San Francisco Apartment

Association Office

265 Ivy Street

San Francisco, CA 94102

Tel 415-255-2288 Fax 415-255-1112

Email memberquestions@sfaa.org Web www.sfaa.org

SFAA Staff

Executive Director Janan New

Deputy Director Vanessa Khaleel

Database & Website Manager Stephanie Alonzo

Government and Community Affairs Charley Goss

Marketing Lara Kisich

Member Services Gershay Castaneda

Education & Member Services Maria Shea

Accountant Crystal Wang

SFAA Officers

President J.J. Panzer

Vice President Robert Link

Treasurer Paul Gaetani

SFAA Directors

Eric Andresen, Oz Erickson, Marina Franco, Craig Greenwood, Andrew Long, Kent Mar, Neveo Mosser, James Sangiacomo, Dave Wasserman

VOLUME XXXVI, NUMBER 8 AUGUST 2025

Published by

San Francisco Apartment Association

Publisher Vanessa Khaleel

Editor Pam McElroy

Art Director Jéna Safai

Production Manager Stephanie Alonzo

Tel 415-255-2288

Web www.sfaa.org

SF Apartment Magazine (ISSN 1539-8161) Periodicals Postage Paid at San Francisco, California and at additional mailing offices. POSTMASTER: Send address changes to the SF APARTMENT MAGAZINE, 265 Ivy Street, San Francisco, CA 94102.

The SF Apartment Magazine is published monthly for $84 per year by the San Francisco Apartment Association (SFAA), 265 Ivy Street, San Francisco, CA 94102. The SF Apartment Magazine is not responsible for the return or loss of submissions or artwork. The magazine does not consider unsolicited articles. The opinions expressed in any signed article in the SF Apartment Magazine are those of the author and do not necessarily reflect the viewpoint of the SFAA or SF Apartment Magazine. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting or other professional services. If legal service or other expert assistance is required, the services of a competent person should be sought. Acceptance of an advertisement by this magazine does not necessarily constitute any endorsement or recommendation by the SFAA, express or implied, of the advertiser or any goods or services offered. Published monthly, the SF Apartment Magazine is distributed to the entire membership of the SFAA. The contents of this magazine may not be reproduced without permission. Publisher disclaims any liability for published articles. Printed by Printing Partners Copyright @2025 by SFAA.

Supervisor Myrna Melgar has introduced new legislation that would tighten rules around unauthorized dwelling units (UDUs)—extra units added to buildings without permits. These types of units are common in San Francisco and are often rented out, but many do not meet city safety or building codes.

If passed, the ordinance would require any property owner submitting a permit or development application to disclose whether there are UDUs on the property. This would include extra units, utility meters, or mailboxes that indicate more people living there than what’s officially allowed.

The Planning Department would then look into the claim, confirm the unit count, and report whether the building falls under rent control rules. If the application includes a plan to remove a rental unit or UDU, the property would need a Planning inspection before approval.

The legislation also expands the Department of Building Inspection’s

oversight program. This would help prevent fraud, bribery, or the submission of false information in permit applications regarding the number of units.

What this means for SFAA members: Be prepared for increased scrutiny around unauthorized units. The proposed changes mean that all units—legal or not—will need to be properly disclosed, and may be subject to inspection. This could affect project timelines and permitting for renovations, additions, or unit removals. It also highlights the importance of maintaining accurate records, and ensuring that all units comply with safety and building code standards.

The measure is currently under review by the Planning Department and is expected to head to the Board of Supervisors for a vote later this year.

SFAA Members Help Lower Recology Rate Hike

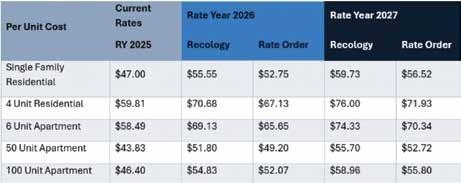

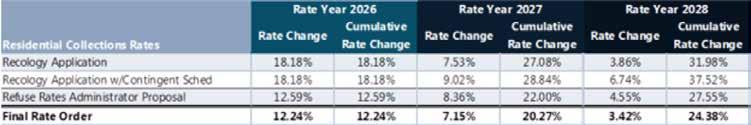

In a meaningful outcome for San Francisco rental property owners, Recology’s proposed three-year rate increase of 30% has been scaled back by 7%. The original proposal would have significantly raised monthly base charges for apartment buildings with six to six hundred units, directly impacting operating costs for housing providers citywide. Although the change to our bills will be modest, without your efforts, we would have seen no change at all.

Thanks to the collective efforts of SFAA members, who submitted official Proposition 218 protest letters and attended the June 25, 2025 Refuse Rate Board hearing. Also, thanks to former Supervisor Aaron Peskin, Small Property Owners of San Francisco, Josephine Zhao, Connected SF, condo owner associations, and a few tenant organizations.

This success reflects the strength of SFAA’s advocacy and the power of an organized, engaged membership. Thank you to everyone who acted. Your participation made a real difference. Turn to page 10 to see the final rate changes.

The Final Rate Order cuts $70 million from Recology’s proposal.

This represents a 5.94% reduction in the rate change in Rate Year 2026, a 6.81% 2-year cumulative reduction in Rate Year 2027, and a 7.461% 3-year cumulative reduction in Rate Year 2028.

The Final Rate Order does not include a contingent schedule for a mixed-waste processing facility. In comparison to a scenario where the contingent schedule is triggered, this would represent an 8.57% 2-year cumulative reduction in Rate Year 2027, and a 13.15% 3-year cumulative reduction in Rate Year 2028.

Turn to page 8 for examples of what to expect from rate increases; however, rates will vary based on the level of service.

A new ruling by the California Court of Appeal could impact how rental property owners and managers across San Francisco—and the state—serve eviction notices.

On June 26, 2025, the California Court of Appeal for the Second District published a decision in Eshagian v. Cepeda that will impact how landlords prepare and serve three-day notices to pay or quit.

In Eshagian v. Cepeda, the court held that the three-day notice was invalid because it failed to provide essential information needed for an “ordinary tenant” to reasonably understand their deadline to pay and avoid eviction. Specifically, “the notice did not state when the notice period commenced or ended, nor did it inform (the tenant)...when the notice was served, which commenced the threeday period.”

The court did not provide instructions on what notices must include to meet the “ordinary tenant” standard, but SFAA and CAA’s current understanding is that:

Notices must inform the tenant of the date the notice period commences (typically, the date of service).

Notices should specify that Saturdays, Sundays, and judicial holidays are excluded from the count.

While SFAA and CAA’s three-day notices were arguably already compliant because they informed tenants that the period begins upon service of the notice, and that Saturdays, Sundays, and judicial holidays do not count, SFAA and CAA have reviewed and updated their respective forms to ensure compliance with this new standard.

Governor Gavin Newsom has signed Assembly Bill 130 and Senate Bill 131, rolling back parts of the California Environmental Quality Act (CEQA) to fast-track housing development in urban areas—especially in San Francisco. The new rules go into effect immediately.

Under the new law, infill projects under twenty acres in previously developed areas can now bypass CEQA review unless they’re in hazardous zones (five acres for Builder’s Remedy sites).

CEQA challenges have historically delayed developments, sometimes for years. With these exemptions, property owners and developers can expect shorter timelines, fewer legal hold-ups, and reduced planning costs. For multifamily projects, that means faster move-ins, quicker leaseups, and lower carrying costs.

AB130 creates a statutory exemption from CEQA for qualifying infill housing— residential or mixed-use projects built on previously developed land, consistent with local zoning and density requirements. These projects also escape hurdles tied to CEQA’s “unusual circumstances” clause. Additionally, local agencies now have just thirty days to approve or reject applications after Tribal consultations conclude—a major acceleration from prolonged CEQA reviews. SB 131 adds flexibility for “near-miss” developments by limiting environmental review to the single disqualifying issue—rather than triggering full CEQA assessment.

Critics warn that eliminating environmental reviews could undermine protections for neighborhoods, biodiversity, and vulnerable communities. The law specifically cites San Francisco’s “unique housing challenges,” signaling a pilot approach that may expand statewide.

Unsecured Property Tax Payments: Unsecured property taxes in San Francisco apply to assets not affixed to real estate, such as business equipment, boats, and possessory interests. Payments must be received by 5:00 p.m. on August 31 to avoid a 10% penalty plus monthly interest. Payments can be made online via eCheck (no fee) or by credit/debit card (2.25% fee) at sftreasurer.org/payments/ property-tax-payment.

Finding the right talent in the competitive San Francisco rental housing industry just got easier. SF Apartment Magazine is launching a dedicated job posting page, connecting employers with skilled professionals in property management,

written by JUSTIN A. GOODMAN

Learn how to fight tenant-defense bureaucracy to reach fair settlements.

The question I get in every one of my unlawful detainer consultations is How much is this going to cost? This is an important question, and it’s incredibly difficult to answer at the outset.

There are several off-ramps along the path to recovering possession of property, including buyout agreements made in advance of an eviction notice, settlements reached during the notice period, or resolutions achieved during litigation. How you approach that project informs your chances of success at earlier stages. Increasingly, however, a sense of tenant entitlement—bolstered by bureaucracy—is shifting the economics of settlement negotiations.

Your SFAA lawyers generally create your claim of right to possession in real time (via service of a required eviction notice, and sometimes, the communications that lead to it). The eviction notice itself is one of the least expensive components of this process, but it’s also the most important part. Unlawful detainer actions are the fastest type of civil litigation, but you pay for that speed by subjecting your claim to a “strict compliance” judicial scrutiny.

What counts as “compliance” is in the eye of the beholder, but San Francisco real property court dismissed

several cases last month because the required, multi-language “Jane Kim Ordinance” form listed the old address for the Rent Board, which just moved from Suite 320 to Suite 700 in the same building. This defect was considered fatal, and the landlords must start over.

Occasional surprises aside, your SFAA attorneys have been forged in an unforgiving practice area that taught us to meet these challenges. San Francisco has made evictions increasingly difficult over the decades, starting with the adoption of the just cause provisions in the first place; curtailing certain types of violations (like subletting); requiring a landlord to establish a proper “dominant motive” (a prima facie add-on that tries to function like a popularity contest for the jury); and so many other additional regulatory necessities that stand between landlords and their property rights.

Unlike other types of litigation—like a fender bender or a breached contract—where the claim has generally already happened before the client hires their lawyer, the San Francisco landlord lawyer works with their client to develop their claim, often months in advance, from the work product itself to counselling on how the landlord “feels” about serving a notice. For instance, making sure their desire to

occupy their property matches the statutory requirements so it’s in “good faith,” or not serving an eviction notice to retaliate.

These days, the biggest difficulty is procedural, not substantive. You’ve heard a lot over the last seven years about Proposition F—the No Eviction Without Representation Act—which provides free, full-scope attorneys to residential tenants in unlawful detainers, regardless of their means and regardless of the merits of the lawsuit. This “take all comers” approach can lead to abuses where Prop. F attorneys litigate positions broader than the right of possession.

Some egregious recent examples: An occupant broke into property and changed the locks, but the police determined it was “a civil matter,” so he received free legal support to stay in possession. Another tenant found Prop. F support litigating disappointment about inheritance against the sibling landlord who inherited her house from their parents. Another had buyer’s remorse about a divorce decree against her ex-spouse landlord, who owned her home.

This is hardly what Prop. F was meant to pay for. Voters passed Prop. F to give tenants a “fair fight,” but individual landlords are essentially fighting City Hall in every lawsuit. The budget has swelled to $18 million for the current fiscal year. Over that same timeframe, Rent Board annual reports show eviction levels dropping

year over year (aside from idiosyncratic spikes for temporary capital improvements during the seismic retrofit years, or habitual late payment evictions when the pandemic ended).

Most of the civil litigation concludes in settlement rather than a determination on the merits. Parties generally litigate on a scale of years, usually while paying their own legal fees over that period. Attorneys, therefore, try to size up the value of the claim, factor in the uncertainty of success, and then encourage settlement for a pragmatic amount. There is a skill in inflicting attrition in litigation to an inflection point, where the writing is on the wall, and further fighting finds diminishing returns.

But in San Francisco, the eviction process has become so complex and politicized that it distorts the basic economics of rental housing. First, unlike most civil disputes where damages are discrete and quantifiable when the lawsuit commences, the start of an unlawful detainer claim— the first day the former tenant is no longer lawfully at the property—is the first day those damages start to accrue.

Of course, the lawsuit is principally about possession, but damages accrue for every day of the unlawful occupancy. Compared to more conventional civil claims, the defendant might want to assess the measure of damages, propose a compromised amount, and settle the case. But this defendant gains ground by enlarging the scope of damages. They’re disincentivized to settle, both because damages are often waived and because that means giving up the prize—a rent-controlled apartment—without a fight.

What does this mean in practical terms? Full staffing for frivolous motions and discovery battles has been the norm for a while. Increasingly, tenants are taking the game for granted. They either aren’t being counselled by their attorneys or they’re refusing to listen. A tenant defending a defunct eviction certainly should vindicate their position. But again, most San Francisco unlawful detainers traverse

the straight and narrow path, and there is a difference between mounting a meritorious defense and relying on obstruction for the sake of obstruction.

And even ignoring the expense of a jury trial, it is increasingly difficult to even get one. I’m actually “in the middle of trial,” as I write this. This means I’ve already started “trial,” and I’ve done many “trial things” since my initial “trial date” almost a month ago. I won two critical evidence screening motions that will strictly limit what the other side can show to the jury, but I’m not done yet. I have to report to court within a few hours of being called in; I have to juggle other work obligations around this one; and, of course, I’ve given up on personal obligations until it’s over.

These days, it takes months, not weeks, to get our statutorily mandated trial date, and given the scarcity of trial judges and departments, you’re more likely to be ordered to a settlement judge. They do their best to facilitate parties settling, but they can only offer a path—they cannot insist that parties follow it. Each deferred day of trial is more time and expense if a tenant takes an unreasonable posture.

There are other ways for tenants to capitalize on the economics of their situation. Prop. F defense attorneys sometimes file “affirmative lawsuits” pointed back in the landlord’s direction, for any number of claims fit loosely within the label of “wrongful eviction.” As I explained in my October 2021 column (“Proof Is in the Privilege”), tenants generally can’t sue a landlord for evicting them because of the litigation privilege. These lawsuits instead find liability in alleged neglect or harassment that was supposedly meant to drive them out unlawfully.

I don’t need to belabor the current struggle in maintaining adequate commercial general liability insurance these days, but confirming coverage has become standard practice before initiating evictions. When tenants pursue these claims, a landlord hopes their carrier provides a defense on the carrier’s dime. Is this insurance-funded counsel the answer to

free eviction attorneys? Hardly. Defense is provided conditionally, under a reservation of rights, while the carrier further investigates whether there are covered losses. Wrongful eviction and tenant harassment under the Rent Ordinance can result in “treble damages” and attorneys’ fee awards, and even if the underlying damages are covered, these amplifiers are not.

An internecine conflict emerges: The carrier tells the insured landlord that they probably don’t have to cover much of the alleged damages, and they may have to pay back the cost of the provisional defense counsel. The landlord insists that they have a big policy limit, and the carrier commits their own wrongdoing by not settling the claim within that limit. The landlord’s unlawful detainer attorney, who insists he doesn’t provide coverage advice but gets foisted into the position of de facto independent counsel anyway, tries to hold the line against a demand for personal contribution while also insisting the settlement include requirement that the tenant vacate (even though the policy doesn’t pay for “buyouts”). And this circus sometimes finds the landlord’s counsel actually working with the personal injury attorney to say mean things to the adjustor so he’ll open the purse strings a bit wider.

I don’t think I’ve ever mediated a case where we nitpicked over the value of individual claims/injuries on a spreadsheet. In my last mediation, we briefly bickered over the replacement value of a tenant’s handmade art that was somehow simultaneously “priceless” and utterly lacking in definable market value, before moving on to measuring the “cost of defense”—a “nuisance value” comparison that figures the litigation budget is the only objective metric at this stage. These kinds of settlements pay a premium for an underdeveloped claim to resolve all conflicts (between claimant and insured, insured and insurer, landlord and tenant) to fully and finally move on.

I don’t mean to sound bleak, and much of this isn’t new. Unlawful detainer

defendants have long viewed obstruction and delay as their greatest assets. But we are hardly at peak eviction levels. The tenant defense budget increases as judicial resources decline.

What can we do? First, these cases are not personal; they are transactional. Do not be reluctant to make responsible settlement offers on principle. Next, be mindful that your case starts with the cause of action your lawyer helps you create. Finally, find strength in your deliberate approach to these problems. This process is about developing litigation pressure to create a “market value” for settlement. If the other side doesn’t see that value, take them to trial and take it away. Maybe they’ll appraise better next time.

The information contained in this article is general in nature. Consult the advice of an attorney for any specific problem. Justin A. Goodman is with Zacks & Freedman and can be reached at 415-956-8100.

written by VARIOUS AUTHORS

This month’s extended column tackles assistive animals, rent deadlines, past pandemic evictions, and more.

Q. I recently discovered that a tenant has been fostering multiple dogs without informing me. The lease allows one pet with written approval. What are my rights, and can I enforce the lease?

A.First, make sure you have evidence that each dog is a pet and not a service animal. Tenants with disabilities have the right to keep service animals in their apartments, even if the housing provider has a lease restriction on the number of permitted pets. Remember, assistive animals, which include both service and emotional support animals (ESAs), are not pets. Service animals are trained to perform a function for their owners, such as guide dogs to assist people who are visually impaired, or a cat that can detect someone’s oncoming seizure.

ESAs, also known as comfort or support animals, are animals that provide emotional, cognitive, or other similar support to a person with a disability to assist them in managing the symptoms of their disability. But since assistive animals are not pets, a “one pet” clause in the lease agreement may not limit the number of dogs that can stay in this housing. For instance, if this tenant has one pet dog and one “foster dog” that is an ESA, then there are no grounds to object.

If the resident’s disability and need for the reasonable accommodation (e.g., living with the assistive animal) is not obvious or readily apparent, a housing provider may ask for documentation to support the request for a reasonable accommodation. However, the resident need not disclose the disability and is required only to provide enough information to document the disability-related need for the animal. Documentation may come from any reliable third party who is in a position to know about the individual’s disability or the disability-related need for the animal, such as a health care provider, therapist, social worker, non-medical service provider, member of a peer support group, parent, child, or other relative. And there is no legal requirement that an animal must be “registered” or “certified” for it to serve as an ESA.

Also, a resident may have more than one assistive animal. If the need for multiple assistive animals is not apparent, the housing provider may request documentation verifying a disabilityrelated need for multiple animals. That said, you may consider whether the total impact of multiple animals in the same residence amounts to an undue burden on your ability to properly operate the building. But be careful when making this decision, and consult with an attorney before denying

your tenant’s request to have more than one animal. In addition, you may not charge someone with an assistive animal a “pet deposit,” “pet rent,” or any other fee, even if you impose these charges on folks with pets. Lastly, restrictions on the breed, size, or weight of assistive animals are prohibited, including those imposed by insurance companies.

Assuming you know that none of these dogs are assistive animals, you may object to multiple dogs if you have a clear clause in the lease agreement limiting the resident to one pet. The SFAA Residential Tenancy Agreement, for example, prohibits all pets and clearly states as such:

22. PETS: No animals are allowed in or about the Premises, or in, on or about the property in which the Premises is located, even temporarily or with a visiting guest, except as allowed by law or by the express written consent of Owner.

Do not process rent until this issue is entirely resolved to your satisfaction, and confer with your attorney to help you draft and serve a proper notice to cure the violation of the rental agreement. Thus, once you have determined that the foster dogs are indeed pets and not service or ESA animals, proceed quickly to address the apparent breach of the lease, which may include the issuance of a formal notice to cure, followed by an unlawful detainer (eviction) court action.

—Dave Wasserman

Q. A tenant consistently pays rent late but always catches up before the grace period ends.

It’s becoming a pattern and causing accounting headaches. Do I have any recourse, or is this just part of doing business?

A.Under Rent Ordinance Sec.37.9(a) (1)(B), a landlord may recover possession of the unit if the tenant habitually pays the rent late. But is rent paid before the grace period ends actually late? It depends.

Many tenants see the grace period date as their actual payment due date—and sometimes they’re right. Your lease states a due date for paying rent. This due date may be inadvertently extended if the lease provides an express grace period or includes a late fee provision that does not clearly distinguish between late fees and rent.

Under those circumstances, rent paid before the grace period ends is timely. Thus, you would not be able to evict a tenant based on habitual late payments. You may not even be able to serve a nonpayment notice until the grace period has passed.

You may or may not be able to change the terms of the tenancy to get rid of the grace period and/or clarify the late fee provision to make sure the lease did not inadvertently extend the rent payment due date. However, the terms of tenancy cannot be changed during a fixed lease term, so you may have to wait. Moreover, the tenant could petition the Rent Board and argue that removing the grace period is a decrease in housing services.

Keep in mind that if the tenant is disabled, they could request a “reasonable accommodation” to keep the extended due date. Unless providing the accommodation would constitute an undue financial and administrative burden or a fundamental alteration of your program, you may have to agree to keep the extended deadline even if removing it would not decrease housing services.

Conversely, serving a nonpayment of rent notice creates a de facto grace period of at least 3 court days before the notice

expires. If this is the grace period you’re referring to, you may have an argument that paying rent before that grace period expires constitutes a late payment (assuming the notice was not premature).

But let’s say it’s established that the tenant was late—the next hurdle is establishing that the tenant was habitually late. Some leases spell it out—a certain number of late payments in a specific period constitutes “habitually late.” Other leases are silent, so you’re at the mercy of the Court.

Bottom line: There isn’t an easy way to force the tenant to pay rent on time. If the grace period is the issue, you may or may not be able to get rid of it. If you can remove the grace period, you may still have to enforce the due date. And then you must show the late payments were habitually late. Unfortunately, there isn’t a quick fix. So, choose your headache.

—Anna Baryudin

Q. A long-term tenant just requested that a wheelchair ramp be installed at the building entrance. My property is older, and this would be a costly renovation. Would this be considered a reasonable request?

A. The Fair Employment and Housing Act (“FEHA”) controls reasonable accommodation and reasonable modification requests found, in relevant part, in sections 12176 through 12185 of the California Civil Code. Since your tenant’s request is a physical alteration to the property, i.e., installing a wheelchair ramp at the entrance of the property, it is a reasonable modification request, rather than a reasonable accommodation request.

Generally, housing providers are not required to undertake the costs associated with a reasonable modification request. As such, if the tenant refuses to cover the cost of the wheelchair ramp, you may deny the request as unreasonable. Similarly, if the client offers to undertake the entire project, you may condition your approval on the tenant providing a

reasonable description of the wheelchair ramp as proposed, including the scope of work required. You may also require assurances that the work will be done in a ”competent manner and that any required building permits will be obtained” (Cal. Civ § 12179(c)(3)). If the tenant refuses to do so, you may deny the request as unreasonable.

However, a housing provider is required to pay for and facilitate the modification if: 1) the modification is necessary because the provider failed to maintain or repair an existing accessible feature; 2) the property receives certain state or federal government subsidies; or 3) the requested modification was required by law when the property was constructed. Should one of these three categories apply, then your tenant’s request would only be unreasonable if it posed you an “undue financial or administrative burden.” The “undue-ness” of the burden is evaluated by various factors, including: 1) the cost of the modification; 2) your overall financial resources; 3) the benefits of the modification to the tenant; and 4) the availability of alternative modifications.

Even if you believe (or know) that the request is unreasonable, the law requires you to respond to the request and engage the tenant in an “interactive process.” The interactive process requires you to make a good-faith effort to work with the tenant as related to their request, and take affirmative steps to evaluate the reasonableness of the request. If you do not timely engage the tenant, or cannot prove that you did, the request will automatically be viewed as denied—and expose you to liability under the law, regardless of the reasonableness of the request. In this regard, if you have not done so, I would advise that you communicate with the tenant in writing, and work with them to understand their disabilityrelated need and to explore options to accommodate that need.

In sum, while you are generally not required to pay for requests for

Written by PAM MCELROY

In San Francisco’s competitive rental landscape, tenant expectations are rising—and so are operational costs. While ancillary income has long helped bridge the financial gap left by operating expenses, the most successful property owners are shifting their approach. Rather than thinking only about squeezing out extra dollars, they’re focusing on elevating tenant experience through hotel-style services, modern amenities, and thoughtful conveniences, all while generating new streams of revenue along the way.

From boutique walk-ups to luxury high-rises, today’s renters are looking for comfort, convenience, and lifestyle perks. And increasingly, they’re willing to pay for them.

High-end buildings may offer full-time concierges, but even small and midsize properties can provide concierge-style perks. Consider arranging weekly on-site visits from local dog walkers, pet sitters, dry cleaners, or mobile car detailing services.

You can negotiate a vendor fee or revenue share while offering tenants a valued convenience. Some property owners have formalized these perks into a “Resident Perks Program,” charging a small monthly fee in exchange for access to a curated menu of services.

For a more hands-on approach, some landlords are coordinating package delivery management, unit cleaning services, and subscription deliveries. Tenants appreciate the thoughtfulness, and building owners enjoy a steady trickle of additional income.

If you’re interested in implementing concierge-style perks but haven’t yet, start small. Try organizing a weekly dogwalking service, or arranging for dry cleaning pick-up and drop-off. Gauge tenant interest, then expand offerings gradually based on demand.

Today’s vending machines offer much more than candy bars. When they’re stocked with everything from energy drinks and healthy snacks to laundry pods, phone chargers, and face masks, vending machines meet residents where they are: busy, tired, and short on time.

Operators typically provide, stock, and maintain the machines in exchange for a share of the profits. According to Lethub, an AI-powered leasing agency, a well-placed machine can generate $1,200–$1,600 a month in gross revenue. Micro-markets—unattended retail nooks with open shelving and self-checkout—can earn even more while enhancing the tenant experience.

This type of amenity generally works best in buildings with at least 20–30 units, where foot traffic justifies the service. To get started, reach out to vending machine providers in your area—many offer full-service options, including installation, restocking, and maintenance. You can negotiate a commission on sales, or charge a flat rental fee for the space.

In a competitive rental market, residents appreciate modern tech upgrades—especially those that make their lives easier. Many of these upgrades are surprisingly easy to implement, even in older buildings.

Focus on the amenities tenants actually want. According to the 2023 NMHC/Kingsley Apartment Resident Preferences Report:

• 91% of renters say secure package delivery is important or very important.

• 83% want high-speed internet bundled with rent.

• 79% prioritize secure building access (keyless entry or controlled access).

• 74% value in-unit washer and dryer access.

• 70% of pet owners rate pet amenities—like dog runs or pet-washing stations—as must-haves.

• 69% consider covered parking essential.

• 66% prefer buildings with fitness centers or shared workout rooms.

• 62% look for EV charging capabilities or bike-friendly amenities.

These figures are a roadmap for increasing tenant satisfaction and justifying value-added service fees. Consider surveying your own tenants to identify top priorities for your specific building type and demographic.

From everyday essentials to concierge-style offerings, elevating tenant experience creates loyalty—and lifts your bottom line.

• Smart Lock Package: $25–$50/month

• Dog Walking Coordination: $10–$15/walk (vendor share)

• Laundry Vending Machines: Passive income

• Package Locker Access: $5–$10/month

• Event Space Rental: $200+/booking

• EV Charger Access: $0.05–$0.10/kWh markup

• Bike Lockers/Storage: $15–$30/month

• WiFi & Tech Package: Bundled or tiered pricing

• Mobile Car Wash/Detailing: Commission or space fee

From smart locks and thermostats to voice-controlled lights and video doorbells, these upgrades offer real value to residents— and a justification for higher rents or tech package fees. Start by surveying tenants about which tech features they’d value most. From there, prioritize low-cost, high-impact improvements. A smart lock on the front door or a secure package area might be all it takes to stand out from the competition.

Some buildings charge a flat monthly tech fee ($25–$50) or offer tiered packages with different levels of automation and connectivity. Partnering with tech vendors can also offset upfront costs. One-time installation or activation fees are another way to cover expenses while signaling premium service.

With online shopping now a daily habit, package security is a must. Installing lockers or creating a dedicated package room not only protects deliveries, but also saves your team time managing boxes.

Smart lockers often include automated notifications and secure access codes. Many landlords charge a small fee for locker access or roll the cost into an amenity fee. Vendors like Amazon Hub or Luxer One may provide lockers at reduced rates or offer revenue shares, depending on your building size.

To get started, evaluate your available space and the volume of deliveries your building typically receives. Smaller buildings may only need a simple, secure storage area with labeled shelving, while larger properties can benefit from a more robust locker system. Consider starting with basic storage and upgrading as tenant demand grows.

San Francisco’s eco-conscious residents increasingly drive electric vehicles—and they’re seeking buildings that can keep them charged. Installing Level 2 EV chargers can attract greenminded tenants and create a long-term revenue stream by charging per kWh used or through monthly subscription fees.

Rebates from PG&E and Peninsula Clean Energy often cover most installation costs. Pair chargers with monetized parking— such as assigned spaces or garage access—and you can easily earn several hundred dollars per unit monthly in added fees.

For more details about EV charging installation and the rebates and incentives available, turn to “Rebates & Incentives” on page 36.

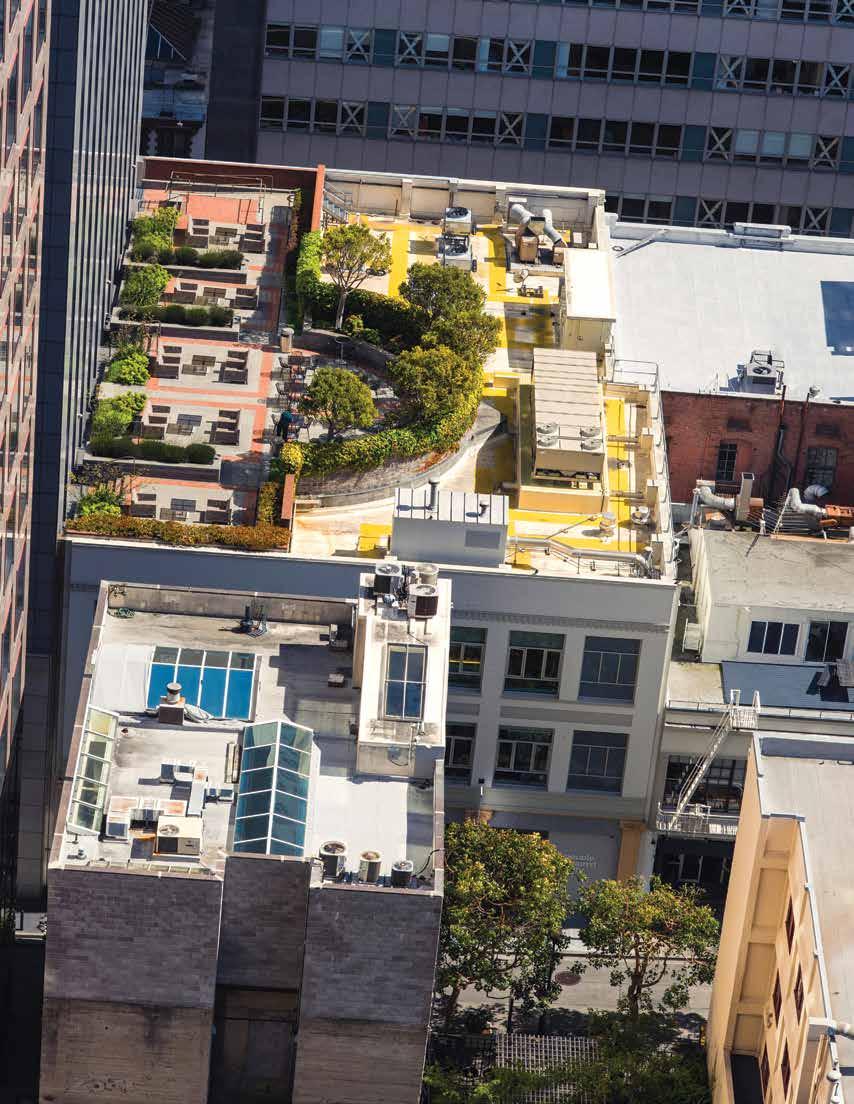

Common areas shouldn’t sit empty. Rooftop decks, lounges, clubhouses, courtyards, and parking lots can all be monetized for tenant events or external rentals. A birthday party, baby

Rising

Written by PAM MCELROY

Sherrill is shaping safer streets, stronger neighborhoods, and smarter housing in District 2.

District 2 Supervisor Stephen Sherrill may be new to City Hall, but he’s already made a name for himself as a handson policymaker with deep roots in the neighborhoods he serves. From family-friendly initiatives to economic recovery tools and public safety priorities, Sherrill shares his vision for a cleaner, safer, and more livable San Francisco—and why constituent voices will continue to shape his approach.

Pam McElroy: As a father in District 2, what do you like most about living in the District? What policies are you prioritizing to make San Francisco more family-friendly?

Supervisor Stephen Sherrill: Where do I start? District 2 (D2) has a little bit of everything. I think we’ve got some of the best parks and playgrounds in the world. I can walk to Fillmore, Union, Sacramento, or Chestnut for some of the best food and shopping anywhere. And don’t forget how beautiful it is. The majesty of the Presidio? Absolutely world-class. The charm of Allyne Park? There’s something for everyone.

In a matter of hours, we can take the kids to get bagels on Sacramento Street, then hop over to Alta Plaza or Lafayette Park, and then rumble down to the Marina to grab sandwiches for a picnic and swim at Crissy Field. Pretty hard to beat.

But for me, it’s all about the families and neighbors. D2 is chock-full of people who love their neighborhoods and this city. And they really want to do the work to make it better, too.

Making the city even more family-friendly starts with safety. That means a fully staffed police department—but it doesn’t end there. We need to invest in technology that ensures our law enforcement can investigate and prosecute crime in the city. We need to ensure our police are urgently responding to calls that affect our children. That’s why I introduced a resolution urging SFPD and the Department of Emergency Management to designate all 9-1-1 calls reporting drug use or suspected drug activity within 1,500 feet of parks, playgrounds, and schools as “Priority A” calls. These 9-1-1 calls will receive the highest level of emergency response, so law enforcement will act swiftly to protect the public, particularly children. Beyond public safety, the key to making the city more family-friendly is affordability.

It’s a four-legged stool: housing, education, transportation, and childcare. We’ve got a twin demographic gap (25-35 year-olds, and middle-income) combined with the lowest per capita population of kids of any major city in America.

This is an existential problem: Young people and middleclass families in our city are leaving, largely due to the high cost of living. We continue to lose our young adults, and even more so, we are losing our young families who see Marin or the East Bay as more affordable and suitable for their children. That needs to change.

McElroy: You’ve sponsored legislation to remove the ban on “formula retail” stores along the Van Ness corridor. What led you to introduce this legislation, and what do you hope will come from it? Does your legislation speak to a need for City Hall to potentially revisit past laws or restrictions?

Sup. Sherrill: The state of Van Ness speaks for itself. It’s in crisis, frankly. The ground-floor commercial vacancy rate exceeds 50%, significantly surpassing the citywide average of 7.7%.

We heard from several businesses that the formula retail controls were preventing them from even considering opening a store on Van Ness. We want more action on Van Ness—we NEED more action on Van Ness. We should be doing everything in our power to make it easier to fill this critical artery in the heart of our city.

This legislation added necessary flexibility to permitting on Van Ness. And that’s a great start. But as San Francisco continues to lag post-pandemic, we in City Hall need to look at every permitting requirement and restriction that inhibits our economic recovery.

I’m proud to have been an early partner with Mayor Lurie on his initial round of Permit SF requirements, which will be instrumental in attracting new businesses, and supporting our existing ones with increased activity. But again, this is just the start. I will continue to work with Mayor Lurie and other stakeholders to identify ways City Hall can be the facilitator—not an obstacle—to business in San Francisco.

McElroy: You intervened early in your tenure to delay a parking policy change after hearing from constituents. How do you plan to maintain

that level of responsiveness as your office faces more complex citywide issues?

Sup. Sherrill: Constituent services drive my office. I have a dedicated team member who fields every drop-in, call, and email, and we are committed to being the most responsive Supervisor office in the city. And responsiveness isn’t just about dealing with individual issues as quickly as possible (though that’s a huge part of it!). It’s also about synthesizing those issues and figuring out how we prevent them from becoming problems in the first place.

Take trees, for instance: broken sidewalks as a result of tree roots are near the top of the 3-1-1 complaint list in D2. Well, the City doesn’t have the resources right now to fix every issue. So, does that mean we should throw our hands up? No! We need to think creatively—and you will see more from us on this topic in the coming months.

The parking issue last December demonstrated a clear example of how we bring constituent voices into policy decisions. While the San Francisco Municipal Transportation Agency (SFMTA) has seen success with Pay or Permit parking in other parts of the city, there wasn’t enough neighborhood outreach before applying a broad-brush approach to the Marina and Cow Hollow neighborhoods. The result was widespread concern—from neighbors and small businesses with commuting employees to park-goers. On Union and Chestnut, one of the biggest challenges for small businesses is employee parking. Many can’t afford to live nearby, and public transit isn’t robust enough for a reasonable commute. We need to make sure these people—who make our neighborhoods the gems that they are—have somewhere to park while they work! And to the SFMTA’s credit, they were open to tabling this and making sure community voices were heard. But that took work, and it’s work that I’ll continue to do every day.

You’ve made safe and clean streets a top priority— what specific benchmarks or metrics are you using to track progress in D2?

Sup. Sherrill: I break this down into two categories: how we’re measuring it and what we’re doing.

The how: We’re tracking SFPD crime statistics, DPW street cleaning data, and 3-1-1 reports. We’re also using what I call “anec-data”—anecdotal feedback. Every time I speak with a constituent— whether at a house party, during a door knock, or at a town hall—I take note of comments like “Hey, things are better” or “This block is still really dirty.” Vibe checks matter, and they’re valid. While the City doesn’t yet offer detailed stats broken down by commercial corridor or district, we plan to roll out more specific data later this summer.

The what: We’re measuring progress through police staffing levels, security camera and Automated License Plate Recognition (ALPR) deployment, and the installation of new trash cans (yes, that’s coming!). We’ve also created a “Neighborhood Priority Individual List”—currently eleven people—who are most at risk to themselves or others in our neighborhoods. We created this list because we can’t solve San Francisco’s challenges with broad strokes. We need to be precise and targeted.

It appears that the Marina Inn is set to become recovery housing operated by the Salvation Army. What services will be provided at the facility? How are you balancing the need for social services and housing in your district with concerns from neighbors and neighborhood groups?

Sup. Sherrill: When it comes to projects like these, it’s important that everyone knows the specifics. Hearing about something like this isn’t easy for any neighborhood.

This will be a sober-only housing facility. The people living there will have already completed an abstinence-based treatment program. So, this isn’t a “drug rehab facility” like many have been led to believe.

And even more importantly, this program doesn’t look like the programs the City has funded in the past. This one has strict rules—regular (and random) drug testing; visitors are not allowed; curfews will be in place; staff will be onsite 24/7. Participants are required to have a daily schedule that includes holding a job and participating in abstinence-based recovery programming. Even though they’ve already completed a rehabilitation program, they’re being required to take it further. People who fail to commit will be moved to a different facility. It’s important to note that the Salvation Army’s abstinence-based program is relatively new to San Francisco. We’ve only been funding this work for a couple of years; it’s still illegal to use state and federal dollars for it. But the success rates are fantastic— nearly six times the statewide average.

Rules and accountability are important. So is being a good neighbor. I’m glad Salvation Army has committed to making the street cleaner than it has been. Participants will do neighborhood cleanups as part of their volunteer requirements.

But we still need to take neighborhood concerns seriously—which didn’t happen during COVID when the Lombard motels were turned into temporary shelters. To be clear: that is not what the Marina Inn is going to be.

We’ve established a Community Council on the Marina Inn, which will include nearby residents, neighborhood associations, the Department of Public Health, and the Salvation Army. This council will meet regularly to ensure community voices are heard and that the program is run with transparency and accountability. We already have an initial feedback list that we’ve taken to the Mayor and SFPD. We’ve received commitments for foot patrols around Lombard and Octavia

Streets, in addition to retired-officer patrols in the neighborhood (these patrollers are known as community ambassadors).

McElroy: What role do you see D2 playing in implementing the City’s housing production goals?

Sup. Sherrill: The biggest policy mistake we’ve made over the past few decades is not doing everything we can to get the pipeline units built. There are over 70,000 units in the pipeline right now—half of which are entitled already. We need to prioritize these homes in our housing discussions. Of course, we can’t control macroeconomic conditions, but we can control local impact fees and local permitting requirements that inhibit the development of already-approved projects. And that’s going to be the challenge of the upcoming year—the great unsticking, if you will.

For example, we’re already using an innovative method called an “enhanced infrastructure financing district” (EIFD) to catalyze large housing projects. My predecessor, Catherine Stefani, started this to create the city’s third EIFD at the 3333 and 3700 California Street projects, led by Prado.

EIFDs were recently authorized by the state, and they allow projects to defer future property taxes in exchange for public infrastructure upgrades. This creative financing mechanism empowers the City to engage with developers and ensure mutually beneficial investments are made to add more homes and improve our city.

We’re pushing for a 2026 groundbreaking on these projects, but we’re also looking to expand these creative financing techniques to add more housing opportunities for all San Franciscans.

Pam McElroy is the editor of SF Apartment Magazine.

Having over 25 rental units of her own, Jackie brings rst-hand experience as a landlord to all of our Rentals In S.F. clients.

Every day, our team endeavors to nd quali ed tenants for our clients. With an expert understanding of the ever changing San Francisco rental market, we have made it our priority to ll your vacant unit quickly, e ortlessly, at market rent and with your ideal tenant!

With just one phone call, Jackie will come over to access your needs, appraise your unit, and do all the marketing, prospecting and screening. We then present you with a quali ed tenant ready to move in.

Call Jackie at Rentals In S.F. to ll your vacancy. It will be one of the best calls you’ll ever make. Just ask all our clients!

Former SFAA winner

* Leasing Agent of the Year

* Landlord of the Year

Practical and cost effective advice to assist with your real estate needs in the City and County of San Francisco.

• Legal services with an emphasis on real estate

• General Matters and Transactions

• Residential and Commercial

• Landlord-tenant matters

• Purchase and sale, co-ownership and condominium conversion issues

• Planning, zoning and permitting issues

• Neighbor, condo association and CC&R dispute resolution

• Real estate transactions and document preparation

Written by CHRISTINE KARLOVIC

Why multifamily buildings need EV chargers now.

As the world shifts toward sustainable living, electric vehicles (EVs) are no longer a passing trend—they are inevitably replacing the internal combustion engine vehicle. Over the past five years, from 2019 to 2024, electric vehicle sales in the United States have increased by a whopping 900%.

This shift is particularly relevant for multifamily buildings, where the integration of EV chargers presents both immediate benefits and long-term advantages that can enhance property value and tenant satisfaction.

The adoption of electric vehicles is rapidly accelerating. According to the Edison Electric Institute, the number of EVs on the road is projected to reach 18.7 million by 2030 in the United States alone. With this influx, the demand for accessible charging infrastructure is expected to grow exponentially. Multifamily buildings that act as early adopters of EV chargers will position themselves to meet this demand head-on.

Integrating EV chargers into multifamily properties is a strategic move that keeps buildings relevant as transportation technologies evolve. While residents may not yet own electric vehicles, anticipating this shift is essential for long-term success. By proactively installing the necessary infrastructure now, property owners can save on the capital expenditure required to retrofit later.

In addition to cost savings, EV charging stations can boost a property’s appeal. Given the higher cost of electric vehicles, this amenity has the potential to attract higher-income

renters and tenants. It also signals a commitment to sustainability and modern living—qualities that increasingly matter to future tenants seeking environmentally conscious and tech-forward communities.

One of the most compelling reasons to install EV chargers in multifamily buildings is the wide range of available rebate programs. State and local governments, along with utility companies, offer generous financial incentives that can cover a significant portion—or even the entirety—of installation costs. This often turns EV chargers into a zero-capital-expenditure amenity that generates recurring revenue, typically around $100 per driver per month.

While electric vehicles are undeniably part of our future, these rebate programs won’t be around forever. Acting now ensures access to these financial benefits before they disappear. Additionally, many EV charger service providers offer systems with no ongoing maintenance costs, eliminating financial risk and making EV chargers a loweffort, high-reward amenity for property owners.

For a brief list of available incentives and rebates, turn to the sidebar on page 36.

Installing EV chargers at multifamily properties presents a strong opportunity to generate additional revenue. Property owners can strategically add a small fee—typically $0.05 to $0.10 per kilowatt-hour (kWh)—to the base electricity cost, creating a new income stream while offering a desirable amenity to residents.

You may be eligible for rebates, incentives, and technical assistance programs that can significantly reduce or even eliminate upfront costs. Below is a snapshot of the top programs currently available.

Funding: Up to $100,000 available per site for market-rate multifamily buildings, and $120,000 for affordable housing.

Eligibility: Applies to new construction, major renovations, or existing multifamily/commercial parking (five-plus units) on CleanPowerSF or Hetch Hetchy power under qualifying electric rates.

Availability: Ongoing; first-come, first-served until funds run out.

How to Apply: Use the EV Charge SF Handbook (Sept 2023) for steps— initial consultation, scope planning, reservation, installation, and post-install verification. Contact: Email powerprograms@sfwater.org or call 415-5540773.

Funding: Provides $500+ per unit for multifamily electrification projects that include EV-ready or efficiency upgrades.

Eligibility: Buildings with five-plus units in the nine-county Bay Area (including SF), with priority for affordable, small (fewer than fifty units), or burdened-area properties.

Availability: Ongoing; funds are allocated until fully reserved.

How to Apply: Visit the BayREN website at bayren.org and navigate to the “Multifamily Property Owners” section.

Funding: Up to $3,500 per Level 2 port or 75% of project cost. Possible add-ons include $2,000 for certain multifamily sites. DC fast chargers are also eligible (up to $80,000 per connector in disadvantaged communities).

Eligibility: Multifamily dwellings statewide—including San Francisco.

Availability: Ongoing until funds are exhausted. There is no limit on the number of ports per applicant.

How to Apply: Visit the CALeVIP portal at apply.calevip.org and complete the online application. Apply before purchasing or installing any equipment.

Funding: Up to $8,500 per Level 2 port.

Eligibility: Applies to multifamily properties statewide.

Availability: Ongoing, but you must reserve funds before purchase or installation.

How to Apply: This program is integrated with CALeVIP. Visit the CALeVIP portal at apply.calevip.org and complete the online application.

Funding: Up to 100% of project cost in existing affordable housing, and 75% of project cost in existing market-rate housing (capped at $100,000/property).

Eligibility: Bay Area multifamily buildings (including San Francisco).

Availability: First-come, first-served while funding lasts.

How to Apply: Complete the online application at svcleanenergy.org/multifamily-charging

This incremental charge can offset operational and maintenance expenses, and in many cases, generate net profit that can be applied toward property taxes or other operational costs. With the average EV driver using around 250–300 kWh per month, this pricing model can yield an additional $12 to $30 per driver monthly, on top of any direct charging fees or lease agreements with EV service providers.

As technology continues to evolve rapidly, one thing remains consistent: the need to deliver electricity from an electric panel to a charger. While EV charger hardware may change over time—becoming faster, smarter, or more user-friendly—the core infrastructure, such as electrical panels, conduits, and wiring, is built to last. Installing this foundational system now ensures that properties are equipped to handle future charger upgrades without needing costly overhauls.

By investing in EV infrastructure today, property owners can take advantage of generous rebates and incentives to offset installation costs. These programs often cover not just the chargers, but also the long-term infrastructure that supports them. This proactive approach creates a future-ready building, positions the property for easy tech upgrades, and signals to tenants a forward-thinking commitment to sustainability and innovation.

Incorporating EV chargers into multifamily buildings is not just a practical decision: it’s also a powerful marketing tool. As more tenants prioritize sustainable living and transition to electric vehicles, having on-site EV charging stations can become a key factor in their housing choices. Many potential renters are willing to pay a premium for the convenience and accessibility of charging their vehicles at home. This desirable amenity attracts environmentally conscious tenants, increasing tenant retention rates and creating a long-term value proposition for property owners.

In today’s climate, corporate responsibility is crucial. Properties promoting sustainability by installing EV chargers demonstrate their commitment to environmental stewardship. This commitment resonates well with tenants, employees, and investors alike, enhancing the brand reputation of property management companies and owners.

Installing EV chargers in multifamily buildings offers clear benefits as we move toward a more sustainable future. These chargers help keep properties relevant as transportation changes, as well as allow property owners to use available rebates. Property owners should install EV charging infrastructure now to remain competitive in a changing market. Buildings with charging stations will attract environmentally conscious tenants and increase property value over time. Investing in EV chargers now prepares properties for the shift in transportation habits and preferences already in motion.

Many local governments, including those in New York City and San Francisco, now require the installation of EV chargers. This mandate isn’t limited to new construction—California’s building code requires that any significant renovation or retrofit include EV infrastructure.

San Francisco code requires that at least 10% of parking spaces in new residential and commercial developments be fully equipped with EV charging stations, while the remaining spaces must be “EV ready,” meaning they’re wired and prepared for future charger installation. If local authorities are mandating these upgrades, it’s smart to take advantage of current rebate programs and incentive funding to cover the costs.

The EV charging industry includes a wide range of companies. These include manufacturers; software providers; maintenance specialists; and full-service engineering, procurement,

and construction (EPC) firms. If your goal is to minimize effort and maximize income, consider partnering with an EPC firm that specializes in EV charger installations and has in-house expertise in rebate processing. The paperwork for many rebate programs can be extensive, but some firms handle it entirely on your behalf. Green Water and Power is one of the few companies with the capacity to manage the entire process seamlessly.

No matter the type of provider you choose, it’s essential to work with licensed electrical contractors who hold specific EV certifications, such as those from the Electric Vehicle Infrastructure Training Program (EVITP) or International Code Council (ICC). Without these credentials, contractors may face challenges getting paid or completing the installation process properly. Understand your state’s requirements for registering EV chargers for commercial operation with the county sealer—similar to how gas pumps are inspected and certified annually for accuracy. Many reputable EPC firms can manage this step.

While there may still be a learning curve and a need for increased public awareness, EV charging is quickly becoming a standard utility—much like internet access. Properties that lack this amenity risk losing tenants to more forward-thinking, better-equipped buildings.

Do electric vehicles catch fire? Yes, but not nearly as often as internal combustion engine (ICE) cars. ICE vehicles are essentially igniting fires all the time as part of their operation!

To provide actual data, Norway, a global leader in electric vehicle adoption, found that “there are between four and five times more fires in petrol and diesel cars,” according to the Directorate for Social Security and Emergency Preparedness. Furthermore, the Swedish Civil Contingencies Agency reported 68 fires per 100,000 vehicles across all types of cars, compared to just 3.8 fires per 100,000 electric vehicles. In Australia,

Do you have a story that has your colleagues in stitches? Ever experienced a housing industry escapade that’s too wild to keep to yourself?

A lesson you learned that we can all heed? We want to hear from you!

SF Apartment Magazine’s quarterly column “Tales from the Corridors ” is your chance to share the funniest, craziest, or most outlandish stories from your life as a property manager or other industry professional. Whether it’s a hilarious mishap, a jaw-dropping encounter, or an unbelievable tale, we want to showcase the unique and entertaining experiences that not only amuse but also offer valuable insights to our community.

SUBMISSION GUIDELINES:

Word Count: Stories should be between 300-750 words.

Tone: Lighthearted, humorous, engaging, and informative.

Anonymity: If preferred, we can publish your story anonymously— just let us know.

How to Submit: Email your story to pam@sfaa.org with the subject line “Tales from the Corridors Submission.” Please include your name, contact information, and relevant details about your story.

Selected stories will be featured in our quarterly publication, giving you bragging rights and a chance to entertain and educate fellow housing professionals across the city.

If you have any questions, please email Pam at the above address. We can’t wait to hear from you!

the Department of Defense found a fire occurrence rate of 0.0012% for EVs, compared to 0.1% for ICE vehicles.

It’s true that EVs can catch fire, but these incidents are rare. When they do occur, the fires can burn intensely. Fortunately, a new class of fire extinguishers designed for lithium-ion battery fires is emerging. Be sure to ask your EV electrical contractor about these extinguishers—they can typically install one in your garage for just a few hundred dollars.

Maintaining EV chargers is crucial, especially given the wear and tear they experience from frequent use. Property owners should partner with a reliable EV charger service provider that has a dedicated operations and maintenance division, equipped with an in-house workforce.

Generally, EV chargers have three essential service categories: electrical maintenance, networking support, and charger repairs. Skilled electricians are responsible for electrical issues, such as replacing faulty circuit breakers or addressing wiring damage caused by pests. Networking technicians tackle challenges related to connectivity, including replacing malfunctioning wireless access points or working with internet service providers to resolve firewall configuration issues. Lastly, specialized EV service technicians handle more complex repairs, such as those related to DC fast chargers or swapping out Level 2 chargers.

By ensuring that these services are adequately managed, property owners can enhance the reliability and accessibility of their EV charging infrastructure.

Green Water and Power has proudly installed over 9,000 EV chargers throughout California. Our comprehensive services encompass site design, engineering, procurement, construction, rebate processing, operations, and maintenance, ensuring a seamless experience for our clients. Visit our website at greenwaterandpower.com or email us at info@greenwaterandpower.com

written by NATALIE DREES

Budgeting isn’t optional—it’s your safety net.

In a city where both charm and challenges are abundant, owning and managing property requires more than quick fixes and market savvy—it demands smart, long-term budgeting.

Whether you own a three-unit Edwardian or a twenty-unit building in the Mission, budgeting is the difference between being prepared and being blindsided.

To ensure your investment is a profitable asset and not a financial burden, think of it as a small business. Unfortunately, many small businesses fly by the seat of their pants, operating without a budget. But as a small business owner myself, I can tell you that budgeting can ease financial woes by anticipating expenses, and knowing if your building is generating enough income to cover them.

Budgeting starts before you even purchase a property. Before you sign on the dotted line, do your due diligence to ensure the building’s income will cover its expenses and still yield a profit.

Be realistic as to what rents will be. If you are purchasing a property with a vacant unit, do not trust the listing agent’s pro forma estimates. Since purchase prices are often based on a formula which factors in income, it is in their best interest to inflate market rents to get their client the maximum sales price for the property. Instead, discuss with leasing agents what rents

they expect the vacant units to generate. Err on the conservative side, and you will be pleasantly surprised when you get more income. Be too aggressive, and you may find yourself with long vacancies as you wait for a high rent. Or, you could end up with a lower rent than budgeted, and a negative cash flow after covering expenses.

I can’t tell you how many new clients come to me with newly purchased buildings saying, “I need to rent this unit for $5,000” when the market would dictate $3,500. I can’t magically conjure a tenant who would pay fiercely above market, and in my experience, any tenant who will pay so much over market is unlikely to be a good tenant or stay long.

If the building is fully occupied, look for banked rent increases and missed passthrough opportunities, and make sure you get all the information from the current owner so that you can take advantage of these increases.

I also highly recommend asking a leasing agent how you can improve a vacant unit or building to increase rents. You may find hidden income streams that add to the building’s value.

Thoroughly conducting this research is how to predict the true expected revenue most accurately. Based on this information, you can make the most educated and strongest offer in a competitive market, or decide to walk away and direct your attention to another property.

Determine your desired return and base your offer on that amount. And remember, if the building isn’t covering your expenses with some return, you should not purchase it. Would you ever purchase a stock that required a monthly payment while waiting for a return?

Let’s face it: when a thirty-year tenant moves out, it’s not just a cleaning bill and a coat of paint. You’re likely looking at a full refresh: new flooring, updated cabinets, fresh paint, and upgraded appliances. If you haven’t budgeted for it, this can feel like a financial punch in the gut.

But imagine the same unit with ten tenants over that thirty-year span. The refreshes would have happened incrementally as small expenses over time. You likely would have paid cumulatively more over those thirty years than with one major remodel, but since the expenses came in smaller increments, you wouldn’t be surprised by the costs.

Manage your expectations by forecasting and budgeting for these more extensive turnovers, especially if you already have a long-term tenant in occupancy. Just because units with long-term tenants tend to be less expensive to manage than others, that won’t continue indefinitely. Once the tenant moves out, there will be an expense surge. Plan ahead so you have the resources and aren’t surprised by these costs.

Below is a quick reference guide to keep handy.

Interior Essentials

• Paint: five years

• Appliances: ten years

• Cabinets: ten to fifteen years

• Flooring: (varies) ten to thirty years for laminate flooring; refinish hardwood floors every ten to twenty years.

Systems

• Water Heater: seven to ten years (tank); twenty-plus years (tankless)

• A/C Unit: ten to fifteen years

• Heat Pump: fifteen years

• Furnace: fifteen to twenty years

Plumbing:

• Copper: fifty to one hundred years

• Galvanized Steel: twenty to fifty years

• Cast Iron: fifty to one hundred years

• Brass: twenty to fifty years

Exterior & Structure

• Siding: twenty to forty years

• Roofing: thirty years

Windows:

• Wood: fifteen to thirty years

• Vinyl: twenty to forty years

• Fiberglass: thirty to fifty years

If you don’t have a line item in your monthly budget amortizing these costs over time, you are artificially inflating your profits. If you don’t want to have a line item for each cost, a good rule is to save 10% of your total monthly rents in a savings account for future expenses.

You can’t control when these systems will fail and need immediate replacement. Plan and save now, so even in a down market, you have cash on hand for these

upgrades. Otherwise, you will be caught scrambling for funds or refinancing.

You might think: “I just bought this building—I’ll plan for upgrades later.” Not so fast.

If you’ve purchased a one-hundred-yearold Victorian, your budgeting timeline doesn’t start from zero. Unless the previous owner immaculately maintained the building, you’re inheriting wear and tear. That gorgeous vintage window trim may need replacement now—not in ten years.

But here’s the upside: budgeting today gives you confidence tomorrow. Replace the windows now, and it could be thirty years before you need to touch them again.

While maintenance and improvements are visible and, therefore, top of mind, other costs rise annually, and these should have budget lines as well. These are:

• Mortgage interest rates

• Property tax

• Insurance

• Vacancies

Make sure you aren’t cutting your returns so close that even a small increase in the above items eats into your profits. While property tax increases are predictable, recent years have shown us that interest rates and insurance costs are anything but. Make sure there is some buffer in your budget, or have some reserves so these increases don’t catch you flat-footed.

Some line items in your budget are onetime hits for the long haul—like a roof or plumbing upgrade. Others are recurring, like paint or appliances. But the bottom line is that every item is a ticking clock.

When you budget intentionally:

• You avoid financial surprises.

• You manage tenant expectations with confidence.

• You maintain property value—and tenant satisfaction.

In the ever-evolving San Francisco rental landscape, proactive budgeting isn’t just a strategy—it’s survival.

Set realistic timelines. Allocate reserves. Plan for both the expected and the inevitable. Your future self (and your future tenants) will thank you.

And, of course, an investment property should generate income and not require personal contributions to stay afloat. If you ever find yourself off-track and unable to cover your expenses—even after exploring all building income streams—there is no shame in selling your investment property. That would be the most prudent investment decision— not a failure.

Natalie Drees is the president of Lingsch Realty and a recipient of three SFAA Trophy Awards for property management. Lingsch Realty provides San Francisco landlords with expert property management, leasing services, and investment property consulting. Natalie can be reached at ndrees@ lingschrealty.com.

modifications, best practice would be to actively engage with your long-term tenant to find a solution that works for both of you.

—Rachel N. Pyle

Q.A prospective tenant is offering to pay several months of rent upfront to “sweeten the deal.” Is it legal—or advisable—for me to accept this?

A.Accepting several months of upfront rent is probably not a good idea. The relevant law here is Civil Code 1950.5, or the security deposit law. While many understand a security deposit as a sum held to cover future defaults or damages, the definition of “security” under this code is far broader.

Civil Code 1950.5 defines security to mean any payment, fee, deposit, or charge, including, but not limited to, any payment, fee, deposit, or charge, except as provided in Section 1950.6, that is imposed at the beginning of the tenancy to be used to reimburse the landlord for costs associated with processing a new tenant or that is imposed as an advance payment of rent …

In the case of Granberry v. Islay Investments (1995), 9 Cal. 4th the court held that charging an higher “rent” payment at the start of the tenancy, which was subsequently lowered in later months, effectively constituted an illegal security deposit. The landlord in Granberry applied this initial higher fee as part of the rental payment without returning it. The court deemed this violated Civil Code 1950.5 and this fee was actually a disguised security payment.

Under California Civil Code 1950.5, the maximum amount a landlord can demand for a security deposit is generally limited to one month’s rent, regardless of whether the unit is furnished or unfurnished. While there are exceptions for smaller property owners (owning no

more than two properties with four units total; allowing two months’ rent) and for military personnel (deposit not exceeding one month’s rent), the general principle prohibits collecting excessive advance payments.

So, when an eager tenant offers you several months of upfront rent, your internal alarm bells should go off. While it might look like a sweet deal, it is likely interpreted as collecting an excessive security deposit. So don’t do it.

—Angelica

Sandoval Montenegro

Q.A prospective tenant submitted a strong application but disclosed a prior eviction during COVID. They say it was due to job loss and not paying rent during the moratorium. Am I allowed to reject them based on that history?

A. It depends specifically on when the rental debt accrued. California Civil Code section 1785.20.4 specifies that a housing provider cannot use “COVID-19 rental debt… as a negative factor for the purpose of evaluating a prospective housing application or as the basis for refusing to rent a dwelling unit to an otherwise qualified prospective tenant.” The covered time period in which the debt accrued is between March 1, 2020, and September 30, 2021, per California Code of Civil Procedure section 1179.02. If the debt accrued during that time period, then you cannot use it as the sole basis to reject a tenant application. If the debt accrued outside of that time period, then you can proceed with your normal tenant screening process. You should return to the prospective tenant and ask about the specifics of when the debt accrued, and request that they provide documentation. Notably, the tenant must be otherwise qualified; therefore, if the tenant does not qualify under some other criterion, then you do not need to worry about this restriction. You may reject them based on that other criterion.

Unlike many other statutes enacted to address COVID-19 rent debt, this statute is not set to sunset. However, the statute

that defines the covered time period is set to sunset on October 1, 2025. So, on October 1, 2025, this statutory restriction may be rendered ineffective. Until then, the safest approach is not to use rental debt accrued between March 1, 2020, and September 30, 2021 when evaluating prospective tenants.

If the debt accrued outside of March 1, 2020, and September 30, 2021, then generally, yes, an eviction is a legitimate criterion upon which to reject a rental application. Landlords have the right to refuse rental applications using their own legitimate screening criteria for prospective tenants, so long as the reasons for refusal are not discriminatory, are applied consistently, and the rejection reasons are communicated to the prospective tenants.The California Fair Employment and Housing Act (FEHA) and the San Francisco Police Code, Article 33, provide the legal framework for addressing discriminatory rental practices. Landlords may not refuse a tenant’s application because of their protected characteristics. Some commonly known examples of protected characteristics are things like race, sex, and religion. California, and more specifically San Francisco, also protect people with characteristics such as family status, marital status, age, disability, source of income, and military status—which more frequently factor into the tenant selection process. Rental debt and past evictions are not covered by these protections.

If the application is denied due to credit history, rental debt, or evictions, then the landlord is required under the Fair Credit Reporting Act to disclose the reasons for the denial to the prospective tenant, and provide that report to the tenant upon request.

—Thomas Koster