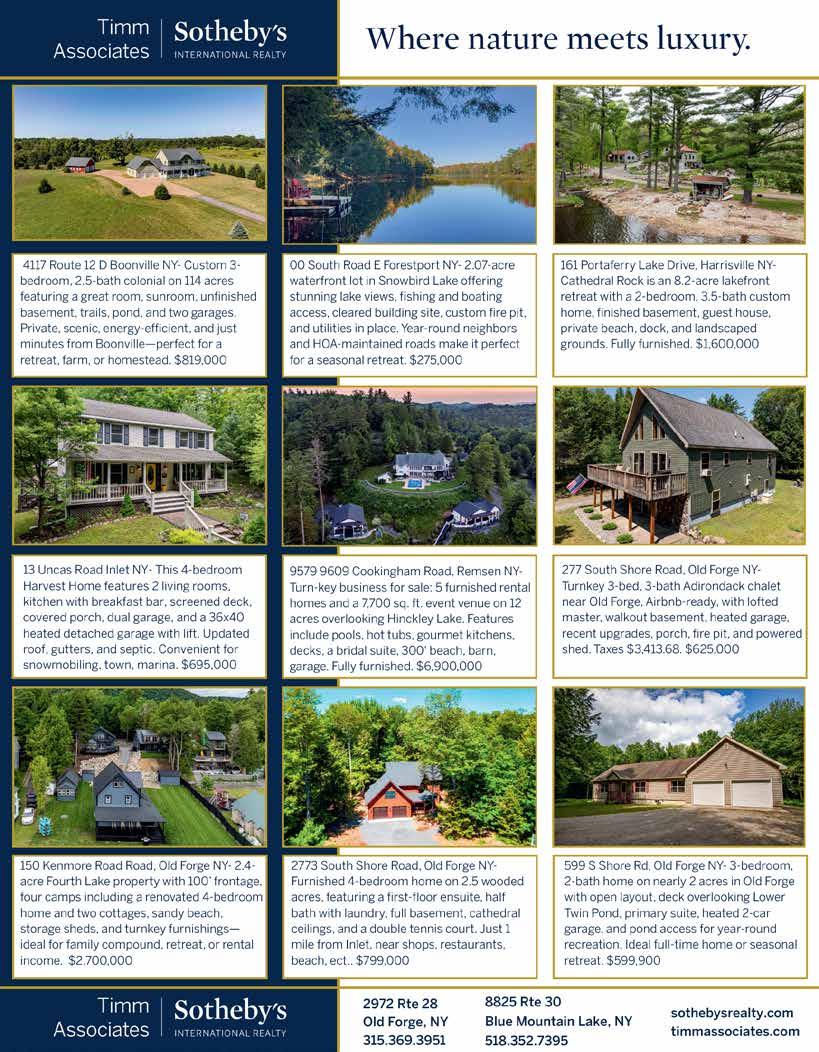

Seasonal Listings

Here we go. Earlier sunsets, cooler weather - the holiday feel begins. Are you ready?

If you're finding yourself needing to make a move during this season, a clean, well-lit, warm, and inviting home may appeal to buyers who are imagining themselves moving in for the winter. Some sources point out that listing in the fall may allow a home to appear in top condition in a comfortable season.

It's not all upside, though. You should also be realistic about limitations this time of the year.

You'll likely find yourself competing with winter weather, reduced daylight, and holiday distractions — but also less competition from other sellers. With potentially fewer listings on the market, you're home has a better chance of standing out. We suggest you make the most of that. Buyers active in November tend to be more motivated (e.g., relocation, job change, end-of-year tax considerations) rather than casual lookers. As the market slows in fall, the buyers who remain are often committed. You may get fewer offers overall, but possibly more meaningful ones.

Listing in November can be a good strategic move if you're well prepared. Although it's not peak time, adjust your strategy. If you're ready to move soon, your home is in good condition, you work with your agent to price competitively, and you handle showings and winter readiness well, you may find yourself gaining a motivated buyer without wading into heavy spring competition.

If you aren't quite ready, your home needs work, or you're hoping for more competition, waiting for spring might be your best option. Overall, listing in November can be a good strategic move if you're well-prepared and your situation aligns.

www.LifeandHomes.com

Save MoneyShop Around

Once you’ve chosen a home, getting Loan Estimates from multiple lenders can help you save money and get a mortgage that best meets your needs. Homebuyers can potentially save $600 to $1,200 per year by getting mortgage offers from multiple lenders.

Requesting a Loan Estimate is simple, and no written documentation is required. Contact the lenders you are considering and tell them you are ready to request a Loan Estimate.

Lenders must give you a Loan Estimate once you’ve submitted six key pieces of information: your name, your income, your social security number, the address of the home you're planning to purchase, an estimate of the home's value, and the loan amount.

The more information the lender has, the more accurate your Loan Estimate will be. You do not need a signed purchase agreement to get a Loan Estimate.

Make sure you’ve told your lender if there is anything unusual about your situation — for example, if you are self-employed, have irregular sources of income, or are purchasing a unique type of property.

Once you’ve submitted the request, each lender is required to send you a Loan Estimate within three business days. Allow a few extra days for mail delivery if the lender is using postal mail. If you haven’t received a Loan Estimate within that timeframe, call the lender and ask why.

Ask each lender for the same kind of loan with the same features. You want to compare apples to apples when you get your Loan Estimates.

Share information about the property taxes and condominium or homeowners’ association dues for the home you plan to purchase

Your Loan Estimate includes an estimate of these costs. If they are escrowed, they are included in your total monthly payment. To get the most accurate estimates, share information you have about these property-related costs with your lenders. The seller or a real estate agent is usually the best source for this information.

Review Your Loan Estimates Carefully

Double-check the important details.

Check if your interest rate is locked. Some lenders lock your rate as part of issuing the Loan Estimate, but some don’t. If your rate is not locked, it can change at any time. Learn what a rate lock is and how it works.

Check for risky features. Certain risky features are listed under Loan Terms on page 1 of the Loan Estimate. Can the loan amount, interest rate, or monthly principal and interest payment increase after closing? Does the loan have a prepayment penalty or a balloon payment? If these features are included in the loan, ask the loan officer why. Ask the lender to give you another Loan Estimate for a loan without the feature, so you can see the difference in costs for a loan with less risk to you.

If there are errors on your Loan Estimate, get them fixed. If your name is misspelled or other key details are wrong, fix them now. Some errors, such as a typo in the address of the property you plan to purchase, could seem minor but are actually major errors that could affect your rate and costs.

For help reviewing your Loan Estimates, consider contacting a housing counselor. You can find a HUD-certified housing counselor online or by calling 1-800-569-4287.

When you receive a Loan Estimate, the lender has not yet approved or denied your loan. This is true even if your rate is locked. The Loan Estimate shows you the terms the lender expects to offer

you. The lender is not offering you the proposed loan, and your decision to proceed does not mean you accept the loan or any of the loan terms. You have not committed to this lender. The lender can ask for certain processing fees up front after you get your Loan Estimate, but you are not committed to a lender or contractually bound to loan terms before you have signed final documents that contain all the material terms of the loan.

(consumerfinance.gov)

What's A Zombie Property?

Zombie properties are homes that the homeowner has abandoned, typically in the face of a foreclosure action. With no occupant to perform basic maintenance, these homes can fall into a state of serious disrepair.

Dilapidated, vacant, and abandoned properties can have a corrosive effect on local communities, lowering property values, attracting criminal activity, creating health and safety hazards, and imposing extra costs on local governments due to the additional police, fire, and building safety resources they require.

The negative impact these properties create can last for years while the community waits for the property to be foreclosed and sold to a new owner.

The law seeks to limit the damage caused by zombie properties by requiring mortgage note holders (“mortgagees”) to inspect, register, and maintain zombie properties until the foreclosure process is complete. The law requires mortgagees to register zombie properties with the Department of Financial Services within 21 business days of learning that the property is vacant.

The Department maintains a registry of vacant properties that it makes available to local government officials. By law, the registry is confidential and not made available to the public. (www.dfs.ny.gov)

Home

Whether you’re buying a cozy cabin by the lake or selling your mountain-view property, I bring unmatched local knowledge and professional expertise to the table.

As a specialist in Southern Adirondack real estate and a local resident, I’m here to ensure you get the best possible deal - every time. From negotiating to closing, I handle the details so you can focus on what matters next - your next chapter.

• Personalized Service

• Market Insight

• Trusted Results

9+ Acre Log Home & Horse Ranch

There is a convenient laundry area near the first floor bedrooms, and the open staircase leads to an oversized primary bedroom with an ensuite bath! If a fourth bedroom is needed, there is extra space in the walkout basement that also includes a family room and a workshop.

Jut as the residence is made for the comfort of people, the barn is constructed to pamper your horses. This 60x60 foot newly constructed building includes eight custom stalls, two of which are super stalls, made to accommodate two horses. There is a huge tack room and plenty of space for feed storage. Along side the barn are four partly sheltered paddocks that enter into a 200 x 120 foot riding ring. As a bonus, there is a 36 by 60 foot second floor on the barn for future expansion (classrooms or apartment maybe?)

Vehicle storage is provided by a one-stall under the house and a three-stall detached garage. The majority of the land is wooded and there are about two acres of meadow near the stable. A small stream provides year-round harmony.

Live the good life in this exceptional contemporary Log Home tucked away in a corner above the orchard on this nine and four-tenths-acre Horse Ranch!

Enjoy the view from the glass-walled living room with its cathedral ceiling and massive stone replace. Entertain in style from the adjoining kitchen/dining area with custom cabinets and built-in appliances. A wrap-around porch brings you outside for summer fun.

Call Bruce Ward today 315-796-4425 for your

Gary Glebus Broker/Owner

5 bedrooms, 2 baths, workshop , barn.

Commercial Building, Main St, Ticonderoga, prime location, former floral shop, retired, high traffic

Brenda Wells Associate Broker

Sheranda Wells R.E. Salesperson

Lakefront Log Home with on 34 acres with 3320 waterfront. Off grid, additional 2.81 acre lot. Eagle Lake, Ticonderoga. $495,000.

Rare Find! Fixer Upper House , pre civil war early settlement known as Coot Hill, 34 acres, off grid ,hike to Big Hollow-Amazing views! $65,000. Schroon Llake-12

$269,000.

North Hudson-Surveyed 3.78 acre building lot with all utilities in place, at the gate of the High Peaks region. $139,900.

flow, retail, office etc. $219,000!

Older Style Home on 2.35 acres with 342’ on the Schroon River.

$250,000

Schroon Lake- Raised Ranch Home w/ 3 bedrooms 2 baths, plus apartment on bottom level, separate metered, 1 mile to Schroon Lake $279,000.

Investors Delight! Commercial building on Main Street , Ticonderoga. Fully rented-$2400 monthly income, 3 Apts plus.

Blue Ridge Road-At Gate of High Peaks region in the Adirondacks, 3 bedrooms, 2 baths, 2 car garage. North Hudson $349,000.

27.8 Acres- Adirondacks-Ideal vacation acreage on both sides of road, $89,000, Seller Financing!

Ticonderoga, New home 1 acre near all amenities in town, ideal retirement home. Asking $135,000.

Northwoods Club Road- Renovated

SALE PENDING!

Income Producing Duplex in Ticonderoga, each unit has 2 bedrooms and full bath,close to all amenities , near public boat launch, Fully rented. $82,500!

Schroon Lake-Near Crane Pond, Adk. Home, plus detached garage with Apt overhead, off grid, 2 lots, 5 acres & 70 acres. Owner retains life use. $269,000

Schroon Lake -Profit Making Adirondacks Log WorksWell Established Real Estate & Business - 1 year bookings already in advance $1,200,000.

Fixer Upper on Broad St in Port Henry, all studded interior waiting for you to finish to your satisfaction, near Lake Champlain boat launch. $59,000.

816+-Acres- Saratoga CountyTowns of Corinth & Edinburg. Remote -Moose- Deer- A Great Recreational Retreat. $739,000.

2 Bedrooms | 1 bath

Offering a spacious 2 bedrooms / 1 bath 1800 sq ft loft located in the Historic Bagg Square District. New construction yet old industrial charm remains. Oversized windows for abundant light, central air & own laundry room. Kitchen features stainless appliances & breakfast bar. Partially furnished living room & dining room.

There are 2 designated parking spaces & on street parking. Gain access through secure back & front entrances w/ metal fire doors. Front secure entrance leads to private stairwell onto foyer. Located in Bagg Square where beside great nightlife it's located minutes to Wynn Hospital, health facilities, higher education, art, culture museums, race course plus Marcy, Schuyler, Frankfort Business Parks. It is easily accessible to Syracuse, Albany via Thruway, Railroad or state routes.

Home Equity Loans What You Need to Know

If you have large or unexpected expenses on the horizon, you may have access to an untapped resource: your home. You could use some of the equity you've built up in your house to meet financial goals, depending on how much equity you have and how you use it.

Here's a guide from the experts at Navy Federal Credit Union to explain how home equity loans work and when you should - or shouldn't - use your home's equity.

What is a home equity loan?

In basic terms, a home equity loan is money you're borrowing using your home as collateral. The equity in your home equals how much of your home's value you actually own (not counting the mortgage you're still paying off).

Home equity loans are frequently offered at lower interest rates than other loans, so they may be a great option for consolidating debt on higher interest credit cards, or large home improvement projects.

You can determine how much equity you have in your home and how much your home equity loan payments are likely to be, using online calculators.

Here are the two most common types of home equity loans:

Fixed-rate equity loan: This is a lump sum amount you'll draw from your home's equity, paying back monthly at a fixed interest rate for the life of the loan, so you'll know exactly what to expect. Fixed-rate home equity loans are typically used for:

* Home improvements/repairs

* Debt consolidation

* Large purchases

* Life events

Home equity line of credit (HELOC): This is a line of credit secured by the home, which lets you borrow funds if and when needed, up to a set maximum credit limit. You only have to repay the funds you borrow. HELOCs are typically used for:

* Home improvements

* Emergency funds

* Medical expenses

* Debt consolidation

The best use of a home equity loan or home equity line of credit is when the money you borrow increases your home's value via renovations or repairs, as this continues building the equity you're borrowing against. You may also have tax benefits for using the loan toward home improvements, so it's recommended to consult a tax professional.

When NOT to use a home equity loan or HELOC

Because these loans use your home as collateral, remember that you'll want to be sure you can stay on track with loan repayments. For this reason, financial experts advise against using home equity to borrow for things including:

A car purchase: An auto loan is usually a better choice for purchasing a new or used vehicle. Interest rates on auto loans tend to be similar or lower than home equity loans, and auto loans usually require little paperwork and fewer fees.

Vacations: It's better to save up for near-term wants like vacations or large-screen TVs than using your home's equity for something offering no financial return.

College: Consider all options - including federal student loans, scholarships, grants and private student loans - before tapping into home equity. A home equity loan may be a consideration if current mortgage rates are significantly lower than federal student loan rates, especially for graduate or professional degrees. But unlike federal student loans, if you use home equity to pay for college, you won't qualify for income-driven repayment plans or loan forgiveness programs.

Starting a business: Your best bet for launching a business is a business loan through a financial institution or the U.S. Small Business Administration (SBA). If your business fails and you have a home equity loan or HELOC you can't repay, you're putting your home on the line.

Recurring expenses: Using home equity to cover everyday bills can be a slippery slope. Consider your long-term ability to repay the loan. Since your home is your collateral, missed payments could lead to foreclosure.

Make a smart plan

Your home equity is a valuable resource for managing your finances. Planning ahead and understanding your repayment responsibilities is crucial for making the best use of a home equity loan or home equity line of credit. For more information and to explore your home equity options, visit NavyFederal.org/equity. Navy Federal is federally insured by NCUA. Equal Housing Lender. (BPT)