INVESTING IN New Braunfels

My connections with my Empower Family are unlike most businesses. We all care very much about each other. We are like one big Empower Community.

I love Lynn! Her regenerative medicine brought years back!! And such a natural look! She is dedicated to making sure it is always perfect and cares about making you comfortable and with little to no pain! I have found my home! Her heart is as beautiful as she is! Love love love Lynn!!”

The one who is truly scientifically proven to improve deep wrinkles, fine lines and texture.

“Lynn is the best! I mean the best! I’ve been several places and they don’t have nothing on Lynn!! Been going to her for a couple years now. I’ll follow her anywhere. She is also a great person with an amazing soul!!”

Let’s

This month only

The Empower Tribe is all about Helping you feel good about yourself and appreciating your true beauty. We are your premier source for top-of-the-line med spa services and products in your quest for great-looking skin and facial features. Whether you’re looking for assistance with hair growth, collagen growth while replacing much needed volume loss through regenerative medicine, or achieving silky, smooth skin, contact our medical spa in New Braunfels, TX.

Lynn Hollis Owner/Aesthetics Nurse

As April ushers in a new season, we're delighted to unveil our very first investment-themed issue. While the mention of "investment" often conjures images of financial transactions, the scope of investment extends far beyond monetary matters. It encompasses a rich tapestry of opportunities for personal growth, community engagement, and familial bonds.

At the heart of investment lies a commitment to self-improvement and empowerment. Investing in oneself means nurturing talents, honing skills, and pursuing passions that propel us toward our fullest potential. Similarly, investing in our families fosters deeper connections, stronger bonds, and a sense of unity that transcends monetary value.

But investment doesn't stop at the individual level—it extends to our communities as well. Whether through volunteer work, support for local businesses, or advocacy for causes we believe in, investing in our communities cultivates a thriving ecosystem where everyone can flourish.

For me, bringing this magazine to New Braunfels was driven by a desire to invest in something greater than myself. I'm passionate about seeing individuals succeed, and this platform provides a unique opportunity to invest in the dreams and aspirations of others. Our community holds a special place in my heart, and I'm committed to finding new ways to serve and uplift those around me.

In this issue, we're excited to not only inspire you to invest in yourself, your community, and your family but also to educate. We'll provide insights and strategies to help you plan for the future. Find out what is shaking up in the real estate world. Moreover, we'll equip you and your children with the knowledge and tools to embark on your own investment journey, ensuring a brighter financial future for generations to come.

So, join us as we explore the myriad facets of investment, from personal growth to financial literacy, and discover how each of us can make a meaningful difference in the world around us. Together, let's build a future where everyone has the opportunity to thrive and prosper.

Samantha Bowers | samantha.bowers@citylifestyle.com

Lauren Mendez | lauren.mendez@citylifestyle.com

Lomonico Photography by Christine Marie Scott Christine@Lomonicophotography.com

CONTRIBUTING WRITERS

Carson Charbonneau, Christy Meaux, Jennifer Larsen, Liz Frazier Peck

Revitalize Visuals, Rose Drake Photography April

1: Christine Lomonico capturing the great turnout for the first Downtown Association meeting of the year. 2: Samantha, Tessa, Amanda and Michelle toasting to the new Chuy’s at their VIP event. 3: Kristin Preiss and Cheri Armstrong at the Tri-County Chamber monthly mixer. 4: San Antonio Rodeo Trail Riders starting the day in front of Gruene Hall. 5: Derek and Jordan Thomas at this years San Antonio Rodeo. 6: Desiree Ansley celebrated with the Gals for Christelle of the Golden Pineapples Galentines Event. 7: Veteran friends Don, Eric, Victor, Jerome and Terry regularly meet for a morning coffee break.

@LIVEOAKLIGHTING

@LOMONICOPHOTOGRAPHY

@ANSLEYSTAINING

@INANDAROUNDNBTX

@NBTXCITYLIFESTYLE

@NBCOFFEE

@KRISTINPREISS

1: Christine Lomonico capturing the great turnout for the first Downtown Association meeting of the year. 2: Samantha, Tessa, Amanda and Michelle toasting to the new Chuy’s at their VIP event. 3: Kristin Preiss and Cheri Armstrong at the Tri-County Chamber monthly mixer. 4: San Antonio Rodeo Trail Riders starting the day in front of Gruene Hall. 5: Derek and Jordan Thomas at this years San Antonio Rodeo. 6: Desiree Ansley celebrated with the Gals for Christelle of the Golden Pineapples Galentines Event. 7: Veteran friends Don, Eric, Victor, Jerome and Terry regularly meet for a morning coffee break.

@LIVEOAKLIGHTING

@LOMONICOPHOTOGRAPHY

@ANSLEYSTAINING

@INANDAROUNDNBTX

@NBTXCITYLIFESTYLE

@NBCOFFEE

@KRISTINPREISS

Where

NBYC is making history with a historic building. They’re bringing students back to Mill Street with a new Youth Center. Over the coming year, New Braunfels Youth Collaborative will completely renovate the former New Braunfels ISD administration offices, along with Academy Street Gym across the street, to house a new, innovative, fun, and wellrounded experience for youth in 6th -12th grades. Learn more on how to contribute at https://thenbyc.com/

The New Braunfels Conservation Society endeavor is to save the disappearing unique German heritage of New Braunfels and Comal County for present and future generations through acquiring, saving, preserving, restoring, displaying and exhibiting historic buildings, artifacts, ephemera and their collective rich history. They will be having their historic home tour April 20th.

Scan to read more

Liz Frazier is a Fee-Only Certified Financial Planner who specializes in creating transparent, tailored financial plans based on client’s specific needs, including: retirement, investing, college planning, debt, budget management, buying a home, divorce, inheritance and any other of life’s changes and stages. She is also a Forbes contributor, the author of Beyond Piggy Banks and Lemonade Stands: How to Teach Young Kids About Finance and Director of Education at Copper Banking, contact Liz at www.lizfrazier.com

Liz Frazier Peck CFP®,

MBA - Financial Planner & Author

Photography by New Braunfels Conservation Society

Photography by Amy Druker

Liz Frazier Peck CFP®,

MBA - Financial Planner & Author

Photography by New Braunfels Conservation Society

Photography by Amy Druker

ARTICLE BY CHRISTY MEAUX PHOTOGRAPHY BY ROSE DRAKE PHOTOGRAPHY

ARTICLE BY CHRISTY MEAUX PHOTOGRAPHY BY ROSE DRAKE PHOTOGRAPHY

We’ve heard it for the last year and then some - Interest rates are high; Interest rates have come down; Oh no, rates are on the rise…

What are home buyers supposed to do? Do they wait for rates to come down? Do they buy now and refinance later? How are they supposed to come up with 20% down payment? How can they afford what they need?

The status of the current market has created a bit of confusion, a lot of chatter, and so much uncertainty. With the media being front and center, and social media being right there with it, it’s hard to know who to trust.

As a wholesale mortgage advisor, when I connect with potential clients, two of the very first items we discuss are down payment options and resources. Borrowers always have a unique story. Maybe it’s the retired Veteran, or one using their VA benefit for the first time. Perhaps it’s a First Time Homebuyer excited and nervous. New investors buying their first short or long-term rental ready to grow their wealth through real estate have increased in our area. We are also seeing home buyers looking for that perfect vacation home/weekend getaway for their family. Then we have those families looking to move from their current home to up-size or downsize, depending on the season their family is in. The good news is today’s financial climate has created an opportunity for our lenders to offer many flexible options. From state-funded down-payment, federal, and lender-specific programs, buyers have access to opportunities to offset the down-payment. We have access to a program with 1% down for first-time buyers, and Fannie Mae’ Homeready at 3% down, plus a Fannie Mae SPCP (Special Purpose Credit Program) which is a grant offering $5000-$6000 in forgivable assistance. There really is something for most everyone. Hearing the excitement from clients when I go over their options, sharing that they don’t have to have 20% down to buy a home – the relief they feel at that moment is one of the best in the mortgage business. Buying a home IS possible!

When I entered the mortgage market six years ago, things had been in flow and the average interest rate had been stable for quite a while. When our world entered the

CONTINUED >

“New Braunfels and the surrounding areas are not slowing down.”

— CHRISTY MEAUX

pandemic of 2020, markets were unstable, and we found ourselves navigating the lowest rates the mortgage and real estate industries had ever seen. Homes were being sold at higher prices than market value, cash was king, and bidding wars were the norm. When the transition back toward regulating these markets started to occur, there was no history on record to predict what this would mean. Once again, we were navigating rates increasing, panic among sellers and buyers, more self-employed applications, new programs to accommodate the market, and the buyers, more investments, rates creeping higher and higher, all through 2023. Nearly three years to navigate things we had never been through. Here we are in 2024, where we’ve seen rates drop, and early February gave us a glimpse of things to come. Rates are still lower than they were, and at the time I’m writing this article – the end of February – interest rates have come back up a bit, but nothing showing we are headed back to where we were. The federal reserve is expected to have rate cuts this year, and we are hopeful. At the end of the day, trust your mortgage advisor, who follows

the markets regularly, who will respond and not react in panic, but create the best opportunity for you - the buyer.

Down payments are flexible in nearly every program, and with great credit, or a willingness to trust someone to help you achieve it, can create better rate incentives. Monthly payments are determined by several factors - the loan amount, the loan to value (down payment percentage), interest rate (credit score + down payment), mortgage insurance, property taxes and homeowner’s insurance.

Don’t be deceived by the fear of the down payment. There are options that make homebuying possible. My colleagues and I work hard every day to make dreams come true. We are collectively excited about the new programs, flexible lending options, and increased inventory. New Braunfels and the surrounding areas are not slowing down. The excitement and freshness of spring has us all ready to do more, and experience the smiles we see when your family walks into that new home, ready to make new memories.

Article By Christy Meaux / NMLS1709296, Mortgage

Advisor;New Braunfels, TX, Edge Home Finance / NMLS 891464, Corporate office: Minnetonka, MN

EAll business owners can benefit from some level of estate planning.

Building protection into your business plan is one of the most important decisions you can make to safeguard your partners, your employees and your family. Here, we will discuss the four key components of estate planning to make sure you are well set up for success.

The most fundamental estate planning tool is a will. A properly executed will, gives clear direction to your executor about how to manage or distribute your assets when you pass away.

Then, a somewhat more complex component of an estate plan is a revocable trust—this is a legal entity created to hold your assets while you’re alive. Among the many benefits is that your appointed trustee can take over management of your assets if you’re incapacitated.

ARTICLE BY JENNIFER LARSEN PHOTOGRAPHY BY REVITALIZE VISUALS - CIERRA LEAVITT

A revocable trust streamlines the transfer of your assets by helping avoid potentially lengthy legal proceedings and costly court fees. A trust may also provide creditor protection for the beneficiaries.

Next are powers of attorney. Naming a healthcare power of attorney means your representative can make crucial medical decisions on your behalf should you be unable to, while a financial power of attorney can pay your bills and manage your finances until you get back on your feet.

Finally, a buy-sell agreement is a powerful estate planning tool. A buy-sell agreement is a way to help ensure a smooth transition of your business and ensure your family’s financial goals are met after you’re no longer around to take care of them. A buy-sell can also outline the terms of succession among the remaining partners, so that all terms are agreed upon in advance.

Some basic estate planning may be done using self-guided online tools, but typically you should use a licensed and experienced attorney to help you draft and execute your plan. The best way to go about it is to make sure that your attorney, financial advisor, and insurance agent are working together on managing and planning your estate.

This educational third-party article is provided as a courtesy by Jennifer Larsen New York Life Insurance Company. To learn more, please contact Jennifer Larsen at 830-312-7179.

Wohlstand Wealth Strategies, LLC is not owned or operated by Eagle Strategies LLC or its affiliates. This article is for informational purposes only. Wohlstand Wealth Strategies LLC as well as Eagle Strategies LLC and it’s affiliates does not provide tax, legal or accounting advice. For advice on such matters and prior to taking related planning action, consult your own professional counsel.

“It takes incredible strength to say, I need help.”

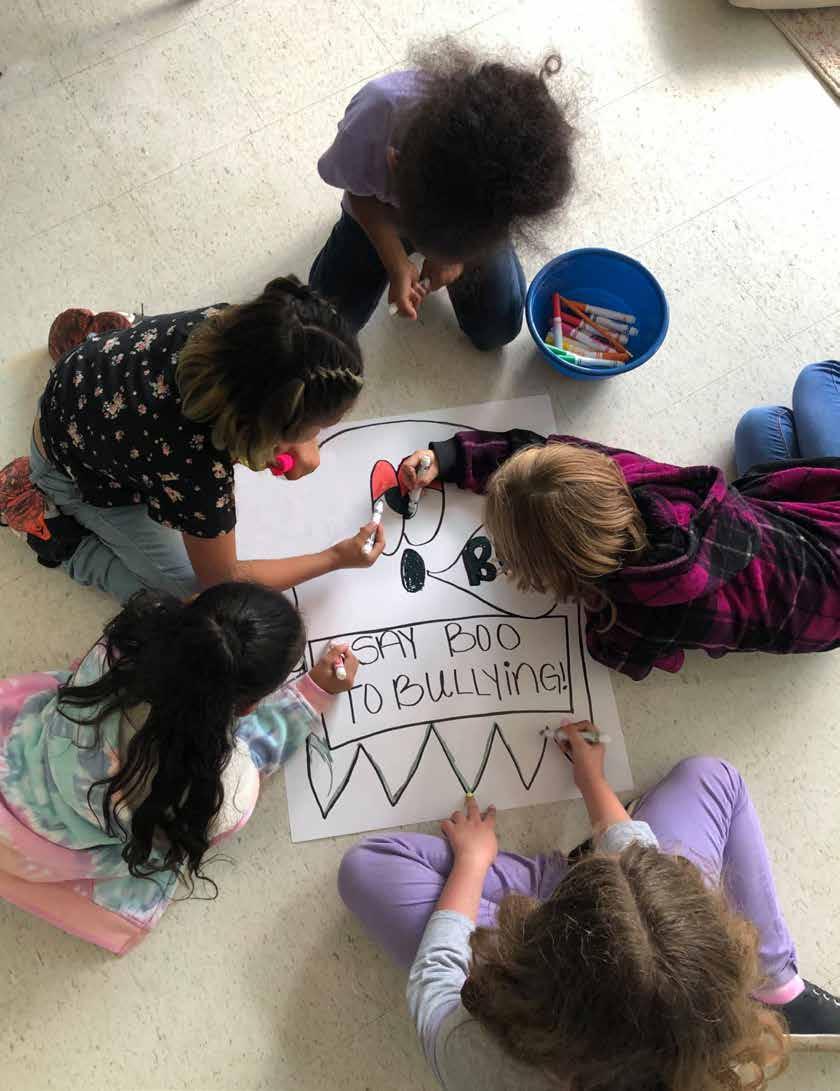

When we send our children to school, we hope and expect that they learn and grow in a healthy environment. Communities in Schools is a non-profit organization that makes that expectation into a reality for your child. It truly takes a village to help raise our young adults. We had a chance to sit down with Susan Wetz who is the CEO of the organization and someone who is deeply passionate about empowering our next generation with emotional and practical knowledge.

Founded in 1993 in New Braunfels, Communities in Schools - South Central Texas, has been a pillar of support for students across the region. They support 13 schools in the New Braunfels area alone, their influence extends to over 42,000 students spanning across 57 schools. From early childhood to graduation and beyond, the organization specializes in delivering programs and assistance that not only foster academic excellence but also cultivate marketable skills, empowering children to become invaluable contributors to their communities.

Susan Wetz, a cornerstone of this organization, underscores the paramount importance of trust between Communities in Schools and its community. Emphasizing a needs-driven approach, she elucidates that each child's experience with the organization is unique, tailored to identify and amplify their individual strengths. A site coordinator makes matches between volunteer and student to ensure the best experience.

Beyond the classroom, Communities in Schools extends its support to parents, offering guidance on navigating available resources and surmounting barriers, be they financial, logistical, or otherwise. One of these resources Susan went on to explain that students can't and shouldn't be asked to focus on academics when they are hungry. And because of partnerships with churches and existing backpack feeding programs, food items in backpacks are given out to children in need. This is a confidential service where the child takes the backpack home and brings it back when finished.

“Students can pop into our offices and have a granola bar during an overwhelming situation to calm down.”

Volunteer opportunities abound, catering to individuals from diverse backgrounds. From administrative roles ensuring operational efficiency to supporting the organization's thrift store, volunteers play a pivotal role in sustaining Communities in Schools' mission.

Some additional impactful volunteering avenues are through mentorship, where individuals provide guidance, support, and encouragement to students, aiding in their holistic development. Volunteers can also contribute their time and efforts in the organization's thrift store, sorting donations, organizing inventory, and assisting customers, thereby directly supporting Communities in Schools' mission. Additionally, volunteers can actively participate in fundraising efforts aimed at converting the New Braunfels ISD Administrative Building into the new student center for middle and high schoolers. This initiative will serve as the new home for Communities in Schools, further enhancing their capacity to support students in need.

Social workers, counselors, and other qualified personnel ensure comprehensive support, facilitating meaningful connections between volunteers and students for optimal experiences. Integral to their mission is the provision of essential services such as food assistance, facilitated through strategic partnerships and confidential distribution methods, ensuring the dignity of those in need. Moreover, the organization strives to create welcoming spaces within their offices, fostering an environment where students can comfortably seek support and process their emotions. “Students can pop into our offices and have a granola bar during an

overwhelming situation to calm down,” says Susan. Allowing students to experience and process their strong emotions is important and is one of the most productive methods of cognitive development.

Reflecting on her three decades of service, Susan Wetz articulates a profound sense of purpose in empowering individuals to seek help when needed, underscoring the transformative impact of genuine support. When asked how long students utilize services Susan Wetz answered that, “[We] would love to work [ourselves] out of a job. We allow students to come to us with their needs, so we often see familiar faces. It comes down to the individual. We have had many people spread news about this through word of mouth so it all depends.” When asked how long she has been with the organization, Susan Wetz answered, “My 30th anniversary comes in August! I joined out of college because I wanted to work with kids and not do the same thing every day. Wish granted!” She goes on to say, “It takes incredible strength to say ‘I need help,’ or ‘I'm not ok’. To entrust that to another person? Wow. To me, there's no bigger honor or responsibility than to be able to help that person.” As the organization continues to navigate through unprecedented challenges, the indomitable spirit of Communities in Schools remains unwavering.

Communities in Schools serves as a testament to the power of collective action in fostering the growth and well-being of our youth. Through their relentless dedication and unwavering commitment, they not only improve the lives of countless students but also enrich the fabric of our communities, leaving a positive mark on generations to come.

“Although they may not understand all the concepts, the earlier you can start exposing kids to finance the better.

As parents, we understand the importance of teaching our kids lessons to help them grow into independent and healthy adults, such as: nutrition, health, safety and kindness. However, when it comes to teaching our kids about finance we don't want to stress them out, think talking about money is rude, or feel they don't need to understand finance until they are older. Yet once a child reaches 18, every step they take from college through retirement will be directly influenced by their ability to manage their finances: student loans, credit cards, jobs, mortgages, savings and starting a family.

Unfortunately, most high schools still don’t teach personal finance, so it’s up to the parents to make sure their kids have a financial education before they hit the real world. Although they may not understand all the concepts, the earlier you can start exposing kids to finance the better. This gives them a solid foundation so they will be comfortable with money and understand the more complex pieces as they get older.

Because most adults weren’t taught finance as a kid, the thought of teaching your child finance may seem overwhelming and intimidating. However, you don’t need to be a sophisticated investor to teach your kids the basics around spending, earning and smart spending.

Earning Money: A lemonade stand, or any variation, is a great way to teach kids

the basics of earning money. Make sure the kids are involved from the beginning. Take them to the store so they see how much money it costs to buy ingredients. Have them decide on the cost of a cup, and then help man the station. At the end, they can count up the money and you can explain how much of that is profit. This allows them to start engaging directly with money.

Smart Spending : Take your kids shopping with you, and explain the decisions you make. Point out examples where you can compare shop and ask them to help check prices. If you have cash handy, let them pay for smaller purchases - this begins the connection that you actually need money to buy things!

Saving: Start a piggy bank system. Label three mason jars as Save, Share and Spend. Divide any money your child receives through allowance and gifts into these three jars. I recommend putting 10% in the Share jar with each deposit. Split the rest between the other two based on their goals. Help them decide what they want to buy with the Save jar proceeds, and track how much they have and how much they need. This simply gets them in the habit of always saving something when they earn money.

Keep In mind, no matter how you choose to engage your kids with finance, the most important thing is to keep it relevant, engaging and simple.

MAXIMIZE STYLE, MINIMIZE SPENDING: THE CAPSULE WARDROBE FINANCIAL ADVANTAGE

ARTICLE BY SAMANTHA BOWERS

Creating your ideal capsule wardrobe is not just a wise financial decision that will pay you greatly, but it's also a style decision. Imagine having an assortment of classic, well-chosen items that you can easily combine and modify to create countless ways to wear them. You're not just following trends when you prioritize high-quality basics like stylish neutral tops, bottoms, and outerwear; instead, you're making an investment in a wardrobe that will last for years and save you a ton of money.

You won't give in to impulsive buys or fads in fashion; instead, you'll know exactly what your own style is and only buy things that fit your wardrobe well. As a result, you'll make fewer excursions to the mall and spend less money on clothing that gather dust in your closet.

A good capsule wardrobe should include:

• (2) Jeans

• (4) Pants

• (4) Shirts/blouses

• (8) T-shirts – long & short sleeve

• (2) Jackets

• (3) Dresses

• (2) Skirts

• (2) Jumpers

• (4-5) Shoes

Creating the ideal capsule wardrobe is, in essence, more than just decluttering your closet; it's a prudent financial move that can result in long-term savings and a more environmentally friendly attitude toward clothing.

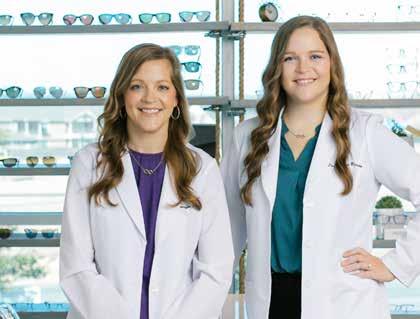

Elevate your eye care Experience and take your Eyewear to the next level!

At Elevated Eye Care, Drs. Jennifer and Kymber Blaschke provide a personalized exam experience along with the latest technology to evaluate your vision and eye health needs. They see patients of all ages and specialize in:

Pediatrics | Myopia Management | Vision Therapy Specialty Contacts | The Management of Ocular Diseases

www.elevatedeyecaretx.com | 830.221.9358 1750 E Common St, New Braunfels, Texas 78130

V@elevatedeyecaretx

PARTNERING LOCATION (SPLASH PAD)

Discover Downtown San Marcos’ Premier conference, meeting & training space: Perfect for Remote Workers and Long Commuters! Escape distractions and isolation, and step into an inspiring environment built for productivity.

Whether you need a quiet room or a dynamic space for client meetings, we’ve got you covered.

Elevate your productivity and work-life balance! Contact us now to book your ideal workspace in Downtown San Marcos and partnering locations throughout the region.

Main Location, 326 North LBJ Drive 78666

Splash Pads (Partnering locations) | Throughout San Marcos splashcoworking.com • 512.667.0492 • @SplashCowork

GREAT FOR TRAINING SESSION

GREAT FOR TRAINING SESSION

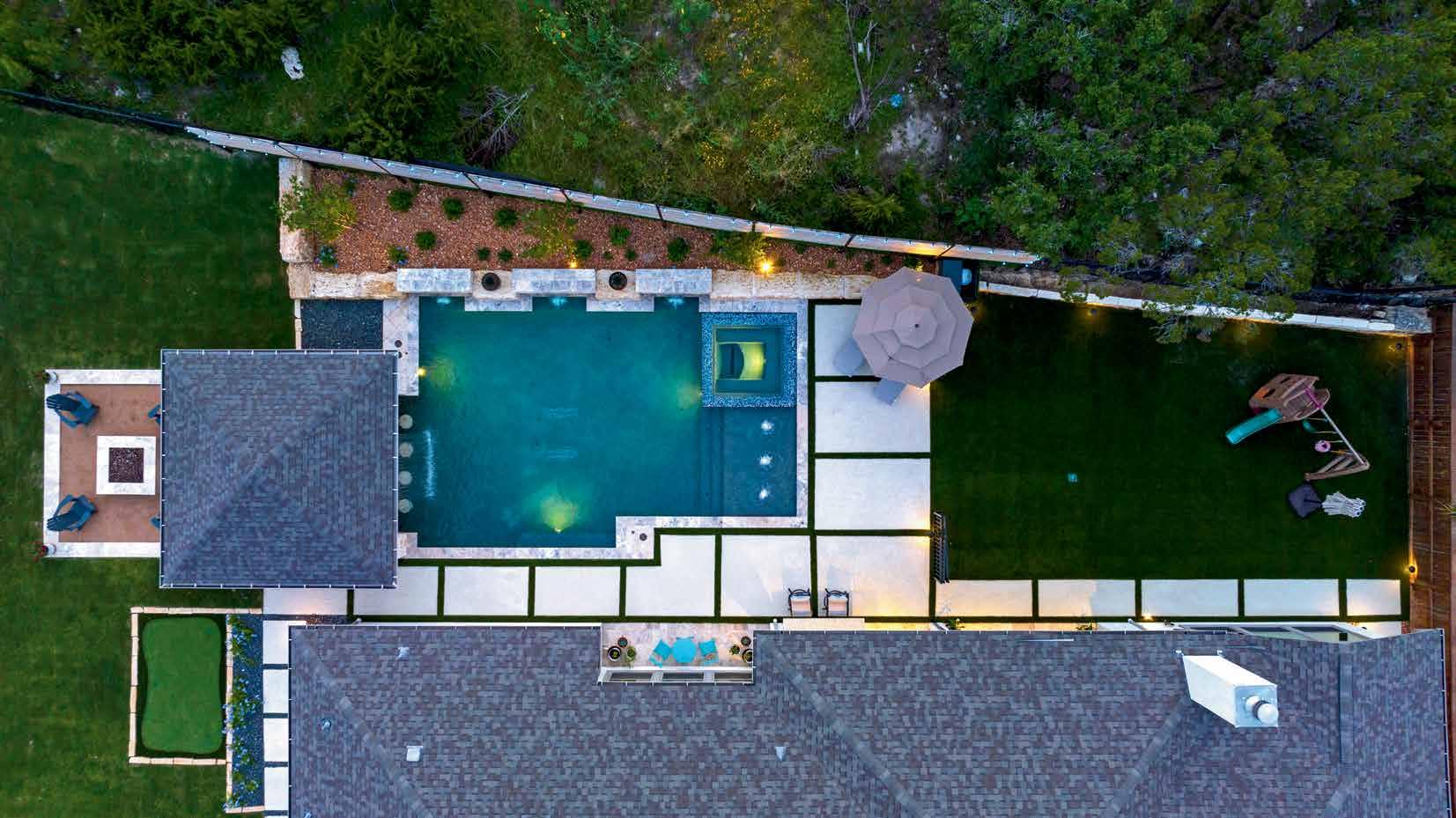

INVESTING IN HOME DESIGN CAN GIVE YOU A PEACEFUL SANCTUARY WHERE YOU CAN ESCAPE FROM THE STRESSES OF DAILY LIFE. SO GO AHEAD, TAKE THE PLUNGE AND REVAMP YOUR LIVING SPACES – IT’S WORTH EVERY PENNY!

There are many things that can help a room feel relaxing, but let’s keep it simple and focus on my top three. I would say that one must incorporate good lighting, great textures, and a decluttered space to truly get the cozy vibes. Let’s tackle each.

It is imperative that there are multiple sources of light in a space. A room needs a soft warm light, so I always like to use a light bulb between 2,700k and 3,000k. Also, and I see this so many times, all lights should have the same temperature light bulb to avoid clashing. It’s not enough to just have recessed or pendant lighting. I always add a table or floor lamp to a space to truly have ambient light. Also, candles are a must for me. They can be scented candles (an extra way to add relaxation) or I like to use remote control tapered candles, so I don’t have to worry about cleaning up wax later.

Textures are seen in toss pillows, rugs, draperies, throw blankets and furniture upholstery. Textures add color, pattern and visual interest. I like to use at least three different textures to help a room feel lived-in and welcoming.

So many times, a person thinks that every nook and cranny and every wall need to have something, and this is not the case. A decluttered space is actually more relaxing because overcrowding of items doesn’t quiet the mind. Decluttering a space can be overwhelming, I get it, so just do it in stages. You’ll love the outcome when the room is tidy, organized and you are only surrounded with what brings you joy.

APRIL 2024

APRIL 4TH

164 Landa Park Drive New Braunfels, TX | 6:00 PM

Live @ Landa is a free, family-friendly event that runs from 6pm to 9pm featuring live music from local and regional bands, along with kids’ activities and food trucks supporting the New Braunfels Parks Foundation. Bring your lawn chairs or a blanket and settle in for some great tunes.

APRIL 6TH

McKenna Events Center - 801 W San Antonio St, New Braunfels, TX | 6:00 PM

Join Hope Hospice for their annual gala at the McKenna Events Center on Saturday, April 6th at 6:00 pm. Enjoy dinner, libations, dancing, live music, a raffle, silent and live auction, and more while supporting Hope Hospice Foundation and the mission of Hope Hospice. Starch your Denim, polish those boots, shine up some bling and come cut a rug!

APRIL 13TH

Folkfest

Museum of Texas Handmade Furniture - 1370 Churchill Dr, New Braunfels, TX | 10:00 AM

An annual celebration of early life in Texas for the original settlers. Immerse yourself in a time from before where crafting was a time honored tradition. Learn how new and old mix together the original heritage of our community.

APRIL 13TH

The Villa - 1190 Gruene Rd, New Braunfels, TX | 12:00 PM

The Villa is teaming up with one of our favorite local non-profits, Pink Warrior Advocates, to bring you their First Annual Beard, Bald & Mustache Competition! Categories include Natural, Freestyle, Partial, Full, Bald, Wiskerina (for the ladies), Handcrafted, Best in Show. Join them for live music, prizes and family fun.

APRIL 13TH

Historic Stelzenplatz at Wurstfest Grounds • New Braunfels, TX | 2:00 PM

A festival known for quality beer - in a city known for quality fun. 30 Texas hill Country breweries and wineries. Over 150 craft beers and wines for one day only.

APRIL 20TH

180 W Mill St, New Braunfels, TX | 11:00 AM

Join New Braunfels Brewing for their 5k Fun Run event. Lace up your running shoes - they have mapped out a 5k-ish course that starts and ends at this awesome taproom in beautiful downtown New Braunfels. Run, walk or jog before celebrating with a locally-brewed craft beverage at the finish line.

WE’VE HELPED DOZENS OF CLIENTS LEVEL UP THEIR SOCIAL MEDIA GAME

THE CONTENT EXPERTS YOU DIDN’T KNOW YOU NEEDED

More Information:

WWW.THESOCIALSHIFTTX.COM