David Fyfe

The former Synergy CEO says collaboration will pave the road to net zero

A STATE TO CALL HOME

Laying the foundation for South Australia’s future

WATER DELIVERED

A thriving SEQ flows from new Fitzroy to Gladstone pipeline

The former Synergy CEO says collaboration will pave the road to net zero

Laying the foundation for South Australia’s future

WATER DELIVERED

A thriving SEQ flows from new Fitzroy to Gladstone pipeline

As a global leader in IoT and connected transportation, Geotab processes and analyses data from over 4 million connected vehicles, generating over 75 billion data points per day. It’s a huge amount of data, and it is most powerful when we have the right tools to securely and efficiently manage it. That’s why we have partnered with Google to leverage Google Cloud’s data analytics and machine learning solutions.

Geotab has been awarded two Google Cloud Customer Awards for its achievements in the transportation sector. Recognition in both the Cross Industry and Sustainability categories underscore Geotab’s successful use of Google Cloud’s analytics to innovate and drive sustainable practices in fleet management.

Kirsten Kliphouse, the President of Google Cloud Americas says that the Awards are an opportunity to recognise the most innovative, technically advanced, and transformative cloud deployments across industries globally built on their platform.

In her congratulatory message to Geotab, she acknowledged Geotab’s role in “serving as an innovator for the industry”, which also highlights Geotab’s innovative integration of data to revolutionise the transportation sector, leading to transformative impacts across organisations and customers around the world.

As the world’s premier EV telematics provider, Geotab has demonstrated its commitment to reducing emissions through its Electric Vehicle Self-Assessment (EVSA) tool, which won Google Cloud’s Award for Sustainability.

The tool provides tailored EV recommendations to support businesses and governments in transitioning to electrified fleets. For two consecutive years, Geotab was also identified as a Cross-Industry winner impactful transformation facilitated by Google Cloud. The award also acknowledges the launch of the Intelligent Transportation Systems (ITS) and its flagship transportation analytics platform Altitude.

Altitude has been pivotal in supporting government agencies by offering actionable, privacyconscious data insights for city planning and transportation network enhancements.

Strong synergy of Geotab and Google Cloud show great potential

As a valued partner in the Google Cloud Ready - Sustainability validation program, Geotab plays a crucial role in accelerating sustainability programs and informing strategic decisions for future developments.

Geotab’s collaboration with Google Cloud delivers significant benefits, including real-time improvements in driver safety and behavior, advancement of sustainability goals, enhanced productivity and significant cost savings.

This partnership not only redefines fleet management standards but also illustrates the impactful role of technology in fostering a more sustainable and efficient transportation industry.

An industry-leading solution

Geotab’s partnership with Google demonstrates the company is at the forefront of leveraging data analytics and machine learning to enhance fleet management, drive sustainability and create safer transportation systems worldwide.

By integrating Google Cloud’s advanced analytics with its telematics expertise, Geotab is confident of continuing its lead in the development of sustainable transportation solutions, demonstrating the profound impact that innovative technology can have on the transportation system today.

Australia now has its emissions-reduction targets locked in at a federal policy level, and with that certainty comes a sharper focus on the role our utilities must play. e government has set a national target to reduce emissions by 62–70 per cent below 2005 levels by 2035. It argues the target is “ambitious, achievable, and in Australia’s national interests”.

While it has not set a renewable energy target beyond the 82 per cent of 2030, few industries will have to take on as much responsibility in the nation’s decarbonisation journey as energy producers, networks and the broader utilities sector. Transforming an entire energy system is nothing short of monumental, yet the progress already made continues to impress.

In just the past year, energy policy has become central to this transition and shaping Australia’s future. And it is the utilities who are the ones preparing to deliver this future. With renewed momentum established by clear goals, federal and state budgets have laid out extensive investment in the critical infrastructure needed to support a cleaner, more resilient nation. e transformation isn’t limited to energy. e water sector has ushered in major updates to the Australian Drinking Water Guidelines, strengthening public health protections. Meanwhile, amendments to the Security of Critical Infrastructure Act 2024 have elevated and expanded cybersecurity obligations for telecommunications providers, recognising the crucial role communication networks play in national resilience.

Across water, energy and communications, Australia is moving con dently toward a more sustainable and secure future—though not without navigating increasingly complex risks and unknowns. What remains constant, however, is the extraordinary work of the leaders, innovators and frontline teams steering this transition. eir expertise and dedication shape the insights, solutions and breakthroughs that de ne the modern utilities landscape. In energy alone, distribution networks are working to balance a ordability, electri cation and grid stability as demand patterns shi .

We are living through one of the most signi cant periods of change the sector has ever seen. Yet despite the pressure, Australia’s essential service providers continue to rise to the challenge—delivering reliability, a ordability and sustainability in equal measure. Our nation would look very di erent without their work, and it remains a privilege to help share the knowledge that allows utilities across all sectors to learn, adapt and thrive together.

Drop Katie a line at katherine.livingston@primecreative.com.au or feel free to call on 03 9690 8766 to let us know what you think.

Don’t forget to follow Utility on social media – find us on LinkedIn, X and YouTube.

Rima Munafo rima.munafo@primecreative.com.au 0413 475 078

CLIENT

Scan to subscribe to Utility’s weekly newsletter –delivered to your inbox every Thursday morning.

A sector in transition pauses to honour the people and projects shaping its future.

In a year de ned by market volatility, rapid electri cation, and the steady rise of distributed energy resources, the Energy Networks Awards served as a rare moment to gather, re ect and recognise the people and programs li ing standards across the sector. Presented in Melbourne at the Energy Networks Dinner, the awards honour excellence across four core areas—consumer engagement, industry innovation, women in networks and individual contribution—with an additional Chair’s Recognition acknowledging foundational work in digital trust.

Energy Networks Australia Chief Executive Dominique van den Berg framed the evening succinctly; “Our awards celebrate the people and projects that are shaping the future of Australia’s energy networks; these winners exemplify the commitment and talent driving our sector forward.”

No small claim. Yet the stories behind each award show how networks are converting ambition into capability— bringing communities with them, and building systems that can carry the weight of Australia’s energy transition.

Western Power’s Carla Basden received the Women in Networks Award for leadership in major customer decarbonisation—work that translates the high-level

goals of clean energy into real projects and measurable capacity on the grid. Basden’s team engages large-scale generators and load customers, navigates infrastructure relocations, and collaborates to sequence investment underpinning the Clean Energy Link transmission expansion. is is not just connection management; it is the practical choreography of grid transformation across one of the world’s largest islanded electricity systems. Western Power has said this program is “having a transformative impact on the decarbonisation of Western Australia,” with the Clean Energy Link – North project alone unlocking more than 1GW of additional renewable generation capacity in the Mid West region—a datapoint that grounds leadership in outcomes customers can feel.

If the transition demands new levers, Essential Energy’s Industry Innovation Award shows one: Australia’s rst ready-to-use vehicle-to-grid (V2G) solution. Built with partners CSIRO, Sigenergy and AUSEV®, and tested at Essential’s Innovation Hub in Port Macquarie, the project gives households a path to use their EVs as exible energy assets—powering homes, supporting the grid, and, potentially, exporting energy back into the market.

Essential Energy’s media materials emphasise the system bene ts—grid stability, customer control and new value streams—as well as the process improvements behind the scenes, from power modelling to streamlined connection processes with AEMO and EnergyCo. It is a reminder that innovation is not only a technology story; it is a delivery story that aligns design, regulation and customer experience.

Consumer engagement: community energy by, and for, community

Ausgrid took home the Consumer Engagement Award for Empowering and energising community: e Wanaruah/Wonnarua Community Energy Strategy—a program that demonstrates how respectful, community-led approaches can guide development and earn social licence. e recognition signals that technical excellence alone is not enough; networks must design with people, not simply for them, particularly when infrastructure is installed close to where communities live and work.

ere’s a broader lesson here. As local energy strategies proliferate, engagement becomes an operating discipline. Done well, it accelerates timelines, reduces con ict and builds durable trust. Done poorly, it stalls projects and erodes con dence. Ausgrid’s award points to the former.

Individual contribution: making complexity usable

Behind every system upgrade or new capability, there are practitioners who make complexity usable. Hadi Lomei of Essential Energy—specialising in power system modelling and renewable integration—won Individual Contribution, recognised for technical leadership that smooths the path for clean projects to connect and perform. Essential’s account highlights how modelling and process improvements reduce friction for developers, strengthen collaboration with market bodies, and build sector capability through education partnerships.

at dual thread—doing the work and teaching the work—is powerful. It raises the oor for everyone, which is precisely what the transition needs.

Chair’s recognition: trust, at grid scale

If distributed energy is to play its full role, it needs a security backbone. e rst-ever Chair’s Recognition Award acknowledged the National Energy Public Key Infrastructure (NEPKI) Team, credited with building the digital trust framework that will allow millions of consumer energy resources—from roo op solar to home batteries and EVs—to connect securely and seamlessly. e gesture is more than symbolic; it signals that governance and cybersecurity are now as foundational as steel and copper.

What the awards say about where networks are heading ree threads stand out across this year’s winners. First, innovation is moving from proofs to products. V2G is no longer a slide; it is a system tested on a network, with households and market interfaces in view. at evolution—from trial to deployment— will de ne the next ve years of distributed energy. Second, leadership looks like integration. Basden’s work sits at the junction of transmission expansion, customer strategy and long-term planning. Lomei’s contribution blends modelling, process redesign and capability building. In both cases, value emerges because the pieces come together.

ird, engagement is an engineering input. Ausgrid’s program is a case study in community- rst design. It treats respect and participation as conditions for delivery, not add-ons—an approach that o en proves faster, cheaper and more resilient over the life of an asset.

The cadence of an industry dinner

Events can feel ceremonial. Yet the Energy Networks Dinner also functions as a barometer of priorities. e category mix—innovation, consumer outcomes, individual practice, and inclusive leadership—signals where attention is turning. e addition of a Chair’s Recognition for digital trust underscores the sector’s understanding that cybersecurity and interoperability underpin customer-centred networks.

e ceremony also reveals how networks are reframing the word “infrastructure.” It is not only about assets in the ground; it is about processes that help communities participate, so ware that helps devices converse securely, and expertise that makes the complex work for ordinary users. Innovation, engagement, contribution: separate awards, shared purpose.

For utilities scanning the horizon, these winners o er practical signals. Transmission expansion needs customer pathways and diverse teams to carry it. Distributed energy needs trust frameworks—and everyday process improvements—to thrive at scale. Community energy needs careful listening and locally relevant design. None of this is abstract; the examples honoured in Melbourne are operating now, on networks with real customers.

As ENA’s Chief Executive put it, the awards “celebrate the people and projects that are shaping the future of Australia’s energy networks.” e sector will need exactly that blend—human skill, technical rigour and community partnership—to navigate the next chapter of the transition. U

WSAA is ensuring its codes are available in formats that meet diverse user needs.

Accessibility is one of WSAA’s commitments. To guarantee that everyone, including people with disabilities, can access WSAA Codes, WSAA o ers two formats: tekReader (a web-based reader) and PDF. Let’s explore how each compares to global standards and requirements.

Accessibility isn’t just a goal—it’s a commitment. For the Water Services Association of Australia (WSAA), that commitment means ensuring every member of the water sector, including people with disabilities, can access the codes that underpin safe and sustainable operations.

To achieve this, WSAA now o ers its codes in two formats: tekReader, a web-based reader designed for interactive use, and PDF, the traditional downloadable option. Both formats aim to make technical standards easier to navigate, but each serves a di erent purpose. TekReader provides a dynamic experience, allowing users to search, zoom and interact with content online, while PDFs remain the go-to for o ine access and printing.

Every member of the water sector, including people with disabilities, should be able to access the codes that underpin safe and sustainable operations.

Why does this matter? WSAA codes are the backbone of water industry best practice, guiding everything from design and construction to maintenance and compliance. If these documents aren’t accessible, critical knowledge stays out of reach—and that’s a risk no utility can a ord. By embracing inclusive formats, WSAA is removing barriers and reinforcing its role as a leader in equity and transparency.

e move also re ects a broader trend in professional standards: accessibility is becoming integral to governance. It’s not enough to publish codes; organisations must ensure they can be used by everyone, regardless of ability or circumstance. WSAA’s approach sets a benchmark for how technical information should be delivered in a modern, connected sector.

For utilities, consultants and contractors, this means easier access to the speci cations that shape projects and protect communities. For WSAA, it’s another step toward a future where knowledge is shared openly and universally—because safe water services depend on collaboration, and collaboration depends on access.

We go beyond installation to ensure your investment in digital metering translates into measurable outcomes.

Solving real operational challenges, from leak detection to billing accuracy, with right-sized, scalable solutions.

The complexity, so you stay focused on your community. Most importantly, we work with you to define success upfront and ensure benefits are realised, not just assumed. From day one to long after rollout, we’re your partner in outcome-driven digital metering.

SA Water’s largest metro network expansion in decades is well underway, and the utility has hit some key milestones that are laying the foundation for the state’s thriving future.

Water utilities across Australia are grappling with rapid housing growth, infrastructure catch-up, and the need to support new developments without compromising existing service standards.

Along with a signi cant upgrade at the utility’s

Bolivar Wastewater Treatment Plant, SA Water is laying the foundations to ensure South Australia’s growing communities and future generations have access to reliable services.

e utility has laid more than 25,000m of new water

and sewer pipes across Adelaide’s northern suburbs in just 12 months, marking a major milestone in the fasttracked delivery of critical infrastructure needed to unlock housing in key growth areas.

SA Water General Manager of Growth Amanda Lewry said the utility is standing at a critical in ection point.

“ is is not just about laying pipe, but about building the backbone of essential service systems to meet our state’s needs for the next 30 years with continued investment,” she said.

“ e entire industry is being tested, and I believe we are rising to the challenge. ere is a renewed sense of purpose across water utilities right now. We understand that the housing crisis requires a shared solution, and it needs infrastructure and leadership. at is what we are seeking to deliver.”

In South Australia, this challenge is being tackled headon as part of a $1.5 billion investment through the South Australian Government’s Housing Roadmap, launched in June 2024.

In what is the largest metropolitan network expansion for SA Water in decades, the signi cant investment will enable an estimated 40,000 new homes to be built across the state over four years.

“We are not just responding to growth, we are now actively enabling it,” Ms Lewry said.

is progress as of mid-October represents more than a quarter of the program’s anticipated total length of pipe to be delivered, with between 20 to 30 construction crews currently active across Adelaide’s north.

More than 100,000 hours of direct construction have been logged to achieve this, with installation spanning new water and sewer trunk mains, pump stations and other key assets.

e scale of work already completed is signi cant, with more than 13,000 metres of new trunk water mains installed to support new development areas including within Angle Vale and Riverlea.

In addition, 12,000m of sewer pipes have been installed across Munno Para and Roseworthy, along with supporting pump stations and trunk assets designed to duplicate and expand network capacity.

ese areas are among the state’s fastest growing, with large green eld developments requiring backbone infrastructure to connect new areas into existing networks.

“We are seeing growth that would usually take a decade to happen, occurring in a matter of years,” Ms Lewry said.

“To keep up, we have had to be bold and adapt our delivery models, compress timelines and move quickly from planning to implementation.”

e utility has also adopted new construction methods such as microtunnelling where possible, acutely aware of the potential for disruption to communities amid the ongoing work.

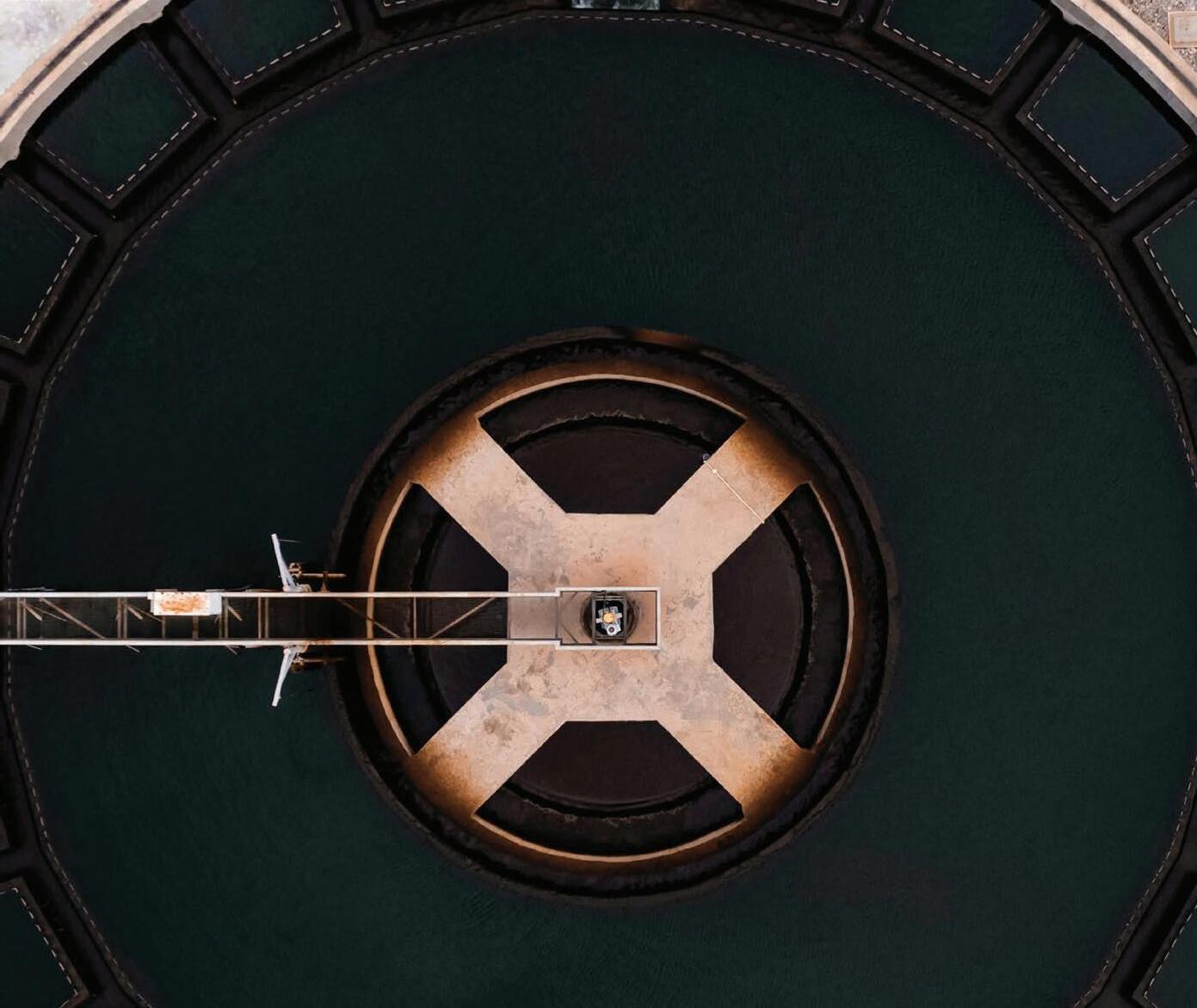

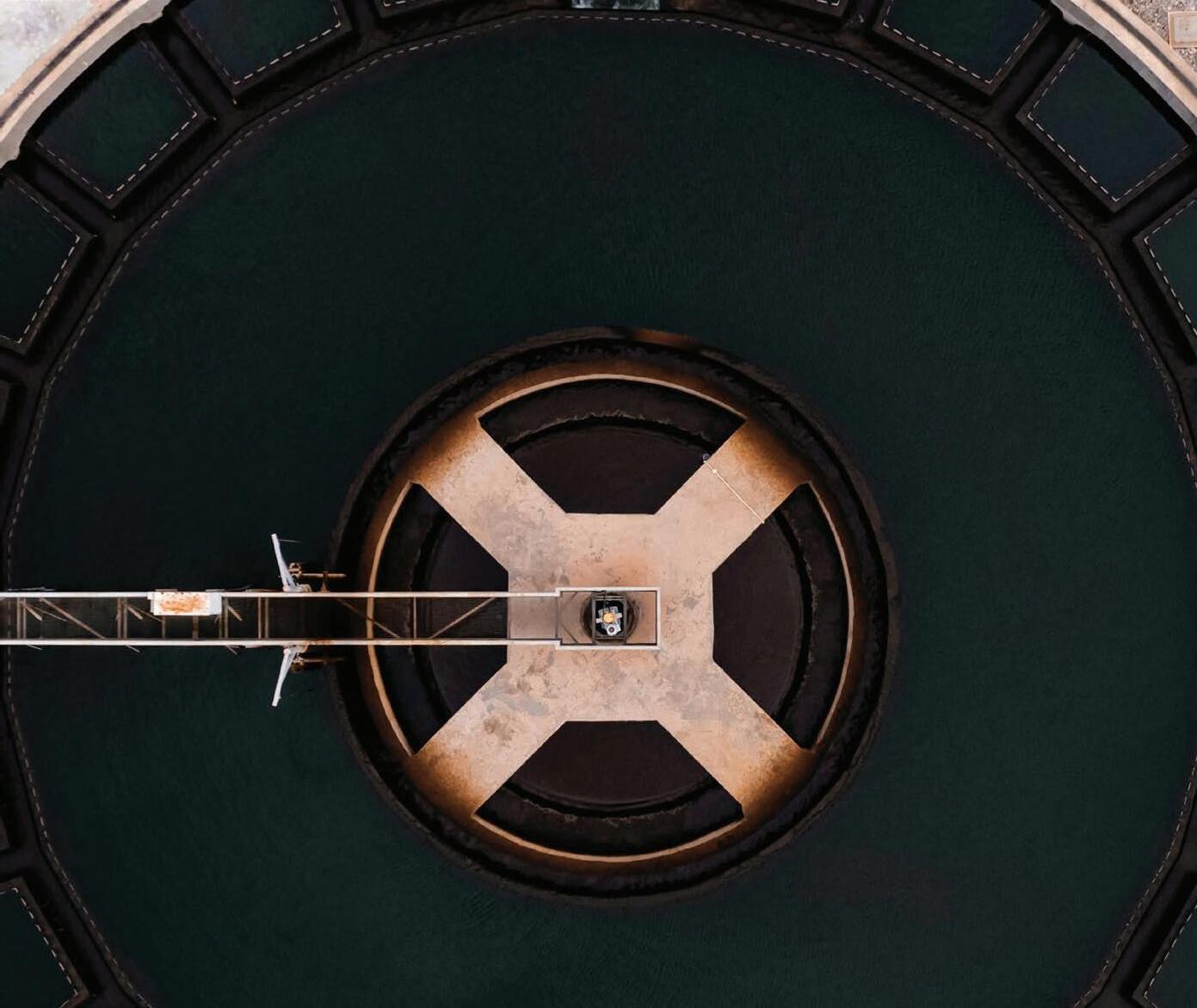

In another signi cant milestone, SA Water is entering the nal stages in the rst of a series of upgrades – totaling $121 million – at its Bolivar Wastewater Treatment Plant, with the facility’s new inlet now operational and primed to serve Adelaide’s expanding north.

Bolivar is the state’s largest wastewater treatment facility, managing wastewater for the majority of metropolitan Adelaide.

e newly installed screens and upgraded inlet structure more than doubles the plant’s daily processing capacity, rising from about 300ML to up to 630ML of raw sewage per day.

e inlet includes eight new screen trains, standing more than 6m high, which lter out items like wet wipes, paper and plastic before the ow of sewage goes further into the system.

e ten existing inlet pipes are also being replaced to support future anticipated ows as new green eld developments in Adelaide’s north connect to SA Water’s sewer network, and two new pump stations now service the screens to reduce manual cleaning and improve safety and e ciency.

Future upgrades at Bolivar will involve optimising its activated sludge reactor process and upgrading the sludge management facility, further increasing the plant’s treatment capacity and operational e ciency.

e $121 million investment comprises $64 million

from SA Water’s 2020–24 capital program and $57 million from its 2024–28 program.

ese upgrades form a central piece of SA Water’s record $3.3 billion capital program and underpin its capacity to support Adelaide’s growing population.

“Upgrading Bolivar is a key step in unlocking wider capacity for housing growth and this work ensures the plant is being prepared for new and expanding communities,” Ms Lewry said.

With early work now well progressed across key northern growth fronts, the next tranche of infrastructure delivery is already underway and is focused on unlocking more land, increasing capacity and reinforcing the backbone of the metropolitan water and wastewater network.

Among the most signi cant upcoming projects is one at Sandy Creek, where SA Water is constructing two new 10ML water storage tanks, a new control valve building and an underground trunk main connecting the tanks to the existing Barossa network.

ese projects will directly support maintaining services to our existing customers while providing the initial investments to support continued residential growth in the Concordia, Roseworthy and Gawler East areas.

At the same time, SA Water is preparing for new water infrastructure expansions west of Angle Vale, and in Adelaide’s southern suburbs at Onkaparinga Heights where new land releases are driving the need for additional network. Capacity

“ e pace we are working at today is unprecedented, and necessary,” Ms Lewry said.

“ is is our once-in-a-generation opportunity and as an industry, we are stepping up.” U

Ageing, compromised, or operationally dangerous assets?

Safe Access Audits

Safe Access Upgrades

Safe Access Design Engineering

Operator Safety Equipment

We simplify all the steps involved in accessing and maintaining assets across the network into a single streamlined process, ensuring operation is simple, safe, and efficient.

Anywhere AUS / NZ

An energy e cient pump can help lower the cost of operating a wastewater network, however, without taking the whole picture into account, these e orts to save can backfire dramatically.

Power is the biggest ongoing expense wastewater network owners face – and most of that energy is spent on your pumps and aeration blowers.

In that case, it makes perfect sense that if you choose a pump that uses less energy you should see a lower cost of ownership. If you also opt for a pump that doesn’t require a huge initial investment, then you’re saving money that can be invested elsewhere in your network to improve the quality of your service, and deliver better outcomes for customers.

It’s the perfect solution, right up until that pump blocks.

Grundfos Water Utility Sales Manager, Jackson Price, explained that an energy-e cient 2kW pump could save utilities approximately $12 per day, but every time a wastewater pump blocks, it costs up to $2000 to rectify.

“By the time you get your crew, an electrician and a truck out there, you suck the tank out, you dispose of all the waste and you x the pump and put it back in. It’s well over 100 times the daily cost of the power,” he said.

“Particularly if your pump also isn’t set up correctly according to the OEMs recommendations – that comes with massive costs.”

is doesn’t mean that you shouldn’t consider the energy e ciency of your pump at all, but Mr Price said that your power consumption is just one part of a much bigger picture.

According to Mr Price, sustained e ciency is the best way to think about balancing performance, cost and reliability. It moves beyond a single metric, such as power consumption, and instead considers how the pump is applied, operated, and maintained throughout its lifecycle.

“When we talk about sustained e ciency, we’re talking about reliability, suitability for the application, ease of maintenance, and whether the pump is installed and operated in line with what the manufacturer recommends,” he said.

“It’s about understanding where the pump sits on its curve, how the well levels are set up, and whether it’s being used the way it was designed to be used.”

A pump that appears e cient on paper can become costly if it is not suited to its environment. In wastewater applications, that means considering the type of solids the pump will handle, the velocity within the rising main, and how well levels and start-stop cycles are managed.

“Every network is di erent,” Mr Price said.

“Even within the same city, one pump station might have a very di erent in ow composition from another. You have to take a holistic approach, one that looks at the system, not just the power draw.”

While it may seem counterintuitive, a pump that uses slightly more energy could sometimes be the more e cient option overall, and Mr Price explained that energy e ciency is only a positive if it doesn’t impact performance.

“ e problem with looking at just power consumption as a key metric is you’re not looking at the cost of that asset over its entire life,” he said.

“If your pump blocks less o en, your total operating cost drops dramatically.”

Frequent blockages don’t just create maintenance headaches; they also lead to signi cant operational issues and shorten an asset’s life. An impeller replacement can cost approximately 30% of the pump’s capital cost. Repeated wear on an impeller due to incorrect selection can reduce an expected ten-year lifespan to only two to four years.

“We’ve seen cases where a pump costs around $8000 to install, but because it’s the wrong pump for the job, it ends up costing the utility more than $100,000 in maintenance over a single year,” Mr Price said.

For utilities, the best way to avoid those unnecessary costs is to involve the original equipment manufacturer (OEM) early in the process. Mr Price said site inspections, accurate data collection and adherence to OEM guidance all play a critical role in ensuring the pump performs as intended.

“ e best thing any utility can do is get the OEM out to inspect the site before selecting the pump,” he said.

“ ey know their product best and can advise on how to set it up and operate it. Measuring power consumption, tracking blockages and following scheduled maintenance all make a big di erence.”

Mr Price also encouraged utilities to pay closer attention to setup details that are o en overlooked, such as the size and velocity of the rising main, well levels and start-stop cycles.

“Well level is a massive consideration that o en never gets looked at,” he said.

“It’s how much water is in the tank and when the pump starts and stops. Getting that wrong can mean you’re running the pump under conditions it wasn’t designed for.”

According to Mr Price, a common misconception is that semi-open impellers are the universal solution for wastewater pumps. While they have advantages in certain conditions, they can create problems in smaller installations.

“In smaller pumps, semi-open impellers can be an Achilles heel,” he said.

“ ey block very regularly if they’re not set up perfectly, and they’re not as forgiving as other designs. Vortex

impellers, for instance, might be slightly less energy e cient, but they tend to block less o en, which means less downtime overall.”

Mr Price said sustained e ciency ties all these considerations together, from pump curves and impeller design to control logic and maintenance. Even start-up and shut-down sequences can in uence performance.

“How you start and stop the pump makes a di erence,” he said.

“Using variable frequency drives can help, but they need to be con gured properly. You want the pump to reach full load as quickly as practical because that increases velocity and reduces the risk of blockages.”

e aim, he said, is to nd the balance between energy e ciency and operational reliability, a balance that delivers genuine savings over time.

“You might not have the lowest power bill, but you’ll have fewer blockages, fewer callouts and a lower total cost of ownership,” Mr Price said.

“ at’s what sustained e ciency really means.” U

For more information, visit grundfos.com/au

As Kwik-ZIP marks 25 years of business, the company pauses to reflect on its many milestones, as well as the people who have helped shape its journey.

For a quarter of a century, kwik-ZIP has been at the forefront of engineering innovation, transforming the way centralisers and pipeline spacers are designed and delivered across the globe. Over the last ve years alone, more than three million Kwik-ZIP units –spanning a range of sizes – have rolled out from precision injection moulds, destined for projects on every continent.

From small-diameter centralisers used in monitor wells and foundation piling, to robust pipeline spacers capable of accommodating diameters in excess of 3.5m, kwik-ZIP’s applications re ect an impressive versatility. Each product is a testament to the company’s ongoing commitment to solving real-world challenges in civil construction, water infrastructure, and energy sectors.

Innovation runs deep at Kwik-ZIP. e relentless pursuit of smarter, more e ective solutions has resulted in an impressive intellectual property portfolio, with ten patents and two design registrations secured globally. Notably, the company’s most recent U.S. patent – granted just two months ago – speaks to Kwik-ZIP’s continual evolution and relevance in a competitive landscape.

From the outset, materials engineering has played a central role in Kwik ZIP’s success. Its products are manufactured from engineered thermoplastic blends that o er high exural strength, excellent temperature resistance, low coe cients of friction, and resistance to abrasion. Crucially, these components are non metallic,

which avoids many of the problems associated with corrosion, damage to composite casing, or complications in environments with chemical exposure.

Compliance and accreditation have also marked important milestones. Kwik ZIP’s HD, HDX and HDXT Series casing spacers have been formally approved under the Water Services Association of Australia (WSAA) Product Speci cation WSA PS 324. is speci cation prescribes standards for casing spacers in terms of material, runner spacing, abrasion resistance, and more – meaning that Kwik ZIP’s products are not just well engineered but recognised by relevant regulatory bodies.

Kwik-ZIP products are also approved for use within many utilities’ infrastructure, including Melbourne Retail Water Association, South-East Queensland’s Infrastructure and Materials (IPAM) list, Sydney Water and the WA Water Corporation. All products are certi ed by the Australian Water Quality Centre (AWQC) for use in contact with drinking water.

Behind every component, patent, and certi cate is KwikZIP’s remarkable team of people who make it happen. e creativity, dedication, and resilience of the people behind the brand have propelled it from a promising idea to a trusted name in the industry.

Founder of the company, Jason Linaker, remains a guiding gure, driving technical development, leadership and the ethos of practical innovation. At every level,

from design to production, from sales and logistics to customer service, the Kwik ZIP team has had to balance strict technical requirements with the unpredictability of eld conditions to deliver for its clients. eir unwavering commitment ensures that every centraliser or spacer produced not only meets rigorous standards but also advances the boundaries of what’s possible.

Of course, Kwik-ZIP’s story is also one of trusted partnerships. Kwik-ZIP’s loyal customers worldwide have placed their con dence in the brand’s ideas, supporting its growth and challenging the team to keep raising the bar. Suppliers, too, have contributed through their reliability, exibility, and spirit of collaboration, helping Kwik-ZIP deliver on its promises, time and again.

ese combined e orts have resulted in tangible achievements. Kwik ZIP products help contractors comply with wastewater, sewerage and water well construction codes; they protect carrier pipes in slip lining applications; they reduce risk to composite casing materials where conventional steel centralisers could cause damage. In many large infrastructure projects, including pipelines and large diameter casing installations, Kwik ZIP’s spacer and centraliser systems have been selected for their reliability, cost e ciency, ease of assembly, and technically validated performance.

As Kwik-ZIP marks its 25th anniversary, the occasion is one for celebration and re ection. It’s a moment to honour the journey so far, appreciate the present achievements, and look ahead with excitement to the innovations yet to come. e legacy of Kwik-ZIP is not just found in the millions of units shipped or the patents granted, but in the spirit of innovation and partnerships that have de ned every step of the way.

Looking ahead, the challenges are many: evolving environmental regulations, increasing demands on sustainability, ever more ambitious pipeline projects, and

much more. Yet, these are exactly the kind of challenges that are well suited to Kwik ZIP’s culture. If there is one thing the company’s history shows, it’s that Kwik ZIP does not rest when there is still room to improve.

Kwik-ZIP Managing Director, Jason Linaker, said, as the company looks to the future, it does so with gratitude for the past and an undiminished passion for what’s still to come.

“ ank you for being part of the kwik-ZIP story.” U

For more information, visit www.kwikzip.com

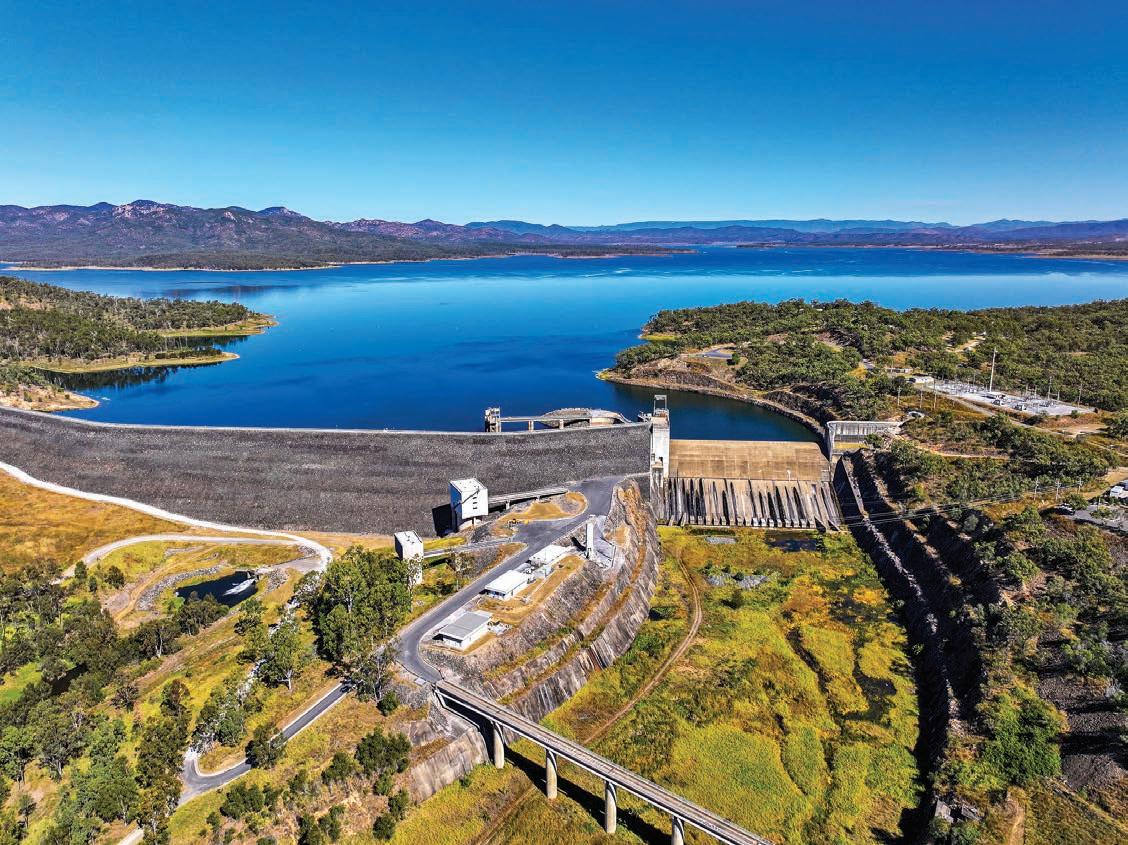

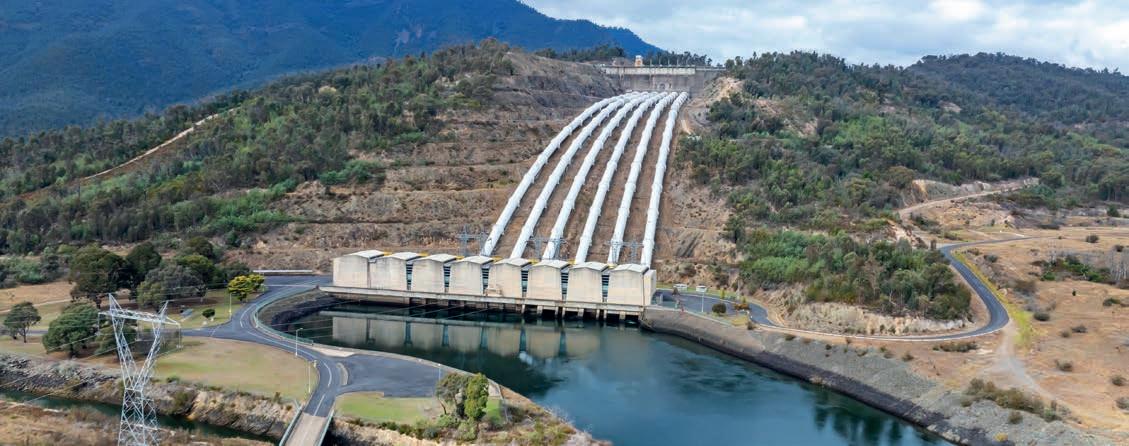

The 117km Fitzroy to Gladstone Pipeline is nearing completion, and the Gladstone Area Water Board’s CEO says it’s delivering a lot more than water for the region.

By Darren Barlow

In Central Queensland, water security is more than an infrastructure challenge – it’s the foundation for jobs, industry, and the future prosperity of our communities.

For decades, Gladstone has relied on one source of water – Awoonga Dam, and a er multiple failed wet seasons the dam is (as of October 2025) at 43 per cent capacity.

Gladstone Area Water Board (GAWB) has an allocation of 78GL per annum from Awoonga Dam, and every precious drop has been allocated to customers in our region.

In 2023, the Queensland Government announced a partial solution to our water supply risk – the Fitzroy to Gladstone Pipeline (FGP), a $983 million raw water

Find

pipeline connecting water from the Lower Fitzroy River in Rockhampton, to GAWB’s existing network in Gladstone.

At 117km long, the FGP will include an intake at Laurel Bank, a facility at Alton Downs to remove sediment and generate good quality raw water, and reservoirs at Aldoga.

When complete, the pipeline will transport 30GL of raw water each year from the Fitzroy River to Gladstone, delivering signi cantly improved and much-needed water security to our region and our customers.

Our role at GAWB is to deliver safe and reliable bulk water services for our customers, which include major industries and Gladstone Regional Council. Our customers are the engine room of Queensland and quite simply, they need water to operate.

ere’s been a drive for new customers and increased demand from existing customers for water. e FGP won’t deliver more water for demand – it’s for water security. Yet we have a queue of potential and existing customers wanting more water, which is why we have published Queueing Guidelines. ese guidelines set out a transparent process for managing customer requests.

A large portion of the water we supply goes to energy production, largely in the form of coal and LNG. Collectively, Gladstone’s industries contribute around $6 billion to the Queensland economy and support about 13,000 direct and indirect jobs in our region. Commentary about the FGP being for hydrogen, renewable energy supply, or no longer required is simply incorrect. We need more water in Central Queensland, and the FGP is part of the water security solution.

Construction of the pipeline is almost complete – more than 400 jobs have been created during construction, with opportunities for trainees, and skilled workers across a range of trades and professions.

We’re proud to have supported 21 trainees, as part of a focus on building local skills for the future.

Importantly, our commitment to investing in the region is not just words – it’s backed by action. So far, through the FGP construction, we have spent more than $150 million with businesses in Rockhampton and Gladstone. at’s money owing directly into local suppliers, sub-contractors, and service providers, strengthening the economic fabric of our communities. Furthermore, we have spent $234 million with businesses in Queensland, and another $206 million with Australian businesses located inter-state.

In total that’s more than $590 million spent to date with Australian businesses.

We could have used overseas suppliers, but we didn’t. It was important to contribute to economic growth by supporting local businesses.

e Fitzroy to Gladstone Pipeline is more than steel and concrete – it’s a vital connection for jobs, skills and water security. It’s an investment in the resilience of our region and a project we can all be proud of.

Gladstone Area Water Board (GAWB), as a Queensland Government Bulk Water Supply Authority, delivers safe and reliable water services which promote economic development and enhance the lifestyle of regional Queensland. GAWB owns and operates Awoonga Dam, along with a network of pipelines, water treatment plants and other distribution infrastructure. GAWB also owns and operates Aquaculture Gladstone, a sh hatchery and interpretive display at Lookout One at Lake Awoonga.

To ensure long-term water security for customers, the 117km Fitzroy to Gladstone Pipeline (FGP) is under development. When delivered, the FGP will become part of the GAWB network and provide enhanced water security and reliability for the region. U

For more information, visit www.gawb.qld.gov.au

You’re under pressure to deliver complex projects faster, safer, and under tighter margins. At Genus, we make that possible.

While others are weighed down by bureaucracy, Genus is a modern Tier 1 contractor: proactive, agile, and collaborative.

We’re big enough to handle nation-shaping infrastructure programs, nimble enough to move fast and care about every detail.

Backed by a strong balance sheet, 1600+ direct employees, and a proven track record working with the likes of Western Power, Ausgrid, Transgrid, and TasNetworks, we’re keeping Australia powered and connected today, while paving the way for what’s next.

Over the next decade, demand for water is going up and rainfall is going down. We can’t a ord to waste a single drop of the precious resource so our critical infrastructure needs to meet the task.

The reality of climate change means longer droughts, more o en. And as Australia’s population booms, the enormous responsibility of ensuring that there’s enough water to go around falls to the utility sector.

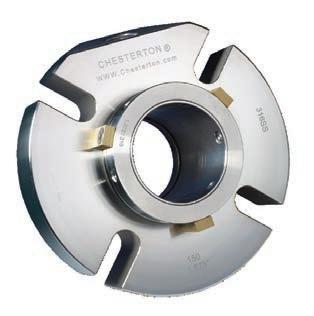

In the dynamic landscape of water and wastewater management, the drive toward e ciency, sustainability, and reliability has never been stronger. Every drop counts – and so does every seal, gasket, and rotating component that keeps critical assets performing optimally.

For decades, A.W. Chesterton has been at the forefront of developing high-performance sealing solutions that help utilities and treatment facilities reduce water consumption, energy use and maintenance downtime. But as the industry embraces smarter infrastructure and data-driven maintenance strategies, traditional sealing approaches are being rede ned by advanced sealing technologies and condition monitoring innovations.

While conventional mechanical seals and packing systems remain the backbone of pump and mixer maintenance, they come with inherent trade-o s – from frequent maintenance intervals to ush water dependency and leakage risks.

With water scarcity becoming a very real threat, the cost of unplanned downtime and water lost through leaks is just too high.

e engineering experts at Chesterton saw that solving these challenges wasn’t just a-nice-to-have, it was vital, so they put their expertise together to develop the next generation of sealing systems.

Chesterton’s split seal designs not only simplify installation but also dramatically cut equipment downtime and associated costs. In water and wastewater applications, where pumps operate continuously under challenging conditions, this can translate to thousands of dollars saved annually and signi cant reductions in resource consumption.

However, choosing the right seal is only one part of a much bigger picture.

Reliability doesn’t happen by chance; it’s engineered. By integrating real-time equipment monitoring of parameters such as temperature, vibration, and seal chamber pressure, operators can detect early warning signs of failure and take corrective actions before costly breakdowns occur. is proactive approach to maintenance aligns perfectly with the industry’s growing focus on predictive asset management and sustainable operations. In Chesterton’s latest advancements, technologies like active throat bushings provide precise control of the seal environment, enabling operation with minimal or even zero ush water

– a critical advantage in regions facing tightening water restrictions.

Across treatment facilities worldwide, Chesterton’s advanced sealing and monitoring solutions are helping engineers achieve measurable performance improvements. From extending pump life cycles to reducing maintenance interventions, these case studies highlight how these technologies empower utilities to do more with less – and Chesterton leverages the lessons learned from these projects to continuously improve its solutions and keep up with evolving industry challenges.

To help utilities and asset owners make an informed decision about the right solution for their facilities, Chesterton has developed a comprehensive guide on how to modernise sealing practices for today’s operational and environmental challenges.

Inside the Advanced Sealing and Condition Monitoring Strategies in Water and Wastewater Plants, eBook, you’ll nd:

• A technical comparison of traditional vs. advanced sealing methods

• Insights into split seal and active throat bushing technologies

• Guidance on equipment monitoring and its impact on seal reliability

• Real-world success stories from the water and wastewater sector

• Application-speci c recommendations to help you make the right sealing choice

Chesterton’s goal is to help utilities discover how the latest innovations in sealing and monitoring can transform their plant’s reliability, sustainability, and cost e ciency. Learn from global examples. Apply proven engineering insights. And start building a water management strategy that’s as resilient as it is sustainable. U

To download the full eBook, scan the QR Code or visit chesterton.com or chestertoncustomseal.com.au

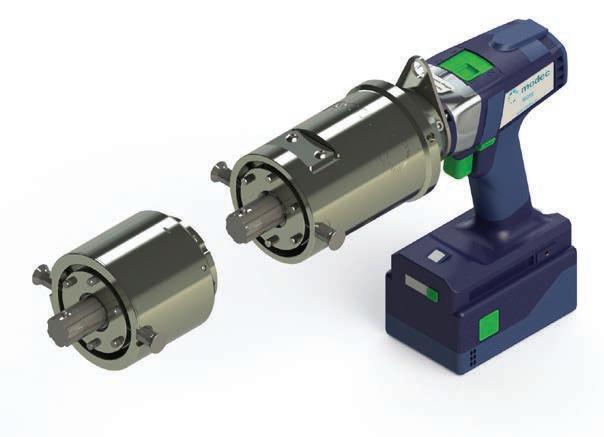

The Chesterton 1510 represents over 40 years of engineering excellence in our most streamlined mechanical seal yet.

A brighter future isn’t going to happen in isolation, and if the water sector is going to deliver one of its largest infrastructure booms in history, it needs collaboration, shared knowledge and accurate data.

The heat of climate change is being felt all over the world, but in Australia’s already drought-prone landscape, water scarcity is a real and urgent risk that’s only going to be exacerbated as temperatures rise.

Population growth and rapid urbanisation threatens to increase demand for this precious resource faster that we can boost supply and these challenges are only intensi ed by ageing infrastructure and a signi cant workforce shortage.

e need to secure our water supply has sparked one of the largest water infrastructure booms in history at a time when the sector is under immense strain, where fragmented technologies, inconsistent data and disconnected systems hinder progress toward smarter, more resilient water management.

Autodesk helps local utilities navigate this complexity through a connected data strategy designed to help them plan, design, manage and optimise their assets more e ectively. By connecting teams and work ows in a uni ed digital environment, Autodesk powers organisations to make faster, more informed decisions – improving e ciencies and sustainability for their communities.

Data is one of the most valuable assets an organisation owns, yet much of it remains untapped and contained in silos. In fact, a research from FMI Big Data report found that 95 per cent of engineering and construction data goes unused, while poor data quality costed the global construction industry an estimated $88B in rework in 2020.

Digital transformation is no longer a nice-to-have, it is essential. And it is not just about adopting new toolsets, but rather the deliberate establishment of connected

systems that turn discrete data into operational insights. Autodesk’s 2025 State of Design & Make Report revealed that customers who embraced this change saw measurable improvements in productivity, pro tability, and customer satisfaction.

e industry has already witnessed several waves of innovation, from drawing boards to CAD, to BIM and Connected BIM. e next leap forward is OutcomeBased BIM, where success is measured by the outcomes it enables.

Autodesk is leading utilities to this transformation, providing tools and intelligence to use structured data and AI to focus on what really matters – the performance and resilience of wet-infrastructure assets. e question now becomes: “What information do I need about my assets to achieve my outcomes?”

By shi ing to this outcome-driven approach, utilities can move beyond reactive to proactive strategies. is allows them to identify risks early and deliver better value to customers.

With platforms such as Info360, Autodesk Tandem, and Autodesk Construction Cloud (ACC), utilities can connect design, analysis and operations in one seamless digital ecosystem.

Together, these technologies enable a shi from reactive asset management to predictive, performancebased approaches. ey help organisations better understand the condition of their networks, forecast potential failures, and plan maintenance activities that target assets that need them most. e result is improved resilience, reduced operational risk, and more sustainable long-term asset management. U

With Vocus Satellite – Starlink, private networks for critical infrastructure can now be extended via Starlink without travelling over the internet.

Remote utility sites can become part of a network with identical security protection as metro areas to support automation and advanced monitoring technologies.

The pressure beneath the surface Australia is the driest inhabited continent, and its water systems are feeling the strain. Climate change is reshaping rainfall patterns, driving longer droughts punctuated by intense oods. e Bureau of Meteorology and WSAA warn that variability is increasing, making traditional planning assumptions unreliable. At the same time, population growth is accelerating demand. e Australian Bureau of Statistics projects more than 30 million people by 2030, with most growth concentrated in cities. WSAA’s future water security analysis shows urban water consumption could rise by 73 per cent within three decades—an increase of more than 2,650 gigalitres annually.

is dual pressure—climate volatility and demographic expansion—means utilities cannot rely on legacy networks alone. Many assets were built decades ago for smaller populations and milder extremes. Infrastructure Australia’s audit notes that pipes, reservoirs and treatment plants are among the country’s most ageing public assets, with some networks still dependent on asbestos cement and cast iron mains installed in the mid-20th century. Break rates are climbing, and deferred renewals compound the risk.

e message is clear: Australia needs new water infrastructure and strategic upgrades to existing systems. Without them, service reliability will falter, costs will

rise, and communities will face unacceptable risks during droughts and oods.

Why building new networks is complex

Delivering this infrastructure is not as simple as laying pipe. Engineering challenges multiply when projects intersect with dense urban environments, constrained corridors and ageing assets. Utilities must navigate geotechnical variability, tra c management, and environmental compliance—all while keeping water owing to customers.

Consider the reality of metropolitan upgrades. A new trunk main may need to cross under rail lines, weave through congested streets, and integrate with live networks without triggering outages. In regional areas, the challenge shi s to scale and remoteness: long pipeline alignments across oodplains, pump stations designed for variable ows, and treatment plants resilient to power uctuations. Add to this the complexity of modern standards—pressure management, digital monitoring, and sustainability targets—and the engineering equation becomes formidable. en there is the delivery risk. Research into Australian infrastructure projects shows persistent cost overruns and schedule delays, o en linked to poor scoping and fragmented governance. For water utilities, these risks translate into budget strain and reputational

exposure. e sector needs partners who can anticipate these pitfalls and design solutions that work rst time.

expertise, not stating it

is is where Lanco Group steps in—not as a contractor chasing milestones, but as an engineering partner embedded in the utility sector’s reality. eir portfolio tells the story. From slip-lining a 450mm distribution main along Ballarat Road to managing complex relocations for rail grade separations, Lanco’s work demonstrates uency in both design and delivery. Projects like the Broadmeadows Reservoir water main replacement required coordination across authorities, tra c interfaces and live network tie-ins—tasks that demand more than technical drawings; they require foresight and negotiation

On the ground, that expertise translates into practical risk management. When a sewer relocation intersects with high-density developments, Lanco’s engineers model hydraulic impacts, stage works to maintain service, and integrate civil, electrical and telecommunication requirements. In subdivisions, they design reticulation systems that future-proof capacity while optimising cost for developers and utilities alike. ese are not abstract capabilities—they are lived practices that reduce surprises and keep projects on track.

Modern water infrastructure must do more than convey ow. It must withstand climate extremes, minimise energy use, and align with sustainability frameworks. Lanco’s approach re ects this shi . eir designs incorporate pressure management to reduce leakage, material selection for durability under variable soils, and layouts that accommodate future digital monitoring. In pump station projects, energy e ciency is not an a erthought; it is embedded through hydraulic optimisation and provision for renewable integration. is matters because utilities face rising expectations—from regulators enforcing tighter standards to communities demanding transparency and environmental stewardship. Projects delivered today will operate for decades; resilience cannot be retro tted later. By integrating sustainability into design and construction, Lanco helps utilities meet these expectations without in ating lifecycle costs.

Infrastructure delivery is as much about people as pipes. Skilled labour shortages, supply chain volatility and stakeholder complexity can derail timelines. Lanco’s longevity in the sector—more than 25 years—has built relationships that smooth these edges. eir accreditation with Melbourne Water and regional authorities signals trust earned through consistent performance. Behind that trust is a team culture focused on collaboration: civil engineers, hydraulic specialists and project managers working as one unit to anticipate issues before they escalate. is collaborative posture extends to utilities. Rather than imposing solutions, Lanco engages early, aligning designs with operational realities and budget constraints. at alignment reduces rework and accelerates approvals—a quiet but powerful lever for on-time delivery.

WSAA’s Strategy 2030 frames the sector’s challenge as enabling thriving communities under climate and growth pressures. Meeting that challenge will require billions in capital works, smarter planning and partners who bring both technical depth and adaptive thinking. Lanco Group exempli es that blend. eir track record across complex urban upgrades and regional schemes shows a capacity to navigate engineering, regulatory and stakeholder dimensions without losing sight of cost and constructability.

As Australia builds the networks that will secure water for the next generation, success will hinge on partnerships grounded in trust and technical excellence. e pipes may run underground, but the expertise that delivers them must be visible—and accountable—above ground. In that space, Lanco Group has already laid strong foundations. U

As Australia warms, recycled water is rising. GAC helps make it trusted.

Australia is warming and rainfall is becoming more variable; utilities now need supply options that are resilient, a ordable and socially acceptable.

at is the logic behind recycled water— t-for-purpose water produced from treated wastewater, stormwater or greywater and used across industry, irrigation, households, and—when advanced treatment is added—drinking water augmentation. e Australian Guidelines for Water Recycling (AGWR) set out a risk-based framework for managing health and environmental risks and, in Phase 2, provide speci c guidance for augmenting drinking water with puri ed recycled water using multiple barriers and performance targets.

Water sector bodies have leaned in. e Water Services Association of Australia (WSAA) has developed toolkits and maps that show puri ed recycled water is neither novel nor niche; more than 35 cities already use it and that number is expected to double by 2050. “Even though the technology has been proven for decades, puri ed recycled water schemes are only now starting to be rolled out at scale,” WSAA’s Danielle Francis said, noting the global trajectory and Australia’s drought resilience planning.

e bene ts are recycled water reduces demand on dams and rivers, provides a rainfall-independent source, and supports liveability through irrigation and industry. Limitations are equally clear: end uses must be matched to appropriate treatment, schemes require rigorous risk management, and community engagement matters.

role for granular activated carbon GAC is porous carbon engineered to adsorb dissolved organics and some micropollutants. In recycled water treatment trains it typically appears in two places. First, in advanced wastewater treatment before the PRW step, to reduce taste-and-odour compounds (such as geosmin and 2-MIB), algal toxins (e.g. microcystin), and a wide

spectrum of synthetic organics. Second, adjacent to membrane and advanced oxidation processes in PRW, as a polishing or bu er barrier to smooth raw water variability and help control disinfection by-products, trace organics and odour precursors. It is a workhorse—quiet, consistent, forgiving of seasonal change—and a critical part of keeping “unknown unknowns” small.

Best practice is not generic media thrown into a vessel and hoped for the best. Pore structure must match the contaminant pro le and hydraulic regime. Coal-based GAC o en provides a balanced mix of micro- and mesopores, capturing larger organic molecules and taste-and-odour compounds at practical empty bed contact times—useful in municipal PRW bu ers and dual-media lters. Coconut shell GAC biases towards microporosity for smaller molecules and is prized for hardness; it is common in point-of-use and some pressure lters. Wood-based carbons tend to o er macroporosity and can shine where colour removal and very large organics dominate. Selecting “the right carbon” means matching pore distribution, hardness, attrition resistance, size grading, and pre-washing to the water’s chemistry and the plant’s hydraulics.

Operators also weigh powdered activated carbon (PAC) for episodic events. PAC dosing ahead of clari cation or ltration can blunt algal blooms quickly, then be removed with sludge—an agile tool during taste-and-odour spikes or toxin alerts—while xed GAC beds provide the steady state backbone.

Myth-busting the “yuck factor”

e most persistent myth about recycled water is simple: that it is “wastewater with a new label.” It is not. Planned potable reuse follows the AGWR: source control, advanced treatment (o en ultra ltration, reverse osmosis, UV-AOP), barrier redundancy, continuous monitoring, and blending

with further ltration and disinfection before distribution.

Sydney Water’s public materials show that PRW is triple-treated before re-entry to raw water storages, then treated again at conventional plants, meeting the Australian Drinking Water Guidelines throughout. at process is audited and regulated.

A second myth suggests recycled water is unproven. WSAA’s mapping and sector research demonstrate otherwise—decades of safe operation internationally and within Australia (e.g., Perth’s groundwater replenishment scheme; South East Queensland’s Western Corridor facilities under drought readiness). As Francis notes, adoption is accelerating as climate variability tightens. e sector does need to talk plainly about risk management, but the evidence base is not thin.

Watch a modern plant during a summer bloom. Operators increase PAC dosing to dampen geosmin and 2-MIB while protecting downstream membranes. In parallel, GAC contactors—selected for hardness to reduce media loss and sized to keep headloss stable—continue polishing dissolved organics so advanced oxidation focuses on what truly needs destroying, not on background load. When the bloom recedes, PAC dosing stops, GAC carries the steady-state load, and the plant avoids customer taste complaints. at is GAC doing quiet work in a sophisticated train.

Sampling regimes matter. Utilities following risk-based management plans validate GAC performance with surrogate parameters (e.g., UV254, THM formation potential) and targeted analytes (e.g., microcystin, pesticides, PFAS where relevant) while tracking empty bed contact time and breakthrough curves to schedule change-outs e ciently. is is how Australian operators keep recycled water within spec across seasons and events, aligned to AGWR risk targets and local regulatory instruments.

James Cumming’s team has built its reputation by collaborating with Australian process engineers on the details that decide whether GAC helps or hinders a scheme: pore structure, grading, pre-washing, hardness, and supply certainty. eir Purazorb™ range is Australian coal-based, NSF-61 certi ed, produced through high-temperature steam activation, and speci ed for municipal taste-and-odour, toxins, and trace organics removal—attributes that sit well beside membranes and AOP in PRW trains. Field examples in Australian plants emphasise the practical side of their approach, including made-to-order sizing and responsive manufacturing for commissioning windows.

A notable pattern in their work is matching media to water chemistry rather than pushing a single “super

carbon.” Where smaller organics dominate, the company can supply coconut-shell grades; where colour and very large molecules drive risk, wood-based carbons can be speci ed; and for Australian PRW with mixed dissolved organics and taste-and-odour loads, coal-based GAC with balanced pore distributions o en wins out. at breadth helps utilities adapt without reinventing plants—GAC beds and dual-media lters become con gurable tools aligned to AGWR risk targets and site hydraulics.

James Cumming’s technical pages also remind engineers that PAC remains valuable in episodic events; their guidance re ects routine practice in Australian WTPs where PAC addresses short-term blooms ahead of clari cation or ltration, while GAC steadies the base load. It is advice o ered from lived operational experience rather than catalogue theory.

e team at James Cumming’s also specialises in the reactivation and regeneration of exhausted granular activated carbon. ey have extensive experience in working with utilities and want to further engage them about the sustainability of their practices, particularly a er the lter media has seen breakthrough of organics and contaminants of concern.

e focus here is on re-activating spent carbon and then using it again, reducing waste and land ll components of running their treatment plants, delivering better outcomes for the utilities and the environment.

WSAA’s broader message is communities need clear, evidence-based water choices they can trust. Puri ed recycled water schemes provide clean and safe water to more than 30 million people and that is set to grow. e technical cra behind that trust—getting the media choice and application right—sits squarely in the domain where teams like James Cumming’s work alongside utilities. U

For more information, visit jamescumming.com.au

Interflow and South East Water renewed critical water mains on both sides of Chapel Street in South Yarra for South East Water. Its success demonstrates that thinking outside the box can result in exceptional project outcomes and reduce the overall impact on the community.

South East Water sought to renew the two water mains on Chapel Street, between Toorak Road and Alexandra Avenue, South Yarra.

e area had experienced signi cant growth and is home to many residents and businesses. Collectively, the two mains serve a customer base of around 12,000 people.

e east-side water main had previously experienced a burst, causing considerable disruption to the public, community, and businesses. South East Water made the decision to extend the scope to include the mains on both sides of the road to ensure certainty of supply for its customers for generations to come.

Inter ow and South East Water collaborated closely during the project to ensure the solutions balanced community and network needs.

On the west side, 560m of DN100 cast-iron cement lined pipe (CICL) was renewed with a new DN225 PVC pipe by open trench li and relay. On the east side, 485m of DN300 CICL pipe was renewed with a 280mm outer diameter HDPE pipe by slip lining, facilitated by a custom process to remove an in-situ cement liner.

e Chapel Street renewal project has mitigated the risk presented by a distressed asset and provided future generations with reliable, high-quality water infrastructure.

e key challenge on this project was reducing the impact of works, particularly noise, in one of Melbourne’s most populated areas.

Works like this on busy roadways are usually contained to nightworks to reduce the impact on tra c. In this case, the impact of noise on residents and business owners was a greater concern. As well as disrupting people during sleeping hours, nightworks would have le a very short working window and prolonged the duration of works.

In addition, ground conditions were extremely rocky, meaning excavation was a di cult and noisy activity.

Finding a trenchless alternative to digging and relaying the mains was crucial to minimising the impact on the area’s 12,000 customers. e DN300 eastern main appeared a good candidate for slip lining – the catch: the pipe had been lined in cement leaving a smaller than expected internal diameter.

Working with the Department of Transport and Planning, the team was able to secure a 7am to 10pm working window, with permission to permanently occupy the clearway with a site compound outside these times. is eliminated almost all nightworks which was hugely bene cial to the community.

e permit process took almost 6 months and included the creation of Tra c Guidance Schemes and Tra c Management Plans.

Inspired by their sewer pipe cleaning process, Inter ow created a bespoke system that could break down the cement liner and allow it to be ushed out. e innovative removal of the cement liner in the eastern main facilitated the slip lining approach, and in turn, reduced the potential for undesired impact on the community.

Seeking to restore two pipelines in Melbourne’s highly populated Chapel Street, Inter ow and South East Water worked together to upgrade both mains while reducing the impact on the community and stakeholders. rough implementing trenchless methodologies and obtaining a large day time working window, both the eastern and western sides of Chapel Street were upgraded, providing the community with a reliable water asset for generations to come. U

We’re Creating

the Future of Water for people, communities and the environment

Construction of new energy sources across Australia, regardless of type, will need to happen as ageing coal fi re power stations reach the end of their life.

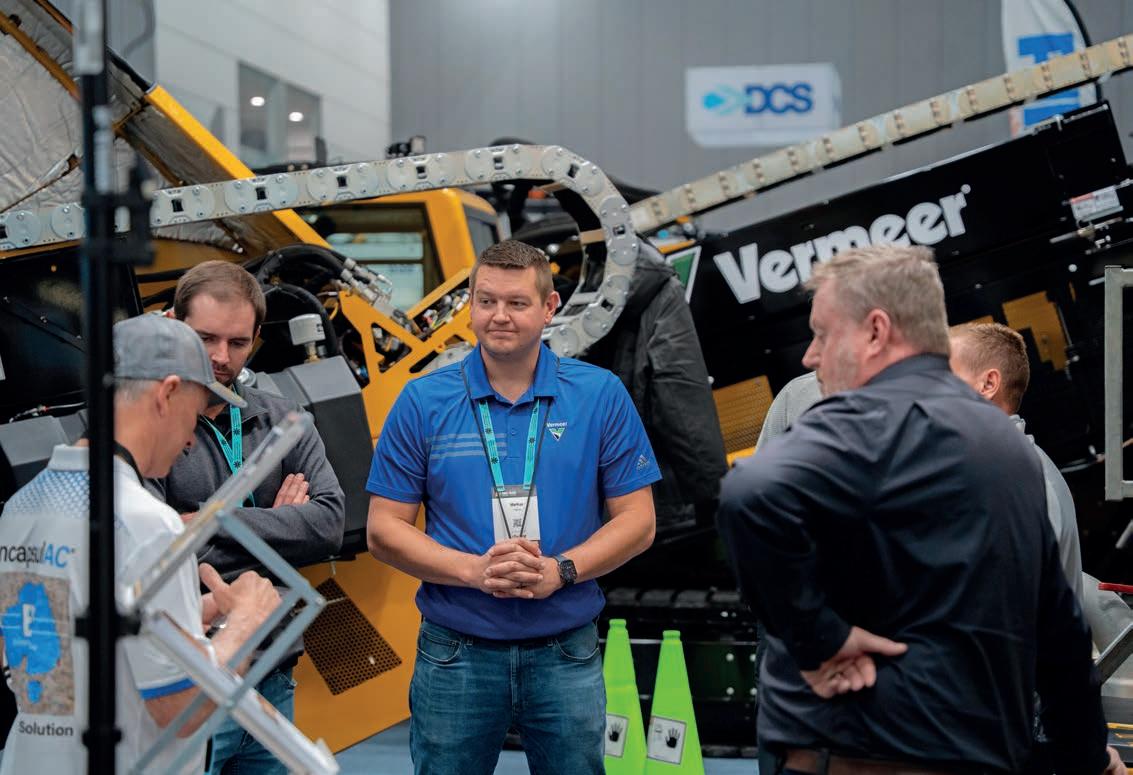

The energy transition depends on sector-wide collaboration, and Genus’s new COO, David Fyfe, says that harnessing everyone’s unique strengths and di erent points of view is what will see Australia through the next 50 years.

If the name ‘David Fyfe’ rings any bells, you’re probably thinking of the former Synergy CEO, who led the utility from 2022–25 as it embarked on its journey to renewables and delivered Western Australia’s rst-ever large-scale battery energy storage system (BESS) in Kwinana.

You may even know him from his role before that as the COO of Western Power – or maybe you’re thinking of the Bali Bombing survivor and motivational speaker, or the Chair of the Fiona Wood Foundation.

You might have even run into him during the 12 years he spent at Telstra.

But, most recently, you’ve probably been introduced to him as the new COO at Genus – a family-founded Aussie business that has grown large enough in a single generation to compete with multi-national Tier 1 contractors.

While change is a constant in Mr Fyfe’s career, he’s anything but capricious.

“I was in the Bali Bombings in 2002, and I ended up in hospital for more than two months with over 60 per cent burns,” he said.

“I had my right leg amputated below the knee and had to learn to walk again. So, for me, life’s really about living –it’s about challenging yourself, growing and experiencing new things.

“ e other thing I really took out of that was the power of people. And how important relationships are as you go through life changing events.”

Take the risk

e second constant in Mr Fyfe’s career has been utilities. “I started o working for British Nuclear Fuels at

Chapelcross Nuclear Power Station. I was a graduate electrical engineer and that was my rst job.”

“I think, when you get your rst job, your goal is just to really learn what working is all about. e nuclear power industry was an integral part of the energy landscape in the UK, and as a young engineer, you’re conscious of it, but it’s not hitting you in the face in the early days, it’s just really about learning and growing as a person.”

“Now I’m 56 and even at this point in time I still want to be continually challenged and continue to learn and grow.”

Mr Fyfe came to Australia in the 1990s and took up an engineering role at Telstra before moving into the sales side of the business where he led a large contract negotiations team in Western Australia.

“I think engineers don’t realise that they’re in sales as well – if you put forward a business case, you’re actually selling something. For me, sales was a great grounding on how to pitch something, how to tell a succinct story and the importance of relationships,” he said.

A er Telstra, Mr Fyfe returned to the electricity sector, where he spent a decade at Western Power, with seven of those years as its COO.

Mr Fyfe oversaw the utility’s work program, including major projects, the network control centre and all the utility’s contractors. is is where he rst met Genus Managing Director and founder, David Riches.

“In the early days, David used to do work on the Western Power network when I was the COO there, and I’ve always had a lot of respect for Genus’ values as a family-run business,” he said

In 2022, Mr Fyfe moved to Synergy as its new CEO, where he and Mr Riches joined forces once again.

“Not long a er I joined, we went down to Collie with the State Government and announced the closure of the Synergy-owned coal- red power station there and a $4 billion investment to build renewable assets,” he said.

“We built Kwinana stage one and two, and when I le , we were just about nished the Collie big battery, and we also got two wind farms through nal investment decision.”

“And Genus actually constructed the two big batteries at Kwinana for us and did an amazing job. e $660 million Kwinana stage two was built on time and on budget, which is a great achievement in the current market.”

With Mr Fyfe at the helm, Synergy thrived and by 2025 the goals Mr Fyfe had set himself for the role had been achieved.

“A er three years, Synergy was in a good place, and it would have been easy to just enjoy the next couple of years there, but that’s just not really who I am,” he said.

“I really do like new challenges, building new relationships and new industries and I like building things and getting stu done.

“Genus is really now a central part of the energy transition … so it was a great opportunity for me to get back into the private sector but still be involved in energy.”

David Riches founded Genus 16 years ago, and the business began as a contractor that worked on overhead powerlines in Western Australia.

Today, the ASX-listed company has a team of more than 1,800, a $2 billion order book with a pipeline of critical infrastructure to deliver across Australia, and a reported $750 million revenue for 2024–25.

“Dave has achieved amazing things over the course of our relationship,” Mr Fyfe said.

“We’ve now got o ces all over the country, we work across emergency services to energy to telecommunications and rail. So, for me, Genus is a fast-growing company, but still at the heart of the energy transition that I’m really passionate about.”

But Mr Fyfe said that what really drew him to Genus was the opportunity to challenge himself at a new organisation with values that aligned with his own.

“ ose values really shine through in everything Genus does – there’s no hierarchy here, no egos, everybody just bands together to get stu done,” he said.

“And whenever we’re doing a job it’s not just about making money, it’s really about building those long-term relationships.”

It’s this focus on learning, collaboration and partnerships that Mr Fyfe believes will be the key to delivering a renewable energy future.

“ ere’s a lot that needs to be done,” he said.

“And it’s the power of people and the sector working together that’s been able to change the system.”

But Mr Fyfe stresses that collaboration doesn’t mean an

echo chamber – and it’s important to have a diverse range of voices and opinions in the conversation.

“I’ve sat on energy panels and had disagreements with the audience, and that’s really enjoyable because challenging our thought processes with di erent views is what will get us through the next 50 years,” he said.

e cost of renewable energy is no stranger to the spotlight, but a key point that Mr Fyfe said is o en overlooked in the energy conversation is the fact that Australia’s thermal power stations, particularly its coalred ones, are reaching the end of their service life and need to be replaced – regardless of whether we transition to renewable energy or not.

“If wind farms and batteries didn’t exist, we would be having to invest a lot of money to replace those assets that are reaching their end of life anyway,” he said.

“We o en talk about how expensive renewables are, but even if we could build a 1000MW coal- red power station in the current market, it’d be a lot of money.

“Large power stations also don’t work very well in a renewable market where you have to ramp up and down very quickly. And I think that discussion sometimes gets lost.”

Views on the Federal Government’s 2035 interim emissions targets have been incredibly diverse across the sector, but Mr Fyfe said that it’s important to have both people saying that they’re too low, and people saying that they’re too high.

“Having that diversity of opinion is good, because that’s when the real issues come to the fore, and where ideas come from. I think a target should always be challenging, because that’s what drives you,” he said.

“ at’s what the sector is all about. It’s all about collaboration between people with very di erent points of view.”

For Mr Fyfe, it’s clear that the future is built on relationships, not just between utilities but at an industry and individual level too – it’s vital that we nurture those partnerships and support everyone to succeed.

“What we try to do at Genus is build long-term relationships with our clients – when we’re not just building a battery project, we’re building a close trust so

that we can move on to the next project with that client,” he said.

“It’s not just about price; it’s about bringing value to the table. And the energy sector needs everyone to be involved.”

As a former client of Genus, Mr Fyfe said that he could always pick up the phone and have an honest conversation with Mr Riches about any challenges – and that willingness to jump in and work together to solve issues was what he really enjoyed about working with the team.

“I’ve been on the other side of the fence, so I bring a client perspective to things,” he said.

“I know what the pressure feels like when a project is running a bit behind.”

ere’s no doubt that Genus has the engineering expertise to deliver great results, but that success is underpinned by its talented team.

For Genus to grow, it needed to not only attract, but nurture the next generation of talent, and Mr Fyfe said that doing so means creating a work environment that people love to be in.

“We’re really committed to increasing our apprentice and traineeship intake, and local training is something that we’re looking at as well,” he said.

“I always say that if I have 1800 people who come to work, do a job that they really enjoy, get rewarded and recognised appropriately, and go home safe and happy to their family, then we will have an amazing business, and that’s what we’re working to do.”

“And doing that comes down to leadership.”

A business’s culture starts at the executive level, and for Mr Fyfe, leadership isn’t about having a title, and he always has an open-door policy that applies to everyone –from the board to the cleaning team.

“I’ve never liked having a title,” he said.

“Mateship is one of our core values, and what that word is about is we make sure our environment is very welcoming for anybody and everybody. Everyone looks out for each other – and when times get tough everybody jumps in together.

“Dave Riches’ happy place is underneath the transmission line, and he’s one of the team. And that’s where our culture really stems from.”

A er he was injured in Bali, Mr Fyfe experienced rsthand just how important it was to have a team and a workplace that supports you.

“I was working at Telstra at the time and they were fantastic,” he said.

“My family had to y out from Scotland and Telstra ew over senior managers just to meet with my family and tell them that they’d look a er me, even if I had to have a year o work.”

In fact, it was a Telstra CEO, David odey, that inspired Mr Fyfe’s approach to leadership.

“If he went out to a call centre in Perth and met a sta

member with sick family member, then the next time he was in Perth, he would remember that person. He was very calm, very personable and very approachable and that’s what I’ve always aspired to be,” he said.

“To be a leader you’ve got to love people. All throughout my career I’ve interviewed people for senior management roles, and when I ask people why they want to be a leader the answer is usually something like ‘it’s the next logical step’, but they forget that as a leader you’ve got to be willing to spend time with people, to invest in people and accept that people are very di erent.”

It’s important to start from a place of trust, and Mr Fyfe’s advice is to remember that your job as a leader is to empower people to do their job and be there to support them.

“ e vast majority of people just want to come to work and do something they enjoy – very few people want to do the wrong thing. As a leader, you’ve got to nd what gets them out of bed every day, what drives them, and then nd jobs that they’re really good at doing,” he said.