abrdn New India Investment Trust

managed by Aberdeen

India: a vibrant investment opportunity

India’s vibrant economy is fast evolving, with remarkable demographics: the largest population in the world, a growing and aspirational middle class and increasing integration into the global economy.

The Indian growth story is an exciting one, with a wealth of opportunities, but not without risk. So, if you’re keen to explore this market’s promise, quality matters. That’s why at abrdn New India Investment Trust we’re always on the lookout for world class, well governed companies that operate in attractive industries and sectors.

For a portfolio that’s at the heart of India’s growth and potential, take a look at abrdn New India Investment Trust

Tax efficient investing

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Eligible for Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs).

Invest via leading platforms.

Three important things in this week’s magazine

Dividend growth stars: searching for growing shareholder returns

With economic uncertainty on the rise, the Shares team looks at companies which are offering attractive, well-covered dividends, with the potential to grow their payouts this year and next year.

Can Europe continue to attract fund inflows?

Being overweight US stocks has long been the default setting for global investors, but European shares are outperforming this year as funds flow back across the Atlantic. Dan Coastworth asks, is there more to come?

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

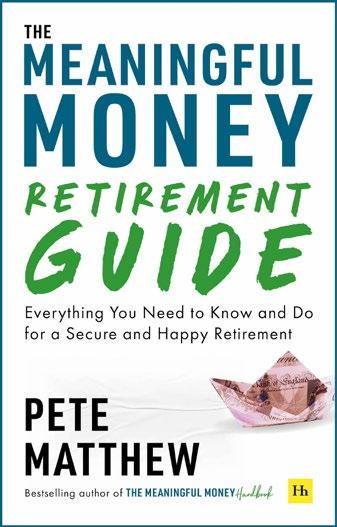

Learn about the three stages of retirement in this important new book

There is a shortage of guides on how to prepare for life after work, which makes ‘The Meaningful Money Retirement Guide’ by financial planner Pete Matthew a welcome addition to the bookshelves.

M&G shares scale new three-year high on partnership with Dai-ichi Life

Profit warning sends MJ Gleeson shares tumbling to 12-month

Bond investors are more cautious, while JPMorgan boss warns of a ‘crack’ coming

Another month, and another change in trade policy from Donald Trump – from this Wednesday (4 June), imports of steel and aluminium are to face 50% tariffs, double the previous levy, after China allegedly violated some deal or other.

Yet markets have barely flinched, with the S&P 500, the Nasdaq Composite and indeed European indices trading just a few percentage points off their all-time highs.

Also, after a huge spike on ‘Liberation Day’, the VIX index of implied 30-day stock market volatility is back to normal levels.

No signs of fear in markets as ‘TACO trade’ leads US stocks back to highs 54

Ditto the ‘Fear-and-greed’ indicator, put together by CNN to show what is driving stock markets at any given point.

This lack of concern is explained by the ‘TACO trade’ (Trump Always Chickens Out), a phrase which has gone viral since it was coined by the Financial Times a month ago.

Not just online, either – traders are increasingly betting the more outlandish the policies the White House announces the less likely they are to be implemented, so if stocks sell off sharply, as they did in April, it’s the cue to keep buying.

Bond markets on the other hand are still nervous, not so much about an ever-shifting trade policy but about Trump’s ‘Big, Beautiful Bill’ which threatens to increase total US debt and interest payments to record levels.

Investment firms which were traditionally big buyers of long-dated US Treasury bonds are now sitting on the sidelines, wary of the budget gap and the growing debt burden.

In an interview with Bloomberg, DoubleLine Capital fund manager Bill Campbell said the firm had two approaches to 30-year Treasuries, either ‘a buyers’ strike’ or outright short-selling.

With an auction of 30-year bonds scheduled for this Thursday (5 June), it will be interesting to see whether the Treasury scales back issuance in the face of lower demand.

and Greed Index

Jamie Dimon, chief executive of JPMorgan Chase (JPM:NYSE), the world’s largest bank, has been unusually vocal, warning US regulators there will be ‘a crack in the bond market’ which will cause panic and potentially require central bank intervention.

We aren’t in the forecasting game, but there are enough sensible people waving warning flags for us to take notice.

Dividend payers are a good fall-back, and in this week’s cover feature we look at a trio of stocks with the potential to keep raising their payouts along with a list of dependable investment trust and fund ‘dividend heroes’.

Also in this week’s magazine, we look at two smaller companies which have recently lost major contracts and seen their shares sold off heavily.

Winning contracts is down to firms themselves, whereas losing them is usually the result of factors beyond their control such as customers cutting back their capital spending.

Given the uncertain economic outlook, we are likely to see more companies warning of contract delays and cancellations, so keep an eye on small-cap holdings especially.

UK Strategic Defence Review sends security stocks higher

The planned investment will create around 1,800 highly-skilled jobs

Continuing reverberations from President Tump’s redrawing of the global world order saw the UK government announce its SDR (Strategic Defence Review), aimed at moving the UK to a position of ‘war fighting readiness.’

Having already committed to increase military spending to 2.5% of GDP (gross domestic product) by 2028, on 1 June Prime Minister Starmer revealed plans to increase spending to 3% during the next parliamentary term (2029-2034).

The spending is aimed at supporting the modernisation of nuclear warheads, the expansion of the nuclear submarine fleet, scaled-up munitions production and enhanced investment in cyber and long-range strike capabilities.

While representing a welcome jump in spending, it may still fall short of the Trump administration’s aspirations to get to the 3% target by 2029 and increased expectations from other NATO (North Atlantic Treaty Organisation) countries.

Later this month the military alliance will vote on a proposal for members to spend 5% of GDP by 2032.

The SDR will see the procurement of up to 7,000 UK-built long-range weapons and £1.5 billion to build at least six munitions and energetics factories.

The government says the Ministry of Defence should lay the industrial foundations for a permanent uplift to munitions stockpiles to meet the demand of ‘high tempo’ warfare.

The funding will see UK munitions spending hit £6 billion in the current parliament and ‘ends the hollowing out of our Armed Forces and will also drive innovation, jobs and growth across the country, allowing the UK to lead in a stronger NATO,’ according to the government website.

350 Aero/Defence £ Jul 2024 Oct Jan 2025 Apr

Source: LSEG

shares higher.

The gains were led by Babcock International (BAB) which jumped 7% to an eight-year high, while BAE Systems (BA.) was up 2% and Qinetiq (QQ.) was 6% higher at 519p, closing in on its alltime high.

Morningstar analyst Loredana Muharremi believes BAE Systems is well positioned to benefit due to its exposure to submarines, munitions and cyber, via its Digital Intelligence division, while Rolls Royce (RR.) will benefit from its role in naval nuclear propulsion.

A broader network of tier-one and tier-two suppliers should also benefit from the localisation of munitions and components, says Muharremi. In this regard it was noteworthy that independent technology group Cohort (CHRT) also saw its shares gain.

While the news is positive for the sector, Muharremi noted any positive impacts will be ‘gradual and backloaded.’

The news sent UK defence and aerospace

Furthermore, because the SDR aligns with the UK’s prior strategic direction, the news is largely already incorporated into market expectations and consensus forecasts, insists Muharremi. [MG]

Nick Train keeps the faith with Finsbury Growth & Income Trust

Train has tilted the trust’s exposure towards data, software and technology platform companies, reducing its weighting in consumer brands.

Veteran stockpicker Nick Train has upped his stake (30 May) in Finsbury Growth & Income Trust (FGT) to 3.92% in a show of confidence in the well-followed fund’s long-run prospects.

The purchase followed results (29 May) for the half to 31 March 2025 which revealed another period of underperformance, the company’s net asset value (NAV) total return of 2.1% lagging the 4.1% rise in the benchmark FTSE All-Share Index.

However, chairman Pars Purewal called out ‘encouraging signs of recovery in a number of companies within the portfolio and in prospects for the UK market as a whole’.

For much of the half, the trust’s portfolio of quality companies with hard-to-replicate data assets or brands, which includes luxury leader Burberry (BRBY), Irn-Bru maker AG Barr (BAG) and software giant Sage (SGE), delivered strong relative and absolute returns, only to give up ground towards the period-end in response to rising concerns over President Trump’s tariffs.

This shift has yet to produce a sustained improvement in performance, yet Train is ‘sure that relatively speaking it has meant your portfolio is better prepared to withstand the effects of tariffs and possible trade wars than it otherwise would have been’.

He explained: ‘It is not clear that tariffs matter at all for major portfolio holdings, such as RELX (REL), London Stock Exchange Group (LSEG) or Experian (EXPN), because their products are digital, not physical. Moreover, the subscription-type revenues earned by that trio and other important holdings, such as Rightmove (RMV) and Sage, are reassuringly predictable.’

Two large holdings which do make products sold globally are Unilever (ULVR) and Diageo (DGE). While the former’s exposure to any permanent USimposed tariffs is relatively modest, the situation for the latter is ‘ostensibly, less reassuring’ conceded Train.

Thankfully, since 2020, ‘buy-and-hold’ investor

Source: LSEG

Spirits leader Diageo derives half its profits from the US and has ‘the misfortune that two of its most important and popular products there are Mexican tequila and Canadian whiskey, both now at risk of tariff imposition’.

Nevertheless, Train continues to look for opportunities to top up the position in the belief Diageo should gain market share through the tariff turmoil, and if Trump cuts taxes for US citizens then ‘Diageo’s exposure to US consumers would be seen as a strength, not, as currently, a weakness’.

In conclusion, Train stressed Finsbury Growth & Income is ‘a collection of outstanding, predominantly global, companies, with obvious growth opportunities. Then I look at our NAV performance and wonder why it isn’t better. Then I think to myself I should probably buy some more Finsbury Growth & Income Trust shares for myself. I do hope all shareholders will be rewarded for their patience, including me.’ [JC]

Capital Global Financials Trust plc

Banking on a brighter future

Financials

SRT Marine shares sail to all-time high on latest systems order

With a £1.2 billion bid pipeline, the firm’s future has never looked brighter

As a long-term price chart shows, shareholders in marine security and defence firm SRT Marine Systems (SRT:AIM) are well used to choppy waters, but even the most seasoned investors will be rubbing their eyes at the stock’s performance this year.

At the time of writing the shares are up 24% on the (shortened) week and 79% on the year to an all-time high of 73.5p after news the company had started work on a €167 million (£140 million) coastal surveillance project for the

Indonesian Coast Guard.

The development is being rolled out in multiple two-year phases and will be supplemented by eight years of ongoing technical support, maintenance and data services.

Chief executive Simon Tucker has often compared the opportunity for SRT’s ‘marine domain awareness’ services with the introduction of air traffic control, which we all now take for granted but for decades didn’t exist. As the world becomes a more uncertain and unstable place, governments need to know who is using their waters as well as who is in the skies, meaning the total addressable market for SRT’s

Eagle Eye shares hit five-year low on

loss of major US contract

Impact on earnings for the year to June 2026 will be ‘material’

It has been a poor 2025 for shareholders in AI-enabled marketing company Eagle Eye Solutions (EYE:AIM), starting with a warning in January that sales this and next financial year would miss forecasts due to a significant fall in professional services revenue and lengthening sales cycles due to the macroeconomic climate.

The company operates a cloud-based platform allowing clients in the retail, travel and hospitality industries to offer personalised marketing to their customers,

sending out more than a billion offers every week.

‘Personalisation is a priority for retailers around the world,’ said chief executive Tim Mason, ‘and it’s right at the heart of our DNA, with our offerings powering many of the world’s largest and most successful loyalty programmes.’

Despite lowering guidance, the firm announced it had reached a ‘transformational’ agreement with one of the world’s largest enterprise software vendors, which would take it into new markets and sectors, with ‘material revenue generation’ expected in 2026/2027.

The company also confirmed it was confident in achieving its

Source: LSEG

systems is still immense.

At the last count the Radstockbased firm had five active nationstate customers for its systems, £320 million of work in hand and £1.2 billion of new prospects, half of which were from existing customers. [IC]

Disclaimer: The author owns shares in SRT Marine Systems

Source: LSEG

medium-term goals of £100 million of revenue and a 30% adjusted operating margin.

This week, however, it revealed it had lost a high-margin contract with a national US grocer, worth £9 million to £10 million in annual revenue, sending its shares down 39% on the day taking them to a five-year low and a 52% loss for the year. [IC]

10 June: GB Group, Oxford Instruments, Vianet

11 June: Fuller Smith & Turner, Molten Ventures, Revolution Beauty Group

12 June: Halma, Mind Gym, Motorpoint, Norcros, PayPoint INTERIMS

10 June: Diales Group, Porvair

12 June: Benchmark Holdings, IDOX TRADING ANNOUNCEMENTS

12 June: Tesco

Tesco’s trading update may hold the key to full-year expectations

Fears of a price war have held the shares back despite market share gains

It has been an unusually unsettled time for shareholders in the UK’s largest supermarket group, with the shares falling heavily in mid-March after rival Asda warned it would start another price war.

The stock tumbled again in midApril when the company revealed operating profit for the current financial year could be as much as 14% lower than last year at £2.7 billion depending on how much ‘firepower’ management invests in prices to maintain market share.

Therefore, analysts and investors will want to know from the firm’s first-quarter trading statement on 12 June whether £2.7 billion was a worst-case scenario or whether it now represents the base case, as the current consensus operating profit forecast is £2.9 billion.

Retail sales in April were stronger than expected, primarily driven by a rebound in food store spending at the expense of non-food.

However, as chief economic adviser to the EY ITEM Club Matt Swanell pointed out, there has been ‘a puzzling inconsistency’ in official data this year with retail sales seemingly outstripping consumer spending.

A clearer picture emerged from the Kantar till roll data for the four weeks to 18 May, with grocery sales up 4.4% thanks to food price inflation of 4.1%, the highest level since February 2024.

As consumers feel the pinch, they are increasingly buying own-brand groceries and looking for deals, but there are fewer promotions than usual.

What retailers are doing instead is trimming prices – according to Kantar, 80% of promotional spending has been straightforward price cuts rather than BOGOFs (buy-one-get-one-free).

In terms of market share, over 12 weeks Tesco improved its take to 28% from 27.6% a year ago, but it was the discounters Aldi and Lidl who gained the most ground, accounting for a combined 19.2% of the market against 18.2% last May. [IC]

GameStop turns to bitcoin as it tries to transform growth profile

Computer games seller has been enviously watching Strategy’s crypto success

Having talked about it for months, GameStop (GME:NYSE) has finally pulled the trigger on its determined, if dicey, bitcoin raid.

The ‘meme’ stock unveiled the purchase of 4,710 bitcoins on 25 May, valued at more than $515 million, as part of an investment strategy designed to ride cryptocurrency potential far beyond its computer games-retailer roots, and it will certainly add an extra dimension to future earnings releases, with the next update set for after the market closes on 10 June.

Analysts project revenue to decline approximately 14.5% year-on-year to around $754.2 million from $881.8 million in the first quarter last year, albeit with cost cuts likely to return earnings to positive territory after last year’s $0.12 loss per share.

But with quarterly revenue having declined from past highs of $2 billion, the new investment strategy, approved by the GameStop board in March 2025, is a clear attempt to reshape its growth trajectory by capturing bitcoin enthusiasm.

Many believe the cryptocurrency can become an independent global reserve asset like gold. The strategy rethink is also, presumably, an attempt to replicate the rampant share price returns of Michael Saylor’s Strategy (MSTR:NASDAQ) –formerly called MicroStrategy – which holds the world’s largest corporate bitcoin collection, worth in excess of $61 billion.

Strategy has seen its share price surge 130% over the past year as bitcoin’s valuation jumped, and now trades at $372, valuing the business at around $104 billion. GameStop stock has been no match, eking out gains of less than 10%, below the returns of the S&P 500. [SF]

Barrick Mining is more than just a ‘gold play’

The company is growing earnings and free cash flow faster than forecast

Barrick Mining (ABX:TSE)

C$27.57

Market cap: C$48 billion

One of the world’s biggest gold producers, Barrick Mining Corporation (ABX:TSE), also known as Barrick Gold, has seen its share price rise 21% this year, but we believe there is a great deal more upside to come.

The gold price has doubled since late 2022, yet gold mining stocks have barely budged, despite the fact they offer leveraged exposure to prices and they pay dividends while physical bullion generates no income.

With gold trading at roughly $3,350 per ounce at the time of writing, there is a huge disconnect, and with some analysts raising their 2025 year-end forecasts to $4,000 per ounce and beyond, it is only a matter of time before this gap closes.

WHAT DOES BARRICK DO?

Toronto-listed Barrick is the world’s second largest gold producer by volume, with mines in 19 countries including six so-called Tier One mines.

In 2019, it bought Randgold Resources, an Africafocused gold mining and exploration company, for $18.3 billion, and in the same year it combined its Nevada mines in a joint venture with Coloradobased competitor Newmont (NEM:NYSE)

Last year, Barrick produced 3.9 million attributable ounces of gold as well as 430 million pounds of copper, which has also been rising in price due to a global push towards electrification and increased infrastructure spending.

Most of its gold came from the US (46%), while 37% came from Africa and the Middle East and the remaining 17% came from Latin America and Asia.

Net earnings were up 69% on 2023 and free cash flow doubled, while the company has little debt and has been using its cash flow to

invest in new facilities as well as buy back its undervalued shares.

STRONG FIRST QUARTER

Net earnings and free cash flow rose 59% apiece in the first three months of this year, while gold production was at the top end of guidance at 758,000 ounces with an average realised gold price of $2,898 per ounce, up 40% on the previous year.

Cash costs of around $1,100 per ounce and all-in sustaining costs of around $1,500 per ounce are expected to trend down during the course of the year, so if the underlying gold price continues to climb margins are going to improve further.

In the meantime, expansion work at Pueblo Viejo in the Dominican Republic and maintenance at Nevada Gold Mines will position both sites for a stronger output next quarter and the rest of this year, while new growth projects are ‘significantly advanced’ according to chief executive Mark Bristow.

The Reko Diq project in Pakistan and Lumwana copper mine in Zambia will ‘materially grow Barrick’s copper and gold production and support our goal to organically grow our gold-equivalent ounces by 30% by the end of the decade,’ says Bristow.

The firm also delivered value in the first quarter with the sale of a 50% interest in the Donlin gold project in Alaska - home to one of the largest

Barrick Cowal Gold Mine in New South Wales, Australia

undeveloped gold deposits in the world - for $1 billion and bought back another $143 million of its shares.

SHARES PRICE COULD DOUBLE

Among the fifteen Wall Street analysts covering Barrick, the average price target for the shares is $24 but the highest is $38 and Shares believes they could go as high as $50 if the gap with the gold price closes.

Gold has historically been a good hedge against economic uncertainty, and never has that been truer than it is today.

So far the big buyers of gold have been central banks, especially those in emerging markets where bullion is a small percentage of total reserves, but institutions have yet to step up in a meaningful way.

The gold market is tiny by comparison with other

What the market expects of Barrick Mining

asset classes – global gold ETF holdings represent just 1% of outstanding US Treasuries and only 0.5% of the market cap of the S&P 500 – so even a small shift out of bonds or equities into gold could have a massive impact on the gold price, argues Niels Jensen of Absolute Return Partners.

‘Given the high operating leverage in many gold mining companies, one could argue that with a gold price at about $3,350/oz, miners could quite possibly significantly outperform bullion over the next couple of years,’ says Jensen.

POTENTIAL RISKS

No investment is without risks, and we wouldn’t expect Barrick shares to go up in a straight line.

The government in Mali, West Africa, has been trying to seize the day-to-day operations of the Tier One Loulo-Gounkoto gold complex, for example, where Barrick holds an 80% stake.

Operations at the site were suspended in January 2025 due to a dispute over taxes and ownership, and a Malian court is due to rule shortly on whether to put the mine under provisional administration.

Similarly, the group’s exposure to copper means sentiment may turn negative if the global economic outlook worsens or Chinese manufacturing data causes a wobble in commodity markets.

However, we believe the current valuation offers an exceptionally attractive risk-adjusted return for investors willing to ride out any adverse newsflow. [SG]

Nvidia stands out as a unique investment case, here’s why

Investors should ignore overvaluation talk and buy the AI chip champion

Nvidia (NVDA:NASDAQ)

$137.38

Market cap: $3.35 trillion

Keeping things simple when it comes to investing is sound advice. We can all be guilty of overcomplicating things on occasion, and sometimes the best investments can be right there in your own portfolios, meaning buying more of a stock you already own can be just as profitable as backing an entirely new one.

Which brings us to Nvidia (NVDA:NSASDAQ). You almost certainty already have exposure to the AI (artificial intelligence) chip champ, if not directly then through the cavalcade of indextracking ETFs – global, US, technology – or via an actively-managed fund.

We all know the company as the chip designer which has captured early leadership in the emerging AI race. Over five years, Nvidia stock has amassed 1,440% gains from under $10, or 73% on an annualised basis. That’s nearly five-times

the annualised return of the Nasdaq Composite (15.8%, according to Morningstar data).

LOOK THROUGH THE VALUATION

The obvious conclusion is Nvidia shares must be on a scorching valuation after such phenomenal success, but that’s not the case.

Stockpedia calculates Nvidia’s 12-month forward PE (price to earnings) multiple at 28.4 times, lower than other perceived AI winners like Microsoft (MSFT:NASDAQ) – 30.9, Broadcom (AVGO:NASDAQ) – 34.2 or Palantir (PLTR:NASDAQ) – 204.

Put it another way, investors have had only three opportunities since 2020 to buy the stock at this valuation or lower, and its average five-year PE multiple stands at around 43 times, based on Shares’ own back of an envelope calculation using a dozen peak and trough data points.

Moreover, Nvidia’s current PEG (price to earnings growth) ratio sits at a hugely attractive one times.

To square the circle, we have to look at just how rapidly Nvidia has been growing in recent years.

Chart: LSEG

Stockopedia calculates EPS (earnings per share) have grown at a CAGR (compound annual growth rate) of 91% since 2020, on 64% compound annual growth in revenue.

That’s impressive by any measure, but it’s truly staggering for a company of this scale, currently the world’s second-largest company at $3.35 trillion (behind Microsoft at $3.43 trillion and $350 billion bigger than Apple at number three).

What’s more, Nvidia’s pace of growth has been getting faster, not slower as the law of large numbers would suggest, peaking in the financial year to the end of January 2025 at 113% and 144% for revenue and EPS respectively.

WHAT DOES THE MARKET EXPECT?

Growth is surely bound to moderate, but by how much? According to Koyfin’s consensus data, the market is forecasting EPS of $1.00 on $45.6 billion revenue in the quarter to the end of July, implying roughly 50% year-on year growth on both metrics.

For the full year to January 2026, the consensus is pitched at $4.28 EPS on roughly $200 billion of revenue, new records both, and year-on-year growth is in the 45% to 50% ballpark.

‘This still seems like a unique opportunity to us,’ wrote Morgan Stanley analysts in a recent note. ‘The largest market-cap semiconductor company in the world is making a strong case that business will accelerate [AI investment] from here, while there is still significant anxiety — almost consensus — that conditions will decelerate,’ they add, referring to the market mood.

Consensus forecasts out to FY 2028

FY 2026 $199.6bn

FY 2027 $250.9bn $5.73

FY 2028

Source: Koyfin

$29.1.8bn $6.59

around China. ‘Our view continues to be that we are materially under-shipping demand.’

They are far from alone. ‘In sum, the more tech earnings I see [this quarter], the more I am liking and feeling more bullish about the upside path for Nvidia,’ wrote Mizuho tech analyst Jordan Klein.

GROWING OPTIMISM

Klein’s increased optimism seems to be catching. Koyfin consensus currently implies 31% per year average growth in revenue and EPS out to full year 2028.

Nvidia’s most recent results impressed across multiple fronts, noted the analysts, as did Shares in a web-only story. ‘Gross margins ahead, revenues ex-China strong, networking recovering, positive commentary on the supply chain ramp on racks,’ the analysts stated.

While there was limited forward guidance on the second half of financial year 2026, Morgan Stanley attributed that restraint to geopolitical sensitivity

Our view continues to be that we are materially undershipping demand”

Putting this into context, these forecasts imply average three-year forward PE and PEG – a metric popular with many fund managers when analysing valuations for fast-growing companies – at 25.6 and 0.95.

Yes, things might not play out exactly as analyst project. Risks remain around restrictions on China, capacity constraints, global investment patterns against the uncertainty of US economic policy, and competition, where Nvidia is facing a joint US Department of Justice and Federal Trade Commission probe into its AI chip domination, accusations the firm has publicly defended.

These are all risks investors must accept before investing, yet none of this is new, and it looks to us that these threats are all priced in, where possible upside is not. Nvidia has beaten, if not smashed, expectations for 10 straight quarters.

In conclusion, while some investors may feel they already have enough Nvidia exposure in their portfolios, others may be open to adding more. That’s firmly Shares’ opinion. [SF]

Invest in Vietnam today for your tomorrow

Vietnam Enterprise Investments Limited (VEIL) is hosting the VEIL Forum on Wednesday 18th June 2025.

The VEIL AGM will be held as part of the Forum. Existing shareholders and those interested in finding out more about VEIL are very welcome to register for the event in London. Remote access is available upon request.

To attend, please register by scanning the QR Code and completing your details by Sunday 15th June 2025.

Why we would stick with hVIVO despite share price fall

During 2024 the group inoculated a record number of volunteers

We highlighted CRO (contract research organisation) hVivo (HVO:AIM) in September 2024 for its leading position in the fast growing HCT (human challenge trials) market.

Industry experts forecast the market will grow from its current size of between $100 million and $150 million a year to between $700 million and $1 billion, and hVIVO itself plans to grow revenue to £100 million by 2028 from £62.7 million in 2024.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

On 30 May, the company revealed that it had lost a ‘significant’ HCT contract while a smaller study had been postponed.

The company laid the blame on current uncertainties in the pharmaceutical industry and the continued depressed biotech financing market, but the market reaction was brutal, sending the shares plummeting by 46% on the day, although they have since recovered by around 26% to circa 11p.

The firm said contracted revenue for the year including the cancellations stood at £47 million and it expected to achieve further contract wins during the year to the end of December 2025.

With all but one of the contracts for 2025 having

Source: LSEG

already commenced the board believes the risk of any further cancellations is low. Management also noted a record sales pipeline including some ‘large, high probability opportunities, in advanced discussions’ which could start in late 2025.

Chief executive Yamin ‘Mo’ Khan added: ‘Projects under discussion would represent some of our largest ever value contracts for human challenge trials, such as the world’s first ever Phase 3 HCT.’

However, the company also said that absent any further contract wins 2025 would likely result in a mid-single digit operating loss.

WHAT SHOULD INVESTORS DO NOW?

We note Khan and chief financial officer Steve Pinkerton increased their respective shareholdings on 30 May, in a show of confidence in the group’s growth prospects.

Growth rarely happens in a straight line, but the current setback looks to be out of management’s control and a reflection of the wider malaise in the market, and while losses are disappointing, we believe the prospects at hVIVO are still significant so we are sticking with it. [MG]

By The Shares team

DIVIDEND GROWTH STARS

THE COMPANIES BOOSTING RETURNS TO SHAREHOLDERS

In an environment where share prices have been volatile, focusing on dividends and those companies which can grow their dividend over time has real merit. The fact these businesses feel confident enough to increase their generosity to shareholders and, in the first place, have the financial strength and discipline needed to sustain a regular payout, are real ticks in the box from an investment perspective.

We ran the data on the biggest dividend increases from UK-listed companies – both for the most recently paid dividend and for the forecast payout for their current financial year. We included names which had an historic and forecast increase in the dividend of at least 6% and offered a forecast

dividend yield of at least 2% (these increases encompassed special dividends). While the yield on offer from long-term gilts is above 4%, the coupon on government bonds doesn’t grow.

The advantage of investing in a dividend-paying company is it has the ability to increase the payout year after year, though this has to be balanced against the fact dividends are not guaranteed and can be cut or cancelled at a firm’s discretion. From our list of more than 70 names, of which you can see a selection in the table, the team has identified three dividend growth stars. Read on to discover more about them and why we think they can continue rewarding shareholders with generous returns well into the future.

Selected dividend growth stars

Selected dividend growth stars

Market cap: £91 million

Workplace benefits and health insurance provider Personal Group (PGH:AIM) may be small now, with a market cap of less than £100 million, but chief executive Paula Constant and chief financial officer Sarah Mace think big.

By 2030, the duo aim to take Personal Group to £100 million of revenue, more than twice what it made last year, and £30 million of EBITDA (earnings before interest, tax, depreciation and amortisation) or three times what it made in 2024.

As well as lifting revenue 13% and EBITDA 29%, the firm won multiple industry awards last year and strengthened its relationship with FTSE 100 accounting and financial software firm Sage (SGE), delivering the best ever months of leads in November and December.

That momentum has carried through into 2025, where the firm is ‘on a great organic trajectory,’ says Paula Constant, as its proposition resonates with customers.

‘We are completely focused on winning new partnerships, maximising the value of our Sage relationship and winning new insurance business,’ explains Constant.

Existing staff benefit partners include B&Q, British Airways, DHL, Mitie (MTO), Ocado Retail and Royal Mail, along with universities and museums.

The Sage Employee Benefit scheme for SME’s delivered a 10% increase in annual recurring revenue last year, while insurance sales rose

18% and an 80%-plus rate of customer retention points to customers valuing the service highly.

There has been plenty going on behind the scenes too, with a focus on recurring revenue streams and less seasonality together with strengthening the balance sheet.

While basic EPS (earnings per share) from operations of 17.7p were up 32%, the full-year dividend was raised by 41% to 16.5p and there is plenty of scope to increase shareholder returns as the firm had cash and bank deposits of more than £25 million and zero debt at the end of December.

Indeed, dividends take priority over M&A, which ‘would have to be absolutely right’ to justify the effort, the money and the headspace, says Constant, especially given the size of the existing addressable market and the significant potential to grow the business organically. [IC]

Market cap: £93.7 million

Investors seeking a fast-growing small-cap with capacity to increase dividends long into the future should also consider pawnbroker-tofinancial services provider Ramsdens (RFX:AIM).

The Middlesbrough-headquartered concern is well-positioned for growth as the UK population continues to grapple with cost-of-living pressures. And while its dividend growth streak was briefly interrupted by Covid-19, Ramsdens’ progressive payouts are underpinned by the group’s strong cash generation and net cash balance sheet.

For the current year to September 2025, Panmure Liberum forecasts a 15% rise in the shareholder reward to 12.9p –implying a respectable 4.5% yield –ahead of a further advance to 13.3p in full-year 2026 with payouts more than twice-covered by earnings.

Guided by CEO Peter Kenyon, the £93.7 million cap has delivered consistent upgrades for the past four years and is benefiting from investments in growth initiatives, the high gold price and the robustness of a jewellery retail business which continues to win market share.

Source: Panmure Liberum, Ramsdens Ramsdens has grown the

One of the UK’s largest retailers offering foreign exchange, pawnbroking, precious metals purchasing and jewellery retailing, Ramsdens benefits from a growing and high-repeat customer base. It currently operates mainly in the North of England and Wales, so there is a significant opportunity to expand its physical estate, wring more growth from existing stores and grow its online presence.

While the soaring gold price has driven chunky upgrades in the current financial year, diversified operator Ramsdens is much more than a play on the price of the yellow metal, since prior year upgrades have been stoked by both the pawnbroking and retail jewellery arms.

On 8 April, Ramsdens said pre-tax profit for the year to September 2025 was expected to be ‘at least £13 million’, ahead of previous expectations, having enjoyed ‘continued positive momentum’ in the half to March 2025.

Based on Panmure Liberum’s current year 29.7p earnings per share (EPS) estimate, Ramsdens trades on less than 10 times earnings, which looks too cheap given the scope for additional upwards earnings revisions and the inventory on the balance sheet.

The broker’s 340p price target implies almost 20% upside from these levels, while FirstCash’s (FCFS:NASDAQ) near-£300 million takeover offer for Ramsdens’ larger rival H&T (HAT:AIM) highlighted the attractions of the pawnbroking and jewellery retailing patch, so a future premium-priced bid for the smaller player shouldn’t be ruled out. [JC]

Tristel (TSTL:AIM) 360p

Market cap: £176.5 million

Infection prevention specialist Tristel (TSTL:AIM) has a dividend yield of just over 4%, which is unusual for a quality growth company. It comes about due to the combination of Tristel’s progressive dividend policy and a lacklustre share price.

Tristel’s dividend per share is forecast to grow by 8.5% per year over the next two years, and historically it has grown by high double-digits, reflecting strong growth in the business.

At the current growth rate, the dividend can double in just under nine years, providing investors with a growing income comfortably above the rate of inflation.

Meanwhile earnings per share are forecast to grow by around 15% a year, implying close to 20% annual shareholder returns.

Tristel annual divident per share track record

Table: * includes special dividend of 3p • Source: Stockopedia, Refinitv

Growth at Tristel has been driven by increasing global penetration of the company’s proprietary chlorine dioxide technology, which is a proven, patented, high level disinfectant used to prevent infections in non-invasive medical procedures such as ultrasound scans.

The advantages of Tristel’s technology include its convenience, speed and safety.

Tristel earns a relatively high 82% gross margin on sales, reflecting the proprietary nature of its products, which translates into strong cash generation. The company is debt free with around £12 million of net cash on the balance sheet.

An important inflection point occurred in 2023 after the company entered the US market after many years of preparation. Tristel received regulatory approval for the use of its high-level disinfectant in ultrasound scans and in May 2025 Tristel received US regulatory approval for ophthalmic procedures.

The US is the world’s largest market for ultrasound scans with around 50 million procedures annually. There are an estimated 16 million ophthalmic procedure performed each year in the US.

Tristel has an established manufacturing base in the US through its partnership with Parker Laboratories, the largest supplier of ultrasound transmission gels in the USA, with a nationwide footprint.

The company estimates the addressable market for the high-level disinfecting of ultrasound devices is $100 million a year. Tristel earns a 24% royalty on all of Parker’s US and Canadian sales. [MG]

GETTING ACCESS TO DIVERSIFIED DIVIDENDS

For those hesitant about taking the risks associated with the dividends from an individual company there are lots of examples of funds and investment trusts which offer a diversified stream of income. Some of these have a specific remit of focusing on dividends, while others have a more balanced approach which still encompasses income.

In the latter category, Royal London Global Equity Select (BL6V111) has a remit of providing growth (through capital gains and income) of 4% a year above the consumer price index over a rolling five-year period. The income class of units in the fund pays out quarterly. The yield is modest at 2.2% but over five years the fund has delivered a total return on an annualised basis of 15.4%.

Investment trusts which also have an income component as part of a balanced approach include BlackRock Income & Growth (BRIG) Investment trusts are a particularly relevant vehicle here thanks to their ability to hold back some of the income they get from underlying holdings to act as a buffer for leaner times. That’s enabled several trusts to consistently increase their dividends for extended periods – some even running into multiple decades.

Examples of trusts which have increased their dividends for 20 years or more include popular one-stop shops Alliance Witan (ALW) and F&C Investment Trust (FCIT), which have increased their dividend for 58 and 54 consecutive years respectively, as well as Merchants Trust (MRCH), which has boosted its payout for 43 years in a row. Steered by Simon Gergel, Merchants yields more than 5% and has ongoing charges of 0.52%.

Examples of trusts which have increased

their dividend for 10 years or more include CT UK High Income (CHI), which looks to beat the total return from the FTSE All-Share by investing in around 40 companies, and Chelverton UK Dividend Trust (SDV) which has a bias towards small and mid-cap listed in London.

Income and value-focused Temple Bar (TMPL) recently announced a change to its dividend policy. With many UK companies shifting at least some of their returns of capital into share buybacks, the company is getting less dividends from its portfolio holdings. In response the trust plans to draw on capital reserves to enhance its payouts.

An income driven trust with a global focus is Scottish American (SAIN) – sometimes known as SAINTS – the names in its portfolio largely drawn from the US and Europe (including the UK).

Fund investors, specifically in OEICs and unit trusts, can be faced with the choice between an ‘Inc’ or ‘Acc’ share classstanding for ‘Income’ or ‘Accumulation’.

Put simply, if you invest in the accumulation version of the fund then any income generated from the underlying investments will be automatically reinvested back into the fund, while the income version will see all of that money paid out to you.

Which one you pick depends on whether or not you’re relying on the fund to pay you out an income that you need to use now.

For example, someone who is drawing their pension may want the fund’s income to help pay for their lifestyle.

However, someone who is still building up their pension pot and doesn’t need any additional income could buy the accumulation share class and see their income reinvested.

Book Review: ‘The Meaningful Money Retirement Guide’, by Pete Matthew

How to prepare yourself for the transition from a life of work to one of leisure

The bookshelves are full of classic books on investing, some of which we have reviewed in these pages, as well as plenty of books of the ‘How I made a million trading from my sofa’ type, which is not our forte, but we haven’t come across many which focus specifically on retirement and how to prepare yourself for it.

As the author Pete Matthew, who by day is head of a family-owned financial planning firm in Cornwall, explains, we all have a vague notion of what we will do when we the happy day comes and we can finally say goodbye to the office or wherever it is we’ve spent the best part of our lives.

For some, the dream will be to spend our retirement traveling, indulging in good food and fine wine, going to the theatre and shows.

For some, it will about taking long strolls along the beach and enjoying the outdoor life, but whatever we plan to do most of us will look forward to no longer having to worry about a daily routine.

Granted, for some the idea of stopping work altogether will be anathema, so the aim might be to gradually reduce the number of hours worked and balance that with more free time, but whatever we want to do ‘in retirement’, our ability to live out those dreams will largely be dictated by our finances.

Where Matthew’s previous book, The Meaningful Money Handbook, discussed how to build wealth over the course of a career, The Meaningful Money Retirement Guide follows on and looks at three distinct phases – ‘The Home Straight’ leading up to retirement, ‘The Great Transition’ into retirement and ‘The New Normal’ once we have adjusted to retirement.

To prepare us not just financially but mentally for the each of the three stages of retirement”

In ‘The Home Straight’, which could be five to 10 years before we plan to retire, we need to start getting all our ducks in a row, working out where we stand financially, maybe making a big push to maximise our savings, and getting our heads round concepts such as pension crystallisation and drawdown.

Having accumulated wealth by spending less than we earned, except for the fortunate few, from hereon in most of us will spending more than we are earning.

A PERIOD OF TRANSITION

In ‘The Great Transition’, we will start accessing our savings and pensions for the first time, including the state pension maybe, depending on what age

we have decided to retire.

Our daily routines will change and we will move to a new pattern of spending, which might seem out of proportion to our income at first, but then we will adjust, and if we have surplus cash we might move to what accountants call the ‘decumulation’ phase, with the aim of whittling down our capital over time.

Once we move on to ‘The New Normal’, which could be months or years into retirement, our spending patterns will have become more regular and predictable, we’ll be more focused on the here and now and enjoying the moment, and for the most part things won’t change from a financial point of view, assuming we don’t need medical care.

There is also the delicate matter of what happens after you retire, and part of the book is devoted to how you can pass your estate on to your family.

True to his role as a professional adviser, Matthew’s aim throughout the book is to prepare us not just financially but mentally for the each of the three stages of retirement, explaining the

implications of each one and providing checklists so we are ready ahead of time for the lifestyle changes we will encounter once we decide to down tools for good.

All in all, the book is well-written and we would highly recommend it to anyone who might have questions about how to plan for their retirement, and looking beyond that, how to transfer on their wealth.

To win a copy of The Meaningful Money Retirement, courtesy of publishers Harriman House, just answer the following question:

What is the current state pension age for men and women? The first correct answer out of the hat will receive a free copy of the book.

Entries to: shareseditorial@ajbell.co.uk

Finding Compelling Opportunities in Japan

Why Wickes could be just the job for growth and income seekers

CEO David Wood explains why ‘the Aldi of home improvement’ has a long growth runway ahead

Warm Easter holiday weather boosted seasonal sales of outdoor and gardening products and encouraged consumers to get out and spend on ‘big-ticket’ projects. Among the beneficiaries was DIY chain Wickes (WIX), where revenue grew 6.9% in the 17 weeks to 26 April 2025. The specialty retailer highlighted ‘strong volume-led’ retail sales, up 9.2%

on a like-for-like basis.

Wickes, which opened its first UK outlet in Manchester in 1972, was demerged from builders’ merchant Travis Perkins (TPK) in 2021 and is now laying the foundations for growth as a standalone business. It has taken investors a while to recognise the Watford-headquartered company’s attractions, but if a share price testing fresh two-year highs is any guide, Mr. Market sees a sunnier outlook ahead for the topsoil, tools and tiles seller.

The stock gained further ground following a first-quarter update (13 May) which confirmed an improving trend in Wickes’ project-based Design & Installation division, which delivered a second consecutive quarter of order growth. Wickes’ Trade segment, which sits within retail and services local trade professionals, remains a source of growth for the company. TradePro sales were up 13% in the quarter, supported by growth in TradePro memberships, which increased by 14% year-onyear to 605,000, up from 581,000 at the previous year-end.

Shares had some preconceived notions about the timber supplies-to-decorating products play ahead of a recent briefing with CEO David Wood – our view was Wickes is dependent on DIY fads and fluctuations in big-ticket spending with highly

seasonal earnings – and we had well-founded concerns over both cost headwinds and competition, since Wickes locks horns with companies ranging from Kingfisher (KGF)-owned B&Q and Screwfix to Selco, Home Bargains, Topps Tiles (TPT), The Range, B&M (BME) and Toolstation to name but a few.

As such, this correspondent jumped at the opportunity to converse with Wood and discuss the merits of the investment case with an experienced retail and consumer sector executive.

BUILT TO LAST

What are the DIY-store operator’s key competitive strengths, asks Shares? Wood politely pulls the author up on this characterisation of the company, which he describes as a home improvement retailer and about so much more than DIY.

‘We operate in the £28 billion and growing UK home improvement market and we’ve grown our business to about £1.6 billion, so there’s still plenty of headroom for growth in a market that continues to consolidate,’ insists Wood.

The enthusiastic boss explains UK market growth is underpinned by the fact we are a property-owning democracy, and Britain’s 29.8 million homes are among Europe’s oldest and least energy efficient, so there’s a constant requirement for repair and maintenance Wickes can capitalise on. And with people working more at home in recent years, even renters have stepped into the DIY market, ‘to freshen up the place where they are spending more time working or socialising’.

Wickes has been around for decades, so just how big is the kitchens, bathrooms and building materials purveyor’s growth potential, wonders Shares aloud?

‘We are at £1.6 billion of sales or about 6% to 7% market share, so there’s a long runway,’ says Wood, who wants to grow the top line to £2.5 billion and beyond. ‘We’ve got 230 stores, we’d like to get to somewhere between 250 and 260 stores, and there may be more, with average sales per store of £10 million. Today, it’s about £7 million,’ he explains.

Another growth opportunity Wood is palpably excited about is the fast-growing yet fragmented home energy solutions market, where this trusted national brand is helping customers improve the energy efficiency of their homes and save money on their energy bills. Last year, Wickes acquired a majority stake in solar installations business Solar Fast, which also boasts a smaller business installing gas boilers.

Wood says the UK is going to have to retrofit rather than build its way to net zero. ‘That’s all about retrofitting solar panels, air source heat pumps, batteries, inverters, EV chargers,’ he enthuses. ‘If you just take those five products alone, we believe in five years that will be a £10 billion incremental market.’

Capturing 10% or 15% of this other market would double the size of the company, he insists. ‘We have big ambition, but I don’t have to take much of that market to put quite a growth accelerant on the business.’

DIFFERENTIATED & DEFENDABLE

Major competitors which have disappeared from the market include Wilko, Homebase and Carpetright, presenting an opportunity for a strong business of scale such as Wickes. Nevertheless, competition for the spoils remains intense, so Shares wants to know

Wickes - a snapshot

Demerged from Travis Perkins 28-Apr-21

who Wood views as Wickes’ main rival. ‘There’s no one competitor we face, because we have this uniquely balanced business with Trade, DIY and Design & Installation,’ he answers. ‘An engine room of success for our business more recently has been Trade. The average Trade customer is worth 10 times that of an average DIYer, so there’s a real benefit of winning with the trade in the first instance.’

Wickes’ head-honcho also emphasises the business is digitally led with roughly two thirds of sales emanating from its digital channels. ‘But the real magic is 98% of the fulfilment comes from the physical estate,’ says Wood, ‘because every one of our stores is a last-mile fulfiller into its local community. Our store network doesn’t need to be as prolific as competitors in this market because of our digital and home delivery strengths. The catchment area of one of our stores is far bigger than most others.’

Wood continues: ‘When I talk about our stores, I say we are like the Aldi of home improvement. Our stores are quite a small store footprint versus the market at large. And within that footprint, we house a highly curated range. We only hold about 9,000 products in store, whereas most of our competitors will hold anywhere between 30,000 and 50,000 products. And two thirds of our sales are own brand.’

‘It brings buying benefits you can pass on to the customer in terms of market-leading prices,’ explains Wood. ‘And the inventory itself is more efficient, so the average stock turn in our business will be two to three times faster than the industry at large. This is a really efficient, lean, low-cost model.’

COSTS & THE CONSUMER

Wood is at pains to point out Wickes is not exposed to new build as a sector. Rather, the focus is on repair, maintenance and improvement. ‘Our endmarkets are homeowners who are improving and maintaining the current properties they have.’ Next, I grill the CEO on the potential hit to the screws-to-sealants seller’s earnings from tariffs. Where does Wickes source the bulk of its products from? Wood assures me about 70% of this UK-only retailer’s goods are in fact domestically sourced, with exposure to Asia limited to the 7% ballpark. ‘We are really insulated in that way, and we don’t operate in the big seasonal categories, we are a very non-seasonal business. If you were to tip your house upside down and give it a good shake, everything that stays in would be Wickes, everything which falls out would be from the other home improvement retailers.’

What specific advantages does this tight range confer upon the paints-to-power saws purveyor?

POSITIVE MOMENTUM

For the year to 28 December 2024, Wickes delivered

Profits moving higher at home improvement retailer Wickes

Wood joined Wickes in May 2019, drafted in to lead the spin-out from Travis Perkins onto the Main Market. A trained accountant who knows his way around the profit and loss account and balance sheet, Wood has amassed almost 30 years in the retail and consumer sector, and boasts extensive board level experience in the UK, Europe and North America, having spent the bulk of his career with Tesco (TSCO), Unilever (ULVR) and Mondelez (MDLZ:NASDAQ).

He tells Shares the separation has afforded Wickes an abundance of opportunities.

‘This business has consistently outperformed the market for growth because the cash we generate, we get to invest in our proven growth levers. And we’ve been able to acquire a business (Solar Fast). Some of that might have been more challenging in a non-retail group where retail would have been lower on the priorities for capital allocation.’

adjusted pre-tax profits of £43.6 million. That was down from £52 million a year earlier, but at the upper end of market expectations and a pretty resilient showing given weaker consumer demand for big-ticket items and the operating cost inflation the company had to shoulder.

And while the dividend was held at 10.9p, Wickes launched a fresh £20 million share buyback, its second since the demerger, having completed a £25 million buyback programme which began in 2023.

In its latest update, Wickes said it remained ‘comfortable’ in meeting this year’s £47.7 million consensus pre-tax profit estimate, despite higher labour costs and what Wood called a ‘challenging external environment’. How has Wickes mitigated the impact from wage and national insurance increases and what is Wood’s assessment of the UK consumer? ‘You always need a degree of nimbleness and agility in the retail sector,’ he chuckles, ‘particularly when you are looking at your opex (operating expenditure) base, but our focus on productivity is just inherent in the business.’

On the consumer, he concedes there is still uncertainty out there and DIYers are being ‘a little bit thrifty and taking on smaller projects. Our Design & Installation business is more muted, but we are encouraged by the fact there’s excess savings in the economy and as interest rates start to come down, it might release some of that.’

WHAT ANALYSTS ARE SAYING?

With a 250p price target on Wickes, Canaccord

Genuity forecasts a near-9% rise in adjusted pretax profit to £47.5 million this year, building to £57 million and £65 million in full-years 2026 and 2027 respectively. Based on the broker’s earnings estimates for 2026 and 2027, Wickes trades on forgiving forward price-to-earnings multiples of 11.7 and 10.3 respectively even after a recent rally and offers investors an attractive 5% dividend yield.

Canaccord Genuity scribe Mark Photiades believes the retailer’s valuation remains ‘too low given opportunities for further growth from store expansion and organic initiatives, especially within TradePro. The development of TradePro, combined with other organic growth initiatives, should position the group strongly as and when underlying housing market conditions improve.’

At Investec, retail guru Kate Calvert is also bullish on the stock with a ‘buy’ rating and 329p price target and sees ‘upside risk to our forecasts given momentum, with potential to double profit before tax when demand picks up’. Analysts at Peel Hunt believe that longer term, Wood’s strategy is ‘clearly delivering and the investment plan remains on track. With five-to-seven new stores set to open this year (including four Homebase conversions), the group looks well placed to benefit from continued recovery in its end-markets.’

By James Crux Funds and Investment Trusts Editor

THE MAN WHO BROUGHT WICKES TO MARKET

The future of money: how AI is transforming finance

There are upsides and downsides to the impact of artificial intelligence in this area

Mark Gardner Award for Journalism

This award was set up in memory of Mark Gardner, a member of the AJ Bell Media Team who sadly passed away in 2022. Well done to University of Salford student Emily Trelfa who took the £5,000 prize associated with the award – a sum which was supplemented considerably thanks to the generosity of Mark’s family. The brief for participants was to discuss the impact of artificial intelligence on the world of money. She impressed the judges with her ‘well written and thoughtfully constructed’ and ‘thought provoking’ article.

When it comes to learning the financial facts of life, young people are now more likely to be talking to a banking bot than a bank manager. As artificial intelligence weaves its way into the fabric of modern life, its influence on financial systems is impossible to ignore.

From automated banking solutions to AI-driven investment strategies, the way we manage money is undergoing a fundamental shift. But, for young people like me, a 21-year-old university student still learning the ropes of financial responsibility, AI presents both an opportunity and a challenge.

One of the most significant ways AI is shaping personal finance is through automation. AI-

powered apps now track spending habits, provide budgeting advice, and even invest money based on individual risk tolerance.

For students juggling tuition fees, rent, and daily expenses, AI-driven financial tools like robo-advisors can serve as a digital financial mentor. The ability to receive real-time insights on spending and saving, without needing extensive financial knowledge, could be transformative for young adults navigating their first major financial decisions.

Many of us already interact with AI in financial settings without even realising it. Banks employ AI to detect fraudulent transactions, while digital assistants like Siri or Google Assistant help track expenses. AI chatbots offer instant financial advice, making customer service more accessible. What’s even more exciting is how AI can bridge the financial knowledge gap.

Many young people graduate with little understanding of investments, credit scores, or financial planning – AI tools could serve as an educational resource, providing personalised guidance tailored to an individual’s financial habits and goals. Of course, AI in finance is not without its risks. AI relies on vast amounts of personal financial information, raising questions about security and ethical data use.

Another pressing issue is economic inequality. While AI-powered financial tools have the potential to democratise access to financial knowledge, they also risk widening the gap between those who can afford premium AI-driven services and those who cannot.

AI is revolutionising the way we handle money, offering young people more control and understanding of their financial futures.

But as we integrate AI into finance, we must remain aware of its limitations and ethical considerations. AI should serve as a tool for financial empowerment – not a substitute for financial literacy. AI is as a valuable assistant, but not a replacement for critical thinking and informed decision-making.

Emily Trelfa

Can the DAX’s performance continue to lure people away from US shares?

Germany isn’t the only magnet as investors are also warming to global ex-US funds

There is a growing divide between the US and Europe from an investment perspective, even though all markets apart from Switzerland have fully recovered from the Liberation Day-triggered sell-off in April.

One might have thought the bounce-back in American shares would have stopped the great rotation away from US assets that we’ve seen since Trump returned to the White House. However, the recovery in share prices doesn’t change the fact that we’re potentially seeing one of the biggest shifts in investor thinking for decades.

Few investors are going to give up on the US completely, particularly as it has been responsible for such great returns in the past. Instead, we’re seeing greater realisation that it’s wrong to be overly reliant on one part of the world for wealth creation.

WAKE-UP CALL TO BE GEOGRAPHICALLY DIVERSIFIED

Donald Trump has done investors a favour, even though certain individuals don’t realise it. When US markets were racing ahead, few people wanted to hear the argument about American stocks being overly expensive. Why spoil the party when there was still fun going on? Well, Trump’s trade policies not only brought the party to an end, but they’ve

also provided an important wake-up call for investors to be more diversified.

Faced with the prospect of an economic wobble in the US, a government with swelling debt, and a country that has lost its triple-A credit rating (Moody’s downgraded the rating earlier in May), it’s not hard to see why US investment appetite has waned.

The US Federal debt currently stands at $36 trillion, and Congressional Budget Office estimates expect another $22 trillion on top by 2036. Half of the publicly held treasuries, or in the region of $14 trillion, will mature and need to be refinanced, and that will entail higher coupons and interest rates than current maturities. That’s why the market is watching the bond market so closely, to see if or when treasury yields prove sufficiently tempting that they persuade investors to take less risk, buy US government bonds and dump US equities.

GERMANY’S KNOCKOUT PERFORMANCE

With significant headwinds for the US equity market, it’s no wonder there is growing talk of investors already looking elsewhere. So, where is the money flowing now?

The natural place to hunt is where there are cheap opportunities such as Europe. Germany’s DAX index is the star performer year-to-date, up 21% between 1 January and 21 May 2025.

DAX versus S&P 500 over five years

Germany has stood out from the crowd because of its decision to ramp up spending on defence and infrastructure, creating a tailwind for various companies in the DAX index. With so much uncertainty around tariffs, it’s understandable why investors have gravitated towards a part of the world still able to offer solid earnings growth potential. The key unknown is whether this rally can continue. The DAX is now trading at its most expensive level in four years at 15 times next 12

months’ earnings. While that is still cheap relative to the US (the S&P 500 is on 21.4 times forward earnings), it’s no longer the bargain that the German index used to be. The market has priced in so much good news which means you have to ask what else will drive the index upwards.

There’s always a risk that investors bank profits on German equities and reallocate the proceeds to the US, particularly if they decide they cannot give up their addiction to Wall Street. However, Trump’s

Market valuations: 12 month forward price to earnings

trade war is still rumbling on and until there is full clarity post-trade deal negotiations, certain investors might decide to hedge their bets and keep money invested in various parts of the world rather than going all-in on the US again.

ONE AREA OF THE FUNDS MARKET IS RED HOT

Seeking broad geographic exposure has long been popular, but specifically looking for global opportunities excluding the US is more of a recent phenomenon. Investors put $2.5 billion into world equity funds that exclude US exposure between the start of December 2024 and the end of April 2025, according to an article in the Financial Times citing data from Morningstar. The bulk of the inflows came in the past three months, and it reverses a trend that saw three years of net withdrawals for world ex-US funds.

The MSCI World ex-US index is having its moment in the sun after a laggard performance. Over the past decade, it has generated half the total returns (+76%) compared to the broader MSCI World index (+151%). The tables have turned since Trump won the US presidential election for the second time. The MSCI World ex-US is up 15% over the past six months versus 2.8% from the MSCI World; and up 7.8% versus 0.2% respectively over three months. There are various tracker funds mirroring the performance of global ex-US indices, such as XTrackers World ex-USA ETF (XMWX).

Alternatively, certain global equity funds have been catching investors’ attention by having a low weighting to the US. For example, Artemis Global Income has one third of its assets in Eurozone stocks because the manager thinks US equities are too expensive. Its US weighting is 24%, as of 30 April 2025, compared to 71% in the MSCI World index.

A year ago, investors would have thought only a brave person would have so little allocated Stateside; now it’s proving to be an advantage.

PUT 8 JULY INTO YOUR CALENDAR

The next big date to watch is 8 July when the 90day pause on higher tariffs ends. That might be the trigger for investors to think long and hard about how they want to position portfolios. If Trump is still keeping various countries dangling by a thread as trade negotiations fail to reach an agreement, don’t be surprised to see even greater interest in investments outside of the US.

However, if he can wrap everything up by that deadline and secure deals and tariffs that aren’t as punishing as previously thought, there’s every chance that investors might feel comfortable with the US again.

It’s impossible to predict what will happen next, but one thing’s for certain is that 2025 will be one for the history books when it comes to significant financial market events.

Comparing returns from a global equity index versus one excluding the US

Source: AJ Bell, FE Fundinfo. Total return in US dollars. Data to 21 May 2025.

MSCI World MSCI World ex-US

WATCH RECENT PRESENTATIONS

Visit the Shares website for the latest company presentations, market commentary, fund manager interviews and explore our extensive video archive.

AOTI Inc (AOTI)

Mike Griffiths, CEO

AOTI produces, rents, and sells medical devices to help resolve severe acute and chronic wounds for customers globally. The company provides efficacious topical wound oxygen solutions for use in both the institutional and the home care setting to improve the health, well-being, and independence of patients. Its products include TWO2 Extremity Chamber, TWO2 Multi-Patch.

Fidelity

Emerging Markets Limited (FEML)

Christopher Tennant , Co-portfolio Manager

Fidelity Emerging Markets Limited draws on Fidelity’s resources across the globe to build a carefully curated portfolio of companies with a strong growth runway. High-quality emerging market companies should deliver strong and sustainable investment returns over the long term but keeping an eye on potential risks is vital.

North American Income Trust (NAIT)

Fran Radano, Fund Manager

North American Income Trust aims to invest in US companies that are either producing income today or growing for income tomorrow. Recognised for its capital growth, the North American market also generates over a third of the world’s dividends. The trust’s experienced managers seek out companies that are turning the region’s innovative ethos into real returns for investors.

Should I lend money to a friend or loved one?

What you should consider before handing over cash to someone you know

When a friend or family member is struggling to stay afloat, lending money to tide them over can seem like the right thing to do.

While this can be a big help for them, it’s also important to consider how it will affect you, especially when it comes to your own finances and your relationship with that person.

And while this money may be called a loan, it’s often never paid back. According to Starling Bank, nearly a quarter of the UK population is owed over £1,000, with almost half of them feeling too awkward to ask for the money to be returned.

One of the main things to consider before lending someone money is if you are in the financial situation to do so. A good rule of thumb is to pretend the amount of money you’re lending is a gift. If you never got that money back, would it harm you financially? If so, you should likely opt against lending.

cash to a friend or family member harmed their relationship with that person over 20% of the time.

I’VE

DECIDED TO LEND HOW SHOULD I HANDLE IT?

If you’ve considered the risks of lending and have determined it is the right decision, there’s a few steps you can take to help the process go more smoothly.

Even though it seems like the nice thing to do, relationships can also suffer from lending money. A study by Bank Rate found lending

First, determine the criteria for this loan. Do you expect to be paid back in full? When would you like your loan repaid, and how often do you expect payments?

Making all these requirements clear with the lendee can help mitigate the chance of misunderstanding down the line.

You will also need to decide if you will be charging interest on the loan. If you do charge interest, this will count as income for you and will need to be documented in your taxes for the HMRC.

If any of the expectations you have laid out are not met, you should also have clear consequences

Personal

in place. This will help act as motivation for repayment but will also give you a clear path of action if the repayments were not to happen.

Once you have made these decisions, it’s imperative they are documented. Even if you have complete trust in the person you are loaning the money to, having documentation on the loan can help keep you clear of any unnecessary complications with the HMRC.

For example, if you loan money and it is not documented, this could be classified as a gift from the HMRC. In the case the lender passed away less than seven years later, this could mean that the money was subject to inheritance tax. Without documentation that it was a loan, it will be hard to prove this agreement. Make sure it is written down and signed, ideally with a witness. If you would like another level of security, you can also get the agreement notarised.

HOW TO SAY NO

If you’re not in the position to offer someone a loan, or simply decide you do not want to, it can be an awkward conversation to turn someone down. But there are a few ways to make your response a little easier. If finances are tight for you, you can simply explain that to the other party. If you’ve decided to say no for another reason, you can simply say you aren’t able to. There’s no requirement for you to offer an in-depth explanation.

You can also follow up by asking if there are other ways you can help. This might be something

like offering to help with their children after school or bringing over the occasional meal. If they are someone who struggles with their spending habits, you can also offer to create a budget with them, if it’s something you and they are comfortable with. Although it may feel awkward in the moment, it could benefit the relationship in the long run. If you feel they are not someone who is likely to be able to repay you, it can stop the build-up of resentment. And if you are not in the position to afford it yourself, it can prevent unnecessary anxiety in your own life.

GIFTING INSTEAD OF LENDING

If you are in the position to help someone without making your own financial position tight, you may also opt to simply give them the money. Although the money will never be making its way back into your pocket, it can simplify the process.

If you’re gifting, you will not need to create any sort of contract with that person, and you can avoid some of the burden on the relationship which is created by being forced to ask for the money back.

It is important to keep an eye on inheritance tax in this case. If you pass away less than seven years after you gift someone money, that gift may be subject to inheritance tax down the line.

BEWARE OF FINANCIAL ABUSE

If you feel that you are being pressured into giving or lending someone money, you could be experiencing financial abuse. Financial abuse is when someone controls how you spend your money or limits your access to income to take away your independence and make you more reliant. This commonly occurs with partners, family members, friends or caretakers.

If you think you could be a victim of financial abuse, you can learn more through the government’s Economic Abuse webpage or through organisations like Surviving Economic Abuse.

Hannah Williford AJ Bell Content Writer

17 JUNE 2025 FARMERS AND FLETCHERS IN THE CITY

3 CLOTH ST LONDON EC1A 7LD Registration and coffee: 17.15 Presentations: 17.55

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

COMPANIES PRESENTING

BRUNNER INVESTMENT TRUST (BUT)

Come rain or shine, the expertly managed Brunner Investment Trust aims to thrive in all market conditions. It has stood firm in the face of changing economic seasons, volatility and market fluctuations to protect, nurture and grow shareholders’ investments.

THE GLOBAL OPPORTUNITIES TRUST (GOT)

GOT invests in a range of assets across both public and private markets throughout the world. These assets include both listed and unquoted securities, investments and interests in other investment companies and investment funds as well as bonds.

THE SCHRODER INCOME GROWTH FUND (SCF)

an AIC Dividend Hero with a 28 year track record of delivering an increasing dividend achieved by investing primarily in above average yielding UK equities.

SHEPHERD NEAME (SHEP)