Welcome to the 155th issue of the Aussie Painting Contractor Magazine.

Happy New Year, and what a start it has been!!

I hope you had a great break and are off to a flying start for 2026.

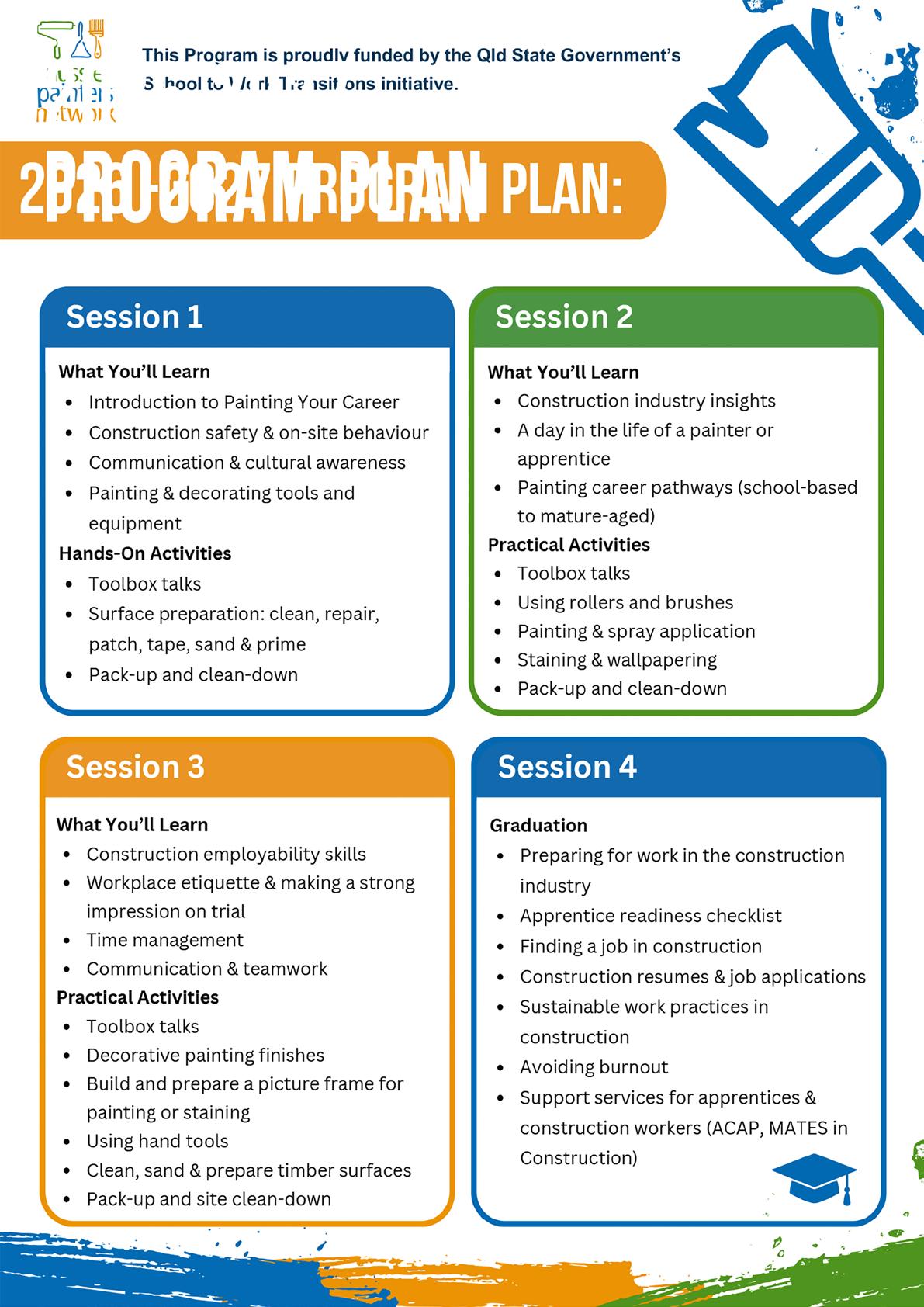

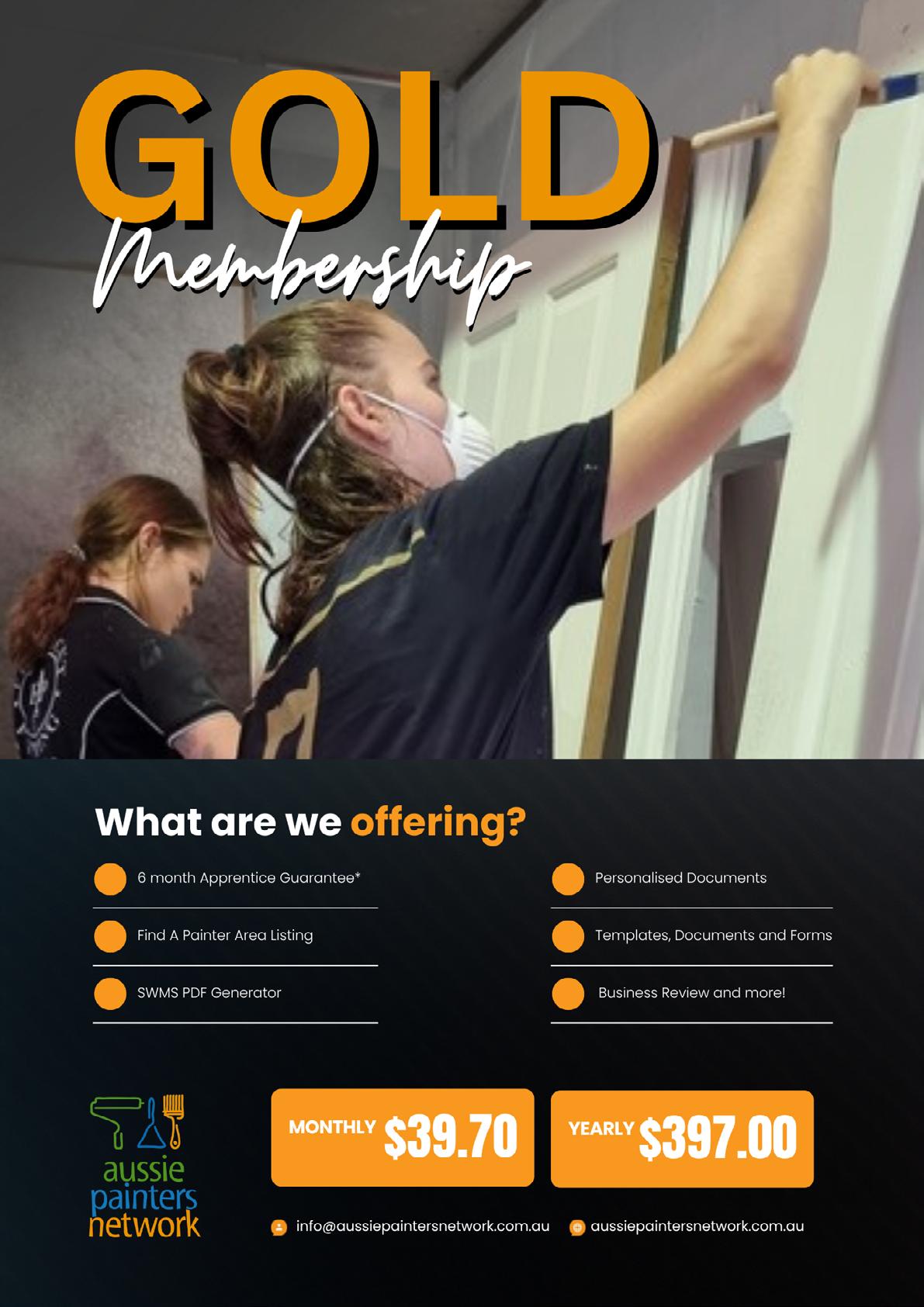

Aussie Painters Network have received Government funding again for the School to Work Transition Program following the success of last year with us placing just under 25% of the school students participants into apprenticeships in the painting industry. We are hoping to increase that over the next 18 months.

As I write this we have had 4 apprentices signed up, another 23 in the sign up process and 56 currently trialling for apprenticeships. If you are looking for an apprentice or two contact APN, we have applicants looking for trials leading to apprenticeship employment.

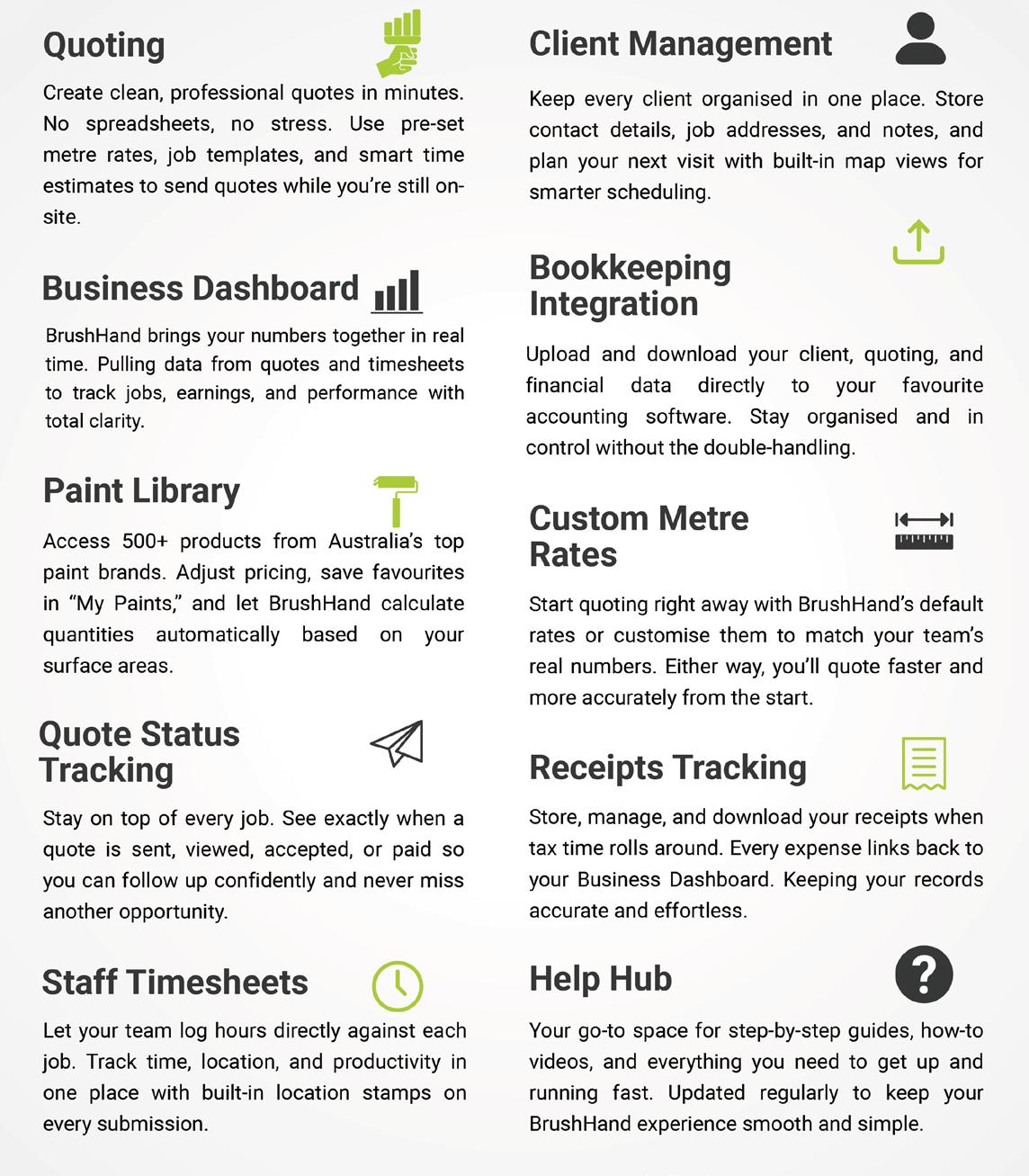

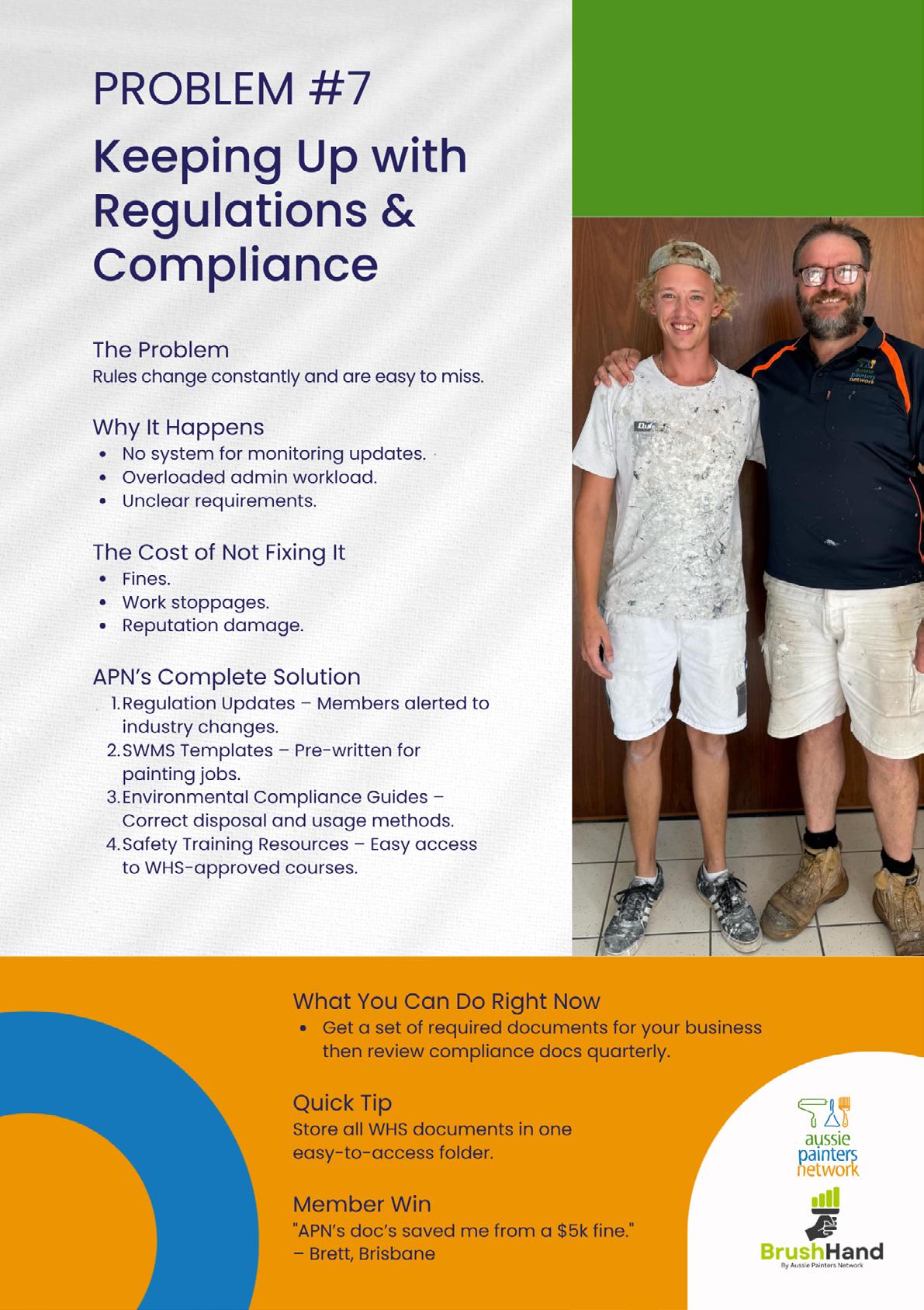

BrushHand his getting rave reviews from those using it. Check out all the features, I have already had feedback that just the “Staff Timesheet feature” has saved an employer three time the subscription fee in the first week. Staff used to just text in the times at the end of the week, but now they are finding out who’s on time and how often some staff are late. They believe that alone has saved the more than $400 dollars in the first week. It also explains why work doesn’t get completed on time.

If you have ant industry questions or assistance with your business, reach out. We are here to help.

'Til next month, Happy Painting!!

Nigel Gorman nigel@aussiepaintersnetwork.com.au

• Aaron Bach

• Anthony Igra

• Fergus O'Connor

• Leo Babauta

• Dissanayake Mudiyanselage Sachinthanee Dissanayake

• Kumar Biswas

• Mario Fernando

• Nigel Gorman

• Oliver Kay

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman GRAPHIC DESIGNER

J. Anne Delgado

4 Adjustments if you want to be MORE CONSISTENT Thriving in a World of DIVERSITY Painting Your Career 2026-2027 Is

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you January incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the

Consistency is often what separates good intentions from real results. Many people know what they should do, but struggle to do it regularly. The issue is rarely a lack of motivation; more often, it’s a lack of adjustment. Becoming more consistent requires changing how you think, plan, and respond when things don’t go perfectly.

A lot of people come to me because they struggle to be consistent with the things they’re trying to show up for: exercise, meditation, meaningful work, etc.

We struggle with consistency, and blame ourselves, get discouraged, give up.

But I’ve found that there are 4 important things we can adjust to become more consistent:

Commitment. How committed to this activity are you? If you want to write more, for example … how committed do you feel towards that writing? We can increase commitment through accountability (commit to someone else or a group) and/or through getting clear on why this matters to us.

Starting small. If you’re struggling to show up for something, reduce how big of a time commitment it is. If you want to meditate, do just 2 minutes if you can’t do 15 minutes. If you want to exercise, do less to start with than you think you can. If you were doing more before, and are struggling to get back to that, forget about what you were doing before — what matters is doing less now so you can be more consistent.

How we view the activity. Are you viewing the activity as something you “should” do? A burden, an obligation, a duty? That’s no fun! How can you view the activity so that it’s more inspiring to you? Maybe it’s an adventure, an expression of your deepest self, an honoring of your heart, a practice in mindfulness, a creation of art, a place to bring your curiosity, or something else that would be fun.

A flexible mindset. Missing a day or two is no big deal. But we make it a big deal when we want to give up because we’re discouraged. What if you embrace the bumps in the road, and let mistakes and misses be a part of the journey?

In the end, consistency is not about doing everything right. It is about making smart adjustments that make doing the right thing easier, more natural, and more repeatable over time.

Leo Babauta ZEN HABITS

Today’s business, school, and family environments are no longer defined by uniformity. They are made up of teams of multi-disciplined specialists from many cultures, countries, and backgrounds. These blended teams face a powerful choice: simply coexist—or actively embrace diversity to achieve shared goals.

In many ways, working in diverse environments is like travelling, whether for business or pleasure. You quickly learn that openness, curiosity, and respect shape the experience. Indonesia, one of Australia’s closest neighbours with a population of over 250 million, captures this philosophy perfectly in its national motto: “Unity in Diversity.” It is a principle the modern world would do well to live by.

Immerse Yourself in the Local Culture

Human nature draws us toward those who look, think, and behave like ourselves. Seeking difference requires intention and a broader worldview. When you step into unfamiliar environments—whether cultural, professional, or social—choose curiosity over comfort. Be open to the richness that surrounds you,

and you’ll discover new ways of thinking, working, and connecting.

Respect is the foundation of every productive partnership. Respect for people, customs, and different approaches to life and work builds trust and opens doors. Take the time to observe local etiquette when visiting schools, workplaces, or communities.

Talent management is more art than science. It requires observing how people respond to challenges, how they collaborate, and how they solve complex problems. Effective leaders recognise strengths as they emerge and align tasks accordingly.

The most successful teams are deliberately structured—bringing together individuals with complementary skills, balancing task-focused strengths with people-oriented capabilities. When projects are thoughtfully designed around individual talents, performance and engagement soar.

The QBCC’s Industry Snapshot provides valuable insights into Queensland’s building and construction industry, including licensing trends, demographic shifts and defect reporting— providing an understanding of industry dynamics, planning workforce development, and improving compliance and quality standards.

SOME NOTABLE CHANGES OVER THE PAST TWO YEARS INCLUDE:

GROWTH IN LICENSEES

• Total licensees under the QBCC Act increased by 6.3% from 96,908 in 2023 to 103,011 in 2025 (total licensees are more than 120,000 under all Acts regulated by the QBCC).

• The most notable increases were in the Brisbane region (+7.5%) and the Sunshine Coast region (+11.7%).

DEMOGRAPHIC SHIFTS

• The proportion of licensees aged under 30 years has slightly increased, indicating a modest rejuvenation of the workforce.

• A large portion of licensees remain over 60 years old, especially in key trades like plumbing, painting and carpentry, highlighting ongoing succession challenges.

DEFECT TRENDS

• Painting continues to top the list of reported defects.

• Driveways and paths defects have increased in frequency.

• The incidence of footing and slab defects has increased.

If you need a refresher on any of these defective work items, the QBCC’s standards and tolerances guide is a quick and easy reference for industry, licensees and home owners, based on recognised industry standards in Queensland.

The QBCC will publish the Industry Snapshot annually to ensure the building and construction industry is armed with current and reliable industry data.

Licensee feedback and suggestions are welcomed, so the QBCC can continue to evolve and provide the most accurate picture of the industry possible.

To read the full and latest version of the Industry Snapshot or find out more on the state of the industry please visit www.qbcc.qld.gov.au

Strong teams are built on shared understanding. Listen carefully for common ground and invite open, respectful dialogue. Clarify meaning, ask questions, and check for understanding.

Begin with a small set of agreed principles and expectations. As relationships deepen and trust grows, expand that shared foundation. Progress may be gradual, but it is lasting.

Move from Tolerance to Celebration

Tolerance is a starting point—not the destination. Acknowledging cultural practices, traditions, and special days demonstrates respect. Celebrating diversity takes it further, transforming difference into a source of strength.

True inclusion is reflected in hiring and promotion practices, in how misunderstandings are handled, and in the willingness to resolve conflict with sensitivity and skill. This level of inclusion requires strong communication, empathy, and effective mediation— but the rewards are immense.

As we move deeper into our social wellbeing and economic prosperity depend on our ability to work, learn, and grow together across cultures.

The good news? The opportunities are limitless. When diversity is embraced, not feared, it becomes one of our greatest advantages.

Have you ever felt delighted (perhaps secretly) when something went wrong for someone else? We may not openly admit it, but many of us have probably felt this way – sometimes intentionally, sometimes unconsciously.

This feeling has a name, borrowed into English from German: “schadenfreude”. And workplaces or other business settings – with all their pressures, rivalries and office politics – can create the ideal conditions for it to arise.

Here’s why we sometimes feel happy at others’ failures, why this emotion can have double-edged consequences, and how it can be reframed to promote learning and personal growth.

What is schadenfreude?

Schadenfreude is a compound word formed from two German nouns: “schaden”, meaning harm, and “freude”, meaning joy.

Importantly, here, we’re talking about something distinct from bullying, or actively causing another person pain.

Research has shown schadenfreude is relatively common in the workplace. It can be found among employees at all hierarchical levels, from lower-level staff to senior management.

For an employee, it might occur when seeing a rival or envied coworker being mistreated by a supervisor.

Similarly, top managers might feel schadenfreude when rivals fail. Our previous research indicates strategic leaders, including chief executives and other strategic level decision-makers, are prone to this emotion.

To investigate this further, our current research is exploring how Australian chief executives respond to competitors’ failure, with a particular focus on how they perceive and experience schadenfreude.

Our preliminary findings, which are yet to be peer-reviewed, suggest leaders recognise schadenfreude as a feeling that arises when a rival organisation encounters misfortune, especially in a competitive industry.

This was evident in their reflections on the PwC tax scandal and the 2022 Optus data breach, when they viewed these organisations as rivals. For instance, one participant explained:

Well, I think human nature again would dictate that you would be going, oh, the competitor, you haven’t done very well […] You can’t help but kind of rub your hands together and say, well, we’re going to get some customers out of this.

On face value, schadenfreude might seem emotionally counterintuitive. Ethically, one might expect that witnessing someone else in distress would elicit a response of empathy or compassion.

So, why is the observer experiencing pleasure or delight instead? Is it a brief lapse in empathy and moral judgement, or is something else going on?

Easing our insecurities

Feelings of schadenfreude can have many drivers. One of the foremost relates to insecurity.

Observing someone performing worse than yourself might make you feel better about your own abilities. This process is known as downward social comparison. In this way, for some people, schadenfreude can serve to enhance self-esteem.

High achievers’ failures are particularly noticeable because they are perceived as being at the top of their field.

Schadenfreude may be reflected in the cultural phenomenon of “tall poppy syndrome”, a tendency to “cut down” those who stand out.

Perceptions of deservingness can also drive this emotion. When someone acts unethically or appears undeserving of success and then faces failure, observers often feel they “got what they deserved”.

Identification with a particular organisation can also drive schadenfreude. If employees feel a strong connection to their organisation, they may view rivals as “out-groups”, making competitors’ misfortunes feel like wins that enhance their organisational pride.

Schadenfreude’s perils

There are a range of hazards to watch out for when navigating this emotion.

First, feeling schadenfreude may lead to overconfidence

at work. When employees or managers perceive their success as relative to others’ failure, they might become complacent, overlook changes and develop blind spots.

Second, schadenfreude can spread through gossip and harm workplace relationships.

If colleagues sense that you take pleasure in their difficulties, they may feel unsafe sharing failures or challenges. This can undermine openness and mutual support, damaging trust and relationships within the organisation.

And third, it can undermine workplace empathy. Employees or managers who take pleasure in others’ misfortune often fail to recognise the challenges their colleagues face.

By prioritising personal satisfaction or winning an advantage over showing compassion, they neglect to put themselves in others’ shoes, which can undermine the organisation’s supportive and overall ethical climate.

A double-edged sword

It may feel like a complex, dark emotion. But by recognising its drivers and meeting it with mindfulness, schadenfreude can be channelled into a positive opportunity for learning and growth.

When you recognise what you’re feeling is schadenfreude, you can pause and think: “Is this really how I want to respond?”, or “Is this really me?”

You might ask yourself reflective questions, such as:

• Could something like this happen to me, too?

• What went wrong for them, and what can I learn from it?

• How can I use this situation to improve myself or my decisions?

Being aware of and mindful about this emotion can give you the chance to shift from simply enjoying others’ failures to learning from them, improve yourself, address your own weaknesses, and prepare for future challenges without losing your moral values.

Dissanayake Mudiyanselage Sachinthanee Dissanayake PhD Candidate, University of Wollongong

Kumar Biswas Lecturer, University of Wollongong

Mario Fernando Professor of Management and Director, Centre for Cross-Cultural Management, University of Wollongong

Selling a business is one of the biggest commercial decisions a business owner will ever make. Whether you’re planning to sell your business this year or simply thinking ahead, understanding the business sale process in Australia puts you in a stronger position.

Too often, business owners only speak to a lawyer once a buyer is already lined up. By then, issues with contracts, leases, intellectual property, or structure can delay settlement or reduce the sale price.

This guide is designed for Australian business owners who want a smooth business sale, a clean exit, and certainty at every stage. It covers how to prepare your business for sale, what happens during the sale process, and what obligations continue after settlement.

Even if you’re not planning to sell immediately, running your business as if it could be sold at any time puts you in a stronger position. Buyers pay for certainty, and preparation reduces delays, renegotiations, and deal risk.

A proactive seller’s due diligence allows you to identify and fix issues before a buyer finds them. This is often done with the help of a commercial lawyer and accountant and should cover:

Business name and trademarks – Confirm that all business names and intellectual property are registered correctly and owned by the right entity. Key contracts – Customer, supplier, and service agreements should be in writing. Handshake deals create uncertainty and reduce value.

PPSR charges – Clear out any old or historical PPSR registrations over business assets to avoid settlement delays.

Lease matters – Review your lease terms and identify

any issues that could concern a buyer, such as short lease terms or unfavourable conditions.

Licences and permits – Make sure all required licences are current, transferable, and documented.

Your accountant plays a key role at this stage. Clean, accurate financials help buyers assess risk and support your asking price. Any inconsistencies or gaps can slow down due diligence or lead to price reductions.

Once a buyer is found and commercial terms are agreed, the process moves into the contract phase. This is where legal precision matters.

Early documents such as a Heads of Agreement or Expression of Interest usually outline:

• Purchase price

• Parties to the transaction

• Settlement date

• Due diligence conditions

While often non-binding, these documents set the framework for the final contract.

The business sale agreement deals with issues including: Restraint of trade – How long and where you are restricted from competing after the sale.

Employee entitlements – How accrued leave and other entitlements are handled.

Purchase price allocation – How the price is split across assets.

Risk allocation – What happens if something goes wrong between signing and settlement.

A well-prepared contract includes detailed schedules and attachments, such as:

• Asset lists

• Intellectual property schedules

• Lease documents

• Licences and permits

• Employee details

Clear disclosure at this stage protects both parties and reduces post-sale disputes.

Once the contract is signed, the buyer typically pays a deposit, which is held until settlement. From this point, both parties are legally committed, subject to any conditions.

Settlement is where ownership formally transfers from seller to buyer. While it can feel like the finish line, there are many moving parts to manage.

• Lease assignment – Entering into a Deed of Assignment and, where possible, securing a release from ongoing lease obligations.

• Business name transfer – Completed through ASIC Connect using a consent-to-transfer number.

• Licences and permits – Transferring operational licences to the buyer, which can take time.

• Plant and equipment – Ensuring leased or financed equipment is properly dealt with.

• Employee matters – Informing staff, calculating entitlements, and confirming transfer arrangements.

• Third‑party contracts – Assigning or terminating customer and supplier contracts in line with their terms.

Financial adjustments are agreed at settlement, including rent, outgoings, stock, and other apportionments. If stock is excluded from the sale, a stocktake may be required.

On settlement day, funds are transferred, keys and access are handed over, and control of the business changes.

Settlement isn’t the end of your obligations. There are several important matters to address after the sale.

Some legal steps continue after settlement, including finalising any remaining documents and ensuring all contractual obligations have been met.

You’ll need to work closely with your accountant to:

• Address tax liabilities arising from the sale

• Finalise outstanding financial obligations

• Ensure proceeds are correctly distributed

• Restrictive Covenants and Non-Compete Obligations

Most business sales include restraints that limit your ability to compete or solicit clients or staff. It’s important to clearly understand what you agreed to and comply with these obligations.

Easily

Run-off insurance can protect you from claims that arise after the sale but relate to the period when you owned the business. Your insurance broker can advise whether this is appropriate for your situation.

Selling a business is not a single transaction. It is a structured legal and commercial process that starts well before you go to market and continues after settlement.

The earlier you prepare, the more control you retain over price, timing, and risk. Clean contracts, clear ownership of assets, and proper legal advice help avoid delays, renegotiations, and post-sale disputes.

Working with an experienced commercial lawyer who regularly handles business sales allows you to anticipate issues before they arise and move through the process with confidence.

If you are considering selling your business now or in the future, a short conversation early can save significant time, stress, and cost later.

We offer a free discovery call with one of our legal team to:

• assess whether your business is sale-ready

• identify legal risks that could impact value or settlement

• explain the business sale process in plain language

• outline next steps with clear, fixed-fee options

There is no obligation and no legal advice given on the call. It is simply a chance to get clarity before you move forward.

Book your free discovery call here: Book a chat with our team today – Free Discovery Call

www,riselegal.com.au

•

•

Individually, small steps can add some value to a business, but when combined they can make significant differences. This becomes especially important during periods of interest rate rises, when borrowing costs increase and profit margins come under pressure. Higher interest rates affect businesses by raising the cost of loans, reducing consumer spending, and increasing uncertainty in investment decisions. As a result, companies must respond proactively rather than relying on a single major adjustment.

Rising interest on debt can be a curse when running a small business. However, there are some quick and easy policies you can start using to combat interest rate rises.

A manufacturer can reduce stock levels by ensuring raw materials are delivered a few days before they’re needed, rather than months before – known as just in-time ordering. A retailer can use a similar approach by cutting stock levels and drawing on a supplier’s reserves after each sale.

Talk to your suppliers about your requirements and help them to anticipate your stock needs. They should be able to provide you with an efficient stock servicing solution. This will allow you to reduce your stock levels, plus the amount you’ve borrowed to pay for the stock and the interest you’d pay.

You can also use your supplier’s terms of payment to your advantage. If you have credit terms from your supplier, you have access to non-interest bearing credit. Use this as much as possible, and ask for favourable terms from other suppliers to reduce the amount of interest-bearing money you’ll need to borrow, and the amount of interest you’ll need to pay.

The amount you’ll be able to save by introducing these small changes to your business could add up to significant savings over a year or two.

Think of your business like a car in development. Improved aerodynamics, fuel injection and weight loss might separately increase fuel economy, but used together they could make the car a marketleader.

Here are three easy tips you can implement in your business to combat the effect that rising interest might have on your bottom line.

Get into the habit of depositing payments promptly. Payments waiting to be deposited or money left sitting in your cash register aren’t working for your business. You could also save time and money by encouraging electronic transfers directly into your bank account.

When in your bank account, these amounts can either reduce your overdraft and save you interest charges, or add to your bank balance and earn you interest.

Follow up on payments as soon as they fall due. A friendly follow-up call should reduce the amount of time you wait to get paid. It will also lessen the period you effectively provide interest-free loans to your customers, while paying interest on the money you’ve borrowed.

Another way to encourage prompt payment is to present customers with an early settlement discount. Offering a 5% discount for payment within 30 days, or a 10% discount for payment on delivery, can speed up your collection of debt.

Most small businesses have a lot of money tied up in stock. If you’re able to moderate this by managing your purchases better, you can decrease the amount of money you borrow and the interest charges you’ll have to pay.

Talk to your suppliers about your requirements and help them to anticipate your stock needs. They should be able to provide you with an efficient stock servicing solution. This will allow you to reduce your stock levels, plus the amount you’ve borrowed to pay for the stock and the interest you’d pay.

You can also use your supplier’s terms of payment to your advantage. If you have credit terms from your supplier, you have access to non-interest bearing credit. Use this as much as possible, and ask for favourable terms from other suppliers to reduce the amount of interest-bearing money you’ll need to borrow, and the amount of interest you’ll need to pay.

The amount you’ll be able to save by introducing these small changes to your business could add up to significant savings over a year or two.

Running a painting and decorating business isn’t just about delivering a great finish on the wall — it’s about quoting profitably, keeping cash flowing, managing jobs smoothly, and making sure the business works for you, not the other way around.

That’s where a 90-day business tune-up can make a powerful difference.

For painters and decorators, thinking in 90-day blocks is practical, realistic, and perfectly aligned with the way trade businesses actually operate. Rather than vague annual goals that get lost in the busy season, a focused quarter gives you clarity, momentum, and measurable results.

Painters and decorators face constant change — weather, client delays, supplier issues, staff availability, and seasonal demand. A 12-month plan often feels too far away to stay relevant.

A 90-day plan allows you to:

• Focus on what will actually move the needle right now

• Adjust pricing, systems, and workload quickly

• Improve cash flow before small issues become big problems

• Build confidence through visible progress

Think of it as a business reset every quarter — short enough to stay sharp, long enough to see real improvement.

Step 1: Review the Last Quarter (Without the Stress) Before you plan forward, take a clear look back. Ask yourself:

• Which jobs were profitable — and which weren’t?

• Did quotes reflect the true time, materials, and effort involved?

• How consistent was your cash flow?

• Were you flat out but still not seeing the money you expected?

For painters and decorators, labour overruns, underquoted prep work, and delayed payments are common profit killers. Identifying these patterns is the first step to fixing them.

This isn’t about judgement — it’s about insight.

Step 2: Tighten Up Pricing and Job Profitability

Many painters are busy but underpaid.

A 90-day tune-up is the perfect time to:

• Review your hourly and daily rates

• Check material mark-ups

• Factor Prep, clean-up, travel, and admin time into quotes

• Set minimum job values

Even small pricing adjustments can make a major difference over a quarter. One or two improved margins per week quickly add up.

Step 3: Improve Cash Flow (Fast Wins First)

Cash flow stress is one of the biggest pressures tradies face.

In the next 90 days, focus on:

• Shortening invoice turnaround time

• Setting clearer payment terms upfront

• Requesting deposits where appropriate

• Following up overdue invoices consistently

Better cash flow doesn’t always require more work — it often comes from better systems.

Step 4: Simplify Systems and Reduce Head Noise

Painters and decorators often wear every hat in the business — quoting, scheduling, purchasing, invoicing, and managing clients.

A strong quarter is supported by simple systems:

• Standard quote templates

• Job checklists for prep, paint, and completion

• Clear scheduling and workload visibility

• Basic tracking of income and expenses

When systems are clear, decisions are easier and stress reduces.

Step 5: Set 3 Clear Goals for the Next 90 Days

Instead of a long to-do list, choose three priorities for the quarter.

For example:

• Increase average job profit by 10%

• Reduce outstanding invoices to under 14 days

• Implement consistent pricing across all quotes

These goals should be specific, measurable, and achievable within 90 days.

This is exactly where the Tradies QuickStart Advantage Program comes in.

The program is designed for painters, decorators, and trade business owners who want:

• Clear financial visibility

• Practical guidance (not theory)

• A structured 90-day improvement plan

• Better profits without burning out

Rather than trying to fix everything at once, the program helps you focus on the actions that create immediate and sustainable improvement — cash flow, pricing, and clarity.

It’s about building a business that supports your life style, not one that consumes it. One Strong Quarter Can Change the Year

A well-executed 90-day business tune-up can:

• Improve cash flow

• Increase profitability

• Reduce stress

• Create confidence in your decisions

For painters and decorators, success doesn’t come from working longer hours — it comes from working smarter. If you’ve been flat out but feel like the business could be performing better, this quarter is your opportunity to reset, refocus, and move forward with purpose.

A strong business isn’t built overnight — but it can be built one powerful quarter at a time.

Download our FREE 21-Step Tradie Success Checklist or book a free intro session to get started.

Please Note: Many of the comments in this article are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

Copyright © 2026 Robert Bauman.

Quoting is one of the most important parts of running a successful painting business. In this video, we break down the process of creating accurate, professional quotes that win jobs and keep your business profitable.

Finding and keeping the right people is one of the biggest challenges for painting and decorating businesses.

Smoko – What does it really Cost

Smoko isn’t just a break – it’s a tradition in the trades. In this video, we take a look at what smoko means on site, why it’s important, and the stories that come with it.

What makes one tradies public liability policy different to another?

We speak with a lot of trade business owners every week, and sometimes we’re asked why there is a difference in cost between two policies which seem the same.

The thinking is, if one public liability policy covers a carpenter for $5 million, it’s no different to another policy which covers the same trade for the same amount.

And with that being the case, why would one policy be more expensive than the other? Presumably the more expensive one is just a rip-off, right?

Two policies which seem the same on the surface can actually be massively different, and can have huge consequences at claim time.

Let’s take a look at some of the differences…

This is a fairly basic difference that most people will understand. Just like your home or car insurance has an excess, so does public liability insurance.

Some policies have an excess as low as $250 per claim, whilst others can be $2,500 or more.

The higher excess could be a result of your higherrisk trade, your claims history or perhaps an insurer which just has a higher excess for their own reasons.

Either way, the difference at claim time is important. You might choose a policy which is $50 a year cheaper but has a $500 excess. If you don’t make a claim, you’ve done well. But if you do make a claim, you would have been better off with the slightly more expensive policy that had a lower excess.

When comparing the premiums on two different public liability insurance policies, make sure you look at the excess and not just the initial cost.

All policies don’t necessarily cover all types of work.

Taking an electrician as an example, some insurer’s standard public liability policies only cover domestic, some cover domestic and light commercial, whilst others cover anything other than industrial.

But that might not be completely obvious when looking at the quote. Instead you need to dig into the Product Disclosure Statement (PDS), policy or policy schedule.

As an electrician you might get one public liability quote for $500 and another for $700. You might think the $700 policy is too expensive, without realising that the cheaper one won’t actually cover the industrial work you’re doing.

If you then need to make a claim for the industrial work you were doing, you could find your claim declined and yourself out of pocket by thousands of dollars (or much more) just because you tried to save a couple of hundred on the premium.

Make sure you check that all of your work activities are included. A good trade insurance specialist broker (such as Trade Risk) can help you through this process.

Whilst there are some fairly standard exclusions across the public liability insurance policies offered by different companies, there are some unique differences too.

Most standard policies will exclude work on airports and oil rigs for example. If you’re comparing a couple of common policies, you won’t notice much difference in that area.

But there can be other differences in exclusions between policies, and sometimes in areas that you wouldn’t expect.

For example one well-known insurer recently limited cover for plumbers working on buildings greater than three storeys.

If you have a policy with that particular insurer, the difference between a three-storey building and a fourstorey building could be a declined claim leaving you in major financial trouble.

So before you decide one policy is more expensive than the other and therefore a rip-off, check the exclusions to see if there is a good reason for the difference in price.

It’s one thing for the policy to be up to scratch, but what about the service behind the product?

This is another area where you need to consider the differences between what’s on offer.

One policy for example could be offered by an onlineonly provider who doesn’t offer phone support. Their public liability quote might be super cheap, but so is their service.

Or perhaps they do offer phone support, but you’re dealing with a call centre filled with staff who only meet the minimum training and experience requirements, and may only deal with a tradie once or twice a week.

Compare that to Trade Risk, where every client has their own account manager who is a qualified and experienced insurance broker. You have their direct mobile number to call them anytime, and you know that you’re dealing with someone who specialises in the trades.

That might not mean much when purchasing the policy, but it could mean an awful lot when things go pearshaped and you need an expert on your side to guide you through the claim process.

The cost of an insurance policy is generally going to take into account the cost of the people standing

behind it. If you want the best service, you’re probably not going to get it from the cheapest policy.

We completely understand that business insurance can become quite complex, which is why we recommend using a specialist trade insurance broker such as us.

But to put the above into context, here’s an example to think about.

Let’s say we’re comparing two cordless drills. I found this Ozito drill at Bunnings for $49, and this Festool drill at Total Tools for $824.

One is almost 20 times more expensive than the other! But they’re both just cordless drills right? You stick a drill bit in the end and makes holes in things…

As a tradie, you’d laugh at us for even mentioning those two items in the same paragraph! But the same is true of public liability, and any other form of insurance for that matter.

You might think that two policies are both the same, but to us we might immediately know they are completely different and not comparable at all.

Just like the Festool drill isn’t a rip-off just because it’s more expensive than the Ozito, one public liability policy isn’t a rip-off just because it’s more expensive than another.

Ultimately it pays to get the right advice. If you can’t tell the difference between two policies, or more likely don’t have the time to conduct a thorough comparison yourself, trust a professional to do it for you.

You’re the expert at your trade and know which tools you need, whilst we’re the experts in trade insurance and know which policies you need.

If you’d like to speak with a trade insurance specialist about you needs, click here to contact us online or call our friendly team on 1800 808 800.

I’ve tried every diet and (nearly) every health fad in my time — except in the last 10-15 years or so, as I’ve settled into the eating habits that work for me. I’ve read tons of research, and am familiar with the bulk of evidence around healthy eating.

And in all the things I’ve tried, and in all the research I’ve read … there is one single eating habit that makes almost all of the difference with your health. The “80/20” of eating habits.

And no, it’s not “keto” or even my beloved veganism … it’s not intermittent fasting, nor is it going glutenfree or doing juice cleanses. (In fact, if it has “cleanse” in the title, avoid it!)

The single eating habit is shifting from processed food to whole foods.

This works for almost anyone, unless you have a special health issue (i.e. if you have celiac’s disease, then gluten-free is for you) … or unless you’re eating 95% whole foods already.

Let’s define “whole foods” as foods that are mostly in their natural state — things like vegetables, beans, whole grains, fresh fruits, nuts, fish, eggs. Then there are minimally processed foods, like yogurt, tofu, dried fruits, nut butters, hummus, etc. — which I think we can include in the whole foods category if they don’t have much added sugars, oils, chemicals, etc.

Here are some examples, depending on where you are:

If you have a Standard American Diet (SAD), then you’re eating mostly processed foods and very little whole foods. Simply substituting one processed food in each meal for one whole food is a huge change. For example, go from a bagel to hummus and carrots, or French fries to a baked potato (not loaded up).

If you eat out a lot, or grab prepared foods (deli sandwich, Pop Tarts) cook some food from scratch at home that include mostly whole foods.

If you eat fairly healthy, but are eating lots of sweets (processed flour and sugar), switch to whole fruits and nuts for a snack.

Slowly, gradually, move your eating from processed foods to whole foods, and you’ll be making yourself healthier fairly painlessly.

Leo Babauta ZEN HABITS

Southeast Australia is enduring a record-breaking heatwave, with temperatures rising above 40ºC in many areas.

For vulnerable people, particularly older Australians, this heat is not only uncomfortable but dangerous. High temperatures can worsen existing health problems and in some cases even prove fatal.

So as the mercury climbs, it’s important to understand why some people are more at risk.

Here’s how to tell if someone is not coping with the heat – and how to stay safe.

Why is it harder for older people to keep cool? Our bodies have a number of processes to regulate temperature.

First, the heart directs blood toward the skin, delivering heat from the body’s core to the surface.

Second, when we sweat and it evaporates off our skin, this allows excess body heat to escape into the air.

But as we age, these processes become less efficient. Older people’s blood flow and sweating are reduced compared to younger people. This means their bodies store more heat for longer.

Why this is dangerous

Often, the real danger isn’t simply overheating – it’s the strain heat puts on the cardiovascular system (the heart, blood and blood vessels) trying to serve two masters.

During hot weather, the heart works significantly harder. It diverts blood to the skin to shed excess heat, while still trying to satisfy the oxygen demands of other vital organs.

This helps explain why, during heatwaves, hospitals are not overrun with older people suffering from heatstroke. Instead, the overwhelming surge in emergency department admissions is mostly due to underlying health conditions that get much worse, such as diabetes and heart, lung or kidney diseases.

Older adults are more likely to have at least one chronic condition, and in heatwaves that last for days without a break these conditions can rapidly worsen.

The more chronic conditions someone has, the more likely they are to be hospitalised during hot weather.

Common medications can also interfere with the body’s cooling mechanisms.

Diuretics increase the risk of dehydration, while beta-blockers and some antidepressants can impair sweating, as can anticholinergic drugs (found in some medications for bladder problems, allergies and Parkinson’s disease).

Social factors can also make things worse

While the number of air conditioners has soared in Australia in the past two decades, rising energy costs mean many older adults may be reluctant to run their units.

Others may live alone or be less mobile. Conditions which affect thinking and memory, such as dementia, can also make it difficult for someone to assess their own risk and remember to drink fluids.

What to look for

Keep an eye out for signs you or your loved ones are not coping with the heat.

For older adults, these can be subtle. Early signs of heat stress include:

• being unusually tired or lethargic

• losing balance

• feeling confused

• feeling short of breath

• urinating less or dark urine (this can indicate dehydration and kidney strain).

In those with chronic conditions, watch for any worsening of usual symptoms.

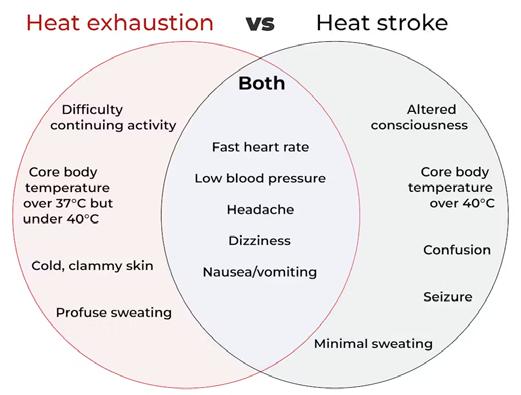

Heat exhaustion is more serious, and requires fluids and rest in a cool environment. Signs of heat exhaustion include very heavy sweating, nausea, headache and muscle cramps.

Heat stroke has similar symptoms but is a medical emergency – it requires immediate medical attention.

Heat stroke is also characterised by hot and dry skin as the body’s heat regulation system fails.

This happens when the body’s core temperature exceeds 40ºC, and can lead to loss of consciousness and organ failure.

How to stay safe

Beyond the usual advice to stay hydrated, seek shade and reduce physical activity, there are some simple strategies that can also help the impact of extreme heat for older adults.

Air conditioning remains the most effective defence against the heat. If you don’t have air conditioning at home, consider going somewhere such as a shopping centre or library during the hottest part of the day.

If you do have an air conditioner, setting it to 26–27ºC and using a pedestal fan can result in a 76% reduction in electricity consumption and improves comfort.

For those without air conditioning, fans alone can help. Wetting the skin or clothing in combination with a fan boosts evaporative cooling without requiring your body to produce more sweat.

However, for older adults (who sweat less) the effectiveness of fans begins to diminish between 33 and 37ºC. Above 37ºC, fans may actually make the body hotter faster than sweating can compensate for.

So for older adults it’s important to keep the skin moist or find other ways to cool down if using a fan when temperature is above 37ºC.

Even something as simple as immersing your hands and forearms in cool tap water – for ten minutes every half hour – has been shown to meaningfully lower body temperatures and stress on the heart.

The bottom line

Heat doesn’t discriminate, but its consequences do. In a heatwave, look out for older family members and neighbours.

If you or someone you know has symptoms of heat stroke such as slurred speech, confusion, fainting, or hot, dry skin, call 000 immediately.

Aaron Bach Researcher and Lecturer in Exercise Science, Griffith University

Fergus O'Connor Research Fellow in Exercise Science, Griffith University

Toxic leaders poison entire companies, and once they get authority over others, they don't let it go willingly. Thankfully, any business can destroy their poisonous influence.

Toxicity thrives when no one tells the truth, but the reverse is also true. If your employees are honest about each other, they can uncover toxic conduct and destroy it. Employees know how obnoxious leaders can be, but reporting their actions isn't always worth the effort.

Not only do toxic people seek revenge, but they also love destroying communication lines. That makes it easier for them to isolate coworkers so they can emotionally manipulate them.

If you want your employees to tell the truth, then you need to reward them. Speaking against a colleague is always risky, especially if they are voicing criticism a superior with the authority or influence to punish them.

You don't have to offer monetary incentives; praising them in private is usually enough, though it doesn't hurt to remind them that you will remember their thoughtfulness when you are writing schedules and planning promotions.

People won't correct their conduct if they don't get clear directions. Procrastinating is easy, and having no deadlines means they are getting away with their toxicity.

Troublesome managers don't always make destructive decisions intentionally. Micromanagers, for example, want to do a good job and work hard; they just don't understand that they are wasting company time.

Create deadlines that your employees can meet. Breaking them down into small steps means everyone can follow their progress and make needed adjustments. It is also a good idea to clarify offenses and punishments. Some actions deserve swift and harsh penalties, including firing; informing your employees is a powerful deterrent.

Knowing when to let members of your leadership team go is vital. Managers influence decisions at every level of your business, including who you hire and fire. Toxic personalities hire job candidates that look like themselves, poisoning your business over time. Don't let them get away with it.

Only the future matters.

The resources you spent on recruiting and mentoring a team member are already gone. You are losing money and damaging your reputation every day a toxic leader stays on staff. You should include all compensation in your calculations, of course, but always make decisions that will help your company in the long term.

In business, character matters. Creating policies that prevent toxic behavior is vital, but people are infinitely creative. Given enough time, people will bypass the system, even if it means bribing and blackmailing coworkers.

Hiring and promoting employees with strong character will transform a corrupt leadership team, as long as they are free to influence their coworkers. If you think toxicity is in a specific level of your command structure, attack it from above.

This simple solution often leads to quick results. You will face stiff resistance, but it will weaken over time as toxic influences lose power.

But what character traits should you seek? Emotional maturity will stand out; it is hard to miss in an employee's actions and work history. Next, look for candidates who value people over possessions. If someone would prefer to walk away from a toxic culture than become part of it, they might be a perfect fit for your team.

If toxic leaders are poisoning your business, then look for a cure; finding one is not as difficult as many companies may think. Toxic personalities aren't immortal, and some aren't even aware how destructive they are. Give them the opportunity to change.

Sandra Price www.tradiebookkeepingsolutions.com.au

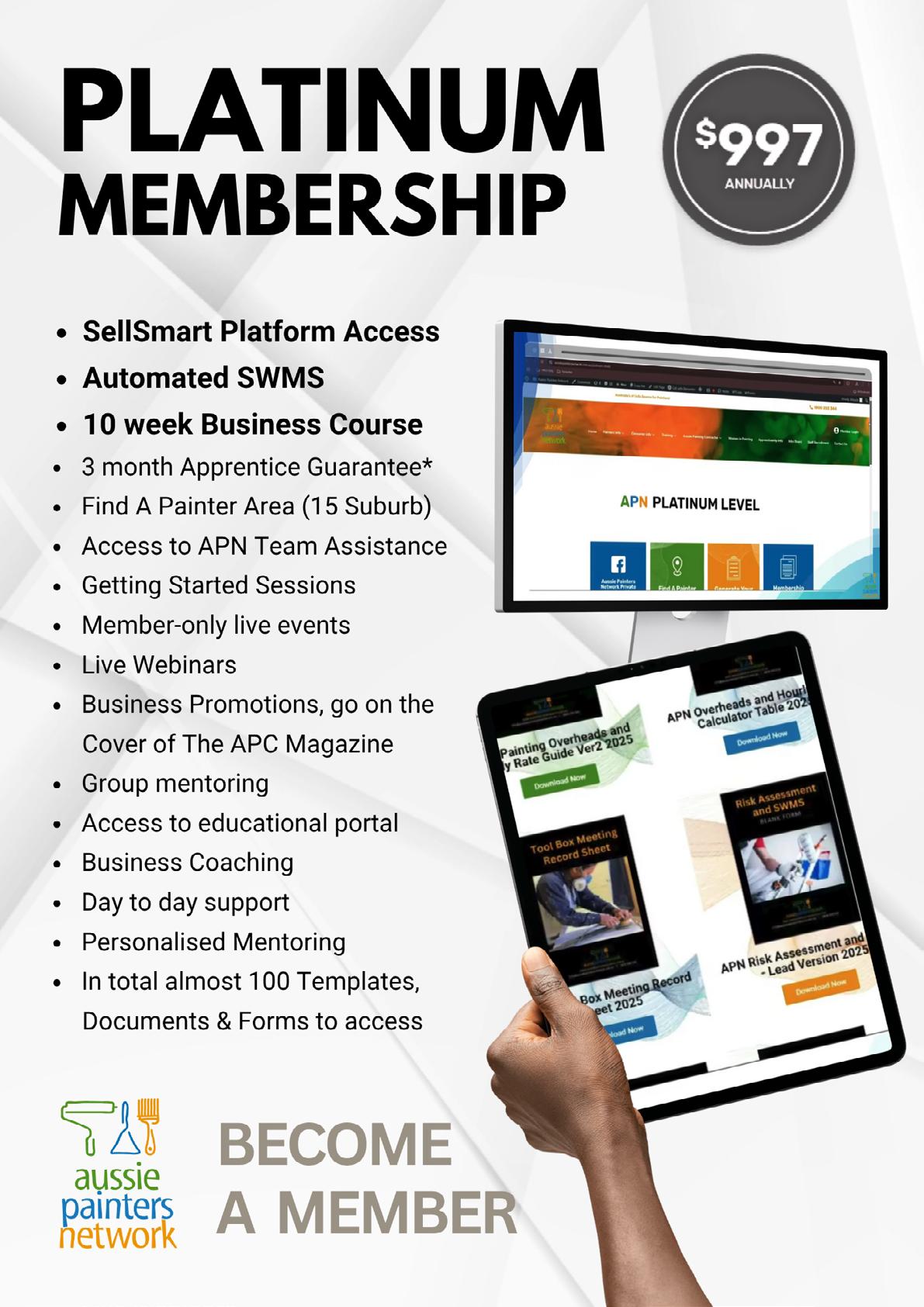

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au

Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA

NT WorkSafe

WorkSafe Tasmania

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au

cancersa.org.au cancervic.org.au

cancerwa.asn.au