CBR Equity Partners is a full-service concierge real estate group committed to delivering a streamlined and tailored experience for all your real estate requirements.

To empower clients by providing expert guidance, transparent communication, and personalized solutions that turn real estate goals into reality With unwavering dedication, we aim to simplify the home-buying and selling process, while fostering relationships built on trust, integrity, and resultsdriven success.

Over the decades, we have cultivated strong partnerships with our real estate affiliates, enabling us to connect you with top-tier professionals, including Licensed, Insured, and Bonded Contractors, Real Estate and Trust Attorneys, Certified Tax Accountants, Escrow and Title Officers, Independent Residential and Commercial Appraisers, as well as Conventional, Private, and Hard Money Lenders. We also have access to trusted Home and Termite Inspection companies to meet your every need

Always act with honesty and uphold ethical practices, putting the client's best interests first.

Keep clients informed with clear, timely, and transparent updates, ensuring they feel confident and involved.

Strive to exceed expectations, going the extra mile to meet clients' goals and build long-term relationships.

Commit to continuous learning and improvement, aiming to deliver exceptional results.

Persevere through challenges with a can-do attitude, always prioritizing client satisfaction

Understand clients' unique situations and priorities, creating a supportive and trusting relationship.

Demonstrate reliability, expertise, and respect in every interaction, ensuring high-quality service.

Embrace market changes and challenges with creativity and problemsolving to find the best solutions.

Work effectively with colleagues, clients, and other professionals to achieve shared goals.

Value relationships within the community, staying actively involved to understand the local market and contribute meaningfully.

DRE #01273267 (917) 224-5222

CbrEquityPartners@gmail.com

Brandon Sen, licensed at 19, specializes in buying, renovating, and selling residential properties in California, NYC, and abroad. With a finance background, he offers expert guidance, market insights, and post-sale support. A “people person,” Brandon values architecture, travel, and lifelong learning

Licensed Real Estate Broker in California 2024

University Berkeley Graduate 2003

Accredited Buyer Specialist (ABR®)

Columbia Business School 2012

Licensed Real Estate Agent in New York -1998

Licensed Real Estate Agent in California - 2000

Master Certified Negotiation Expert (MCNE)

Real Estate Negotiation Expert (RENE)

Certified Luxury Home Marketing Specialist (CLHMS)

Certified Listing Expert Agent

Alina is a dedicated and dynamic agent who began her real estate career at just 20 years old. With deep Eastern European roots and fluency in three languages, she bridges cultures and communities to connect with a wide range of clients. Alina proudly serves end users, developers, sellers, investors, and buyers offering personalized strategies to meet each client’s unique goals. Based in both Silicon Valley and Los Angeles, Alina is known for her friendly approach and sharp negotiation skills, ensuring every transaction is as seamless as it is successful. Her Master’s degree in Education gives her a natural ability to guide clients through the complexities of the real estate process with clarity and confidence.

Master Certified Negotiation Expert (MCNE)

Real Estate Negotiation Expert (RENE)

Accredited Buyer Specialist (ABR®)

Certified Listing Expert Agent

Certified Luxury Home Marketing Specialist (CLHMS)

Before we begin house hunting, it’s essential to understand what you can comfortably afford. Getting pre-approved not only gives you a clear picture of your buying power, it also shows sellers you’re a serious buyer with verified finances and credit

Connect with a trusted lender to discuss your home goals and financial situation.

Provide key information such as your income, employment history, credit score, monthly debts, assets, savings, and a valid form of identification. You’ll also need to authorize a credit check so your lender can evaluate your eligibility.

If you qualify, your lender will issue a pre-approval letter stating how much you may be eligible to borrow. While this isn’t a guarantee of final loan approval, it shows sellers that your finances have been reviewed and that you’re a serious buyer. Most pre-approvals are valid for 60 to 90 days and may be subject to additional verification during the home buying process.

With your pre-approval in hand, you can tour homes knowing exactly what you can afford and make competitive offers that stand out to sellers.

You will be asked to provide personal information such as your Social Security number, income, assets, debts, credit information and the specifics on the type of property you wish to purchase.

During the application process the lender will update any information and documentation that has already been submitted.

Your mortgage package will be reviewed and completed by the processor.

Once the processor has completed the loan package, it is submitted to the underwriter for approval.

All parties are notified of the approval and loan documents are completed and sent to both the title and escrow companies.

The title company ensures that the property title is clear and legitimate. Once this process is complete, title insurance is issued for the property

Once you have signed the loan documentation, your lender reviews the loan package, and upon approval, funds are wire-transferred to the title company

When the title company receives the funds, they are released to the seller, less taxes and fees and you are recorded as the owner of your new home. 1 2 3 4 5 6 7 8

1

3 2 4

We start by understanding what matters most to you how you live, what you value, and what you're looking for in a community. This allows us to focus on neighborhoods and homes that feel like the perfect fit from day one.

We’ll define your must-haves, nice-to-haves, and budget, guiding our search Then, we’ll explore both MLS and exclusive off-market listings to find homes that align with your vision.

Representation Agreement

Before we start touring homes, we’ll sign a buyer representation agreement This formal step marks the start of our partnership and ensures you receive dedicated support every step of the way.

Time to tour! We’ll arrange property viewings based on your preferences and availability. If needed, we can also preview homes for you to save you time and ensure they align with your goals.

5

Once we find “the one,” we’ll craft a competitive offer and negotiate the price, terms, and contingencies always keeping your best interests at heart. It may take a few attempts to perfect, but stay patient you’re on the right track

In most cases, the contract provides you with a timeline to obtain financing, as well as time to inspect the physical condition of the home. We will walk you through these terms and coordinate next steps to ensure a smooth buying process.

6

7

8

After signing the contract, escrow is opened. During this period, a neutral third party holds funds and documents while key steps like the earnest money deposit, home inspection, appraisal, and loan approval are completed before closing.

In the final stage before closing, you’ll review loan documents, fulfill any remaining contract obligations, and prepare for the transfer of ownership. The escrow or title company will finalize all paperwork, while we ensure everything stays on track for a smooth closing process.

Before we close, we’ll do a final walkthrough. Then it’s time to sign, fund, and celebrate! Ownership officially transfers, and the keys are yours.

Before we dive into the home search, we start by defining your lifestyle

What is your daily routine like?

Consider how proximity to work, school, or public transportation can affect your daily life.

Do you have a preferred style of living?

Do you lean more towards urban, suburban, or rural environments?

What is your ideal commute time?

Understanding your comfort zone when it comes to commuting will help narrow down location choices.

How many bedrooms and bathrooms do you need?

Think about how much space you’ll need now and in the future

What condition of the home are you comfortable with?

Are you open to homes that need some work, or do you prefer something move-in ready?

After defining your needs and priorities, it’s time to start the search.

Understanding what you value in a home and community helps us identify the neighborhoods and homes that will truly fit your life

What is most important to you in a community?

Think about amenities like parks, gyms, grocery stores, and coffee shops.

What are your future plans? Are you planning to grow your family, or is this your forever home? Consider long-term needs when selecting your ideal neighborhood.

What is your budget, and what financing options are available?

This will help narrow the search to homes within your financial comfort zone.

Are you willing to compromise on certain features?

Which aspects are “must-haves” and which ones are flexible?

Do you have any specific location requirements? Is there a particular school district, neighborhood, or proximity to work that’s important?

We’ll explore both MLS listings and off-market oppor find homes that match your goals.

Now that we have your list of potential homes, it’s time to see them in person Showings allow us to explore homes firsthand, evaluate the space, and consider factors that may not be visible in photos.

does

Take time to assess the surrounding area noise levels, traffic, and overall vibe.

Does the home meet your functional needs?

Pay attention to room sizes, layout, storage, and accessibility

What condition is the home in?

Look for potential repairs or issues that could affect your decision to make an offer.

What is the potential for future upgrades?

Consider whether the home allows for future renovations or expansions.

Does it align with your long-term plans?

Consider if this home will serve your family’s needs now and in the future

Here are some general guidelines for writing a strong offer:

Review the relevant sales and market conditions prior to making an offer.

Factors to consider include the condition of the home, length of time on the market, competition and urgency of the seller.

Give yourself room to compete.

Ideally, you will want to find homes that are below your maximum so you have room to negotiate on price, should the need arise.

While it is important to offer a price that is attractive to the seller, they will often consider other elements before acceptance.

How much money you put down on the property, and any contingencies or financing terms are just a few factors that may make the difference.

After your offer has been written, we will meet with the seller’s agent to negotiate on your behalf.

The seller may accept, reject, or counter the offer with changes.

You will be notified immediately of the outcome.

Should the seller counter, we will work with you to review each specific request and move the contract forward to closure

In a real estate transaction, escrow is an independent third party that holds important documents and funds When opening escrow, the buyer and seller determine the terms and conditions for the transfer of ownership of the property via the purchase contract.

Escrow ensures that all mutually agreed upon terms and conditions are met prior to the transfer of ownership and distribution of funds.

Escrow protects both you and the seller by managing the following tasks:

Holding buyer’s good-faith deposit (typically 3% of the purchase price).

Disclosing escrow and title fees to the buyer’s lender.

Calculating prorated taxes and HOA fees.

Providing a title report and title insurance

Ensuring that state and local transaction laws and rules are followed.

Obtaining all necessary and notarized signatures from all parties.

Ensuring the paperwork is legal and binding.

Recording the transfer documents and insuring their accuracy.

Receiving the down payment from the buyer

Receiving funds from the buyer’s lender.

Paying liens, overdue tax, and HOA dues.

Distributing proceeds to the seller.

We will open escrow on your behalf after the contract has been signed by both you and the seller. After escrow is opened, you have three days to wire your 3% deposit money into escrow.

Your escrow officer will oversee all aspects of your real estate transaction, such as signing paper-work, completing a title search and obtaining hazard and title insurance.

Often, there is a problem with the loan where the appraisal comes back lower than the offer price, or a structural problem is discovered during an inspection.

The length of escrow is determined by the purchase agreement. Depending on the terms, it can last a few or even 90 days. A typical escrow is 21-30 days.

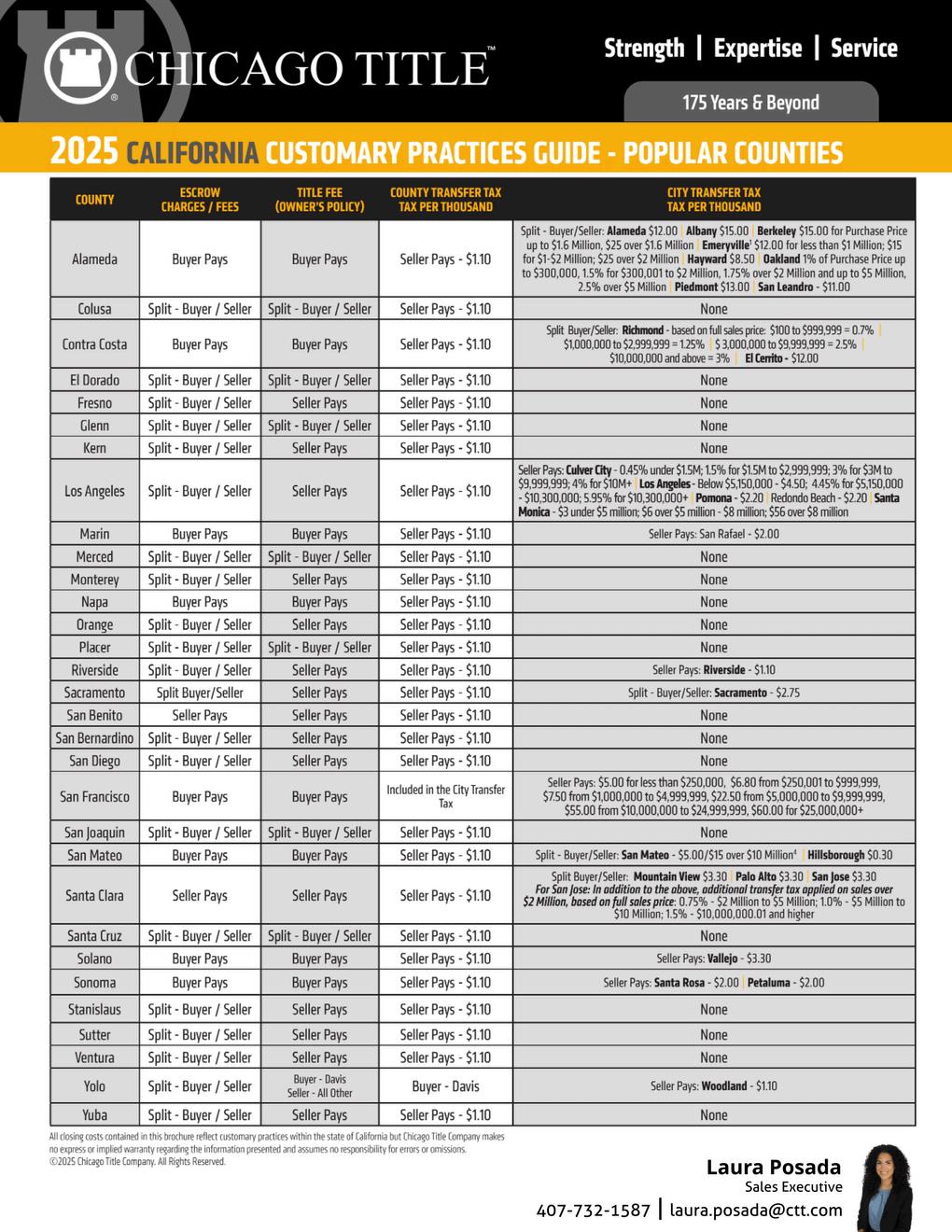

Many fees are negotiable; however, there are some fees that you and the seller are required to pay.

Buyer typically pays:

Inspections

Their share of escrow fees from the title company

Loan fees required by your lender

Title insurance premium

Fire and hazard insurance premium

Seller typically pays:

Real Estate commissions

Any judgments or tax liens

Any unpaid homeowner’s dues

Transfer taxes

Delinquent property taxes

Their share of escrow fees from the title company

Closing costs are fees paid by the buyer and the seller at the close of your home. During the escrow process you will have received a Good Faith Estimate which includes your closing costs and settlement charges. Typically, closing costs are 1-2% of the purchase price of your home. A few days prior to closing, your lender will give you a detailed breakdown in the Closing Disclosure Statement.

Closing costs include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed-recording fees, initial deposit for your escrow account, home owners insurance and credit report charges.

In addition, there are nonrecurring costs and prepaid costs. Nonrecurring costs are one-time fees associated with buying a property or getting a loan. Prepaid costs are those that recur over time, such as property taxes and homeowner’s insurance.

How is real property assessed?

Real property is assessed upon change of ownership and, in certain circumstances, the construction of improvements The new assessed value is equivalent to the purchase price and is subject to being increased by as much as 2% each year.

How are property taxes billed?

Property taxes are billed annually and paid in two equal installments You can also have your taxes impounded monthly. An impound account is managed by your mortgage company. As the homeowner you pay for property taxes and insurance along with your mortgage payment When your property taxes are due, the mortgage company sends the money to the tax collector or insurance company.

When are property taxes due?

The fiscal year runs from July 1 thru June 30

The first installment is due November 1 and it is late December 10. The second installment is due February 1 and it’s late April 10 You can remember these dates with this mnemonic device: No Darn Fooling Around = November it’s due, December it’s late. February it’s due, April it’s late.

When do I start paying my property taxes?

After change of ownership, a supplemental tax bill may be issued to collect taxes owing for the current tax year based on the difference between the previous and the new assessed values of the real property The seller is responsible for the payment of taxes due prior to close of escrow, and the buyer is responsible for the payment of taxes due after close of escrow, including any supplemental tax bill.

How is the base property tax rate set?

Under Proposition 13, passed by California voters in 1976, the base property tax rate is set at 1% of the full cash (or assessed) value of real property.

What are Mello-Roos?

Real property can be subject to continuing tax levies under the Mello-Roos Act. Such levies are used to finance certain designated public services and capital facilities Among the services and facilities typically financed through “Mello-Roos districts” are police and fire protection services, ambulance and paramedic services, parks, elementary and secondary schools, libraries, museums, and cultural facilities

MARK YOUR CALENDARS! California Property Taxes: Due Dates

FEBRUARY 1st - 2nd Installment Due

MARCH 1st - Assessment Date

APRIL 10th - 2nd Installment Delinquent at 5pm

JULY 1st - Beginning of Fiscal Year

NOVEMBER 1st - 1st Installment Due

DECEMBER 10th - 1st Installment Delinquent at 5pm

How you hold title has important tax and inheritance implications. If you are unsure which is the best for you, please consult your Attorney, CPA or Financial Planner.

The comparison chart below is provided for information only. It should not be used to determine how you hold title. We strongly recommend that you seek professional counsel to determine the legal and tax consequences of how title is vested

Community Property

Only husband and wife

Ownership and managerial interests are equal (except control of business is solely with managing spouse)

Title is in the “community ” Each interest is separate but management is unified

Both co-owners have equal management and control

Requires written consent of other spouse or actual conveyance by deed

Separate interest is devisable by will

Purchaser’s Status

Purchaser can only acquire whole title of community; cannot acquire a part of it

On co-owner’s death 1/2 belongs to survivor in severalty 1/2 goes by will to descendant’s devisee or by succession to survivor

Successor’s Status

If passing by will, tenancy in common between devisee and surviving results

Creditor’s Rights

Property of community is liable for debts of either spouse which are made before or after marriage Whole property may be sold on execution sale to satisfy creditor

Strong presumption that property acquired by husband and wife is community

Joint Tenancy

Any number of persons (can be husband and wife)

Ownership interest must be equal

Sale or encumbrance by joint tenant servers joint tenancy

Equal right of possession

Conveyance by one co-owner without the others breaks the joint tenancy

Purchaser will become a tenant in common with other co-owners in the property as to the purchaser’s interest Other owners may remain joint tenants

On co-owner’s death his/her interest ends and cannot be disposed of by will Survivor owns the property by survivorship

Last survivor owns property

Co-owner’s interest may be sold on execution sale to satisfy creditor Joint tenancy is broken, creditor becomes a tenant in common

Must be expressly stated

Tenancy In Common

Any number of persons (can be husband and wife)

Ownership can be divided into any number of interests equal or unequal

Each co-owner has a separate legal title to his/her undivided interest

Equal right of possession

Each co-owner’s interest may be conveyed separately by its owner

Purchaser will become a tenant in common with other co-owners in the property

On co-owner’s death his/her interest passes by will to devisee or heirs No survivorship right

Devisee or heirs become tenants in common

Co-owner’s interest may be sold on execution sale to satisfy his/her creditor Creditor becomes a tenant in common

Favored in doubtful cases except husband and wife cases

Tenancy In Partnership

Only partners (any number)

Ownership interest is in relation to interest in partnership

Title is in the “partnership”

Equal right of possession but only for partnership purposes

Purchaser acquires interest that partnership owned

Title Holding Trust

Individuals, groups of persons, partnership or corporations, a living trust Ownership is a personal property interest and can be divided into any number of interests

Legal and equitable title is held by the trustee

Right of possession as specified in the trust provisions

Designated parties with the trust agreement authorize the trustee to convey property Also a beneficiary’s interest in the trust may be transferred

Community Property

Right of Survivorship

Only husband and wife

Ownership and managerial interests are equal

Title is in the “community,” management is unified

Both co-owners have equal management and control

Right of survivorship may be terminated pursuant to the same procedures by which a joint tenancy may be severed

Purchaser acquires interest that partnership owned

A purchaser may obtain a beneficial interest by assignment or may obtain legal and equitable title from the trust

On partner’s death his/ her partnership interest passes to the surviving partner pending liquidation of the partnership Share of deceased partner then goes to his/her estate

Heirs or devisee have rights in partnership interest but not specific property

Partner’s interest cannot be seized or sold separately by his/her personal creditor but his/her share of profits may be obtained by a personal creditor Whole property may be sold on execution sale to satisfy partnership creditor Arise only by virtue of partnership status in property placed in partnership

Successor beneficiaries may be named in the trust agreement, eliminating the need for probate

Purchaser can only acquire whole title of community; cannot acquire a part of it

Upon the death of a spouse, his/her interest passes to the surviving spouse, without administration, subject to the same procedures as property held in joint tenancy

Defined by the trust agreement, generally the successor becomes the beneficiary and the trust continues

Creditor may seek an order for execution sale of the beneficial interest or ma seek an order that the trust estate be liquidated and the proceeds distributed

A trust is expressly created by an executed trust agreement

Surviving spouse owns property

Property of community is liable for debts of either which are made before or after marriage; whole property may be sold on execution sale to satisfy creditor

Must be expressly stated

Buyer wins that speak for themselves

3985 Meier Street, Los Angeles

Sale Price: $1,500,000

Secured at $250K Under Asking

3981 Meier Street, Los Angeles

Sale Price: $1,500,000

Another $250K Saved Off Asking

1602 Stearns Drive, Los Angeles

Sale Price: $1,755,000

Won in a Multiple-Offer Scenario

995 Crespi Drive, Pacifica

Sale Price: $1,750,000

Negotiated $49K Off List Price

227 Arguello Boulevard, San Francisco

Sale Price: $1,968,000

Negotiated $30K Under Asking

227 Richardson Drive, Mill Valley

Sale Price: $2,260,000

Negotiated the Seller to Pay the Buyers Closing Fees

2647 Garfield Street, San Mateo

Sale Price: $1,630,000

Mastered the Market, Closed the Deal

13359 Chandler Boulevard, Sherman Oaks

Sale Price: $2,625,000

Working with Alina was a pleasure! They made the process

as this was our first time building a house. I continue to see and hear from the team who is checking in on how we're doing, despite having been in the house for almost a year. A fantastic group to work with.

- Nadya K.

WithAlina'sexpertassistance,Ijust closedonmydreampropertyatan amazingprice!Sheguidedme throughfindingthehouse, negotiatingtheprice,obtaining financing,inspectionsandthe closing,managingtheprocess seamlesslyandpatiently.

I'mthrilledandrecommendher withoutreservation!

-Steven

My friend from Bay Area recommended me Alina as a trusted and reliable agent.

When I moved from LA she became a great advisor for me and my family. She helped us get our first condo in our preferred location with a top rated school for my son. I will highly recommend her. She is on schedule and always available to her clients, very clear that her real estate career is her priority.

- Elena D.

Working with Alina to purchase our condo in Redwood Shores was an absolute pleasure, and we couldn’t be more grateful for her

throughout the entire process. From the moment we expressed interest in the property, Alina went above and beyond to ensure that every step of the journey was smooth and stress-free. We cannot recommend her enough for someone who is looking for a trustworthy and knowledgeable real estate agent.

- Irena K.

My partner and I had an incredible experience working with Alina on the finding and purchasing of our new home in Redwood City. She provided excellent guidance, shared good

found properties that really suited us and what we were looking for, was patient, insightful and supportive through the negotiation and closing processes. I expect to work with Alina in the future and highly recommend her

- Dan J

tions

Working with Alina to buy our first home in San Francisco was a fantastic experience. She patiently visited many listings with us until we found the perfect home and walked us through every step of the buying process. was evident in every aspect of the sale - she even negotiated a counteroffer for us with several seller concessions. Throughout the closing process and even after the sale was finalized Alina was available to answer questions and provide guidance. Alina was not just our real estate agent but also a trusted advisor and advocate. She went out of her way to make our home buying experience perfect. I highly recommend Alina to anyone looking for their dream home in the Bay Area.

- Irina M.

“He was always available to answer my questions...”

Working with Brandon Sen and his incredible team to sell my home has been an absolute pleasure! From the moment we started, Brandon’s professionalism, attention to detail, and dedication were evident. The entire process was seamless and stress-free. What I loved most was how accessible Brandon was he was always available to answer my questions, provide updates, and guide me through every step of the sale. Thanks to Brandon’s expertise and his team’s hard work, the sale was quick and smooth, exceeding my expectations. I couldn’t have asked for a better experience! He lives on the west side of LA like myself and was always available to accommodate showings, inspections, marketing, staging, etc. No one knows the area like he does. If you’re looking for an agent who’s professional, reliable, and truly cares about your needs, Brandon Sen and his team are the way to go.

- Andrew M.

Alina is your dedicated REALTOR® with a passion for helping clients achieve their real estate goals She began her career at the age of 20 and brings a unique perspective shaped by her Eastern European heritage and fluency in three languages allowing her to connect with clients from a variety of cultural backgrounds.

Passionate about real estate, Alina sees it as a stable and rewarding investment. She is known for her hardworking, friendly, and optimistic approach, as well as her strong negotiation skills Alina is by your side every step of the way, offering expert guidance to help you navigate the buying or selling process with confidence. She handles the behind-the-scenes details to ensure a smooth and stress-free experience

Outside of real estate, Alina enjoys spending time with her family and actively participates in community events and charitable activities

With a Master’s Degree in Education, she takes pride in educating and empowering her clients, helping them confidently navigate the complexities of the real estate market.

Brandon Sen practically grew up in real estate. In high school he worked overseeing his father’s properties, and was an officially licensed real estate professional at 19. He purchased his first property at 21 during his sophomore year at a University. Since then, Brandon has bought, renovated, and sold many properties. He invests predominantly in residential real estate and owns properties in California/New York City as well as overseas

Now he brings his well-rounded skill set to CBR Equity Partners, with deep and personal knowledge of all sides of the transaction. Whether a buyer or a seller, a client has Brandon’s complete attention as he confidently guides the process, beginning, of course, with an in-depth conversation to determine the client’s needs. The next step is education; Brandon is committed to ensuring a client understands every pertinent aspect of the market -- from contextualizing listings, assessing and analyzing competing properties, and to maintaining realistic expectations. Clients rely on him to walk them through negotiations, keep them abreast of changes in the always-evolving market, and to provide referrals for property inspectors, attorneys, title companies, and lenders. All of which he does happily, relishing the opportunity to connect with new and long-term clients alike It’s no surprise that clients and colleagues describe him as a “people person ” Growing up in both California and New York City, Brandon holds degrees in Corporate Finance and International Banking He lives, works, and plays in the Los Angeles/Orange County area as well as the San Francisco Bay Area Brandon prides himself on his “after care.” Long after a seller has sold a home or a buyer has settled into a new house, he’s always available for a client “Even once the dust has settled after a transaction you can always count on me to answer any questions or concerns you may have.”

In his (rare) spare time, he loves to read, constantly educate himself and travel - 66 countries and counting He is very international and cosmopolitan in his mindset yet there is nothing he enjoys more than spending time with his family and close friends and giving a helping hand to those in need of his help or advice.

Whether you're just starting to imagine our next chapter or already picturing life in your new home, we’re here to help you every step of the way. Your story matters let’s begin it together.

Thank you for the opportunity to present our proven winning buying strategy to help you find and purchase your property.