MARKET REPORT

END OF YEAR 2025 • JACKSON HOLE

MARKET REPORT

END OF YEAR • THE JACKSON HOLE MARKET

Jackson Hole closed out 2025 with strong momentum, marked by a 24% increase in total sales and a 49% jump in overall dollar volume year-overyear. A total of 387 properties sold, generating nearly $1.9 billion in volume. While inventory rose modestly and days on market edged slightly higher, buyer demand, particularly at higher price points, remained resilient, supported by an increase in cash transactions and a surge in luxury and condo activity.

Single-family home sales held relatively steady, declining just 1% YOY, while pricing strength remained evident. Average sale price rose 20% to $5.68 million, and total dollar volume increased 22% to $891 million. Inventory increased 13%, but days on market declined slightly, indicating continued buyer confidence for well-priced homes, particularly in the upper tiers of the market.

The condo and townhome segment was one of the strongest performers in 2025, with sales jumping 40% and total dollar volume surging 168% year-over-year. Average sale price increased 79% to $3.63 million, driven largely by significant activity in Teton Village and the town of Jackson. While days on market increased modestly, this segment continues to attract buyers seeking lower-maintenance ownership and a more accessible entry point into the Jackson Hole market.

The luxury market ($5M+) delivered exceptional results in 2025, with sales rising 16% and total dollar volume climbing 25% to over $716 million. Median luxury pricing increased 28%, signaling strength beyond just headline transactions. Although

inventory increased, days on market declined 21%, underscoring sustained demand for high-quality, well-located properties.

Commercial real estate saw a dramatic resurgence, with transactions increasing from 5 to 22 sales yearover-year. Total dollar volume more than doubled to $140 million, despite a decline in average sale price, reflecting a broader mix of deal sizes rather than weaker demand. Cash purchases dominated the commercial segment. Rising inventory and longer days on market suggest a more deliberate pace, but investor interest remains strong.

Vacant land sales increased 27% in 2025, while total dollar volume decreased 8% to $240 million. Although average pricing declined 29%, the median sale price rose 25%, indicating strength in mid-range and premium parcels. With days on market increasing slightly, land buyers appear selective but active, particularly for parcels with development potential or long-term value.

2025 reinforced Jackson Hole’s position as a highly competitive and resilient real estate market. Strong performance in condos, luxury properties, and commercial assets offset more measured activity in single-family homes and land. Increased cash usage, rising dollar volume, and sustained high-end demand suggest the market remains well-positioned heading into 2026, particularly for sellers with premium assets and buyers prepared to act decisively.

$1.9B

TOTAL DOLLAR VOLUME 49% INCREASE YOY

AVG SFH SALES PRICE 20% INCREASE YOY $5.7M

MEDIAN SFH SALES PRICE 10% INCREASE YOY $3.4M

387

TOTAL TRANSACTIONS 24% INCREASE YOY

272

ACTIVE LISTINGS 17% INCREASE YOY

With many sales occurring outside of the MLS (Multiple-List Service), it is important to manually track ALL Teton County real estate sales. Typically, it is the higher-end sales that go unreported, vastly skewing the accuracy of MLS data alone. Our market report accounts for all sales, providing a comprehensive overview and deeper insight into the market.

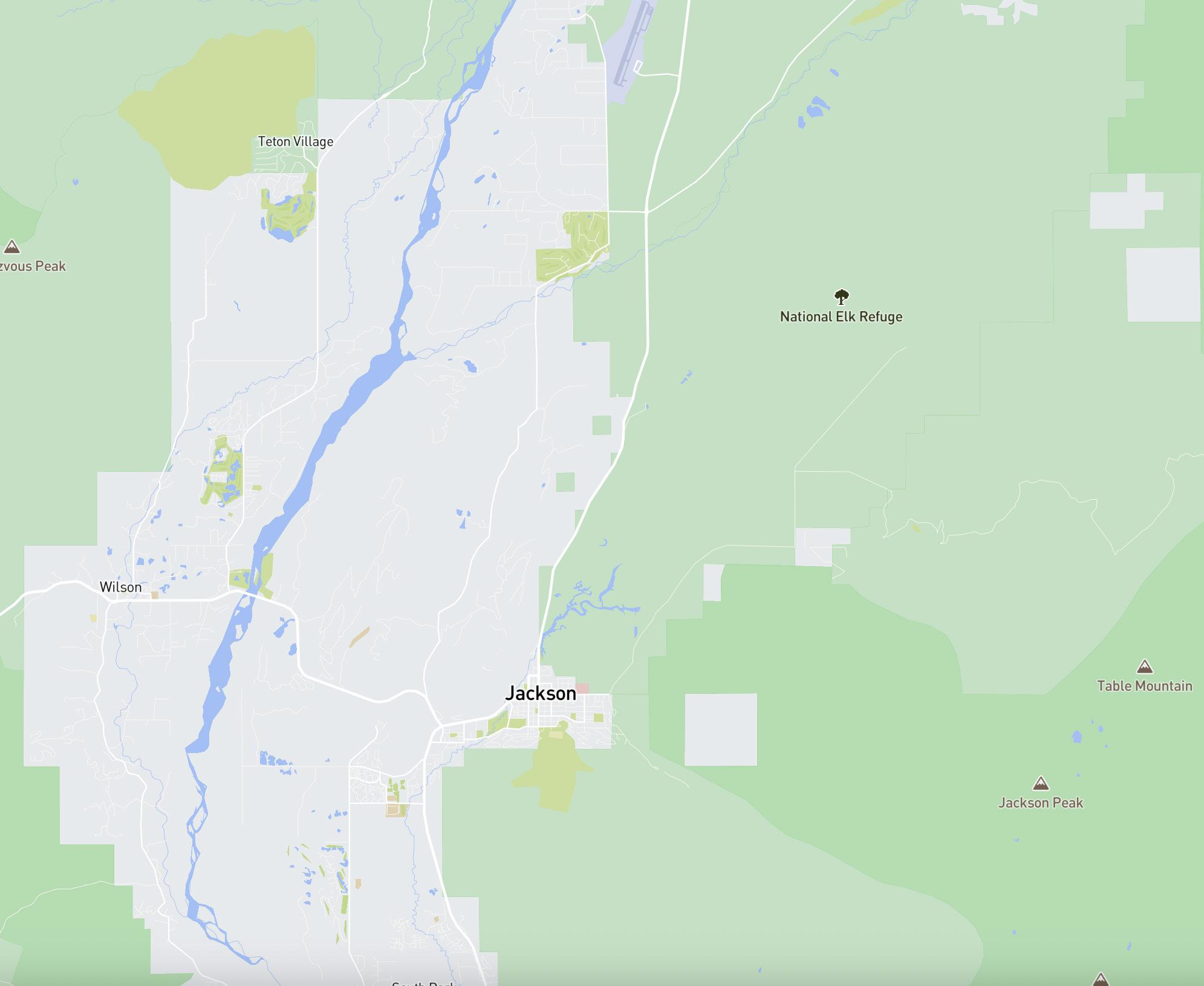

TRANSACTION DISTRIBUTION BY LOCATION

TETON VILLAGE (52) - MLS AREA 1

TETON PINES (25) - MLS AREA 2

NORTH OF WILSON (18) - MLS AREA 3

SOUTH OF WILSON (19) - MLS AREA 4

SKYLINE RANCH TO SAGEBRUSH DRIVE (32) - MLS AREA 5

EAST GROS VENTRE BUTTE (6) - MLS AREA 6

NORTH OF GROS VENTRE JUNCTION (20) - MLS AREA 7

TOWN OF JACKSON (140) - MLS AREA 8

SOUTH OF JACKSON TO SNAKE RIVER BRIDGE (47) - MLS AREA 9

SOUTH OF JACKSON TO COUNTY LINE (28) - MLS AREA 10

SINGLE FAMILY HOMES

SOLD · LISTED AT $4.975M · TOWN OF JACKSON REPRESENTED BY DOUG HERRICK

Single-family home sales in Jackson Hole remained strong and stable in 2025, underscoring a market driven by quality over quantity. Buyer demand continued to concentrate on well-located, higher-value properties, reinforcing the area’s appeal as both a primary and secondary home destination for a well-capitalized buyer base.

Pricing strength defined the year. The average singlefamily sale price rose 20% YOY to approximately $5.68 million, while the median increased 10% to $3.4 million. Total dollar volume climbed 22% to $891 million, signaling that buyers remained willing to commit significant capital to premium assets, even as overall activity moderated. Market conditions stayed balanced. Active listings

increased 13%, offering more choice, while average days on market declined slightly to 143 days, evidence that appropriately priced homes, particularly in the upper tiers, continued to sell efficiently. Cash transactions remained dominant, and interest rate sensitivity appeared limited among the high-net-worth buyers driving demand.

Overall, 2025 reflected a single-family market defined by resilience and confidence. Rising prices, strong dollar volume, and steady absorption position Jackson Hole’s residential sector to enter 2026 from a place of strength rather than correction.

CONDOS/TOWNHOMES

The condo/townhome market in Jackson Hole delivered a standout performance in 2025, emerging as one of the most active segments of the market. Buyer demand accelerated across a wide range of price points, driven by interest in lower-maintenance ownership, proximity to amenities, and a more accessible entry into the Jackson Hole lifestyle. Well-located developments, particularly in town and resort-adjacent areas, continued to attract both primary residents and second-home buyers.

Pricing strength was a defining feature of the quarter. The average condo/townhome sale price surged 79% YOY to approximately $3.63 million, while the median price increased 15% to $1.6 million. A newly completed

luxury condominium building in Teton Village delivered and fully sold out in 2025, significantly elevating the quarter’s average sale price. Total dollar volume rose sharply by 168%, exceeding $541 million. This growth was fueled by a notable increase in higher-end condo sales, including a rise in transactions over $5 million, reflecting expanding buyer confidence in this segment.

The 2025 condo/townhome market demonstrated momentum and pricing power. With rising values, strong dollar volume, and continued demand for low-maintenance and resort-oriented properties, this segment enters 2026 as a key driver of Jackson Hole’s residential market.

SOLD · LISTED AT $1,300,000 · JACKSON REPRESENTED BY GREG HAHNEL

VACANT LAND

SOLD LISTED AT $2,250,000 WILSON REPRESENTED BY GRAHAM FAUPEL MENDENHALL

The vacant land market in Jackson Hole saw increased activity in 2025, as buyers continued to pursue long-term value and future development opportunities. While buyer selectivity remained high, demand persisted among those looking to secure land in a supply-constrained market.

Sales activity increased 27% year-over-year, with 52 parcels sold and total dollar volume dropping 8% to approximately $240 million. Median land prices climbed 25% to $2.8 million, signaling strength in mid- to upper-tier parcels, while the average price declined 29% to $4.6 million due to fewer ultra-highvalue transactions. This pricing split reflects a more balanced distribution of sales rather than weakening demand.

Market conditions reflected a gradual expansion of choice. Active listings increased 37% year-overyear, while days on market dipped slightly to 205 days. Cash transactions continued to dominate, underscoring the long-term investment mindset prevalent in the land market.

Overall, the 2025 vacant land market demonstrated resilience and steady demand. With rising median prices, increased sales activity, and continued interest from buyers focused on future value, the land sector remains a foundational component of Jackson Hole’s real estate landscape heading into 2026.

LUXURY

Jackson Hole’s luxury market closed 2025 on a notably strong footing, with sustained buyer engagement at the highest price points. Transactions continued to favor properties offering architectural distinction, privacy, and enduring lifestyle appeal, signaling that discretionary buyers remain confident in the market’s long-term fundamentals.

Luxury transactions increased 16% year-over-year, generating approximately $717 million in total sales volume, up 25% from Q4 2024. The median luxury sale price advanced 28% to $9.47 million, while the average price reached roughly $11 million, an 8% annual increase. This performance reflects depth across the luxury spectrum, with momentum

supported by a wider range of high-value sales rather than a concentration of record-setting deals.

Supply expanded meaningfully during the quarter, with active luxury listings up 38%. Even with greater selection, absorption improved, as average days on market declined 21% to 159 days. Cash purchases continued to dominate, underscoring the prevalence of equity-based buyers and insulating the luxury segment from broader financing pressures. As 2026 begins, luxury real estate remains a defining driver of Jackson Hole’s market, anchored by scarcity, global demand, and long-term wealth preservation appeal.

SOLD · LISTED AT $43,000,000 ·

REPRESENTED BY RYAN BLOCK

JACKSON HOLE

COMMERCIAL

Commercial real estate activity in Jackson Hole accelerated in 2025, reflecting renewed investor interest across retail, office, and mixed-use properties. Demand was driven by limited inventory, strong tourism fundamentals, and the long-term stability of Jackson’s local economy. Buyers remained focused on assets offering durable income streams, high visibility, and strategic positioning within the valley.

Transaction volume rose sharply year-over-year, with 22 commercial properties closing throughout the year, compared to just 5 in 2024. Total dollar volume more than doubled to approximately $140 million. While the average sale price declined to $6.36 million, this shift reflects a broader range of

deal sizes rather than reduced demand, as activity expanded beyond a handful of large transactions.

Market conditions pointed to a more methodical pace. Active commercial listings increased 57%, and average days on market lengthened to 228 days, indicating longer due diligence periods and more deliberate underwriting. Cash purchases dominated the segment, highlighting the presence of experienced investors and owner-users. As Jackson Hole continues to balance growth with limited commercial supply, the sector enters 2026 with sustained investor interest and long-term stability.

SOLD · LISTED AT $2,400,000 · JACKSON

REPRESENTED BY BREEZY WOODFIN

HOLE

Estate