International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

Adwait Mandge1, Rohan Fatehchandka2, Kunal Goudani3, Tanaya Shelke4, Prof. Pramila M. Chawan5

1,2,3,41B. Tech Student, Dept of Computer Engineering, and IT, VJTI College, Mumbai, Maharashtra, India 5Associate Professor, Dept of Computer Engineering, and IT, VJTI College, Mumbai, Maharashtra, India

Abstract - Loan risk assessment is crucial for financial security. This study combines ensemble learning for loan default prediction and time series analysis for ghost borrower detection. Using PyCaret, we optimize model selection to identify high-risk borrowers. Additionally, ARIMA, LSTMs, and anomaly detection techniques analyze transaction patterns to flag fraudulent behaviors like suddenwithdrawalsandpost-loaninactivity.Byintegrating predictive modeling and anomaly detection, we enhance early fraud detection. This approach provides financial institutions with a comprehensive risk management framework, improving decision-making and reducing potentiallosses.

Key Words: Machine Learning, Deep Learning, Ensemble, Loan Default Prediction, Ghost Borrower Detection, TCN

1.INTRODUCTION

Accurate loan default prediction is vital for financial institutions to mitigate risks. Traditional credit assessment methods often overlook hidden patterns, making machine learning a powerful alternative. This study utilizes PyCaret to compare ensemble techniques like bagging, boosting, and stacking for loan default prediction.Byanalyzingborrowerdemographics,financial history, and loan details, we evaluate model performance using accuracy, precision, recall, and F1-score, identifying themosteffectiveapproachforcreditriskassessment.

To enhance fraud detection, we address ghost borrowers fraudsters who manipulate financial records to evade repayment. We integrate time series analysis using TCN (Temporal Convolution Networks) to identify suspicious transaction patterns. By combining predictive analytics with fraud detection, our study provides actionable insights to improve lending decisions and reducefinanciallosses.

Random Forest learning technique is used to solve various problems of regression and classification problems. It builds several trees during training and

aggregates the outcomes to increase prediction accuracy. Features are randomly selected at every node(feature bagging), and each tree in the forest is trained on an arbitrary subclass of the data (bootstrapping). Random Forest reduces variation and overfitting and averages the outcomes of these trees, which enhances generalization. The advantages of this algorithm are handling large datasets, reducing overfitting, and maintaining good accuracyeveninthepresenceofmissingdata.

XGBoost (Extreme Gradient Boosting) is a scalable and extremely effective gradient boosting implementation. It constructs decision trees sequentially, aiming to fix the mistakes caused by preceding trees with each new tree. XGBoostusesgradientdescenttominimizetheoverallloss functioninordertooptimizethemodel.Performanceand speed are well-known for XGBoost, particularly with tabular or structured data.The advantages of this algorithm are its speed, scalability, handling of missing data,andregularizationtominimizeoverfitting.

Neural Networks replicatethecompositionofthehuman brain. Neural networks comprise multiple bands of neurons connected by edges with weights that are updatedduringtraining.Neuralnetworksarewidelyused in deep learning processes as they can interpret occurrences of perplexing repetitive sequences. The advantages of this algorithm are its flexibility, it can interpretinformationfromhugedatasets,anditspotential toreplicatelateralrelationships.

Multi-Layer Perceptron (MLP) is used in deep learning tasks. MLPs consist of multiple layers which are interconnected to each other, every neuron of one layer acts as an input to the neuron in the next layer. MLPs are used in classification, regression, and serve as the foundation for more intrinsic neural networks. Its capability to handle both regression and classification problems, and its role as a foundation for more advanced neuralnetworksisadvantageous.

Temporal Convolutional Networks (TCNs) areatypeof deep learning architecture designed for sequence modelingtasks,offeringanalternativetorecurrentneural networks(RNNs)likeLSTMsandGRUs.TCNsleverage1D

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

dilated causal convolutions, ensuring that predictions at any time step depend only on past information, making themsuitablefortime-seriesforecasting,naturallanguage processing, and anomaly detection. They utilize residual connections and dilation to capture long-range dependenciesefficiently,allowingforparallelcomputation and stable gradients, unlike RNNs, which suffer from vanishinggradientsandsequentialprocessinglimitations.

3.1 Problem Statement: “Topredictloandefaultusing machinelearningtechniques.”

3.2 Problem Elaboration: For financial organizations, loan failure poses a serious problem since it can result in large losses and elevated risk. Conventional credit evaluation techniques are frequently ineffective and have trouble identifying subtle trends in borrower behavior, which leads to imprecise forecasts. The volume of loan data has increased due to the growth of digital financial services, necessitating the use of more advanced algorithms to forecast defaults. Loan default prediction canbeautomatedanddata-drivenwithmachinelearning; nevertheless, choosing the best algorithm can be difficult, especially in cases when the datasets are unbalanced and defaults are few. In order to determine which machine learning model performs best, this study compares the efficacy of several algorithms in forecasting loan defaults. Assistingfinancialinstitutionsinmanagingriskbetterand makingmoreinformedloandecisionsistheaim.

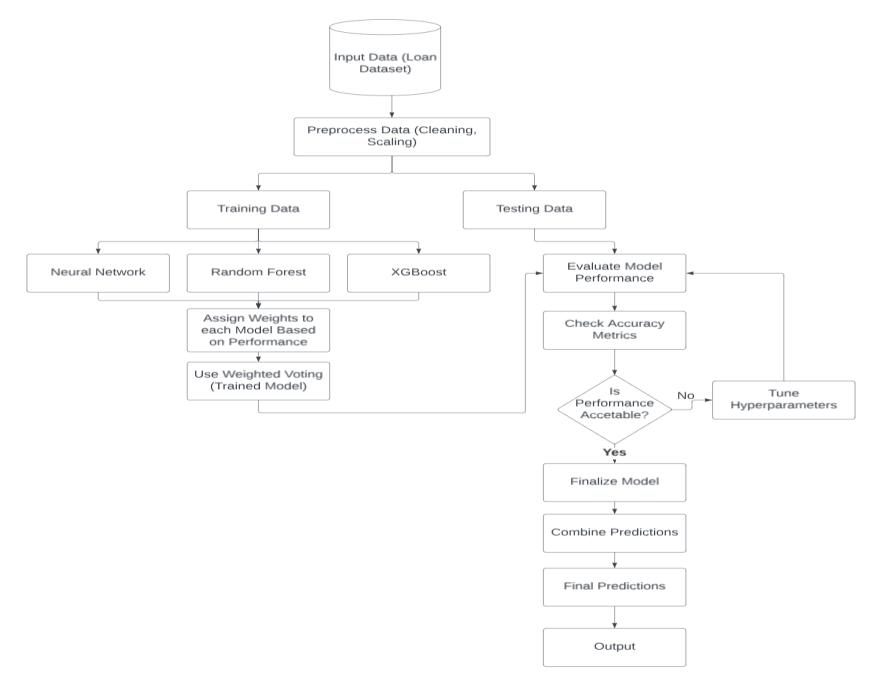

3.3 Architecture of the proposed models: 3.3.1 Loan Default Prediction System

The architecture of our loan default prediction model followsastructuredmachinelearningpipeline,integrating ensemble learning techniques to enhance predictive accuracy. The system is designed to preprocess financial datasets, extract meaningful patterns, and make robust predictions through a combination of machine learning models. The workflowconsists ofseveral keystages:data preprocessing, model trainingusing ensembletechniques, andperformanceevaluationwithhyperparametertuning.

This flowchart represents an ensemble learning pipeline for loan default prediction using multiple models. This ensemble learning pipeline for loan default prediction integratesNeuralNetworks,RandomForest,andXGBoost. The dataset undergoes preprocessing, including cleaning and scaling, before training. A weighted voting approach combines predictions based on model performance. After evaluation on a test set using accuracy metrics, hyperparameter tuning is applied if needed. Once optimized, final predictions are generated, leveraging the strengths of multiple models to enhance predictive accuracyandrobustness.

The dataset for this study was collected from Kaggle, containing loan default prediction records with 34 attributes. These attributes include loan_purpose, Credit_Worthiness, open_credit, business_or_commercial, Credit_Score, age, LTV, Region, Security_Type, and Status. These features capture essential financial and demographic details about loan applicants, providing insights into their creditworthiness and likelihood of default. The dataset also includes variables like credit_type, co-applicant_credit_type, and dtir1 (Debt-toIncome Ratio), which are crucial indicators for assessing risk. With a mix of categorical and numerical attributes, this dataset offers a well-rounded foundation for training predictivemodels.

Effective preprocessing enhances the reliability of machine learning models by systematically cleaning and transforming data. This study follows a structured pipeline, beginning with data cleaning and feature selection using pandas. Redundant columns (e.g., Interest_rate_spread, credit_type, Upfront_charges) are removed, and missing values are handled by imputing numerical features with the median and categorical featureswiththemode.Categoricalvariablesareencoded using one-hot encoding with drop_first=True to avoid the dummy variable trap. PyCaret automates key preprocessing tasks, including feature scaling, transformation,imbalancehandling,andfeatureselection,

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

beforesplittingthedatasetintotraining(75%)andtesting (25%)setswith Status asthetargetvariable.

To address class imbalance, SMOTE generates synthetic samples for the minority class, improving predictive fairness. Numerical features undergo standardization via StandardScaler (mean = 0, std = 1), while PowerTransformer ensures Gaussian-like distributions for skewed data. Finally, column names are sanitized using regularexpressionstoremovespecialcharacters,ensuring compatibility with machine learning frameworks. This streamlined approach optimizes model performance and enhancespredictiveaccuracy.

This project utilizes an ensemble learning approach, combining multiple machine learning models to improve predictiveperformance.Theindividualmodelsusedare:

1. Multi-Layer Perceptron(MLP) Classifier

2. Random ForestClassifier

3. XGBoost Classifier

The final prediction is made using a weighted ensemble method, where each model's contribution is proportional toitsaccuracy.

1. Multi-Layer Perceptron (MLP) Classifier

MLP is an artificial neural network with multiple layers that captures complex data relationships. It consists of an input layer, hidden layers, and an output layer, using activation functions like ReLU to introduce non-linearity. It learns through backpropagation and gradient descent, makingiteffectivefornon-linearpatternsinfinancialdata likeloandefaultprediction.

2. Random Forest Classifier

Random Forest is an ensemble learning method that buildsmultipledecisiontreesusingdifferentdatasubsets. It reduces overfitting by training trees independently and making predictions through majority voting. It is efficient withhigh-dimensionalandimbalanceddatasets,makingit suitableforrobustclassificationtasks.

3. XGBoost (Extreme Gradient Boosting) Classifier

XGBoost is a gradient boosting algorithm optimized for high performance and accuracy. It builds decision trees sequentially, correcting previous errors, while using regularization to prevent overfitting. Its efficiency in handling large datasets makes it a top choice for fraud detectionandcreditriskmodeling.

Ensemble learning enhances accuracy and robustness by integrating multiple models to make more reliable predictions. The strengths of MLP (captures complex patterns), Random Forest (reduces overfitting), and XGBoost(enhancesgeneralization)areleveragedtogether. Predictions from each model are weighted based on accuracy, and a final probability score is calculated. This approachensuresbetterbias-variancetradeoff,improving loan default prediction performance compared to individualmodels.

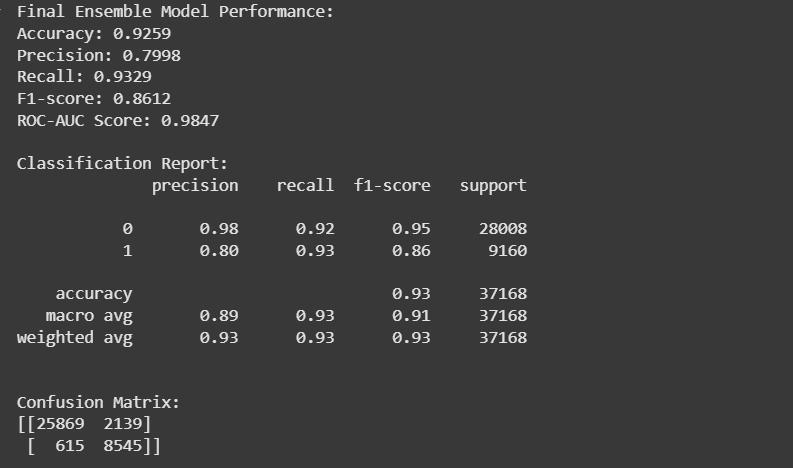

Thefinalensemblemodelachievesanaccuracyof92.59%, indicating strong predictive performance. It has a precision of 79.98%, meaning 79.98% of predicted defaulters were actual defaulters, and a recall of 93.29%, showing it successfully identified 93.29% of all actual defaulters.TheF1-scoreof86.12%balancesprecisionand recall effectively. The ROC-AUC score of 98.47% suggests excellent differentiation between defaulters and nondefaulters. The classification report shows that for nondefaulters (Class 0), precision is 98% and recall is 92%, while for defaulters (Class 1), precision is 80% and recall is 93%. The confusion matrix reveals 25869 true negatives, 2139 false positives, 615 false negatives, and 8545 true positives, showing that while the model correctly predicts most cases, it misclassifies some nondefaulters as defaulters. Overall, the model is wellbalanced, with high recall ensuring minimal missed defaults.

Highrecall(0.9329)indicatesthemodel'sstrongabilityto correctly identify positive cases, minimizing false negatives. This is particularly crucial in applications such as fraud detection, medical diagnosis, and intrusion detection, where missing a true positive can have serious consequences. With a recall of 93.29%, the ensemble model effectively detects the majority of actual positive instances, reducing the risk of undetected critical cases. Additionally, a high F1-score (0.8612) balances precision and recall, ensuring that the model does not generate too many false positives while still identifying true positives effectively. This trade-off is essential in scenarios where both false positives and false negatives carry significant consequences. An F1-score of 86.12% demonstrates that the model is well-optimized for overall reliable classification, making it a robust choice for practical applicationsrequiringhighaccuracyandminimalerrors.

A model with high recall ensures fewer missed detections, while a high F1-score ensures a balanced and optimal classification performance. This is particularly beneficial in applications where false negatives are costly but precision cannot be sacrificed entirely

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

Fig-2 FinalEnsembleModelPerformanceMetricsand ConfusionMatrix(LoanDefaultPrediction)

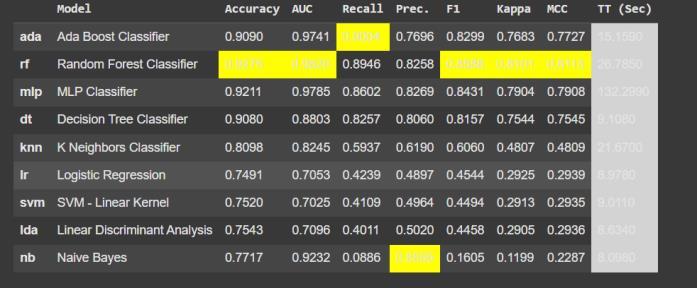

The comparison table shows that the Random Forest Classifier (RF) achieves the highest accuracy (92.75%), AUC (98.20%), and F1-score (85.88%) among all models, making it the best performer overall. The MLP Classifier (Neural Network) follows closely with an accuracy of 92.11% and AUC of 97.85%, indicating strong performance in complex decision boundaries. The AdaBoost Classifier has a slightly lower accuracy (90.90%) but excels in recall (90.04%), making it more suitable for identifying positive cases. Traditional models like Logistic Regression (74.91%) and SVM (75.20%) lag significantly behind, with Naïve Bayes (77.17%) performingtheworstinaccuracybutsurprisinglyhavinga high precision (85.56%), meaning it correctly identifies many positive cases but struggles with overall performance. The ensemble-based Random Forest ,MLP and XGBoost models outperform individual classifiers, reinforcing the advantage of ensemble learning in boostingpredictiveperformance.

Fig-3 ComparativePerformanceofMachineLearning Models(LoanDefaultPrediction)

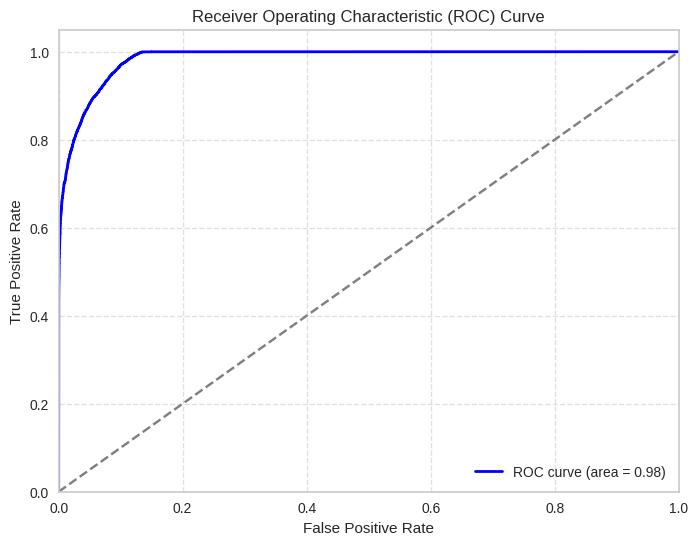

This ROC curve evaluates the classification performance by plotting the True Positive Rate (Recall) against the False Positive Rate atvariousthresholds.The blue curve represents the model’s performance, with an AUC (Area Under Curve) of 0.98,indicatingexcellentdiscrimination between classes. The diagonal gray line represents a random classifier (AUC =0.5),and the model significantly outperforms it. A higher AUC value suggests that the

model effectively distinguishes between positive and negativeclasses.

Fig-4 ROCCurvefortheEnsembleModel(LoanDefault Prediction)

3.3.2 Ghost Borrower Detection:

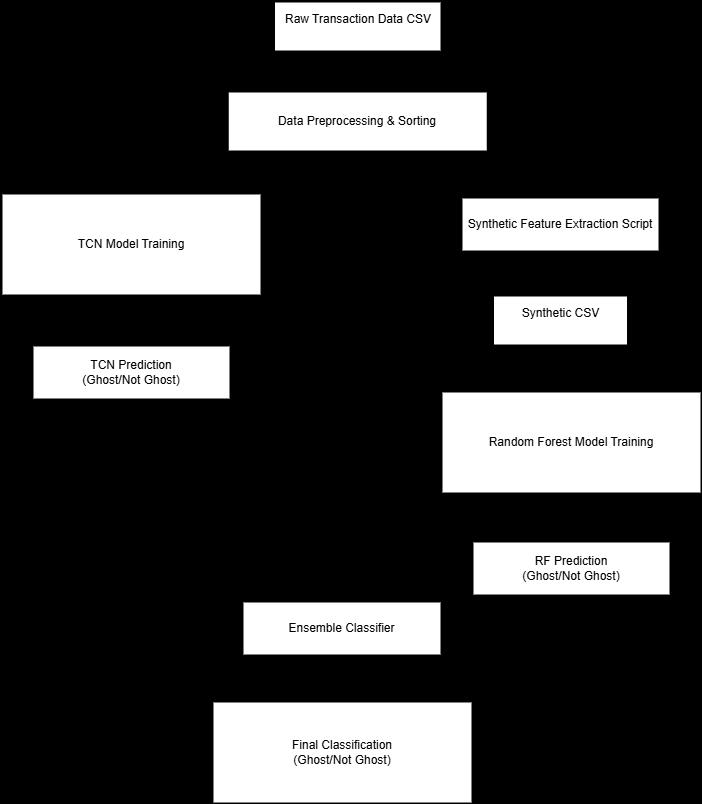

The architecture of our Ghost Borrower Detection System is designed to leverage both temporal patterns in transaction data and aggregated customer-level features to enhance fraud detection accuracy. At its core, the system employs a hybrid ensemble approach, integrating a Temporal Convolutional Network (TCN) for sequential transaction analysis and a Random Forest Classifier for feature-based classification. The TCN extracts temporal dependencies from transaction sequences using 1D convolutional layers with causal padding, ensuring that past data influences future predictions without leakage. Meanwhile, the Random Forest model identifies key risk indicators by analyzing customer behavior at an aggregated level and providing feature importance insights. These models are dynamically weighted based on their individual accuracy, and their predictions are combined using an ensemble mechanism to enhance robustness. This multi-layered architecture ensures a comprehensive evaluation of borrower risk, enabling early detection of ghost borrowers beforesignificantfinanciallossoccurs.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

Thisflowchartrepresentsan ensemble learning pipeline for ghost borrowers using multiple models. This ensemble learning pipeline for detecting ghost borrowers integrates Temporal Convolutional Networks (TCN) and Random Forest Classifiers. The transaction-level dataset undergoes preprocessing, including cleaning and feature extraction. TCN captures sequential transaction patterns, while Random Forest analyzes aggregated features for classification and feature importance. A dynamic weighting mechanism adjusts based on model accuracy. Aftertraining,modelsareevaluatedonaseparatedataset using accuracy metrics, with hyperparameter tuning if needed.Finalpredictionsaregeneratedthroughweighted voting, leveraging both models’ strengths to enhance predictive accuracy and robustness.

3.3.2.1

This study utilizes a synthetically generated dataset containing transaction-level financial records to detect ghost borrowers fraudulent actors who default after securing a loan. Each record includes key attributes such as customer_id, transaction_type, amount, loan_date, loan_amount, borrower_type (ghost/non-ghost), balance, and days_since_loan. Additionally, aggregated features for aRandomForestclassifiercapturepre-loanandpost-loan transactional behavior, including transaction counts, deposit and withdrawal totals, early withdrawal patterns,

and repayment trends. Key indicators like the largest withdrawal ratio and post-loan activity further enhance fraud detection, providing a robust foundation for predictivemodeling.

This study follows a structured preprocessing pipeline to enhancemodelperformanceandreliability.Missingvalues in activity_after_large_withdrawal, loan_payment_total,and loan_payment_count are imputed with zero to maintain consistency. Feature engineering introduces derived variables such as withdrawal_to_loan_ratio, repayment_ratio,and transaction_activity_ratio toimprove predictive power. The target variable borrower_type is transformedintoabinaryformat(1forghostborrowers,0 for normal borrowers) for supervised classification. Key features selected include loan_amount, pre_loan_transaction_count, first_week_withdrawal_ratio, post_loan_transaction_count, and repayment_ratio. Finally, numerical features are standardized using StandardScaler toensureuniformityandoptimizemodelperformance.

This project implements a hybrid ensemble strategy to identify ghost borrowers by integrating two complementarymodels.:

1. Temporal Convolutional Network (TCN) Model

2. Random ForestClassifier

The final decision is derived through a weighted combination of their predictions, with each model's influence determined by its validated performance.Both the algorithms give us probability of a person being a ghost borrower whichisthencombinedusingensemblelearning.

1. Temporal Convolutional Network (TCN) Model

TCN is a neural network architecture tailored for sequential data analysis. It utilizes causal convolutionstocapturetemporaldependenciesin transaction records. Trained on raw transaction data including features such as customer_id, date, transaction_type, amount, loan_date, loan_amount, borrower_type, and balance TCN analyzes the sequence of transactions to detect anomalous patterns indicative of ghost borrower behavior. Its strength lies in effectively modeling time-dependent relationships and detecting deviationsfromnormaltransactionaltrends.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

The Random Forest classifier operates on a synthetic feature set derived from the raw transaction data. This synthetic dataset is generatedbyaggregatingtransactioninformation into summary statistics, such as pre-loan transaction count, deposit and withdrawal totals, first-week withdrawal metrics, and post-loan activity metrics. By constructing an ensemble of decisiontrees,RandomForestreducesoverfitting andcapturesnon-linearinteractionsamongthese engineered features, efficiently predicting borrowersasghostornon-ghost.

ToovercometheindividuallimitationsoftheTCN and Random Forest models, an ensemble method is implemented. This approach combines the predictions from both models using a weighted scheme, where each model's contribution is proportional to its accuracy and reliability on validation data. By integrating the temporal insightsfromtheTCNwiththeaggregatedfeature perspective of the Random Forest, the ensemble classifier achieves a more robust and balanced bias-variance tradeoff, leading to improved ghost borrowerdetectionperformance.

3.3.2.3

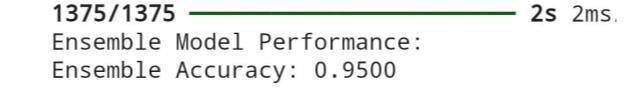

Fig-6 EnsembleModelAccuracyOutput(GhostBorrower Detection)

The ensemble model achieved an accuracy of 95.00% in detectingghostborrowers,demonstratingitseffectiveness in identifying fraudulent loan defaulters. The high accuracy suggests that combining multiple models enhances predictive performance by capturing critical patterns in borrower behavior. This result reinforces the model’sreliabilityin distinguishingghost borrowersfrom legitimateones.

The proposed integrated framework for loan default prediction and ghost borrower detection can be enhanced by several innovative directions. Future work mayimplement advanced ensemble techniques,suchas heterogeneous stacking with deep learning models, to boost prediction robustness. Incorporating Explainable AI (XAI) will offer clear, interpretable insights into

decision-making,helpingfinancialinstitutionsunderstand key risk factors. Additionally, leveraging real-time data integration and adaptive learning, possibly through reinforcementlearning,can create dynamicloanapproval and fraud detection systems that evolve with emerging trends. Expanding training datasets with alternative financial records, macroeconomic indicators, and regional data will enhance generalizability across diverse economicconditions.Finally,furtherresearchinenhanced feature engineering for ghost borrowers by incorporating digital footprints, social media data, and other alternative sources could enrich the synthetic datasetandimproveanomalydetectionaccuracy.

In this paper, we presented an advanced loan default prediction model using ensemble learning techniques, combining Random Forest, XGBoost, and Neural Networks in a stacking framework. Detailed data preprocessing, including missing value treatment, feature engineering, and normalization, enhanced model effectiveness. Evaluation using metrics such as Accuracy, Precision, Recall, F1-score, and AUC-ROC coupled with hyperparameter tuning and crossvalidation demonstrated improved performance over single-modelapproaches.

Additionally, we addressed the challenge of ghost borrowers by integrating a Temporal Convolutional Network (TCN) to analyze transaction sequences with a Random Forest classifier based on engineered features. This hybrid approach effectively identifies anomalous borrowing behavior.Our integrated model offers financial institutions a powerful tool to mitigate loan default risks,detect ghost borrowers,andoptimize lending decisions. Future work on Explainable AI, realtime data integration, and adaptive risk assessment will further enhance its impact on financial risk management

This work is supported in part by Prof. Pramila M. Chawan. We thank the reviewers for their valuable discussionsandfeedback.

[1] VijayKumar,RachnaNarula,AkankshaKochhar"Loan Default Prediction using Machine Learning Models" 2024DOI:10.5281/zenodo.8337054

[2] Jinchen Lin "Research on loan default prediction based on logistic regression, randomforest, xgboost and adaboost" 2023 pp DOI: 10.1051/shsconf/202418102008

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 04| Apr2025 www.irjet.net p-ISSN:2395-0072

[3] WanjunWu"MachineLearningApproachestoPredict LoanDefault2022DOI:10.4236/iim.2022.145011

[4] Platur Gashi, “Loan Default Prediction Model” 2023, DOI:10.13140/RG.2.2.22985.01126

[5] Lai,L,“Loandefaultpredictionwithmachinelearning techniques”. In: 2020 International Conference on Computer Communication and Network Security (CCNS).pp.5–9.IEEE(2020)

[6] Xu Zhu, Qingyong Chu,Xinchang Song, Ping Hu,Lu Peng, Explainable prediction of loan default based on machine learning models DOI:10.1016/j.dsm.2023.04.003

[7] Zhao X, Guan S. CTCN: a novel credit card fraud detection method based on Conditional Tabular Generative Adversarial Networks and Temporal Convolutional Network. PeerJ Comput Sci. 2023 Oct 10;9:e1634. doi: 10.7717/peerj-cs.1634. PMID: 37869461;PMCID:PMC10588710.

[8] A.Mandge,R.Fatehchandka,K.Goudani,T.Shelke,and P. M. Chawan, "A Survey on Loan Default Prediction using Machine Learning Techniques," International Research Journal of Engineering and Technology (IRJET),vol.11,no.11,pp.XX-XX,Nov.2024

[9] Boulieris, P., Pavlopoulos, J., Xenos, A. et al. Fraud detection with natural language processing. Mach Learn 113, 5087–5108 (2024). https://doi.org/10.1007/s10994-023-06354-5

[10] Loan Default Dataset Kagglehttp://bit.ly/3BA9WeX

BIOGRAPHIES

Prof. Pramila M. Chawan, isworkingasanAssociate Professor in the Computer Engineering Department of VJTI, Mumbai. She has done her B.E.(Computer Engineering) and M.E.(Computer Engineering) from VJTI College of Engineering, Mumbai University. She has 28 years of teaching experience and has guided 85+ M. Tech. projectsand130+B.Tech.projects.Shehaspublished143 papers in the International Journals, 20 papers in the National/ International Conferences/ Symposiums. She has worked as an Organizing Committee member for 25 International Conferences and 5 AICTE/MHRD sponsored

Workshops/ STTPs/FDPs. She has participated in 16 National/InternationalConferences.WorkedasConsulting Editor on – JEECER, JETR,JETMS, Technology Today, JAM&AER Engg.Today,The Tech.WorldEditor– Journals of ADR Reviewer -IJEF, Inderscience She has worked as NBA Coordinator of the Computer Engineering DepartmentofVJTIfor5years.Shehadwrittenaproposal under TEQIP-I in June 2004 for ‘Creating Central Computing Facility at VJTI’. Rs. Eight Crore were sanctioned by the World Bank under TEQIP-I on this proposal. Central Computing Facility was set up at VJTI through this fund which has played a key role in improving the teachinglearning processatVJTI.Awarded by SIESRP with Innovative & Dedicated Educationalist Award Specialization : Computer Engineering & I.T. in 2020 AD Scientific Index Ranking (World Scientist and UniversityRanking2022) – 2ndRank- BestScientist, VJTI Computer Science domain 1138th Rank- Best Scientist, ComputerScience,India.

Kunal Goudani, B-Tech Student, Dept. of Computer Engineering and IT, VJTI, Mumbai, Maharashtra, India

Rohan Fatehchandka, B-Tech Student, Dept. of Computer Engineering and IT, VJTI, Mumbai, Maharashtra, India

Adwait Mandge, B. Tech Student, Dept. of Computer Engineering and IT, VJTI, Mumbai, Maharashtra, India

TanayaShelke, B.TechStudent,Dept.of ComputerEngineeringandIT, VJTI,Mum