When someone says the word “Investment”, what comes to mind? Do you immediately think in terms of money and adjusting your financial holdings? How about the investment you have in your home or business? The truth of the matter is an investment is anything we devote resources to with the expectation of a valuable or worthwhile return. As parents, we all invest continually in the well-being and thriving of our children and then, hopefully again in our grandchildren. When we devote the time, energy, and expense associated with taking a class or continuing education for credentialing, we are investing in ourselves to better serve our clients, students, community, etc. Regardless, investment, in one form or another, illustrates our commitment to the improvement of something or someone and that is essential to contributing to any community. In short, we’re all better off when someone makes the investment in people, in property, in education for the learning of truth, in their business, in the community, and in our country. Our military is made up of individuals who have and are continuing to invest in learning a skill or set of skills to the service of their fellow soldier and their nation with some paying the ultimate price for doing so.

At Snohomish City Lifestyle, our most recent investment is in the hiring of our new editor, Kelly Bone. We have been blessed by one of our valued partners, VanderBekenRemodel, whose owners introduced us to Kelly where we learned of her and her family’s long history in Snohomish. Join us in welcoming Kelly to the team and look forward to hearing from her often in these pages. She is an educated professional with a gift for relationships and communication. We know you will be blessed by her infectious smile and thoughtful insights if you get the opportunity to sit with her for any length of time or read her regular contributions to this publication.

Finally, won’t you join us by continuing to invest? Hire that young person, bring on an intern, pay for someone to take a class that will help improve their skills, visit the Senior Center and learn something new, buy that property, remodel that house, or start a business. Continue to invest because each time you devote resources to a worthwhile outcome, our community just gets better and who knows, someone may be inspired by what they see you do.

PUBLISHER

Shannon Coy | shannon.coy@citylifestyle.com

EDITORIAL COORDINATOR

Teresa Coy | teresa.coy@citylifestyle.com

ACCOUNT MANAGER

Bradon Coy | bradon.coy@citylifestyle.com

CONTRIBUTING WRITERS

Michelle W. Parnell, Courtney Evans, Rebecca Porter

CONTRIBUTING PHOTOGRAPHER

Dawning Memories

CHIEF OPERATING OFFICER

Schowengerdt

Perry EXECUTIVE DIRECTOR OF HR

Thompson

OF FIRST IMPRESSIONS Jennifer Robinson

TECHNICAL DIRECTOR

AD DESIGNER Matthew Endersbe

1: Bill Webster MCs the GroundFrog Day Festivities looking forward to KlaHaYa Days this Summer 2: GroundFrog Day Festivities 3: Mrs. Tacoma, Sarah Eno with friend Beth Graef of Travelmation 4: Grab your friends and make memories at the Plant Bar experience 5: The Petal and The Stem opens their Plant Bar 6: Business Ladies of Society hosts “Galentine’s” Day Celebration 7: February Engage Snohomish gathering sponsored by the Snohomish Chamber of Commerce

1: Bill Webster MCs the GroundFrog Day Festivities looking forward to KlaHaYa Days this Summer 2: GroundFrog Day Festivities 3: Mrs. Tacoma, Sarah Eno with friend Beth Graef of Travelmation 4: Grab your friends and make memories at the Plant Bar experience 5: The Petal and The Stem opens their Plant Bar 6: Business Ladies of Society hosts “Galentine’s” Day Celebration 7: February Engage Snohomish gathering sponsored by the Snohomish Chamber of Commerce

Energy Exteriors NW celebrates a decade of excellence in enhancing homes with top-quality windows, doors, and siding solutions. Throughout the past 10 years, we’ve upheld a commitment to superior craftsmanship, energy efficiency, and customer satisfaction. Our journey has been defined by innovation, reliability, and a passion for transforming our customers’ homes from the exterior. We’re grateful for the trust of our customers and the dedication of our team. Here’s to another decade!

April 27th to April 30th Snohomish Board & Brush will be closed as they move the studio from 2707 Bickford Ave to Historic Downtown Snohomish 119 Glen Ave. Look forward to joining them at their Grand Re-Opening on May 2nd, visit www. boardandbrush.com to register for the afternoon of celebration.

Snohomish High School’s Band and Choir are preparing to visit and perform at Disneyland in April. They have been fundraising for their trip and so far have raised over $22,000.00. If attending an athletics event, look for the concession booth where people are wearing red Snohomish High School band T-Shirt to support the band.

To donate to the choir, visit the Snohomish High School Choir webpage at www.shschoir.club.

Photography by Doug Ramsay

Photography by Doug Ramsay

For many homeowners, the garage serves as extra storage, even an afterthought when, in actuality, it is one of the first spaces of the home that families enter at the beginning and

Grimsley stresses that garage remodels are not about having the fanciest garage in the neighborhood, it is about providing peace of mind that the garage is a clean, safe space to use

“A GARAGE CAN BE SO MUCH MORE THAN JUST A STORAGE PLACE.”

end of each day. The garage entrance also often serves as the main point of entry to a home for visiting family and friends. With that in mind, remodeling a garage is more than just an investment that adds monetary value to a home. It is an investment in peace of mind, the safety of family and friends as they use the space, and in the future projects and memories that will be created there.

“We all have garages and know that feeling of walking into a cluttered, dirty space that you don't want to be in, and where you don't want to look for anything. Sometimes garage floors are unsafe, and things are being stored in ways that are potentially hazardous,” said Bryan Grimsley, owner of Omega Garage Solutions. “A garage can be so much more than just a storage place, and we focus specifically on garage upgrades and extending the living space of a home into the garage.”

in whatever way a family wants to use it, whether that is to store possessions, park vehicles, or serve as a game room or home gym.

“When we work in a garage, I like to start in the home by getting a feel for the person’s style and needs. I want to understand how they intend to use the garage and how to create the most value for them,” he explained. “Once I have a good understanding of what it is they're looking for, I'll put together a 3D design using our software. Before I leave, they're able to see not only the design in their actual space, but they have the pricing as well.”

According to Grimsley, about half of the projects involve reorganizing the garage and providing storage solutions that not only look nice but allow for easy access to stored items. “For organizing garages, we use custom-designed cabinets, overhead storage systems, and slat walls, which is a great

way to organize things for a great value,” he explained.

Other customers prefer the remodeling to be concrete coating specific. “We go in and take a nasty, dirty, and potentially unsafe garage floor and turn it into a floor that you can feel safe using,” he added. “The coating also allows for quick and easy clean up when spills occur while preventing staining.”

Grimsley loves witnessing the quick transformation of spaces going from unorganized and messy to an organized, functional, and aesthetically pleasing space. He finds fulfillment in watching the joy experienced by homeowners when they see the remodeled space.

“Most of our jobs take anywhere from one day to three days, so there is a level of instant gratification that a homeowner sees in that change,” he shared. “To see the transformation happen so quickly and be able to get instant feedback by seeing how happy the entire family is when their garage is transformed overnight is a pretty fun thing to watch.”

“IT IS AN INVESTMENT IN PEACE OF MIND.”

For Grimsley, one of the best parts of being a family-owned, local business is serving the community. “Snohomish is our home,” he shared. “My kids go to school here, we do business locally, and we want to create valuable experiences and spaces for our neighbors.”

To see examples of completed projects, products available, and schedule a consultation using the contact form, visit garagebyomega.com. Inquiries can also be made by calling or texting 425224-6155. Follow Omega Garage Solutions on Facebook and Instagram for stunning before and after photos, videos of work in progress, and customer reviews.

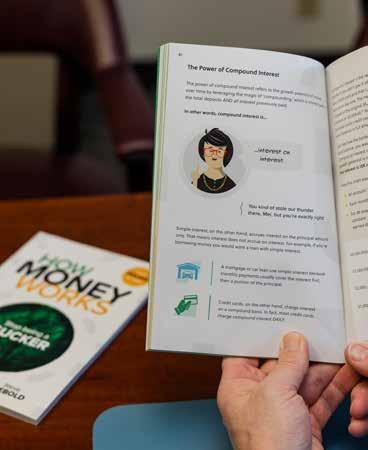

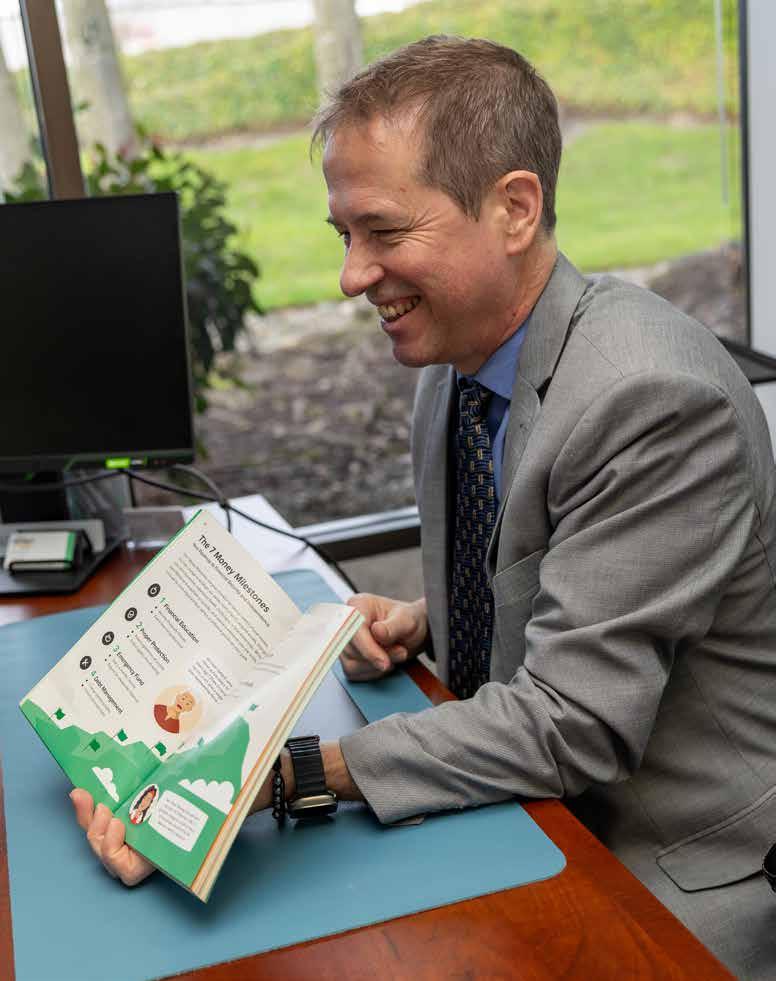

Bengt Johnson’s passion for financial literacy began as a young man growing up in Annapolis, Maryland. The son of a Naval Academy professor, he learned early in life about making and managing money through books.

“I remember getting a book called Good Cents: Every Kid's Guide to Making Money,” shared Johnson. “It was written for kids and had about 100 different ideas about how to make money. So, I started my own business painting house numbers on the curb. Then, after reading Tom Sawyer and his story of getting all the neighbor kids to paint the fence for him, I got my brother and friends and we started painting together and splitting the money. The next thing I knew, I had my own little business going.”

After years of working in education, Johnson merged his passion for teaching and financial literacy into his role as financial educator with Wealth Wave. “This company is really focused on education first, and being a former teacher, I love the teaching part,” he said. “I also enjoy that a-ha moment for people… seeing the light bulb go on and the excitement of learning something that they can put to use to help themselves and their family.”

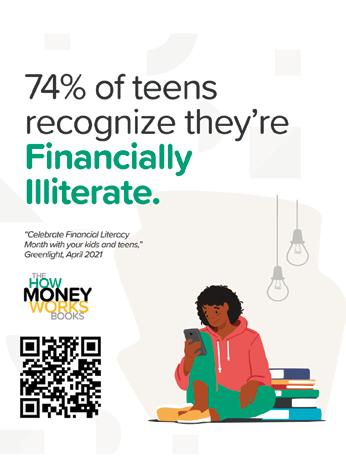

A large part of financial literacy is providing people with the resources to succeed. “As a nationwide firm, we want to educate 20 million families to be financially literate and I want to be a big part of that,” he explained. “This means not only reading about money and how it works, but taking action based on that knowledge. Taking action often means a lifestyle change, which takes time, but is worth it in the long term.”

ARTICLE BY MICHELLE W. PARNELL | PHOTOGRAPHY BY DAWNING MEMORIESThe resources are full of inspiring examples from people like John D. Rockefeller, whose story is told in the How Money Works book series. “As a teenager, Rockefeller started working and saved up $50. His parents advised him that there was a farmer down the road and he could loan the farmer money to buy seed and supplies,” shared Johnson. “At the end of the year, the farmer paid him back the $50 plus $3.50 in interest. At that time, Rockefeller had just spent three days working in the fields digging potatoes and for his own labor, he got paid $1.12. This was the a-ha moment for Rockefeller. Three days of hard work earned $1.12 and on the other hand, he put some money to work and it earned $3.50. This same idea is open to any of us. You can put money to work through assets that are going to grow and pay you.”

In addition to providing resources for financial literacy, Johnson’s goal is to get to know each client’s situation and work with them to achieve their financial goals and dreams. “I want to do everything in the best interest of that person in front of me, so I want to get to know them first,” he explained. “The next step is helping people see where they are financially by being aware of what they have coming in, which are assets, and what is going out, liabilities.”

Once all the information is collected, Johnson sets up a personal financial website as a resource for clients to track the different aspects of their financial situation. “Now, they can see everything in one place - all their different accounts, investments, property, and goals, including their timeline for when they want to retire,” he said. “This helps us create a customized and comprehensive plan that is not just wealth management, but also protecting them and their assets through proper insurance.”

“I also enjoy that a-ha moment… seeing the light bulb go on and the excitement of learning something that they can put to use to help themselves and their family.”

Bengt often hears that people wish they had these resources earlier in life. “It’s never too late to start for yourself,” he encouraged, “but it’s also nice to give your children the gift of financial education while they’re young, when you wish you’d had it yourself.”

Johnson often hears that people wish they had these resources earlier in life. “It's never too late to start for yourself,” he encouraged, “but it's also nice to give your children the gift of financial education while they’re young, when you wish you’d had it for yourself.”

To begin your journey to financial literacy and request resources such as the books Change Your Literacy, Change Your Life and How Money Works, visit wealthwave.com/bengtjohnson. For additional information, email bengt.johnson@wealthwave.com or call (425) 366-7524. Wealth Wave is located at 13010 NE 20th Street Suite 100 in Bellevue.

Q: What is a Home Equity Conversion Mortgage (HECM)?

A: A HECM loan allows homeowners who are 62 years of age or older to borrow money by tapping into the equity that exists in their home.

Q: Are there restrictions that dictate how a HECM borrower can use their loan proceeds?

A: The proceeds are not only non-taxable but can be used for any purpose, such as supplemental retirement income, funding home modifications to better age in place, delay social security benefits, pay off debt, or act as an emergency fund.

Q: It seems that only people who are struggling financially take out a HECM, is that true?

A: It is not a last resort. More and more HECM’s are being utilized to diversify investment strategies and can help seniors enhance their quality of life in retirement.

Local Expert, Rebecca Porter with One Trust Home Loans, answers our questions about Home Equity Conversion Mortgage (HECM). Rebecca calls Snohomish “home” and has a passion for educating seniors and their families as they begin to navigate their golden years.

Q: If you chose a HECM loan, does the bank then own the home?

A: No, you retain ownership of your home and will not relinquish the title. Instead, you are borrowing against the home.

Q: When a borrower takes out a HECM, will they lose their Social Security and Medicare benefits?

A: No, Social Security and Medicare benefits are generally unaffected by a HECM. Medicaid, a need-based program can be, so work with a qualified financial adviser to determine how much you can take from HECM funds each month to remain within the Medicaid limits.

Q: Can children or heirs keep the home with a HECM Loan?

A: Just like a regular mortgage, they can keep the home by acquiring their own financing to pay off the outstanding mortgage upon their family member’s death. Unlike a traditional mortgage, a HECM is a non-recourse loan, meaning that you or your heirs will never owe more than the value of the home.

Q: How much are the monthly payments?

A: A HECM loan has a deferred repayment, making monthly payments optional. The loan only becomes due and payable when you pass, sell your home, move or you can no longer meet the loan terms (including payment of property taxes, insurance, or property upkeep).

The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges including property taxes, fees, hazard insurance. The borrower must maintain the home. If the homeowner does not meet the loan obligations, then the loan will need to be repaid. This is not tax advice. Consult a tax professional. These materials are not from HUD or FHA and were not approved by HUD or a government agency. This is an Advertisement. All products are not available in all states. All options are not available on all programs. All programs are subject to borrower and property qualifications. Rates, terms and conditions are subject to change without notice. For more information on Reverse Mortgages, visit: https://onetrusthomeloans.com/reverse-mortgage-disclosures/. CalCon Mutual Mortgage LLC, dba OneTrust Home Loans is an Equal Housing Lender NMLS #46375; 3838 Camino Del Rio North Suite 305, San Diego CA 92108. Corporate phone (888)488-3807. Licensed by the Department of Financial Protection and Innovation under California Residential Mortgage Lending Act, Branch License #4131248. For more licensing information visit: https:/ontrusthomeloans.com/licensing-information/.

4

“While owning a business may not be for everyone, perhaps it could be for you.

Embarking on a small business can be an exhilarating and potentially rewarding endeavor. Ensuring the stability of your business hinges on making intelligent financial decisions upfront, preventing potential challenges and steering clear of unforeseen debt. When discussing investments and finances, opening a business may not immediately come to mind. However, could it be a smart financial investment?

1. You are entering the business world for the potential of substantial financial gains. Unlike traditional employment where one awaits a pay raise, in business, individuals can give themselves pay increases based on profits.

2. The asset value of businesses. Business enterprises are not only valuable assets themselves but can also be measured in terms of money. This enables business owners to use the business as collateral for loans or sell it if financial assistance was ever required.

3. The advantage of self-employment tax for entrepreneurs. The government provides waivers to encourage more people to enter business, and the Section 199A deduction allows qualifying business owners to deduct 20% of the business profits from their taxes. This is one example of many tax benefits that business owners could claim.

4. Be your own boss, set flexible deadlines, and shape your enterprise according to your vision. Building something from scratch provides a fulfilling sense of accomplishment. It may also leave a legacy behind leading to generational wealth.

Great business professionals generally do not settle for one venture. They are always looking for the next hill to climb once the first enterprise becomes successful. Consider joining the vibrant and supportive business community of Snohomish and experience a life well lived with fellow entrepreneurs from all over the valley to support your dream. We are here for you!

APRIL 2024

APRIL 5TH

1211 4th Street, Snohomish | 6:30 PM

Thumbnail Theater has been hosting an All-Ages and Family-Friendly Mic since 2006 - one of the longest continuously operating community Open Mics in Snohomish County. Known for a casual, warm, welcoming experience where people of all ages can perform on stage. For more information visit www.thumbnailtheater.org and join us for a fun evening supporting our local talent.

APRIL 6TH

Snohomish Senior Center | 8:30 AM

Breakfast is served from 8:30-10:30 at the Snohomish Senior Center located at 506 4th Street. Pancakes or French Toast, Scrambled Eggs, Sausage Links, Biscuits and Gravy, Coffee or Tea, Juice. $7.00 suggested donation but all are welcome.

APRIL 13TH

Spring Bazaar

Snohomish Senior Center | 9:00 PM-3:00 PM

Every spring the Senior Center invites you to join them as they welcome a variety of local crafters as they showcase their unique goods. It's a great place to find special gifts for loved ones or yourself! If you have questions, please contact carolstultz@frontier.com.

APRIL 20TH

Flower World, 9322 196th St SE, Maltby | 10:00 AM

Love to garden but have limited space? Join the experts at Flower World as they discuss how simple it is to get big beauty in small spaces. Clinic is free and RSVP is not needed to attend.

APRIL 26TH-28TH

The Evergreen State Fairgrounds

As spring blossoms, so does the opportunity for homeowners to rejuvenate their living spaces at the 2024 Washington State Evergreen Spring Home Show. Adults: $8, Seniors: $6. While there, be sure to visit the Energy Exteriors NW booth and let them know you were invited by Snohomish City Lifestyle.

APRIL 28TH

Dairyland, 12125 Treosti Rd. Snohomish | 4:30 PM

Saddle up and put your boots on! Empowering Strides invites you to their third annual fundraiser and auction. Join them for a western-themed night of dinner, drinks, dancing and a silent auction. For tickets and more information visit www.empoweringstride .com/hooves-n-boots.

A date night at home is the perfect occasion to shower your loved ones with affection and appreciation. While storebought gifts and cards have their charm, there’s something incredibly special about receiving a handmade gesture. By opting for a handmade date night, you’re not just expressing love but also showcasing your thoughtfulness and effort. These handmade creations convey a personal touch that can’t be replicated.

Make it feel like an extra special at-home date night with thoughtful touches from the heart—and hands.

Yield: 1 pound

2 cups all-purpose flour, plus more for dusting 4 large eggs

1. Mound the flour in the center of a work surface with a well in the middle. Crack the eggs into the well and beat with a fork until smooth, then work flour into eggs with the fork. Use a bench scraper to work in the rest of the flour a little at a time. When the flour is incorporated, form the dough with your hands into a rounded mass for kneading. Lightly dust your workspace with flour and knead dough about 10 minutes, until smooth and elastic. Cover dough with a bowl or plastic wrap and rest 1 1/2 hours, or chill overnight.

2. To roll by hand, flour a clean work surface. Vigorously roll dough to a very thin circle and roll constantly with even pressure as it stretches for several minutes until as thin as possible, almost translucent.

3. To cut by hand, lightly fold sheets one at a time into thirds and cut to desired thickness. Recipe from MarthaStewart.com .

16 ounces Bokek Dead Sea Salt 20 drops lavender essential oil

In a mixing bowl, add drops of the essential oil to the bath salt and mix well; store in a glass jar. Add 1/3 to 1/2 cup of the scented salts to a bath for a relaxing experience. SeaSalt.com

1/2 cup heavy cream

8 ounces bittersweet chocolate, chopped 1 teaspoon pure vanilla extract 1 cup cocoa powder, for dusting what

1. Bring the cream to just a simmer in a saucepan over low heat. Pour the cream over the chocolate in a bowl and let stand about 10 minutes to melt the chocolate. Add the vanilla, stir until smooth and set aside to cool for 1 hour at room temperature.

2. Beat chocolate at medium speed until thick and light-colored. Spread over the bottom of a baking dish, smooth and refrigerate 2 hours until firm.

3. Pour cocoa powder onto a deep plate or shallow bowl, and using a melon baller or small ice cream scoop, scoop out balls of chocolate. Roll in cocoa powder until coated and transfer to a parchment-lined baking sheet. Recipe from FoodNetwork.com