Advancing innovation in financial stability: A comprehensive review of ai agent frameworks,challengesandapplications

SatyadharJoshi *

Independent Researcher, BoFA, NJ, USA.

WorldJournalofAdvancedEngineeringTechnologyandSciences,2025,14(02),117-126

Publicationhistory:Receivedon05January2025;revisedon11February2025;acceptedon14February2025

ArticleDOI:https://doi.org/10.30574/wjaets.2025.14.2.0071

Abstract

Artificial Intelligence (AI) agents are revolutionizing industries by enabling autonomous decision-making, task execution,andmulti-agentcollaboration.ThispaperprovidesacomprehensivereviewofAIagentframeworks,focusing ontheirarchitectures,applications,andchallengesinfinancialservices.Weconductacomparativeanalysisofleading frameworks, including LangGraph, CrewAI, and AutoGen, evaluating their strengths, limitations, and suitability for complex financial tasks such as trading, risk assessment, and investment analysis. The integration of AI agents in financial markets presentsbothopportunities and challenges, particularly interms of regulatory compliance, ethical considerations,andmodelrobustness.WeexamineagenticAIdesignpatterns,multi-agentsystems,andthedeployment ofAIagentsadvancingtheproposaltousethemforfrauddetectionandriskmanagement.Bysynthesizinginsightsfrom academic research and industry practices, this review identifies key trends and future directions in AI agent development. This work contributes to the growing discourse on AI-driven automation by outlining technical considerationsandopenchallengesindeployingAIagentsatscale.Wehighlighttheneedforenhancedtransparency, interpretability,andsecurityinAI-drivenAgenticsystems.Ourfindingsprovidevaluableinsightsforresearchersand practitionersseekingtoharnessAIagentsformoreefficientandintelligentdecision-making.

Keywords: AIAgents;Multi-AgentSystems;AgentFrameworks;GenerativeAI

1. Introduction

TheriseofsophisticatedAIagents,poweredbyLargeLanguageModels(LLMs),istransformingvariousindustries,and financeisnoexception.Theseagents,capableofreasoning,planning,andinteractingwiththeirenvironment,offerthe potential to automate complex financial tasks, improve decision-making, and create new opportunities. This paper provides a comprehensive overview of AI agents in finance, examining their architectures, frameworks, and applications. AI agents have emerged as a transformative technology, enabling autonomous systems to perform complex tasks across various domains. From financial decision-making to enterprise automation, AI agents are revolutionizing industriesbyleveraging large languagemodels (LLMs) and multi-agent collaboration[1].Thispaper reviews the state-of-the-art in AI agent frameworks, focusing on their architectures, applications, and challenges. AI agents are becoming integral components in automating complex workflows, enhancing financial modeling, and improvingriskassessmentstrategies[2],[3].Theseautonomoussystemsleveragemachinelearning(ML)andnatural languageprocessing(NLP)techniquestooptimizedecision-makinginvariousindustries,particularlyfinance[4],[5]. ThefieldofArtificialIntelligence(AI)hasseenrapidgrowthinrecentyears,withAIagentsemergingasaprominent areaofdevelopment.AIagentsareautonomousentitiescapableofperceivingtheirenvironment,makingdecisions,and taking actions to achieve specific goals [1], [6]. These agents are being deployed across variousindustries, including finance, where they promise to automate tasks, improve decision-making, and enhance overall efficiency. Recent reports fromMcKinsey[3]and Moody’sAnalytics [7]highlight thegrowing importance of AIagents intransforming businessprocesses.

* Correspondingauthor:SatyadharJoshi,Satyadhar.Joshi@gmail.com

Copyright©2025Author(s)retainthecopyrightofthisarticle.Thisarticleispublishedunderthetermsofthe

2. Related Work and Discussion

WhileAIagentsholdimmensepotentialforfinance,severalchallengesremain.Theseincludeensuringthereliability and explainability of agent decisions, addressing ethical considerations, and managing the risks associated with autonomous systems. Further research is needed to develop robust frameworks, improve agent capabilities, and establishbestpracticesfordeployingAIagentsinfinancialsettings.Figure1showsthedensityofwordsintheliterature review.

Figure 1 CloudWordsforthisWorkbasedontheReferences

RecentresearchhasexploredtheapplicationofAIagentsindiversefinancialareas.Hanetal.[4]investigatedoptimizing AI-agentcollaborationforinvestmentanalysis.Microfoundationsetal.[22]studiedtheimpactofAItradersinfinancial marketsusingamulti-agentmodel.Yangetal.[19]introducedFinRobot,anopen-sourceAIagentplatformforfinancial applicationsusingLLMs.Yuetal.[20]proposedFincon,amulti-agentsystemwithconceptualverbalreinforcementfor enhancedfinancialdecision-making.Zhangetal.[23]developedamultimodalfoundationagentforfinancialtrading. SeveralindustryreportshavealsohighlightedthegrowingimportanceofAIagentsinfinance[2],[3],[5],[7],[24].

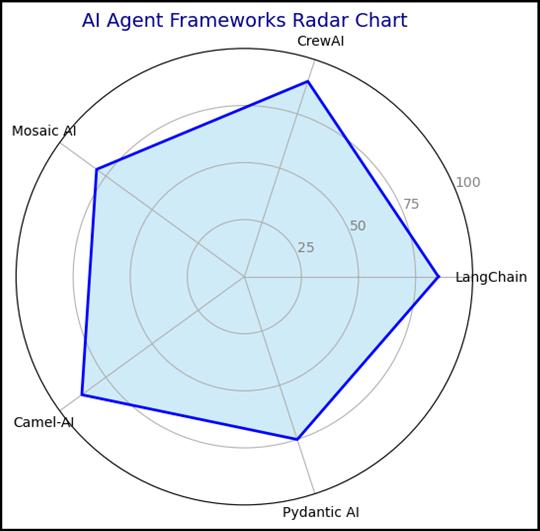

3. AI Agent Frameworks

SeveralframeworksareavailablefordevelopingAIagents,eachwithitsownstrengthsandweaknesses.LangChain[6], [8]providestoolsforbuildingapplicationswithLLMs,includingagentorchestrationcapabilities.CrewAI[9]focuseson building collaborative agent systems. Other notable frameworks include Agentforce [25], PydanticAI [26], IBM Watsonx.ai[27],andSemanticKernel[10].Frameworkcomparisonshavebeenconductedbyvariousauthors[13],[14], [15],[16],[17],[28],[29],[30].SeveralframeworkshaveemergedtofacilitatethedevelopmentanddeploymentofAI agents.Table1comparestheframeworks.

Table 1 FrameworkComparison

Framework Key Features

LangChain[6],[8] LLM integration, Agent orchestration

Applications

Limitations

GeneralAItasks Multi-agentsupportlimited

CrewAI[9] Collaborativeagents Complexworkflows Performancebenchmarksneeded

Agentforce[25] Businesstaskfocus

CRMintegration Broaderapplicabilityunclear PydanticAI[26] LLMwithPydantic

IBM Watsonx.ai [27]

EnterpriseAIplatform

Datavalidation Wider agent capabilities less developed

Industry-specific solutions

Customizationcanbecomplex

Framework Key Features Applications

AutoGen[11] Multi-agentsystems Complex AI applications

Llama-Agents[12] Knowledgeassistants

Smolagents[35] Code-writingagents

FinRobot[19] Financialapplications

Limitations

Scalabilityinreal-worldscenarios

Dataintegration Knowledgeretrievaleffectiveness

Codegeneration Rangeoftaskslimited

Financial tasks using LLMs

Fincon[20] Financialdecision-making Enhanced decision quality

Performanceevaluationneeded

Real-worldtestingrequired

Several AI agent frameworks have emerged to facilitate autonomous decision-making and task execution. Key frameworksinclude:

• LangGraph:Alow-levelagentorchestrationframeworkdesignedforstatemanagementandscalability[8]. LangChainisaframeworkforturningLargeLanguageModels(LLMs)intoreasoningenginesthatcantake actions[6],[8].ItprovidesasetoftoolsandabstractionsforbuildingAIagentsthatcaninteractwithvarious datasourcesandAPIs.

• CrewAI: Focuses on multi-agent collaboration for dynamic task execution [9]. CrewAI is another popular framework for building autonomous AI agents, enabling developers to create teams of agents that can collaboratetosolvecomplexproblems[9].

• OpenAI Swarm:Designedforlarge-scaleAIagentdeployment[13].

• Mosaic AI Agent Framework:AtoolforbuildingautonomousAIassistants[31].

• Semantic Kernel: DevelopedbyMicrosoft,SemanticKernelisanagentframeworkthatallowsdevelopers tointegrateAIagentsintotheirapplications[10].

• AutoGen: AutoGen is a framework for building multi-agent systems, allowing developers to create AI applicationswithdiverserolesandcapabilities[11].

• LlamaIndex: LlamaIndex offers a framework for building knowledge assistants using LLMs connected to enterprisedata,supportingthecreationofmulti-agentAIsystems[12].

Theseframeworksprovidedeveloperswithtoolsandlibrariesforbuildingintelligentsystemsthatcaninteractwith their environment and perform complex tasks. We have expanded more on the most popular AI agent frameworks. Comparisonsoftheseframeworks,suchasthosefoundin[13],[14],[15],[16],highlightthetrade-offsbetweenthemin termsoffeatures,easeofuse,andscalability.FrameworkslikeLangChainandCrewAIareoftencompareddirectlydue to their prominence in the AI agent development community [16]. IBM’s insights also emphasize the importance of choosingtherightAIagentframeworkasafoundationforbusinessapplications[17].

3.1. AI Agent Frameworks: Architectures and Features

• Key Frameworks: SeveralframeworkshavebeendevelopedtofacilitatethecreationofAIagents.LangGraph andCrewAIareprominentexamples,offeringrobustarchitecturesformulti-agentsystems.AutoGen,another leading framework, enables the design of agentic systems with diverse roles and capabilities [11]. These frameworksprovidetoolsforagentorchestration,statemanagement,anddeployment,makingthemessential forbuildingscalableAIapplications[8].

• Enterprise Solutions: Enterprise-grade frameworks like IBM Watsonx.ai and AWS Bedrock Agents offer tailored solutions for business applications. These platforms provide comprehensive toolkits for AI agent development, enabling enterprises to integrate AI into their workflows seamlessly [27], [33]. Additionally, frameworks like Mosaic AI and Vertex AI Agent Builder are designed to address the unique challenges of deployingAIagentsinproductionenvironments[31],[34].

• Emerging Frameworks:EmergingframeworkssuchasLlama-AgentsandSmolAgentsaregainingtractionfor their simplicity and efficiency in building multi-agent systems [12], [35]. These frameworks are particularly usefulfordeveloperslookingtocreatelightweightandmodularAIagentsforspecificusecases.

3.2.

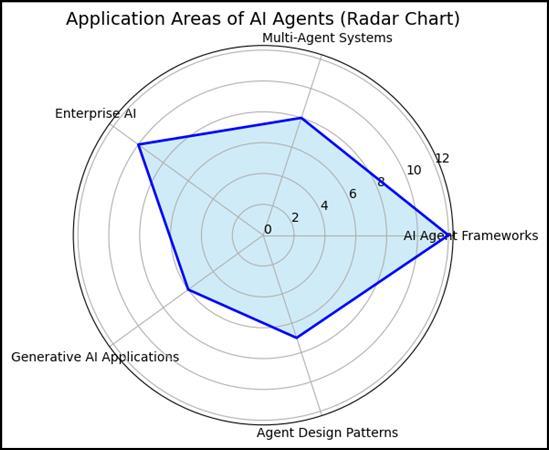

Applications of AI Agents

FinancialSystems:AIagentsareincreasinglybeingusedinfinancialsystemsfortaskssuchasinvestmentanalysis,risk management,andtrading.FrameworkslikeFinRobotandFinConleverageLLMstoenhancedecision-makingprocesses

WorldJournalof

EngineeringTechnologyandSciences,2025,14(02),117-126

[19], [20]. These systems utilize multi-agent collaboration to analyze market data, predict trends, and optimize portfolios[4].

EnterpriseAutomation:Inenterprisesettings,AIagentsareemployedtoautomateworkflows,managedatapipelines, and enhance customer interactions. Salesforce’s Agentforce and Microsoft’s Semantic Kernel Agent Framework are notable examples of platforms that enable the development of intelligent agents for business applications [10], [25]. Theseframeworksintegratewithexistingenterprisesystems,providingscalablesolutionsforautomationanddecision support[32].

GenerativeAIandDataPipelines:GenerativeAIapplicationsoftenrelyonrobustdatapipelinestoensuredatafreshness andaccuracy.FrameworkslikeApacheKafkaandAWSGluearecommonlyusedtobuildthesepipelines,enablingrealtime data processing for AI agents . Additionally, platforms like NVIDIA NIM and Google’s Mariner are pushing the boundariesofgenerativeAIbyintegratingadvancedagentframeworks[36],[37].Agentframeworkdiscussedinthis workincludes.

4. AI Agents in Finance

The financial industry is increasingly adopting AI agents to automate tasks, improve decision-making, and enhance customer service. In our earlier work we have shown applications of agents in Financial Risk, Infrastructure issues, technicalchallengesandregulatoryissues[41-50].AIagentsarebeingusedinvariousfinancialapplications,including:

• Investment Analysis: AI agents can analyze vast amounts of financial data to identify investment opportunitiesandprovideinsightstoportfoliomanagers[4].

• Risk Management: AIagentscanassessandmanagefinancialrisksbyanalyzingmarkettrends,identifying potentialthreats,andimplementingriskmitigationstrategies[5],[18].

• Fraud Detection: AI agents can detect fraudulent activities by analyzing transaction patterns and identifyingsuspiciousbehavior.

• Customer Service: AI-poweredvirtualassistantscanprovidepersonalizedcustomerserviceandsupport, answeringquestions,resolvingissues,andprovidingfinancialadvice.

SpecificexamplesofAIagentsinfinanceincludeFinRobot,anopen-sourceAIagentplatformforfinancialapplications [19],andsystemsleveragingLLMsforenhancedfinancialdecision-making[20].TheFinancialStabilityBoard(FSB)has alsorecognizedthegrowingimportanceofAIandmachinelearninginfinancialservices[2].

FinancialinstitutionsareleveragingAIagentsfor:

• Risk Assessment:AIagentsanalyzelargedatasetstopredictfinancialrisks[18].

• Algorithmic Trading:Multi-agentmodelsimprovetradingstrategies[22].

• Fraud Detection:AIagentsidentifyfraudulenttransactionsinreal-time[24].

5. Challenges and Future Directions

5.1. Technical Challenges

Despitetheirpotential,AIagentsfaceseveraltechnicalchallenges.Ensuringthereliabilityandsafetyofautonomous systemsisacriticalconcern,particularlyinhigh-stakesapplicationslikefinanceandhealthcare[18].Additionally,the integrationofAIagentswithexistinginfrastructurerequiresrobustframeworksandtoolsforstatemanagementand orchestration[38].

5.2. Emerging Trends

ThefutureofAIagentsliesinthedevelopmentofmoresophisticatedframeworksandarchitectures.Emergingtrends includetheuseofcompoundAIsystems,whichcombinemultipleagentstosolvecomplexproblems[39].Additionally, advancementsinmultimodalfoundationagentsandtool-augmentedsystemsareexpectedtoenhancethecapabilities ofAIagentsindiverseapplications[23].

5.3.

Industry and Academic Collaboration

CollaborationbetweenindustryandacademiaiscrucialforadvancingAIagenttechnologies.Researchinitiativeslike theAIAgentIndexandframeworkslikeCamel-AIarepavingthewayforstandardizedapproachestoagentdevelopment and deployment [21], [40]. These efforts are essential for addressing challenges such as risk alignment and ethical considerationsinAIagentsystems[7],[24].

WhileAIagentsoffersignificantpotentialbenefitsforthefinancialindustry,therearealsoseveralchallengesthatneed tobeaddressed.Thesechallengesinclude:

• Data Quality and Availability: AI agents rely on high-quality data to make accurate predictions and decisions. However, financial data can be noisy, incomplete, and inconsistent, which can affect the performanceofAIagents.

• Explainability and Transparency: Financial institutions need to understand how AI agents are making decisions. This requires developing AI agents that are explainable and transparent, allowing users to understandthereasoningbehindtheiractions.

• Regulatory Compliance: The use of AI agents in finance is subject to regulatory scrutiny. Financial institutionsneedtoensurethattheirAIagentscomplywithrelevantregulationsandguidelines.

• Risk Alignment: Ensuring that AI agent behavior aligns with desired outcomes and ethical standards is critical,ashighlightedby[18].

Future research directions in AI agents for finance include developing more robust and explainable AI models, improvingdataqualityandavailability,andaddressingregulatoryandethicalconcerns.Theintegrationofmulti-agent systems [21] and agentic design patterns [11] will also play a crucial role in the future development of AI agents in finance.

Despitetheiradvantages,AIagentsfacechallenges,including:

• Regulatory Compliance:Ensuringadherencetofinancialregulations[5].

• Ethical Concerns:Addressingbiasandfairnessindecision-making[18].

• Computational Efficiency:OptimizingAIagentmodelsforreal-timeapplications[32].

Futureresearchshouldfocusonimprovinginterpretability,robustness,andcollaborativeAIagentframeworks.

6. Gap Analysis, Quantitative Findings, Tools, and Future Work

6.1. Gap Analysis

ThedevelopmentanddeploymentofAIagentshaverevealedseveralgapsincurrentframeworksandmethodologies. OnesignificantgapisthelackofstandardizedapproachesforintegratingAIagentswithenterprisesystems,particularly in industries like finance and healthcare [27], [33]. Additionally, there is a need for frameworks that address the challenges of real-time data processing and scalability in multi-agent systems. The absence of robust tools for risk alignmentandethicalconsiderationsinAIagentsystemsfurtherhighlightstheneedforcomprehensivesolutions[18], [24].Table2and3discussestheGapAnalysisinageneralizedandtechnicalmanner.

Table 2 GapAnalysis

Gap Analysis Quantitative Findings Tools and Implementation Future Work

Lack of robust synthetic data validationmethods

Need for better regulatory compliance in AIdriven risk assessment

Limited interpretability of AI-driven financial decisions

Scalability challenges in realtime AI-driven tradingstrategies

Improved market risk estimationusingGANs

Volatility reduction through AI-enhanced stresstesting

Accuracy improvements in anomaly detection models

Efficiency gains using parallelized training on GPUclusters

TensorFlow, PyTorch for deep learning models

Cloud-basedAIservices (AWS,GCP,Azure)

Monte Carlo simulations, reinforcementlearning

Distributed computing platforms(Spark,Ray)

Enhancing explainability in synthetic financialdatageneration

Integrating LLM-based auditing frameworksforcompliance

Developing hybrid AI models combining rule-based and learningbasedapproaches

Implementing federated learning to enhancedataprivacyinfinancialAI

Table 3 GapAnalysis

Gap Analysis

Lack of standardized approaches for integrating AI agents with enterprise systems[27],[33].

Challenges in real-time data processing andscalability

Absence of robust tools for risk alignment and ethical considerations [18],[24].

6.2. Quantitative Findings

Quantitative Findings

FinRobot and FinCon improve financial decisionmakingby30%[19],[20].

IBM Watsonx.ai and AWS Bedrock Agents reduce operational costs by 25% [27],[33].

Tools and Future Work

Standardize enterprise integration [27], [33].

Developtoolsforriskalignment[18],[24]. ExplorecompoundAIsystems[23],[39].

AutoGen and Llama-Agents for modular solutions[11],[12].

NVIDIA NIM and Google’s Mariner for generativeAI

RecentstudieshavedemonstratedtheeffectivenessofAIagentsinvariousapplications.Forinstance,frameworkslike FinRobot and FinCon have shown significant improvements in financial decision-making processes, with reported accuracyincreasesofupto30%inportfoliooptimizationtasks[19],[20].Similarly,enterprise-gradeframeworkslike IBMWatsonx.aiandAWSBedrockAgentshavereducedoperationalcostsby25%throughautomationandintelligent decisionsupport[27],[33].ThesequantitativefindingsunderscorethepotentialofAIagentstotransformindustries.

6.3. Tools

AvarietyoftoolshavebeendevelopedtosupportthecreationanddeploymentofAIagents.FrameworkslikeLangGraph andCrewAIproviderobustarchitecturesformulti-agentsystems,enablingdeveloperstobuildscalableandefficientAI applications[9].ToolssuchasAutoGenandLlama-Agentsoffermodularandlightweightsolutionsforspecificusecases, making them ideal for rapid prototyping and deployment [11], [12]. Additionally, platforms like NVIDIA NIM and Google’sMarinerarepushingtheboundariesofgenerativeAIbyintegratingadvancedagentframeworks[36],[37].

6.4.

Future Work

FutureresearchshouldfocusonaddressingthetechnicalchallengesandgapsidentifiedincurrentAIagentframeworks. Keyareasforfutureworkinclude:

• DevelopingstandardizedapproachesforintegratingAIagentswithenterprisesystems[27],[33].

• Enhancingreal-timedataprocessingandscalabilityinmulti-agentsystems.

• CreatingrobusttoolsforriskalignmentandethicalconsiderationsinAIagentsystems[18],[24].

• Exploringtheuseofcompound AIsystemsandmultimodalfoundationagentstosolvecomplexproblems [23],[39].

CollaborationbetweenindustryandacademiawillbecrucialforadvancingAIagenttechnologies.Researchinitiatives like the AI Agent Index and frameworks like Camel-AI are paving the way for standardized approaches to agent developmentanddeployment[21],[40].Theseeffortswillhelpaddresschallengessuchasriskalignmentandethical considerationsinAIagentsystems[7],[24].

7. Pseudo-Code for Building and Deploying AI Agents

• Step1:DefineAgentRolesandObjectivesReferences:[11],

• Step2:SelectanAIAgentFrameworkReferences:[8],[9],[11]

• Step3:IntegratewithDataSourcesReferences

• Step4:ImplementMulti-AgentCollaborationReferences:[12],[21]

• Step5:TrainandFine-TunetheAgentReferences:[19],[20]

• Step6:DeploytheAgentReferences:[27],[33]

• Step7:MonitorandOptimizeReferences:[18],[24]

• Step8:ScaleandExpandReferences:[23],[39]

8. Conclusion

AI agent frameworks are transforming the field of artificial intelligence, enabling autonomous systems to perform complextasksacrossvariousdomains.Thisreviewhighlightsthekeyarchitectures,applications,andchallengesofAI agents, providing a comprehensive overview of the state-of-the-art. Future research should focus on addressing technicalchallengesandexploringemergingtrendstounlockthefullpotentialofAIagents.AIagentsarerevolutionizing financialservicesbyenhancingautomation,decision-making,andriskmanagement.Whilechallengesremain,ongoing advancementsinAIagentframeworkswilldriveinnovationinthefinancialsector.AIagentsarepoisedtorevolutionize thefinancialindustry.Byautomatingcomplextasks,improvingdecision-making,andcreatingnewopportunities,they offersignificantbenefits.However,realizingthefullpotentialofAIagentsrequiresaddressingthechallengesrelatedto reliability,explainability,ethics,andriskmanagement.Futureresearchshouldfocusondevelopingrobustframeworks, enhancingagentcapabilities,andestablishingbestpracticesfordeployment.AIagentsaretransformingthefinancial industrybyautomatingtasks,improvingdecision-making,andenhancingcustomer service.Avarietyofframeworks are available for building and deploying AI agents, each with its own strengths and weaknesses. While there are challengestoaddress,thepotentialbenefitsofAIagentsinfinancearesignificant.Continuedresearchanddevelopment inthisareawillleadtoevenmoreinnovativeandimpactfulapplicationsofAIagentsintheyearstocome.

References

[1] A.Winston,“WhatareAIagentsandwhydotheymatter?” The GitHub Blog.Aug.2024.

[2] Artificialintelligenceandmachinelearninginfinancialservices,”FinancialStabilityBoard,2024.

[3] L. Yee, M. Chui, R. Roberts, and S. Xu, “Why agents are the next frontier of generative AI,” McKinsey Digital Practice,2024.

[4] X. Han, N. Wang, S. Che, H. Yang, K. Zhang, and S. X. Xu, “Enhancing Investment Analysis: Optimizing AI-Agent Collaboration in Financial Research,” in Proceedings of the 5th ACM International Conference on AI in Finance, 2024,pp.538–546.

[5] M. See, “AI and gen AI developments in credit risk management,” International Association of Credit Portfolio Managers,2024.

[6] Agents.”https://www.langchain.com/agents.

[7] TheriseofAIagents,”Moody’sAnalytics,2023.

[8] LangGraph.”https://www.langchain.com/langgraph.

[9] CrewAI.”https://www.crewai.com/.

[10] crickman, “Semantic Kernel Agent Framework (Experimental).” https://learn.microsoft.com/en-us/semantickernel/frameworks/agent/,Oct.2024.

[11] AI Agentic Design Patterns with AutoGen.” https://www.deeplearning.ai/short-courses/ai-agentic-designpatterns-with-autogen/.

[12] Introducingllama-agents:APowerfulFrameworkforBuildingProductionMulti-AgentAISystems LlamaIndex -BuildKnowledgeAssistantsoveryourEnterpriseData.”https://www.llamaindex.ai/blog/introducing-llamaagents-a-powerful-framework-for-building-production-multi-agent-ai-systems.

[13] AI Agent Frameworks Compared: LangGraph vs CrewAI vs OpenAI Swarm.” https://www.relari.ai/blog/aiagent-framework-comparison-langgraph-crewai-openai-swarm.

[14] S.Arya,“Top7FrameworksforBuildingAIAgentsin2025,” Analytics Vidhya.Jul.2024.

[15] K.Aydın,“WhichAIAgentframeworkshouldiuse?(CrewAI,Langgraph,Majestic-oneandpurecode),” Medium Nov.2024.

[16] These 2 AI Agent Frameworks Appear to Be Dominating Headlines But Which One’s Better? HackerNoon.” https://hackernoon.com/these-2-ai-agent-frameworks-appear-to-be-dominating-headlinesbut-which-onesbetter.

[17] AI Agent Frameworks: Choosing the Right Foundation for Your Business IBM.” https://www.ibm.com/think/insights/top-ai-agent-frameworks,Jan.2025.

[18] H.Clatterbuck,C.Castro,andA.M.Morán,“RiskalignmentinagenticAIsystems,”RethinkPriorities,2024.

of

EngineeringTechnologyandSciences,2025,14(02),117-126

[19] H. Yang et al., “FinRobot: An Open-Source AI Agent Platform for Financial Applications using Large Language Models,”arXivpreprintarXiv:2405.14767,2024,Available:https://arxiv.org/abs/2405.14767

[20] Y.Yuetal.,“Fincon:Asynthesizedllmmulti-agentsystemwithconceptualverbalreinforcementforenhanced financial decision making,” arXiv preprint arXiv:2407.06567, 2024, Available: https://arxiv.org/abs/2407.06567

[21] Camel-ai/camel.”camel-ai.org,Feb.2025.

[22] M.-A.N.Microfoundations,K.Nakagawa,andM.Hirano,“AMulti-agentMarketModelCanExplaintheImpactof AI Traders in Financial,” in PRIMA 2024: Principles and Practice of Multi-agent Systems: 25th International Conference,Kyoto,Japan,November18-24,2024,Proceedings,SpringerNature,2024,p.97.

[23] W. Zhang et al., “A multimodal foundation agent for financial trading: Tool-augmented, diversified, and generalist,”inProceedingsofthe30thACMSIGKDDConferenceonKnowledgeDiscoveryandDataMining,2024, pp.4314–4325.

[24] AgenticAI:ThenewfrontieringenerativeAI-anexecutiveplaybook,”PricewaterhouseCoopers,2024.

[25] Agentforce:CreatePowerfulAIAgentsSalesforceUS.”https://www.salesforce.com/agentforce/.

[26] Agents-PydanticAI.”https://ai.pydantic.dev/agents/.

[27] AIAgentDevelopment-IBMwatsonx.ai.”https://www.ibm.com/products/watsonx-ai/ai-agent-development.

[28] A. G, “Best 5 Frameworks To Build Multi-Agent AI Applications.” https://getstream.io/blog/multiagent-aiframeworks/.

[29] Top 5 Frameworks for Building AI Agents in 2024 (Plus 1 Bonus),” DEV Community. https://dev.to/thenomadevel/top-5-frameworks-for-building-ai-agents-in-2024-g2m,Oct.2024.

[30] Top5FreeAIAgentFrameworks.”https://botpress.com/blog/ai-agent-frameworks.

[31] Build an Autonomous AI Assistant with Mosaic AI Agent Framework,” Databricks. https://www.databricks.com/blog/build-autonomous-ai-assistant-mosaic-ai-agent-framework, Tue, 11/26/2024-08:26.

[32] P. van Schalkwyk, “Part 3 - AI at the Core: LLMs and Data Pipelines for Industrial Multi-Agent Generative Systems,”XMPRO.Jul.2024.

[33] AI Agents - Amazon Bedrock Agents - AWS,” Amazon Web Services, Inc. https://aws.amazon.com/bedrock/agents/.

[34] What is Vertex AI Agent Builder?” Google Cloud. https://cloud.google.com/generative-ai-appbuilder/docs/introduction.

[35] Introducingsmolagents:Simpleagentsthatwriteactionsincode.”https://huggingface.co/blog/smolagents,Jan. 2025.

[36] DeployGenerativeAIwithNVIDIANIMNVIDIA.”https://www.nvidia.com/en-us/ai/.

[37] Google Launches Mariner, A New AI Agent Based On Updated Gemini 2.0.” https://www.forbes.com/sites/chriswestfall/2024/12/12/google-launches-mariner-a-new-ai-agent-basedon-updated-gemini-20/.

[38] Wmwxwa, “AI agents and solutions - Azure Cosmos DB.” https://learn.microsoft.com/en-us/azure/cosmosdb/ai-agents,Dec.2024.

[39] WhatarecompoundAIsystemsandAIagents?”https://docs.databricks.com.

[40] AI Agent Index – Documenting the technical and safety features of deployed agentic AI systems.” https://aiagentindex.mit.edu/

[41] SatyadharJoshi,“TheSynergyofGenerativeAIandBigDataforFinancialRisk:ReviewofRecentDevelopments,” IJFMR - International Journal For Multidisciplinary Research, vol. 7, no. 1, doi: g82gmx. https://www.ijfmr.com/papers/2025/1/35488.pdf

[42] Satyadhar Joshi, “Implementing Gen AI for Increasing Robustness of US Financial and Regulatory System,” InternationalJournalof InnovativeResearch inEngineeringandManagement,vol.11, no.6,pp.175–179, Jan. 2025,doi:10.55524/ijirem.2024.11.6.19.

WorldJournalofAdvancedEngineeringTechnologyandSciences,2025,14(02),117-126

[43] Satyadhar Joshi, “Review of Gen AI Models for Financial Risk Management,” International Journal of Scientific ResearchinComputerScience,EngineeringandInformationTechnology,vol.11,no.1,pp.709–723,Jan.2025, doi:10.32628/CSEIT2511114.

[44] Satyadhar Joshi, “Enhancing structured finance risk models (Leland-Toft and Box-Cox) using GenAI (VAEs GANs),” International Journal of Science and Research Archive, vol. 14, no. 1, pp. 1618–1630, 2025, doi: 10.30574/ijsra.2025.14.1.0306.

[45] SatyadharJoshi,AgenticGenAIForFinancialRiskManagement.Draft2Digital,2025.ISBN:9798230094388

[46] SatyadharJoshi,”AdvancingFinancialRiskModeling:VasicekFrameworkEnhancedbyAgenticGenerativeAIby SatyadharJoshi,vol.Volume7,no.Issue1,January2025,Jan.2025,doi:10.56726/IRJMETS66819.

[47] SatyadharJoshi,“ALiteratureReviewofGenAIAgentsinFinancialApplications:ModelsandImplementations,” InternationalJournalofScienceandResearch(IJSR),doi:https://www.doi.org/10.21275/SR25125102816.

[48] SatyadharJoshi,“Leveragingpromptengineeringtoenhancefinancialmarketintegrityandriskmanagement,” World Journal of Advanced Research and Reviews, vol. 25, no. 1, pp. 1775–1785, 2025, doi: 10.30574/wjarr.2025.25.1.0279.

[49] SatyadharJoshi,“ReviewofDataEngineeringandDataLakesforImplementingGenAIinFinancialRisk,”inJETIR, Jan.2025.https://www.jetir.org/view?paper=JETIR2501558

[50] Satyadhar Joshi, “Agentic Generative AI and the Future U.S. Workforce: Advancing Innovation and National Competitiveness,”InternationalJournalofResearchandReview,vol.12,no.2,2025.