“A STUDY ON THE GROWTH OF DERIVATIVES MARKET IN INDIA”

Prof. Satyajitsinh Gohil Assistant professor, Darshankumar Patel,

PIMR – MBA Parul University, Vadodara ***

Darsh PatelABSTRACT - Thetremendous volatilityof financial marketsisa definingcharacteristic.The constant upsand downsinthe pricesofcommodities,sharesofstock,and financial instruments,aswell asothertradableitemslike oil, representa serious threat to enterprises that rely on stable prices in these markets cost estimates Hedging is a tool available in contemporary financethatmaybeusedtomitigatethiskindofrisk.Hedgingisacommonuseofderivatives.Ofcourse,therearealsosome whoutilizeitforspeculating,whichisillegalinIndia.

Productswithvaluegeneratedfromoneormoreunderlyingassetsorbasesareknownasderivatives.Derivativesareakindof financial instrument that is based in part on the value and characteristics of another asset, called an underlying asset. Any prudent investor would prioritize lowering risk and increasing return certainty. Derivatives are a kind of contract that emerged out of the need to reduce exposure to risk. Futures and forwards for interest rates and currencies, as well as their respectivestructures,mechanisms,hedgingtechniques,andpricedetermination.

Key Words: Derivatives Market, Stock Market, Future & Option, Hedging, Commodity Market, Risk Management, Trading, ProfitMakingStrategies.

1. GENERAL INFORMATION

1.1 Derivatives: what are they and how do they work?

Thevalueofa derivativeisderivedfromthevalueofanunderlyingasset.Thereareseveral usesfortheseintricatefinancial instruments,suchasspeculation,riskmanagement,andgainingexposuretonewassetclassesortradingvenues.

1.2 Definitions of Different Derivatives

Thereareessentiallyfourcategoriesofderivativecontracts,andtheyareasfollows:

Financialderivativesknownasoptionsprovidethebuyertherightbutnotthedutytopurchaseorsellanunderlyingassetata predetermined price (the strike price) within a certain time frame (the term "options expiration"). American options are perpetual, meaning they may be cashed in whenever the option term is over. However, European options are only tradable untiltheirexpirydate.

Futurescontractsarestandardizedagreementsthatprovidetheholdertheright,onacertaindateinthefuture,topurchaseor sell the underlying asset at a predetermined price. Participants in a futures contract not only have the authority but are obligatedtoactinaccordancewithitsterms.

Futures contracts are very liquid since they are exchanged on the exchange market, where they are also intermediated and regulated.

Futurescontractsarestandardizedtomakeiteasierforpurchasersandsellerstoliquidatetheirpositionsbeforethecontract expires.

Forwards

Theholderofaforwardcontract,liketheholderofafuturescontract,hastherightbutalsothedutytofulfillthetermsofthe deal.However,sinceforwardscontractsareOTC,theyarenotsubjecttothesametradingrulesandrestrictionsasexchangetradedgoods.

In light of the lack of a universal template for such agreements, they may be altered to fit the specific needs of each party. Ratherofbeingunwoundpriortotheirexpiration,forwardcontractsaretypicallykeptuntiltheexpirationdateanddelivered into.

Swaps

Swaps are a kind of derivative contract in which two parties agree to swap financial liabilities. Investors often embark into interest rate swaps as their first swaps contract. The swap market is not a centralized marketplace. Due to the necessity for swapscontractstobeflexibleinordertomeetthedemandsofbothparties,theyaretradedindirectly,overthecounter.

Different swaps, such as credit default swaps, inflation swaps, and total return swaps, have emerged to meet the changing demandsofthemarket.

2. INTRODUCTION OF THE STUDY

2.1 Derivatives in Finance: The Basics Contracts with a Future Date

Aforwardcontractisabasic,individuallynegotiatedagreementbetweentwopartiestoacquireorsellanitematafuturedate and price. They are often exchanged between two financial institutions or between a financial institution and its customer, unlikefuturescontractswhicharetradedonanexchange.

Example

An American auto parts supplier agrees to accept payment of $1,000,000 in 90 days from an Indian business. Therefore, the importer is dollar deficient, in the sense that it owes dollars for delivery in the future. Let's pretend the current value of a dollaris$48.However,thedollarmightstrengthenagainstthe'48duringthefollowingthreemonths.Toprotectthemselves from currency fluctuations, importers may negotiate a 90-day forward contract with a bank at a price of '50 to hedge their exposuretocurrencyfluctuations.Onemilliondollarsfromthebankwillbegiventotheimporterin90days,andfiftymillion rupeeswillbegiventothebankbythe importeraspartofaforwardcontracthedgingafuturepayment.Ontheagreeddate, importerwillpaybank'50million,andbankwillpayimporter'1million,atthethen-currentexchangerateforthedollarplus ninetydays.Acurrencyforwardcontractlikethisoneisrathercommon.

Following is a condensed explanation of how a forward contract works:

Duetothefactthatforwardcontractsareagreementsbetweentwoparties,theyarevulnerabletotheriskofdefault byoneoftheparties.Theseareriskierthanfuturescontractsbecausetothepotentialforoneorbothpartiestofailto fulfilltheirobligations.

Two, due to the factthattheyareall individuallydrafted,no twocontractsare the samein terms ofduration, value, expiry,assetkind,quality,etc.

Third,inaforwardcontract,oneparty"goeslong"bycommittingtopurchasetheassetatafuturedate.Byagreeingto sellthesameassetonthesamedateatthesameprice,theotherpartytakesashortposition.Anopenpositionrefers toasituationinwhichoneofthepartiestotheforwardcontracthasnocorrespondingobligation.

Theterm"hedger"isfrequentlyusedtorefertoapartywhohasaclosedposition.

Thedeliverypriceistheagreeduponamountinaforwardcontract.The deliverypricethatwouldapplyifaforward contractwereenteredintoatacertaintimeisreferredtoastheforwardpriceforthatperiod.Theforwardpriceand thedeliverypriceshouldbetreateddifferently.Atthemomentoftheagreement,bothpartieshaveanequalamount

of leverage. While the delivery price is guaranteed to stay constant over time, the forward price is subject to fluctuation.

Derivativeassets,alsoknownassyntheticassetsintheforwardmarket,maybecontractedintheforward contractby combiningunderlyingassets.

On the expiry date, the forward market requires the delivery of the underlying asset to satisfy the contract. In the event of a contract rescindment, the aggrieved party is stuck dealing with the same counter party it originally dealt with,whichmayuseitsmonopolisticpowertodemandwhatevertermsitpleases.

Therelationshipbetweenforwardandunderlyingassetpricesisknownasacoveredparityorcost-of-carryrelation ina forwardcontract(seealso:clause 7).Theseconnectionsarealsouseful forcalculatingfutureassetvaluesbased onarbitrage.

Intheforeigncurrencymarket,forwardcontractsandinterestratebearinginstrumentsarewidelyused.Theforward rate is quoted by the majority of big, worldwide banks at their "forward desk" inside their foreign currency trading room.

As well as the current rates, these institutions also quote their respective forward rates for the foreign exchange market.

Various forward contracts, including hedging contracts, transferable specified delivery contracts, and nontransferablespecifydeliverycontractsareallpermissibleundertheIndianForwardContractActof1952.Youarenot restricted from selling or trading your hedge contract, and it is not tied to a specific delivery of any kind. Specific delivery contracts are freely transferable from one party to another, but they are only concerned with one set shipment.Theremustbea delivery.Non-transferableparticulardeliverycontractsareexactlywhattheysound like: contractsforthesupplyofaveryspecificitemorservicethatcannotbeassignedtoanyoneelse.s

Aforwardcontractisanagreementbetweentwopartiestopurchaseorsellaniteminthefutureatacertainpricefordelivery at a future date and location. Because of the unique needs of each business, these agreements are seldom cookie-cutter templates.

Predictions of the Future

Futurescontracts,likeforwardcontracts,areagreementsbetweentwopartiestoacquireorsell anitemata future dateand price.Typically,afuturescontractwillbeexchangedonaspecializedmarketcalledafuturesexchange,whichestablishesrules andregulationsforthetradeoffuturescontracts.

Example

Sincehecan'tpredictwhatthepriceofsilverwill be, a silvermakerisworriedabouthis capacitytomakea profit.Basedon current output, he anticipates having about 20,000 ounces of silver available within the next two months. He is OK with the presentsilverpriceof£1052.5perounceandtheJulyfuturespriceof£1068perounceatFMC.However,heisconcernedthat pricesmaydecreaseinthefuture.So,he'sgoingtostarttradingfutures.WithadeliverydateinJuly,hewillbesellingfourMCX contracts,eachfor5000ouncesat'1068.

Standardization

Theamountofthecommodity,thequalityoftheasset,thedayandmonthofdelivery,theunitsofpricequotation,theplace of settlement, etc., are all common specifications in a futures contract. The Chicago Board of Trade (CBOT) and the Chicago MercantileExchangearetwoofthemajorfuturescontractexchanges(CME).Eachfuturescontracttermisspelledoutindetail.

House Clearing

The clearing house is a subsidiary of the exchange that mediates transactions between buyers and sellers of futures. Essentially,itensuresthatthoseinvolvedinatransactionwillfulfilltheirobligations.Multiplemembersoftheclearing house haveofficesincloseproximitytotheclearinghouseitself.Forthisreason,everycontracthastheclearinghouseasits counter party.

Compensation Amount

Each futures contract is marked-to-market at the end of each trading day since they are all executed via the same exchange. Thesettlementpriceisdeterminedbytheexchange.Everycontract'sdailygainorlossisdeterminedbasedonthissettlement price.Members'accountsarecreditedordebitedaccordingly.

Margin and Settlement Every Day

Futures contracts also have the additional characteristic of requiring the buyer to place an initial margin deposit with the broker. Minimum margin requirements for various assets are typically established by the exchange, but the broker has the flexibility to establish larger margin restrictions for his customers based on the clients' creditworthiness. To reduce the possibilityoflossoneithersideofafuturesdeal,marginaccountsareusedascollateral.

Estimating the Size of a Tick

Futurespricesarequotedinunitsofcurrency,withaminimumpricechangeofoneticksize.Asaresult,futurespricesshould beroundedtotheclosesttick.

Thebasisofafuturescontractisthepricedifferentialbetweenthefuturespriceandthecashpriceoftheunderlyingasset.

3. LITERATURE REVIEW

Derivatives,astheauthorpointedoutinthepriorchapter,havereceivedwidespreadcriticism fortheirallegedlydestructive characterinthefinancialmarketsandtheimpactsthishasspilledoverintotheactualeconomy (Sharma, 2018).Derivatives areoftenthoughtofasfinancial toolsthathavecaused financial lossesorcorporatecollapses, asnoted byMcClintock,1996. Furthermore,heclaimsthattheir(thederivativesmarket)isblamedfortherisingworldwidefinancialinstabilityoftheglobal economy.Fearfulofbothfirm-specificandsystemicrisks,thepublichashadamixedreactiontoderivatives,alongwithother transactionsthatwereoncehailedashallmarksofmarketefficiencysuchasconglomeratemergersandjunkbond

offerings

Credit,legal,market,liquidity,andmanagementrisksareallpartofthefirm-specificrisks,while"greatercompetitionbetween banks and non-bank financial institutions, greater interconnectedness of financial markets, increasing concentration of derivativestrading,thereduceddisclosureoffinancialinformationthroughoff-balance-sheetactivities,andincreasedmarket disturbancesduetofinancialandtelecommunicationinstabilities"areallpartofthesystemicrisks (Beckett,2015 ).

Severaltheoreticalargumentshavebeenmadeagainstthefunctionofderivatives,andtherehavebeenheateddisputesonthe reasonswhyderivativesshouldexist.Theirveryexistenceasaconcepthasbeencriticized(Dodd,2017).Therefore,theauthor believes it is important to comprehend the origins of derivatives in the financial sector, as well as their pervasive character overthedecadesofglobalfinancialmarketevolutions.

Accordingto Chris Gaffney (2019),theUSdollar'sdominanceovertheworld'sfinancialmarketshascontributedsignificantly totheirexplosiveexpansion.But,hesays,thingsarelookinggoodinLondonandTokyo.Furthermore,the"investmentbanks, securitiescompanies,andfuturesandoptionsexchanges"arechallengingthe"commercialbanksandstockexchanges,"which hadpreviouslydominatedthemarket.Theonce-dominantonshoremarket,whichwasheavilyregulated,hasbeensuperseded byoffshoremarkets,whicharegovernedbyfewerrules.

TheunexpectedbreakdownoffixedratesinseveralnationsincludingMexico,Thailand,Korea,Russia,andBrazilinthemid1990sisanotherexampleofhowtheglobalfinancialmarketshaveevolvedsincethecollapseoftheBrettonWoodsAgreement on pegged exchange rates in the early 1970s. As a result of these occurrences, regulators, users, and controllers are under increased pressure to comprehend the role of investment managers and company treasurers in the assessment and managementoffinancialandoperationalrisks.ThemovetowardaunifiedEuropeanregulator,aswellastheimplementation ofGRCandtherecommendationsoftheBaselCommittee,are examplesofhowregulationandcontrolshaveevolved.It'snot onlythattheinternethasmadetheglobeaverydifferentplaceinthelasttwodecades;it'salsothatit'sopenedupaplethora ofnewoptionsforfiscalmanagement (Gaffney 2019).

One way to look at derivatives is as a product of social engineering and market demand in the financial sector, with deep historical origins in the actual economy (Sharma, 2008). According to Brenner (2016), the need to control highly increased volatilityandfluctuationsresultingfrominflationproblems,currencyproblems,debtdefaults,andmanyotherfactorsbecame acuteastheproduction-dominanteconomybegantogivewaytothefinancialeconomyinthelate1960sandearly1970s.

4. PROBLEM STATEMENT

Wheninvestorshavetoomanyderivativesontheirbooksandarethusoverleveraged,problemsmightdevelopwhenthevalue of the derivative swings against them and margin calls must be made. Futures, options, contracts for difference (CFDs), and swapsareallverypopularformsofderivativestrading.Marketrisk,counterpartyrisk,liquidityrisk,andconnectivityriskare the four main types of derivatives risks that will be discussed in this article. No. Since derivatives are so pervasive, they will unavoidablyplayaroleinanyfinancialcrisis,buttheycannotconstitutetherootoftheproblem.They'rejustinstrumentsthat may be utilized well to mitigate danger or improperly to create new dangers without compensating advantages. Forward contractshavelimitedutilitybecauseofthreeprimaryissues:

Findingawillingcounterpartycanbetime-consumingandexpensive;

The forward’s market is illiquid because of their unique characteristics, making it difficult to sell forwards to other partiesifdesired;and

Onepartytypicallyhasanincentivetobreakthecontract.Sinceinvestorsmayenterthemarketwithverysmallsums ofmoneyandhavetheirbenefitsfrompriceswingsamplified,gearingistheprimaryriskofetcderivatives.

5. OBJECTVES OF THE STUDY

There is no advance of principle to be returned and no interest or dividends to be earned, unlike with debt instruments.

Risk management, hedging, arbitrage across markets, and speculation are just few of the many applications for financialderivatives.

Agoalofthisanalysiswillbetodissecttheworkingsoffuturesmarkets.

Findoutwherebuyersandsellersstandintermsofprofitsandlosseswhendealinginfutures

6. RESEARCH METHODOLOGY

6.1 METHODS FOR DATA COLLECTION & VARIABLES OF THE STUDY

Methods for data collection

PrimaryData

SecondaryData

Primary Data

Primarysourceofdatawascollectedbyquestionnaire.

Secondary Data

Secondarysourceofdatawascollectedfrom

Books

Journals

Magazines

Web’sbigdataes

Sampling

The sample technique utilized for data gathering is convenient sampling. The convenience sampling method is a nonprobabilitystrategy.

Sampling size

Bigdataindicatesthenumbersofpeopletobesurveyed.Thoughlargesamplesgivemorereliableresultsthansmallsamples butduetoconstraintoftimeandmoney,

Plan of analysis

Diagrammaticrepresentationthroughgraphsandcharts

Findings&suggestionswillbegiventomakethestudymoreuseful

7. DATA ANALYSIS AND INTERPRETATION

Tools for Data Analysis Sampling Strategies

Non-probabilitysampling, onthe otherhand,is whensamplesare selectedfroma population ina non-random fashion.Asit doesnotneedacompletesurveyframe,non-probabilitysamplingmaygatherdataquickly,effectively,andaffordably.

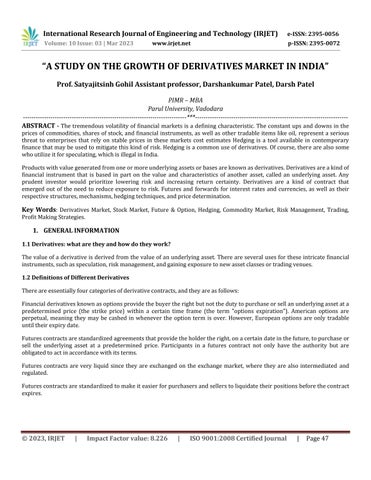

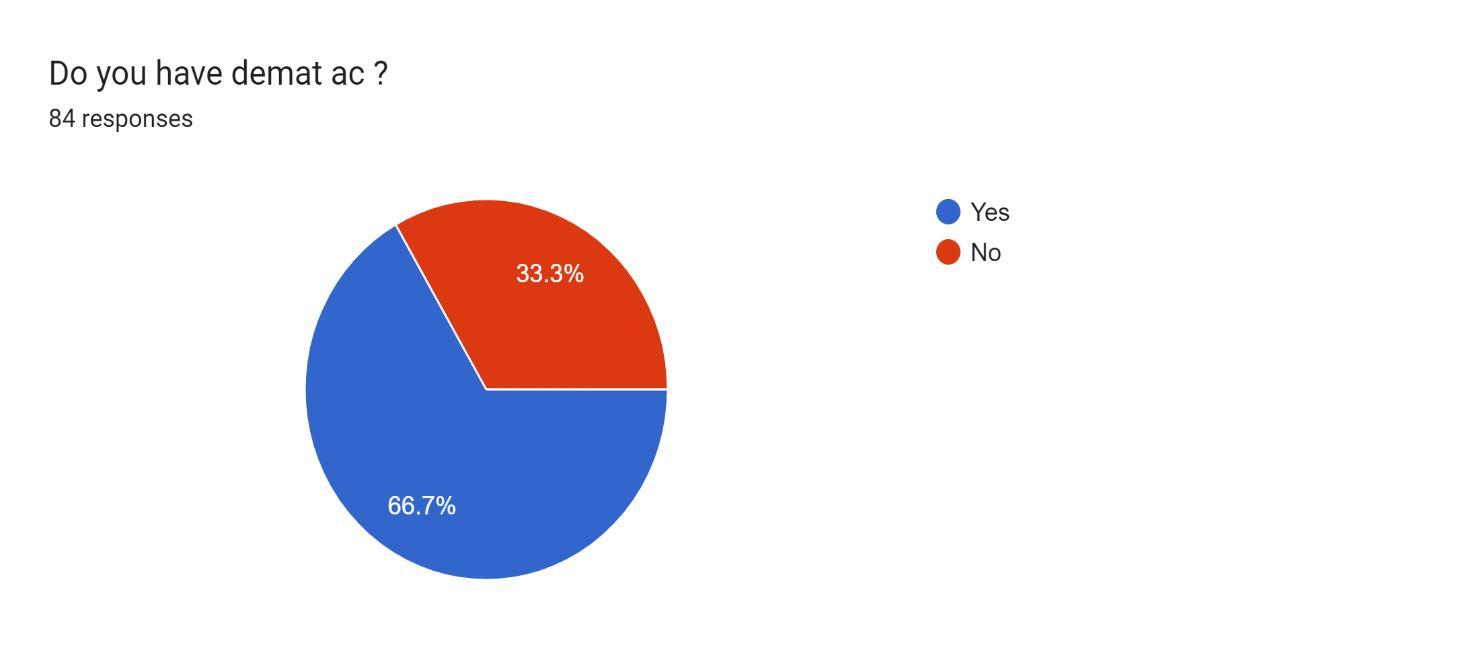

Chart 2 showsthatonly51.2%peoplehaveproperknowledgeforderivatives.Rest31%aresomewhatawareaboutitwhile 17.9%areunaware.Soasaconclusionofthischart,awarenesscampaignmustbedoneforlocalpublic.

WHICH TYPE OF DERIVATIVES DO YOU PREFER THE MOST?

Which type of derivatives do you prefer the most?

Chart 3 showsthatmajorlypreferfuturecontractaswellasoptioncontract.Afterthatcontractspeoplepreferswapscontract andlesspreferforwardcontract.

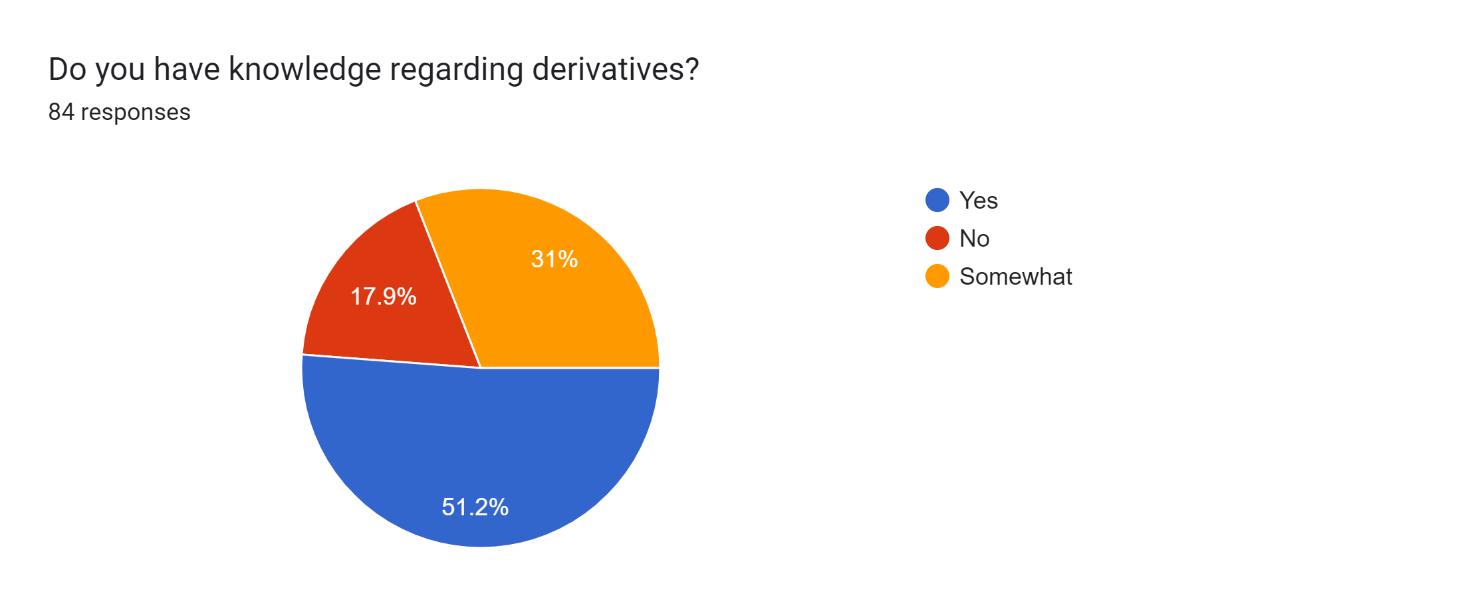

Chart 4 showsthat66.7%ofrespondentswhichismostcommoninvestmentbracketis2000–4000Rs.Inderivativeson monthlybasis.Alsofewrespondentsinvestmorethan10000Rs.Inderivativesonmonthlybasis.

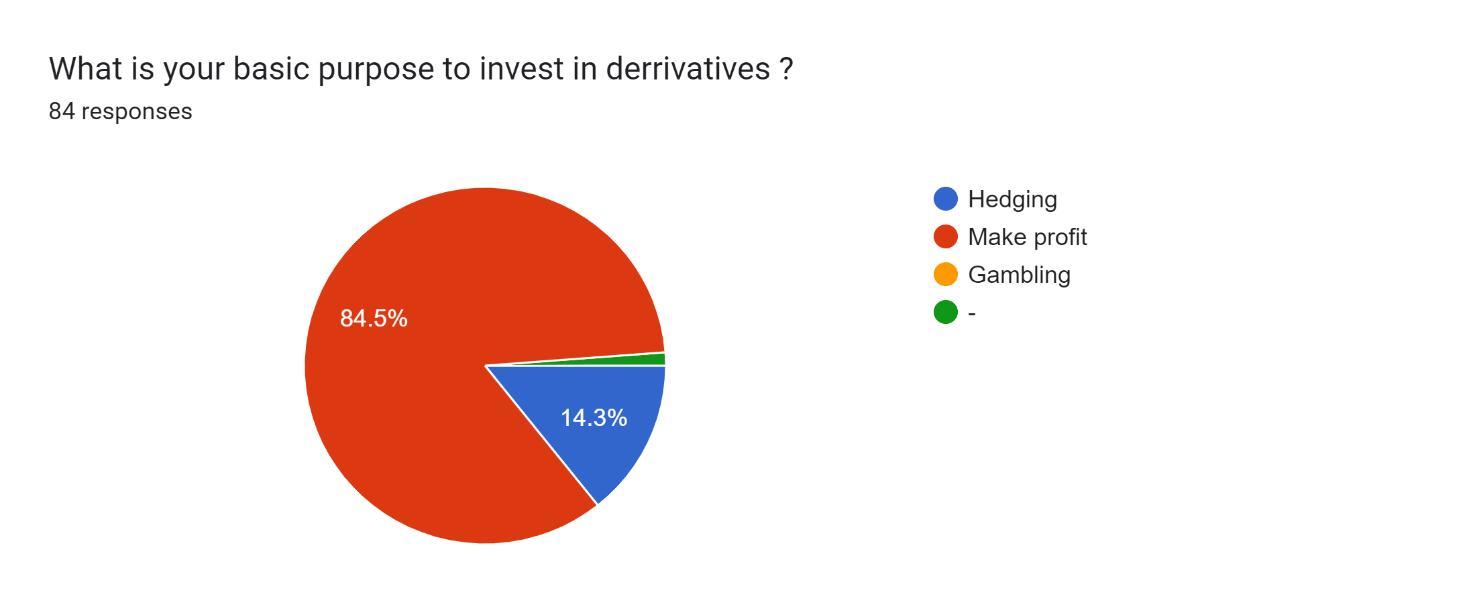

Chart

mostofrespondent’spurposetoinvestinderivativesistomakeprofit&only10.7%respondent’shave hedgingpurposewhichisverysad.

Do you believe that derivatives trading is a risky or safe investment option in India?

I am not sure

Chart 6 showsthatmorethan60%ofrespondentsbelievethatriskandsafetyfactorsIntradingofderivatives,dependsonthe marketconditionsbutstillmorethan20%believeitsriskyandlessthan10%believeitssafe.

How confident are you in the stability and reliability of the derivatives market in India?

Chart 7 showsthat62%peoplearesomewhatconfidentaboutstabilityandreliabilityofthederivativesmarketInIndiawhile only11%peopleareveryconfidentaboutstabilityandreliabilityifthederivativesmarketinIndia

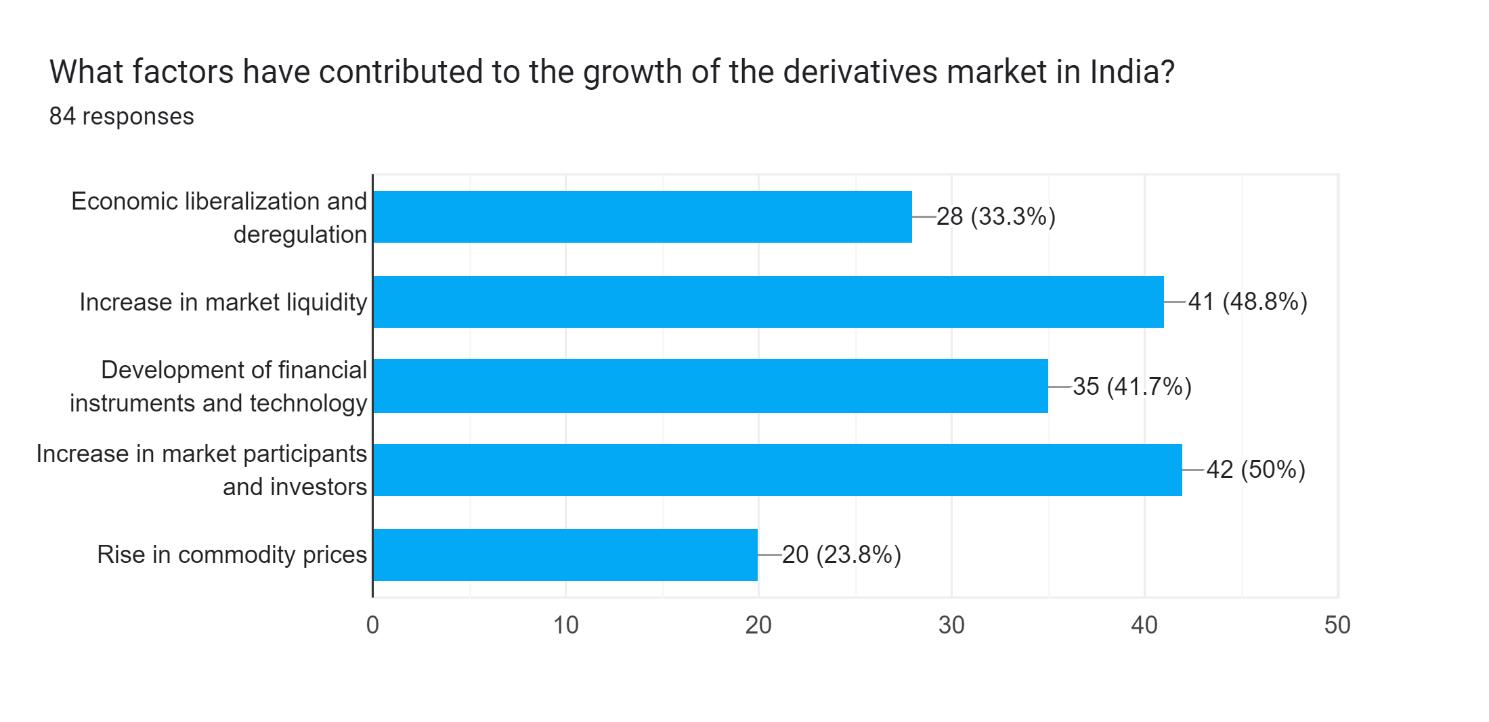

Chart 8 showsthatthefactorslikeIncreaseinmarketliquidityandincreaseinmarketparticipantsandinvestorshave contributedmajorityofthepartinthegrowthofderivativesmarketinIndia.Theyare48.8%and50%respectively.

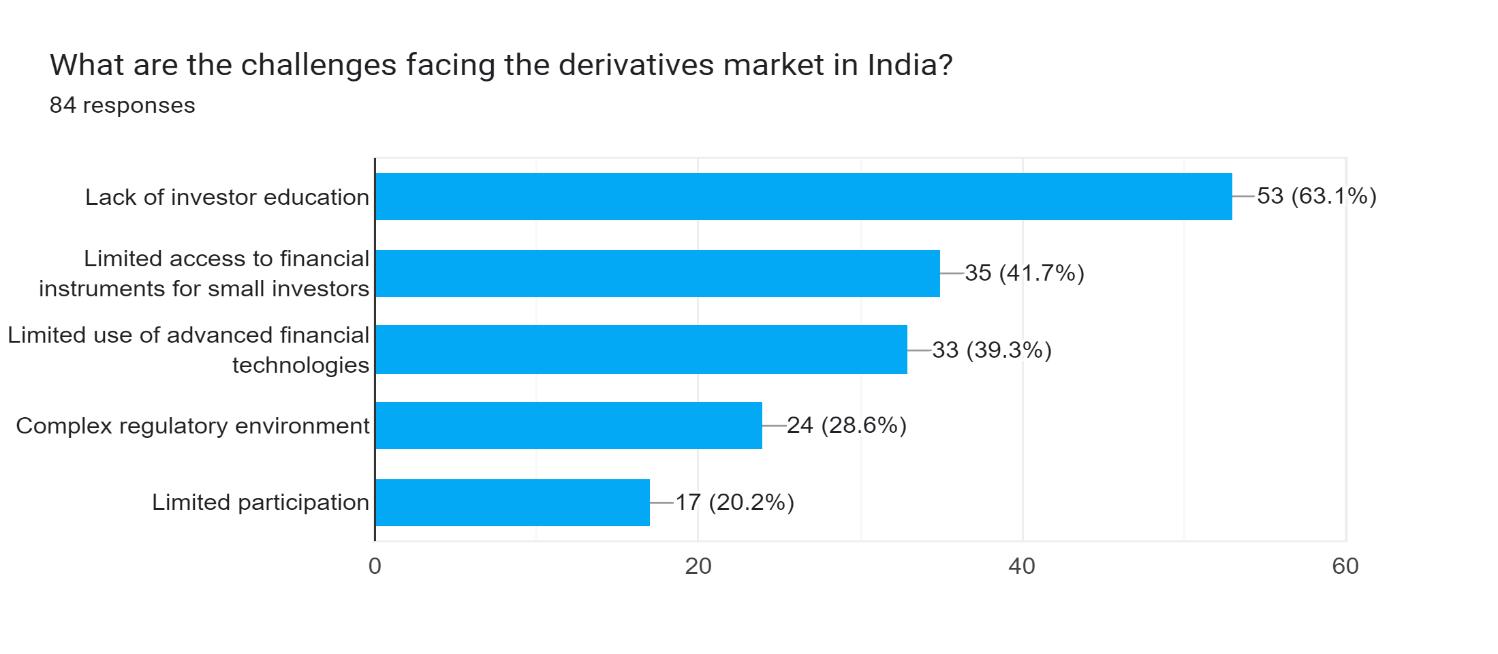

Chart 9 showsthatthemostcommonchallengefacedbyderivativemarketislackofinvestoreducationwhichis63.1%andit representsthatlimitedparticipationisthelowestchallengefaced.

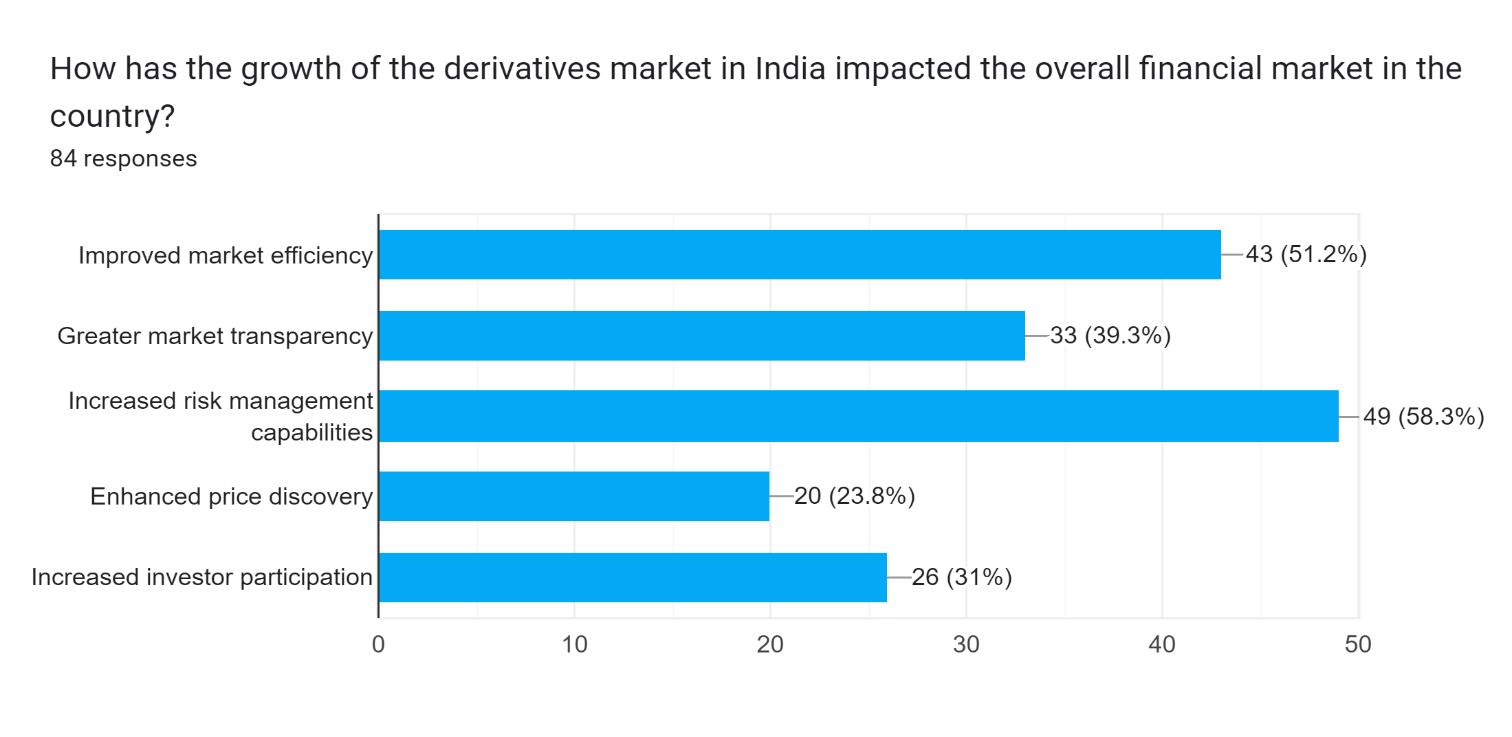

Chart 10 showsthatIncreasedriskmanagementcapabilitieshaveimpacted58.3%derivativemarketsforoverallfinancial marketinthecountrywhichishighestamongallothers.

8. HYPOTHESES TESTING AND METHODS

8.1 Analysis of a Hypothesis Testing Strategy

Inordertodeterminewhetherornotthenullhypothesisiscorrect,researchersconductstatisticaltestsbasedonsamples.

Datafromrepresentativesamplesofthepopulationistheprimarytoolusedbystatisticiansintestingtheories. Whencomparingtwohypotheses,analystsalwaysuseasampledrawnatrandomfromthewholepopulation. Oneexampleofanullhypothesisistheargumentthattheaveragereturnoninvestmentforagivenpopulationiszero. Anewtheoryornullhypothesisispresentedasachallengetotheexistingdominantparadigm.Theonlycorrectansweris(1) or(2).Oneofthetwochoicesisalwaystherightone.

8.2 Testing Hypothesis Methodology

Analysts must first provide competing hypotheses when attempting to choose amongst numerous alternative explanations.

Onceallrelevantdatahasbeengathered,ananalysisstrategyoutliningthecriteriatobeusedtoassessthefindingsof thedatacollectionmustbedeveloped.

Thethirdstageinvolvesputtingyourknowledgefromthepriortwophasesintopracticebycarryingoutthenecessary processesandevaluatingthesampledata.

Thelaststageistodrawconclusionsfromthedataanddeterminewhetherthenullhypothesismaybediscarded.

9. CONCLUSION/SUGGESTIONS

Stock futures are a kind of derivative contract that gives the holder the right, but not the obligation, to purchase or sell a specified basket of stocks on or before a certain date. After purchasing the contract, you are legally bound to abide by its conditions.

Bydoingso,hedgersmaytransfertheirrisktospeculators,andinvestorscanhaveagoodsenseofwhereastock'sor anindex'sfuturespriceislikelytosettle.

Itassistsinforecastingthefuturedemandandsupplyofsharesbasedonthepresentfutureprice.

Thefuturesmarketisbasedonmargintrading,whichmeansthateventinyspeculatorsmayparticipatebyputtingup justafractionofthefullvalueoftheirassetsinordertomaketrades.

Based on my findings, I expect stock prices will track the performance of the underlying assets in the future. I've narroweditdowntothreemajorcorporations:Wipro,TCS,andInfosys.

In most cases, investors may expect a return on their money by buying Infosys at a price that is higher than the company'sunderlyingassetvalue.

Whereas investors are generating typical gains despite the fact that the value of future prices and the value of underlyingassetsarepracticallysameforWiproandTcs

10. BIBLIOGRAPHY

F.Black andM.S.Scholes,"ThePricingof OptionsandCorporateLiabilities,"Journal ofPolitical Economy81(2016): 637–654.

Journal of Financial Economics 7:229-263 (2017) Cox, J.C., S.A. Ross, and M. Rubinstein, Option Pricing: A Simplified Approach.

Towit:Hsia,C.-C.(2019)"OnBinomialOptionPricing,"6(1),JournalofFinancialResearch:41-46.

ConsumptionandPortfolioRulesinaContinuousTimeModel,byR.C.Merton(2015),JournalofEconomicTheory,3, pp.373

413.

The Theory of Rational Option Pricing, Bell Journal of Economics and Management Science, 4, 141-183, R.C. Merton (2018).

TheCapitalAssetPricingModelbyA.F.Perold,publishedinJournalofEconomicPerspectives,2014,pp.3-24.

TwoStateOptionPricing,RandlemanandBartter(2015),JournalofFinance34,1093-1110.

G.Anderson,Cityboy:BeerandLoathingontheSquareMile,HeadlinePublishing,2018.