The people behind the brands explain why the region’s creative industry is suddenly surging.

The people behind the brands explain why the region’s creative industry is suddenly surging.

“

Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, JD, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors for 2025. Charles has achieved the #1 ranking four times within the past five years.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the highest-ranking Fee-Only Advisor on the list.*

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial and Charles Schwab.

Floor Covering Brokers Carpet One and Carpet Galleria in Traverse City recently announced an ownership change. Michael and Kristi Watkins - longtime employees and leaders (pictured above) - purchased the two flooring stores from owners Denny and Jo Lauterbach, who have retired. Under the new ownership, all current employees will remain in place. Floor Covering Brokers Carpet One is entering its 40th year in operation. Carpet Galleria, a well-established local flooring retailer, became part of the Lauterbachs’ business portfolio in 2022. Together, the two stores comprise the largest floor covering business in northern Michigan.

Miller Canfield has opened a new office in downtown Traverse City. The office, located at 202 E. State Street, opened January 1. Steve Roach serves as the resident director. “Our clients here are navigating sophisticated legal issues while also facing the unique opportunities and pressures of a thriving tourism, hospitality, agricultural and manufacturing economy,” Roach said. “We’re excited to build on the work we have here and to be a long-term partner to businesses throughout the region.”

Northern Michigan Startup Week (NMSW) 2026 is set for April 2024. NMSW 2026 will feature expanded programming, new collaborations, and more ways to connect across the entrepreneurial ecosystem. The week will feature events designed for entrepreneurs, students, innovators, educators, investors, and startup enthusiasts from across northern Michigan and the broader Great Lakes region. Hosting partners include 20Fathoms, Northwestern Michigan College, Grove Incubator, and the MSU Research Foundation

The Benzie County Chamber of Commerce and the Economic Development Partnership recently announced their integration – combining the strengths of the private sector business network with county economic development interests – and the appointment of Jon Willow as executive director. Willow brings extensive experience in economic development, coalition building, and rural community engagement to the leadership role. Most recently, she served as the 2025 Innovation Fellow at Michigan State University’s Regional Center for Economic Innovation.

Golden-Fowler Home Furnishings in Traverse City recently announced its fourth ownership transition in 65 years of operation. Amanda Eshleman assumed the role of owner and president on January 1. Like the owners before her, Eshleman worked her way through every position in the company prior to taking the helm.

EB2 Vintage has completed its move to 1316 W. South Airport Rd. and will be holding a grand opening Feb. 14 from 11-5. The store, owned by Carla Weaver, offers vintage furniture, decor, local art, gifts, classes and consignment; eb2vintage.com.

The Fifth Third Foundation has awarded $25,000 to Venture North Funding and Development to help small businesses in northern Michigan. The money will be used to provide lowcost loans and no-cost business consultation. Venture North has provided 212 low-cost loans to northern Michigan businesses totaling more than $13 million, leveraging an added $33+ million from commercial lending partners, creating and retaining over 1,400 jobs. It has also provided more than 800 businesses with no-cost consulting services.

NOVELLO CLINIC EXPANDS SERVICES

Novello Specialty Clinic in Traverse City is now offering advanced gastroenterology services onsite through a new telemedicine clinic with Henry Ford Health. This expansion allows patients to receive specialty care locally, reducing the need for travel while staying connected to a full range of diagnostic and follow-up services.

During this season of rest for many when the snow falls and our winter sports are enjoying their spotlight, the social and corporate planners are hard at work with suppliers getting ready for what is undoubtedly going to be yet another amazing season of festivals, weddings and meetings in beautiful northern Michigan.

This often-misunderstood industry is one of the oldest professions, dating back to the ancient Olympics. I’d give anything to join Bill and Ted and hop in their time machine to see what those event planners were up to. Did they write the timeline on a tablet? How did they crowd control? How did they handle marketing and registration?

Traverse City has a long and solid history of events. The planners who run the meetings, festival and weddings today – we’re ready. We’re excited. We are the glue that brings together the vendors. We’re the taste makers, the influencers of the region, the story curators, the memory makers, the dream weavers, the trend setters, but we are so much more.

For being around as long as this industry has been around, I am constantly shocked about how long it took for associations and four-year degrees to become developed. I believe this is part of what has taken many people so long to fully understand what planners do. Humor me for a quick story to get the full background from my perspective.

In 1987, I was hooked and didn’t even know what I was hooked on. I had just planned a canned food drive at my school for student council. Other than the phil-

anthropic effort that I enjoyed, there was something else, but I couldn’t put my finger on it. Fast forward to winter of 1997, I came home from my freshman year of college at Albion completely devastated. I was a music major, but I had a 2.0 in music theory and had to take it for four more years. I did not want to sing anymore.

Frustrated, I went to the library computer to “Ask Jeeves” what I should do for the rest of my life. I knew I loved being organized because I planned things at school, served on student senate, liked leading and enjoyed details. I found an association for event planners. I quickly joined the International Special Events Society (ISES) as a student member.

based in Traverse City is astounding for a mid-sized market. Our work takes a special person … a special breed, if you will. So, to know that there are so many of us up here is mind blowing. The seasoned veterans in this town could collectively write a New York Times best seller that would blow your mind. You see, no one really knows or gets what we do unless you’re in the industry. Let me try to explain.

The abundance of talented planners based in Traverse City is astounding for a mid-sized market.

ISES’s closest chapter was in Toledo. The association was only 10 years old when I joined.

The same year, I found a distance learning program from George Washington University. They mailed me VHS tapes, books and workbooks. Since then, the industry has come a long way. ISES finally changed its name to ILEA, International Live Event Association, in 2016. Today, there are dozens of associations for each niche market for planners and numerous colleges with four-year degrees in event management. I’d say the industry has really matured, elevating what we do from task master to so much more.

The abundance of talented planners

For years, Jennifer Lopez (“The Wedding Planner”) made our jobs looks silly, trivial and like all planners regardless of industry were more of an assistant with a headset and a clipboard.

As a corporate planner myself, it made it even harder to shake. That is not the case. Here’s what we are regardless of being a meeting, wedding, festival or other planner: We are the orchestra conductors of the meeting or event; we don’t know how to play every single instrument, but we have to be semi-experts enough and bring in the best partners to work with us. As business owners, CEOs and leaders, we have to be experts in contract law, creative development, marketing, software (lots of software), supply chain management, logistics, bookkeeping, budget management, staffing, human resources, leadership, food and beverage (and all of the dietary that comes with it), religious holidays and

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

STAFF

customs, travel, airlines, hotels, technology, production and communications (and Psychology 101 from college helps!)

You also should be an extrovert with an amazing memory and/or write everything down. When the meeting or event takes place, it’s like putting on a 24-hour play. We are also – for most meetings and events – the only ones who are sober and making sure everyone is safe. A Forbes magazine article on “The Top Stressful Careers Heading Into 2026” lists leisure and hospitality as number one. “Event planner” is often ranked in the top five on many most stressful job lists due to the high pressure, deadline-driven work that we do. So please understand why I give a fake smile and grit my teeth when you ask my how my “party planning” business that I’ve owned for 18 years is going. We are multifaceted experts. We are lifelong learners staying on top of the industry trends and what is best for our clients. Our industry is continuing to help others understand what we do. So, spread the word ... we’re ready for you! The planners, the suppliers, the hotels, the restaurants, transportation, the rental companies, the venues … we’re all ready! Bring it on!

Allison Beers is the founder and CEO of Events North and proud to be headquartered in Traverse City. Events North is a full-service meeting and incentive management agency. Its clients are based across the country and it operates meetings all over the world. Events North celebrates 18 years in business this year. EventsNorth.com.

COPY EDITOR

Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Marc Morris

SERVING

Grand Traverse, Kalkaska, Leelanau and Benzie counties

AD SALES

Lisa Gillespie lisa@northernexpress.com

Kim Murray kmurray@tcbusinessnews.com

Kaitlyn Nance knance@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Michele Young myoung@tcbusinessnews.com

COVER PHOTO BY

Megan Renae Studios

The Traverse City Business News

Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2026 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

By Art Bukowski

Melissa Conradie runs Conradie Event Design with her husband, Dawie Conradie. Her company is a boutique wedding planning & event design company that has helped hundreds of clients achieve that perfect day and scores of organizations host amazing events. We thank her for showing us around her home office! If you have a suggestion for a From The Desk Of feature, please email Art Bukowski at abukowski@tcbusinessnews.com.

1. Each of these signature projects took 12-18 months of very detailed planning and 2-3 weeks to build out the structures. It’s always surreal to stand in the room on the day of and truly reflect back on all of the time and trust it took to get to that moment. To see the joy it brings is the “why” in all that we do.

2. This is a review from the client we started our company with in 2011 and still work with today. This reminds me that all it takes is one person to believe in you and give you a chance. They see you are motivated and hardworking. This person is very instrumental in my story of building the company and their trust over the years means the world to me.

3. This has been on my desk since 2023. It’s a thank you letter from the mother of a bride. This particular event was a huge production, and with a production like that, the expectations, of course, are really high. We made her really happy, and she expressed that in the card. It’s always on my desk because it’s a reminder of the fact that we’re in charge of people’s most precious moments.

4. One of my favorite parts about event planning is the design process. On any given day you will find linen swatches and decor samples scattered about. Fun fact: before my first client had us plan their mother’s 90th birthday party, which started our company, I was scheduled to move to South Africa where my husband is from and finish out my schooling to go into interior design.

5. Working with my husband is honestly great. If there’s ever going to be a person that knows how you operate and knows your personality well, it’s going to be your significant other. We have a really great balance with our whole team as well. They’re like family, and they all have a bond with Dawie and myself.

6. You will always find a cup of coffee on my desk, music playing, a lit candle and often times fresh flowers. Creating welcoming spaces is what our company does, and my office space is a direct reflection of what inspires me.

7. As you can imagine, there are so many details and logistics that go into planning events. A staple next to my computer is always my notebook. This monogrammed Shinola notebook was a gift from one of our sweet wedding couples as a thank you gift they sent me on their one-year anniversary.

8. Lola is my English Bulldog. Chances are if you have had a call with me and it’s during one of Lola’s 20 naps of the day, you’ve heard me explain that the loud rumbling noise in the background is Lola snoring.

Coryn Briggs, Senior Director of Marketing, Traverse City Tourism

Paul Britten Jr., Executive Vice President/Sales and Marketing, Britten, Inc.

Jennifer Lake, Owner, Brand Tonic

Fernando Meza, Owner/CEO, Oneupweb

Chip Rice, Director of Marketing, Interlochen Center for the Arts

Aaron Swanker, Co-owner, Flight Path Creative

Carly Wujcik, Owner, WURCK Consulting

By Art Bukowski

The business world is constantly evolving, but one thing will never change: If you’re not connecting with customers, you’re in big trouble.

In an increasingly competitive environment where consumers are crunched for time and pummeled with promotions at every turn, careful and effective marketing

is more important than ever. But how do today’s marketers navigate a dizzying array of channels, tactics and technologies? How do they know what’s really working? And how do they do it all within budget?

The TCBN convened a roundtable of local marketing professionals to discuss the trends, opportunities and challenges within this busy and vital space.

As with the average consumer, modern marketers simply have far more choices (or distractions, depending on how you look at it) than they did even a decade ago. One essential social media platform became three or four. Digital opportunities have exploded. Even old-school channels like outdoor, TV and print are far more diverse.

Add in artificial intelligence, which came on the scene with guns blazing, and you have an overwhelming suite of technologies and channels through which customers can be wooed.

So what’s worth pursing, and what’s just noise? Now more than ever, these marketers said, it’s critically important to figure out who you’re targeting – and why – before you give any thought to what tools you’ll use to connect with them.

“Every successful or experienced marketer knows the channels will always change. The possibilities will always

expand and contract, always ebb and flow, but you can’t ever abandon the basics,” said Carly Wujcik of WURCK Consulting. “You have to understand who that target audience is, which starts to shape where you might find them, and then you have to understand what problems you solve for them and communicate that message clearly.”

It’s tempting to get distracted by the how, marketers say, but you’ll be spinning your wheels – and wasting your money – if you don’t start with the who, what and why.

“Marketing, I feel, has always been an act of empathy,” said Chip Rice, director of marketing for Interlochen Center of the Arts. “No matter what industry, no matter what business, if you’re an agency or direct to consumer, it’s really understanding who they are, what they need and the solution that you provide. And if you don’t provide a solution, you’re not doing business with them.”

A marketing plan that clearly identifies will, in fact, be the best way to make sense of the madness when it comes to this overwhelming buffet of methods and solutions.

“The basics are not gone, and in fact, I think they’re more important than ever, because otherwise, you’re chasing down every possibility, the possibilities are endless, and how do you decide?” Wujcik said. “You have to have that clarity.”

This can be, of course, a challenge. Sometimes, clients (in the case of agencies)

or leadership (in the case of internal marketing teams), push for action before a plan is in place. But good marketers push back.

“They’ll say they want to campaign for X. Well, why? What’s it for, and who’s it for? So giving them the roadmap first is so critical,” said Jennifer Lake, owner of Brand Tonic in Traverse City. “There seems to be a lot more education with clients. Let’s really understand your goal, and then we can build a strategy.”

And it’s not just about defining a marketing plan – it’s about making sure your house is in order. No matter how urgent you are to connect with and convert customers, for instance, you can’t (or shouldn’t) do it with a bad website, an ill-defined brand or unclear value proposition.

“You cannot outrun a weak brand. You can, for a little while with a hell of a lot of money, but you can’t do it sustainably,” Wujcik said. “And that has always been the case.”

Despite an onslaught of new platforms, solutions and channels, these marketers say they are leaning heavier than ever into tried-and-true practices.

“It’s not necessarily about using new tools, but using the tools that you have and… fine tuning those strategies, really segmenting and honing in,” said Coryn

Briggs, senior director of marketing at Traverse City Tourism.

So, what time-honored tactics still work in 2026?

“Email marketing is never going to go away, much to my dismay, because I feel like it can be so challenging,” Briggs said. “But it’s a qualified list of people that have opted in to receive your communications. So you’re targeting people that have asked for you to message them and have shown interest in or engagement with the content that you’ve served up to them.”

Paid digital (Google Ads, as one example) are also still very effective, as is paid traditional media (print, outdoor) for both general awareness campaigns and those seeking conversions. Back again with a vengeance after COVID is the importance of in-person marketing, particularly the B2B event circuit, Wujcik said.

“But we’re shifting how they are treating those events, treating them more like a campaign,” she said. “We’re going into it with an objective rather than just show up and showcase our services or our tools. Who do we want to be getting in front of while we’re there? What are we doing with the leads after the show? What automation can we leverage to follow up?”

Still, experimentation is vital. Lean on the known tactics, but don’t be afraid to reserve a little money for trying something outside the box.

“If you’re able to have that little bit of

“Turnkey is a huge thing that we promote. From design, building and installation… people just need us to be the easy button. Because there’s so much going on in the world, and they want to trust that somebody’s just got it from start to finish.”

– Paul Britten Jr., Executive VP/Sales and Marketing, Britten, Inc.

budget for that moonshot idea, it’s really important to (do that), or maybe try a tried-and-true method a new progressive way,” Briggs said. “Those often lead to results that you may not expect.”

“About 70 or 80 percent of our budget is focused on those channels that are known to be producing for us, and then we reserve 20 to 30 to just constantly be testing and trying things,” Rice added. “As soon as we stop testing, we’ll die.”

Experimentation is not for the weak of heart, though, especially since it might not deliver immediate results.

“You need to allocate budget to experimentation and then take time to actually see it through. I’ve had a lot of clients

onboard a new tech stack, and then they give it about three months before they’re they’re done,” said Fernando Meza, CEO of Oneupweb in Traverse City. “And it’s like, how the hell are you ever going to expect anything to work out?”

Themes and messages

In terms of what’s working in marketing messaging, certain themes are rising to the top. One is that consumers are looking for quick, efficient solutions, so messaging that supports that goes a long way.

“Time [is huge],” Meza said. “When we launch certain campaigns for clients, the ones that perform best are the ones

that help to solve the problem as quickly as possible.”

And businesses need to show that consumers can trust them to deliver these solutions with relatively little input or hassle.

“Turnkey is a huge thing that we promote. From design, building and installation…people just need us to be the easy button,” said Paul Britten Jr., executive vice president for sales and marketing at Britten, Inc. “Because there’s so much going on in the world, and they want to trust that somebody’s just got it from start to finish.”

Trust has been important forever, but in an increasingly inauthentic and fragmented world, businesses are advised to keep doing whatever they can to build it.

“Consumers are doing their own thing. They have their own process. They’re going to go look at all the reviews, and it’s hard to control. We’ll have a client that comes to us as a four-point-something in their Google reviews. We can’t control that, so we can implement systems to get more reviews and bump this up,” said Aaron Swanker, CEO of Flight Path Creative in Traverse City. “Are you building trust? I think it’s a big thing coming into this year.”

And it’s not about how often or how many times you ping consumers these days. It’s about making sure you have something good to say.

becoming a thing as tools like Google’s AI overview are delivering so much information that a user doesn’t need to travel beyond that first step.

“About 70 or 80 percent of our budget is focused on those channels that are known to be producing for us, and then we reserve 20 to 30 to just constantly be testing and trying things. As soon as we stop testing, we’ll die.”

– Chip Rice, Director of Marketing, Interlochen Center for the Arts

“It’s not the volume play that it once was,” Wujcik said. “It’s about restraint and quality and making sure that what you’re putting out matters.”

Optimizing your website – both holistically and individual pages of content – remains important. The methods for doing so have evolved considerably over the years, with certain early tactics (keyword stuffing) now drawing penalization from search engines.

“Making sure that you’re optimizing your content front and back end, website and beyond, so that it can be found by the people who are looking for it is so critical,” Wujcik said. “And unfortunately for us as marketers, that is a perpetually moving target. We always have to learn. I mean, it changes every day.”

But things on this front – and indeed the entire nature of how people interact with the internet – is rapidly changing with AI. So called “zero-click searches” are

“The real challenge is with SEO and search. We’re already seeing declines in organic web traffic because people – and I do it myself –don’t have to go to your website if the answer’s right there on the results page,” Rice said. “So it’s structuring and optimizing data so it has a voice in there and can be present and visible.”

Briggs agreed that it’s more critical than ever to make sure website content is primed to work with modern search technologies.

“There’s all of this talk about how websites are dying; I’m sure we’ve all seen it,” she said. “I don’t think that they’re necessarily dying, I think they’re just changing. I think the structure and how they’re built is changing, and how we mark data and content up so that it can be read online through the [large language models] and anything AI related.”

Website structure aside, marketers are also dealing with significant shifts away from traditional – and even AI supported – searches. Younger people are using social media to find information in the same way older folks use search engines.

“You have recent studies that show social media being its own search engine – TikTok or Instagram are surpassing searches on Google,” Briggs said. “And I think that’s a generational shift in terms of how people consume content.”

“I have two teenagers, and they laugh at me if I Google something. They just go to YouTube and use it really the way we

used Google. They just go there to find answers,” Rice added. “[My two kids are] a small sample size, but times are changing.”

Part of this shift is that younger consumers place much higher value in user-generated content, which seems much more authentic (even if it, like everything else, can still be monetized).

“Three or four years ago, we sold a million and a half in video production. No way is that happening, ever again,” Meza said. “Now, you spend $5,000 to get some micro-influencer to go do some user-generated content, and that performs better, if not as good, as the $50,000 investment, and you can scale that so much easier.”

This group is largely bullish on AI, mostly because it allows them and their staffs to do more with less.

“We’ve really embraced AI and are mostly positive about it. We look to leverage it for efficiencies,” Rice said. “I mean, our team is finite. It’s a good, healthy-sized team, but we still are limited by number of people and hours in a day. We’re using AI everywhere we can to just help us do more.”

And it’s not just explicit AI solutions. Programs that have been around for years are adding AI wrinkles, and they’re a huge boost to productivity.

“Yes, there’s new shiny tools and there’s new awesome things, but the primary resources that we use – LinkedIn, Google, Microsoft Outlook – they’re all adding these AI add-ons to them,” Britten said. “Every tried-and-true tech platform is adding some type of AI functionality.”

“It’s an incredible assistant. It helps us a lot from a research perspective, especially competitor research,” Meza added. “And from a sales side, it’s incredible. Having to work with creative to come up with spec work is now not as hard. Our time invested in the sales process is now cut in half.”

Removing the human element of certain functions and interactions comes with risk, but as long as the system performs as good or better than a human, people are less likely to care.

“It comes down to the experience, really. I don’t really care if I talk to a human or I get a system if I have a positive experience,” Rice said. “You can get a person on the phone who is terrible or helpful, and you can have an automated system that is smooth and seamless or

one that drives you crazy. So it really just depends.”

There are definite efficiencies in the creative world as well – AI is a great tool for image processing and cleanup, for example – but this is where things get a little more hairy. Why hire a designer when ChatGPT can kick out a few logos for you?

Lake says it’s all about quality. There’s nothing wrong with starting with AI for brainstorming, she says, but then things need to go further.

“I always teach people that (AI) is just going to generate the base ideas that everyone else is going to come up with,” she said. “Let’s get all the junk ideas out, then come back and talk about what we’re really trying to do and make it creative, because it still has to be unique.”

A skilled professional with context and a handle on subtleties and nuances can still produce a logo or other creative content that’s worlds better – and more effective – than AI, Lake says. Some people will be just fine with the full AI content, but that’s not all bad.

“That’s OK. It happens in a lot of industries. [Professional assistance] is not right for everyone. But here, we want the people who appreciate the value we bring in the ideas and concept, and how we execute,” she said. “The real detail, the fine design, the great concepting – I like to think that’s not going away.”

“There’s always people looking for a shortcut, and shortcuts are always there, but that isn’t where the great work happens,” Rice added.

Meza and others are not overly worried about AI coming for creative jobs.

“Yeah, it’s something that we’re having to navigate, but it’s always like that. I remember when the first handheld HD camera rolled out and everyone in Hollywood thought that that was it. That was the end of time,” he said. “At the end of the day what happens is better ideas surface up. Strategies get better. It pushes us.”

Plus, there is already considerable scorn of AI content among certain segments of the population.

“I feel like people are almost overly sensitive to it,” Briggs said. “We don’t use any AI generated images here. We purposefully work with local photographers [because we] have an incredible region to photograph. And we’ll sometimes share photos on our social media and people will call it out.

That’s too perfect. That’s an AI image.”

By Ross Boissoneau

Mixing presentations with coaching and office camaraderie sounds like a great idea. As long as you don’t charge for the experience. And please, don’t forget the bagels. That in a nutshell is the premise of the Breakfast Lab at startup incubator 20Fathoms in Traverse City. The in-person, free Breakfast Lab takes place each Thursday, and is geared to help entrepreneurs in all phases of their business.

The morning starts with a selection of breakfast treats such as bagels or donuts, with a presentation of 45 minutes to an hour. It’s followed by free time, which attendees can use for peer coaching, visiting with other entrepreneurs or they can plug in and work at the facility’s co-working space. The lab is free of charge and open to all. While you can register ahead of time, walk-ins are welcome.

Delaney Keating was involved from the start. It was during her tenure as director of entrepreneurship and commercialization at 20Fathoms that she and Erin Srebinski created the program.

“It’s a flexible, accessible program,” said Keating, who is now operations director at Michigan Founders Fund.

With funding coming from an ARPA small business grant, the program is

free time which attendees could use how they wished.

“We were brainstorming in late 2024. Rural areas are different. So we broke [the presentation] into pieces without a gigan-

“What’s really nice is it’s all kinds of small startups. Food, tech, child-care, services – some really creative ideas come out.”

– Phil Hallstedt, Owner, Hallstedt Homestead Cherries

offered free of charge.

“A breakfast program, coaching, a free day of co-working [which otherwise costs $30],” she said. “It was incentivized enough.”

Srebinski, the manager of startup education at 20Fathoms, now oversees the program. She says the program evolved from a more structured meeting into a concise presentation by an expert in a field entrepreneurs could use – marketing, financing, perfecting a pitch – followed by

tic program no one has time for,” she said.

Ostensibly, the goal is to help attendees hone their pitch decks, their visual presentations to gain funding and support for their business. Srebinski says the presentation format started as a six-week program, with a different presenter every week. They then repeated the process.

“But the subject matter wasn’t really the draw. It was the regular meeting,” Srebinski said.

Attendees agree. They say the program

is much more than just a series of presentations. Breakfast Lab attendees also can take advantage of one-on-one coaching with the 20Fathoms Startup Services team and other experts. Perhaps best of all is the opportunity to meet and connect with other entrepreneurs.

“The key advantage I see is the ability to network,” said John Velis. He is one of the developers of the application Memory Bright, designed to help those dealing with dementia by collecting photos, films and other media. They are then loaded into a presentation the person and their family can watch and listen to, similar to a PowerPoint series of slides and films.

He says as a remote worker in rural Leelanau County, he misses the regular interaction he had over 30 years as a secondary school teacher and instructor at Northwestern Michigan College.

“When you’re not working with others, [this networking opportunity] lightens the burden. 20Fathoms does a really nice job of providing networking opportunities,” Velis said.

Kalob Hagen of Luigi Solutions, which

teaches people how to build an app in a day, says he began participating in the labs last year.

“I learned so much... It covers a lot of ground,” he said.

Gretchen Swanson, who also works with the program as director of talent at 20Fathoms, says there are typically between 15 and 20 attendees. Some come for only one or two meetings, while others seldom miss.

“We have a group of regulars. It’s an interesting mix,” she said.

While Hagen and Velis both come from the tech world, Srebinski and Swanson are quick to note the presentations are not exclusively relegated to technology.

“It’s open and welcoming, not just tech. It’s all things valuable to entrepreneurs at any level,” Srebinski said.

Phil Hallstedt would agree with that. He started Red Truck Orchards Cherry Vinegar, an offshoot of his Hallstedt Homestead Cherries, a u-pick orchard in Northport. He’s only too happy to extol the virtues of cherries in general and his cherry vinegar in particular.

“It’s bright and complex, with a lingering cherry finish, excellent with salad dressing, marinades, sauces and beverages,” he said.

He’s just as upbeat about the Breakfast Lab.

“What’s really nice is it’s all kinds of

small startups. Food, tech, child-care, services – some really creative ideas come out,” he said.

Sarah Alexander attended to help launch her Sleeping Bear Granola.

“I started the company not knowing there was a support system like this out there,” she said. “It’s an opportunity to network with folks who had been through it.”

Alexander says she was a regular for a while, but her attendance lately has been more sporadic. It’s not because she sees less value, but because of the distance she must travel from her home in northern Manistee County.

Recognizing the challenges for those who don’t live in the Traverse City area, 20Fathoms plans to offer the program virtually as well. The hope is that it will help draw people from further away, though everyone acknowledged the experience won’t be the same.

“We’ve had folks from Elk Rapids and Benzie,” Srebinski said, though those places are the exception. “Most folks are from Leelanau and Grand Traverse.”

Alexander for one is intrigued by the idea, though she says not attending in person means it will be lacking in some ways, particularly by limiting the networking.

“That doesn’t have the same energy, but it would make it more accessible,” she said.

Indeed it does, and Scott Walters is Exhibit A. The AccuWeather executive

“It’s open and welcoming, not just tech. It’s all things valuable to entrepreneurs at any level.”

– Erin Srebinski, Startup Education Manager, 20Fathoms

native joined the Jan. 15 meeting from his native Pittsburgh, the first to become a virtual participant in the breakfast lab. He said he sees the program as a way to make connections as he begins to navigate the possibilities of a move to his favorite place.

“I’m a Pittsburgher but my mom is from Chelsea, Michigan. My parents met at U of M, and we had family in Ludington and Northport. I’ve been coming to the area since I was a baby.

“I went to MSU and still have lots of friendships from college I maintain. I consider myself an honorary Michigander and

have a desire to be up there at least part of the time if not fulltime,” he said.

The head of IT and information security at AccuWeather, Walters said he has had some business and product ideas. “I’ve mulled some things over, done some prototype things,” he said. Walters said with a college major in history and a background in art along with his tech expertise, he sees the Traverse City and Leelanau areas as destinations where he could enjoy the outdoors and use his skills to make a living. “What I want is to meet like-minded people, make connections in the area,” he said.

By Marivi Bryant, columnist

We are living in a moment where marketing feels louder, faster and more crowded than it ever has before. Technology has accelerated nearly everything from how quickly ideas are generated to how easily content is created and distributed. AI is now part of everyday workflows, and automation has made it possible to design, publish and promote at a pace that would have felt impossible not that long ago.

While all of this has created efficiency, it has also surfaced something else. People are realizing that what they actually want from brands is not more content or more cleverness, but more humanity.

As marketing becomes more automated, the value of care, empathy and authenticity increases, because people still want to feel understood and seen, not simply reached. Marketing rooted in empathy is not a rejection of technology, it is a response to it, especially in moments when the tools make it easy to produce more without thinking more. It reflects a growing awareness that meaningful connection still comes from understanding people, not just getting in front of them. That belief matters everywhere, but it carries particular weight in a place like Traverse City.

This is a relationship-driven community. It is small, interconnected and personal, and reputation travels quickly. Word of mouth still holds real weight, and people notice when marketing feels genuine and when it feels performative, whether that is a business acknowledging feedback in a thoughtful way or pushing out messaging that feels disconnected from what is actually happening on the ground. In a town where business owners see their customers at the grocery store, at school events, or walking downtown, marketing does not live in isolation from real life. Here, empathy is not a soft idea, it is a business advantage. It builds trust, and trust is what creates loyalty over time.

In practice, empathy in marketing rarely shows up as a single moment or a perfectly executed campaign. More often, it shows up earlier, in how decisions are made before anything is launched. It can look like adjusting messaging after hearing the same question come up again and again at the counter, or rethinking a promotion because

More humanity – not campaigns – will connect you to customers

it does not reflect how customers are actually using a product or service. At its core, it starts with a willingness to understand what people care about, rather than assuming what should matter to them.

When that step is skipped, marketing tends to feel transactional or out of touch, like a promotion that feels tone deaf to the season or a message that sounds good on paper but does not match the in person experience. When it is prioritized, the work feels more natural and more relevant because it is rooted in what people are actually experiencing rather than assumption. Empathy becomes a lens for decision making, not a message added at the end. At the same time, there is a noticeable sense of panic in marketing right now. AI is here, and for many, the instinct is to move faster, cheaper and louder in order to keep up. That can look like rushing to automate social posts, cutting corners on messaging, or pushing out content simply

because the tools make it easy. Technology itself is not the problem. Used thoughtfully, it can remove friction and support execution. The issue arises when speed and automation start to replace strategy and care instead of supporting them.

The irony is that as marketing becomes more automated, the most valuable work often becomes more human.

For small businesses, this is where empathy becomes real, especially in a community like Traverse City, where everyday interactions shape reputation. It shows up in how feedback is received and responded to, in whether marketing aligns with the actual experience of being a customer, and in the consistency between what is promised and what is delivered. Those details are what people remember and talk about.

a place to a friend or choosing to return themselves. Over time, those experiences compound into trust, and trust is something no ad budget can manufacture.

As we look toward the next era of marketing, the businesses that stand out will not be the ones that move the fastest or shout the loudest. They will be the ones that understand that in a small community like ours, relationships and reputation mean everything.

Marivi Bryant is the founder and president of HOME Agency, a people-first national creative, marketing, and digital firm partnering with mission-driven organizations and brands across the country. With nearly 25 years of experience spanning the Phoenix Suns, NASCAR, State Farm and Blue Cross Blue Shield, she believes the most effective marketing is rooted in empathy, community and real human connection. Bryant lives in Traverse City with her husband and two children. MARKETING PROMOTION & DESIGN

Empathy builds loyalty because people feel seen, not sold to. It shapes reputation because people share how a business made them feel, whether that is recommending

By Kierstin Gunsberg

It’s everywhere. Brochures in hotel lobbies, magazines in waiting rooms, piling up inside your inbox. And because it’s everywhere, good, genuine marketing that swoons its intended audience from the get-go is becoming more and more important to standing out against the fray. Meet some of the agencies helping northern Michigan businesses do just that behind the scenes.

Since opening in 2000, strategic marketing agency Idea Stream has built a roster of famil iar names including Miner’s North and Sonny’s Body Shop.

“When I look back, what stands out most is the lon gevity of those relationships,” said Idea Stream Founder and Owner Marsha Stratton. After celebrating 25 years in the northern Michigan marketing scene, watching campaigns play out in real time over the decades has been the high point for Stratton.

“It’s always fun when we get to do something big and visible, like BATA bus wraps or billboards, and see our client’s names all over town,” she said.

Where you’ve seen their work: Idea Stream’s portfolio runs the gamut from web design that showcases the work of area builders like Mac Custom Homes to highlighting Cobblestone Farm’s features for faraway brides and grooms. The agency has also designed labels and packaging for Herkner Farms’ fruit toppings and is the team behind photo and drone footage assets for Copper Ridge Surgery Center.

On the creative process: Keeping her team – which includes three other creatives –lean, and the overhead at her downtown Traverse City office low means “more of our clients’ budgets can go toward outbound marketing and media,” said Stratton.

Keeping things simple on the home front has also played a big part in allowing her team to channel their energies totally to client goals and challenges while developing strategies in which “no detail is ever overlooked.”

What’s rolling out: Grand Traverse State Bank, a brand-new community-based bank set to launch this quarter, collaborated with Idea Stream over the last year to build their brand from the ground up. It’s a full-scale project that’s involved everything from developing the bank’s internal marketing strategies to designing good old-fashioned signage.

Eric Campbell can’t quite put a number on how many projects he and creative partner Jacquie Auch tackled at their boutique design firm, Proof Positive, in 2025.

“We do dozens and dozens of projects throughout any given year,” said Campbell, whose retainer clients keep the pair busy with a steady stream of smaller work throughout the week.

Where you’ve seen their work: The team has developed everything from marketing materials for the Grand Traverse Conservation District and Austin Groesser’s TC startup, Big Dipper Cookie Co. This last year Campbell and Auch launched Prout Financial Design’s revamped website, complete with video assets that bring visitors straight into the office. They also wrapped up a full packaging redesign for Traverse City beverage brand Northwoods Soda (a.k.a. the original supplier of Wild Bill’s Root Beer).

Campbell and Auch also expanded their agricultural niche, adding Lake Ann’s Wanderwood Farmstead and Old Mission Peninsula’s Local Yokels Farm to their 2025 calendar, two detail-oriented projects that Campbell said show just how “sophisticated and savvy” farm branding can be, right down to the wallpaper he designed for the latter’s market bathrooms.

On their creative process: Regardless of scope, the pair’s process of brand building starts the same way: by digging into who a client is below the surface, then bringing their history and values to center in order to authentically appeal to their audience.

Once that’s established, it’s easier for Proof Positive to create anything from a squareone campaign to a light rebrand that feels totally genuine to their client’s brand identity – something businesses can’t afford to overlook, explains Campbell.

“Consumers are savvier than ever and are attracted to honesty and integrity in a brand,” he said. “That’s what sticks.”

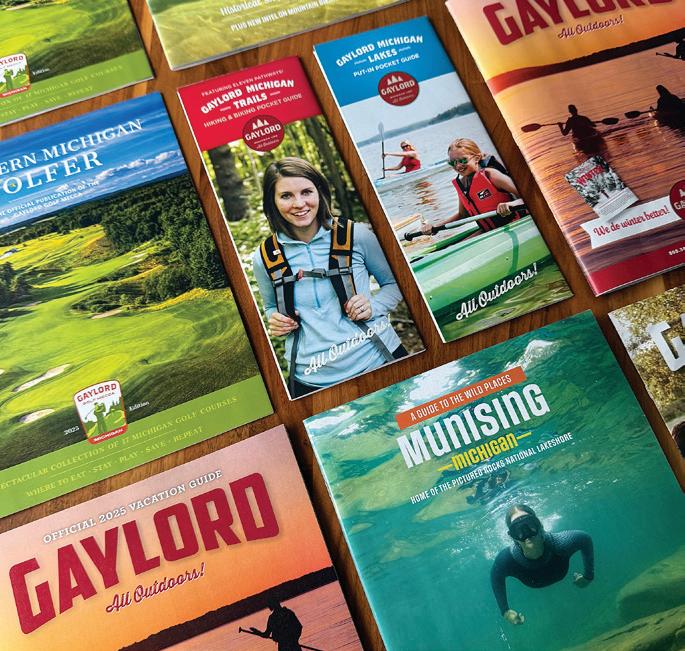

What’s rolling out: Next up for Proof Positive is the continuation of a Brand Guidelines project for Oryana that kicked off last year, plus their annual update of outdoor-recreation focused visitors guides for the Gaylord Convention and Tourism Bureau and the Munising Visitor’s Bureau.

From brand consulting to full collateral rollouts, Audra Tompkins estimates that up to 90% of her marketing work over the past year was with northern Michigan organizations. She and business partner Jennifer Lake helm Brand Tonic, a boutique agency based in Traverse City’s SoFo neighborhood, where keeping contracts as local as possible allows them to offer clients more direct access – including meeting onsite to iron out campaign details. “That proximity allows us to stay connected,” said Tompkins.

Where you’ve seen their work: All over the packaging for Grocer’s Daughter chocolates, Copper Aesthetics metallic accented designs, Grand Traverse Pie Company’s modern brand identity, and Old Town Playhouse’s colorful, abstract logo. A large cut of Brand Tonic’s long-term clients are nonprofits. “Helping an organization evolve while staying true to who they are is one of our strengths,” said Tompkins, who along with Lake has added The Botanic Garden at Historic Barns Park, Leelanau Conservancy, Rotary Charities of Traverse City, and BATA to their portfolio over the years.

On their creative process: Keeping things close to home also helps the creatives manage audiences and expectations at the local level, while catching nuances out-of-area agencies might miss – from featuring the wild flora that pops up across The Botanic Garden in print materials, to incorporating the pine-green shades surrounding NMC into its brand identity, to knowing that a slice of Grand Traverse Pie Company’s cherry crumb is best captured in a state of messy imperfection across its visual collateral.

What’s rolling out: Lake and Tompkins have been collaborating with longtime client Interlochen Center for the Arts on fundraising campaign theming and an upcoming logo and design for the school’s centennial celebrations as they approach their 100th anniversary in 2028.

For the husband and wife duo behind Copper Bottom Creative Co., Emily and John Petrovich’s most recent work has centered around the demands of creating marketing plans, ad designs and website builds for national clients along with a growing slate of northern Michigan work — all while juggling school pick-ups for their two young children.

The company started out in Colorado in 2009 before moving to Elk Rapids. Collaborating with other working parents looking to scale their business is practically part of the Petrovich’s own business plan.

“It seems to have brought us connection with clients who are also family and community-focused,” Emily said.

Where you’ve seen their work: The latest update to Edson Farms’ website featuring a mix of graphics and photography that the Petroviches curated to complement a brand identity that they call both clean and fresh. Copper Bottom Creative is also behind the Elk Rapids DDA’s newest marketing push, designing print campaigns around the business owners and community members surrounding River Street.

“The goal was for people viewing the ads to see the real faces and families behind the businesses,” said Emily, adding that the process has “has offered an opportunity for connection within the community.”

On their creative process: The Petroviches say a big lesson they learned when they first launched was the importance of always carrying out ethical strategies in order to build trust with their clients, while helping those clients do the same with their own customers. With AI making its way into more workflows – sometimes showing up as unsettling and uncanny – that authentic approach is becoming even more important to their work.

What’s rolling out: Copper Bottom Creative Co. just signed on to a brand refresh and full website redesign for Elk Rapids Harbor Days. As Elk Rapids locals, Emily says this one feels extra special.

By Ross Boissoneau

Most nonprofit organizations have a particular challenge when it comes to marketing and public relations. Their budgets for such activities are typically small, even non-existent. Yet they have to find ways to get their messages out.

Northwestern Michigan College (NMC) instructor Caroline Schaefer-Hills wanted to provide her visual communications students with experiences outside the classroom. Although she’s been instructing for 26 years, she still works as a freelancer, which she says helps her stay current with the marketing and graphic design industries. So she decided to come up with a program that would provide that same kind of experience for her students.

She hit upon the idea of matching NMC students with nonprofits, providing both with something they needed.

“I wanted to work with nonprofits – get students real-world experience,” she said.

The college was supportive, so Schaefer-Hills reached out to some area nonprofits, and the program took off. Tom

Maynard, director of operations at the Great Lakes Children’s Museum, says his organization utilized the program to celebrate the organization’s 25th anniversary.

“It’s our 25th year of operation – we needed a special logo,” he said.

They presented us with an array of logos,” Maynard said.

The organization then determined which ones they liked and worked with the NMC students to craft the product they ultimately chose to use.

“We have some who are dual-enrolled [high school and college] and people in their 40s on their second career. It makes such a dynamic classroom.”

– Caroline Schaefer-Hills, instructor, NMC

Maynard says his organization has worked with numerous student-led programs over the years, and when NMC reached out they were happy to collaborate.

“I work with lots of student collaborations,” he said. While some are unsuccessful, he noted, “some are gold,”

This one was among the latter.

“These [students] did a lot of work.

“It was a good process of refinement,” he said.

The work went beyond just logos to include Instagram tags and other marketing and media materials. Maynard says he works with a number of educational institutions, and this was one of the most successful collaborations.

Amanda Harvey was one of the stu-

dents who worked on the Children’s Museum project. She said working as part of a team of several students required them to not only communicate clearly with the client but with one another. “In my group we had a woman in her late 30s who was married and had kids, some like me (around) 26, and kids of 19 or 20. You have to work together. It’s challenging but (it’s) like the real world.”

Harvey said they broke down the assignment so some students worked on the digital side, others printing. Their challenge was to come up with a design that was both scientific and whimsical, that didn’t depart too much from the organization’s pre-existing logo. She also worked on another project as part of a two-person team, creating materials for the college’s experiential learning program. “We got to make badges (and) logos,” she said. She said working on-campus with just one other student made the process fairly simple and straightforward.

The class project is free to the nonprof-

“It was genuinely inspiring to watch the students ask questions, take ownership of their work, and gain confidence.”

– Jill Wilson, Executive Director, Norte

its selected. It can include any of several elements, including logos, brochures, ad campaigns, posters, infographics, announcements, invitations, film, motion graphics, animations, exhibition design and television commercials. In short, most anything relating to visual communications, graphic design, branding, commercial art, illustration and film or web design.

Schaefer-Hills says the goal of this real-world assignment is to provide opportunities for students to interact with clients. It exposes them to the world outside NMC, including commercial printing and production, film and new media production, creative advertising, graphic design and packaging.

Norte Executive Director Jill Wilson said her organization embraced the program last year.

“We had the opportunity to work alongside Northwestern Michigan College Visual Arts students on logo development and a set of short, easy-to-understand videos focused on bicycle safety basics, like helmet fitting and bike fitting,” she said. She says the partnership functioned as a mini-internship experience, and it proved to be valuable for everyone involved.

“As a small nonprofit, Norte Youth Cycling is often operating at full capacity. Having motivated, up-and-coming young adults step in with fresh ideas, current skills and creative energy made a real difference,” she said.

Like Maynard, Wilson praises the process. She says the direct, ongoing communication between the organization and the students was invaluable.

“We met regularly in person, talked through goals and expectations, provided direct feedback, reviewed drafts and proofs, and saw the students thoughtfully make adjustments before delivering final versions,” she said. “The process felt collaborative, professional, and productive from start to finish. It was genuinely inspiring to watch the students ask ques-

tions, take ownership of their work, and gain confidence.”

Best of all, the final outcome provided Norte with materials that will have utility long past the duration of the program.

“The final logos and videos are tools we will use for years to come, and the experience reinforced how meaningful real-world learning partnerships can be,” said Wilson.

Schaefer-Hills says the size of the program – capped at 19 as that is the maximum number of the program’s Mac lab – allows her to easily oversee the projects and provide any assistance needed. It also allows the students to work both independently and in collaboration with other students as they work with clients who actually have needs in the marketplace, rather than just learning the tools and being confined to classroom presentations.

The mix of ages and experience in the class also more closely mirrors the work world outside the college.

“We have some who are dual-enrolled [high school and college] and people in their 40s on their second career. It makes such a dynamic classroom,” she said.

While the Great Lakes Children’s Museum benefited from the student’s efforts, Maynard knows firsthand how valuable the program is for the NMC students. That’s because he gleaned such experience in his own college days.

“I’ve been on the student side,” he said. “As a student I got to do something similar in my college days. Creating something in the real world gives you a great sense of pride.”

Better yet for him was the end result.

“I ended up getting a job” from the program, he noted.

Wilson agrees, saying such a partnership provides something both parties need and benefit from.

“We would gladly participate in this type of collaboration again and encourage more opportunities that connect NMC students with community-based organizations,” she said.

By Art Bukowski

The Grand Traverse region’s tourism economy has diversified over the years, but one thing that will (hopefully) never change is its reputation as the state’s premier location for conferences, events and group gatherings.

The TCBN checked in with some local event venues (this is not meant to be an exhaustive list, as the region is brimming with such facilities) to see what’s new for 2026.

Katie Leonard, Director of Sales

What opportunities and challenges do you expect in the meetings/event space world in 2026?

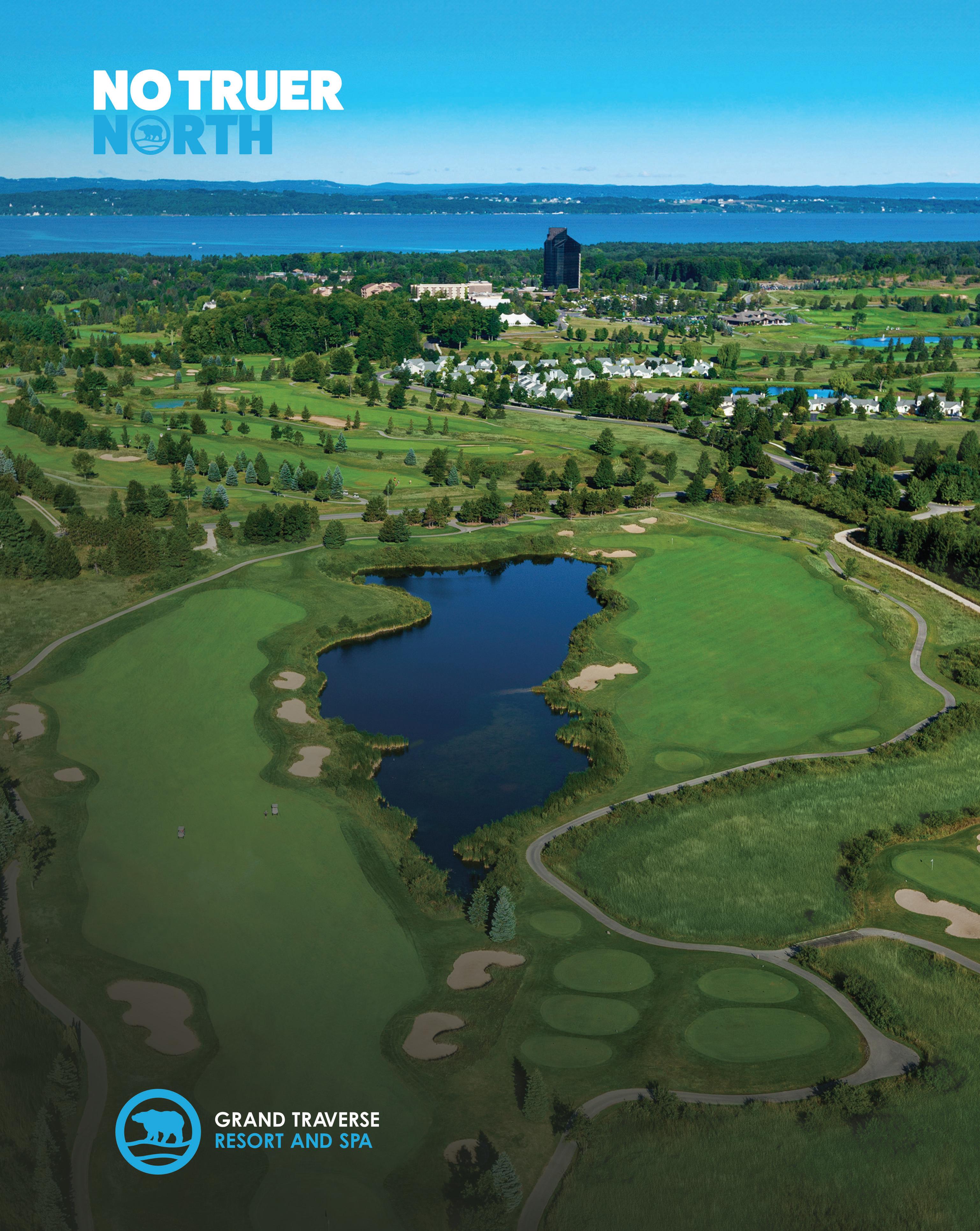

In 2026, the meetings and events landscape continues to grow with a strong focus on destination-driven gatherings. Planners are looking for indoor-outdoor options, custom audio-visual and immersive team-building amenities. Our 86,500 square feet of adaptable space and scenic settings go beyond the traditional conference room. We always welcome the opportunity to showcase the beautiful region to our meeting planners, event hosts and conference attendees. We are seeing more groups want to engage in out of the boardroom activities and our 900-acre property, plus the Traverse City region, offer great access to relaxation, fun and unique networking.

What’s new or exciting in terms of your facilities, services or amenities this year?

This year we are thrilled to highlight enhancements across our property that elevate both business and leisure experiences. From new services and products at Spa Grand Traverse and updated weight machines and equipment in the Health Club, to refreshed offering in food and beverage and enhanced features on the golf course, these changes outside of the meeting rooms provide meaningful experiences before, during and after meetings.

Please name a few interesting groups you have booked for this year. We are excited to welcome back some of our favorite annual groups that leave a lasting impression on our property and the region, like the Special Olympics Michigan Winter Games. We are also thrilled to be this year’s host of the Pure Michigan Governor’s Conference on Tourism.

Brittney Primeau, Director of Communications

What opportunities and challenges do you expect in the meetings/event space world in 2026?

Meeting planners continue to face economic pressure and shorter lead times, but we have the resources to help them redefine the ROI of an event. Instead of doing more with less, we are focusing on doing more with meaning. Today’s attendees crave authenticity, wellness and environmental stewardship, which can be challenging in some regions, but plays perfectly in northern Michigan, specifically at Crystal Mountain. With unique outdoor venues for meetings and networking, we can help planners manage budget constraints without sacrificing quality and still deliver a successful meeting and memorable experience that attendees are expecting.

What’s new or exciting in terms of your facilities, services or amenities this year?

This past fall, Crystal Mountain installed two high-tech TrackMan golf simulators, offering a weather-proof venue for team building and continued networking. Also, as more guests seem to be traveling with their pets, we recently added more pet-friendly units to our lodging inventory. By providing premium cat and dog packages, our goal is to provide flexibility to all guests and provide a sense of home away from home.

Please name a few interesting groups you have booked for this year.

Crystal Mountain can accommodate a wide variety of groups throughout the year, from small, intimate weddings to large corporate events with hundreds of attendees. Crystal Mountain also hosts various community events, including the Beer and Brat Festival in May and the Total Archery Challenge in June, which each attract 2,000-plus people.

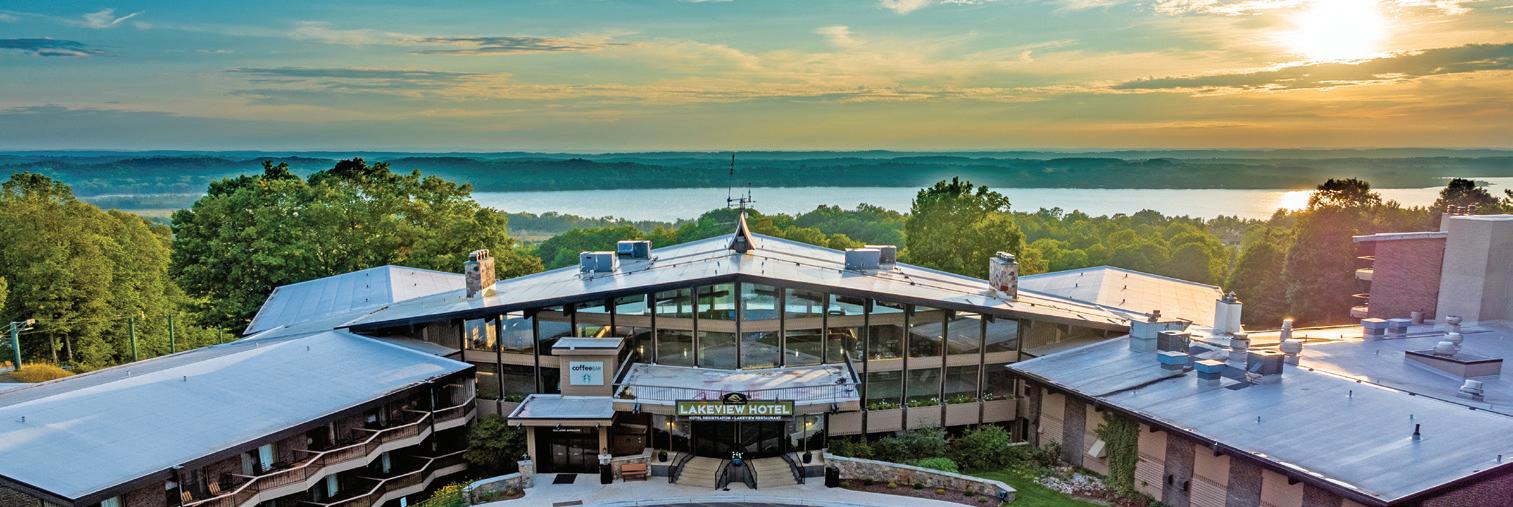

Lisa Monache, Area Director of Sales and Marketing

What opportunities and challenges do you expect in the meetings/event space world in 2026?

In terms of challenges, conferences and off-site meetings for government entities have been cancelled or severely limited due to budget cuts. The Traverse City lodging market has also become oversaturated, and this will become even more of an issue as additional properties come online in 2026 and 2027.

What’s new or exciting in terms of your facilities, services or amenities this year?

Hotel Indigo Traverse City has partnered with OncoreAV to install new audio/visual equipment in all of our function spaces. This includes wall-mounted monitors in each of our boardrooms and dual screen suspended projection and enhanced sound capabilities in the ballroom, which can be sectioned into Ballroom A and Ballroom B. Group presentations and training programs will benefit greatly from these improvements.

Please name a few interesting groups you have booked for this year.

A premier group travel company has booked a series of eight motorcoach trip stops in 2026, and we are already planning for their return with the same series in 2027. Our largest group will be an insurance company membership incentive outing in June for four nights, at 90 rooms per night.

Tracey Ramsey, Vice President, Lodging and Sales

What opportunities and challenges do you expect in the meetings/event space world in 2026?

While our corporate and association meeting planners have clearly returned to in-person meetings, they are no longer booking as far in advance as they once did. Groups that previously booked five to 10 years out are now committing just one to two years ahead. This shift creates increased competition with our social markets, such as golf outings and weddings. All segments are now vying for accommodations, event space and tee times within a much shorter booking window, placing greater pressure on availability. As a result, sales managers must remain highly proactive and agile, staying on their booking toes to balance demand across all markets and maximize opportunities.

What’s new or exciting in terms of your facilities, services or amenities this year?

Staffing levels are stronger than they have been since the pandemic, allowing us to expand our food and beverage offerings. We’ve broadened our lunch options and introduced a new theme and menu at Cedar River’s River Bistro, featuring deli-style gourmet sandwiches, house-made pickle chips and our famous truffle fries. In addition, we’ve expanded and enhanced our outdoor seating options across patios, bonfire areas and poolside spaces in preparation for the spring and summer seasons.

Please name a few interesting groups you have booked for this year.

Shanty Creek Resort is proud to once again host the Michigan Open this June. In 2026, we also look forward to welcoming major events such as the Michigan Bear Hunters Association and the Michigan Association of Chiefs of Police, bringing nearly 500 and more than 300 attendees, respectively, to experience the resort.

What opportunities and challenges do you expect in the meetings/event space world in 2026?

Venue Blue’s biggest opportunity in the events world is that we are a blank slate venue. We have plenty of open space to convene and create any type of event you can imagine. The pavilion is 4,000 square feet while the lawn areas provide more space to spread out and enjoy the company of your guests! The biggest challenge for our clients we’ve seen has been the unknown costs of events. We have companies who have cut their event budgets and weddings that are sourcing decorations and attire from out of the country and are worried about impending tariffs.

What’s new or exciting in terms of your facilities, services or amenities this year?

2026 marks our third year open, and we are more booked than ever. We are continually excited to work with brides, grooms and all members of the community coming together on Grand Traverse Bay. Additionally, with the M-22 construction complete, we will have a brand new crossing signal to help all pedestrians get to Discovery Pier safely.

Please name a few interesting groups you have booked for this year.

This summer we are thrilled to host the Uncrewed Triple Challenge with Traverse Connect and the United States Coast Guard. While we host a few public events, with more in talks in coming years, most of our clients are celebrating a wedding celebration with us. Ceremonies, receptions, welcome parties and bridal showers, it’s an absolute photo op out on Discovery Pier!

What opportunities and challenges do you expect in the meetings/event space world in 2026?

In terms of opportunities, there is growing demand for experiential events that go beyond the ordinary, providing tailored experiences. There is also significant opportunity to capitalize on the shift toward regional and smaller scale meetings, offering personalized service and unique local touches that make each event feel special.

One of the biggest challenges will be navigating tighter budgets, which could affect the scale of events. Additionally, staying ahead of technological advances, such as AI-driven event platforms, will require ongoing investment and training. Lastly, the heightened focus on sustainability means venues must proactively adapt their operations to meet greener standards which, while rewarding, can also involve upfront costs and logistical hurdles.

Taryn Miracle, Director of Sales and Marketing

What’s new or exciting in terms of your facilities, services or amenities this year?

We are really excited about our new national and local partnerships. We have been working with Moet + Chandon, Veuve Clicquot on a partnership, so you’ll see several experiences throughout the year with that partnership, including our upcoming Veuve Cozy Cabana. Locally, we also recently partnered with Brys Estate Vineyard & Winery. They are featured in our new Winter in the Vines package and will be featured in our spring and summer experiences. Both also offer plenty of opportunity for our group team building program.

Please name a few interesting groups you have booked for this year.

We are grateful and proud to be home for the Detroit Red Wings during their time in Traverse City every September for training camp. Additionally, we have booked our first hotel buyout for a company’s incentive trip which will bring nearly 200 people on property.

Design and build a state-of-the-art ophthalmology practice focused on efficiency, patient comfort and future growth.

Burdco delivered exactly what we needed— an expanded, well-planned space that enhances patient flow and satisfaction. Their expertise and attention to detail made decision-making easy, and their commitment to timelines was incredible— completing our build within days of the original projection. We highly recommend Burdco for their professionalism, accuracy and ability to turn vision into reality.

Jenelle Whipple-Keller, Interim Director of Sales and Catering

What opportunities and challenges do you expect in the meetings/event space world in 2026?

Economic pressures will be one of the most defining challenges for the meetings and events industry in 2026. Rising labor, food and beverage, transportation and technology costs continue to strain budgets, while many organizations remain cautious with spending. Planners are being asked to deliver high-quality, engaging experiences with tighter financial constraints and increased scrutiny around return on investment.

At the same time, this pressure creates opportunity – driving more strategic sourcing, shorter booking windows, flexible contracting and creative program design. Success will depend on strong partnerships, transparent pricing and the ability to adapt offerings while still delivering meaningful, impactful events.

What’s new or exciting in terms of your facilities, services or amenities this year?

Recently an upgrade of our A/V system was completed making wireless A/V options available in all meeting spaces. Along with hotel renovations of guest suites, lobby and water park facilities, there has never been a better time to host an event at Great Wolf Lodge. Booking a summer event? Make sure and ask about our semi-private pool deck on Thunder Bay for an exclusive outdoor meeting by the pool. Culinary is heating up with Executive Chef James Walker leading the pack to new heights in 2026.

Please name a few interesting groups you have booked for this year.

This year, we’ve seen strong momentum from both social and educational groups, which continue to be a great fit for Great Wolf Lodge. We’ve hosted a variety of school-related programs, youth organizations and educational associations that value our family-friendly environment, ample meeting space and built-in recreation.

On the social side, multi-generational reunions, faith-based gatherings and affinity groups have been especially impactful, as they benefit from our all-under-one-roof experience. Some of our largest groups this year have included educational conferences and youth-focused events welcoming many attendees, combining learning, connection and fun in one destination.

What opportunities and challenges do you expect in the meetings/event space world in 2026?

The biggest concern facing the hospitality industry in 2026 is food cost. Food prices were consistently on the rise throughout most of 2025 and they are continuing to trend that direction. We have seen sharp increases in the past with beef and seafood, but rising inflation seems to be affecting everything we order, especially produce.

Chad Schenkelberger, Director of Food Services

Chelsea Harland, Sales and Social Media Manager

What’s new or exciting in terms of your facilities, services or amenities this year?

The Hagerty Center just completed an upgrade of the entire audio/visual system. We now feature six 100-inch LED TVs, two 10-by-6-foot portable LED video walls and upgraded speakers throughout the ballroom to give our guests a completely immersive experience.

Please name a few interesting groups you have booked for this year.

The Hagerty Center is proud to be the home in 2026 for the Lakebed Conference and the [Northwestern Michigan College] 75th Anniversary celebration. The largest event we will host this year is the Great Lakes Culinary Institute’s signature event, A Taste of Success.

What opportunities and challenges do you expect in the meetings/event space world in 2026?

events. Attendees are seeking gatherings that feel meaningful and memorable, with cre ative use of space and thoughtful programming. Hybrid events also remain an important tool, allowing organizations to extend their reach beyond in-person attendance. One of the ongoing challenges in our region is workforce-related: recruiting and retaining skilled staff amid the rising cost of living in Traverse City.

What’s new or exciting in terms of your facilities, services, or amenities this year?

Please name a few interesting groups you have booked for this year.

welcoming additional winter performances by their string quartet. We’re also hosting three outdoor craft and vendor shows on the historic front lawn, bringing in hundreds of vendors and attendees.

This year, we’re excited to enhance the guest experience on our historic walking tours with upgraded wireless headset technology. These new headsets allow us to comfort ably accommodate larger tour groups while ensuring every participant can hear clearly, regardless of group size or surrounding activity. The improved audio quality creates a more immersive and engaging experience, allowing guides to share stories and historical details without raising their voices or competing with background noise. This upgrade not only improves accessibility and comfort for guests, but also gives us greater flexibili ty to offer larger tours in conjunction with meetings on property.

At the same time, this pressure creates opportunity – driving more strategic sourcing, shorter booking windows, flexible contracting and creative program design. Success will

on Thunder Bay for an exclusive outdoor meeting by the pool. Culinary is heating up with Executive Chef James Walker leading the pack to new heights in 2026.

Please name a few interesting groups you have booked for this year.

This year, we’ve seen strong momentum from both social and educational groups, which continue to be a great fit for Great Wolf Lodge. We’ve hosted a variety of school-related programs, youth organizations and educational associations that value our family-friendly environment, ample meeting space and built-in recreation.

groups have been especially impactful, as they benefit from our all-under-one-roof expe rience. Some of our largest groups this year have included educational conferences and youth-focused events welcoming many attendees, combining learning, connection and fun in one destination.

What opportunities and challenges do you expect in the meetings/event space world in 2026?

Looking ahead to 2026, we see continued demand for immersive, experience-driven events. Attendees are seeking gatherings that feel meaningful and memorable, with creative use of space and thoughtful programming. Hybrid events also remain an important tool, allowing organizations to extend their reach beyond in-person attendance. One of the ongoing challenges in our region is workforce-related: recruiting and retaining skilled staff amid the rising cost of living in Traverse City.

What’s new or exciting in terms of your facilities, services, or amenities this year?

This year, we’re excited to enhance the guest experience on our historic walking tours with upgraded wireless headset technology. These new headsets allow us to comfortably accommodate larger tour groups while ensuring every participant can hear clearly, regardless of group size or surrounding activity. The improved audio quality creates a more immersive and engaging experience, allowing guides to share stories and historical details without raising their voices or competing with background noise. This upgrade not only improves accessibility and comfort for guests, but also gives us greater flexibility to offer larger tours in conjunction with meetings on property.

Please name a few interesting groups you have booked for this year.

We’re delighted to continue our partnership with the Candlelight Concert series, welcoming additional winter performances by their string quartet. We’re also hosting three outdoor craft and vendor shows on the historic front lawn, bringing in hundreds of vendors and attendees.

By Merek Roman, columnist

Last September, I stood in front of Traverse City Mayor Amy Shamroe with just two and a half minutes to evaluate the speech she’d just given to our Cherry Capital Toastmasters club. My role that evening: evaluator. The meeting wasn’t typical; we’d invited the mayor and three other local candidates preparing for the November 2025 election to speak and receive honest, constructive feedback in a fun, completely non-partisan setting.

Mayor Shamroe’s three-minute speech, “What Exactly Does a Mayor Do?” was packed with valuable information. But after six years in Toastmasters, I’ve learned that great content is only half the battle. How you deliver it – your pace, your voice, your presence at the lectern – can make or break the message.

Our Traverse City Toastmasters club, one of the oldest in Michigan, has been meeting every Thursday since the 1980s. In one fast-paced, supportive hour each week, lawyers, engineers, salespeople, retirees, and everyday residents step up to speak, evaluate, time speeches, count “ahs” and “ums,” tell jokes, or simply cheer each other on. Why do they bother? Because whether you’re running for office, leading a nonprofit, or just want to feel less awkward at the next family reunion, clear communication changes everything.

New members start with an icebreaker speech. Some are funny (“I once froze solid and had to be escorted off stage”), others vulnerable (“Group settings make me want to disappear”), and many are simply honest (“I just want to speak without my heart pounding out of my chest”).