IMPACT REPORT

Matchmaking Sponsor

Silver Sponsors

AI, CLOUD & DATA TRACK

Platinum Sponsor

Gold Sponsor

Silver Sponsor

ECOMMERCE & RE TAIL TRACK

Gold Sponsor

Silver Sponsor

FINANCE & FIN TECH TRACK

Platinum Sponsor

Gold Sponsor

Silver Sponsor

CYBERSECU RITY TRACK

Platinum Sponsor

Silver Sponsor

Mexican businesses are facing a complex environment plagued by economic and regulatory uncertainty, high competition, and limited access to financing. To remain competitive, numerous companies are investing in technology. However, without careful planning and deployment strategies, these technologies can fail to address the main needs of the company, while opening the door to costly cyberattacks.

The country’s retail sector is also undergoing a digital transformation driven by the convergence of online and offline channels. However, the sector needs a unified digital payment framework to accommodate Mexico’s high reliance on cash, which still represented 38% of point-of-sale transactions in 2023. The sector is proving quick to change, with fragmented infrastructures giving way to centralized systems that support omnichannel strategies and integrated operations.

Global trade tensions and inflation are forcing companies to rethink their supply chain, logistics, and consumer engagement. Now more than ever, businesses need to adapt to technological transformation, regulatory shifts, and emerging digital threats. Some key trends driving the greatest transformation are AI, cybersecurity, and fintech. For example, Generative AI and advanced analytics are reshaping business operations, allowing organizations to transition from manual data processing to real-time decision making and scalable AI deployment. This is no longer a future trend but a current strategic tool.

As digital transformation accelerates, cybersecurity has become a boardlevel priority. Automated, scalable systems are now necessary to reduce human error and enhance policy enforcement in hybrid and multi-cloud environments. A unified identity management framework is also essential to combat the rising number of breaches.

Mexico Business Forum 2025 highlighted the urgent need for strategic alignment among industries facing rapid digitalization. Its emphasis on technology adoption, regulatory evolution, and cross-sector collaboration positioned it as a pivotal event in the country’s business and innovation agenda. Offering a strategic platform to address market trends, decision makers converged in one place to address the challenges and provide solutions within the sectors that are driving the greatest transformation of the 21st century.

389 companies

635 conference participants

Breakdown by job title

35.4% Head / Manager/ Executive / Associate / Consultants / Coordinators

26.3% Director / VP / COO / CFO

21.9% CEO / DG / President / Country Manager

9.0% CISO / CTO / CIO / CDO

7.2% Founders and Co-Founders

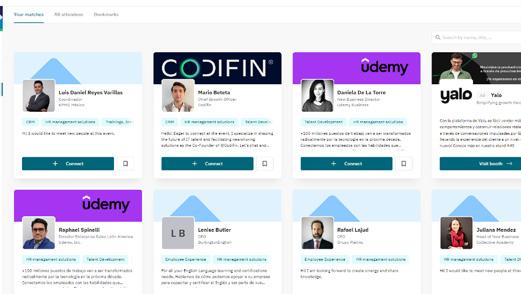

Matchmaking

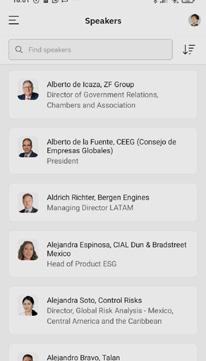

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Business Forum 2025 attendees

MBE App Impact

419 participants

2021 matchmaking communications

867 1:1 meetings conducted

100 speakers

2nd edition

17 sponsors

22,077 visits to the conference website

Conference social media impact Pre-conference social media impact 5,476 direct impressions during MBF 82,912 direct pre-conference LinkedIn impressions

19.4% click through rate during MBF

pre-conference click through rate 30.92% conference engagement rate

pre-conference engagement rate

Matchmaking intentions

Total

3,694 2,442 Networking 1,252 Trading

• A&A BUSINESS CONSULTING

• Aaxis

• Actinver

• ADAC

• Advice robo

• Adyen

• Akamai Technologies

• Algosec

• ALLECTrO

• ALLErGEN Fr EE MEXICO

• ALMACENES DC

• AlmaMatters

• Aloi

• Alta Cultura Empresarial

• Alvos

• Amazon Web Services Mexico

• AMCID_Mx

• American Eagle

• AMIVE

• AM r HealthCare

• AMSOC

• ANEr PV

• ANETIF

• Apex Forge Capital

• Aplzo

• Arabela

• Area Industrial

• Arena Analytics

• ASAMEP

• Asesoría en Farmacias

• Asociación Mexicana de Mujeres Jefas de Empresa

• AT&T México

• Atalait

• ATTOM CAPITAL

• AWS

• B2V Media

• Banamex

• Banco Azteca

• Banco Base S.A. Institución de Banca Múltiple, Grupo Financiero Base

• Bankaool

• Banngu & LP México

• BANXICO

• Bayer

• Bayonet Technologies Inc

• B BVA Mexico

• Becerril, Coca & Becerril

• Belvo

• Bigbox

• Bitsafve

• Bitso

• BIVA - Bolsa Institucional de Valores

• Bixo

• Blip

• Blooms Trade

• B NP Paribas

• Borealix

• Brixton Venture Lab

• Buildtech and consulting solutions

• Business France

• BUSINES S TO VALUE

• Campa & Mendoza

• CANCHAM

• Capwatt

• Cenace

• Centro Médico ABC

• Chedraui Mexico

• CHEQPAY

• Ci Banco

• CIAL Dun & Bradstreet

• Cinepolis

• Círculo de Crédito

• Clara

• Clarke Modet y Cia Mex

• Clip

• Cluster Espacial México

• CMV r&r Partners

• CNBiogás

• CODECO

• COFECE

• Cognitus IT Solutions

• COMC E Nacional

• Comercializadora Full Vending Mexico

• Cometa

• Comisión Nacional Bancaria y de Valores

• ConaLog

• CONCENTr IX

• Concepto Móvil SA de CV.

• Conecta

• Conexa

• Consejo Nacional de la Industria Maquiladora y Manufacturera de Exportación AC

• COPACEA

• Coppel

• Corteza.ai

• COSMOS

• Cosmos/Polymath 360

• Covalto

• Creatio

• Credimotion

• Criskco

• Crowdlink

• Cushman & Wakefield

• D24

• Danone

• Data4Sales

• Datawifi

• Deep Dive

• Delegación General de Québec en México

• Dell Technologies

• Desteia

• DEUNA

• DIN code

• Ditobanx

• DO r MIMUNDO

• D raexlmaier

• Dubai Chambers Mexico

• Duers

• Ebury

• EDSA

• El Gran Bajío Network

• El Palacio de Hierro

• El Puerto de Liverpool

• Eleia Mexico

• ElevenLabs

• Endeavor

• Engie

• Engine CX

• Enterprise Source Capital de México

• ENTO r NO DE MAr KETING Y TECNOLOGIA SA DE CV

• ESource Capital

• Estée Lauder

• Eureka/Ualá

• Eureka&Co

• Facultad de Contaduria, UNAM

• Farmacia San Pablo

• Farmacias del Ahorro

• Feer

• FEMSA

• FEMSA Ventures

• Ferrer & Asociados

• Fidelity Marketing

• Fidelizador

• Financiera Monte de PIedad

• Finerio Connect

• Finnosummit

• Finsolar

• Finsus

• Fintech Mexico

• Fintoc

• Finvero

• Firm Energy

• Fiserv

• Flexlex

• Fluid Attacks

• Fractalia

• Fracttal

• Framecrete

• Fr AUDECTION

• Freshworks

• From

• Ftech

• Fundación C arlos Slim

• G300

• Garrigues

• GBM

• Gecko Global Services

• Genesis

• Gepp

• GIBHO r SMArT SErVICES SAS DE CV

• GKM

• Glitzi

• G NP Seguros

• Gregario

• Groovinads

• Grupo Acustik Noticias

• Grupo Axo

• Grupo BAL

• G rupo Bimbo

• Grupo Coppel

• Grupo Dormimundo

• Grupo dportenis

• Grupo Elektra

• Grupo Financiero Banorte

• Grupo Flecha Amarilla

• Grupo Fórmula

• G rUPO JULIO

• Grupo México Infraestructura

• G rupo SSSIA

• Guros

• HAMOC

• Healf

• Health and Home SA de CV

• HEB Mexico

• HEGEWISCH LOPEZ

• HeyGIA.ai

• Hits Book Group

• Holland House México

• Hospitales MAC

• Howden

• HSBC

• Huawei Mexico

• I. C.

• IBH

• Icomm

• INDMEX - EMBAJADA

D E LA INDIA

• Industrias H24 S. A. de C.V.

• Intercam

• International SOS México Emergency Services

• Invest Hong Kong

• Iron Mountain México

• IT Mentoring

• Izei Consulting

• J rr TI

• Jüsto

• Kantar

• KAYAK

• Keyo

• Kfeína Bit

• Kin Analytics

• Kindor

• Kinsu

• Klarna

• Koin

• Konfio

• KOTr A

• Kovix

• Kranon

• Krino | Karpilot

• Kueski

• La Casa de Toño

• La Frutología

• La Nao Consulting

• La Portada Canada

• Lacoste

• Launch LATAM

• Lawtin

• Leadin

• LEAH Inmobiliaria

• Limbic

• LINKO

• Lotux

• Loxical

• Mabe

• Macropay

• Marketing4Ecommerce

• Marsh McLennan

• Martinexsa Mexico, S. A. de C.V.

• Mastercard

• Mazmobi

• MEDIKIT

• MEDMAC

• MeetingDoctors

• Melonn

• Mendel

• Mercado Libre

• Mexican Internet A ssociation

• MI r AGLOBAL

• Mizuho Bank

• Mobility ADO

• Mondelēz International

• Moova

• motoAI

• MUFG Bank

• Mujer Visión Social

• Mundi

• MUTT Data

• Nacional Monte de Piedad

• Natura & Avon

• N eoAddition

• Neuma-Huawei

• Newmont

• Ngrenta

• Nido Ventures

• NielsenIQ

• Nissan Mexico

• Norkut

• NOX MY Pr ESS

• Nufi

• OCA Global

• OCETIF

• ODESSA

• Office of British Columbia in Mexico

• Oggi Jeans

• Okta Inc.

• ONESEC

• Ontario Trade & Investment Office

• Openbank México

• Oz Forensics

• PALO IT

• Paybook - Syncfy

• PayJoy

• PayPal

• Peñaranda

• Pixeron

• Pomelo

• Priceshoes

• ProChile

• Product Latam

• Prosa

• ProximityParks

• Ptree

• Puntored

• Pure Storage

• Qurable

• r3D

• radicloud

• rappi Turbo Mexico

• rappiC ard Mexico

• red hat

• redes DIW SAPI de CV

• reforma / 180

• reforma Bicentenario SAdeCV

• regcheq

• reinventa

• r Er Energy Group

• rGL Entertainment, Inc.

• Saavi Energia

• Salav roshfrans Corporation

• Sally Beauty

• Samsonite

• Scitum

• Secretaría de Desarrollo Económico del Estado de México

• Sellebrate

• ServiceNow

• Shein

• Shinkansen

• Sigh

• Sistema de Transferencias y Pagos - STP

• SiVale

• Snowflake

• Softtek

• SOLU

• Solvimás

• Spin

• Stori

• Stripe

• Sula Entertainment

• Swiss Business Hub en México

• Symple Global

• Táctica TI

• Tapi

• TEC360 CLOUD

• TECHNISOFT

• Tecnologia Orientada al Servicio SA de CV (TOSSA)

• Televisa Univision

• Teramind

• Texas-European Chamber of Commerce

• THALES

• The IS r M

• The Swatch Group Mexico

• Tiendas 3B

• Toka Fintech

• Tokio Marine Mexico

• TOSSA

• TOTALPLAY

• Tr ANBOX

• Tr ASFO r MA

• Trol

• Truora

• Twilio

• TYT Contact Center

• Ualá

• Uber

• Uber Eats Mexico

• Unico

• UNIVErSAE

• Unnax Mexico

• UPAGO

• US Embassy

• Ve eam Mexico

• Veriph.One

• Vertebra

• VFO Mexico

• Visa Mexico

• Viwala

• VOLAr IS

• VP Smart

• Walmart

• Wecare

• Whtelabs

• WiseThink Solutions / INDMEX

• Wollef

• WOMEX Business Club

• Wyder

• XalDigital

• YAKATIAK

• Yango Tech

• Yeo Consulting

• Zumit Tech

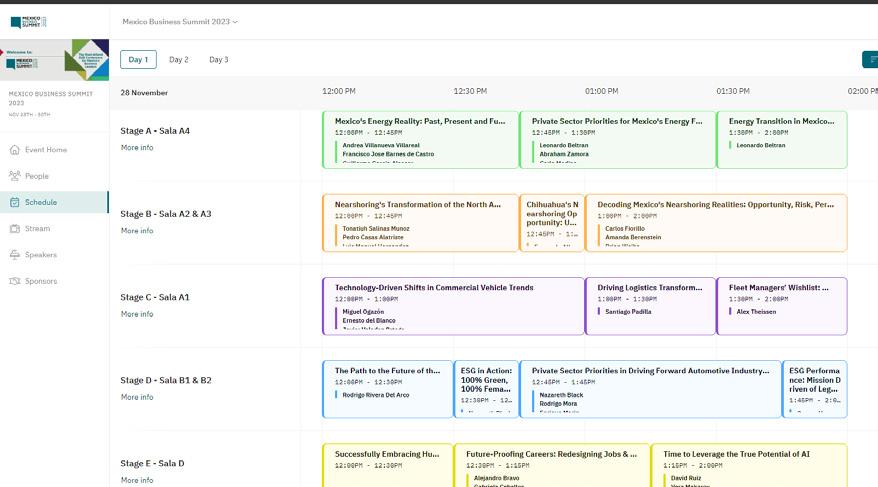

WEDNESDA Y, APRIL 9

EFFICIENT MODERNIZATION: OPTIMIZING RESOURCES IN A DYNAMIC MARKET

STAGE A|B

09:00 COMPETENCE 4.0: HOW TECHNOLOGY IS REVOLUTIONIZING THE ECONOMY

Speaker: Andrea Marvan, COFECE

09:30 BUSINESS TRENDS WITH GENERATIVE AI

Speaker: Rubén Mugártegui, Amazon Web Services Mexico

10:00 GENAI, A KEY FACTOR FOR BUSINESS COMPETITIVENESS

Speaker: Juan Francisco Aguilar, Dell Technologies Mexico

10:30 HARNESSING THE POWER OF AI, DATA AND CLOUD TO TRANSFORM DECISION MAKING

Speaker: Ernesto Serrano, Snowflake

REIMAGINING FINANCIAL ACCESS: IDENTITY SOLUTIONS AND OPEN BANKING

STAGE A

12:00 REIMAGINING FINANCIAL INCLUSION IN MEXICO: MOVING BEYOND STAGNATION

Moderator: Juan José Villaseñor, Stori

Panelists: Ricardo Olmos, Spin by OXXO

José Murillo, rappiCard Mexico

Ximena Salgado, Bitso

12:40 EMBEDDED FINANCE: PIONEERING PATHWAYS TO REVENUE AND RELEVANCE

Moderator: Mariana Allende, Mexico Business

Panelists: Andrés Albán, Puntored

Duarte Libano-Monteiro, Ebury

Paulina Aguilar, Mundi

Lisset May, Kueski

13:20 OPEN BANKING IN MEXICO: BREAKING THROUGH REGULATORY GRIDLOCK

Moderator: Beatriz Durán, Unnax Mexico

Panelists: Rafael Fragoso, Grupo Financiero Banorte

Alejandro Servín, BBVA Mexico

Othón Moreno, BANXICO

CYBERSECURITY PRIORITIES FOR MEXICO’S EXPANDING E-COMMERCE SECTOR

STAGE B

12:00 ADDRESSING CYBER RISKS IN MEXICO’S UNIFIED COMMERCE TRANSITION

Moderator: Ricardo Shuck, TEC360 CLOUD

Panelists: Camila Ponton, Natura Mexico

Gerardo Quintanilla, El Palacio de Hierro

12:50 SECURE IDENTITY. ALL SECURE.

Speaker: Victor Borga, OKTA

13:10 SECURING THE DIGITAL SUPPLY CHAIN: PROTECTING E-COMMERCE BUSINESS FROM CYBERATTACKS

Moderator: Juan Carlos Carrillo, ONESEC

Panelists: Alejandro Tinoco, San Pablo Farmacia

Jardany Navarrete, The Swatch Group Mexico

THE TRANSITION FROM OMNICHANNEL TO UNIFIED COMMERCE

STAGE A

15:00 THE SHIFT TO UNIFIED COMMERCE: OVERCOMING RETAIL TECH CHALLENGES

Moderator: Diego Sánchez, Mabe

Panelists: José Barrera, Natura and Avon

Omar Trujillo, Liverpool

15:50 EMPOWERING THE MEXICAN ECOSYSTEM THROUGH AI, CLOUD, FINANCE, E-COMMERCE AND CYBERSECURITY

Speaker: Pablo Corona, Mexican Internet Association

16:10 TURNING PREDICTIVE ANALYTICS INTO ACTIONABLE RETAIL STRATEGIES

Moderator: Patrick Lassauzet, SHEIN Mexico

Panelists: David Jaime, Nielsen IQ

Daniel Colunga, Uber Eats Mexico

Israel Enriquez, Grupo Axo Omar Capur, Walmart

PRIORITIZING CYBERSECURITY INVESTMENT,

INNOVATION

STAGE B

15:00 MAXIMIZING CYBERSECURITY ROI: STRATEGIES FOR RESOURCE ALLOCATION

Moderator: Manuel Díaz, Huawei Mexico

Panelists: Felipe García, Televisa Univision

Enrico Belmonte, Peñaranda

Mariana Mendoza, Engie

Octavio Medrano, Saavi Energia

Jesús Medina, Grupo Financiero Banorte

15:50 CYBERSECURITY STRATEGY & REGULATION: DRIVERS OF DIGITAL TRANSFORMATION AND PROSPERITY

Speaker: Ernesto Ibarra, Alianza México CiberSeguro

16:10 BEYOND THE HYPE: STRATEGIC AI INVESTMENTS IN CYBERSECURITY

Moderator: Jesús Díaz Garaygordobil, Hospitales MAC

Panelists: Chava Valades, AlmaMatters

Felipe Absalon, Bayer

Erwin Campos, Grupo Bimbo

THURSDAY , APRIL 10

STAYING COMPETITIVE: ADAPTING TO MARKET PRESSURES IN RETAIL

STAGE A

09:00 BUILDING RESILIENT RETAIL STRATEGIES IN A SHIFTING MARKET

Moderator: Ricardo Pérez, Sally Beauty

Panelists: Kelly Kroger, Grupo Axo

Cristián Campos, Samsonite

Andre Braga, Jüsto

Moises Blanga, Grupo Dormimundo

09:50 AMERICAN EAGLE: ENHANCE SALES WITH PAYMENT SOLUTIONS AND AI

Panelists: Erick Caballero, Adyen Mexico

Eder Dávalos, American Eagle

10:10 DATA THAT CREATES CONNECTIONS: FORMING STRONG AND SUCCESSFUL PARTNERSHIPS

Panelists: Sergio Hernández, CIAL Dun & Bradstreet

10:30 SHIFTING VALUE: RETAIL STRATEGIES FOR LOYALTY IN A PRICE-DRIVEN MARKET

Moderator: Carolina Arévalo, Twilio

Panelists: Andrés Palacio, rappi Turbo Mexico

Bernardo Bazúa, Grupo Coppel

Christian Vega, H-E-B Mexico

Rafael Orozco, Chedraui Mexico

PREDICTING MEXICO’S FINANCIAL FUTURE: ANALYTICS IN ACTION

STAGE B

09:00 INFORMED FINANCIAL INNOVATION: REIMAGINING SERVICES WITH PREDICTIVE ANALYTICS

Moderator: Pedro Freixas, Banamex

Panelists: Eduardo Martínez del Río, GBM

Juan Manuel Andrade, Deep Divel

Pedro Armengol, rappiCard Mexico

Alberto Ramos, Clara

10:00 RISK & REWARD: PREDICTIVE ANALYTICS IN FRAUD DETECTION & CREDIT SCORING

Moderator: Nicole Reich, Independent Board Member

Panelists: Jorge Ulises González, Actinver

Priscila Barrantes, PayJoy

Joaquín Domínguez, Ualá

Bernardo Caraveo, Iron Mountain

SECURING MEXICO’S DIGITAL FINANCE EXPANSION

STAGE A

12:00 CYBERSECURITY PRIORITIES FOR MEXICO’S FINANCIAL ECOSYSTEM

Moderator: Carlos Ortiz, Veeam Mexico

Panelists: Jenny Mercado, ODESSA

Adrián Alva, Mizuho Bank

Valther Galván, PrOSA

Ricardo Shuck, TEC360 CLOUD

13:10 FUTURE-PROOFING CYBERSECURITY FOR MEXICO’S FINANCIAL INCLUSION AGENDA

Moderator: Romeo Sánchez, STP

Panelists: Francisco García, BNP Paribas

Emilio Martínez, Covalto

Zeus López, Banco Azteca

Edgar Frías, GBM

12:50 MAXIMIZE OPERATIONAL RESILIENCE IN FINANCIAL SERVICES

Speaker: Alejandro Aguado, Pure Storage

MAXIMIZING AI ROI: KEY STEPS FOR EARLY ADOPTION

STAGE B

12:00 SCALABLE DATA QUALITY THROUGH AI-CLOUD SYNERGY

Moderator: Rodrigo Olivares, Nissan Motor Americas

Panelists: Francisco Andrade, Danone

Juan David Ospina, Círculo de Crédito

Carlos Taboada, AT&T México

Juan Martin Pampliega, MUTT Data

12:50 QUANTUM COMPUTING MEETS AI: THE POWER OF COLLABORATIVE INTELLIGENCE

Speaker: Francisco Aguirre, Dell Technologies

13:20 BREAKING DATA SILOS: FUELING INNOVATION WITH INTEGRATED SYSTEMS

Moderator: Alejandra Bojorquez, Creatio

Panelists: Daniel Vargas, Gepp

Luis Apón, Arabela

Denis Genova, XalDigital

Paco Silva, Snowflake

PROACTIVE CLOUD SECURITY: IMPLEMENTING PAC

STAGE A

15:00 BEYOND THE SCORE: HOW AI IS POWERING MEXICO’S NEXT RETAIL REVOLUTION

Speaker: Dr. Diederick Van Thiel, Advicerobo

15:20 SHAPING UNIFIED PAYMENT SOLUTIONS FOR MEXICO’S RETAIL AND E-COMMERCE GROWTH

Moderator: Juan Manuel Ortiz, Grupo Elektra

Panelists: Gonzalo Tercero, Visa Mexico

Allan Picos, PayPal

Santino Ruzzante, Conexa

José Jaime Gutiérrez, Clip

DRIVING RETAIL GROWTH THROUGH A UNIFIED PAYMENTS INFRASTRUCTURE

STAGE B

15:00 SHIFTING TO PROACTIVE CLOUD SECURITY WITH POLICY-AS-CODE

Moderator: Diego Valverde, Mexico Business

Panelists: Yami Hagg, Mondelēz International

José Arriaga, Tokio Marine Mexico

José Antonio Goyri, Totalplay

15:50 INTERNAL RISK MANAGEMENT: HOW TERAMIND PROTECTS YOUR BUSINESS FROM WITHIN

Speaker: Oscar Lorenzana, Teramind

COMPETITION 4.0: HOW TECHNOLOGY IS REVOLUTIONIZING T HE ECONOMY

The Mexican economy is undergoing a transformation driven by technology, particularly the fintech sector. This disruption has highlighted regulatory gaps and structural inequalities that require urgent attention. Competition is the key driver of innovation that leads to the improvement of services, propelling economic growth in Mexico, says Andrea Marván, President, COFECE.

In 2016, Mexico had about 100 fintech startups; by 2023, this number had grown to over 650, positioning the country as one of the three largest fintech ecosystems in Latin America, according to Marván. This rapid growth has been fueled by increasing demand for accessible and flexible financial products. “Where there is competition, there is incentive to innovate, not only to generate economic rivalry, but to transform people’s lives through accessible and personalized financial services,” says Marván.

The regulatory framework that has supported the ecosystem has played a crucial role in the sector’s growth, providing legal certainty for innovative players, explains Marván. Fintech firms have disrupted a sector long dominated by traditional banks. Their rapid expansion has enabled small businesses to access credit and individuals to open accounts and make digital payments using smartphones, without the need for in-person procedures. “Over 50% of Mexicans do not have a bank account, but they do have a smartphone,” says Marván.

However, regulation has not kept pace with innovation, explains Marván. While the Fintech Law lowered entry barriers for new players, further reforms are needed to create a flexible legal framework that does not stifle sector dynamism with bureaucratic processes, she adds. To address this problem, COFECE has issued multiple recommendations, particularly regarding the conduct of dominant banks, to level the playing field and encourage competition.

A key area is data access. Open finance initiatives rely on making consumer data portable and securely sharable across platforms. Marván points out that financial data, once overlooked, now holds significant economic value. “Forty years ago, data had no value. Today, data is the new oil,” she adds. Allowing users to transfer services, such as pre-authorized payments, when switching banks could enhance competition and improve customer experience.

However, the market is far from uniform. Investment is concentrated in certain urban regions, and a persistent digital divide means many people still rely on cash or store money at home. About 90% of all transactions in Mexico are still made in cash, explains Marván.

The rise of AI introduces further complexity. AI can improve credit scoring and financial product personalization, but it also presents risks. Algorithms may lead to market distortions or anticompetitive behavior if left unchecked. Marván explains that companies remain accountable for their algorithms, and regulatory agencies must work together to ensure responsible innovation. “If an algorithm fails, the company is still responsible,” she adds.

Public policy must now facilitate innovation without imposing disproportionate restrictions. Strengthening competition, decentralizing ecosystems, and fostering collaboration with the private sector are

essential to ensure that technology becomes a true economic and social driver. According to Marván, competition should not be viewed as a threat, but as a foundation for

developing talent, promoting disruption, and delivering inclusive economic growth in the digital age, “Competition is not a rival, it is an ally. It helps develop talent,” says Marván.

BUSINESS TRENDS ARISING WITH GEN ERATIVE AI

Generative AI (Gen AI) is emerging as a transformative force in the global business landscape, offering the ability to create text, images, videos, audio, or code across diverse use cases. While AI has existed for decades, the evolution from basic machine learning models to advanced generative models marks a pivotal shift in how businesses interact with technology.

“Generative AI has the potential to enhance value and keep companies competitive in increasingly demanding markets,” said rubén Mugártegui, General Director, Amazon Web Services México, at Mexico Business Forum 2025.

Unlike earlier AI systems designed for specific tasks, GenAI leverages pre-trained base models that can be customized for various business processes. This flexibility enables organizations to seamlessly integrate the technology into both established and emerging operations.

According to AWS, generative AI is projected to become a US$158.8 billion market by 2028, contributing an estimated 7% to global GDP growth. Its impact is expected to reshape roles in two-thirds of existing jobs, not by eliminating them but by aligning them with evolving market demands.

“The question is no longer whether AI will be adopted, but how to implement it effectively in each company’s operations,” Mugártegui emphasized. “Technological adoption is accelerating exponentially. While the radio took 38 years to reach 50 million users, television took 13 years, and Facebook 3.5 years, GenAI achieved the same milestone in just one month.”

This rapid pace leaves companies with less time to adapt and compete. In response, 63% of executives plan to increase investments in new business development, with 61% ranking it among their top strategic priorities.

Gen AI offers three strategic pathways for businesses:

+ Optimizing processes to maintain competitiveness (return on Employee, rOE)

+ Adding value to differentiate in the market (return on Investment, rOI)

+ Creating new business models or products (return on Future, rOF)

“Organizations must define how Gen AI aligns with their goals, whether optimizing operations, scaling value, or innovating from scratch,” Mugártegui explained.

In Latin America, this strategic positioning is particularly crucial. The region’s AI platform market is projected to grow by 41% between 2022 and 2026, with 40% of CxOs planning AI investments. However, challenges persist in aligning AI capabilities with specific business contexts.

One major barrier is identifying the right use cases. Many companies lack a clear roadmap to operationalize generative AI, grappling with challenges like training teams, conducting proof-of-concept trials,

and integrating models into existing digital infrastructures. These obstacles are more pronounced in emerging markets, where access to specialized talent and advanced ecosystems is limited.

“In 2023, companies were hesitant to adopt AI due to concerns about data security, compatibility, and proper usage. By 2024, we began addressing these issues with tailored strategies,” Mugártegui noted.

AWS highlighted its collaboration with Grupo Ángeles in healthcare as a success story. By integrating generative AI into medical check-up systems, processes that previously took three weeks were reduced to three hours, with diagnostic precision improving by 15%. “This demonstrates Gen AI’s potential to expand operational capabilities and deliver clear r OI,” Mugártegui noted.

In another example, a leading automotive manufacturer in Mexico uses GenAI to define its product roadmap for the next decade. The system analyzes vehicle development while evaluating the broader business model, identifying factors critical to success.

“It is not just about the car; it is about the business model supporting it. That is where GenAI adds strategic value,” said Mugártegui.

To maximize value, AWS advocates a multimodel approach. Instead of relying on a single generative AI model, companies can deploy a hub of models tailored for specific tasks, safely managed in controlled environments. This approach allows simultaneous management of various functions while minimizing operational risks.lored for specific tasks and safely deployed in controlled environments. This allows companies to manage different functions simultaneously while reducing operational errors.

As a technology partner, AWS supports companies in identifying optimal use cases across the three strategic pathways (rOE, rOI, rOF). For instance, 37% of IT companies in Mexico leverage Gen AI for cloud and cybersecurity. However, the key conversation today revolves around effectively applying these models on the ground.

“Choose the right use case, train your teams, embrace AI, and most importantly, think big but start small,” Mugártegui advised.

GENAI, A KEY FACTOR FOR BUSINESS COMPE TITIVENESS

The integration of Generative AI (GenAI) into business processes and projects is transforming how organizations approach data, decision-making, and operational execution. Unlike earlier technologies focused on optimizing individual tasks, GenAI is driving broad organizational transformation through scalable and reusable systems, according to Juan Francisco Aguilar, Director General, Dell Technologies México.

“To fully benefit from GenAI, companies need to modernize their products, transform supply chains and legal frameworks, and bring intelligence directly to where information is generated: at the edge,” says Aguilar.

By 2025, organizations are expected to integrate AI across key processes, moving from experimentation to large-scale deployment. In Mexico, approximately 4 million PCs are obsolete and unable to support the processing demands of modern AI workloads. “The foundation of a GenAIdriven company begins with modernization,” Aguilar shares. “Organizations must invest in updated technology capable of handling new processing requirements.”

AI adoption also requires a complete technology stack, from data preparation

and model development to deployment and continuous management. Operating AI models within private environments offers organizations greater control over sensitive information and supports a hybrid approach, where models and APIs operate across onpremises, device, and edge locations, which “minimize latency and respond to events in real time,” according to Aguilar.

One of the core developments anticipated by 2025 is the widespread deployment of AI agents. These systems are designed to plan, decide, and act toward defined goals, and will play a central role in how people interact with AI in both professional and personal contexts, according to Dell Technologies. They are being integrated into areas like software development, fraud detection, cybersecurity, and autonomous operations, and require infrastructure upgrades from data centers to endpoint devices.

For successful enterprise AI implementation, several foundational factors must be addressed. “Each customer is different. Having a clear use case and determining how

much business support exists for it is key,” states Aguilar. There must be a clear strategy, and a roadmap aligned with the actual needs of the company and the end customer. From there, GenAI can produce rapid prototyping and experimentation to reduce production time and costs.

Aguilar highlights that security and infrastructure are the most important to produce and use valuable data-driven insights. “Security is fundamental,” he states. “With so many connected devices, protocols must be in place to secure the ecosystem, including each company’s cloud processing or in situ data centers.”

Beyond technology, however, organizations must develop AI fluency among their teams to become truly competitive. This includes the ability to integrate AI into business processes and adapt quickly to emerging technologies. “Technology alone is not enough,” Aguilar concludes. “Organizations must invest in human capabilities, management changes, and experimentation to make GenAI a true driver of business value.”

HARNESSING DATA, AI, AND CLOUD TO TRANSFORM DECIS ION MAKING

Corporate data and analytics strategies have undergone a significant transformation in the past year. These sectors have shifted their focus from internal process optimization and AI-driven decision-making to ethical and responsible data utilization, strict regulatory adherence, and data protection. This

evolution also includes the deep integration of AI into products and services, as well as data democratization, says Ernesto Serrano, General Manager, Snowflake Mexico.

“AI is becoming fundamental, making the ethical and responsible use of data crucial. Generative AI is not the objective itself, but a transformative element for people and companies to impact business processes. The focus should not be on GenAI as the destination, but rather as the path,” says Serrano.

Serrano highlights that the industry is moving towards an AI-centric future built on a foundation of data, with AI being deeply integrated into products and services to generate tangible business value. He emphasizes the transformative potential of

GenAI across various organizational domains through the strategic application of data.

Snowflake, says Serrano, identified two key technological disruptions significantly influencing data and analytics strategies. The first is ensuring data interoperability, requiring companies to construct flexible architectures capable of integrating diverse data sources through open table formats, open catalogs for data access management, and optimal processing engines for specific use cases.

The second is AI, particularly GenAI, which is having a profound impact. Serrano underscores that about 80% of global data is now unstructured. To use it effectively for informed decision making, businesses need to converge structured and unstructured data in analytical processes across all channels. “Technological disruptions are a constant. The key is to understand that technological disruption is not a problem, but an opportunity, and organizations that can anticipate these disruptions will be best positioned,” Serrano says.

Snowflake is enabling organizations to leverage these disruptions. The company’s solutions unify data and AI capabilities within a robust ecosystem, says Serrano. He adds that these solutions are easy to use, connected, and reliable. They can also adapt to evolving data architectures and democratize data access for users with varying technical expertise, from SQL and Python proficiency to natural language queries, all while ensuring stringent security and governance.

“AI is becoming fundamental, making the ethical and responsible use of data crucial. GenAI is not the objective itself, but a transformative element for people and companies to impact business processes. The focus should not be on GenAI as the destination, but rather as the path”

Ernesto Serrano Country Manager | Snowflake

Snowflake’s ecosystem has grown rapidly over the past five years. The platform supports over 11,000 customers who collectively run more than 6.4 billion queries daily, says Serrano. The ecosystem includes thousands of companies, with over 680 actively sharing more than 2,500 datasets and applications on the Snowflake Marketplace. “We offer a marketplace where customers can commercialize their data, generating 115,000 monthly visits; it is a space to create a strong income source for their companies,” says Serrano.

The more data companies use, the better decisions they can make, says Serrano. For that reason, he urges companies to use more than their own internal data, but to also incorporate the data generated by their customers, suppliers, and their suppliers’ suppliers.

For example, says Serrano, Nissan uses Snowflake to analyze customer reviews and posts from various online forums. This enables the company to gain valuable insights into customer experiences at dealerships, ultimately improving overall customer satisfaction. By leveraging Snowflake, Nissan reportedly achieved results two months faster than with other technological alternatives, processed millions of records in seconds, and attained a 97% effectiveness rate in sentiment analysis, directly impacting its customer experience strategies.

Companies such as WHOOP and Travelpass achieved a 65% cost reduction and a 350% increase in data delivery speed by using Snowflake, says Serrano. Blue Yonder also successfully leveraged the technology to optimize its processes, he adds.

However, data democratization is an essential step, as data should not be confined to specific teams within an organization but made accessible to all relevant actors, says Serrano. He highlights that Snowflake actively promotes data democratization within organizations and their ecosystems, empowering individuals with varying levels of technical expertise to leverage data for insights and decision-making.

REIMAGINING FINANCIAL INCLUSION: MOVING BEYOND STAGNATION

Mexico’s push for financial inclusion has reached a critical inflection point. While millions now hold digital accounts, true inclusion remains elusive, constrained by structural inequality, lack of trust, and products that fail to resonate with users’ real needs. The path forward seems clear: the sector must shift from merely expanding access to delivering meaningful, responsible, and personalized financial experiences.

“We need to go beyond creating access and start creating products that people actually want to use. True inclusion is never just about having an account; it is about improving people’s lives,” says Ximena Salgado, Vice President of Product and Technology, Bitso.

According to the latest data from the National Survey of Financial Inclusion (ENIF), only 49% of adults in Mexico have a bank account, reflecting a modest increase from previous years. “The ENIF shows advances in increasing access to financial products, but not necessarily in their effective use or in real financial inclusion,” says Salgado. The urban-rural divide remains significant: in rural areas, just 22% of adults have access to formal financial services.

The challenge lies not just in providing access to bank accounts, but in designing financial products that people can use responsibly to improve their quality of life, says Salgado. This focus on user-centric design is key to making products relevant and effective.

But inclusion goes beyond product design or education, says José Murillo, CEO, rappiCard México. “Inclusion is never just about access or education ; it is about making products intuitive, not requiring financial literacy courses to use. Institutions must earn people’s trust. A clear example is credit bureau access, which should be a near-human right for financial empowerment,” he explains.

Financial education is one barrier that has long hindered progress, with over 56% of Mexican adults only reaching secondary school, and no formal financial education available to many. This lack of knowledge prevents many from navigating the financial system effectively.

There is also a widespread reliance on cash, which accounts for over 85% of transactions in Mexico. This cash dependence is further exacerbated by infrastructure challenges . On average, a user is 7km away from a bank branch, and many must travel more than 20 minutes to reach financial services, says ricardo Olmos, Director of Spin, OXXO. The company aims to address this problem by taking advantage of its widespread reach. OXXO operates in over 1,200 municipalities, so about 80% of individuals in Mexico can reach one store within 5 minutes, says Olmos.

There are several other critical barriers that must be addressed to expand inclusion. These include financial education, infrastructure, lack of fiscal culture, and cash dependence, says Olmos. He suggests embedding financial

education into existing infrastructures, such as OXXO stores, which serve over 1 million small businesses. This approach would allow for financial learning in spaces people already frequent, bringing financial literacy to the people, especially in underserved areas.

“For true financial inclusion, we must focus on designing products that are intuitive, accessible, and responsible, and work together to create a financial ecosystem that serves everyone, no matter their background or location”

Ximena Salgado Vice President of Product and Technology | Bitso

Fintechs have made significant strides in closing some of the demand-side gaps, such as simplifying the process of opening accounts and offering quick, frictionless experiences. However, systemic barriers persist. “One of the most pressing systemic issues is the ongoing lag in financial access for many people,” says José Villaseñor, Vice President of Global Payments Network, Stori. He adds that inclusion must be sustainable, responsible, and tailored to improve quality of life: “Inclusion starts with people, and real inclusion requires diverse teams who reflect the populations they serve.”

Financial inclusion should start from a holistic view of the customer, says Salgado. This approach should analyze “how they earn, spend, save, invest, and protect their money,” he adds. By moving beyond biases and recognizing that inclusive design benefits everyone in the long run, institutions can develop products that genuinely cater to the needs of the underserved, says Salgado. “Accompaniment is key: education, trustbuilding, and long-term support must be built into the product lifecycle,” he adds.

While financial access has improved, particularly with mobile banking usage rising 50% between 2020 and 2023, leading the general population away from cash remains a challenge. However, the fintech sector is challenging the status quo by offering

“fast, frictionless experiences,” says Murillo. However, to truly drive change, products must outperform traditional alternatives to create meaningful disruption.

In addition to personalized product design, trust and regulation play vital roles in advancing financial inclusion. Villaseñor says that inter-agency coordination is necessary to avoid duplication and accelerate innovation.

“There must be better collaboration between public and private sectors,” says Salgado. He, however, adds that regulations need to evolve to reflect real consumer usage patterns. Without understanding how consumers use financial products in their everyday lives, regulations could create more friction rather than promoting genuine inclusion.

Mexico’s regulatory framework has made significant strides with initiatives like the Fintech Law, but the next step is digitizing more processes, from tax payments to reducing cash dependency. Olmos calls for industry-wide efforts to simplify experiences and enforce digital-first payment policies, especially for informal merchants who need to see that accepting digital payments will benefit their business.

“For true financial inclusion, we must focus on designing products that are intuitive, accessible, and responsible, and work together to create a financial ecosystem that serves everyone, no matter their background or location,” says Salgado.

EMBEDDED FINANCE: PIONEERING PATHWAYS TO REVENUE, RELEVANCE

Fueled by a booming e-commerce market and a drive for greater financial inclusion, embedded finance is experiencing significant growth in Latin America. Mexico is a key player in this market, as numerous platforms are integrating services like digital wallets and buy-now-pay-later (BNPL) options to enhance customer experience and expand market reach, though data protection and limited consumer trust continue to be critical challenges in growing this market.

Embedded finance in Latin America is projected to reach US$20 billion by 2027, according to Juniper research. Adoption among businesses has surged, with over 65% of fintechs and e-commerce platforms in Mexico integrating embedded financial services to enhance customer retention and streamline operations. Embedded finance can help companies, especially smaller ones, expand their market reach, says Paulina Aguilar, Co-Founder and CrO, Mundi. “Mundi was created to provide quality financial products and access to a wider range of services, enabling businesses to expand into new markets and reach more customers. Finance is not just about stability; it is also a powerful tool for growth,” she adds.

In Mexico’s financial ecosystem, digital wallets, BNPL services, and integrated payment solutions have gained significant traction. The country’s e-commerce market, valued at over US$50 billion, has been a major

driver, encouraging retailers, marketplaces, and even traditional companies to embed financial solutions into their offerings.

Embedded finance integrates financial services into common apps such as e-commerce, food delivery, and wellness platforms, says Mariana Allende, Journalist & Industry Analyst, Mexico Business. This technology is expected to significantly reshape global payments and collections, growing rapidly in Latin America as regulatory frameworks mature. This growth is expected to coincide with advances in blockchain and tokenization.

Experts also call for including financial education in the sector’s vision, as it will support financial inclusion, which embedded finance is pushing forward. “We must continue investing, especially in people who are new to the financial system, providing them with education in this area. Governments are also increasingly focusing on and deepening their efforts in this, and we are all involved in the sector,” says Andrés Albán, CEO and CoFounder, Puntored.

The most common applications of embedded finance include embedded payments, lending, insurance, and investment solutions. Digital platforms are adopting seamless payment systems to reduce transaction friction and improve checkout experiences, with over 70% of online transactions now processed through embedded payment systems.

Lending and BNPL solutions have been particularly transformative, as over 40% of Mexicans lack access to traditional banking services. With embedded lending, businesses can expand financial accessibility, and BNPL transactions in Mexico are expected to grow by 50% annually.

With 54% of Mexico’s adult population still unbanked, embedded finance aims to bridge the gap by offering accessible and flexible financial products. For example, BNPL services have allowed millions of Mexicans

to make purchases without needing a credit card, contributing to increased consumer spending and higher conversion rates for businesses. “We aim to offer a solution to the more than 80% of Mexicans without credit cards, allowing them to make purchases and defer payments in installments, even without a bank account,” says Lisset May Cervantes, SVP of Sales, Kueski.

“We must continue investing, especially in people who are new to the financial system, providing them with education in this area. Governments are also increasingly focusing on and deepening their efforts in this, and we are all involved in the sector”

Andrés Albán CEO and Co-Founder | Puntored

making data protection a top priority. Experts say that companies featuring strong internal and certified processes will have an advantage and offer more security to their clients. “Similar to ISO-9001 for quality, ISO-27001 is the international standard for information security. We are proud to say we hold this certification, which involves a very complex process to guarantee we meet all client needs,” says Duarte Libano-Monteiro, Chief Business Officer, Ebury.

However, the implementation of embedded finance still faces challenges. CrowdStrike reports that Mexico ranks among the top five countries in Latin America for cyberthreats,

Companies must also navigate regulatory requirements related to anti-money laundering (AML) measures and consumer data protection under the country’s Fintech Law. Experts say that handling data securely is essential for consumer trust and further adoption. “Beyond just technology, tools, and regulations, building a reputation on transparency is key. For us, transparency means no hidden costs, no fine print, and a genuine commitment to privacy. This reputation must be built, as one instance of non-compliance can lose client trust,” says Aguilar.

OPEN BANKING IN MEXICO: BREAKING THROUGH REGULATOR Y GRIDLOCK

Mexico’s open banking ecosystem holds the potential to drive financial inclusion, improve credit access, and foster innovation. However, its development faces key challenges such as fragmented systems and low levels of financial education. Unlocking the full benefits of open finance requires coordinated efforts among the industry to establish common standards, prioritize user experience, and promote trust in secure data sharing practices.

“Open finance is about enabling individuals to access financial services in a manner that suits their preferences and needs,” says Othón Moreno, Director General of Payment Systems, Banxico.

In 2018, Mexico was the pioneer in Latin America in regulating open banking, largely due to its Fintech Law. The law mandates financial institutions to share customer data (with consent) through standardized APIs,

facilitating interoperability and financial inclusion. An open banking model would allow companies to access customer data to offer more accurate and personalized offers and products.

“The United Kingdom is a global benchmark on this topic, as is Brazil. Mexico has learned from them about regulatory frameworks, information protection, and placing the customer at the center,” says rafael Fragoso, Digital Banking Executive Director, Grupo Financiero Banorte.

Globally, it is estimated that the volume of transactions derived from open banking and open finance initiatives could exceed US$600 trillion by 2027, reflecting the enormous potential for growth and the relevance of this model in the modern economy, says Nick Grassi, Co-CEO and Co-Founder, Finerio Connect.

“Open banking represents an opportunity to evolve the system by placing the user at the center, with a common protocol that enhances the user experience,” says Beatriz Durán, Country Manager, Unnax Mexico.

According to the National Banking and Securities Commission (CNBV), Mexico’s fintech sector has grown by over 18% annually, with more than 650 fintech companies operating in the country. Furthermore, data from FinTech México indicates that at least 45% of fintech companies in the country are actively implementing or planning to integrate open banking services.

Despite this, customers still face distrust in data sharing, as Mexico has become the target of over 714 million cyberattacks targeting users of Mexico’s banking, fintech, and e-commerce apps every day, says mobile enterprise security specialist Appdome. Statista data shows that 65% of Mexican consumers are hesitant to share financial data with third parties due to privacy concerns.

However, the benefits of open finance can significantly outweigh these concerns when implemented securely. “With open finance, the receiving entity can optimize scoring models or, in the case of financial products, gain a better understanding of the customer and offer a more suitable product,” says Alejandro Servín, Head of Open Banking, BBVA Mexico.

Servín adds that open banking accelerates credit issuance for businesses and strengthens inclusion and digitalization among individuals. He says that one of the model’s long-term advantages is its potential to foster better financial habits among users. “Banks can help categorize expenses and recommend minimum savings levels, enabling access to credit services and improved financial planning,” says Servín.

“We aim for a person to understand their past through the various financial tools they have used, understand the present and their commitments, and with that, also prepare for the future, “ says Fragoso.

ADDRESSING CYBER RISKS IN MEXICO’S UNIFIED COMMERCE TRANSITION

As unified commerce continues to expand across Mexico, businesses are facing increasing challenges in securing data and digital infrastructures. The integration of traditional retail systems with emerging digital platforms has resulted in more complex, interconnected environments, which in turn have expanded the attack surface and introduced new vulnerabilities.

“The attack surfaces are becoming broader, more complex, and more dynamic. Companies must not only modernize their

value propositions but also align their cybersecurity budgets with the evolving market needs,” said r icardo Shuck, Vice President of Cybersecurity, TEC360 Cloud, speaking at Mexico Business Forum 2025.

In this rapidly evolving digital landscape, organizations are under pressure to implement security strategies that prioritize protection from the very design phase. The shift toward unified commerce requires businesses to move beyond perimeter security models, adopting a comprehensive

approach that ensures every interaction within the system is protected. However, many companies still lack the tools necessary to safeguard their data and systems from increasingly sophisticated cyberattacks.

“One of the main challenges is the unification of customer identities across multiple channels. Each channel interacts with customers in different ways, so it is crucial for organizations to understand this complexity to address it effectively,” explained Gerardo Quintanilla, CISO, El Palacio de Hierro.

Experts stress the importance of proactively adopting security solutions that are embedded from the design phase, with AI and machine learning playing a key role in these updated strategies. By analyzing behavioral patterns and detecting anomalies in real-time, these technologies enable faster responses to potential threats. However, integrating legacy systems with newer platforms remains a complex task, requiring significant technical coordination and continuous training for personnel.

“Every operational change comes with updates to infrastructure, protocol revisions, and process realignments. For us, moving from traditional, person-to-person models to digital platforms meant rethinking our entire approach to cybersecurity,” explained Camila Ponton, Director of Information Technology, Natura.

To improve system resilience, companies are adopting a security-by-design approach and emphasizing collaboration between cybersecurity and IT teams during development. Several organizations have implemented Zero Trust models, risk analysis

frameworks, and advanced authentication measures, including biometrics.

“We introduced biometric onboarding to improve user security. Initially, it caused some friction, but over time, users came to appreciate the added protection. These solutions are essential, particularly when third-party involvement is required. It is crucial to verify their standards and ensure proper handling of sensitive data,” Ponton added.

The integration of legacy and modern systems also presents additional organizational challenges, particularly in terms of company culture. resistance to change and gaps in cybersecurity knowledge across departments can delay implementation and reduce effectiveness.

“Not all tools are suitable for every scenario. It is vital to understand each department’s unique needs and select technologies accordingly. In many cases, collaborating with specialists ensures that investments are made in the right areas,” said Quintanilla.

For organizations aiming to balance innovation with security, the primary objective remains clear: protect data integrity without compromising the user experience. Security considerations must be integrated into every stage of innovation to ensure business continuity.

Quintanilla emphasized that companies cannot innovate successfully without a solid governance framework. “As organizations adopt AI, they must ensure their growth is ethical and sustainable. This involves balancing business goals with cybersecurity responsibilities”.

“Every operational change comes with updates to infrastructure, protocol revisions, and process realignments. For us, moving from traditional, person-to-person models to digital platforms meant rethinking our entire approach to cybersecurity”

to move from reactive to proactive security strategies.

Camila Ponton Director of

Information Technology | Natura

As unified commerce continues to grow, ensuring regulatory compliance has become a top priority. Companies must stay aligned with both local and international data privacy regulations to protect customer trust and avoid legal issues.

reputation is equally important. Experts stress that organizations must maintain integrity and handle personal data responsibly, ensuring compliance with relevant regulations and performing consistent internal audits.

“At our company, we focus on secure transactions and collaborate with domain experts. Every decision we make is driven by a commitment to customer satisfaction and safe operations,” Quintanilla shared.

“Internal audits and strong data governance are essential. In addition, companies must foster awareness of emerging threats and continuously refine their response strategies,” Ponton added.

Looking ahead, further automation and predictive analytics will define the next phase of cybersecurity for unified commerce. AIpowered platforms will be able to detect and mitigate risks in real-time, allowing businesses

SECURE IDENTITY. A LL SECURE.

In a landscape where 80% of security breaches are driven by identity-related attacks, organizations are facing significant disruptions in their access to platforms and services. At the Mexico Business Forum 2025, Víctor Borga, regional Sales Director in Latin America, Okta, proposed unified identity management as a critical strategy to mitigate risks and propel digital

“The future will require collaboration between businesses and regulators to establish adaptable cybersecurity standards. As digital transformation accelerates, consumer expectations for security will continue to rise,” concluded Quintanilla.

The effective implementation of Zero Trust models is also seen as fundamental. By securing every interaction point, limiting data exposure, and controlling access in real-time, retailers can better manage risk.

“Tokenization, encryption, and just-intime data access are essential to protect customer information. Every touchpoint matters—especially in retail, where identities are distributed across various systems,” Ponton remarked.

However, the digital shift also introduces new risks, especially as AI technologies become more prevalent. Companies must create robust frameworks to ensure that the security tools designed to protect data do not become vulnerabilities themselves. Given that AI can be used both constructively and maliciously, the main challenge will be identifying and mitigating threats while still leveraging the benefits of new technologies.

In the long run, cybersecurity in unified commerce is expected to evolve through greater automation, with platforms able to detect and address risks in real-time through deeper integration of AI and predictive analytics.

transformation. His approach: ensuring security, visibility, and orchestration from a single platform.

“Identity has become the top attack vector. Internal fragmentation has created silos that attackers are able to exploit, and the only way to counter this is with a unified identity strategy,” Borga explained.

Organizations today are undergoing structural shifts across various dimensions. This fragmentation is apparent in the rise of open finance, mergers and acquisitions, generational workforce changes, organizational silos that stifle innovation, the accumulation of technical debt, and the continuous evolution of threats and regulations.

One of the main concerns raised by Borga was the growing frequency of identity-based attacks. According to data shared during the forum, 80% of data breaches currently stem from identity-related attacks. In 2023, for example, session cookies were stolen from employees at Fortune 1000 companies, posing significant risks to operational integrity.

“Attacks have surged by 180% compared to last year, and the average time to detect and contain a breach is 290 days,” Borga noted.

With the increasing diversity of users and resources, the complexity of identity management has grown. Organizations now need to manage access for employees, privileged users, contractors, partners, customers, and even non-human accounts. This explosion of identities creates operational silos that are difficult to manage.

In many cases, companies are deploying as many as 25 different solutions to address these challenges, making them attractive targets for cybercriminals.

Borga emphasized that “identity has become the primary attack vector for cybercriminals” due to fragmentation and the absence of a unified architecture.

Okta, a leader in identity security, offers solutions designed to ensure secure access for both internal users and external platform customers. Okta’s approach revolves around two main solutions: Auth0 for internal users and Okta for external clients. Both solutions emphasize secure access without compromising security, privacy, or the user experience. “Secure access for everyone, but not just anyone,” Borga stated, underlining the importance of balancing accessibility with protection.

Borga highlighted that Auth0 enables organizations to accelerate time to market, reduce risks, and facilitate the adoption of a unified identity strategy. Instead of developing internal solutions that require complex assembly, this solution enables faster deployment with fewer integration failures, resulting in quicker gains and greater efficiency in access management.

From a technical perspective, Okta offers an architecture based on three fundamental principles of modern identity security:

+ Protection beyond authentication

+ Prevention, detection, and containment of threats

+ Deep integrations that accompany users throughout their journey on the platform

Okta also secures all internal modules needed to safely orchestrate identities. These tools are designed not only to manage access but to ensure secure interactions at every touchpoint within enterprise systems. “Identity tools should be viewed as security tools, not just access tools,” Borga explained.

When it comes to interoperability, Okta is a flexible solution with more than 7,500 integrations available, enabling companies to link their enterprise tools without compromising security. The platform is also fully compliant with relevant international regulations, including those in the financial sector.

Okta’s business strategy has been adopted by prominent clients such as Kavak, Xepelin, Fintual, TV Azteca, Mercado Libre, Clip, and Farmacias San Pablo, all of whom have consolidated their brands, products, and services under a unified identity framework.

Borga also addressed the growing cyber threat landscape in Mexico. This increase in threats has fueled greater awareness around cybersecurity, especially identity management solutions. “In Mexico, adoption of these tools has skyrocketed in recent years. While there is still work to be done to strengthen the digital culture, the progress has been impressive,” he said.

Today, Okta serves over 20,000 enterprise clients globally, processing more than 20 billion logins each month, with an SLA guarantee of 99.9%.

SECURING ECOMMERCE: PROTECTING SUPPLY CHAINS FROM CY BERATTACKS

Legacy systems are invaluable assets for businesses, storing critical data that is often difficult and costly to migrate to more modern technologies. However, these systems present significant security risks due to their obsolescence, lack of effective monitoring, and vulnerabilities when interacting with newer systems. As e-commerce continues to expand and digital transformation accelerates, businesses must focus on securing these infrastructures to prevent cyberattacks that could compromise operations and customer trust.

“It is difficult for companies to invest in legacy systems if they do not see a return on investment (rOI). They invest in frontend technologies but tend to neglect the backend,” says Carlos Carrillo, Director of Cybersecurity Consulting Services, ONESEC.

“It is not just about cybersecurity; it is about managing information security risk. Mexico is a country with high levels of insecurity, fraud, and social engineering. Businesses must take a hard look at their security practices. It is essential to shift from a ‘trust everyone’ model to one with zero tolerance for security breaches”

Jardany Navarrete

Information Security and Operations Technology Manager | The Swatch Group Mexico

This approach, while seemingly cost-effective in the short term, becomes problematic over time as legacy systems grow increasingly difficult to manage and maintain. “The risk of not upgrading technology is that eventually, it becomes impossible to find people who can manage the equipment,” Carrillo explains.

“You have many systems operating for years, and integrating them with new technologies, even those considered trendy, is difficult because the scope of what they can do is often not fully understood,” says Alejandro Tinoco, Chief Information Security Officer at San Pablo Farmacia. This lack of understanding can result in security vulnerabilities, especially when legacy systems are involved.

As both experts point out, the issue is not just about upgrading for the sake of modernization, but ensuring that security is maintained throughout the process. Carrillo emphasizes that proper inventory management is crucial for mitigating risks. “It is important to have a detailed inventory of everything you have—from APIs to their versions. This is key to understanding where vulnerabilities lie,” he says.

Without an accurate inventory, businesses cannot fully assess their exposure to cyber threats. Yet, monitoring legacy systems remains a pressing challenge. “How do you

monitor systems that weren’t designed to be monitored?” Carrillo asks. Without built-in security protocols, older systems are harder to protect from modern cyberattacks.

“It is not just about cybersecurity; it is about managing information security risk. Mexico is a country with high levels of insecurity, fraud, and social engineering. Businesses must take a hard look at their security practices. It is essential to shift from a ‘trust everyone’ model to one with zero tolerance for security breaches,” says Jardany Navarrete, Information Security and Operations Technology Manager, The Swatch Group Mexico.

The challenge of transitioning to more secure systems is compounded by the fact that many organizations are still using legacy systems that were not designed for modern security standards. “You have to manage the obsolescence of these systems. Legacy systems have outdated security controls that are no longer adequate,” Tinoco points out. This makes it crucial for businesses to not only modernize but also ensure that their security measures are up to date.

“In security, there is a clear shortage of information professionals. It is also important to consider the configuration of specialized teams because different generations work differently,” explains Tinoco.

Despite these challenges, Navarrete emphasizes that modernizing to more secure systems is ultimately an investment. “The ideal solution is to begin migrating to more modern systems, which, although costly, should be seen as an investment, not an expense,” he asserts.

The reality is that no system is completely risk-free, but proactive risk management can significantly reduce exposure to cyberattacks. Both Carrillo and Navarrete stress the importance of preparation. Carrillo notes that regular testing and response plan drills are key to minimizing the impact of an incident. “The incident response plan is not just for the events themselves; it must be practiced at least once a year,” he advises. By regularly testing security measures and ensuring the organization is ready to respond to incidents, businesses can better protect their operations and data.

THE SHIFT TO UNIFIED COMMERCE: OVERCOMING RETAIL TECH CHALLENGES

Mexico’s retail sector is transforming rapidly, driven by the exponential growth of e-commerce and an urgent need for digital integration. Fragmented systems and siloed data continue to obstruct seamless customer experiences, positioning unified commerce as a critical solution to centralize operations,

align business strategies, and ensure longterm growth.

In 2024, Mexico’s e-commerce market reached MX$789.7 billion (US$39.3 billion), with expectations to surpass US$70 billion by 2025, according to the Mexican Association

of Online Sales (AMVO). Yet, the fast-paced digitalization of the industry comes with challenges, particularly in unifying diverse sales channels under a cohesive architecture.

“CDPs can track transactions in real time and adjust offers accordingly. But errors in data extraction can lead to ineffective promotions. Specialized roles, such as data scientists and prompt engineers, are crucial to ensure success”

Omar Trujillo Director – Enterprise Architecture and Data Engineering | Liverpool

Such integration requires robust infrastructure, including Customer relationship Management (CrM), Customer Data Platforms (CDPs), and scalable, cloudbased solutions. Experts underscored the evolving role of the point of sale, now interacting with digital tools, necessitating workforce adaptation for future demands.

The shift from omnichannel to unified commerce is not more than a technological change—it represents a fundamental rethinking of businesses operations and customer value delivery. Diego Sánchez, Global E-Business and Digital Director, MABE, highlighted the strategic importance of this distinction. “As decision-makers, we must understand where the company’s revenue originates to determine where to invest. This is especially critical in Latin America, where profitability and performance are paramount,” Sánchez remarked during Mexico Business Forum 2025.

Today’s consumers demand real-time personalization and seamless experiences. “Customers expect fluidity, and unified commerce delivers that,” noted Marco Gelosi, CEO, Transforma. “They also demand immediacy. Technology has removed uncertainty in product searches–customers now know exactly what is available.”

Executing this transition poses technical challenges, particularly in creating an integrated ecosystem across business units. José Barrera, Director of Digital and E-Commerce, Natura and Avon, pointed to their three channel approach: e-commerce, sales consultants, and physical retail. “The challenge is building an ecosystem that enables 360° conversion across all channels,” Barrera explained.

Despite the promise of unified commerce, legacy systems remain a significant barrier. High costs, inflexible architectures, and integration complexities often hinder progress. “Legacy systems represent rigidity and cost,” Barrera observed. “The solution is gradual, modular transitions. IT must prioritize and scale strategically.”

Gelosi echoed this, emphasizing inventory control and data integration as dual challenges. Successful convergence of hardware and data systems can eliminate system rigidity, though not all retailers have the resources for this level of transformation.

AI has emerged as a key enabler in addressing these challenges. Trujillo highlighted its role in creating interoperability layers that reduce fragmentation over time. However, success depends on applying the right tools to welldefined use cases.

“We must balance innovation and adoption. Overly complex solutions can disrupt internal processes long-term. Both elements must work in tandem to enhance the customer experience,” Sánchez emphasized.

r eal-time data synchronization is foundational to unified commerce, enabling precise offers, inventory management, and demand alignment. This capability differentiates businesses by allowing them to respond instantly to customer needs across multiple platforms.

Trujillo explained the technical demands of this process. “CDPs can track transactions in real time and adjust offers accordingly. But errors in data extraction can lead to ineffective promotions. Specialized roles, such as data scientists and prompt engineers, are crucial to ensure success.”

The panel also highlighted hyperpersonalization and AI-driven content as competitive must-haves. Leveraging generative AI to analyze navigation patterns allows companies to predict market trends and tailor offers by platform, product, or customer preferences.

Sánchez cautioned against rushing into complex data projects. “Around 80% of data initiatives fail due to early-stage errors. We need agile internal and external structures. Experimentation is vital, but trial and error must guide us to the unified commerce framework we require.”

EMPOWERING THE MEXICAN ECOSYSTEM THROUGH CYBERSE CURITY, AI

Artificial intelligence will not dominate humanity, at least not yet. However, it is fundamentally reshaping how businesses, governments, and societies operate. According to Pablo Corona, President, Mexican Internet Association, the conversation about AI must shift from hype and fear to realistic opportunities, protections, and responsibilities.

“Artificial intelligence is faster than humans but less sensitive,” said Corona. “It processes information more efficiently but lacks the ability to abstract or reason as we do.” He emphasized that while AI can outperform humans in tasks like data processing, it lacks contextual understanding. “If you feed an AI science fiction books, it might say it wants to become Skynet. But that is not a decision;it is merely reflecting its inputs.”

rather than fearing obsolescence, Corona encouraged executives to embrace augmentation. “The winners of this decade will be the augmented humans, those who use AI as a tool while preserving the sensitivity and judgment that machines lack.”

A greater concern lies in the integration of digital systems into the physical and social infrastructure. From insulin pumps and pacemakers to traffic lights and water treatment facilities, the digital and physical

worlds are increasingly interconnected. “We used to protect systems like medieval castle, with a drawbridge and single entry point,” Corona explained. “Today, it is like securing a skyscraper with multiple exits, service doors, and windows.”

He cited real-world examples of cyber vulnerabilities: in 2017, a cyberattack crippled Estonia’s power grid; in Colombia, ransomware shut down hospitals for three months; and in the United Kingdom, patients died after hospital systems were hacked. “Cybersecurity now involves safeguarding the very fabric of society,” he stated.

One common misconception, Corona noted, is that cloud security is solely the provider’s responsibility. Instead, it is a shared duty: providers maintain infrastructure integrity while clients must ensure secure configurations, including strong passwords, permissions, and encryption. “Companies need to verify who manages their data infrastructure, understand

how it is protected, and recognize their role in keeping it secure,” he said.

“The goal is to fully harness these technologies while minimizing their risks,” Corona concluded. “Cybersecurity is not just about bits and bytes. It is about protecting trust, lives, and the systems that underpin our society.”

TURNING PREDICTIVE ANALYTICS INTO ACTIONABLE RETAIL STRATEGIES

Predictive analytics is reshaping decisionmaking in retail and e-commerce. However, unlocking its full potential requires more than large datasets; it demands clarity of purpose. The key lies in defining the right questions before diving into data and technology.

“At the heart of analytics is asking the right question. Without it, analytics becomes a directionless tool,” says Omar Capur, Senior Director of Ecommerce, Walmart. He notes that for many businesses, especially smaller ones, having complete data is often an exception rather than the rule.

Daniel Colunga, Director General, Uber Eats Mexico, agrees and stresses the importance of focusing on what can be controlled. “You can’t change the outcome, but you can influence it by adjusting the inputs. Our experiments must be rigorous, with tolerances of just 1 or 2%,” explains Colunga. On a platform managing millions of transactions, even a 0.10% shift can mean significant financial impact, making accuracy critical.

Colunga also points out a significant challenge in Mexico: “Not all data is digitized.

Complementing available data with fieldwork is essential.” For Uber Eats, predictive analytics is deeply integrated into operations, from optimizing delivery times to real-time adjustments for weather and traffic conditions.

Data alone is not enough, though. “Feeding data into a system is not the solution; you need the right data and the infrastructure to interpret it effectively. AI and predictive analytics are now foundational in market research,” says David Hernández, retail Analytics Director for Latin America, NielsenIQ.

However, the integration of these tools demands a shift in how success is measured. “Why are we still using outdated KPIs to evaluate companies? We need to question if these metrics truly drive operational improvements,” Hernández argues.

Patrick Lassauzet, Head of Corporate Communications, SHEIN Mexico, highlights the importance of understanding consumer behavior to guide strategy. “Mexican consumers embrace omnichannel shopping. They browse in-store, buy online, and return in-store. Creating a seamless experience is crucial,” he says.

This omnichannel model generates vast amounts of data, but it only becomes actionable when aligned with clear goals. “Using advanced tools without a defined purpose is like owning a Ferrari but never driving it,” Colunga remarks.

Capur emphasizes the role of practicality alongside technology. “Sometimes, analytics gives you the answer you want to hear.

Simplifying data management and applying common sense is just as important,” he says. Capur also points out that many companies still view e-commerce as secondary to traditional operations. “E-commerce is not the side business anymore; it is the main business,” he states.

Predictive analytics, ultimately, does not offer definitive answers. Instead, it delivers refined hypotheses. “Analytics does not replace intuition or common sense. But when paired with clear objectives, it provides tremendous value,” concludes Capur.

MAXIMIZING CYBERSECURITY ROI: STRATEGIES FOR RESOURCE ALLOCATION

Organizations worldwide are facing a significant challenge: balancing the growing demands for cybersecurity with the constraints of limited budgets. As digital transformation accelerates, so do the threats and the complexity of managing cybersecurity. In this context, strategic investment in cybersecurity is no longer optional, but organizations often struggle with balancing tight budgets while addressing pressing needs.

“When the budget is tight, prioritize the most critical issues and use a layered model. You can have a strong network, but if identity controls are weak, you are exposed. Investment in identity should be a priority,” says Felipe García, Global Vice President of Information Security, Televisa Univision.