rate taxpayer, so would pay:

20% tax on £17,430 of wages = £3,486

No tax on £500 of dividends, because of the Dividend Allowance

8.75% tax on £19,500 of dividends = £1,706.25

Total tax: £5,192.25

How much extra tax from 6 April 2026?

The dividend tax rate will go up from 6 April 2026 from 8.75% to 10.75% for basic rate taxpayers, and from 33.75% to 35.75% for higher rate taxpayers. The additional rate will remain unchanged at 39.35%.

The tax hike is designed to bring in additional

APRIL2026

income for the government to help pay for public services and improve the country’s finances.

Let’s the use the same example to show the impact of the higher tax rate on Billy:

£20,000 in dividends and £30,000 in wages in the 2026 to 2027 tax year.

20% tax on £17,430 of wages = £3,486

No tax on £500 of dividends, because of the Dividend Allowance

10.75% tax on £19,500 of dividends = £2,096.25

Total tax: £5,582.25

Difference: £390

In this example, the dividend tax changes would mean Billy loses an extra £390 to the taxman. That’s the equivalent of a year’s worth of pet or home insurance, or a couple of months’ worth of council tax payments, or a big chunk of an annual broadband bill.

Rather than sit back and do nothing, there are various paths to follow to help minimise the hit to the dividend tax changes. In certain situations, you can avoid paying tax completely.

Option 1

Make the most of your ISA allowance

You don’t pay any tax on dividend income if the investments are held inside an ISA. Adults can contribute up to £20,000 each year across the full range of ISAs, although the proportion going into a Lifetime ISA is capped at £4,000.

There are no restrictions on taking money out of an ISA, apart from the Lifetime ISA where there is a 25% penalty unless using the money to buy your first home or you’re aged 60 and above.

A tax wrapper like a Stocks and shares ISA offers convenience and flexibility, so take advantage of the annual allowance rather than automatically using a dealing account where capital gains and income are subject to tax.

Option 2

Become tax savvy with ‘Bed and ISA’

If you have investments in a dealing account and unused ISA allowance, there is a neat way to shelter those assets from the tax man.

You sell the investments and immediately buy them back within the ISA, so you don’t pay capital gains tax or dividend tax on future profits. You only pay one dealing charge for the transaction. Note that the sale part of the Bed and ISA transaction potentially triggers capital gains tax on profits to date.

Option 3

Rethink which investment types go into

different accounts

Anyone who regularly buys both income and growth-oriented investments should

think about which assets end up in a dealing account once they’ve used up their annual ISA allowance.

For example, let’s say Nikki each month puts £1,666 into a technology fund that pays no dividends and a £1,666 into an income fund. After six months, she would have used up her £20,000 ISA allowance. Nikki makes the next six months’ investments in a dealing account until the start of the next tax year when the clock resets on allowances and she can fill her ISA again.

On the basis that she continues to invest the same amounts each month in the same two investments, Nikki might want to use her ISA solely for the income fund going forward, and to put further technology fund investments into her dealing account.

In doing so, she would not be subject to dividend tax on additional investments in the income fund, and nor on the tech fund assuming it continued to have no yield.

Watch out for tax on reinvested income

While we’re talking about dividends and taxes, a common error is to think that dividends payments from ‘Acc’ funds are tax-free.

‘Acc’ stands for accumulation and is the version of a fund that automatically reinvests any dividends. The version of a fund that pay dividends to investors in cash will have the letters ‘Inc’ (standing for ‘Income) in its name.

Anyone who holds an ‘Acc’ fund outside of an ISA or SIPP (self-invested personal pension) could be liable for tax on the income stream, even though they haven’t received any cash.

Income reinvested in accumulation units is known as a ‘notional distribution’ and is taxable in the same way as the income from income units.

By Dan Coatsworth Head of Markets

What to expect from big tech as AI fever subsides

Six of the so-called ‘Magnificent Seven’ are set to report their earnings between the last week of January and the first week of February. Combined these companies add up to a combined $17 trillion of market valuation – or around 30% of the entire value of the US market’s flagship S&P 500 index.

The mood music feels like it has already shifted from the excitement stage characterised by investors cheering on every increase in AI infrastructure spending to a more sober assessment of tangible progress in productivity.

Specifically, investors and analysts will be looking for the emergence of new AI use cases and revenue streams or clear signs that AI is lowering costs and increasing corporate profit margins. Corporate adoption has been slower than expected, reflecting lengthy pilot testing and integration challenges as businesses grapple with new ways to work.

This contrasts sharply with the consumer space where OpenAI’s ChatGPT has garnering more than 900 million weekly users and Google-owner

Alphabet’s Gemini has notching up more than 650 million monthly users.

Although even here the penetration rate of paid subscriptions has been relatively muted at less than 5% of total users.

What’s already in the numbers?

It’s worth pointing out that outlook statements from the big technology firms will be just as revealing as the quarterly numbers themselves. Currently, analysts are projecting mid-teens percentage earnings growth for fiscal 2026.

This is consistent with the broader technology sector which is expected to lead earnings growth across the S&P 500 universe with investment research firm Zacks forecasting 17.4% sector growth in 2026.

Microsoft is probably the purest way to get access to the AI revolution due to its enterprise software dominance, role as the second largest cloud operator and OpenAI stake.

Investors will be looking for continued strong growth in Microsoft’s Azure cloud division after the company raised projections for capital expenditures in 2026 to a range of $140 billion to $160 billion.

There will be a focus on how quickly large corporate clients are adopting Microsoft’s AI assistant Copilot across its enterprise suite of products including Excel, PowerPoint and Outlook.

Apple is the largest technology company to report in early 2026 and the second biggest constituent of the S&P 500 with a market value of just over $4 trillion. Analysts believe 2026 could be a pivotal as the iPhone maker reveals its AI strategy.

There have been reports that the company is considering using Google’s Gemini for cloud-based AI generative features. Initiatives could include charging a premium fee of $10 to $20

Key dates

Overseas stocks

Johnson & Johnson (Q4) ☽ 21-Jan

Procter & Gamble (Q2) ☼ 22-Jan

Express (Q4) ☼ 23-Jan Texas Instruments (Q4) ☼ 27-Jan

per month for advanced ‘Apple Intelligence’ features, integrated into the high-margin services segment.

Another area of potential monetisation is a revenue sharing arrangement from third party AI apps sitting in the IOS (iPhone operating system) ecosystem.

While revenues from services are becoming a more meaningful part Apple’s business at around a quarter of overall sales, the iPhone remains the company’s largest revenue generator.

Strong demand for the recently launched iPhone 17 is expected to drive double-digit growth in revenues over the important holiday period to the end of December 2025.

strives to shift the investment narrative towards FSD (fully selfdriving vehicles) and human robotics.

Consensus forecasts are pencilling in a significant decline in earnings per share from the prior year reflecting continued margin pressure from price cuts amid rising competition.

Any signs that gross margins for the automaker are stabilising should be taken positively by investors.

Tesla’s energy generation and storage division is expected to see continued steady growth with a ramp-up in volumes for the Megapack 3 in expected in 2026.

Alphabet (Q4) ☽ 03-Feb

Microsoft (Q2) ☽ 04-Feb

Meta Platforms (Q4) ☽ 04-Feb

Eli Lilly (Q4) ☽ 10-Feb

UK Stocks

Games Workshop (HY) 20-Jan

Ryanair (Q3) 26-Jan

Crest Nicholson (FY) 29-Jan

GSK (Q4) 04-Feb

AstraZeneca (Q4) 05-Feb

Unilever (FY) 05-Feb

Barclays (FY) 10-Feb

Key economic announcements

Europe CPI Dec 19-Jan

UK inflation Dec 21-Jan

US Core PCE 22-Jan

US GDP (Q3) 22-Jan

US Durable Goods (Nov) 26-Jan

US interest rate decision 28-Jan

Key: Q=Quarter. HY= Half year. FY=Full year. TS= Trading statement. ☽ = After market close. ☼ = Before market open.

What should investors expect from Tesla?

As ever with EV maker Tesla, the quarterly numbers will probably take a back seat to the long-term outlook as the Elon Musk-run company

A major catalyst to watch for is the approval and potential roll-out of Tesla’s robotaxi in key markets including Europe, although regulatory hurdles remain.

In short, analysts will be looking for Musk to prove that heavy investments in AI and the transition to FSD and robotics are gaining traction.

Consensus 2026 earnings forecasts and growth for technology companies

*Except Microsoft 12 months to 30 June 2027, Tesla 12 months to 30 September 2027

Source: Stockopedia, LSEG, Zacks, Yahoo

What next for Rolls-Royce after a 14-fold return in three years?

The performance of Rolls-Royce shares since CEO Tufan Erginbilgiç took the helm at the start of 2023 is astonishing.

The shares have increased nearly 14fold to even outperform the poster child of the dominant AI theme Nvidia. At the time of writing they have just outmatched the chip giant on a total returns basis (encompassing share price gains and dividends) over that period.

What is behind the recovery?

How has Erginbilgiç achieved this turnaround in fortunes? There is little doubt that he has been helped by the backdrop. The return to a level of normality in the aviation space coming out of the pandemic has helped boost engine flying hours which, in turn, increases the amount Rolls can achieve in lucrative spares and repairs revenue on its large installed base of engines.

However, Rolls’ problems, particularly with generating cash flow and the durability of its engines, predate the pandemic so the astonishing

recovery cannot simply be attributed to improved market conditions.

Some of the initiatives launched by Erginbilgiç have included a shake-up of the management team Under its current CEO RollsRoyce has beaten Nvidia

return (%)

– which encompassed bringing in fellow BP alumni Helen McCabe as chief financial officer – and a cull of middle managers in the business.

He has applied a framework of four ‘pillars’ to achieve his goals. This includes ‘holding up a mirror’ to make clear how dire the company’s position was. This was evident when he addressed staff in the early weeks of his tenure and described Rolls as a “burning platform”.

The second pillar involved setting a clear strategy which would resonate with Rolls’ large workforce (of more than 40,000). Third, involved managing performance with clear targets and fourth aimed to deliver the previous three with pace and intensity.

One of the most important individual things Erginbilgiç has done is to renegotiate previously lossmaking sales and supply contracts with its airline customers. Investment in the reliability of its engines supported this process and the impact this has had on profit and cash flow is marked.

In February 2025 the company announced it would hit 2027 targets for operating profit two years early. After a strong first-half performance it lifted its 2025 guidance yet again from £2.7 billion to £2.9 billion to between £3.1 billion and £3.2 billion and lifted free cash flow guidance to between £3 billion to £3.1 billion.

At the peak of its cash problems in the middle of the last decade, the company’s cash flow was a paltry £179 million.

WHAT IS ROLLS-ROYCE’S COMPETITION?

Rolls’ main rivals include, from the US, GE Aerospace and Pratt & Whitney (a subsidiary of RTX Corp) as well as France’s Safran and Germany’s MTU Aero Engines.

Where is future growth coming from?

There is no question Erginbilgiç has done a fantastic job on almost any measure but the question investors will be asking is what comes next? These questions are leant greater weight by the company’s valuation as, to justify an elevated valuation, a company typically needs to deliver significant growth.

Rolls currently trades at more than 40 times expected 2026 earnings compared with a 10-year average multiple of around 15 times. It also trades at a premium to some of its peer group.

In the civil aerospace arena, the potential untapped opportunity for Rolls-Royce lies in narrow-body planes. Rolls exited this market in 2012 to focus exclusively on the wide-body engines in larger planes used on long haul flights. Yet around 85% of commercial aircraft sales fall into the narrow-body category.

The company is keen to get a slice of this action using its new UltraFan technology, though the complexity and set-up costs involved mean it is looking to bring on board a partner – with US counterpart Pratt & Whitney reported to be in the frame.

It also needs to strike a deal with one of the world’s two main plane manufacturers, Airbus or Boeing. There are suggestions Airbus might be leaning in another direction for its next generation of narrow-body planes which could be an obstacle for Rolls.

Source: Sharescope, 9 January 2026

ROLLS-ROYCE – A BREAKDOWN

As the chart shows, civil aerospace accounts for well in excess of half of the group’s revenue, cash flow and operating profit. The remainder is almost entirely accounted for by its power systems and defence arms.

The company’s defence business is a market leader in engines for military transport and patrol aircraft, with repair and maintenance again a vital component of its work. It also has a significant footprint in the naval space and is the sole provider of powerplants for the UK nuclear submarine fleet.

Like other defence companies, Rolls is benefiting from a step change in European military spending as countries respond to a shift in US foreign policy. Given its significant exposure to the nuclear submarine agreement between the UK, US and Australia (Aukus), there will be relief that Washington has reaffirmed its commitment to the deal after a review conducted in 2025.

What about nuclear energy?

While it currently makes no contribution in terms of profit and cash flow there is also significant excitement about Rolls’ involvement in small modular reactors which are supposed to be more compact, simpler, cheaper and quicker to

get up and running than conventional nuclear energy assets.

It is worth adding the proviso that this is, as yet, a relatively untested technology but in November 2025 it was announced Rolls would site three SMRs on Anglesey with the UK government investing £2.5 billion in the project.

In a world where artificial intelligence is consuming huge amounts of power, nuclear energy is increasingly being seen as a relatively clean and reliable solution. The company’s power systems arm is already benefiting from the significant energy demands associated with AI.

This business, historically known for supplying diesel and gas engines to hospitals, ships, and military bases, expanding into the data centre market that powers artificial intelligence.

By Tom Sieber Editor

Why hitting 75 still matters when it comes to your pensions

When the pensions lifetime allowance was abolished in 2024, it was widely seen as good news for people with larger pension pots. But it also created a bit of a myth; that age 75 no longer matters in the world of pensions.

It’s true that there is no lifetime allowance test at 75 to worry about, but it remains a key point where HMRC draws a line under certain tax advantages. Here’s why age 75 still deserves a place on your retirement radar.

1

Tax relief on what your pay in

If you’re a UK resident under age 75, you’ll receive income tax relief on your own pension contributions. This can be on up to 100% of your UK earnings, or £3,600 if lower. Keep in mind that relevant UK earnings include payments like salary and bonuses before tax, but not property rental income,

savings interest or dividends.

But pension rules still say tax relief must stop once you turn 75, so in practice most pension schemes just don’t accept new personal contributions after this.

If you’re still working past your 75th birthday, your employer can in theory still pay into your pension. They can benefit from tax relief on what is paid in, and you will benefit from a boost to your savings, but the contributions need to meet the tax rules, including being for the purposes of trade.

2

Impact on pension death benefits

There is still a ‘cliff edge’ that applies to pension death benefits. Your 75th birthday can make a big difference to how much your beneficiaries might receive from your pension.

If a pension holder dies before age 75,

money left in their pension(s) can usually be passed on tax-free if the transfer to your beneficiaries happens within two years. On death at or after age 75, your beneficiaries will pay income tax at their marginal rate on money they withdraw from inherited pensions.

From 6 April 2027, pensions will also be included in people’s estate for inheritance tax. This could lead to high effective rates of tax for some beneficiaries.

3

Age 75 and tax-free cash

Although the pension rules don’t say you must take your tax-free cash before age 75, some older plans have some restrictions.

If you do decide to delay taking some of your tax-free lump until age 75 and then die before taking it, your previous tax-free entitlement is lost and anything paid to your beneficiaries from your unused pensions will be taxed at their own marginal rate.

If you turned age 75 before the lifetime allowance was abolished, check if you’re

entitled to any more tax-free cash. The rules have been amended so that cash allowances are no longer reduced by the former age 75 lifetime allowance test.

It’s fair to say that the lifetime allowance means reaching 75 is no longer a question of being penalised for saving too much in a pension, but here are three tips if you’re approaching this milestone.

1. Check the rules of your pension scheme, particularly if anything changes at age 75.

2. If you’ve still got pensions you haven’t fully accessed, check how much of your lump sum allowance you have left and consider withdrawing any remaining tax-free cash before age 75.

3. Review who you’ve nominated as your pension beneficiary(s).

For many people, taking the time to plan before reaching this milestone can make a meaningful difference to how tax-efficient their retirement and estate planning turns out to be. The best course of action for you will depend on your personal circumstances. It’s a complex area so please also consider taking financial advice to avoid any costly mistakes.

Charlene Young Senior Pensions and Savings Expert

How to screen for the very best companies

Just as when you’re buying a new jacket or set of kitchen knives, paying attention to quality when you are investing in a company’s shares is often a decision which can pay off in the long term. With this in mind, we are exploring how you can go about identifying some of the UK’s very highest quality companies.

While there is no generally accepted definition, quality investing is rooted in traditional fundamental analysis which can be used to identify companies with superior financial health, robust balance sheets and earnings stability.

Why is quality investing out of favour?

These traits are thought to have contributed to the long-term outperformance of quality investing, although the investment style has fallen out of favour in recent times.

Berkshire Hathaway’s Warren Buffett and Charlie Munger are known for their preference for owning high-quality companies with durable competitive advantages and holding them for the long term.

On this side of the Atlantic, Fundsmith founder Terry Smith is also an advocate for quality. “Over the long term, it’s hard for a

a much better return than the business which underlies it earns,” explains Smith.

Of late, the quality investment style has lagged the general market partly due to the excitement surrounding AI-related stocks and investor enthusiasm for growth and momentum stocks. According to research by Barclays published in September 2025, the MSCI World Quality index had underperformed the broader MSCI World index by around 11% since the middle of the previous year, its biggest deviation in the past two decades. Quality

Quality investing sits on three core pillars, each with their own financial metrics. The first pillar measures the ability of a company to deliver high returns on the capital provided by shareholders.

This is captured in the ROE (return on equity) which measures after tax profit as a percentage of shareholders equity. Firms which demonstrate a sustainably high ROE implies the existence an economic moat.

Just as a moat around a castle helped keep out attackers, this enables a business to maintain high returns on equity for many years and prevents competitors eroding its economic advantages.

Another popular metric is ROCE (return on capital employed) which is a measure of the ability of a company to deliver profits to all its providers of capital, including debt financing.

The second quality pillar assesses balance sheet strength, and the amount of debt a company uses to run the business. High quality companies tend to have low amounts of debt to run their operations. This makes them more robust in times of rising interest rates and less sensitive to economic downturns. It is also worth noting that higher amounts of debt may flatter ROE.

The last pillar of quality measures the consistency and reliability of earnings. Quality companies tend to have smooth, predictable earnings, which lowers their overall risk profile.

Quality firm’s also convert a healthy amount of earnings per share into free cash flow. This is the cash left over after accounting for all expenses and investments needed to maintain the competitiveness of a business.

While quality-focused investors don’t ignore valuations altogether, they tend to accept you have to pay a premium for quality companies.

How to create a quality screen

Subscription-based financial software services provided by firm’s like Stockopedia and ShareScope can be used to create a list of companies for further research.

We have used Stockopedia to build a quality screen. First, we narrowed the universe down to companies with a market value of more than £500 million.

The characteristics of quality companies means they tend to be larger, more mature businesses. This step reduces the universe from more than

Feature: Quality screening

1,200 stocks to 300.

We are interested in companies which demonstrate sustainably high ROEs of at least 15% a year over the last five years. This further reduces the universe down to 90 names.

Quality companies tend to convert a high ratio of earnings per share into free cash flow. We set the threshold at 80% and above, which reduced the universe to 74 names.

Finally, we want to see evidence of growth in free cash flow. Companies which generate more cash than they need to stay competitive and grow, can provide enhanced shareholder returns through progressive dividends and share buybacks.

We set the threshold at an annualised growth rate of at least 10% a year, which has reduced the universe to 36 companies, which is a more manageable list of names for further research.

Stocks

which have demonstrated their quality

Fantasy miniatures maker Games Workshop has been an extraordinary UK success story with the shares gaining 160-fold over the last 30 years, excluding dividends, culminating in FTSE 100 membership in December 2024.

Key to the Nottingham-based company’s success is its vertically integrated business model and ownership of intellectual property. Games Workshop controls the entire value chain, from design and manufacturing, through to distribution and retail stores.

These traits allow the business to earn high returns on equity capital and to generate strong

Feature: Quality screening

Name FCF conversion (x) FCF five-year compound annual growth rate (%) ROE five-year average (%) Key: FCF= Free cash flow, ROE = Return on equity, FCF conversion = Free cash flow divided by earnings per share Source: Stockopedia, Refinitiv

free cash flows.

Global credit data and analytics group Experian has built a strong competitive position through its dual-engine growth strategy.

Experian’s large consumer database allows it to develop unique insights and consumer engagement tools which are then monetised by its B2B (business-to-business) division through targeted offers.

The business benefits from network effects which means the more customers use its services, the more valuable they become, which creates a positive feedback loop, attracting more customers.

The company recently guided for 6% to 8% organic sales growth in fiscal 2026 and margin expansion from operating leverage and productivity gains. Operating leverage is the effect where companies with relatively high fixed costs see operating profit grow faster than revenues during periods of growth. However, the effect also works in reverse, amplifying losses during downturns.

The UK’s largest manufacturer and Europe’s largest defence contractor, BAE Systems has benefited from escalating geopolitical threats and increased defence spending since the invasion of Ukraine.

The shares have risen by 245% over the last five years compared with a 45% gain for the FTSE 100 index.

The company benefits from long-term contracts and recently reported an order backlog of more than £75 billion, providing high sales visibility for many years.

Ashtead enjoys consistent cash flows

Construction equipment rental firm Ashtead benefits from structural growth divers and a dominant market position in the US, where it generates most of its revenues.

The penetration of equipment outsourcing is relatively less developed in the US, providing Ashtead with a growth runway as more firms seek to reduce capital expenditure and gain access to a modern fleet.

Ashtead maintained its full-year outlook after reporting slightly lower than expected first half adjusted pre-tax profit on 9 December, impacted by lower hurricane activity in the second quarter. Nevertheless, the second largest US equipment

rental firm, which operates under the name Sunbelt Rentals, announced a new $1.5 billion share buyback which coincides with its primary listing move to the New York Stock exchange in March 2026. The company’s consistent cash flow has enabled it to reliably grow its dividends over a long period.

It is worth noting that Ashtead runs its operations with relatively high levels of debt financing, raising the risk profile of the group during economic downturns.

The world’s largest catering firm Compass, which serves offices for the likes of Google and Amazon, benefits from the structural growth trend in outsourcing. The global food services market is estimated to be worth around $360 billion a year.

Compass has a 15% market share, which means nearly three-quarters of the market is run by inhouse operators. Recent inflationary pressures and increasing regulatory complexity have made it harder for in-house operators.

The company’s scale and expertise allows it to offer better value and higher quality, helping to drive a sustainable increase in market share from first-time outsourcers.

On 25 November Compass reported better than expected underlying operating profit of £3.34 billion for the year ended 30 September and guided for 10% growth in 2026.

Can you invest in quality stocks with trackers?

Investing in individual companies may not suit all investors, so it worth knowing that there are passive fund alternatives which seek to track quality indices developed by index providers such as MSCI and S&P Dow Jones.

The largest and cheapest is the iShares Edge MSCI Quality Factor UCITS ETF which seeks to replicate the performance of the MSCI World Sector Neutral Quality index.

The ETF has £3.2 billion of assets and an annual charge of 0.25% a year. It replicates the underlying index by selecting a sample of the most relevant index constituents.

Martin Gamble Shares and Markets Writer

How I invest: from being paralysed by indecision to passing on the investing habit

Five years ago, Lily turned to investing mostly out of frustration. Interest rates were floating around 1%, and her savings were barely growing. In fact, when you factored in inflation, she was losing money.

Her thought process was simple: “This is not good enough”. She hadn’t considered investing as much previously, partly because she was saving to buy a house, and partly because she just didn’t feel that she knew enough. But now, the numbers weren’t adding up and living on the outskirts of London with a family to support, she needed them to.

Getting started and using an ISA

She started by speaking with a friend who had taken the plunge with investing. They recommended a few different platforms for her, and from there, she began researching what to invest in and was hit with a flood of information. In the end, she decided to go with what she knew, and invested in the AJ Bell Adventurous fund as well as some Apple stock. It was a company she knew, she explained, and it felt like a good place to get going. She also became a reader of Shares.

Her new reading habit quickly turned out to be a money-saving move. Knowing that she planned to deal in funds and shares, she had opened a dealing account. But after reading up, realised that she could have put that money instead into an ISA, and would be protected from capital gains and income tax. Now, she tries to max out her £20,000

contribution each year. Even though Lily isn’t investing with a specific goal, she said she liked the satisfaction of watching the growth and being able to build her wealth.

“It’s not just investing,” Lily says. “It’s also about making the most [of what’s available], depending on where the government is allowing you to make the most.”

Even once she’d made her initial investment, Lily found herself hesitant to dive into the market further. She was reading much more about investing, and was looking for a golden opportunity, and the right time to seize it.

Waking up to the power of compounding

But she soon realised that she was having a difficult time deciding when that would be. And at the same time, she was learning about the power of compounding, and starting to feel that the waiting was, literally, costing her.

“I lost a little bit of a time. I thought, ‘I’m waiting to see when the right opportunity is.’ But what happened was, I wasn’t investing. There was no compounding happening in, for example, four months because I hadn’t done any investment. Later on you have this pressure mounting on you that it’s financial year end.”

She decided to set up a direct debit to keep the money flowing in, without having to fight the indecision each month, and to give herself relief from facing the April ISA allowance deadline with panic.

The power of compounding

Compounding is sometimes known as the ‘snowball effect’. The more and longer you invest, the faster that money will grow, making your pot larger at an exponential rate. This is why time in the market is emphasised so often in investing. For example, if you maxed out your £20,000 ISA allowance for five years with a return of 5% after fees, you’d end up with £116,437, with £16,437 of market return. But if you kept that investment going for 10 years, it would become £265,867, with £65,867 coming from the market return.

Passing on the investing habit

Lily didn’t grow up in a family of investors, and it wasn’t something that they spoke about with her when she was growing up. But she’s making the effort to change that pattern for the next generation. She’s opened a Junior ISA for her child, who will be headed to university in just a few years.

Even if they opt for the student loan route, she’s glad it could go towards something else, like a house deposit, a few years down the line.

“I like to tell my child we have to start early. We have to start soon. When you start earning, you have to put some money aside each month, because it is all about compounding,” Lily says.

So far, Lily says her kid isn’t too interested in their own investment journey. To be fair, few 16-yearolds would be. But she hopes with time, the messages will sink in.

She’s kept up on her own education as well, learning about stocks other than the big US names, and focusing more on the UK market. She’s also becoming more comfortable with the market ebbs and flows. This year, she took a leap and purchased a group of UK-based stocks in April’s market dip. “They’re doing pretty good, excellent actually,” she says.

Hannah Williford AJ Bell Content Writer

• Just started investing and learning some lessons?

• Experienced the ups and downs of the market over decades?

• Started investing in funds and now dipping your toe in stocks?

Whether you’re a novice or a long-time market enthusiast we want to hear from you about your experiences. Get in touch with your name and a few lines describing your approach to investing. If you’re selected to feature in the magazine we’ll be in touch to get the full story.

CONTACT: Email sharesmag@ajbell.co.uk with the words ‘My portfolio’ in the subject line

£50 gift voucher for published case studies in Shares magazine

TERMS AND CONDITIONS

The offer Subject to the terms below, the offer is to receive a £50 digital gift voucher when your experiences as an investor are published in Shares magazine (“Case study”).

The offer is open between 13 November 2025 and 30 September 2026 (“Offer Period”). Payment is only made to case studies published in Shares magazine. Submissions do not guarantee your case study will be published. The Editor decides which case studies to publish and in which format.

Eligibility rules

You must be 18 or over and resident in the UK to qualify for the promotion.

Employees of AJ Bell (the publisher of Shares magazine), its affiliated companies, and the immediate families of any such employees are not eligible for the offer. Receiving the offer

If your case study is published is valid, a link to download the voucher will be sent to your registered email address within 4 weeks of the article being published. AJ Bell will not take any responsibility for your failure to supply accurate information which affects acceptance or delivery of the offer. Details about how we may process your personal information can be found here.

General We reserve the right to amend, suspend

or withdraw the offer and/or these terms without prior notice and at our sole discretion by posting a notice on our website.

AJ Bell will not be held liable if any unforeseen event means that we are unable to fulfil this offer. In this event, no compensation will be payable by us. By making a claim in the offer, you are deemed to accept the terms and conditions of our digital gift voucher partner.

The offer is non-exchangeable, nontransferable and no cash alternative is offered. By participating in the offer, all claimants

are deemed to accept these terms and conditions.

The Promoter of this offer is AJ Bell. The Promoter’s principal place of business is at 4 Exchange Quay, Salford Quays, Manchester, M5 3EE. The Promoter may exclude from participation anyone who we believe to be taking unfair advantage of the offer.

DISCLAIMER: Shares/AJ Bell does not provide advice or personal recommendations. The case study articles are for information only. You must do your own research and consider your own personal circumstances before making investment decisions.

Why UK bank shares have soared in recent years

The UK banking sector has delivered strong price returns to investors over the last five years, averaging 218% compared with a 50% gain for the blue-chip FTSE 100 index.

On a total return basis, including dividends, the sector has chalked up 279%, making it the secondbest performing sector in the FTSE 350 index after the aerospace and defence sector.

It is worth pointing out that from a longer-term perspective the share prices of the domestically focussed banks Lloyds and NatWest still languish well below their highs in 2007.

That is not true for internationally diversified UK banks like HSBC and Standard Chartered, whose share prices have since eclipsed their 2007 highs, while Barclays sits somewhere in the middle, remaining around 25% below its 2007 highs.

What explains the strong performance?

Strong returns over the last five years represents a renaissance for banks after a decade in the doghouse following the financial crisis in 2008 which required banks to rebuild their beaten-up balance sheets.

The last five years have also witnessed a radical change in the interest rate environment which was driven by the Bank of England hiking interest rates from virtually zero before the pandemic to 5.25% in 2023.

This pushed up interest rates across the yield curve which has provided a positive tailwind for the sector. The yield curve represents the cost of

borrowing money over different lengths of time, from a few months to 30 years.

The yield curve normally slopes upward which means borrowing costs get progressively more expensive. For example, two-year interest rates are roughly 3.6% while 10-year rates are 4.5%.

This interest rate spread allows banks to make a positive ‘net interest margin’ on the difference between the rate of interest they charge on longterm loans and the interest they pay on short-term deposits to attract funding.

As interest rates normalised post 2020 towards a typical upward sloping curve, net interest margins ‘fattened’ significantly, resulting in record-breaking profits for sector in 2024.

Banks have also benefited from the fact they typically pass on higher interest rates to savers with a lag while increasing lending rates immediately.

How sustainable is the boost from higher rates?

UK banks actively manage interest rate risk and typically use five-year rolling hedges to smooth their income.

Hedges put on during the period of ultra-low interest rates in 2020 matured during 2024 and 2025 which means banks have an opportunity to put on new hedges at today’s higher rates of between 4% and 5%.

Analysts believe this could give banks an income boost by protecting net interest margins through the next few years even if the Bank of England cuts short-term interest rates.

That suggests the fundamental profit drivers may remain resilient, but what about the share prices?

NatWest and Barclays are top 10 positions in the Temple Bar investment trust which is managed by fund managers Ian Lance and Nick Purves at valuedriven investment firm Redwheel.

Commenting on the outlook for banks, Lance says: ‘It should be self-evident that the returns witnessed in recent years are unlikely to be repeated in the next few years as the rerating component of the return is unlikely to be repeated. That said, the valuations of the banks still look reasonable at a time that fundamentals remain strong.’

NAV = net asset value

Source: LSEG, Bloomberg, consensus estimates at 6 January 2026

Are balance sheets healthy?

After many years of rebuilding capital buffers following the financial crisis, capital ratios across the sector are now healthy. Tier one capital adequacy ratios average 17% across the sector.

This is a measure of a bank’s core financial strength which compares equity capital to total risk-weighted assets. In other words, how much capital does a bank have to absorb future losses from its loan book.

UK banks must meet the Basel 6% minimum tier one capital level and the Bank of England’s higher system-wide 13% benchmark, which considers extra buffers for tougher economic times.

The Bank of England has estimated that UK banks have tier one capital resources equivalent to about 2% of their risk-weighted assets, giving them adequate headroom.

This healthy position has allowed the sector to shift from hording cash to aggressively returning capital to investors via share buybacks and dividends. The six largest banks announced or distributed £36 billion of dividends and share buybacks in 2024 according to S&P Global Ratings. Healthy dividend yields and aggressive share buybacks has attracted the attention of value investors and those seeking core income stocks.

What does the competitive landscape in the UK look like?

The ‘Big Four’ banks comprising Lloyds, NatWest, Barclays, and HSBC dominate, controlling around 80% of UK household deposits with the rest held by building societies and mutual banks.

The largest banks have seen their market share shrink over the five years as digital challenger banks like Monzo and Revolut have become more popular.

Over 2024 and 2025 traditional banks lost an estimated £100 billion in deposits as consumers moved money to these challengers, which were offering higher short-term savings rates.

Lloyds is the clear market leader in mortgages with roughly a 19% market share, followed by Nationwide Building Society with 17% and NatWest with 11%.

The building societies and mutual firms hold just under a third of the UK mortgage market.

Challenger banks and specialist lenders collectively account for roughly 60% of gross lending to small businesses, exceeding the combined share of traditional banks.

Lloyds is the largest credit card issuer in the UK, holding nearly 22% of outstanding credit balances in 2024. Alongside Barclays and HSBC, these three banks account for around half the UK credit card market.

What are the banks’ strategies?

The two broad themes which stand out across the sector in recent times include an efficiency push through digitalisation and artificial intelligence and increasing diversification into higher margin business segments.

As the most domestically focused bank Lloyds fortunes are heavily tied to the performance of the UK economy.

The company is undergoing a strategic transformation under CEO Charlie Nunn which has seen a move into capital-light business segments such as wealth management, pensions and insurance.

For example, in 2025 the bank fully acquired

Schroders’ 49.9% stake in their joint venture, Schroders Personal Wealth in exchange for a 19.1% stake in Cazenove Capital.

The business was rebranded as ‘Lloyds Wealth’ and accelerates the push into the ‘mass affluent’ sector which serves clients with more than £75,00 in income or investable assets.

Lloyds is closing many of its physical branches to lower operating costs while investing in AI and data as it pursues a ‘digital first’ strategy.

Management believes these initiatives will generate an additional £1.5 billion of revenue by the end of 2026.

The company has adopted a progressive dividend policy which has seen the dividend increase by an average of 16% a year over the last three years. Total shareholder distributions have totalled £14.4 billion since 2021.

UK banks' share price performance

Source: Google Finance

Fellow domestic player NatWest is following a similar strategy of reducing costs amid a digital transformation with around 80% of retail and commercial customers using the bank’s digital channels.

NatWest recently entered a five-year partnership

Amazon’s web services company AWS and professional services group Accenture to drive productivity gains.

It was also the first UK bank to partner with ChatGPT owner OpenAI.

NatWest’s growth strategy includes strategic acquisitions and a key milestone in 2025 was the integration of Sainsbury’s Bank which added roughly one million accounts.

After nearly 17-years of government ownership following the financial crisis, NatWest finally returned to full private ownership in May 2025. The bank is targeting a return on tangible equity of greater than 18% and a cost-to-income ratio of around 47.8%.

For context, return on tangible equity is a profitability metric which measures how much profit a bank generates relative to its tangible equity capital.

Tangible equity is calculated as shareholders’ equity minus intangible assets like goodwill and other non-physical assets.

For example, if a bank has £10 billion in tangible equity and it generates £1.5 billion in net profit, its return on tangible equity is 15%. This would be considered a healthy return for the banking sector.

The cost-to-income ratio measures the efficiently of a bank’s operations. It is calculated by dividing operating expenses by operating income, expressed as a percentage.

Operating expenses include items like staff salaries and administrative costs. Well-run banks typically aim to achieve cost-to-income ratios below 50%.

Reducing the importance of

investment banking

Barclays is in the middle of a multi-year transformation aimed at simplifying the business. This involves reducing the relative size of its investment banking division and increasing the size of higher returning businesses like Barclays UK corporate bank.

The company is targeting £2 billion of efficiency savings by the end of 2026 and exiting non-core international markets to focus on the UK and US. Barclays bolstered its UK unsecured and credit card

business after integrating Tesco’s bank in late 2024.

Barclays has committed to returning at least £10 billion to shareholders in 2026 and uniquely, moved to more frequent quarterly share buybacks. The bank is targeting a return on tangible equity of 12% in 2026.

HSBC and Standard Chartered are the least UK-exposed banks with market-leading franchises across Asia and the Middle East.

Under new CEO Georges Elhedery HSBC has undergone a strategic overhaul to simplify its spawling organisational structure and focus on increasing market share where it believes it has competitive advantages.

The business now operates four divisions including Hong Kong, the UK, global corporate and institutional wholesale and international wealth management.

A key development for HSBC is its bid to buy the remaining 37% of Hang Seng bank it does not already own in a $13.6 billion deal aimed at consolidating its leading position in the Hong Kong market.

Share buybacks have been put on hold until the bank absorbs the cost of buying Hang Seng.

How do I buy passive exposure to banks?

Not all investors will be comfortable choosing individual banks to invest in, and while there are no UK-specific bank sector ETFs, there are European products which provide exposure to UK banking stocks.

The largest pan-European banks ETF is the Amundi STOXX 600 Banks UCITS ETF which has £1.8 billion of assets and annual charges of 0.3%. It is the only ETF to track the STOXX 600 Banks index.

The ETF seeks to replicate the performance of the underlying index using derivatives. Dividends are accumulated and reinvested. HSBC is the fund’s largest holding at 12.8% while Lloyds, Barclays and NatWest feature in the top 10 holdings.

Martin Gamble Shares and Markets Writer

I’m a cash

lover,

what

do the Budget Cash ISA changes mean for me?

Ask the experts

Laura Suter is on hand to answer your personal finance questions.

If you’d like a question considered for a future edition send it in now.

I’ve seen the changes to Cash ISAs announced in the Budget, and I’m worried about how it’ll affect me. I max out my Cash ISA every year by putting in the full £20,000, so any change to the rules or limits could clearly impact me and my savings plan, as I’m under the age of 65. Can you explain what’s changed and what it means for someone in my position?

Janet, London

Laura Suter, AJ Bell Director of Personal Finance,

says:

This was one of the big changes to come out of the Budget: an overhaul of how Cash ISAs will work. Let’s cover what’s changing. For anyone under the

age of 65 they will be limited to putting £12,000 into their Cash ISA from April 2027. They will still have the full £20,000 annual ISA allowance overall, so they can put the remaining £8,000 into their investment ISA – or just not use it, if they’re that way inclined. For anyone over the age of 65 the Cash ISA limit is still the full £20,000. On paper this means they are unaffected by this, but there is some devil in the detail we’ll come on to later.

What is happening?

For those under 65, it means their tax haven for cash will be cut. The Government’s plan is that this will spur more people to start investing – the reality is perhaps not quite so clean cut. The Government view is that too many people are putting too much money in cash and overlooking the benefits of investing. And for some people this is true – we’re a nation of cash lovers and many people just stick their savings in cash and don’t consider investing. So the Government hopes that removing an incentive to save loads in cash will nudge people towards putting their money to work in financial markets.

For those who currently save the full £20,000 in Cash ISAs each year, like yourself, it means you

Ask Laura: Your questions answered

have three main options: investing that money, putting it into a taxable cash account or switching to something like Premium Bonds. (Or you can stick it under your mattress, but that’s not going to be any match in the fight against inflation, so we’ll disregard it for now).

Most people will resort to a normal savings account and pay tax on that savings interest, if it exceeds their Personal Savings Allowance. At least that’s what people said when we surveyed them before the Budget. And based on our own figures, the cost of this will add up over the years into a far meatier tax bill for individuals – particularly for the highest earners. We know that millions of people are already paying tax on their savings interest, and that is only likely to grow after this change comes in.

What does it mean for your savings?

For some people the safety of cash will be worth the higher tax bill, even if some of their interest is being eroded by tax. But I think it’s important for people to be aware of just how much of their returns will disappear if that savings interest is taxed. Let’s take someone with a non-ISA account that’s paying 4% interest a year on the money. An additional rate taxpayer doesn’t get any tax-free Personal Savings Allowance, so every penny of interest they get will be taxed at 47% from April next year. It means that after tax that effective 4% interest rate becomes 2.12%. That’s a dramatic drop, and one more people need to be aware of if they are hoping for their cash to keep up with or beat inflation.

As a result, Premium Bonds are likely to become a more popular choice too. These accounts have no guaranteed interest rate or return, but winnings from the monthly prize draw are tax free. Clearly it’s a gamble and you might win nothing, but for those who are facing a high tax bill for their savings interest it might seem more appealing.

is a good opportunity to reset and assess whether you are just sticking to cash as a default and whether investing could be a better option. You mention that you regularly put £20,000 into your Cash ISA – is that because you need a cash pile or you have short-term financial plans that require you to stick to cash, or is it just a default move because investing seems daunting or complicated? If the latter, it’s probably worth challenging that view.

Why you won’t necessarily be able to rely on ‘cash-like’ holdings

And the eagle-eyed will notice that I previously mentioned potential details and knock-on effects even for those over the age of 65. That’s because the Government is planning to bring in a raft of measures to stop people just stuffing their investment ISA with the remaining £8,000 of ISA allowance and putting it in ‘cash-like’ investments. These are things like money market funds, shortdated bonds, T-Bills or just leaving it in cash in the investment account.

How will the Government police this? We’ve not got a huge amount of detail at the moment but it looks like cash in an investment ISA may face some sort of charge (an explicit charge or a tax, who knows?) or that certain investments may be restricted in an ISA. And for those thinking of sneakily paying the full £20,000 into their Stocks and shares ISA and then transferring it to a Cash ISA, think again. Because the Government also plans to ban transfers from investment ISAs into Cash ISAs, to stop just that kind of trick. More details on all of these measures will be announced in 2026 and one thing is for sure –I’ll dig through them and explain them all when we have the small print.

The other main option is investing the remaining £8,000. For some that won’t fit with their financial plans or risk tolerance, but this change to Cash ISAs

For now, the main thing to remember is that nothing has immediately changed: we won’t see these plans come into force for another 16 months. So don’t panic, wait for more detail and we’ll definitely keep you updated. But in the meantime, you could take a look at how much you have in cash and assess whether it’s necessary.

How do private equity trusts shape up as an investment?

Investors can get FOMO about private equity; an industry wrapped in old-school allure. Even if it is a small portion of a large industry, private equity firms are known for investing in F1 teams and the NFL. It’s not a stretch of the imagination to picture deals being celebrated on yachts and in Michelin star restaurants.

Some investors want to join in on the action, while others feel that a select group having access to investments, they don’t is simply unfair.

Are boom times for private equity coming to an end?

Private equity firms have been successful with acquisitions in the past 10 years or so. Low interest rates facilitated access to cheap debt to finance the deals. But this summer, some investors became uneasy when the Yale Endowment Fund, one of the stalwart supporters of private equity, sold $2.5 billion worth of its assets.

Certainly, the industry has found things more of a struggle since 2022, when rates shot up and private equity companies lost their access to cheap debt. Being forced to pay out more interest has eaten into returns and made funding transactions more difficult.

One way that investors can currently access private investments is through investment trusts. The average share price total return for private equity trusts with assets of £1 billion or more (if you strip out 3i which is typically seen as an outlier in the investment trust space), was 10.3% in the past year. Over the past five years the average return was 97.7%. This is higher than the 9.2% over one year and 42% over five years for the investment trust universe as a whole.

Private equity assets are hard to value, as unlike

something which trades on a stock market, there is no way of regularly valuing private companies. To reflect this, all but one trust in the private equity space trade at a discount of 10% or more to the net asset value of the holdings, with some discounts upwards of 50%.

Shavar Halberstadt, who covers private equity for the research team at Winterflood, says: “In the case of investment trusts, these are vehicles that have existed for several decades, so they’ve been through many different cycles. The 2008 cycle was particularly challenging for a number of these trusts.

“That’s really when we saw a discount of at least 15% emerging on these shares, because a couple of them back then ran into real difficulties. We think that we’re now almost 20 years on and that the discounts that we’re currently seeing are certainly not justified.”

What are private equity trusts doing to address discounts?

“From the beginning of 2022, the average discount on private equity investment trusts widened from 15% to about 30%. That was due to a lot of uncertainty, including Russia’s invasion of Ukraine and interest rates rising,” Halberstadt says.

“A number of factors coincided for people to be very sceptical of private holdings, [including] that they weren’t sure about the quality of the underlying valuation or what the valuation would look like the next time that it is published. People were also being much more sceptical of growthbiased investments that invest in stuff that has distant cash flows or sort of long term in the future payouts which mechanically become worth less if interest rates go up by a lot.”

Performance and discounts of largest private equity investment trusts (excluding 3i)

Includes private equity trusts with assets of £1 billion or more.

Source: Association of Investment Companies, data to 15 December 2025

However, the sector did respond to these criticisms. Many changed their reporting structure to give clearer valuations. A majority also have started engaging in share buybacks, where the trust itself purchases its shares to help close the discount.

“Those kinds of measures have helped to mitigate discounts. They’re now in the 20 to 25% range from 30 plus percent ranges,” Halberstadt says. “But we think they have a lot further to go. And if interest rates do come down further, which is a distinct possibility, then that’s something that’s definitely helpful.”

It is also worth noting that some private equity trusts don’t necessarily hold early-stage businesses. Instead focusing on cash-generative, established firms.

What is the Long Term Asset Fund?

Recently, a new competitor to the private equity trusts has entered the ring, the Long Term Asset Fund (LTAF). This instrument lets investors gain exposure to private equity through an open-ended fund but with restrictions on how frequently you can buy and sell units in the fund. Fund managers also keep a portion of the fund in cash or easier-tosell investments to help cover withdrawals.

“I think there’s a sense in which people are trying to reinvent the wheel, whereas the investment

trust structure is a 200-year-old wheel that kind of has made it through all the events of those centuries,” Halberstadt says. “That’s not saying that there’s nothing that can be improved, but I think we’ll have to see how these how these new structures behave in a crisis.”

Notably, the dawn of this type of instrument coincides with another important trend. Fund managers who hand-pick stocks are struggling to beat the market; investors have noticed and have started to abandon ship.

Private equity provides a potential solution to this: it is, by its nature, an active investment, and a way to woo back the investors who have dumped their active fund holdings. Managers can also justify a higher fee to investors because of the hands-on approach of private equity.

This kills two birds with one stone. Private equity ups their fundraising rates, and asset managers get clients back. However, remember there are risks associated with investing in private equity, not least the lack of transparency, more limited ability to buy and sell and, in some cases, the less mature nature of the businesses involved.

Hannah Williford AJ Bell Content Writer

What do skyhigh government debt and records for equities and gold mean for investors?

Ask the experts

Russ Mould is on hand to answer your queries about the financial markets.

If you’d like a question considered for a future edition send it in now.

Equities and gold are close to all-time highs, while government debt has also sky rocketed. What does this mean for investors?

Simon

Russ Mould, AJ Bell Investment Director, says:

The combination of Liberation Day’s tariffs, wars in the Middle East and Eastern Europe, worries over the long-term impact of artificial intelligence on jobs, galloping government debts and stretched budgets and active debate about stock market bubbles does not look like a favourable one for investors. However, many will look back upon 2025 with contentment. Equities, bonds and commodities all provided positive returns.

That said, there are some discordant notes, notably ructions in the cryptocurrency arena, while the ongoing surges in gold and silver may yet be harbingers of heightened volatility in the year ahead. From this perspective, the calm in the equity and fixed-income markets may look odd, especially as Western governments continue to overspend and pile up fresh borrowing, the interest payments for which could crimp growth and crowd

out more productive investment elsewhere. However, there may be method in markets’ thinking, and the core thesis seems to be the socalled ‘debasement trade.’

A bond bonanza could be coming

A backbench rebellion over the two-child welfare cap by Labour MPs in the UK, the ‘Bloquons Tout’ public protests over changes to pensions in France and the debate over Obamacare subsidies that led to the government shutdown in America all had the same starting point as their origin: sovereign debt.

All three nations have longstanding records of spending more than they generate in tax, with the result that borrowing is up in absolute terms, but also as a percentage of GDP. That may not be such an issue when interest rates are zero, as for much of the 2010s and early 2020s, but even small increases in headline borrowing costs, and thus sovereign bond yields, mean the interest bill can surge quickly.

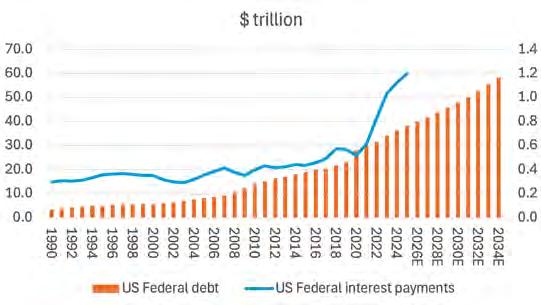

It took America until 2003 to amass a total federal debt of $7 trillion. According to Congressional Budget Office estimates, the second Trump administration will add $7.4 trillion to the federal debt across its four-year term alone. Add in Federal Reserve interest rate hikes, and the need to issue new treasury bonds as old ones mature, and America’s interest bill now exceeds $1.1 trillion, or a fifth of the tax take.

President Donald Trump and treasury secretary Bessent are alert to the danger. They are trying to boost growth, raise tax income from tariffs

US federal debt pile, and the interest bill, continue to grow

and hector the US Federal Reserve into lowering interest rates, all in the cause of making the interest bill more manageable and reducing the debt-toGDP ratio.

And it is the prospect of rate cuts that is supporting the US treasury market, where the benchmark 10-year yield is grinding lower, with the result that US sovereign bond market prices are grinding higher – even though supply continues to rise.

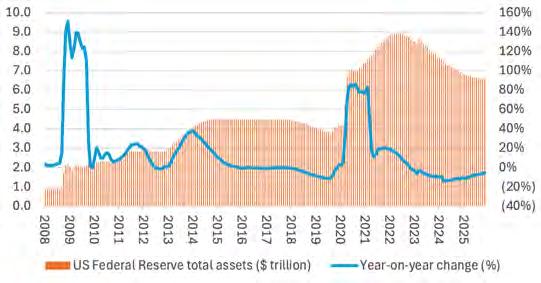

Speculation about a return to quantitative easing

Given that interest rates seem much more likely to trend down than up, not least because the government cannot really afford higher borrowing costs, the risk-reward profile for treasuries seems skewed toward return, all things being equal, especially now the US Federal Reserve’s balance sheet is no longer shrinking as quantitative tightening comes to an end. There is no chance of Fed asset holdings going back to their pre-Financial Crisis levels. Chatter already abounds that the Fed could return to quantitative easing (or QE for short) and bond-buying in the event of any unexpected economic or financial market turbulence.

Such price-insensitive bond buying could bring near-term gains there are two long-term dangers here.

The first is a recession. America’s public finances are a mess when the economy is doing well. A downturn would lower tax income, increase welfare spending and further increase the supply of US Government bonds. The only way out of that may be QE, or something that looks like it, and

US Federal Reserve has halted quantitative tightening

keeping interest rates artificially low.

This is one form of the debasement trade, as government uses money printing, inflation and, in effect, financial repression to salt down debt-toGDP ratios. This scenario plays to soaring gold and silver prices, as buyers seek protection from ‘paper’ promises, where inflation is the enemy and supply is plentiful, by buying ‘hard assets,’ where supply only grows slowly and there is perceived haven value.

The second is inflation. If the headline rate exceeds treasury yields, then fixed-income investors could start to see the value of their US treasury holdings erode in real terms.

Gold and silver may get a further bid given how they were a good hedge against the ravages of inflation in the 1970s. Equities may respond more favourably to higher nominal GDP, and corporate earnings, growth, although a sustained inflationary outburst, again like that of the 1970s, would probably see multiple compression and overall valuations come down, since nominal growth would be less scarce (and less valuable).

Both dangers represent the risk of currency, or asset, debasement owing to inflation and galloping supply (of money, bonds, or both).

It does therefore make sense that all three asset classes, fixed-income, equities, and precious metals, can go up at once. But it seems unlikely to last forever, given the fragile nature of government finances, and the Scylla and Charybdis of inflation and recession which lie in wait on either side of the scenario currently priced in by financial markets, namely steady growth, cooler inflation and gently lower interest rates.

Three ways to protect your investments from a stock market crash

There is a recurring question being posed by investors right now: is there going to be a stock market crash? There is a very simple answer to this question: yes there is. Booms and crashes are part and parcel of the market cycle.

It might be simple, but this truism isn’t especially helpful. What people really want to know is whether a correction in share prices is imminent, and preferably the date on which it will happen. But while we can confidently say there will be another stock market crash at some point, we can’t predict when that might be.

Could it be in 2026? It could. But equally the market could rise another 20%, 50% or (who knows) 100%, before share prices take another significant tumble. In which case, sitting on the sidelines and watching the ascent will be painful.

This lack of visibility is no doubt enough to deter some people from investing at all. That approach doesn’t come without its drawbacks though. Anyone sitting out of the stock market over the long term is highly likely to receive lower returns from cash in the bank, and ultimately that means a smaller pot of gold at the end of the rainbow.

However, if you’re wary about investing, there are strategies you can employ to have your cake and nibble at it too. That’s the case whether it’s current market conditions which make you reluctant to invest, or if you are simply a cautious soul who wants to keep risk relatively low.

1. Regular savings to the rescue

One of the simplest and most effective ways to mitigate stock market risk is to set up a regular

savings plan, which invests your money on a monthly basis. This means even if the stock market falls, your fresh investments buy in at cheaper prices. This leads to a smoother investing journey than sticking a lump sum into the market in one go.

The following example compares the return on £1,000 invested as a lump sum and through regular investment over five months.

This is just a hypothetical illustration and in a steadily rising market a lump sum investment would have performed better over this period. However, it is very rare for markets to go up in a straight line over the long-term.

This approach is most effective for those who are still building up their investment pot and are going to be saving for some years to come. If you’ve already done most of your saving and are close to retirement, or in it, you may have to pull other levers to dial down risk.

Source: AJ Bell

2. Asset allocation can dial down risk

One of those levers is to adjust your asset allocation. The investment world is not composed solely of shares. Investors can also put their money into bonds, and other assets such as gold, property,

infrastructure, and absolute return funds. These other assets tend to perform differently to shares, and so when stock markets are falling, some of these assets may actually be rising. Bonds in particular are widely used as a foil against stock market corrections. When shares take a tumble, there is often a flight to safe assets, and that often means investors buying bonds, pushing up their prices. This isn’t always the case, and there

are times when both shares and bonds sell off, but nonetheless they are a useful tool for those looking to mitigate the risk of a portfolio comprised solely of shares.

How much you invest in shares versus bonds and other assets really depends on how much risk you want to take. A common cautious investment approach has historically been a 60/40 portfolio, which holds 60% in shares and 40% in bonds and other assets, but there’s no hard and fast reason to stick to that allocation. To add more risk, you could increase the stock market exposure, and to dial it down you could add more bonds.

If you want someone to pull these strings for you, it might be worth considering a multi-asset fund. These are funds which invest in a range of assets, but primarily shares and bonds, and they’re run by a professional fund manager. They come in a variety of risk profiles so you can pick one which suits your own enthusiasm for the thrills and spills of the stock market.

3. Diversify and rebalance your stock market portfolio

As well as your asset allocation, you can also address risk within the stock market side of your portfolio by diversifying and rebalancing. Diversification across funds, stocks, sectors and regions means your portfolio is less vulnerable to poor performance in just one area making a big dent in your wealth. Regular rebalancing also helps to keep that diversification in place, otherwise strong performance from one area can lead to it swamping your overall portfolio.

We’ve seen precisely such a dynamic play out in global stock markets over the last decade, with US stocks, and in particular the technology sector, performing exceptionally well. The result is that the S&P 500 now makes up over 70% of the MSCI World Index, one of the most common benchmarks of the global stock market. And within the S&P 500 itself, the Magnificent Seven tech titans make up over a third of the index. These US tech companies will therefore be writ large across many investors’ portfolios, and a downturn in this highly valued

sector could therefore have an especially large and unwelcome impact.

The risks of not investing

Everyone knows investing in the stock market comes with the risk of losses attached. But there are other financial risks which tend to fly under the radar. Inflation risk is a big one. If you only ever hold cash, your returns may not match price rises over the long term, leading to a reduction in your buying power.