Data-Driven Approach to Stock Market Prediction and Sentiment Analysis

Shreya Bamane1 , Mitali Belge2 , Shweta Sharad Nikam3 , Ankita Umale4 , Monica Charate5

Shreya Bamane1 , Mitali Belge2 , Shweta Sharad Nikam3 , Ankita Umale4 , Monica Charate5

1, 2, 3 Computer Science and Technology, Usha Mittal Institute of Technology, SNDT Women’s University

4 5Professor, Dept. Computer Science and Technology, Usha Mittal Institute of Technology, SNDT Women’s University

Abstract - Predicting stock market prices has been an interest- ing topic because of high gains against investment over a short period of time, therefore it interests analysts and researchers for a long time. Stock prices are hard to predict because of their highly volatile nature which depends on diverse political and economic factors, change of political factors, investor sentiment, and many other factors. The method of predicting stock prices that are based on historical data or textual information alone has been proven to be insufficient. Existing studies studied by analysts in sentiment analysis have found that there is a very strong correlation between the movement of stock prices and the publication of news articles. Several sentiment analysis studies have been attempted at various levels using different machine learning algorithms such as Random Forest, etc. The prediction system in this paper shows both the results of predicting past data using Recurrent Neural Network(RNN) with Long Short- Tem Memory(LSTM) i.e RNN-LSTM algorithm and sentiment analysis using Support Vector Machine (SVM) algorithm to improve the accuracy of stock price prediction.

Key Words: RNN-LSTM, SVM, stock market, sentiment analysis

1. INTRODUCTION

Thefinancialmarketisdynamicbecauseitkeepschanging and is a composite system. This is a place where people can buy and sell currencies, stocks, equities and derivatives over virtual platforms or apps supported by brokers. The stock market has allowed investors to own shares of public companies through trading, exchange or overthecountermarkets.Thismarkethasgiveninvestors a great chance of gaining money and having an opportunity to live a prosperous life through investing smallinitialamountsofmoneywhichislowriskcompared to the risk of opening a new business or the need for a high salary career that demands a great amount of effort. Stockmarketsareinfluencedbyfactorswhichareinlarge amounts causing the uncertainty and change in the market.

Thestock marketappears in every newspaper, every day. Since it is quite often intensively discussed people are always keen on knowing what will happen. People could havegoodreturnsontheirinvestmentsifpropermethods and algorithms are used to predict. Previous methods of stock predictions involve only the use of a single method that is using historical data. But stock markets are so volatilethattheyaremainlyaffectedbyeventshappening in the world. Therefore sentiment analysis of a stock is also required. This paper combines two things, one is historicaldatatopredictthepossiblevaluesofstocks and two,sentimentanalysistounderstandthesentimentfora company,givinganinvestorabetterunderstandingofthe stocksfuture.Inthisproject theproblemissolved, with a system constructed to predict news polarity which may affectchangesinstocktrends.

Time-seriespredictionwhichuseshistoricaldataisacommon technique widely used in many real-world applications such as weather forecasting and financial market prediction. It uses continuous data that is the historical data over a period of time to predict the outcome of the next unit of specified time period. Numerous time series forecasting algorithms have been effective in practice. The most common algorithms are currentlybasedonrecurrentneuralnetworks(RNNs)and a special form, Long-Short Term Memory (LSTM), it is a type of RNN. The stock market is a representative area that represents time series data, and many researchers havestudieditandpresentedvariousmodels.

For sentiment analysis Support Vector Machine (SVM) algorithm is used, it is a machine learning algorithm that analyzes data and recognizes patterns or decision boundaries in a data set, and is primarily used for classification and regression analysis. SVMs can handle multiple different types of variables, this nature of SVM makesitthepreferredalgorithmforsentimentanalysis.In Module 2, of this paper SVM algorithm is used to predict the sentiment of a particular company in the market on thebasisofnewsheadlines.

2. RELATED WORK

2.1 Literature Survey

TheStockMarketPricePredictionUsingLSTMRNN [1]hascreatedthesystemforstock pricepredictionusing RNN with LSTM. It takes the historic time series data of different stocks from Yahoo Finance. The data is preprocessed and regularized. The set LSTM model is trained with the train data, the optimizer used is Adam optimizer. After the training is done, the LSTM model is tested using test data of different stocks. The design has enforced LSTM for stock price vaticination and it has redounded in RNN- LSTM giving better results than the traditional machine learning algorithm. The Stock Market Prediction using ANN [2] proposed a design that tries to prognosticatestockpricesusingmachinelearningwayson the NSE. It uses direct retrogression and SVM regression. Linear regression is used for prognosticating the open price of the stock for the coming day using the close price ofthestockfortheformerday.SVMregressionisusedfor prognosticating the difference between close and open prices of the stock for the coming day. They trained the ANNmodelbyusingstockdata.colorfulfeaturessimilaras stochastic pointers, moving pars, and RSI are uprooted from the literal stock data. External factors like foreign exchange rate, NSE indicator, moving parts, relative Strengthindicatoretcareusedtogetaccurateresults.The datasetisalsodividedintotrainingandtestingsets which are used for training and testing the delicacy of the ANN model. The design attempts to prognosticate whether a stockpriceoccasionallyinthefuture willbeadvancedorlowerthanit’sonagivenday.

TheSentimentAnalysisofTwitterDataforPredictingStock Market Movements [3] have applied sentiment analysis and supervised machine learning principles to the tweets taken from twitter and dissected the correlation between stock request movementsofa companyandsentimentsin tweets. This design employed two different textual representations, Word2vec and Ngram, for assaying the publicsentimentsintweets.Thentheyactuallycontributed tothefieldofsentimentanalysisoftwitterdata.Sentiment analysisisthetaskofjudgingopinioninapieceoftextbook as positive, negative or neutral. The disadvantage of this design is that they’ve considered only twitter data for assaying people’s sentiment which may be poisoned because not all the people who trade in stocks partake theiropinionsontwitter.

The Twitter Sentiment Analysis Approaches A Survey [4] hassurveyeddifferentexplorationpapersofdifferentalgorithm and styles used to achieve sentiment analysis in twitter.Social mediahasproventohaveitsaffectonstock prices. In this check, they’ve distributed the approaches into four orders machine learning, wordbook- grounded,

mongrel (combines machine learning and wordbookgrounded approaches) and graph- grounded approaches. Over 40 papers of recent explo- ration on TSA ( Twitter Sentiment Analysis) were compactly reviewed and categorized. From the discussion it was con- cluded that TSAwillbeanactiveexplorationareainthecomingtimes.

In An SVM-based approach for stock market trend prediction [5] they have used Hidden Markov Model to predict the close price ofthestocks of next day. They haveuseda ton of historical stock prices data of companies that are Apple Inc., IBM Corporation, TATA Steel and Dell Inc. Inputs that were given were the High Price, Low Price, OpenPriceandClosePriceofthenextday.Themodelhad been first trained for 7 months. Model testing was done usingMAPEvalues.

InStockmarketpredictionusinghiddenmarkovmodels

[6] they have taken the SVM based way for the prediction priceofstockmarkettrends.Theproblemhasbeensolved in two parts, i.e. selection of features and direction predictionoftrendsthataregoingoninmarket.Theyhave used SVM correlation for selection of the features which affects the price. Linear SVM has been applied to the data seriestopredictdirection.Thesystemhasshowntoselect good feature and control the overfitting that occurs on stockmarketprediction.InEnsemblemodelforstockprice movementtrendpredic-tionondifferentinvestingperiods [7] first they have selected the most relevant features for the prediction outcome of the stock price by using calculations of the maximal information coefficient. They have built their assembler model by using the three different outstanding classifiers on stock market trend prediction SVM, Random forest and AdaBoost have been intelligently named as the SRAVoting. Their model has been used on Chinese Stock Market and the conclusion is that SRAVoting gives higher accuracy than SVM but at the same timelesserbuy/sellstrategiesthanSVM.

H. Gunduz, Z. Cataltepe and Y. Yaslan [8] have used deep neuralnetworktechniquesforstockpriceprediction.Similarly, in Stock market prediction using an improved training algorithm of neural network [9], they have suggested some further improvements for stock price predictionusingneuralnetworksusingagoodperforming training algorithm which they have designed by themselves.InStockindexpredictionusingregressionand neuralnetworkmodelsundernonnor-malconditions[10] have suggested techniques themselves on handling a nonnormalsituationwhichoftenrisesduringtheperformance of the system and cause great disruptions or lead to incorrectpredictions.InStocktransactionpredictionmodelling and analysis based on LSTM [11] they have conducted similar works and have designed a model for

applyingtheLSTMtostockpredictionwithagoodamount ofscopeforimprovingthestockpredictionaccuracy.

InEvaluationofbidirectionalLSTMforshortandlong-term stockmarketprediction[12]theyhavefurthercontributed to the field by creating better staging experiments and simula- tions for having good feasibility of applying deep learningtechniquesforthepredictionofstockprice.

In[13]theyhaveshownthatANNmodelworkswellevenif there is no clear relation between attributes and output. But disadvantages that are unignorable are that time required for prediction is far more than other methods. ANNfacesanissuewithoverfittingproblem.

AcomparativeliteraturesurveyisdoneonSupportVector Machine to prove that results of ANN are more accurate than

SVM. But disadvantages found are only attributes having clear relationship can be supplied as attributes[14]. If not thentheaccuracywillbereduced.

InPredictingtheFuturewithSocial Media.[15]theyfound out that there is a correlation between trading volumesof stocks tradedinNASDAQ-100and queryvolumes(i.e.,the number of user requests submitted to search engines on theInternet).

In Twitter mood predicts the stock market[16], they conductedaresearchinwhichtheirfindingswerefoundabout DowJonesAverageIndex,inthattheynoticedthatthereis a negative correlation between sentiments like hope, fear andworryintwittertweets.

In Sentiment Analysis on Twitter with Stock Price and Significant Keyword Correlation[17] they have used Pearson correlation coefficient for investigation of the correlation ofsentiments ofthe public withstock increase anddecreaseforstocks.

B.ExistingSystem

The Existing system for Stock Price Prediction [1] uses RNN with LSTM. It uses Historical Stock Data i.e. time series dataset of the stock for prediction. A time series datasetisthedata takenina seriesofdata pointsindexed in time order. This dataset works well with the RNN for prediction. In this System, we have taken all the required data from Yahoo finance to collect the stock datasets of various companies such as Apple, Google, and Tesla. The Datasetisthenpreprocessedwhichincludesdata cleaning and normalization. The collected Historical Stock Data is used to get Predicted Stock Prices for n Data Points. Then AdjacentClosevaluesareretrievedfromData.TheDatais Normalized using the Adjacent Close values. After the Normalization of the Data, the Data is then split into train data and test data. The Train model is obtained using the

RNN-LSTM input layer and hidden layers, using the loss function and the optimizer. Then the obtained model is trainedandtestedandisusedtoplotagraphofPredicted v/sTrueData.

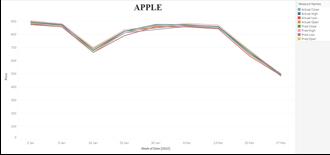

The model is tested using varied trial values for loss functionofmeansquarederrorandtheAdamoptimizer is used- Adam is an optimization algorithm which is used to update the weights of the network iterating based on trainingdata.SeveralLSTMarchitecturesaretestedtofind the best model with the lowest loss value. The loss observed,whichisthelostvaluefortheLSTMarchitecture after three epochs, is 0.5770. The loss observed for the Deep LSTM after three epochs is 3.1464e−04, which is quite better than the other models. As the LSTM architecturehasgotthebestlossvalue,thebehaviorisalso checked by varying the inner architecture, i.e. the number of cells and the number of layers keeping constant the activationfunctionofthehiddenlayer,herehiddenlayeras hyperbolic tangent function and of the output layer as the rectifiedLinearUnitfunctionareobservedtogivethebest results.ThentheHistoricaldataofApple,GoogleandTesla are tested using 10 epochs and the graph of Predicted vs True Data is plotted for each of the stocks. The results show that the RNN-LSTM model is prone to give more accurate results than the traditional machine learning algorithms.

3. RELATED WORK

In this project, two main algorithms are used, Long Short TermMemory(LSTM)andSupportVectorMachine(SVM).

3.1 Long Short Term Memory (LSTM)

Long Short-Term Memory (LSTM) [18] was introduced by Hochreiter and Schmidhuber in 1997 to cope with the problem of long-term dependencies. LSTM is capable of processingsequentialdata.Averylargearchitecturecanbe successfullytrainedusingLSTMthususedindeeplearning. LSTM is a type of RNN network structurewhich has three “gate” structures. The three gates placed in an LSTM unit arecalledinputgate,forgettinggateandoutputgate.While information is used in LSTM’s network, it can be selected by rules. One gate is dedicated for reading out the entries from the cell, the output gate. Another gate like a input to theprogramisneededtodecidewhendatashouldberead intothecell,thisiscalledtheinputgate.Finallyagatethat will help to reset the content collected by the cell, that is the forget gate. This design was used in order to decide when to remember and ignore inputs at the hidden state. Only the information accepts to the algorithm will be left, and the information that does not conform will be forgotten through the forgetting gate. By using gates they were tremendously able to improve memory capacity and controlthememorycell.

Min-max normalization (commonly referred to as feature scaling) performs a linear transformation on the original data. This method gets all scaled data in the range (0, 1). Theformulatoachievethisis:

Inthisproject,historicalstockdatatablecontainingtheinformation of open, the high, low, close, volume of a particular day to predict the coming day’s stock prices is taken.Thedatainthedatasetareexplainedasbelow

OPEN: The price of the first trade for any company or a scriptinastockexchangeisitsopeningpriceforthatday.

CLOSE: The volume ladened normal of all the trades happenedduringthelasthalfanoftradingprice.

HIGH: The loftiest price for which a stock is traded on a scriptinaday.

LOW: The smallest price for which a stock is traded on a scriptinaday

VOLUME:Numberofstockstradedinaday

Here, LSTM in layers with timesteps of 120 days is being used.

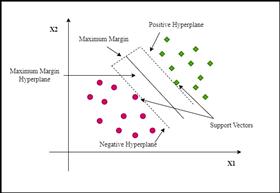

3.2 Support Vector Machine (SVM)

Support Vector Machine or SVM [19] is a Supervised learningalgorithm,whichisusedforClassificationaswell as Regression problems. Primarily, it’s used for ClassificationproblemsinMachineLearning.Developedat AT&T Bell Laboratories, SVMs are one of the most robust prediction styles, being grounded on statistical learning frameworks. The purpose of the SVM algorithm is to produce the best line or decision boundary that can insulate n- dimensional space into classes so that it can effortlessly put the new data point in the correct order in the future. This best decision boundary is called a hyperplane. SVM chooses the extreme points vectors that help in creating the hyperplane. These extreme cases are called support vectors, and hence the algorithm is nominatedasSupportVectorMachine.SVMcanbeoftwo types

LinearSVM: LinearSVMisusedforlinearlydivisibledata, whichmeansifadatasetcanbeclassifiedintotwo classes by using a single straight line, also similar data is nominated as linearly divisible data, and classifier is used asLinearSVMclassifier.

Non-linear SVM: Non-Linear SVM is used for non-linearly separated data, which means if a dataset can not be classified by using a straight line, also similar data is nominated as non-linear data and classifier used is called asNon-linearSVMclassifier.

The data is news captions, attained using a web news scraper targeting a particular stock. The data is also collected from the news scraper, it's pre-processed to be used for the bracket. After the word vectorization of the data is completed, the training dataset is also fed to the SVM algorithm with a direct kernel for the classification andtraining.alsothetestdatasetisusedwiththeSVMfor predictionofthesentiment.

4. PROPOSED WORK

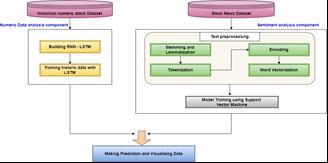

Fig

:MechanismofProposedSystem

For years, research has been done on predicting stock prices based on historical stock price data alone. In this system, financial news articles from well-known sources are used to avoid fake news that may be prevalent on social media. It includes both stock price prediction and sentiment analysis. This approach is better because

financial news related to the company has a significant effect on its stock price. Hence, taking into consideration the financial news of a company instead of only considering the past stock prices can lead to a better prediction system. This system will give better accuracy andwillberobustascomparedtotheothersystems.This system uses Recurrent Neural Network with its special type Long Short Term Memory (LSTM) for the historic data prediction and Support Vector Machine for the sentimentanalysispart.

This section describes each component of the proposed model:

In the historic data analysis component, the stock related dataset of companies will be taken from Yahoo Finance. Thisdatasetfortherespectivecompanyincludestheopen, close,highandlowvaluesforagivenday.Itwilltake120 days of stock data of the company. Further it divides the data into two parts, training data and testing data, where 75% of the data will be used for training and 25% of the data will be used for testing. Then the data is preprocessed, i.e. feature scaling, creating an array data structure to store the data. Now as the dataset is ready it can be used for the RNN- LSTM model and train the historic data with LSTM and predict the output. The outputwillbeplottedintheformofagraph.

In Sentiment Analysis component, the analysis of stock newsdataisperformedasfollows:

Fornewsdata,theobjectiveistoclassifynewstobeeither positive or negative sentiments. So news headlines are extracted from the websites. Then these headlines are preprocessed, followed by news classification using the SupportVectorMachinealgorithm.

Thefollowingsectiondescribesthedetailsoftheproposed steps.

Text preprocessing: There are a several preprocessing stepsthatareperformedasfollow:

Stemming:Porterstemmerisappliedonthedatatoreturn each word to its stem and remove suffixes such as (-Ed,ing,-ion…etc.) to reduce the complexity in the document and minimize the processing time which improves the modelperformance.

Lemmatization: It is a text normalization technique that switches any kind of a word to its base root mode. Lemmatization is mostly responsible for grouping or categorizing different inflected forms of words into the root form, which has the same meaning (Caring returns Care).

Tokenization: Each news article or financial report document is split into meaningful words called tokens

(Forexample,thetext“Itisraining”canbetokenizedinto ‘It’,‘is’,‘raining’).

Encoding: Text encoding is a conversion process to convert meaningful text into number vector representation so as to preserve the context and relationship between words and sentences, such that a machine can understand the pattern associated with any textandcanmakeoutthecontextofsentences.

Vectorization: It is a classic approach of converting input data into vector form to reduce the complexity of dealing withtextdata.

After data preprocessing, the Support Vector Machine features algorithm is used. Each headline is labeled as positive or negative. Then, the feature extraction is done and SVM is trained to predict the sentiment on news headlines.

4.1 Workflow of Proposed Model

Fig -3:WorkflowDiagram

TheStockMarketTrendPredictionandAnalysissystemis divided into two major modules. The first module is Historic Data Prediction and the second module is the Sentiment Analysis. Investors will therefore benefit from an automated system that forecasts stock prices. An automatedsystemcangatherfinancialnewsrelatedtothe companies of interest in real time and can execute a machine learning model on those data to predict the sentiment,alongwithhistoricalstockpriceinformation,to

predict price. The workflow for both these modules is explainedindetailbelow:

1) Historic Data Prediction: Historicdataanalysisisan inevitable part of stock market prediction. For this system, historical stock price data is used. Dataset of respectivecompaniesisgatheredfromYahooFinance website which includes the open, close, high and low values for a given day. The system takes 120 days of stockdataofthecompany.Furtheritdividesthedata into two parts, training data and testing data, where 75% of the data is used for training and 25% of the dataisusedfortesting.Thesystemthenpreprocesses the data i.e feature scaling, creating an array data structure to store the data is executed. After the preprocessingthedatasetisreadyfortheconstructed RNN- LSTMmodel,fortrainingtheLSTM model with historic data and predict the output. The output of thismodelwillbethenextday’sopen,close,highand lowpricesofaparticularstockthatarepredicted.

2) Sentiment Analysis: Sentiment analysis is a crucial component of this approach because the output of this module is used to determine the trend of a specific stock. Social media sentiment analysis is a great source of data and can offer insights that can showpositiveornegativeviewsonstocksandtrends.

Inthismodule,newsheadlinesareextractedfromthe web and the data is pre-processed and cleaned (i.e. Stemming, Lemmatization, Tokenization). The input for this module is the news headlines of the stock, each headline is then classified as positive, negative andneutral,afterwardsthefeatureextractionisdone and then the data is used to train the Support Vector Machinetopredictthesentiment.

5. IMPLEMENTATION DETAILS

The Dataset is gathered from Yahoo Finance website for thehistoricalstockpricesofcompanies.

The first dataset is to train the RNN-LSTM model and the second dataset is to test and predict the values. The trainingdatasetwouldhave5yearsofdata,whichisfrom 1stJanuary2017to1stJanuary2022.TheTestingdataset wouldhave120daysofdatathatisfrom1stJanuary2022 to 1st May 2022. 120 days period is used for testing because the average price of a particular stock is calculatedfor120daysandasitisagoodpointinbetween long and short time periods. After all the unnecessary columnsaredeletedandonlytheoneswhicharerequired arekeptwhich areopen,high,low,closeandvolume.The codeisexecutedinGoogleColabandthenthecsvfilesare uploadedtothesessionstorage.Thenthelibrariesnumpy, matplotlib.pyplotandpandasareimported.

The training set is then imported from session storage to print it. Feature scaling is the process of normalizing the rangeoffeaturesinadataset.Thedatasetsusuallycontain features that are varying in magnitude, range and units. Therefore, for this machine learning model to interpret these features on the same scale feature scaling is implemented. After feature scaling, RNN-LSTM model is constructed.InthistheLSTMlayersareaddedtothestack with dropout out regularization. Then model is then trainedandtestedwithtrainingandtestingdatasetwhich were imported. The predicted values are visualized using graphsforclarityandbetterunderstandingoftheresults.

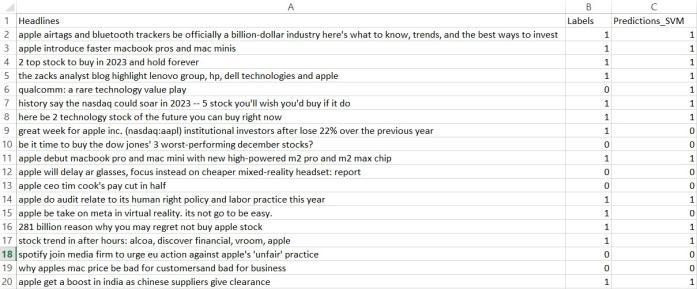

Sentiment analysis module first collects news headlines from the website www.finviz.com[20]. This data is collected in an excel sheet and then it is labeled into two labels: label1

= negative; label 2 = positive. This labeled data then goes through word preprocessing: stemming, lemmatization, word vectorization. After the data is preprocessed it is split into train and test datasets where the ratio of train and test data set is set to 80:20 respectively. This data is then used to train and test the SVM algorithm for sentimentanalysis.

6. RESULTS

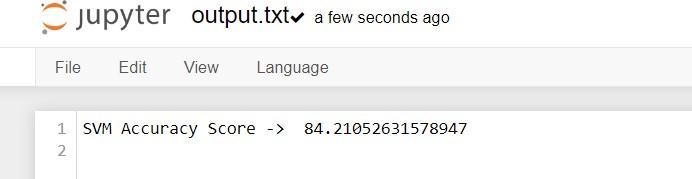

The module 1 of the system results a graph of the company stock created on the basis of prediction value from the RNN-LSTM model. The module 2 of the system which performs sentiment analysis results into the sentiment prediction of news headlines using the SVM machine learning algorithm to predict sentiment as negative or positive for a particular headline and the accuracyforapplestock.

Both modules are incorporated in the website for the consumer. The consumer first has to sign up to use the system. After that they can search for the company in the searchbarwhichtheywanttoknowabout.

7. CONCLUSION

Theaimofthissystemistoanalyzethehistoricdataofthe stocks, and train the machine learning algorithm with it andmakepredictionsonthefuturetrendofthestockand Taking the sentiments into consideration via news headlines and perform sentiment analysis on them using SVM machine learning algorithm and give the current sentimentaboutthestock.Unliketraditionalstockmarket forecasting systems, the new approach incorporates the sentimentofthestock marketparticipantsvia newsfeeds andmovingaveragesofstockprices.Thiswebapplication would help the user to take in consideration two factors for a particular stock i.e. the future trend and the sentiment for it, before considering making a decision for investment in stock market. This system would be useful foruserswhoareunawareofthestockmarket.Thishelps the new users to make a decision who don’t have go throughthehassletotakealookintothehistoryofastock to make an investment and research the news about it as theycanusethissystemtoachievethateasily.

8 FUTURE WORK

Thefutureworkforthissystemistoimprovetheaccuracy of the stock prediction using more hybrid algorithms as they might yield better accuracy. A feature like Risk analysiscanbe addedtocheck how performance of other stocks affect a particular stock, which can be used to consider the future of the stock. More visualization tools can be added for more pictorial representation of the predictions, which would make understanding the stock trend more understandable. A combination of results can be used to produce a more realistic and hybrid result for prediction, that will give more points to take into consideration for making an investment as well as analyzingthestock.

REFERENCES

[1] K. Pawar, R. S. Jalem, and V. Tiwari, “Stock Market Price Prediction Using LSTM RNN,” in Emerging Trends in Expert Applications and Security, ser. Advances in Intelligent Systems and Computing, Springer,vol.841,2018,pp.29–38.

[2] M.Gurjar, P. Naik, G. Mujumdar, andT. Vaidya, “Stock market prediction using ANN,” International Research Journal of Engineering and Technology, vol. 5, no. 3, pp.2758–2761, 2018.

[3] V. S. Pagolu, K. N. Reddy, G. Panda, and B. Majhi, “Sentiment analysis of Twitter data for predicting stock market movements,” in 2016 international conference on signal processing, communication, power and em- bedded system (SCOPES), 2016, pp. 1345–1350.

[4] O. Adwan, M. Al-Tawil, A. Huneiti, R. Shahin, A. A. Zayed, and R. Al-Dibsi, “Twitter sentiment analysis approaches:Asurvey,” International Journal of Emerging Technologies in Learning (iJET), vol. 15, no. 15,pp. 79–93, 2020.

[5] Y.-H. Lin, H.-W. Guo, and J. Hu, “An SVM-based approachforstockmarkettrendprediction,”in Neural Networks (IJCNN), The 2013 International Joint Conference on,IEEE,2013,pp.1–7.

[6] A. Gupta and B. Dhingra, “Stock market prediction usinghiddenmarkovmodels,”in Engineering and Systems (SCES), 2012 Students Conference on, IEEE, 2012,pp. 1–4.

[7] J.Yang,R.Rao,P.Hong,andP.Ding,“Ensemblemodel for stock price movement trend prediction on different investing periods,” in Computational Intelligence and Security (CIS), 2016 12th International Conference on,IEEE,2016,pp.358

361.

[8] H.Gunduz,Z.Cataltepe,andY.Yaslan,“Stockmar-ket direction prediction using deep neural networks,” in 2017 25th Signal Processing and Communications Applications Conference (SIU),IEEE,2017,pp.1–4.

[9] M. Billah, S. Waheed, and A. Hanifa, “Stock market prediction using an improved training algorithm of neuralnetwork,”in 2016 2nd International Conference on Electrical, Computer & Telecommunication Engineering (ICECTE),IEEE,2016,pp.1–4.

[10] K.V.SujathaandS.M.Sundaram,“Stockindexprediction using regression and neural network models under non normal conditions,” in INTERACT-2010, IEEE,2010,pp.59–63.

[11] S. Liu, G. Liao, and Y. Ding, “Stock transaction prediction modelling and analysis based on LSTM,” in 2018 13th IEEE Conference on Industrial Electronics and Applications (ICIEA),IEEE,2018,pp.2787–2790.

[12] K. A. Althelaya, E. M. El-Alfy, and S. Mohammed, “Evaluation of bidirectional LSTM for short-and longterm stock market prediction,” in 2018 9th International Conference on Information and Communication Sys- tems (ICICS),IEEE,2018,pp.151–156.

[13] K. Lucas, C. Lai, N. James, and K. Liu, “Stock forecastingusingsupportvectormachine,”in Proceedingsofthe Ninth International Conference on Machine Learning andCybernetics,IEEE,2010,pp.1607–1614.

[14] R. I. Rasel, N. Sultana, and N. Hasan, “Financial Instability Analysis using ANN and Feature Selection Technique: Application to Stock Market Price Prediction,” IEEE,2016.

[15] S. Asur and B. A. Huberman, “Predicting the Future with Social Media,” in Proceedings of the ACM International Conference on Web Intelligence, 2010, pp. 492–499.

[16] J. Bollen, H. Mao, and X.-J. Zeng, “Twitter Mood Predicts the Stock Market,” Journal of Computational Science,vol.2,no.1,pp.1–8,2011.

[17] L. Zhang and B. Liu, “Sentiment Analysis on Twitter withStockPriceandSignificantKeywordCorrelation,” IEEE,p.130,2013.

[18] S. Hochreiter and J. Schmidhuber, “Lstm can solve hard long time lag problems,” Advances in neural information processing systems,vol.9,1996.

[19] C. Cortes and V. Vapnik, “Support-vector networks,” Machine learning,vol. 20,pp.273–297,1995.

[20] M.P.Cristescu,R.A.Neris¸anu,andD.A.Mara,“Using data mining in the sentiment analysis process on the financial market,” Journal of Social and Economic Statistics,vol.11,no.1-2,pp.36–58,