Tax-saving moves you can still make for 2025

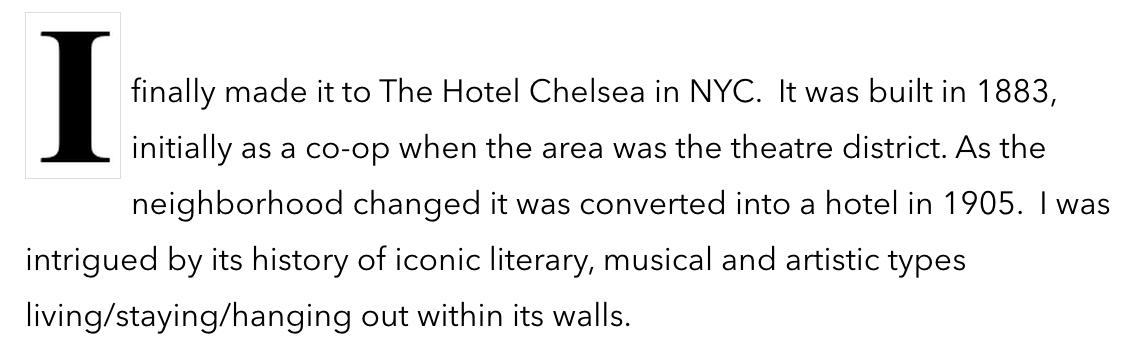

Tax season is here, but you still have time to make smart moves that may lighten your 2025 tax burden.

Contributing to an IRA is one of the most popular strategies. For 2025, you can contribute up to $7,000, or $8,000 if you’re 50 or older. Traditional IRA contributions may be tax-deductible, while Roth IRAs offer tax-free growth.

If you have a high-deductible health plan, consider a Health Savings Account. These provide triple tax benefits: first, contributions reduce taxable income, second, growth is tax-free and finally withdrawals for qualified medical expenses aren’t taxed. Limits for 2025 are $4,300 for individuals and $8,550 for families, plus an additional $1,000 if you’re 55 or older. Are you self-employed? A retirement plan known as a SEP IRA lets you contribute up to 25% of compensation, capped at $70,000.

Consult a tax professional to find the best options for your situation – and act before April 15.

Matthew Besier, your Edward Jones financial advisor

At 179 East Beck Street

This article was written by Edward Joes for use by Matthew Besier your local Edward Jones Financial Advisor

Member SPIC

https://www.LinkedIn/In/MatthewBesier-AAMS

https://www.Facebook.com/EJAdvisorMatthewBesier

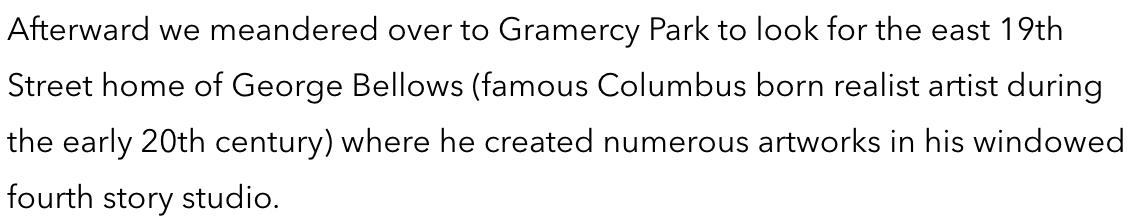

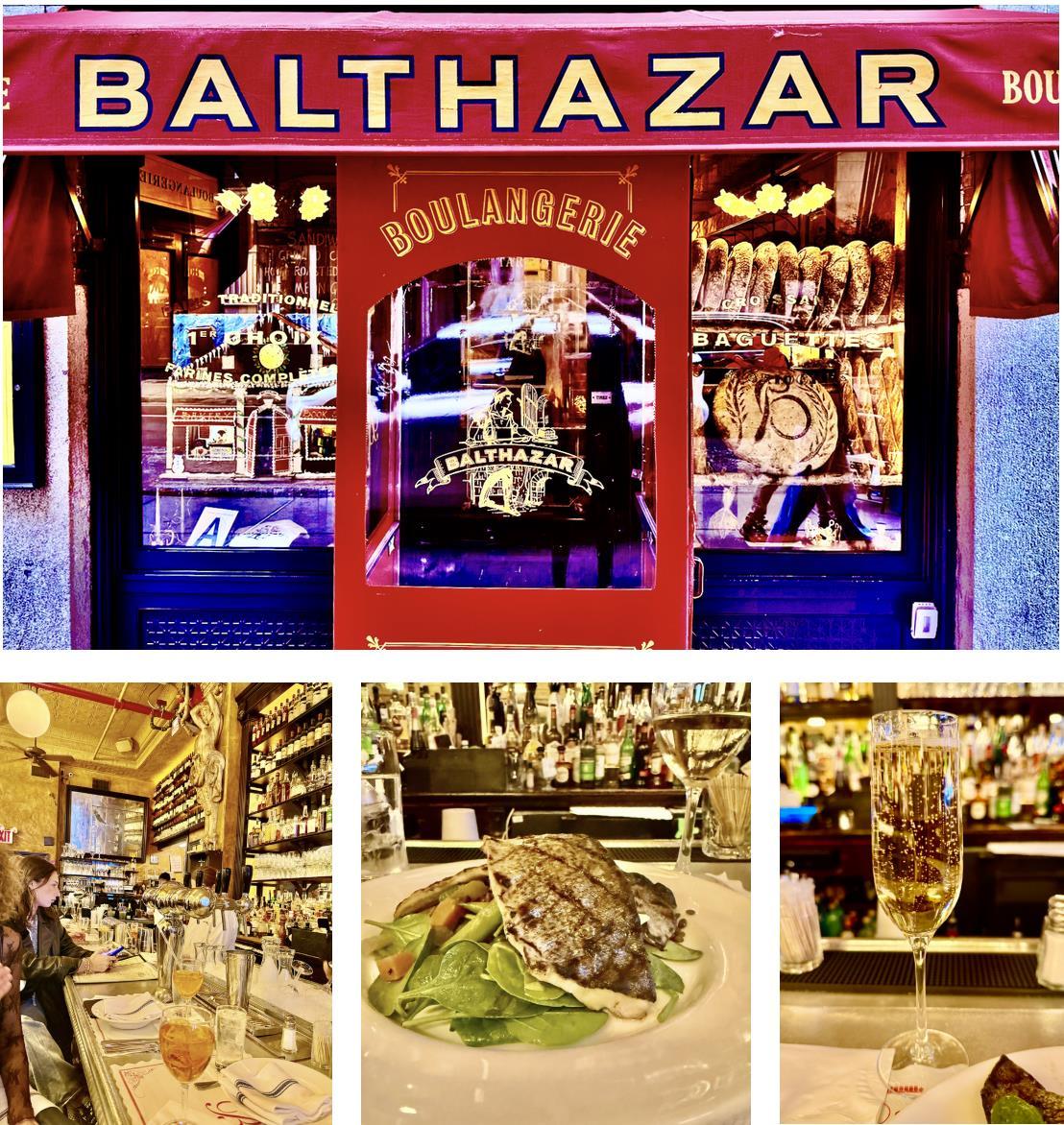

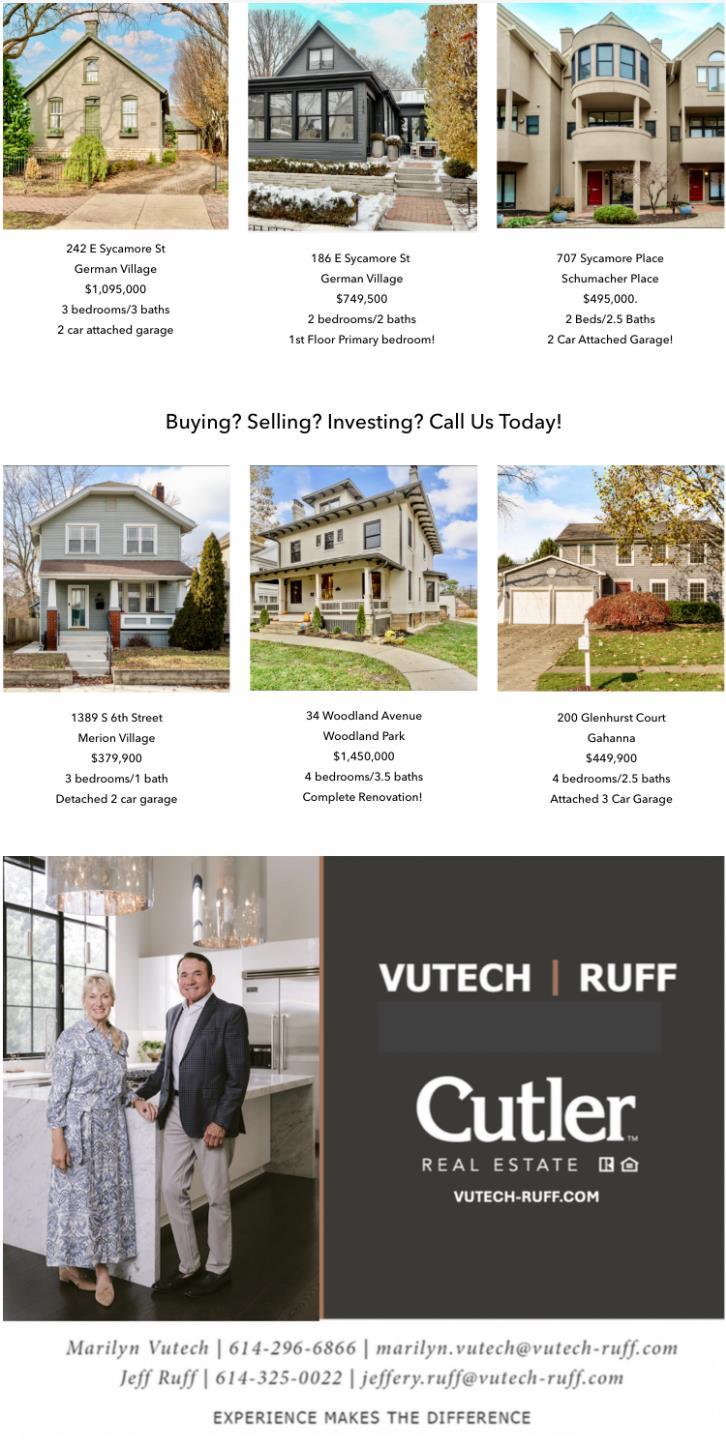

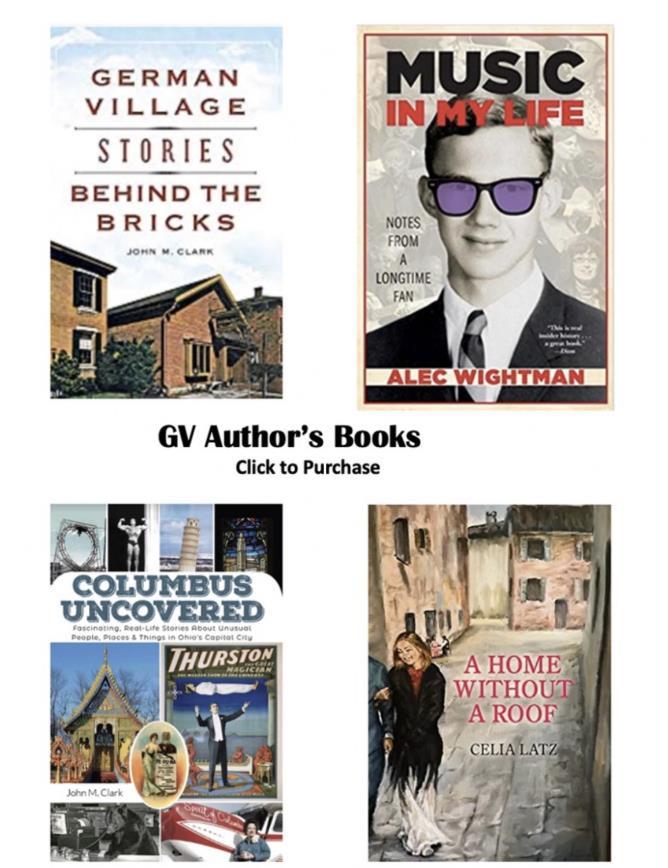

ASeasonal Stroll through German Village