International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

GrowUP - A Modern way of Trading

Ms. Satwik Shukla, Ishan Patel, Aryan Pal, Nimish SrivastavaDepartment of Information Technology, Inderprastha Engineering College, Ghaziabad, Uttar Pradesh, India ***

Abstract: As the name GrowUP suggests the major aim of this project is to grow, earn and learn. The people who are beginners or newcomers in cryptocurrency trading face a lot of problems, questionnaires and queries regarding algorithmictradingstrategiesinday to daylife.GrowUPisanefficientwayofalgorithmictradinginreallife,athingthat automaticallytradeson yourbehalf.

Keywords: Algorithmictrading,bot,earn,cryptocurrency.

I. INTRODUCTION

Everydecision madeintradinghastwomajorcomponents:whattobuy orsell,and whentobuyorsell it.Everytrading strategy consists of determining how to figure out what to buy and when to buy or sell it. There are two major ways to evaluate these questions: fundamental analysis and technical analysis. Fundamental analysis makes an evaluation about thevalueofasecuritybyexaminingmanyaspectsofthefinancialconditionofacompany.Thisismeanttodetermineifthe currentpriceofthesecurityisundervaluedorovervaluedtopredictwhetherthepricewillincreaseordecreaseinvalue. Thesedecisionsareoften basedonseveral metrics.Someof thesemetricsinclude theP/E ratio,whichisthe ratioofthe priceofthestocktothecompany'searnings.

GrowUPisaBitcoinTAtradingandbacktestingplatformthatconnectstopopularBitcoinexchanges.GrowUPisatoolthat makesitvery easytoautomateyourown trading strategies. Wecan eithercreate ourown tradingstrategyor startwith thebuilt inexamplestrategies.

II. METHODOLOGY

GrowUP is a tool that is designed as a starter kit for automated trading on the cryptocurrency market. GrowUP aims to have a low barrier entry to writing your own strategies (however a basic scripting knowledge is required for users who createtheirownstrategies).

Market Data

GrowUP aggregates all market data into various timely candles (OHLC, VWP and amount of trades). This means GrowUP only has to store candles on disk, which take up a predictable amount of space on the harddrive. The tradebot will use someadditionalmarketdata(theorderbook)toexecuteordersefficiently,butthisdataisnotvisibleanywhereelse.

Strategies

Strategiesaresimplescriptsthathandlenewmarketdata(OHLCcandles)aswellascalculatedindicatorresults(strategies specifywhatindicatorsthey wantwithwhichsettings).Everytimethereisnewdatathestrategycandeterminetosignal either LONG or SHORT. That's about it! This very simple design (candles + indicator values go in => signals come out) is quitepowerful.

Unfortunatelythissimpledesigncansometimesbelimiting,herearesomelimitations: Sincestrategiesareonlyfedcandles(andindicatorvalues):

a. Strategiescannotactonasmallertimeframethan1minute.

b. Strategiescannotseeanytrades.

c. Strategiescannotlookattheorderbook

Strategiesdonotknowwhatthecurrentportfoliolookslike. StrategiescanonlytriggeraLONGorSHORTwhichsignalstogo"allin".

International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

Execution Strategy

WhenyouareusingGrowUPforarealtradebotGrowUPwillcreateordersattheexchangewheneveryourstrategysignals anadvice(longorshort).Ifyourstrategysignalsalongadvice,GrowUPwilltrytobuyasmuch"asset"asitcangetwithall your"currency"(ifyourstratisrunningonUSD/BTCthatwouldmeanbuyingBTCwithallyourUSD).Asforcreatingthe ordersGrowUPisconservativeandstaysonyoursideoftheorderbook(thismeansyoudon'tloseonthespread,slippage ortakerfees).

Features

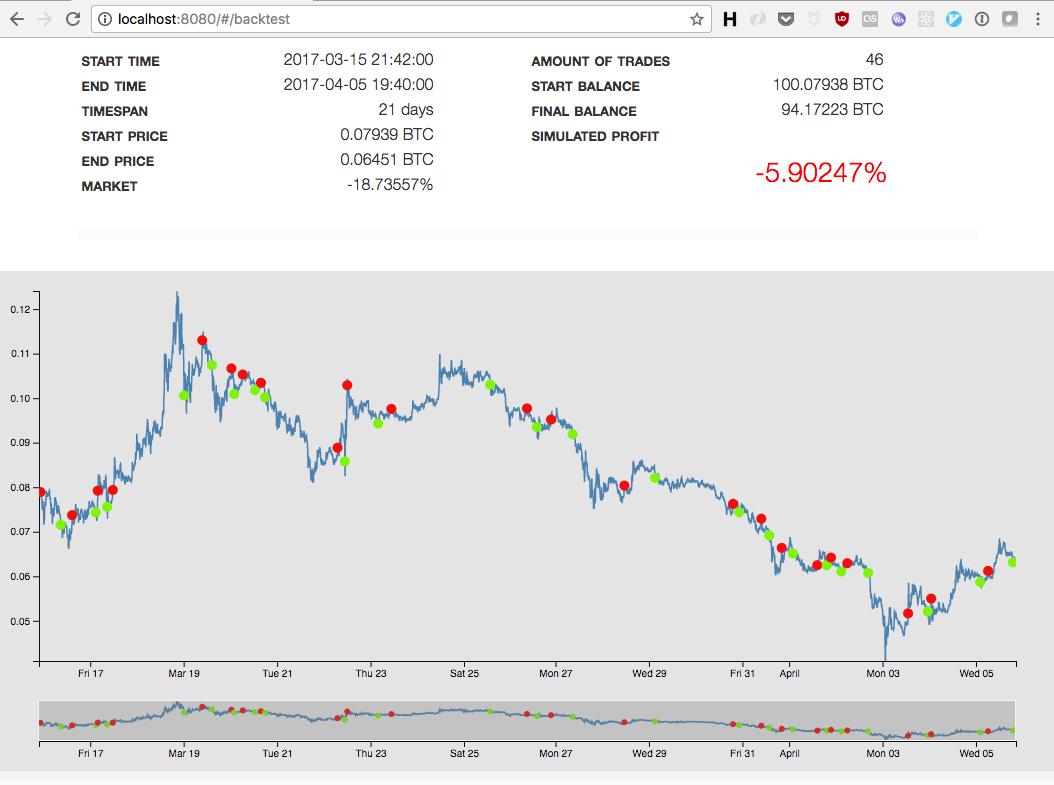

● Backtesting

GrowUP supports backtesting strategies over historical data. A Backtest is a simulation where you simulate runningastrategyoveralongtime(suchasthelast30days)inamatterofseconds.Backtestingrequireshaving market data locally available already. After a backtest GrowUP will provide statistics about the market and the strategy'sperformance.

Importantthingstoremember:

1. Justbecauseastrategyperformedwellinthepast,doesnotmeanitwillperformwellinthefuture.

2. Becarefulofoverfitting,inotherwords:don'tsimplytweakastrategyuntilyougethighprofitandassumethat willbeasprofitablewhengoinglive.

3. Thebacktestsimulationislimited,thisisnotreallyaproblemonbiggermarkets(suchasBTC/USD)butthe differencesbetweenbacktestsandlivetradersonverylowvolumemarketsmightbebig.

International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

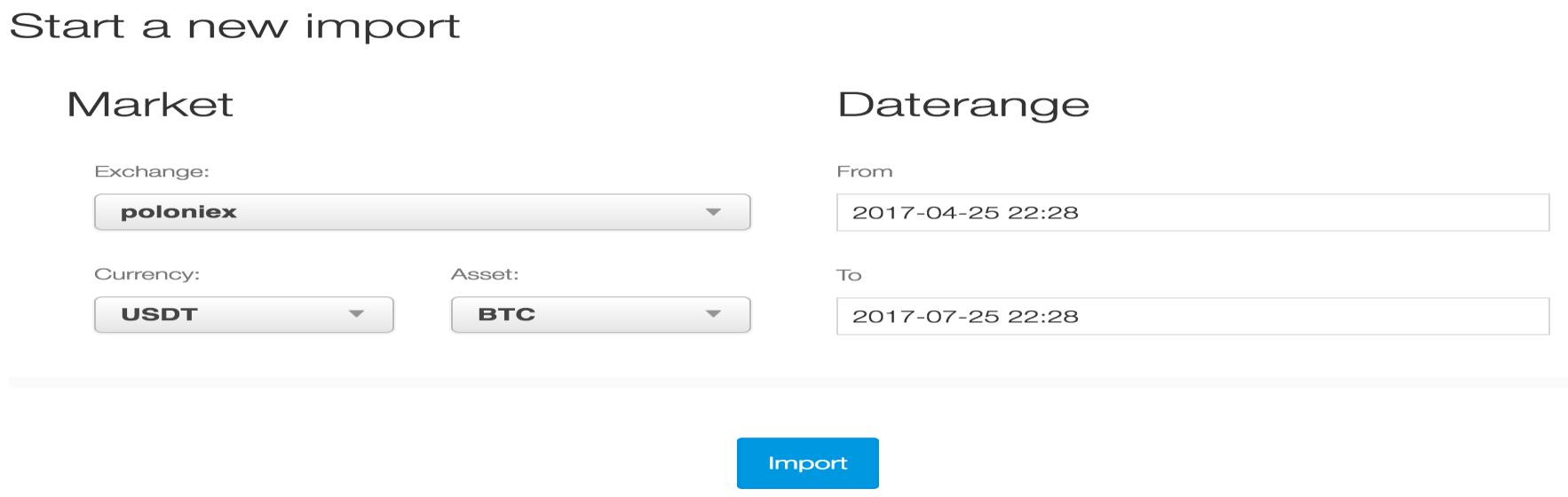

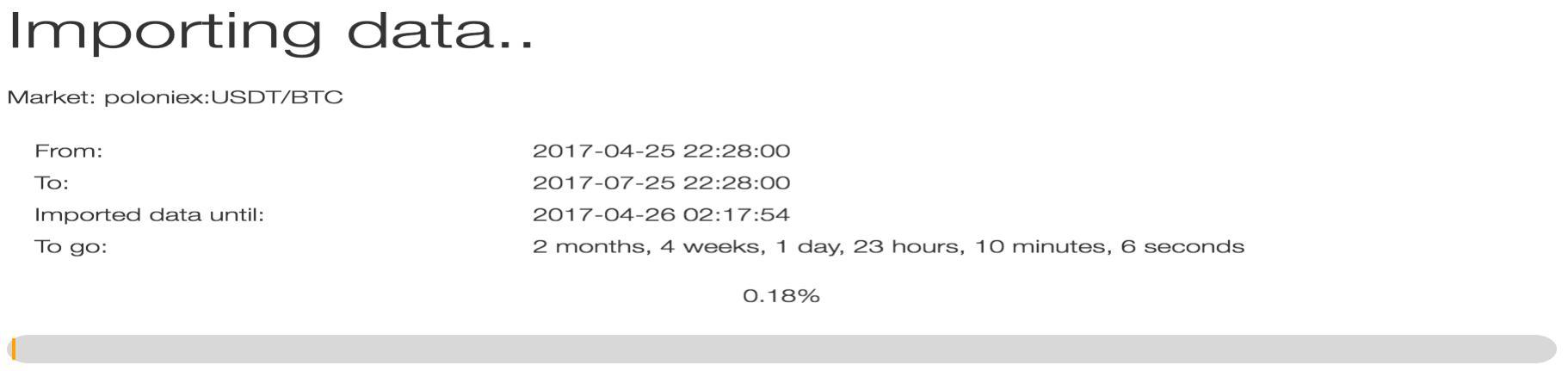

● Importing

In order to backtest our strategies we will need to have historical market data to test with. The easiest way of gettingthisdataisimportingitdirectlyfromtheexchangeusingtheGrowUPUI(notethatthisisnotsupportedat allexchanges,checkthislisttoseewhatexchangesGrowUPcanimportfrom).

We can start an import by navigating to the tab "Local tab" and scrolling to the bottom and click "Go to the importer".Thisbringsustotheimportingpagewiththisatthebottom:

OnceweconfigurethemarketanddaterangeyouwanttowatchandclickimportGrowUPwillautomaticallydownload historicalmarketdatafromtheexchange:

● Paper Trading

GrowUPcanautomaticallyrunastrategyoverthelivemarketsandsimulateinrealtimewhatwouldhappenifwe would have traded on its signals. Paper trading and backtesting are the two simulation modes that come with GrowUP.It'sagreatwaytoexperimentwithstrategieswithoutputtingyourmoneyontheline.

Youcanstartapapertraderbygoingtolivegrowsandclickingon"StartanewliveGrow".

Keepinmindthatapapertraderisasimulation,andtheaccuracydependsonthemarketwedecidetoruniton (you'll get pretty accurate results on big markets like USD/BTC). We can read more about the details and limitationsofthesimulationonthebacktestingpage.

© 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal | Page 2917

International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

Technical Indicators used

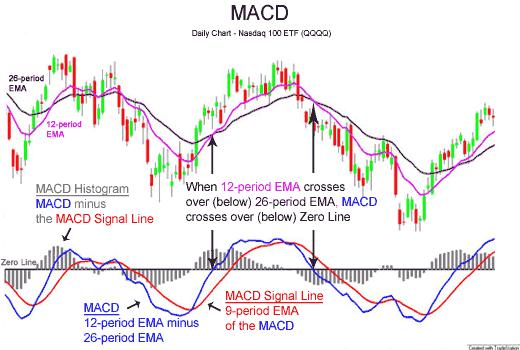

● MACD (Moving Average Convergence Divergence)

Moving average convergence divergence (MACD) is a trend following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26 period exponentialmovingaverage(EMA)fromthe12 periodEMA.

● RSI (Relative Strength Index)

RSIcomparesthemagnitudeofrecentgainsandlossesoveraspecifiedtimeperiodtomeasurespeedandchange ofpricemovementsofasecurity.Itisprimarilyusedtoattempttoidentifyoverboughtoroversoldconditionsin thetradingofanasset.

International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

● DEMA (Double Exponential Moving Average)

TheDEMAisafast actingmovingaveragethatismoreresponsivetomarketchangesthanatraditionalmoving average.Itwasdevelopedinanattempttocreateacalculationthateliminatedsomeofthelagassociatedwith traditionalmovingaverages.

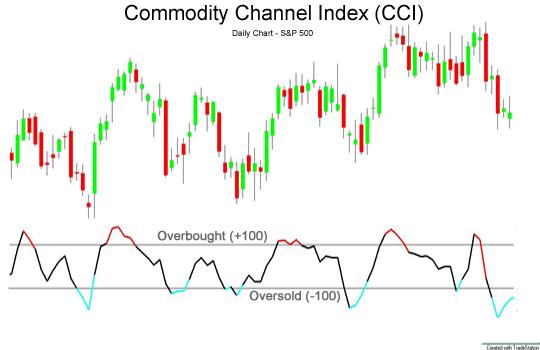

● CCI (Commodity Channel Index)

The Commodity Channel Index (CCI) is a momentum based technical trading tool used most often to help determinewhenaninvestmentvehicleisreachingaconditionofbeingoverboughtoroversold.

2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal |

International Research Journal of Engineering and Technology (IRJET) e ISSN:2395 0056

Volume: 09 Issue: 04 | Apr 2022 www.irjet.net p ISSN:2395 0072

III. RESULTS AND CONCLUSION

Tradingisahighlycomplexprocesswhichconsistofanunimaginableamountofrandomness;withthehelpofthistool we can make some prediction and patterns in the market to book some profits more efficiently by eliminating different types of losses which are made by a person which, including factors such as emotions, money management, time of executionandexperience.

Inthisstudy,wedesignedasysteminwhichapersoncandopapertradingusing differentstrategiesandbacktesttheir strategies.

IV. FUTURE WORK

Althoughthereissomethinginthisprojectthatisbeingkeptoutforthefutureinordertomakethisprojectmore optimistic,reliableandeffective.Herearesomeofthefutureconsiderations:.

● Improvestabilityofneweventandbacktestengine

● Porttheoldsupportedexchangestosomenewbrokersoftware

● newUI

● advancedordersfromcreatedstrategies(TakeProfitandStopLoss)

REFERENCES

[1]. EadiciccoL.Howthetechbehindbitcoincouldrevolutionizewallstreet.Time;2016[accessed2018May21].

[2]. BrogaardJ,HendershottT,RiordanR.High frequencytradingandpricediscovery.RevFinancStud.2014;27(8):2267 306.doi:10.1093/rfs/hhu032

[3]. BaurDG,HongK,LeeAD.Bitcoin:mediumofexchangeorspeculativeassets?JIntFinanMarketsInstitutionsMoney. 2017;54:177 189

[4]. Ben DavidI,HirshleiferD.Areinvestorsreallyreluctanttorealizetheirlosses?Tradingresponsestopastreturnsand thedispositioneffect.RevFinancStud.2012;25(8):2485 532.doi:10.1093/rfs/hhs077

[5]. PichlL,KaizojiT.Volatilityanalysisofbitcoin.QuantFinanceEcon.2017;1:474 85.doi:10.3934/QFE.2017.4.474.

[6]. Biondo AE, Pluchino A, Rapisarda A, Helbing D. 2013 Are random trading strategies more successful than technical ones?PLoSONE8,e68344.(doi:10.1371/journal.pone.0068344)

[7]. Kristoufek L. 2015 What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis.PLoS ONE10,e0123923(doi:10.1371/journal.pone.0123923

[8]. BritoJ,ShadabHB,CastilloA.Inthepress.Bitcoinfinancialregulation:securities,derivatives,predictionmarkets,and gambling.ColumbiaSci.Technol.LawRev.(doi:10.2139/ssrn.2423461)

[9]. Bollen J, Mao H, Zeng X. 2011 Twitter mood predicts the stock market. J. Comput. Sci.2, 1 8. (doi:10.1016/j.jocs.2010.12.007)

[10].SharpeWF,SharpeW.1970Portfoliotheoryandcapitalmarkets,vol.217.NewYork,NY:McGraw Hill.

© 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal | Page 2920