International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 10 Issue: 04 | Apr 2023 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 10 Issue: 04 | Apr 2023 www.irjet.net p-ISSN: 2395-0072

Abstract On 1st of July 2017, Goods and Services Tax (GST) was launched by Government of India after many deliberations. GST was implemented with a motive of converting multiple taxes into a single tax would be very useful. In India petroleum products, alcoholic drinks and electricity are not considered under GST regime. Studies on petrol and diesel have already done, but the impact of GST on Compressed Natural Gas (CNG) has not yet done. The consumption rate of CNG in India has grown 3.3 % in 2021-22. Also in consumption of CNG, India stands within 14 globally. The study mainly focused on variations in prices of CNG and the main aim is to identifying the effect of GST on CNG if decided to let it under GST regime. So, the first objective of this study is to analyze the current trends and variation in price of CNG and to analyze the price effect of CNG after implementing GST. Second objective is to quantify the customer benefit on CNG price by implementing GST and to conduct a cost benefit analysis of GST implementation for different stakeholders. The analysis will give a clear idea about the benefits and losses occurred to government and consumers while implementing GST.

Keywords GST implementation, benefits of stakeholders,CNGpriceanalysis.

TheawarenessofmovingtowardsGSTwasproposed in the Budget speech for 2006-07 by the Union Finance Minister. In the field of indirect tax reforms in India, the introduction of the Goods and Services Tax (GST) is a very substantial step. The ill effects of cascading or double taxation in India will diminish through the implementation ofGST as it integratesa several number oftaxesofbothcentralandStatetouniteintoasingletax andoverlaythewayforacommonnationalmarket.

Compressed Natural Gas (CNG) is an environmentfriendly alternative automotive fuel. The cleaner fuel playsanimportantroleinreducingvehiculargreenhouse gas emissions and environmental pollution significantly. As its name suggests, CNG is natural gas compressed

***

Dr. Regi Kumar V. Indiaunderpressuresothatmoreofitoccupieslesservolume inyourfueltank.CNGiscompressedtoapressureof200 to 250kg/cm2.In thiscompressedform,itoccupies less than 1 per cent of its volume at atmospheric pressure. CNG differs from Liquefied Petroleum Gas (LPG) in its constituents.CNGisgaseous,consistingofabout80to90 percentmethane,whereasLPGisaliquid,consistingofa compressed mixture of propane and butane in liquid form.

CNG has following advantages: It is green fuel, safe fuel and it has high auto ignition temperature, low operationalcost,dualfacility,increasedlifeofoils

To study the impact of GST on CNG, first we want to studythecurrenttrendsofCNGonselectedperiod.Then thepreandpostGSTpricevariationisstudy.Theimpact ofGSTondifferentstakeholders isanalyzed. In orderto support this we are analyzing the price variation CNG with respect to natural gas price. To quantify the loss andbenefitsoccurredtogovernment.

In the paper titled "Technical overview of compressed natural gas (CNG) as a transportation fuel," MuhammadImranKhanexaminesthehistory,potential, and difficulties of natural gas fuel and vehicles that run onitaroundtheworld,aswellastheenvironmentaland financial implications. Technical features of compressed naturalgasqualities,storageissues,safetyissues,andits impactonengineperformance,efficiency,andemissions are covered in detail, as well as any obstacles to the adoption of natural gas automobiles. The economic, emission performance and safety aspects have been chosen as the major indicators for the comparative evaluation of natural gas as a fuel for vehicles. The findings indicated that CNG offers a number of advantages over diesel and petrol fuel, including significantcostandpollutionsavings.

The effects of producing crude oil and natural gasinemergingnationsontheeconomyandecologyare covered in Stanley Ngene's article. The purpose of

producing crude oil and natural gas is discussed in this essayalongwiththeelementsoftheseproductsthatare harmful to the environment and the general public's health. The study examined all of the procedures and end products used in the production of crude oil and natural gas, noting their effects on the environment and the general public's health in addition to emphasizing the economic gains accruing to the producing nations and their citizens. A thorough understanding of how these processes and products interact with the environment is thought to help producing companies and governments of producing nations make better decisions about how to reduce the negative effects of productionactivitiesontheenvironmentandthegeneral public'shealth.

In his article titled "Does the Indian Financial Market Nosedive Because of the COVID-19 Outbreak, in Comparison to After Demonetisation and the GST", Mishra, A.K., examined the impact of COVID-19 on the IndianFinancialmarketandcompareditwiththerecent two structural changes, namely the implementation of GST and the implementation of demonetisation. The negative stock returns were avoided using daily stock return, net foreign institutional investment, and exchange rate data from 2003 January 3 to 2020 April 20.Whencomparedtotheeffectsofdemonetizationand the GST, COVID-19 has a more negative influence on stock returns, according to Markov switching vector autoregression.

Thestudyarticle"GST inIndia:reflectionsfrom food and agriculture" by Singh, N.P., et al., tries to emphasizetheGST'sexpectedeffectsoninputpricesand thecostofgrowingvitalcrops.Aftertakingintoaccount certain presumptions and conducting a thorough study of the tax rate, the impact of GST on input prices and cultivation costs was examined, and a favourable conclusionwasreached.Whiledairyproductshavebeen added to the tax net, tax rates on machinery and equipment utilized in the dairy business have been slightly decreased. The tax incidence on agricultural processing machinery and equipment has grown. The adoption of technology, the pricing of agricultural commodities,andthecostsofinputswillallbeimpacted bythesechangesintaxrates,whichwillultimatelyaffect farm earnings. We have made an effort to emphasize potential effects of GST on input costs and the cost of growingessentialcropsinthisarticle.

The world's need for transportation has tremendously increased due to rising urbanization and industrialization, which has also resulted in a concentration of automobiles in major cities. With more than 19 million natural gas cars operating globally and ever-stricterpollutionregulations,naturalgasisgaining popularity as a transportation fuel. This essay discusses the history, future, and difficulties of using compressed

naturalgasasatransformationfuelgloballyaswellasits environmental and financial implications. Technical features of compressed natural gas qualities, storage issues, safety issues, and its impact on engine performance, efficiency, and emissions are covered in detail,aswellasanyobstaclestotheadoptionofnatural gas automobiles. The economic, emission performance and safety aspects have been chosen as the major indicators for the comparative evaluation of natural gas as a fuel for vehicles. The findings indicated that CNG offers a number of advantages over diesel and petrol fuel,includingsignificantcostandpollutionsavings.

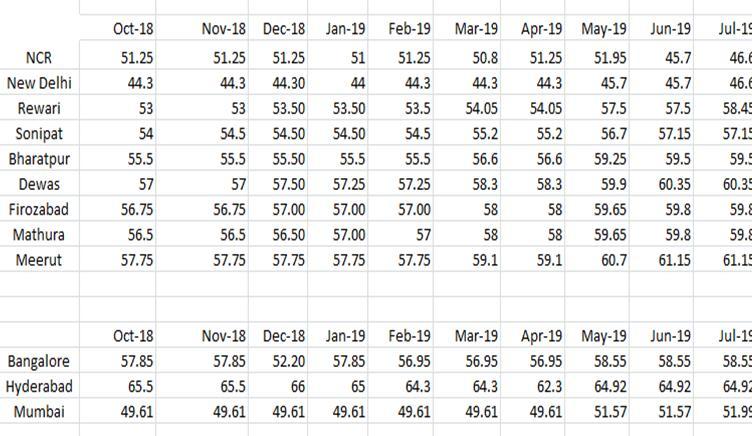

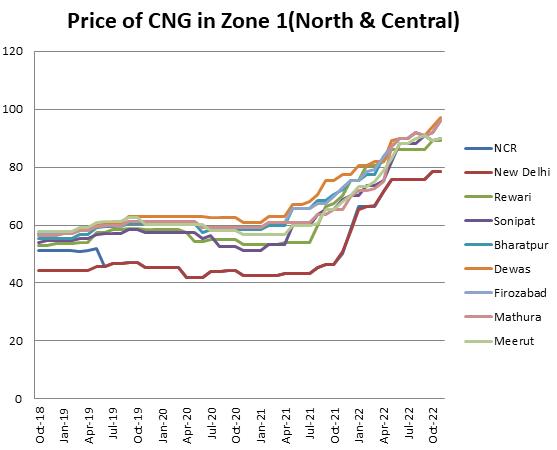

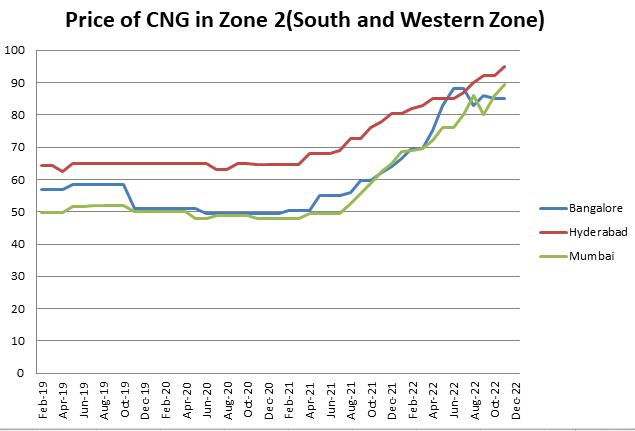

The data collection is done for study is from 2018 to 2022. The price of CNG is collected for selected cities: National Capital Region (NCR), New Delhi, Rewari, Sonipat, Bangalore, Dewas, Mumbai, Bharathpur, Hyderabad, Firozabad, Mathura, Meerut. And these 12 citiesarefurtherdividedinto2zones:Zone1andZone2. Zone 1 comprises of NCR, New Delhi, Rewari, Sonipat, Bharatpur,Dewas,Firozabad, Mathura andMeerut.Zone 2comprisesofBangalore,HyderabadandMumbai.

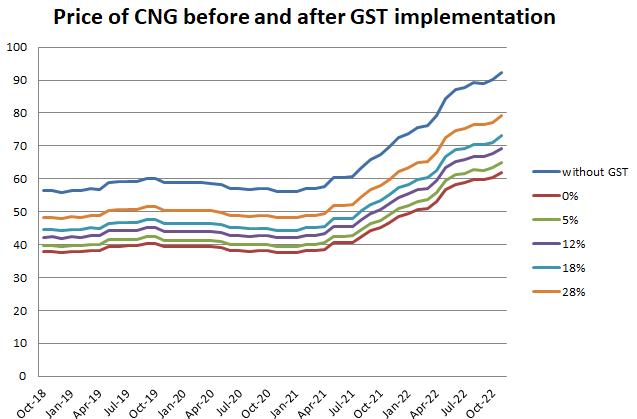

GST is implemented to the current price of ATF and CNG.Therearemainly5GSTslabs.Soweimplementthe currentpricesofATFandCNGoneachslabandcheckthe price variation. The 5 GST slabs that are available in presentGSTschemesare0%,5%,12%,18%and28%.

ForimplementingGSTfirstwefindoutthebaseprice ofeachfuelwithoutanytaxes.Forthatweneedtostudy thecurrenttaxstructureofATFandCNG.Thesalestaxes will be varying in each state. The sales tax is also called Value Added Tax (VAT). There is customs tax which is commonforallprices.

So we can conclude that there are 3 taxes mainly availabletoGSTexemptedproducts:Customstax,Excise tax and VAT. So for applying GST first we want to avoid

the present taxes and then different slabs should be applied.

For example, if a product cost is Rs.100 which includes multiple taxes of 30%( which includes customs tax,excisetaxandVAT).SoforapplyingGSTfor0%slab, we should exclude the 30% tax. So a price of Rs.70 is obtained without GST. Rs.70 itself be the 0% slab. While applying 5% slab, multiply the amount Rs.70 with 0.05 andgetthepricefor5%slabGSTprice.In a similarway the12%,18%and28%slabsarefindout.

Cost Benefit analysis is done to ascertain that the losses and profits occurred to the stakeholders. In the study 3 main stakeholders are considered: Consumer, State government and Central Government. For finding theC/Bratiofollowingequationsaretobedone.

Forconsumers, C/Bratio=presentcost/costafterGST

ForCentralGovernment,

C/Bratio=RevenueafterGST/Presentrevenue

ForStateGovernment, C/Bratio=RevenueafterGST/Presentrevenue

IfC/Bratio>1,efficient

IfC/Bratio<1,inefficient

Soiftheratioislessthan1,itindicatesthesystemor the stakeholder is having loss and in similar way, if the ratio is greater than 1, it indicates the stakeholder is having profit. And if the ratio is equal to 1, it indicates that the system is neither profit nor loss, the system is stable. From this one can identify whether the system is inprofitorloss.

From the results and discussion the quantification of profit and loss to state and central government can be computed. From the steps mentioned in methodology theobjectivescanbeaccomplished.

PricevariationofCNGisdonebyplottingpriceofCNG against the time period. From doing so the price variationsand trends of CNGpricecan be analyzed. The period of price hike taken place is marked. The reason behind the hike can be analyzed by analyzing the variationsofprice.

The price variation of CNG during the selected period and places are done in figure 1. From the figure 1, it is clear that during the periods of COVID-19 and RussiaUkraine war the price of CNG was more or less slightly increasing. But after their effects, the price increases steeply.

The price variation of zone 2 is figured in figure 2. From the graph, it is similar to the zone 1 scenario. In Bangalore there shows a highduringApril 2022 than in othercities,butdecreasestolowerpriceafterwards.The selectedcitiesforCNGpricevariationinzone2isvaried widelythanzone1cities.

Fromanalysingbothzones,thesituationissimilar.So the combined effects of GST implementation can be done. The results will not alter by combining the two zones.

There are 5 GST slabs in current Indian tax system. They are 0%, 5%, 12%, 18% and 28%. The 0% GST meansthereis0%taxforthecommodity.Sothe0%GST

slab is not considered for calculation. In that slab the revenuetotheGovernmentwillbenull.

loss. Thus by knowing the ratio, one can confirm the statusofsystem.

Thepricevariationbeforeandaftertheapplicationof GST is shown in figure 3. From the figure it is seen that even by applying the highest prevailing GST slab, the price ofCNG will be less.So theconsumers will get CNG at lower price than current situation. The topmost line (darkblue)showsthepriceofCNGbeforeapplyingCNG. Other lines below that are the price of CNG after applyingGSTinvariousslabs.

There are different tax structures for different commodities.ForthepriceofCNG,thepricestructureis shown in table 2. From the table one noticeable thing is that,thereis0% taxinDelhi.Thisisdone topreventing the worse air pollution. CNG is a fuel which emits less pollution. So for promoting the use of CNG, Delhi government,exemptsthetaxonCNG.

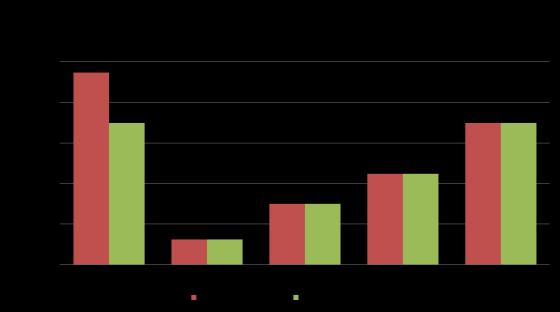

The revenue obtained by state and central government before and after applying GST is expressed in bar diagram. The maroon colour indicate the revenue obtained by central government and green colour indicates the revenue obtained by state government. BeforeapplicationofGST,therevenuesobtainedbyboth governments were different, but after applying GST, the revenue obtained by both the governments is equal. If the GST slab is 5%, then 2.5% of tax goes to Central government and rest 2.5% goes to state government. The tax is divided to 50% and given to both governments.

Toascertainthelossandprofit,theCostbenefitanalysis is done. It confirms whether the system is in profit or

Fromthetable3,theCostbenefitratiocanbefoundout. Fromthetable,forconsumerstheratioisgreaterthan1 and it implies that the system is profitable. The consumer will get the fuel at lower cost when GST is implemented. But for both the central and the state government, the revenue obtained through the sales of CNG will decreased considerably. The next step of our study is to quantify the loss obtained by the central and stategovernments.

Table4:PercentageofrevenuelossbyGovernment

Fromtable4,thelossobtainedbybothcentralandstate government is visible by the implementation of GST. As theslabgoesincreasingthelosspercentagewillalsoget reduced.ForStategovernment,in28%slab0istheloss percentage. This is because without applying GST, the stategovernmentisnowlevying14%ofGST.Thisisthe reason the value zero comes in state government loss percentage.

The implementation of GST is considered to be a boon. FromtheworkdoneitisconcludedthatthepriceofCNG is going on increasing day by day. By analysing the variationofitsprice,itisseenthatduringCOVID-19and Ukraine war period, the price of CNG increased slowly. After the effect, the price increases rapidly towards the endof2022.

From applying GST one can view that the price of CNG decreases considerably. This means that the current prevailing tax for CNG is much higher than 5 slabs of GST. Hence by implementing GST government (both central and state government) will have to face a loss and the customers will enjoy the benefits as the price goesdecrease.SobytheapplicationofGSTthecommon people will be benefited. As the CNG price decreases by applying GST, the people will prefer the usage of CNG And thus air pollution can also be reduced as in Delhi. Theresultsisascertainedbythecostbenefitanalysis

[1] Mishra, A.K., Rath, B.N. and Dash, A.K., (2020) Does the Indian financial market nosedive becauseoftheCOVID-19outbreakincomparisontoafter demonetisation and the GST. Emerging Markets Finance andTrade,56(10),2162-2180.

[2] E. M. Amarfio, M. Gyagri and S. A. Marfo., (2017) Determining the Key Factors Affecting Global PricingofCrudeOilUsingTrendAnalysisandNumerical Modelling. Ghana Journal of Technology, Vol.2,No. 1, pp. 82.

[3] Esha Bansal., (2018). A Study on Impact of GST on Indian Economy. International Journal of Research and Innovation in Applied Science (IJRIAS) VolumeIII,IssueII,ISSN2454-6194.

[4] Stephen P. A. Brown and Mine K. Yücel., (2008) What drives natural gas price? The energy journal,ISSN0195-6574-EJ-Vol29-No2-3.

[5] SoheilSibdari.et.al.,(2018).Ontheimpactof jet fuel cost on airline’s capacity choice: Evidence from the U.S. domestic markets. Transportation Research Part E:LogisticsandTransportationReview,Volume111.

[6] B. Gaudenzi and A. Bucciol, 2016. Jet fuel price variations and market value: A focus on low-cost and regular airline companies, Journal of Business Economics and Management, ISSN 1611-1699/eISSN 2029-4433,Volume17(6):977–991.

[7] Akshay Bagde and Syed Aamer, 2015. A review on implementation of CNG on Two Wheelrs, International Journal for Scientific Research & Development,Vol.3,Issue10.

[8] Peter Morrel and Willaim Swan,2006. Airline Jet Fuel Hedging: Theory and Practice. Department of Air Transport, Cranfield University, Review paper.DOI:10.1080/01441640600679524.

[9] Dr. Sajjan Choudhury and Aniket Pundir, 2020. A systematic review on GST in India, The Mattingley Publishing Co., Inc. Volume 83 Page Number: 15920–15924

[10] Stanley Ngene et al., Environmental and Economic Impacts of Crude Oil and Natural Gas Production in Developing Countries, International Journal of Economy,Energyand Environment 1(3):64-73.

[11] Marte Ulvestad & Indra Overland (2012): Natural gas and CO2 price variation:impact on the relative cost-efficiency of LNG and pipelines, InternationalJournal of EnvironmentalStudies,69:3,407426.