BEECHWOOD SMOKED SWEETCURE DRYCURE

BEECHWOOD SMOKED SWEETCURE DRYCURE

10x10x2

10x10x2

5x5x5 lardon dark medium light

5x5x5 lardon dark medium light

NO.1 NO.1

THE SUMMIT OF MT. EVEREST

THE HILLARY STEP

THE SOUTH SUMMIT

THE BALCONY

THE SOUTH COL

BEECHWOOD SMOKED SWEETCURE DRYCURE

BEECHWOOD SMOKED SWEETCURE DRYCURE

10x10x2

10x10x2

5x5x5 lardon dark medium light

5x5x5 lardon dark medium light

NO.1 NO.1

THE SUMMIT OF MT. EVEREST

THE HILLARY STEP

THE SOUTH SUMMIT

THE BALCONY

THE SOUTH COL

Welcome to 2026… and what promises to be another exciting year. We all know the challenges ahead but our resilience, innovation and determination as an industry will undoubtedly shine through.

This issue sees key players at Greencore and Pure talk avour pro les, the growing market strength of sushi and other consumer trends. Also, the BSA highlights the cost burden of the Deposit Return Scheme (DRS) – and what you can do to get your voice heard.

AI, automation and machinery are bubbling with innovation in foodservice, as Grote, FTG Navigator, Invisible Systems and Faerch can testify. And with show season already approaching, it’s time to book your tickets. We preview lunch! NORTH and the International Food & Drink Event.

Happy new year everyone!

Alex Bell, Tel: 01291 636349, email: alex@jandmgroup.co.uk

James Morgan, Tel: 01291 636342, email: james.morgan@jandmgroup.co.uk

Gareth Symonds, Tel: 01291 636339, email: gareth@jandmgroup.co.uk

Subscriptions and Customer Service Tel: 01291 636338, email: subscriptions@sandwichandfoodtogonews.co.uk

Editorial Address Sandwich & Food To Go News, Engine Rooms, Station Road, Chepstow NP16 5PB www.sandwichandfoodtogonews.co.uk

In association with The British Sandwich & Food To Go Association.

+44 (0) 1291 636338

+44 (0) 1291 630402 www.sandwich.org.uk info@sandwich.org.uk

Paper used in the production of this publication is sourced from sustainable managed forests.

BSA 04-05 Deposit Return Scheme (DRS) advisory

NEWS

06-12 Round-up of the latest stories

THE BRITISH SANDWICH & FOOD TO GO ASSOCIATION

14-19 The Sammies 2026

FTG – THE YEAR AHEAD

20-26 Greencore / Pure / Booker / Ditsch UK Ltd

PREVIEWS

28 lunch! NORTH

42-43 Food, Drink & Hospitality Week 2026

SPOTLIGHT

30 Planglow

AI/ROBOTICS/AUTOMATION

32-40 Grote / FTG Navigator / Invisible Systems / Faerch

ADVISORY

44-45 Worknest

REGULARS

47-50 Index / Manufacturers & distributors

51 Classi eds

The Deposit Return Scheme (DRS) is yet another cost burden on the horizon – and BSA director Jim Winship wants a ected businesses to voice their concerns.

The retail and hospitality sectors face yet another signi cant challenge. Over the next few years, new environmental legislation –particularly around packaging waste – will potentially impose substantial costs and administrative pressures on businesses already feeling the pinch. Alongside the costs owing from packaging taxes under the Extended Producer Responsibility (EPR) regime,

small retailers, cafés, restaurants, takeaways and delivery businesses could endure a further layer of complexity with the introduction of the Deposit Return Scheme (DRS).

While many smaller operators –those with turnovers below £1 million and using fewer than 25 tonnes of packaging – have been relieved to nd themselves exempt from EPR fees, that may be short-lived. Suppliers will inevitably pass increased costs down the supply chain. For larger operators, the burden is immediate and substantial.

England, Scotland and Northern Ireland are due to introduce a DRS in October 2027. Wales has indicated it intends to follow the same timeline, although nal details remain unclear.

In England, Scotland & NI the scheme will apply to plastic bottles (excluding milk bottles) and cans

ranging from 150ml to three litres. Consumers pay a deposit – expected to be 20p per container – which they can reclaim by returning the empty container to any retailer selling drinks, regardless of where it was originally purchased. Refunds are issued in cash or via vouchers.

Wales intends to include glass in the scheme. Whether this materially di ers from the other nations’ models has not been con rmed.

While the principle is simple, the execution is not.

The producer adds the deposit to the product price, which is passed via wholesalers and retailers to the consumer. When the empty container is returned, the retailer refunds the deposit, then recovers the amount from the scheme administrator.

While DRS already operates in around 50 countries worldwide, and

has demonstrable environmental bene ts, its real-world impact on small businesses is often underestimated.

Ireland, which launched its scheme in 2024, saw 1.2 billion containers returned in the rst year, alongside a reported 50% reduction in litter. A trial at New College Lanarkshire also demonstrated high engagement, with 20,000 cans and bottles returned in just one month when students were o ered 20p vouchers via reverse vending machines.

There is no doubt that DRS can reduce litter and improve recycling –but who pays the price for delivering it?

With an estimated 6.5 billion bottles and cans sold in the UK each year, accounting for 43% of all litter, DRS represents a fundamental shift in how waste is managed.

In England, Scotland & NI, it will be overseen by a not-for-pro t Deposit Management Organisation (DMO). While it sets deposit levels and designs the scheme, challenges will emerge at operational level.

Large supermarkets are expected to install reverse vending machines (RVMs), starting at £3500. While these automate much of the process, they are not viable for everyone. For cafés, sandwich bars, convenience stores and takeaways, returns are likely to be manual, requiring sta to:

● Accept containers not necessarily purchased on site

● Refund deposits in cash or vouchers

● Scan and register each container

● Store returned packaging securely for collection.

This creates multiple problems:

● Disruption at busy trading times

● Pressure on limited storage space

● Hygiene risks from unemptied or soiled containers

● Increased sta workload and training requirements.

People may also collect discarded containers for cash, bringing badly contaminated packaging into foodhandling environments.

Storing used containers at the back of premises also becomes problematic once they have a cash value, increasing risks around theft, vermin and cleanliness.

Restaurants, cafés and bars face an additional complication. Where drinks are consumed on site, customers are entitled to reclaim the deposit.

In Ireland, businesses have been investigated for charging deposits but failing to return containers to customers – leading to reputational damage and the risk of enforcement action, which is potentially complex and contentious.

Micro-businesses operating from premises smaller than 100m2 will not

be required to act as return points, and exemptions may be available based on layout, design or proximity to other return locations.

But opting out is not always straightforward or sensible. Evidence from other countries suggests that up to 80% of consumers spend their refunded deposit in the return location, which could make participation commercially attractive – if the operational burden were manageable.

Some businesses may choose not to charge the deposit at point of sale but this needs to be clearly communicated. Even then, they will still have paid the deposit to suppliers and must handle, store and return empty containers to reclaim the funds.

While we understand the DMO is considering a handling fee to help businesses meet costs, this has not been referenced in any of the information released so far.

The environmental case for DRS is strong – but unless the scheme is designed with the realities of retail and hospitality in mind, it risks becoming another unfunded mandate imposed on a sector already stretched. If changes are required, the time to in uence decision-makers is now.

We need to engage with the DMO to ensure the system is workable, proportionate and fair.

Are you satis ed with the current proposals, or do you believe there is a better, less onerous way to administer DRS?

Please share your views with BSA director Jim Winship at jim@sandwich.org.uk. Your feedback is vital in shaping our representations to the Deposit Management Organisation and ensuring the voice of retail and hospitality is properly heard.

Welcome to 2026 and our rst update of the year. We cover o crucial hospitality data, packaging innovation and the growth of Taiwanese cuisine.

Total till sales at UK major supermarkets grew by 3% in the last four weeks ending 27 Dec 2025, according to NielsenIQ (NIQ) data.

Shoppers spent £19.6bn over the four-week period, with grocery sales peaking in the week ending 20 Dec where shoppers spent £5.3bn, the biggest week of 2025. With the extra day of trading the following week, with Christmas Eve on a Wednesday, this bene ted large, full range stores1

With 29% of households opting to shop for groceries online2, this was

the fastest-growing channel (+9.9%), driving eCommerce share to 13.5% of sales, up from 12.6% last year3

In terms of category performance, impulse (soft drinks, snacks and confectionery) grew by +5.7% and fresh foods grew (+ 4.9%), as intense competition drove retailers to make signi cant price cuts to win-out the category in the last week before Christmas. Frozen foods also saw an increase (+1.2%), while beer, wine and spirits declined1 (-0.1%).

Shoppers buy more fresh foods at this time of the year and 32% of eCommerce sales in December were in this category, growing by +9.9%.

Ocado (+12.8%) retained its position as the fastest-growing retailer for the second consecutive Christmas, due to the continued growth of online spending. Meanwhile, Lidl (+9.4%) led growth among store-based retailers. Both Sainsbury’s (+5.7%) and Waitrose (+5.5%) had a successful period, aided

by new shoppers and more visits. Tesco (+3.7%) gained market share, and M&S (+4%) also experienced good growth, although this was against higher comparatives compared with last year. Morrisons (+3.1%) had their best trading in six months having seen sales fall in December last year. Sales at Asda (-6.5%) dropped considerably during December.

Mike Watkins, head of retailer and business insight at NielsenIQ, said: “It’s clear that the convenience of shopping online bene ted a lot of UK shoppers over Christmas. Retailers with sales momentum at the start of the quarter were able to extend this. Considering the external mood and continued pressure on nances, it was a Christmas of cautious celebration and a good four weeks for most retailers.”

1 NIQ Scantrack Total Coverage.

2 NIQ Homescan FMCG.

3 NIQ Sc’track eCommerce (defined mult grocers).

Lumina Intelligence’s Operator Data Index (ODI) has highlighted the rise of premium all-day dining, techenabled QSR growth and immersive ‘multi-mission’ venues driving spend.

The quarterly stats reveal that UK hospitality operators are increasingly winning share through experience-led formats, tech integration and rapid-format innovation. While overall performance remains uneven, the latest ODI ndings show that growth is being concentrated among those creating stronger reasons to visit, whether through premiumisation, entertainment, convenience or digitally enabled service, rather than a reliance on scale alone.

Restaurant turnover is growing modestly (+0.8%) but ne dining is outperforming, driven by resilient consumer demand. Brands like Dishoom and Wagamama have capitalised on premium positioning and a versatile allday o ering, appealing to younger consumers and those prioritising atmosphere and occasion over price. In a Experience has become a critical di erentiator, boosting both visit frequency and spend, as consumers become more discerning about where they dine.

Meanwhile, pubs and bars (+2.0%) are nding growth by reinventing traditional formats into immersive destinations. Operators are increasingly creating multi-mission spaces (combining food, drink and entertainment) to maximise dwell time and spend. Nightlife concepts from Hard Rock and the rise of competitive socialising venues including Flight Club and NQ64 demonstrate how experiential positioning is reshaping consumer expectations.

Success is being driven by agility. Strong performers are adapting quickly through smaller high-footfall footprints, loyalty ecosystems, tech integration, and hybrid concepts.

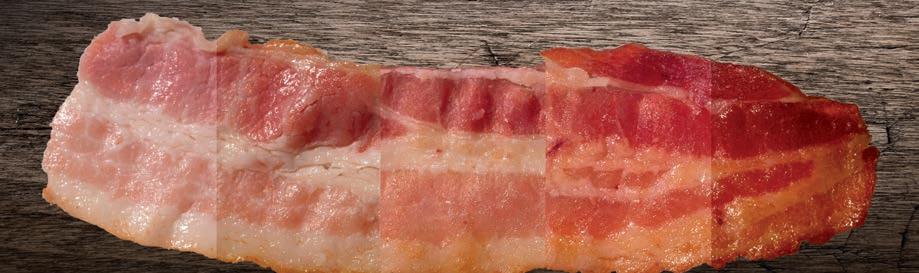

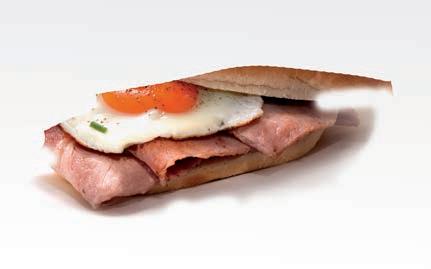

Ready to eat

Convenient to use

Natural beechwood smoked bacon rashers

•Succulent and ready to eat

•No additives

•EU-27 origin

•Diced / strips / slice / whole llet

•Versatile

•Great tasting

•Crunchy

•The ideal ingredient

Coated breast llet products

•Crunchy coatings with tender chicken

•Cookin 5 range

•Be-spoke product design service

•EU-27 origin

•Limited handling

•Natural beechwood smoke

•Convenient, cook it your way

•Great tasting

•Ready to eat

•Convenient

•Thinly sliced

•The perfect breakfast rasher

Already introduced in Ireland with bespoke children’s meal packaging and in France with the Gastronorme range, Sabert Corporation Europe is now launching PULPUltra™ across Europe and the UK & Ireland.

“Over a decade ago, Sabert was the rst to bring quality, functional bagasse pulp packaging solutions to the European market,” said Alex Noake, senior vice president and MD for Sabert Europe. “Now we are pioneering PULPUltra™, a gamechanging, next-generation, nointentionally-added-PFAS formulation that meets both legislative standards and customer expectations for superior strength and heat resistance.”

PULPUltra™ is a solution for fresh, ready-to-eat dishes and hot foods. Made from over 95% bagasse bres and treated with a barrier spray coating

of <5%, PULPUltra™, it’s designed to deliver Oil and Grease Resistance (OGR) permeation in direct contact, hot food applications.

PULPUltra™ is freezer-safe and able to retain frozen goods integrity, perishable goods freshness, and keep factory-conditioned items intact. It is safe for microwaves, conventional ovens and MerryChef applications, suitable for single PET sealing or multiwelding. It is recyclable, compliant with European Packaging and Packaging Waste Regulation (PPWR) and certi ed as Compostable TÜV OK Compost Industrial.

“Every product we make is rigorously tested to comply with food safety standards,” said Sabert quality environment, health & safety manager, Isabelle Ernotte.

“From 12 August 2026,

Regulation (EU) No 40/2025 on PPWR introduces new measures, including Article 5(5) paragraph 5, of Regulation (EU) No 40/2025 which restricts and introduces limits on the presence of per- and poly uoroalkyl substances (PFAS), often referred to as ‘forever chemicals’ due to their persistence in the environment and human body.

“PULPUltra™ will help customers stay ahead of these changes with products that already meet the next generation of sustainability standards.”

Notpla, the award-winning sustainable packaging innovator, is returning to its roots at Imperial College London to help reduce single-use plastic across the university’s catering operations. Imperial is working with Notpla as part of the Sustainable Imperial strategy, set up to deliver evidencebased solutions to climate change, embrace new technologies, challenge conventional thinking and lead by example on Imperial’s campuses.

The news sees Notpla’s seaweedbased, home-compostable packaging now in use at Imperial’s campus food & drink outlets, marking a full-circle

moment for the company. Notpla’s origin traces back to Imperial’s Innovation Design Engineering master’s degree, where co-founders Pierre Paslier and Rodrigo Garcia Gonzalez developed the edible liquid bubble called Ooho – and began their journey to rede ne packaging with sustainable materials.

“To see our packaging at Imperial, where the journey began, is incredibly meaningful. It shows how universities can lead by example – supporting innovation, closing the loop and educating the next generation at the same time,” said Paslier.

Imperial’s president, Professor Hugh Brady, said: “Notpla represents the power of science and enterprise to provide solutions to some of the world’s biggest problems – in this case by helping businesses to replace millions of pieces of single-use plastic. It’s a proud moment to see Notpla

go full circle from students with big ideas, to entrepreneurs scaling their business in our ecosystem, to being suppliers in our own sustainability e orts on campus.”

It also helps address a growing concern on university campuses: the presence of microplastics and chemicals such as PFAS that can leach from conventional plastic-lined takeaway packaging into hot food.

Notpla’s packaging is:

● Made from renewable seaweed extracts

● Home-compostable, breaking down like a piece of fruit peel

● Compliant with the strictest UK & EU packaging regulations. And o ers a 100% plastic-free and PFAS-free coating.

Kung Fu Mama – the Taiwanese noodle bar created by Ottolenghi co-founder Noam Bar-Chang and founder of Kung Fu Mama Retail Chris Hsu – is opening its second London restaurant in Q1 2026, in Jubilee Place, Canary Wharf.

It follows the success of the debut Covent Garden site and marks another step in the growing momentum behind Taiwanese cuisine. Known for its contemporary take on street food anchored in high-quality, traditional ingredients, the restaurant continues to introduce Londoners to a modern expression of this culinary culture.

At the heart of Kung Fu Mama’s o ering are its signature sun-dried noodles, crafted using a traditional hand-folding method that gives them a uniquely rm, springy texture. Expect bold avours with nutrientdense components: proteins are ovenbaked instead of fried, extra-virgin olive oil replaces seed oils, and salt, sugar and fat are carefully moderated. Dishes include noodle bowls such

as Chicken with Ginger & Sesame; 12hrs Beef with Szechuan Pepper; Grandma’s Beef and Tomato Noodles; and Traditional Beef Noodle Soup.

Bao sandwiches, designed to be enjoyed burger-style, include OvenBaked Chicken Bao; Ginger and Sesame Chicken Bao; and Soft-Shell Crab Bao. The sides feature Mixed Greens; Cucumber Salad; and WoodEar Mushroom Salad. For dessert, guests can enjoy Taiwanese night market classics like Mango Shaved Ice Cream or Pineapple Pie.

Bar-Chang said: “London’s enthusiasm for Taiwanese food has exceeded our expectations, and we’re excited to bring our contemporary take on these avours to Canary Wharf in early 2026. Chris and I set out to create food that is high-quality, nutrient-dense, joyful and full of character – dishes we’d happily serve to our own families – and we’re proud to see this vision resonating with Londoners. This second opening feels like an important step in putting Taiwanese cuisine more rmly on the UK map.”

Hsu added: “Kung Fu Mama Retail introduced sun-dried noodles to the UK for the rst time, and it has been amazing to watch people fall in love. Expanding the restaurant concept to allows us to show even more diners how versatile and avour-packed these noodles can be. We’re thrilled to bring more of Taiwan’s street food culture to London in 2026.”

Jestic Foodservice Solutions has added Moduline’s HHF Multifunction Holding Systems to its premium portfolio of commercial kitchen equipment. The innovative range is designed to ensure all types of food stay hot, ready and delicious.

Moduline’s new Multifunction Hot Holding product line goes beyond conventional equipment, o ering controlled humidity, automated probe-based holding, custom program storage, alongside full regeneration cycles up to 120°C – delivering multifunctional performance in one reliable solution.

Thanks to CLIMA CHEF intelligent humidity control, the core temperature probe and gentle, periodic ventilation, each dish remains ready to be served with minimal e ort. With its operating temperature 30°C-120°C, it helps deliver a smooth service.

Michael Eyre, product director at Jestic Foodservice Solutions, said: “With our reputation for premium solutions, the Moduline Multifunction Holding Systems are no exception. What makes these products so unique is the capabilities of the core probe holding function, which allows the operator to hold food at a precise temperature, preventing overcooking.”

It comes with user-friendly controls, a capacitive black mask digital control panel and LED lighting. Jestic will also roll out Moduline’s updated ‘K Controller’ across selected lines.

Check out jestic.co.uk.

Middleton Foods, a leading manufacturer of dry blends, has expanded its growing portfolio of mixes with a new Premium Plus Gluten Free Barbecue Marinade. Inspired by UK trends, this rich and avourful marinade o ers a simple, versatile way to enhance menus.

It delivers a Mesquite smokey pro le, with a rich depth of avour and tangy, spicy tomato base notes. Easy to use and consistent in performance, the new marinade strikes an ideal balance between savoury smokiness and mouth-watering sweetness.

Paul Stanley, foodservice manager, commented: “We’re very excited to be adding our new Premium Plus Gluten Free Barbecue Marinade to the Middleton Foods range. It’s been developed to give caterers a quick, convenient way to deliver outstanding avour and quality to customers. We’re con dent this marinade will become the go-to choice for anyone looking to elevate their menus with a rich, authentic barbecue taste.”

For the best results, add 60g to 1kg of your chosen protein (or 6% of the weight of your protein). Place the protein in a large bag or bowl and add the glaze. Tumble and shake until the meat is evenly coated. Leave the coated product to develop into a tasty rich sauce.

With the constant rise in consumer demand for bold barbecue avours, Middleton Foods is enabling caterers to remain ahead of their customer needs, while ensuring that high quality, taste and convenience are at the heart of their o er.

Middleton Foods is a family owned and operated business. Find out more at middletonfoods.com.

Bakery brand Wrights is celebrating its 100th anniversary with a year-long series of celebrations and investment.

Founded in Stoke-on-Trent in 1926, Wrights supplies savoury pastry and sweet bakery ranges into retail, foodservice and its own bakeries and forecourt outlets across the UK.

To mark its centenary year, Wrights – now part of The Compleat Food Group – is making a major investment as it targets continued growth. This includes refreshing retail shops and growing its store network across the UK. It will also be launching special edition products and delivering targeted marketing.

Wrights began 100 years ago, when John James (Jack) and Lizzie Wright began selling Meat & Potato Pies from their doorstep in Stoke-on-Trent during the Great Strike. Their rst shop opened in 1929 and quickly became a local staple, famed for pies, sausage rolls and pastries.

The brand grew to national prominence in the 1980s by pioneering frozen, unbaked savoury products, introducing the Bake-O model and creating innovative recipes, including the iconic Chicken Balti Pie, now a favourite among football fans nationwide.

Acquired by The Compleat Food Group in 2021, Wrights serves over 800 customers, with more than 500 products across savoury and sweet bakery and ready meals. The brand, which employs over 600 people, has also extended

Award-winning ingredients and readyto-eat products specialist, Beacon Foods, has been praised for its waste management system, following an annual inspection in Nov 2025.

The family-owned company, which has four units in Brecon Enterprise Park, has achieved the Certi cate of

its retail footprint beyond Sta ordshire, opening eight forecourt shops in the last two years, with more to come.

Wrights’ year-long programme of celebrations and initiatives will feature a Wrights Roadshow, with a branded van touring the UK to o er sampling experiences, while a commemorative centenary logo will be introduced across packaging, vehicle livery and retail outlets.

At the heart will be two new products. The rst is the Centenary Chicken & Leek Pie, created in collaboration with chef and Great British Menu star, Thom Bateman. The second is a Centenary Limited Edition Caramel Custard Slice, a take on Wrights’ iconic Vanilla Custard Slice. Both are available later this year in Wrights’ retail shops and via wholesale.

Community engagement also plays a central role, with school roadshows and charity partnerships with Dougie Mac and Macmillan Cancer Support. Digital activations, including social media campaigns and a specially produced video, are set to further amplify the milestone.

For more info, visit compleatfood.com/brands/wrights.

Environmental Management Phase 3 of the Seren Environmental Standard (BS 8555) for the 11th year in a row.

It relates to the processing of raw fruit and vegetables to produce sauces and chutneys for their subsequent packaging and onward delivery to customers. The inspection by Tarian Inspection Services reported no incidents or issues with water quality testing in the past year.

“Again, risks and opportunities appear to be managed well and the system is documented to a very high standard,” said the report. “Records are excellent and the environment manager is very competent at managing the essential plant to ensure environmental compliance.”

The inspector commented about the “very comprehensive” emergency

safety plan and notes that a carbon footprint plan is in place. The company’s plans for the next year include expanding Unit 3, calculating the company’s carbon footprint and continuing to review procedures.

The report is a feather in the cap for Beacon Foods’ environment manager, Paul Davies. He completed The Chartered Institution of Waste Management (WAMITAB) Level 4 Medium Risk Operator Competence for Non-Hazardous Sludge and Land Spreading quali cation.

“The BS 8555 Environmental Management System standard accreditation is very important to our customers as it’s a measurement that we are doing things correctly to improve environmental performance,” explained Davies.

HAND PACKED HOT HANDRAP & RAPTRAY

HIGH PERFORMANCE

Keeps food hot, fresh and tasty with custom vents to protect food from sogginess or drying out

REDUCED LABOUR

Engineered to keep your food tasting its best for up to 4 hours - with flexible formats customised for your recipe.

It’s intuitive and easy to assemble and pack product

MACHINE PACKED HOTRAP

Paper-based structure delivers gentler and more distributed heating, resulting in higher quality food

Designed for batch cooking from frozen to maximise e ciency

INCREASED SUSTAINABILITY

Recyclable board. Sandwich formats ship and store flat, reducing carbon emissions

Single packaging SKU and longer hot hold reduces food waste

CUSTOMER-FRIENDLY ONE SKU, ALL THE WAY THROUGH!

Formats designed to showcase your product and are easy to hold when eating

One package: from filling, distribution and cooking, food is touched only by the consumer

The judges have their pencils sharpened and clipboards at the ready as they await the entries for this year's Sandwich & Food to Go Industry Awards. And there's just enough time for you to enter.

With the entry deadline of 4 February fast approaching, Sammies HQ is buzzing with excitement. We’ve already received a fantastic selection of nominations that we’re eager to present to the judges.

you can nd out more about them on the Sammies website.

While you can, of course, enter the awards on your own behalf, we also welcome your nominations. If you've encountered a product or place worthy of recognition, tell us about it.

The Sammies Awards' rigorous judging process, ensures that winners are truly deserving and can con dently celebrate their success.

One of the Sammies Awards’ greatest strengths is that the process for deciding the winners and nalists in each category is conducted by judges who are completely independent.

Not only that, they are also wellrespected experts in the industry and

While big companies are undoubtedly doing incredible work with exciting new products and clever environmental initiatives, a brilliant idea on a smaller scale is equally impressive.

Our judges ensure that smaller businesses are recognised alongside the big hitters by factoring this into their decision making.

The winners will be announced at the Sandwich & Food to Go Industry Awards Dinner on 7 May 2026 at the Royal Lancaster London.

In the meantime, you’ll nd an outline of each award category in the following pages.

Full details and entry information are available on the awards website: www.thesammies.co.uk

This award shines a spotlight on the independent retailers, so often leading the way in new trends and tastes.

Open to any sandwich (not a range), this award rewards innovation within the sandwich market, in both the hot and cold sectors.

From forecourts and motorway services to airports, railway platforms and bus stations, this award recognises the work businesses are doing to develop and drive this sector.

This award recognises development and innovation by suppliers and focuses on new ingredients.

This award recognises the work being done to provide consumers with new, interesting and innovative healthy-eating products.

This award is a broad category aimed at new equipment, ordering systems, software or similar innovative product ideas or business initiatives.

This award will recognise the work being done by the convenience retailers to develop the sandwich and food to go market in the high street.

This award recognises development and innovation by suppliers and focuses on new packaging.

This award recognises development and innovation in the food to go market by manufacturers and foodservice businesses.

This award recognises those retailers who have done the most to develop their business over the past year.

This award will recognise the work being done by café retailers to develop either the high street or in-store market.

This award recognises the work being done by the chain retailers in developing the market in the high street.

This award is presented to a sandwich or food to go retailer, manufacturer or supplier who has initiated a successful and innovative marketing campaign to achieve strategic goals.

This award is designed to recognise the work being done at all levels of the industry to reduce the sectorʼs impact on the environment and improve sustainability.

This award recognises the overall contribution made by manufacturers to elevate and grow the industry.

This lifetime achievement award is in the gift of the British Sandwich & Food to Go Association management committee and is special recognition of the recipientsʼ contribution to the industry.

Thereʼs still time to enjoy the benefits of sponsoring. All sponsorship packages include a table at the awards dinner. If youʼd like to sponsor, email Sandra Bennett: sandra@jandmgroup.co.uk

We've reached that point in the competition where the contestants have received the sponsor ingredients and are feverishly concocting their recipes in the hope of progressing to the regional heats. Here's a reminder of this year's sponsor ingredients.

Sodiaal has chosen two cheeses to inspire competitors this year.

The cow's milk cheese Brie, from the heart of the Auvergne region, is the product of the know-how of its master cheesemakers and ripeners.

Sodiaal Cheese Category

And not to be confused with Swiss Gruyère, the French Gruyère PGI slices are ripened in two stages. Both cheeses come pre-sliced for foodservice.

Joining us as sponsor for the competition this year, we welcome new BSA member Liba Bread, who are bringing their expertise in flatbreads to the UK from their home in Sweden.

Liba Bread Flatbread Category

Sweden'sʼ No.1 seller, the flatbreads are produced with just a handful of simple ingredients. For the competition, you can be creative and daring or both. You choose what you want to impress with: Liba Oat, Liba Tandoori or Liba High Protein flatbread.

A popular addition to the competition in 2025, Flexeserve and ProAmpac are again joining forces for our exciting Hot-Hold Food to Go Competition.

Flexeserve/ProAmpac Hot-Hold Category

The chefs must produce a hot-hold food to go using a ProAmpac packaging product from the ʻSome Like It Hotʼ range. It will then be placed into a Flexeserve Zone unit.

Judging takes place 2.5 hours later.

At the end of November, the entrants received the sponsor ingredients to help them create their recipes.

The recipes will then be judged by the sponsors, with the best progressing to one of the regional heats.

Heat winners in each of the categories will progress to the live nal, which takes place on 7 May 2026 at the Royal Lancaster London ahead of the Sammies Awards Dinner, where the winners will be revealed.

Mozzarella is a semi-soft pasta filata cheese, renowned for its fresh taste and unique stretching qualities when melted.

The Heats

NORTHERN HEAT

3 March 2026 at Roberts Bakery, Northwich

MIDLANDS HEAT

4 March 2026 at Flexeserve, Hinckley

SOUTHERN HEAT

5 March 2026 at Brakes, Reading Futura

Futura Foods offers mozzarella in a wide range of convenient formats – including Individual Quick Frozen (IQF) medallions and pearls – giving foodservice and manufacturing customers maximum versatility.

The IQF format brings a host of processing and product benefits, while mozzarella itself remains the must-have Italian cheese that melts like a dream. From pizza and pasta to paninis, salads and beyond, mozzarella is widely featured across countless menus.

With over 125 years of expertise, Kings Fine Cooked Meats know a thing or two about delivering the quality, consistency and flavour that chefs and menu developers desire.

Pulled gammon is moist, flavourful & slightly salty with a natural fibrous texture. It mixes easily with sauces or performs well on its own, as the perfect filling for a sandwich or a delicious addition to salad and pasta dishes.

H. Smith Food Group plc is one of the UKʼs leading independent frozen foodservice companies specialising in the oriental, fusion/ crossover and food-to-go markets.

Chicken is an extremely popular and versatile ingredient for both sandwiches and food-to-go dishes. Weʼre excited to see what competitors can do with ours.

H. Smith Food Group Chicken Category

Greencore category lead and BSA Management Committee member, Arun Mayor, reveals areas of focus for the business, including an expansion of its product repertoire.

As we enter 2026, the UK food-togo market continues to evolve at pace. For Greencore, the year ahead is de ned by staying relentlessly close to the consumer, supporting retail partners with insight-led growth strategies and strengthening leadership across the wider chilled food landscape.

From an external perspective, our obsession with the consumer has never been stronger. During 2025, we saw FTG missions, needs and expectations evolve faster than ever –and we expect that pace of change to accelerate further.

People are informed, demanding and open to experimentation. In response, we will create products grounded in consumer insight, while supporting retailers with strategic thinking in a competitive market.

A key enabler of this is the evolution of our long-term Category Drivers. These will be refreshed and redeployed, providing a framework to underpin FTG strategies over the next three years and beyond. And these are not static – they are designed to ex as consumer behaviour shifts.

Internally, a major focus for 2026 will be the integration of Bakkavor.

"FTG is no longer defined by a single format, and demand continues to broaden across salads, sushi, ready meals and snacking occasions."

Bringing together two leading chilled food businesses creates an exciting opportunity to combine complementary strengths, capabilities and expertise. Our priority throughout this process is to maintaining absolute continuity of service for retail partners.

While Greencore is synonymous with sandwiches, our output has evolved signi cantly in recent years. FTG is no longer de ned by a single format, and demand continues to broaden across salads, sushi, ready meals and snacking occasions.

That said, the sandwich remains a cornerstone of the category. In 2025 alone, over 610 million sandwiches were sold in the UK1. This enduring popularity re ects an unbeatable combination of familiarity, convenience and value for money.

The opportunity, and challenge, lies in balancing this core strength with innovation across categories, ensuring retailers can o er trusted favourites and fresh points of di erence.

And one notable trend is consumers seeking greater variety – not just avour pro les but formats and eating occasions. A standout example was the Strawberry Sando, where demand exceeded expectations. Its success highlights a willingness to embrace novelty, especially when blending familiarity with inspiration from global food culture.

Sushi is another major growth driver, with market volumes up 14% year on year2. This re ects a broader appetite for pan-Asian cuisine and product formats. Sushi has evolved far beyond its traditional sh-based roots, incorporating Western avours, indulgent toppings and sauces, and formats such as onigiri that lend themselves to on-the-go snacking.

However, these trends must be viewed through the lens of cost-ofliving pressures – value for money remains paramount. Consumers want excitement and variety but not at the expense of a ordability.

Alongside this, convenience and speed will shape purchasing decisions in 2026, while the younger generation’s desire for instant grati cation needs to be balanced against price sensitivity. Our role is to deliver great-tasting products within frictionless, e cient shopping

journeys. With so much competition for on-the-go food & drink spend, getting this right is critical.

As a BSA Management Committee member, I’ve seen rst-hand the important role the Association plays. One achievement we were particularly proud of in 2025 was our work to improve hospital patient safety. Collaborating with NHS Supply Chain Food, the BSA helped drive positive changes to Patient Feeding Supply Standards, reducing the risks posed by listeria. These were endorsed by the Food Standards Agency, NHS England, the Hospitals Caterers Association and British Dietetic Association, demonstrating a powerful example of what collective action can achieve.

Looking ahead, the BSA has ambitious plans for 2026. A key objective is to bring members together more frequently to connect, learn and share best practice across the industry. There is real momentum behind this agenda and I’m excited about what lies ahead.

As FTG continues to evolve, consumer insight and e ective category management is more important than ever to this resilient and exciting sector – and I’m sure 2026 will not disappoint!

(i) & (ii) Circana Tot Mkt’plc, 52 w/e 30 Nov 25.

wholesale to catering and retail, the healthy FTG group Pure has been making waves since 2009 –and in partnership with the likes of Wildfarmed, the clear goal is growth.

As we embark on 2026, the portents are good for Pure. Fully focused on producing inspiring food that delivers on the eye as well as the tastebuds, there’s a real freshness and colour to its menus and approach.

“It’s the rst year for our brand as a fully multi-channel business,” said Pure founder and CEO, Spencer Craig. “A little over two years ago, we began to diversify from primarily being a high-street retailer. We now have three established and growing sales channels with our core retail business; a catering for meetings and events operation; and FTG wholesale.”

As consumers become more savvy and discerning when it comes to dietary choices, Craig has always maintained the same ethos.

“Do what you’re best at. Pure is not a ‘value’ o er (although we are always about value for money). Customers and clients buy our food for the quality, sustainability, provenance, health bene ts and taste. We need to

do these even better than before –and if we stay true to our values, we will be even more successful.”

Successful diversi cation involves an acute understanding of di erent markets, while also remaining ahead of the trends curve.

“We know customers want di erent avours and experiences. However, I don’t think we should overplay this in any of our sales channels. FTG is eaten most often when you’re on the move for a di erent reason – at the o ce, commuting, travelling, in a meeting – and these are moments where familiarity plays a part.

“The big advantage Pure has over other wholesalers is that we serve millions of customers a year via retail. We really know what customers want and can then apply this to our menu development. The bigger trend that we see is a move towards healthier products, quality ingredients and nutrient-dense recipes.”

With a desire to re ne its menu, while improving the message around sustainability, it’s essential Pure works with like-minded businesses.

“We have brilliant partnerships –and one of the most long-standing in retail is with Belu. We have free water stations front-and-centre in our shops to encourage reusables. This has saved millions of bottles over the past decade and is a re ection of our values.”

Pure’s catering business donates to children’s food & education charity Magic Breakfast with every delivery –and is pretty close to 300,000 contributions, alongside other fundraising activities.

“And in 2025, we launched our most successful partnership so far with Wildfarmed. We are the only

brand that uses 100% Wildfarmed our in all our sandwiches and 100% Wildfarmed oats in our breakfast pots. We also have a big product launch planned with them for April 2026.

“My next ideal collaboration is with another brand/chef across a range of products, so watch this space!”

For so many operators, the past ve years have thrown up challenges that no one could have predicted. However, Pure has still grown to 20 shops across London, showing versatility and resilience.

“We have changed! And we are new to the wholesale model but I do have one observation which is industry wide. I think the whole sector needs to work on moving away from being a cheap/value/meal deal o er, as this has diminished what we all do. In reality, the ingredients of, for example, a ham & cheese sandwich are not that di erent in quantity to a ham &

cheese pizza – but the retail price of a pizza is often more than double.

“I don’t know how to tackle this as an industry but years of meal deals in supermarkets has made the perception of FTG as something cheap and not representative of the ingredient, labour and transport costs to get great products into fridges.”

But the elephant in the room is always cost – and price point is a major factor in decision-making.

“Quality and value for money wins every time. I don’t go to places any more because portions are smaller or the prices are unrealistic.

“The challenge for Pure – across all channels – is to give customers value for money. This means quality ingredients, nutrient-dense recipes that ll you-up and great taste. We need to push ourselves to the limit to deliver this because the cost-of-living crisis is not going away any time soon.”

Leading foodservice wholesaler Booker reveals the trends it expects to see in the out-of-home (OOH) market in 2026, with fusion, exibility and shareability front and centre.

When it comes to the new year, there are many exciting concepts on the horizon. Blended global cuisines, quality fast food for sharing, loaded and topped dishes, chicken, café culture and colour trends are all set to shape the hospitality sector.

In terms of dining out or ordering in, people want elevated experiences they cannot easily recreate themselves. World food is transformative, with a desire for modern combinations. For something out of the ordinary,

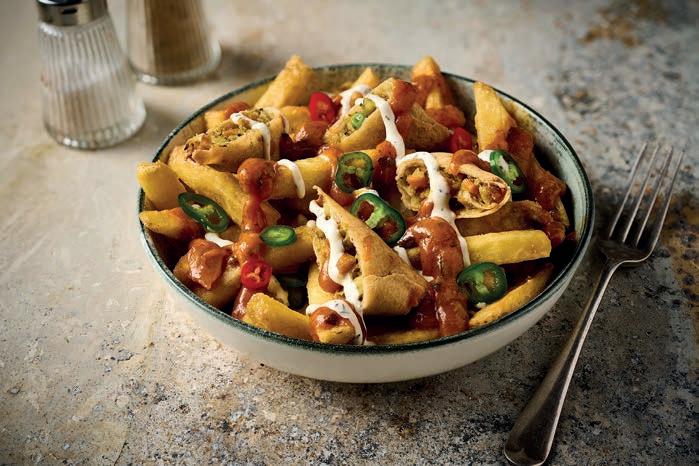

consider components from di erent global cuisines for added texture, taste and spice – think Thai green curry risotto, tandoori sh tacos, Texas toast with an English breakfast, and samosa curried loaded fries. Fusion dishes that can be customised by the chef and to the diner’s preference bring a depth of avour, encouraging repeat visits.

There’s a wealth of possibilities using ingredients already in stock – plus they can be enhanced with sauces, dips and seasonings to create a personalised signature dish.

Loaded fries are booming within all areas of hospitality – diners enjoy the novelty, plus they’re visually appealing, lling, value for money and can be personalised. As well as a main, they’re enjoyed during di erent dayparts, either as a snack, sharing meal or side.

Again, look to global in uences for toppings. Get creative with Korean pulled pork and kimchi, Mexican chilli with fajita seasoning, jalapenos and chipotle sauce, chicken tikka masala with coronation mayo – all Booker best-sellers.

These dishes can be compiled quickly with ease, both for dining in-venue and in boxes for on-thego. When presented well, using good quality fries, toppings and condiments, they deliver a wow factor.

Also, chicken shop-style products are moving away from high street chains and onto more mainstream menus, driven by convenience, familiar avours, formats and price point – they’re even appearing in pizza restaurants. Fans love the bold, spicy avours and globally inspired nature of chicken-based dishes so pubs, bars, restaurants and world

food takeaways can capitalise on low ingredient costs and ease of preparation. With the right seasonings, spices, sauces and dips, these hit the sweet spot of a ordability, shareability and customisation all year round.

Traditional co ee shops and highstreet cafés are thriving, alongside dessert-only venues, parlours and chains, tapping into demand for sweet treats as a standalone OOH mission.

We are a strong partner for this sector, as sourcing products with us allows customers to diversify their o ering and change the menu seasonally with ease, catering to evolving customer preferences, viral trends and dining out behaviours.

The interest in sharing multiple dishes among groups is also well established, thanks to its sociable and exible dining experience, driven by customers wanting variety and excitement – plus it allows creativity. Small plates, group grazing and portion sharing as concepts are likely to enjoy growth; not only for dishes and dinners but also desserts.

With quality components, bitesized pieces and creative plating, shareable plates appeal to a broader audience and encourage daytime visits during quieter times. While the format works well for cheeses and charcuterie, meat platters, chicken

shop-style foods and hand-held fried foods, we’re seeing an emergence into sweets. With the addition of sauces, fresh fruit, nuts and simple chocolates, visually appealing, ‘Instagrammable’ social media content is an opportunity to capitalise. Booker relaunched its range of frozen desserts, with 15 premium products balancing classic favourites with trending combinations, ensuring something for everyone. They come in convenient formats, such as pre-sliced, trays, bars and individual portions –easy to store, prepare and plate up.

Green will continue to lead colour trends in the year ahead, fuelled by pistachio-led products. While the ‘Dubai’ viral sensation may have reached its peak, there are other options for the on-trend nut. Invest in pistachio-based desserts, toppings and garnishes – such as pistachio cream and spread, chopped pistachios and kadayif for Dubai-style sundaes, shakes, cookies and pancakes.

Also on the green trend is matcha, fuelled by health bene ts, distinctive avour pro le, pairing potential and vibrant look. It’s no longer a niche item but a must-have for outlets.

When it comes to purple, beetroot is the emerging contender but ‘ube’ is going to be the buzzword. The purple yam from the Philippines has

a vibrant violet colour and sweet, vanilla-like avour – expected to lead to widespread use in desserts, cakes, ice creams, shakes and lattes.

Karen Poole, head of own brand and product at Booker, said: “These are challenging times with cost pressures from all angles, but we’re cautiously optimistic. There’s real creativity and a desire to elevate menus to keep the sector buoyant, drive footfall and give consumers great dining experiences.

“The hospitality landscape is shifting and consumer expectations are evolving, so Booker is poised to help chefs optimise menus, bringing diversity, choice and value. We’re meeting demand head on, especially with the relaunch of our Chef’s brands, and we work with our foodservice and catering customers to give them the products and ingredients they need to remain competitive and boost pro ts.

“We have high hopes for the 2026 summer of sport bringing a real boost. With 190 UK branches, Booker can deliver time and cost-savings, with improved supply chain management by working with partners who understand the needs of operators.”

Booker’s Winter Catering Guide is out now, spotlighting trending lines, including own label and branded favourites. Designed for caterers, chefs and operators, it includes menu ideas and inspiration. Booker has locked down prices on 450 products and ingredients until 3 March 2026. Find

We caught up with Ditsch UK sales & marketing executive Lucy Rogers, to talk partnerships, trends and the quest for quality.

Following the acquisition of WorldBake by Ditsch UK Ltd, can you expand on that business journey?

It marks a natural step in a longstanding partnership. We’ve worked closely with Ditsch for years, sharing values around quality and innovation. Becoming part of the Valora Group gives us greater scale and support, while retaining the same team, products and customer- rst approach.

Tell us about the main areas of focus.

This year is about building momentum. Our priorities are product

innovation, strengthening our pretzel and bakery ranges for the UK FTG market, enhancing customer support and improving operational e ciency – all while helping customers drive growth in challenging conditions.

Consumer expectations around FTG are changing all the time. How will you take advantage?

Consumers want quality, convenience and value. We’re responding with versatile bakery products that work across multiple eating occasions – from grab-and-go to premium sandwich carriers – helping operators deliver great taste with commercial appeal.

How do you identify the next trend and deliver on taste?

We combine market insight, feedback and close collaboration with Ditsch’s European innovation teams. Concepts are tested thoroughly to ensure they deliver on avour, consistency and ease of use, not just trend appeal.

There are huge nancial challenges for hospitality operators. How do you ensure value for money and quality?

We focus on high-quality products that are easy to handle, reliable in performance and deliver strong perceived value on a menu. That balance helps operators protect margins, while still o ering premium experiences to consumers.

Who are you working with currently – and who would you like to partner with in the future?

We work with a wide range of foodservice, retail and wholesale partners – from independents to national brands. Going forward, we’re keen to collaborate with operators looking for tailored bakery solutions and long-term partnerships.

This next chapter as Ditsch UK Ltd allows us to bring elite baking expertise to the UK, while staying true to the values that built WorldBake. We’re excited about what’s ahead.

lunch! NORTH is back at Manchester Central, promising to be bigger and better than ever.

creates a unique environment where FTG meets the wider hospitality industry, from cafés and co ee shops to restaurants, pubs and bars. A standout feature is its free-to-attend keynote seminar theatre, with speakers to be announced in February.

After a hugely successful debut in 2025, lunch! NORTH (sponsored by Uber Eats) returns to Manchester Central on 10-11 March 2026.

Building on the 16-year legacy of the lunch! show, the northern version was created to support the strength of hospitality beyond the capital. Now in its second year, it continues to connect innovative suppliers with leading local, regional and national FTG operators.

Once again co-located with Northern Restaurant & Bar (NRB), the combined o ering of both shows

Among the speakers is Nick Ayerst, GAIL’s managing director, who takes part in a keynote interview on day two. Also, the Co ee Shop Leaders Panel will feature Matt Farrell, co-founder of Bold Street Co ee. While the Marketing Leaders Panel includes Annabel Mackie, marketing director at itsu.

“The response to the rst lunch! NORTH exceeded expectations,” said group event director, Chris Brazier.

“We saw fantastic engagement from exhibitors and buyers, really validating the decision. For 2026, the focus is on bringing in even more quality buyers to do business with our innovative exhibitors and continuing to champion the northern FTG community.

“There’s a real sense of pride, creativity and community in the north. We’re also seeing increasing investment from operators traditionally based in London and the south, which speaks volumes about the strength and opportunity in the northern market.

“Exhibitors can access real buyers actively looking for products, concepts and solutions. The show attracts a powerful mix of independent operators and multi-site brands. Add to that the co-location with NRB and exhibitors can also connect with professionals from restaurants, pubs, bars and hotels under one roof.”

Other big names such as illy cafe, Yorkshire Tea, Simply Lunch, Welbilt, Hip Pop, Lindt and Vita Coco have also been con rmed, with more to be announced soon – 400 suppliers will be spread across both shows.

“Focused, targeted events are more important than ever. It’s not about trying to be everything to everyone; it’s about serving the FTG and café community properly. Our ambition is for lunch! NORTH to be the de nitive annual meeting place for the sector in the north and the success of year one has put us rmly on that path.

“And while attendance matters, relevance matters more. lunch! NORTH attracts people with real purchasing power and a genuine intent to discover suppliers,” concluded Brazier.

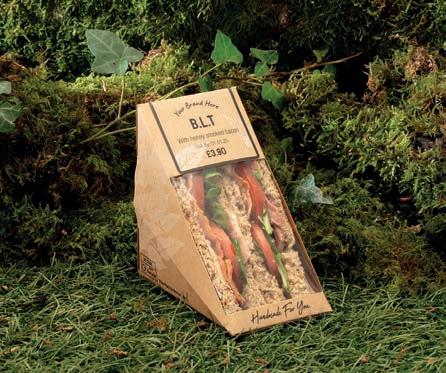

Planglow is celebrating its 40th year in 2026. Here, co-owner and marketing director, Rachael Sawtell, focuses on the FTG landscape and the importance of enduring relationships.

Planglow is a multi-award-winning labelling and packaging provider that launched in 1986, when programmer John Scott and salesman Phillip Saunders developed a revolutionary system for caterers to create and print their own labels. Founded as a family business, this ethos very much remains today.

We pride ourselves on our team, business relationships and robust working knowledge of the industries and areas our stakeholders operate within. Many customers have been with us for decades, some since the very beginning. When I visit them with an account manager, they are often greeted with hugs and exchanges about one another’s families.

I joined Planglow in 2005. The business was already established;

labelling was our core o ering. We had started to receive customer feedback asking for cardboard packaging which complemented our labelling o er, so my rst marketing project was to launch our rst card cup and sandwich wedge as an alternative to the then ubiquitous clear plastic wedges.

Over the years, we’ve expanded to accommodate consumer behaviour and trends. The biggest shift we’ve seen, dating back to the beginning of Planglow, is the growth of hot graband-go. Initially fuelled by the boom in street food around 10 years ago, lockdown profoundly altered the way we approach meals. Today, with many workplaces continuing to operate hybrid and remote working, the lines are blurred between takeout and ‘grab-and-go.

But the industry’s greatest catalyst for change has been the environment, which is at the core of everything we do. The introduction of legislation has been the most impactful. The increasing number of people with allergies led to the introduction of Natasha’s Law, altering the way foods are packaged, labelled and displayed. We updated our software, LabelLogic Live, well in advance of regulatory updates. This ensured customers had ample opportunity to achieve compliance ahead of the deadline.

Most recently, we’ve developed our new Back to Nature range –which includes recyclable and certi ed compostable products – in response to the Extended Producer Responsibility (EPR) and Simpler Recycling initiatives, and a requirement for more environmentally minded products that support a circular economy. As our new agship o ering, it ful ls this on multiple levels, including enhanced quality and shelf life, o ering a choice of disposal routes and priced 5% lower than our other ranges.

Back to Nature also helps us meet a primary objective: 90% of packaging compostable or recyclable by 2027. We are proud to say that 81% is certi ed home and/or industrially compostable or meets the OPRL standards for recyclability (up from 74% in 2024). We continue to expand this with a view to exceeding this target and many more, so watch this space. And while we may be 40, we’re only just getting started!

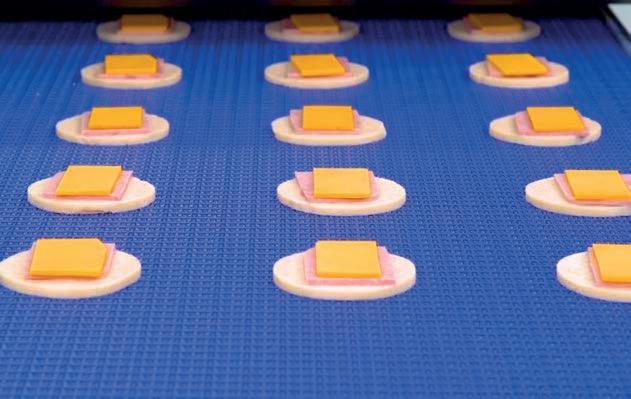

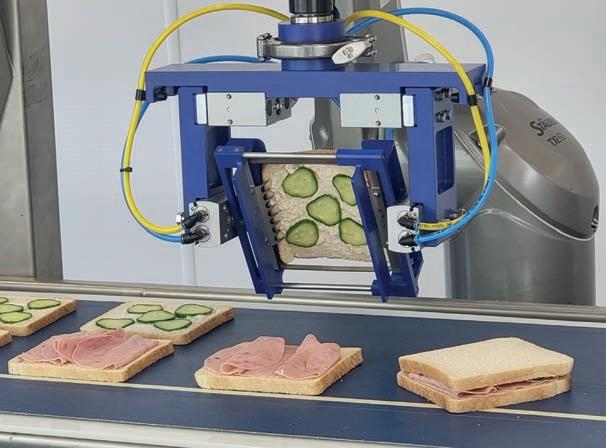

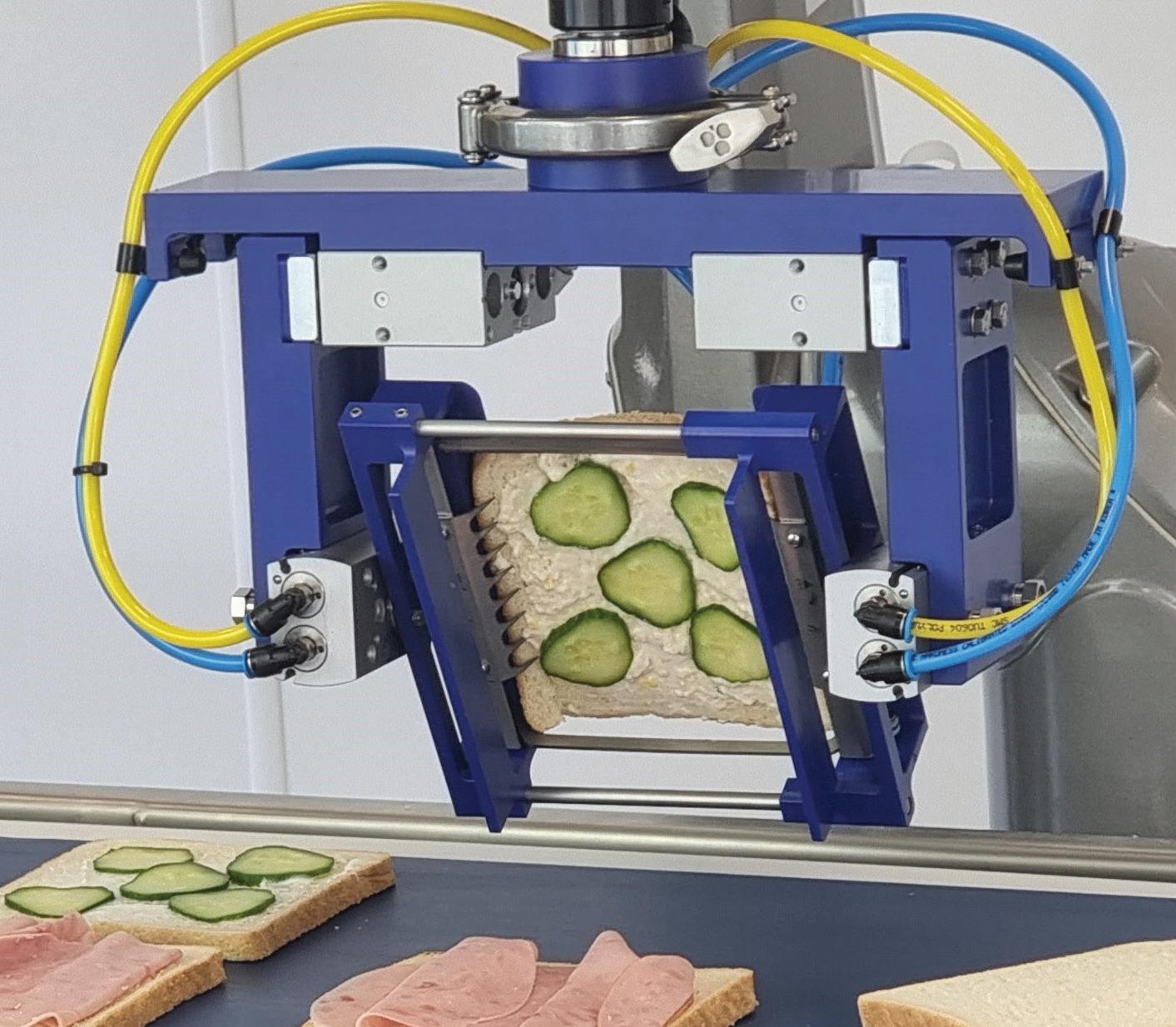

The Grote Company team reveals how its machinery range continues to transform the shop oor.

FTG is a growth market. How is Grote Company helping manufacturers and suppliers adapt?

We want manufacturers to step up and meet this growth. With restaurant prices soaring and people watching their budgets, prepared food o ers a viable alternative to dining out. Consumers lead busy lives, so convenient options are attractive – and that’s where we come in.

Grote supports a wide range of FTG categories, including sandwiches, ready and frozen meals such as cordon bleu, savoury baked goods with sliced meat and cheese, meat snacks and pizza. Our portfolio ranges from slicers and sandwich assembly lines to depositors, pizza topping systems and food-handling robotics.

We’re focused on helping producers automate key processes and improve throughput as preferences evolve.

What’s exciting about automation right now?

Seeing how accessible and impactful automation has become for manufacturers of all sizes. Today’s technology is transforming the shop oor, allowing production lines to run at higher speeds with greater consistency, while signi cantly reducing waste and downtime.

We’re seeing layered approaches to automation that allow manufacturers to scale over time.

● Standalone automated equipment like slicers, depositors and topping applicators take high-speed, repetitive tasks and precisely execute them all shift long.

● Integrated systems take it a step further, featuring fully connected processes and centralised line controls, allowing processors to free up sta from tedious transfer and repositioning tasks.

● Fully robotic systems take automation to the next level, working closely with a processor’s integrated process systems to quickly and accurately transfer, position and

place products in applications that would previously have required manual handling by sta . Looking ahead to 2026, we expect continued growth in exible, scalable automation – solutions that allow manufacturers to respond quickly to changing product formats, labour availability and consumer demand, while building long-term operational resilience.

FTG is no longer just sandwiches. How do you adapt to consumer expectations for global avours, fusion, etc? Producers must adapt recipes, ingredients and formats –often within the same production line.

To support this shift, these need to be exible enough to add or adjust ingredients at multiple points in the process – that exibility is core to how Grote Company designs its equipment. Our solutions enable processors to produce a wider range, without signi cant new capital investment.

● Grote sandwich lines can produce multiple formats and recipes on a single line.

● Grote depositors can apply condiments, butter/oil, wet salads, sauces and more across sandwiches, meals and baked goods.

● Our versatile slicers slice meat/cheese/vegetables on the same machine with simple changeovers.

And we work with leading sandwich and FTG producers in the UK, mainland Europe and US. We expect to deepen these relationships, while expanding further into Eastern Europe and Asia.

How do you think AI is changing your sector?

One area is data analysis. While data is often collected, it’s not always e ectively analysed. AI can help uncover insight that can be used to enhance performance.

Rising costs and sta retention are challenging areas. How can you help?

There is no one-size- ts-all solution. That’s why we start by listening and working closely with each customer to understand their speci c goals and constraints.

In some cases, processors want to extend the life of existing equipment by repurposing or upgrading older machines. Others need to recon gure their lines to keep pace with product trends or add automation to reduce reliance on hard-to- ll roles. For some, investing in new equipment is the right next step.

Fully automate fresh sandwich-making with Grote’s fixed equipment and robotic solutions. Choose from individual machines up to turnkey, multi-lane lines for high-volume production. Increase throughput and automation. Improve accuracy and quality. Increase ROI.

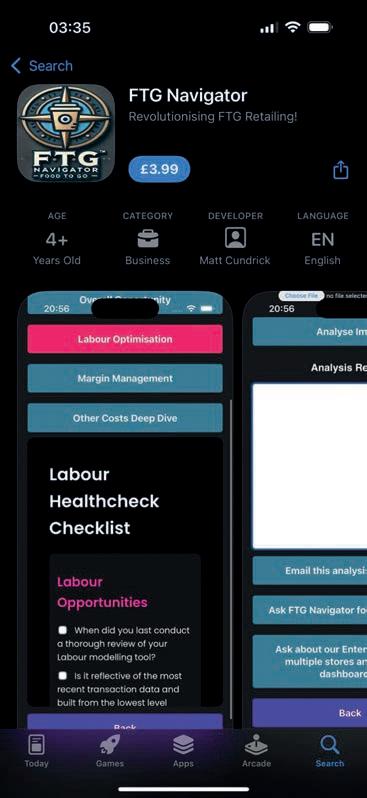

The heartbeat of the FTG Navigator team, Matt Cundrick has a unique understanding of how operators can use technology to their advantage.

FTG is hugely vibrant in 2026. How have you seen it develop? It is the best sector in retail. Fastmoving, endlessly creative and brutally commercial, it gives you genuine space to make your mark if you care enough.

I’ve been in FTG for over 25 years and it’s given me lifelong friendships, the chance to travel the world and the privilege of working with brilliant people. I genuinely feel lucky to still be excited by it.

I often think back to an early role at M&S Milton Keynes, where FTG was literally a one-metre fridge of fairly uninspiring sandwiches. That same store today tells a story of evolution. The

fridge is now eight full bays, taking up a huge proportion of the shop. And you will nd salad bowls, poke bowls, smoothies, vitamin shots and strawberries & cream sandwiches. The pace of innovation has been extraordinary.

We’ve also lived through the rise and fall of heavily manned hot food counters. At their peak, these were stunning: pizzas, roast meat carvery, sandwiches, freshly prepared salads and fresh juices providing real theatre. They worked brilliantly, especially as eating habits changed nationally.

What’s overlooked is how FTG bene ted from broader economic shifts. As austerity took hold, followed by energy shocks and cost-of-living pressures, customers steadily traded down the food hierarchy. Fine dining to casual dining, casual to QSR, QSR to FTG. For a long period, FTG hoovered up that demand.

But the pressure didn’t stop there. Rising labour costs, waste, energy and operational complexity began to squeeze the sector too. Many of the most innovative, labour-heavy and

high-waste o ers fell away, replaced by centrally produced, packaged products with longer shelf life.

We saw waves of sushi bars, driven by strong margins and operational simplicity. They did well, but in many cases the sector lost some of its spark. It became safer, atter and less joyful. What’s interesting is that international innovation didn’t slow down in the same way. Ireland powered on; Australia and NZ pushed boundaries; across Asia, FTG kept evolving at speed. That gap is now feeding back into the UK and I think we’re entering another in ection point.

What are key trends in terms of Arti cial Intelligence?

AI is not just a smarter spreadsheet. When properly understood, it touches almost every part of the FTG operation: forecasting, waste, marketing, labour planning, customer ow, even how food is produced.

One of the biggest shifts will be robotics. Small-format, task-speci c automation has huge potential to help retailers do better things, faster and more consistently. This is something I’m personally investing in and excited to bring to market in 2026.

Forecasting is another area where AI is already delivering real returns. Tools that predict sales and production requirements are now incredibly accurate and genuinely pro table. Importantly, low-cost versions exist, making this accessible beyond the big players. Platforms like Cybake and Martee AI are wellrespected in this space.

We’re also seeing improvements in apps and customer interfaces, as well as marketing tools that use geolocation and behavioural data to tailor messaging in real time. Businesses like Axon Vibe are leading here.

Add to that improved insight into customer ow, tra c patterns and catchment behaviour through systems such as Nimbus Maps, and operators suddenly have access to a level of intelligence that was unimaginable even a few years ago.

Let’s talk about FTG Navigator. It’s really two things. The rst is the AI app, designed to give retailers a genuinely a ordable tool that drives sales, or their money back. Using machine-learning visual analysis, it identi es missed opportunities in FTG displays and feeds back practical actions in seconds – speed, clarity and impact.

The enterprise version takes this further for larger, multi-site businesses. It brings insight together across estates, tracks progress over time and creates a measurable loop of improvement rather than one-o audits.

The second side of FTG Navigator is what someone recently described to me as a ‘global boutique consultancy’, which I secretly love. In reality, we’re a small team of four: deep sector experience combined with new energy, young researchers and project leads. Together, it’s a powerful mix.

We exist to help people make more money from FTG. We specialise in supermarkets, convenience and forecourts, right at the cutting edge, where small changes make big di erences.

The gap we ll is simpli cation. There’s a huge amount of data and tech available but it’s overwhelming. We help turn that into clear decisions and fast action.

Can you expand on business partnerships and future ambitions?

I’m incredibly proud of our global connections, supporting retailers and suppliers across Ireland, Australia, South Africa and NZ.

Some of the work we’ve done over the long term means a

huge amount to me. Park Garage Group is a great example. They took the decision to close 12 Greggs franchises to build their own destiny. Over the past year, we’ve helped create Bakery 79, supporting range, commercial structure, supply chain and operations.

But crucially, we also embedded tech: Cybake to manage production, sales and waste, and FoodDocs to manage safety while providing central visibility of quality and standards.

Seeing Bakery 79 win ‘FTG Store of the Year’ at the Forecourt Trader Awards is one of my proudest moments.

Keells in Sri Lanka is another incredible journey. We added over 60% revenue in the rst year, overhauled the food proposition, introduced modular concepts, led pizza innovation, built a fried chicken o er and launched a sweet treats and dessert bar. More than the numbers, it’s been about working shoulder-toshoulder with amazing people.

Beyond that, we support forecourt operators rethinking local food models, café chains rebuilding pro tability, pizza brands aligning franchising standards, and start-ups scaling exciting ideas across the UK.

One relationship I’m very proud of is with Win Win Water. A fully compostable, bio-based water bottle with zero plastic. I’ve never charged them for work – my daughter told me I had to help, whatever it took.

Becoming a shareholder in 2025, then seeing them launch in GAIL’s was emotional.

I’ve also realised that I need to put my money where my mouth is, so I co-own some convenience stores. There’s no better way of becoming a better consultant/ advisor than getting involved.

Looking ahead, I want to work with those committed to change. It’s not about brand size; it’s about potential and people. The best work happens when belief and e ort are real.

How can independent operators with smaller budgets utilise AI? Honestly, start simple. Lean into tools like ChatGPT, even the free versions. Teach it your business and your competitors. Ask it questions. The results can be astonishing.

Read, learn and experiment. Attend events. Watch TED Talks. Rekindle the curiosity that got you into retail in the rst place and view it through an AI lens. Language models can help analyse data, problem-solve, review layouts and even scan visuals. The more you ask, the better it gets.

Most importantly, this is currently high-ROI, low-cost investment. That window won’t stay open forever. Early adopters win.

This sector is full of opportunity but it’s not easy. Government policy, labour costs, energy and supply chain pressures are real. The temptation is to scale back: less fresh food, more packaged product,

fewer people, longer shelf life.

But that’s a vicious cycle. It might relieve short-term pressure, especially with tempting listing fees from bigbrand suppliers but it risks eroding the very reason customers come to you.

The future is about doing things di erently. Adapting the model, not abandoning it. Leaning into AI, automation and external support to see the next phase of the game.

Check out ftgnavigator.com.

Key Features Include:

• Accurate digital temperature control

• Precise control of high seal pressure and duration

• Exact index positioning of top and bottom tooling ensures consistent sealing

• Printer options available

• Low maintenace costs

• Labour saving

The Soken HS52C delivers high speed production with a sealing rate of up to 1400 sandwich packs an hour

This combined system has the ability to seal the very latest biodegradable cardboard packaging in a variety of sizes.

The ultimate solution for your vegetable needs, with a capacity up to 1,500 kg/hr.

■ Up to 100 programmable recipes

■ 150 mm belt width for higher throughput

■ Save production time and labour costs

Freshness is the cornerstone of customer loyalty. Chief operating o cer at Invisible Systems, Ben Ings, explains how temperature control is key to ensuring quality.

In food retail, trust is everything. A soggy sandwich or wilted salad can send a customer straight to a competitor. In a market where growth often comes from winning share, protecting quality means protecting your brand. In fact, 41% of UK grocery shoppers switched from their main supermarket in June 2025*, with 20% turning to discounters. This shows the fragility of loyalty in the food sector.

Freshness is now a baseline expectation. Customers assume that what they pick up will look and taste good. When expectations aren’t met, the impact goes beyond a single lost sale; it can erode con dence in your business. And when there’s endless choice, second chances are rare.

The threats to freshness are often invisible. Over lled fridges that block air ow, inconsistent temperature zones or underperforming equipment can all compromise cold and hot food, as well as frozen – even when products are technically ‘in date’. Without accurate, real-time data on temperature and environments, these issues often go undetected until it’s too late. UK grocery retailers, including supermarkets, waste an estimated 270,000 tonnes of food annually.

Increasingly, food retailers of all sizes –from supermarkets to speciality shops and convenience stores – are turning to real-time temperature monitoring. By capturing granular data on the equipment environment and performance, they can identify issues before negatively impacting stock. Picture a busy lunchtime rush, with a fridge crammed full of sandwiches and other FTG options, leaving little room for air to circulate. The result is uneven cooling – some items remain perfectly chilled, while others warm just enough to lose their crispness.

These hidden risks create a chain reaction of operational challenges for retailers, with manual checks becoming the default, diverting teams from higher-value tasks. Equipment problems often go unnoticed until they cause costly disruptions or lead to energy ine ciencies that spike utility bills. Compliance adds another layer of complexity, with recordkeeping and audit preparation taking longer than they should.

Automated monitoring issues alerts if there are dips in temperature, such as from doors being left open, overstocked shelves or equipment failing. If anything is agged by the IoT sensor-based platform, sta can quickly reorganise and ne-tune settings to limit the impact on food, and schedule maintenance to x more major issues. It’s a proactive approach that protects both product integrity and brand reputation.

Plus, because data is captured automatically, it eliminates the need for time-consuming manual checks and reduces the risk of human error. Our data has found that retail sta

currently spend up to two hours each day manually monitoring and recording temperature data, which is time that could be better spent.

With routine checks handled digitally, employees are less focused on paperwork and have more breathing space to focus on serving customers or maintaining a welcoming storefront. For business leaders, this means smoother compliance processes, since data is always recorded accurately and o ers greater visibility into how time is used. For maintenance teams, it enables a shift from reactive xes to planned, preventative maintenance, minimising downtime and reducing costs.

Also, automating temperature monitoring unlocks actionable insights. With visibility into live food environments, retailers can make smarter decisions, from adjusting store layouts to prioritising equipment upgrades where they matter. The result? Stronger freshness protection, reduced waste and improved operational and energy e ciency.

Shoppers today are choosing retailers they trust to deliver good quality, fresh food. This is evident every year with the biggest festive battle across FTG: the Christmas sandwich! A poor-tasting turkey sandwich? Blacklisted.

visibility into the conditions shaping every product on the shelf.

Switching brands is a non-issue for consumers, and it’s con dence in a retailer that keeps them coming back. They expect every item to look and taste exactly as promised, every single time. And consistency starts with

Retailers who invest in real-time temperature protect freshness, cut compliance risk, boost people and energy e ciency, and shift from reactive xes to proactive management for long-term resilience.

*Reward: Trends reshaping grocery spend.

Successful operations depend on Urschel for cutting edge solutions. Rely on Urschel for rugged, high-powered machinery to maximize capacity and cost-savings. Precision cuts, sanitary stainlesssteel design, backed by service and support for the long life of your machine.

Discover more Urschel cutting solutions at urschel.com.

As European recyclers face signi cant market pressures and operational challenges, Faerch’s integrated facility, Cirrec, continues to demonstrate stable performance and steady progress. Cirrec has increased its internal supply of tray-based recycled PET (tray rPET), supporting the ambition to scale circular packaging solutions at industrial level.

Cirrec is now performing with such steady progress that it can provide its full annual output capacity of approx 27,000 tonnes of pellets for internal consumption within the Faerch Group. This secures Faerch’s access to highquality recycled raw material and strengthens the company’s position as a truly integrated recycler-producer.

Faerch, a leader in rigid plastic food packaging, is advancing the transition to circularity by expanding its integrated recycling model. And the Cirrec Division enables it to turn postconsumer trays into new food-grade

packaging, ensuring quality, security of supply and true material circularity.

Faerch’s recycling platform is built on the principle that yesterday’s resources must stay in the loop. This is driven by collaboration across teams, partnerships throughout the value chain and a focus on improving processes and outcomes. By producing packaging with tray rPET, Faerch demonstrates how responsible design and resource e ciency can go hand in hand: every tray is made from materials that have already served a life – now renewed to protect food and minimise environmental impact.

Tim Rademacker, divisional CEORecycling at Faerch Group and Cirrec, said: “Faerch ensures stability and quality in packaging by managing the recycling process through Cirrec. This allows us to secure high standards for raw materials, quality, and reliable supply for all PET food packaging applications within the Faerch Group.”

Looking ahead, Faerch has targeted 25-30% tray rPET content across its portfolio by 2026. This goal is integrated into certi cation processes and re ects the company’s commitment to sustainability.

Achieving this milestone will require continued e ort and close collaboration across the value chain. By strengthening its internal consumption of tray rPET, Faerch aims to provide customers with greater supply stability, quality assurance and price resilience – supporting them in navigating market uctuations and emerging regulatory requirements.