THE BALLET THEATRE COMPANY: Investing in the Arts For 25 Years

THE BALLET THEATRE COMPANY: Investing in the Arts For 25 Years

April is our Investment Issue and while that might conjure thoughts of articles on financial investing, we're actually taking a broader look at the concept of investing. We make investments all the time in different ways in our lives, like in our health, the arts, in schools, and even in fitness.

For instance, if you're looking to pump up your fitness game, GYMGUYZ provides in-home training and workouts. The local franchise is owned by Christian Silva, a longtime fitness instructor, and the company brings the gym to you, either at home or in the office.

We spoke with the leader of the Ballet Theatre Company about how her organization has been investing in the art of dance for more than 25 years.

Since it's tax season, we also look at how your financial investments might impact your income taxes in our Q&A with Jason Cerniglia of Ameriprise Financial/ Coastal Wealth Management and David Mozeleski of RBC/MC Wealth Solutions, both of Glastonbury.

We also spoke with Stephanie Johnson of Comparion Insurance and Coe Bancroft, of State Farm Insurance, about why it's important to protect the various investments in your life with the right insurance coverage.

Lastly, Passover, one of the most sacred of Jewish holidays, starts on April 22 this year and we have a story that looks at the history of the holiday and includes a recipe for one of the most popular of Seder dishes, Matzo ball soup.

We hope you enjoy this month's issue of Glastonbury Lifestyle Magazine and that you have a Happy and Healthy Passover!

GARY PERRELLI, PUBLISHER @GLASTONBURYLIFESTYLEPUBLISHER

Gary Perrelli | gary.perrelli@citylifestyle.com

EDITOR

Eileen McNamara eileen.mcnamara@citylifestyle.com

ACCOUNT MANAGER

Jill Barry | jill.barry@citylifestyle.com

PUBLISHER ASSISTANT

Ivy Perrelli | ivy.perrelli@citylifestyle.com

CONTRIBUTING WRITER

Brian Boyer

CONTRIBUTING PHOTOGRAPHERS

Brian Ambrose, Connecticut Headshots,

Taylor, Carrie Draghi, Thomaas Giroir, Michela Semenza, Lanny Nagler

CHIEF EXECUTIVE OFFICER Steven Schowengerdt

CHIEF OPERATING OFFICER Matthew Perry

EXECUTIVE DIRECTOR OF HR Janeane Thompson

DIRECTOR OF FIRST IMPRESSIONS Jennifer Robinson

TECHNICAL DIRECTOR Josh Klein

AD DESIGNER Mary Albers

LAYOUT DESIGNER Emily Lisenbee

Michael J. Grille, MD

Pain Management Anesthesiologist

Dr. Michael Grille has established himself as one of the top Interventional Pain Management Specialists in the Northeast. With Fellowship training at the prestigious Cleveland Clinic, he brings a wealth of clinical expertise in order to develop the best and most comprehensive pain management plan to address any chronic pain condition.

Michael J. Robbins, DO

Pain Management Anesthesiologist

Dr. Michael Robbins was recognized as one of the “Best Pain Management Physicians in New Haven”, and he has brought his clinical excellence and experience to the local community. Dr. Robbins is a board-certified anesthesiologist and pain medicine specialist. He has extensive knowledge in spinal mechanics, and he provides treatment for a wide range of pain issues.

Bright J. Selvaraj, MD

Pain Management Anesthesiologist

Dr. Bright Jebaraj Selvaraj brings national pain management experience to the forefront of the IAA Pain Center. Having completed his Residency at New York Presbyterian Hospital and his Pain Management Fellowship with Oregon Health, Dr. Selvaraj has been a welcome addition to our growing Pain Management Team.

•

•

•

•

1-7: The CT River Valley Chamber held a Business Before Hours at VRSim Inc., East Hartford. Photography by Brian Ambrose

1-7: The CT River Valley Chamber held a Business Before Hours at VRSim Inc., East Hartford. Photography by Brian Ambrose

The CT River Valley Chamber of Commerce has been named the 3rd largest Chamber in Greater Hartford by the Hartford Business Journal. "Thanks to your incredible support, our membership has grown, and we're now standing even stronger together," the chamber said. "This achievement wouldn't be possible without the amazing businesses and individuals who make up our community," a Chamber official said. "Let's continue this journey of growth and success." Visit CRVChamber.org for information.

Steve & Kate’s Camp is opening a new summer camp on the Watkinson School campus in Hartford. From June 17 - Aug 16, children ages 4 to 12 can participate in the activities they love – from moviemaking to sports, coding and sewing. “It’s a perfect fit as Watkinson and Steve & Kate’s Camp are very aligned philosophically," said ead of School Teri Schrader says. Visit Watkinson.org for more information.

The Glastonbury Greater Together Advisory Committee is accepting applications for grants totaling $25,000 by June 4. Grants of up to $5,000 will be awarded. Any nonprofit registered as a 501(c)(3) organization that serves the residents of Glastonbury is eligible to submit an application. Nonprofits do not need to be headquartered or based in Glastonbury but must serve and benefit Glastonbury residents. Residents may apply in partnership with a registered 501(c)(3) nonprofit. Visit HFPG.org for information.

The CT River Valley Chamber of Commerce recently announced several new members to its Board of Directors, including Derek Mazzarella, a financial advisor with Gateway Financial; Ann-Marie Katzer a senior vice president with American Eagle Financial Credit Union; Julie Parrett, strategic planner and public relations specialist with VRSim Inc.; Michelle Nicholson, owner of The Flour Girl Bakery; and Gary Perrelli, publisher of Glastonbury Lifestyle Magazine. Visit CRVChamber.org for more information.

A group of local residents is organizing a First Annual Holocaust Remembrance event to raise awareness and education about the Holocaust. They have partnered with the First Church of Christ of Glastonbury for an event scheduled for May 9. As part of the gathering the group is holding an essay contest for local high schoolers and has invited holocaust survivors to speak, including Rabbi Philip Lazowski or West Hartford. Visit GHRP.net for more information.

Watkinson School has added two new employees to its staff. Thomas Murphy is the school's new Director of Development and Max Schweitzer will coach Boys Varsity Tennis. Thomas formerly worked in fundraising, development, and alumni relations at the Francis Ouimet Scholarship Fund in Massachusetts. Max, who founded a private tennis coaching business, brings decades of tennis experience to Watkinson as both a player and a coach. Visit Watkinson.org for more information.

HAVING A BABY OR GETTING MARRIED THIS YEAR?

BOOK YOUR SHOWERS AT SAINT CLEMENTS CASTLE & MARINA TODAY!

Breakfast Selection

ASSORTED BAKED GOODS

FLUFFY SCRAMBLED EGGS

BELGIAN WAFFLES

Cold Selection

TOSSED FIELD GREENS SALAD

FRESH SEASONAL FRUIT

WWW.SAINTCLEMENTSCASTLE.COM

Entree Selections

PAN SEARED SALMON

CHICKEN PICCATA

CHICKEN MARSALA

COD LOIN

Pasta Selection

PENNE PASTA

FARFALLE

PENNE RIGATE

Dessert Selection

FRUIT TART, TRIPLE-LAYER CHOCOLATE MOUSSE CAKE, NY CHEESECAKE , CARROT CAKE, CHOCOLATE MOUSSE Beverages

FRESHLY BREWED REGULAR AND DECAFFEINATED COFFEE AND ASSORTED TEA, ORANGE, CRANBERRY, AND APPLE JUICES, ASSORTED SODAS

Customize your celebration with some of our unforgettable enhancements!

Food Enhancements Drink Enhancements

Charcuterie Board

Donut Wall

Parfair Station

Grand Marnier French Toast

Applewood Smoked Bacon

Traditional Eggs Benedict

Build Your Own Spritz Bar

Bubbles Bar

Bloody Mary Bar

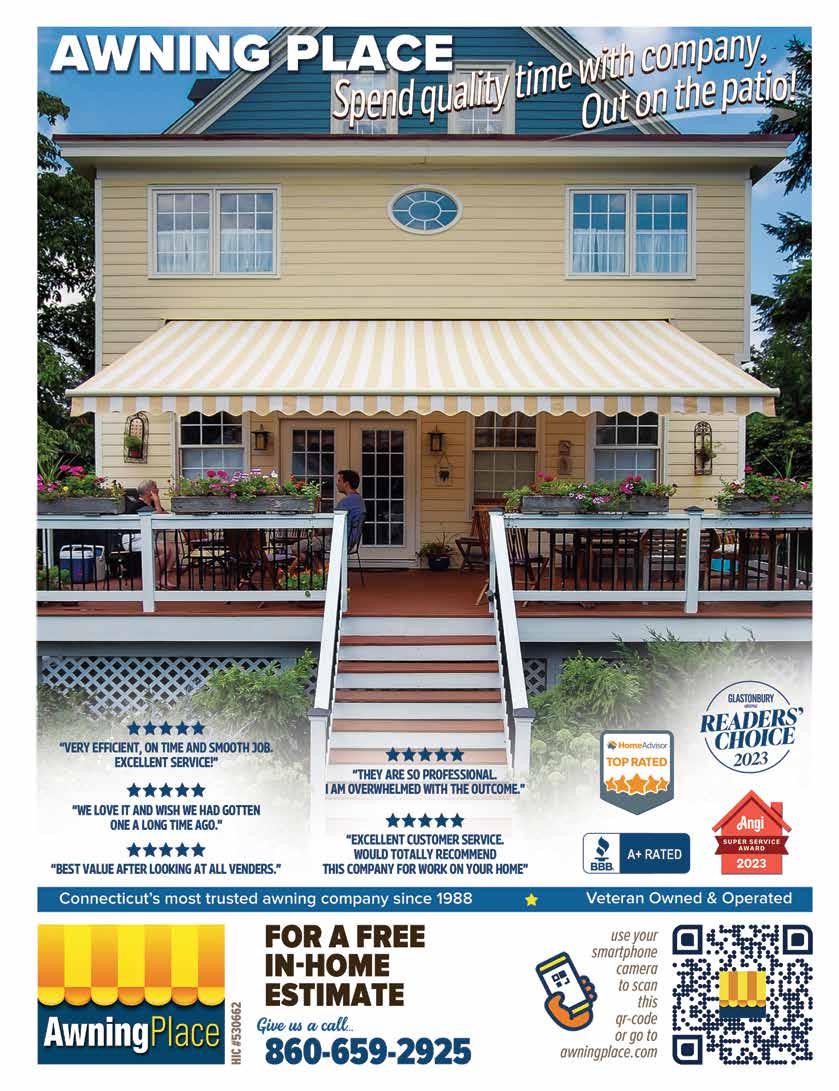

Since its inception 25 years ago, the Ballet Theatre Company (BTC) in West Hartford has been more than just a dance organization—it’s been a beacon of joy, passion and inclusivity for the

where dancers of all ages and abilities can thrive.

In addition to its training school, BTC is a professional ballet company comprised of 10 talented professionals

“WE'RE COMMITTED TO MAKING DANCE ACCESSIBLE TO EVERYONE, REGARDLESS OF THEIR BACKGROUND.”

community. Led by Director Stephanie Dattellas, whose love for dance began at the age of 3, the organization has evolved from a performance ensemble to a thriving training school and professional ballet company, enriching lives and spreading the magic of dance far and wide.

“Dance has been a part of my identity since childhood. It’s been my solace, my joy and my passion,” Stephanie says. “To be able to share that with others through BTC is truly a dream come true.”

Starting as a performance ensemble, BTC has expanded its offerings over the years to include a wide range of classes, workshops and programs, ensuring that everyone has the opportunity to experience the transformative power of dance. With 130 students and 3 adult faculty members, the training school provides a nurturing environment

from diverse regions, including South Africa, Texas, Maryland and California. Together, they captivate audiences with their artistry and grace, showcasing the beauty of ballet and inspiring future generations of dancers.

But BTC’s impact extends beyond the studio walls. Through community enrichment initiatives, such as partnerships with the Miracle League of CT, Girl Scouts of CT and Boys and Girls Club, the organization brings dance to underserved populations, spreading joy and fostering a sense of belonging.

“The arts have the power to transform lives, but they can also be exclusive,” Stephanie says. “That’s why we’re committed to making dance accessible to everyone, regardless of background or income level.”

One of BTC’s unique offerings is its behind-the-curtain program, which allows participants to explore the

world of costume design and stagecraft. This hands-on experience gives aspiring artists a glimpse into the inner workings of a production and ignites their passion for the performing arts.

As the world continues to evolve, BTC remains steadfast in its mission to provide access to the arts, reach more people throughout the state and advocate for the importance of arts education. The COVID-19 pandemic served as a stark reminder of the vital role that the arts play in our lives, with many turning to dance and other forms of expression for comfort and inspiration during challenging times.

“Many of the kids who come to us start out shy and reserved, but through dance, they blossom into confident, outgoing individuals,” Stephanie says. “It’s incredible to witness the transformation firsthand.”

Looking ahead, BTC is poised to continue making a difference in the lives of countless individuals, spreading joy, passion and the magic of dance wherever they go, she adds. “Our journey is far from over. There are still so many hearts to touch, so many lives to enrich. Together, we’ll keep dancing towards a brighter, more inclusive future.”

Ballet Theatre Company

20 Jefferson Ave., West Hartford

Phone: 860-570-0440

Online: Dancebtc.org

On Social: @Dancebtc

ARTICLE BY EILEEN M. MCNAMARA | PHOTOGRAPHY BY BRIAN AMBROSE

GYMGUYZ: BRINGING THE WORKOUT, AND EXPERTISE, TO YOU

ARTICLE BY EILEEN M. MCNAMARA | PHOTOGRAPHY BY BRIAN AMBROSE

GYMGUYZ: BRINGING THE WORKOUT, AND EXPERTISE, TO YOU

As anyone who has embarked on a new fitness goal can tell you, the biggest hurdle is getting out, whether for a run, an indoor workout, or to the gym. Sure, you can buy expensive gym equipment for your garage, spare bedroom or basement, but how many of us end up using that stationary bike or treadmill as coat racks? What if your workout came to you instead, trainer, workout, and the equipment? That’s the business model of GYMGUYZ, a new in-home personal training service for all fitness levels.

Christian Silva, owns the local franchise of GYMGUYZ, which serves the Farmington Valley area - including West Hartford - and towns east of the Connecticut River as well.

A personal trainer with a Master’s Degree in Exercise Science and 27 years of coaching experience, Christian started his GYMGUYZ personal training business last year.

“Fitness and helping others are my passions, they’re my life.”

Christian started a GYMGUYZ local franchise after working as a personal trainer and in fitness management at high-end fitness clubs in New York City and Massachusetts.

“My area of expertise has always been fitness coaching and working with all different types of ability levels. Some trainers have a narrow focus, but my team and I work with clients covering the entire fitness spectrum – from folks who are seeking everything from post rehabilitation, senior exercise, adaptive training for people with disabilities, youth strength training to advanced sports training.”

GYMGUYZ trainers use a dynamic, personalized program that the trainer draws up following a free fitness assessment with clients. Whether their goal is to lose weight or improve their general

“My area of expertise has always been fitness coaching and working with all different types of ability levels.”

fitness, GYMGUYZ designs a flexible program to meet a broad range of its clients’ fitness needs. The programs are designed to be fun and challenging, and each session is different. The key is in developing motivational and personalized programs, either for one-on-one sessions or group workouts. After the initial free assessment, training sessions can be purchased in blocks of sessions or individuals can enroll in one of their popular monthly programs designed to meet every person’s budget and fitness needs.

GYMGUYZ launched in 2008 and began franchising in 2013. There are now over 135 franchises in the U.S., as well as numerous ones overseas. Christian said the certified trainers bring all the equipment needed for each workout. In the age of Amazon shopping and other types of online experiences, Christian said he thinks of GYMGUYZ’s approach to in-home personal training as “the DoorDash of working out.”

“We’re very easy, we’re very convenient, and our workouts are very efficient and effective which keeps our clients coming back for more. Exercise is a difficult habit for many people, so

we have to keep it this way. Nothing is easier than us bringing the gym to you. We use equipment such as kettlebells, dumbbells, medicine balls, stability balls, hurdles and fitness bands. You’d be amazed at the types of workouts, and the different levels of intensity you can achieve, with minimal equipment. We can give you a great workout right in your living room and you won’t miss a beat.

“We have a team of trainers who all have the highest level of coaching certifications, are trained by me, and they are background-checked and drug-screened to assure our clients safety.

Workouts are only one facet of the services GYMGUYZ provides, he adds.

“We also offer corporate and community fitness programs, virtual coaching and workouts with our own GYMGUYZ app, in-home stretching services, metabolic testing that ties into our nutritional coaching programs. These services are bundled into our monthly lifestyle plans or can be purchased ala carte. For more information or to schedule your free assessment, Gymguyz.com/west-hartford or call 860-352-5859.

ARTICLE BY EILEEN M. MCNAMARA | PHOTOGRAPHY BY CARRIE DRAGHI

ARTICLE BY EILEEN M. MCNAMARA | PHOTOGRAPHY BY CARRIE DRAGHI

Tax season is upon us and if you have investments that means you’ll probably need to pay some kind of state or federal tax on them. We asked local investment advisors David Mozoleski and Jason Cerniglia for some tips on what kinds of investments are taxed and how to mitigate your exposure.

Q. WHAT KIND OF TAXES DO YOU PAY ON INVESTMENTS?

Jason: For Non-Qualified (non-IRA and non-ROTH) one could potentially pay taxes on dividends, interest and income from money markets, bonds and CDs, as well as potential capital gains. Annuities owned in a non-IRA would have distributed gains taxed as income. In IRA accounts and retirement plans (401k, 403b, 457 plans, etc) distributions are taxed as income, generally. In Roth IRA accounts, growth and distributions are, generally, tax free. Finally, one should be aware of potential taxes (or the avoidance of those taxes) through a step up in basis estate planning strategy.

David: Almost everything you own and use for investment and personal purposes is a capital asset. For example, if you own shares in Company X, those shares are capital assets. When selling those shares, you will incur a gain or a loss. And, depending upon how long you held that asset, you will incur a longterm or short term- gain/loss. A capital gain or loss is short term if you held the capital asset for one year or less. Short-term gains are taxed at ordinary income tax rates and long-term capital gains are taxed at preferential lower rates. The current capital gain rates are 0, 15, and 20 percent. You should consult your tax professional for your rate status.

Q. ARE THERE TAX-FREE INVESTMENTS?

Jason: Yes, there are some investments that can grow tax-deferred and tax free. Annuity investments placed in a non-qualified account can generally grow tax deferred. Gains on annuities are typically taxed (as income) upon distribution from the annuity. Municipal bonds in non-IRA accounts can be federally tax free and, sometimes, state tax free. There are also other types of fixed income instruments that could offer tax rebates or tax free growth opportunities at the state and/or federal level. CONTINUED >

David: Tax-exempt bonds are a popular choice for investors looking to minimize their federal and state income tax bills. Tax-exempt bonds are typically called municipal bonds. The bond (debt security) is issued by local, county and state governments. This debt is basically a loan between you, the investor, and the corresponding municipality. The debt issuer agrees to pay you, the investor, a rate of interest in exchange for your capital investment in the municipality. Interest income is tax free, but if you sell the municipal bond at a profit, the investor will have a capital gain to declare on that bond investment. Check with your investment professional to make an informed decision about tax-exempt investments and knowing how to calculate a bond’s taxable equivalent yield.

Q. ARE THERE INVESTMENT WRITE-OFFS AT TAX TIME?

Jason: There are some additional potential write offs but the one used most often is a write-off of up to $3,000 in non-Qualified capital losses against earned income. Any losses above $3,000 can be used to offset capital gains (in perpetuity and until used)

David: An investor can use a capital loss to offset ordinary income up to $3000 per year if you don’t have capital gains to offset the loss. An investor can take a total capital loss on a stock if you own stock that has become worthless because the company went bankrupt and was liquidated.

Q. WHAT ARE SOME OF THE MOST COMMON WAYS TO MINIMIZE INVESTMENT TAXES?

Jason: Avoiding taxes entirely is quite difficult. Dividends, even if reinvested, are taxed regardless of whether one takes the dollars or reinvests them (for example). Understanding a client’s risk profile, investment timeline, and tax bracket can allow an Advisor to provide sound guidance on a path to minimize taxes.

David: Your prior year-end planning is the ideal time to minimize investment taxes. Example strategies include: 1) Harvesting your losses by selling investments that may have unrealized losses to offset those losses against other gains. 2) Harvesting gains if you have capital loss carryovers from prior tax years. 3) Maximizing contributions to either company- sponsored or personal IRAs to take advantage of tax-deferred growth. 4) Use appreciated stock rather than cash when contributing to charities. Please check your tax professional for all tax savings strategies.

Ameriprise Financial Services/Coastal Wealth Management

Mystic: 56 Williams Ave. 860-245-0251

Glastonbury: 628 Hebron Ave., Ste. 301 860-430-1780

Online: Ameripriseadvisors.com (Search Glastonbury)

DAVID MOZELESKI

RBC/MC Wealth Solutions Group

200 Glastonbury Blvd. Suite 103

Office: 860-657-1760

Cell: 860-256-1785

Online: us.rbcwm.com/mcwsg

CUSTOM FRAMING GALLERY WALLS REPAIRS

PHOTO PRINTING

ENLARGEMENTS

PHOTO RESTORATION SCANNING DIGITAL CONVERSION

SHADOWBOXES MEDALS & HONORS MEMORABILIA

THIS SACRED JEWISH HOLIDAY IS LADEN WITH HISTORIC SIGNIFICANCE AND FOOD RITUALS

ARTICLE BY EILEEN M. MCNAMARA

RECIPE BY:

LEAH KOENIG

Passover is one of the most sacred and widely observed holidays in Judaism. It honors the story of the Israelites’ departure from ancient Egypt, where they were enslaved by the pharaohs. Passover this year begins before sundown on Monday, April 22, and ends after nightfall on Monday, April 30.

Jews observe the weeklong festival with a number of important rituals, including a traditional Passover meal known as a seder, along with the abstinence of leavened foods and telling the story of their flight out of Egypt and into the desert.

On the first two nights of Passover, families and friends gather for the seder.

A seder plate at the center of the table contains other Passover foods with particular significance to the exodus story, including matzo, a lamb shank bone and a mixture of fruits, nuts, wine and a charoset, which represents the mortar Jews used while bonding bricks as slaves in Egypt.

MATZO BALLS

• 4 large eggs, lightly beaten

• 1 cup matzo meal

• 1⁄4 cup seltzer

• 1⁄4 cup neutral vegetable oil

• 2 Tbsp. finely chopped mixed fresh herbs (such as parsley, dill, chives, and fennel fronds)

• 1 tsp. kosher salt

• 12 oz. medium carrots, peeled, divided 1 (31⁄2-Ib.) whole chicken. cut into 8 pieces

• 1 Ib. medium-size yellow onions, halved lengthwise

• 1 medium (about 13-oz.) fennel bulb, quartered, 1⁄4 cup packed fennel fronds reserved

• 2 large celery stalks, trimmed and halved crosswise

• 1⁄4 cup loosely packed fresh flat-leaf parsley sprigs

• 6 medium garlic cloves, smashed

• 2 fresh or dried bay leaves 10 cups cold water

• 10 cups cold water

• 1 Tbsp. plus 1 tsp. kosher salt, plus more to taste

• 1 tsp. black pepper, plus more to taste

• 1⁄2 cup packed fresh flat-leaf parsley leaves

• 1⁄2 cup packed fresh dill fronds

• 1⁄4 cup sliced fresh chives

• 1 Tbsp. grated lemon zest (from 1large lemon)

• Edible flowers (optional)

1. Make the matzo balls: Stir together eggs, matzo meal, seltzer, oil, chopped mixed herbs, and salt in a large bowl. Cover and refrigerate 30 minutes.

2. Meanwhile, bring a Dutch oven filled with generously salted water to a boil over medium-high. Reduce heat to medium- low to maintain a simmer while you shape the matzo balls.

3. Using lightly moistened hands, scoop out chilled matzo mixture by heaping tablespoonfuls, and roll into balls, carefully adding each ball to simmering water after you shape it. (You will have 18 to 20 balls total.)

4. Cover Dutch oven; simmer matzo balls until tender and puffed, 45 to 55 minutes. To test for doneness, remove 1 matzo ball from water, and cut in half. It should be uniformly pale in color throughout. Remove from heat. Remove matzo balls from water, and transfer to a plate. Let cool 30 minutes. Proceed with making soup, or refrigerate matzo balls in an air- tight container up to 1 day.

5. While matzo balls cook, make the soup: Cut 2 carrots in half crosswise, and place in a large stockpot. Add chicken, onions, fennel bulb, celery, parsley sprigs, garlic, and bay leaves to stockpot. Cover with 10 cups cold water. Bring to a boil over high. Reduce heat to medium-low, and gently simmer, partially covered, until chicken is very tender and falling off the bone, about 1 hour and 30 minutes, occasionally skimming any foam that accumulates. Soup should maintain a very gentle simmer; if it starts to bubble too vigorously, nudge the heat down a little.

6. While soup cooks, cut remaining carrots into thin (1 1⁄2 × 1/16 × 1⁄16-inch) julienned strips. Set aside.

7. Remove chicken from stock mixture; transfer to a cutting board, and let stand until cool to the touch, about 10 minutes. Meanwhile, place a fine wire-mesh strainer over a large heatproof bowl; pour stock mixture through strainer. Discard solids. Return strained stock to stockpot; stir in salt and pepper. Add julienned carrot strips. Bring mixture to a simmer over medium-low. Simmer, covered, until carrots are tender, about 10 minutes.

8. Remove and discard chicken skin and bones from meat. Shred meat into bite- size pieces. Return shredded chicken to stockpot, and return to a simmer over medium-low. Simmer until warmed through, about 2 minutes. Season with additional salt and pepper to taste.

9. Place parsley leaves, dill fronds, chives, lemon zest, and reserved fennel fronds on a cutting board; roughly chop mixture, leaving some larger pieces intact.

10. Place 3 or 4 matzo balls in each of 6 bowls: top evenly with soup. Generously scatter bowls with herb mixture. If desired, decorate with a few edible flowers. Serve immediately.

MAKE AHEAD: Cooled matzo balls stored in an airtight container can be stored in an airtight refrigerator up to 1 day. SERVES 6

THREE QUESTIONS WITH INSURANCE EXPERTS ON HOW, AND WHAT, YOU SHOULD COVER

PHOTOGRAPHY BY BRIAN AMBROSE, ELIZABETH TAYLOR

“As a fourth generation insurance professional, I care very deeply for doing what is right and best for the people who entrust me with their insurance needs.”

- Coe Bancroft

We all have so many important things in our lives we need to protect -- homes, cars, jewelry, even our lives and health. How do we figure out how to prioritize them and how much coverage we should have? We spoke with two local insurance experts, Stephanie Johnson of Comparion Insurance and Coe Bancroft of State Farm Insurance here in Glastonbury, to get some answers.

1.WHAT ARE THE MOST IMPORTANT THINGS IN LIFE THAT YOU SHOULD PROTECT WITH INSURANCE?

Stephanie: When it comes to personal insurance you want to make sure that you’re insuring your major assets. Auto and Home/Condo insurance being the most common and then personal liability policies like an Umbrella helps provide extra liability coverage above your underlying auto and home coverage. When working with a local agent we recommend insurance that sometimes client have not thought about like

jewelry, pet and renters insurance. Also making sure all your toys are property insured like motorcycle, RV, golf carts, ATV, motor home, trailers, etc.

Coe: In general, the most important things to insure are your items of value that would be a financial hardship to replace without the help of an insurance payment, the liability protection to keep your assets and income safe from people making a claim against you for things like negligence, and protection for the potential costs of having you or a family member die or become disabled (including loss of future income potential).

2. WHAT ARE THE MOST COMMON THINGS PEOPLE FORGET TO PROTECT WITH INSURANCE OR DON’T REALIZE THEY NEED TO INSURE?

Stephanie: The most important thing to protect is yourself with life insurance. Many clients think that life insurance through work is plenty, but the reality is we

>

“A local agent with many carriers gives consumers options and someone who can shop it around for them.” - Stephanie Johnson

don’t own our employer’s benefits so it can change at any time. Life insurance provides financially security to your family in the event you are no longer here. There is a misconception that it is very expensive, however policies are offered at all different price points to meet the client with what they can afford.

Coe: An often overlooked protection I see is for expensive items like jewelry, laptops, and musical instruments, but the most commonly missed coverage is related to life insurance. It has many uses that are not widely known or misunderstood. One example is for couples who might not realize how their social security or pension income is reduced when the retired wage earner passes. This gap can be filled with life insurance and therefore be important to a surviving spouse beyond simply paying for the funeral and probate expenses. Whatever their situation is, I am here to uncover needs and recommend options.

3. WHAT ROLE DOES A LOCAL AGENT PLAY IN HELPING PEOPLE DECIDE WHAT TYPES OF COVERAGE THEY NEED AND HOW MUCH COVERAGE?

Stephanie: Right now, the insurance industry is experiencing a lot of changes and more expensive

losses that are causing it to be harder for consumers to get the right coverage at an affordable price. This is due to the rising prices of uses cars, rental cars, sensors on vehicles, shingles for homes, lumber, etc. The price to insure your home and auto is becoming more expensive every year. A local agent with many carriers gives consumers options and someone who can shop it around for them. It also allows us to place the right client with the right insurance company, so clients do not overpay for their insurance. In addition, local agents can help educate clients on what kind of coverage they should have based of their personal risks, for example a client with a pool has a different risk then someone without. This allows for the client to have property coverage in the unfortunate event there is a claim.

Coe: I live and work in Glastonbury and am committed to our community. As a fourth generation insurance professional, I care very deeply for doing what is right and best for the people who entrust me with their insurance needs. I work to help my customers look at their situation to help them recognize and address their potential future needs and raise awareness of ways they can improve their lives with appropriate and affordable insurance options.

We provide comprehensive foot and ankle care, from conservative to surgical management of podiatric conditions.

Common Issues & Procedures

Athletes’ Foot + Fungal Toenails · Hammertoe · Warts · Gout

Minimally Invasive Bunion Surgery · Foot + Ankle Fractures

Ulcerations + Wounds · Ingrown Toenails · Heel Pain

For more information, visit us online at www.ValePodiatry.com

Urgent Appointments available for infections and fractures.

Board

renbrook.org/visit

APRIL 2024

APRIL 1ST

Welles-Turner Memorial LIbrary, 2407 Main St. | 6:30 PM

Join Historian Kelvin W. Cole for a comprehensive and refreshing lecture about the Connecticut River and what it has meant to the region since its first discovery. Visit WTMLIB.info for more information.

APRIL 4TH

Glastonbury Planetarium, 95 Oak St. | 6:00 PM

Get ready for the solar eclipse occurring on April 8th. Presented by the Glastonbury Planetarium at the Glastonbury-East Hartford Magnet School, come learn about the science of eclipses, how to view them and our history with these natural events that were once thought to be omens of disaster. Visit Glastonburyplanetarium.org for information.

APRIL 5TH

Watkinson School, 180 Bloomfield Ave., Hartford. | 9:00 AM

Watkinson School in Hartford is hosting Information Session for parents, beginning 9 a.m., with registration and refreshments. Parents will have the opportunity to meet faculty and school leaders, tour the school's 40-acre campus, see classes in session and hear from a panel of current students. Alternative dates are available by request. Visit Watkinson.org for more information.

APRIL 6TH

275 Dug Road, South Glastonbury | 7:00 PM

The Comedy Craft Beer Tour brings the best of Northeast comedy to local breweries, wineries, and any other venue that serves alcohol throughout New England and beyond for an evening that keeps the drinks flowing, and the laughs coming. The show runs 7-9 p.m. Checkin and seating starts at 6 Email nancy@hopsonthehillbrewery.com for tickets and information.

APRIL 6TH

XL Center 1 Civic Center Plaza, Hartford | 11:00 AM

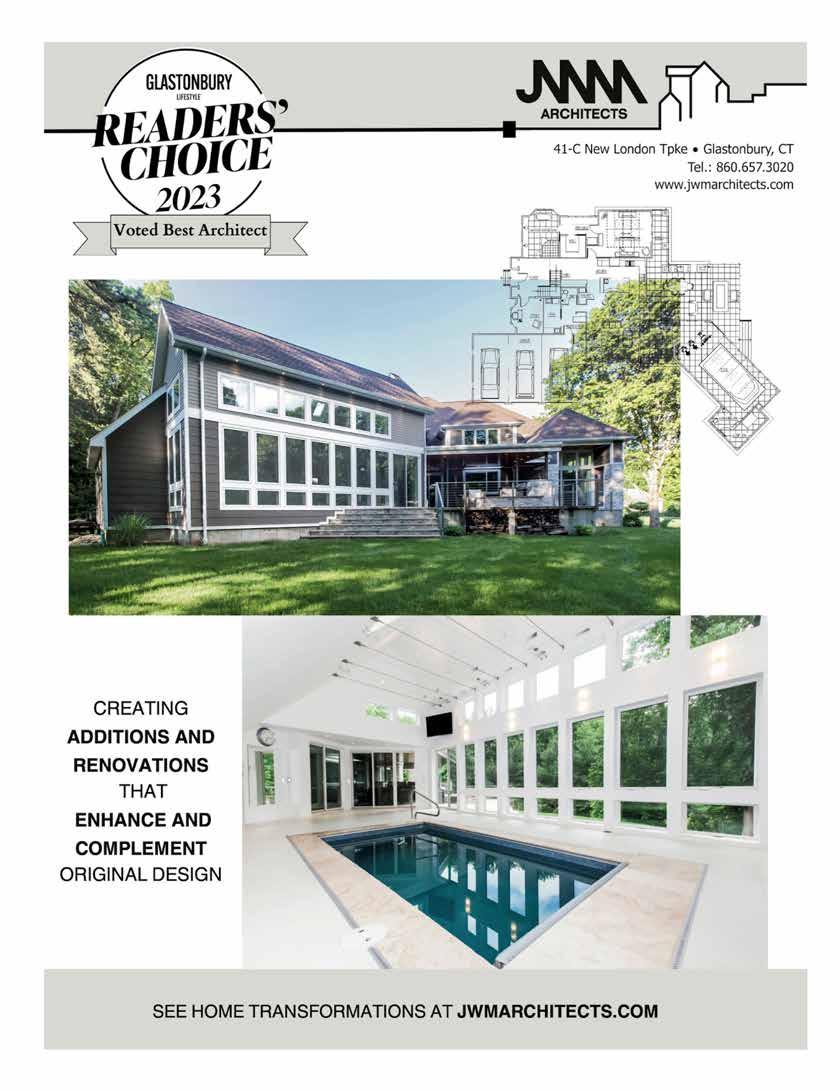

The Hartford Spring Home Show is one of the largest home expos in New England and JWM Architects of Glastonbury will be one of the featured vendors at the event. The home show will include more than 300 vendors in all, representing all the finest and most innovative companies in the home improvement industry. Visit Jenksproductions.com for information and tickets.

APRIL 8TH

Welles-Turner Memorial Library, 2407 Main St. | 3:00 PM

Come celebrate the solar eclipse with us at our viewing part on the library's front lawn. A celestial kid's craft will also be available in the Children's Room. Safe viewing glasses will be available (while supplies last). No registration required for this free event. Visit WTMLIB.info for more information.

CONTINUED

APRIL 12TH

Riverfront Community Center, 300 Welles St. | 9:00 AM

The Greater Glastonbury chapter of Veterans and Allies Coffeehouse provides a comfortable location for all veterans and allies, to meet, learn, and socialize. The coffeehouse will deliver information relating to veteran experiences, benefits, and service. Speakers are scheduled for each event. Visit My Rec at glastonburyct.gov for more information.

APRIL 19TH

Academy Building, 2143 Main St. | 6:00 PM

Kids ages 5-11 get a special night out while parents get a night off. Do your shopping, enjoy a dinner out or a quiet night at home. Kids get to hang out with their friends and favorite summer camp staff at a party complete with a pizza dinner, crafts, games and a movie. Visit My Rec at Glastonburyct.gov for information.

APRIL 21ST

Welles-Shipman-Ward House, 972 Main St., South Glastonbury | 11:00 AM

Ye Olde Lebanon Towne Militia will host multiple colonial living demonstrations, including men at arms drilling and firing muskets, from 11 a.m. to 3 p.m. The militia will be joined by storyteller "Privateer Big Bear," who will spin tales of adventures on the high seas. Open to the public, $10 for ages 10 and over. Visit HSGct.org for information.

APRIL 23RD

Cotton Hollow Kitchen, 840 Main St., South Glastonbury | 6:00 PM

Cotton Hollow Kitchen and Brickroad Productions present "Gangsters In Love," a mafia comedy murder mystery. Join us for an Italian-themed, three-course dinner, complete with fun, laughter, suspense, mystery, and lots of audience participation! Tickets are $65 and doors open at 4:30 p.m. for drinks at the bar. Visit Cottonhollowkitchen.com or call 860-781-8555 to reserve a seat.

APRIL 28TH

Welles-Shipman House, South Glastonbuory | 12:00 PM

Join the Historical Society of Glastonbury for a demonstration of Colonial-era cooking over an open hearth from noon to 3 p.m. Visit Hsgct.org for more information. Admission is $40, reservations required, email julie.thompson.hsg@gmail.com. HSG also will host tours of Green Cemetery - corner of Hubbard/Main Street - on various dates throughout April. Tickets are $10, email diane.hoover.hsg@gmail.com for information..