Annual Report 2025

We are PARRA

Our story began in 1947, when the Parramatta Eels first entered the Sydney Rugby League competition and ignited a powerful spirit in Western Sydney.

Since then, Parramatta Leagues has been more than a club. We’ve been a cornerstone of the community – supporting the mighty Eels, fostering local pride, and bringing people together through sport, wellbeing, and belonging. It’s our legacy, and it lives in everything we do. But our journey is far from over.

PARRA is the next chapter – a unified identity that brings all our venues, people, and purpose together. We believe in putting people first. Our purpose is to support our community – to be a beacon for our members and fans, and to keep our club at the forefront of entertainment, connection, and care.

We stand by our community in all its forms – backing local causes, championing grassroots sport, and inspiring pride for the blue and gold. Every experience at PARRA is built with our people in mind, because their joy is our mission.

As we grow, our strength lies in unity. We’re creating places where everyone can belong, be uplifted, and make lasting memories.

This is PARRA – here to inspire, unite, and uplift our community with heart.

Meet the board

Darren Adam | Director

Stephen Bull |

Phil Sim | Director

Greg Monaghan | Director

Richard Foda |

Sue

Back row

Front row

President’s report

It is an honour to present my first President’s Report for the PARRA Group. I begin by sincerely thanking Greg Monaghan for his outstanding service as President. His leadership has shaped the strong organisation we are today, and we are pleased he will continue contributing on the Board. We also acknowledge Joy Cusack for her valued service as a Director, and warmly welcome Stephen Bull, who joins us on the Board, stepping in to Joy’s position.

Our Club continues to thrive, with over 65,000 members, 33,000 Eels members, and a 65-year legacy of connection. Our purpose remains clear, to strengthen our community through sport, entertainment, and belonging. I am pleased to report that the Club has once again achieved a successful financial outcome, reflecting the strength of our operations, the loyalty of our members, and the dedication of our team. The group delivered an Operating Profit (EBITDA) of $17,323,406 and Net Profit of $21,012,128. We continue to remain debt free and have commenced building reserves for stage 1 of the Parramatta LIVE, the new Clubhouse development. This was achieved while also contributing to grassroots sports, junior league, and naturally, the NRL and NRLW Eels.

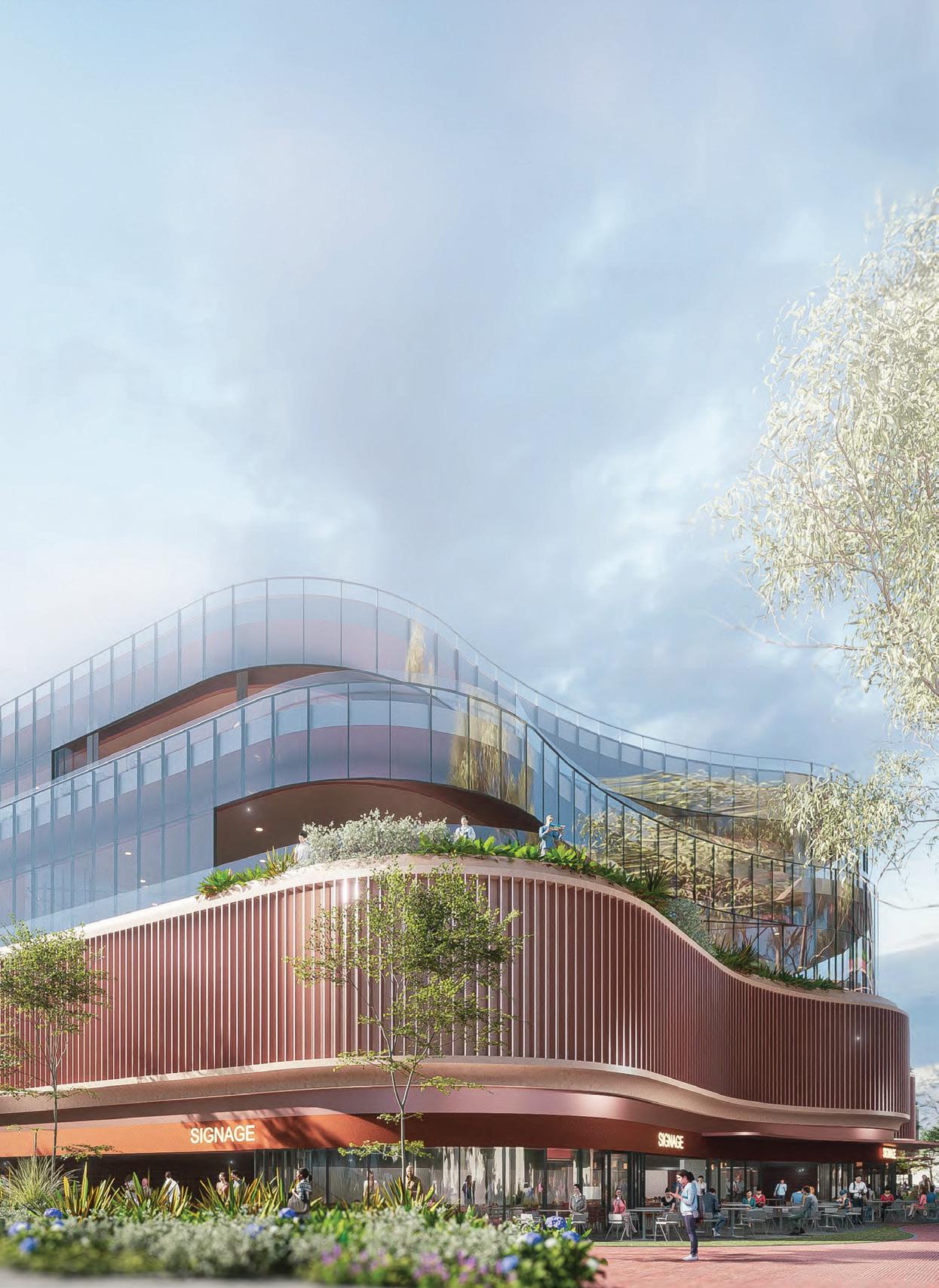

This financial strength has also enabled us to move forward to the next milestone in the masterplan phase, lodgement of the Development Application for Parramatta LIVE in August 2025, a transformative entertainment, dining, and accommodation precinct set to bring exciting new experiences for the members of our group, and to the community.

Our hospitality venues — Parra Leagues, Viking Sports, and Dural Club — have also enjoyed record visitation. The launch of Dural Kitchen has reinvigorated the venue, creating a vibrant hub for locals to gather and enjoy.

And upgrades to Vikings and at Parra Leagues have meant that members experienced new revitalised outlets, food and beverage offers and of course a variety of promotions. We also proudly introduced the PARRA Masterbrand, uniting our sports, venues, and programs under one identity that celebrates belonging, diversity, and wellbeing across Greater Western Sydney.

As we celebrate our achievements, we also pause, honour and reflect with sadness the passing of Life Foundation Members Norm Simmons and John Hugh Lyons, whose lasting contributions will always be remembered.

On the Rugby League side, another major achievement was the opening of the $70 million Centre of Excellence and Community Centre at Kellyville, the world’s largest rugby league training facility and Australia’s first gender-equal elite complex.

On the field, we have much to celebrate, starting with winning the Flowers Memorial Trophy once again (the top club award in the NSWRL) which achievement highlights our consistent success across the entire club structure, not just a single team. Under new Head Coach Jason Ryles, the men’s program has embraced fresh energy and unity, while our NRLW team continues to inspire with their skill and determination. With strong playing groups and rising talent, optimism is high.

My sincere thanks go to CEO Chris Dimou and his dedicated team, and to PNRL President Matthew Beach, CEO Jim Sarantinos, and the Eels organisation for their continued partnership. Together, through the spirit of PARRA, we will keep inspiring, uniting, and uplifting our community with heart — building on our proud legacy and creating experiences that bring Western Sydney together.

Our purpose remains clear: to strengthen our community through sport, entertainment, and belonging.

Mark Jenkins President

Mark Jenkins

CEO report

The 2025 financial year has been one of progress, milestones, and momentum for the PARRA Group.

After the distraction of a costly failed Extraordinary General Meeting (EGM) our efforts have been squarely focused on what we do best, supporting our members and our community. We introduced Eels Lane, a dynamic new venue for members, continued to enhance Vikings by updating the club and its food and beverage offerings, and subsequently began collaborating with local authorities on initiating the Development Application (DA) for Parramatta LIVE.

Proudly this DA was submitted in August 2025 and is currently with council for feedback and endorsement. Parramatta LIVE is a visionary project set to transform the precinct featuring a landmark new clubhouse that has long been requested by members and the wider community. In addition, the development will include a culinary hub, outdoor gathering spaces, premium hotel, family entertainment venue, Youth Hub, and flexible conference facilities. Parramatta LIVE will cement the area as a centre for business, culture, and community connection. As I conveyed to members at last year’s Annual General Meeting (AGM), delivery of this Masterplan project will be a marathon not a sprint.

Another major highlight was the launch of Dural Kitchen at Dural Club, creating a vibrant destination where members can gather, graze, and connect. This investment reinforces our commitment to delivering exceptional experiences in welcoming, inclusive spaces. As we reflect on 2025, our progress across key strategic pillars has strengthened our foundation and positioned us for a bright future.

Why we are now focusing on EBITDA

We are placing greater focus on EBITDA, a non-IFRS measure, because in the Directors’ opinion it reflects the true strength of the Club’s dayto-day operations — how well we are performing before the impact of financing costs, tax and accounting items such as depreciation, essentially our net operating cash. This provides a clearer picture of the Club’s operational health and long-term sustainability, which is critical to protecting members’ interests. While statutory (net) profit remains important as the final bottom line, EBITDA helps us better understand performance, make smarter decisions, and build a stronger future for our members. We note that these adjusting items are required to be included in statutory profit under Australian Accounting Standards.

Our people & culture

Our people remain at the heart of our success. This year we saw strong staff engagement, reflected in improved eNPS and positive survey results. Investment in learning and development remains a priority, with 26 staff completing Certificate III, 13 completing Certificate IV, five completing a Diploma of Leadership, and eight participating in our Advanced Development Program. Tailored development plans for operational staff ensure our team has the skills and support to deliver exceptional member experiences.

Our financial strength

We have maintained a robust financial position that ensures long-term stability. Group total assets reached $195,211,408, up $24,840,825 from last year, with member funds increasing to $153,219,828 and a continued zero net-debt position. Our Clubs achieved strong operational results, with licenced Club EBITDA of $16,861,494 and Net Profit of $12,042,262. This strength enables ongoing investment in our people, community, and visionary projects across Greater Western Sydney.

Our member experience

Member experience is the cornerstone of success, and it begins with our people. Our members’ wellbeing underpins everything we do. Our strategic intent is to be leaders in the industry in responsible gaming by embedding safer gaming practices into every aspect of our operations, from venue design, staff training, member engagement and data-driven risk monitoring. The introduction of digital membership cards has been another enhancement to members’ experience and has been a standout success, strengthening engagement and simplifying access to rewards. Every initiative is designed to ensure members feel valued, supported, and connected to the PARRA community.

Our operational excellence

Operational excellence means working smarter for our members and community. By streamlining processes, using data insights, and applying best practices, we’ve enhanced efficiency and responsiveness. Understanding trends and refining workflows delivers seamless experiences and strong business performance—supporting both daily operations and future growth.

Our community impact

Creating meaningful community impact remains core to our mission and over the past year, we partnered with local organisations to amplify that impact. Additionally, our dedicated employees contributed significant volunteer hours to initiatives that make a real difference. These efforts reflect our ongoing commitment to foster connections, support those in need, and strengthen Parramatta and Greater Western Sydney. We will continue to develop programs that empower, unite, and uplift the community for generations to come.

In closing, I want to extend my heartfelt gratitude to our PARRA Board of Directors for their invaluable support. I am deeply appreciative of Group President Mark Jenkins for his guidance and leadership since June, and I want to recognise Greg Monaghan for his exemplary service as President for nearly six years. Additionally, I thank Joy Cusack for her unwavering commitment and significant contributions to our Club, particularly over the last 6 years as Director. Joy, you will always be an integral part of the PARRA family. I would also like to express my sincere appreciation to Eels President Matthew Beach and the PNRL Board, as well as CEO Jim Sarantinos, for their commitment on and off the field. I am equally grateful to our leadership team and all our employees, whose commitment ensures that each experience is both positive and memorable. The future of the PARRA Group is full of promise. Together, we will continue to building on our achievements inspire, unite, and uplift our community, and reaching new heights in the years ahead.

241 employed contributing significantly to the economy in the region

8,523 training hours Our people Financial strength Member experience

$21M Profit $132M Revenue

65,025 club membership

783,088 club visits

9,622 new members

$11M Investment in all Venues and Parramatta LIVE Masterplan

624 volunteer hours by staff

$1.39M community donations from PLC Operational excellence Community impact

Parramatta LIVE

A New Chapter for Our Club and Our Community

For decades, parra leagues has been more than a building—it has been a place where families gather, friends connect, and memories are made. As we look to the future, we are excited to share the next chapter: a brand-new clubhouse that will serve our members and community for generations to come.

This year, we reached an important milestone by lodging the Development Application. While construction is still on the horizon, we are already imagining the possibilities for our members: spaces that are welcoming, vibrant, and designed to bring people together.

The new Parramatta LIVE precinct has been carefully planned to enhance the way our members experience the Club. Open, lightfilled dining areas, casual social spaces, and welcoming family zones will make it easy to gather, celebrate, and enjoy time together.

A dedicated Youth Hub will support young people, providing programs and spaces to inspire and nurture the next generation of Western Sydney leaders. Flexible function and event spaces will offer members more ways to come together for celebrations, milestones, and community events.

This project is guided by the voices of our members. Your feedback has shaped every part of the design—from accessible spaces to green courtyards, from intimate corners and lively gathering areas. Significant trees will be preserved, landscaped spaces enhanced, and public areas improved— creating a Club that feels open, connected, and alive with community spirit.

The new hospitality venue is about more than architecture—it is about people’s lives. It is about shared meals, laughter, celebrations, and support through life’s milestones. It is about creating a space

where generations of families can gather, where young people can learn and grow, and where every member can feel at home.

As we move closer to construction, the excitement is tangible. This Club will be a place where connections are strengthened, memories are made, and experiences are shared. It will be a hub for families, friends, and neighbours—a true home for our community.

We can’t wait for our members to enjoy the spaces we have imagined together: to share meals, celebrate special moments, support young people, and simply spend time with each other. This new hospitality venue is our promise to you—a space that inspires, unites, and uplifts everyone who walks through its doors.

Eoin Gubbins

General Manager

Dural Club

Dural Club Dural Kitchen: A vibrant new dining destination bringing our community together

Dural Club has enjoyed an exciting year with the launch of Dural Kitchen, a fresh and vibrant culinary experience designed for members to gather, graze, and enjoy time together. The new dining space has quickly become a destination in its own right, offering a relaxed, welcoming environment where friends and families can connect over delicious food. The “gather and graze” concept encourages members to explore a variety of dishes in a shared setting, enhancing the dining experience and fostering community.

Alongside Dural Kitchen, the Club has hosted a wide range of functions—from

Will Corbett

General Manager

birthdays and anniversaries to milestone celebrations. A standout highlight was a wedding, showcasing how our spaces cater to elegant, unforgettable occasions while keeping the warm, inclusive atmosphere members love.

Our team is passionate about creating outstanding experiences, whether in beautifully designed function spaces or in Dural Kitchen. Members can look forward to more opportunities to connect, celebrate, and create lasting memories in a welcoming, vibrant environment.

Parramatta Leagues Club

A

year of energy, excitement, and exceptional experiences for our members

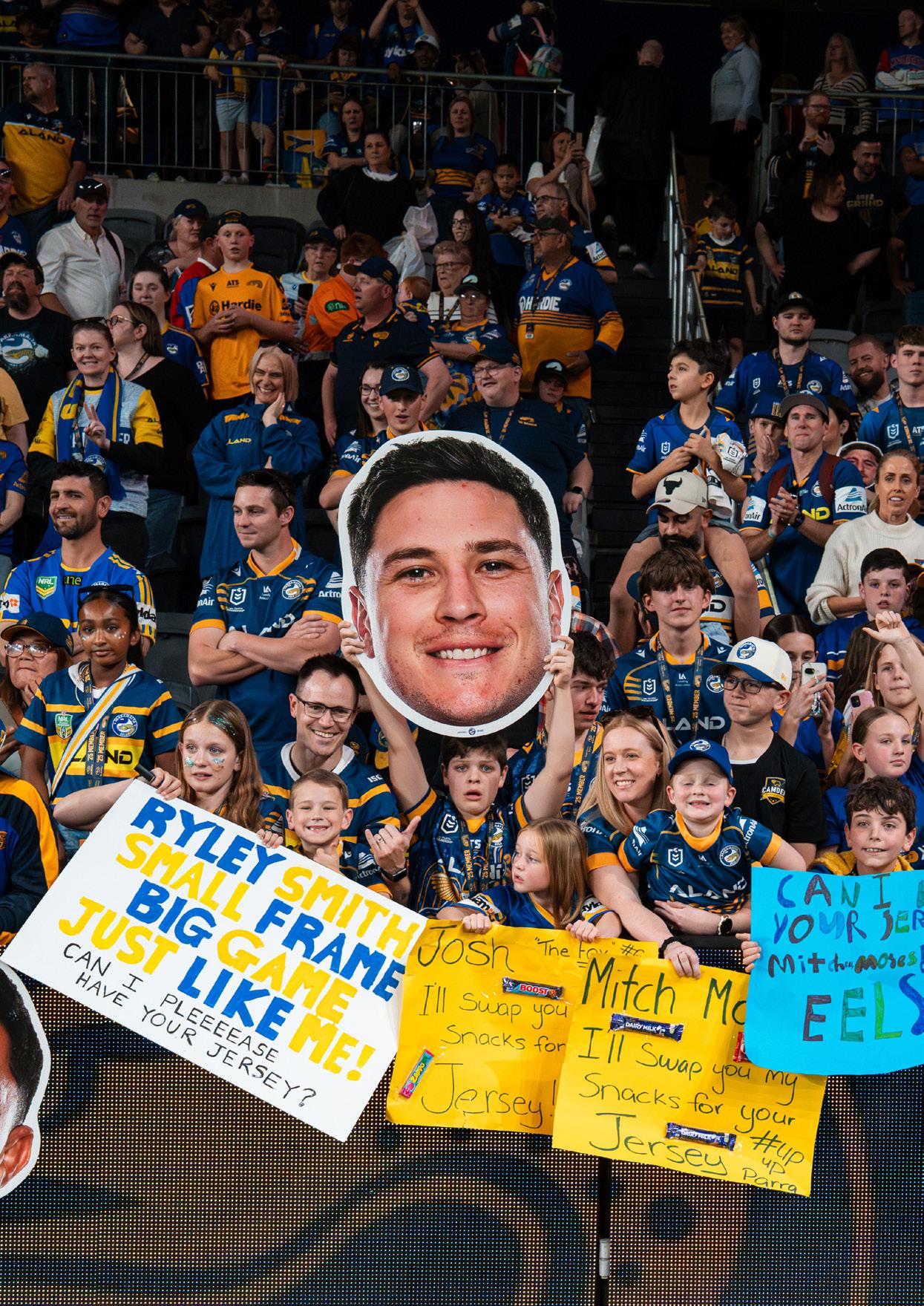

Parra Leagues Club has enjoyed another fantastic year, filled with energy, great food, and moments that brought our community together. It was a huge season at CommBank Stadium, with Eels supporters and visiting Panthers and Tigers fans packing the precinct. We made every home game special with music, marching bands, and a fun, welcoming game-day atmosphere across the Club.

Our Masterclasses were a highlight, with members diving into pasta, dumpling and Oktoberfest-themed cooking sessions— sharing skills, laughs, and great memories.

Promotions like “Your Adventure Awaits” and the “Cash Car Carnival” added extra excitement, rewarding members with incredible prizes while keeping the Club buzzing.

Our chefs also shone in the Perfect Plate Awards, showcasing the creativity and quality behind our dining experiences. Looking ahead, we will continue building on this momentum with more engaging Masterclasses, exciting promotions, and award-winning food—giving our members even more reasons to connect, celebrate, and enjoy Parra Leagues.

Parramatta Leagues Club

Vikings Sports Club A year of family fun, community spirit, and memorable moments

Vikings Sports Club continues to be the local destination of choice – a welcoming, value-driven venue for families and our community. This year’s Halloween Kids Disco brought more than 150 families together for a night of costumes, music, and laughter. Family Fun Day was another highlight, featuring rides, jumping castles, a petting zoo, and visits from the local fire brigade and army, along with a Cougars BBQ and a car show from local enthusiasts.

We were also proud to support the World’s Greatest Shave – a cause close to one of our team members’ families, who have been personally affected by cancer.

Our members rallied behind the effort, reflecting the generosity and spirit of our community.

For adults, standout events, including wine degustations, offered relaxed and social experiences.

Looking ahead, we will continue delivering engaging events, family-friendly activities, and memorable moments for our members.

Daniel Graham General Manager Vikings Sports Club

2026 - 2030 Strategic Plan

Our focus for the future - Parramatta LIVE

We will commence with Stage 1: an iconic new clubhouse, which will be a destination our members love. The vibrant, welcoming community precinct where every visit brings joy, connection and pride, now and for generations to come.

Culture of trust & safety

Our strategic intent is to lead the industry in responsible gaming by embedding harm minimisation into every aspect of our operations, from venue design and staff training to member engagement and data-driven risk monitoring. We aim to set the standard in accountability and governance to ensure every member feels safe and confident.

Our purpose, mission & vision

Our vision

To provide a network of premium hospitality, entertainment, sporting, and complementary businesses and services for the benefit of our members, fans, and community.

Our mission

Creating memorable experiences that give our members, fans, and community reasons to cheer.

Our purpose

We bring together our community, support local causes, sport, and the Parramatta Eels to promote wellbeing, happiness, and pride.

Our brand promise

Inspire, unite, and uplift our community with heart.

Our values

We lead through serving one another, our members, and community, with excellence.

We bring passion to what we do and strive for excellence.

We demonstrate integrity, openness, honesty, accountability, and courage.

We are welcoming, inclusive, and respectful.

We work together to achieve unity and success through collaboration.

Strategic objectives

Our people and culture

Build a caring, high-performing, culture driven team that puts members first and delivers excellence through the Parramatta LIVE transformation and beyond.

Our member experience

Deliver exceptional, personalised experiences that make every member feel recognised, valued, and proud to belong.

Our financial strength

Secure a strong financial future so we can keep investing in the experiences, spaces, and programs our members love.

Our

commitment

to responsible entertainment

Deliver premium entertainment that is firmly anchored in our core principle of member wellbeing.

Our community

Strengthen our positive impact by supporting wellbeing, inclusion, and sport across the communities we serve.

How we’ll deliver for our members

Build Parramatta LIVE

Create social, entertainment, dining, and community spaces — all shaped by your feedback, so every visit is welcoming and enjoyable.

Member experience

We will use technology, data and member insights to deliver a higher level of service through effortless connections and personalised experiences, strengthening relationships with members and ensuring every interaction is meaningful, relevant and deeply connected to our community.

Growing beyond gaming

Exploring new opportunities and experiences that align with our purpose and depeen our connection to the community.

Giving back

Expanding community programs and partnerships to make a meaningful difference for our members and the communities we serve.

Culture of trust and safety

Setting the standard in accountability and governance to ensure every member feels safe and confident.

Culture of innovation

Using technology and creative approaches to make every interaction simple, smooth, and enjoyable.

Eels CEO report

A year ago, we embarked on a new era of change at the Eels, and I am immensely proud of what we have achieved.

The positivity and optimism from our Members and fans, along with the strong support of our partners, have been truly inspiring. The Eels badge represents our shared pride and purpose — uniting our past, present, and future as we move forward together.

In his first year as Head Coach, Jason Ryles has had a transformational impact on our Club. His courage and conviction in making tough decisions have united our community and fostered a genuine sense of connection and belonging among players, staff, members, partners, and supporters. Under Jason’s leadership, our football program has strengthened significantly — not only in performance but also in culture and purpose.

Our commitment to change and continuous improvement has been unwavering, and in the second half of the season we began to see the results of this work on the field. The future of our football program is incredibly exciting. Our current playing group continues to grow together, and a wave of talented young players emerging through our pathways will shape our success in the years ahead.

In the NRLW, our team narrowly missed the Finals, but their resilience and progress were outstanding. This strong foundation will drive sustained success in seasons to come.

Off the field, we marked a new era by welcoming back James Hardie as our Principal Partner. Their partnership has been exceptional, supporting key initiatives and strengthening our community connection. We also thank our major partners — ALAND Developments, Actron Air, ATS Building Products, McDonald’s, Carroll & O’Dea Lawyers, Jawa Off-Road Campers, Macron, and the City of Parramatta — for their ongoing commitment and belief in our vision.

Beyond football, we remain focused on strengthening engagement with the Eels community.

Jim Sarantinos Chief Executive Officer Parramatta

Community connection

Beyond football, we remain focused on strengthening engagement with the Eels community. Throughout 2025, our NRL players visited more than 130 schools and attended numerous Parramatta Junior League training sessions. We donated over $100,000 worth of merchandise to charities and, through partnerships with organisations such as Ronald McDonald House, created memorable experiences for children and families.

Foundation

This year, we proudly launched the Parramatta Eels Foundation, a vital step toward long-term sustainability and success. The Foundation will support our football programs, facilities, and community initiatives — investing in the future of the Eels, developing the next generation of players, and delivering programs that create lasting positive change.

Centre of Excellence & Community facility

In 2025, we moved into our new Centre of Excellence and Community Facility, a world-class venue uniting our men’s and women’s programs, connects our pathways with our elite teams, and strengthens ties with the wider Eels community.

The Eels Institute

Launched in October, The Eels Institute is a Club-first educational initiative in partnership with TAFE Queensland. The Dual Diploma program blends nationally recognised qualifications with realworld industry experience, empowering the next generation of sports professionals.

Financial Reporting

In 2025, the Club achieved a net profit after tax of $6.3m, primarily driven by government grants of $7.8m net of tax, for the completion of the Centre of Excellence project. These grants were offset by a $1.5m operating loss, reflecting our continued strategic investments in Elite Pathways, women’s rugby league programs, a significant cost uplift for the operations of the Centre of Excellence, and disappointing gameday ticket sales early in the season.

Board and Leadership

In February 2025, Matthew Beach was appointed Chairman, bringing strong leadership, governance experience, and deep passion for the Club. We thank Vicki Leaver for nine years of dedicated service and welcome Mickey Beaini to the Board, whose business acumen and community expertise will add great value.

Thank you

On behalf of the Club, I thank the PARRA Group President Mark Jenkins, CEO Chris Dimou, and the entire Board and staff for their continued partnership. To our players, coaches, staff, volunteers, sponsors, members, and fans — your passion and commitment drive this great Club forward. Together, we look ahead with confidence to a successful 2026 season.

42,455 Parra Eels Play Schools & holiday program participants

12,205 Active Kids hours

133 local schools visited by Eels players (NRL & NRLW)

497 hours spent in the community (NRL & NRLW)

Centre of Excellence & Community Centre

In 2025, the Parramatta Eels officially opened the $70 million Centre of Excellence and Community Centre at Kellyville Memorial Park — a landmark achievement for the Club and the broader Western Sydney community.

Funded through the support of the Australian and NSW Governments, The Hills Shire Council, and The PARRA Group, the precinct represents the largest rugby league training facility in the world. It features five full-sized rugby league fields and is Australia’s first gender-equal elite training complex, with identical facilities for men and women across the NRL, NRLW, and Elite Pathways programs.

The adjoining Community Centre forms part of an international-standard match venue, including a 1,500-seat grandstand, multi-purpose function rooms, and community education spaces. This development provides a platform for the Club to expand its community engagement, grassroots participation, and educational initiatives across Western Sydney.

The opening of the Centre of Excellence marks a transformative moment in the Club’s history — providing world-class facilities for our football programs while creating a central home that unites players, staff, members, fans, past players, partners, and the wider community.

In June 2025, Parramatta Eels Principal Partner James Hardie was announced as the naming rights sponsor of the facility, now officially titled the James Hardie Centre of Excellence and Kellyville Memorial Park Community Centre. This partnership reflects a shared commitment to supporting the Western Sydney community and fostering opportunities both on and off the field.

The project was made possible through strong collaboration between all levels of government and The PARRA Group, demonstrating a shared vision for community growth, sporting excellence, and inclusivity.

The PARRA Group continues to play a pivotal role in supporting the development of rugby league and the local community, contributing more than $1 million annually to local initiatives. The establishment of this world-class facility further strengthens that commitment and will deliver lasting benefits for generations to come.

Top row: Dr. Andrew Charlton MP opening the Parramatta Eels Centre of Excellence. Eels legends Peter Wynn, Steve Ella, Denis Fitzgerald

2nd row: Parramatta Eels CEO Jim Sarantins at the official opening of the Centre of Excellence. Parramatta Eels players Lincoln Fletcher, Rachael Pearson, Elsie Albert, Aaliyah Soufan

3rd row: Hills Shire Council Mayor, Councilors and staff at the opening of the Parramatta Eels Centre of Excellence

Football update

The 2025 season was a year of meaningful change — all designed to strengthen our foundations for the future.

The appointment of Jason Ryles as Head Coach marked a major milestone in this journey. Jason arrived with a clear vision for how he wanted the team to play and the culture he wanted to build. His leadership has created strong alignment across the Club and renewed commitment to a longterm plan for sustainable success.

NRL

We began the season slowly but showed steady improvement as the year progressed. It was pleasing to finish strongly, winning five of our last seven games — including three against top-eight opponents — giving members and fans renewed optimism heading into 2026.

Jason, his coaching staff, and the playing group are determined to build on this momentum, with a strong pre-season already underway to set the platform for next year.

Several players were recognised with representative honours in 2025. Mitch Moses and Zac Lomax were selected for NSW Origin, while Junior Paulo, Isaiah Iongi, Will Penisini, Jack De Belin, and Kitione Kautoga represented their nations at the Pacific Championships. Mitch Moses and Josh Addo-Carr were named in the Kangaroos squad for the Ashes Tour, and Jack Williams represented Australia in the Prime Minister’s XIII.

Mark O’Neill

General Manager of Football Parramatta Eels

Retention & recruitment

Our recruitment strategy aligns closely with Jason’s philosophy and the Club’s football vision. This year we overhauled the roster, securing talented and experienced players who complement our evolving game style, while extending contracts for key players including captain Mitch Moses and several emerging stars who will lead the Club forward.

Combined with the continued development of players from our Elite Pathways Program, these changes have positioned us strongly for 2026 and beyond. Our focus remains on adding quality, balance, and depth across all positions to sustain success over the long term.

NRLW

Our NRLW team narrowly missed the Finals but demonstrated significant progress, with several young players earning their debut opportunities. Despite early injuries, the growth and resilience shown were a testament to the strength of our women’s pathways.

The season ended on a high with a strong final-round win, and Head Coach Steve Georgallis and his staff are determined to build further next year. A major milestone was the full integration of the NRLW program into our Centre of Excellence, providing our female athletes equal access to world-class facilities alongside the men’s squad.

Representative honours included Abbi Church, who debuted for NSW Origin and the Australian Jillaroos and also represented the Prime Minister’s XIII alongside Chloe Jackson Kennedy Cherrington (NSW) and Rory Owen (QLD) earned State of Origin selection, while Elsie Albert, Fleur Ginn, Ryvrr-Lee Alo, Lindsay Tui, and Martha Mataele represented their nations at the Pacific Championships.

Elite pathways

Our Elite Pathways continue to flourish, with all four junior representative teams qualifying for the Finals. The Lisa Fiaola and Tarsha Gale teams both won premierships — an outstanding achievement — while the SG Ball side reached a thrilling Grand Final. We now have an exceptional group of young players progressing through our system, including three Australian Schoolboys, each with a clear pathway to first grade. With experienced coaching staff embedded across every level, we remain focused on developing players ready to excel at the elite NRL and NRLW levels.

Culture and Connection

Our Club feels more united than ever. The connection between players, staff, members, fans, past players, and partners continues to strengthen. We often say “the badge connects us all”, and that spirit was evident throughout the season — from open training sessions and fan days across Fairfield, Granville, Parramatta, and Kellyville, to the genuine way players engage with supporters and Club greats. The sense of belonging within the Eels community is real and growing.

This year we also celebrated key milestones: Junior Paulo became only the 14th player in Club history to play 200 games in blue and gold and reached 250 NRL games; Dylan Walker celebrated 250 NRL games; and Josh Addo-Carr reached 200 games and 150 career tries — proud achievements that reflect our shared commitment and pride.

Thank you

On behalf of the football department, I extend my heartfelt thanks to our staff, players, families, and volunteers for their tireless efforts. To our members, fans, and partners — your unwavering passion and loyalty continue to drive this great Club forward. Together, we are building something special and look ahead with confidence to a successful 2026 season.

The

connection between players, staff, members, fans, past players, and partners continues to strengthen.”

Our staff

At PARRA, it’s our people who make the difference. Behind every smile, every interaction, and every memorable experience is a team dedicated to inspiring, uniting, and uplifting our community with heart. Our staff bring the PARRA brand to life—showing that we are not just a group of clubs, but a connected, welcoming community where everyone belongs.

Being part of PARRA means more than a role; it means contributing to something bigger. Every day, our team lives our SPORT values—Service, Passion, Openness, Respect, and Teamwork—through the way

they greet members, support each other, and create experiences that make our members, fans, and community feel seen, valued, and proud to belong.

This is what sets PARRA apart. It’s the warmth, pride, and sense of connection that our staff bring to every corner of our clubs. Together, we create moments that matter, deepen relationships, and amplify the impact of everything we do. Our staff are at the heart of our community-first approach, reminding everyone who walks through our doors that PARRA is real, human, and made stronger by the people who make it happen.

Being part of PARRA means more than a role; it means contributing to something bigger.

One PARRA. One Team. With Heart.

Brenda Bradney Vikings Sports Club

Staff focus

After 38 years with PARRA, Brenda Bradney is retiring. Her dedication, warmth, and connection to colleagues and the community have left a lasting mark on the Club. We caught up with Brenda to hear about her journey, favourite memories, and what she’ll miss most.

What first brought you to Parra, and what kept you here all these years?

My sistes-in-law both worked at the Club and encouraged me to apply. From day one, it felt like home. The people, the culture, and the sense of belonging have kept me here all these years — it quickly became more than just a job; it became part of my life.

What’s one of your favourite memories or proudest moments?

There have been so many — from receiving awards to celebrating milestones at long-service dinners. But the greatest reward has been working alongside colleagues who feel like family.

How has Parra changed since you started?

The Club has evolved into a more professional and forward-looking organisation, and it’s been rewarding to see that growth.

What will you miss most?

Definitely the people — my team and the everyday connection with our community.

Any message for your Parra teammates?

Thank you for the friendship, support, and care. And after nearly four decades, Chris has been the best CEO I’ve ever worked with.

Our community

Supporting the game and building community PARRA supports grassroots rugby league in two important ways. Through our partnership with Parramatta Junior Rugby League, we strengthen community, improve wellbeing and create opportunity for young people and families. Separately, our support of Parramatta Referees

Our staff give back

Our Community Connect Volunteer Program is all about giving back and bringing our PARRA family closer to the communities we serve. Every staff member is encouraged to take part, with up to a full day of paid leave available to volunteer with a wide range of local organisations.

Community Connect embodies our commitment to meaningful engagement. It’s more than volunteering—it’s about building connections, making a real difference, and enriching both our community and our team. Over the past year, we’ve proudly supported charities including the Parramatta Female Factory, Northcott, Camp Quality, Kids with Cancer Foundation, and Dignity. The program gives team members the chance to support causes they care about while reinforcing PARRA’s values of unity, care, and positive impact—showing that making a difference is something we do together.

ensures match officials are developed, mentored and supported, keeping the game safe, fair and connected at every level. Together these contributions reflect PARRA’s purpose of bringing people together, building pride locally, and delivering long term positive impact for the communities we serve. Now and always together.

Community Connect gives team members the opportunity to support causes they care about.

Volunteering at Ronald McDonald

Christmas with Parramatta Mission

Eels Supertee

We are proud to support a program that brings comfort, care, and a touch of imagination to children when they need it most—the Supertee – Parramatta Eels Edition. More than just a team garment, the Supertee is a specially designed medical shirt that empowers children in hospital, making life a little easier for both families and hospital staff.

Crafted from soft, breathable cotton with easy-access shoulder and side panels, the Supertee allows parents and medical teams to change and care for children while accessing or bypassing medical lines, all without compromising comfort. At the same time, it encourages creativity and imaginative play, helping children feel like the superheroes they truly are, even during challenging times.

The Parramatta Eels Edition adds another layer of inspiration. Designed to reflect the resilience, courage, and determination of every young fan’s favourite team, it reminds children that they have the strength to face obstacles and embrace their inner hero. Wearing the Supertee, kids don’t just receive practical support—they gain a sense of connection, belonging, and fun, which can make all the difference during their hospital stay.

For our members, supporting this initiative is a meaningful way to make a positive impact in our community. It is an opportunity to stand alongside families, show support for children facing health challenges, and celebrate the small victories that matter so much in their lives. Seeing a child wear the Supertee and imagine themselves as part of the Parramatta Eels family is a reminder of the power of community, care, and kindness.

At PARRA, our focus has always been on inspiring, uniting, and uplifting our community with heart. The Supertee – Eels Edition embodies this mission, blending innovation, compassion, and joy to bring comfort and hope to children in hospitals across Australia and around the world. It is a program that allows us to make a lasting difference—reminding every child that they are brave, strong, and truly part of our PARRA family.

Parramatta Eels Foundation

In 2025, the Parramatta Eels Foundation was officially launched, establishing a dedicated platform for individuals, organisations, and philanthropic donors to support key football, community, and social impact initiatives.

The Foundation was created to strengthen the Club’s long-term sustainability and deepen its community impact, with a focus on three key areas:

Academy & Pathway Programs

Developing the next generation of male and female players through elite coaching, education, and welfare support.

Centre of Excellence & Community Centre

Supporting the growth and operation of the Club’s world-class high-performance and community facilities at Kellyville.

Social Impact & Community Programs

Delivering initiatives that promote mental health, respect, cultural connection, and active lifestyles across Western Sydney.

All funds raised through the Foundation are being reinvested into key initiatives that support the long-term growth of the Club, helping to build future pathways for players and expand the reach of community programs across Western Sydney.

In its first year, the Foundation raised funds through a range of successful initiatives — including opportunities for members and fans to purchase a Grandstand Seat and have their name displayed on the seats at the new Centre of Excellence, the support of key donors and coterie groups, and the Foundation Long Lunch, among others.

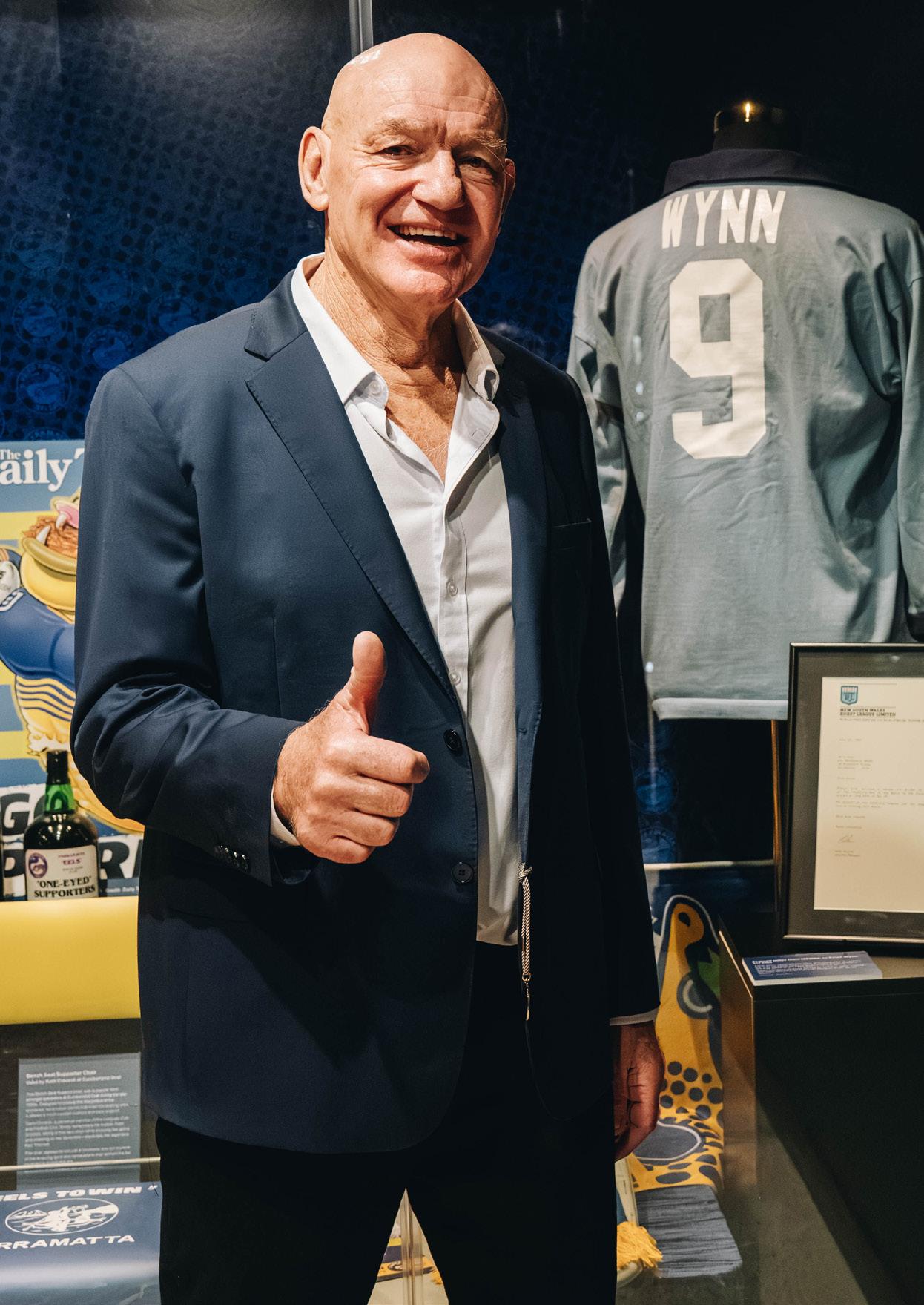

To celebrate the Foundation’s launch, the Club hosted the inaugural Eels Foundation Legends Long Lunch, a special event uniting the Club’s most iconic figures, partners, and supporters in celebration of the Eels’ proud legacy and exciting future.

The event was headlined by Eels legends Peter Sterling and Nathan Hindmarsh, alongside The PARRA Group Patron Peter Wynn, and other Blue and Gold greats including Steve Ella and Nathan Cayless. Guests enjoyed stories from past and present while contributing to fundraising efforts through auctions and exclusive experiences.

The Legends Long Lunch drew strong attendance from Western Sydney business leaders, government representatives, and corporate partners, establishing it as a signature annual event that celebrates the Eels’ heritage while supporting its future.

Through the Parramatta Eels Foundation, the Club has created a powerful mechanism to invest in people, programs, and facilities that drive excellence on the field and positive change off it, ensuring the Eels remain a proud and community-focused organisation for generations to come.

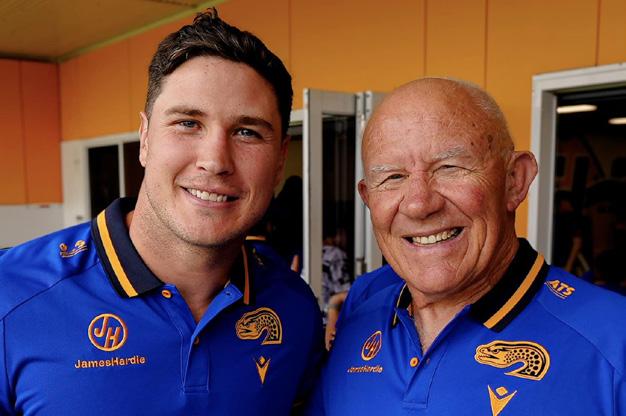

Our patron

This year, Peter Wynn was elected as Patron of our Club, following Member approval at the 2025 Annual General Meeting. This was a momentous occasion, celebrating one of Parramatta’s most respected and beloved figures.

Peter’s outstanding legacy as a Premiership-winning Parramatta Eels player, a successful local businessman, and a tireless advocate for our Club made him an exceptional choice for this role. As a Life Member of the Eels and a Perpetual Member of Parramatta Leagues,

Peter has consistently shown unwavering dedication to both the Club and the wider Western Sydney community. His passion, commitment, and connection to our members are truly remarkable.

Peter Wynn’s election as Patron was met with great enthusiasm from our members, honouring his lifelong contribution to Parramatta and the Club. His leadership and example continue to inspire, reflecting the pride, commitment, and heart of our Parramatta community.

Honour roll

Life Elected Members

Listed in chronological order based on when each Life Elected member was elected.

Jack Argent *

Stan Simpson *

Spencer O’Neill*

Bob Jones *

Stan Lewis*

Albert Baker *

Peter Leach *

Arthur Drew *

Jack Boyle *

Bill O’Keefe *

Dan Mahoney *

Roy Fisher *

Kevyn Maddocks *

Peter Rogers *

Billy Rayner *

Keith Gillett *

Ron Hilditch

Alan Overton AM OAM *

Frank Sutton *

Frank Keane *

Gary Morris *

Life Foundation Members & Foundation Members:

A.Adams*

Alan Williams *

Albert Wiffen *

Allan Cresswell*

Allan Weekes*

Alvin Hartley*

Arthur Mcburney *

Basil Cohen *

Bernie Tamplin *

Brian Catt*

Bryan Simpson*

C.Harris*

Cecil Pratt *

Cedric Wootton *

Charles Griffiths*

Charlie Bruce*

Charlie Vild *

Clifford Stevenson *

Colin Barlow*

Colin Oliver *

Cyril Shean*

Daniel Martin *

Darcy Williams*

David Bambrick *

Dennis Cooney*

Don Mclean *

Douglas Duncan*

Eddie Boulous*

Frank McCaffery

Frederick Kensitt*

George Bosnich *

Gillian Partridge*

Gordon Molloy

Gordon New*

Henry Reid*

Herbert Mitchell*

Jack Anderson *

James Mulvihill*

Jim Dalton*

John Feletti*

John Lyons

John Miller OAM*

John Purves*

John Styles *

Keith Anson *

Ken Vine *

Kenneth Spence *

Kevin Hughes *

Laurence Doolan*

Leonard Johnstone *

Les Hitchcock*

Matthew Johnston *

Maxwell Mayo*

Noel Barnes *

Noel Pickering *

Norman Rochester*

Norman Simmons *

Patrick Connolly*

Peter Friend *

Peter Winch

R.Robertson *

Raymond Carter

Raymond Hinson*

Raymond Newland *

Reg Lane *

Reg Manning *

Reg Prudames *

Richard McGarrigle*

Robert McLeod

Rolf Trudgett*

Ronald Cater*

Ronald Collyer*

Don Ritchie *

Denis W Fitzgerald AM

Joe Joseph *

Peter Miller

Cyril Shean *

Christopher Jurd*

Dr Michael Johnson

Ronald Croghan *

Ronald Dixon *

Ronald Freeman

Ronald Mclean*

Ronald Parkes *

Ronald Pond *

Ronald Prudames*

Ronald Simpson *

Ronald Tarrant *

Ross Stewart*

Roy Gray *

Rupert Smith *

Sidney Eades*

Spencer Morey*

Stanley Ingram *

Stanley Morgan *

Stuart Murray*

Thomas Gates OAM*

Thomas Vernon *

Wally Webster OAM *

William Doolan*

Directors’ report

Your directors submit their report on Parramatta Leagues’ Club Ltd (the “Company”) and the entities it controlled (collectively, the “Group”) for the year ended 31 October 2025.

Directors

The names of the Company’s directors in office during the financial year and until the date of this report are set out below. The directors were in office for this entire period unless otherwise stated.

Gregory Monaghan

Darren Adam

Mark Jenkins

Philip Sim

Richard Foda

Susan Coleman

Stephen Bull (Appointed: 11 October 2025)

Joy Cusack (Resigned: 16 September 2025)

Dividends

The Group is limited by guarantee and is prevented by its constitution from paying dividends.

Principal activities

The principal activities of the Group during the course of the financial year consisted of the conduct and promotion of licensed social clubs for members of the club and promotion of rugby league football within the Parramatta district.

There were no significant changes in the nature of the Group’s activities during the year.

Overall objectives

To ensure Parramatta Leagues’ Club Ltd is one of the most professional and progressive multi-purpose hospitality venue in Greater Western Sydney, by providing excellence in service and amenities for all members; and to foster, encourage, promote and control the development, playing and interests of rugby league football within the area of the geographical boundaries of Parramatta National Rugby League Club Pty Limited, a subsidiary within the Group, as defined from time to time in the by-laws of the league’s governing body.

The short term objectives of the Group are to focus on member satisfaction through the refresh of the Clubhouses and new development opportunities, while operating within a robust governance and compliance framework.

Focus on member satisfaction through the refresh of the Clubhouses and new development opportunities, while operating within a robust governance and compliance framework

The long term objectives of the Group are to:

• Bring together our community and support local causes, sport and the Eels to promote wellbeing happiness and pride;

• Provide a network of premium hospitality, entertainment, sporting and complementary businesses and services for the benefit of our community; and

• Ensure our long term financial viability by the diversification of our business within our catchment area.

The Group measures success by focusing on the following key areas:

• Improved facilities for our members; Increasing clubs engaged membership;

• Engaged and well trained employees;

• Focus on governance, risk and compliance initiatives; and

• Sound financial management and performance monitoring.

Operating results for the year

The net profit after tax of the Group for the year ended 31 October 2025 was $17,238,984 (2024: $24,667,298).

Significant changes in the state of affairs

The Company’s subsidiary, Parramatta Power Soccer Pty Ltd, which has been dormant since 2006 was liquidated on 12 September 2025.

There were no other significant changesin the state of affairs of the Group during the year.

Significant events after the reporting period

There were no significant events occurring after the reporting period which may affect either the Group’s operations or results of those operations or the Group’s state of affairs.

Likely developments and expected results

Likely developments in the operations of the Group and the expected results of those operations in future financial years have not been included in this report as the inclusion of such information is likely to result in unreasonable prejudice to the Group.

Environmental regulation

The Group is not subject to any particular or significant environmental regulation under laws of the Commonwealth or of a State or Territory.

Meetings of directors

The number of meetings of Company’s directors held during the year ended 31 October 2025 and the number of meetings attended by the directors was:

A = Number of meetings attended

B = Number of meetings held during the time the directors held office during the period

Committee membership

Gregory Monaghan*

Darren Adam Chair Member -

Mark Jenkins*

Philip Sim -

Richard Foda Member Chair -

Susan Coleman - - Member

Stephen Bull Member Member -

Joy Cusack Member Member -

* At the June 2025 board meeting, Gregory Monaghan retired as President, and Mark Jenkins was appointed as the new President.

** Gregory Monaghan served as an ex-officio member until the June 2025 board meeting, after which Mark Jenkins assumed the role.

Insurance of directors and officers

During the financial year, Parramatta Leagues’ Club Ltd held a management liability insurance policy under the directors and officers liability cover. The liabilities insured are legal costs that may be incurred in defending civil or criminal proceedings that may be brought against the directors and officers in their capacity as officers of the Company, and any other payments arising from liabilities incurred by the directors and officers in connection with such proceedings. This does not include such liabilities that arise from conduct involving a wilful breach of duty by the directors and officers or the improper use by the officers of their position or of information to gain advantage for themselves or someone else or to cause detriment to the Company. It is not possible to apportion the premium between amounts relating to the insurance against legal costs and those relating to other liabilities.

Indemnification of auditor

To the extent permitted by law, the Company has agreed to indemnify its auditor, Ernst & Young (Australia), as part of the terms of its audit engagement agreement against claims by third parties arising from the audit (for an unspecified amount). No payment has been made to indemnify Ernst & Young (Australia) during or since the financial year.

Membership

The Company is a company limited by guarantee and is without share capital. The number of members as at 31 October 2025 was 65,025 (2024: 64,493).

Members’ limited liability

In accordance with the Constitution of the Company, every member of the Company undertakes to contribute an amount limited to $4 per member in the event of the winding up of the Company during the time that he or she is a member or within one year thereafter.

Auditor’s independence declaration

The directors have received an independence declaration from the auditor of Parramatta Leagues’ Club Ltd. This has been included on page 33.

Ernst & Young (Australia) was appointed as auditor in accordance with Section 327 of the Corporations Act 2001

Signed in accordance with a resolution of the directors.

Mark Jenkins Director

Sydney 18 December 2025

Tel:

Auditor’s independence declaration

Auditor’s independence declaration to the directors of Parramatta Leagues Club Limited and its controlled entities

Tel:

As lead auditor for the audit of the financial report of Parramatta Leagues Club Limited for the financial year ended 31 October 202 5, I declare to the best of my knowledge and belief, there have been:

a. No contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the audit;

b. No contraventions

Auditor’s independence declaration to the directors of Parramatta Leagues Club Limited and its controlled entities

c. No non-audit services provided that contravene any applicable code of professional conduct in relation to the audit.

This declaration is in respect of Parramatta Leagues Club Limited and the entities it controlled during the financial year.

As lead auditor for the audit of the financial report of Parramatta Leagues Club Limited for the financial year ended 31 October 202 5, I declare to the best of my knowledge and belief, there have been:

o contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the audit;

Ernst & Young

b. No contraventions of any applicable code of professional conduct in relation to the audit ; and

c. No non-audit services provided that contravene any applicable code of professional conduct in relation to the audit.

This declaration is in respect of Parramatta Leagues Club Limited and the entities it controlled during

Daniel Cunningham Partner 18 December 2025

Ernst & Young

Daniel Cunningham Partner 18 December 2025

A

Consolidated statement of profit or loss and other comprehensive income

For the year ended 31

Consolidated statement of financial position

Consolidated statement of changes in equity

For the year ended 31 October 2025

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

Consolidated statement of cash flows

For the year ended 31 October 2025

Notes to the consolidated financial statements

For the year ended 31 October 2025

1. Corporate information

The consolidated financial statements of Parramatta Leagues’ Club Ltd (the “Company”) and its subsidiaries (collectively, the “Group”) for the year ended 31 October 2025 were authorised for issue in accordance with a resolution of the directors on 18 December 2025.

Parramatta Leagues’ Club Ltd is a notfor-profit entity limited by guarantee, incorporated and domiciled in Australia.

The Company’s registered office and principal place of business is 1 Eels Place, Parramatta, NSW 2150.

The nature and operations and principal activities of the Group are described in the directors’ report. Information on the Group’s structure is provided in Note 21. Information on other related party relationships of the Group is provided in Note 22.

2. Accounting policies

a. Basis of preparation and statement of compliance

These general purpose consolidated financial statements have been prepared in compliance with the requirements of the Corporations Act 2001 and Australian Accounting Standards - Simplified Disclosures. The Group is a not-for-profit entity for the purposes of preparing these consolidated financial statements.

The consolidated financial statements have been prepared on a historical cost basis and is presented in Australian dollars and all values are rounded to the nearest dollar ($).

b. Changes in accounting policies and disclosures

New and amended standards and interpretations

The new and amended Australian Accounting Standards and Interpretations that apply for the first time in 2025 do not materially impact the consolidated financial statements of the Group.

Accounting Standards and Interpretations issued but not yet effective

Certain Australian Accounting Standards and Interpretations have recently been issued or amended but are not yet effective and have not been adopted by the Group for the annual reporting year ended 31 October 2025. The directors have not early adopted any of these new or amended standards or interpretations. The Group intends adopt these new and amended standards and interpretations, if applicable, when they become effective.

c. Going concern

The consolidated financial statements have been prepared on a going concern basis, which contemplates continuity of normal business activities and realisation of assets and settlement of liabilities in the ordinary course of business.

The Group generated an operating profit during the year ended 31 October 2025 of $17,238,984 (2024: $24,667,298), and as at that date the Group ‘s total current liabilities exceeded total current assets by $877,008 (2024 : total current assets exceeded total current liabilities by $985,734) and the Group ‘s total assets exceeded total liabilities by$153,219,828 (2024 : $135,980,844). The Group generated positive operating cash flows of $26,083,122 (2024:$41,251,873).

The directors have concluded that the use of the going concern assumption in the preparation of this year’s consolidated financial statements is appropriate.

d. Basis of consolidation

The consolidated financial statements comprise the financial statements of the Company and its subsidiaries as at 31 October 2025. Control is achieved when the Group is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Specifically, the Group controls an investee

Notes to the consolidated financial statements

For the year ended 31 October 2025

if, and only if, the Group has:

• Power over the investee (i.e., existing rights that give it the current ability to direct the relevant activities of the investee)

• Exposure, or rights, to variable returns from its involvement with the investee

• The ability to use its power over the investee to affect its returns

Generally, there is a presumption that a majority of voting rights results in control.

To support this presumption and when the Group has less than a majority of the voting or similar rights of an investee, the Group considers all relevant facts and circumstances in assessing whether it has power over an investee, including:

• The contractual arrangement(s) with the other vote holders of the investee

• Rights arising from other contractual arrangements

• The Group’s voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control. Consolidation of a subsidiary begins when the Group obtains control over the subsidiary and ceases when the Group loses control of the subsidiary. Assets, liabilities, income and expenses of a subsidiary acquired or disposed of during the year are included in the consolidated financial statements from the date the Group gains control until the date the Group ceases to control the subsidiary.

Profit or loss and each component of other comprehensive income (OCI) are attributed to the equity holders of the parent of the Group and to the non-controlling interests, even if this results in the non-controlling interests having a deficit balance. When necessary, adjustments are made to the financial statements of subsidiaries to

bring their accounting policies in line with the Group’s accounting policies. All intra-group assets and liabilities, equity, income, expenses and cash flows relating to transactions between members of the Group are eliminated in full on consolidation.

A change in the ownership interest of a subsidiary, without a loss of control, is accounted for as an equity transaction.

If the Group loses control over a subsidiary, it derecognises the related assets, liabilities and other components of equity, while any resultant gain or loss is recognised in profit or loss. Any investment retained is recognised at fair value.

e. Current versus non-current classification

The Group presents assets and liabilities in the consolidated statement of financial position based on current/non-current classification. An asset is current when it is:

• Expected to be realised or intended to be sold or consumed in the normal operating cycle;

• Held primarily for the purpose of trading;

• Expected to be realised within twelve months after the reporting period, or

• Cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period.

All other assets are classified as non-current.

A liability is current when:

• It is expected to be settled in the normal operating cycle;

• It is held primarily for the purpose of trading;

• It is due to be settled within twelve months after the reporting period, or

• There is no right to defer the settlement of the liability for at least twelve months after the reporting period.

The Group classifies all other liabilities as non-current.

Notes to the consolidated financial statements

For the year ended 31 October 2025

2. Accounting policies (continued)

f. Revenue recognition

The Group is in the business of providing sporting, social and entertainment activities and amenities to their members and guests. Revenue from contracts with customers is recognised when control of the goods or services are transferred to the customer at an amount that reflects the consideration to which the Group expects to be entitled in exchange for those goods or services. The Group has generally concluded that it is the principal in its revenue arrangements, because it typically controls the goods or services before transferring them to the customer.

Revenue is recognised for the major business activities as follows:

i. Sale of goods

Revenue from the sale of goods comprises revenue earned from the provision of food, beverage and other goods and is recognised (net of rebates, returns, discounts and other allowances) at the point of sale or delivery as this corresponds to the transfer of control of the goods.

ii. Rendering of services

Revenue from rendering of services comprises revenue from gaming facilities together with other services to members and other patrons of the club. Revenue from rendering of services is recognised when the services are provided and is measured at the fair value of the consideration received or receivable.

iii. Sponsorship

Revenue from sponsorship is recognised over a period when the Group satisfies a performance obligation by transferring a promised good or service to a customer. Revenue is measured at the fair value of the consideration received or receivable.

iv. Membership income

Revenue from membership subscription and future ticket purchases by the members are deferred as unearned income and are brought to account evenly over the course of the membership period in accordance with contractual performance obligations.

v. Grants income

Government grants received to fund specific programmes arise from an agreement which is enforceable and contains specific performance obligations. Revenue is recognised as income when the performance obligations of the contract are satisfied. Each performance obligation is considered to ensure that the revenue recognition reflects the transfer of a control, there may be some performance obligation where controls transfers at a point in time and others which have continues transfer of control over the life of the contract.

Where control is transferred over time, generally input method of cost is deemed to be the most appropriate method to reflect the transfer of the benefit. Any income received where the performance obligation is not yet satisfied as at reporting date, is recorded as grant in advance.

vi. National Rugby League (“NRL”) distribution grant

Grants from the National Rugby League are recognised as revenue in the period in which the funding relates to the extent that expenditure has been incurred in accordance with the terms and conditions attached to these grants.

vii. Rental income

Revenue from rental receipts is recognised in the period the rental relates to and is recorded in accordance with the rental agreement.

viii. Gate receipts

Revenue from gate takings is recognised when the match takes place or when services are provided.

Classification and measurement of revenue

Revenue is recognised over time if:

• the customer simultaneously receives and consumes the benefits as the entity performs,

• the customer controls the asset as the entity creates or enhances it; or

Notes to the consolidated financial statements

For the year ended 31 October 2025

• the seller’s performance does not create an asset for which the seller has an alternative use and there is a right to payment for performance to date. Where the above criteria are not met, revenue is recognised at a point in time.

g.

Deferred income

Deferred income is recognised if a payment is received or a payment is due (whichever is earlier) from a customer before the Company transfers the related goods or services. Deferred income is recognised as revenue when the Company performs under the contract (i.e., transfers control of the related goods or services to the customer).

h. Finance

income

Interest income is recorded using the effective interest rate (EIR) method. The EIR is the rate that exactly discounts the estimated future cash receipts over the expected life of the financial instrument or a shorter period, where appropriate, to the net carrying amount of the financial asset. Interest income is included in finance income in the consolidated statement of profit or loss and other comprehensive income.

i. Finance costs

Finance costs are expensed in the period in which they occur. Finance costs consist of interest and other costs that the Group incurs and are calculated using the EIR method.

j. Cash and cash equivalents

Cash and cash equivalents in the consolidated statement of financial position comprise cash at bank and on hand and short-term highly liquid deposits with a maturity of three months or less, that are readily convertible to a known amount of cash and subject to an insignificant risk of changes in value.

For the purpose of the consolidated statement of cash flows, cash and cash equivalents include cash as defined above.

k. Trade and other receivables

A receivable represents the Group’s right to an amount of consideration that is unconditional (i.e., only the passage of time is required before payment of the

consideration is due). They are generally due for settlement within 30 days and therefore are all classified as current. Trade receivables are recognised initially at the amount of consideration that is unconditional unless they contain significant financing components when they are recognised at fair value. The Group holds the trade receivables with the objective to collect the contractual cash flows and therefore measures them subsequently at amortised cost using the EIR method.

For trade receivables, the Group applies a simplified approach in calculating expected credit losses (ECLs). Therefore, the Group does not track changes in credit risk, but instead recognises a loss allowance based on lifetime ECLs at each reporting date. The Group has established a provision matrix that is based on its historical credit loss experience, adjusted for forward-looking factors specific to the debtors and the economic environment.

l. Inventories

Inventories are valued at the lower of cost and net realisable value.

Net realisable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated costs necessary to make the sale. Costs are assigned on the basis of weighted average costs.

m. Property, plant and equipment

Capital work in progress is stated at cost, net of accumulated impairment losses, if any. Property, plant and equipment is stated at historical cost less depreciation. Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably. The carrying amount of any component accounted for as a separate asset is derecognised when replaced. All other repairs and maintenance are charged to consolidated profit or loss during the reporting period in which they are incurred.

Notes to the consolidated financial statements

For the year ended 31 October 2025

2. Accounting policies (continued)

Depreciation on assets is calculated using the straight-line method to allocate their cost or revalued amounts, net of their residual values, over their estimated useful lives or, in the case of leasehold improvements, the shorter lease term as follows:

Land Not depreciated

Buildings 10 to 40 years

Plant and equipment 3 to 10 years

Poker machine 3 to 5 years

Motor vehicles 8 years

Leasehold improvements 20 to 40 years

Capital work in progress Not depreciated

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount (Note 2.p).

Gains and losses on disposals are determined by comparing proceeds with carrying amount. These are included in the consolidated statement of profit or loss and other comprehensive income.

n.

Intangible assets

Intangible assets acquired separately are measured on initial recognition at cost. The cost of intangible assets acquired in a business combination is their fair value at the date of acquisition. Following initial recognition, intangible assets are carried at cost less any accumulated amortisation and accumulated impairment losses. Internally generated intangibles, excluding capitalised development costs, are not capitalised and the related expenditure is reflected in profit or loss in the period in which the expenditure is incurred.

The useful lives of intangible assets are assessed as either finite or indefinite.

Intangible assets with indefinite useful lives are not amortised, but are tested for impairment annually, either individually or at the cash-generating unit level. The assessment of indefinite life is reviewed annually to determine whether the indefinite life continues to be supportable. If not, the change in useful life from indefinite to finite is made on a prospective basis.

An intangible asset is derecognised upon disposal (i.e., at the date the recipient obtains control) or losses when no future economic benefits are expected from its use or disposal. Any gain or loss arising upon derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the asset) is included in the consolidated statement of profit or loss and other comprehensive income.

Purchased poker machine entitlements

Purchased poker machine entitlements are not amortised. Instead, purchased poker machine entitlements are tested for impairment annually or more frequently if events or changes in circumstances indicate that it might be impaired, and are carried at cost less accumulated impairment losses.

Poker machine entitlements acquired by way of club amalgamation are, in accordance with AASB 3 Business Combinations initially brought to account at the date of amalgamation at the fair value at the date; and subsequently accounted for in accordance with the above policy.

o. Leases

The Group assesses at contract inception whether a contract is, or contains, a lease. That is, if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

i. Group as a lessee

The Group applies a single recognition and measurement approach for all leases, except for short-term leases and leases of low-value assets. The Group recognises lease liabilities to make lease payments and right-of-use assets representing the right to use the underlying assets.

Right-of-use assets

The Group recognises right-of-use assets at the commencement date of the lease (i.e., the date the underlying asset is available for use). Right-of-use assets are measured at cost, less any accumulated depreciation and impairment losses, and adjusted for any remeasurement of lease liabilities. The cost of right-of-use assets includes the amount of lease liabilities recognised, initial direct costs incurred, and lease payments made

Notes to the consolidated financial statements

For the year ended 31 October 2025

at or before the commencement date less any lease incentives received. Right-of-use assets are depreciated on a straight-line basis over the shorter of the lease term and the estimated useful lives of the assets, as follows:

Car park 79 years

Motor vehicles 3 to 4 years

If ownership of the leased asset transfers to the Group at the end of the lease term or the cost reflects the exercise of a purchase option, depreciation is calculated using the estimated useful life of the asset.

The right-of-use assets are also subject to impairment. Refer to the accounting policies in Note 2.p Impairment of assets.

Lease Liabilities

At the commencement date of the lease, the Group recognises lease liabilities measured at the present value of lease payments to be made over the lease term. The lease payments include fixed payments (including in-substance fixed payments) less any lease incentives receivable, variable lease payments that depend on an index or a rate, and amounts expected to be paid under residual value guarantees. The lease payments also include the exercise price of a purchase option reasonably certain to be exercised by the Group and payments of penalties for terminating the lease, if the lease term reflects the Group exercising the option to terminate. Variable lease payments that do not depend on an index or a rate are recognised as expenses (unless they are incurred to produce inventories) in the period in which the event or condition that triggers the payment occurs.

In calculating the present value of lease payments, the Group uses its incremental borrowing rate at the lease commencement date because the interest rate implicit in the lease is not readily determinable. After the commencement date, the amount of lease liabilities is increased to reflect the accretion of interest and reduced for the lease payments made. In addition, the carrying amount of lease liabilities is remeasured if there is a modification, a change in the lease term, a change in the lease payments (e.g., changes to future payments resulting from a change in an index or rate used to determine such lease

payments) or a change in the assessment of an option to purchase the underlying asset.

Short-term leases and leases of lowvalue assets

The Group applies the short-term lease recognition exemption to its short-term leases (i.e., those leases that have a lease term of 12 months or less from the commencement date and do not contain a purchase option). It also applies the lease of low-value assets recognition exemption to leases that are considered to be low value. Lease payments on short-term leases and leases of low-value assets are recognised as expense on a straight-line basis over the lease term.

ii. Group as a lessor Leases in which the Group does not transfer substantially all the risks and rewards incidental to ownership of an asset are classified as operating leases. Rental income arising is accounted for on a straight-line basis over the lease terms and is included in revenue in the consolidated statement of profit or loss and other comprehensive income due to its operating nature. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount of the leased asset and recognised over the lease term on the same basis as rental income. Contingent rents are recognised as revenue in the period in which they are earned.

p. Impairment of assets

Assets are tested for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash inflows which are largely independent of the cash inflows from other assets or groups of assets (cash-generating units). Non-financial assets that suffered impairment are reviewed for possible reversal of the impairment at the end of each reporting period.

Notes to the consolidated financial statements

For the year ended 31 October 2025

2. Accounting policies (continued)

q. Investment properties