AdviceTech 2025 Turning data into growth TEASER

Document classification: General use only. This document is for general use. Modification of content is prohibited unless you have Netwealth’s express prior written consent.

Benchmarks for technology adoption

Introduction: A data boom meets a tech boom

Trends that matter

A data boom meets a tech boom

Introduction

Our industry is facing two forces at once – a data boom with more portfolio, market, and personal data from more sources, and a tech boom, with new platforms and AI tools arriving faster than it is possible to trial them.

Clients now expect instant access and seamless experiences through portals and apps, which means data flows must be real‑time and consistent across Customer Relationship Management (CRM) investment platforms, planning, portfolios, documents, and staff systems.

Historically, tech fragmentation created rework and frustration with many firms using over 20 tech tools. However, things are shifting to a focus on integration, so that systems talk better with each other, and a single update can cascade across the business.

When tightening privacy and advice documentation obligations – from GDPR to Australia’s data privacy laws – are factored in, it is clear that clean data, integrated workflows, strong governance, and pragmatic AI are how to turn complexity into capacity and client trust.

Netwealth’s 2025 AdviceTech research points to six trends that turn complexity into capacity: turning data into action, data driven personalisation, automation across the advice lifecycle, AI going mainstream with Generative AI (GenAI), trust and cybersecurity as non negotiables, and a connected data backbone.

This report not only outlines these trends, but provides plenty of practical tools and checklists to help position your business for scale, without outspending your peers.

"Leaders are turning data complexity into capacity with six big moves."

Data feeds

AdviceTech Stars a benchmark for technology adoption

Introduction

Like prior years, Netwealth’s 2025

AdviceTech research identifies a consistent leadership segment –AdviceTech Stars – who achieve commercial scale, systems.

Structurally, AdviceTech Stars skew to multi‑disciplinary professional services firms (42% of them vs. 24% of Non‑S tars) and have an (AFSL) Australian Financial Services License (66% vs. 40% Non Stars), giving them the scope to package and price broader propositions.

Operationally, Stars run larger teams (an average of 34 full time employees (FTEs) vs. 11) and serve far more clients (39% have over 500 active clients vs. 7% Non S tars), signalling process maturity across compliance, advice production, and service.

Financially, Stars are more likely to manage over $250 million of (FUA) Funds Under Advice (94% vs. 13% Non Stars) as they have more clients with more wealth (27% have clients with balances over $1m vs. 14%), converting to higher revenue. As EBITDA margins are similar (44% have 20%+ margins vs. 40%), they produce meaningfully higher absolute profit dollars.

What makes this success durable is their technology mindset and execution. Stars adopt more tools (on average they use 27 technologies vs. 19 Non Stars), resource them properly with an in‑house technology manager (41% vs. 15%), and their decision makers maintain a tech ‘early‑adopter’ or ‘pragmatist’ fast follower mindset (76% vs. 52%). Almost half intend to increase technology investment next year (45% vs. 27%), and their use of Artificial Intelligence (AI) is three times more likely to be ‘widespread’ (27% vs. 9%). These signals point to a leadership team and workforce that treat technology as a growth lever.

Yet, Stars are careful not to outspend the market, with technology spend as a share of revenue the same for both groups (7.9% of revenue). That parity suggests Stars aren’t leading because they ‘outspend’, but because they ‘out‑execute’, prioritising the right systems, integrating them effectively, resourcing change, and converting adoption into measurable client and commercial outcomes.

This is why AdviceTech Stars are a benchmark for our industry, and we reference them throughout the report.

Technologies

Six trends that matter Introduction

Turning data into action

01

Advice firms are embracing enhanced analytics for their daily and strategic decision‑making.

Among AdviceTech Stars, two‑thirds (67%) track core Key Performance Indicators (KPIs, e.g., revenue, time spent), analyse staff resourcing, and monitor staff and client satisfaction. Two thirds of Stars are relying on data to generate broad business insights (64%), to conduct business scenario planning (e.g. revenue or staffing) (56%), and many use data to highlight cross‑sell opportunities.

Dashboards are becoming a key operating system for the business, with almost two thirds (63%) of Stars using them (with most of the rest intending to), favouring live dashboards with drill‑downs, alerts, and AI‑assisted insights.

Data-driven personalisation

02

Due to e commerce, streaming, and other digital services, we have become accustomed to highly personalised experiences across web, mobile, and in person. Clients now expect communications that reflect their personal circumstances and preferences.

AdviceTech Stars are building automated workflows where life‑event changes, portfolio exceptions, or market signals are automated into audience‑appropriate messages or adviser‑trig gered alerts for review.

Over half (51%) of Stars already receive triggered life‑event alerts about their clients, with expanding plans for deeper behaviour insights and portfolio alerts. This helps to improve timeliness and relevance of advice, without sacrificing adviser oversight.

Data-driven client management

03

Automation has moved from experiment to routine. Core workflows, including onboarding, Statements and Record of Advice creation, cashflow modelling, and client reviews are increasingly ‘templated + data‑prefill’, with AI producing strong first drafts for human review.

Almost half (46%) of AdviceTech Stars automate client onboarding (such as ID checks and forms), around three quarters (77%) automate client meetings, the agenda or notes, and around eight in 10 Stars (79%) fully or partially automate portfolio performance reporting.

With many core processes at least partially automated, Stars are delivering faster turnarounds, fewer errors, and easier auditing.

Six trends that matter Introduction

AI is now an everyday assistant, not a pilot.

Widespread use among AdviceTech Stars has tripled to 27%, with the rest doing some type of trial or pilot.

The big wins are practical, with 83% of Stars using AI use it to summarise meetings and generate file notes; 60% to create content; and 51% to analyse unstructured data.

Generative AI (GenAI) is at the heart of this trend, increasingly embedded in enterprise software (like Microsoft 365 Copilot) or stand alone services like ChatGPT or Google’s Gemini.

More specialised AI uses (e.g., modelling, compliance checks) are also emerging as knowledge, culture and governance mature.

As digital ecosystems expand, advice firms are increasingly exposed to cyber threats.

AdviceTech Stars are increasing risk controls across people, clients, and systems. For example, multi factor authorisation (MFA) is now common for staff accessing internal systems (adopted by 90% of Stars), along with role‑based access and cyber training and drills.

MFA for clients when accessing portals is used by over three quarters of Stars (77%), and secure document sharing tools are being embraced widely (77%).

Stars are spending more time on tech vendor due diligence (79% of them), data backup and disaster recovery protocols (87%), and regular cybersecurity reviews (92%).

Many are also formalising data policies for retention/ deletion and quality (62 of Stars%), ensuring they treat client data with the same diligence as client assets.

Most advice firms run over 20 technology systems, requiring double handling of information and creating potential for mismatches and incomplete reporting. AdviceTech Stars (who use more tech) are solving this with integration technologies and a governed ‘single source of truth’ for the data.

Among Stars, the use of integration technologies has jumped from 21% (2020) to 63% (2025). Firms start with ‘built‑in data feeds’ from and to core systems, then progress to low‑code integration tools (e.g., Workato), then may look to leverage public Application Programming Interfaces (APIs).

Stars are starting to adopt a centralised data warehouse or data lake that normalises, matches and merges data records, and synchronises data two‑ways between systems like Xplan, Xero, and Netwealth.

The result for Stars is cleaner data, fewer manual fixes, better reporting, and a robust foundation for personalisation and AI.

Trend 01: Turning data into action

Data dashboards

Key insight Turning data into action

AdviceTech Stars embed analytics in daily operations and strategic choices, turning data into action.

Netwealth’s 2025 AdviceTech research shows how leaders make data usable every day. Operationally, two thirds (67%) of Stars track core KPIs like revenue and time spent – a simple habit that unlocks efficiency. They also use data analysis for staff performance (33%), planning resourcing (31%), and monitoring staff satisfaction (38%) to avoid bottlenecks and burnout.

Growth is also guided by data, with a quarter (26%) using it to find new clients and another 31% considering it.

Firms use data to set direction, with two‑thirds (67%) supporting strategic decisions with data, others generating broader insights (64%), running scenario planning on revenue and staffing (56%), forecasting sales (64%), and tracking competitors and market trends (36%).

The results include spotting unprofitable clients, under‑used services, and cross‑sell opportunities. Also, it is possible to decide where to invest training, streamline processes, or focus marketing.

Using data to find new clients

Tracking business KPI's (e.g. revenue, time spent

Using data to generate business insights

Forecasting sales or revenue using internal or external data

Using data to conduct business scenario planning (e.g. revenue, staff, growth events)

Analysing staff performance using data or analytics tools

Using data to plan staffing and resourcing

Data dashboards as an operating system

Turning data into action

Data dashboards turn scattered data into live, decision making information, and AdviceTech Stars are embracing them.

Data dashboards offer different ‘lenses’ on the same data stack. A data stack is made up of multiple systems and software (e.g., a CRM, investment platform, commission management platform), and the dashboard brings this information together to create a single view. Among Stars, usage is up to 63% in 2025 from 43% in 2021, whilst another 24% plan to adopt dashboards, meaning 87% are either using them or intending to.

Today, around 7 in 10 Stars (71%) still lean on built‑in reports from their CRM, investment platform, or accounting system. Meanwhile, 42% of Stars also use Excel to bring things together and visualise information. The trend is toward purpose‑built data dashboards, such as Power BI. Power BI is now used by about a third of Stars (33%), and across all firms has climbed from 20% (2023) to 26% (2025), with Tableau also in the mix.

What makes dashboards powerful isn’t just the charts, but the ability to ‘live refresh’ data, to customise layouts, be interactive (with filters, drill‑downs, etc.), the intelligent alerts, and AI‑assisted insights that turn metrics into action. Dashboards can be shared, scheduled, and set to alert you when events occur.

Use of dashboards/reporting tools for business-related data to better understand your business?

Which of the following dashboards or reporting tools does your business use for important business-related data to better understand your business?

Built in analysis

Data dashboards

Gallery of data dashboards

Turning data into action

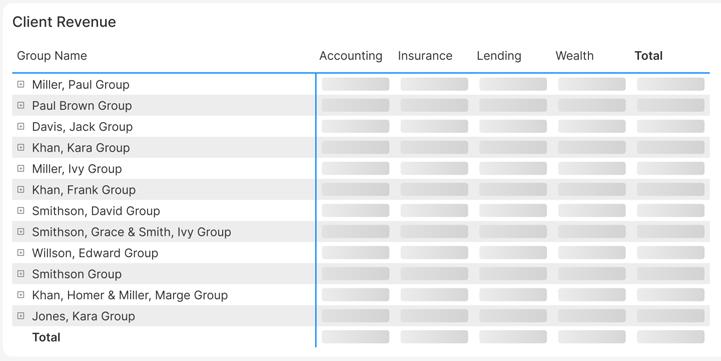

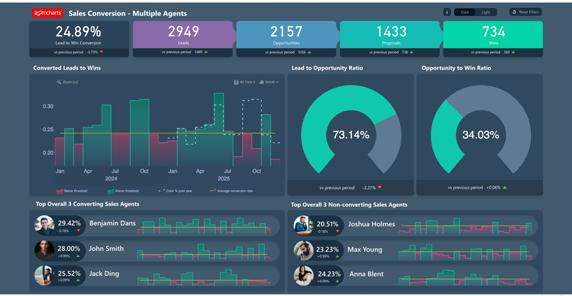

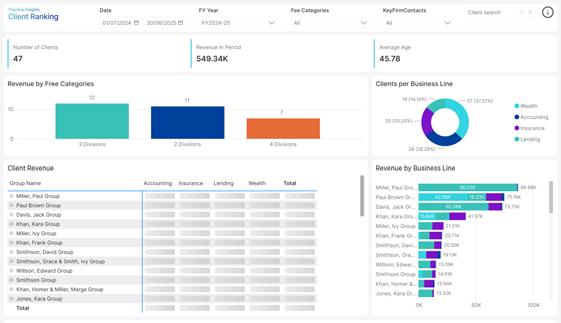

Data dashboards help your business make better decisions.

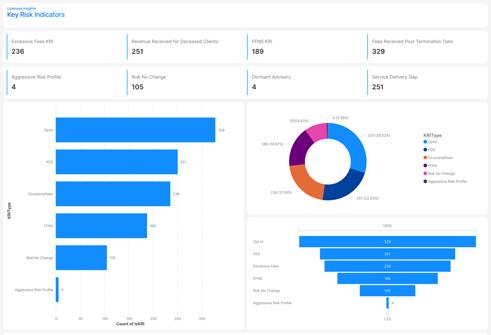

Executives use data dashboards to look at revenue, margins and risks; sales leaders examine client segments and cross‑sell opportunities; people leaders track staff engagement and resource capacity; marketing teams follow leads, conversion and return on investment (ROI); whilst operations teams use them to visualise risk.

Here are some key example dashboards with key metric:

Research methodology

For our 2025 Netwealth AdviceTech Report, we interviewed 302 Australian financial advisers to get their views on new technologies and the impact on their business. The survey took place in June 2025 via an online quantitative questionnaire with our partners CoreData.

AdviceTech segmentation methodology

In the 2020 AdviceTech Report, we identified a segment of firms called AdviceTech Stars, based on the success of the business and the rate at which they adopt technology.

We developed a Business Success Score comprised of measures such as a practice’s funds under advice (FUA) and revenue growth or decline from the previous year. We also considered a ratio of FUA to active clients and to length of business operation. Practices that have better business success score higher. The average Business Success Score is 55 out of 100 for all practices. For AdviceTech Stars this is 71.

We also developed a Technology Adoption Score, comprised of the number of technologies used by a practice, how many technologies they are considering implementing in the short term, and characteristics about their technology investment and management. Practices that adopt more technology in a planned manner score higher. The average Technology Adoption Score across all practices is 68 out of 100. For AdviceTech Stars this is 81.

Tech scoreSuccess score Segment size

AdviceTech Stars

Not AdviceTech Stars

All firms

Technology Adoption and Business Success Scores

Stay informed, subscribe today

Between Meetings with Matt Heine

Listen to thought leaders on what opportunities they see for financial advisers and the wealth industry.

Unique perspectives from industry specialists

CPD accredited webinars featuring research and insights on the trends that matter.

Trending topics on personal and business effectiveness

This thought provoking email unpacks business trends, strategies, ideas, and frameworks.

Short, sharp insights for busy advisers

Dive into the latest trends shaping the advice sector directly from your inbox.

Browse the full archive netwealth.com.au/web/insights

Speak to Netwealth

Netwealth Investments Limited

Level 6, 180 Flinders Street, Melbourne, VIC 3000

Freecall 1800 888 223

Email contact@netwealth.com.au

Web netwealth.com.au

Disclaimer: This information has been prepared and issued by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109, AFSL 230975. It contains factual information and general financial product advice only and has been prepared without taking into account the objectives, financial situation or needs of any individual. The information provided is not intended to be a substitute for professional financial product advice and you should determine its appropriateness having regard to you or your client’s particular circumstances. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product. For information regarding the relevant target market for Netwealth products, please refer to the products Target Market Determination available under the ‘Forms & Documents’ page at http://www.netwealth.com.au. While all care has been taken in the preparation of this document (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information.