International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

1

Academician & Researcher, Jaipur, India***

Abstract - The financial landscape, both domestically and internationally, is fast evolving, making it possible to predict a bright future for the mutual fund sector. Investor confidence in this industry is still high, though. The factors affecting people's decisions to invest in mutual funds will be assessed in the current study, along with the mediating role that investor perception plays. Using a cross-sectional study design and a quantitative research methodology, 390 questionnaires are delivered to individual investors. Smart PLS 4 is then used to evaluate the data. The results show that risk and return, asset liquidity, speed, low transaction costs, tax advantages, transparency, and fund safety were all important variables in determining whether to invest in mutual funds. Investor perception is also a barrier between these elements and mutual fund investing. By investigating the multiple factors that affect investors' decisions to invest in mutual funds, the study adds to the body of knowledge. It also contributes by exploring investor perception's mediating function.

Key Words: Investors' perceptions, Mutual Fund Structures,AssetManagement,InvestorsServices,SEM.

The extent to which investments are encouraged will significantly impact the economy's growth and stability (Dadhich&Kant,2022).Thegeneral public'smoneymust bedirectedtowardworthwhileprojectswiththehelpofa few specialized organizations. A mutual fund is a type of trust that collects the savings of several individuals with similar financial goals (Agrawal, 2019; Shao et al., 2022). The monies raised are invested using capital market instruments, including shares, debentures, and other securities. Unit holders get distributions of the proceeds from these assets in proportion to the units they possess. As a result, mutual funds are the best investment option fortheaverageinvestor sincetheyofferaffordableaccess to a diversified, expertly managed portfolio of securities (Dhall et al., 2021; Sheth et al., 2017). In the Indian context, mutual funds are a fascinating phenomenon. In less than ten years, it has changed the investing behaviours of medium and small investors in India. As a result, each business or financial school now includes mutualfundresearchasamust.Investorsmustknowhow mutual funds function and what to expect if they truly wanttoprofitfromthisnewfinancialtool.Smallinvestors

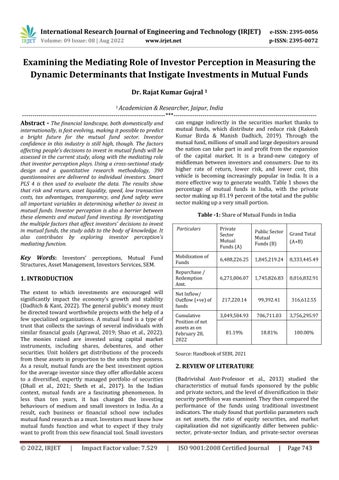

can engage indirectly in the securities market thanks to mutual funds, which distribute and reduce risk (Rakesh Kumar Birda & Manish Dadhich, 2019). Through the mutualfund,millionsofsmallandlargedepositorsaround the nation can take part in and profit from the expansion of the capital market. It is a brand-new category of middleman between investors and consumers. Due to its higher rate of return, lower risk, and lower cost, this vehicle is becoming increasingly popular in India. It is a more effective way to generate wealth. Table 1 shows the percentage of mutual funds in India, with the private sectormakingup81.19percentofthetotalandthepublic sectormakingupaverysmallportion.

Table -1: ShareofMutualFundsinIndia

Particulars Private Sector Mutual Funds(A)

PublicSector Mutual Funds(B)

GrandTotal (A+B)

Mobilizationof Funds 6,488,226.25 1,845,219.24 8,333,445.49

Repurchase/ Redemption Amt. 6,271,006.07 1,745,826.83 8,016,832.91

NetInflow/ Outflow(+ve)of funds 217,220.14 99,392.41 316,612.55

Cumulative Positionofnet assetsason February28, 2022

3,049,584.93 706,711.03 3,756,295.97 81.19% 18.81% 100.00%

Source:HandbookofSEBI,2021

(Badrivishal Asst-Professor et al., 2013) studied the characteristics of mutual funds sponsored by the public andprivatesectors,andthelevelofdiversificationintheir securityportfolioswasexamined.Theythencomparedthe performance of the funds using traditional investment indicators.Thestudyfoundthatportfolioparameterssuch as net assets, the ratio of equity securities, and market capitalization did not significantly differ between publicsector, private-sector Indian, and private-sector overseas

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

mutual funds. (Dadhich et al., 2019) conducted a comparativeexaminationofthreeAMCs'mutualfundswas used to study investor knowledge regarding choosing the bestmutualfundscheme.Thisanalysisalsoshowedthata lotofinformationonmutualfundsisnotreadilyaccessible to the general public. Investors in mutual funds cannot compare the mutual funds on the market because there is no information on fund styles or comprehensive league tables. The mutual fund industry in India was thoroughly examined by (Dadhich, Hiran, et al., 2021) in terms of performance, selectivity, timeliness, and persistence. Accordingtohisresearch,equityfundsperformbetterthan incomefunds.Whileinstitutional fundshavetriumphedin income funds, broker-backed funds have done well in equity funds. He found that Pakistani fund managers are highly skilled at market timing. In theirstudy, researchers looked at the impact of fundamental elements, including the economy, industry, and business, on the performance of mutual funds. By gathering monthly data on important macroeconomic factors over 228 months spanning 19 years, an effort was made to analyze the economy thoroughly. (Dadhich et al., 2022) evaluated the mutual fund industry using percentage analysis to look at a number of factors, including assets under management, investorprofiles,andserviceclassification.

(Dadhich,Purohit,etal.,2021)assessedhowwellinvestors understood mutual funds and the numerous factors influencing their choice of mutual fund investments. The study found that because of their high rate of return, high level ofsafety,high liquidity, andconvenience paired with low volatility, mutual funds had a comparative advantage over alternative investing options. It ranked third among available investment options, behind only insurance and government bonds. Most respondents (78%) were aware oftherisksconnectedwithmutualfundproductsandwere generallyhappywiththeserviceprovidedbymutualfunds (Cioroianu et al., 2021; Dadhich, 2017a). The growth of mutual fund operations has made a competitive edge in servicequalityadifferentiatingfactor(Dadhich,2017b).To identify areas for improvement in service quality, it is crucialtoassessthecurrentstateoftheAMC'sfacilitiesand gatherpertinentfeedbackontheiractualperformance.

The following considerations served as the basis for the study's hypotheses, which were developed in light of the literaturereviewthatcamebeforeit:

H1:Investors'impressionwheninvestinginmutualfunds isunremarkableaboutmotivationalfactors.

H2: There is no connection between investing in mutual fundsandmotivatingfactors.

H3:Investorperceptionandmutualfundinvestmenthave nodiscerniblerelationship.

The following conceptual framework's motivating drivers are risk and return,asset liquidity, speed,low transaction costs,taxadvantages,transparency,andfundsafety.These motivating variables influence how potential investors view investing in mutual funds, and strong and favorable perceptionsmotivateuserstodoso.

Anefforthasbeenundertakentoelicitrelevantresponses regardingthepotentialformutualfundsinIndia.

a. Data collection: Data from both primary and secondary sources were used in the study. The researcher used a well-structured, sequentially developed questionnaire to contact each respondent individually, as suggested by (Agrawal, 2019; Dadhich, 2017c; Hair et al., 2018). There were two sections to the questionnaire. The first featured statements regarding enablers that encourage mutual fund investing, while the second provided demographic dataaboutrespondentsbasedontheirbeliefs.Afive-point Likertscale wasused to obtaininvestorfeedback on each statement. The five options for the investors' responses were: strong agree, agree, can't say, disagree, and highly disagreed. The responses, which were individually gathered for mutual funds in the public and private sectors,arecombined.

a. Analysis software: Smart-PLS were used to enter, examine, and interpret the acquired data in a meaningful way. The study uses the dependability test and structural equation modelling (SEM). Respondents from the five major Rajasthani districts of Jaipur, Udaipur, Bikaner,

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

Jodhpur,andBanswaraareusedintheresearch.Atotalof 400 participants were polled for the study. Only 390 people, however, answered every question. Therefore, only these respondents were included in the analysis. Further,thestudycollecteddatafromApriltoJuly2022.

Noinvestor makesan investmentinvain,whichisa wellknownfact.Peoplecanmakemutualfundinvestmentsfor a variety of reasons, such as regular income, growth, liquidity, tax benefits, and speculation (Kumar Naresh, DadhichManish,2014).Peoplehave severalgoalsinmind whilemakingfinancialdecisions,andtheyprioritizethese goals differently. The information obtained from respondentsinthisrespectisrepresentedinthefollowing table:

Factors Classification Freq. %

Gender Male Female Total

Age 20-30 30-40 Above40 Total

Income <6lakhs 6-10lakhs >10lakhs Total

Education Graduate P.G. Professional Total

210 180 390

150 122 118 390

120 130 140 390

152 090 148 390

53.80 46.20 100

38.40 31.30 30.30 100

30.80 33.40 35.80 100

38.90 23.20 38.90 100

Table 1 lists the 390 samples used for the study; of these, 53.80 percent were men, 46.20 percent were women, 38.40percentwereinthe20–30agerange,31.30percent wereinthe30–40range,andtheremaining30.30percent wereovertheageof40.Income rangedfrom6 lakh,6-10 lakhandabove10lakhwithcorrespondingpercentagesof 30.80, 33.40, and 35.80. Graduate, P.G., and professional degrees made up the bulk of the educational background; theywere38.90,23.20,and38.90.

Usingsmart-PLS3,thecurrentstudyanalysesdata.Dueto its model parsimony, it is becoming more and more popular,andvariousstudieshaveusedthisprogramtoget accurate results from tiny sample sizes (Dadhich, Rao, et al., 2021; Hair Jr, Joseph F., G. Tomas M. Hult, Christian Ringle, 2016). The analysis of the present study was mainly divided into two major components. The validity

andreliabilityofthemeasurementmodelwereassessedin the first section. The second section assessed the structural model using structural equation modelling to test the hypotheses (SEM). During the evaluation of the measurement model, the loading of variables, Cronbach's alpha, composite reliability, and average variance extracted (AVE) were all evaluated. The external consistencywasalsoassessedusing discriminant validity. According to(Hair,J. F.,Ringle,C.M.,andSarstedt,2011), factor loading should be greater than 0.5. To achieve convergent validity, the AVE should be larger than or equal to 0.5 (Fornell C. and Larcker D. F., 1981). Furthermore, the reliability must be higher than or equal to 0.7. Figure 2 shows the evaluation of the measurement model. As a result, it can be assumed that all values are abovetheminimumthresholdvalue.

Table -3: ReliabilityandConvergentValidityofthe Factors

Scale

Ch.α rho_A CR AVE MSV

MotivatingFactors 0.715 0.622 0.898 0.588 0.485 Investors'Perception 0.925 0.758 0.725 0.559 0.556 MutualFund Investment 0.715 0.658 0.466 0.425 0.406

The structural model was reviewed after the measurement model had been assessed. The direct and indirect impacts of this inquiry section were examined using PLS bootstrapping. The value of f2 was used to assesseachexogenousvariable'seffectmagnitude,andR2 wasusedtocalculatethetotalvarianceexplained.Finally, the model's quality was assessed using its projected relevance. Using a minimum t-value of 1.96, the hypotheses were tested. The direct impact of the independent manifest on the dependent manifest, or investmentinthemutualfund,isshowninTable4.Thetvalueforeachconnectionisbiggerthan1.96andpositive. Each direct variable, therefore, has a significant relationship with the dependent variable. Therefore, H1, H2,andH3areregardedasvalid.

SN Structural Path Sam pleX 95% Conf.Int. T Stat P.val. F2

H1 Motivating Factors→IP 0.38 2 (0.129, 0.135) 6.5 4 0.04 3 0.19

H2 Motivating Factors→MFI 0.24 5 (0.309, 0.395) 3.7 6 0.00 1 0.36

H3 Investors' Perception→ MFI

0.31 2 (0.409, 0.429) 4.6 0 0.00 2 0.41

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

It demonstrates that risk and return, asset liquidity, practicality, low transaction costs, tax benefits, transparency, and fund safety all have significant and positive effects on mutual fund investment (t-stat=6.54, p.value=0.04, F2-0.19). These factors influence an investor's Perception of mutual fund investment, and a positive perception encourages consumers to invest in mutual funds. Additional motivators were also significant in completing the investment (t-stat=3.76, p.value=0.00, F2-0.36). It demonstrates that investor perception moderates all motivators and mutual fund investment (tstat=4.60, p.value=0.02, F2-0.41). However, the value is positive and 0.05 in all mediation theories. Investors' perceptions amplify the beneficial influence of all direct factors on mutual fund investment. As a result, investors' perceptions serve as a bridge to perfect investing. Aside fromitsmajorcontribution,thestudyhassomelimitations. This study's sample was drawn from only five cities in Rajasthan.Onlysignificantmotivatingenablersinfluencing mutual fund investment are investigated in a proposed conceptualframework,andthesamehasbeeninlinewith previousstudies(Dadhichetal.,2020).

Regardingmutualfunds,growthhasalwaysbeenregarded as the most important goal, followed by regular income and liquidity. They have decided that speculation is the leastoftheirworries.Mostinvestorschoosemutualfunds based on their past performance. Prospectuses/newsletters were the most common source ofinformationusedbyinvestorswhenmakinginvestment decisions, followed by brokers and sub-brokers. Most investors have used the absolute return on their mutual fund plan to assess their success. Public sector mutual fund investors identified the primary gap was dissatisfaction with the services provided. On the other hand, the primary deficiency identified in private sector mutual funds was a lack of awareness. Compared to the public sector, the private sector mutual fund industry is expectedtohavea bright future. Thisstudy examinedthe various factors influencing investors' mutual fund investment decisions. According to the survey findings, motivating factors such as risk and return, asset liquidity, practicality, low transaction costs, tax benefits, transparency, and fund safety have a subsumptive effect oninvestinginmutualfunds.Thestudyisanovelattempt to quantify the dynamic enablers that catalyze mutual fund investing. These motivation enablers foster a favorable perception of AMC investment (Dadhich, 2016; Sharma et al., 2022). Furthermore, a positive perception leads to increased investment in various asset allocation schemes. Furthermore, investors appear to be drawn to mutual funds because of their low transaction costs, low tax rates, and transparency. To encourage mutual fund investment, organizations must first understand investor preferences and perceptions before developing new and

inventive schemes that benefit existing and prospective investors while also being profitable for the company. Furthermore, the survey found that the mutual fund industry has a lot of potential in the coming years. It has risen rapidly in recent years and is expected to continue growing at a healthy rate. As a result, there is a good chance that consumers will invest in mutual funds. The current study's findings contribute to both theory and practice of mutual fund investing. Mutual fund providers should expand their investor services to attract more participantstomutualfundschemes.

[1] Agrawal, N. M. (2019). Modeling Deming's quality principles to improve performance using interpretive structural modeling and MICMAC analysis. International Journal of Quality and Reliability Management, 36(7), 1159–1180. https://doi.org/10.1108/IJQRM-07-2018-0204

[2] Badrivishal(2013).AStudyonMutualFundswithDue Reference to SBI Mutual Funds. International E ConferenceonAdaptingtotheNewBusinessNormal–TheWayAheadDecember3-4,2020,Mysuru,IndiaA, 2(1),16–23.

[3] Cioroianu, I., Corbet, S., & Larkin, C. (2021). The differential impact of corporate blockchaindevelopment as conditioned by sentiment and financial desperation. Journal of Corporate Finance, 66, 1–29. https://doi.org/10.1016/j.jcorpfin.2020.101814

[4] Dadhich, M. (2017a). An analysis of factors affecting on online shopping behavior of customers. ZENITH International Journal of Business Economics & ManagementResearch,7(1),20–30.

[5] Dadhich,M.(2017b).AnAnalysisofVolatilityofMacro Economic Variables on Gold Price. Pacific Business ReviewInternational,9(12),21–25.

[6] Dadhich, M. (2017c). Impact of Demonetization on Indian Economy. International Journal of Research in SocialSciences,7(8),208–215.

[7] Dadhich, M., Chouhan, V., & Adholiya, A. (2019). Stochastic pattern of major indices of Bombay stock exchange. International Journal of Recent Technology and Engineering, 8(3), 6774–6779. https://doi.org/10.35940/ijrte.C6068.098319

[8] Dadhich, M., Chouhan, V., Gautam, S. K., & Mwinga, R. (2020). Profitability and Capital Adequacy Approach for Measuring Impact of Global Financial Crisis Vis-ÀVis Indian Banks. International Journal of Advanced ScienceandTechnology,29(4),2344–2365.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 08 | Aug 2022 www.irjet.net p-ISSN: 2395-0072

[9] Dadhich,M.,Hiran,K.K.,&Rao,S.S.(2021).Teaching – Learning Perception Toward Blended E-learning Portals During Pandemic Lockdown. Springer Singapore. https://doi.org/10.1007/978-981-161696-9_11

[10] Dadhich,M.,&Kant,K.(2022).Empiricalinvestigation of extended TOE model on Corporate Environment Sustainability and dimensions of operating performance of SMEs: A high order PLS-ANN approach. Journal of Cleaner Production, 363, 1–16. https://doi.org/10.1016/j.jclepro.2022.132309

[11] Dadhich,M.,Poddar,S.,&Kant,K.(2022).Antecedents and consequences of patients' adoption of the IoT 4.0 for e-health management system: A novel PLS-SEM approach. Smart Health, 25(5), 1–14. https://doi.org/10.1016/j.smhl.2022.100300

[12] Dadhich, M., Purohit, H., & Bhasker, A. A. (2021). Determinants of green initiatives and operational performance for manufacturing SMEs. Materials Today: Proceedings, 46(20), 10870–10874. https://doi.org/10.1016/j.matpr.2021.01.889

[13] Dadhich, M., Rao, S. S., Sethy, S., & Sharma, R. (2021). DeterminingtheFactorsInfluencingCloudComputing Implementation in Library Management System (LMS): A High Order PLS-ANN Approach. Library Philosophy and Practice, 6281. https://doi.org/https://digitalcommons.unl.edu/libp hilprac/6281

[14] Dhall, N., Khandelwal, S. K., Malik, R., & Chawla, N. (2021).InvestorsAwarenessandPerceptionTowards Mutual Fund Investment: An Exploratory Study. International Journal of Advanced Research, 9(06), 383–393.https://doi.org/10.21474/ijar01/13026

[15] Fornell C. and Larcker D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of MarketingResearch,18(1),39–50.

[16] Hair, J. F., Risher, J. J., & Ringle, C. M. (2018). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

[17] Hair Jr, Joseph F., G. Tomas M. Hult, Christian Ringle, and M. S. (2016). A primer on partial least squares structuralequationmodeling(PLS-SEM).

[18] Kumar Naresh, Dadhich Manish, R. S. S. (2014). Determinant of Customers' Perception towards RTGS and NEFT Services. Asian Journal of Research in Banking and Finance, 4(9), 253–260. https://doi.org/10.5958/2249-7323.2014.00960.2

[19] RakeshKumarBirda&ManishDadhich.(2019).Study ofICTandE-GovernanceFacilitiesinTribalDistrictof Rajasthan. ZENITH International Journal of MultidisciplinaryResearch,9(7),39–49.

[20] Shao, Z., Zhang, L., Brown, S. A., & Zhao, T. (2022). Understanding users' trust transfer mechanism in a blockchain-enabledplatform:Amixedmethodsstudy. Decision Support Systems, 155(January), 113716. https://doi.org/10.1016/j.dss.2021.113716

[21] Sheth, K. N., Mittal, H., & Prajapati, F. (2017). Performance Evaluation of Public and Private Mutual Funds Schemes in India. International Journal for Scientific Research & Development, Vol. 5, (November), 194–199. https://doi.org/10.13140/RG.2.2.17035.80165

[22] Dadhich, M. (2016). A Comparative Study of Investment Portfolio of Life fund of LIC of India and ICICIPrudentialLifeInsurers.InternationalJournalof Research in Economics and Social Sciences, 6(10), 229–238

[23] Sharma, R., Dadhich, M., & Chauhan, K. (2022). The Impact Assessment of Pandemic on Financial Indicators of Selected BSE Listed Companies: A Comprehensive View. International Research Journal of Engineering and Technology (IRJET), 9(2), 483–494.

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal | Page747