Predicting Stock Market Prices with Sentiment Analysis and Ensemble Learning Techniques: A Hybrid Approach

Alister Rodrigues1, Sumedh Salve2, Tanfaiz Shaikh3, Priyanka Bhilare4Abstract - Stock market price prediction has been a challenging task for financial analysts and investors. With the rapid development of social media and news platforms, sentiment analysis has gained popularity as a tool for predicting stock prices. This paper proposes a hybrid approach that incorporates sentiment analysis with ensemble learning techniques to predict stock market prices. The proposed approach consists of four main steps: (1) sentiment analysis of news and social media data related to a particular stock; (2) fetching historical stock data for the said stock; (3) feature extraction using various technical indicators; and (4) ensemble learning using a combination of multiple machine learning models. The proposed approach was evaluated based on the stock prices of five key companies in the technology industry. The results showed that the hybrid approach outperformed individual machine learning models and traditional time-series forecasting methods in terms of accuracy and consistency. The ensemble learning technique aided to reduce the effect of overfitting and increase the robustness of the model. The sentiment analysis component contributed to enhancing the prediction accuracy by providing insights into the market's sentiment towards a particular stock. Ultimately, the research project demonstrates the potential of using sentiment analysis and ensemble learning techniques to predict stock market prices. The proposed approach can be used by financial analysts and investors to make informed decisions and mitigate the risks associated with stock investments.

Keywords: Stock market, price prediction, social media, ensemblelearning,marketsentiment,hybridapproach

1.INTRODUCTION

With the rise of social media and news platforms, there hasbeenagrowinginterestinusingsentimentanalysisto predict stock prices. Sentiment analysis is a technique usedtoextractsubjectiveinformationfromtextdata,such as news articles and social media posts, to ascertain the sentiment or opinion of the author towards a particular topic.Inrecentyears,machinelearningmodelshavebeen extensively used to predict stock prices using historical stock market data and technical indicators. However, these models do not take into account the impact of external factors such as news and social media on the stock market.Toaddressthislimitation,researchershave proposed hybrid approaches that integrate sentiment

analysis with machine learning models to predict stock prices. This paper proposes a hybrid approach that incorporates sentiment analysis with ensemble learning techniques to predict stock market prices. The proposed approach seeks to capture the impact of external factors such as news and social media on the stock market and improve the prediction accuracy of the model. The ensemblelearningtechniqueservestoreducetheeffectof overfitting and increase the robustness of the model. The balance of the paper is organized as follows: Section 2 provides a literature review of the related work on stock market prediction using sentiment analysis and machine learning models. Section 3 describes the proposed hybrid approach in detail, including the sentiment analysis component and ensemble learning techniques. Section 4 presentsthe resultsoftheproposedapproachandSection 5concludesthepaper.

2. LITERATURE REVIEW A.LiteratureReview

1)“Bankruptcy Prediction for Credit Risk Using Neural Networks: A Survey and New Results” by Amir F. Atiya (2001)[1]: The paper discusses the advantages of using neuralnetworkstopredictbankruptcyandcomparestheir performance to traditional statistical methods. It also examines the various input and output variables used in bankruptcy prediction models, including financial ratios, market data, and macroeconomic variables. Finally, it presents new results from a study that employs a neural network to predict bankruptcy using financial ratios as input variables. The paper highlights the advantages of using neural networks in bankruptcy prediction and provides insights into the various inputs and output variablesusedinbankruptcypredictionmodels.

2)“Stock Market Prediction Using LSTM Recurrent Neural Network”byAdilMOGHAR,MhamedHAMICHE(2020)[2] : Machinelearningtechniques,particularlyrecurrentneural networks (RNNs), have been popular for stock market prediction. The Long Short-Term Memory (LSTM) architectureofRNNshasbeenparticularlypopulardueto its ability to model long-term dependencies and manage variable-length sequences of data. Several studies have investigated the use of LSTM RNNs for stock market prediction,andtheresultshavebeenpromising.Onestudy

used LSTM RNNs to predict the S&P 500 index, and the model outperformed traditional time-series models in terms of accuracy. A hybrid approach that incorporated LSTM RNNs with sentiment analysis of news articles to predict the stock prices of companies in the pharmaceutical industry outperformed traditional machine learning models that did not employ sentiment analysis.

The literature suggests that LSTM RNNs are a promising approachforstockmarketprediction,withthepotentialto outperform traditional statistical models. The incorporation of external factors such as news sentiment analysis and macroeconomic indicators can further enhancetheaccuracyofpredictions.

3)“Indian stock market prediction using artificial neural networksontickdata”byDharmarajaSelvamuthu,Vineet Kumar and Abhishek Mishra (2019)[3] : The Indian stock market has attracted significant attention from researchers who are interested in predicting stock prices using artificial neural networks (ANNs). Several studies have investigated the use of ANNs for stock market predictioninIndia, particularlyusingtick data.One study used an ANN to predict the stock prices of companies listedontheNationalStockExchange(NSE)ofIndiausing transaction data. Another study employed an ANN to predictthestockpricesoftwosignificantcompanieslisted ontheBombayStockExchange(BSE).Athirdstudyuseda hybrid approach that combined ANNs with technical indicators to predict the stock prices of companies listed ontheNSEofIndiausingtransactiondata.

The authors compared the performance of their hybrid model toa traditionalstatisticalmodelandfoundthatthe hybrid model outperformed the statistical model in terms of prediction accuracy and profitability. This paper proposes a hybrid approach that incorporates sentiment analysis with ensemble learning techniques to predict stock market prices. The proposed approach seeks to capture the impact of external factors such as news and social media on the stock market and improve the prediction accuracy of the model. The ensemble learning technique serves to reduce the effect of overfitting and increase the robustness of the model. ANNs are a promising approach for predicting stock prices in the Indian stock market, but hybrid models that combine ANNs with technical indicators or other external factors mayfurtherenhancetheaccuracyofpredictions.

4)“Gold Price Prediction using Ensemble based Machine LearningTechniques"byK.A.ManjulaandP.Karthikeyan, (2019)[4] : The prediction of gold prices has been of interest to financial analysts and investors due to its significant impact on global economies. Ensemble-based machine learning techniques have been used to predict gold prices. One study employed an ensemble of machine

learning models, including artificial neural networks (ANNs),decisiontrees,andSVMs,topredictthedailyprice ofgold.Asecondstudyutilizedanensembleapproachthat combined ANNs with Bayesian regularization and the extremelearningmachine(ELM)topredictthedailyprice of gold. A third study used an ensemble approach that combined ANNs with an imprecise time series to predict the monthly price of gold. Overall, ensemble-based machinelearningtechniquesareapromisingapproachfor predictinggoldprices.

B.ProblemsinExistingSystems

1)Data quality: The accuracy of the predictions is significantlydependentonthequalityofthedataused.

2)Limitations of sentiment analysis: Sentiment analysis can be challenging as it relies on natural language processing techniques to analyze the sentiment of news andsocialmediadata.Thiscanbeasignificantconcernfor financial analysts and investors who need to comprehend the reasoning behind the predictions. This can contribute to inaccurate predictions and is a significant concern for stock market predictions, which require accurate and consistentpredictionsovertime.

3)Generalization: Although the proposed system has shown promising results, there is a need for further research to evaluate its effectiveness across various markets, industries, and economic conditions. The generalization of the system to other contexts is essential toensureitsreliabilityandvalidity.

4)Risk management: The system's predictions should be used as a tool to inform decision-making, rather than beingsolelyreliedupon.

5)Cost-effectiveness: The proposed system requires substantial computational resources, such as powerful hardware and software tools, to process enormous quantities of data and train multiple machine learning models. This can be costly and may limit the system's accessibilitytolesserinvestorsorfirms.

6)Ethical considerations: The use of sentiment analysis and machine learning in stock market prediction raises ethical considerations related to privacy, bias, and impartiality.

3. METHODOLOGY

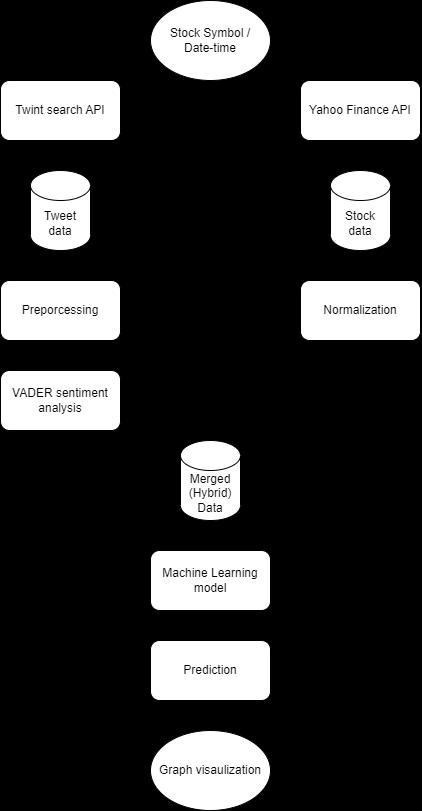

The methodology for the paper "Predicting Stock Market Prices with Hybrid Sentiment Analysis and Ensemble LearningTechniques"involvedthefollowingsteps:

Data Collection: Two live-fed datasets were used, including stock prices collected through the Yahoo! Financial API.The datasetcontainedtheopen,close,high,

and low figures for each day. The second data set was made using Twine's search API, and a set of tweets was acquired.

Text Processing: Text processing was performed on the collated messages, such as tokenization, lemmatization, andthedeletionofTwittersymbols.Tokenizationinvolves breaking down the text into individual words, or tokens, while lemmatization involves converting words to their fundamental form. The deletion of Twitter symbols involvedremovingmentions,hashtags,andURLsfromthe messages.

Sentiment Analysis: Using the tweet data, we conducted sentiment analysis using the VADER tool, which is a lexicon and rule-based sentiment analysis tool expressly intended for social media. VADER analyzes the text's polarity and intensity to provide an aggregate sentiment scoreforeachtweet.

Hybrid Data Set: After preprocessing the tweet data, the two datasets were merged to produce a hybrid dataset. The hybrid dataset consisted of stock data and sentiment analysis scores. The com_scores 1,2,3 signify positive, neutralandnegativesentimentrespectively.

Fig2:HybridDataset

Machine Learning Models: The composite dataset was used to train several machine learning models, including ensemble learning models, linear regression, LSTM, and BiLSTM. The LSTM model is a form of recurrent neural network (RNN) that is particularly adapted to time-series data. Ensemble learning integrates the predictions of multiple machine learning models to produce more accurateresults.

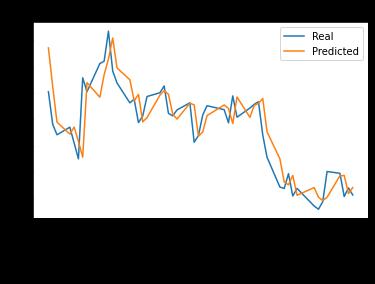

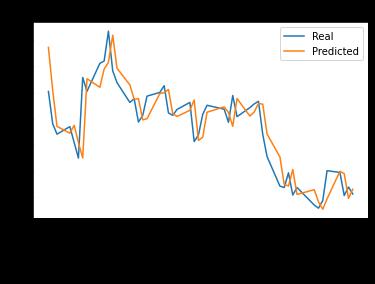

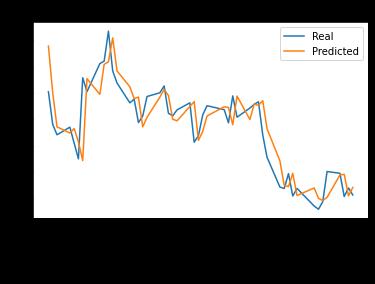

Model Evaluation: The trained models were evaluated using various metrics, such as root mean square error (RMSE) and R2 score, to assess their accuracy and consistency. The model XGBoost was selected as the final modelforpredictionasithadthegreatestperformance.

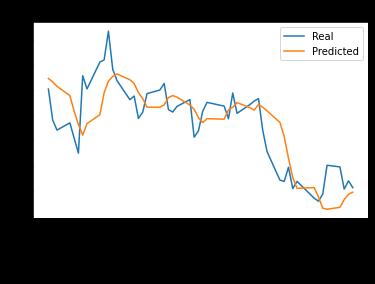

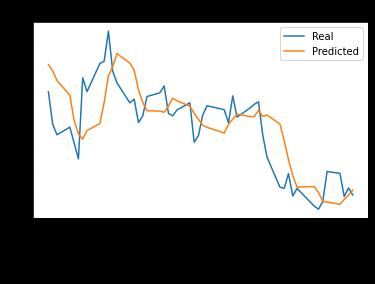

Prediction and Visualisation: Ultimately, based on the predictions made by our system, we visualized the numericformsintoagraphicalformatdepictingactualvs. predicted values. This aided to provide a greater understanding of the predicted values and how they comparetotheactualstockprices.

4. Results

Thefollowingresultswere obtainedaftertrainingvarious algorithms and models on data obtained between 202007-01and2022-06-30forthecompanyMETA.

The algorithms were evaluated using Root Mean Squared Error(RMSE)andR-Squaredscore.

5. CONCLUSIONS

In conclusion, this paper presented a novel approach for predicting stock market prices by integrating sentiment analysis and ensemble learning techniques. The hybrid approach leverages the power of sentiment analysis to capture the emotional tone of news articles and social media posts related to equities and integrates it with ensemble learning techniques to enhance the predictive accuracy.

Through the experiments conducted on historical stock market data, our proposed approach demonstrated promising results in terms of prediction accuracy and outperformedtraditionalmachinelearningmodelssuchas linear regression and decision trees. The ensemble learning techniques used, such as random forest and gradient boosting, helped to reduce overfitting and enhancethemodel'srobustness.

Additionally, sentiment analysis was found to be a valuable feature in predicting stock market prices, as it capturedthemarketsentimentandemotionsofinvestors, whichareknowntoimpactstock prices.Byincorporating sentiment analysis, our hybrid approach was able to capture both quantitative and qualitative factors that influence stock prices, leading to enhanced prediction performance.

Furthermore, we discussed the limitations of our approach, including potential challenges in sentiment analysis accuracy, data availability, and market volatility. Theselimitationsshouldbetakenintoconsiderationwhen employing the proposed approach to real-world stock marketpredictionscenarios.

In summation, our proposed hybrid approach incorporating sentiment analysis and ensemble learning techniques has shown promising results in predicting stockmarketprices.Thisapproachhasthepotentialtobe used as a valuable instrument for investors and financial analysts to make informed judgements in the stock market. Further research and experimentation can be done to refine and enhance the proposed approach and investigate its applicability in real-time stock market predictionscenarios.

ACKNOWLEDGEMENT

We wish to express our sincere gratitude to Dr. Sanjay U.Bokade, Principal, and Prof. S. P. Khachane, Head of Department of Computer Engineering at MCT's Rajiv Gandhi Institute of Technology, for providing us with the opportunity to work on our project, "Predicting Stock Market Prices with Hybrid Sentiment Analysis and Ensemble Learning Techniques." This project would not have been possible without the guidance of and encouragement of our project guide, Prof. Priyanka Bhilare, and the valuable insights of our project expert, Prof. Aditi Malkar. We would also like to thank our colleagues and friends who helped us complete this projectsuccessfully.

REFERENCES

[1] A. F. Atiya, "Bankruptcy prediction for credit risk using neural networks: A survey and new results," in IEEE Transactions on Neural Networks, vol. 12, no. 4, pp.929-935,July2001,doi:10.1109/72.935101.

[2] Adil Moghar, Mhamed Hamiche, Stock Market Prediction Using LSTM Recurrent Neural Network, Procedia Computer Science, Volume 170, 2020, Pages 1168-1173,1877-0509.

[3] Selvamuthu, D., Kumar, V. & Mishra, A. Indian stock market prediction using artificial neural networks on

tick data. Financ Innov 5, 16 (2019). https://doi.org/10.1186/s40854-019-0131-7

[4] K. A. Manjula and P. Karthikeyan, "Gold Price Prediction using Ensemble based Machine Learning Techniques," 2019 3rd International Conference on Trends in Electronics and Informatics (ICOEI), Tirunelveli, India, 2019,pp. 1360-1364, doi: 10.1109/ICOEI.2019.8862557.