International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

Patil1 , Vivek Patil2 , Pranav Sawant3 Dipak Kadam 4, Sandesh Patil 5, Prof S.A. Babar 6

1,2,3,4,5 Students, Department of Computer Science & Engineering, Sanjeevan Engineering and Technology Institute Panhala (Maharashtra, India).

6 Assistant Professor, Department of Computer Science & Engineering, Sanjeevan Engineering and Technology Institute Panhala (Maharashtra, India) ***

Abstract - The main purpose of this journal is to find the most accurate model to forecast the value of the share market. During the procedure of considering various approach and variables that must be taken into account, we found out that methodology like random forest and support vector machine were not utilized fully. In, this journal we are going to develop and analysis a more efficient technique to forecast the stock movement with perfection. We have taken the stock market values from last five days from the yahoo finance which is an authenticating source of information. The dataset is stored in the CSV file which is already pre processed and we will use it for prediction. Therefore, our journal will be focusing on the techniques. After the storing data we are going to apply random forest algorithm and support vector machine algorithm to bring precise output. In addition, the proposed paper examines the utilization of the forecast system in real world settings and issues related with the precise output of the overall values given. This paper is going to represent an extraordinary machine learning model. The victorious forecast of share will be benefit to the all stock market organization and will supply real world answer to all the issues that shareholder face.

Key Words: Machine Learning, Forecast, Dataset, Stock, Share Market, Random forest, SVM.

The stock market is a place where shares of public listed companiesaretraded.Ashare(alsoknownasequity) isa security that represents the ownership of fraction of corporationorcompany.Theactoftryingtodeterminethe future value of a company stock or other financial instrumenttradedonanexchangeiscalledasstockmarket prediction.Themodelwillbepowerful,exactandproficient. Theframeworkshouldworkasperthegenuinesituations and ought to be appropriate to certifiable settings. The frameworkisadditionallyexpectedtoconsidereveryoneof the factors that could influence the stock's worth and execution.Therearedifferentstrategiesandapproachesto executingtheforecastframeworklikeFundamentalAnalysis, TechnicalAnalysis,MachineLearning,MarketMimicry,and Time series angle organizing. With the progression of the computerizedperiod,theexpectationhasclimbedintothe mechanicaldomain.Themostunmistakableandpromising strategy includes the utilization of Artificial Neural

Networks,RecurrentNeuralNetworks,thatisessentiallythe execution of AI. AI includes man made reasoning which engagestheframeworktogainandimprovefromprevious encounters without being customized on numerous occasions.CustomarytechniquesforexpectationinAIuse calculations like Backward Propagation, otherwise called Backpropagationblunders.Oflate,numerousscientistsare utilizingagreateramountofoutfitlearningprocedures.It would utilize low cost and delays to foresee future highs while another organization would utilize slacked highs to anticipate future highs. These forecasts were utilized to shapestockcosts.Securitiesexchangecostexpectationfor brieftimeframewindowsgivesoffanimpressionofbeingan irregular cycle. The stock cost development throughout a significantstretchoftimetypicallyfostersastraightbend. Individuals will quite often purchase those stocks whose costsaresupposedtoascendsoon.Thevulnerabilityinthe securitiesexchangeforgoindividualsputtingresourcesinto stocks.Consequently,thereisaneedtopreciselyforeseethe financial exchange which can be utilized in a genuine situation. The techniques used to foresee the financial exchangeincorporatesaperiodseriesestimatingalongside specializedinvestigation,AIdisplayingandanticipatingthe variablesecuritiesexchange.Thedatasetsofthesecurities exchangeforecastmodelincorporatesubtletiesliketheend costopeningvalue,theinformationanddifferentfactorsthat areexpectedtoforeseetheitemfactorwhichisthecostina givenday.Thepastmodelutilizedconventionalstrategies forexpectationlikemultivariateexaminationwithaforecast time series model. Securities exchange forecast outflanks whenitistreatedasarelapseissuehoweverperformswell whentreatedasagrouping.Thepointistoplanamodelthat increasesfromthemarketdatausingAImethodologiesand checkwhat'sinstoredesignsinstockworthturnofevents. TheSupportVectorMachine(SVM)canbeutilizedforboth groupingandrelapse.IthasbeenseenthatSVMsaremore utilizedinarrangement basedissuelikeourown.TheSVM procedure, we plot each and every information part as a pointinn layeredspace(wherenisthequantityofelements ofthedatasetaccessible)withtheworthofcomponentbeing theworthofaspecificdirectionand,thuscharacterizationis performedbyfindingthehyperplanethatseparatesthetwo classes unequivocally. Prescient strategies like Random woodsmethodareutilizedforsomethingverysimilar.The arbitrarytimberland calculationfollowsanoutfitlearning system for grouping and relapse. The irregular woodland

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

takesthenormalofthedifferentsubsamplesofthedataset, this builds the prescient precision and lessens the over fittingofthedataset.

Financial exchange expectation is fundamentally characterizedasattemptingtodecidethestockworthand presentastrongsuggestionforindividualstobeawareand foresee the market and the stock costs. It is by and large introduced utilizing the quarterly monetary proportion utilizing the dataset. In this way, depending on a solitary datasetmaynotbeadequatefortheexpectationandcangive an outcome which is erroneous. Thus, we are pondering towards the investigation of AI with different datasets reconciliation to anticipate the market and the stock patterns.

Theissuewithassessingthestockcostwillstayan issue in the event that a superior securities exchange forecast calculation isn't proposed. Foreseeing how the securitiesexchangewill performisverytroublesome.The developmentinthefinancialexchangenotsetinstonebythe opinions of thousands of financial backers. Financial exchange expectation, requires a capacity to foresee the impact of late occasions on the financial backers. These occasionscanbepoliticaloccasionslikeanexplanationbya politicalpioneer,apieceofinformationontrickandsoon.It canlikewisebeaglobaloccasionlikesharpdevelopmentsin monetaryformsandwareandsoforth.Thislargenumberof occasions influence the corporate profit, which thusly influences the opinion of financial backers. It is past the extentofpracticallyallfinancialbackerstoaccuratelyand reliably foresee these hyperparameters. This multitude of variablesmakestockcostforecasttrulychallenging.When therightinformationisgathered,itthencanbeutilizedto prepareamachineandtoproduceaprescientoutcome.

Duringawritingoverview,wegatheredaportionofthedata about Stock market expectation instruments at present beingutilized.

The new examinations give a solid confirmation that the greaterpartoftheprescientrelapsemodelsiswastefulin out of test consistency test. The justification for this shortcoming was boundary shakiness and model vulnerability. The examinations additionally closed the customary procedures that guarantee to take care of this issue. Support vector machine regularly known as SVM furnishes with the bit, choice capacity, and sparsity of the arrangement.Itisutilizedtolearnpolynomialspiralpremise work and the multi facet perceptron classifier. It is a preparation calculation for grouping and relapse, which dealswithabiggerdataset.Therearenumerouscalculations

onthelookoutyetSVMfurnisheswithimprovedproficiency and exactness. The relationship investigation among SVM andsecuritiesexchangeareasofstrengthforshowsbetween thestockcostsandthemarketrecord.

The financial exchange forecast has turned into an undeniably significant issue in right now. One of the techniquesutilizedisspecializedexamination,howeversuch strategies don't necessarily yield precise outcomes. Thus, creatingstrategiesforamoreexactpredictionissignificant. Byandlarge,speculationsaremadeutilizingforecaststhat aregottenfromthestockcostinthewakeofthinkingabout every one of the variables that could influence it. The procedurethatwasutilizedinthiscasewasarelapse.Since monetary stock imprints produce huge measures of informationatsomerandomtimeanextraordinaryvolume of information needs to go through investigation before a forecastcanbemade.Everyoneofthestrategiesrecorded underrelapseenjoysitsownbenefitsandimpedimentsover itsdifferentpartners. Oneofthevital strategiesthatwere referencedwasdirectrelapse.Themannerinwhichdirect relapse models work is that they are in many cases fitted utilizingtheleastsquaresapproach,howevertheymaythen againbelikewisebefittedinalternateways,forexample,by reducing the "absence of fit" in another standard, or by decreasing a debilitated variant of the most un square's misfortunework.Alternately,theleastsquaresapproachcan beusedtofitnonlinearmodels.

TheutilizationofAIandman madebrainpowerprocedures toforeseethecostsofthestockisarisingpattern.Anever increasingnumberofscientistsputtheirtimeconsistentlyin concocting ways of showing up at strategies that can additionally work on the exactness of the stock forecast model. Because of the tremendous number of choices accessible,therecanbennumberofwaysonthebestwayto foreseethecostofthestock,howevereverythingstrategies don't work the same way. The result fluctuates for every strategy regardless of whether similar informational collectionisbeingapplied.Inthereferredtopaperthestock cost expectation has been completed by utilizing the arbitrarywoodlandcalculationisbeingutilizedtoanticipate the cost of the stock utilizing monetary proportions structurethepastquarter.Thisisjustasingleviewpointon issue by pushing toward it utilizing a prescient model, utilizingtheirregularwoodstoforeseethefuturecostofthe stock from verifiable information. Nonetheless, there are generallydifferentelementsthatimpactthecostofthestock, likefeelingsofthefinancialbacker,popularassessmenton the organization, news from different outlets, and even occasionsthatmakethewholesecuritiesexchangevary.By

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

utilizingthemonetaryproportionalongsideamodelthatcan successfullyexaminefeelingstheprecisionofthestockcost forecastmodelcanbeexpanded.

Thefinancialexchangeexpectationprocessisloadedupwith vulnerability and can be impacted by different elements. Thusly,thesecuritiesexchangeassumesasignificantpartin businessandmoney.Thespecializedandbasicexamination is finished by wistful investigation process. Virtual entertainmentinformation hasa higheffect becauseof its expandedutilization,andittendstobeusefulinforeseeing the pattern of the financial exchange. Specialized examinationisfinishedutilizingbyapplyingAIcalculations on authentic information of stock costs. The strategy generallyincludesgatheringdifferentvirtualentertainment information, news to separate opinions communicated by people.Differentinformationlikeearlieryearstockcostsare additionally thought of. The connection between different informationfocusesisthoughtof,andaforecastismadeon these data of interest. The model had the option to make expectationsaboutfuturestockqualities.

Monetaryassociationsandtradershavemadedifferentelite modelstoendeavorandbeatthemarketforthemselvesor their clients, yet on occasion has anyone achieved dependablyhigher than typicallevelsofproductivity.Inany case,thetestofstockgaugingissocaptivatingconsidering the way that the improvement of several rate centers can construct benefit by an enormous number of dollars for theseassociations.

The time series forecast issue was explored in the work habitats in the different monetary organization. The expectationmodel,whichdependsonSVMandautonomous examination,consolidatedcalledSVM ICA,isproposedfor securities exchange forecast. Different time series investigationmodelsdependonAI.TheSVMisintendedto takecareofrelapseissuesinnon straightgroupingandtime series examination. The speculation mistake is limited utilizingasurmisedwork,whichdependsonriskdecreasing standard. Accordingly, the ICA method removes different significant elements from the dataset. The time series forecast depends on SVM. The consequence of the SVM model was contrasted and the consequences of the ICA procedurewithoututilizingapre handlingstep.

Thecurrentframeworkcomesupshortwhenthere are uncommon results or indicators, as the calculationdependsonbootstraptesting.

Thepastoutcomesdemonstratethatthestockcost is eccentric when the conventional classifier is utilized.

The presence framework revealed exceptionally prescientqualities,bychoosingafittingtimespan for their investigation to acquire profoundly prescientscores.

Thecurrentframeworkdoesn'tperformwellwhen thereisanadjustmentoftheworkingclimate

It takes advantage of just a single information source,henceprofoundlyone sided.

The current framework needs some type of info understanding,inthiswayneedofscaling.

It doesn't take advantage of information pre handling strategies to eliminate irregularity and deficiencyoftheinformation.

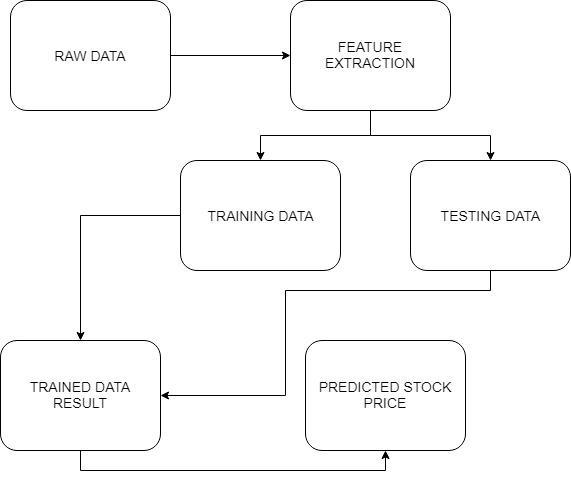

Inthisproposedframework,wecenteraroundanticipating the stock qualities utilizing AI calculations like Random Forest and Support Vector Machines. We proposed the framework"Securitiesexchangecostexpectation"wehave anticipatedthefinancialexchangecostutilizingtheirregular timberlandcalculation.Inthisproposedframework,wehad theoptiontopreparethemachinefromthedifferentdataof interestfromthepasttomakeafutureexpectation.Wetook information from the earlier days stocks to prepare the model.WealtogetherusedtwoAIlibrariestodealwiththe issue.ThefirstwasNumPy,whichwasutilizedtocleanand controltheinformation,andpreparingitintoastructurefor investigation.Theotherwassklearn,whichwasutilizedfor genuine investigation and expectation. The informational index we utilized was from the earlier day’s securities exchangesgatheredfromYahooFinancewhichisavalidated source, 80 % of information was utilized to prepare the machine and the rest 20 % to test the information. The essentialmethodologyoftheadministeredlearningmodelis to gain the examples and connections in the information fromthepreparationsetandafterwardrepeatthemforthe testinformation.Weutilizedthepythonpanda'slibraryfor informationhandlingwhichjoineddifferentdatasetsintoan informationoutline.Theadjusteddataframepermittedusto set up the information for highlight extraction. The dataframe features were date and the end cost for a

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

particular day. We utilized this multitude of elements to prepare the machine on irregular backwoods model and expectedthethingfactor,whichistheexpenseforagiven day.Weadditionallymeasuredtheprecisionbyinvolvingthe expectations for the test set and the real qualities. The proposedframeworkcontactsvariousareasofexploration including information pre handling, arbitrary timberland, etc.

Arbitrary woods calculation is being utilized for the securitiesexchangeexpectation.Sinceithasbeennamedas oneofthemoststraightforwardtoutilizeandadaptableAI calculation,itgivesgreatprecisionintheexpectation.Thisis generallyutilizedinthecharacterizationerrands.Asaresult ofthegreatunpredictabilityinthesecuritiesexchange,the errandofforeseeingisverydifficult.Infinancialexchange forecast we are involving irregular timberland regressor which has a similar hyperparameters starting around a choicetree.Thechoiceinstrumenthasamodellikethatofa tree. Ittakesthechoiceinlightof potential results, which incorporates factors like occasion result, asset cost, and utility. The arbitrary woods calculation addresses a calculationwhereitarbitrarilychoosesvariousperceptions andelementstoassembleafewchoicetreesandafterward takes the total of the few choice trees results. The informationispartedintosegmentsinlightoftheinquiries onanameoratrait.Theinformationalindexweutilizedwas from the earlier day’s securities exchanges gathered from theyahoofinanceaccessibleontheweb,80%ofinformation wasutilizedtopreparethemachineandtherest20%totest the information. The fundamental methodology of the regulated learning model is to gain the examples and connectionsintheinformationfromthepreparationsetand afterwardimitatethemforthetestinformation.

Theprincipalundertakingofthehelpmachinecalculationis torecognizeaN layeredspacethatrecognizablyordersthe data of interest. Here, N represents various elements. Between two classes of data of interest, there can be numerousconceivablehyperplanesthatcanbepicked.The goal of this calculation is to find a plane that has greatest edge.Augmentingedgealludestothedistancebetweendata of interest of the two classes. The advantage related with expanding the edge is that it gives is that it gives some support sofutureinformationfocuses can be all themore effortlesslyarranged.Choicelimitsthatassistwithgrouping informationfocusesarecalledhyperplanes.Inviewofthe place of the information guides relative toward the hyperplane they are credited to various classes. The component of the hyperplane depends on the quantity of qualities,ontheoffchancethatthequantityofpropertiesis

two, the hyperplane is only a line, in the event that the quantity of characteristics is three, the hyperplane is two layered.

Yahoo Finance is a web based local area for information examination and prescient demonstrating. It likewise contains dataset of various fields, which is contributed by information excavators. Different information researcher contends to make the best models for anticipating and portraying the data. It permits the clients to utilize their datasets so they can assemble models and work with differentinformationsciencedesignerstoaddressdifferent genuineinformationsciencechallenges.Thedatasetutilized intheproposedprojecthasbeendownloadedfromYahoo finance. The informational collection is an assortment of securitiesexchangedataaroundacoupleoforganizations. Theinitialstepisthechangeofthiscrudeinformationinto handled information. This is finished utilizing highlight extraction,sinceinthecrudeinformationgatheredthereare variouspropertiesyetacoupleofthosecreditsarevaluable with the end goal of forecast. Thus, the initial step is highlightextraction,wherethekeycreditsareremovedfrom theentirerundownoftraitsaccessibleinthecrudedataset. Include extraction beginsfromanunderlyingcondition of estimated information and fabricates inferred values or highlights. These highlights are planned to be useful and non excess, working with the ensuing learning and speculation steps. Include extraction is a dimensionality decrease process, where the underlying arrangement of crudefactorsislessenedtologicallysensibleelementsfor simplicity of the executives, while still exactly and thoroughlyportrayingtheprimaryenlighteningassortment. The element extraction process is trailed by a characterization interaction wherein the information that was gotten after highlight extraction is parted into two unique and unmistakable fragments. The preparation informational collection is utilized to prepare the model while the test information is utilized to anticipate the precision of the model. The parting is done such that preparing information keep a higher extent than the test information.

Theirregulartimberlandcalculationusesanassortmentof irregular choice trees to investigate the information. In laymanterms,fromthecompletenumberofchoicetreesin the woods, a group of the choice trees search for explicit propertiesintheinformation.Thisisknownasinformation parting.Forthissituation,sincetheultimateobjectiveofour proposedframeworkistoanticipatethecostofthestockby investigatingitsverifiableinformation.

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072

take the forecasts from the prepared model on the contributions from the test dataset. Consequently, it is separatedintheproportionof80:20where80%isforthe preparation set and the rest 20% for a testing set of the information

Informationassortmentisanexceptionallyessentialmodule andtheunderlyingadvancetowardstheventure.Itforthe mostpartmanagestheassortmentoftherightdataset.The datasetthatwillbeutilizedinthemarketforecastmustbe utilizedtobesiftedinviewofdifferentangles.Information assortmentlikewisesupplementstoimprovethedatasetby addingmoreinformationthatareouter.Ourinformationfor themostpartcomprisesoftheearlierdaysstock costs.At first,wewillexaminetheYahoofinanceandasindicatedby theprecision,wewillutilizethemodelwiththeinformation topreciselyinvestigatetheforecasts.

Informationpre handlingisapieceofinformationmining, whichincludeschangingcrudeinformationintoamorelucid organization.Crudeinformationisnormally,conflictingor deficient and generally contains numerous blunders. The information pre handling includes information cleaning, informationcoordination,informationchange,information decrease.

Preparingthemachineisliketakingcareoftheinformation to the calculation to finish up the test information. The preparationsetsareutilizedtotuneandfitthemodels.The test sets are immaculate, as a model ought not be passed judgment on in view of concealed information. The preparationofthemodelincorporatescross approvalwhere we get an established inexact presentation of the model utilizing the preparation information. The thought behind the preparation of the model is that we a few starting qualities with the dataset and afterward upgrade the boundarieswhichweneedtointhemodel.Thisiskepton reiterationuntilwegettheidealqualities.Inthismanner,we

Themethodinvolvedwithapplyingaprescientmodeltoa bunch of information is alluded to as scoring the information.Theproceduresusedtoprocessthedatasetis theRandomForestAlgorithmandbackingvectormachine calculationwhicharetypicallyutilizedfororderaswellas relapse.WewillfindthetypicalworthofRandomwoodland calculation and backing vector machine calculation to amplifytheexactness

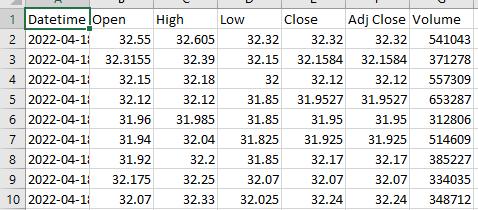

ThisCSVfilecontainsrawdatacollectedfromyahoofinance which is an authenticated source for international stock market. There are 7 columns out of which 6 attributes columnsthatdescribetheriseandfallinstockprices.Some oftheseattributesare(1)HIGH,whichdescribesthehighest valuethestockhadinpreviousdaysinthatparticulartime. (2)LOW, is quitethecontraryto HIGH and resembles the lowestvaluethestockhadinthatparticulartimeofperiod. (3)OPENisthevalueofthestockattheverybeginningof thetradingday,and(4)CLOSEstandsforthepriceatwhich thestockisvaluedbeforethetradingdaycloses.Thereare otherattributessuchasVolumeandAdj.closebothofthese playsaverycrucialroleinourfindings.

Thisisapictorialrepresentationofthedatapresentinour csvfile.

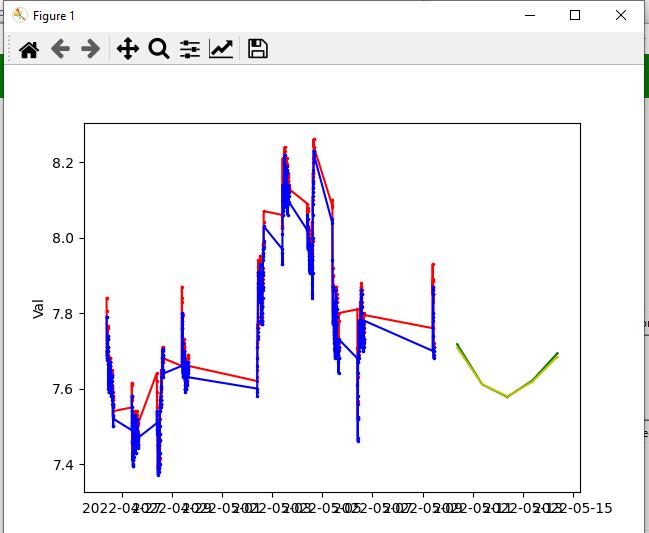

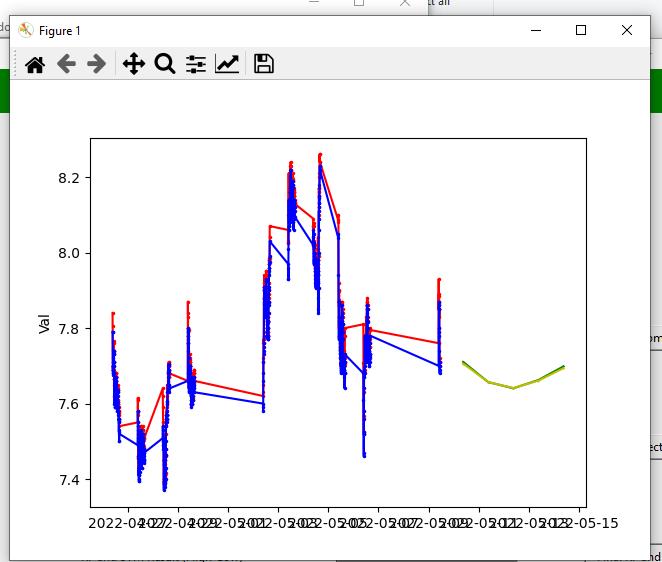

AfterapplyingtheRandomForestalgorithm,wegotgraphof trainingaswellastestingandthepredictedvaluearealso showninthatparticulargraph.Asampleofgraphofrandom Forestalgorithmisshownbelowintheformofimage.

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

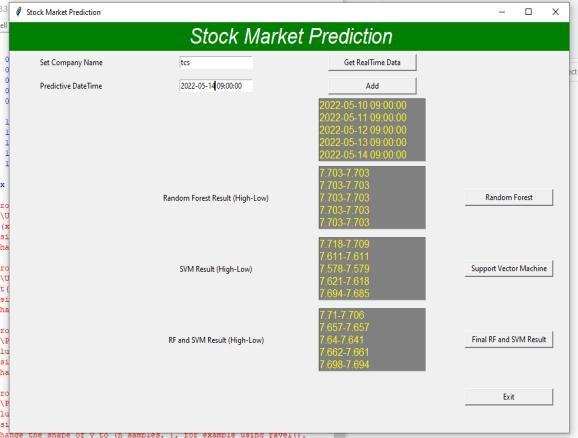

Intheendthisdesktopapplicationwillshowallthedetailed values of HIGH and LOW in Desktop application for that particularperiodoftime.Thisdesktopapplicationcanshow youmultiplevaluesatasingletime,wehavetoaddthedate andtimeforwhichvaluetobepredictedandclickonADD buttonandafterapplyingboththealgorithmswegotallthe valueinamoment.Asampleofthisisshownbelowinthe image

Fig 3:Randomforestgraph

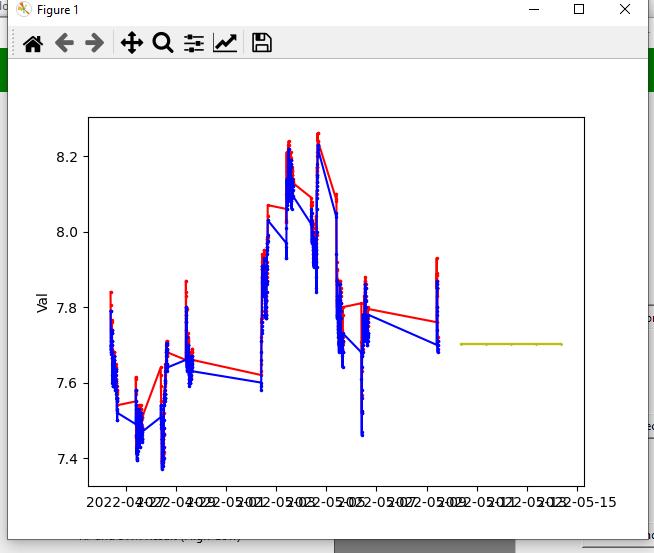

Similarly,thegraphforthesupportvectormachineisshown below

In this project we are going to find the average value of random forest algorithm and support vector machine algorithm. For this module also our desktop application shows graph. A sample of that particular graph is shown belowinthefigurenumber5.

Fig 6:FinalOutput

Byestimatingtheprecisionofthevariouscalculations,we tracked down that the most reasonable calculation for anticipatingthemarketcostofastockinviewofdifferent data of interest from the verifiable information is the irregulartimberlandcalculation.Thecalculationwillbean extraordinary resource for representatives and financial backersforputtingcashinthesecuritiesexchangesinceitis prepared on a tremendous assortment of verifiable informationandhasbeenpickedsubsequenttobeingtried onanexampleinformation.TheventureshowstheAImodel to foresee the stock worth with more precision when contrastedwithrecentlyexecutedAImodels.

[1]AshishSharma,Dinesh Bhuriya,Upendra Singh.ICECA 2017.Survey of Stock Market Prediction Using Machine LearningApproach.

[2] Loke.K.S. IEEE,2017.Impact of Financial Ratios and TechnicalAnalysisonStockPricePredictionUsingRandom Forests,

[3] Xi Zhang1, Siyu Qu1, Jieyun Huang1, Binxing Fang1, Philip Yu2, Stock Market Prediction via Multi Source MultipleInstanceLearning.IEEE2018.

Fig 5:Averagegraphvalue

[4]VivekKanade,BhausahebDevikar, SayaliPhadatare, PranaliMunde,ShubhangiSonone.StockMarketPrediction: UsingHistoricalDataAnalysis,IJARCSSE2017.

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072 © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal | Page118

International Research Journal of Engineering and Technology (IRJET) e ISSN: 2395 0056

[5] SachinSampatPatil, Prof. Kailash Patidar, Asst. Prof. MeghaJain,ASurveyonStockMarketPredictionUsingSVM, IJCTET2016.

[6]HakobGRIGORYAN,AStockMarketPredictionMethod Based on Support Vector Machines and Independent ComponentAnalysis,DSJ2016

[7] Raut Sushrut Deepak, ShindeIshaUday, Dr. D. Malathi, MachineLearningApproachInStockMarket

[8] Pei Yuan Zhou , Keith C.C. Chan, Member, IEEE, Carol XiaojuanOu,CorporateCommunicationNetworkandStock PriceMovements:InsightsFromDataMining,2018.

[9] Zexin Hu , Yiqi Zhao and Matloob Khushi, A Survey of ForexandStockPricePredictionUsingDeepLearning

[10]M Umer Ghani, M Awais and Muhammad Muzammul Stock Market Prediction Using Machine Learning (ML)Algorithms.

Volume: 09 Issue: 05 | May 2022 www.irjet.net p ISSN: 2395 0072 © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal