Despite Its Size, Glens Falls MSA Places In Top Tier Of U.S. Economic Strength

BY JIM SIPLON, PRESIDENT WARREN COUNTY EDC

When I first came to this area more than a decade ago, I was struck by the sense that this was a place that punched way above its weight. It had assets that communities many times its size were lacking like a 400 bed hospital, a professional hockey team and arena, a SUNY college campus, a world-class art collection…I could go on as you know with many more attributes. I tell people who haven’t been here that we are the gateway to the Adirondack Park and the bridge to the Capital Region all at the same time.

The federal government developed the concept of Metropolitan Statistical Areas (MSAs) nearly 75 years ago and refined it to the current criteria in the 1980’s. My predecessor Ed Bartholomew and others worked to get this area adopted officially as an MSA as an aggregation of Warren and Washington Counties and ours is one of the smallest in the country…smaller than all but 17%. Put another way, more than 4 out of 5 metropolitan areas in the U.S. are bigger.

A recent report from Area Development Magazine and Chmura Economics and Analytics examined economic fundamentals in both every MSA and economic market in the country ranging from the NY-NJWhite Plains MSA (population 11,588,916) to Pecos, Tx (population 10,618). While the study identified many high preforming areas in the South and Western U.S., it also had a surprising and robust set of measures for our modest Glens Falls MSA despite our small size.

To summarize the many pages of data

and rankings, our Glens Falls MSA is in the top 18% (175 of 949) of all U.S. markets. In the primary category (Economic Strength) our area was in the top 10% nationally (92 of 949), top 6% (5 of 84) of Mid-Atlantic markets and top 4% (3 of 58) of New York and Northern New England markets. The news is not uniformly good though-as one would expect. The major area we lag behind in is our workforce. We know our workforce has been flat or declining for some time and continues to age with a median age approaching 50. We rank in the bottom half

Continued On Page 7

New Upper Glen Street Showroom Focuses On Custom Design And Energy Efficiency

EDITOR NOTE: NAME UPDATED IN CAPTION FOR OWNERS 1/21/2026 BY CAROL ANN CONOVER

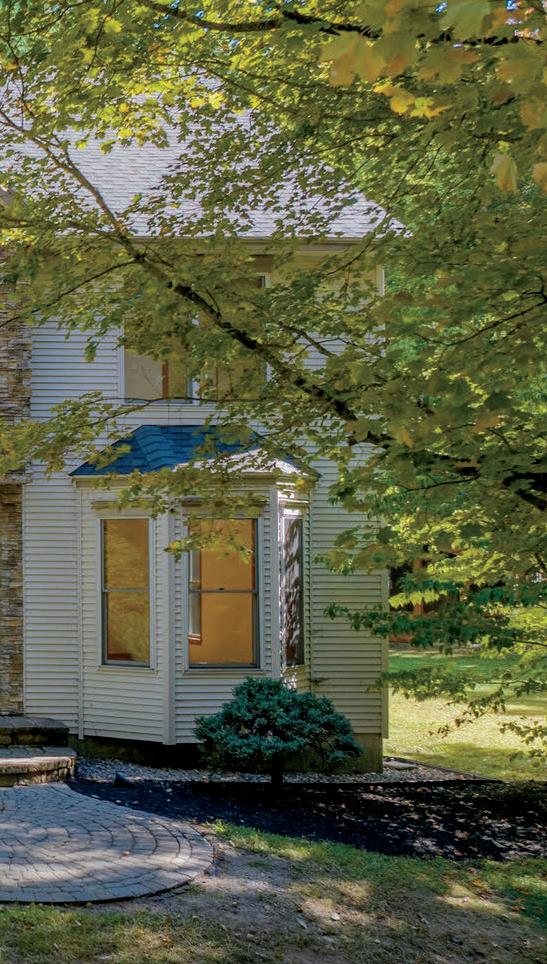

Homeowners looking for personalized design guidance rather than off-the-shelf solutions now have a new local option with the opening of a collaborative home design and improvement showroom on Upper Glen Street.

Tim and Michelle Schultz are launching a multibrand showroom at 704 Upper Glen St. that brings together custom window treatments, interior design services and energy-efficient replacement windows and doors. The space unites Gotcha Covered of Saratoga, Designs on Glen and Window Depot of the Adirondacks, offering what the owners describe as a consultative, one-on-one alternative to the stock selections and self-guided experience typical of big-box retailers.

The concept is designed to help homeowners make cohesive decisions that balance aesthetics, performance and budget, rather than purchasing products in isolation. Clients can work directly with experienced professionals to evaluate everything from fabric and light control to insulation value and window performance.

“We’re really focused on the personal side of design,” Tim Schultz said. “Big-box stores serve a purpose, but many homeowners want guidance tailored to their space, their home and how they live. That’s what we’re providing here.”

Michelle Schultz brings extensive design and industry experience to the showroom. She previously owned a tile and marble design studio in Clifton Park and later served as a district sales manager for Hunter Douglas, working with dealers across multiple states. Her background allows her to guide clients through complex interior decisions, helping them understand how materials, textures and window solutions interact within a space.

Tim Schultz, owner of Window Depot of the Adirondacks, spent more than 25 years in technology sales before transitioning into home improvement. He said that consultative approach carries over naturally into helping homeowners assess window and door options, particularly as energy efficiency becomes a growing concern for older homes common throughout the region.

The showroom features interactive displays where visitors can see and feel fabrics, operate motorized window treatments and compare window and door systems firsthand. The location sits across from Mohan’s on Upper Glen Street, an area

Lake George Winter Carnival Plans Five Weekends Of Events And Competitions

BY PAUL POST

Five weekends of frosty revelry are on tap as Lake George Winter Carnival has a full slate of activities planned for North Country residents and visitors alike.

The fun starts Saturday, Feb. 7 with outhouse races, a Jeep parade and fireworks and continues through March 7-8 with a Chillin’ and Choppin’ lumberjack competition.

“We do it to give back to the community and to promote tourism,” said Jessyca Darrah, co-chair with Nancy Nichols, of the allvolunteer Winter Carnival Committee. “The intent is for local businesses to make money. We need more of the community to step up and get involved. We’re always looking for volunteers. We want to grow the committee, we want more people actively involved.”

Now in it’s 64th year, Winter Carnival is the mainstay of ongoing efforts to promote more year-round tourism not only in Lake George, but throughout Warren County. Recent efforts such as Ice Castles at Charles R. Wood Park, and Winter’s Dream at Fort William Henry, have had short-lived runs due largely to mild winters the past few years.

But the return of an “old-fashioned winter” with sustained cold and numerous snowfalls has set the stage for a highly successful 2026 Winter Carnival.

“People should pay close attention to our Facebook page and website (lakegeorgewintercarnival.com) because we’re adding more activities as we go,” Darrah said. “The schedule will be updated throughout the month.”

On Page 11

Log Jam Restaurant Celebrates 50 Years With Debut

Of Signature Spruce Lager

The Log Jam Restaurant, a longtime Lake George dining institution, will kick off its 50th anniversary celebrations with a special First Pour Celebration on Wednesday, January 21, from 4:30 to 7:30 p.m., marking five decades of locally owned hospitality, community connection and Adirondack-inspired dining.

The anniversary event will debut Log Jam Spruce Lager, a signature craft beer brewed locally in collaboration with Northway Brewing Co. in Queensbury. The First Pour event will be the public’s first opportunity to sample the spruce lager on draft.

Guests attending the celebration can expect live music by Jordan Dyer and Megan Houde, along with beer and appetizer specials. The spruce lager will be available year-round at The Log Jam, with cans and four-packs launching soon. The First Pour event offers an exclusive opportunity to taste it fresh from the tap.

“Reaching 50 years is a significant milestone for our restaurant and our team,” said Tony Grecco, Manager of The Log Jam Restaurant. “This event is a way for us to honor an exciting collaboration, celebrate with our amazing customers and kick off a year of 50th Anniversary celebrations.”

Founded in 1976, The Log Jam Restaurant is a locally owned and operated dining destination in Lake George, New York, known for its warm Adirondack-inspired atmosphere, fresh salad bar and delicious steak and seafood dishes. The restaurant

by David White and his family since 1988. The Log Jam has welcomed locals and visitors alike with a menu rooted in tradition, featuring handcrafted cocktails, locally inspired dishes, and a dedication to exceptional service. The 50th anniversary year will feature additional celebrations and offerings throughout 2026. Learn more at www.logjamrestaurant.com.

Business / Personnel Briefs

Northern Insuring Agency, Inc. is pleased to announce the addition of Chelsea Chaplin to our Business Insurance Division in the Glens Falls office.

Chelsea brings with her 14 years of experience in the insurance industry, along with a strong commitment to exceptional customer service. Her expertise and dedication make her a valuable addition to our team as we continue to provide trusted insurance solutions to our clients.

Please join us in welcoming Chelsea to Northern Insuring Agency!

Northern Insuring Agency, Inc., founded in 1930, specializes in Auto, Home, Business, Life & Health Insurance, and Employee Benefits services.

First New York Federal Credit Union is pleased to announce the appointment of Vik Muktavaram as its next President and CEO.

Muktavaram, the ninth chief executive in the credit union’s 88-year history, joins First New York following the planned retirement of current President and CEO Lucy Halstead.

Muktavaram is currently the Executive Vice President & Chief Financial Officer at Sunmark Credit Union. He joined Sunmark as the Chief Risk Officer in 2022 and was named Interim Chief Financial Officer in 2024. Prior to joining Sunmark, he was a Principal with Satori Consulting, a New York City-based management consulting fi rm. Before that, he served as Chief Risk Officer for Old Mutual Bermuda, an investment management com-

pany, and spent over a decade in management consulting.

“Vik’s range of experience and commitment to the credit union movement stood out during our search process,” said Brian Krawiecki, Chair of First New York’s Board of Directors. “First New York has a great team, and we are excited to bring Vik on board as their new leader.”

Muktavaram earned an MBA from Columbia Business School, a master’s degree in co mputer science from Oklahoma State University, and a bachelor’s in chemical engineering from Osmania University.

Warrensburg Supervisor Kevin Geraghty has been selected to chair the Warren County Board of Supervisors for 2026, his fi ft h consecutive year and ninth year overall in the role.

He was chosen at the board’s annual organizational meeting Jan. 6. Geraghty previously served as chair from 2013 through 2016 and again beginning in 2022.

“I would like to thank my colleagues for their support,” Geraghty said, noting fi nancial challenges facing the county while expressing confidence in the board and county staff.

Bolton Supervisor Ron Conover nominated Geraghty, with no other nominations made.

Geraghty has served as Warrensburg town supervisor since 2006 and previously worked in management at the former International Paper Co. mill in Corinth.

He was sworn in Friday and also appointed Queensbury at-large Supervisor Nathan Etu as county budget officer.

Local Entrepreneur Brings ‘Functional’ Fitness Focus To Glens Falls, Hudson Falls

BY ANN DONNELLY

For James Lenhart, the path to business ownership in the fitness industry began not in a corporate boardroom, but in a small high school weight room in Ticonderoga, New York. Today, as the owner-operator of Anytime Fitness franchises in Glens Falls and Hudson Falls, Lenhart is using his background in kinesiology and professional strength training to help a new generation of Adirondack residents reach their physical goals.

Lenhart’s interest in fitness was sparked at age 14 when his physical education coaches suggested he visit the weight room to improve his performance in baseball and football. He quickly noticed the "positive impact" on his body and decided to pursue a career helping others experience similar changes.

"I thought I would love to do something like this and help people," Lenhart said.

He attended SUNY Cortland, a school renowned for its physical education and kinesiology programs. He earned a Bachelor of Science in kinesiology, a field he defi nes as the "study of human movement." During his college years, Lenhart secured a strength and conditioning internship with the New York Jets, followed by another internship at the University of South Florida in Tampa.

While Lenhart spent three years in management and sales for a large health club chain in Florida, the pull of home and family eventually brought him back to upstate New York. A personal loss—the unexpected passing of a close high school mentor who was also a friend’s mother—solidified his decision to return to the Glens Falls area in 2014 to be closer to his family.

Lenhart was working as Manager of Anytime Fitness in Latham when, in 2017, Scott Daley, owner of the Glens Falls and Hudson Falls locations, recruited Lenhart to come on board as Manager. After nearly a decade of

increasing responsibility, he purchased both locations on Jan. 3, 2023.

Transitioning from manager to owner brought new fiscal challenges, including navigating tax codes and managing large-scale expenses like a recent HVAC installation and gym remodels. Lenhart emphasized the importance of a "rainy day fund" for small business owners, noting that "anything can happen."

Lenhart’s vision for the future of his clubs required a significant investment to meet franchise requirements and better serve his 1,000-plus members. Recognizing that a fullscale renovation and rebrand were necessary for both the Glens Falls and Hudson Falls locations, he embarked on the rigorous process of securing an SBA 7(a) loan.

The journey to secure the necessary capital was long and detailed. Lenhart worked with Pursuit Lending to navigate the extensive requirements of the loan. He noted that while the process was long and thorough, the support he received made the difference. "It's extensive, but that's understandable, and working with Pursuit makes all the difference," Lenhart said. He maintained constant communication with his lending team, often being on the phone two or three times a week for several months to ensure every fi nancial detail was in place.

To strengthen his application, Lenhart also utilized the New York State Small Business Development Center (SBDC). He worked closely with an advisor to develop the professional pro formas and profit projections required for SBA compliance. Th is expert assistance ensured that when it came time to present his fi nancials to lenders, there was no doubt about the business’s viability. Lenhart described the fi nal result of this collaborative effort as a "slam dunk" that allowed him to complete the construction and branding up-

Continued On Page 11

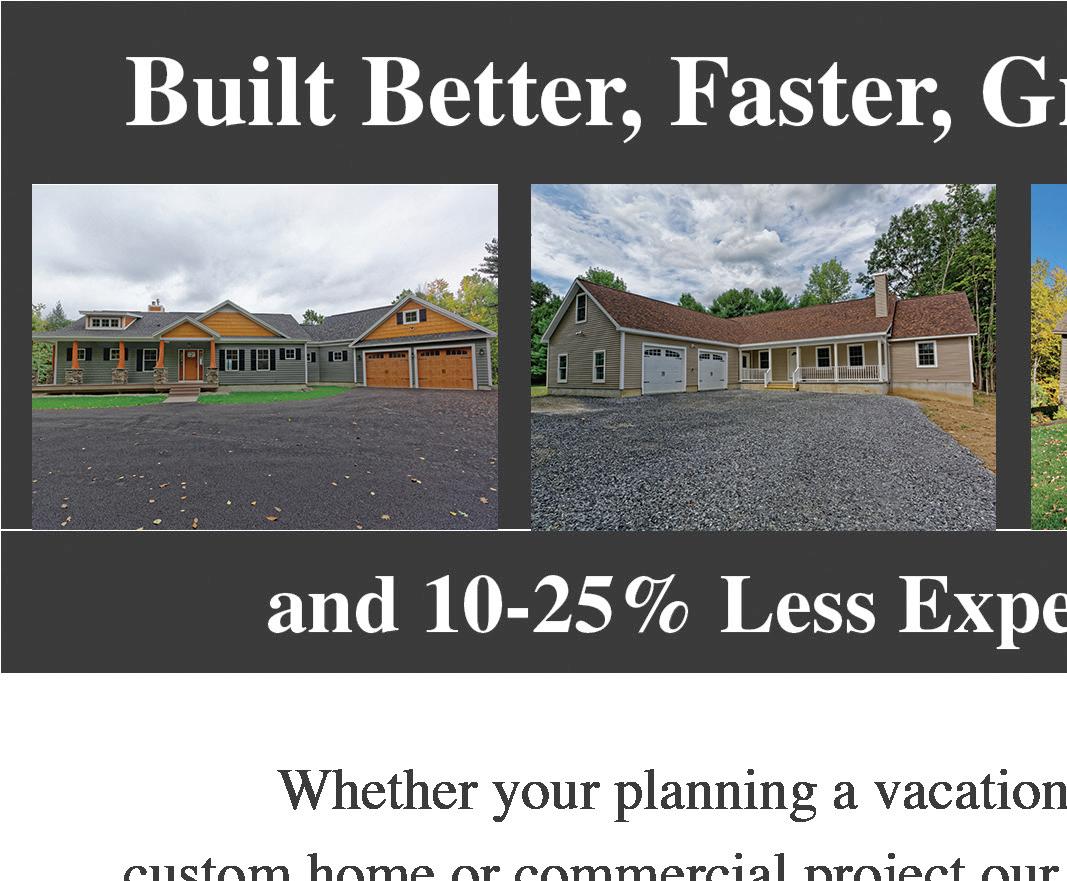

O’Connor Construction Is Poised For Future Success As Fift h Generation Takes The Helm

BY ROD BACON

Ownership of O’Connor Construction has passed to the fifth generation of the family.

On December 18, President Pat O’Connor finalized the purchase of the 120-year-old company from his uncles, Kevin O’Connor and Brian O’Connor.

“Several years ago my uncles came to me and said ‘You’re the next one to take over if you want to’ so I’ve been preparing for this for quite some time,” said Pat.

The $4 million transaction was brokered by Nic Ketter of Glens Falls-based Realize Brokers. Edward P. Fitzgerald of McPhillips, Fitzgerald & Cullum LLP represented the sellers. Kara I. Lais of FitzGerald Morris Baker Firth PC represented the buyer.

The sale included equipment and real estate at company headquarters at 147 Meadowbrook Road in Glens Falls.

Pat said he feels well prepared for his new role. He joined the company in 2014 after working for a few other contractors in the area. He rose through the ranks, eventually being named vice president. This required he take on more responsibility, which gave him additional experience and insight into company operations. He also earned an associate degree in construction technology from Hudson Valley Community College and a bachelor’s degree in construction management from SUNY Delhi.

Since its establishment in 1905, the company has grown from founder Thomas O’Connor hauling dirt with a horse and wagon between Glens Falls and Ticonderoga to include excavation and site preparation for area contractors, paving, concrete work, retaining walls, and sports courts.

Currently, the company is doing site work for a development underway in Wilton by BBL Construction Services, as well as constructing roads for Phyllian’s Bluff, a 31-lot subdivision near Saratoga Lake being built by Witt Construction.

Pat has ambitious plans for the future.

The company’s annual revenue is $7 million-$10 million, and he wants to grow that to $100 million within the next 10-15 years. That would require expanding his contracting radius from 100 miles to 300 miles. He now bids on contracts from Albany to Plattsburgh and east to the Vermont border. An expanded radius would take him to Syracuse and possibly as far as Buffalo to the west and into Vermont to the east. He is especially interested in expanding north of Ticonderoga.

“There are a limited number of site guys up there,” he said. “I think the northern market has the most opportunities.”

To do this he would have to increase his 30-member workforce. The company offers health insurance, IRAs, and vacation time.

There is also the possibility that he may develop some of his own properties.

“I think what I would like to do is build something like a thirty-unit apartment building that would generate revenue for me and my family,” he said.

The sale of the construction company has not taken Pat’s uncles from the business world. They continue to operate O’Connor Quarry, which they founded in the mid-’80s to provide sand for their excavation work. Since then they have expanded their offerings to include a variety of stone, sand, gravel, mulch, compost, and soil products.

Pat has been married for 11 years. He and his wife, Sara, have two daughters, Sophia and Bria. While it is much to early to think about business succession, he does not want O’Connor Construction to pass out of the family.

“There’s a possibility that my younger daughter, Bria, might take over when it comes time for me to retire,” said Pat.

To learn about the services offered by O’Connor Construction go to etoconnor. com.

To view the products available at O’Connor Quarry go to oconnorquarry.com.

ADKtechs Marks 20 Years, Prepares For Major Expansion At Moreau Commons

BY ANN DONNELLY

For Jared Humiston, the journey from a rented apartment in Argyle to the cutting edge of the regional tech industry has been defined by a single, unwavering mission: to make technology work for the client.

As Adirondack Technical Solutions — known more commonly as ADKtechs — marks its 20th anniversary, the company is preparing for its most significant transformation yet. On March 1, the firm will relocate its headquarters from its longtime home in Washington County to the new Moreau Commons, a strategic move designed to fuel the next decade of growth.

The company’s origins are humble, born from a conversation between a landlord and a tenant. Humiston, now President and CEO, recalls that “literally how we started was with one customer, who was looking for consistent support services.”

“It started as kind of like a side hustle, and then he told somebody, then they told somebody,” Humiston said. Within four years, the business had scaled to 40 accounts through word-of-mouth referrals.

In those early days, the industry was tethered to hardware. “Most everything was built around hardware sales and physical on-premises solutions,” Humiston explained, noting that the company essentially built “small clouds” for individual firms, hosting their email and websites locally.

As technology evolved toward the cloud, Humiston recognized that the traditional managed service provider model was flawed. Instead of chasing volume, ADKtechs made the bold decision to shrink its client base to grow its impact. Over the last four years, the firm strategically reduced its customer count from hundreds to just 50.

“I just didn’t feel comfortable with it,” Humiston said of the industry-standard model. “There was just too much chaos, and it was all reactive. We maintained and grew the revenue while significantly lowering the accounts that we manage.”

This shift allows ADKtechs to operate as a Virtual Chief Information Officer (vCIO) for its clients, focusing on strategy rather than just fixing broken laptops. “Our value is your uptime,” Humiston said. “If my team is at your place on the weekend or working through the night, you’re not able to take care of your customers.”

The upcoming move to the former Suzuki dealership site, which is now Moreau Commons, represents the fulfillment of a long-term vision. While Humiston was hesitant to leave Argyle, the lack of infrastructure—specifically, sewer and water limitations—made a multi-use expansion there impossible.

The new location places ADKtechs closer to the talent pools of Clifton Park and Saratoga County while remaining central to a client base that stretches the length of the East Coast.

“Sometimes you get to join a vision, sometimes you get to create a vision,” Humiston said. “In this case, we get to join Brian and Ben’s vision

there [at Moreau Commons]. It puts us closer to hundreds of thousands more people.”

The facility will also offer conveniences for employees, such as an on-site barber shop, salon, and coffee shop. Humiston views these perks as essential for recruitment. “Time is a form of currency as well,” he noted.

The company’s culture is central to its success. ADKtechs provides 100% health benefits for employees and their families, unlimited time off, and quarterly profit sharing.

“We can’t have customers without great employees,” Humiston said, emphasizing that cultural fit is prioritized over technical expertise during hiring. “I will sacrifice nothing to sacrifice the culture that we’ve built, the peace that our team has.”

This investment has resulted in an exceptionally quiet help desk. At the end of last year, the company managed over 2,000 endpoints with only a single ticket in the queue.

While ADKtechs serves diverse sectors like healthcare and finance, its largest vertical is construction. Humiston takes pride in reframing technology from an overhead expense to a valuable tool for “blue-collar” businesses.

“Technology really should enhance your business. It shouldn’t be a crutch,” Humiston says. By moving blueprints and payroll to the cloud, construction firms can take on more jobs and eliminate unnecessary travel.

As ADKtechs enters its third decade, the focus is now on guiding clients through the complexities of artificial intelligence.

“AI is going to be that driver,” Humiston said. “We’re not trying to slow your progress; we’re trying to guide your progress and make sure you’re not opening yourself up to some things out there that you may not be aware of.”

For more information about ADKtechs, visit their website at adktechs.com.

Economic Outlook 2026

Technology Moves The Basement To Boardroom

BY DAVID ANDRADE, PRESIDENT STORED TECHNOLOGY SOLUTIONS, INC.

For years, the relationship between a business and its IT provider was purely transactional. You called them when outages occurred or the Wi-Fi dropped, and you paid them to make the problem go away. Today, that break-fix model isn’t just outdated, it’s holding back your ability to scale. In 2026, there should be a shift in how your company utilizes technology. Think of it as moving the technology from the basement to the boardroom.

Tech is no longer a background function. It’s the backbone of daily operations and a competitive advantage. The organizations that thrive this year won’t just be those with the newest gadgets, but those that redefine their relationship with how technology makes their business better.

The most significant shift we have seen in recent years is replacing the “IT vendor” with the mindset of a strategic partner. Today’s business leaders expect their technology teams to understand their business model, their business goals, and the unique pressures of operating in a seasonal, tourism driven economy. This partnership extends into the realm of cybersecurity, tying into the overall resilience of the company. Small to mid-sized businesses remain primary targets because attackers know there’s a lack of internal resources and budget allocated.

Every industry has seen the change that Artificial Intelligence (AI) has made. The reality is, AI isn’t a future concept. It’s already embedded in the tools we use every day including Microsoft 365, Google Workspace, and social media platforms. Those who embrace AI-powered systems to automate routine tasks will scale, while those who hesitate will find themselves bogged down by manual workflows. By allowing AI to handle the “noise” and provide deeper system insights, your team is freed up for the higher-value work that actually drives revenue growth. Utilizing AI is no longer optional, it’s the modern approach to business decision making and automations. Businesses that hesitate will risk falling behind.

Leaderships involvement in technology should no longer just be asking, “Is our technology working?” The forward-thinking ones are asking:

“Is our technology helping us grow?”

“Is it improving customer experience?”

“Is it making our team more productive?”

This shift changes everything. Technology reviews are no longer technical check-ins, but rath-

Courtesy StoredTech

er strategic conversations. This check-in is where every decision can be tied directly to a tangible outcome. One of the most effective ways to ensure these outcomes is through standardization. Managing dozens of different tools and systems creates “technical debt” and security gaps. A unified, streamlined approach is a strong way to stay resilient.

We saw this recently with a multi-generational construction company dealing with thirty years of project data and too many silos. The foreman was using one app for project updates, the sub contractor using another for change orders, and the back office was still tracking hours on a legacy spreadsheet. The breaking point came while the concrete trucks sat idling, costing the company thousands, and the team was scrambling to confirm a spec change because the systems were disconnected. It was a wake-up call that tech shouldn’t be a hurdle but a tool to drive success.

A ‘single source of truth’ and standardizing every device from the office to the field was a big part of modernization.

As our Upstate NY business community grows, it’s key to remember technology is a key driver of success. The companies that focus on blending smart tech with strategic thinking are the ones that will thrive. Working closely with your technology partner to align your tools, security, and strategy with your business goals is what sets you apart. Treat technology as a growth engine, and not just an expense, and you’ll be leading the way in 2026 and beyond.

Rising Costs Demand New Economic Strategy

BY STATE SENATOR DAN STEC R–QUEENSBURY, 45TH DISTRICT

As state lawmakers head into the 2026 Legislative Session, we must chart a better direction. Poor state planning, combined with the Climate Leadership and Community Protection Act (CLCPA) energy plan that’s driving up costs while failing to stabilize our grid for the future, have caused New York’s economy to stagnate and added to the pressures small businesses have faced in the post-COVID economy.

Between energy rates, consistently high taxes and fees and bureaucratic red tape and inflationinduced supply cost increases, action must be taken to provide financial relief. Small businesses often operate on tight financial margins. A statemandated transition to green energy and the continued increase in electric and gas costs eat away at these margins, reducing a business’ ability to hire, promote or retain its workforce.

Given this reality, it only makes sense for New York State to scale back and at the very least delay the green energy initiatives laid out it in the CLCPA. Late last year, the governor agreed to delay the all-electric building mandate. That should only be a start. According to a report last month by New York Independent System Operator (NYISO), our energy grid is at an “inflection point.”

An aging generation fleet and flagging green energy development is leading to a long-term energy shortfall. Investing in an all-of-the-above energy portfolio that includes nuclear and hydrocarbon, in addition to the initiatives proposed via the CLCPA would stabilize our grid, create jobs and ultimately lower costs for consumers.

There must be a decrease in state spending. As of today, New York State is facing a $4.2 billion budget deficit. Our most recent state budget was more than $250 billion, a sum more than the budgets of Florida and Texas combined. This type of reckless spending is unsustainable, and our taxpayers are the ones who bear the brunt of it. Each year, New York is ranked as having the worst climate for economic development and this state spending – funded through a dizzying amount of taxes and fees – is a major reason. Instead of funneling money into top-down initiatives, reducing state spending and putting money back in the hands of local entrepreneurs is a better direction. After all, these are the men and women who actually create jobs and opportunities in our communities.

If state government is going to assist in economic development, it should be by improving infrastructure. That means a commitment to repairing our roads and bridges. Whether it’s an 18-wheeler transporting goods or a family taking a trip to the Adirondacks, we must ensure that everyone can safely travel through and within our region. Investing in that helps pave the way for increased commerce and economic activity. But when addressing infrastructure, we must go even further.

New York must help ensure our region has access to affordable, high-speed broadband and cell phone service. From helping to pass a repeal of a

costly fiber-optic tax that made it near-impossible for broadband to be installed in rural communities in our region to updating the Adirondack Park Agency’s archaic cell tower policy, I’ve repeatedly called for action that would facilitate the development of fiber-optic lines and cell phone towers. Through an ongoing state investment and public-private partnerships, now is the time to finally ensure 100 percent (or close to that mark) broadband and cellular access. These are essential tools for new and developing businesses alike, connecting them to potential customers and resources they may not otherwise have access to. Ideally, our economy should reflect our local character and attributes. For the North Country and Adirondacks, that means harnessing the potential of communities and locations like Lake George, Lake Placid and the High Peaks. Outdoor recreation – from boating to skiing and hiking –is a core component of our economy year-round. A commitment to protecting our mountains, lakes and waterways through the state’s Environmental Protection Fund and continued support for our ski trails and Olympic facilities is crucial in maintaining the economic viability of our tourism and recreation-based economic sectors. But improving our economic outlook is about more than just sustaining what’s working; it’s about finding new ways to create opportunities for growth and development. Companies like Ward Lumber, Barton Mines and Finch Paper are industry leaders and sources of good-paying, skilled career opportunities. Investing in workforce development initiatives provides residents with the tools necessary to work at local landmarks such as these or to start the next generation of locally owned and operated trades. In addition to jobs and revenue, a focus on the affordable housing crisis is needed. Scaling back the regulations that make new construction costly and tackling the mandates that drive up property taxes are crucial in keeping families in our communities. If people can afford to live and work in our region, we can improve our economic outlook and build a stronger future for our region.

Rebuild NY Economy With Fiscal Discipline

BY ASSEMBLYMAN MATT SIMPSON R–LAKE GEORGE, 114TH DISTRICT

Representing much of the North Country, I’ve witnessed fi rsthand the determination of our residents and businesses to thrive amid ongoing challenges. While our state’s economy shows signs of stagnation, rooted largely in Albany’s persistent tax-and-spend approach and overregulation, there are pathways forward through reforms that prioritize affordability and fi scal responsibility.

New York’s job market has revealed underlying vulnerabilities. Without health care sector job growth, the state would have lost over 50,000 jobs in 2025. Th is weakness spanned multiple industries. Such broadbased slowdowns underscore the ripple effects of state policies that have made it harder for businesses to hire and expand. In rural districts like the 114th, where small enterprises represent much of the local economy, these trends hit particularly close to home.

Housing remains a critical concern, with prices in New York having outpaced the national average. While supply constraints play a role, true affordability extends beyond just building more units and demands an economy that generates the jobs and incomes to support them. In areas like Glens Falls/Queensbury and into the Adirondacks, we need infrastructure upgrades and a less adversarial business climate to attract development.

Child care is another fi nancial hurdle families are forced to grapple with. New York currently ranks as one of the least affordable states for child care, with the average annual cost for center-based care exceeding $20,000. The Child Care Assistance Program was meant to cover almost the entire cost of private child care for nearly 100,000 low- and middle-income families. Unfortunately, the funding for these subsidies did not match demand, and many providers were forced to close when funds dried up. Th is puts an immense burden on families when teachers are displaced in the middle of the year. I am hesitant to introduce new programs until we fi x the good ones fi rst.

We also need to be mindful not to oversimplify complex conversations in the health care sector with blanket solutions. There are existing solutions like the 340B Drug Pricing Program, which save hospitals millions year-to-year at no cost to taxpayers that can unfortunately be exploited. The erosion of such programs means less money channeled back into expanded health care services, resulting in higher costs for recipients. There are many programs from decades ago that work but only need to be modernized and saved from neglect. Let’s start with those.

Energy policy presents another pivotal area for 2026. Affordable, reliable energy is essential for economic vitality, yet Albany’s ambitious goals under the Climate Leadership and Community Protection Act (CLCPA) have driven up utility bills and complicated housing development. A paused mandate for zero-emission appliances and heating in most new buildings could add about $20,000 to home construction costs if implemented. Studies indicate our infrastructure isn’t yet equipped for full electrification, risking outages and higher costs. While pursuing sustainable energy is commendable, the approach must be practical and transparent to avoid burdening families and businesses. I advocate for a full cost-benefit analysis of the CLCPA to ensure it aligns with our economic realities, preventing an energy shortfall that could

hinder growth.

Th is affordability crisis is intertwined with our state’s fi scal habits. Last year’s budget swelled to a record quarter-trillion dollars, double Florida’s budget despite similar populations, and exceeding the combined budgets of Florida and Texas. With some of the nation’s highest property and income taxes, plus burdensome regulations, New York ranks dead last (50th) on the Tax Foundation’s State Tax Competitiveness Index and Economic Outlook. A projected $4.2 billion budget gap for the coming fi scal year highlights the unsustainability of yearover-year spending increases. Unfunded mandates from Albany trickle down to local governments, raising costs for counties and towns in the 114th district and beyond.

Albany’s tax-and-spend agenda has infl ated costs across the board. Since Gov. Kathy Hochul took office, overall prices rose by 18%, with specific spikes in housing (up 23%), utilities (up 34.7%), groceries (up 20%) and medical care (up 7.2%). New York now ranks third nationally for housing cost burden, making it increasingly difficult for families to stay rooted here.

Th is cycle of rising costs fuels outmigration. Between 2020 and 2024, New York’s population declined by 1.2%, while Florida’s grew by 8.2%. Businesses and retirees are relocating southward, taking talent and revenue with them.

To revive everyday affordability, I’ll again champion legislation to temporarily suspend state sales taxes on housekeeping supplies and ready-to-eat foods. Sales tax receipts are projected to grow more than 3% in the coming year; redirecting this windfall back to consumers would provide immediate relief for essentials like motor fuel and personal care items. Additional steps, such as eliminating taxes on overtime pay and tips, would support middle-class workers in hospitality and other key sectors prominent in the North Country.

Ultimately, real change demands deregulation, trimming bureaucracy and curbing spending to create a more competitive environment. Less is more in an arena where so many laws have added to the bureaucracy that it can be paralyzing. By focusing on lower taxes and fi scal discipline, we can prioritize New Yorkers’ needs over expansive agendas.

Assemblyman Matt Simpson represents the 114th Assembly District, which includes parts of Warren, Essex, Washington and Saratoga counties, as well as the town of Northampton in Fulton County. For more information about Assemblyman Matt Simpson, Please visit his official Assembly website.

Market Outlook 2026 Growth With Volatility

BY DAVID M. KOPYC, CRPC PRESIDENT OF RETIREMENT PLANNING GROUP LLC

As forecasts for 2026 take shape, the consensus view is cautiously optimistic. The U.S. economy is expected to remain resilient, supporting continued gains in both stock and bond markets, even as investors adjust to higher volatility and a gradual shift away from the AI-driven tech dominance of recent years.

Most economists anticipate a “soft landing” scenario in which the economy avoids recession, inflation continues to moderate—though remaining above the Federal Reserve’s 2 percent target—and interest rates trend lower as the Fed continues cutting in response to a softening labor market.

For equity investors, Wall Street strategists are largely aligned in their outlook for another solid year. Major indexes such as the S&P 500 are projected to post double-digit gains, with year-end targets ranging roughly between 7,400 and 8,100. Strong corporate earnings growth, ongoing capital spending tied to artificial intelligence, and a generally marketfriendly policy environment are expected to underpin the bull market’s momentum.

Artificial intelligence remains a central driver of growth, with expectations that S&P 500 earnings could rise 14 to 15 percent in 2026. At the same time, analysts expect market leadership to broaden. While mega-cap technology stocks have carried much of the rally to date, value stocks, small- and mid-cap companies, and international developed markets are increasingly viewed as more reasonably priced opportunities.

Underlying these projections is a steady economic backdrop. U.S. gross domestic product growth is forecast in the 2.0 to 2.4 percent range, supported by strong consumer spending and continued business investment.

Still, risks remain. Elevated valuations— particularly in parts of the technology sector—leave markets vulnerable if earnings fail to meet expectations. Policy uncertainty could also emerge with the appointment of a new Federal Reserve chair in May 2026. Geopolitical tensions and shift s in trade policy, including tariffs, add another layer of potential volatility.

On the fi xed-income side, the outlook is also constructive. Bonds are positioned to deliver solid returns driven largely by coupon income. The Federal Reserve is expected to continue its rate-cutting cycle, potentially bringing the federal funds rate into a 3.00 to 3.25 percent range by the end of 2026.

As short-term rates fall, long-term yields

are likely to remain relatively elevated due to lingering inflation concerns and high levels of government debt issuance. That dynamic points toward a steeper yield curve. In this environment, investors are advised to emphasize high-quality investment-grade corporate bonds and intermediate-term U.S. Treasuries with maturities in the two- to 10-year range.

One notable shift is that both cash and fi xed-income investments are expected to deliver positive real, inflation-adjusted returns—something investors have not consistently seen in recent years. However, inflation is projected to remain “sticky,” hovering around 3 percent, which could limit the pace and scope of future rate cuts. Corporate credit spreads are also tight, raising the possibility of widening and reinforcing the importance of careful credit selection.

For the general public, the takeaway for 2026 is balance. The environment suggests continued growth, but also ongoing volatility and structural uncertainty. Diversification across asset classes, sectors, and geographies remains essential, as does periodic rebalancing—particularly after strong gains in areas such as AI.

With bond yields offering meaningful income, fi xed income may once again play a dual role as both an income source and a stabilizing force during equity market swings. Investors should also be prepared for periodic pullbacks and sector rotations, keeping a long-term perspective as conditions evolve.

As always, these broad trends serve as a framework rather than a prescription. Individual fi nancial decisions are best made in consultation with a qualified fi nancial advisor who can tailor strategies to specific goals, timelines, and risk tolerance.

Stories Create Loyalty In Tough Economies

BY NEAL SANDIN PRESIDENT, 643 RESEARCH

Economic uncertainty reigns, with concerns about tariffs, rising unemployment and inflation, and the possible “AI Bubble” spilling out from social media feeds and news outlets. With higher costs for groceries, utilities, as well as at the gas pump and seemingly everywhere else, people are becoming more discerning about where to spend their hardearned money. The challenge for brands and market researchers that work for them is not to focus too much on one single factor: price.

Many companies when faced with economic hurdles immediately reduce prices. Th is is understandable. After all, a typical question that the market researcher asks is if there is anything preventing someone from buying something. Not surprisingly, the fi rst answer is always cost. If things were only a little less expensive, they would buy. Yet ironically, reduction of prices can actually cause people to not buy from a brand.

For example, if Rolls-Royce suddenly started selling their vehicles at a Honda Civic price point, many people would wonder about the brand and if the quality was truly there. The true appeal of Rolls-Royce is that it is exclusive. These vehicles belong to a rarefied group, one that is full of brand-loyal customers. The more exclusive, the more exciting the brand, the more it captures the imagination on both an emotional and social level. All of this creates and reinforces customer loyalty.

Some may conclude from this that a higher price is required to create exclusivity. While it is true that a Rolls-Royce at $30,000 is not nearly as remarkable as a Rolls-Royce at $300,000, it is the stories we tell about the brand that truly makes them something special. Rolls-Royce played a key role in royal weddings, including between Princess Diana and Prince Charles. Yet, that Honda Civic that can last 200,000 miles also tells a story, one that Rolls-Royce never could, that of road trips and memories with loved ones. These stories give people a reason to buy from that brand. They make the customer want to spend their money with a specific company and not anyone else. Stories create loyalty.

In other words, being unique is not enough. To be exclusive, a brand needs to be distinctive while also being evocative. The mechanic who stayed late to fi x the car so that the college graduate could reach that job interview, the jacket that inspires dreams of travel because of the claim that it can keep you warm even on Mt. Everest, the honest and competent tax professional who fi nds a way to save the client from severe penalties, all of these inspire

Marketing In 2026 Lean In, Don’t Hide

BY SARA MANNIX FOUNDER & CEO OF MANNIX MARKETING

As we look forward to 2026, the economic narrative is split. On one hand, many growthminded businesses in the Saratoga and Glens Falls regions are entering the first quarter with record-breaking volume. On the other hand, a “wait-and-see” attitude has taken hold at the enterprise level, with major corporations slowing spending as they anticipate a potential market correction or the bursting of the “AI bubble.”

For local business owners, this contradiction represents a rare window of opportunity. While large-scale competitors hesitate, local businesses can use their agility to claim market share that’s currently being left on the table.

emotion. They are also social, all moments or hopes that people can share with others. In essence, they are exclusive. They are moments and experiences that other brands cannot (or do not) recreate. A compelling story creates a reason to buy and a reason to be loyal, more so than any change in price. The challenge for the market researcher is to fi nd those stories in a world of anxious clients and brands.

Exclusivity can work the other way too.

A story of being overcharged, of dishonest workmanship, of rude after-sales service, all undercut customer loyalty and create a type of exclusivity that works against the brand. At that point, the company will be forced to lower prices because there is no other reason for customers to purchase their products and services. In other words, lowering prices can signal to customers that the brand has nothing special to offer and might be a liability. There are times that offering discounts can help brands, as we see during Black Friday and the holiday season. Individualized discounts for loyal customers can also evoke loyalty if done with sincerity and personalization. However, cutting costs across the board can make a customer go from “I want to shop there” to “I guess it is good enough.” “Good enough” does not evoke loyalty, especially when economic tides eventually change for the better.

Doors open for brands when they are specific. Being all things to all people means there is, by defi nition, no exclusivity, no reason for consumers to be excited or loyal. Market researchers need to push beyond a fi xation on cost to fi nd the story that evokes a strong and compelling emotion, that is different from all others, and work with brands to bring that to the market.

The data behind the “Downturn Dividend” tells a clear story. It is a common reflex to cut marketing budgets at the first sign of uncertainty. However, history proves this is often a brand’s most expensive mistake. Research into the 1981–82 recession found that businesses that maintained or increased their advertising saw sales growth 256% higher by the time the economy recovered than those that cut their budgets.

We saw a modern version of this “Downturn Dividend” right here in our own backyard during COVID-19 in 2020. While much of the country was closing its doors and going quiet, leaders in Lake George pushed forward to aggressively market the region as a safe outdoor destination. By being the first movers to lean into the uncertainty rather than retreat from it, Lake George outpaced all of its competitive markets that summer and the following summer.

When competitors go quiet, your share of voice becomes exponentially louder and cheaper to acquire. In 2026, marketing is not an expense to trim; it is the strategy that ensures you gain ground while others simply hope to survive.

AI strategy in 2026 is about execution, not hype. In 2024, AI was a novelty. In 2026, it is a teammate that an expert must manage. At our agency, we utilize “agentic AI” to eliminate administrative friction, allowing our team to focus on being the true authorities and experts our clients need.

If the AI bubble pops, it’s just the market catching up to reality. We’ll stop focusing on what AI might do and start focusing on what it actually delivers for your bottom line. For a business, this is good news. It means the “trick” SEO that has cluttered search results will fail, and excellence will be rewarded once again. To win the current search wars on Gemini and ChatGPT, you must implement generative engine optimization (GEO). This requires moving beyond generic optimization and focusing on utilizing schema coding (JSON-LD) and creating a technical roadmap that tells AI engines exactly why your business is the source of truth for a specific query.

The boat dealer market illustrates the shift toward authenticity. Nowhere is the need for

excellence clearer than in the boat dealer market. Every dealer can list a generic boat description. However, AI engines now prioritize the “heart” of what you sell. Only an authoritative dealer can answer the nuanced questions customers actually ask:

“Which boat is perfect for the specific depths and traffic of Lake George?”

“How does the long-term valuation of a used pontoon compare to a new one over five years?”

If you haven’t been clear about your unique selling points, you will be invisible to generative search. People buy from brands that represent their values and answer their hardest questions with transparency.

Local authority is becoming the safest growth strategy. In an era of big-tech distrust, the safest bet for any business’s bottom line is a hyperlocal authority strategy. We see even nationally competitive brands doubling down on local markets because the cost to acquire a local customer is lower, and their loyalty is significantly higher.

We leverage our city hubs: Saratoga.com, Albany.com and LakeGeorge.com to provide our clients with immediate regional authority. True authority in 2026 also requires being where your customers are. For instance, being a helpful expert on platforms like Reddit is now a legitimate search strategy, as these communitydriven spaces are being heavily sourced by AI engines.

Here is my practical advice for 2026. If your marketing dollars are being spent poorly, don’t wait; change and test a new agency or strategy. But if you have a partner who can ensure a positive return on ad spend (ROAS), now is the time to be aggressive.

2026 will reward the brave, those who embrace AI to amplify their human expertise, and those who understand that being a local authority is the best defense against global volatility. Do not throw your head in the sand. Answer your customers’ hardest questions, clarify your brand identity, and use today’s prosperity to build a foundation that is untouchable by the next economic cycle.

MITCHELL B. MUROFF, ESQ. FOUNDER, MUROFF HOSPITALITY GROUP

As we look ahead to 2026, the hospitality industry enters the year on far more stable footing than many anticipated just a few years ago. While 2025 was marked by moderation rather than acceleration, it ultimately proved to be a year of normalization—one that set the stage for measured, sustainable growth rather than speculative excess.

Nationally, 2025 saw travel demand remain resilient despite higher interest rates, inflationary pressures, and continued labor challenges. Leisure travel continued to outperform expectations, particularly in drive-to markets and experience-based destinations. According to STR data, a CoStar company, occupancy stabilized across most U.S. markets, average daily rates held firm, and revenue per available room posted modest but consistent gains. Importantly, hotel fundamentals remained strong even as transaction volume slowed, reflecting a market adjusting to higher capital costs rather than weaker demand.

As we move into 2026, national forecasts from major hospitality analysts such as CBRE and JLL point to continued incremental growth rather than dramatic swings. New hotel supply remains constrained due to elevated construction costs and financing hurdles, which is expected to support pricing power for existing assets. At the same time, easing inflation and the potential for lower interest rates later in the year could help unlock transaction activity that has been sidelined since mid-2023. Investors are increasingly focused on well-located, operationally sound assets with clear paths to efficiency and modest value-add, rather than largescale redevelopment or speculative growth.

For the Northeast—particularly New York and New England—the outlook for 2026 is especially encouraging. The region benefits from a dense population base, strong seasonal tourism, and a growing preference for regional travel over longhaul destinations. Unlike gateway cities that rely heavily on international travel or large convention demand, many Northeast markets are driven by leisure travelers, outdoor recreation, weddings and events, and repeat visitation—segments that have proven durable through multiple economic cycles.

In Upstate New York and across the broader Northeast, we continue to see strength in selectservice and economy-branded hotels, as well as independent properties that cater to experiential travel. These assets tend to perform well in uncertain economic environments because they appeal to value-conscious travelers while still capturing strong seasonal demand. Branded select-service hotels benefit from loyalty programs and centralized marketing, while independent operators who actively manage expenses and guest experience can outperform expectations, particularly in tourist-driven markets. Other industry observers, including HVS, have similarly noted the resilience of leisure-oriented regional markets and well-located select-service hotels relative to convention- and gateway-dependent assets.

Nowhere is this more evident than in the Capital Region, Saratoga, Glens Falls, and the greater Adirondack and Lake George markets. These areas are fundamentally leisure-oriented destinations, supported by outdoor recreation, cultural attractions, seasonal events, and a steady flow of regional visitors from New York City, New Jersey, Montreal, and New England. Unlike urban markets dependent on corporate travel or convention

business, these regions benefit from diversified demand drivers that are less sensitive to economic volatility.

Lake George and the Adirondacks, in particular, continue to attract buyers and operators focused on long-term ownership rather than shortterm yield. Many properties in these markets are family-owned, independent hotels that have operated successfully for decades. As generational ownership transitions continue, 2026 is likely to bring increased listing activity, particularly among owners who weathered the post-pandemic recovery and now see an opportunity to capitalize on stabilized earnings. Buyers, meanwhile, remain active—especially owner-operators and regional investors seeking lifestyle assets with strong seasonal cash flow.

Saratoga Springs and the surrounding Capital Region benefit from a slightly different but complementary dynamic. Events such as the Saratoga Race Course season, regional colleges, medical institutions, and state government activity provide a blend of leisure and weekday demand that supports year-round operations. Select-service hotels in these markets continue to perform well, and investors remain attracted to assets that combine predictable demand with manageable operating complexity.

Looking ahead to 2026, the key themes shaping the hospitality outlook are discipline, adaptability, and local market knowledge. Rising operating costs and labor challenges are not disappearing overnight, but experienced operators are learning to manage them more effectively. Technology adoption, smarter staffing models, and selective capital improvements are helping hotels protect margins without sacrificing guest experience.

In summary, 2026 is shaping up to be a year of opportunity for the hospitality industry—particularly in leisure-driven, regional markets like those served by the Saratoga and Glens Falls Business Journals. While the era of easy money is behind us, the fundamentals of travel demand remain strong. For owners, investors, and operators who understand their markets and manage with discipline, the year ahead offers stability, selective growth, and renewed confidence in the long-term value of hospitality real estate.

Mitchell B. Muroff, Esq. is founder and principal of Muroff Hospitality Group, a boutique real estate brokerage specializing in the sale of hotels, inns, resorts, and hospitality assets throughout New York State and New England.

Glens Falls MSA

Continued From Page 1

at 50% (488 of 949) in this critical component. We simply don’t have enough workers to fully satisfy our existing economy, essentially throttling our otherwise remarkable output and productivity.

Besides feeling proud and perhaps somewhat surprised, what else should we be drawing from all of this information? First, the narrative of inevitable decline of upstate New York is not entirely true, especially for the Glens Falls MSA. We have always had a diversified and robust economy relative to our neighbors, buoyed by a tourism component that brings a third of our economic output from those living elsewhere. Second, our unique geographic positioning at the edge of the Adirondack Park, the largest state park in the nation nearly the size of New Jersey, means we will continue to be a retail, professional services and healthcare nexus for a large region including the Adk Park north and west of us. Finally, our ability to offer a place where unmatched natural resources and enterprise can both be had has always attracted people and continues to beckon new generations of talent.

The EDC has helped define this unique mix of three economic components (Experience, Services and Enterprise) in its core strategy for the regions economy. We continue to help develop a year round tourism economy that is more profitable for all, protecting our assets that are fully or partially publicly funded-especially healthcare, supporting our existing businesses and manufacturers while expanding entrepreneurial support and investing in natural resource protection, like fresh water, as its own economic engine. This is the unique strategy for not only our immediate area (i.e. the Glens Falls MSA) but the larger Adirondack region that shares many of the same components and constraints.

All of this validates the need for ongoing capacity development that will allow

the ongoing retention, attraction and support for residents that makeup our workforce with the same intensity we used to reserve for business recruitment alone. We need to create housing and the associated attributes of sustainable communities to bring the right mix of new workers, skills and demographics to fuel our existing economy in ways that is aligned with our unique place. This is the hard work of “soft infrastructure” like housing, broadband, public transportation and childcare along with the traditional water, wastewater, power and roads that we often think of. The EDC and LDC were full partners in the Warren County Housing Study of two years ago that detailed the need for significant new housing and continue to look for ways to offer resources and appropriate development opportunities to meet it. By fueling the strategy with the universal elements of placemaking and community resources, we optimize our future.

Examples abound…the remarkable rebirth of downtown Glens Falls spurred by the now 10 year ago DRI that has levered the initial $10M into more than $47M of total investment, the ongoing commercial and residential development of Queensbury, the recent Lake George DRI, the renewal of North Creek built on its first ever wastewater system that has generated nearly $40M in total investment that is aligned with the resources of the ADK park. The innovative LDC pre-development fund to support strategies for both communities inside and outside the Adirondack Park boundary is another. We are succeeding, you can see that by simply looking around but there is more to do to refine our strategy, align resources and help lead this remarkable area become the place we all know it has been and will continue to be.

Yeah, we punch above our weight…always have and always will.

Longtime Employee Shannon Stafford Promoted To Lead Aviation Mall

BY PAUL POST

Eighteen-year Aviation Mall employee

Shannon Stafford has been promoted to manager of the Queensbury shopping center, which was purchased at auction recently for $21 million.

She succeeds James Griffith, who left shortly after the acquisition to pursue opportunities in real estate.

Stafford began her career at the mall as a customer service representative in October 2007 and worked her way up through a series of roles, including administrative assistant, operations coordinator and operations manager, before assuming her new position.

The 50-year-old mall was purchased Sept. 10 by Eric Jacobov, principal of the Manhattan-based investment firm Concord Capital New York. Previously owned by Syracuse-based Pyramid Companies, the property went into receivership in July 2024 and was managed for the following year by The Woodmont Company of Fort Worth, Texas, on behalf of Deutsche Bank and M&T Bank.

The auction, held at the Warren County Municipal Center, concluded the judicial foreclosure process. Jacobov outbid the only other party present, a group of investors led by Michael Vopelak, which dropped out after offering $19 million.

Although significantly impacted by the growth of online shopping, the mall is seeing renewed activity with the recent opening of ADK Karting Experience, a large entertainment complex, and the Dec. 1 debut of On Deck Athletics, a baseball training center owned by former professional player Brett Rodriguez of Queensbury.

“I think they’re going to have a huge impact,” Stafford said. “The community is looking for places to come out and do activities. It’s a family-type environment. It gives people a place to go with their kids, and they can shop, go to restaurants or the movies. It’s a one-stop thing, especially in wintertime.”

A new eatery, Pabonnie’s Pizza, has also opened recently in the food court.

Stafford said a leasing specialist markets available spaces, while she conducts tours with prospective tenants. “The biggest challenge is making sure we get the right mix of stores and entertainment so people can come in and enjoy the mall,” she said.

The center comprises more than 720,000 square feet of retail space. Major tenants include Regal Cinemas, Target, Dick’s Sporting Goods, Ollie’s Bargain Basement and

JCPenney, an original tenant dating back to October 1975, when the mall first opened.

The largest vacant space is a 50,000-square-foot area adjacent to Ollie’s, formerly part of the Bon-Ton store.

Before his departure, Griffith said the mall generates about $80 million in taxable revenue annually and attracts more than 8,000 visitors per day. However, it has lost some Saturday morning winter traffic this season after the Glens Falls Farmers Market relocated to a year-round site at The Ed on South Street in downtown Glens Falls.

In her previous roles, Stafford said she learned the mall’s operations “inside and out,” overseeing contractor bids, project reviews, sprinkler and fire inspections, and other behind-the-scenes functions.

As mall manager, she now oversees housekeeping and maintenance staff, including scheduling and ensuring crews have the supplies and equipment needed to do their jobs.

Concord Capital New York manages multiple strip plazas, but Aviation Mall is its first enclosed shopping center. Jacobov has said increasing occupancy through new tenants is his top priority, though the property’s zoning for multifamily residential development also factored into his interest.

“That’s definitely a bonus and adds potential,” he said at the time of purchase. “We’re going to look into that deeper. It’s a big plus.”

Hometown Golf And Social Brings High-Tech Simulators And Year-Round Play To Glens Falls

BY

With the click of a switch Mike Gerarde can take people from cold, wintry Glens Falls to beautiful Pebble Beach Golf Course in sunny California.

You can almost taste and smell salty ocean mist as waves pound the shore around the iconic seventh hole.

It’s all possible thanks to the high-tech, colorful simulators at Gerarde’s new business, Hometown Golf and Social, which occupies a former Trustco branch office at the top of Glen Street hill, across from Harding Mazzotti Arena.

Patrons can choose from one of 85 courses. Like Pebble Beach, some are among the most difficult in the country and host major events such as The Players Championship at TPC Sawgrass, the Phoenix Open at Scottsdale or Bethpage where the Ryder Cup was held last September.

Or customers can play local links such as Hiland, Glens Falls Country Club and The Sagamore.

It’s quite a venture for Gerarde, who never played golf competitively in high school or college, but is now one of the area’s most accomplished teaching pros.

A Queensbury High School and Syracuse University alum, he discovered a knack for identifying and correcting problems in the games of people he played with. “I started giving tips, suggest they consider doing this or that and you’d see some pretty good improvement,” Gerarde said.

Renovating the former bank office took months of hard work in preparation for opening this past November. Teller counters and offices had to be ripped out, ceilings taken down to make room for the tall, 15-foot-wide simulators, and a small kitchen and bar area were installed.

State-of-the-art simulators help players improve considerably. For example, force plates in the floor force detect the exact percentage of weight on each foot and weight transfer when swinging. Cameras, some with face-on views, let people see what they might be doing wrong.

“If someone says they can’t stop slicing, we can identify that pretty quick, give them drills that normally work and see improvement pretty quick,” Gerarde said. “A lot of times people come in and just want their overall game to get better.”

Although similar, the business models at PSG Golf in Saratoga and Hometown Golf and Social in Glens Falls are also quite different.

PSG, which has a small chipping and putting area, is primarily for members who are given a key fob and have 24-hour access to the facility, allowing them to come in whenever they want, practice things and get a lesson (one per week) from one of the site’s four certified teachers.

“Each year we knock down the hours we’re open to the public,” Gerarde said. “We’re headed toward making it a members-only facility. But for now we are open on weekends for the public to just come in and play.”

Hometown Golf and Social is more entertainment-oriented. In addition to golf, simulators can be switched over to a variety of children’s games such as baseball, soccer and cornhole, or a birthday party-type program as well.

Commercial Loan Program Commercial Loan Program

Working

Renovations

Friends encouraged him to take this ability more seriously and before long he obtained U.S. Golf Teaches Federation certification and launched PSG Golf, an indoor facility at 615 Maple Avenue in Saratoga Springs. PSG are the initials of his late father, who indirectly made Gerarde’s golf future possible.

His parents owned Queensbury-based KEENA PEO Services, a payroll management and human resources consulting firm, which had a corporate membership at Glens Falls Country Club when he was growing up.

“So I played a lot of golf,” Gerarde said, smiling.

Based on the success of PSG Golf, which opened in 2022, he decided to start a similar venture in Glens Falls. The building, at 100 Glen Street, is owned by Peter Hoffman, whom Gerarde leases from.

The bar and kitchen are bigger than in Saratoga, too.

Gerarde’s cousin, Lizzie Milligan, and his girlfriend, Morgan Flatley, serve up golf-themed menu items such as Augusta Spread, and BLT Jefferson and Fisher Club named for Jefferson Park and Fisher’s Island golf clubs, respectively.

“We do lessons here, but we also host kids parties and at night we turn the music up and play a little golf,” Gerarde said.

Hometown Golf and Social is open 5-10 p.m. Monday and Tuesday; 11 a.m. to 10 p.m. Wednesday, Thursday and Sunday; and 11 a.m. to midnight Friday and Saturday.

Visit: www.warrencountyny.gov/LDC

Planning For 2026, Hudson Headwaters Balances Growth, Costs And Regional Stability

BY CAROL ANN CONOVER

As Hudson Headwaters Health Network looks toward 2026, the nonprofit organization is advancing a growth strategy centered on capital investment, workforce sustainability and long-term financial stability — priorities that increasingly shape the region’s health care and economic landscape.

As one of the North Country’s largest nonprofit employers and safety-net providers, Hudson Headwaters is moving forward with a multiyear plan to expand dental and primary care capacity across its seven-county service area, while working to protect critical revenue streams that help offset rising operating costs and persistent reimbursement challenges.

A recent Northern Border Regional Commission grant will serve as a catalyst for expanding dental services — an area leaders identify as both a pressing community need and a significant operational investment. The funding supports planning and early development for expanded dental capacity in Ticonderoga, the addition of a new dental site in northern Saratoga County, and upgrades to HHHN’s existing dental office in Warrensburg.

“As one of the region’s only nonprofit safety-net dental providers, Hudson Headwaters accepts all patients regardless of insurance status or ability to pay,” said Pam Fisher, director of external affairs for Hudson Headwaters. “We see how deeply insufficient access to dental care affects families, seniors and children every day. The NBRC funding is an important start toward gaining the significant resources required to close the dental-access gap in our community.”

Hudson Headwaters Health Network currently serves approximately 157,000 patients annually through dozens of health centers across a largely rural region. Limited access to dental providers — particularly those able to serve Medicaid and uninsured patients — has placed increasing demand on safety-net organizations, driving the need for expanded infrastructure and workforce recruitment.

HHHN leaders say the dental expansion will be paired with a fundraising campaign later in 2026 as the organization works to secure the capital and operational resources needed to recruit providers, equip clinical spaces and sustain long-term operations. Beyond improving patient outcomes, the initiative is expected to reduce preventable emergency department use and downstream medical costs — factors with broader implications for regional health systems and employers.

Alongside dental investments, Hudson Headwaters Health Network is continuing to expand primary care capacity. In early February, the organization will open a new Malone Family Health center, replacing a temporary site established in December 2023 on the University of Vermont Health–Alice Hyde Hospital campus. The new 13,000-square-foot facility is designed to

address long-standing primary care shortages in Franklin County.

“Since establishing a temporary location in Malone, the network has steadily recruited providers and built patient relationships while constructing a permanent facility near the hospital campus,” Fisher said. “Thanks to 340B savings, the Network could invest in this important capital project and honor our nonprofit mission to expand access where there are significant health care shortages. That ability to invest while maintaining operations is critical in rural markets.”

Many of these capital projects have been supported, in part, by savings generated through the federal 340B Drug Pricing Program. Established by Congress in 1992, the program allows eligible safety-net providers like HHHN to purchase outpatient medications at lower prices and reinvest those savings into services and infrastructure that expand care access and meet community needs.

For Hudson Headwaters, 340B savings have become an important financial stabilizer amid rising labor, supply and facility costs. Since 2018, the network estimates it has reinvested approximately $68 million in 340B savings into capital projects and service expansions throughout the region.

Those investments have included preserving obstetrics services at Glens Falls Hospital after the closure of a private OB-GYN practice, helping keep nearly 1,000 births annually in the region. In Plattsburgh, Hudson Headwaters expanded pediatric services following the closure of a private office, supporting care for roughly 6,000 children. In Washington County, the organization opened Salem Family Health in 2025, a more than 14,000-square-foot primary care center with on-site laboratory services operated by Glens Falls Hospital.

Each year, 340B savings are also used to offset losses in core service lines, including preventive care, dental, pediatrics, obstetrics and gynecology, behavioral health and care management — services that are often financially unsustainable under current reimbursement models.

Hudson Headwaters is working alongside other safety-net providers, including Glens Falls Hospital, through the Community Health Care Association of New York State, to advocate for safeguards that protect 340B savings from further erosion. While 37 states have enacted laws to protect the program at the state level, New York providers continue to push for stronger protections.

“The 340B program is a lifeline for health centers and their patients,” said Fisher.

“Hudson Headwaters is an active member of the Community Health Care Association of New York State (CHCANYS), a membership organization representing New York’s 80 community health centers statewide. CHCANYS’ 2026 legislative agenda includes safeguarding 340B savings from erosion by third parties. We are in regular contact with

Business Report

Outsource the Busywork, Grow Faster

BY SHAWN WEINBERGER KEENA SALES & MARKETING MANAGER

January has a way of slowing things down just long enough for business owners to catch their breath. After the rush of year-end deadlines and holiday logistics, the calendar resets, and there’s a moment, however brief it may be, to look back at what worked, what dragged on longer than it should have, and where time was lost to tasks that rarely advance the organization’s mission or goals.

For many small and midsize companies, those time-wasters share a common thread: they’re administrative. Payroll quirks, paperwork, fi ling deadlines, benefits questions—each is essential, but none is central to why the business exists. On a lean team, that work can quietly consume more hours than anyone intends.

As owners step back and take stock, the weight of these tasks becomes impossible to ignore. Th at’s when outsourcing starts to feel less like a choice and more like a lifeline. Bringing in outside support doesn’t mean losing control. It means reclaiming time, energy, and focus for the areas that grow the business.

One of the most comprehensive ways to achieve that balance is by partnering with a Professional Employer Organization, or PEO. Unlike a company that handles only one piece of the puzzle, a PEO steps in as a full partner. Th rough a co-employment model, it manages payroll, benefits, compliance, and other HR responsibilities all at once, giving small and midsize businesses the expertise and support they need while leaving them in control of daily operations and strategy.

Almost immediately, owners notice the difference. They watch as payroll runs smoothly, tax fi lings don’t cause surprises, and questions about benefits or compliance

are quietly managed in the background. Beyond these operational advantages, a PEO can also provide guidance on HR best practices and employee development, giving teams the support they need to focus on growth, innovation, and long-term success. It’s not easy to challenge how things have always been done. For some, growth happens when they are able to separate the idea of control from the act of handling everything in-house. A PEO relationship doesn’t replace decision-making or business strategy; it frees owners to focus on both. Growth, innovation, and long-term planning can fi nally take priority when administrative burdens are lifted.

Starting 2026 strong doesn’t always mean doing more; sometimes it means letting go of what no longer needs to be handled alone so the year ahead can fi nally be spent on the work that truly moves the business forward.

BY ANN DONNELLY

After years of honing his craft, from a cheap

espresso machine to commercial roasting, Ryan McNaughton has realized his goal of opening a dedicated brick-and-mortar coffee shop: Stinky’s Coffee Co. The shop is the anchor tenant in the newly developed Moreau Commons commercial hub at 1377 Route 9. McNaughton hopes to transform the highly visible former Suzuki dealership, which sat vacant for roughly 10 years, into a central community gathering spot.

The Moreau Commons project, which aims to bring more local development to the area, is led by local entrepreneurs Brian McKenzie and Ben Alden. Stinky’s was reportedly the first business to sign on. McNaughton cited the location’s traffic and accessibility as key factors in his decision. “It's perfect. It's got parking. It's got access to a traffic light,” McNaughton said, noting the constant flow of traffic heading to and from the Northway Exit 17 and Saratoga.