REGISTER NOW

BECAUSE YOUR STORY DESERVES THE SPOTLIGHT

REGISTER NOW

BECAUSE YOUR STORY DESERVES THE SPOTLIGHT

Inanincreasinglyinterconnectedworld,thewaymoney

moveshasbecomeasimportantasthevalueitcarries. Paymentstodayarenolongerjusttransactions;they areenablersofcommerce,inclusion,innovation,andtrust. Fromreal-timecross-bordertransferstoembeddedfinance andintelligentfraudprevention,PayTechisreshapingthe globaleconomiclandscapeatanunprecedentedpace.

ThisspecialeditionofCIOLooktitled, The 10 Most Influential PayTech Leaders Creating Global Impact, celebratesthevisionarieswhoareredefininghow individuals,businesses,andgovernmentsinteractwith financialecosystems.Theseleadersstandattheintersection oftechnology,regulation,andcustomerexperience, navigatingcomplexglobalmarketswhiledelivering seamless,secure,andscalablepaymentsolutions.

Whatunitestheleadersfeaturedinthiseditionisnotonly theirtechnicalexpertise,butalsotheirpurpose-driven approach.Theyarebuildingplatformsthatempowersmall businessestocompeteglobally,expandfinancialaccessto underservedcommunities,andcreateresilient infrastructurescapableofsupportingdigitaleconomies. Theirworkdemonstratesthatinnovationinpaymentsisas

muchaboutresponsibilityandtrustasitisaboutspeedand convenience.

Asregulatoryframeworksevolveandcustomer expectationscontinuetorise,PayTechleadersfacethe challengeofbalancingcompliance,cybersecurity,and innovation.Thestorieswithinthesepagesrevealhow strategicleadership,ethicaldecision-making,and collaborativeecosystemsaredrivingsustainablegrowth acrossborders.Theseexecutivesarenotmerelyresponding tochange;theyareactivelyshapingthefutureofglobal finance.

Throughinsightfulprofilesandleadershipjourneys,this editionoffersreadersadeeperunderstandingoftheminds poweringtheworld’smostimpactfulpayment transformations.Wehopetheirstoriesinspireindustry professionals,entrepreneurs,andinnovatorstothinkboldly, actresponsibly,andcontributetoamoreinclusiveand connectedfinancialfuture.

Happy Reading!

Managing Editor

THE FRONT PAGE EXCLUSIVE

Driving Digital Payments Innovation Through Strategic Product Leadership

Pooja M Bansal Editor-in-Chief

Deputy Editor Anish Miller

Managing Editor Prince Bolton

DESIGN

Visualizer Dave Bates

Art & Design Director Davis Mar�n

Associate Designer Jameson Carl

SALES

Senior Sales Manager Fa�ma A.

Manager- Media Partnerships Amira A

Customer Success Manager Nelson M. Sales Execu�ves Tim, Smith

TECHNICAL

Technical Head Peter Hayden

Technical Consultant Victor Collins

FOLLOWUSON WE ARE ALSO AVAILABLE ON

Research Analyst Eric Smith

CONTACTUSON

Email info@ciolook com For Subscrip�on www.ciolookmedia.com

Copyright © 2026 CIOLOOK, All rights reserved. The content and images used in this magazine should not be reproduced or transmi�ed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from CIOLOOK. Reprint rights remain solely with CIOLOOK.

SEO Execu�ve Alen Spencer www facebook.com/ciolook/ www.x.com/ciolookmagazine

January,2026

AljaZwart Partner

ErikaJordan HyperbaricDirector

JoyceDeuley StrategicCommunications Specialist

JulianHuener ProductManagerPayment

mofo mofo.com

HyperbaricHealing TreatmentCenter hyperbaricsorlando.com

Teamb.Strategy N/A

PorscheAG porsche.com

KennethAmponsah ChiefRiskOfficer(CRO)

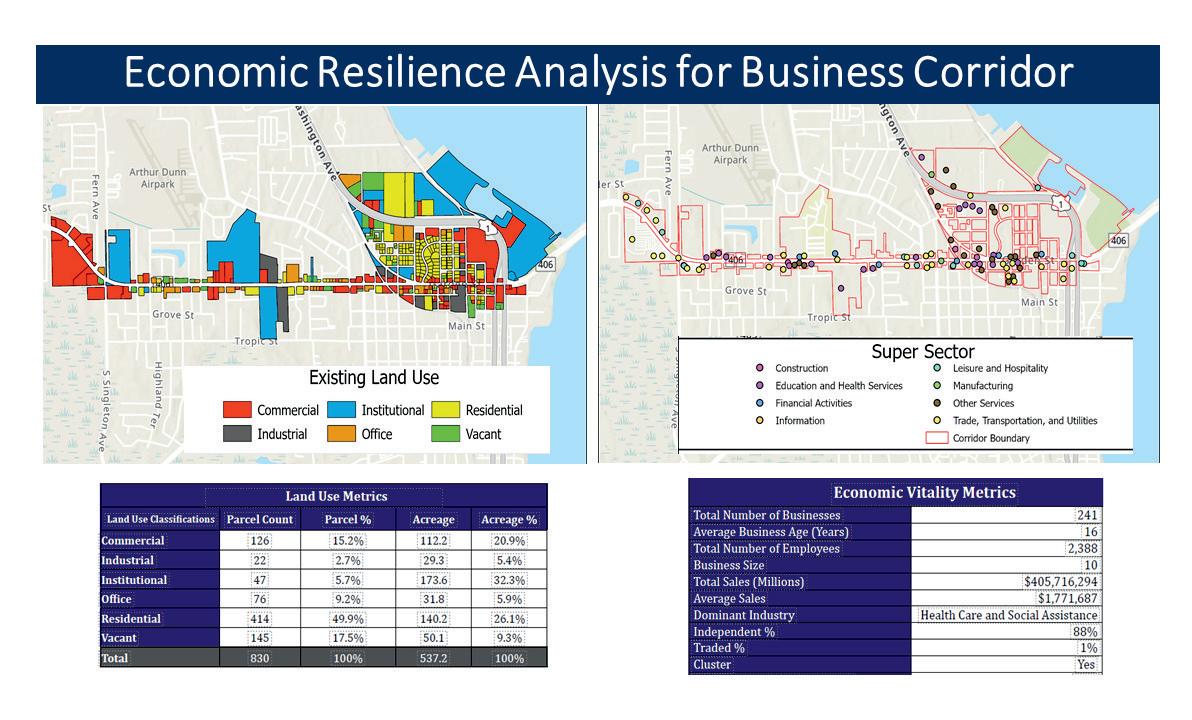

LuisNieves-Ruiz DirectorofEconomic Development

LydonCharnley

ChiefExecutiveOfficer

MichaelMbuthia

SecretaryUnitedStates InternationalUniversityAfrica(Alumni)

MoboladeOjeahere

GroupHeadTransaction Banking

RogerAbouantoun FounderandDirector

UBAGhanaLtd uba.com/ghana cedarium cedarium.com

ZakPay zakpay.com

UnitedStates International University-Africa usiu.ac.ke

FirstBankNigeriaPlc firstbanknigeria.com

Cedarium cedarium.com

Strategicpartnerwithexpertiseinbusinessdevelopment, advisoryservices,relationshipmanagement,marketanalysis, andcollaborativeleadership,enablingscalablesolutionsand value-drivendecision-making.

Clinicaloperationsleaderwithexpertiseinhyperbaricmedicine, patientsafety,regulatorycompliance,multidisciplinaryteam leadership,andperformanceoptimizationwithincomplex healthcareenvironments.

Strategiccommunicationsexpertspecializinginbrand storytelling,mediarelations,stakeholderengagement,crisis communication,andmessagingstrategiesthatalign organizationalvisionwithpublicperception.

Paymentproductmanagerspecializinginproductlifecycle management,user-centricdesign,fintechsolutions,crossfunctionalcollaboration,anddeliveringscalable,securedigital paymentinnovations.

Riskmanagementexecutivewithexpertiseinenterpriserisk frameworks,regulatorycompliance,governance,strategic oversight,andstrengtheningorganizationalresiliencethrough proactiveriskmitigation.

Economicdevelopmentleaderskilledinpolicyplanning,publicprivatepartnerships,investmentattraction,communitygrowth strategies,anddata-driveninitiativesthatstrengthenregional economicecosystems.

Results-drivenchiefexecutivewithstrengthsincorporate strategy,financialoversight,organizationalleadership,market expansion,andbuildinghigh-performingteamstodeliver sustainablebusinessgrowth.

Administrativeandalumnirelationsprofessionalskilledin governance,stakeholdercoordination,recordmanagement, strategiccommunication,andfosteringstronginstitutionaland alumniengagementnetworks.

Transactionbankingleaderwithdeepexpertiseincash management,tradefinance,digitalbankingsolutions,risk mitigation,anddrivingoperationalefficiencyacrossenterprise clients.

Visionaryfounderanddirectorwithstrongstrategicplanning, organizationalleadership,stakeholderengagement,and executioncapabilities,drivingsustainablegrowth,innovation, andlong-termbusinessimpact.

Thepaytechindustryaroundtheglobeisatacritical point.Realtimepayments,artificialintelligence, embeddedfinanceandcrossborderinnovations havecontributedtotheentrenchmentofdigitalpaymentsin thedaytodaybusiness.Diversityinleadershiphasceased beingafringedebateintheindustryandhasbecomecentral tobusiness.Womenpaytechleadershipisnolongerjusta matterofequity.Itisbecomingastrategicrequirementthat canhaveadirectimpactoninnovation,riskmanagement, customertrustandlong-termgrowth.Whilerepresentation

hasimprovedoverthepastdecade,womencontinuetohold adisproportionatelylownumberofseniordecision-making positionsinpayments,fintechinfrastructure,andfinancial technologyplatforms.Ithasbeenrecognisedbymany organisationsthatentryleveldiversityhasbeenenhanced; however,thepipelinewithleadershipstilllosestalentsat mid-careerandexecutivelevels.In2026,thedebatehas changedtooutcomemetrics,responsibility,anddeveloping systemsenablingwomentonotonlyenterthepaytech industry,butalsodominateitinsize.

Womenexecutivesaddnewinsightsespeciallyinpaytech,a sectorthatdirectlyrelatestoconsumers,merchants, regulators,andfinancialinstitutions.Theproductsof paymentshavetoprovidethebalancebetweenthespeed, security,utility,andcompliance,andinmanycases,the productsneedtocoveravarietyofdemographicgroups. Experienceofresearchandindustrypracticehas continuallydemonstratedthatmoregenderdiverse leadershipteamsareinabetterpositiontodevelop inclusiveproducts,detectnewrisksandrespondto customerneedsinawaythatisfine-tuned.Thismultiplicity ofunderstandinghasnowbecomeacompetitiveedgein 2026whentheunderservedandsmallbusinessesarea targetofpaytechsolutions.

Governancewise,womenheadshavealsobeen instrumentalinenhancingcomplianceculture,andethical decisionmaking.Duetotheincreasedscrutinyofdata protectionandfraudpreventionandsystemicresilienceas regulatorsacrosstheglobeenhancetheirvigilance,boards andexecutiveteamsarediscoveringtherelevanceof balancedleadershipstyles.Firmsthathavewomeninsenior paytechwilltendtobeinabetterpositiontohandle regulatoryrelationshipandestablishtrustwiththe stakeholders.Thistrustiscrucialinanindustrywith reputationandreliabilitybeingthedirectproportional factorstoadoptionandscale.

Structuralbarriersremainakeychallengeineffortsto empowerwomeninpaytechleadershippositions.Theseare lowaccesstohighvisibilityprojects,imbalancedpromotion ofsponsorshipatseniorlevelsandunconsciousnessin promotionsandinvestmentchoices.Mostinnovative paytechcompaniesaretacklingthesechallengesin2026, usingstrategicandtransparentleadershipdevelopment models.Performancemetricsarealsobecomingan importantfeatureofstructuredmentorshipandsponsorship programsamongseniorexecutives,andarenolonger symbolicinnature.

Alsovitalistheredesignofthecareerpathwaysto implementthetruthofthecontemporarywork.Themodels ofleadershipthatareflexible,remotefirstexecutive,and performancereviewsbasedonoutcomeshaveenabled womentostickontheleadershippathsatvariousstagesof theirlife.Targetedupskilling,especiallyofcybersecurity, artificialintelligence,andproductarchitectureisalsobeing

investedbyPaytechorganisations.Suchinvestmentsalso makesurethatwomenarenotrelegatedtothesupport functionsbutarecentraltothetechnicalandstrategic decisionmaking.

Inadditiontoindividualcompaniesithasbecomeavery strongforceofchangeindustrywide.Paytechassociations, venturecapitalfirmsandregulatorsareincreasinglytaking activerolesincreatinginclusiveleadershipecosystemsin 2026.Theexpectationsofinvestorshavechanged,andthe metricsofdiversityhavebecomemoreimportantin investingandvaluation.WomentechCEOsareestablishing themselvesascredibleleadersinscalablefinancial infrastructure.

Inthefuture,theempowermentofwomeninpaytech leadershippositionswillbealong-terminvestmentandnot anoccasionalproject.Thenormalizationofwomenaschief executives,chieftechnologyofficersandboardchairsin paymentsorganisationswillmeasurethesuccess.Asthe industrykeepsshapingthewaymoneyflowswithina digitaleconomy,inclusiveleadershipwillnotonly determinewhoisbenefitingintheinnovationworld,but alsothemannerinwhichtheinnovationinquestionis broughtinresponsibilityandfairness.

Womenintheleadershipofpaytechisnolongeranaimbut astrategicnecessitythatattractsinnovation,trustandlongtermexpansion.Throughstructuraldismantling,investment incareergrowthandbuildingindustrywidecoalition,the industrycancreateastrongpipelineofwomenleaderswho canmakekeybusinessandtechnologydecisions.The paytechwillrelyondiversityandinclusiveleadershipin 2026thatwillmirrorthemarketsinwhichitoperates. Gettingwomentotheexecutiveandboardpositionsisnot onlyaquestionofequitybutanecessitytohaveastrong, innovative,andresponsibledigitalpaymentsecosystemthat willbenefitbusinesses,consumers,andsocietyoverall.

Intoday’srapidlyevolvingdigitaleconomy,financial transactionsarenolongerconfinedtotraditional bankinginterfaces.Theriseofembedded finance—wherefinancialservicesareseamlesslyintegrated intonon-financialplatforms—hasredefinedhowconsumers interactwithmoney Attheforefrontofthistransformation aretheembeddedpaymentpioneers,innovatorswhoare reshapingthelandscapeofcommercebymakingpayments nearlyinvisible,intuitive,andfrictionless.

Embeddedpaymentsrepresentaparadigmshiftinhow financialservicesaredelivered.Insteadofrequiringusersto navigateseparatebankingappsorpaymentgateways, transactionsnowoccurorganicallywithintheplatforms peopleusedaily.Forexample,ride-hailingapps,ecommercemarketplaces,andsubscriptionservices

increasinglyallowuserstopaywithouteverleavingthe app.

Theleadersdrivingthismovement,theembeddedpayment pioneershaveleveragedtechnology,designthinking,and data-driveninsightstomakefinancefeeleffortless.Their workextendsbeyondmereconvenience;ittransformsthe waybusinessesgeneraterevenue,managecustomer relationships,andoptimizeoperationalefficiency.

Oneofthemostsignificantimpactsofembeddedpayments isonthecustomerexperience.Consumerstodayexpect seamlessinteractionsacrosseverytouchpoint.By integratingpaymentsintoplatformsusersalreadytrust, businessescanreducefriction,minimizecartabandonment, andcreateasmootherjourneyfromdiscoverytopurchase.

Embeddedpaymentpioneershaverecognizedthatthekey toadoptionliesnotjustintechnology,butinhumancentereddesign.Byunderstandingconsumerbehaviorand anticipatingneeds,theyensurethatpaymentflowsare intuitiveandunobtrusive.Fromone-clickcheckoutsto automatedbillingforsubscriptions,theseinnovations removethecognitiveloadfromfinancialtransactions, makingcommerceaseffortlessasscrollingthroughasocial feed.

Embeddedpaymentsarenotjustaboutenhancing convenience—theyalsoenableentirelynewbusiness models.Subscriptionservices,“buynow,paylater” solutions,anddigitalmarketplacesthriveonfrictionless paymentsembeddeddirectlywithintheirplatforms. Businessescanmonetizemoreefficiently,andconsumers gainflexible,accessiblewaystomanagepurchases.

Theembeddedpaymentpioneershavebeeninstrumentalin drivingthesemodels.Byintegratingpaymentsolutions directlyintosoftware,theyallowcompaniestoembed financingoptionsatthepointofsale,tailorpricing structures,andcreatepersonalizedpaymentexperiences. Thisintegrationtransformsordinarytransactionsinto strategictouchpointsthatdeepenengagementandloyalty

Attheheartofembeddedfinanceliessophisticated technology.APIs(ApplicationProgrammingInterfaces), securetokenization,andreal-timedataanalyticsallow platformstoprocesspaymentsquickly,safely,andinvisibly. Thesetechnologiesenableinstantauthorization,fraud detection,andcompliancewithoutdisruptingtheuser experience.

Thevisionofembeddedpaymentpioneersextendsbeyond simpletransactions.Theyaimtobuildecosystemswhere paymentsarenotjustfunctional,butintelligent.Predictive analytics,AI-driveninsights,andpersonalizedfinancial recommendationsareincreasinglybecomingpartofthe embeddedpaymentstoolkit,providingbothbusinessesand consumerswithactionableintelligencethatenhances decision-making.

Beyondconvenienceandbusinessinnovation,embedded paymentshavethepotentialtodrivefinancialinclusion.By

embeddingfinancialservicesintoplatformsthatpeople alreadyuse,accesstobanking,credit,anddigitalpayments expandstounderservedpopulations.Thisdemocratization offinancehelpsbridgegapsinaccess,enablingmillions worldwidetoparticipateinthedigitaleconomy

Theembeddedpaymentpioneersareleadinginitiativesto reachmarketspreviouslyexcludedfromtraditional financialsystems.Byloweringbarriersandsimplifyinguser experiences,theyempowerindividualsandsmall businessestomanagefinancesmoreeffectively,fostering economicgrowthandresilienceinemergingmarkets.

Despiteitspromise,embeddedfinancefaceschallenges. Regulatorycompliance,dataprivacy,cybersecurity,and interoperabilityremaincriticalhurdles.Asmoreplayers entertheecosystem,theneedforrobuststandardsand collaborativeframeworksbecomesessential.

However,thevisionaries—theembeddedpayment pioneers—continuetonavigatethesecomplexitieswith innovationandforesight.Theircommitmenttobalancing seamlessexperienceswithsecurityandcomplianceensures thatembeddedpaymentsremainreliable,trusted,and scalable.

Conclusion:AFutureofInvisibleFinance

Aswemovedeeperinto2026,embeddedpaymentsareno longeranicheinnovation—theyareamainstreamnecessity. Theembeddedpaymentpioneersareredefininghowwe perceive,access,andmanagemoney,makingfinancetruly invisibleandintegratedintoeverydaylife.

Fromenhancingconsumerconveniencetoenablingnew businessmodelsandfosteringfinancialinclusion,the impactofthesepioneersisprofound.Theyremindusthat innovationinfinanceisnotmerelyabouttechnology—itis aboutunderstandinghumanbehavior,anticipatingneeds, andcreatingexperiencesthatmakelifesimpler,smarter, andmoreconnected.

Invisiblefinanceisnolongeravisionofthefuture;itisthe realitybeingshapedtodaybythesetrailblazers.As businessesandconsumerscontinuetoembraceembedded payments,theworldwillwitnessanerawheremoney movesasseamlesslyasinformation—efficiently,safely,and almosteffortlessly