A D O P T E D

B U D G E T

HTAPS S

A D O P T E D

B U D G E T

HTAPS S

Professionalism

We will demonstrate knowledge and competence in our work, respect for others, and dedication to ethical behavior.

Accountability

We will accept and expect personal responsibility for our words, decisions, and actions.

Teamwork

We will communicate, collaborate, and unify around common goals.

Honesty

We will provide full transparency from policy through implementation.

Sustainability

We will provide services that assure ongoing organizational, financial, and environmental preservation to meet the needs of the present without compromising the future.

Safety

We will safeguard our community, people, and property.

The Mayor, Council Members and Employees of the City of Peachtree City recognize that our primary responsibility is to provide high quality services to our residents. We are therefore committed to:

Ensuring residents a safe and healthy environment in which to live, work and enjoy leisure time

Providing consistency in the delivery of municipal services in a fiscall y responsible manner

Responding in a courteous, timely, and effective manner to the expressed needs, concerns, and expectations of our residents

Promoting a sense of community through family oriented activities and citizen involvement

A baseline should be set and serve as an agreed upon point of departure for subsequent budget discussions i.e.: a new facility or service.

Any additional services above the baseline shall be fully funded at the time of the adoption of the annual budget and ongoing funding sources shall be clearly identified. Such ongoing funding sources must be either new or increased revenues or clearly identified expense reductions.

Peachtree City continues to deliver Uncompromised Excellence by aligning our budget with the City’s Strategic Pillars: a safe, family-friendly community, an active, healthy community, an attractive community, a thriving, resilient business community, and a city organization that is innovative, high performing, and sustainable. The FY2026 Proposed Budget is designed to maintain strong service levels, responsibly manage growth, and invest in the long-term health of our community.

The FY2026 General Fund is proposed at $57.9 million, a 2.7% increase over FY2025. Revenues and expenditures remain balanced, with no expected use of reserves or increase to reserves. Over the past 13 years, the City’s millage rate has decreased by 1.338 mills, which is $5,416,728.43 of annual savings to our residents city wide. This reflects our commitment to fiscal discipline while continuing to meet community expectations. This year’s budget has been shaped by the new Statewide Floating Homestead Exemption, which freezes homesteaded property values at FY2025 levels for FY2026. While this limits revenue growth, it provides tax relief for our homeowners. Non-homesteaded properties will be assessed at fair market value, but with a full rollback, those properties are receiving tax relief as well.

When comparing property taxes across all Fayette County jurisdictions, the differences are small. On a median-valued home in Peachtree City ($508,732), the monthly property tax bill is about $498.78. That is about $15 less than Tyrone and $14 less than Fayetteville per month. Even unincorporated Fayette County, which does not provide the same level of city services, is just $34 per month cheaper than Peachtree City—less than the cost of most monthly utility bills.

What makes this comparison important is not just the cost, but the value of what residents receive by living in Peachtree City. Peachtree City provides its own Fire and EMS services directly, which are nationally recognized for quality. If those services were not delivered directly by the City, residents would pay more for Fire and EMS through county taxes and receive less quality services in return. This is why our municipal rate appears higher than some others—because we fund these essential services ourselves. When accounting for that,

Peachtree City residents pay less for Fire and EMS than the rest of Fayette County while receiving better services.

Put another way: of the total monthly taxes due, only about $99.26 goes to the City of Peachtree City but if you moved to unincorporated Fayette County, you would not save $99.26 per month. You would save $34.25 per month because services that Peachtree City now provides to you would then start to be charged to you by Fayette County instead.

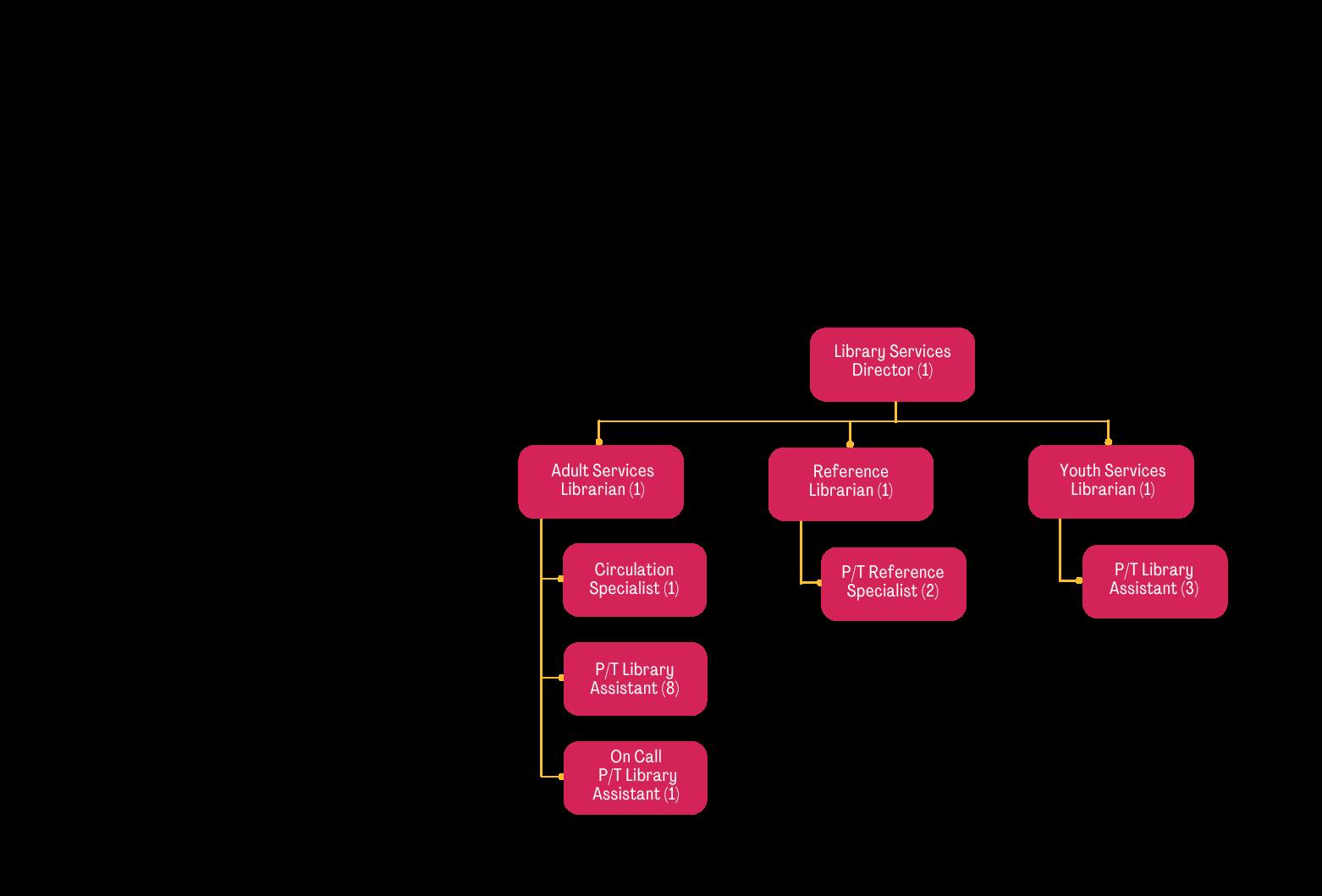

Most importantly, you would not receive the level of services that you currently receive in Peachtree City. Your dollars fund advanced police accreditation and one of the safest cities in the state, ISO-1 fire protection, one of the fastest response emergency medical service providers in the state, more than 100 miles of multi-use paths, one of the busiest public libraries in the state, grounds maintenance of our entire city, and extensive parks and recreation amenities, plus more. For just over a dollar more per day, residents enjoy a safer, healthier, and higherquality community—demonstrating that Peachtree City remains both a cost-effective and value-rich place to call home.

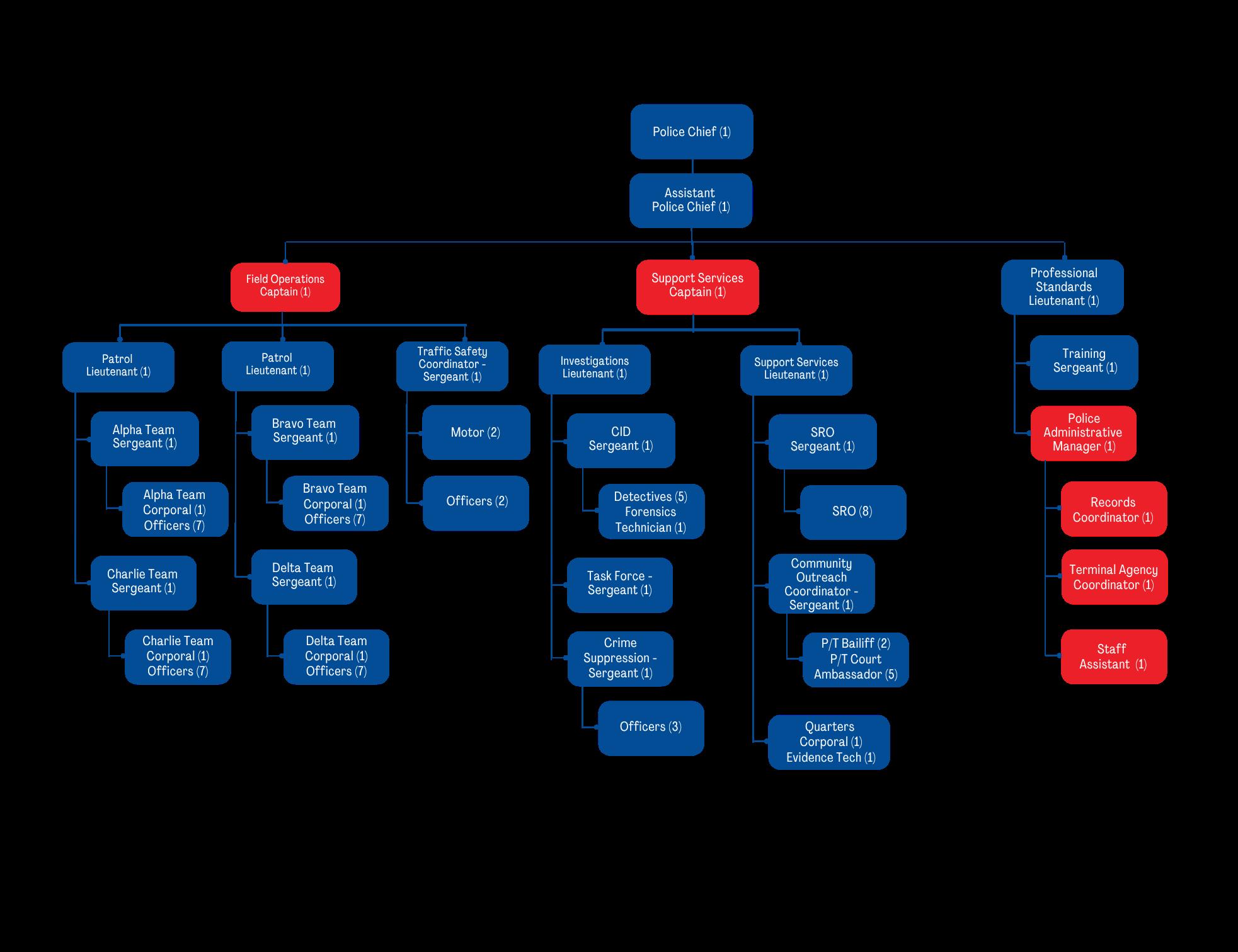

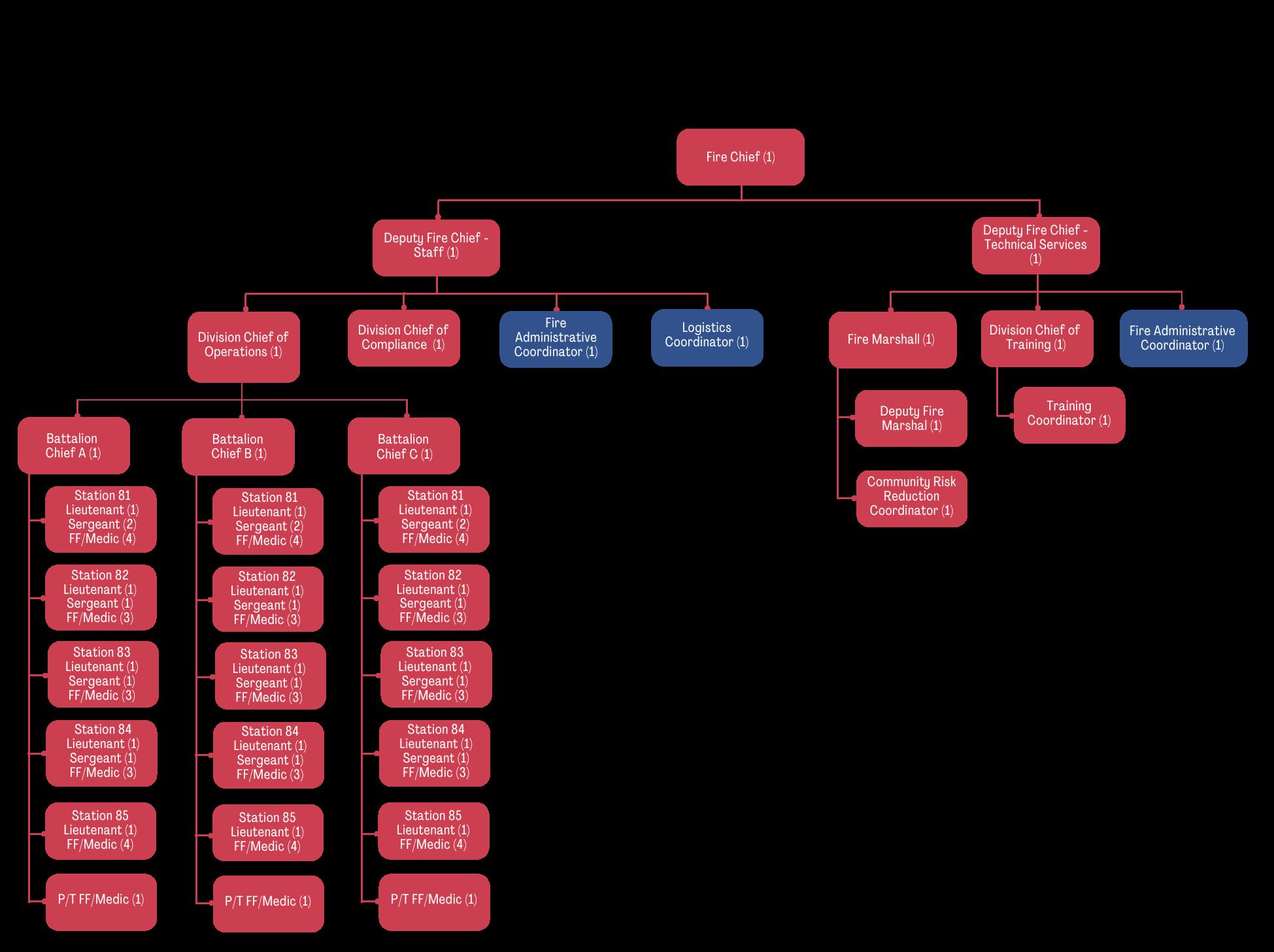

• Public Safety: Three new firefighter positions and the reclassification of three police roles.

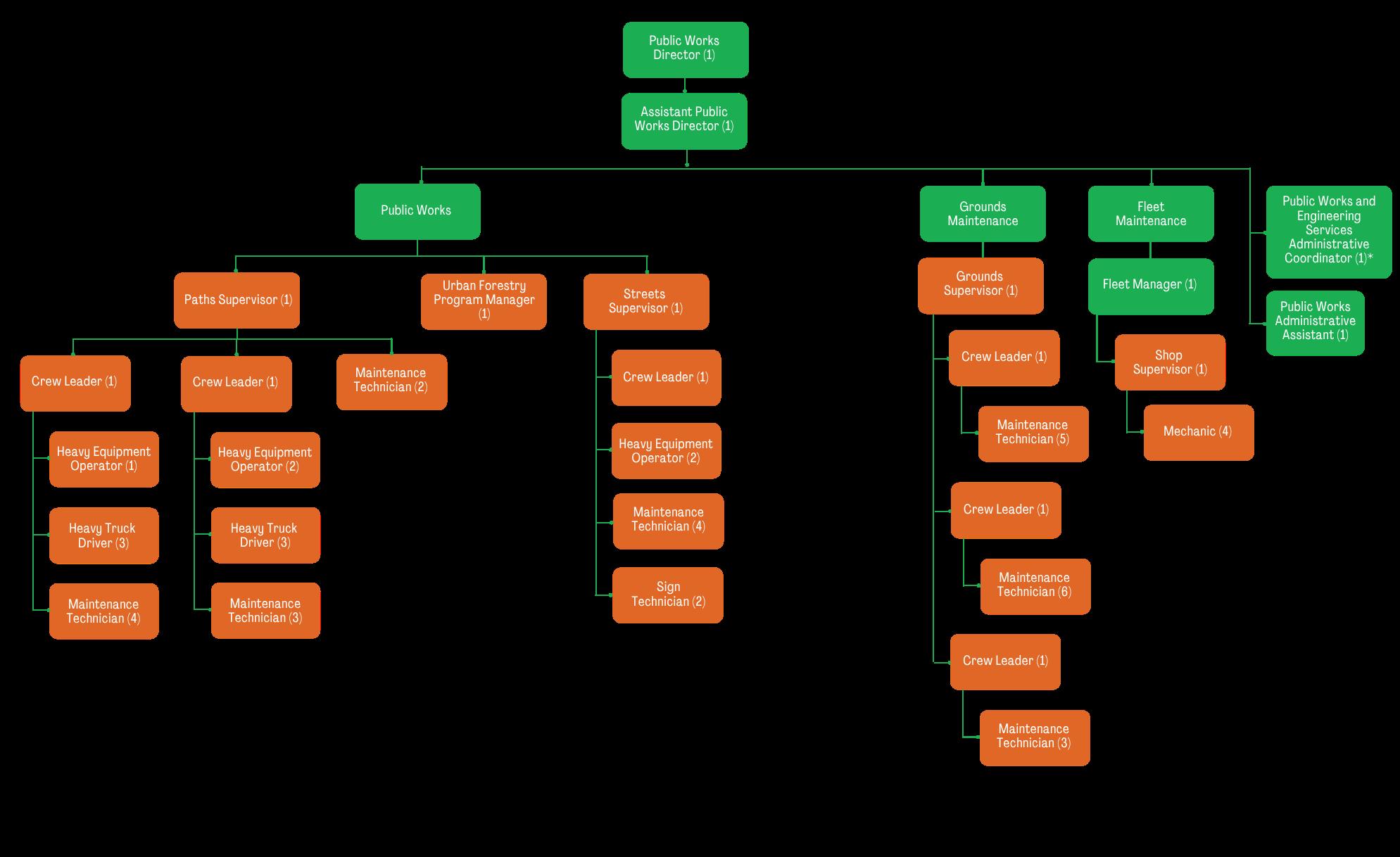

• Public Works: One new equipment operator for consistent street sweeping.

• Capital Projects: Facility improvements, police vehicle replacements, technology upgrades, and new Library HVAC.

• Employee Compensation: A 2% cost-of-living adjustment (COLA) ensures competitiveness in a challenging labor market.

• Stormwater Utility Fund: $2.9 million budget, including $600,000 for renewal and extension projects.

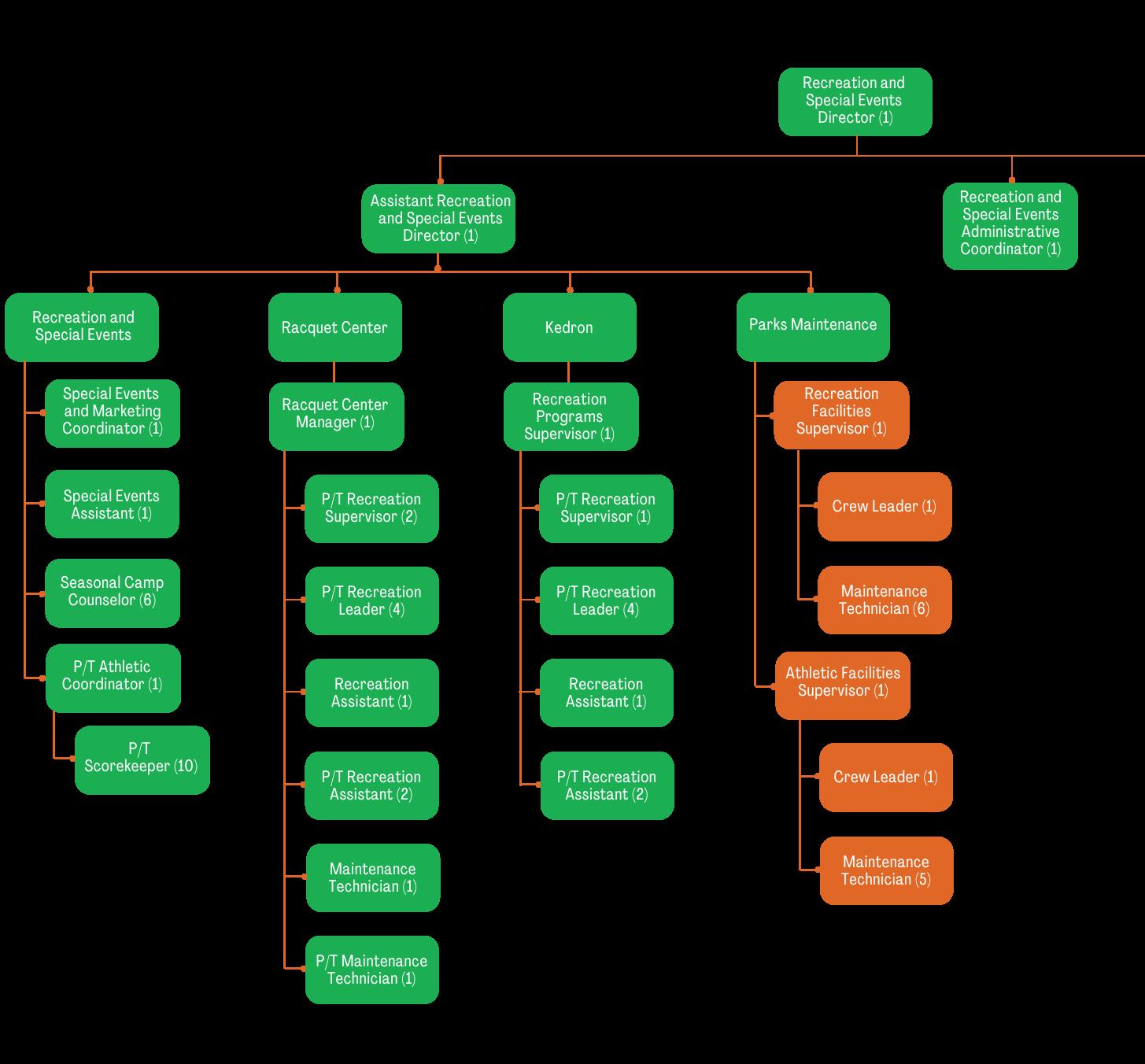

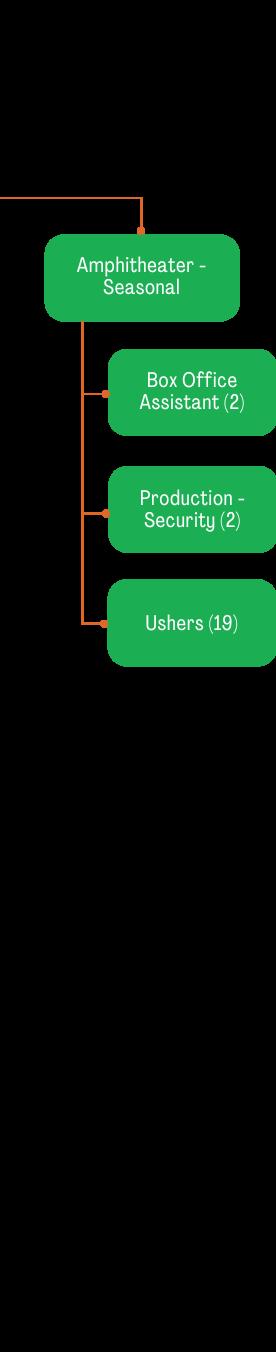

• Amphitheater Fund: $2.0 million funded through ticket sales, sponsorships, and hotel/motel tax revenues.

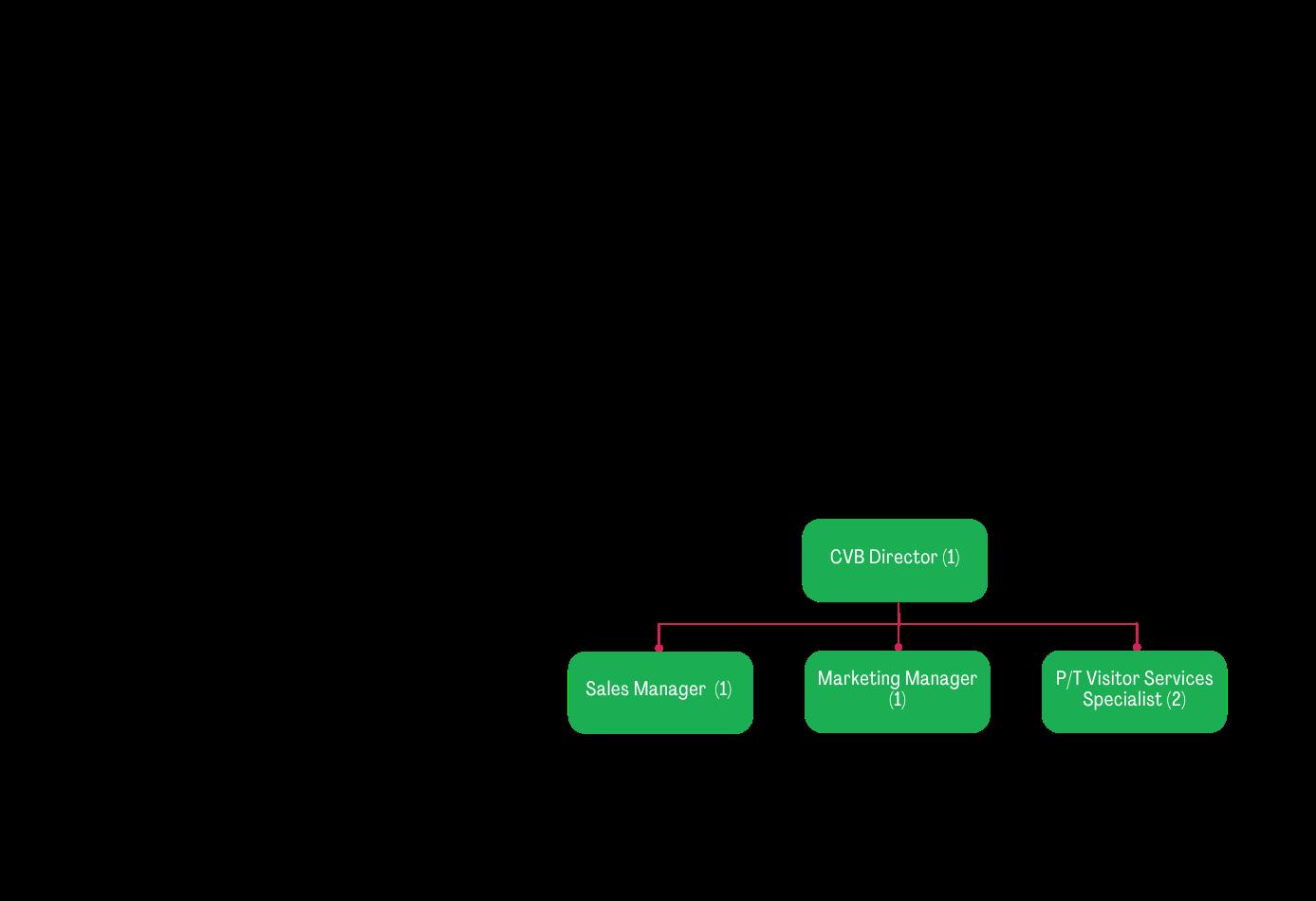

• Hotel/Motel Fund: $2.1 million budget, divided between the Convention & Visitor’s Bureau, the Tourism Product Development (TPD) Fund, and the General Fund.

• Impact Fees: $4.1 million available, primarily dedicated to new path projects.

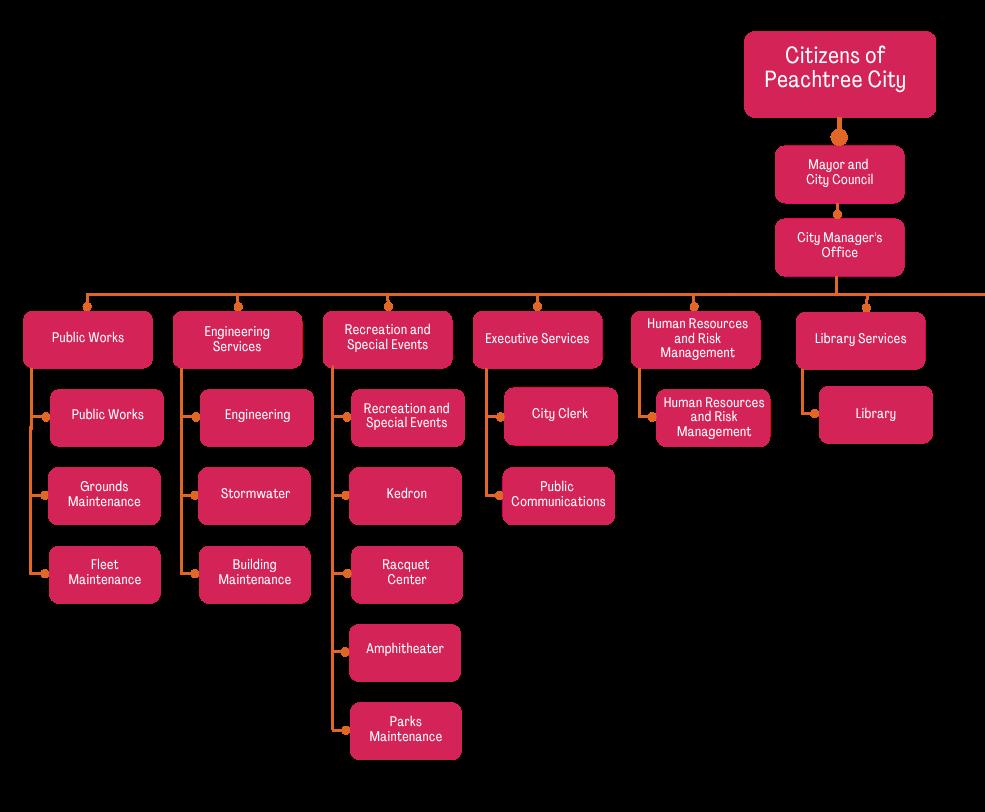

Peachtree City manages more than 200 miles of streets, 100 miles of multi-use paths, 4,800 traffic signs, 29 tunnels, 36 bridges, 280 neighborhood entrances, 95 miles of pipe, 8,000 drainage structures, 100 detention ponds, 40 parks, with 3,048 acres owned (18% of land in the city) and nearly 400 employees serving over 40,000 residents. Sustaining these assets requires continued investment in people, infrastructure, and innovation.

Our path forward emphasizes:

• Keeping pay at the 85th percentile for employee retention.

• Encouraging smart economic development.

• Investing in safety, maintenance, and service sustainability and stability.

• Engaging citizens through our citizen volunteer advisory groups and programs like PTC 101 and Slice of the City.

The FY2026 Budget reflects a balance of fiscal prudence and strategic investment, ensuring Peachtree City remains a safe, vibrant, and sustainable community for families, businesses, and future generations.

Respectfully submitted,

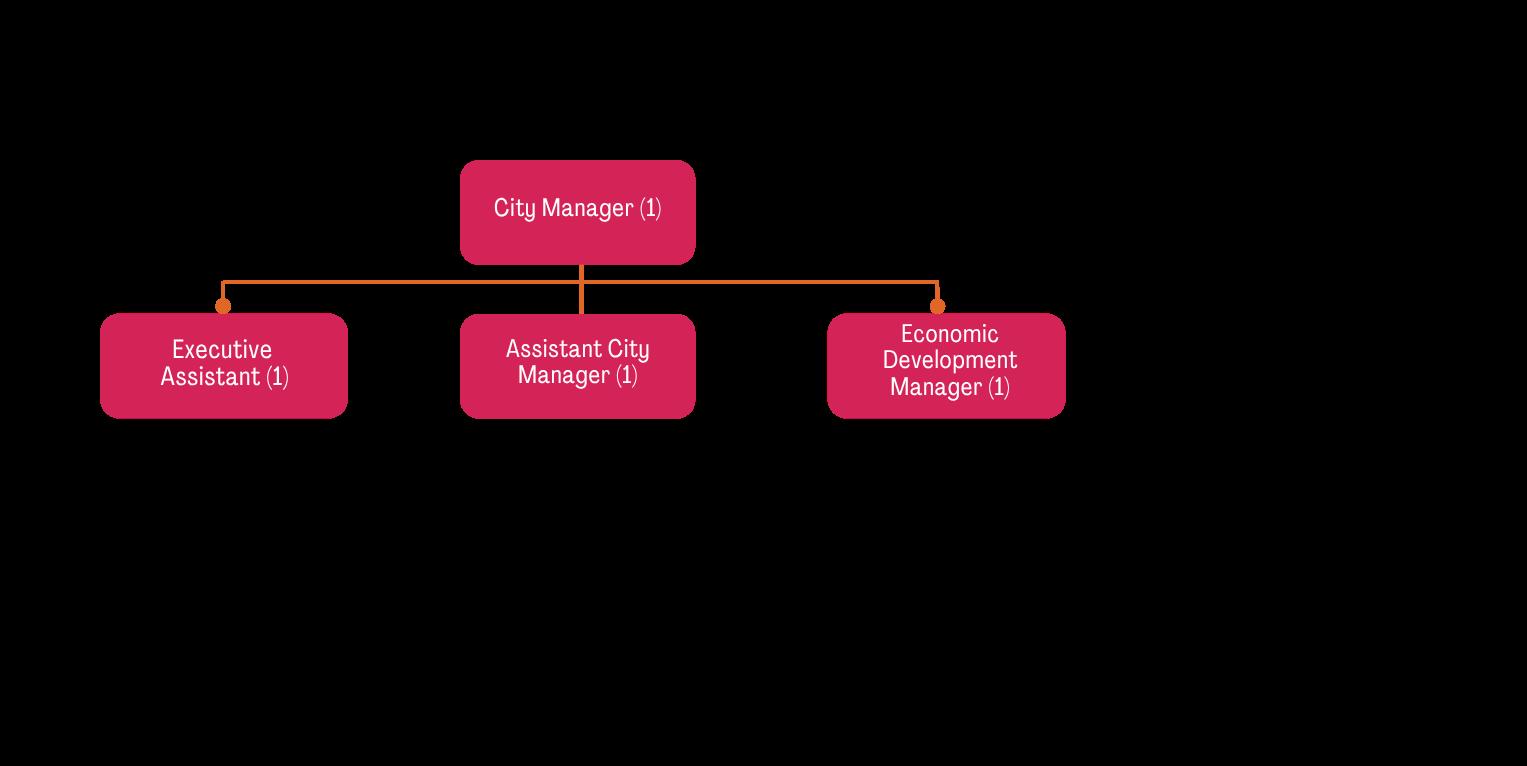

Justin Strickland City Manager

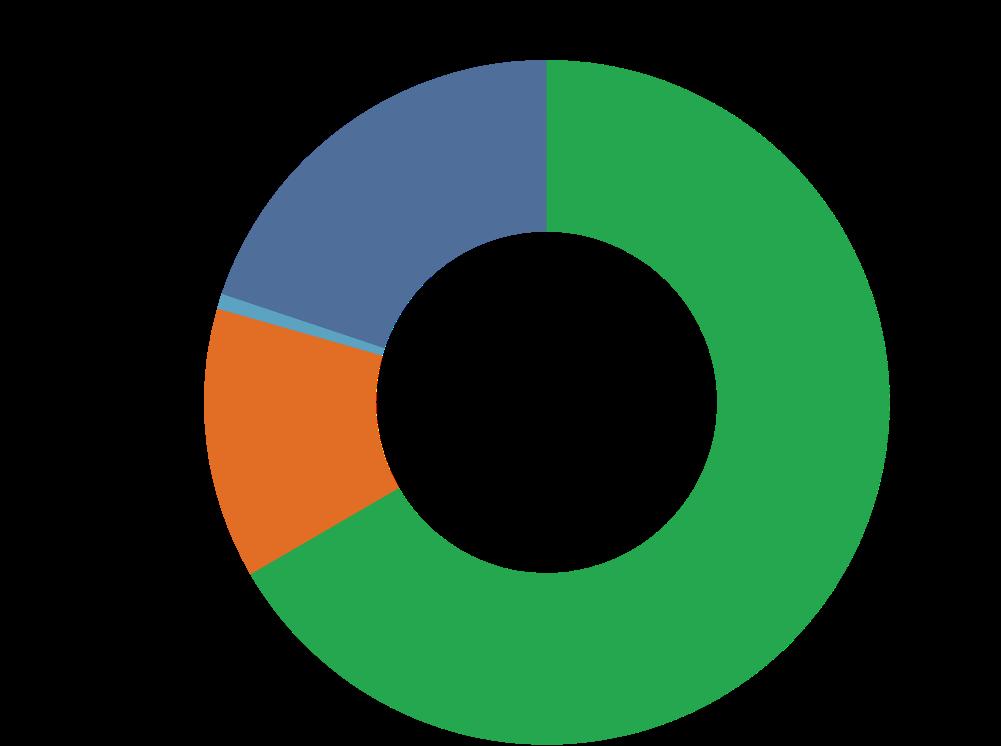

TOTAL DUE FOR A HOME VALUED AT $508,732 IN 2026

On a total annual property tax bill of $5,985.33, two-thirds (66.6%) is dedicated to the Fayette County Board of Education, which levies 19.60 mills for maintenance and operations. About one-fifth (19.9%) of the property tax bill supports Peachtree City maintenance and operations, ensuring high-quality public safety, infrastructure, and local amenities. Together, the Board of Education and the City account for approximately 13/15 of a homeowner’s total property tax obligation. The remaining 2/15 of the property tax bill (13.5%) is directed to Fayette County for County maintenance and operations and E-911 services. This breakdown highlights that while property taxes are often viewed as a single payment, they are in fact distributed across multiple local entities, with the City of Peachtree being only a 19.9% portion of it, that collectively provide education, safety, and quality of life for our residents.

When comparing final property tax bills for a home with a market value of $508,732 across Fayette County’s jurisdictions, the differences are surprisingly small. Peachtree City’s total annual property tax burden is lower than both Tyrone and Fayetteville, with all three municipalities falling within $177 of each other. In fact, across the entire county, the difference between the highest and lowest tax bills is less than $590 per year. Put another way, the daily cost of property taxes (Schools, County, and Municipal) is $16.40 in Peachtree City, $16.88 in Tyrone, $16.85 in Fayetteville, $15.95 in Brooks, and $15.27 in Unincorporated Fayette County or Woolsey. This means that living in Peachtree City costs only $1.13 more per day than living in the lowest-taxed jurisdictions—a gap that has narrowed from $1.38 over the past two years. The conclusion is clear: regardless of jurisdiction, the cost of living in Fayette County is nearly the same from a property tax standpoint.

Peachtree City has maintained a long tradition of fiscal responsibility, carefully managing the millage rate to balance service delivery with taxpayer affordability. While rates rose during the Great Recession to sustain essential services, the past decade has been marked by a series of millage rate reductions and stabilization efforts. Since reaching a peak of 7.178 mills in 2012–2013, the City has steadily lowered the rate, bringing it closer to long-term historical averages. These reductions have been made possible by several positive trends: steady growth in the City’s tax base, strong expansion in the industrial and commercial sectors, and significantly higher sales tax revenues. In fact, Local Option Sales Tax (LOST) collections have grown by more than 80% since 2013, complemented by SPLOST revenues that continue to support capital investments which removes that burden from the General Fund. Together, these factors have allowed the City to reduce and stabilize the millage rate while still maintaining financial strength and delivering the highquality services that residents and businesses expect.

LOST continues to be one of Peachtree City’s most important and reliable revenue sources. Collections have grown steadily over the past decade, increasing from $6.5 million in 2013 to more than $11.8 million in 2024, with projections around $12.5 million in 2025 and forecasted to rise to nearly $15 million by 2030. This growth reflects both the strength of Fayette County’s retail economy and the city’s ability to capture sales tax contributions not only from residents but also from visitors and shoppers throughout the region. On average, LOST revenues have grown by approximately 5–6% annually, helping the City offset inflationary costs and reduce the millage rate over the past decade. These funds are critical in supporting general operations, public safety, multi-use paths, parks, athletics, and infrastructure, ensuring that a portion of the cost of City services is shared broadly across all who engage in our local economy, rather than falling solely on property owners.

$14,000,000

$12,000,000

$10,000,000

$8,000,000

$6,000,000

$4,000,000

$2,000,000

5 Year Financial Model

Sources of Funds:

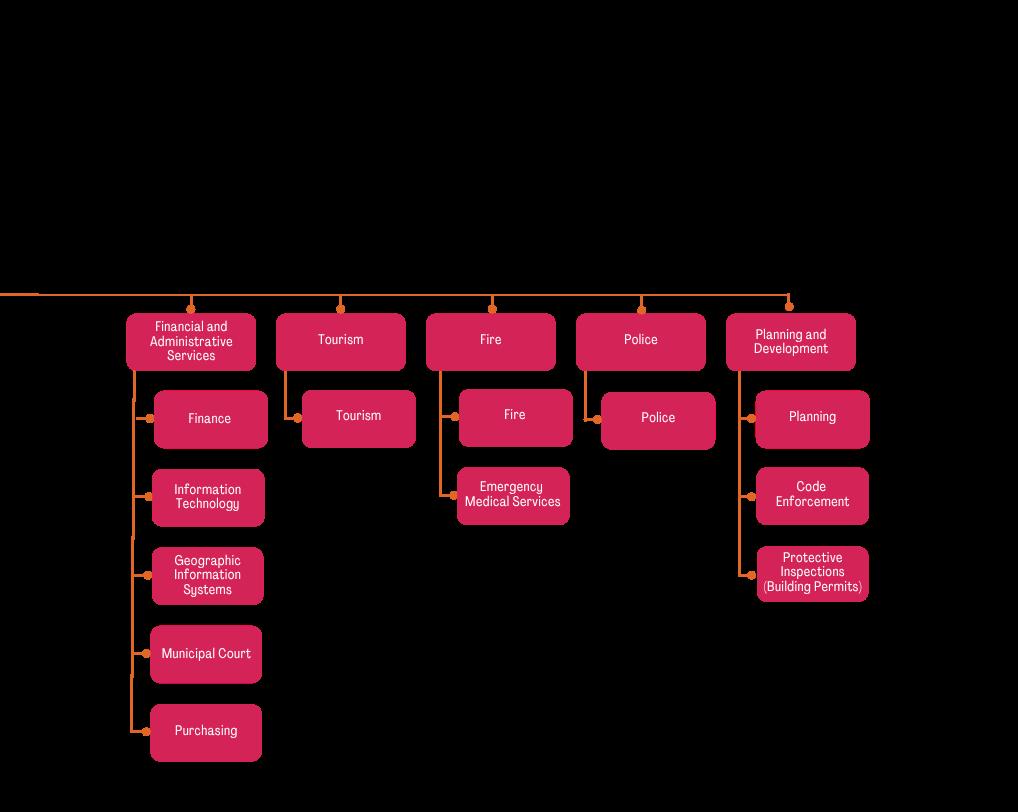

LIBRARY ADMINISTRATION

TOTAL LIBRARY ADMINSTRATION

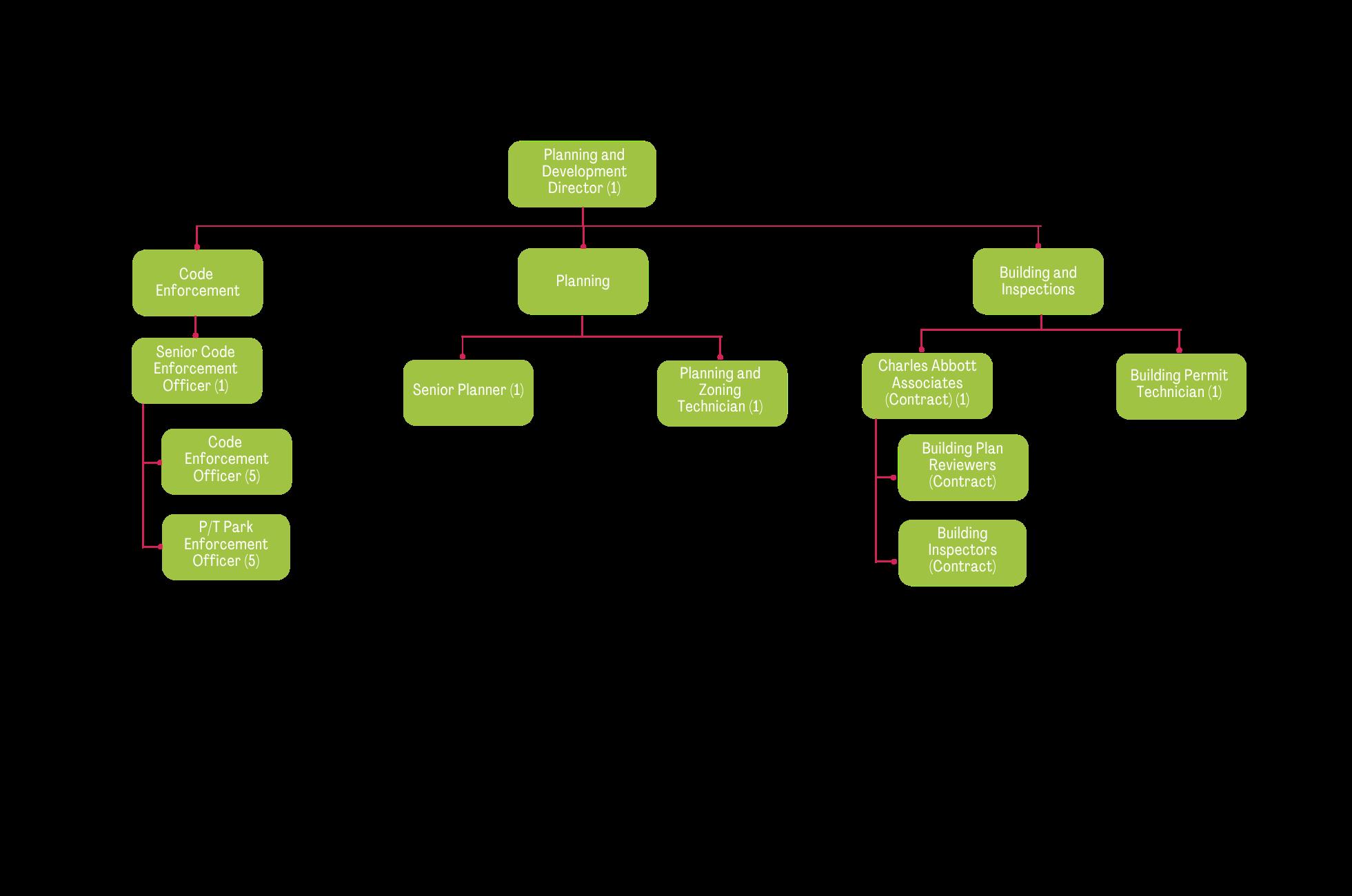

PROTECTIVE INSPECTION ADM PLANNING DEPARTMENT

CODE ENFORCEMENT

TOTAL PLANNING & DEVELOPMENT

TOTAL DEPARTMENT BUDGETS

GENERAL ADMINISTRATION BUDGET LIABILITY INSURANCE

CONTINGENCY-

CONTINGENCY - FACILITIES MAINTENANCE

CONTINGENCY - GEN'L ADMIN.

TOTAL GENERAL ADMINISTRATION 954,665

OPERATING TRANSFERS

PAYMENT TO KPTCB - RECYCLING 0 PAYMENT TO AIRPORT AUTHORITY 0

OPERATING TRFR TO CIP FUNDS

OPERATING TRFR TO FUND 400 2,850,195

TOTAL INTERFUND TRANSFERS

DEPARTMENTAL SAVINGS (813,980) 763,147 3,613,342 58,716,255 57,902,275

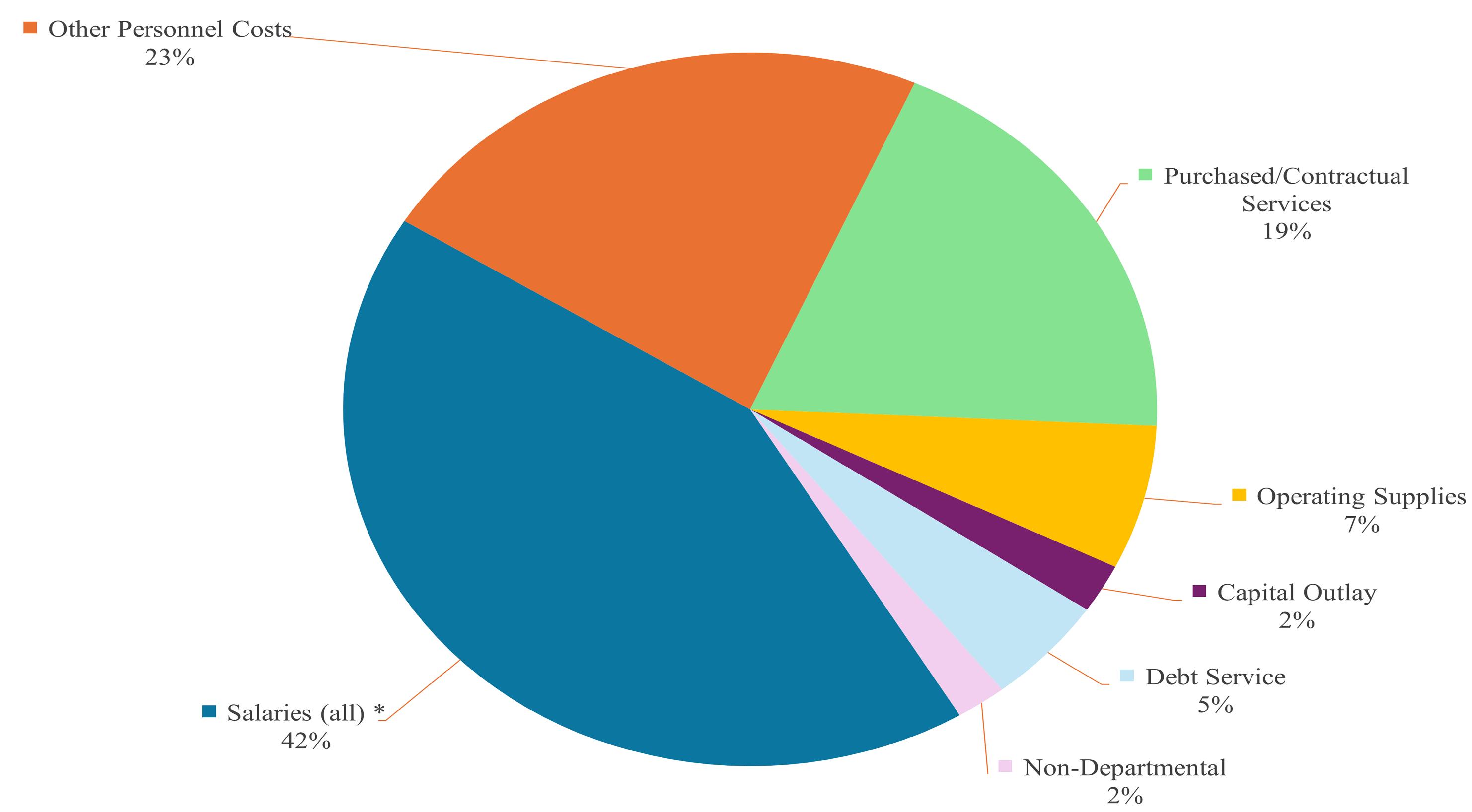

Public Works & Grounds, $7,468,703, 13%

Fire/EMT, $14,000,451, 24%

Recreation & Special Events, $6,014,911, 10%

Library Administration, $1,364,655, 2% Planning & Development, $1,900,898, 3%

General Admin/Transfers/Savings, $908,832, 2%

Debt Servcie, $2,850,195, 5% City Manager/Economic

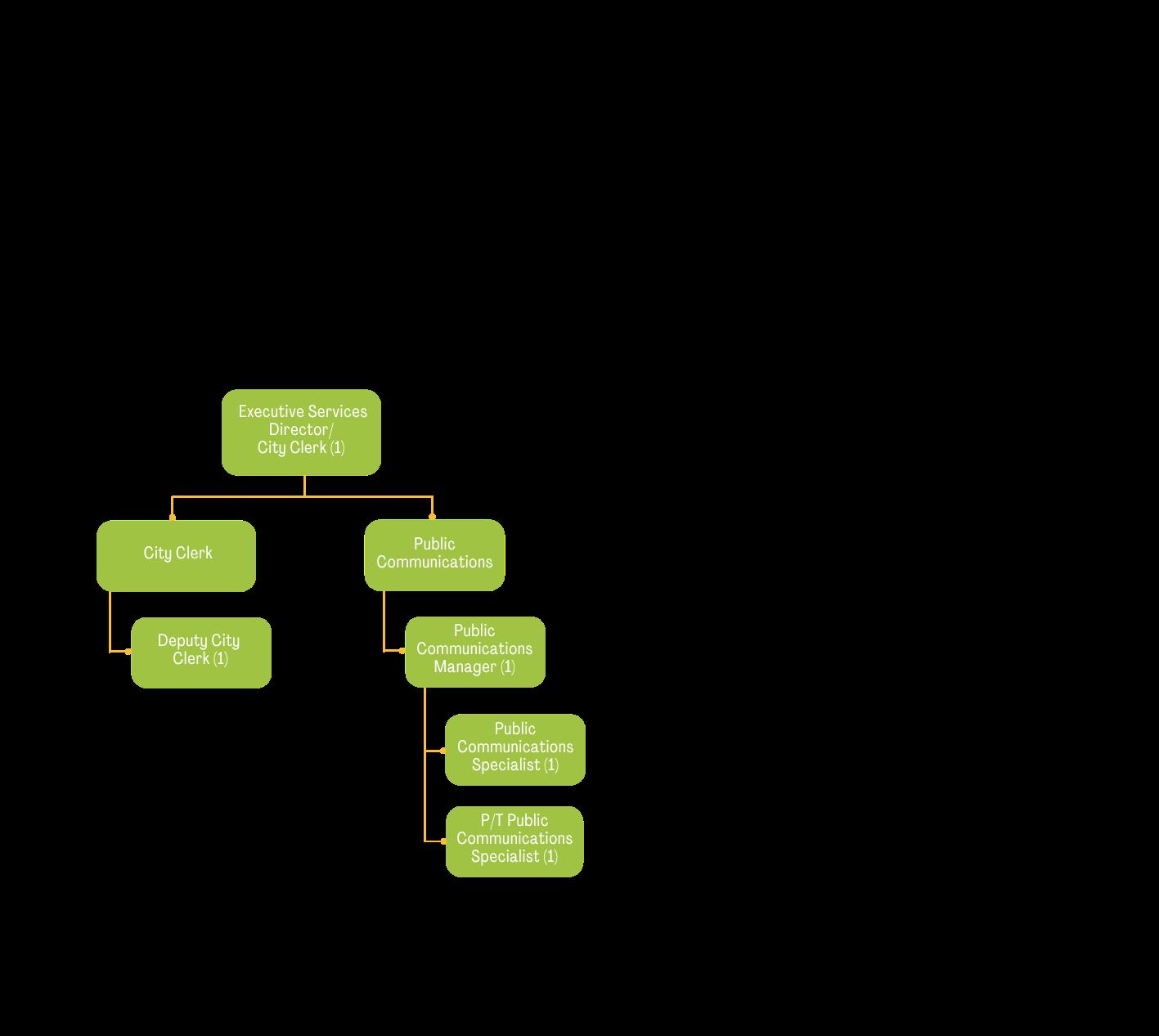

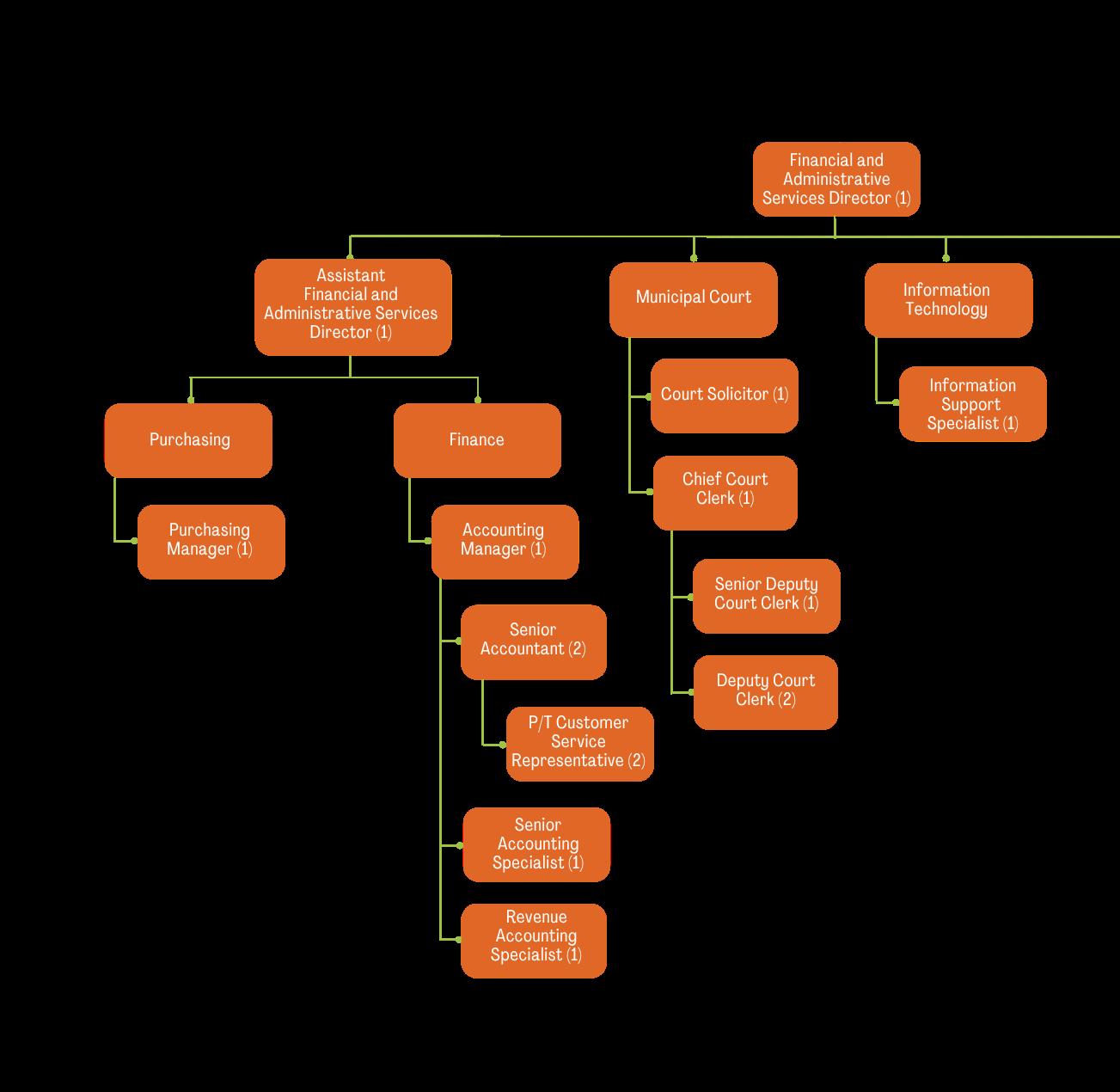

Development, $1,106,654, 2% Executive Services, $1,172,528, 2% Financial & Administrative Services, $5,125,853, 9%

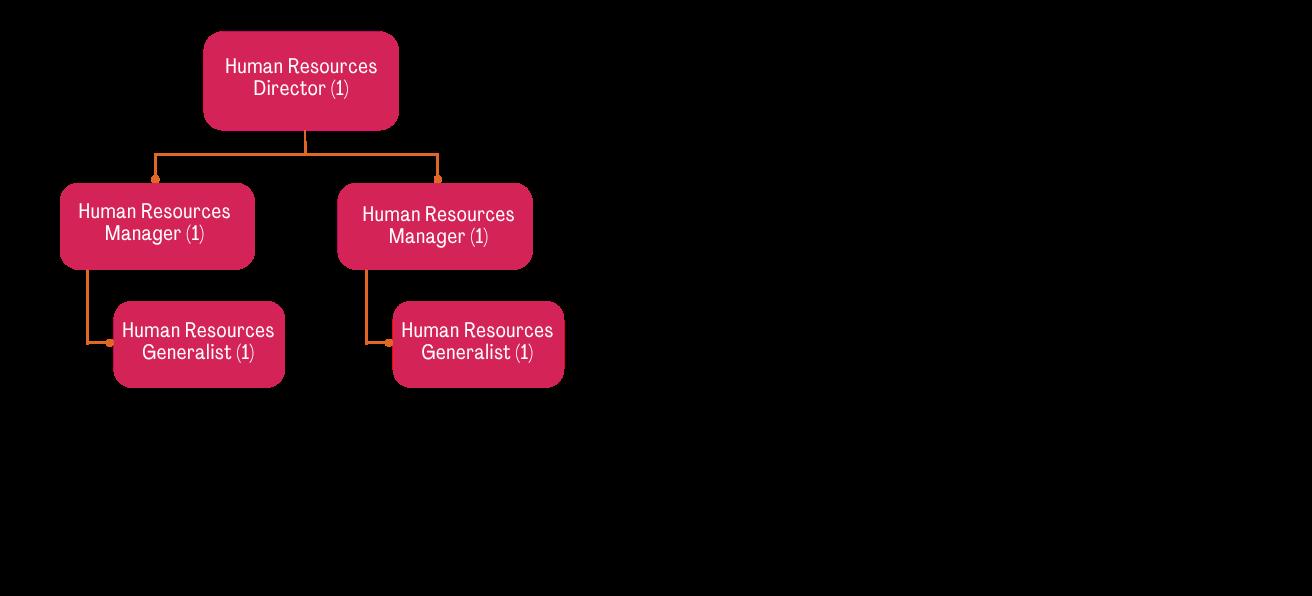

Human Resources, $989,009, 2% Engineering & Facilities Maintenance, $2,255,081, 4% Police , $12,866,610, 22%

511100 REGULAR SALARIES

511101 HOLIDAY PAY

511125 SALARIES - TRAINING

511135 SALARIES - K-9 HANDLING

511200 PART TIME/TEMPORARY EMPLOYEES

511300 OVERTIME SALARIES

511310 ON-CALL PAY

579145 SAVINGS

23,551,513.00

Personnel

512100 GROUP INSURANCE - HEALTH

512101 GROUP INSURANCE - L/T DISABILITY

512102 GROUP INSURANCE - DENTAL

512103 GROUP INSURANCE - LIFE

512105 GROUP INSURANCE - FIRST RESPO - CAN/PTSD

512200 SOCIAL SECURITY

512300 MEDICARE

512400 DEFINED BENEFIT PENSION

512401 DEFINED CONTRIBUTION PENSION

512500 TUITION REIMBURSEMENT

512600 UNEMPLOYMENT INSURANCE

512700 WORKERS COMPENSATION

512900 CELLPHONE STIPEND

512910 CLOTHING ALLOWANCE

512925 FSA ADMIN FEES

Total Other Personnel Costs 13,304,327.00

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continued - Supplies

Continue on the following page.

Continue on the following page.

DEPARTMENTAL

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

Continue on the following page.

City of Peachtree City

Fund: 275 HOTEL / MOTEL TAX FUND 0000 Taxes 275-0000-314100

1505

2,108,539.00

Fund: 276 HOTEL/MOTEL - TPD FUND 0000

1505

(232,750.00) (100.00)

(232,750.00) (100.00)

(232,750.00) (37.06)

0.00 (30,000.00) (100.00) 0.00 (138,760.00) (100.00) 0.00 (150,000.00) (100.00) 0.00 0.00 0.00

0.00 (172,298.12) (100.00) 0.00 (491,058.12) (100.00) (320,351.00) 232,750.00 (42.08) 395,351.00 (232,750.00) (37.06)

(232,750.00) (37.06) 0.00 0.00

2,644,597.00 2,503,890.00 (232,750.00) (8.50)

2,644,597.00 2,503,890.00 (232,750.00) (8.50)

2,503,890.00 (232,750.00) (8.50) 2,503,890.00 (232,750.00) (8.50)

Financed Equipment

John Deer 5060e Tractor

Zero Turn Mowers (2 @ $14,000)

F150 Admin Vehicle

F150 PU Truck Replace (5003)

Capital Projects

Kedron Aquatic Center Carpet Replacement

Kedron Aquatic Center Interior Door Replacement

Kedron Fieldhouse HVAC Unit RTU3

Meade Girl's Softball Mens & Womens Restroom Floor resurface

Meade Lacrosse Mens & Womens Restroom Floor resurface

PAC Soccer Consession - HVAC replacements

PAC Upper Pinwheel Mens & Womens Restroom Floor resurface

PAC Lower Pinwheel Mens & Womens Restroom Floor resurface

Financed Equipment

Misc. Software/Hardware Upgrades

HP Nimble Storage Replacements

Cisco Switch Replacements (Core Infrastructure)

Data Center UPS Replacements

PC Replacements

Backup Storage Device Replacment

Financed Equipment

Patrol Vehicles (10 @ $85,000)

Finger Print Machines (2 @ $20,000)

PD Evidence Storage (cell phone info)

Financed Equipment

Replace Staff Vehicle (22026) 2015 Intercepter (Glennie)

Replace Staff Vehicle (22025) 2015 Intercepter (Winkles)

New cardiac monitor

Capital Projects

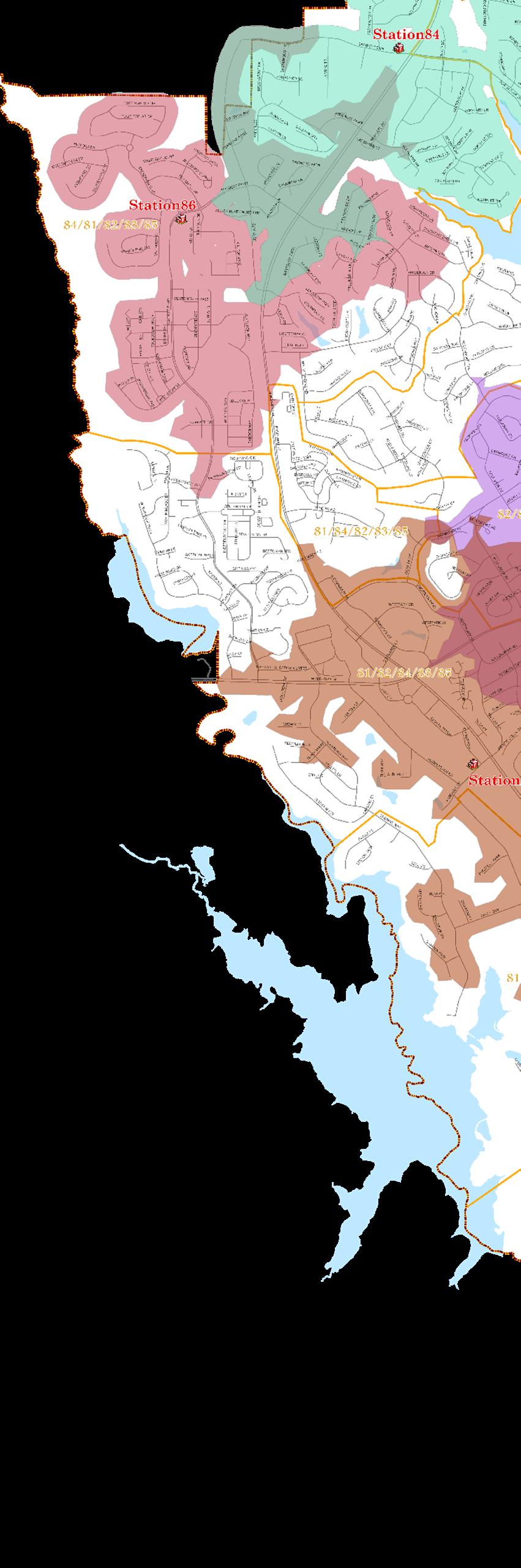

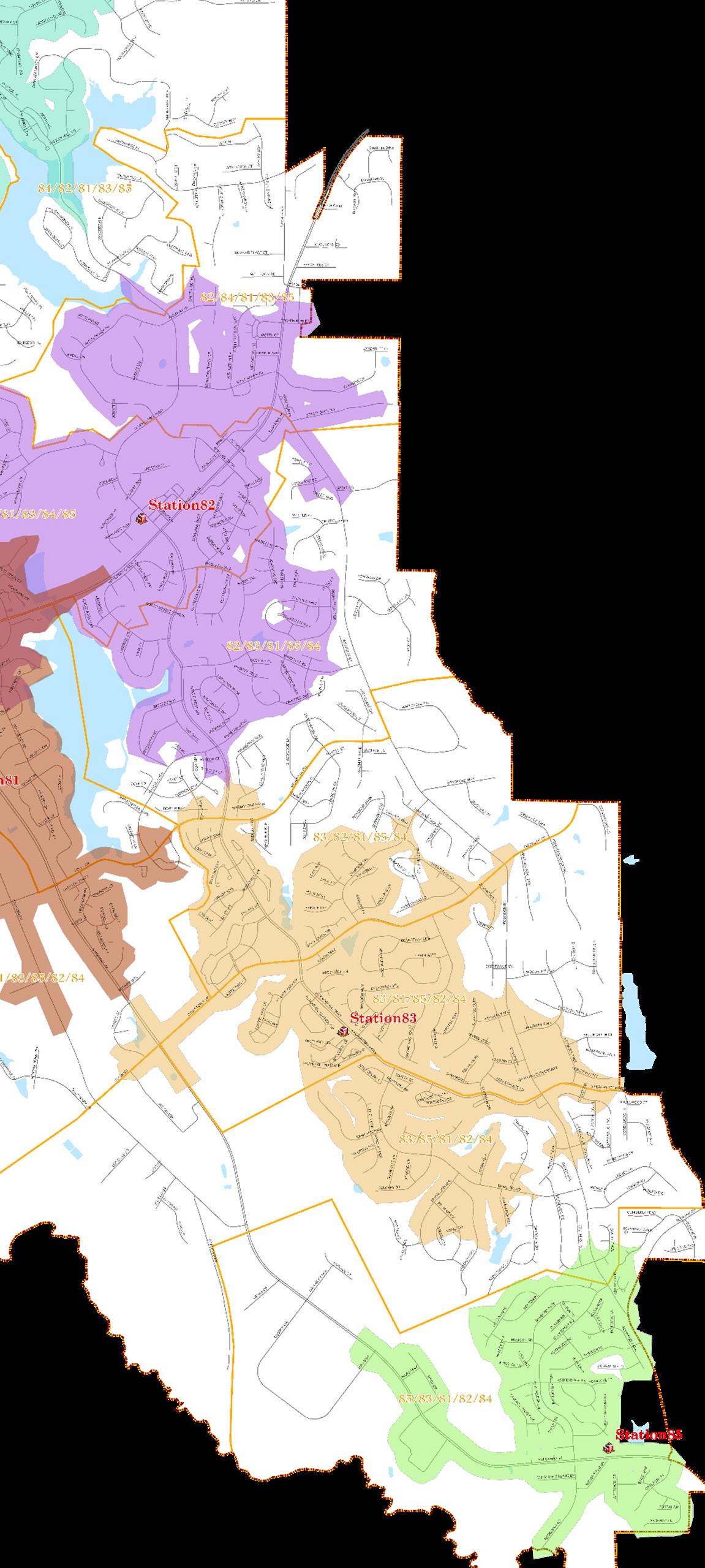

Station 84 HVAC

Station 81 Renovation

PEACHTREE CITY

GENERAL LONG-TERM DEBT PRINCIPAL AND INTEREST DUE

As of September 30

Leases Totals

Grand Totals

13,597,519.48 Ties with Debt Service Schedule for Bonds, Notes, & Leases

City of Peachtree City

Basis

(3)Only

521-4250-344271

521-4250-344272

521-4250-344273

05/30/2025 02:13 PM Page: 1/6

1,343,257.00

1,390,257.00 600,000.00 (82,073.79) (12.03)

521-4250-581100

3,458,831.21

05/30/2025 02:13 PM Page: 4/6

Fund: 565 AMPHITHEATER FUND 6180 Purchased & Contracted Services

565-6180-521210

565-6180-521300

565-6180-561000

05/30/2025 02:13 PM Page: 5/6

565-6180-573107

565-6180-573111