Welcome to our third edition of El Dorado Hills City Lifestyle, the “Investment” issue. Investing conjures up images of ticker symbols, intricate graphs, and a lexicon of acronyms one might need a Rosetta Stone in financial lingo to decipher. We wanted to bring it down to its most basic form; taking the right steps toward the future. In this issue, we’ll explore investing, not just limited to monetary pursuits, but to also encom pass what truly holds value in our lives.

We're thrilled to present insights from a local financial luminary, shedding light on the importance of imparting early financial wisdom to our children that will help put them on an early path to success. Additionally, we explore how enhancing your living space can not only enrich your immediate surroundings but also boost the value of your home with a local kitchen and bath design expert. We showcase a local family who has invested in something unique by turning their love of craft brewing and plant cultivation into a dynamic duo that adds a brewery with character and enjoyment to our community here in El Dorado Hills.

Furthermore, we advocate that investing in our community through charitable endeavors is a powerful way to make a positive impact on the lives of others. By supporting local charities, we can contribute to the welfare and development of those in need. In this issue, we spotlight a charity close to my heart, deeply intertwined with the fabric of El Dorado Hills.

As you navigate your investment journey, whether it involves bolstering your 401K, promoting financial well-being within your home and family, or simply dedicating your time to meaningful endeavors, we hope this issue serves as a wellspring of inspiration. May it empower you to cultivate wealth not only in your financial portfolio, but in the richness of your everyday experiences.

April 2024

PUBLISHER

Kristy Murdoch | kristy.murdoch@citylifestyle.com

PUBLICATION DIRECTOR

Todd Murdoch | todd.murdoch@citylifestyle.com

EDITOR

Kristal Johnson | kristal.johnson@citylifestyle.com

SOCIAL MEDIA COORDINATOR

Cadence Murdoch

CONTRIBUTING WRITER

Courtney Adams

CONTRIBUTING PHOTOGRAPHER

Kimberlee Brooke & Co

PHOTO EDITOR

Scott Hallmeyer | scott@thecreativhaus.com

Thompsons Family of Dealerships is just a short trip up the hill from El Dorado hills. With 3 convenient locations in scenic Placerville, choose among our selection of luxurious SUVs, trucks, and fun off-road vehicles. Enjoy the luxury of adventure here in El Dorado County.

Toyota

Hummer EV and GMC

Jeep, Ram, and Wagoneer

Toyota

Hummer EV and GMC

Jeep, Ram, and Wagoneer

From April 1 to April 30, Miraflores Wine Club members are invited to purchase pre-selected cases of Miraflores wines at an incredible price of $100 off plus your Wine Club discount of 20%! They are extending this sale offer to new club members as well. Join at mirafloreswinery.com/wine-club

El Dorado Hill’s premier health and wellness facility, Passport 2 Health, invites you to join them for their weekly workout. Aimed at improving your balance, coordination, flexibility, and strength, this 30-minute in-home workout will jump-start your day and get your body moving in the right direction. Please visit passport2health.co or call 916-984-4128 for more details.

Get a glimpse into the world of content creation. Join Producers Doug Stanley and Charlene Taylor at SmackDab Studios for a hands-on, open-house experience on April 24 from 4 PM- 7 PM. Specializing in content creation, YouTube channel shows, and video content for marketing purposes, SmackDab Studios invites you to an unforgettable evening at the Charm Studio Loft, 4364 Town Center Blvd, Suite 215, El Dorado Hills. To RSVP text or call 916-712-5897

They say behind every successful small business is a family. That is both figuratively and literally the case for the Boring Rose Brewing Company. The business is owned by four family membershusband and wife Bill and Paula Rose, and their son Billy and his wife Jamie (maiden name Boring) Rose. In addition to the familial link between the owners, the brewing company employs a host of varied Rose and Boring family members, who all lend their unique talents and skills. Jamie's father, Matt Boring, utilized his construction and electrical abilities to build the greenhouse and brewery. Jamie's twin sister, Kenzie Boring, lends her green thumb and environmental knowledge as the brewery and nursery assistant. Joey Rose, the second of the three Rose children, has an eye for design and works alongside Alex Underwood to create the logos, graphics, and murals that adorn the Boring Rose brand and brewery. Katie Rose, the youngest of the Rose children, is a singer/songwriter who can be found performing at the Boring Rose taproom. Suffice it to say, their website summarizes it perfectly when they state that they are, 'the perfect blend of beer, plants, and family!’

When you read the distinctive and diverse biographies of the owners, it certainly seems like creating a nursery, brewery, and restaurant was in the cards - if not specifically designed for them. Bill grew up on a ranch where he harvested barley, wheat, and oats. He went on to lead a career in executive technology management positions, which would ultimately arm him with a particular business savvy. Paula grew up with a similar love of nature, as her family spent quality time exploring the outdoors. She has worked as a community liaison, art teacher, and digital designer, allowing

her to lend her creative flair to the family business. Billy grew vegetables in his childhood and ultimately earned his degree in horticulture. He now considers himself a 'plant nerd,' which makes him the perfect match for his wife, Jamie. Jamie grew up raising prize-winning 4H goats, earned her degree in biology, and was the Greenhouse Manager for Habitat Horticulture. If you were looking for an 'A-team' for cultivating a local nursery and brewery, you'd be hard-pressed to find better candidates.

So, with this diversified combination of ingredients (family ties, experience, and expertise), how does the Boring Rose blend taste? Scanning the Yelp reviews, adjectives like ‘unique,’ ‘fun,’ and ‘friendly’ appear with discernible frequency. Patrons enjoy the artfully curated plant shop, the selection of traditional, time-tested beer and adventurous, bold seasonals, the lively entertainment, and the relaxed, conversational atmosphere. And being as multi-faceted and unique as it is, you might think Boring Rose would be content just to maintain the status quo. But they are oriented toward continual growth and opportunity; they're currently working on an IPA collaboration with the Pink Boots Society, an organization that supports women brewers, that'll be released for International Women's Day. For St. Patrick's Day, they'll release an Irish Red Ale with Lions of the North, a local Irish band. They also plan to hold a variety of workshops in the coming spring and summer months, with subjects ranging from charcuterie to succulent wreaths. So come down to Boring Rose one of these nights to play trivia, listen to live music, drink great local beer, converse with friends, and marvel at the beauty of nature - you'll feel just like family.

CONTINUED >

6-8 people 30-60 Minutes

Boring Rose will be holding charcuterie workshops this upcoming Easter and Mother’s Day. You’ll get a step-bystep tutorial with a seasonal twist on the art of charcuterie. In the meantime, below is a simple recipe you can assemble and enjoy at home. The recommended Boring Rose pairings are detailed as well.

Directions:

Place cheeses (cut into cubes, triangles, etc.) and cured meats (formed into roses, fans, and ribbons) on the charcuterie board in an aesthetically pleasing arrangement. Add small containers of olives and nuts. Arrange groupings of fruits, pretzels, and chocolates around the cheeses and meats. For the best visual impact, group by color and type. Complete your board with various dried fruits, crackers, and baguettes.

Ingredients:

Variety of cheeses: We recommend one soft cheese, one hard cheese, and one mild cheese.

• Brie pairs well with the Dragon Point IPA, El Dorado Hills IPA

• Gouda with the Latrobe Lager, Lost Horizon Hazy, and White Rock Weizen

• Aged White Cheddar and Manchego with the Latrobe Lager, Stampede Stout, Lover’s Leap Stout, Banbury Cross, and French Creek Saison

Variety of cured meats:

• Salami (peppered and/or plain) pairs well with the Prairie City Pale Ale and Clarksville Kolsch

• Prosciutto pairs with the Pacific Crest Pilsner, Fest

• Soppressata with the Stampede Stout, Lover’s Leap Stout, Banbury Cross, and French Creek Saison

• Seasonal fruits: green, red, or black grapes, blueberries, and strawberries

• A variety of dried fruits and nuts: dried apricots and figs, salted nuts, or honey nuts

• Savory accouterments: olives and other pickled vegetables

• Sweet accouterments: yogurt pretzels and chocolates

• Crackers

• Sourdough/french baguette slices

Perhaps your financial education began with entrepreneurial ventures like a lemonade stand on a scorching summer day or with your parents setting up an allowance system. Maybe it was during a family game night playing Monopoly, where landing on Free Parking seemed like a windfall (Fun

on numbers. Being a father of two boys (ages 10 and 13), he recognizes the significance of introducing financial education to children early on. He has even conducted a personal finance class at a local middle school, acknowledging the absence of such education in our school system.

Fact: not an official rule!). However, whether through these experiences or others, many of us likely didn't receive thorough preparation for the financial complexities of adulthood.

Financial education is vital, comparable to teaching personal hygiene or history. Even if a child struggles with household chores, they should learn money management, fostering self-reliance. Research shows that good financial habits lead to higher confidence, reduced stress, and clearer goals. It's about empowering our children to make thoughtful choices. Adarsh (Adi) Shyamsundar, owner of Polaris Capital Management in El Dorado Hills, emphasizes that it’s about cultivating a mindset of planning and accountability, not just focusing

Here are some strategies he recommends for parents to help their children invest in their financial future:

Adi suggests a simple approach: parents should teach children about money from a young age, explaining its nature and the reasons for spending or saving. As kids mature, it's crucial to discuss earning money and differentiate between essential needs and optional wants.

The best way to start a budget with your kids is to begin by recording the money they have and then categorizing their expenses, ensuring that saving and investing are included in the budget plan.

Encouraging financial responsibility, parents should guide their children to set aside at least 15% of their allowance or earnings for savings or investment. Furthermore, it is pivotal to help them define objectives for significant expenditures, such as acquiring a phone, a gaming console, or their first car.

The official age to obtain a credit card is 18. However, Adi points out that in many cases, parents can add their child as an authorized user to help them build credit history and impart financial discipline. However, it's important to note that the parents are liable for any charges made on the card, so a teaching opportunity around trust may follow.

Summer jobs offer teenagers an excellent opportunity to earn money and gain practical experience in handling financial responsibilities. One surprising aspect for teens entering the workforce is learning about the deductions from their paychecks. These temporary positions allow teens to earn income without disrupting their studies during the school year and may also help them explore and identify their passions.

Studies show giving boosts happiness, health, and social connections, inspiring others. It's vital to teach kids generosity in financial education, shaping them into empathetic, responsible individuals who contribute to society.

Life presents moments akin to landing on Park Place; promising yet already claimed, while Boardwalk thrives with hotels. These experiences often involve regrettable decisions, but they're natural and offer growth opportunities. Mistakes provide valuable lessons, enabling us to recalibrate, learn, and move forward toward success.

In the digital age, financial transactions are effortless, but online security is crucial. Understanding cybersecurity basics is vital, especially with the rise of cryptocurrencies. Platforms like Reddit expose individuals to speculative strategies. Adi notes the wealth of online learning platforms for teens, but parents must navigate challenges in monitoring content. Engaging with teens helps guide them towards reliable resources, fostering critical thinking skills.

Adi offers his suggestions to enhance your child's financial literacy.

Apps:

• Money Masters

• Trading Game

Books:

• The Infographic Guide to Personal Finance - A Visual Reference for Everything

You Need to Know (Infographic Guide Series)

by MicheleCagan CPA and Elisabeth Lariviere

• The Psychology of Money: Timeless Lessons of Wealth, Greed and Happiness by

Morgan HouselApplying these valuable tips to foster a positive mindset in money management in our children can set them on a trajectory toward greater financial success in the future. The objective is not to dictate what they should do with their money but rather to guide them in developing thoughtful perspectives and a deeper understanding of the choices they make.

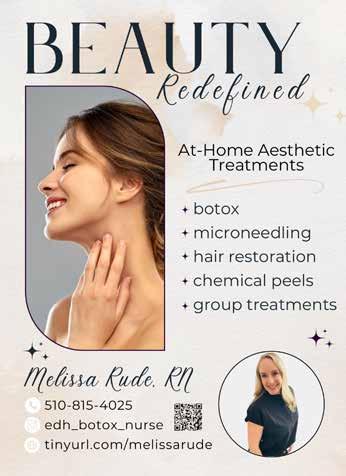

ARTICLE BY JILL BROWN | PHOTOGRAPHY BY FOLSOM KITCHEN AND BATH

ARTICLE BY JILL BROWN | PHOTOGRAPHY BY FOLSOM KITCHEN AND BATH

Certain home renovation projects can not only elevate aesthetic appeal but also amplify your property's overall value. Whether revitalizing outdated spaces or aiming to increase resale value, strategic upgrades can promise substantial returns.

When it comes to optimizing gains on home renovation investments, kitchen and bathroom makeovers offer unparalleled benefits. These spaces serve as focal points for residents and buyers, making them prime candidates for upgrades. Revamping outdated features, updating fixtures, and enhancing functionality significantly maximize property appeal and value.

Home renovations offer rewards beyond financial benefits. Enhancing your living space has also demonstrated a positive impact on overall quality of life, promoting mental well-being. Upgrading your property fosters a sense of ownership and connection with your home.

With 25+ years of experience, I have seen the transformative power of timely renovations and maintenance. Trends evolve, but the need for upkeep remains constant. Key elements such as appliances, cabinetry, and fixtures may need updating to prevent future issues.

Attention to detail and maintenance make a significant difference when purchasing a home. Recognizing that a home has a good infrastructure not only offers immediate livability but also provides a solid foundation for future personalized customization, increasing the property's value over time.

Home renovation projects are investments that not only elevate property value but can also enrich the overall well-being of the homeowner. Prioritizing purposeful upgrades, regular maintenance, and thoughtful investments ensures long-term benefits beyond monetary returns.

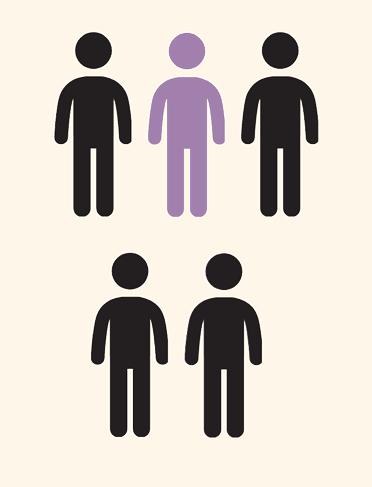

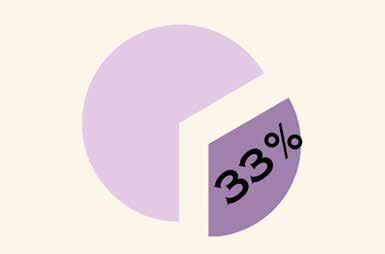

Since 1977, Big Brothers Big Sisters of Northern Sierra has operated under the belief that inherent in every child is the ability to succeed and thrive in life. Serving about 250 children annually in Northern Sierra counties, it offers exclusive oneon-one mentoring, outcome-based tracking, and ongoing relationship support.

Anyone, from high schoolers to retirees, can become a Big Brother or Big Sister. “Bigs” are diverse individuals who want to be positive role models, committing as little as an hour every other week to a child. Our professional staff trains all volunteers and provides ongoing support for each relationship.

Being a “Big” is not for everyone. You can also attend, volunteer, or sponsor our events or provide gifts for our auctions.

Although it is considered a primarily affluent area, more than half of the children we serve live in El Dorado Hills. Currently, there are 57 children on the waitlist (several right here in EDH).

Visit www.bbbsns.org for information on how to contribute.

Every “little “ bit counts!

UPCOMING EVENT SPONSORSHIPS:

12th Annual Golf For Kids’ Sake

May 20th

Serrano Country Club

El Dorado Hills

The Big Bloody Mary Battles

June 22nd

Nevada County Fairgrounds

Grass Valley

BIG Autumn Auction

October 25th

Folsom Community Center

Folsom

For more information on any of these upcoming events or for sponsorship opportunities, call Juan at 530.626.1222.

ARTICLE BY CADENCE MURDOCH

CEO Brenda Frachiseur of the Northern Sierra Chapter Enlightens Us

ARTICLE BY CADENCE MURDOCH

CEO Brenda Frachiseur of the Northern Sierra Chapter Enlightens Us

At Miraflores Winery, our passion is to craft balanced new world wines, and indulge the senses with gracious and welcoming surroundings. Escape the hectic pace of daily life and let your cares drift away with a visit to our winery.

VOTED BEST WINERY 8 YEARS RUNNING!

mirafloreswinery.com | 530.647.8505

V mirafloreswinery B mirafloreswinery

Flower Beds

With sunny skies upon us, it’s time to start planting flower beds! The colorful flowers and fresh floral scents mark the beginning of Spring. It can be hard deciding what you’re going to do so we put together a guide to give you a little gardening inspiration. With everything you need to know including plant necessities and tastefully decorating your garden, we have you covered!

ARTICLE BAILEY MORRIS PHOTOGRAPHY

Decide on a color scheme that includes 2-3 colors that complement each other.

When choosing which plants you will use, take into consideration how tall the plants will grow and place the tallest in the back.

Different flowers have different soil requirements. Make sure you check what soil will fit your plants' needs best.

Look at the location of the flower beds.

Is it in a sunny area or a shady area? Depending, make sure you choose flowers that will thrive in that area.

Create a centerpiece with some fun decor. You can use a bird bath, fountain, or even an antique wagon filled with more flowers.

Retirement marks the culmination of years of dedication, perseverance and sound financial choices. It's often envisioned as a period of relaxation, exploration and deep connection with family and friends. However, this dream doesn't just manifest. It necessitates forward-thinking and detailed planning, regardless of one's financial status. Amid global economic changes, evolving life expectancies and intricate tax systems, an all-encompassing and strategic retirement plan is more crucial than ever.

A key element of effective retirement planning is diversifying your income sources. While staples like 401(k)s or IRAs are foundational, it's equally important to branch out. Dividend-bearing stocks can provide regular dividends, bonds offer both periodic interest and principal return and real estate, whether directly or indirectly owned, has potential for both rental income and value growth. Private investments can also yield passive income and impressive returns.

Tax considerations significantly influence retirement strategies. Each financial action, from asset sales to account withdrawals, can carry tax consequences. Knowing these details can greatly influence one's overall retirement income. Tactics such as Roth IRA conversions can help distribute tax liabilities over time, allowing for taxfree withdrawals later on. Using strategies like tax-loss harvesting can balance out capital gains, ensuring proactive steps to reduce tax impact.

Annuities have long been recognized as a popular retirement income source. An annuity is essentially a financial contract that can offer a steady and predictable income, with options that might even extend to lifetime payouts. Available in varieties like fixed, variable and indexed, they often come with tax advantages. However, retirees should also be aware of certain drawbacks. These might include fees and expenses, issues around liquidity, and potential concerns related to inflation.

Delving into the world of Alternative Investments, retirees can consider assets such as hedge funds, private equity and real assets, among others. These investments may promise higher returns and provide diversification away from traditional stocks and bonds. However, the complexities of these investments mean they often come with challenges like illiquidity, higher fees and the need for a thorough understanding of the investment itself.

Delaware Statutory Trusts (DSTs), while not familiar to everyone, can be a potential retirement income source. Historically rooted, DSTs offer a form of passive real estate investment, which can lead to regular distributions. They also open doors to 1031 exchange possibilities, offering tax deferral benefits. But, just like any other investment, DSTs have their limitations, notably the lack of liquidity and the heavy reliance on trust management.

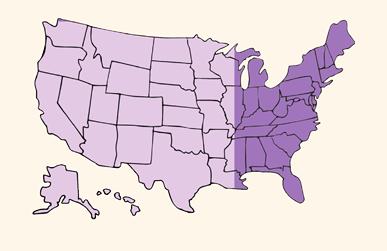

Introduced by the Tax Cuts and Jobs Act of 2017, Qualified Opportunity Zones (QOZs) were designed to spur economic development. Investing in these zones can lead to deferral, reduction and even the potential elimination of certain capital gains taxes. However, they often require a long-term investment horizon, and retirees must be well-versed with the specifics of the chosen opportunity zone.

Rental income remains a favorite for many looking for consistent returns. Whether through direct property ownership or Real Estate Investment Trusts (REITs), real estate can offer passive income, tax benefits and appreciation. Yet, the

responsibilities tied to property management, the uncertainties of market fluctuations and other associated costs must not be ignored.

The backbone of many retirement plans, Social Security Income, provides a safety net for millions. Established with the intent of financial assistance, the amount one receives depends on various factors. There are also strategies retirees can employ to maximize these benefits, such as deciding on the optimal time to claim or considering the implications of working while receiving benefits.

Beyond the immediate realm of retirement, estate planning emerges. This encompasses not just post-retirement arrangements but also asset distribution for future generations or charitable endeavors. Regularly reviewing wills, trusts and beneficiary designations ensures alignment with changing circumstances.

Philanthropy seamlessly integrates with retirement plans. Beyond fulfilling a personal mission to give back, it also carries financial benefits. Using instruments like donor-advised funds or charitable trusts lets individuals make impactful societal contributions while enjoying tax advantages.

You only get one retirement. In the ever-evolving world of finance, staying updated and flexible is essential to ensure the continued relevance and efficiency of one's retirement strategy.

Securities offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC. Advisory services offered only by duly registered individuals of Csenge Advisory Group, LLC. MAS, Csenge Advisory Group, LLC and Impact Wealth, LLC are not affiliated entities. Investing involves risk, including the potential loss of principal. This is intended for informational purposes only. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. Our firm is not permitted to offer and no statement made during this presentation shall constitute tax or legal advice. Our firm is not affiliated with or endorsed by the U.S. Government or any governmental agency.

Every retirement journey is distinct, and each vision merits expert guidance. Impact Wealth is based in Boulder Colorado. You can contact them at Impact@ImpactWealth.com.

APRIL 2024

EVERY SUNDAY

EDH Town Center Behind Nibblers and Trek Bicycle | 9:00 AM

The El Dorado County Certified Farmers’ Market Association is dedicated to the farmers in El Dorado County and has created four markets in El Dorado County. Saturday in Placerville, Sunday in El Dorado Hills at Town Center, Tuesday in South Lake Tahoe, and Wednesday in Cameron Park. edhtowncenter.com

APRIL 6TH

The Placerville Shakespeare Club, 2940 Bedford Ave, Placerville | 4:00 PM

This family-friendly event includes live music, vendors, a dinner featuring delicious soups and fresh breads, and a keepsake handmade bowl to take home as a reminder of the cause. Proceeds from the event fight hunger through the Upper Room Dining Hall, the Hands4Hope Emergency Food Pantry, and Earth Angels in Ghana. Tickets are $20/presale or $25 at the door hands4hopeyouth.org/emptybowls

APRIL 13TH

Marshall Gold Discovery State Historic Park, 310 Back St, Coloma | 8:30 AM

The California Gold Rush Run is held inside the Marshall Gold Discovery State Historic Park, set in the beautiful foothills of Coloma along the south fork of the American River. This was the site where gold was found in 1848 sparking the gold rush and accelerating California's statehood. For more information about the race, please visit tctruns.com/california-gold-rush-trail-run-spring

APRIL 20TH

4364 Town Center Blvd, #128 El Dorado Hills | 12:00 PM

Good ol’ fashioned cornhole fun! No strict rules and no strict competition. Kids are welcome to play. The winner receives a $100 Gift Card. Sign up in the amphitheater with Greg at noon, or email EDH@brickyard916.com. Bags fly at 1 PM!

APRIL 20TH - 21ST

El Dorado County, Sierra Foothills | 11:00 AM

Explore one of the world’s most diverse and exhilarating wine regions at El Dorado Wines Passport Weekend on April 20-21, 2024. Sip and savor award-winning wines while enjoying perfectly paired bites, music, and a bounty of other experiences at more than 20 participating wineries throughout the picturesque foothills of El Dorado County. eldoradowines.org/passport

APRIL 27TH

El Dorado County Fairgrounds, 100 Placerville Dr, Placerville | 10:00 AM

Catalyst Community presents the 39th Annual Kids’ Expo. This popular free event has grown to be El Dorado County’s largest collaborative children’s event. Sit behind the wheel of a fire truck, spin prize wheels or get your face painted! Families can participate in a wide variety of creative activities while learning about community services, educational programs, and businesses.

Sonny’s

“I love Sonny and his humans too. LOVE the food and will never buy meat anywhere else again.”

-Debbie B.

INVESTING IN HOME DESIGN CAN GIVE YOU A PEACEFUL SANCTUARY WHERE YOU CAN ESCAPE FROM THE STRESSES OF DAILY LIFE. SO GO AHEAD, TAKE THE PLUNGE AND REVAMP YOUR LIVING SPACES – IT’S WORTH EVERY PENNY!

There are many things that can help a room feel relaxing, but let’s keep it simple and focus on my top three. I would say that one must incorporate good lighting, great textures, and a decluttered space to truly get the cozy vibes. Let’s tackle each.

It’s imperative that there are multiple sources of light in a space. Rooms need a soft warm light, so I always like to use a light bulb between 2,700k and 3,000k. Also, all lights should have the same temperature light bulb to avoid clashing. It’s not enough to just have recessed or pendant lighting. I add a table or floor lamp to a space to truly have ambient light. Candles are a must for me. They can be scented candles (an extra way to add relaxation) or I like to use remote control tapered candles, so I don’t have to worry about cleaning up wax later.

Textures are seen in toss pillows, rugs, draperies, throw blankets and furniture upholstery. Textures add color, pattern and visual interest. I like to use at least three different textures to help a room feel lived-in and welcoming.

So many times, a person thinks that every nook and cranny and every wall need to have something, and this is not the case. A decluttered space is actually more relaxing because overcrowding of items doesn’t quiet the mind. Decluttering a space can be overwhelming, I get it, so just do it in stages. You’ll love the outcome when the room is tidy, organized and you are only surrounded with what brings you joy.