Q3 2025 set the stage for a pivotal reset in the Downtown Sarasota condominium market - one that, while still subdued, carries early signs of long-term stabilization. Average and median prices remained largely unchanged from prior quarters, reflecting a market that continues to find its footing. Sellers have taken note of shifting buyer sentiment, adjusting expectations accordingly. The average new listing price softened by 11% quarter over quarter and 22% year over year to $1.71 million, signaling a pragmatic recalibration in response to sustained softness in the condominium market.

The headline number for the quarter tells the story succinctly: just 33 closed transactions, the lowest quarterly total since tracking began in 2010. This figure represents a 60% decline year over year and stands as the single largest driver behind the 32% cumulative drop in total dollar volume for the first three quarters of 2025 compared to the same period last year.

Beneath the surface, there are early indicators that the foundation for a more balanced market is forming. As expected, the slower pace has prompted the delisting of excess, overpriced inventory, reducing total active listings by roughly 15%. This contraction is a healthy development, creating a more accurate reflection of true, salable inventory. There is 11.3 months of inventory on the market which keeps the balance of power firmly in the hands of buyers, however this metric has remained stable this quarter.

By Simon Bacon, Executive Director | Developer Services

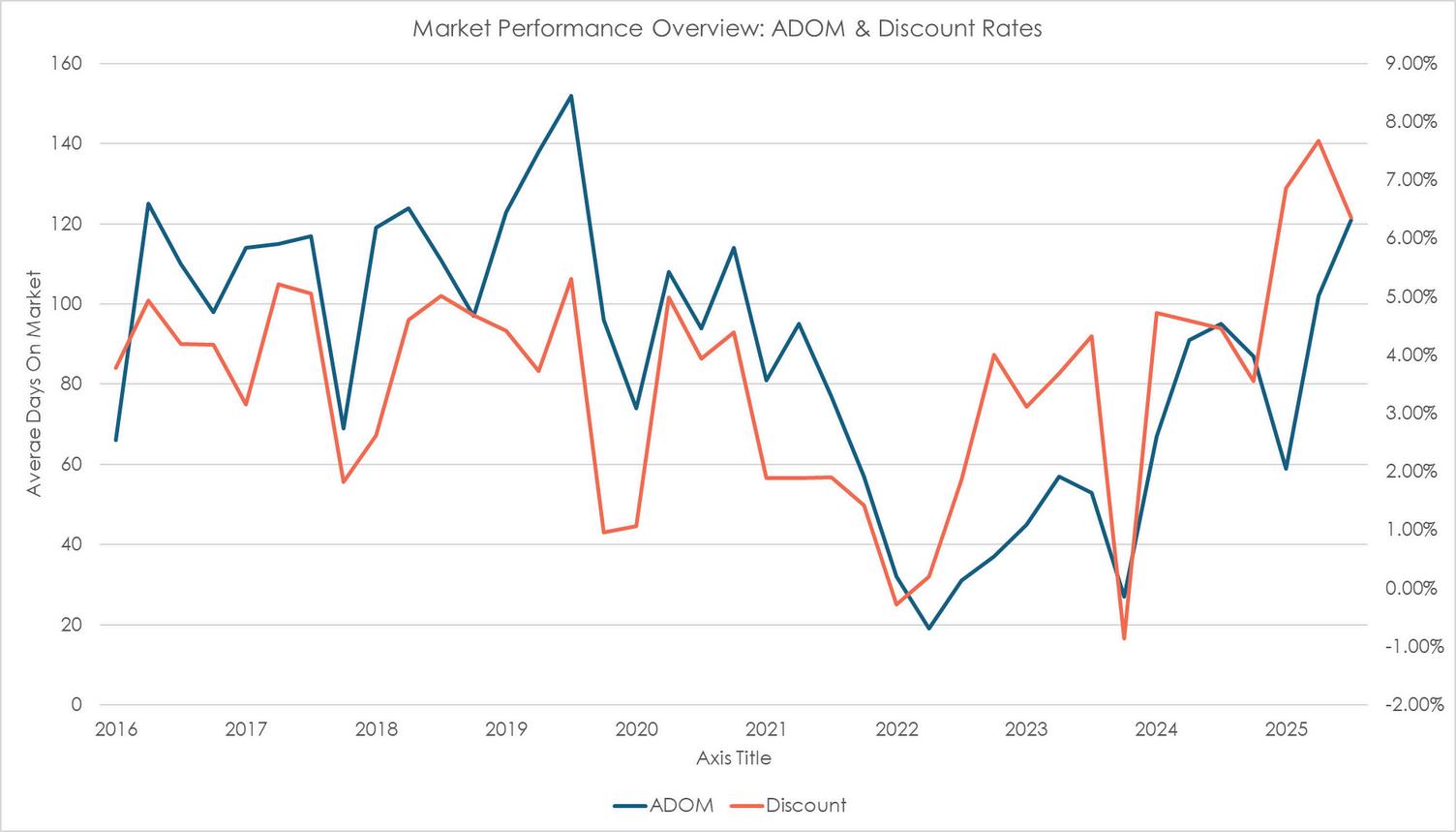

Two long-awaited positive shifts finally materialized this quarter. Days on market increased, bringing the timeline for sales back in line with historical norms, while the average listing discount tightened slightly to 6.4%, approaching levels consistent normalized market behavior. Together, these factors suggest that sellers and buyers are gradually reestablishing alignment—a critical step toward restoring confidence.

Transactions over $3MM saw a 36% decline in dollar volume through the first three quarters vs. the same period last year. This was punctuated by a 14.7% decline in average closed price and a 17.8% decline in the median price. The average listing discount also came down by over 15% indicating that perhaps sellers are becoming more realistic about value.

While Q3’s figures underscore the depth of the slowdown, they also point toward the beginning of a recalibration process that could lay the groundwork for renewed stability heading into 2026. In a market defined by patience, discipline, and realism, Downtown Sarasota may be quietly setting the stage for its next phase of recovery.

Closed Dollar Volume

fell 51% to $51.2M, compared to $105M in Q3 ‘25

Closed Transactions QoQ

down slightly by 55% with 33 closings last quarter New Listing Dollar Vol was $150.7M down by over Q3 ‘24 volume of $

Listing Discount has increased by 42% YoY from 4.46% to 6.36%

2016 - 2025 TOTAL $ CLOSED 10-YEAR A Q3 Y $370

TEN-YEAR AVERAGE

2016 - 2025

New listings dollar volume, signed and closed hit its lowest level since mid 2019, illustrating the return of more normalized market metrics

Re-calibration of Units Listed, Dollars Listed, Signed & Closed trendlines will lead to more consistency in the downtown market

Q2 2022 was the peak of the previous cycle, and caused the relationship between ADOM and Discount invert, these metrics are nearing their pairing point again.

Average New List Price increased by 2% from last quarter to $5.3M in Q3 ‘25

Listing Discount increased by 11% from 9.13% in Q2 ‘25 to 7.69% in Q3 ‘25

QUARTER-OVER-QUARTER

|

|

0% | 5 CLOSED LISTINGS -55% | 31 NEW LISTINGS -15% | $4,135,000 AVERAGE PRICE CLOSED

Average Price Closed at $4.13M down by 15% from $4.84M last quarter

A discerning buyer pool helped drive more value in their favor, reducing the average closed and listed price, and increasing the listing discount to 9.1%. Existing inventory for the $3M+ market saw greater de-listing as sellers come to terms with market expectations.

Average closed prices softened by 15% QoQ and 20% YoY, reflecting a healthy market correction and recalibration in buyer expectations for the high-end segment.

While listings and sales volumes have dipped, volumes remain up year-over-year, showing that interest in luxury properties is still present despite slower pacing.

As Downtown Sarasota navigates its recalibration phase, the groundwork is quietly being laid for a more disciplined and resilient market. With inventory tightening and buyer-seller expectations beginning to align, the coming quarters may offer strategic entry points for those prepared to act with precision. For developers, the pre-launch pipeline presents both opportunity and responsibility to deliver product that meets the evolving expectations of a more value-conscious buyer. For agents, the shift from urgency to intentionality marks a new chapter: one where insight, patience, and positioning will define success in a market poised for thoughtful resurgence.

1605 MAIN STREET, S SARASOTA,