International Research Journal of Engineering and Technology

(IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p-ISSN: 2395-0072

(IRJET) e-ISSN: 2395-0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p-ISSN: 2395-0072

1PG Student 2PG Coordinator & Assistant Professor 3Head PG & Assistant Professor

1,2,3Department of Civil Engineering; U.V.Patel College of Engineering; Ganpat University; Mehsana; Gujarat,India ***

Abstract The Indian Construction Industry is a huge industry having a 9% share in GDP, also contributing as 2nd highest employer among various other industries after the agricultural sector. According to a survey, only 16% of business owners are left with liquidity which would help their business last only for 3 4 months. About 479 infrastructure projects show cost overruns worth Rs. 4.4trillion, eachproject worth more than 150 crores. The construction industry being such a vast andimportant industryfor the nation’s economy,it can be gauged from the fact that the slow down or failure of this industry will bring a halt to the nation’s development

In order to identify the cause and mitigate them the present study is conducted to identify the factors affecting the construction cash flow. Various kinds of literature were reviewed which highlighted the fact thatcashflowforecasting during the execution stage was lacking or might be not forecasted itself Hence the present study is conducted to identify the factors affecting the construction cash flow. A questionnaire survey was conducted to identify the factors which were later tested for their reliability and also analysed by various Indexing methods like the Probabilistic Approach Method, and Frequency Index Method. Out of sub factors identified under 7 different factorial heads, results showed that the top most factor affecting cash flow forecasting was cost overrun, time overrun, arbitration, faulty cash flow models, change in the financial position of clients, etc. The research concluded with the fact that the identified factors under different heads must be given most priority while forecasting cash flow andtimely revision and identification of new factors plays an important role in having accuracy in projecting construction cash flow.

Key Words: Construction Cash-Flow, Cash-flow cycle, cash-flow model, Cash Flow Forecasting, Cash-flow analysis.

TheconstructionindustryinIndiaisoneofthelargest,with atotalcontributionof9%tothecountry'sGDP.Apartfrom that,theIndianconstructionsectoremploysmorethan51 million people, placing it second only to the agriculture businessamongotherindustries.BetweenApril2000and

September 2021, foreign direct investment (FDI) in the constructiondevelopmentindustrywas$26.16billionand, intheinfrastructuresectorwas$25.95billion[1].TheIndian ParliamentpassedameasuretoestablishaNationalBank forFinancingInfrastructureandDevelopment(NaBFID)to fund infrastructure projects in India, recognizing its importance.Thefactthatcementproductioncapacitygrew by8%inApril2022overApril2021canlikewisebeusedto gauge the country's construction sector growth[1]. It is obvious from these statistics that the nation's economic growth is heavily reliant on the construction sector's expansion.Asaresult,thebuildingindustryisthecoreofthe country's economy. This wheel is the foundation for job creation,countryeconomicdevelopment,andFDIinflows,all ofwhichcontributetohigherGDP.

Itisawell knownfactinthebusinesscommunitythat"Cash isKing,"whichmeansthateverybusinessorindustry,large orsmall,requiressufficientliquiditytooperatesuccessfully. This liquidity can take the form of cash, credit, or capital from institutional or non banking financial companies (NBFCs), and it is very significant in the construction industrybecauseitisoneofthemostcrucialvariablesthatis often overlooked. Given that the construction sector contributesupto9%ofthenation'sGDP,itisapparentthat a large sum of money is required to keep it running smoothly. Many other sectors, such as the steel, glass, mining,andcementindustries,arebuiltonthefoundationof thissector.

“Cashflowcanbedefinedasthemovementofmoneyintoor outsideoftheproject,companyororganization.Anetcash flowofthecompanyisthedifferencebetweenthecompany’s cashflowingintotheprojectandthecompany’scashgoing outofthebusiness.Itisthedifferencebetweenexpenseand revenue”stated[2].

The quantity of cash pumped into the construction sector hasanimpactonthesmoothoperationofotherdependent businesses.Dailywagersandlabourers,whoarepaidona dailyormonthlybasis,arethemostcommonemployeesin the construction industry. The essential consumable raw materials,suchascementandsteel,aredeliveredafterapart

© 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

paymentof90%ormorehavebeenmade.Inaddition,the general credit limit on some shuttering supplies, such as plywood,pinewoods,props,andshutteringplates,aswellas ready mixconcrete,bricks,andothermaterials,is20to40 daysfromthedateofthepurchaseorder.Inthemajorityof cases, the construction industry's billing cycle is based on milestonecompletion,whichmeansthatwork in progress bills are submitted at the end of each milestone, while paymentstolaborer’s,subcontractors,andmaterialvendors aremadewellbeforethemilestoneiscompletedoraboutto becompleted,aspercreditlimitintheworkorder.Asper thestandardsequenceofpaymentstobereceived,itusually takes about 30 40 days to receive full payment for the invoice generated. Hence the time between cash disbursementsandcashreceiptsisknownascashflowcycle.

Cash Flows are usually of three types namely Neutral, PositiveandNegativecashflow.

Neutral Cashflow: Situationwhereincomeandexpenseare similar.(Itisarareoccurrence,mightbevisibleforshorter durationsbutisstillanacceptablesituation.)

Positive Cashflow: Situationwhereoutgoingsarelessthan incomings.(Itisanidealstrategyforsuccessfulbusinessand awin winsituationforallthestakeholders.)

Negative Cashflow: Situationwhereincomingsarelessthan outgoings.(Itisnotsuitableforanybusinessstrategyasit clearlyshowstheoutgoingsaremorethanincomings.)

As per a report in Business Standard news, daily 479 infrastructure projects show cost overruns worth Rs. 4.4 trillion, each project worth more than 150 crores. [3] Inflationandpriceriseandthegreatlabourmigrationhave playedaroleonthepartofclientsandcontractorsstopping the ongoing work due to project cost overrun and time overrun. According to a survey by LocalCircles, which coveredover8400businesses,only16%ofbusinessowners areleftwithliquiditywhichwouldhelptheirbusinesslast for only 3 4 months. [4] Hence cash flow management is mandatory in the application of practices in managing projectcashflowagainstasetbaseline.

Inordertoaccuratelyforecastthecashflow,itisnecessaryto understandallthefactorsandvariablesthataffectsthecash flowcalculations.Hencethisstudyisconductedtolistout and identify all the variables that affects the construction cashflow.

Themainobjectiveoftheresearchpaperistoidentifythe factorsthataffecttheconstructioncashflowwiththehelpof literatures and interviews with industrial experts. The secondaryobjectivewastoanalyzeallthefactorsaccording

toitsweightageandgivethem ranksaccordingly.Various indextestswereconductedtocheckandcomparetheresults accordingly.

Firstly,theliteratureswillbereviewedtostudytheprevious cash flow models designed by past researchers and the method of analysis incorporated by them. Later, various identifiedfactorswouldbecollectedandorganizedintoalist of categories and at last a proper method of data analysis wouldbeconductedtoidentifythemostandleastimportant factors.Asurvey/questionnairewillbepreparedandfloated tothecontractorsinandaroundAhmedabadcityalongwith interviewmightbeconductedanddatawillbecollected.The datalater,willbeanalyzedforvarioustests,andresultswill beinterpreted.

Fromthevariousliteraturesstudied,theresearchersmainly focusedondevelopmentofvariousmathematicalmodelsfor cashflowforecastingalongwithsimulationprocesstoverify thestabilityofdevelopedmodels.Variousmethodsusedby researchers were identified and results were studied. By referring such research papers, it proved to be very beneficialtohaveaninsightofselectiononleastuseddata analysis methods as well as the type of research which wouldcontributewelltothesociety.

Sr. No .

Country of Origin Author Research Contributi on

1 CANADA

Yaqiong Liu, Tarek Zayed, Shujing Li[5]

Theauthor identified various factors affectingcash flowand developeda stochastic modelforcash flow forecasting.

Method of Data Analysis

Analytical Hierarchy Process with Simulation

2 ROMANIA

Augusti n Purnus, Consta nta Nicolet a Bodea [6]

The results ofthisstudy suggest that the construction companies should carefully consider different

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified

Case Study along with Probabilistic Methodology

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

factors that can influence decisions both in the bid tender stage, but especiallyin the implementat ion phaseof infrastructu reprojects

3 EGYPT

Moham ed Razek, Hosam Hosny, Ahmed Beheri [7]

The research developed a cash flow risk model which was compared with on site available data.

Monte Carlo Simulation + Probability distribution with @RISK software

7 UAE

Hasan Mahmo ud, Vian Ahmed, Salwa Beheir y[11]

The study’s contribution to the body of knowledge is the creation of theCFRI,the validationof the index, the collection of data with analysis.

RIIMethod

8 UK

Henry Odeyin ka, Ammar Kaka, Roy Marled ge[12]

4 VIETNAM

Thi Tu Oanh Le, Thi Thanh Thuy Vu,Van Cong Nguyen [8]

The research identified factors and suggestedto use the modified modeltothe companies invietnam

Factor AnalysisTest SPSS

9 INDIA

The research identified the importance of cash flow forecasting with the help of computer software.

ANOVA

5 CANADA

Tarek Zayed, Yaqion g Liu [9]

The author identified various factors affecting cash flow and developed a stochastic model for cash flow forecasting.

Analytical Hierarchy Process

10 INDIA

G Dhamo daran, K.R. Divaka r Roy [13]

The research developed a mathematic al model for cash flow which reduced a lot of man hours as comparedto traditional method.

Mathematical Model

6 INDIA

Vaidehi Nirmal, Ashish B. Ugale, Dr. Nitin Ingole [10]

The research through the questionnair e survey identified the need of cash flow forecasting.

Frequency and Percentage Analysis

Moham mad Faisal Khan, Rajiv Banerj ee[7]

Various factors identified where checked for variability and uncertainty.

Cronbach’s Alpha

Forthepurposeofthisresearchpaper,thedatacollection methodtobeusedwasQuestionnaireSurveymethod.Inthis method,a questionnairefilled with questionsisfloated to the target audience, who in turn fills out the data and submitsitback.Themediumforquestionnairefloatingcan be postal method, online data forms via Google Forms, MicrosoftFormsorSurveyWebsites,In personformfillups,

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072 © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

etc.Thismethodofdata collectionisthemost economical methodbutatthesametimeconsumesalotoftime.Also,the data from questionnaire survey cannot be assumed to correcteverytime.Variousreliabilitytestsaretobedoneon itbeforethedataanalysisisstarted.Questionnairesurvey makesitquitesimplewhenthesurveysamplesizeisvast and has no geological boundaries. Questionnaire survey comprisedofquestionswhoseresponseswasbasedona5 pointLikertScalemultiplechoiceanswer.

Thebasisofthisresearchisthequestionnairesurveywhich was designed by reviewing the literatures extensively, as well as interviews with the industry experts, internet articles, etc. The questions so designed were later on validated by the 5 industrial experts whose valuable suggestionsandinputsforthesamewereaccommodatedfor thebettersurvey.

ThestructureofQuestionnairewasdividedintofewpartsas below:

1.

This section deals with the respondent’s personal information like Name, Contact Details (Email Id), Experience, Designation, and at last the name of organization.

This section deals with the financial factors affecting the company'scashflow.Respondentsaresupposedtoselectan appropriate option from the 5 points Likert Scale ranging fromVeryLowtoVeryHigh.Thissectionhas18questions allarebasedonLikertScale.

Thissectiondealswithquestionsbasedonpurchasesmade duringaprojectlifecyclealongwithquestionsbasedonthe market related section which directly or indirectly affects theprojectcashflow.Respondentsaresupposedtoselectan appropriate option from the 5 points Likert Scale ranging fromVeryLowtoVeryHighandcomprisesof7questions.

Thissectiondealswithquestionsbasedonfactorsaffecting cash flow forecast before and during the execution stage. Respondentsaresupposedtoselectanappropriateoption fromthe5pointsLikertScalerangingfromVeryLowtoVery Highandcomprisesof11questions.

Thissectiondealswithquestionsbasedonfactorsaffecting cashflowforecastduetoHRPoliciesandPersonalReasons. Respondentsaresupposedtoselectanappropriateoption fromthe5pointsLikertScalerangingfromVeryLowtoVery Highandcomprisesof7questions.

Thissectiondealswithquestionsbasedonfactorsaffecting cashflowforecastduetopandemicsaswewitnessedinthe last 2 years. Respondents are supposed to select an appropriate option from the 5 points Likert Scale ranging fromVeryLowtoVeryHighandcomprisesof3questions.

7. Other Section: 8.

Thissectiondealswithquestionsbasedonfactorsaffecting cashflowforecastduetovariousotherlessfocusedfactors. Respondentsaresupposedtoselectanappropriateoption fromthe5pointsLikertScalerangingfromVeryLowtoVery Highandcomprisesof6questions.

Table 2: LikertScaleDesign

Inthispaper,theformulausedtodeterminethepopulation isasperCochran’sFormula were,

eisthedesiredlevelofprecision=12%

pisthe(estimated)proportionofpopulation=0.5

q=1 p=0.5

z confidencelevel=1.96

Hence considering sample size = 67

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

The analysis of 6 major factors affecting the construction cashflowareanalysed.Thesefactorsare1)FinancialFactors

2)Market&PurchaseRelatedFactors3)Priorto&During Construction Factors 4) HR + Personal Section Factors 5) Pandemic Factors 6) Other Factors. Each of these factors comprisesofvariousquestionswhichweretobeanswered byrespondents.Theresponsescollectedwerefirsttestedfor itsrelabilitywiththehelpofSPSSsoftwarebyperforming theCronbach’sAlphatest.Theresponseswerelatertested uponbyProbabilisticAnalysismethodandFrequencyIndex Method.

Areliabilitytestisperformedtocheckthereliabilityofthe accumulateddata,beforebeginningtheanalysiswork.The test is known as Cronbach’s Alpha Test. This test was performed in the software Statistical Package for Social SciencespopularlyknownasSPSS.

Table

Case Processing Summary N %

Cases Valid 67 100.0 Excluded 0 0 Total 67 100

a. Listwise deletion based on all variables in the procedure.

Cronbach’sAlpha Nofitems 0.903 52

TheCronbach’salphavaluecanbeconsideredasthedata’s reliabilitystatisticsvalue.Thevalueofalphais0.903asis consideredofexcellentconsistency.Henceitisappropriate to assume that the data accumulated has excellent consistencyandcanbereliabletouseforotherdataanalysis methods.

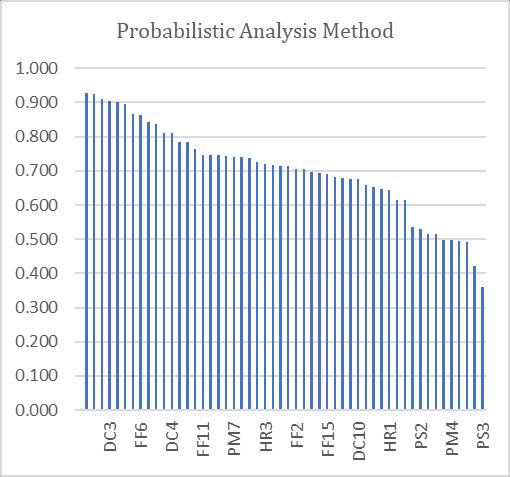

Probabilityisthepossibilityoftheeventtooccur.Asperthe responsesgeneratedbythequestionnairesurvey,thefactors are ranked as per the responses by allotting the required weightage as per responses. The reasons for selecting the Probability analysis is that, from the literature review summaryitwasevidentthatnopastresearchershaveused theprobabilisticanalysisfordataanalysis. Theresponses

arelatercheckedfortherankswithothertestingmethods andthedataarecomparedwitheachother. were, =totalweightageofFactors

A=Likertscalelengthpoint(i.e.,5) N=No.ofResponse(i.e.,67)

Figure 1 PA Method

Table 4: ResultsasperProbabilityAnalysisMethod

CODE QUESTIONS PA RANK

DC8

DC9

OS5

DC3

Impact of project cost overrun 0.928 1

Impactofprojecttime overrun 0.925 2

Impact of issues resulting into ArbitrationOccurrence 0.910 3

Impact of Faulty Cash FlowModel 0.904 4

FF7

Impact of change in financial position of clientsoncashflow 0.901 5

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

OS6

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

Impact of corruption, and political influence affectingcashflow 0.896 6

DC1

Impact of accuracy in estimation of quantities during the tendering stage on cashflow

FF6

FF18

0.866 7

Impact of change in payment conditions between each billing cycleoncashflow 0.863 8

Impactofpriceriseof constructionmaterials oncashflow 0.842 9

OS2 Vagueness in scope of workoncashflow 0.836 10

DC2

Impact of variation in quantities executed andBOQquantitieson cashflow 0.812 11

DC4 Impact of lack of cash flow analysis for the project 0.812 11

FF5

DC11

Impact of change in progressive payments from clients on cash flow 0.785 13

Impact of work stoppages due to municipal violations, pandemic and war situations

0.785 13

OS3 Addition/Elimination of scope of work on cashflow 0.764 15

FF11

Impact of higher lending rates for moneyborrowedfrom bankoncashflow 0.746 16

PM2 Impact of higher rate of inflation on cash flow 0.746 16

OS4 FrequentQA/QCissues oncashflow 0.746 16

HR7

Impact of low retention of labour teams due to various reasons

0.743 19

PM7 Impact of material vendor strikes on constructioncashflow 0.740 20

DC5

HR6

Impact of failure of performance strategy due to changes, variationorder,etc 0.740 20

Impact of shortage of technicallysoundstaff 0.737 22

PM5

HR3

Impact of decision to hire or purchase machinery and equipment’s 0.725 23

Impact of disputes related to work on cashflow 0.719 24

PM1

FF4

Impact of rate escalation on projects cashflow 0.716 25

Impact of selection of billing cycle/billing frequencyoncashflow 0.713 26

DC7

FF2

Impact of re work on cashflow 0.713 26

Impact of upfront payment from clients for material procurement on cash flow

0.704 28

HR2

FF1

Impact of having fair relations with clients, consultants and companyoncashflow 0.704 28

Impactofmobilization advances on company's cash flow cycle 0.696 30

FF13 Impact of advance payment on materials oncashflow 0.693 31

FF15

ImpactofHighPayroll Expenses on company'scashflow 0.690 32

FF10 Impact of large retention percentage oncashflow 0.681 33

PM3

Impact of selection of inventory management strategy oncashflow 0.678 34

FF12 Impact of delay in releasing of retention amount 0.675 35

DC10 Impact of unavailabilityofskilled staff and required 0.675 35

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

materialoncashflow

FF9

FF16

Impact of Interim Bill Certification from Consultant on Cash flow 0.660 37

ImpactofinvertedGST structure on construction service and construction materials

FF8

0.654 38

Impact of capital financed from Institutional or NBFC sources? 0.648 39

HR1 Impact of Communication Skills onCashflow 0.645 40

FF14

Impact of credit availability for material procurement oncashflow 0.615 41

PM6 Impact of taxation on materials to be purchased 0.615 41

OS1

PS2

Impact of extreme weather adversities affecting labor productivity on cash flow

Impact of additional cost like food + accommodation + travel on company cashflow

DC6

HR4

FF3

PM4

HR5

0.534 43

FF17

Impact of clearing labour wages and material dues on time affecting the negative cashoutflow

0.493 50

PS1

PS3

Impact of regular sanitization of premisesoncashflow 0.421 51

Impact of health insurance, ppe kits, masksetconcashflow 0.361 52

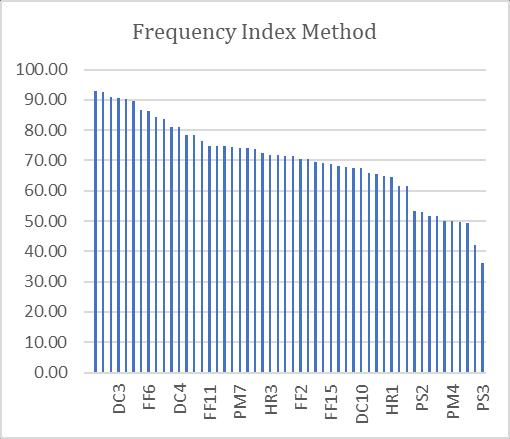

Frequency analysis is a method of analysis that is used in manyscientificstudies.Itisquitepopularmethodofanalysis as it provides a simple quantitative result. Frequency Analysisisalsoanimportantareaofstatisticsthatdealswith thenumberoftimesaneventoccurs.Thismethodisusedto rank the causes of criticality of various factors based on frequencyofoccurrenceasidentifiedbyrespondents[14] were, a=weightofLikertscale n=no.responseonath scale N=No.ofResponse(i.e.,67)

0.528 44

Impact of higher competition among contractors affecting contractor'scashflow 0.516 45

Impact of sub contracting work on cashflow 0.516 45

Impactofdeductionof mobilization advance fromeveryRABill 0.499 47

Impactofprovisionof facility to repair and store excess materials oncashflow 0.499 47

Impact of high employeeturnoveron cashflow 0.496 49

Table 5: ResultsasperFIMethod

CODE QUESTIONS PA RANK

DC8

DC9

Impact of project cost overrun 92.84 1

Impact of project time overrun 92.54 2

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

OS5

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

Impact of issues resulting into ArbitrationOccurrence 91.04 3

DC3 Impact of Faulty Cash FlowModel 90.45 4

FF7

OS6

Impact of change in financial position of clientsoncashflow 90.15 5

Impact of corruption, and political influence affectingcashflow 89.55 6

DC1

FF6

Impact of accuracy in estimation of quantities during the tenderingstageoncash flow

86.57 7

Impact of change in payment conditions between each billing cycleoncashflow 86.27 8

HR7

Impactoflowretention of labor teams due to variousreasons 74.33 19

PM7

DC5

Impact of material vendor strikes on constructioncashflow 74.03 20

Impact of failure of performance strategy due to changes, variationorder,etc 74.03 20

HR6 Impact of shortage of technicallysoundstaff 73.73 22

PM5

HR3

Impact of decision to hire or purchase machinery and equipment’s 72.54 23

Impact of disputes relatedtoworkoncash flow 71.94 24

FF18

Impact of price rise of constructionmaterials oncashflow 84.18 9

OS2 Vagueness in scope of workoncashflow 83.58 10

DC2

Impact of variation in quantities executed andBOQquantitieson cashflow 81.19 11

DC4 Impact of lack of cash flow analysis for the project 81.19 11

FF5

DC11

Impact of change in progressive payments from clients on cash flow 78.51 13

Impact of work stoppages due to municipal violations, pandemic and war situations

78.51 13

OS3 Addition/Elimination of scope of work on cashflow 76.42 15

FF11

Impact of higher lending rates for moneyborrowedfrom bankoncashflow 74.63 16

PM2 Impactofhigherrateof inflationoncashflow 74.63 16

OS4 FrequentQA/QCissues oncashflow 74.63 18

PM1

FF4

Impact of rate escalation on projects cashflow 71.64 25

Impact of selection of billing cycle/billing frequencyoncashflow 71.34 26

DC7

FF2

Impact of re work on cashflow 71.34 26

Impact of upfront payment from clients for material procurement on cash flow

70.45 28

HR2

FF1

Impact of having fair relations with clients, consultants and companyoncashflow 70.45 28

Impactofmobilization advancesoncompany's cashflowcycle 69.55 30

FF13

FF15

Impact of advance payment on materials oncashflow 69.25 31

ImpactofHighPayroll Expenses on company'scashflow 68.96 32

FF10 Impact of large retention percentage oncashflow 68.06 33

PM3

Impact of selection of inventorymanagement strategyoncashflow 67.76 34

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

International Research Journal of Engineering and Technology (IRJET)

FF12

DC10

FF9

FF16

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

Impact of delay in releasing of retention amount 67.46 35

Impact of unavailabilityofskilled staff and required materialoncashflow 67.46 35

Impact of Interim Bill Certification from Consultant on Cash flow 65.97 37

ImpactofinvertedGST structure on construction service and construction materials

65.37 38

FF8 Impact of capital financed from Institutional or NBFC sources? 64.78 39

HR1 Impact of Communication Skills onCashflow 64.48 40

FF14

PM6

Impact of credit availabilityformaterial procurement on cash flow 61.49 41

Impact of taxation on materials to be purchased 61.49 41

FF17

cashflow

Impact of clearing labor wages and material dues on time affecting the negative cashoutflow

49.25 50

PS1 Impact of regular sanitization of premisesoncashflow 42.09 51

PS3

Impact of health insurance, ppe kits, masksetconcashflow 36.12 52

The largest contributing factor affecting the construction cashflowwastheproject'scostoverrunandproject'stime overrun, according to all three methods of study (Probabilistic Analysis, Frequency Index Analysis, and RelativeImportanceIndex).ArbitrationOccurrence,Design of Faulty Cash Flow Model, Change in Client Financial Position,PresenceofCorruptionandPoliticalInfluence,Lack ofAccuracyinQuantityEstimationDuringBOQPreparation, ChangeinPaymentCondition,PriceIncrease,andVagueness in Scope of Work were among the top ten contributing factors.

OS1

PS2

Impact of extreme weather adversities affecting labor productivity on cash flow

Impact of additional cost like food + accommodation + travel on company cashflow

53.43 43

52.84 44

DC6

Impact of higher competition among contractors affecting contractor'scashflow 51.64 45

HR4 Impact of sub contracting work on cashflow 51.64 45

FF3

PM4

Impactofdeductionof mobilization advance fromeveryRABill 49.85 47

Impact of provision of facility to repair and store excess materials oncashflow 49.85 47

HR5 Impact of high employee turnover on 49.55 49

Financial Factors: Top Financial Factors as per results derived.

Table 6: FinancialFactorsRankingTable

Impactofchangeinfinancialpositionofclientson cashflow 01

Impactofchangeinpaymentconditionsbetween eachbillingcycleoncashflow 02

Impact of price rise of construction materials on cashflow 03

Impact of change in progressive payments from clientsoncashflow 04

Impactofhigherlendingratesformoneyborrowed frombankoncashflow 05

Impact of selection of billing cycle/billing frequencyoncashflow 06

Impact of upfront payment from clients for materialprocurementoncashflow 07

Impactofmobilizationadvancesoncompany'scash flowcycle 08

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072

Impactofadvance payment onmaterialsoncash flow 09

ImpactofHighPayrollExpensesoncompany'scash flow 10

Impactoflargeretentionpercentageoncashflow 11 Impactofdelayinreleasingofretentionamount 12

ImpactofInterimBillCertificationfromConsultant onCashflow 13

ImpactofinvertedGSTstructureonconstruction serviceandconstructionmaterials 14

Impact of capital financed from Institutional or NBFCsources 15

Impact of credit availability for material procurementoncashflow 16

Impactofdeductionofmobilizationadvancefrom everyRABill 17

Impactofclearinglaborwagesandmaterialdues ontimeaffectingthenegativecashoutflow 18

Purchase & Market Related Section: Top factors in this categoryasperresultsderived

Table 7: Purchase&MarketRelatedFactorsRanking Table

RESULTS RA NK

Impactofhigherrateofinflationoncashflow 01

Impact of material vendor strikes on construction cashflow 02

Impactofdecisiontohireorpurchasemachineryand equipment 03

Impactofrateescalationonprojectscashflow 04

Impact of selection of inventory management strategyoncashflow 05

Impactoftaxationonmaterialstobepurchased 06

Impact of provision of facility to repair and store excessmaterialsoncashflow 07

Before & During Construction Factors: Topfactorsinthis categoryasperresultsderived.

RESULTS RANK

Impactofprojecttimeoverrun 01 ImpactofFaultyCashFlowModel 02

Impact of accuracy in estimation of quantities duringthetenderingstageoncashflow 03

Impact of variation in quantities executed and BOQquantitiesoncashflow 04

Impactoflackofcashflowanalysisfortheproject 05

Impact of work stoppages due to municipal violations,pandemicandwarsituations 06

Impactoffailureofperformancestrategydueto changes,variationorder,etc 07

Impactofre workoncashflow 08

Impact of unavailability of skilled staff and requiredmaterialoncashflow 09

Impactofhighercompetitionamongcontractors affectingcontractor'scashflow 10

HR + Personal Factors: Topfactorsinthiscategoryasper resultsderived

Table 9:HR+PersonalFactorsRankingTable

RESULTS RA NK

Impactoflowretentionoflaborteamsduetovarious reasons 01

Impactofshortageoftechnicallysoundstaff 02

Impactofdisputesrelatedtoworkoncashflow 03

Impact of having fair relations with clients, consultantsandcompanyoncashflow 04

ImpactofCommunicationSkillsonCashflow 05

Impactofsub contractingworkoncashflow 06

Impactofhighemployeeturnoveroncashflow 07

Pandemic Factors: Top factors in this category as per resultsderived

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified

International Research Journal of Engineering and Technology (IRJET)

e ISSN: 2395 0056

Impact of additional cost like food + accommodation+traveloncompanycashflow 01

Impactofregularsanitizationofpremisesoncash flow 02

Impactofhealthinsurance,ppekits,masksetcon cashflow 03

Other Factors: Top factors inthis categoryas per results derived

Impact of issues resulting into Arbitration Occurrence 01

Impact of corruption, and political influence affectingcashflow 02

Vaguenessinscopeofworkoncashflow 03

Addition/Elimination of scope of work on cash flow 04

FrequentQA/QCissuesoncashflow 05

Impact of extreme weather adversities affecting laborproductivityoncashflow 06

Thestudyfocusedonthecreationofaquestionnairesurvey basedonliteraturereviews,expertvalidations,stakeholder interviews,and,finally,informationfromprintanddigital media.FinancialFactors,Purchase&MarketRelatedFactors, Before & During Construction Factors, HR + Personal Factors,PandemicFactors,andOtherMiscellaneousFactors wereallcorrectlyrecognizedbythequestionnaire. Abriefreviewoftopmostrankedfactorsisgivenbelow:

Financialfactorshaveasignificantimpactoncashflow.Ifa client'sfinancialsituationchanges,ithurtscashflow.Itmay alsobedisruptedifthepaymenttermsarechangedinthe middleofabillingcycle.Theincreaseinmaterialpriceshasa short termimpactoncashflowsinceitresultsina bigger out of pocketcommitmentbecausepaymentsaremadeon time. All financial aspects must be thoroughly forecasted basedontheirrank,historicalexperiencebasedonsimilar projects,andotherconsiderationstocompensatetosome extentratherthanfaceenormouslosses.

Thiselementhasasignificantimpactonnegativecashflow sinceitdealswiththebuysection,whichnecessitatestimely paymenttovendorsorsubcontractors.Whenthecontractor raisesabillforthesame,thecontractorsreceivepayment. As a result, the contractor's cash flow may be harmed because a big sum of money is disbursed and may not be reimbursedforalongperiod.Foragivenperiodoftime,the contractorwillalsohavealossofinterestcharge.

Thekey factorsthat affect cashflowarecost overrun and time overrun. As a result, some provisions for it must be determined duringcashflowanalysisand honored onlyif andwhentheconditionofcostandtimeoverrunsisrealized. Certainconditionsmustbekeptinmindwhenfinishingthe contract,asthey mayaidthecontractorsintheeventof a dispute over overruns. Another issue that influences cash flow is a flawed cash flow analysis caused by a lack of experience. When constructing the cash flow, extreme cautionmustbeexercised.

Low labor retention, as well as a shortage of technically competent personnel, were the key factors affecting cash flow.Thecashflowisimpactedbecauseeverytimea new labor gang comes, certain accommodations for food and lodgingaremade,resultinginunforeseenexpensesthatmay berecoveredfromthelaborbills.Communicationskillsplay a minor influence in cash flow because, in some cases, a portionofthemoneycanberecoveredjustbypersuading clients.

Duringtheanalysisofthefindings,itwasdiscoveredthatthe questionsinthispartwerefrequentlyratedlowtomedium. Althoughthisparthasaminorimpactoncashflow,itmust betakenintoaccountwhenestimatingcashflow.

Thekeydiscoveredreasonsinthispartweretheprevalence of arbitration disputes and the system's corruption. All of thishasa detrimental impactoncashflow,and necessary precautionsmustbetakenthroughoutconstructiontoavoid suchoccurrences.Itisalsovitaltopre determinethescope of work, which will aid contractors in determining the appropriateexecutionstrategyaswellascashflowforecasts. If the scope of work expands or contracts, the cash flow analysischanges,resultinginstrategyfailure.Ifnumerous sites are up and running at the same time, it may have a significantimpactoncashflow.

In this study, it was concluded that numerous elements affectcashflow.Thesecriteria,aswellastheprobabilistic

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072 © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

andfrequencyindexapproaches,wereputtothetestalong with the reliability test. In the future, various simulations andmodelsmaybecreatedtoestablishacommoncashflow forecasting method that can be used by all construction stakeholders

[1] NIPFA,“ConstructionIndustryinIndia|Construction Sector Investments,” Invest India. 2022, [Online]. Available: https://www.investindia.gov.in/sector/construction

[2] K. N. Jha and Pearson., Construction project management : theory and practice.Pearson,2015.

[3] PTI,“479infrastructureprojectsshowcostoverruns worth Rs 4,” 2022. https://www.business standard.com/article/economy policy/479 infrastructure projects show cost overruns worth rs 4 4 trillion 121080100174_1.html.

[4] D. Sanchita, “Many Indian startups and small businessesarerunningoutofcashfast,anewsurvey shows Business Insider India.” https://www.businessinsider.in/business/startups/ news/a new survey shows startups msme firms are running out of cash/articleshow/76398244.cms.

[5] Y. Liu, T. Zayed, and S. Li, “Cash flow analysis of constructionprojects,” Proceedings,Annu.Conf. Can. Soc. Civ. Eng., vol. 3, no. January 2009, pp. 1306 1313,2009.

[6] A.PurnusandC.N.Bodea,“Multi criteriaCashFlow AnalysisinConstructionProjects,” ProcediaEng.,vol. 164, no. June, pp. 98 105, 2016, doi: 10.1016/j.proeng.2016.11.597.

[7] M.A.ElRazek,H.E.D.Hosny,andA.ElBeheri,“Risk factorsinconstructionprojectscashflowanalysis,” Int. J. Comput. Sci. Issues,vol.11,no.1,pp.199 215, 2014.

[8] T.T.O.Le,T.T.T.Vu,andC.VanNguyen,“Identifying factorsinfluencingonthecashflowofconstruction companies:EvidencefromVietnamstockexchange,” Manag. Sci. Lett., vol. 10, no. 1, pp. 255 264, 2020, doi:10.5267/j.msl.2019.7.036.

[9] Y. Liu, T. Zayed, and S. Li, “Cash flow analysis of constructionprojects,” Proceedings,Annu.Conf. Can. Soc. Civ. Eng.,vol.3,pp.1306 1313,2009.

[10] M.V.P.Nirmal,“Cash FlowManagementinBuilding Construction Projects,” Int. J. Res. Appl. Sci. Eng. Technol., vol. 7, no. 12, pp. 564 573, 2019, doi: 10.22214/ijraset.2019.12092.

[11] H. Mahmoud, V. Ahmed, and S. Beheiry, “ConstructionCashFlowRiskIndex,” J. Risk Financ. Manag., vol. 14, no. 6, p. 269, 2021, doi: 10.3390/jrfm14060269.

[12] H. A. Odeyinka, A. Kaka, and R. Marledge, “An EvaluationofConstructionCashFlowManagement Approaches in Contracting Oraganizations,” Assoc. Res. Constr. Manag., vol. 1, no. September, pp. 3 5, 2003,[Online].Available:http://www.arcom.ac.uk/ docs/proceedings/ar2003 033 041_Odeyinka_Kaka_and_Marledge.pdf.

[13] G.DhamodaranandK.R.D.Roy,“Estimationofcash flow from value of work done for construction projectsinIndia,” Int. J. Eng. Adv. Technol.,vol.8,no. 2,pp.433 437,2019.

[14] R.Mamata,P.Chauhan, D.Patel,C.Panchal,andD. Bhavsar,“RII&IMPI :effectivetechniquesforfinding deley in construction project,” Int. Res. J. Eng. Technol.,vol.03,no.01,pp.1173 1177,2016.

Volume: 09 Issue: 06 | June 2022 www.irjet.net p ISSN: 2395 0072 © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |