International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Islamic Azad University Tehran North Branch, Iran ***

Thepurposeof thepresent studyistoinvestigatethe effectoforganizational innovationandtheuseofonline businesseson improving the financial performance of startups. In terms of purpose, the research is developmental-applied and in terms of natureandmethoditisa descriptive-surveyresearch. Thestatistical populationof theresearchconsists ofallmanagersand experts of creative companies in Tehran, and according to the latest statistics of the "Ecological Development Program of Creative Companies", the Vice President for Science and Technology, is 248.With the inclusion of at least 2 managers and experts in each company, the statistical population was equal to 496. Random Sampling is used to conduct the research and the sample size is 220. Data collection tool was a standard questionnaire with 17 questions and structural transaction modelingwithPlssoftwarewasusedtotestthehypotheses.

Theresultsshowthattheuseofe-commercehasadirectnegativeeffectonoperatingcostsofsalesinstartupswithanegative effectof0.535,theuseof e-commercehasa directpositiveeffectonthe returnonassetsofstartupsby0.485andfinallythe use of e-commerce It has a direct positive effect on innovation in startups by 0.460. Innovation also does not mediate the relationship between e-commerce usage and operating costs of sales in startups, but mediates the relationship between ecommerceusageandsalesreturnsinstartups.

Keywords:organizationalinnovation,useofonlinebusinesses,financialperformance,returnonassets,startups.

Economic globalization has a profound effect on all industries around the world. However, the trend of globalization is not uniform and there are many differences in the degree of integration of industries in a single global market (Caciolatti et al., 2020). in this case, economic globalization puts increasing pressure on manufacturing companies, especially small and medium-sizedenterprises(SMEs)andstartups,whichmustcompeteglobally(SotoAcostaetal.,2017).Inthisregard,withthe advent and development of Internet technologies, manufacturing companies are using e-business technologies to increase productivity and quality, reduce operating costs and respond more quickly to the needs of customers and business partners (Jardim Goncalves et al., 2012). As a result, the effective adoption and use of e-business technologies has become a major managementconcern(Popaetal.,2016).

This is especially important for startups. Start-ups are said to start with a simple and basic idea and grow rapidly and make money (Ramezani Bidgoli, 2019). Startup is a temporary organization that has been created with the aim of finding a repeatableandscalablebusinessmodel (NowruziandMazlum,2016).Temporarymeansthata 10-year-oldstartupdoesnot makesense.Thejobofastartupistoquicklyfindtherightbusinessmodelintheshortestpossibletime,sospeedandtime are important factors in the success of a startup, that is, the later it discovers the desired business model, the less chance of success.Conceptssuchasuncertainty, reproducibilityandscalabilitycanalsobementionedamongtheconceptsrelatedto a startup(Soheilietal.,2019).

Inaddition,theimportanceoftheliteratureine-commercestillreliesheavilyonstudiesinlargecorporations,withveryfew studiesinsmallandmedium-sizedenterprisesandstartups(Lopez-NicholasandSotoAcosta,2010).Inaddition,theeffectsof technology use on business value in startups are still unknown, and it is difficult to find studies that analyze the use of ecommerceintheperformanceofstart-ups,andthereareveryfewstudiesthatExaminetheuseofe-commercethroughoutthe product value chain of start-ups and small businesses (Soto Acosta et al., 2015). However, given the e-business conceptual

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

frameworks, it is the level of e-business integration and integration that creates the best opportunities for business value in thesecompanies(Popaetal.,2018).

Another issue is that most research on the adoption / use of e-commerce has focused on countries with high e-commerce intensities (such as the United States, Canada, and the Scandinavian countries) (Kongaut and Bohlin, 2016). However, the international growth of e-business needs to expand this research to other less studied and developing countries (including Iran)todemonstratethepotentialforgrowthofdifferentcultures(Hernandezetal.,2019)and impactanalysis.Theuseofecommerceontheperformanceofstart-upsinthesecountriesshouldalsobedetermined(VincentandZakkarvia,2021).

Theperformanceofthefirminthee-businessliteratureisprimarilymeasuredusingsubjectivemetrics(Palaciosetal.,2014; Soto-Acosta et al., 2015), and shows few traces of objective metrics (Lucas et al., 2013). In addition, most studies have examined the direct relationship between e-commerce and corporate performance, while very little work has been done to identify the variables that mediate this relationship. Therefore, there is a need to develop more comprehensive research modelsthatcanexamineintermediatemetrics,especiallyinstart-ups.

To address the above gaps in the literature, this article focuses on the country's startups and start-up businesses in creative companies. This article not only analyzes the direct effect of e-commerce usage on financial performance, but also the mediatingeffectoforganizationalinnovationandotherissuesinthesecompanies.Astudyofthebirthandactivityofstartups inrecentyearsinthecountryshowsthattheaveragelifeexpectancyofstartupsisalmostthreeyears,andafterthreeyears, they are no longer recognized as a startup. 14.4% of startups are more than 3 years old and have probably not been able to becomeanindependentcompanyduetofinancial problemsandlack ofinvestment.There are several reasons forthe endof the three-year period of being recognized as a startup, including the acquisition by other large companies, increasing the number of offices to more than one center, increasing revenue, increasing the number of employees to more than 80 and increasing the number of members. The principal referred to more than five people or the sale of shares of the principal members. In fact, in a simple sentence, a startup achieving profitability can be considered the end of being recognized as a successful startup. All of this is associated with technological approaches to business and the need to identify the effect of onlinebusinessandpracticesoninnovationand.Theperformanceofstartupsisveryimportantintheirsurvival.

Inthisregard,themainquestionofthepresentresearchiswhatistheeffectoforganizationalinnovationandtheuseofonline businessesonimprovingthefinancialperformanceofstartups?

The "knowledge-based view" considers knowledge to be the most important strategic resource available to a company and statesthatacompany'sknowledgeisusuallydifficulttoimitateandsociallycomplexand,therefore,isrelatedtothepotential for sustainable competitive advantage and superior company performance. (Nickerson and Zenger, 2004). This view is an extended view of the "resource-based view" that provides the basis for explaining why companies in an industry systematically perform differently over time (Hoopes et al., 2003). The resource-based approach shows that the effects of individual and company-specific resources on performance can be significant. In general, resources broadly include assets, infrastructure,skills,etc.,basedonthetwobasicclaimsofresourceheterogeneityandresourceimmobility.Theresourcesand capabilitiesofcompetingfirmsareheterogeneouslydistributedandmaybeasourceofcompetitiveadvantagewhentheyare valuable, rare, difficult to emulate, and not replaceable (Barney, 1991). At the same time, resources and capabilities are the sourceof sustainablecompetitiveadvantage.Italsohighlightstheroleofcomplementarity between resourcesasa sourceof commercialvalue.Companyresourcesareconsideredcomplementarywhentheexistenceofonesourceincreasesthevalueof another (Ravichandran and Lertwong Satien, 2005). This complementarity of resources is the cornerstone of the resourcebasedperspectiveandhasbeenused, for example,asanexplanationofhowtoovercomeICTanditsparadoxical natureand contributetothecommercialvalueofcompanies(BethandGrover,2005).E-businesstechnologyitselfisoftenimitativeand, therefore, such tools should not be a source of competitive advantage (Barney, 1991). However, as Marona Sardan et al. (2014)argue,"thecombinationofInternetresourcesandothervaluableresourcesofthecompany,andtheirintegrationinto theorganizationofprocesses,mayleadtobetterperformanceofthecompany.Since knowledgeisakeyfactorforcompanies becomemorecompetitive,e-businesstoolsmayfacilitateknowledgecreationandsharing(DelGiudiceetal.,2018).

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Every business enterprise can be described by controllable variables that determine its relative success in the market. Identifying and manipulating these variables determines the extent to which a start-up business benefits from gaining a competitive advantage. By focusing efforts to maximize performance in startups and start-ups based on these key success factors, entrepreneurs can achieve extraordinary market advantages over their competitors. The key factors for success appear in different patterns depending on the type of industry. They are the factors determining a company's ability to competesuccessfullyintheindustry.Allstart-upsneedtoidentifythekeytosuccessintheirindustry;Otherwise,theywillbe thelosersofthisfield(Malekpour,2015:93).

Success factors for startups can be broadly classified into three dimensions: organization, process, and technology. The organizationaldimensionincludeselementssuchassupportforcommittedmanagement,aclearvision,andawell-established business, in turn, the process dimension includes business-based competition and a balanced team composition. Is an interactive, business-oriented development approach and change management. The technology dimension also considers elementssuchasbusiness-based,scalableandflexibletechnicalframework,anddataqualityandintegrity.Finally,itshouldbe saidthatstartupsneedprerequisitestoimplementbusinessintelligence,withoutwhichinvestinginbusinessintelligencewill not be profitable for them (Musa Khani and Saeedi, 2010). Therefore, the role of business intelligence in the operational successofstart-upsisveryimportant.

From a practical point of view, start-ups have been considered in the new economy approach. And the purpose of forming these companies is to gain research and technological achievements from production to market, to meet the social and economic needs of society and to transfer technology to the owners of ideas in the economy. These companies are usually basedonriskyideasandtheirbusinessmodelisquiteinnovativeandtheirmarketsarenotcompletelyclearatfirst(Nadafiet al.,2017).

Properfinancingisoneofthemostdifficultandcomplexelementsintheprocessofstartinganentrepreneurialbusinessand playsaveryimportantroleinstartinganddevelopinganentrepreneurialbusiness.Thevariousmethodsandapproachesthat exist in the field of entrepreneurial financing provide entrepreneurs with many choices and decisions that can further complicate the process (Eckhart et al., 2006). Financing is one of the bottlenecks in the process of entrepreneurship development. Finding ways to overcome this obstacle and accelerate the engine of entrepreneurship development and thus economic growth is a significant issue in many countries. Meanwhile, what seems to be most influential in financing small businessesareinformalinvestorswhocandecidetospendmoneyinsteadofspendingmoneyonit.Entrepreneurs'businesses should be left to the wheel of production and entrepreneurship. Evidence and research show that start-up entrepreneurs in the start-up phase cannot count on the help of reputable banks and financial institutions. Findings from the Global Entrepreneurship Watch study in 42 different countries in 2006 show that less than half of these countries have sufficient informalbusinessinvestment.Investorshavebeenfamilymembers,friends,co-workers,neighbors,andstrangerstomeetthe informalstartupneedsinthisreport(Bygrave&Quill,2007:4).

Thereisnodoubtthattheseinformalresourcesareessentialforentrepreneurshipbecausebanksandevenventurecapitalists are more inclined to invest in superstar companies. Hence, most of their resources are allocated to organizations that are in the pre-growth and development stage, not to organizations that are in the start-up stage. The World Entrepreneurship Watchmanexplicitlystates,"Ifanationwantstohaveanenvironmentinwhichentrepreneurshipcanthrive,itmustpayclose attentiontotheissueofinformalinvestment." Researchersshouldmakeagreatdealofefforttostudyinformalinvestorsasa source of entrepreneurial financing. " Helping in the entrepreneurial process is of great importance (Aspray and Cohoon, 2017:2).

Butoveremphasisonformalsourcesoffinancingatthestart-upstageandlackofattentiontoinformalsourcesinourcountry canbeoneofthereasonsfortheformationofentrepreneurialactivities(AminiNejad,2011).Manyentrepreneurshipprojects in our country either fail due to lack of financial resources of the entrepreneur or companies with ideas, or do not find the desired development due to the novelty and purity of their original idea. This important case demonstrates the importance andnecessityofstudyingfinancialperformanceforentrepreneursandnewbusinessesbasedonthetheoreticalliterature.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Based on resource-based theory, Bharadwaj (2002) develops a research model for analyzing the relationship between enterprise-specific information technology (IT) resources and financial performance. Experimental findings show that profit ratios are significantly higher for companies with superior IT capabilities, while cost ratios are significantly lower. Ravichandranetal.(2005) examinedtherelationships betweenITresources,informationsystem capabilities, ITsupport for core competencies, and financial performance, and the results showed that firm performance depends on how IT resources areusedtoenhanceafirm'scorecompetencies.(Amunaetal.,2019).TheworkofZuandKramer(2002)providesempirical supportforthepositiverelationshipbetweene-commercecapabilityandbusinessvalue.Theyalsoconcludedthatinorderto achievehigherbenefitsfrome-commerce,companiesneedtoaligntheire-commercecapabilitiesandITinfrastructure.Inthis regard,Zu(2014)foundthatcomplementaritybetweene-commercecapabilityandITinfrastructurepositivelycontributesto the company's performance, because these company-specific resources become more effective when combined. Lucas et al. (2013)concludedthattheadoptionofe-businessstrategyduetotheadaptationofbusinessprocesseshasa positiveeffecton business performance that can improve decentralized hierarchical coordination, specific technical and operational requirements, and decentralization of employee competencies. However, little is known about the benefits of e-business in termsofcost-cuttingorrevenuegenerationforstartup-specificareas,whilefindingstudiesanalyzingtheuseofe-commercein startup production is less common (Soto Acosta et al., 2015). Previous research has shown that the use of Internet-based technologies may bring benefits in the form of significant cost reductions and improved efficiency of start-up business processesacrossthevaluechain,suchashumanresourcemanagement,procurement,marketing,salesorcustomerservice.In addition,thesebenefitsareexpectedtobeimportantinactivitiesthatmayrequirehigherlevelsofinformation(Palaciosetal., 2014) In this regard, the business may improve the effectiveness of supply chain management by facilitating cooperation between the company and its business partners. Automation of core business activities such as procurement, order processing, production planning, or inventory management also allows companies to reduce errors and costs, as well as improve operational efficiency throughout their supply chain. Also, from a resource-based perspective, previous studies suggestthatfirmsthatdevelopfirm-specificcapabilities,suchasITcapabilities,mayachievehighereconomicreturnsbecause they are more resource-efficient than competitors (Santhanam and Hartono, 2017). For the reasons mentioned above, two researchhypothesesarepropose

H1.Theuseofe-commercehasadirectnegativeeffectontheoperatingcostsofsalesinstartups

H2.Theuseofe-commercehasadirectpositiveeffectonthereturnonassetsofstartups.

Knowledgebroughttobusinessesbyonlinespaceenhancesknowledgeexchangeandcollaboration,andstimulatesinnovation (Acosta et al., 2014). Previous literature shows that knowledge creation is the main prelude to the development of new products, services and processes (N. Choi et al., 2006). However, knowledge creation depends on the collective ability of employeestoshareandcombineexistingknowledge(DelGuidesandDellaProta,2016;).Thus,knowledgesharingisanother important premise of innovation (Del Guides and Maguini, 2014). Internet technologies have great potential for creating competitive advantage through the development of important innovations in products, services and business processes. MaronaCardinetal.(2014)believethatmostparticipatorytechnologiesarepositivelyassociatedwithinnovationinstartups andstart-ups.Thesetechnologiesfacilitate thecreation ofvirtual teams,where employeesare empoweredand motivatedto sharereal-timeexperience,knowledgeandpersonalinformation.Similarly,technologiessuchaswebsitesorextranetscanbe used to share knowledge with customers and suppliers and use it for innovation (Adamides and Caracapilidis, 2006). In summary,thebenefitsofe-business,whichincludetheefficientsharingofinformationandknowledgeaswellasworkingwith people from remote locations, are expected to stimulate the development of organizational innovation. Based on these arguments,thethirdhypothesisisproposed:

H3:Theuseofe-commercehasadirectpositiveeffectoninnovationinstartups.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

There is literature that has found positive relationships between e-business and corporate performance as measured by objective financial metrics (Lee et al., 2011). However, few studies have examined these relationships in start-ups. Even less researchhasanalyzedtheeffectofintermediateoutcomesorintermediariesonthecomplexrelationshipsembodiedintheebusiness-performance link. However,there isresearch thatexaminestheimportanceofInternettechnologies forknowledge creation (Lopez-Nicholas and Soto-Acosta, 2010) and the relationship between information technology, knowledge management,innovation,andcompanyperformance(e.g.,Lopez-NicholasandMerono-Sardan,2014)examinedthefindingof direct and indirect positive links between information technology, knowledge management, innovation and company performance. Thus, innovation may mediate the relationship between e-commerce usage and firm performance given its potentialtoreducecostsandimproveassetreturns.So,thefollowinghypothesesareraised:

H4:Innovationmediatestherelationshipbetweene-commerceusageandoperatingcostsofsalesinstartups

H5:Innovationmediatestherelationshipbetweene-commerceusageandproductivityinstartups.

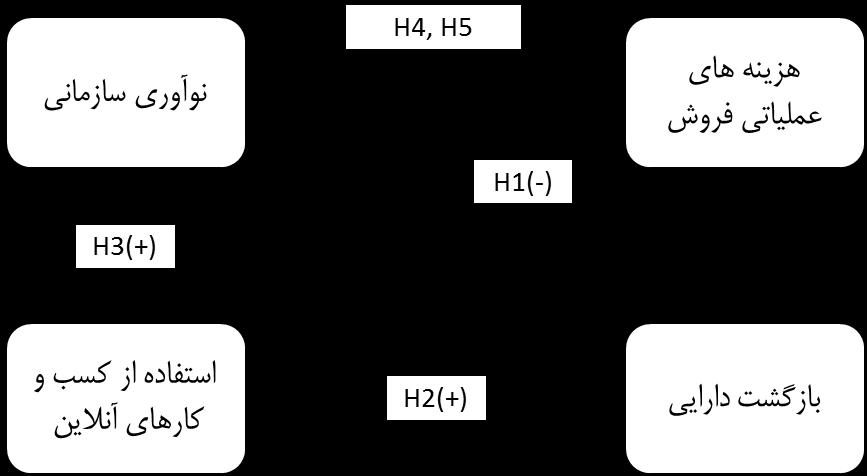

Basedontherelationshipsbetweenresearchvariables,theresearchconceptualmodelcanbedevelopedasFigure1:

This research is developmental-applied in terms of purpose. Because in the field of examining the effect of organizational innovation and the use of online businesses on improving the financial performance of startups, in the theoretical part to explain its various dimensions and in the operational part to provide practical and executive solutions for start-ups. On the other hand, this research is descriptive-survey in terms of nature and method. The statistical population of this research consists ofall managersand expertsof creative companiesinTehran,whose number,accordingto thelateststatisticsofthe "Creative Companies Ecology Development Program" of the Vice President for Science and Technology, is 248 According to theinquiry,atthetimeofthestartoftheresearch,accordingtothelatestreport,thereare248creativecompanies,whichwith the inclusion of at least 2 managers and experts in each company, the statistical population was equal to 496. Sampling was simplerandom.Todeterminethesamplesize,CharlesCochran'sformulahasbeenusedandbasedonthisformula,thesample sizeforthecommunityof496companiesisequalto216people,ofwhich220questionnaireshavebeendistributedtoensure a sufficient numberof returnquestionnairesinthestatistical sample.Data collectiontoolwasa standard questionnaire with 17questions.Inorder to measurethevalidity ofthe questionnaire in thisstudy, contentvalidityand construct validityhave been used. To assess the content validity, the questions have been adapted from reliable sources and then provided to professors and experts, and the number of questions and their content has been approved. Confirmation, construct validity used.Cronbach'salphacoefficienthasbeenusedforreliability.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Inordertoanalyzethedataobtainedfromthequestionnaires,firstinthedescriptiveanalysissection,thestatisticalsampleof theresearchwasreviewed.TheresultsofthesecalculationsaregiveninTables1:

Demographic variable

Frequency Percentage

Female 164 36 Male 220 64 Education BA/BS 135 37.1 MA/MS 165 42.9 PHD 104 19.9

Gender

Also, the results of measuring the reliability of variables as well as their central descriptive statistics (mean) and dispersion (standarddeviation)aregiveninTable2:

Key variables

Cronbach's alpha calculated Mean Standard Deviation

Organizational Innovations 0.832 4.1 0.711 Using Online Businesses 0.808 3.9 0.862

Operational costs of sales 0.837 3.6 0.890

Return on assets 0.893 3.8 0.791

Ascanbeseen,basedontheresultsofTable2,mostofthestatisticalsamplestudiedhadamaster'sdegree.Also,thereliability obtainedforall4mainvariableswasacceptableabove0.70,whichindicatesthereliabilityofthequestionnairequestions. On theotherhand,descriptivestatisticsshowthatintermsofcentralstatistics,theaverageofall5variableswasabovethemean (3)andbelowtheallowablestandarddeviation(1),andthereforetheirmeanandstandarddeviationarewithintheallowable range.

In this section, the Kolmogorov-Smirnov test is used to determine the type of data distribution as normal or abnormal, and based on that, because the sig value of the test for all variables is less than 0.05, the null hypothesis is zero. Based on the normality,thedistributionofquantitativeresearchvariableswasnotconfirmed(P<0.05),inotherwords,thedistributionof allquantitativeresearchvariablesisabnormal.

BasedontheresultsofKolmogorf-Smirnovtestand determiningtheabnormalityofthestatisticalpopulationdistribution,to testthemodelofthisresearch,dataanalysisbystructuralequationmodelingbasedonvariancewithSmartPLSsoftwarewas used.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Table 2 shows the divergent and convergent validity statistics for the validity and reliability of the research measurement model:

Index/Variable cp AVE α

OrganizationalInnovation 0.961 0.892 0.940

UsingOnlineBusinesses 0.838 0.511 0.758

Operationalcostsofsales 0.894 0.586 0.875 AssetsReturn 0.916 0.785 0.863

Co-occurrence between multiple variables occurs when there is a large correlation (greater than 0.9) between multiple variablesthatresultsinredundantinformation.Thisrepetitionofinformationreducesthepredictivepowerofeachindividual independent variable (Field, 2009; Pallant, 2007). Table 4 shows the results of the correlation coefficients between the researchvariables.

variable 1 2 3 4

OrganizationalInnovation 0.854

UsingOnlineBusinesses 0.323 0.715

OperationalCostsofsales 0.570 0.460 0.756 AssetReturn 0.809 0.314 0.527 0.886

InTable5,thecross-sectionalloadsoftheitemsontheresearchstructuresarereported.

ObviousVariable Factorload CriterionLimit Result 1 0.931 Over0.7 FactorConfirmed 2 0.949 Over0.7 FactorConfirmed 3 0.953 Over0.7 FactorConfirmed 4 0.777 Over0.7 FactorConfirmed 5 0.725 Over0.7 FactorConfirmed 6 0.758 Over0.7 FactorConfirmed 7 0.719 Over0.7 FactorConfirmed 8 0.777 Over0.7 FactorConfirmed 9 0.724 Over0.7 FactorConfirmed 10 0.800 Over0.7 FactorConfirmed 11 0.818 Over0.7 FactorConfirmed 12 0.822 Over0.7 FactorConfirmed

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

13

0.791

Over0.7 FactorConfirmed 14 0.818 Over0.7 FactorConfirmed 15 0.907 Over0.7 FactorConfirmed 16 0.903 Over0.7 FactorConfirmed 17 0.847 Over0.7 FactorConfirmed

AccordingtoTable5,therootmeansquareoftheextractedvarianceofallresearchvariablesisgreaterthantheircorrelation with other variables. Therefore, the criterion for examining the divergent validity of research variables is established. In addition, numbers below the diameter of the correlation matrix have been reported to investigate the relationship between thevariables.Ascanbeseen,thecorrelationcoefficientofallvariableswitheachotherispositiveandsignificant.

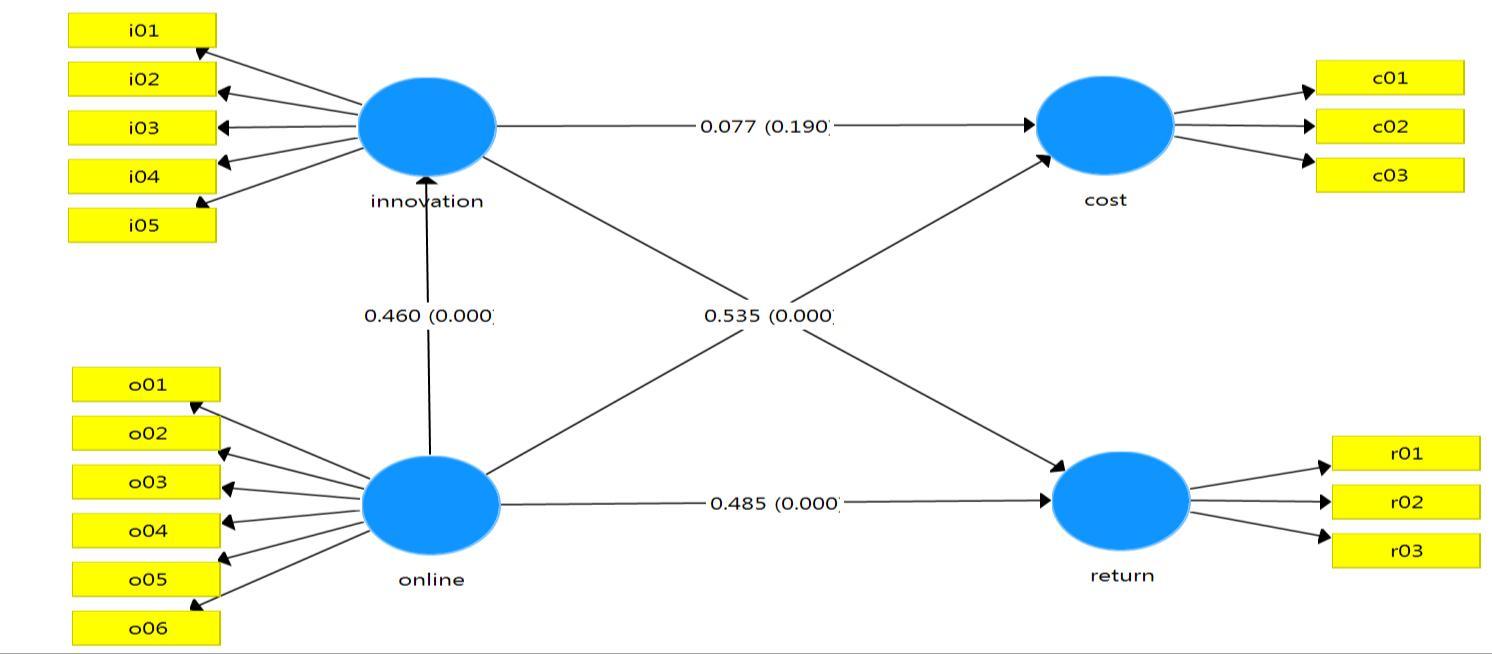

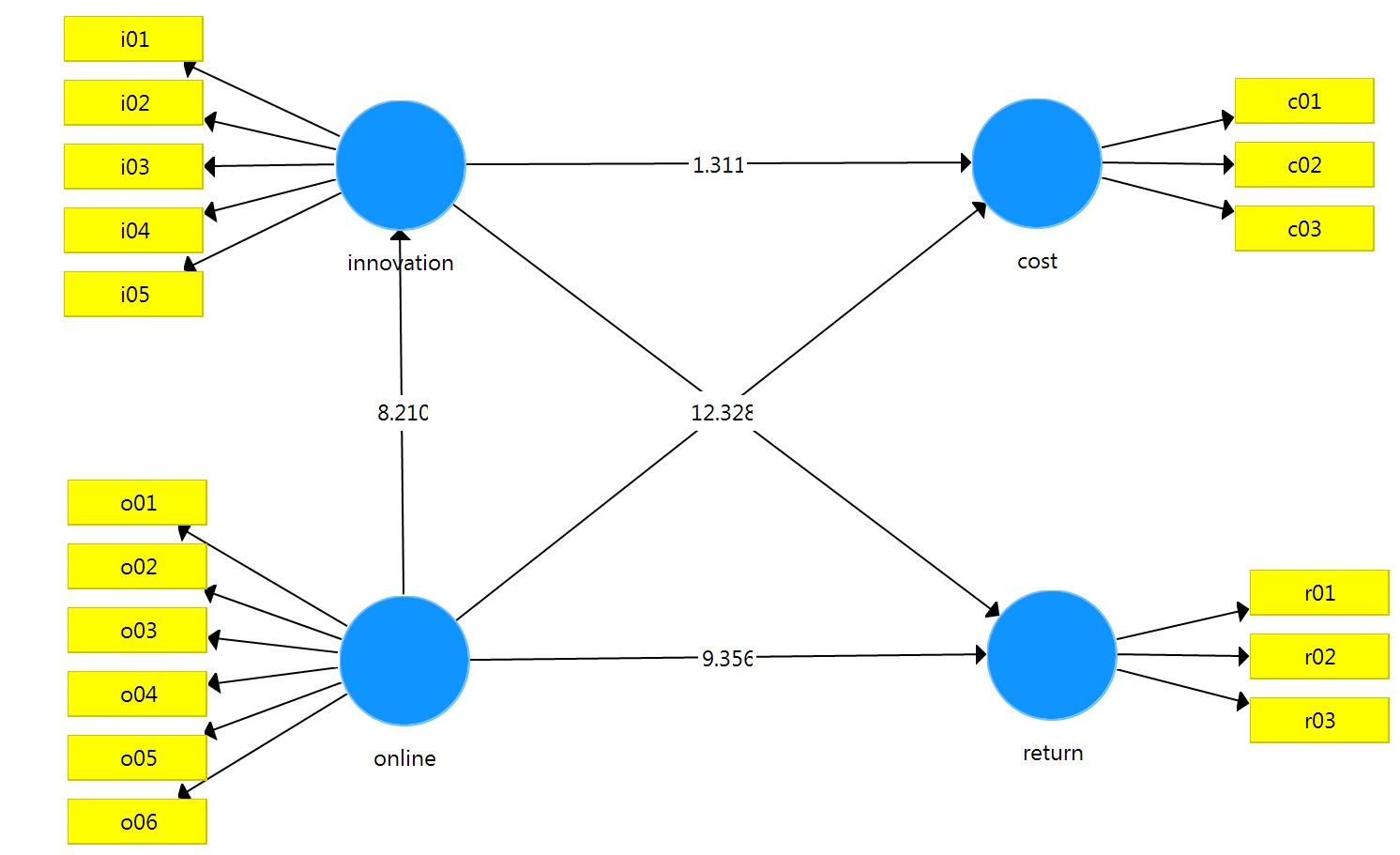

Theproposedconceptualmodelisexaminedthroughthestructuralequationmodelingmethodandaccordingtotheresearch hypothesesmentionedinthetheoreticalframework,thepartialleastsquaresmethodisusedtoestimatethemodel.InFigures 3 and 2, the tested model shows the relationship between research variables. According to this figure, the effect of numbers insidethecircleofvarianceareexplained.Andtheresultsweregivenbelow

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

InTable 6,the estimation of pathcoefficientsand explained varianceofresearchvariablesandthe resultof testing research hypothesesarereported.

Hypothesis

Direct path coefficient(β) یت یه رامآ Meaningful statistics Results

1 Theuseofe-commercehasadirectnegative effecton theoperatingcostsofsalesinstartups. 12.328 0.535 0.000 Confirmed

2 The use of e-commerce has a direct positive effect on thestartups’assetsefficiency 9.356 0.485 0.000 Confirmed

3 The use of e-commerce has a direct positive effect on theinnovationinstartups 8.210 0.460 0.000 Confirmed

43.4TestresultsofhypotheseswithmediatingvariablesbasedonBaronandKennymethod

Table7showsthetestresultsofhypotheseswithmediatingvariablesbyBaronandKennymethod:

Hypothesis Correlation between independentand dependent variable

Innovation mediates the relationship

Correlation between independent variable and mediator variable

Correlation between mediator variable and dependent variable

Confirmed(H1) Confirmed(H3) Rejected α statistics 1.311

Investigating the role of the mediatorvariable Results

Since the effectof themediator variable on the intermediary in this hypothesis, ie the effect of

rejected

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

between the use of e-commerce and the operating costs of sales in startups

Innovation mediates the relationship between using ecommerce and asset efficiency in startups

Rejected Crstatistics1.434 Rejected Cr statistics 1.311

organizational innovation on sales operating costs has not been confirmed, so this hypothesis is rejected and innovation does not mediate the relationship between ecommerce usage and sales operatingcostsinstartups.

Confirmed Cr statistics 4.011

Sincetheeffectofthemediator variableonthedependentis confirmedinthishypothesis,ie theeffectoforganizational innovationonthereturnon assets,sothishypothesisis confirmed.Andinnovation mediatestherelationship betweene-commerceusage andsalesreturnsinstartups.

confirmed

Inordertomeasurethefitofthestructuralmodeloftheresearch,twoindicatorsofcoefficientofdeterminationandGOFare reportedbelow.

Items GOF

UsingOnlineBusinesses 0.330 0.419 Operatingcostsofsales 0.412 AssetReturn 0.482

As can be seen in Table 7, the values of the coefficients of determination for the latent variables of the model express the degreeofinfluenceofthedependentvariablesontheindependentvariable.Infact,fromthevaluesinthetableabove,0.330is inferred from structural changes in the use of online businesses, 0.412 from structural changes in sales operating costs, and 0.482 from structural changes in return on assets by the structure entering them. That is, the independent variable of organizationalinnovationisexplained.TheGOFindexisalsoabovethecriterionof0.3andisacceptable.

Theperformanceofstart-upsisambiguousduetotheentrepreneurialnatureoftheirstart-upsandthetimeittakestoachieve quantitatively stable financial indicators, and as a result, researchers' financial performance of these companies from the financial and operational dimensions of performance, rules and regulations. Non-financial (for example, product market results, such as market share, introduction of new products and marketing effectiveness and internal process results), are measured(CaseiroandCoelho,2017).

Thisstudywasconductedinlinewiththepurposeof"examiningthe effectoforganizationalinnovationandtheuseofonline businesses on improving the financial performance of startups" and the results showed that the use of e-commerce has a direct negative effect on operating costs of sales in startups. The rate of 0.535, the use of e-commerce has a direct positive effectonthereturnonassetsofstartupsby0.485andfinallytheuseofe-commercehasadirectpositiveeffectoninnovation

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

in startups by 0.460. Innovation also does not mediate the relationship between e-commerce usage and operating costs of salesinstartups,butmediatestherelationshipbetweene-commerceusageandsalesreturnsinstartups.

TheresultsofthisstudyareinlinewiththeresultsofCaseiroandCoelho(2017)intermsofachievingonlinebusinesscapacity inlearningaboutinnovationnetworksandperformance. TheresultsofPopaetal.'s(2016)researchintermsofachieving ebusiness results have a direct effect on financial performance and establish a positive relationship with organizational innovation. Also, the results of Kaya and Patton (2011) research in terms of access to "knowledge-based resources, organizational learning orientation and the type of market orientation affect the innovation and performance of start-up businesses"; The results of the research of Kitab et al. (2011) in terms of achieving "simultaneous acquisition of knowledge fromexternalandinternalsourcesincreasesperformanceintheproductmarketofstart-ups";

Therefore,inlinewiththeobtainedresults,itisrecommendedtothemanagersanddecisionmakersofcreativecompaniesto increasetheirmarketresearchinthefieldofmarketsrelatedtotheirproduct/serviceandtoincreasetheirresearchteamsin newmarketstocreatemoreknowledge.Fromthemarketsandareasofcreatingnichemarketsandidentifyingthestrengths and opportunities and weaknesses and threats of the company to operate in electronic markets. Also, use and model the research results of market research companies that systematically and systematically conduct longitudinal and transverse research in the market. On the other hand, in their strategic marketing plans to move to the target markets, identify the amount of innovations required in the field of market-product well and proceed to produce the product and operate in a specific market. Develop, update, strengthen and integrate in-company information systems and make more specialized and betteruseofin-companyresearchinformationsystems,whichistheresultoftacitknowledgeandexpertiseofexperts,sothat theycanmakemoreinnovations.

Thisresearchhasbeendonecross-sectionallyandperhapsitsresultsaslongitudinalresearchcanprovideothergeneralizable results.Also,duetothecoronaepidemic,moreaccesstomorestartupcompanieswasnotprovidedinordertoprovidemore generalizableresults

Inthisregard,futureresearchersarealsosuggestedtoconductthisresearchagainduringthelongitudinalresearchandalsoto investigatethereasonsfornotconfirmingthemediatingroleofinnovationintherelationshipbetweentheuseofe-commerce andsalesoperatingcostsinstartupsandthishypothesis.Testinotherstatisticalcommunitiesandotherstart-upcustomers.

Amuna, Y. M. A., Abu-Naser, S. S., Al Shobaki, M. J., & Mostafa, Y. A. A. (2019). Fintech: Creative innovation for entrepreneurs. International Journal of Academic Accounting, Finance and Management Research (IJAAFMR), 3(3).

Aspray, W., and Cohoon, J. M. (2017). A Review of Research Literature on Women’s Entrepreneurship in the InformationTechnologyField.NationalCenterforWomenandInformationTechnology.

Bharadwaj,A.S.(2000).Aresource-basedperspectiveoninformationtechnologycapabilityandfirmperformance:an empiricalinvestigation. MIS quarterly,169-196.

Bygrave, W. D., and Quill, M. (2007). 2006 Financing Report. Babson College, MIT, USA and London Business School, UK.GlobalEntrepreneurshipMonitor.

Cacciolatti,L.,Rosli,A.,Ruiz-Alba,J.L.,&Chang,J.(2020).Strategicalliancesandfirmperformanceinstartupswitha socialmission. Journal of Business Research, 106,106-117.

Caseiro, Nuno, Coelho, Renaldo (2017). The influence of Business Intelligence capacity, network learning and innovativeness on startups performance.JournalofInnovation&Knowledge,10,1-7.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 09 Issue: 09 | Sep 2022 www.irjet.net p-ISSN:2395-0072

Cohoon, J. M., & Aspray, W. (2017). A critical review of the research on women’s participation in postsecondary computing education.TheMITPress.

Eckhardt,J.T.,Shane,S.,andDelmar,F.(2006).MultistageSelectionandtheFinancingofNewVentures.Management Science,52(2),220-232.

Jardim-Goncalves, R., Popplewell, K., & Grilo, A. (2012). Sustainable interoperability: The future of Internet based industrialenterprises. Computers in Industry, 63(8),731-738.

Kaya, N., & Patton, J. (2011). The effects of knowledge‐based resources, market orientation and learning orientation oninnovationperformance:AnempiricalstudyofTurkishfirms. Journal of international development, 23(2),204-219.

Kongaut, C., & Bohlin, E. (2016). Investigating mobile broadband adoption and usage: A case of smartphones in Sweden. Telematics and informatics, 33(3),742-752.

Lopez-Nicolas, C., & Soto-Acosta, P. (2010). Analyzing ICT adoption and use effects on knowledge creation: An empiricalinvestigationinSMEs. International journal of information management, 30(6),521-528.

Meroño‐Cerdan, A. L., Soto‐Acosta, P., & López‐Nicolás, C. (2014). Analyzing collaborative technologies' effect on performancethroughintranetuseorientations. Journal of Enterprise Information Management

Nickerson, J. A., & Zenger, T. R. (2004). A knowledge-based theory of the firm the problem-solving perspective. Organization science, 15(6),617-632.

Palacios, L., Rosado, H., Micol, V., Rosato, A. E., Bernal, P., Arroyo, R., ... & Taylor, P. W. (2014). Staphylococcal phenotypes induced by naturally occurring and synthetic membrane-interactive polyphenolic β-lactam resistance modifiers. PLoS One, 9(4),e93830.

Popa,S.,Soto-Acosta,P.,&Perez-Gonzalez,D.(2018).Aninvestigationoftheeffectofelectronicbusinessonfinancial performanceofSpanishmanufacturingSMEs. Technological Forecasting and Social Change, 136,355-362.

Ravichandran, T., Lertwongsatien, C., & Lertwongsatien, C. (2005). Effect of information systems resources and capabilities on firm performance: A resource-based perspective. Journal of management information systems, 21(4), 237-276.

Santhanam, R., & Hartono, E. (2017). Issues in linking information technology capability to firm performance. MIS quarterly,125-153.

Soto-Acosta, P., Popa, S., & Palacios-Marqués, D. (2016). E-business, organizational innovation and firm performance inmanufacturingSMEs:anempiricalstudyinSpain. Technological and Economic Development of Economy, 22(6),885904.

Soto-Acosta,P.,Popa,S.,&Palacios-Marqués,D.(2017).Socialwebknowledgesharingandinnovationperformancein knowledge-intensivemanufacturingSMEs. The Journal of Technology Transfer, 42(2),425-440.

Vincent,V.Z.,&Zakkariya,K.A.(2021).RoleOfBusinessIncubationOnTheFinancialAndNon-FinancialPerformance OfTechnologyStartups:AMultivariateMultipleRegressionAnalysis. Journal of Entrepreneurship Education, 24(5),116.

Zhu,K.,Kraemer,K.L.,Xu,S.,2014.Theprocessofinnovationassimilationbyfirmsindifferentcountries:atechnology diffusionperspectiveone-business.Manag.Sci.52(10),1557–1576.