real estate sign is seen in front of a house for sale in West Los Angeles, Nov. 19, 2020.

real estate sign is seen in front of a house for sale in West Los Angeles, Nov. 19, 2020.

The median age of first-time homebuyers in the U.S. has climbed to a record of 40 as soaring prices and mortgage rates over the last few years delay homeownership for millions of Americans.

The age at which people purchase their first home has climbed rapidly since 2021, when the median was 33, according to a National Association of Realtors survey of transactions from July 2024 through June. In 1981, when the survey was first conducted, the median age was 29 years old.

NAR’s annual profile of buyers and sellers, released Tuesday, portrays a housing market in which younger, cash-strapped Americans are struggling to become homeowners while a wealthier, often older cohort is able to make bigger down pay-

The NAR warned that the loss of a decade of homeownership could cost Americans roughly $150,000 in equity on a typical starter home.

ments and pay cash for houses.

The NAR warned that the loss of a decade of homeownership could cost Americans roughly $150,000 in equity on a typical starter home. The median price of an existing home currently stands at $415,200 – up more than 50% since 2019. At the same time, mortgage rates are roughly twice as high as they were in late 2021.

“The implications for the housing market are staggering,”

Jessica Lautz, NAR’s deputy chief economist, said in a statement.

“Today’s first-time buyers are building less housing wealth and

How to keep old house, move up to dream

Now that we are seeing some 2,000- to 2,500-square-foot homes on the market for 21 to 45 days, it may be time to take advantage of this buyer’s market and convert the home you bought as a starter home 10 years ago into a rental property, and move up to a four- or five-bedroom house while your three to five kids are still kids.

Step 1: Contact a local mortgage professional and see what the numbers look like if you convert your home worth $500,000 to $600,000 into a rental and buy your dream home for $700,000 to $900,000.

Step 2: Talk to a property manager about the market rent you will be able to get from a high-quality tenant today, like a military family that wants out of California as soon as their current assignment ends at Travis AFB.

property manager, the multimillionaires I know that retire with large monthly incomes from their free and clear single-family homes paid very close attention to their rental properties over the years. Keeping a rental is like having a part-time job.

Step 4: If you need the rental income to qualify for your new house, the lender will require a one-year lease agreement and a deposit check from the tenant to prove the lease is for real. Yes, you can lease to family members as long as the rental income is at market rate and not inflated.

will likely have fewer moves over a lifetime as a result.”

Over the past year, firsttime buyers accounted for 21% of the market, the lowest since the NAR began collecting such data in 1981 and about half the pre-2008 norm.

As with first-timers, the typical repeat buyer is also older, rising to 62 this year from 61 a year earlier. They typically also have much more money to spend, with repeat buyers making median down payments of 23%, the highest level since 2003. The share of all-cash buyers matched a record 26%, dominated by Baby Boomers paying cash for their next homes in retirement, Lautz said in an email.

NAR mailed the surveys in July, collecting 6,103 survey responses from buyers who purchased a home between July 2024 and June for their primary residence.

Step 3: Decide if you want to be a landlord and make your departing residence a longterm investment as part of your retirement plan. Keep in mind that even if you have a great

Step 5: Odds are you are leaving behind a $550,000 home with $250,000 in equity and a 3.5% mortgage with

Q: My wife and I own a small, older home in Davis that I inherited from my mother about two years ago. We’ve had a tenant in it ever since, but now we have a problem. Late last year, the tenant, a young man with a wife and two chil dren, lost his job and had not been able to get another one. He got almost four months behind in the rent payments, but we felt so sorry for him we told him we’d give him time to get on his feet and then he could pay the back rent.

Apparently he is making some money now, and in January, he started paying us about 75% of the contracted rent payments each month. We just got another payment from him. When I asked him about the four months of back rent, and the 25% he’s not paying now, he says he’ll pay back the 25% in a few months, but he didn’t think he should have to pay the four months rent because once we accepted his January payment, we couldn’t enforce payment of the back rent. Is that correct? My wife and I have never had a rental before and we read your column every Saturday so I know all the laws in California are against the landlord, so I guess this is possible. Can you give us some advice?

A: The guy owes you the rent. Period.

Frankly, even if he didn’t, I think it’s a pretty pathetic guy who would attempt to take advantage of someone who was trying to help him. In short, you’ve been taken advantage of.

As in so many legal myths, this one has a small spark of truth which your tenant is trying to stretch way past the breaking point.

accept any money short of the full amount due comes from a

accurate statement of the total amount due when they serve a is the service to the tenant of a notice to pay rent or quit. That notice must contain the correct

If, after service of the notice, you accept a partial payment, the figure in the notice is no longer accurate and the court may, ultimately, throw out your lawsuit.

After the notice is served the landlord may choose to accept a partial payment, but they then have to recalculate the amount owing and serve a new notice. Or the landlord can refuse to accept a partial payment altogether.

In your case, you haven’t yet served any notices so you’ll have no problem accurately calculating the amount currently owing.

In my humble opinion, you and your wife have bent over backward for this guy when most landlords would have evicted the moment the rent was overdue, regardless of the reasons.

The tenant has repaid your kindness by trying to defraud

Two Custom Homes on One Large lot. Welcome to this exquisite custom single-stor y estate, offering 4 beds, 4 baths (2 full, 2 half) and 3,200 sq ft of luxurious living. Situated atop a serene cul-desac on nearly 1 acre. Enjoy unobstructed canyon views from your backyard oasis. The main home boasts Brazilian Cherrywood floors w/Walnut inlays, crown molding, tray ceilings, and designer finishes throughout. A formal living room features built-ins, a fireplace, and triple glass doors with views to the canyon. The chef ’s kitchen showcases Sub-Zero, Thermador & Viking appliances, dual islands w/sinks, glass-paneled 7 piece custom trimmed cabinetry, and a built-in beverage center. The spacious primary suite includes a fireplace, patio access with wrap around patio, spa-like ensuite with custom stone soaking tub and separate dual shower head w/skylight. Secondar y bedrooms w/Jack & Jill bathroom. A theater room completes the layout. Step outside to a resort-style pool & spa, solar-heated. With an oversized 3-car garage plus RV/boat parking area. Detached 886 sq ft 1-bed, 1-bath guest house with balcony, and full kitchen and private driveway, Peaceful setting near wineries and Rancho Solano G olf Course.

ered at $1,300,000

These are the local homes sold recently, provided by California Resource of Lodi. The company can be reached at 209.365.6663 or CalResource@aol.com.

TOTAL SALES: 4

LOWEST AMOUNT: $525,000

HIGHEST AMOUNT: $1,230,000

MEDIAN AMOUNT: $872,000

AVERAGE AMOUNT: $874,750

789 Barton Way - $830,000

09-18-25 [3 Bdrms - 1421 SqFt - 1987 YrBlt], Previous Sale: 11-11-03, $413,000

1517 London Circle - $525,000

09-17-25 [2 Bdrms - 1095 SqFt - 1980 YrBlt] 1800 Pacifica Court - $914,000

09-18-25 [4 Bdrms - 1886 SqFt - 1957 YrBlt], Previous Sale: 05-29-20, $736,000 448 Samuel Court - $1,230,000

09-18-25 [4 Bdrms - 3508 SqFt - 2005 YrBlt], Previous Sale: 03-14-05, $921,706

TOTAL SALES: 2

LOWEST AMOUNT: $625,000

HIGHEST AMOUNT: $860,000

MEDIAN AMOUNT: $742,500

AVERAGE AMOUNT: $742,500

765 Figtree Lane - $860,000

09-16-25 [4 Bdrms - 3439 SqFt - 2023

YrBlt], Previous Sale: 12-06-22, $770,000 640 Heirloom Court - $625,000

09-17-25 [3 Bdrms - 1753 SqFt - 2021

YrBlt], Previous Sale: 09-08-21, $570,500

TOTAL SALES: 21

LOWEST AMOUNT: $339,000

HIGHEST AMOUNT: $1,765,000

MEDIAN AMOUNT: $640,000

AVERAGE AMOUNT: $703,333

401 Arlington Circle - $649,000

09-17-25 [4 Bdrms - 1894 SqFt - 1976 YrBlt], Previous Sale: 10-19-22, $609,000 2257 Bellamy Court - $545,000

09-15-25 [3 Bdrms - 1678 SqFt - 1973

YrBlt], Previous Sale: 11-24-98, $135,000 5069 Brookdale Circle - $650,000

09-15-25 [3 Bdrms - 1308 SqFt - 1985

YrBlt], Previous Sale: 02-20-24, $660,000 1965 Buckingham Drive - $581,000

09-19-25 [3 Bdrms - 1828 SqFt - 1966 YrBlt], Previous Sale: 02-27-25, $400,000

2875 Carmel Way - $645,000

09-18-25 [4 Bdrms - 2320 SqFt - 1976 YrBlt]

26 Del Prado Circle - $410,000

09-18-25 [2 Bdrms - 1234 SqFt - 1983

YrBlt], Previous Sale: 11-09-21, $427,000

1973 Finch Way - $570,000

09-16-25 [4 Bdrms - 1896 SqFt - 1969 YrBlt], Previous Sale: 04-27-16, $300,000

5266 Finkas Lane - $710,000

09-16-25 [4 Bdrms - 2430 SqFt - 2016 YrBlt], Previous Sale: 11-03-16, $510,000

5349 Gramercy Circle - $630,000

09-19-25 [4 Bdrms - 2195 SqFt - 2017

YrBlt], Previous Sale: 03-05-20, $525,000

621 Greentree Circle - $640,000

09-17-25 [3 Bdrms - 2177 SqFt - 2005

YrBlt], Previous Sale: 04-06-20, $532,000

681 Hillside Drive - $1,100,000

09-18-25 [3 Bdrms - 3178 SqFt - 2001 YrBlt]

653 Julmar Circle - $562,500

09-15-25 [3 Bdrms - 1382 SqFt - 2004

YrBlt], Previous Sale: 06-25-08, $265,000

5326 Laurel Ridge Court - $1,765,000

09-17-25 [3 Bdrms - 2425 SqFt - 2017 YrBlt], Previous Sale: 09-23-13, $275,000

725 Meadowlark Drive - $339,000

09-17-25 [3 Bdrms - 1145 SqFt - 1967 YrBlt]

3088 Muse Way - $750,000

09-17-25 [4 Bdrms - 2602 SqFt - 2019 YrBlt], Previous Sale: 05-21-19, $582,000

401 Oakwood Drive - $620,000

09-15-25 [3 Bdrms - 1653 SqFt - 1989

YrBlt], Previous Sale: 05-08-98, $185,000

2986 Pebble Beach Circle - $1,122,000

09-19-25 [4 Bdrms - 3096 SqFt - 2006 YrBlt], Previous Sale: 05-22-06, $920,777

2194 Pomona Place - $585,000

09-15-25 [4 Bdrms - 1738 SqFt - 1976 YrBlt]

2859 Rebecca Drive - $655,000

09-19-25 [4 Bdrms - 2117 SqFt - 2002

YrBlt], Previous Sale: 08-20-02, $329,629

224 East Tennessee Street - $571,500

09-18-25 [5 Bdrms - 1985 SqFt - 1952 YrBlt], Previous Sale: 03-01-23, $546,000

2365 Waterside Drive - $670,000

09-17-25 [4 Bdrms - 2022 YrBlt], Previous Sale: 03-01-23, $710,000

TOTAL SALES: 6

LOWEST AMOUNT: $379,000

HIGHEST AMOUNT: $515,000

MEDIAN AMOUNT: $456,000

AVERAGE AMOUNT: $450,833

238 South 4th Street - $462,000

09-15-25 [2 Bdrms - 1320 SqFt - 1938 YrBlt]

330 Cypress Drive - $379,000

09-15-25 [2 Bdrms - 1154 SqFt - 2002 YrBlt], Previous Sale: 10-07-04, $299,000

417 Eagle Crest Way - $515,000

09-19-25 [2 Bdrms - 2137 SqFt - 2013

YrBlt], Previous Sale: 07-17-20, $482,000

2087 Revival Lane - $450,000

09-15-25 [3 Bdrms - 2022 YrBlt], Previous Sale: 03-31-22, $537,000

560 Stewart Way - $484,000

09-18-25 [3 Bdrms - 1191 SqFt - 2000

YrBlt], Previous Sale: 06-13-25, $420,500

353 Watson Hollow Drive - $415,000

09-19-25 [2 Bdrms - 1391 SqFt - 2003

YrBlt], Previous Sale: 09-27-16, $319,000

TOTAL SALES: 1

LOWEST AMOUNT: $610,000

HIGHEST AMOUNT: $610,000

MEDIAN AMOUNT: $610,000

AVERAGE AMOUNT: $610,000

1740 Newark Lane - $610,000

09-16-25 [3 Bdrms - 1839 SqFt - 2004 YrBlt], Previous Sale: 11-09-21, $595,000

TOTAL SALES: 16

LOWEST AMOUNT: $294,000

HIGHEST AMOUNT: $1,085,000

MEDIAN AMOUNT: $627,500

AVERAGE AMOUNT: $665,563

172 Andover Drive - $585,000

09-19-25 [4 Bdrms - 1402 SqFt - 1977

YrBlt]

202 Bantry Drive - $625,000

09-17-25 [3 Bdrms - 1708 SqFt - 1991 YrBlt], Previous Sale: 11-29-17, $445,000

330 Buck Avenue - $900,000

09-17-25 [3 Bdrms - 2848 SqFt - 1928 YrBlt]

243 Colby Drive - $575,000

09-16-25 [3 Bdrms - 1658 SqFt - 1990 YrBlt]

4780 Covey Lane - $950,000

09-16-25 [4 Bdrms - 1708 SqFt - 1972 YrBlt]

739 Edenderry Drive - $610,000

09-19-25 [2 Bdrms - 1564 SqFt - 1999 YrBlt], Previous Sale: 04-03-03, $329,900

7319 June Bug Lane - $840,000

09-17-25 [4 Bdrms - 1496 SqFt - 1973 YrBlt]

949 Lancaster Street - $658,000

09-17-25 [4 Bdrms - 1981 SqFt - 2008

YrBlt], Previous Sale: 09-11-08, $400,000

1218 Marshall Road - $540,000

09-15-25 [4 Bdrms - 1602 SqFt - 1964 YrBlt], Previous Sale: 00/1992, $137,000

1801 Marshall Road #808 - $294,000

09-18-25 [2 Bdrms - 948 SqFt - 1986 YrBlt], Previous Sale: 10-26-21, $320,000 1013 Portofino Avenue - $500,000

09-18-25 [3 Bdrms - 1229 SqFt - 2006

YrBlt], Previous Sale: 10-27-17, $371,000

450 Sandstone Drive - $630,000

09-16-25 [4 Bdrms - 1961 SqFt - 1972

YrBlt], Previous Sale: 01-16-15, $415,000 149 Shubin Way - $702,000

09-15-25 [3 Bdrms - 2464 SqFt - 2016

YrBlt], Previous Sale: 05-05-16, $551,000

312 Summerfield Drive - $455,000

09-19-25 [5 Bdrms - 2148 SqFt - 1986

YrBlt], Previous Sale: 07-12-02, $305,000 512 Twilight Street - $700,000

09-17-25 [5 Bdrms - 2405 SqFt - 2011

YrBlt], Previous Sale: 04-12-13, $398,500

201 Wild Sage Drive - $1,085,000

09-19-25 [4 Bdrms - 3123 SqFt - 2016

YrBlt], Previous Sale: 11-17-21, $1,031,000

TOTAL SALES: 21

LOWEST AMOUNT: $264,000

HIGHEST AMOUNT: $1,419,000

MEDIAN AMOUNT: $465,000

AVERAGE AMOUNT: $548,619

333 14th Street - $264,000

09-18-25 [1 Bdrms - 1262 SqFt - 1925 YrBlt] 2261 Bennington Drive - $823,000

09-19-25 [4 Bdrms - 2820 SqFt - 2000 YrBlt], Previous Sale: 09-13-18, $699,000 41 Canterbury Circle - $350,000

09-16-25 [3 Bdrms - 1294 SqFt - 1989 YrBlt], Previous Sale: 00/1989, $165,000 1201 Glen Cove Parkway #313$360,000

09-19-25 [2 Bdrms - 1014 SqFt - 1992 YrBlt], Previous Sale: 01-05-12, $86,500 425 Gonzaga Avenue - $465,000

09-16-25 [4 Bdrms - 1260 SqFt - 1962 YrBlt]

613 Jennings Avenue - $445,000

09-15-25 [2 Bdrms - 810 SqFt - 1942 YrBlt], Previous Sale: 09-21-21, $420,000 568 Jennings Avenue - $370,000

09-16-25 [2 Bdrms - 840 SqFt - 1941 YrBlt], Previous Sale: 04-26-13, $120,000 112 Lilac Court - $460,000

09-17-25 [3 Bdrms - 1170 SqFt - 1977 YrBlt], Previous Sale: 05-01-13, $171,000 219 Mayo Avenue - $545,000

09-17-25 [2 Bdrms - 1087 SqFt - 1940 YrBlt], Previous Sale: 07-19-22, $585,000 432 Miller Avenue - $439,000

09-15-25 [3 Bdrms - 1428 SqFt - 1952 YrBlt], Previous Sale: 10-21-19, $310,000

102 Nantucket Lane - $1,419,000

09-19-25 [2 Bdrms - 1337 SqFt - 1984 YrBlt], Previous Sale: 06-22-22, $495,000 951 Oakwood Avenue - $460,000

09-18-25 [3 Bdrms - 1020 SqFt - 1951 YrBlt], Previous Sale: 07-12-16, $280,000 1444 Ohio Street - $550,000

09-17-25 [3 Bdrms - 1422 SqFt - 1939

YrBlt], Previous Sale: 09-30-21, $620,000 939 Ohio Street - $300,000

09-18-25 [3 Bdrms - 1209 SqFt - 1915 YrBlt]

420 Sheldon Avenue - $455,000

09-16-25 [2 Bdrms - 1069 SqFt - 1955

YrBlt], Previous Sale: 11-03-09, $80,500 32 Shoal Drive - $500,000

09-15-25 [3 Bdrms - 1795 SqFt - 1990

YrBlt], Previous Sale: 07-29-05, $538,500

141 Stratford Street - $650,000

09-16-25 [4 Bdrms - 2206 SqFt - 1978

YrBlt]

7612 Tidewater Drive - $805,000

09-16-25 [4 Bdrms - 2662 SqFt - 2016 YrBlt], Previous Sale: 09-23-16, $612,000

337 Whitney Avenue - $605,000

09-17-25 [4 Bdrms - 1978 SqFt - 1989

YrBlt], Previous Sale: 07-30-14, $330,000

224 Woodson Way - $699,000

09-16-25 [4 Bdrms - 1846 SqFt - 1980

YrBlt], Previous Sale: 12-17-13, $365,000

170 Wren Court - $557,000

09-19-25 [3 Bdrms - 1270 SqFt - 1982 YrBlt]

From Page 3

you out of four month’s rent. My advice is to serve him with a notice to pay rent or quit which includes the total amount due, including the four months of rent and the missing 25% payments.

If you don’t get all of your money within five days, file an unlawful detainer lawsuit which will begin the eviction process.

Depending upon whether the tenant wants to show up in court to fight the eviction or not, it can take from four to six weeks, from start to finish. Eventually, the Sheriff will show up and physically remove the tenant and his family.

I know the prospect of making a family homeless is disturbing, but it’s either that or accepting the fact you’ve inherited four new dependents who don’t seem to appreciate your kind gesture.

Tim Jones, Esq., is a real estate attorney in Fairfield. If you have any real estate questions you’d like answered in this column, you can contact him at AllThings RealEstate@TJones-Law.com.

JEFF OSTROWSKI BANKRATE.COM

Home prices remain near record highs. Mortgage rates have retreated but remain well above their pandemic lows. Add it up, and homebuyers are feeling discouraged.

With housing affordability squeezing buyers, one in six (16%) of aspiring homebuyers have given up on purchasing a home in the past five years because they could not find anything they liked or could afford, according to a new Bankrate survey. Nearly 3 in 10 (28%) aspiring homeowners said the price of a home in their area was the most important issue when deciding whether to purchase a home. That’s in spite of a broad desire for homeownership – the vast majority of U.S. adults still consider owning a home a linchpin of the American dream, according to Bankrate’s 2025 Home Affordability Survey.

“U.S. home affordability is at its worst level in decades,” says Stephen Kates, financial analyst at Bankrate. “The punishing combination of high home prices, low supply and high mortgage rates has caused one in six home shoppers over the past five years to give up completely.”

Benjamin Clark, broker-owner of Buyer Representation in Salt Lake City, Utah, and president of the National Association of Exclusive Buyer Agents, agrees. “Prices have gone up significantly since Covid,” he says. “Interest rates have gone up significantly since Covid. And buyers’ incomes have not necessarily gone up.” Still, he says, buyers shouldn’t give up – new buying opportunities are opening up as the housing market cools nationallly.

Homebuyers are feeling discouraged. Amid affordability challenges – namely record-high home prices and elevated mortgage rates – 16% of people who were looking to buy over the past five years have abandoned their search.

Younger generations believe they have fewer financial opportunities compared to older generations. Gen Z (ages 18-28) leads the way in this feeling, with 54% of Americans in this age group saying older generations had it better.

Many millennial buyers have abandoned their searches. Millen-

nials are the most likely to have given up on purchasing a home in the last five years because they couldn’t find anything they liked or could afford at 22%, followed by Gen Xers at 17%.

When asked about what the important issues are for determining their interest in buying a home, aspiring homeowners are most likely to point to the cost of homes in the area (28%) followed by the amount in their savings (16%), job situation (16%), an interest in staying in the same area long term (14%) and per-

sonal relationships (4%). Among those who are interested in purchasing a home, the cost of homes in the area is the most important factor across generations, genders and income brackets.

Among aspiring homeowners, just 7% are actively shopping for a home – searching for-sale homes in their area or attending open houses. Gen Zers are the most likely to be shopping for a home, with 1 in 10 (9%) doing so, followed by millennials (ages 29-44) at 7%, Gen Xers (ages 45-60) at 7% and baby boomers (ages 61-79) at 5%.

“Despite the difficulty in finding homes to purchase, nearly half of home shoppers report that prioritizing a home purchase in their local area is the

most important factor influencing their decision,” Kates says. “For buyers who are struggling but remain committed to finding a house, expanding your search is a necessity. The house you can buy might be a little farther, a little older or a little weirder than you initially wanted, but you can make it your own.”

Across generations of aspiring homeowners, millennials are the most likely to have given up on purchasing a home in the last five years because they couldn’t find anything they liked or could afford at 22%, followed by Gen Xers at 17%, Gen Zers at 12% and baby boomers, also at 12%.

To gauge attitudes about the sharp rise in home prices – and the decline in affordability – since 2020, we asked: “Compared to previous generations, how would you best describe the financial opportunities available to people of your generation?” A third of total Americans said they have more opportunities to achieve financial goals than previous generations, 28% perceived similar opportunities and 39% believed they have fewer opportunities today.

But there’s nuance within those results. Younger generations believe they have fewer opportunities compared to older generations. Gen Z leads the way in this feeling, with 54% of Americans in this age group saying older generations had it better. Among millennials, 48% say they’re at a disadvantage, followed by 38% of Gen Xers and just 22% of baby boomers.“ Younger Americans are feeling this disadvantage at a time when home ownership is increasingly out of reach

“Gen Z and millennials are in

See Survey, Page 12

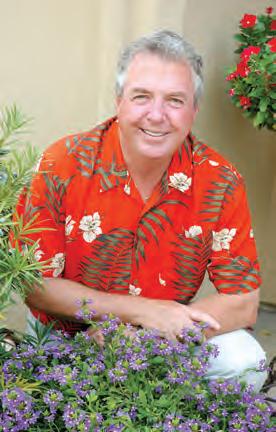

Ithought about titling this column “A Shrub for All Seasons.” It would be kind of a verbal take off the “Man for All Seasons.” But my shrub goes dormant, so I decided the best description would be “A Shrub for All Reasons.” Let me explain.

My sister sent me three photos in early October and asked, “How do you like my Double Play Candy Corn spirea?” My first thoughts were something like “they are drop dead gorgeous” followed by “you can’t do that.” They are taking your breath away the first week of October, in the shade, in containers, growing in the Dallas-Fort Worth area.

My sister’s house is situated where these shrubs are in sun spring and early summer then shifting to shade. The look in October is a draping or cascading of branches with new growth and the leaves exhibiting a “look at me” yellow.

Ever since Double Play Candy Corn spirea made its debut it has been slaying dragons or naysayers with its abilities. This first being it won’t work in the hot humid South. But it will and it does and partners with any plant you have in mind or “For All Reasons.”

Over the years The Garden Guy and son James have grown them in beds and large containers like horse troughs. No matter the size of the Double Play Candy Corn spirea you start with, you are in store for one of the great gardening experiences in your life.

James and I will both admit we didn’t know what we were doing at first. And now after seeing my sister’s October shady

version I think we still have a lot

In the beginning James was part of a large landscape team. The first Double Play Candy Corn was cut back hard in the fall. James, I’m sure, told me he thought they were dead, just

little twigs.

I can’t remember which combinations came first but it was magical. There were partners with pansies, and dreamy combos with both Primo Wild Rose and Dolce Spearmint heuchera.

But it was a heavenly marriage with Lemon Coral sedum that took my breath away. Nobody anticipated the dazzling horticultural displays.

From Page 2

24 to 26 years left to pay because you refinanced between 2019 and 2022. Before you move, do a $100,000 HELOC with no points or fees for the down payment on your new house, and even if you have the down payment via your savings or a 401k loan, having that HELOC in place for cash reserves down the road is comforting. Do not do an owneroccupied HELOC and then move out to your new house one week after you get the HELOC because the three credit unions I belong to will not be happy about your lack of disclosure. I would suggest you set up your HELOC now for when you buy after Easter or after school gets out in June next year.

For those of you that have 760-plus FICOs, you will be amazed how low the PMI rates are today, so putting 5% down is actually much better than most people think and rates for 760 people are a full 1% better today than last year. Nike stock is down but I still love “Just Do It” now before you have four teenagers sharing one bathroom.

Jim Porter, NMLS No. 276412, is the branch manager and senior loan adviser of Solano Mortgage, NMLS No. 1515497, a division of American Pacific Mortgage Corporation, NMLS No. 1850, licensed in California by the Department of Financial Protection and Innovation under the CRMLA / Equal Housing Opportunity. Jim can be reached at 707-449-4777.

If you’re looking for a flooring material that checks nearly every box on durability, affordability and design, ceramic tile easily comes to mind.

It’s been a classic choice for hundreds of years, and with good reason. Ceramic tile doesn’t just hold up under the daily grind, but thrives on it.

A well-installed and well-maintained tile floor can last 20 years at minimum, and in some cases, people are still walking on tile that’s been in place for a century. That’s staying power most other materials can’t claim.

The appeal of ceramic tile isn’t just about numbers and lifespan. It’s about the sheer variety you can put on your floors. From polished neutrals to bold mosaics to tiles designed to look like wood or marble, ceramic tile can be as understated or as dramatic as you want it to be. Advances in printing technology have turned ceramic into a chameleon of flooring options, giving you near-limitless design flexibility.

Functionally, ceramic has plenty of advantages as well. It’s nearly impervious to water once sealed properly, which explains why you see it in kitchens, bathrooms, mudrooms and entryways. In warmer climates, it often makes its way into living areas and even bedrooms. The smooth, nonporous surface makes it resistant to allergens such as dust, pollen and mold, which is welcome news for anyone in the household with asthma or seasonal sensitivities. And when it comes to cleanup, tile is about as low-maintenance as it gets. A sweep and a mop usually handle the worst of spills, and it doesn’t soak up stains the way wood or carpet might.

A

option is without its drawbacks, and ceramic has a few that are worth thinking about before you commit. The biggest maintenance task with ceramic tile isn’t the tile itself, but rather the grout. Those thin lines between tiles can absorb moisture, stain or even harbor mold if not sealed and resealed on a regular basis. Most people assume a one-time seal is good enough, but experts recommend resealing annually to keep grout in peak condition. Skip this step, and you may find yourself scrubbing grout lines more often than you’d like.

Comfort is another trade-off. Ceramic tile is notoriously hard underfoot, which is both a blessing and a curse. On the plus side, it doesn’t dent or warp easily. On the downside, if you’re standing at the sink or stove for an hour, you’ll probably feel it in your legs. And in the winter, ceramic tile can feel like stepping onto an ice cube. Area rugs and cushioned mats go a long way toward softening the experience, but you’ll want to think carefully about where in the house you place it.

it’s less forgiving to your belongings. Drop a plate or a wineglass, and odds are you’ll be sweeping up shards instead of setting it back in the cupboard. And while ceramic is tough, it’s not indestructible. A hard enough impact can crack a tile, and while replacing one or two tiles is doable, it’s still a hassle.

Another consideration is safety. The smooth surface of ceramic tile can become slippery when wet, especially in bathrooms and kitchens. Some homeowners solve this by choosing textured tiles that offer a little more grip, but texture also tends to trap dirt, which means more scrubbing.

Alternatives exist if ceramic tile doesn’t feel like the perfect match. Porcelain is denser, stronger and more water-resistant, though usually more expensive and harder to install. Natural stone provides a unique and luxurious look, though it comes at a higher price point and often requires more upkeep. Vinyl and laminate tiles mimic the look of ceramic or stone at a lower

warmth, though it demands more maintenance.

Cost-wise, ceramic tile is generally friendly to your budget. You can expect to pay around $2 to $10 per square foot for the tile itself, with installation running between $1,300 and $7,500 for a typical project. Highend or custom tile can climb higher, but most homeowners find that ceramic tile provides a sweet spot of value compared to stone or hardwood. It’s also more forgiving to the DIY crowd than porcelain or natural stone, although you’ll still need plenty of patience and the right tools if you decide to tackle it yourself.

At the end of the day, ceramic tile represents one of the most balanced flooring options available. If the trade-offs don’t bother you, ceramic tile can be a floor that looks great, performs reliably and potentially lasts longer than you’ll own your home.

Tweet your home care questions with #AskingAngi and we’ll try to answer them in a future column.

From Page 6

In the commercial horticultural world of shopping center gardens, containers get changed out and thus some Double Play Candy Corn were used as annuals.

The Garden Guy on the other hand sees them as forever plants. I wait until the first buds pop in the spring and cut back to around 8 inches. Then the carnival-like color of foliage follows with blooms in April and May. I love the rosepink blooms, but the foliage is on the amazing side.

The foliage begins in the early spring as if on fire. Leaves of orange, red and yellow prevail. Partner it with red azaleas and you’ll think you need eye protection as you gaze at the beauty.

Blue perennial salvias like Rockin Blue Suede Shoes, Rockin Playin’ The Blues and Unplugged So Blue all seem like the perfect complementary color scheme. Then there are the perennial ver-

From Page 5

their prime home-shopping years but face a high barrier to entry,” Kates says.

Intriguingly, income only has a minor impact on respondents’ beliefs that they have the same or greater opportunities than prior generations.

Education levels affect how Americans view homeownership.

Among those who never attended college, 13% say they have never owned and have no desire to. That falls to just 9% of Americans who attended some college, 5% of those with four-year degrees and

2% of Americans who attended graduate school.

“Our data shows that education influences homebuying aspirations and views on economic opportunity in surprising ways,” Kates says. “College-educated respondents were more likely to aspire to homeownership but also more likely to believe their generation has fewer opportunities than previous ones. Income level alone did not mirror this result, leading us to conclude that higher education raises lifestyle expectations regardless of income or financial outcomes.”

While the current housing market is discouraging, there are ways to cope with the challenges that can come with buying

a home. Consider these tactics:

•Understand that the market has changed in buyers’ favor: While frustration has been the rule in recent years, the balance of power has shifted. “Four or five years ago, you had to get an offer in within a day, or you missed your opportunity,” Clark says. “Now, buyers have the opportunity to slow down, see a variety of homes. If you’re in a market where there is excess inventory, buyers do generally have more leverage.”

•Look for down payment assistance: Every U.S. state offers some type of down payment assistance for first-time buyers. While the typical national package is worth $18,000, according to Down Payment Resource, some buyers get much more. In fact, some intrepid buyers are scoring down payment assistance packages

benas like Superbena Cobalt, Violet Ice and Large Lilac just screaming “try me!”

As you can tell we are excited about the combinations we have done with Double Play Candy Corn spirea in Georgia. And I haven’t even told you about the combinations with Supertunia petunias, Superbells calibrachoas, ColorBlaze coleus and Upscale Red Velvet Monarda.

My sister Susan showed us the October shady version in Texas. Maybe you’ll be the one to drape a shady wall or train to a trellis. I’m not going to say it can’t be done. Show me your Double Play Candy Corn spirea creations.

Norman Winter is a horticulturist, garden speaker and author of “Tough-asNails Flowers for the South” and “Captivating Combinations: Color and Style in the Garden.” Follow him on Facebook @Norman WinterTheGardenGuy. He receives complimentary plants to review from the companies he covers.

worth $100,000 or more.

•Make a smaller down payment: Yes, 20% is the gold standard for down payments, but it’s not required. Federal Housing Administration (FHA) loans let you put down 3.5%. Some conventional loans require just 3%. And eligible service members, veterans and their surviving spouses can put down nothing for Veterans Affairs (VA) loans. The fees are higher for VA and FHA loans compared to conventional mortgages, but they allow millions of buyers to become homeowners.

•Consider a fixer-upper: Formica counters? Outdated bathrooms? Ugly carpets? Homes in need of updates can still offer value if you’re willing to put in a little work. And if the fixes are cosmetic rather than structural, you can make repairs as your finances allow.

•Pull back your expectations and be open to compromise: Smaller homes are usually cheaper than larger homes. So are properties in less desirable neighborhoods. Most buyers compromise on something, and your first house is unlikely to be your dream home, so you might need to scale back some of your hopes in order to become a homeowner.

• Bankrate’s 2025 Aspiring Home Buyers Survey was conducted using an online interview administered to members of the YouGov Plc panel of individuals. Total sample size was 2,319 adults. Fieldwork was undertaken Aug. 13-15. The survey was carried out online. The figures have been weighted and are representative of all U.S. adults (aged 18+).

Three quarters of Americans (74%) are optimistic about their financial futures despite recent market volatil ity and uncertainty, according to new research.

Capturing the goals, challenges and feelings of North Americans regarding their finances, research for “The Pulse of North America” report was conducted by Edward Jones and Cerulli Associates during April’s increased market volatility. An encouraging 79% of respondents indicated they are on track to achieve or have already achieved a financially ful filled life.

“Sentiment from our own clients confirms this,” said David Gunn, principal, head of U.S. and Canada Business Units at Edward Jones. “In the half a million con versations our financial advisors have had with clients in the past five months, only a quarter of our clients highlight financial stress. This reflects the power of deep, personal, trusting relationships and holistic financial advice.”

Despite 49% of respondents indicating that inflation is a source of financial stress, Americans remain steadfast in the pursuit of financial fulfillment. They define fulfillment as having the freedom to pursue their passions (46%), make a better life for themselves and their families (42%), and have security and protection from unforeseen events (41%).

To become more financially fulfilled, Americans are most willing to change their discretionary spending habits (45%), pay off their debt (33%), and improve their financial literacy (28%). This flexibility will help them tackle potential obstacles, including rising living costs (59%), unex-

pected financial setbacks (35%), and insufficient income or savings (27%). Nearly two-thirds of respondents (63%) indicated they would need to earn a $150,000plus salary annually to achieve financial freedom.

When it comes to tracking financial progress, only 18% of Americans benchmark themselves against their own goals and plans rather than those of others, while 33% primarily compare

themselves to their peers, 22% to their significant others, and 19% to their colleagues.

Respondents indicated that they are tracking confidently against financial and other life goals, reporting that they are on par with or ahead of others when it comes to specific objectives, such as achieving financial stability (88%), travel goals (84%), financial literacy (83%), saving for retirement (80%), and achieving homeownership (78%).

“Even with heightened market volatility and economic uncertainty, American investors have stayed the course with their portfolios and long-term plans,”

added Gunn. “They are making meaningful progress by keeping the future in mind, while expressing willingness to pivot in real time with the help of a financial professional.”

While 57% of DIY investors have a financial plan, this number increases to 77% for Americans who regularly engage with a financial advisor. Those working with a financial advisor are doing so to manage

financial risk (28%), seek a second opinion on financial decisions (26%), or based on recommendations from family members or other professionals (25%). Americans who regularly work with a financial advisor are more likely to feel optimistic about their financial future than those who manage their finances on their own (79% vs 71% respectively).

For more research insights, visit www.edward jones.com/pulse.

Despite uncertainty, Americans are feeling confident about their finances, especially those who rely on professional advice.

$1,175,000

$1,695,000 1687