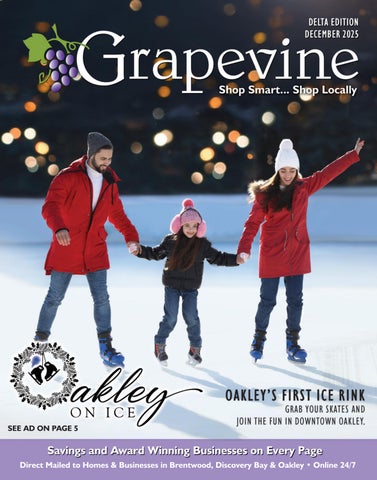

FOR YOUR FINANCIAL HEALTH

Seven Essential Facts of the One Big Beautiful Bill Act (OBBBA)

I plan to benefit you today by giving you informational bullet points on how the OBBBA will affect your 2025 and 2026 taxes. You can also use this information to help you research and plan your financial transactions throughout 2026, rather than at the end.

The “One Big Beautiful Bill Act” (OBBBA), signed into law on July 4, 2025, by President Trump, represents a sweeping legislative package with significant, permanent changes to the U.S. tax code and federal spending. For middle-class individuals and owners of closely held businesses, the law provides a mix of new opportunities for deductions and credits, alongside permanent extensions of existing tax rates.

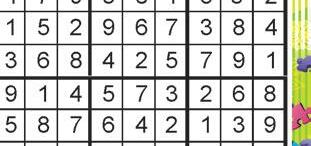

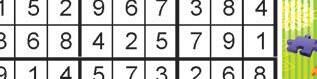

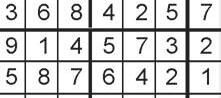

For Individuals and Middle-Class Families

•Permanent Tax Rate and Standard Deduction Structure: The OBBBA permanently extends the individual income tax brackets (ranging from 10% to 37%) that were set to expire at the end of 2025. The law also makes permanent the increased standard deduction, simplifying filing for many taxpayers.

•Increased SALT Deduction Cap: The cap on the State and Local Taxes (SALT) deduction has been temporarily raised from $10,000 to $40,000 for married couples filing jointly (and $20,000 for single filers), a change effective from 2025 through 2029. This offers significant relief for those in high-tax states.

•Deductions for Tips and Overtime Pay: The act introduces a temporary tax deduction (through 2028) for qualified tips (up to $25,000) and qualified overtime pay (up to $12,500, or $25,000 for joint filers) for eligible individuals who meet certain income limitations.

•Enhanced 529 Plans: The law expands the use of 529 education savings plans, allowing up to $20,000 per year (up from $10,000) to be used for K-12 education expenses, including tuition, books, and tutoring.

For Closely Held Businesses

•Permanent 20% Qualified Business Income (QBI) Deduction: The popular 20% QBI deduction (Section 199A) for owners of passthrough entities (S corporations, partnerships, and sole proprietorships) is now a permanent fixture of the tax code, offering long-term tax

certainty for business owners.

•Restored 100% Bonus Depreciation: The OBBBA permanently restores the ability for businesses to immediately deduct 100% of the cost of eligible new and used equipment and certain production property placed in service after January 19, 2025, encouraging capital investment.

•Immediate Expensing of R&D Costs: The prior requirement to amortize domestic research and development (R&D) expenses over five years has been repealed. Businesses can now immediately deduct 100% of these costs, a change that also allows certain small businesses to file amended returns for previous years.

The OBBBA’s provisions require careful review with a tax advisor to navigate the complexities and leverage the opportunities available for your specific situation. The IRS provides official guidance on the changes related to the One, Big, Beautiful Bill provisions on its website at https://www.irs.gov/newsroom/ one-big-beautiful-bill-provisions.

I am available for consulting with you on how these changes personally apply to you for 2025 and 2026. My contact information is: Marlen C. Rosales, CPA, Founder & Principal at Certified Accounting Services Co., 1120 – 2nd Street, Suite 105, Brentwood, CA 94513, (925) 392-8047, marlen@cpa-casco. com, www.rosales-cpa.com.

I Rent, Why

Should I get Insurance?

It is a common misconception that the landlords’ or owners policy will cover the tenant’s possessions but that is false. A basic renter’s insurance policy is usually just a few hundred dollars a YEAR.

Perhaps you are in bed sleeping soundly and a rusty pipe bursts, drenching everything in dirty water or you turn away from the stove for just a brief moment, only to come back to a grease fire? You take your family to the movies only to come back to find your home ransacked and empty. This is a tragedy that does not have to happen. In the event of calamities such as these and more the owner’s policy will only cover the owner’s property. If you are the tenant you may have lost everything including the roof over your head in an instant. The renter’s policy may be used to replace your belongings and often pay for temporary housing or loss of use. Coverage is also provided for personal liability protection and medical payments to others.

But wait there is more, remember when we talked about that fire, what if the

bathtub or sink overflowed. Would you be responsible? If there is bodily injury or property damage to someone else, you may responsible through negligence if any of these incidents are deemed your fault. Can someone sue for damage caused by your negligence if there’s nothing to take? Yes. We live in California, where anyone can and often will sue anyone for anything and everything. You might not have anything to take today, but the person holding that judgement will sit on it, renew it as necessary, and pounce when there’s finally something to collect. Is that the shadow you want to live under?

And don’t forget about other nearbyhomes and their insurance companies that are going to look at your assets, and your future earnings to recoup their loss.

How does the thought of giving half your paycheck to the other residents of the building for the next fifty years sound simply because you didn’t have California renters’ insurance liability coverage?

Some basic Tips

•Shop around for homeowners insurance. Compare prices, service, and coverage.

•Provide complete and accurate information to your agent or broker when requesting a quote or completing an insurance application.

•Read before signing. Make certain the policy reflects the limits and deductibles, coverage purchased, keep a copy of all

signed documents in a safe place with other vital records.

•Ask the broker or agent to explain any wording you find confusing.

•Keep an inventory of personal property, listing all of the items you own, the dates purchased, and the price. If possible, take pictures of important and valuable items. You may want to videotape your home and possessions as well. Keep these records in a safe place away from home, preferably in a safe-deposit box, the cloud, or a relative’s house. And remember to update periodically.

•A Home Inventory Guide is available on the internet or drop me an email.

•Remember that most policies cover replacement cost not current value so just because your furniture may have seen better days does not mean its worthless.

•If you have anything of unique values such as an antique furniture or collector items tell you agent you may need a rider for additional coverage

You won’t know until you get a quote so get peace of mind -- and full protection -call your insurance company today!

Patrick McCarran is a local Realtor and Broker. Call/text 925-899-5536 • pmccarran@yahoo.com • CallPatrick.com

Independently owned and operated. Equal Housing Opportunity. In association with Realty One Group Elite DRE#0193160.

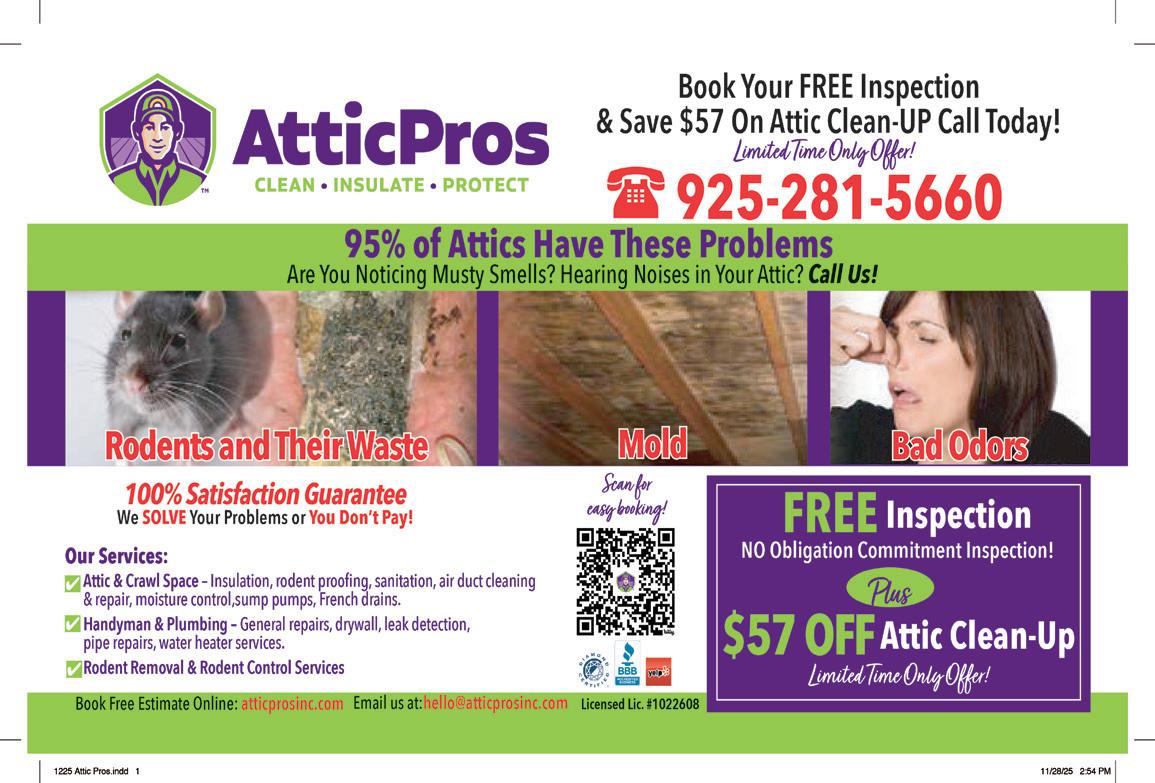

ANTS

RODENT CONTROL

RECEIVE A FREE RODENT INSPECTION TO DETERMINE THE BEST TREATMENT OPTIONS FOR YOU. FOLLOWING COMPLETION OF TREATMENT. YOU’LL RECEIVE 4-WEEKLY CHECK-UPS.

EXPANDED

TERMITE

Ongoing Events

AFTER SCHOOL ACADEMY

Tuesdays-Thursdays, 1:30-6:30pm, Village Community Resource Center, 633 Village Drive, Brentwood or Byron Community Library Club, 3926 Main St., Byron. Literacy and homework support for K-5th Grade. Info 925-626-7892 or jose@vcrcbrentwoodca.org.

AL-ANON MEETING - BRENTWOOD

Friday, 8pm, Brentwood United Methodist Church, 809 2nd Street, Brentwood. Support Group for families and friends of Alcoholics. No need to register, info call Trisha 510 910-1389

AL-ANON MEETING - DISCOVERY BAY

Monday, 12:15pm, Delta Community Presbyterian Church, 1900 Willow Lake Rd., Discovery Bay. Support Group for families and friends of Alcoholics. No need to register, info call Charlie (925) 858-5382.

AMERICAN LEGION AUXILIARY

1st Tuesday, 5pm, Legion Hall, Basement, 757 First St., Brentwood. Info Dolly 925-890-7357.

AMERICAN LEGION POST 202 MEETING

2nd Wednesday, 6:30pm, Veterans Hall, 757 First St., Brentwood. Info AML202.org or 925-516-2141.

ANIMAL RESCUE RECON DOG ADOPTIONS

Saturdays, 10am-1pm, Pet Food Express, 5829 Lone Tree Way, Antioch. Info 925-392-7654 or animalrescuerecon.com.

BETHEL ISLAND LIONS CLUB

1st and 3rd Wednesday, 7pm, Scout Hall, 3090 Ranch Ln., Bethel Island. Info Dave 925-595-1451.

BRENTWOOD ALZHEIMER’S CAREGIVER SUPPORT GROUP

2nd Thursday, 7-8:30pm, Brentwood. Please call 800.272.3900 to register for the meeting.

BRENTWOOD LIONS CLUB

1st Wednesday, 6:30pm, BW Community Center., 35 Oak St., Brentwood. Call for more info 925-587-3783. www.lcobw.com

BYRON DELTA LIONS CLUB

1st Friday, 10am, St. Anne’s Catholic Church, 2800 Camino Diablo Rd., Byron. Info Kathy 925-980-6696.

CANCER SUPPORT COMMUNITY

Tuesdays, 1-3pm, 3505 Lone Tree Way., Suite 3, Antioch.

DASH ADOPTIONS

Fridays, 5-8pm at Petsmart, 5879 Lone Tree Way, Antioch. 1st & 3rd Sunday, 12-3pm, Petco, 5481 Lone Tree Way, Brentwood. Info 925-219-0151 or deltaanimalssafehaven.org.

DELTA SHADOW BOXERS PARKINSON’S SUPPORT GROUP

1st Wednesday, 2-5pm. Merrill Gardens., 2600 Balfour Rd., Brentwood. Info Sue 925-550-2756

DISCOVERY BAY CORVETTE CLUB

1st Thursday, 7:30pm. Discovery Bay Yacht Club, Bilge Room Info Tim Denham 408-210-3814.

DISCOVERY BAY LIONS CLUB

1st Tuesday, 6:30pm, Discovery Bay Yacht Club. Info Rita Caruso 925-640-5746, www.discoverybaylions.com.

DISCOVERY BAY PICKLEBALL CLUB FREE TRAINING

1st Saturday, 11:00am, (weather permitting) Discovery Bay Community Center 1601 Discovery Bay Blvd, Discovery Bay.

DELTA GROUP SIERRA CLUB

2nd Friday, 5pm, Oakley Tavern, 3685 Main St., Oakley. Covers Antioch, Pittsburgh, Bay Point, Oakley, Brentwood, Bethel Island, Discovery Bay, and unincorporated areas of ECCC. Info Joeandlu@comcast.net.

DELTA WOMEN’S SOCIAL CLUB

2nd Thursday, 11:30am. Info Gloria 925-513-8731.

DIG - DELTA INFORMAL GARDNERS

4th Monday, 7:30pm, Brentwood Methodist Church, 809 Second St., Brentwood. Info Bob 925-642-0080 or deltainformalgardners.org.

DELTA QUILTERS GUILD

For information REGARDING meetings & events, go to deltaquilters.org

DOFBWOW (Daughter’s of Faith Becoming Women of Wisdom) 2nd & 4th Thursday, 6:45pm, via Zoom. Contact True Free Love Ministry via email truefreeloveministries@gmail.com.

GFWC - BRENTWOOD WOMENS CLUB

3rd Wednesday, 11:30am,Contact Sedar for more Info 925-550-4486.

GRIEF SUPPORT GROUP

Thursday, 5pm, Immaculate Heart of Mary Library, 500 Fairview Avenue, Brentwood. Info Mary Ann Smith 925-240-1706 or Linda Quilici 925-308-7799.

HELPING ONE WOMAN

3rd Tuesday’s, 6-8pm, Brentwood Community Center 35 Oak St., Brentwood. Email: howdiscoverybay@gmail.com

HALO ADOPTIONS

Saturdays & Sundays, 12-1:30pm, Antioch Pet Food Express, 5879 Lone Tree Way, Antioch (excludes the 3rd Sat).

HOSPICE OF THE EAST BAY

Informational Session and Training. Info 925-887-5678 or volunteers@hospiceeastbay.org.

HOW OVER-EATERS ANONYMOUS MEETING

Thursdays, 10-11am, Brentwood Professional Plaza, Fellowship Hall, 8385 Brentwood Blvd., Suite B, Brentwood. AA Big Book Discussion. Info Peggy 925-200-2281

MINISTRY OF CARING ( Summer Schedule 6/4-8/27)

Wednesday, 10:30-11:30am, will be changing meeting location during summer, Veterans Park, Balfour Rd., Brentwood. Widow/widower Grief Support Group. Info Mary Ann Smith 925-240-1706 or Connie Conover 925-392-8037

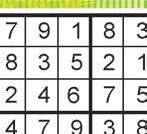

ODO PLAN ADVANTAGES!

• Low Cost, NO Deductibles, NO Annual Maximum, NO Waiting Periods + 10% Off All Dental Treatment

What is the Annual (12-month) Membership Fee due at Enrollment?

• Individual: $ 390 (includes 2 regular cleanings, 2 exams, all necessary x-rays during those exams)

• Individual: $ 525 (includes 3 periodontal maintenances, 2 exams, all necessary x-rays during those exams)

• Child (up to 18): $ 360 (includes 2 regular cleanings, 2 exams, all necessary x-rays during those exams)

AS THE YEAR COMES TO A CLOSE, DON’T FORGET TO USE YOUR DENTAL INSURANCE AND FSA FUNDS BEFORE THEY EXPIRE! SCHEDULE YOUR APPOINTMENT WITH US TODAY!