Managing Director

Shankar Shivaprasad

Co-founder & CEO

Shashank M

Chief Editor

Ujal Nair

Head of Operation

James Smith

Head of Production

Tom Hanks

Head of Research

Catherine D’Souza

Head of Media Sales

John Smith

Advertising Contact Info@wboutlook.com

Content Managers

Kevin Thomas

Laura Edwards

Sathyanarayana B

Amith Raj S

Business Developers

Daisy Cooper, Mark Cooper, Justin Wong, Elena Davis, Eric Thomson

Graphic Designer

Charles Smith

Chandan R

Video Editor

C Gidieon Sam Issac

Accounts Manager

Steve Smith

Office Address

32 Pekin St #05-01

Singapore 048762

Phone: +65 86159608

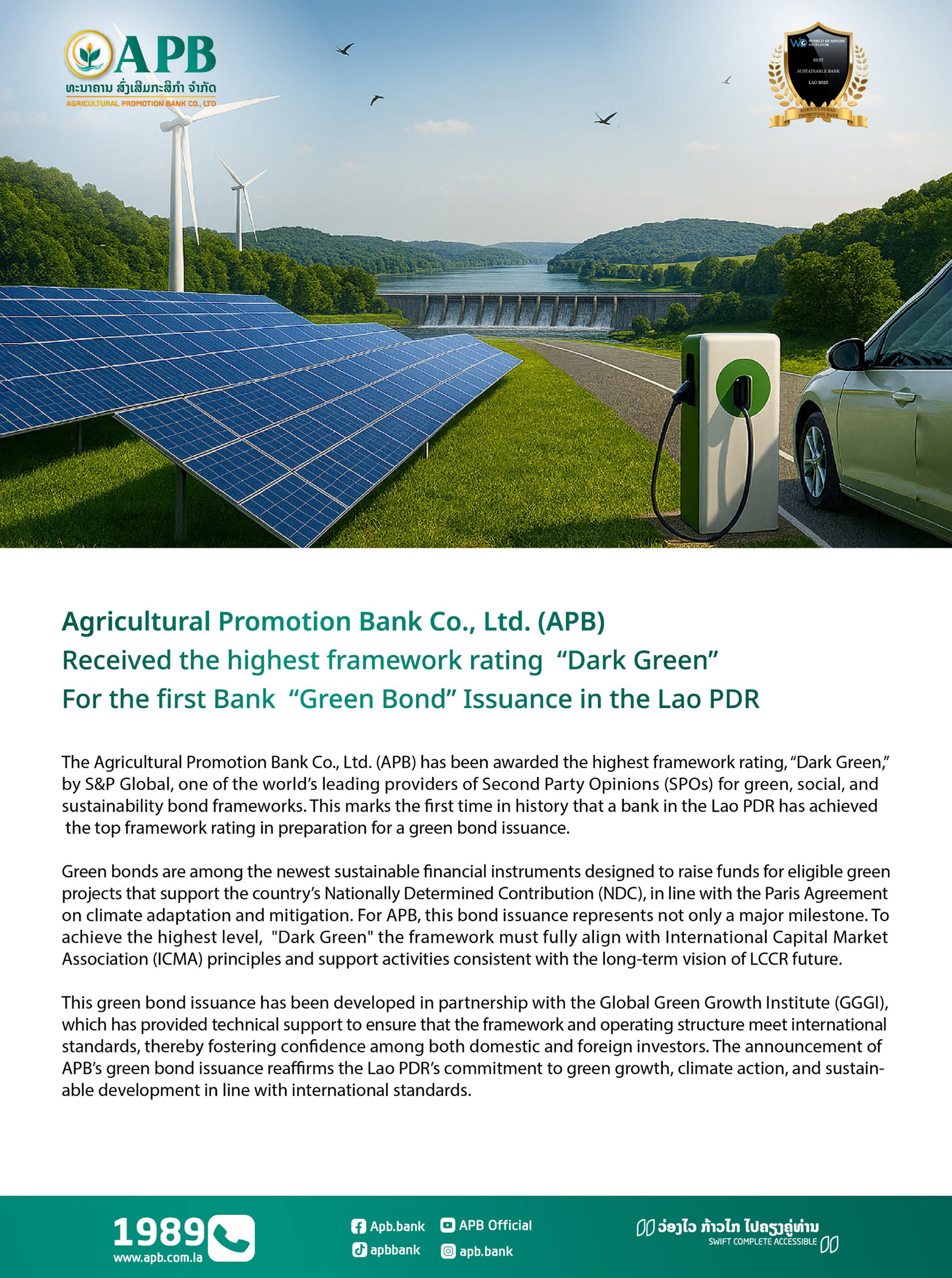

The global business and financial landscape in 2025 is marked by resilience, innovation, and transformation. Equity markets across the US, Europe, and Asia continue to show strength, with technology and energy sectors driving growth, while sustainable finance and green bonds are reshaping investment priorities. From the rise of digital-first strategies in emerging economies to the acceleration of fintech and cooperative insurance models, businesses worldwide are adapting to shifting consumer expectations, regulatory frameworks, and the urgent call for sustainability. This dynamic environment sets the stage for recognising the leaders who are redefining excellence.

This exclusive issue is a celebratory curation, highlighting the exceptional companies honoured at the World Business Outlook Annual Awards 2025—companies that have set benchmarks in their respective industries. Tradernet has redefined global trading platforms with seamless access to diverse markets, while the Agricultural Promotion Bank Co. Ltd. of Laos has pioneered sustainable finance through its landmark green bond issuance. In Myanmar, Eager Communications Group has transformed connectivity with cutting-edge telecom infrastructure, driving socio-economic growth. PHirst Park Homes in the Philippines continues to champion affordable housing with innovative communitycentric designs. McDermott stands tall in powering global energy security with integrated offshore engineering solutions, while Budget Saudi Arabia has emerged as a leader in mobility and logistics, combining customer-centric services with sustainability initiatives. These organisations exemplify how vision, innovation, and execution distinguish true leaders from their peers.

As we honour these trailblazers and many more, we also look forward to the grand gathering of global business leaders, diplomats, industry pioneers, innovators, and changemakers at the World Business Outlook Annual Awards Event 2025. The event will be held on November 8th at the luxurious Pullman Bangkok King Power Hotel in Bangkok, Thailand. This grand gala is a premier opportunity to network with global industry leaders, celebrate success, and gain insights into the strategies that define world-class organisations. Mark your calendars for an evening of inspiration and celebration—we look forward to welcoming you to Bangkok!

Be sure to check out our website at www.worldbusinessoutlook.com

PHirst Park Homes Crowned First Choice in Homes Providing Company Philippines 2025

Driving Excellence: How Budget Saudi Arabia Leads the Kingdom’s Car Rental Industry in 2025 12 McDermott: Powering Global Energy Security with AwardWinning Integrated Solutions

The Positive Impact of the Telecommunication Sector on Myanmar’s Economy

The Philippine housing landscape remains under pressure from a substantial backlog in low-cost and affordable segments, which experts estimate at several million units nationwide. Rapid urbanisation, steady population growth, and lingering pandemic-related supply challenges have sustained demand for high-quality yet affordable homes.

PHirst Park Homes’ focused approach to first-home communities directly addresses this gap, providing accessible financing options, expandable house designs, and community amenities that cater to evolving family needs.

PHirst Park Homes has been recognised as the “First Choice in Homes Providing Company Philippines 2025” by Singapore-based World Business Outlook. This honour highlights PHirst’s mission to deliver affordable, welldesigned, and community-focused housing across the

Philippines and beyond, while setting new benchmarks in first-home development.

PHirst Park Homes, the first-home brand of Century Properties Group, was founded on the 4C principle: Complete Homes, Conceptive Amenities, Connected Essentials, and a Convenient buying and selling experience. Since its launch, the company has focused on masterplanned communities that integrate green spaces, thematic parks, outdoor cinemas, village shuttles, and retail strips into each development. This integrated approach has enabled PHirst to rapidly expand its footprint, bringing thoughtfully designed house-andlot and townhouse models to key growth corridors.

By the end of 2020, PPHI had completed 1,536 houseand-lot units in Tanza and Lipa, showcasing its ability

to meet the country’s surging demand for quality homes in a year. In 2021, the company introduced four projects valued at P14.31 billion, followed by seven more communities delivering 9,349 units across Tanza (Cavite), Lipa and Nasugbu (Batangas), San Pablo and Calamba (Laguna), Pandi (Bulacan), and Magalang (Pampanga), worth P11.25 billion in sales value.

PHirst’s growth trajectory accelerated in 2024 and early 2025. By April 2025, the company had completed construction on approximately 15,000 units across its 27 active projects nationwide and had delivered over 10,000 homes to first-time buyers by mid-2025. In early 2025, PHirst Park Homes launched three grand projects in South Luzon: Century PHirst Centrale Batulao in Nasugbu; PHirst Park Homes San Pablo East, a 12.77-hectare project with 1,440 fully finished Calista townhouses; and PHirst Park Homes Sto. Tomas, a 37-hectare community offering over 3,000 homes. On May 31, the company unveiled PHirst Park Homes Magalang East, a 24-hectare sequel development with 2,290 fully finished units, including both Calista Townhouses and Unna Single Attached models.

PHirst Park Homes’ portfolio features versatile designs tailored to Filipino families. The Calista Townhouse cluster includes the Calista End, the inner-unit Calista Mid, and the Calista Pair option that combines two adjacent homes into one larger dwelling. The Unna single-attached model offers standalone living with one shared firewall, while the Brenna bungalow caters to those seeking onestorey, open-space layouts. Every model comes with provisions for future expansion, ensuring adaptability to growing household needs.

In September 2025, PHirst Park Homes marked its Mindanao debut with the P5.3 billion PHirst Park Homes

Gen San project in General Santos City. Set on 25 hectares, the community will offer over 2,000 fully finished homes in two signature models: the Amani townhouse and the Dua single-attached unit. Both home types feature expandable layouts, replicating PHirst’s promise of “a home in a park, and a park in a home” through generous open spaces and thematic amenities.

Backing this operational success, parent company Century Properties Group reported a 31 percent increase in net income to P2.44 billion for 2024, while overall revenue climbed 15 percent to P14.64 billion. The first-home segment generated P9.9 billion in revenue—a 34 percent jump year-on-year—underscoring strong market demand for affordable housing solutions.

Sustainability and community resilience are central to PHirst’s model. The company established an in-house water services management group, PH20, to oversee water infrastructure and ensure a reliable supply in its developments. PH20 operations currently cover PHirst Park Homes Batulao (Batangas), PHirst Sights Bay (Laguna),

PHirst Park Homes Tayabas (Quezon), and PHirst Park Homes Balanga (Bataan), bolstering operational efficiency and reducing dependency on external utilities. Complementing this, PHirst-Build—its precast and cast-in-place construction arm—drives waste reduction and quality control, cutting construction timelines and environmental impact across multiple sites.

Looking ahead, PHirst Park Homes will continue to expand its footprint across key areas in the Philippines within the year and the following years. Bolstered by strategic partnerships and ongoing investments in construction technology, PHirst aims to sustain its leadership in the firsthome sector, ultimately bringing quality, affordable housing to even more Filipino families.

Budget Saudi Arabia, the flagship brand of Unitrans Group of companies, an industry leader in transportation solutions, has become the premier name in car rental and leasing within Saudi Arabia through continuous innovation, an unwavering focus on customer experience, and dynamic executive leadership. Founded in 1978, the company has progressed from a single location with 20 cars to a robust network with over 105 offices, a combined group fleet exceeding 58,000 vehicles, and a staff of more than 2,400 dedicated employees. In 2024, Budget Saudi Arabia completed the strategic acquisition of AutoWorld, and the synergies were fully established, enhancing the growth of the company. The operational integration after the AutoWorld acquisition resulted in optimised costs for procurement, insurance, and administration, strengthening Budget’s market position. Strategic investments were made in expanding logistics solutions, notably through subsidiaries like Overseas Development LLC, to capitalise on Saudi Arabia’s logistics sector growth under Vision 2030.

In 2025, Budget Saudi Arabia reaffirmed its reputation for excellence by securing three prestigious awards from the globally acclaimed World Business Outlook, a testament to its transformative role in the sector. The three titles are:

• Best Car Rental Company Saudi Arabia 2025

• Most Outstanding Customer Service in Transportation Saudi Arabia 2025

• Best CEO in Car Rental & Logistics in Saudi Arabia 2025 (awarded to Mr. Fawaz Abdullah Danish)

These accolades reflect not only the company’s operational strength but also its dedication to redefining standards in the car rental industry.

Operating across all regions in Saudi Arabia, Budget Saudi Arabia delivers a comprehensive suite of mobility solutions—car rentals, long- and short-term leasing, pre-owned vehicle sales, international and domestic

reservations, cross-border rentals, chauffeur services, and premier limousine services. Notably, the company has invested in advanced infrastructure, including extensive workshop facilities and the largest maintenance network in the Kingdom, ensuring superior vehicle quality and reliability throughout its service network. By listening intently to the nuanced demands of its diverse clientele, Budget Saudi Arabia has maintained its trusted status among locals, tourists, and business travellers alike.

World Business Outlook honoured Budget Saudi Arabia as the “Best Car Rental Company Saudi Arabia 2025”—an accolade rooted in tangible operational achievements and exceptional market impact. The company’s robust expansion, both organically and through strategic acquisitions, has elevated its share in long-term and flexible leasing services, with an unparalleled fleet size, superior coverage, and high asset reliability. Comprehensive customer services—like hands-on support, transparent

policies, and user-friendly booking platforms—underscore the company’s commitment to making car rental seamless, flexible, and trustworthy. These efforts have reshaped local transportation experiences, setting industry benchmarks for service quality, safety standards, and innovation.

The “Most Outstanding Customer Service in Transportation Saudi Arabia 2025” award reflects Budget Saudi Arabia’s intensive and enduring focus on customer satisfaction. The company’s success pathway has hinged on creating bespoke service packages, providing swift and responsive assistance, and offering multi-lingual support, as well as leveraging digital touchpoints—such as the Budget App—to offer quick bookings and dynamic service management. Customer-centric programs like the Corporate Leasing Offers, cross-border rental options, premier limousine services, the highly popular “At your

Door-step Services (ADS), and nationwide chauffeur services illustrate Budget Saudi’s agility in meeting both individual and corporate needs, while maintaining rigorous service standards.

At the heart of Budget Saudi Arabia’s extraordinary success is Mr. Fawaz Abdullah Danish, the company’s President and Group CEO, who won the “Best CEO in Car Rental & Logistics in Saudi Arabia 2025” award. Mr. Danish’s strategic vision and relentless pursuit of

operational excellence have transformed Budget Saudi into one of the world’s largest franchises for a single brand of the global ABG Group and a regional powerhouse. Under his leadership, the company successfully listed on the Saudi Stock Exchange (Tadawul), expanding its footprint, profitability, and brand reputation. Mr. Danish’s ability to inspire the management team of dynamic executives to build and manage a customer-centric corporate culture, drive innovation, and respond agilely to market changes has contributed directly to Budget Saudi Arabia’s sustained growth and resilience, especially during challenging times like the global pandemic.

He has been recognised for steering pivotal mergers and acquisitions along with his team and integrating sustainability into the company’s core strategies, further underscoring his credentials as a transformative industry leader. The company’s repeated wins across leadership and customer service awards exemplify Mr. Danish’s brand of value-driven, ethical business management.

In pursuance of the Vision 2030 of the Kingdom, the company has formulated a comprehensive growth strategy to achieve accelerated growth in fleet, revenue, network, and infrastructure to serve the customers efficiently and deliver operational efficiency to create historic achievements, thereby delivering value and earnings to the stakeholders.

The company’s relentless pursuit of service quality, innovative product development, responsive digital transformation, and consistent commitment to sustainability—including green fleet management— have elevated its status beyond just commercial success and into the realm of socially responsible business leadership. Its CSR activities, collaborating with Green initiatives by planting over 3,000 tree saplings in association with Jeddah Forestation Project, induction of Hybrid & EV vehicles to ensure sustainable mobility in KSA and active participation in Community development projects by sponsoring major organizations such as Jeddah Orphans, Saudi Heart Society to name a few and Saudi Football Federation, Saudi Weightlifting

Federation, Saudi Games to promote Sports and games initiatives speaks volumes of its commitment to society. Furthermore, in collaboration with the Royal Commission of Al Ula, Budget Saudi contributes to Tourism transportation and Heritage preservation. The efforts at its facilities to recycle and reuse emphasise developing a culture that is responsible for the environment and sustainability.

The company’s extensive investments in talent development and alignment with Saudi Arabia’s Vision 2030 reflect a broader strategy for impact—well beyond financial metrics alone. Budget Saudi Arabia’s ongoing value creation, market adaptability, and community engagement showcase precisely why World Business Outlook’s expert panel deemed it worthy of three major awards in 2025.

Budget Saudi Arabia’s triple triumph at the World Business Outlook Awards 2025 stands as a powerful validation of its pivotal role in shaping modern transportation and logistics in the Middle East. Through innovative expansion, unmatched customer service, and visionary leadership from Mr. Fawaz Abdullah Danish, the company continues to redefine industry standards and inspire confidence among stakeholders across the region. In an arena where excellence is the only benchmark, Budget Saudi Arabia’s achievements make it the model for future-focused, responsible, and customer-driven business in Saudi Arabia.

McDermott’s Subsea and Floating Facilities business line has been recognised for its exceptional leadership in offshore engineering and construction, securing two prestigious awards from the Singapore-based World Business Outlook magazine:

• Most Premier Fully Integrated Provider of Engineering and Construction Solutions Malaysia 2025

• Best Offshore Engineering Solutions Provider Malaysia 2025

These accolades underscore McDermott’s unrivalled capacity to deliver complex, end-to-end energy infrastructure across the globe, from the Gulf of Mexico to Asia and frontier basins in Africa and South America.

Leveraging over a century of collective expertise, a global team of more than 2000 professionals driving subsea and deepwater project execution from Malaysia, Houston, and London, McDermott’s Subsea and Floating Facilities operations stand at the forefront of offshore energy solutions delivery to customers worldwide.

• Engineering, Procurement, Construction, and Installation (EPIC) for subsea production systems, pipelines, flowlines, risers, and umbilicals

• Design and fabrication of floating production, storage, and offloading (FPSO) units

• Modular and field construction for jackets, topsides, and fixed platforms

• Marine construction and installation supported by a versatile fleet of pipelay and construction vessels

This integrated model enables McDermott to optimise costs, mitigate risks, and accelerate project timelines. It is this holistic capability—coupled with a focus on safety, quality, and sustainability—that earned the company its “Most Premier Fully Integrated Provider of Engineering and Construction Solutions Malaysia 2025” award. Meanwhile, its deepwater engineering expertise, technology, and track record of delivering offshore projects clinched the “Best Offshore Engineering Solutions Provider Malaysia 2025” accolade.

The “Most Premier Fully Integrated Provider of Engineering and Construction Solutions” award reflects McDermott’s unique ability to unify engineering, procurement, fabrication, and installation under a single umbrella. This integrated delivery model streamlines project interfaces, enhances schedule certainty, and brings cost optimisation. Securing the “Best Offshore Engineering Solutions Provider” title speaks to their deepwater pedigree. From pipelaying at water depths nearing 3,000 meters in the Gulf of Mexico and executing complex welding scopes offshore in West Africa to fabricating the largest and heaviest jacket structure in company history for a project in Western Australia and delivering offshore transportation and installation services in East Malaysia, McDermott’s Subsea and Floating Facilities team consistently delivers technically complex projects with precision and reliability.

Interview with McDermott: Vision, Innovation, and the Road Ahead

To delve deeper into McDermott’s global offshore strategy and outlook, we sat down with Mahesh Swaminathan, McDermott’s Senior Vice President, Subsea and Floating Facilities. Here is an edited transcript of our conversation.

Q1. Tell us about your company’s products and services in the energy sector.

Our Subsea and Floating Facilities business line delivers comprehensive EPIC solutions for offshore projects across shallow to ultra-deepwater environments. We design and install subsea production systems, pipelines, flowlines, risers, and umbilicals, alongside floating production

and storage facilities. Backed by decades of execution experience, dedicated engineering centres, and inhouse fabrication capacity, we provide end-to-end delivery of complex offshore infrastructure. Today, we enable energy development from Australasia to Africa, and South America—regions where robust energy security is critical to national growth and development.

Q2. Can you brief us on how your company is leading from the front in the energy transition sector?

When it comes to the transition, it is important to say that we recognise the need for traditional oil and gas to coexist alongside emerging energy sources. The key lies in how we support field development or redevelopment through the replacement of infrastructure to enhance existing production. By deploying smarter engineering, fabrication, and marine construction tools, and by actively working to reduce emissions from our own operations, we help make offshore field development more efficient and environmentally responsible. This approach enables us to contribute meaningfully to a lower-carbon sector while continuing to meet global energy demands. This can involve:

• Designing subsea and floating structures with a reduced emissions footprint over their lifecycle

• Applying advanced materials and digital-centric tools to optimise energy efficiency of these facilities

• Delivering bespoke solutions for the safe and environmentally responsible removal of infrastructure at the end of its operational life cycle

Simultaneously, we look to new frontier oil and gas projects as vital for energy security in emerging markets. Through the subsea infrastructure solutions we offer, we not only help unlock dormant reserves, but also support economies in achieving a balanced energy mix that underpins economic growth while transition pathways mature.

Q3. 2030 is fast approaching. What is your opinion on where the world stands now in terms of the Paris Agreement goals?

I believe it is important to acknowledge that oil and gas will continue to play an essential role in energy security,

especially in high-growth regions of Asia, Africa, and South America, where demand is surging. To bridge the gap, projects must be executed with emissions-reduction measures that drive real change. Carbon capture storage also stands out as central to driving down operational carbon intensity. Add to this robust decommissioning and asset retirement plans. Faster permitting and stronger policy frameworks are imperative. Governments and industry must collaborate to streamline regulations, incentivise technology adoption, and mobilise finance toward transitional infrastructure.

Q4. According to you, what is the future of the deepwater energy sector? What are the challenges in this sector that need immediate attention from the world?

As I have alluded to before, I believe the future of the deepwater energy sector remains robust and strategically important, especially as global energy demand continues to grow and mature basins decline. Deepwater projects offer access to large, high-quality reserves that are critical for energy security, particularly in emerging markets. With advancements in subsea technologies and integrated project delivery models, deepwater developments have the potential to continue scaling efficiency and become increasingly aligned with sustainability goals. However, several challenges require urgent attention:

• Carbon Intensity: Deepwater operations are energyintensive. Reducing emissions across the asset lifecycle, from engineering and fabrication to installation and operations, is essential to align with global climate targets.

• Cost and Schedule Certainty: Despite technological progress, deepwater projects still face risks related to cost overruns and delays.

• Regulatory and ESG Pressures: Operators must navigate evolving environmental regulations and stakeholder expectations around transparency, biodiversity impact, and community engagement.

• Workforce and Skills Transition: As the sector integrates more digital and low-carbon technologies, there’s a growing need to upskill the workforce and attract new talent with expertise in automation and data science.

Ultimately, the deepwater sector must evolve, not just in what it delivers, but in how it delivers it. The companies that lead will be those that combine technical excellence with environmental responsibility and operational agility.

As the energy landscape evolves, McDermott remains committed to bridging the gap between existing hydrocarbon infrastructure and a lower-carbon future. Their asset-based positions them to partner with clients in navigating the energy transition while safeguarding global energy security.

McDermott’s current project portfolio and track record demonstrate that operational excellence, environmental stewardship, and strategic innovation can co-exist. As we approach 2030 and beyond, this integrated, balanced approach will be critical to powering resilient economies and achieving the world’s climate ambitions.

The global human population has become one large biological race, due to the evolution of the telecommunications sector (telecom). In 2025, more than 5.5 billion people will utilise the internet and mobile technology to be interconnected. Telecom companies create various infrastructures to ensure that data in the form of audio, video, text, and voice gets transmitted for communication. Recent technologies have brought the telecom industry to the brink of evolution. In Myanmar, hailed as one of the world’s emerging economies, the telecommunications industry has played a major role in economic development. Among the major players in the Myanmar’s telecom market, one name has gained prominence in recent years. Whether the task be implementing the Traffic Management System in a large city, or laying out metropolitan fibre networks, providing broadband infrastructure, Eager Communications Group has completed them with elan.

The Government of Myanmar formed the Information and Communication Technology (ICT) sector to boost educational programmes for youth, e-governance and infrastructure development. With able assistance from the Asian Development Bank, the World Bank Group and Government support in the form of public sector loans, output-based aid and private sector finance have provided consistent revenue growth to the industry.

Experts opine that the mobile and broadband segments will contribute to Myanmar’s economic development in the coming years.

In recent years, the Ministry of Transport & Communications (MoTC) has designed the Universal Service Strategy (2019 to 2026) and Spectrum Roadmap (2022 to 2026) regulations. These two policies will boost mobile broadband/5G services and infrastructure development in the telecom sector.

It is in these conditions that Eager Communications Group, established in 2014, has firmly cemented its name in the telecom industry by winning the reputed title of Leading Telecommunication Solutions Provider in Myanmar 2025. The World Business Outlook Awards, in its fourth annual year, has again identified Eager Communications Group in the telecom sector for its remarkable contribution to setting new benchmarks in excellence for 2025 in the Southeast Asian region.

Since 2014, Eager Communications Group has not left any stone unturned in building the best quality infrastructure for providing telecom services in Myanmar. Their execution strategies are well-designed to respect the project requirements, cater to the culture & heritage of the local population, improve the quality of life and promote socioeconomic development in Myanmar.

To provide top-notch services both domestically and abroad, the management of Eager Communications Group, which is made up of skilled professionals, carefully selects specialists with outstanding telecom knowledge and strong business ethics.

Additionally, they have designed a foolproof construction strategy to assist Myanmar’s population.

They are to:

• Offer the best connectivity solutions for businesses to improve customer engagement & digital transformation

• Improve the health conditions of the local population in rural, sub-urban, urban and remote areas of Myanmar

• Help the educational institutions in developing new educational courses/programs for all types of students/ graduates/postgraduates

• Generate relevant job opportunities catering to the educational qualifications in rural and urban areas

• The constructed buildings and development project cater to Governmental guidelines and international standards in terms of technical quality and governance.

Keeping in tune with the goals, the infrastructure team has succeeded in providing fiber optic networks in all parts of Myanmar (Example – Yangon/Mandalay cities). When it comes to mobile brand infrastructure, they are in the process of building infrastructure for

• Yangon City Development Committee

• Mandalay City Development Committee

• National and International Banks

• Mobile Network Operators

• And Internet Service Providers.

Despite their achievements in construction projects and improving the economic and social status of local populations, the management remains committed to satisfying the expectations of consumers, employees, investors, and stakeholders. They have designed a Corporate Social Responsibility in tune with international standards.

The Jury at World Business Outlook has reviewed the high technical quality of the infrastructure solutions in projects that Eager Communications Group has completed. Many global companies have won similar awards, but what differentiates is its commitment to designing operational practices that protect the local flora and fauna, reduce air pollution and take steps to prevent water pollution. They have also taken steps to ensure that employees (including contractor

employees) and the public get a safe environment during a visit or working hours. They won the award title for their commitment to delivering operational environments that offer premium telecommunication services to satisfy local and international customers.

The projects ECG is working on speak for themselves. The most important and recognised ongoing projects are:

• Installing the FOC (Fiber Optic Cable) and FOD (Fiber Optic Duct) in the well-known cities of Yangon and Mandalay to provide bandwidth as well as cable services to internet service providers and telecom companies.

• They have completed implementing 63 KM of FOD in the Kawkareik to Myawaddy route. The other notable ongoing project is the installation of FOD

for nearly 470 km in the Taunggyi to Loikaw to Taungoo route.

The telecom industry in Myanmar has seen positive changes since 2013. With foreign companies such as Telenor (Norway), Ooredoo (Qatar) gaining a license to operate as telecom carriers in the country, the lifestyle of the local population and business revenue changed. Eager Communications Group has established partnerships with Telenor, Mytel and Ooredoo in mobile networking services. As per telecom experts, the broadband and internet market is poised to grow at an alarming rate. The volume of data that telecom systems are capable of sending will also see an improvement that should enrich people’s lives. Businesses in various sectors are expected to become more efficient and make a valuable contribution towards the growth of Myanmar’s economy.

Health and life insurance coverage in the UAE carries more than transactional weight. It sits within a broader national framework — one that expects insurance products to operate with discipline, transparency, and moral clarity. As the participation widens and oversight deepens, the nature of policy delivery has started to separate into distinct tiers.

A growing number of providers are moving toward mechanisms anchored in mutual support. These models avoid ambiguity in contract terms, maintain clear treatment of surplus, and apply investment rules bound by religious and legal standards.

Takaful Emarat, established in 2008, applies this approach across its life and health coverage offerings. Its model relies

on pooled contributions, with protections extended to all participants through a fixed set of rules.

Fund segregation is maintained, and every obligation is reviewed under the firm’s appointed Shariah board. Claims are efficiently handled through participant funds. Investment activity remains within screened channels. All processes are reviewed by an independent Shariah board, creating a form of insurance that answers to both compliance bodies and ethical governance.

As this format becomes integral to the UAE’s domestic coverage strategy, World Business Outlook has acknowledged the contribution of a leading entity in this space. And, Takaful Emarat – Insurance (P.S.C.) has been awarded the title of:

The recognition shows the firm’s consistency in applying cooperative insurance principles within a regulated system. Across their product categories, Takaful Emarat maintains proper separation of accounts, defined claims execution, and surplus treatment in accordance with approved religious and financial standards.

Takaful Emarat operates differently from conventional insurance. The concept of Takaful is based on the following principles:

• Mutual Cooperation: Participants cooperate with one another for the common good of the group.

• Contributions for Assistance: Each participant makes a contribution to assist others in times of need.

• Donation-Based Agreement: The Takaful contract functions as a donation agreement, designed to share losses and spread liability through a community pooling system.

• Elimination of Uncertainty: The elements of uncertainty are removed, as both the contributions and compensation amounts are clearly defined.

• Ethical Sharing: Takaful does not seek to profit at the expense of others, ensuring fairness and equity within the system.

The board includes reputed scholars in the Sharia Board, such as Dr. Moosa Khoory and Dr. Azzedine Benzeghiba, each of whom carries decades of experience in Islamic finance jurisprudence. Their guidance supports all core activities, from product approval to surplus distribution methodology.

The company’s corporate Health plans are designed to serve employers looking to consolidate health protection under a single policy. Coverage includes both employees and their dependents, applied through a single contract. The plan connects users to a medical network that spans local and international providers, including hospitals, clinics, and specialist care centres. In addition to it, Takaful Emarat also offers a wide variety of individual health plans to ensure comprehensive coverage and access to quality health care services.

When it comes to protecting what matters most — your family, your legacy, and your peace of mind — life coverage plays a foundational role. In a world increasingly seeking ethical and value-aligned financial solutions, Takaful Emarat’s life protection plans stand out by blending mutual cooperation with faith-based integrity. Whether your goal is simple protection or long-term wealth accumulation, our solutions support every stage of life.

Takaful Emarat’s Pure Protection Plans provide straightforward life coverage without any investment component — offering essential financial security with

simplicity and clarity. Under the Takaful model, participants contribute to a shared Tabarru’ fund, which supports others in times of need. With affordable contributions, optional riders, and a fully Shariah-compliant structure, these plans are ideal for individuals and families seeking peace of mind rooted in ethical assurance.

Designed for those planning future milestones such as education, Hajj, or homeownership, Takaful Emarat’s Savings Plans combine life cover with regular, disciplined savings. Contributions are partially invested in Shariahcompliant funds, with benefits paid upon maturity or in the event of death. These plans ensure transparent fund allocation and encourage halal financial growth, free from interest and unethical industries.

Takaful Emarat’s Investment Plans enable participants to make lump-sum contributions that are invested in ethical, Shariah-compliant funds — while maintaining life cover. Offering market-linked performance, these plans are tailored for individuals seeking long-term, halal wealth creation.

Every Takaful Emarat offering is built on the foundation of transparency and trust — featuring clear fee structures, certified Shariah oversight, surplus sharing, and a fully digital process. Together, these elements empower customers to protect and grow their future in alignment with their faith and values.

Hamdi Osman, Founder and CEO of SolitAir

In the fast-moving world of international cargo logistics, some companies take decades to establish a credible footprint. SolitAir has done it in just a year. Establishing its operations in October 2024, this UAE-based exclusive cargo airline has rapidly emerged as a transformative force in air freight, with accomplishments that defy its startup status.

From its launch at Dubai World Central (DWC), SolitAir set ambitious targets and began rewriting the narrative for what a new cargo airline could achieve. In a major accomplishment, SolitAir obtained an Air Operator Certificate (AOC) in the UAE in record time, made possible through the exceptional support and collaboration of the General Civil Aviation Authority (GCAA). This is an achievement that speaks volumes about the airline’s operational discipline, regulatory compliance, and unwavering determination. For a startup, clearing such a critical regulatory hurdle so swiftly is nothing short of extraordinary.

SolitAir is already redefining air freight excellence. Driven by a tech-enabled, customer-centric B2B model, the company ensures fast, reliable airport-to-airport movement of goods tailored to the bespoke needs of integrators, freight forwarders, airlines, SMEs, and booming e-commerce markets.

Despite being a newcomer, SolitAir boasts a growing fleet of seven advanced Boeing 737-800 freighter aircraft, purpose-built for handling everything from perishables and pharmaceuticals to dangerous goods and relief supplies with unmatched reliability and responsiveness.

What truly sets SolitAir apart is its meteoric expansion. In just over one year, the airline has established operations across 23 countries and 34 cities, building a strong presence in Africa, the Middle East, the Indian Subcontinent, and parts of China. With a target of connecting over

50 cities by 2027, SolitAir serves as a critical logistics partner, proving that rapid growth and operational excellence can indeed go hand in hand.

Every detail, from SolitAir’s 220,000 square foot infrastructure at DWC (Al Maktoum International Airport) to its advanced cold storage and secure warehousing solutions, has been meticulously developed to offer seamless, high-volume cargo movement. Direct runway access and on-site customs and police presence ensure compliance and efficiency, even for the most sensitive shipments. These are extraordinary benchmarks for a company barely past its first anniversary.

SolitAir’s startup DNA brings agility and flexibility that customers value. The airline offers:

• Scheduled freighter services for steady, reliable cargo demand.

• Flexible charters and ad-hoc solutions tailored to urgent and unique requirements.

• Long-term programs and recurring charters customized for regular clients.

• Interline agreements that expand network reach by partnering with other leading airlines.

In a little over a year, SolitAir has set new standards for what is possible in the cargo aviation industry, not just keeping pace, but leading the way with innovation, speed, and reliability. Its rapid path from startup launch to network expansion and regulatory milestones is a testament to the vision and dedication of its team.

As international trade and logistics demands continue to surge, SolitAir’s journey proves that bold ideas, executed with precision, can achieve “impossible” goals in record time. For the global market, SolitAir isn’t just a company to watch, it’s a company already making history.

Many young adults focus on building careers, traveling, or paying down student loans, understandably so. Life insurance often doesn’t make the list of immediate priorities. Choosing to lock in a whole life insurance policy early in life can offer significant long-term advantages. It isn’t just a financial tool for those with dependents or mortgages; it can be a powerful asset for millennials looking to secure their future.

One of the most compelling reasons to purchase whole life insurance when you’re young is the cost. Life insurance premiums are largely based on age and health status. When you’re in your twenties or early thirties, you’re likely in peak health, meaning insurance providers view you as a low-risk client. That translates to more favorable rates, lower premiums for a policy that will stay with you for life.

Whole life insurance differs from term policies in that it guarantees coverage for the entirety of your life, not just a set term. The premium stays the same, so by locking in a rate early, you beat the price inflation that comes with age. This can result in substantial savings.

Whole life insurance includes a cash value component that grows. This built-in savings feature accrues interest at a rate set by the insurance provider and can become a significant financial asset if allowed to mature uninterrupted. The longer the policy remains active, the more it grows.

For most millennials, this means time is on your side. By starting early, you give the policy decades to accumulate value. The cash value can be borrowed against, used for emergencies, or even to help fund a major expense like a down payment or educational costs.

Millennials often seek personalized financial strategies, and life insurance is no exception.

Whole life policies can be customized through riders and additional features that align with specific goals. For those seeking a more comprehensive approach, coverage options for millennials include disability waivers, accelerated death benefits, and long-term

care riders, providing peace of mind beyond the basic payout. A very common misconception is that life insurance is rigid. In truth, many insurers offer adaptable plans that can evolve with your life stage.

You might begin with a smaller policy and expand it as your income increases or your family grows.

Locking in whole life insurance early provides a sense of financial security that’s hard to replicate. Even if you don’t yet have a spouse, children, or mortgage, having a guaranteed benefit in place protects against the unknown. It ensures your loved ones won’t carry the financial burdens in the event of your passing, even if those loved ones are your parents or siblings.

For entrepreneurs and freelancers, an increasingly common path among millennials, this kind of financial anchor can be particularly reassuring. Unlike employerprovided term insurance that vanishes when you change jobs, your whole life policy stays with you, offering reliable continuity.

Many young adults don’t immediately think about legacy planning, but it’s another benefit of whole life coverage. The death benefit can be used to leave money to family, support a cause, or contribute to a trust or educational fund. When structured properly, this benefit passes tax-free to beneficiaries, creating a meaningful and efficient way to transfer wealth.

This long-term perspective can be valuable for those who might not accumulate large assets elsewhere. The guaranteed payout of a whole life policy offers an accessible way to build an inheritance, regardless of market fluctuations or economic changes.

Purchasing a policy while you’re young and healthy guarantees insurability for the future. Even if you develop a chronic illness or experience a major health event later in life, your whole life policy remains in force

as long as you pay your premiums. This future-proofing aspect of whole life insurance is particularly important given the rising rates of chronic conditions in younger generations.

If you wait until a health issue arises, your ability to get approved or to afford the coverage you want could be limited. Taking proactive steps today can eliminate these concerns down the road and ensure that your options remain open.

Whole life insurance may not top the list of financial priorities for most young adults, but its long-term value makes it worth considering. Locking in a policy early provides lower premiums, a growing cash reserve, future flexibility, and dependable coverage regardless of life’s twists and turns.

There are many circumstances that require fast cash: medical bills, anniversaries, down payments, studies, house renovations, everything you do in this life involves money. Getting a loan is not difficult, what is more difficult is finding out what moneylender to go to when in need of cash. In this article we are going to look over some of the elements which you must take into consideration when choosing a moneylender, so that you can eventually choose the best licensed moneylender for your needs.

We’re going to start by defining the concepts we are going to address in this article. A credit company is, essentially, a financial company, which the Cambridge dictionary defines as “a company that provides loans”. The primary role of these institutions is, therefore, that of providing loans. These institutions are different from banks in the sense that they are often more flexible in terms of requirements, which means that it is technically easier for your loan application to get approved.

In Singapore, these companies must be licensed by the National Government and they are often referred to as “moneylenders”. If you’re thinking of contacting moneylenders, the first thing you must do is visit the online Registry of Moneylenders and make sure that the credit company in Singapore that you choose is licensed by the government.

There are many benefits you can get from working with moneylenders, which you cannot get from banks or other financial institutions. Here is a list of some of them:

• The chances of loan approval are higher: your application’s approval is subject to multiple factors, including credit score and income. These two factors can get in your way of obtaining a loan in Singapore. However, in comparison to banks, moneylenders are more flexible in terms of loan payment and in terms of approval, which increases your chances of getting a loan.

• Their approval times are a lot faster: Not just that, but their system is typically more digitalized and you can apply for a loan fully online. Companies are able to get you a personal loan in as little as 24 to 36 hours. In extreme circumstances, the fast approval rate can truly make the difference and help you out when you need cash the most. This gives moneylenders the edge when it comes to performance.

• Their range of loans is a lot bigger than a bank’s. The best licensed moneylender offers multiple loans that you can choose from. These can vary from personal, payday and instant loans to business, lifestyle, renovation, debt consolidation and mortgage loans. Basically, regardless of whatever your need may be, Singapore’s best licensed moneylender companies can get you the right loan for your need fast.

The more options you have, the more difficult it is to find the best among the mediocre. That’s true in any field. In this section we are going to look over some of the elements which are a must when deciding on a company, if you want to go for the best. Here they are:

Obviously license and reputation come first when looking for the best of the bunch. If the moneylender

you’re considering is not licensed by the National Government, you should not work with them. Licensed moneylenders are subject to multiple guidelines set by the Government, all set in place in order to improve your borrowing experience.

According to the guidelines provided by the Government, licensed moneylenders are not allowed to solicit for loans via text and they must meet the borrower face to face before signing the documents. This is done in order to protect you, the borrower, and ensure good and lawful practices.

When it comes to reputation, the best way you can check their image is to look at their reviews. Do not stop at the reviews on their website, check their social media platforms as well. Another important thing you can look for is awards and prizes that the moneylender proudly showcases on their website.

The more moneylenders there are, the more options you have in terms of rates and fees. The moneylenders are limited by law to a maximum of 4% interest rate per month and, while that is nationally regulated, there are some other things you can ask about in order to make the best choice:

• Ask the moneylender if they use the flat interest rate or the effective interest rate. This gives you a better image of the final cost you’re going to pay.

• Ask the moneylender if there are any additional fees you should know about. Depending on the financial agency you’re going with, you might expect processing fees, late payment fees or early repayment fees. This is normal; what is not normal is that you do not know about the costs, so you should ask about it beforehand if the moneylender doesn’t transparently share this information with you.

Another aspect that is different depending on the

moneylender company you end up going for is the loan amount and the tenure. Some companies are known for offering smaller loans for shorter periods of time, while some other ones are known for going for bigger loans that spread over a few years. Depending on your financial needs, going for a company that has more experience with the type of loan you need can be more beneficial.

The same goes for tenure. The longer the repayment plan, the more interest you end up paying in the long run. However, the monthly rates might be lower and more manageable. It is all depending on your need and, if you’re not sure what option to go for, a financial consultant can offer you the best advice in this regard.

The fintech industry is booming, and PayTech startups are at the forefront of the revolution. Choosing the correct software solution can transform how a PayTech company handles payments, compliance, and customer data, directly impacting its ability to compete in an increasingly crowded market. For founders and operators in this space, understanding what banking software offers and how it integrates with their vision is vital for sustainable growth.

Banking software acts as the backbone for managing financial transactions and data within PayTech platforms. It automates processes that were once manual and prone to error, from customer onboarding to payment processing. A reliable software system enables startups to scale operations without compromising accuracy or security.

Security is paramount, given the sensitive nature of financial data. Robust banking software includes advanced encryption, fraud detection, and regulatory compliance tools, helping startups protect themselves and their users from cyber threats and legal risks. Startups without solid banking infrastructure often struggle to keep pace with these demands, which can hinder growth or lead to costly setbacks.

Several features within banking software are particularly valuable for PayTech startups aiming for rapid expansion. Real-time transaction monitoring provides visibility and control, allowing businesses to detect anomalies and react quickly to potential issues. Integration capabilities with other fintech services and APIs enable startups to build versatile platforms that cater to diverse customer needs.

Automated compliance management also plays a crucial role. Given the complex and evolving regulations around payments and financial services, software that simplifies audits, reporting, and adherence reduces operational burdens and lowers risk. Scalability is another attribute; as transaction volumes grow, the software must handle increased loads without sacrificing performance.

Choosing the right banking software provider is a critical decision that influences long-term success. As the team behind Baseella explains, partnering with a software company that understands the unique challenges PayTech startups face makes integration smoother and ensures ongoing support as needs evolve. It’s important to consider the provider’s reputation, customer support, and ability to customize solutions.

A collaborative approach enables startups to tailor the software to fit their specific workflows and business models, rather than settling for one-size-fits-all solutions. This flexibility can be a game-changer, helping companies differentiate themselves in competitive markets. Establishing clear communication channels and setting realistic timelines also contribute to successful software implementation.

Customer experience is a key differentiator for PayTech startups, and banking software directly influences how

customers interact with the platform. Fast, error-free payment processing builds trust and satisfaction, encouraging repeat usage and referrals. Features like instant notifications, easy account management, and accessible support empower users and improve retention.

Conversely, slow or unreliable software can frustrate users and damage a startup’s reputation. Delays, errors, or security concerns often lead customers to switch to competitors, which is particularly damaging in the early stages of growth. Investing in software that enhances usability and reliability positions startups to build loyal customer bases important for scaling.

Navigating the complex landscape of financial regulations is one of the biggest hurdles for PayTech startups. Banking software that includes built-in compliance tools helps manage these challenges efficiently. Automated KYC (Know Your Customer), AML (Anti-Money Laundering) screening, and audit trails reduce the risk of violations that could result in fines or operational shutdowns.

Staying compliant also builds credibility with partners, investors, and users. Startups demonstrating strong governance and regulatory adherence are more likely to secure funding and partnerships. Having a software system that evolves with regulatory changes means

that compliance remains an ongoing priority without overwhelming internal teams.

As PayTech startups grow, maintaining control over financial processes becomes increasingly complex. The right banking software offers dashboards and analytics tools that provide real-time insights into transaction flows, revenue streams, and potential bottlenecks.

Automation reduces manual intervention, freeing staff to focus on strategic growth initiatives rather than routine tasks. Having a scalable software platform ensures that performance remains consistent even during rapid expansion or sudden spikes in transaction volume.

Choosing the right banking software is more than a technical decision; it’s a strategic move that can propel a PayTech startup toward sustained growth and competitive advantage. Features like robust security, compliance automation, scalability, and user-friendly interfaces all contribute to building a platform that meets the demands of today’s financial ecosystem. By exploring solutions, startups can partner with providers who understand their unique challenges and growth ambitions. Investing in the right software infrastructure today lays the foundation for innovation, efficiency, and trust that will power the PayTech companies of tomorrow.

In today’s fast-paced and highly transparent business environment, corporate accountability has evolved from being a compliance requirement into a strategic imperative. Public expectations are shifting. Consumers, investors, and regulators are no longer satisfied with vague statements about responsibility. They want measurable actions, and they want consequences when companies fall short.

As a result, risk management now sits at the heart of financial planning. Companies that prioritize ethical conduct, transparent operations, and preventative legal strategies are not only protecting themselves from lawsuits, but they are also positioning themselves for long-term stability.

The rise of social media, real-time news, and public accountability has changed the nature of business risk.

A poorly handled safety issue or ethical failure can trigger a reputational crisis that quickly snowballs into shareholder loss, consumer backlash, and legal repercussions.

This is especially true in industries that deal directly with the public, such as transportation, manufacturing, health, and consumer goods, but even tech companies and service providers are seeing increased scrutiny around data privacy, workplace practices, and environmental impact.

The message is clear: companies cannot afford to treat public trust as a soft metric. It is a financial asset that you must protect with the same rigor as intellectual property or infrastructure.

From a purely financial perspective, the costs of legal

negligence can be staggering. According to industry estimates, corporate lawsuits related to workplace injuries, defective products, and misconduct cost U.S. companies billions annually. In many of these cases, punitive damages are sought in addition to compensatory ones, especially when there is evidence of gross negligence or intentional harm.

Understanding how punitive damages work and how they differ from compensatory damages is essential for business leaders, especially those in industries where safety and compliance are mission-critical. Punitive damages are awarded to punish and deter, not just to make the victim whole. This legal tool signals to companies that failing to take responsibility can result in serious, long-term consequences.

The existence of punitive damages reinforces the need for proactive risk assessment and internal accountability measures. It is no longer enough to simply react when a problem occurs. Businesses must show that they took deliberate steps to prevent foreseeable harm.

Innovative companies are investing in internal audits, compliance programs, and employee training as part of their risk management strategy. Businesses should build legal foresight into product development, workplace policy, and customer interactions.

Incorporating scenario analysis, where companies imagine worst-case legal or reputational events, can also strengthen preparedness. The goal is not paranoia but proactive design: building systems that can absorb shocks without unraveling.

Insurance remains a key piece of the liability puzzle. General liability, professional liability, and cyber liability policies offer crucial layers of protection, but not all policies cover punitive damages, especially in states where these damages are not insurable by law. That makes it all the more important for companies to be

familiar with the legal frameworks in their operating regions.

Finance leaders should work closely with risk officers and insurance professionals to ensure the company’s coverage is comprehensive and aligned with its risk profile. In some cases, self-insurance or captives may be appropriate for larger enterprises seeking more control.

At the heart of sustainable risk management is culture. A company that prioritizes ethical decision-making at every level, from C-suite to factory floor, will naturally mitigate risk more effectively than one that relies only on top-down enforcement.

Creating a culture of responsibility means:

• Encouraging employees to speak up about unsafe or unethical practices

• Rewarding transparency rather than secrecy

• Embedding accountability into performance reviews

• Treating compliance as a shared responsibility rather than a departmental task

You cannot fake culture. Investors, partners, and the public are increasingly adept at distinguishing between performative gestures and genuine commitment.

For businesses of all sizes, the question is not if a legal or reputational challenge will arise, but when. The companies that will thrive in this landscape are those that approach accountability not as a checkbox, but as a core strategic pillar.

Negligence is expensive, but proactive, ethical operations can be both a shield against risk and a magnet for opportunity. As financial stakeholders continue to factor ESG, brand reputation, and legal exposure into their decisions, corporate responsibility will increasingly define which companies earn trust and which are left behind.

Malaysian SMEs today are undergoing significant digital transformation. With intensified competition and ever-changing regulations, these companies find themselves under pressure to improve operational efficiencies, meet compliance requirements, and keep up with technological changes.

Representational image

Also, the impending e-Invoicing mandate by the Inland Revenue Board of Malaysia (LHDN) has further aggravated the importance of timely digital adoption by businesses.

Traditional accounting systems are fueled by manual operations, limited access, and outdated tools, which often fall short in addressing present-day complex demands. As a result, the chances of errors are high, which results in inefficiencies and compliance risk.

That is the reason various SMEs are swiftly switching towards cloud-based accounting platforms.

To explore in depth why cloud-based accounting solutions are the leading option for Malaysian SMEs, read the complete article.

Cloud accounting services provide small and mediumsized enterprises with the ability to see their financial information at their ease, whenever they want, regardless of location. This flexibility supports contemporary business models, including remote work and multi-site operations.

Moreover, tracking cash flow, monitoring expenses, and monitoring profitability on demand grants SMEs an important edge in the current-day business environment. For resourceful growth and engaging operations, businesses should search for the best cloud accounting software in Malaysia.

This helps SMEs to find trustworthy solutions that cater to their special requirements. Additionally, by switching to the best solutions, you experience automated invoice generation, built-in tax compliance, real-time dashboards, and seamless integrations.

Traditional accounting processes are time-consuming and full of mistakes. Mistakes in data entry, calculation errors, or loss of paperwork can lead to inaccurate reporting and expensive corrections.

Cloud-based accounting system also manages core tasks, for example, bank reconciliation, invoicing, and recurring billing, which ultimately saves time.

Such capabilities minimize human interaction in routine tasks, resulting in a boost in accuracy and lowering the risk of errors.

For Malaysian SMEs with scarce human resources, it resonates with an efficient allocation of resources, ensuring smooth financial processes. Over a period,

automation thereby strengthens the accounting procedure, making it more reliable and transparent.

Adhering to Malaysian tax regulations has grown more complicated, particularly with the implementation of the LHDN e-Invoicing mandate. To address this, local cloud-based accounting solutions are designed to manage SST, electronic invoicing, and audit-related needs.

For any SME, this means fewer risks of non-compliance, less dependency on external consultants, and improved preparedness toward audits. Overall, cloud-based solutions help businesses fulfil their obligations, vital to avoid penalties or reputational harm.

Traditional accounting software usually comes with significant upfront costs associated with licenses, hardware, and updates. Cloud software, however, comes under a subscription method, usually with tiered pricing.

This allows a small and medium-sized enterprise to invest only in the features it requires and scale up as it grows. This also eliminates the need for any bulky IT infrastructure or maintenance, because updates, security patches, and backups are automatically handled by the service provider.

SMEs with tight budgets highly benefit from it, reducing financial strain while simultaneously providing them with industry-grade features.

5. Enhanced Data Security and Backup

Safeguarding financial data is a priority for any business.

Cloud-based accounting platforms offer high levels of security through data encryption, role-based access control, and multi-factor authentication.

For SMEs in Malaysia, this level of protection is typically stronger than what internal setups can offer, particularly in the absence of specialized IT staff. This leads to better data consistency and system dependability.

6. Better Collaboration with Finance Professionals

Cloud platforms support smooth collaboration among business owners, finance departments, and external accounting professionals. Multiple users can access the same data simultaneously, reducing the need for file transfers or version tracking.

SMEs benefit from quicker insights, fewer misunderstandings, and stronger partnerships with financial advisors. In a rapidly evolving economic environment, such efficient collaboration is crucial for informed decision-making and proactive financial management.

The shift to cloud-based accounting is not just a trend; it is a practical response to the modern demands of running a business in Malaysia. With growing compliance requirements, tighter competition, and the need for real-time data, SMEs are recognizing the limitations of traditional systems.

Cloud solutions offer automation, security, flexibility, and scalability, all vital for sustainable growth. Hence, as the business landscape continues to evolve, embracing cloud accounting positions SMEs to remain agile, efficient, and compliant, while building a solid foundation for long-term financial stability and success.

The digital payment revolution continues to transform how businesses manage financial transactions worldwide. Modern payment management systems have transformed from basic card processors into sophisticated platforms that orchestrate complex payment workflows, security protocols, and customer experiences.

Organizations are discovering that their choice of a payment management system has a direct impact on customer satisfaction, operational efficiency, and revenue growth.

The acceleration toward digital-first payment solutions shows no signs of slowing. Businesses now demand a payment management system capable of handling diverse transaction types while maintaining seamless user experiences. This evolution reflects fundamental shifts in consumer behavior and the competitive necessity for organizations to adapt their payment infrastructure.

A modern payment management system integrates cutting-edge technologies to deliver experiences that

customers now consider standard expectations rather than luxury features.

Contemporary payment management system design prioritizes flexibility and scalability above all else. These platforms utilize cloud-native architectures that automatically adjust to transaction volumes while maintaining consistent performance.

The underlying technology stack comprises sophisticated APIs that enable businesses to tailor payment flows to meet specific operational requirements.

Security measures have evolved to include multiple authentication layers, real-time monitoring, and advanced encryption protocols. The infrastructure supports global compliance requirements while adapting to regional regulatory variations.

Today’s payment management system serves as a central hub connecting various business functions:

• Customer relationship management platforms

• Inventory management systems

• Accounting and financial reporting tools

• Marketing automation platforms

This connectivity creates unified ecosystems where payment data flows seamlessly across different organizational departments. Business leaders gain access to comprehensive analytics that inform strategic decisions about customer acquisition, pricing strategies, and market expansion opportunities.

The real-time nature of modern payment processing enables immediate transaction confirmations and instant settlement notifications.

Digital payment adoption has reached critical mass, with businesses recognizing the need to support multiple payment options to remain competitive.

Digital wallets have become essential components of any comprehensive payment management system. These platforms offer one-click payment experiences that significantly reduce checkout friction and improve conversion rates. The technology enables secure credential storage while providing convenient access across multiple devices and platforms.

Super apps represent the next evolution in payment processing integration. These comprehensive platforms combine:

• Messaging and communication services

• Social media functionality

• E-commerce capabilities

• Financial services and payments

Payment management systems must adapt to support embedded payment functionality within these integrated environments.

image

Instant payment systems have gained significant traction as businesses seek faster access to funds and improved cash flow management. Real-time payment processing eliminates traditional batch processing delays, providing immediate transaction confirmation and settlement.

Account-to-account transfers offer compelling alternatives to traditional card networks by enabling direct bankto-bank transactions. Also, there are cost advantages for high-value transactions and business-to-business payments.

The benefits of real-time payment processing extend beyond speed improvements:

• Enhanced cash flow predictability

• Reduced transaction uncertainty

• Improved customer satisfaction through instant confirmations

• Lower processing costs for certain transaction types

Machine learning and artificial intelligence have become integral components of modern payment management systems. These technologies enhance security, improve user experiences, and provide valuable business insights through advanced data analysis and analytics.

Advanced fraud detection systems utilize machine learning algorithms to analyze transaction patterns and identify potentially suspicious activities. These systems learn from historical data to improve accuracy over time while reducing false positive rates that can frustrate legitimate customers.

Real-time risk assessment capabilities enable payment systems to make split-second decisions about transaction authorization. The technology considers multiple factors, including transaction history, device fingerprinting, behavioral patterns, and geographic location, to accurately assess risk levels.

Payment management systems now leverage artificial intelligence to optimize customer experiences by presenting personalized payment options. Machine learning algorithms analyze individual customer preferences, transaction history, and behavioral patterns to recommend optimal payment methods during checkout.

This personalization extends to:

• Dynamic payment method ordering based on customer preferences

• Customized checkout flow optimization

• Intelligent payment retry logic for failed transactions

• Personalized promotional offers and incentives

The result is improved conversion rates and reduced cart abandonment through more relevant and convenient payment experiences.

The expansion of payment options beyond traditional credit and debit cards has accelerated significantly. Modern payment management systems must accommodate diverse payment preferences while maintaining security and operational efficiency.

BNPL services have evolved from niche offerings to mainstream payment options that businesses integrate directly into their checkout processes. These services allow customers to split purchases into manageable installments while providing merchants with immediate payment settlement.

The expansion of BNPL applications now includes:

• Traditional retail purchases

• Service-based transactions

• Travel and hospitality bookings

• Healthcare and medical services

• Educational and training programs

A payment management system requires a flexible architecture to support various BNPL terms, regulatory compliance requirements, and integration with multiple service providers.

QR code payments continue to evolve, incorporating enhanced security features and expanding into broader application scenarios. These contactless payment methods offer convenience for both online and offline transactions while maintaining strong security protocols.

Dynamic QR code generation includes transaction-specific security tokens that prevent fraud and ensure payment authenticity. Payment systems generate unique codes for each transaction, providing traceability and enhanced security compared to static QR implementations.

The payment industry continues to explore innovative technologies that could fundamentally change how transactions are processed and experienced by customers.

Voice-activated payment systems represent an emerging frontier in payment processing technology. These systems prove particularly valuable for:

• Recurring subscription renewals

• Simple product reorders

• Service appointment bookings

• Quick balance inquiries and transfers

Voice payment technology requires sophisticated natural language processing and multi-factor authentication to ensure security while maintaining convenience.

The integration of cryptocurrency payments into traditional payment management systems progresses as regulatory frameworks develop. Businesses prepare for broader digital currency adoption by updating their payment infrastructure to support various cryptocurrency options.

represent significant developments that payment systems must accommodate as governments explore the implementation of digital currencies. These government-backed digital currencies could provide new payment rails that complement existing infrastructure.

Modern payment security extends far beyond basic encryption to encompass comprehensive risk management strategies and advanced authentication methods.

Biometric authentication technologies provide enhanced security without compromising user experience.

Common biometric authentication methods include:

• Fingerprint recognition for mobile payments

• Facial recognition for device-based authentication

• Voice verification for telephone transactions

• Retinal scanning for high-security applications

A payment management system integrates these authentication methods to provide layered security while maintaining a seamless user experience.

Multi-layered security approaches protect sensitive payment data throughout the entire transaction lifecycle. Advanced encryption protocols ensure that payment information remains secure during transmission and storage.

Tokenization technology replaces sensitive payment data with unique tokens that have no value outside specific transaction contexts. This approach minimizes data breach risks while enabling payment processing functionality.

The adoption of advanced payment systems creates measurable impacts on business performance and customer relationships.

Modern payment systems streamline business operations through automated reconciliation processes, real-time reporting capabilities, and integrated financial analytics, enabling more efficient management of financial transactions.

These features reduce manual processing requirements while providing actionable insights about payment performance and customer behavior.

Customer experience improvements include faster checkout processes, multiple payment option availability, and reduced transaction failures.

Payment management systems must navigate increasingly complex regulatory requirements across different jurisdictions and industry sectors. Builtin compliance monitoring and reporting capabilities help businesses maintain regulatory adherence while minimizing operational burden.

Risk management features include real-time transaction monitoring, automated risk scoring systems, and customizable fraud prevention rules.

Successful payment system implementation requires careful planning and consideration of both current needs and future growth requirements.

The chosen payment management system must align with business objectives while providing flexibility for future expansion.

Key evaluation criteria include:

• Scalability and performance capabilities

• Security and compliance features

• Integration and customization options

• Cost structure and pricing models

• Vendor support and reliability

Successful implementation extends beyond technical integration to encompass staff training and change management processes. Team members must understand new payment procedures, security protocols, and customer service approaches.

Proper implementation planning includes comprehensive testing phases, backup procedures, and performance monitoring systems to ensure smooth transitions from the existing payment infrastructure.

The evolution of payment systems reflects the broader digital transformation occurring across industries worldwide. Organizations that invest in modern payment infrastructure position themselves to capitalize on emerging opportunities while meeting the evolving expectations of their customers.

The payment management system landscape of 2025 and beyond will offer unprecedented capabilities in terms of processing speed, security protocols, and customer experience optimization.

Cryptocurrency adoption continues to grow in 2025, with more individuals and institutions participating in the digital asset economy than ever before. From Bitcoin to emerging altcoins, crypto represents both an investment opportunity and a means of conducting global transactions with speed and privacy. However, as interest increases, so does the risk of fraud, scams, and technical missteps.

Whether you’re a first-time buyer or an experienced investor, understanding how to buy crypto safely in 2025 is critical to protecting your funds and maintaining control over your assets. This guide will walk you through best practices, updated tools, and common mistakes to avoid when purchasing crypto this year.