View The European Lifestyle Report and stay up to date with the latest property news, views, insights and properties via your device: knightfrank.com/europeanlifestyle

View The European Lifestyle Report and stay up to date with the latest property news, views, insights and properties via your device: knightfrank.com/europeanlifestyle

The global wealthy are on the move – and Europe is emerging as a key magnet

KATE EVERETT-ALLEN

Head of European Residential Research

The wealthy have always had options – but never have they exercised them with such urgency and volume.

WANT THE LATEST PROPERTY NEWS, VIEWS AND INSIGHTS?

Property newsletter

European Residential Update

Debate rages as to the exact numbers that are voting with their feet, but we know the global tally of high-net-worth individuals (HNWIs) making a move across borders will exceed six figures this year. What we’re witnessing is more than just a demographic shift. It’s a reflection of a fundamental reshaping of the global wealth landscape –driven by geopolitical friction, a recalibration of tax regimes and a new era of heightened mobility.

Why now? Push and pull in a changing world

The reasons for this shift are no longer limited to taxation. Today’s HNWIs are reacting to an intricate matrix of pressures and opportunities.

Push factors: Instability and uncertainty

• Political volatility in key markets such as the US, China, and parts of the Middle East is prompting many to seek more stable jurisdictions.

• Trade tensions, ongoing conflicts in Ukraine and Gaza, and the deepening divide between the US and China are creating uncertainty for investors.

• Domestic changes, such as the abolition of the UK’s non-dom regime, Switzerland’s proposed inheritance tax and Italy’s doubling of its flat tax fee are prompting the wealthy to reassess not just where they want to live, but how to balance lifestyle and family priorities with smart tax planning.

Pull factors: Opportunity, lifestyle, and security

• The remote work revolution and rise of digital infrastructure make relocation easier than ever.

• Golden Visa programmes, attractive private education options, and comparatively affordable luxury real estate in Europe are appealing to HNWIs.

• Europe’s ease of accessibility, excellent healthcare systems, and liveability index scores are increasingly persuasive for those prioritising lifestyle.

Europe: A safe harbour in a stormy sea

Against this backdrop, Europe is re-emerging as a prime destination for global wealth. A year ago, the mood was tentative. Now, sentiment has shifted sharply.

• Inflation has fallen significantly across much of the continent, boosting real household incomes.

• The European Central Bank (ECB) has implemented eight interest rate cuts to date, positioning the eurozone as a lower-debt-cost region versus other advanced economies, including the UK and the US.

• Consumer and investor confidence is rising. European equities delivered their strongest quarterly performance in Q1 2025, outperforming the S&P 500 by 18.4% in dollar terms, the widest margin in over 30 years.

Fiscal flexibility and geopolitical credibility

• The European Union (EU) is asserting a stronger geopolitical identity, aligning more closely on defence, technology, and green energy, while maintaining strategic distance from both US- and China-led blocks, positioning itself as a third, independent and stable alternative.

• Germany, historically fiscally conservative, is now signalling a more pro-growth fiscal stance.

Southern Europe leads the recovery

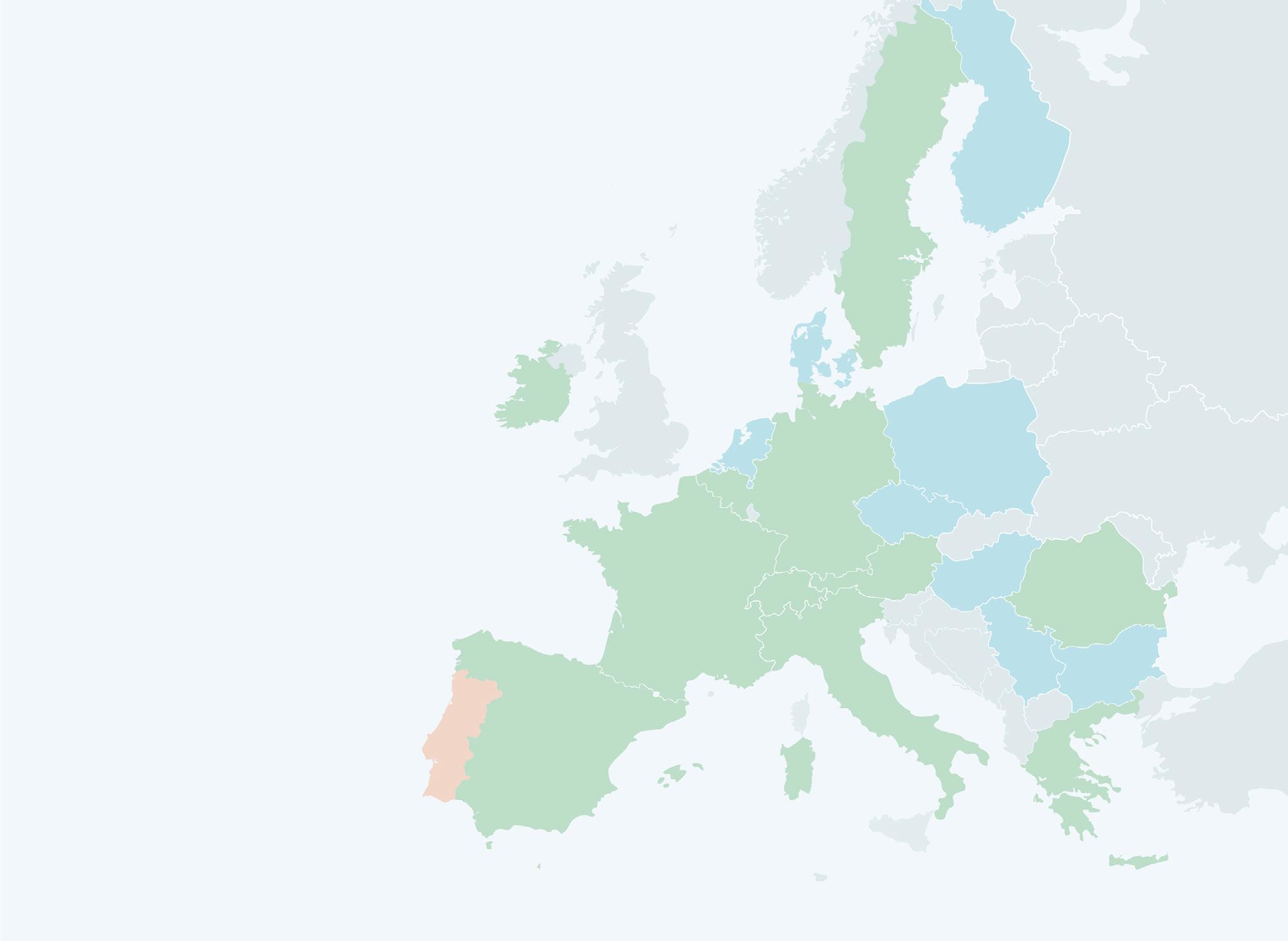

• Of the markets tracked Spain, Portugal, Greece and Ireland now lead the continent in GDP growth forecasts. Iberia also outperforms when it comes to price growth and transaction volumes.

New trends among mobile wealth

• Try-before-you-buy: Renting before purchasing is increasingly popular.

• Cities rebound: Urban centres like Madrid, Lisbon, and Milan are seeing renewed demand.

• Four-year horizons: Many buyers are opting for mid-life, mid-term relocations focused on education, investment, and lifestyle optimisation.

Climate and culture now top considerations

Today’s wealthy aren’t just looking for tax benefits they’re looking for resilience (see page 20):

• Climate risks, including floods and wildfires, are influencing purchasing decisions.

• Overtourism concerns are shaping regulatory responses. Cities such as Barcelona and Venice are clamping down on short-term rentals to protect local housing affordability.

• However, Europe’s cultural heritage, strong legal framework, stable political governance, and transparent, well-developed property markets continue to exert significant soft-power appeal.

Meet the Team

1. Wealth migration: Tax regime shakeups, rising geopolitical tensions, and changing visa landscapes are driving the global wealthy to migrate. Europe’s political stability, lifestyle, and strategic neutrality make it their top destination.

Urban revival: Madrid, Lisbon, and Milan are seeing renewed demand, while nearly half of relocators favouring cities for their anonymity, culture, and convenience.

Lifestyle mobility: Wealth migration is increasingly shaped by ‘try-before-you-buy’ renting and mid-life relocations for education and lifestyle, often on a four-year horizon.

Alexandra Britton-Davis, a Partner in the London office of Saffery specialising in international private wealth, breaks down what the UK's abolition of the non-domicile tax regime means for long-term residents and non-doms alike

BRITTON-DAVIS

What’s changing with the UK nondom regime – and why should UK residents and non-doms care?

The UK abolished the nondom regime in April 2025. Historically, a person’s domicile status determined whether their overseas income, gains, and assets were taxed in the UK.

From 2025, domicile will no longer be relevant. Instead, tax will be based on residency –specifically for inheritance tax (IHT) whether someone has been UK resident for 10 of the past 20 tax years.

This change impacts not just non-doms but also UK nationals considering retirement abroad, as it reshapes how UK IHT applies to foreign assets.

How does this affect UK residents who plan to retire abroad – say in Europe – in the next 5–10 years?

For UK nationals or long-term UK residents, this reform could actually bring tax advantages if they plan to retire overseas.

Once you’ve been non-resident for 10 tax years, your non-UK assets would fall outside the scope of UK IHT. So, if you move to France, Spain, or Portugal now, by 2035 your overseas property and investments could escape UK death duties altogether – as long as they’re held offshore. That’s a powerful incentive to plan early.

Does this mean the UK is now aligning more closely with other countries’ tax systems?

Yes, in some ways. Most countries base taxation on residency, not domicile, so the UK is catching up. The reforms provide more clarity and simplicity. Previously, some people – especially those with complex backgrounds – were unsure whether HMRC would treat them as UK-domiciled or not. Now, the test is simpler: if you’ve been out of the UK for 10 full tax years, your overseas estate is generally excluded from UK IHT.

Which European countries are most favourable from an inheritance tax perspective?

Several stand out. Portugal has no inheritance tax on transfers to close family members, and Italy has lower rates and significant exemptions on gifts to close family. Malta has no inheritance tax at all. Cyprus and Austria are also attractive, with no general estate tax. On the other hand, countries like France and Spain do have inheritance tax,, but their systems can still be beneficial depending on your family

“ This change impacts not just non-doms but also UK nationals considering retirement abroad, as it reshapes how UK inheritance tax applies to foreign assets.”

ALEXANDRA BRITTON-DAVIS

situation and planning. Italy, France and Switzerland also have estate tax treaties with the UK which can, in some circumstances, override the UK’s 10 year tail. However, you must also be aware of forced heirship rules in many European countries, which can override your UK will unless properly planned for.

What if I keep my UK property after moving abroad?

UK assets, such as property or UK business interests, will always remain within the scope of UK IHT – regardless of your residency.

So, if you keep a London flat and pass away 15 years after moving to Spain, that UK asset will still attract inheritance tax. However, downsizing in the UK and making the most of the nil rate band (currently £325,000 per person) can help mitigate the remaining tax exposure.

Are there risks around exit taxes or timing your move?

The UK doesn’t currently impose exit taxes for individuals, unlike some other countries.

But if you’re planning to dispose of UK investments before or after moving, timing is crucial. You could trigger capital gains tax if you're still UK-resident when you sell. Ideally, you’d take advice both in the UK and your

destination country before relocating, to manage any transitional risks.

Final thoughts – what’s your main advice for those considering moving abroad?

Don’t let the tax tail wag the dog. Choose a location that suits your lifestyle. But do plan early. The 10-year non-residency rule means if you start preparing now, you can significantly reduce your UK

IHT exposure by the time you retire.

And wherever you go, always consider local tax rules, succession laws, and ensure your wills are updated to reflect your cross-border assets.

“Don’t let the tax tail wag the dog.”

Conducted in July 2025, the Knight Frank European Relocation Survey collected responses from 704 HNWIs across 11 countries and territories, including the UK, US, Belgium, France, Germany, Italy, Ireland, the Netherlands, Portugal, Spain, and Switzerland. Together, these respondents represent more than 30 nationalities. Of the participants, 56% identified as male, with millennials forming the largest generational group (45%), followed by Gen X (29%).

Our survey gathers insights from over 700 HNWIs across Europe and beyond, offering a distinctive view of the motivations, preferences, and attitudes of the global wealthy toward Europe’s leading cities and lifestyle destinations Source: Knight Frank Research

Around 46% of respondents are considering either relocating to, or moving within, Europe. The leading motivations are business opportunities and financial stability, alongside tax incentives. Political, social and personal stability sits in third place followed by retirement lifestyle and healthcare quality. Last year, tax was a less influential driver, ranking third behind 1) security/ privacy and 2) employment. However, recent changes to tax regimes appear to have elevated its importance in the decision-making of high-net-worth individuals (HNWIs).

Some 63% of respondents work remotely, averaging 61% of their workweek spent working from home. US, UK, and Belgian respondents reported the highest levels of remote work. Additionally, Gen X has the largest share of remote workers compared to other age groups. This trend is making it easier for entrepreneurs, freelancers, creatives and tech specialists to relocate.

Half of respondents are considering applying for a European visa within five years, with the Golden Visa (29.7%) the most appealing option, especially for millennials, while Gen X prefers retirement visas.

Tax rules are influential for 59%, particularly among UK residents and millennials. Income tax and property tax rank as the most critical relocation considerations, followed by capital gains and wealth taxes. Income tax matters most across all groups, while wealth taxes weigh more heavily for respondents from the UK, US, and France.

UK residents find tax incentives the most influential when considering where to relocate to

Milennials are the generation most influenced by tax incentives

Income tax ranked highest across all groups, while UK, US, and French respondents rated wealth taxes more important than others

Cities are now the top choice for relocation, with coastal areas taking second place – reflecting a renewed interest in urban living that contrasts with the pandemic era’s preference for resorts and alpine retreats. Healthcare, international schools, and transport links remain the most important priorities for those considering a move. Among cities, Lisbon is most popular, just ahead of London and Madrid, while Chamonix leads non-city markets. Preferences vary across generations and nationalities, with younger people favouring London and Gen Z/Boomers preferring Lisbon.

What

Which of the following environments most appeal to you for relocation? Average ranking

US respondents prefer cities, the UK like coastal markets and Italians favour rural and alpine locations

is top for milennials and Gen Z, Lisbon ranks highest for Gen X and Baby Boomers

Tuscany ranks highest for Gen X and Baby Boomers, Chamonix is top for all remaining generations

Nearly half of respondents would most likely purchase a house or villa, making it the clear favourite residential property type as those relocating seek space for family living or entertaining as well as privacy and minimal disruption. Apartments and penthouses are the next most preferred, favoured by 31.5% of respondents, while country estates appeal to just over 10% of respondents.

What type of residence would you be most likely to purchase? (Select one) Top three property types

Source: Knight Frank Research

For those considering relocation to Europe, especially with business interests or family spread across multiple countries, year-round accessibility is essential. Seasonal reductions in flight routes –such as to the Balearics or Greek islands in winter – are no longer as limiting, but you can refer to our Databank on page 23 for a detailed overview of direct flights to each of the 20 European locations tracked in this year’s report.

While approximately 85% of Europe now has 5G coverage, availability can vary significantly between markets. Some 71% say digital connectivity would influence their location choice. However, one option for professionals trading stocks or currencies, fibre-optic connections are increasingly being installed to ensure fast and reliable connectivity.

71% of respondents said digital infrastructure e.g. the availability of superfast fibre broadband would influence their location decision

We have selected five of Europe’s top international schools, ideal for families seeking a fresh start, global mobility, and first-class education

With most private schools in the UK passing on the 20% VAT charge, Europe’s top international schools are seeing a surge in demand – particularly from mobile, high-net-worth families seeking a better lifestyle, tax efficiency, and world-class education. From alpine boarding in Gstaad to coastal campuses in Marbella, these institutions combine elite academics with exceptional facilities and strategic locations. Each is a relocation anchor – offering access to global universities, cultural capital, extensive alumni networks and strong returns on family life.

Highlights:

Equestrian centre, sailing fleet, alpine sports, concert hall, tech labs

INSTITUT LE ROSEY ROLLE & GSTAAD, SWITZERLAND

One of the world’s most prestigious boarding school, Le Rosey, offers bilingual French-English education with International Baccalauréat (IB) and French Baccalaureate options across two seasonal campuses: a lakeside estate in Rolle and a winter campus in the ski resort of Gstaad.

• Location: 30 mins from Geneva Airport; private lakeshore campus; Gstaad chalet campus

• Curriculum: IB / French Baccalauréat; 20+ languages offered

International schools are the second most important consideration for those relocating to Europe (see page 9)

Source: Relocation Survey FIND OUT

• Facilities: Equestrian centre, sailing fleet, alpine sports, concert hall, tech labs

• No. of students: 380 / No. of nationalities: 52

• Age range: 8-18

• Fees: Juniors from CHF 103,500. Cadets to Seniors from CHF 154,200.

• Ideal for: UHNW families seeking year-round prestige, discretion, and multilingual fluency.

Highlights:

Bilingual options and 98% IB pass rate; strong links with Spanish and UK universities

Aloha College provides a British international education and has an outstanding record of securing places for its students at leading universities in the UK, Spain, and across the globe.

• Location: Marbella’s desirable Nueva Andalucía district, just minutes from golf courses, beaches, and private clinics

• Curriculum: English National Curriculum, IGCSE, IB Diploma & A-Levels

• Facilities: New science labs, performing arts centre, sports fields, innovation hub

• Highlights: Bilingual options and 98% IB pass rate; strong links with Spanish and UK universities

• No. of students: 930 / No. of nationalities: 57

• Age range: 3-18

• Fees: c.€12,000–€20,000 per annum depending on year group

• Ideal for: Families seeking sun, lifestyle, and dual academic pathways in a stable EU location.

Highlights:

Outdoor learning emphasis, Thrive enrichment programme (MUN, coding, STEAM)

MOUGINS BRITISH INTERNATIONAL SCHOOL MOUGINS, FRANCE

Tucked between Cannes and Valbonne in Sophia Antipolis tech park, Mougins combines a green, secure campus with high-end facilities and a UK-based curriculum tailored for mobile, globally minded families.

• Location: 15 mins from Cannes; 30 mins from Nice Airport; near private estates & expat hubs

• Curriculum: UK National Curriculum, IGCSEs, IB Diploma

• Facilities: Science labs, performance theatre, library, gym, football pitch, woodland classrooms

• Highlights: Outdoor learning emphasis, Thrive enrichment programme (MUN, coding, STEAM)

• No. of students: 523 / No. of nationalities: 40

• Age range: 3-18

• Fees: c.€10,000–€25,000 per annum

• Ideal for: Families relocating to the Côte d’Azur seeking academic consistency and lifestyle access.

Highlights:

100+ nationalities; strong university placements (Oxbridge, Ivy League, Bocconi)

ST GEORGE’S BRITISH INTERNATIONAL SCHOOL ROME, ITALY

With a city-centre junior campus near the Vatican and a spacious senior school overlooking the Apennines, St George’s is Rome’s most prestigious international school, blending British rigour with Italian flair.

• Location: Central Rome (Junior); La Storta (Senior) with 14-acre green campus

• Curriculum: UK National Curriculum, IGCSEs, IB Diploma, US diploma

• Facilities: Pools, pitches, labs, theatres, art & music studios, 400-seat auditorium

• Highlights: 100+ nationalities; strong university placements (Oxbridge, Ivy League, Bocconi)

• No. of students: 1,000 / No. of nationalities: 100+

• Age range: 3-18

• Fees: c.€17,000–€26,000 per annum

• Ideal for: Diplomatic, mobile families who value city living with countryside space and top-tier education.

Highlights:

60+ nationalities; strong AP scores; US and international college acceptances

Located in the green suburb of Pozuelo de Alarcón, ASM delivers a US education with strong Advanced Placement (AP) results. Families enjoy the blend of American schooling with access to Madrid’s cultural and economic centre.

• Location: Pozuelo de Alarcón; 20 mins to city centre; secure residential area

• Curriculum: US Curriculum, AP, US High School Diploma

• Facilities: Innovation hub, sports complex, black box theatre, science & robotics labs

• Highlights: 60+ nationalities; strong AP scores; US and international college acceptances

• No. of students: 1,030 / No. of nationalities: 60+

• Age range: 3-18

• Fees: c.€11,500-€24,000 per annum

• Ideal for: American expats, globally mobile professionals, and families seeking top-tier bilingual education with a US pathway.

Two of Europe’s leading agents reveal where the smart money is moving, what’s really selling, and the deals you’ll never read about

From Alpine chalets to Riviera villas, Europe’s super-prime market (US$10 million+) operates in its own orbit – discreet, complex, and compelling.

The last five years have played out in three acts. First, the pandemic, when global elites scrambled for sanctuaries: space, seclusion, sea views. Next, the macroeconomic jolt: rising rates, currency swings, geopolitical uncertainty –prompting some buyers to hesitate. Now, the third act: sellers are more pragmatic, inventories are up, and prices in many markets remain below their peaks. For well-advised buyers, this is potentially a golden moment.

Two seasoned insiders – Alex Koch de Gooreynd and James Davies – share what’s driving today’s high-end deals from the Algarve to Zermatt.

MOBILITY, NECESSITY, DESIRE

Q: With geopolitical risk, currency volatility, and tax changes, how has the market shifted in the past year?

AKG Mobility is the defining change. Ultra-wealthy buyers can pivot overnight when fiscal policy shifts. Switzerland, Dubai, Monaco, Italy – all attract those seeking stability, security, and a friendlier tone from governments.

JD Two main drivers: necessity (relocating for tax or regulation, keeping Geneva, Zurich and Monaco busy) and desire (lifestyle-led purchases like French ski chalets or Portuguese golf retreats). Geneva’s Left Bank has enough supply for choice; in Monaco, turnkey stock is scarce, pushing many to rent first.

INSIDE DEALS YOU’LL NEVER HEAR ABOUT

Q: Most memorable deal of the past year?

AKG A lakefront Swiss estate owned by a premier client of one our private banking contacts: amazing renovation but a rare product and a high price so to

protect the reputation of the house we kept the house totally private. No photos, no publicity – just a quiet whisper between trusted hands.

JD A two-and-a-half-year search for a couple with no fixed location in mind. We toured everywhere from Mallorca to the Algarve, the Riviera to Ibiza – plus the US and Caribbean. They’re now securing a Balearic waterfront home. The process was as valuable as the purchase: constant touchpoints, travelling together, narrowing infinite options to one perfect fit.

Q: How do you source and sell discreetly?

AKG Trust comes first. We work in layers – private outreach via bankers, family offices, and advisors. Sometimes a single WhatsApp image opens a door, but behind it we have a full data room ready.

JD It’s about network depth and client profiling. In liquid markets like Lake Geneva or The Alps, exclusivity is prized. Elsewhere, it’s precision matchmaking – such as selling a CHF20 million+ Swiss apartment entirely off-market with encrypted PDFs, Non-Disclosure Agreements (NDAs), and curated introductions. Often, the seller is invisible online, but with the right connections – often via Knight Frank’s Private Office – we can make it happen.

Q: Name three most resilient European super-prime markets and one rising wildcard.

AKG

• Geneva’s Left Bank – liquidity, lifestyle, legacy.

• Verbier – increasing demand for primary residences amongst families.

• Quinta do Lago – maturing beyond its UK/Irish roots.

• Wildcard: Comporta – beautiful, hidden, ecoconscious, but five years from full prime.

JD • Monaco – unmatched fundamentals: limited supply, constant demand.

• Courchevel 1850 – winter stronghold.

• Paris – 16th Arr – deep-pocketed buyers chasing trophy homes.

• Wildcard: Mallorca – growing super-prime appeal with easy access and strong lifestyle offer.

Q: Are trophy purchases about status or strategy?

AKG Status is still there, but buyers also prioritise privacy, security, and a property’s unique cachet. Motivations are often strategic – hedging geopolitical risk, establishing a base for children’s schooling, or creating legacy assets with generational value.

JD Trophy buyers are less swayed by financing or market cycles; they’re driven by passion. They want the most extraordinary properties: perhaps a €50m+ Alpine chalet with world-class wellness, or an Italian lakefront estate with record-breaking frontage.

CURRENCY AS A CATALYST

Q: Has FX movement influenced buying?

AKG Yes. US buyers in the UK, factoring sterling’s weakness and prime price drops in central London, are effectively getting 20%-30% discounts versus pre-Brexit 2016. We’re also seeing more buyers deliberately seeking Swiss franc exposure to hedge risk.

JD Currency fluctuations can influence some of our clients. If there are suddenly big shifts they may choose to convert prior to even finding a specific property just to take advantage of the currency play. Prime central London is currently attracting growing interest from US and Swiss buyers given the currency fluctuations and London’s current market.

Q: How much is truly off-market today, and how has it changed?

AKG Around 60%-70% of deals start off-market, now via encrypted PDFs, NDA-only WhatsApps, and

trust-based referrals. Who sends the message to the client often matters as much as what is in it.

JD Around half of my instructions are off-market. NDAs are more common but can slow the process. Buyers still expect full visuals, not vague pin drops on Google Maps – the art is balancing discretion with enough detail to intrigue.

Q: Are clients renting before buying in super-prime Europe?

AKG They’d like to, but in many locations rental stock isn’t up to standard, and in Switzerland it can be tax-inefficient. The concept is appealing, but execution is tricky.

JD In Monaco, it’s standard. Around 80% of arrivals rent for one to three years to secure schools, test neighbourhoods, and wait for the right property –but competition for prime rentals is fierce.

Q: Most unexpected client request?

AKG One buyer wanted to spend CHF 20 million on a home solely for their art collection. Another is considering buying a Swiss hotel to recreate their childhood visits for their own kids. Super-prime is personal.

JD Requests range from measuring a car park's ceiling height in Monaco for a customised car (it didn’t fit) to tailoring entire searches to a pet’s fourhour private jet travel limit. True service means anticipating – and solving – problems no one else thinks to ask.

From sun-ripened vines to ancient olive groves, more high-net-worth buyers are swapping boardrooms for barrels, bottles, and lucrative side hustles. Here’s what you need to know to turn your dream into reality

TYPICAL YIELDS

From grove to glass

OLIVE OIL

MATURE TREE: 15–50 kg olives/year

OIL YIELD: 15–25% of fruit weight

PER HECTARE: 300–700 litres oil

TIME TO FIRST HARVEST: 5–7 years

ORGANIC: Lower yield, higher price

FRANCE

Bordeaux & Provence

• Grape varieties: Cabernet Sauvignon, Merlot, Syrah and Grenache

• Olives: Southern Provence offers boutique opportunities

• Climate: Atlantic influence in Bordeaux, Mediterranean in Provence

SWITZERLAND

Valais & Vaud

MATURE VINE: 2–10 kg grapes/year

PORTUGAL

Alentejo & Douro Valley

• Olives: Galega, Cobrançosa; sunny, dry conditions

• Grape varieties: Touriga Nacional, Aragonez; excellent value for newcomers

• Climate: Warm summers, mild winters; suited for mechanised and boutique production

GREECE Corfu

Imagine waking to golden sunlight streaming through a centuries-old grove or vineyard, pressing your own oil or wine from hand-picked fruit, and sharing it over dinner beneath a starry sky.

For many, it sounds like a romantic daydream. Yet for a growing share of high-net-worth buyers, it’s becoming a serious lifestyle – and business –choice. Our network, selling homes amongst other locations across Italy, France, Spain, Portugal, Switzerland and Greece, reports that around one in eight clients now enquire about properties with the potential for sideincome ventures like these.

Knight Frank’s new Head of International Vineyards, Alexander Hall, explains “This isn’t just about rustic charm. Done well, it’s a blend of passion, business and a tangible asset that appreciates over time.”

But before you commit, you’ll need to understand the markets, the climates, and the yields that can make or break your side hustle.

The global olive oil market is expanding steadily, fuelled by demand for healthy fats, transparent sourcing, and artisanal quality. Europe – led by Spain, Italy, Greece, Portugal and France – produces over 65% of the world’s olive oil. The market is split in two: bulk commodity oils face razor-thin margins, while premium extra virgin oils sell for €10–€30 per litre when tied to a strong provenance and direct-to-consumer model. Small producers who focus on organic farming, storytelling, and integrated experiences – tastings, workshops, agri-tourism – are thriving.

Europe’s vineyard sector is drawing investors who see wine not only as a luxury product but as a legacy asset. France, Italy, Spain, Portugal – and, perhaps surprisingly, Hungary – account for more than 60% of global production (Source: World Population Review).

The spectrum ranges from high-volume, low-margin estates to boutique wineries producing limited vintages at €30–€150 a bottle. Organic and terroir-driven labels, particularly with heritage or lifestyle branding, attract the strongest premiums.

Alexander adds “For those investing in a European wine estate it isn’t about chasing industrial margins. It’s about securing a tangible, income-producing asset with built-in lifestyle returns – a place where business meetings might take place over a barrel tasting, and “asset appreciation” includes the view from your terrace.”

WINE YIELD: 65–75% of grape weight

PER HECTARE: 5,000–12,000 litres wine

TIME TO FIRST HARVEST: 3–5 years

ORGANIC/BIODYNAMIC: Lower yield, higher prestige

EUROPE’S BEST LOCATIONS ITALY

Tuscany & Piedmont

• Olives: Frantoio, Leccino, Coratina; rolling hills, heritage groves

• Grape varieties: Sangiovese, Nebbiolo, Barbera; boutique-friendly estates

• Climate: Mediterranean warmth, mild winters Puglia

• Olives: High output, good value land

• Grape varieties:Negroamaro, Primitivo; larger estates possible WINE

• Olives: Not a major commercial crop due to alpine climate, but small experimental groves thrive in sheltered microclimates along Lake Geneva and Ticino

• Grape varieties: Pinot Noir, Chasselas, Gamay; steep terraced slopes produce high-quality, smalllot wines with premium pricing

• Climate: Alpine-moderate with warm summers, cool nights; lake influences extend the growing season and preserve acidity

SPAIN

Andalucía & The Balearics

• Olives: Picual, Arbequina, Hojiblanca; largest global production in Jaén

• Grape varieties: Tempranillo, Garnacha; Priorat offers boutique, steep vineyards

• Climate: Hot, dry summers; minimal rainfall

• Olives: Koroneiki, Kalamata; ideal for organic production

• Grape varieties: Assyrtiko, Agiorgitiko; rugged terrain suits small, lifestyle estates

• Climate: Mediterranean, low humidity, strong terroir influence

WHAT MAKES THE BEST OLIVE OIL & WINE?

Quality begins with land and climate:

• Soil – Well-draining, mineral-rich; slightly alkaline for olives

• Slope – Aids sun exposure and drainage

• Climate – Hot, dry summers; cool nights for acidity and flavour

• Microclimate – Wind, humidity, and water access shape complexity

Both olives and vines thrive under a degree of adversity – challenging conditions often produce the most characterful results.

PRACTICAL & FINANCIAL ESSENTIALS

• Subsidies/Tax incentives – The EU has incentives for organic/sustainable farming. Plus, in some countries such as France, there is no CGT on agricultural holdings, no transfer or wealth tax.

• Certification – Organic/biodynamic requires 2–3 years’ transition

• Regulations – Some regions restrict planting or require DOP/AOP registration

• Land costs vary – €5,000/ha in rural Andalucía; €100,000+/ha in prime Tuscany or Provence

• Local expertise – Engage agronomists, viticulturists, or estate consultants.

The latest policy announcements affecting wealth flows and property markets in Europe and beyond

Over the past 12 months, governments have issued a rapid succession of announcements addressing rising debt, housing affordability, overtourism, and climate concerns. Blink, and you could miss another set of changes. This space is set to become even more crowded, as we explore on page 21. Expect stricter citizenship requirements, potential new wealth taxes from left-leaning administrations, fewer Golden Visa options, and, most notably, tighter regulations on holiday lets and Airbnb properties, explored in detail on the opposite page.

Ended Golden Visa programme in 2025; proposed (unlikely) 100% tax on non-EU buyers. New rent controls, stricter short-term rental rules, and a housing law capping rents to improve affordability.

UK

Scrapped non-dom tax status in April 2025; new IHT and foreign income rules and fouryear residence-based framework. The Labour Government is rumoured to be considering revisions to stamp duty, council tax, and capital gains tax as part of measures to address its tight fiscal headroom.

SWEDEN

State income tax threshold raised to SEK 625,700; aviation tax abolished, boosting take-home income and lowering travel costs.

From 1 January 2025, exit tax extends to shares in investment funds and special investment funds held privately.

Considering changes to its Golden Visa programme to attract foreign investment. Backlog of 45,000 applications. Proposal to extend citizenship qualifying period from 5 to 10 years.

FRANCE

Parliament approved 2% wealth tax on assets over €100m; Senate approval unlikely. Alternative 0.5% “differential minimum tax” being prepared. From 1 April 2025, a 0.5% increase to Stamp Duty for all buyers and property types across all French Departments.

ITALY

Flat-tax for HNWIs doubled to €200,000; inheritance and trust rules clarified; nonresidents gain capital gains step-up. Ancestry-based citizenship tightened.

SWITZERLAND

Geneva cut personal taxes 5–11% from January 2025; Vaud eased inheritance taxes; lump-sum regime continues. Proposed 50% inheritance tax on estates above CHF 50m faces national vote.

GREECE

Family Office regime expands to include foreign tax residents; family members can join non-dom regime anytime for €20,000 each.

Proposed “Gold Card” Visa would grant permanent residency to foreign nationals investing US$5 million. As of June 2025 over 68,700 individuals were reported to have joined the waiting list. Foreign buyer ban extended to

This landscape is evolving rapidly. While the rules may not directly affect those planning to relocate permanently, they offer prospective residents insight into the city’s trajectory and the authorities’ willingness to intervene to preserve its authenticity

LONDON

Properties can be rented for 90 days per year without planning permission. Exceeding 90 nights requires planning permission. The property must be registered with the local council and higher rates of council tax apply.

MADRID

LISBON

Hosts must register properties under Alojamento Local and follow zone restrictions. New city centre Airbnb licenses are restricted. Existing licenses are valid until 2030, pending municipal evaluation.

Hosts must register the property with the Mairie for “meublé de tourisme” status. Main residences are limited to 120 days per year, secondary residences can be let year-round with town hall declaration. Rules can vary from town to town with caps on the number of Airbnbs permitted in some smaller villages.

Source: Knight

Properties used for short-term tourist rentals must be registered with Madrid’s City Council and obtain a tourism license number.

From 3 April 2025, new rentals need 60% approval from the property owners of the building; existing ones are exempt. Madrid has paused new licenses until 2026.

PARIS

Primary residences in Paris can be rented for up to 90 days per year. This limit does not apply to individual rooms or secondary homes, but additional approvals are needed to convert them to “meublé de tourisme.” All rentals must be registered with City Hall.

BARCELONA

Starting in 2029, homes cannot be rented as tourist accommodation as the City Council halted the issuing and renewal of licenses. Renting private rooms within homes has been prohibited since 2020.

Political neutrality, no income tax, and lifestyle appeal make it a top refuge for ex-non-doms and EU-focused UHNWIs.

Consistent tax policy, security, and its forfait fiscal regime continue to attract wealthy families, especially from Northern Europe.

Despite the 2025 flat tax hike, Italy’s lifestyle offer and relative flexibility keep it attractive, particularly for those seeking EU residency.

Portugal’s remodelled NHR tax regime, quality lifestyle, and affordability continue to attract investors despite real estate’s removal from the golden visa. Growing tech hubs in Lisbon and Porto, alongside Brazilian, Turkish, and North American interest, boost its appeal.

Spain remains attractive due to its lifestyle, connectivity, and strong expat hubs in Madrid, Barcelona, and along the Mediterranean coast. Some regions, including Madrid, Andalucia and the Balearics have a 100% wealth tax exemption.

Climate shifts, new rules, and lifestyle trends are reshaping Europe’s luxury property market – here’s what the discerning buyer needs to know

With more than 25 years spent helping clients find their perfect homes in Europe’s most coveted destinations – and now heading up a network of 38 offices across the continent – Mark Harvey has seen market fashions come and go and knows exactly which shifts have staying power.

Kate Everett-Allen sat down with Mark to get his take on the key themes shaping Europe’s prime property markets.

Mark, what’s top of mind for buyers right now?

Right now, the European prime market feels like it’s at a turning point. Buyers aren’t just chasing a postcard view or a famous postcode – they’re weighing climate realities, new regulations, lifestyle priorities, and how easy it is to move around the globe. Prestige still matters, but it’s no longer the only currency.

How is climate change influencing buyer decisions?

A few years ago, conversations with buyers mainly focused on amenities like golf courses and restaurants, as well as purchase costs and location. Today, I’m just as likely to be asked about solar panels, passive cooling, water security – even whether an insurer will still cover the area a decade from now. On top of that, authorities are increasingly restricting which properties can be rented based on energy efficiency.

This is already the case in France, where homes with poor energy ratings simply cannot be let.

That shift is influencing what and where people buy. We’re seeing demand along Portugal’s Atlantic coast in places like Comporta, as well as in the greener corners of southwest France, Alpine retreats, and the northern Italian lakes.

In some southern European markets some buyers are going higher or inland to avoid the worst of summer heat. And increasingly, wellness and sustainability go hand in hand –buyers want properties that nurture their health as much as their finances. What impact will overtourism and the resulting regulations have on Europe’s prime property markets?

Overtourism isn’t just a buzzword – it’s reshaping city policies. From Barcelona’s planned ban on new short-term rentals by 2028 to caps in Balearic towns, and ongoing

debates in Amsterdam, Venice, and Lisbon, city authorities are taking action to protect liveability and preserve housing for residents. As holiday lets dominate city centres, investments in local infrastructure – such as hospitals and roads – are quickly becoming redundant, with residents moving to the suburbs and commuting instead.

For relocators, the clampdown on holiday lets can be a net positive. While they may curb speculative short-term rental returns, they help maintain the integrity of the local social fabric, ensuring vibrant year-round communities instead of hollowed-out tourist enclaves. For HNWIs seeking integration, cultural authenticity, and long-term capital stability, regulated markets will prove more attractive over time. Authorities have an important role to play in addressing this issue and finding ways to support a stable housing market. A common misconception is that Airbnb properties are mostly owned by foreigners, when in fact domestic ownership – both private and institutional – dominates. The real challenge lies in developing a balanced, long-term approach that improves affordability while still supporting tourism and encouraging responsible investment.

Are you noticing any shifts in how long people are willing to relocate?

We’re seeing more families planning a four- to five-year stint abroad – long enough to settle in, explore schools, and test the lifestyle, yet short enough to remain flexible.

Our Relocation Survey (page 6) confirms this trend. Among the 40% of respondents planning a temporary move to Europe, 48%

said they would relocate for four years or less.

In some markets, there’s also a tax advantage. Staying under four years can limit your liability to local-sourced income and, in certain countries, make you eligible for expat-friendly tax regimes.

The most successful moves I’ve seen are those where people plan for change from the outset: arranging visas and tax strategies, choosing a home that will resell easily, and creating a school plan that works whether you decide to stay longer –or leave sooner.

Looking ahead, what key themes will shape the market by 2030?

The way I see it, four big shifts are coming.

First, integrated wellness amenities will become the norm – think private spas, ice baths, and spaces designed for health as much as beauty.

Second, buyers will prioritise security – personal, political, and financial – more than ever.

Third, authenticity will win. A Provençal farmhouse with olive groves or a Mallorcan cortijo with shaded courtyards will always resonate more than a generic luxury build.

Finally, we’re already seeing the start of an urban revival. Twenty years ago, the dream was a country estate, but the appeal has diminished – too much responsibility, too many headaches. Younger generations of wealth increasingly value the ease of city living: anonymity, culture, and convenience. In 5–10 years, we’ll likely see secondary cities like Bordeaux, Malaga, Porto, Florence, and Lausanne rise in prominence – not alpha cities, but beta hubs with strong longterm potential.

Our experts reveal the top three prime international buyers in key European markets, highlighting who’s been driving demand over the past year

Unsurprisingly for the Knight Frank network, UK buyers continue to dominate across our European network. US and Chinese purchasers also remain prominent, while Germany, France, Switzerland, and the Scandinavian countries consistently emerge as key international buyer groups in the prime segment.