International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056 p-ISSN:2395-0072 Volume: 09 Issue: 12 | Dec 2022 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056 p-ISSN:2395-0072 Volume: 09 Issue: 12 | Dec 2022 www.irjet.net

1Computer, AISSMS COE, No1, Kennedy Road, Pune, 411001, Maharashtra, India. ***

Abstract In this research, we examine current approaches and then suggest fresh approaches for predicting the stock market. We tackle the issue from three separate angles: fundamental analysis, technical analysis, and machine learning application. The weak form of the Efficient Market Hypothesis is supported by research showing that historical prices do not contain relevant information but that out-of-sample data may be predictive. News that is pertinent to any company listed on the stock market has an impact on future stock movement. We demonstrate how machine learning and fundamental analysis could be used to help investors make decisions. Techniques for machine learning come in handy here. Intelligent investors can use machine learning techniques to predict the behaviour of the stock market since they are aware that the examination of numerical time series produces accurate findings. Utilize the SVM technique to train the dataset and forecast the stock market.

Keywords Machine Learning, SVM, Feature Extraction, Classification, Data Analytics, Stock Market, Decision Tree

One of the highest rated industries for producing money for middle class investors is investment in stocks. Then, high class investors and traders engage in actual trading. The most crucial factor for investors is a company's share price, which is constantlysubjecttoupsanddowns.Toavoidfinanciallossandultimatelytomakemoney,itisessentialtokeepaneyeon the livesharemarketpriceandmakequickdecisions.

Youmustresearchthecompany'spastfinancial performanceandplannedcourse ofactionforthis.Youcanchoosetoinvest basedonageneralmarketandcompanyinvestigation.However,researchhasitslimitsbecauseitisimpossibletodetermine withabsolutecertaintywhetherastudyoranalysisisaccurate.

The company's financial trajectory and future plans must be researched for this. You can choose to invest based on a comprehensive review of the market and the company. However, you are limited in what you can learn because it is impossibletoknowforsurewhetherastudyoranalysisisaccurate.

Discoveringthefutureworthofbusinessstockandotherfinancialassetstradedonanexchangeismadepossiblewiththeaid of stock price prediction utilising machine learning. Gaining significant profits is the whole point of making stock price predictions.It'schallengingtoforecasthowthestockmarket.

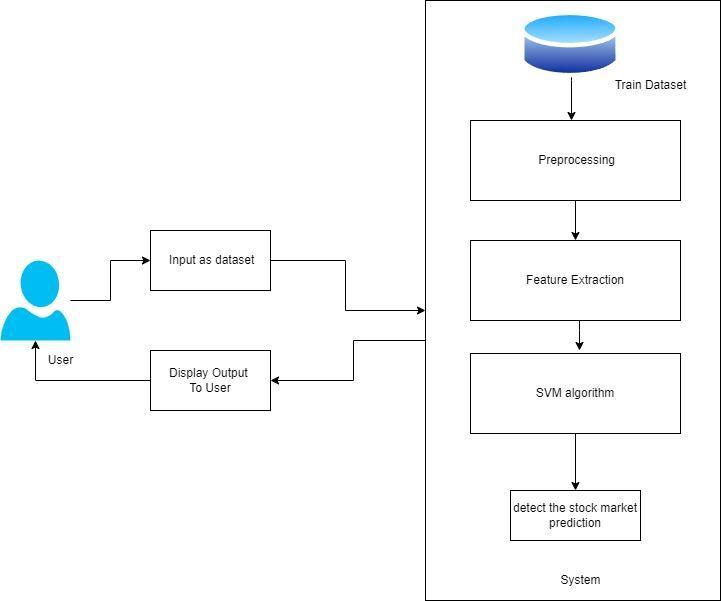

IEEE 2021

Improving Traditional Stock Market Prediction Algorithms Using Covid-19Analysis

By taking into account the parameters linked to COVID-19, the proposed work seeks to improve the stock market forecast capacity of

The process of predicting stock market trends is difficultduetoitsdynamic and turbulent nature. The COVID-19 pandemic in recentyearshasmadethis work even more difficult. The market has never been more volatile because to the increase in COVID-19 cases

Due to the fact that these standard trend prediction algorithms do not take into consideration how the pandemic has affected stock market

Volume: 09 Issue: 12 | Dec 2022 www.irjet.net

severalpopular prediction models.

IEEE 2019 Analysis of Investor Sen timent and Stock Mar ket Volatility Trend Based on Big Data Strategy [1].

In order to create a comparable analysis index, this article gathers data on the web news emotion index, web search volume, social network emotion index, and social network heatindex.

(IRJET)

e-ISSN:2395-0056 p-ISSN:2395-0072

worldwide. movements, this has led to their poor performance.

Prediction of stock marketvolatilityand risk aversion in the financial sector.

Brings a fresh viewpoint and a new framework for measuring the risk of market volatility.

IEEE 2017 Combining of Random For est Estimates using LSboost for Stock Market Index Prediction[2].

Each of the prediction models is selected with technical indicatorsas inputs.

The goal of this study is to use regression to forecastthefuturevalues of stock market indexes basedonthestock prices inthepast.

The proposed prediction model may also be used in other fields, such as forecasting GDP, energy use, or weather.

IEEE 2018 Literature review on Artificial Neu ral Networks Techniques Application for Stock Mar ket Prediction and as DecisionSupport Tools[3].

This study shows that the LSTM's capability exhibits a consistent rate of stock market prediction accuracy.

The results of this study show that an LSTM can reliably display a stock's accuracyrate.

Future research may evaluate the results utilisingalarge database that is now available as well as examine them using statistical methods.

IEEE 2018 Predicting the Effects of News Senti ments on the StockMarket[4].

The effects of news feelings on the stock market were

A potent indicator of stock movements, sentiment scores gleaned fromtheanalysisofnews articles can be effectively leveraged to forecast

The system can be enhanced to operate on a broadscale.

International Research Journal of Engineering and Technology (IRJET)

e-ISSN:2395-0056 p-ISSN:2395-0072

recovered, extracted, and examined in thispaper.

Support Vector Machine (SVM):

short-termtrends.

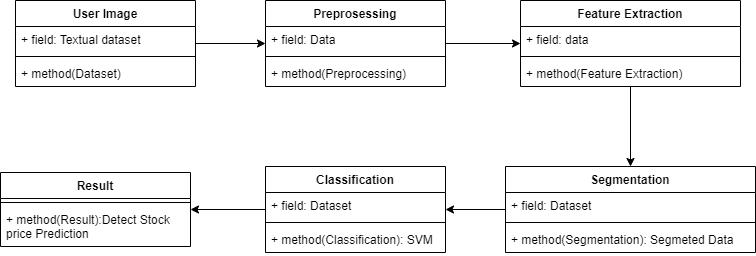

ThesupervisedlearningmethodSupportVectorMachineisusedtoaddressproblemsinbothclassificationandregression.To swiftly classify further data points in the future, this SVM algorithm's main goal is to identify the best line or decision boundarythatmaydividen-dimensionalspaceintoclasses.Thenameofthisbestdecisionboundaryisahyperplane.

A supervised learning method called a decision tree can be used to solve classification and regression problems, but it is typicallyfavouredfordoingsoItisatree-structuredclassifier,whereeachleafnoderepresentstheclassificationoutcomeand insidenodesrepresentthefeaturesofadataset.ThetwonodesinadecisiontreearetheDecisionNodeandLeafNode.While Leafnodesare the resultsofdecisionsanddo nothave anymore branches, Decisionnodes are used tocreate decisions and havenumerousbranches.

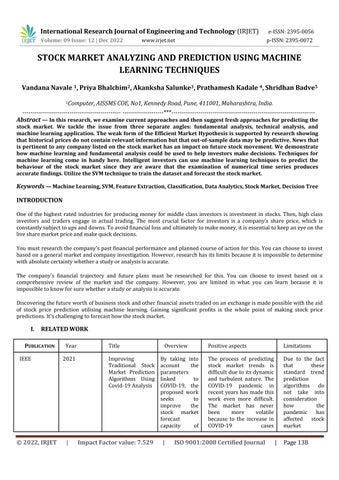

Datapreparationistheprocessoftransformingrawdataintosomethingamachinelearningmodelcanuse.Itisthefirstand mostcrucialstepintheprocessofcreatingamachinelearningmodel.

Whenworkingonamachinelearningproject,itisnotalwaysthecasethatwearepresentedwiththecleanandprepareddata. Additionally,youmustprepareandcleanupyourdataeverytimeyouworkwithit.

It is not always the case that we come across the clean and prepared data when developing a machine learning project. Additionally,anytimeyouworkwithdata,youmustcleanitupandformatit. Therefore,weuseadatapretreatmentactivity forthis.

Usingthefeatureextractionmethod,abigquantityofrawdataisdividedintomoremanageable,morecompactgroups.

Thesehugedatasetssharethetraitofhavingmanyvariablesthatdemandalotofcomputationalpowertoprocess.Theterm "feature extraction" refers to techniques for choosing and/or combining variables into features, which significantly reduces theamountofdatathatneedstobeprocessedwhileproperlyandfullycharacterisingtheinitialdataset.

This is made feasible via segmentation, a method of categorising clients into different groups based on characteristics or behaviour. Customer segmentation can be useful for other marketing tasks like upselling techniques, product recommendations,andpricing.

Volume: 09 Issue: 12 | Dec 2022 www.irjet.net © 2022, IRJET | Impact Factor value: 7.529 | ISO 9001:2008 Certified Journal | Page140

International Research Journal of Engineering and Technology (IRJET)

e-ISSN:2395-0056 p-ISSN:2395-0072 Volume: 09 Issue: 12 | Dec 2022 www.irjet.net

Classification:

Itispossibletocategorisethealgorithmforsupervisedmachinelearningusingregressionandclassificationalgorithms. We have forecasted the results for continuous values using regression techniques, but we require classification algorithms to predicttheresultsforcategoricalvalues.

The Classification algorithm is a Supervised Learning method that is used to classify fresh observations on the basis of training data. In classification, a programme uses the dataset or provided observations to figure out how to divide new observations into different classes or groupings. Cat or dog, yes or no, 0 or 1, spam or not spam, etc. are a few examples. Classesmaybedenotedbytargets,labels,orcategories.

Unlike regression, classification producesa categoryas opposed toa value astheoutputvariable, suchas"Green or Blue," "fruitoranimal,"etc.BecausetheClassificationmethodisasupervisedlearningtechniqueandhasinputandoutputdata,it needslabelledinputdata.

Mathematical Model: LetSistheWholeSystemConsistof S=I,P,O

Where, I=CURLOC,SELOC,LOG,RE,PRO

LOG=userloginintosystem

SECO=SelectCompany

PRO=StockMovements

R=Shareprice

P=Process

Step1:userwilllogin Step2:UserwillselectCompany Step3:UserwillAnalyzeData

Step3:UserwillApplyMathematicalAlgorithmicMethod Step4:SystemwillgivePredictionaboutfurther Stockmovement

OUTPUT:predictstockmarketprice System Architectural Diagram

International Research Journal of Engineering and Technology (IRJET)

e-ISSN:2395-0056 p-ISSN:2395-0072 Volume: 09 Issue: 12 | Dec 2022 www.irjet.net

Conclusion:

Here, we discovered that machine learning technology can be used to predict stock market movements. A graph of any company's stock price cannot be read in detail by a single individual. In the real world, we must analyse data at a massive scale with many different businesses. As a result, we may use machine learning techniques to make considerably better predictions.WemayutilisetheSVMalgorithmtogreatlyincreasetheaccuracyofourpredictions.

References:

1) UniversityofBradford,2017.H.Isah,"SocialDataMiningforCrimeIntelligence:ContributionstoSocialDataQuality AssessmentandPredictionMethods."

2) UniversityofBradford,2017.H.Isah,"SocialDataMiningforCrimeIntelligence:ContributionstoSocialDataQuality AssessmentandPredictionMethods."

3) Expert Systems with Applications, vol. 83, pp. 187–205, 2017. E. Chong, C. Han, and F. C. Park, "Deep learning networksforstockmarketanalysisandprediction:Methodology,datarepresentations,andcasestudies."

4) A unique data-driven stock price trend prediction system was developed by J. Zhang, S. Cui, Y. Xu, Q. Li, and T. Li in 2018.ExpertSystemswithApplications,vol.97,pp.60–69.

5) Expert Systems with Applications, vol. 105, pp. 11-22, 2018. L. S. Malagrino, N. T. Roman, and A. M. Monteiro, "Forecastingstockmarketindexdailydirection:ABayesiaNetworkapproach."

6) "Stock Price Prediction Using Artificial Neural Network," by M. B. Patel and S. R. Yalamalle, International Journal of InnovativeResearchinScience,Engineering,andTechnology,vol.3,June2014,pp.13755–13762.

7) Wen Fang, Jie Wang, and Jun Wang. Elman Recurrent Random Neural Networks for Financial Time Series Prediction[J].NeuroscienceandComputationalIntelligence,2016(12):1–14

8) Twitterisawonderfulsitetospothealthconcerns,accordingtoV.M.Prieto,S.Matos,M.Alvarez,F.Cacheda,andJ.L. Oliveira.2014,PLoSONE,vol.9,no.1,articlee86191.

9) "Overcoming data scarcity of Twitter: Using tweets as bootstrap with application to autism-related topic content analysis," A.Beykikhoshk,O.Arandjelovi,D.Phung,andS.Venkatesh,inProc.IEEE/ACMInt.Conf.Adv.Social Netw. Anal.Mining,Paris,France,August2015,pp.1354–1361.

10) Deep learning- and word embedding-based heterogeneous classifier ensembles for text categorization, Z. H. Kilimci andS.Akyokus,Oct.2018,Complexity,vol.2018,art.no.7130146.