Annual Report

Melbourne Recital Centre acknowledges the Traditional Custodians of the lands on which we work, live, perform and learn. We pay our respects to the people of the Kulin Nation, their Elders past and present and to all Aboriginal and Torres Strait Islander Peoples.

Cover: Ngulmiya (July 2024)

Credit: Laura Manariti

Year at-a-glance

About Melbourne Recital Centre

Message from MRC’s Chair, Peter McMullin AM

Message from MRC’s CEO, Sandra Willis

MRC’s Vision, Values and Purpose Our Work

MRC’s Strategic Plan 2025–2028

Our Strategic Pillars MRC’s Strategic Priorities

Elevate Our Role in the Precinct

Create a Master Plan

Define Our Curatorial Strategy Support Artists and Access

Build Visitation and Audience Markets

Adapt for Sustainability and Resilience

Our Key Achievements

Creative Victoria Strategic Initiatives Alignment Our Commitment to Creative State First Peoples First For Every Victorian Whole of State Health and Wellbeing Development Report – Community Impact Community and Creative Engagement Report Our Donor Community Our Partners Organisational Structure Our Board Our Committees Our Executive Management Environmental Performance

Financial Summary

Statement of Corporate Governance

Financial Report

179,456 total atttendance

total number of performances

513

From major capital investments in our future, to collaborations with artists, organisations and festivals from across Victoria and beyond, the 2024–2025 Financial Year saw countless highlights at Melbourne Recital Centre. highlights

Jul 2024

Sold-out performances of Peter and the Wolf, presented in partnership with Museums Victoria’s Playbound Festival Melbourne Recital Centre’s Strategic Plan 2025–2028 launched

Aug 2024

ABC Melbourne’s The Friday Revue broadcast live-to-air from Elisabeth Murdoch Hall

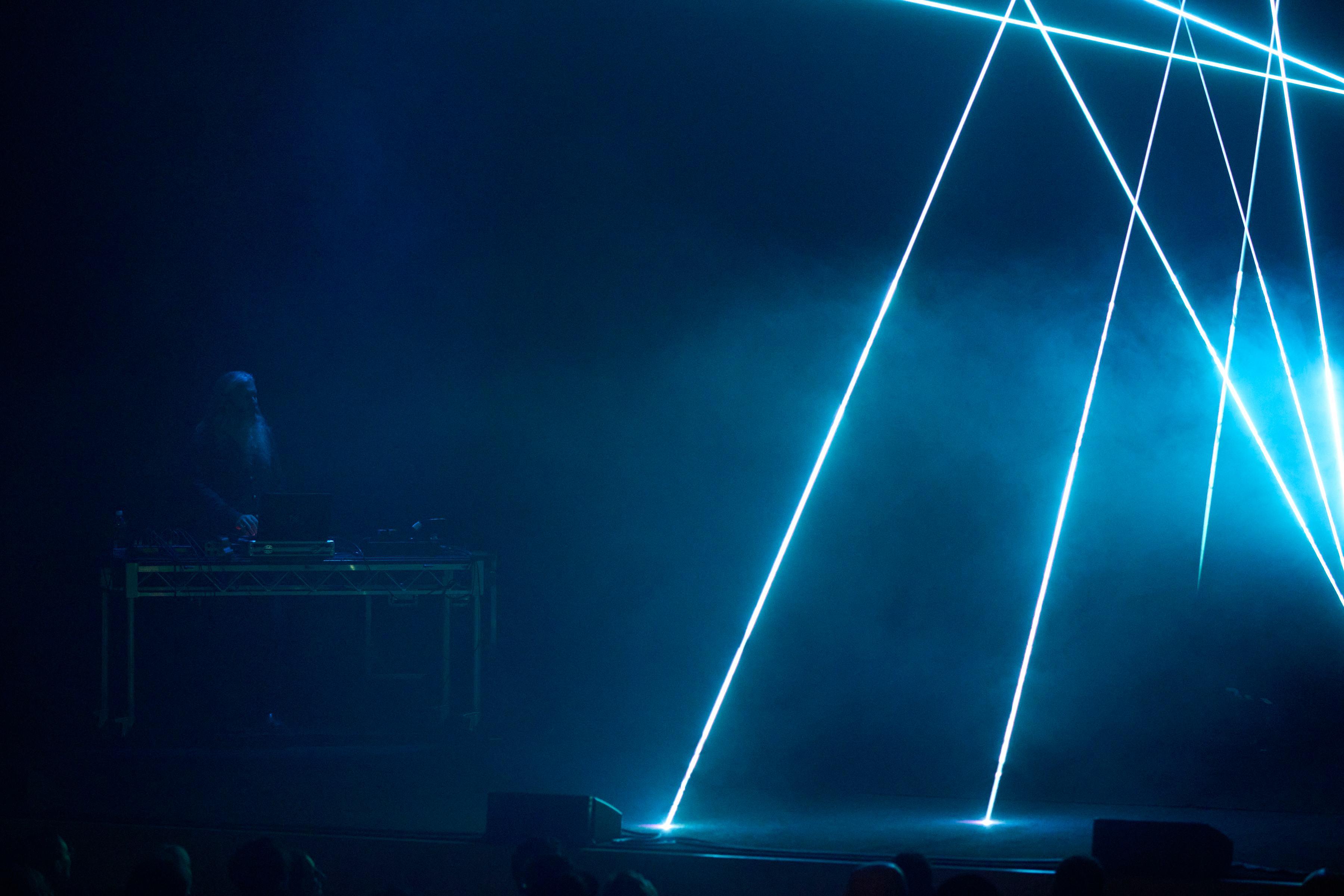

Partnership with the Now or Never festival culminated in a contemporary dance work MOUNTAIN, and music visionaries Actress (London) and HTRK (Melbourne) collaborating in Elisabeth Murdoch Hall

First Nations curator Neil Morris presented MINYERRA, transforming the Primrose Potter Salon into an ethereal Yorta Yorta soundscape

Oct 2024

Robin Fox, founder of Melbourne Electronic Sound Studio, appointed the 2025 Artist-in-Residence

2025 Classical subscription season launched, inviting audiences to Ready Your Ears for the year ahead

Refreshed launched and embedded into MRC’s day-to-day operation

Australian Art Orchestra with a special anniversary performanc

2024 Artist-in-Residence Forever Changed

Dec

Summer of contemporary music featured sold-out performances by Rufus Wainwright, T Robin Fox and more

Jan

2025

Apr 2025

Refreshed brand experience and accessibility-focused website launched

Michael Griffiths – It’s A Sin, presented as part of Midsumma Festival, paid tribute to the Pet Shop Boys in the Primrose Potter Salon

Matthias Goerne and Daniil Trifonov captivated audiences with a performance of Schubert’s Winterreise

ARM Architecture appointed to lead the transformation of The Peter and Ruth McMullin Beacon into a new venue for performances and events, overlooking the transforming Melbourne Arts Precinct

Brooklyn-based instrumentalist Claire Chase presented the Australian premiere of Liza Lim’s Sex Magic, showcasing the extraordinary contrabass flute

Daniel Lozakovich, one of the world’s most sought-after young violinists, captivated audiences with a performance of JS Bach’s Violin Partitas

Jun 2025

Welcomed the first of three technical secondments from regional performing arts centres, including Swan Hill, Geelong and Bendigo

May 2025

TINA – A Tropical Love Story, presented as part of YIRRAMBOI, transformed Elisabeth Murdoch Hall into a hub of First Nations drag cabaret

Peter McMullin AM appointed as Melbourne Recital Centre’s new Chair

RISING partnership continued, including Speak Percussion’s debut of Pigeons, a new contemporary piece supported by MRC’s ongoing Creative Development program

Iain Grandage AM announced as Melbourne Recital Centre’s new Director of Programming

About Melbourne Recital Centre

Pictured: Baroque Competition (June 2025)

Credit: Nico Keenan

Architecture of Excellence A Legacy Written in Sound

The 2007 gift from the Kantor and Calvert-Jones families enabled the establishment of Melbourne Recital Centre’s self-presented artistic program; Elisabeth Murdoch Hall is named in honour of this gift and in memory of our founding patron, the late Dame Elisabeth Murdoch AC DBE. In 2018, Lady Primrose Potter AC extended this transformative legacy; the Primrose Potter Salon bears her distinguished name.

Backed by Victoria’s vibrant music community and the Victorian Government, MRC was founded on a single truth: live music has the power to make lives better.

Peter and Ruth McMullin Beacon will join the fold.

Our spaces ensure every note resonates with crystalline clarity, creating what visitors consistently describe as an unparalleled listening experience.

A Stage for Every Story Every Experience for the Taking

Hosting hundreds of concerts and events per year, spanning classical through contemporary, Melbourne Recital Centre has become Australia’s preeminent destination for music in all its diversity. From world-class international artists to emerging local talent, our stages welcome every genre, every voice, every story.

Here, people discover connection through music, with programming that crosses boundaries of genre, age and culture. Each performance contributes to building a community united by shared musical experiences.

In the heart of Melbourne, music is more than an artform – it’s a common language that creates opportunities for belonging and celebrates the connections that bind together diverse communities.

message from Chair,MRC’sPeter McMullin AM

When I accepted the ministerial appointment to Chair Melbourne Recital Centre’s Board this year, succeeding Professor Emeritus Andrea Hull AO, I recognised and appreciated the responsibility of stewarding one of Australia’s premier cultural institutions. Transitioning from serving as Board Member to serving as Chair reinforces my commitment to ensure MRC’s continued excellence in an increasingly complex cultural landscape, as experienced this financial year.

This year of planning, transition and recalibration required us to confront external forces and challenges while reinforcing our commitment to community connection and artistic excellence. The challenges facing our creative industries demand strategic resolve and measurable impact.

Through this, MRC has continued to champion and build dynamic and diverse musical connection – serving classical enthusiasts, contemporary artists, emerging musicians, international performers, local residents and more. Our programming bridges generational, cultural and artistic boundaries, creating meaningful connections that strengthen Victoria’s cultural cohesion and build sustainable networks across our creative ecosystem.

As Melbourne Recital Centre now marks 16 years of operation, it has evolved from aspiration to achievement. This financial year’s efforts continue to steer the trajectory towards 2028 and the completion of the Melbourne Arts Precinct transformation. Leadership continuity during this time has been essential. I extend my sincere appreciation to former Chair Andrea Hull AO for her dedication and stewardship during an exceptional tenure. The Hon. Mary Delahunty retired from the Board after nine years of dedication and governance leadership. I sincerely thank Mary for her service. We welcomed new members Anthony Cavanagh, Kate Duncan and Mark Freeman to the Board; their expertise and contributions are proving invaluable.

To my fellow Board colleagues and committee members: your dedication during this period of recalibration ensures MRC remains both culturally significant and financially sustainable. Thank you.

I acknowledge and thank the Victorian Government for its ongoing support of Melbourne Recital Centre and the creative industries, and Minister for Creative Industries, the Hon. Colin Brooks MP, for his advocacy and leadership. The State Government’s critical support enables Melbourne Recital Centre to pursue excellence, creativity and connection for Victorians.

Peter McMullin AM Chair, Melbourne Recital Centre

Operations team embrace this complex challenge with creativity and precision reminded us that at Melbourne Recital Centre, we don’t just present music — we make the impossible possible.

The launch of our renewed Community and Creative Engagement Plan has strengthened our connections within the community. Choir 3006 has evolved from a concept to a thriving weekly gathering of Southbank locals. Over 1000 people have experienced live music through our Share the Music program, which aims to remove barriers to access for those who need it most. Our Emerging Composer Commissions represent investments in unheard voices and stories waiting to be expressed through music.

Our partnerships with the Australian Brandenburg Orchestra, Australian Chamber Orchestra, Melbourne Chamber Orchestra, our co-presentations with ANAM supporting emerging musicians, the Melbourne International Jazz Festival, the Melbourne Symphony Orchestra’s Ears Wide Open series, the Australian String Quartet and Musica Viva Australia have provided audiences with diverse programming and exceptional artistry through their distinctive experiences on our stage.

Behind the scenes, planning for the Peter and Ruth McMullin Beacon is underway with ARM Architecture. This new space will enhance our capacity to present intimate musical programming and host events with breathtaking views of Melbourne.

of donors and supporters, the remarkable musical experiences that take place nearly every day of the year at Melbourne Recital Centre would not be possible.

Sincere thanks to the members of Melbourne Recital Centre’s Board for their thoughtful governance and strategic stewardship, navigating the balance between fiscal responsibility and artistic ambition with wisdom and commitment to MRC's sustainability. A huge thank you to the entire Melbourne Recital Centre staff, along with the extensive network of artists whose expertise and dedication ensure that our programs are delivered with skill and care. Your commitment to excellence has ensured that we remain both culturally vital and financially strong.

Finally, to our audiences — whether you're a longtime subscriber or have discovered us for the first time — your enthusiasm and response to what we do inspires our ambitions every day.

As we look toward the future, we hold fast to our purpose to amplify Australia's diverse music ecology, connect people and inspire positive change. Live music has the power to transform lives and strengthen communities. With unwavering community support, Melbourne Recital Centre will continue as the intimate heart of Victoria's musical life, where every performance reminds us of music's extraordinary capacity to move, inspire, and unite us all.

Sandra Willis CEO, Melbourne Recital Centre

MRC’s ValuesVision, and Purpose

Music is the heart and soul of what we do.

Our Vision

A thriving, creative future where music and storytelling are fundamental to our lives.

Our Purpose

We amplify Australia’s diverse music ecology to connect people and inspire positive change.

our ethos

Our Values

We are for the music lovers, the music makers and the sound creators, the administrators and the operators, who unite to make music accessible for all.

Ambition: We experiment, ideate and innovate with energy and enthusiasm.

Creativity: We are creative on and off stage to unlock new possibilities.

Collaboration: We are curious and connected, finding strength in sharing and learning.

Enrichment: We work to ensure artistic, social, financial and environmental benefits.

Inclusivity: We champion accessibility and diversity, so everyone feels welcome.

Integrity: We are honest, transparent, trustworthy, generous and kind.

Pictured: Siobhan Stagg with Freiburg Baroque Orchestra (March 2025)

Credit: Laura Manariti

Pictured: Luke Howard x Simon Burgin (May 2025)

Credit: Laura Manariti

our Strategic Pillars

Place

We are a place for music on the lands of the Kulin Nation, at the heart of the Melbourne Arts Precinct.

Music

We are where music finds its stages; MRC is a world-class, specialist livemusic venue spanning the realms of classical and contemporary music.

Experience

We create experiences that resonate. We amplify opportunities for more people to come together to enjoy and discover live music and storytelling.

Connection

We build purposeful community, cultural and commercial relationships that enrich the lives of all Victorians.

People

We value our people individually and as an ensemble. We invest in our people, their growth and capabilities.

Performance

We proactively manage our business for resilience and sustainability.

MRC s Strategic Priorities

Elevate Our Role in the Precinct

Strengthened precinct leadership through ongoing collaboration with MAP Co and expanded collaborations with community, artistic, presenting and education partners including The University of Melbourne

Activated the building for Open House Melbourne, welcoming architectural, sound and design enthusiasts to discover MRC in new ways

Hosted the Amplify (formerly FReeZA) Summit with nationally renowned youth music organisation The Push, welcoming young people aged 12–25 from across metropolitan, regional and rural Victoria to connect with industry, expand networks, build skills and discover new pathways to work in the live-music sector

Create Mastera Plan

Commenced the redevelopment of The Beacon and appointed ARM Architecture to lead the project

Define Our Curatorial Strategy

Expanded our community’s creative potential with broadened artistic partnerships and innovative programming approaches, including the introduction of the Creative Development program, which subsidises access to MRC’s exceptional spaces to support artists and creators hone their craft

Strengthened programming foundations through a commissioned organisational data and insights review, which provided valuable recommendations on how to pursue business development, sustain artistic excellence and artistic breadth, and respond to the market

Build Visitation and Audience Markets Support Artists and Access

Launched a refined Community and Creative Engagement Plan, which is strategically focused on discovery pathways, deeper community engagement and multifaceted learning opportunities

Delivered targeted industry development programs, including regional training secondments, masterclasses and early childhood music sessions

Progressed organisational inclusion commitments through continued collaboration on the finalisation of our Access and Inclusion Plan and Reconciliation Action Plan

Created sustainable artist development pathways that connect emerging talent with professional opportunities through the Accelerando mentoring program

Completed a comprehensive brand redevelopment and website transformation, enhancing accessibility, discovery and revenue generation

Improved MRC s data and insights foundations, enabling increasingly proactive responses to evolving audience behaviours and market fluctuations

Launched Free Music monthly matinees, which connect musicians with other music lovers

Introduced Choir 3006, a free weekly choir, welcoming hundreds of Southbank participants to experience the power of singing and community connection

Diversified audience engagement activities, expanding pathways for cultural participation

05 04

Adapt for Sustainability and Resilience

Appointed MRC’s inaugural Chief Operating Officer, who is leading the optimisation of business operations and performance, financial strategy, governance and risk

Implemented business model reforms, strengthening operational efficiencies and fiscal discipline

Optimised the programming balance between self-presented and venue-hire modes, aligning creative, community and commercial imperatives

Expanded proactive fundraising initiatives and enhanced donor stewardship activities, including the introduction of the Chair’s Circle initiative

Our Key Achievements

Attendance at public events at the Melbourne Recital Centre*

Participation by students

All facility safety audits conducted Website (number of unique site visitors)^

Volunteer hours Melbourne Recital Centre Members

668 1,237 1 1,091,630 15,597 179,456 2024–2025 results

650 1,300 1 650,000 12,000 230,000 2024–2025 target

Report against BP3 (Budget Paper 3) measures as agreed with Creative Victoria 659 948 1 1,026,471 22,183 178,158 2023–2024 results

*Results for 2024–2025 show a slight improvement compared to 2023–2024; however, they fell short of the target. This is primarily due to a nation-wide decline in market confidence, reduced touring affordability, and lower agency risk appetite, which led to decreased activity across both our Self-Presenting and Venue Hire programs.

^In 2024–2025, the increase in website visitation was driven by the launch of our dynamic new brand and a high-performing website, making it easier and faster for visitors to browse, engage, and complete their bookings.

Pictured: Allison Russell (supplied)

Creative StrategicVictoriaInitiatives Alignment

Our Commitment to Creative State 2025

Melbourne Recital Centre aligns with Creative State 2025’s vision of a state where creative people, ideas and enterprises thrive, and where everyone has equitable access to and benefits from a rich creative culture.

We remain committed to championing and actively contributing to Victoria’s strengths and partnering with the Victorian Government to address the systemic challenges facing our creative industries, and to identify areas for future collaboration and sustainable investment.

Pictured: Ngulmiya (July 2024)

Credit: Laura Manariti

For Every Victorian First Peoples First

knowledge, practice, protocols and cultural authority will be at the heart of the creative industries, forging stronger and enduring partnerships with First Peoples’ creative communities.

Melbourne Recital Centre demonstrated meaningful commitment to First Nations leadership through both governance and curatorial appointments. MRC appointed new Board director Anthony Cavanagh, who is a Taungurung man from Victoria. This appointment strengthens the representation of First Nations Peoples at the highest decision-making level and enhances governance frameworks and strategic direction. The appointment of Yorta Yorta, Dja Dja Wurrung, Wiradjuri, Ngurai Illum Wurrung man and creative practitioner Neil Morris as curator of Future/ Present – a transformative series platforming First Nations stories, songlines and community connections. Morris’ evocative sound experience MINYERRA transformed the Primrose Potter Salon, creating immersive journeys through woka (country), yenbena (ancestors) and mulana (spirit), using atmospheric textures and pulsing rhythmic voicings that honoured cultural protocols while engaging diverse audiences.

Our transition of the successful MobTix pilot program to a permanent accessible ticket offering exemplifies MRC’s sustainable commitment to removing barriers for First Nations Peoples, ensuring equitable access to our programming while building enduring community relationships. In partnership with YIRRAMBOI, MRC presented the sparkling First Nations drag cabaret TINA – A Tropical Love Story, a heartfelt tribute to the indomitable spirit of Tina Turner and personal story brought to life by First Nations drag performer, Miss Ellaneous (Ben Graetz).

Creative

State: Every Victorian –regardless of cultural background, age, gender identity, location, income or ability – can take up their right to participate in the cultural and creative life of the state and creative careers.

Melbourne Recital Centre’s renewed Community and Creative Engagement program represents a strategic evolution of our access initiatives, designed to deepen participants’ connections with music while fostering measurable community impact. This comprehensive approach ensures programming reaches across demographic boundaries, creating meaningful pathways for cultural participation.

Our partnerships with festivals – including Midsumma, YIRRAMBOI, RISING, Alter State and Asia TOPA – demonstrated active championing of inclusive access, participation and representation. These strategic alliances amplify Victoria’s vibrant diversity while strengthening our role as a cultural connector that transcends traditional venue boundaries, building sustainable networks that benefit multiple stakeholder groups.

Whole of State Health and Wellbeing

experiences, creative expression and rewarding and sustainable careers.

Melbourne Recital Centre actively addresses regional equity through targeted professional development opportunities, with our Regional Tech Secondments program welcoming practitioners from across regional Victoria to gain invaluable hands-on experience in our world-class venues. This initiative provides essential career pathway support while building the skilled workforce that strengthens Victoria’s creative industries.

Our Accelerando mentoring program exemplifies our commitment to nurturing talent regardless of location, with participants from Mildura through to Cann River accessing highlevel musical development opportunities, which culminated in professional debut performances in the Primrose Potter Salon. This approach ensures geographic barriers do not limit creative potential while building regional connections to Melbourne’s cultural infrastructure.

Creative State: The nature of work –and workplaces – in the creative industries have unique issues that impact the mental health and wellbeing of the people who work in them. Work to address these concerns and to foster healthy, safe and respectful working environments.

Understanding music’s profound impact on wellbeing, Melbourne Recital Centre launched Choir 3006 in February 2025. This is a new open-access weekly lunchtime choir for Southbank locals, workers and visitors. This initiative leverages the documented benefits of group singing and social connection, creating a supportive community space that prioritises mental health and creative expression.

The program’s immediate popularity and participant enthusiasm demonstrate how creative initiatives can address workplace wellbeing challenges while also building strong community connections. By providing accessible creative outlets within the working day, MRC contributes to healthier, more sustainable creative work environments across the precinct.

Development Report –Community Impact

We extend our sincere gratitude to the passionate community of donors, partners and sponsors, whose extraordinary generosity plays a vital role in bringing Melbourne Recital Centre to life. It is only through the support we receive from our community each year that we can sustain and enrich Victoria’s vibrant musical ecosystem by presenting great local and international artists, nurturing emerging Australian talent, and ensuring that the special joy of live music is accessible to everyone in our community.

In August 2024, we were honoured to acknowledge the generosity of the late Eva Besen AO and Marc Besen AC by naming our Level 2 function space The Eva and Marc Besen Suite in their honour. Eva and Marc were among MRC’s most passionate concert goers and had been coming to the MRC since it opened in 2009. Their decades-long support for a wide range of ensembles and artists who appear on our stages continues to have a profound impact on the vibrancy of Australia’s music scene.

In February 2025, our much-loved annual gala dinner saw over 100 of our most generous donors gather on the stage of Elisabeth Murdoch Hall to join us in celebrating the MRC’s sixteenth birthday, and to raise vital funds to support our suite of impactful young artist development programs. The many highlights of this memorable evening include guests enjoying a deeply moving performance by former Artist-in-Residence William Barton and being wowed by the Flinders Quartet’s energetic rendition of a new work, Perpetuum by outstanding young composer Chloe Dewhirst, an alumna of our Making Waves program for emerging composers.

This year also marked the launch of the Marshall McGuire Emerging Composer Commission. Founded in celebration of our former Director of Programming’s nearly decade-long leadership of MRC’s artistic vision, this important donor-supported initiative pays tribute to Marshall’s passionate commitment to supporting the next generation of Australian composers.

We also extend a special thank you to the generous donors of the Signature Event Circle, whose support enabled us to welcome the outstanding Freiburg Baroque Orchestra back to Elisabeth Murdoch Hall for the first time since 2020. Joined by the exceptional Australian soprano Siobhan Stagg, this year’s Signature Event was an example of our commitment to ensuring that Melbourne continues to stand as a proud peer among the world’s great musical cities.

Marking the beginning of a significant new chapter for philanthropy at Melbourne Recital Centre, in June 2025 we proudly established the Chair’s Circle as an important new initiative to acknowledge, celebrate and grow our community of major donors. Under the leadership of our new Chair, Peter McMullin AM, this circle of philanthropic leaders is dedicated to ensuring the long-term flourishing of Melbourne Recital Centre as a beacon for musical excellence.

We also gratefully acknowledge the support of our business partners: Ashurst, The Langham Melbourne, Quest Southbank, Mount Camel Ridge Estate and Port Phillip Estate. Their generosity amplifies the impact of our work and elevates the experience of Melbourne Recital Centre for our artists and audiences alike. We hope that everyone in our community will support them as they continue to support us.

Finally, to all our amazing supporters – no matter the size of your gift – thank you. We are deeply grateful for your support, and we look forward to continuing our work together to ensure an inspiring musical future for Melbourne Recital Centre and our whole community.

Community and Creative Engagement Report

Melbourne Recital Centre’s new three-year Community and Creative Engagement Plan ensures that our audiences and artists look and sound like Melbourne, in all its diversity, and positions MRC as a core contributor to industry growth for musicians, composers and technicians.

Contributing to a more inclusive society, MRC’s community and creative engagement activities make this a place where Victorians of all ages, backgrounds and abilities have the opportunity to inspire and be inspired, by taking their seat, or taking the stage.

Pictured: Robin Fox (January 2025)

Credit: Laura Manariti

Engaging Community Programs

Enriching Artist Development Opportunities

1013 people accessed live performances at MRC through the Share the Music ticket and transport subsidy program

Two Music Always tours (16 performances) brought live music to 523 people living in aged-care and assisted-living facilities across Victoria

75 students who are blind or deaf took part in the Sound Matters and Sound Vibrations workshop programs

16 Relaxed Performances created engaging live-music experiences for students attending special developmental schools and for members of community groups with sensory requirements; these performances reached 628 audience members

64 Song Play early childhood music sessions introduced our youngest audiences (aged 0–4) to the joy of live music

450 locals from Southbank and the surrounds became members of Choir 3006, a weekly lunchtime drop-in choir hosted in the Primrose Potter Salon

221 student musicians and teachers attended the Sound Insights program, presented in partnership with the Australian Music Examination Board (AMEB), to showcase student repertoire while providing vital performance and practice techniques

Eight exceptional young musicians participated in the Accelerando mentoring program, which provides unique professional development opportunities that are tailored to encourage careers in music lice Chance and Chloe Kim were awarded the er Music Commission, working with Syzygy Ensemble

Seven finalists aged between 18–25 competed in the 2024 Great Romantics Competition; the Elisabeth Murdoch Prize was won by Tasmanian pianist Sheng-Yuan Lynch

10 finalists under the age of 18 took part in the 2025 Baroque Competition; first prize was won by Samuel Hooper, a 15-yearold violinist from Tasmania

The Making Waves program provided opportunities for 15 VCE student composers to have their major compositions performed and recorded by professional local artists

Three regional technicians joined our back-of-house team from arts centres in Swan Hill, Geelong and Bendigo as part of our Regional Tech Secondment program

The Marshall McGuire Emerging Composer Commissions were awarded to The University of Melbourne alumni Moses KingtonWalberg and Lilijana Maticevska, who will be composing for art music ensemble Rubiks Collective

10 local ensembles took part in the Free Music program, making use of the Salon space before opening their rehearsal process for the public

Over 250 young people from across Victoria joined us at MRC for The Push’s annual Amplify (formerly FReeZA) Summit as part of our Tech Track Partnership program, which focuses on event and stage management training

Our Donor Community

MUSIC CIRCLE

Thank you to the donors who support the depth and vibrancy of MRC's musical program and who play a crucial role in ensuring we can continue to present a broad range of the greatest musicians and ensembles from Australia and around the globe.

Salon Program Benefactor

Lady Primrose Potter AC

Beacon Benefactors Peter McMullin AM & Ruth McMullin

$30,000+

Joy Selby Smith

$20,000+

Alan & Mary-Louise Archibald Foundation

John & Lorraine Bates

Colin Golvan AM KC & Dr Deborah Golvan

Konfir Kabo & Monica Lim

Robert Peck AM, Yvonne von Hartel AM,

Rachel Peck & Marten Peck of peckvonhartel architects (Signature Event Circle Benefactors)

Susan Thacore

$10,000+ Anonymous (1)

Warwick & Paulette Bisley

Jim Cousins AO & Libby Cousins AM (Signature Event Circle)

Craig & Bernadette Drummond

Alex & Nelly King

Dr David Li AM & Angela Li

Cathy Simpson & John Simpson AM (Signature Event Circle)

Andrew Wheeler AM & Jan Wheeler (Signature Event Circle)

Igor Zambelli OAM

$5,000+

Ballandry (Peter Griffin Family) Fund

Mary Bram & the late Arnold Bram

Heather Carmody & Anthony Baird

Maggie Cash

Mary Draper AM

George & Laila Embelton

Dr Mary-Jane Gething AO

Linda Herd

Amy & Paul Jasper

Ann Lahore

Diana Lempriere

Maria McCarthy

Dr Mark Medownick & Dr Alla Medownick

Rosemary O’Connor

Tom Smyth

Jenny Tatchell

Janet Thomson

Dr Michael Troy

Vivian Wang Youth Music Foundation of Australia Inc (Signature Events Circle)

$2,500+

Anonymous (1)

Donald Abell

Michael Bennett & Kate Stockwin

Nigel & Sheena Broughton

Bill Burdett AM & Sandra Burdett

Alastair Campbell & Sue Campbell

Alex & Elizabeth Chernov

Michael Cowen & Sharon Nathani

Martin Duffy & Patrick Kennedy

Alistair Hay & Dr Jennifer Miller

Catherine Heggen

Dr Alastair Jackson AM

Christopher Menz & Peter Rose Dr Rosemary Nixon

Susan Pelka & Richard Caven

Emeritus Professor Margaret Plant OAM

Christopher Reed Sirius Foundation Maria Sola

Patricia & Vaughan Speck

The Ullmer Family Foundation Dr Victor Wayne & Dr Karen Wayne OAM

$1,000+

Anonymous (4)

Liz & Charles Baré

Catherine Belcher Debbie Brady

Kaye Cleary

Christine & Michael Clough

John & Chris Collingwood The Hon. Mary Delahunty

Vivien & Jack Fajgenbaum Margaret Farren-Price & Prof. Ronald Farren-Price AM

Mark & Danuta Freeman

George Golvan KC & Naomi Golvan Gras Foundation Trust

Lyndsey & Peter Hawkins

John Howie AM & Dr Linsey Howie Penelope Hughes

Prof. Emeritus Andrea Hull AO

In memory of the late Harry & Maria Johnson

Angela Kayser

Irene Kearsey & Michael Ridley Assoc. Prof. Sebastian King

Angela & Richard Kirsner

MacKenzie Gobbo Foundation Janet McDonald

Banjo McLachlan & Paul Mahony Mercer Family Foundation Maria Mercurio

Stephen Newton AO

Dr Paul Nisselle AM

Greg Noonan

Kerryn Pratchett

Eda Ritchie AM

Anne Runhardt & Glenn Reindel

Greg Shalit & Miriam Faine

John Taberner & Grant Lang

C. Tegner

Lyn Williams AC

$500+

Anonymous (4)

Jenny Anderson

Dr David Bernshaw & Caroline Isakow

Jannie Brown

Roger & Coll Buckle

Fiona Bunworth

Min Li Chong

Emilia Cross

Bruce Dudon

Jean Dunn

Chris Egan

Haydn Gibson

Janine Gleeson

Helen Herman

Dr Robert Hetzel

Jenny & Peter Hordern

Dr Garry Joslin & Prof. Dimity Reed AM

Daniel Kirkham

David Klempfner

Jennifer K Marshall

Ian McRae AO & Åsa Hasselgard

Helen Perlen

Erskine Rodan OAM & Christine Rodan

Dr Ronald Rosanove & Elizabeth Rosanove

Prof. Cheryl Saunders

Terry & Margaret Sawyer

Christine Stott

Dr Alison Street

Lia Tran

ACCESS TO MUSIC AND LEARNING OPPORTUNITIES FOR ALL

Thank you to the donors who support learning and access programs that share the music by bringing high-quality music and learning opportunities to people from all walks of life.

$100,000+

Prof. Dimity Reed AM

$30,000+ Graeme & Angelina Wise

$20,000+

Krystyna Campbell-Pretty AM

The Hon. Justice Michelle Gordon AC &

The Hon. Kenneth M Hayne AC KC

$10,000+

Canny Quine Foundation The Sentinel Foundation

$7,500+

The Jack & Hedy Brent Foundation

$5,000+

Anne Burgi & Kerin Carr

David & Xenia Williamson

$2,500+

Prof. John Langford AM & Julie Kidd Ralph and Ruth Renard

$1,000+

Anonymous (1)

Keith & Debby Badger

Debbie Brady

Elizabeth Cross

Prof. David Forrest

Maria Hansen

June K Marks

Ann Miller

The Hon. Ralph Willis AO &

Carol Willis OAM

$500+

Anonymous (2)

Dr Christine Bayly

James Bostock

Roger & Coll Buckle

Anne Burton

Ellen & B Easton

Assoc. Prof. Jody Evans

Doug Hooley

Graham Jephcott

Helen Lovass

Miriam McDonald

Lorraine Moir

Elizabeth O’Keeffe

Andrew & Georgina Porter

Elizabeth Reid & George Robin Allison Summers

Tony Way

Peter Willis & Eleneth Wooley

Dr Jenny York

NURTURING ARTISTIC DEVELOPMENT

Thank you to the donors who support our enriching artist development programs. These help create a wide range of opportunities for local musicians and ensure a vibrant musical future for MRC, Victoria and beyond.

Betty Amsden Kids and Family Program Benefactor

The late Betty Amsden AO DSJ

Young Artist Development Benefactor

The Peggy & Leslie Cranbourne Foundation

Merlyn Myer Music Commission The Aranday Foundation

The Yulgilbar Foundation

$80,000+

Margaret S Ross AM & Dr Ian C Ross

$20,000

Jane Kunstler The Vizard Foundation*

$10,000+

Warwick & Paulette Bisley

Julie Kantor AO

$5,000+

Russell & Deborah Basser John & Lorraine Bates* Krystyna Campbell-Pretty AM Carrillo Gantner AC & Ziyin Gantner Angela Kayser* Bruce Parncutt AO

$2,500+

The Hon. Justice Michelle Gordon AC & The Hon. Kenneth M Hayne AC KC* In memory of the late Harry & Maria Johnson

Martine Letts The James & Leo Ostroburski Foundation

$1,000+

Anonymous(1)

Peter J Armstrong* Ken Barelli Debbie Brady* Mary Bram*

Ann Gordon

Penny Hutchinson

Dr Barry Jones AC & Rachel Faggetter* Rupert Myer AO and Annabel Myer Anne Runhardt & Glenn Reindel

Joy Selby Smith*

Helen Symon KC & Ian Lulham

Leslie Thiess

Clayton & Christina Thomas

Brigitte Treutenaere & Paul Donnelly* Sandra Willis

$500+

Anonymous (1)

Lesley Alway

Paula Dwyer & Charlie Happell Kingsley Gee & Zhen Fu*

Graham Goldsmith AO & Deborah

Goldsmith

Charles & Cornelia Goode

Liz Grainger

Peter Jopling AM KC & Richard Parker Dr Garry Joslin & Prof. Dimity Reed AM

Sean King

Dr David Li AM & Angela Li

Sue Lloyd-Williams & David Hauser Clementine Lucas

Richard Murray & Jacquie Blackwell Peter and Wendy Nottle

A LASTING LEGACY

Thank you to this extraordinary group of donors for supporting the future of Melbourne Recital Centre both now and for generations to come.

Inaugural Patrons

Jim Cousins AO & Libby Cousins AM Anonymous (4)

The late Betty Amsden AO DSJ Jenny Anderson John & Lorraine Bates

Jennifer Brukner OAM

The Estate of Kenneth Bullen Roger Chao Emilia Cross Kingsley Gee & Zhen Fu Guan

Charles Taylor Hardman Jenny & Peter Hordern Dr Garry Joslin Jane Kunstler Janette McLellan Christopher Menz & Peter Rose Rosemary O’Connor Elizabeth O’Keeffe

Penny Rawlins Prof. Dimity Reed AM

Sandy Shaw

The Estate of Beverley Shelton & Martin Schönthal

Mary Vallentine AO

TAKE YOUR SEAT

Thank you to the donors who have dedicated an Elisabeth Murdoch Hall seat in the last 12 months.

Warwick & Paulette Bisley Patricia Daly Prof. Emeritus Andrea Hull AO Dr Rosemary Nixon AM In memory of Margaret Reece

List of patrons as at 30 June 2025

*Marshall McGuire Emerging Composer Commission

our partners

Founding patron

The late Dame Elisabeth Murdoch AC DBE

Board Members

Peter McMullin AM, Chair

Andrew Apostola

Andrew Cavanagh

Benefactor Patrons

The late Betty Amsden AO DSJ

Peter McMullin AM and Ruth McMullin

Lady Primrose Potter AC patrons & life members

Founding Benefactors

The Calvert-Jones Family

The Kantor Family

Helen Macpherson Smith Trust

Robert Salzer Foundation

Lyn Williams AM

The Hugh Williamson Foundation

Kate Duncan Assoc. Prof. Jody Evans

Mark Freeman

Liz Grainger Monica Lim

Life Members

Lin Bender AM

Deborah Cheetham AO

Jim Cousins AO

Kathryn Fagg AC

Margaret Farren-Price & Ronald Farren-Price AM

Richard Gubbins

Penny Hutchinson

Julie Kantor AO

Stephen McIntyre AM

Richard Mills AO

Jordi Savall

Mary Vallentine AO

Program Partners

Supporting Partners

Media partners

Anonymous (1)

The Aranday Foundation

Alan and Mary-Louise Archibald Foundation Ballandry Peter Griffin Family Fund Foundations

The Jack & Hedy Brent Foundation

The Peggie Leslie Cranbourne Foundation

The Marian & E H Flack Trust

Gailey Lazarus Foundation

Margaret Lawrence Bequest The James & Leo Ostroburski Foundation

The Sentinel Foundation Sirius Foundation

organisational structure

Minister for Creative Industries Colin Brooks MP

Board of Directors & Committee of Management Melbourne Recital Centre Secretary, Department of

Board Sub Committees Audit & Risk Committee Governance, Renumeration & Nominations Committee Foundation Advisory Committee

Our Board

Peter McMullin AM

Appointed 15 March 2021

Reappointed 4 March 2024

Appointed Chair 7 April 2025

Peter McMullin AM is the Chairman and Director of McMullin Group. He is also President of the Confederation of AsiaPacific Chambers of Commerce & Industry, Vice-Chair of the ICC World Chambers Federation for South-East Asia & Oceania, Honorary Consul of Georgia in Victoria, Special Counsel at Cornwalls Lawyers, Founder and Chair of The Good Business Foundation, and Board Director of the Australian Chamber Orchestra.

Andrew Apostola

Appointed 16 October 2023

Andrew Apostola is the Chief Executive Officer and co-founder of Portable, innovation partners for public good based in Melbourne. Andrew is a thought leader in creating positive social change through ethical and innovative design and technology. He holds an MBA from The University of Melbourne and a PostGraduate Diploma in English Literature.

Anthony Cavanagh

Appointed 12 August 2024

Anthony Cavanagh is a Taungurung man from Victoria and has been the Chief Executive Officer of Ganbina since 2013. He is a past member of the ANZ Bank’s Indigenous Advisory Council, an alumnus of the Williamson Leadership program, the Melbourne Business School’s MURRA Indigenous Business program, and has also studied at Stanford Business School in the United States. Anthony is a past Director of Philanthropy Australia. In addition to his leadership and governance roles, Anthony holds a Graduate Certificate in Indigenous Business Leadership from The University of Melbourne and is a Certified Community Director.

Kate Duncan

Appointed 12 August 2024

Kate Duncan is the Chief Executive Officer of Australian youth music organisation The Push. Leading the organisation, Kate oversees the strategic direction, focusing on giving every young person the opportunity to participate and thrive in Australian music. Prior to The Push, Kate spent several years in local government developing a range of award-winning youth music programs, as well as within the Victorian Government managing the National Youth Week grants program. Kate is a scholarship recipient of Melbourne Business School’s ForPurpose Executive Leadership program. She is a member of the Victorian Arts Industry Council and a previous member of the ABC Advisory Council.

Assoc. Professor Jody Evans

Appointed 25 June 2018

Reappointed 15 March 2021 and 4 March 2024

Dr Jody Evans is an Associate Professor of Marketing at Melbourne Business School, where she specialises in leadership, stakeholder engagement and strategic storytelling for purpose-driven organisations. With a career spanning over 25 years, she has helped shape initiatives that build community, attract support and amplify impact across the arts, education and social sectors. Jody has led nationally recognised programs supporting women in leadership and is actively involved in philanthropy and Board governance. Her previous Board roles include the Shepparton Art Museum Foundation and the Public Galleries Association of Victoria. She is currently Chair of the Foundation Advisory Committee at Melbourne Recital Centre.

Appointed 12 August 2024

Mark Freeman is the Managing Director of the Australian Foundation Investment Company, which is Australia’s largest listed investment company. It manages Djerriwarrh Investments Limited, Mirrabooka Investments Limited and AMCIL Limited. Mark started his career as an investment analyst at JBWere in 1994 where he advised Australian Foundation Investment Company, Djerriwarrh Investments Limited, Mirrabooka Investments Limited and AMCIL Limited on their investment and dealing activities. He was admitted as a Partner of Goldman Sachs JBWere in 2001. In 2007, he joined the four investment companies as the Chief Investment Officer and was appointed as Managing Director of the companies in 2018. Mark is currently a Board Member of the Mannix College Foundation.

Mark

Freeman

Appointed 3 March 2020

Reappointed 3 March 2023

Liz Grainger is a chartered accountant and a graduate member of the Australian Institute of Company Directors. She provides consultancy services to a wide range of public and not-for-profit organisations in the areas of strategy, governance, public sector funding and financial management. She has held executive roles at Deloitte in London and in the federal and Victorian public sectors. Liz is a former Board Member of Craft Victoria and Arena Theatre Company, and is currently a Director of VicScreen, Geografia and The Mission to Seafarers Victoria Inc. She has also served as an external member on the Audit and Risk Committees of Victoria Police, Southern Metropolitan Cemeteries Trust and Film Victoria, and currently serves in this capacity for Energy Safe Victoria.

Appointed 15 March 2021

Reappointed 4 March 2024

Monica Lim is a sound artist and composer whose work spans installations, performance art, contemporary dance and new instrument-making. Monica has completed her PhD at The University of Melbourne in interactive composition, with research interests in movement-led composition, new interfaces for musical expression and creative AI. She is a cofounder of philanthropic organisation Project Eleven.

Monica

Lim

Liz

Grainger

retired board directors

The MaryHonourable Delahunty

Appointed 1 July 2016

Reappointed 18 March 2019 and 3 March 2022

Retired 2 March 2025

The Honourable Mary Delahunty is a non-executive Board Member of the McClelland Sculpture Park and Gallery; a non-executive Board Member of the National Library of Australia; a graduate of the Australian Institute of Company Directors; a former Minister for the Arts, Victoria Government; a former Minister for Planning, Victorian Government; a former Minister for Education, Victorian Government; a non-executive Board Member of The Centre for Advancing Journalism at The University of Melbourne; a former interviewer and presenter on ABC’s The 7.30 Report and Four Corners; and a Gold Walkley winner for international reporting.

Professor Emeritus Andrea Hull AO

works projects and fundraising campaigns. Professor Hull has made a significant contribution to Victoria’s cultural landscape and Melbourne’s Arts Precinct. A former Chair of the ABC Advisory Council, Professor Hull has held Board positions across the breadth of Australia’s cultural and not-for-profit sectors, including at the Florey Institute, the National Museum of Australia, the Breast Cancer Network of Australia, and the Melbourne Forum. She is Professor Emeritus of The University of Melbourne and consults widely on problem-solving, cultural management and executive coaching.

Charlena Chan

Retired December 2024

Our committees

as at june 2025

Board Committees

The Board has established several standing committees. Decisions made by these committees become recommendations for consideration by the Board. These committees are the: Audit and Risk Committee Governance, Remuneration and Nominations Committee Committee of Management, Melbourne Recital Centre Foundation Advisory Committee Executive Committee.

Committee of Management Melbourne Recital Centre

On 23 October 2008, the Melbourne Recital Centre land at Southbank (Crown Allotment 2338, City of South Melbourne, Parish of Melbourne South) was reserved for public purposes (arts and recital centre). The Minister for the Environment and Climate Change appointed the Melbourne Recital Centre as the Committee of Management for that reserve with effect from that date. The Melbourne Recital Centre Committee of Management is the Board of Directors of Melbourne Recital Centre.

Financial and Other Information Retained by the Accountable Officer

Relevant information detailed in Financial Reporting Direction (FRD) 22 Standard Disclosures in the Report of Operations under section 3 of the Financial Management Act 1994 (Vic) is retained by the Company’s Accountable Officer. The items listed below are available to the relevant Ministers and Members of Parliament:

a statement that declarations of pecuniary interests have been duly completed by all relevant officers details of shares held by a senior officer as nominee or held beneficially in a statutory authority or subsidiary details of publications produced by the Melbourne Recital Centre about the activities of the Melbourne Recital Centre and where they can be obtained details of changes in prices, fees, charges, rates and levies charged by the Melbourne Recital Centre for its services, including services that are administered details of any major external reviews carried out in respect of the operation of the Melbourne Recital Centre details of any other research and development activities undertaken by the Melbourne Recital Centre that are not otherwise covered either in the report of operations or in a document that contains the financial statement and report of operations details of overseas visits undertaken including a summary of the objectives and outcomes of each visit details of major promotional, public relations and marketing activities undertaken by the Melbourne Recital Centre to develop community awareness of the services provided details of assessments and measures undertaken to improve the occupational health and safety of employees, not otherwise detailed in the report of operations a general statement on industrial relations within the Melbourne Recital Centre and details of time lost through industrial accidents and disputes, which are not otherwise detailed in the report of operations a list of major committees sponsored by the Melbourne Recital Centre, the purposes of each committee and the extent to which the purposes have been achieved, and details of all consultancies and contractors including consultants/contractors engaged, the services provided, and expenditure committed to for each engagement.

Audit and Risk Committee

Liz Grainger, Chair Mark Freeman Monica Lim Deirdre Blythe (external member) Kushal Shah (external member)

Governance, Remuneration and Nominations Committee

As at 30 June 2025, the Chair position of this committee remained vacant. Andrew Apostola Anthony Cavanagh Kate Duncan Peter McMullin AM

Committee of Management, Melbourne Recital Centre

Associate Professor Jody Evans Andrew Apostola Anthony Cavanagh Kate Duncan Liz Grainger Monica Lim Peter McMullin AM

Foundation Advisory Committee

Associate Professor Jody Evans, Chair Monica Lim

Peter McMullin AM

Peter Armstrong (external Member) Jim Cousins AO (external Member) Elisabeth Ee (external Member) Alex King (external Member) Clementine Lucas (external Member) Mairi Nicholson (external Member) Yvonne von Hartel (external Member)

Executive Committee

Peter McMullin AM, Chair

Associate Professor Jody Evans Liz Grainger

Our Executive Management

CHIEF EXECUTIVE OFFICER

Sandra Willis

Sandra Willis is an experienced arts executive with over 25 years of distinguished experience in cultural leadership across Australia’s leading performing arts organisations. Her senior positions include Executive Director of Opera Queensland and leadership roles with Opera Australia, Bell Shakespeare and Oz Opera, where she delivered major artistic programs, organisational strategies, and stakeholder engagement initiatives. Her career spans theatrical production, event and strategic management, and executive leadership across both arts and hospitality sectors. Sandra has held a number of Board positions for arts organisations and is currently an executive council member for the Association of Asia Pacific Performing Arts Centres. She is recognised for her commitment to artistic excellence, organisational sustainability, and broadening access to the arts for diverse communities.

Image credit: Laura Manariti

CHIEF OPERATING OFFICER

(from March 2025) Finance, People & Culture, Governance, Company Secretariat, Information Technology, Building Services, Commercial Management

DIRECTOR OF ENGAGEMENT & EXPERIENCE

Latoyah Forsyth Event and Brand Marketing, Communications, Audience Engagement and Development, Digital, CRM and Reporting, Ticketing Services, Visitor Experience, Front of House and Foyer Bars

HEAD OF OPERATIONS

van

Event and Production Management, Technical, Stage Door

HEAD OF DEVELOPMENT

DIRECTOR OF PROGRAMMING

Alistaire Bowler

Sponsorship, Philanthropy

Jasja

Andel

environmental performance

Melbourne Recital Centre maintains its commitment to environmental sustainability by minimising its environmental impacts and promoting a green future for our community. MRC continues to monitor and modify the behaviour of waste management, HVAC scheduling and building systems to improve its environmental performance.

Note: The above figures include usage by the Melbourne Recital Centre and café tenancy space occupied by Blondie Café. Waste comprises general, co-mingled, paper and cardboard.

financial summary

financial summary overview

The Five-Year Financial Summary presents Melbourne Recital Centre’s operating result for each year, before taking account of significant nonoperating items such as depreciation charges; donations and grants for capital purposes; and investment income reinvested to generate future growth in endowed funds.

In 2024–2025, the operating result was a small surplus, in line with expectations and reflecting MRC’s steady post-pandemic recovery and strong focus on the management of margins and overhead costs.

Pictured: Joep Beving (July 2024)

Credit: Laura Manariti

1. Income from the Victorian Government

Throughout the five-year period, the annual recurrent operating grant from the Victorian State Government has been supplemented by additional grants to fund the unavoidable costs of maintaining Melbourne Recital Centre’s core operations during the periods of pandemic-related closures, and the subsequent recovery. The need for this level of support has gradually decreased as audiences have returned, albeit slowly, to live performances.

2. Other operating income

While other operating income has increased over the last three years, it has yet to regain pre-pandemic levels. This responds to cost-of-living pressures and the broader shifts in audience behaviour that are being experienced across the whole live performance sector.

Within other operating income, MRC’s revenue from its commercial operations in 2024–2025 was in line with that for the previous year, with higher revenues from venue hire and other commercial operations (primarily food and beverage sales) compensating for a planned reduction in MRC’s own presenting activities.

3. Operating result before non-operating items

The 2024–2025 result reflects disciplined cost management and improved margins from commercial activities, notably MRC’s own presenting activities. These have partially compensated for the reduction in additional government support from the previous year.

4. Depreciation and similar charges

Depreciation is treated as non-operating expenditure as there is no expectation that Melbourne Recital Centre will have the financial capacity to fund the ongoing depreciation costs with respect to the building and building fit-out now recognised on its balance sheet (note 8). Funding for MRC’s capital additions is largely provided through the State Budget and the Cultural Facilities Maintenance Fund, managed by Creative Victoria (note 6).

5. Donations to the Public Fund Endowments

A proportion of the philanthropic income received by Melbourne Recital Centre funds operating requirements in the short to medium term, notably the delivery of the Community and Creative Engagement Programs. MRC also seeks to build the corpus of its endowments over time to generate an income stream through returns on invested funds. Donations added to the corpus are not included in the operating result for the purpose of this analysis.

6. Other income applied to capital purposes

In any year, Melbourne Recital Centre may receive funds from the Victorian Government and philanthropic sources, which are expended on property, plant and equipment. Government grants for capital purposes received prior to 1 July 2022 were included in the financial statements of the Victorian Government Department of Jobs, Skills, Industry and Regions (DJSIR) and are not shown here.

In 2024–2025, all funding from the Cultural Facilities Maintenance Fund (note 4) was recognised as contributed capital, and it is expected that this treatment will continue going forward.

7. Non distributable investment income

A proportion of the investment income generated each year is reinvested to strengthen the long-term growth of the endowments and is not available for operating purposes. In any year, this figure corresponds to the strategic allocation of investment assets and overall market performance.

8. Total net assets

The significant increase in reported total net assets between 2020–2021 and 2021–2022 is a result of the transfer of the land, building, and building fit-out, occupied and operated by Melbourne Recital Centre at 31 Sturt Street, to its own balance sheet, reflecting MRC’s substantive control and use of these assets.

The decrease in total net assets between 2023–2024 and 2024–2025 represents the comprehensive result for the year, notably the depreciation charge incurred on the transferred assets.

Statement Corporateof Governance

Manner of Establishment

Melbourne Recital Centre was registered on 2 March 2006 as a public company limited by guarantee with the sole shareholder being the State of Victoria, represented by the Minister for Creative Industries.

Melbourne Recital Centre is also a public entity under the Public Administration Act 2004 (Vic). Melbourne Recital Centre is registered as a charity with the Australian Charities and Not-for-profits Commission.

Melbourne Recital Centre has its own constitution and compliance and reporting requirements informed by both the Victorian Government policy and legislative frameworks as well as the Corporations Act 2001 (Cth). In abiding by the Code of Conduct for Directors of Victorian Public Entities, the Directors of Melbourne Recital Centre are committed to the highest standard of corporate and public sector governance.

Objectives of the Company

Powers and Duties of Directors

Under the Melbourne Recital Centre Constitution, Clause 2, the objectives of Melbourne Recital Centre include the promotion of live music, by, without limitation:

undertaking preparations for – and assisting in the funding of – the construction of Melbourne Recital Centre commissioning musical performances and programming for Melbourne Recital Centre promoting Melbourne Recital Centre, and planning and managing the operations of Melbourne Recital Centre.

Melbourne Recital Centre constitution, Clause 13.6:

The Directors are responsible for managing the Company’s business and affairs and may exercise to the exclusion of the Company in general meeting all the Company’s powers which are not required, by the Corporations Act 2001 (Cth) or by Melbourne Recital Centre’s constitution, to be exercised by the Company in general meeting.

The Directors may decide how cheques, promissory notes, bankers' drafts, bills of exchange or other negotiable instruments must be signed, drawn, accepted, endorsed or otherwise executed (as applicable) by or on behalf of the Company.

The Directors may pay out of the Company’s funds all expenses of promotion, formation and registration of the Company and the vesting in it of the assets acquired by it.

The Directors may: appoint or employ a person to be an officer, agent or attorney of the Company for the purposes, with the powers, discretions and duties (including powers, discretions and duties vested in or exercisable by the Directors) for the period and on the conditions they think fit authorise an officer, agent or attorney to delegate all or any of the powers, discretions and duties vested in the officer, agent or attorney, and subject to any contract between the Company and the relevant officer, agent or attorney, remove or dismiss any officer, agent or attorney at any time, with or without cause.

A power of attorney may contain any provisions for the protection and convenience of the attorney or persons dealing with the attorney that the Directors think fit.

The Company is committed to the implementation of the requirements of the competitive neutrality principles and is satisfied that its activities comply with the Victorian Government’s Competitive Neutrality Policy.

C

Public DisclosuresInterest Act

The Public Interest Disclosures Act 2012 (Vic) (the Act) encourages and assists people in making disclosures of improper conduct by public officers and public bodies. The Act provides protection to people who make disclosures in accordance with the Act and establishes a system for the matters disclosed to be investigated and rectifying action to be taken.

Melbourne Recital Centre does not tolerate improper conduct or serious misconduct by employees, nor the taking of reprisals against those who come forward to disclose such conduct. It is committed to ensuring transparency and accountability in its administrative and management practices and supports the making of disclosures that reveal corrupt conduct, conduct involving a substantial mismanagement of public resources, or conduct involving a substantial risk to public health and safety or the environment.

Melbourne Recital Centre will take all reasonable steps to protect people who make such disclosures from any detrimental action in reprisal for making the disclosure. It will also afford natural justice to the person who is the subject of the disclosure to the extent it is legally possible.

Melbourne Recital Centre is not eligible to receive public interest disclosures; however, disclosures of improper conduct or detrimental action relating to Melbourne Recital Centre can be made to the Independent Broad based Anti corruption Commission (IBAC). Further information about making disclosures to IBAC can be found at www.ibac.vic.gov.au.

As required by section 58(5) of the Act, Melbourne Recital Centre has made the Public Interest Disclosure Policy available on its website, melbournerecital.com.au. This policy provides procedures for protecting people who make protected disclosures from detrimental action by Melbourne Recital Centre or any member of its sta

In 2024 2025, Melbourne Recital Centre received no complaints or assessable disclosures as advised by IBAC.

Workplace Health Safety and

Melbourne Recital Centre has a Workplace Health and Safety (WHS) Committee that monitors, reviews and updates MRC’s occupational health and safety policies and procedures and reviews incidents reported at Melbourne Recital Centre. Several Key Performance Indicators have been identified to enable the measurement of WHS and provide a valuable tool in the management of these issues. Results for the year are outlined in the table below.

Compliance with the Building Act 1993 (Vic)

Melbourne Recital Centre is committed to being an inclusive organisation for employees, artists, audiences and communities.

We are proud to offer a workplace that embraces diversity and strongly encourages applications from Aboriginal and Torres Strait Islander peoples, members of the LGBTQIA+ community, people with disability, and individuals from culturally and linguistically diverse backgrounds.

Our Gender Equality Action Plan 2021 2025, our Disability, Access and Inclusion Plan, and Reconciliation Action Plan provide strategic guidance to support diverse talent and acknowledge the lived experiences that shape our workplace culture.

These Action Plans are actively supported by the Gender Equality, Diversity & Inclusion Initiative Working Group, which serves as a forum to plan and monitor the implementation of gender, diversity and inclusion initiatives across the arts sector.

In the 2024–2025 financial year, Melbourne Recital Centre made tangible progress, including:

improved gender balance across both front-of-house and back-of-house teams implemented initiatives to enhance venue accessibility for audiences and employees embedded accessibility features on our new website finalised our Reconciliation Action Plan.

As at 30 June 2025, Melbourne Recital Centre was responsible for one government-owned building located at 31 Sturt Street, Southbank Vic. 3006. Melbourne Recital Centre uses appropriately qualified consultants and contractors to ensure compliance with the building and maintenance provisions of the Building Act 1993 (Vic), Building Regulations 2018 and the National Contruction Code. Melbourne Recital Centre is responsible for maintaining assets as well as inspecting and auditing infrastructure and services (lighting, lifts, fire and ventilation facilities).

In 2024–2025, Melbourne Recital Centre reports on the following matters: Number of major works undertaken

Number of building permits, occupancy permits or certificates of final inspection issued

Number of emergency orders and building orders issued

Number of buildings that have been brought into conformity with building standards

Our people are at the heart of MRC. Melbourne Recital Centre recognises that their expertise, creativity and commitment make possible the extraordinary experiences we deliver and is dedicated to strengthening their capabilities and fostering a high-performing, accountable and values-driven culture that delivers exceptional outcomes for our community.

Staff members are appointed under ongoing, fixed term or casual contracts as per the Melbourne Recital Centre Enterprise Agreement 2021 and/or in accordance with the Public Entity Executive Remuneration Policy.

Employees have been correctly classified in workforce data collections as outlined in the table on the next page.

Public employmentsector principles and Victorian Public Sector Code of Conduct

All staff members are bound by the Code of Conduct for Victorian Public Sector Employees. Melbourne Recital Centre complies with the values (section 7) and the employment principles (section 8) of the Public Administration Act 2004 (Vic).

Melbourne Recital Centre is committed to applying merit and equity principles in appointments of staff members. Selection processes in place ensure that applicants are assessed and evaluated fairly and equitably based on the key selection criteria and other accountabilities, and without discrimination.

Melbourne Recital Centre is committed to having a balanced working environment where equal opportunity and diversity are valued.

There was no emergency procurement activated in 2024–2025.

In 2024–2025, there was no single government advertising campaign with total media spend of $100,000 or greater (exclusive of GST).

In 2024–2025, there were three consultancies where the total fees payable to the consultants were $10,000 or more. The total expenditure incurred during this period in relation to these consultancies is $78,115 (excluding GST). Details of the individual consultancies are outlined below.

In 2024–2025, there were four consultancies engaged during the year where the total fees payable to the individual consultancies was less than $10,000. The total expenditure incurred during 2024–2025 in relation to these consultancies was $12,499 (excluding GST).

No reviews or studies were undertaken in 2024–2025. Reviews and Studies Expenditure

Information and C Technologyommunication

Expenditure

For the 2024–2025 reporting period, Melbourne Recital Centre’s total information and communication technology (ICT) expenditure was $1,252,664, comprising the breakdown outlined below.

All Operational ICT Expenditure

Total Business as Usual (BAU) ICT Expenditure

ICT expenditure related to projects to create or enhance ICT capabilities

Total non-Business as Usual (non-BAU) ICT expenditure

Operational expenditure

ICT expenditure refers to Melbourne Recital Centre’s costs in providing business-enabling ICT services within the current reporting period. It comprises Business As Usual (BAU) ICT expenditure and Non-Business As Usual (Non-BAU) ICT expenditure. Non-BAU ICT expenditure relates to extending or enhancing current ICT capabilities. BAU ICT expenditure is all remaining ICT expenditure that primarily relates to ongoing activities to operate and maintain the current ICT capability.

Local Jobs First

The Asset Management Accountability Framework (Maturity Assessment)

The Local Jobs First Act 2003 (VIC) introduced in August 2018 brings together the Victorian Industry Participation Policy (VIPP) and the Major Project Skills Guarantee (MPSG) policy, which were previously administered separately.

During 2024–2025, Melbourne Recital Centre did not commence or complete any Local Jobs First Standard or Strategic projects.

The Asset Management Accountability Framework (AMAF) is a non-prescriptive, devolved accountability model of asset management that considers cradle-to-grave lifecycle review of assets. Melbourne Recital Centre assesses its maturity level as ‘Competent’ over each of the key stages of asset review including Leadership and Accountability; Planning; Acquisition; Operation and Disposal.

In 2024–2025, MRC did not run any grants programs. Grants

financial report

directors report

The Directors present this report on Melbourne Recital Centre for the financial year ended 30 June 2025.

Directors

Company Secretary

Membership of

RecitalMelbourneCentre

Principal Activities

Company Objectives

net results

The names of each person who has been a Director during the period and to the date of this report are:

Peter McMullin AM, Chair (Appointed 7 April 2025)

Professor Emeritus Andrea Hull AO, Chair (Term ended 2 March 2025)

Andrew Apostola

Anthony Cavanagh (Appointed 12 August 2024)

The Hon. Mary Delahunty (Term ended 2 March 2025)

Kate Duncan (Appointed 12 August 2024)

Associate Professor Jody Evans (Resigned 22 August 2025)

Mark Freeman (Appointed 12 August 2024)

Liz Grainger

Monica Lim

The Directors have been in office since 1 July 2024 to the date of this report unless otherwise stated. All directors are independent of the management.

Joanne Kuluveovski held the position of Company Secretary at the end of the financial year.

Melbourne Recital Centre (‘Centre’ or ‘Company’) is a Company limited by guarantee. The sole member of the Company is the Minister for Creative Industries, the Hon. Colin Brooks MP.

The principal activity of the Company during the financial year was planning and managing the operations of Melbourne Recital Centre.

The objectives of the Company include the promotion of live music, by, without limitation: undertaking preparations for and assisting in the funding of the construction of the Melbourne Recital Building; commissioning musical performances and programming for Melbourne Recital Centre; promoting Melbourne Recital Centre; and planning and managing the operations of Melbourne Recital Centre.

The net operating result from transactions, after depreciation and amortisation was a deficit of $3.3 million (2023-24: deficit of $3.3 million).

Excluding depreciation and amortisation, the net operating result from transactions was a surplus of $1.3 million (2023-24: surplus of $1.7 million). The previous year included additional Government grant support for operations and an exceptional donation. In the current year these have been partially compensated for by higher investment income, and robust cost management.

The total comprehensive result was a deficit of $2.7 million (2023-24: deficit of $2.7 million), after accounting for unrealised gains in the market value of the Company’s investments of $0.6 million (2023-24: $0.6 million).

Dividends Paid or Recommended

Operating Activities

Significant Changes in State of Affairs

Proceedings on Behalf of the Company

After

Balance Date Events

Future Developments

Environmental Regulations

In line with the Company’s constitution no part of the income or property was paid, transferred, or distributed, directly or indirectly, by way of dividend, bonus, or other profit distribution, to any of the members or directors during the financial year.

The Company continued to experience a steady recovery in its core operations with strong demand from venue hirers and an increase in income from other commercial activities including food and beverage sales. A planned reduction in the Company’s own presenting activities saw lower total revenues in this area, but improved margins. A strong focus on cost management across the organisation ensured that, overall, most non-employee expenses were kept at the level of the previous year, or generated savings.

There were no significant changes in the Company’s state of affairs during the year.

No person has applied for leave of Court to bring proceedings on behalf of the Company or intervene in any proceedings to which the Company is a party for the purpose of taking responsibility on behalf of the Company for all or any part of those proceedings. The Company was not a party to any such proceedings during the year.

As at the signing of this report, no matters or circumstances have arisen since the end of the financial year which significantly affected or may significantly affect the operations of the Company, the results of those operations, or the state of affairs of the Company in future financial years.

Next year marks the second year of the Company’s Strategic Plan 2025-28, a pivotal year in embedding the strategies developed in 2024-25 and advancing toward a robust business model which will ensure a financially sustainable future for Melbourne Recital Centre.

No significant environmental regulations apply that are likely to have a material effect on the operations or financial results of the Company.

During the financial year $7,108 ($6,182 in 2023-24) was paid by the Company to the Victorian Managed Insurance Authority for directors’ and officers’ liability insurance premiums and recorded as an expense in the comprehensive operating statement. The insurance provides cover for directors and officers of Melbourne Recital Centre against certain personal liabilities that they may incur by reason of their duties as directors and officers.

The lead auditor’s independence declaration for the year ended 30 June 2025 has been received and can be found on page 5 of the financial report.

This report is made in accordance with a resolution of directors, pursuant to section 298(2)(a) of the Corporations Act 2001. On behalf of the directors

Peter McMullin

AM Chair of the Board

Melbourne 9 September 2025

DECLARATION OF RESPONSIBLE BODY, CHIEF EXECUTIVE OFFICER, AND CHIEF FINANCIAL OFFICER

The attached financial statements for Melbourne Recital Centre have been prepared in accordance with Direction 5.2 of the Standing Directions of the Assistant Treasurer under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting Standards including interpretations, the Australian Charities and Not-for-profits Commission Act 2012, the Australian Charities and Not-for-profits Commission Regulations 2022, and other mandatory professional reporting requirements.

We further state that, in our opinion, the information set out in the comprehensive operating statement, balance sheet, cash flow statement, statement of changes in equity, and accompanying notes, presents fairly the financial transactions during the year ended 30 June 2025 and financial position of the Company at 30 June 2025.

At the time of signing, there are reasonable grounds to believe that the Company is able to pay all of its debts, as and when they are due and payable, and we are not aware of any circumstance which would render any particulars included in the financial statements to be misleading or inaccurate.

We authorise the attached financial statements for issue on 9 September 2025.

Peter McMullin AM Chair of the Board

Melbourne 9 September 2025

Sandra Willis Chief Executive Officer

Melbourne 9 September 2025

Sharon Li Chief Operating Officer/ Chief Financial Officer

Melbourne 9 September 2025

MELBOURNE RECITAL CENTRE

OPERATING STATEMENT (a) FOR THE FINANCIAL YEAR ENDED 30 JUNE 2025

Other Economic Flows Other Comprehensive Income

Changes to asset revaluation reserve

Total other economic flows other comprehensive income

Comprehensive result

The accompanying notes form part of these financial statements.

Notes:

(a) This format is aligned to AASB 1049 Whole of Government and General Government Sector Financial Reporting. (b) ‘Gain/(loss) on disposal of fixed assets’ includes unrealised and realised gains/(losses) from revaluations, impairments, and disposals of all physical assets and intangible assets, except when these are taken through the asset revaluation surplus. (c) ‘Gain/(loss) on market value of investments’ includes unrealised and realised gains/(losses) from

disposals of investments, except when these are taken through the

at

through

and

MELBOURNE RECITAL CENTRE BALANCE

SHEET (a) AS AT 30 JUNE 2025

The accompanying notes form part of these financial statements.

Note: (a) This format is aligned to AASB 1049 Whole of Government and General Government Sector Financial Reporting. (b) Other non-financial assets include inventory and prepayments, which represent payments in advance of

extending beyond that financial accounting period.

MELBOURNE RECITAL CENTRE CASH FLOW STATEMENT (a) FOR THE FINANCIAL YEAR ENDED 30 JUNE 2025

The accompanying notes form part of these financial statements. Notes: (a) This format is aligned to AASB 1049 Whole of Government and General Government Sector Financial Reporting.