Economic and Management Sciences

Owned and published by Optimi, a division of Optimi Central Services (Pty) Ltd.

7 Impala Avenue, Doringkloof, Centurion, 0157 info@optimi.co.za www.optimi.co.za

© Optimi

Apart from any fair dealing for the purpose of research, criticism or review as permitted in terms of the Copyright Act, no part of this publication may be reproduced, distributed, or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage and retrieval system without prior written permission from the publisher.

The publisher has no responsibility for the persistence or accuracy of URLs for external or third-party internet websites referred to in this publication, and does not guarantee that any content on such websites is, or will remain, accurate or appropriate.

There are instances where we have been unable to trace or contact the copyright holder. If notified, the publisher will be pleased to rectify any errors or omissions at the earliest opportunity.

Reg. No.: 2011/011959/07

Economic and Management Sciences

Study guide

Grade 9

NOTE: The Entrepreneurship Worksheets are included as a booklet at the end of the book, as Market Day opportunities come up at different times in the year. Learners running ongoing businesses can then also access them with ease.

PLEASE NOTE:

1. Activities are numbered according to the three themes so that they form a continuous unit throughout the terms:

Activity Eco 1 – x (Economy)

Activity Fin 1 – y (Financial literacy)

Activity Ent 1 – z (Entrepreneurship)

You are provided with a workbook containing all the necessary answer sheets you will need to complete the financial litecacy activities.

SampleThis is a talking study guide! Look out for QR codes located throughout the study guide. Scan them to give you more information and additional examples. Simply download a free QR reader or click on the active links in the eBook versions to access these 60 – 90 second interactive lessons. They will help you revise or catch up on concepts you may have missed.

Research and referencing

Plagiarism (copying someone else’s ideas or work without acknowledgement) is taken very seriously at school, university and in the business world. It is important that you learn how to avoid plagiarism early in your life. Different schools have different plagiarism policies, but if you are caught committing plagiarism at university, you could face a worldwide ban from studying for a few years.

In business (this includes movies, books, magazines, articles, video games, etc.) there are numerous examples of people who committed plagiarism and who have been taken to court which resulted in them receiving either stiff sentences, losing their degrees or having their careers completely ruined.

In order to avoid plagiarism, you need to acknowledge any sources you use. So, for example, if you look up something on the internet, take an article to school to use, or even get verbal information from your parents or guardians, you must acknowledge the source of the information.

For exercises in this book, please use the following formats to cite your sources:

Website: Give the complete URL and the date on which you downloaded the information so that someone checking the information can go straight to the site. The date is essential as websites are constantly updated and change.

Books: State the author’s surname and initials. Date of publication. Name of the book. Name of the publisher. Place of publication.

Articles: State the author’s surname and initials. Date of publication. Name of the article. Source of the article (e.g. magazine/newspaper). Name of the publisher. Place of publication.

Interview: State the person’s surname and initials. Date of the interview. Subject of the interview. Place of the interview.

These are simple guidelines. Put the citations directly after the information you got from that source.

In more formal projects, you will be required to do both citations (as above) and a reference list at the end of the project. The most common format is the Harvard Method – you can read up more about this on the internet.

Term 1

Financial Literacy and

The Economy

Unit 1: Revision (Grade 8 concepts)

Recap the following main concepts from Grade 8 and ensure that you work through the Financial literacy terminology included on the following pages.

Cash received for services delivered/donations received/ commission earned, etc.

Cash sales

• Customer pays cash

• Customer pays per card (credit/debit card)

• Customer pays per EFT

Cash payments

• Payments by EFT

• Withdrawals per EFT (transfer of funds to personal account)

• Petty cash (repair of petty cash advance)

• Cash float

• Cash wages

• Cash withdrawals

Cash withdrawal with the business’ debit card

orders

Revision of accounting concepts

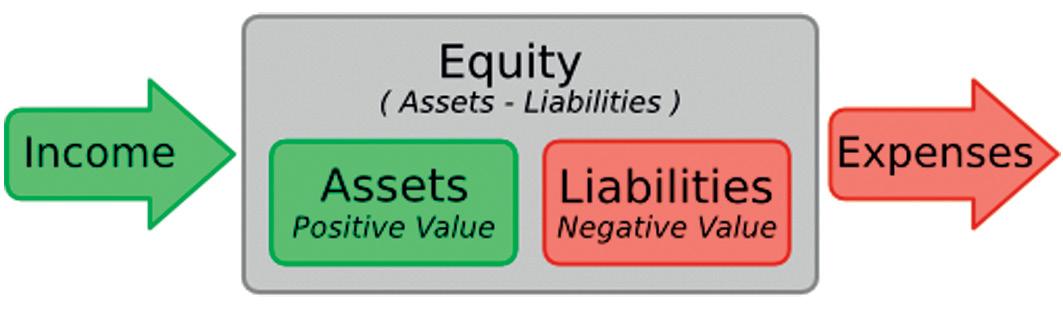

Owner’s equity

Owner’s

equity

Capital is money given by the owner, in order to start a business. This is why Capital is called owner’s equity (owner’s money).

○ If the owner withdraws funds from the business it is known as Drawings

Assets

Assets are the possessions (belongings) of the business.

Assets can be divided into two categories, i.e. fixed assets and current assets.

Fixed assets include:

○ Land and Buildings; Vehicles and Equipment

○ Financial assets, e.g. fixed deposit.

Current assets include:

○ Trading inventory (also known as Trading stock or goods)

○ Trade and other receivables (Debtors – people/businesses that owe the business money).

○ Cash and cash equivalents (Cash float and Petty cash in the business or cash in the current bank account or in a savings account).

Liabilities

The business is in debt (owes money to someone) and is liable to pay this money to whoever it owes the money.

○ Current liabilities: Creditors (The business owes money to the creditor because it bought goods from the creditor on credit) and Bank Overdraft.

○ Long-term liabilities/Non-current liabilities: Mortgage bond (a long-term loan from the bank used to buy fixed property or any other long-term loan). Any debt that will be repaid in longer than the current financial year.

Income

The business receives money for services rendered or when goods are sold. If the business receives money, the owner/entrepreneur will have more money in the business. Income increases the owner’s equity.

○ Current income from services rendered

○ Sales (profit is made when stock is sold)

○ Rent income

○ Interest income (shown separately in the Income statement with a note)

○ Commission income (money earned on selling goods on behalf of someone else).

Expenses

○ Rent expense

○ Telephone

Expenses

Money paid for a service rendered to our business, e.g. telephone or water and electricity. If the business pays an expense, it means the owner will have less money in the business. Expenses decrease the owner’s equity.

○ Water and Electricity

○ Salaries (Paid monthly)

○ Wages (Paid weekly)

○ Advertising

○ Stationery

○ Repairs

○ Insurance

○ Fuel

○ Interest expense (show separate in the Income statement with a note)

○ Packing material

○ Cost of sales (the cost price of the goods we have sold)

Accounting cycle and the flow of transactions

Cheques

Cheques have been a method of trading since the 13 th century as a substitute of gold, silver, coins and paper money. Cheques enabled the buyer to make payments without carrying physical cash. It was used as a deposit payment. The buyer had to write out a cheque to the beneficiary who would then take it to their nearest bank to cash. The bank would take the cheque, analyse the information and make a payment to the beneficiary from the buyer’s available balance (bank account).

As technology advanced up until the 20 th century, electronic funds transfers (EFT) became more popular. This led to cheques becoming obsolete. An electronic funds transfer is when the buyer makes a payment to the beneficiary via the internet.

SampleOn 2 October 2020 the South African Reserve Bank decided to phase out cheques as it had largely fallen out of use. Since 31 December 2020 cheques are no longer accepted as a payment method or deposit in South Africa.

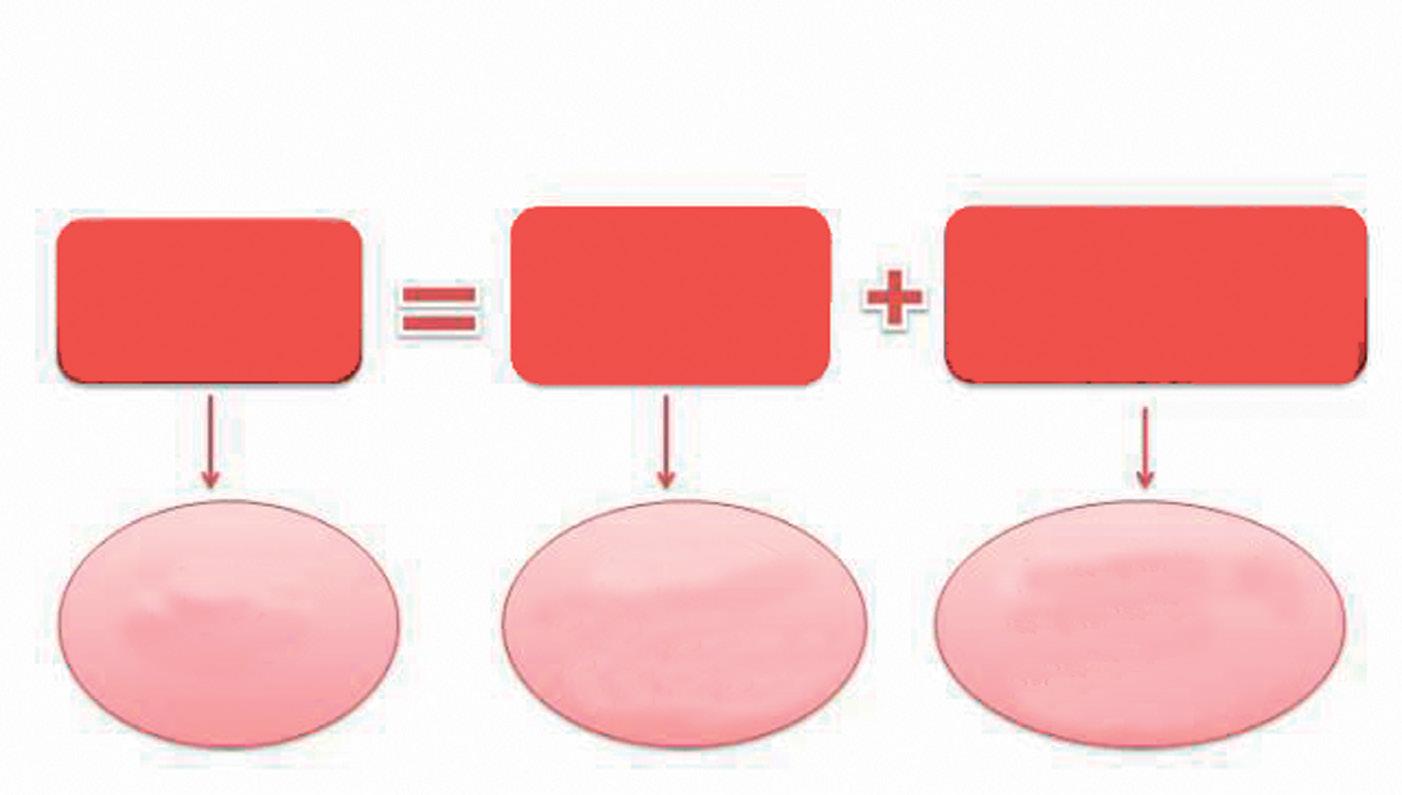

The Accounting Equation: Assets = Owner’s Equity + Liabilities

It is often said that in Accounting the ‘books have to balance’. The accounting equation is an excellent tool that can be used to make sure we understand one of the basic principles of Accounting, i.e. to show how money was spent.

Sample

For a business to function, it has to raise capital. Capital can either be sourced from the owner (Owner’s Equity) or it can be borrowed (a liability that has to be repaid).

Whatever the source of the capital (own capital or borrowed capital), the business has to show exactly how the money was used to buy assets such as land and buildings, vehicles, equipment and trading inventory, and which portion of the capital is still held in cash. The aim of any business is to make a profit and the accounting equation will help to show how profit (income now kept in cash in the bank) was used to pay for expenses.

Example: The owner of Coco Cakes contributes R250 000 cash as his capital. The business then buys new baking equipment and stoves, R130 000. The deposit (R10 000) was paid from the money contributed (deposited in the bank) by the owner and the balance will be paid off over 12 months (liability).

Explanation:

Accounting equation

Owner’s Equity

The asset Bank increased by R250 000 when the owner deposited the capital contribution into the business’s bank account and owner’s equity increased by R250 000 (owner’s interest in business).

The assets increased by R130 000 (the equipment bought), but at the same time there is R10 000 less in the bank (assets decreased because of the deposit paid). Liabilities increased by R120 000 because the business took out a ‘loan’ from the creditors.

Assets = Owner’s Equity + Liabilities

+ R250 000 (bank) = R250 000 (capital)

+ R130 000 (equipment) = R0 + R120 000 (creditors) - R10 000 (bank)

Here is a step by step guide to assist you when answering a question on the accounting equation.

Remember: A = OE + L

The left-hand side must equal the right-hand side.

See the examples below.

When answering a question on the accounting equation, ask yourself the following:

1. What two accounts are affected?

2. What type of accounts are they?

3. Do they increase or decrease?

4. By how much?

Example: The owner withdrew R150 for his personal use.

1. What two accounts are affected? Drawings and Bank

2. What type of accounts are they? Drawings = OE and Bank = Asset

3. Do they increase or decrease? Both decrease

4. By how much? R150

In a table format:

Do you see both sides are equal?

You could also be asked to say if the account is debited or credited.

Example:

1. The owner of Bibi’s Repairs, Jabez Bibi, deposited R200 000 in the bank account as part of his capital contribution. Issued receipt 01.

2. Bought a truck from Swift’s Vehicles for R450 000. Pay per EFT 01.

3. Jabez Bibi, the owner went on holiday and paid for his hotel, R20 000.

4. Paid water and electricity, R750.

5. Received R1 900 for services rendered.

6. Bought a safe, R9 190.

7. Mr Swift rents a part of a building owned by Bibi’s Repairs. He paid R6 500 rent.

1. +200 000 Bank increases

3. -20 000 Bank decreases

REMEMBER:

The left-hand side of a General Ledger account is DEBIT and the right-hand side is CREDIT.

Debit Credit

Alternatively, the accounting equation can be asked in a different format such as:

EXAMPLE: Alternate format

Activity Fin 2

Study the transactions and complete the accounting equation.

1. Edward Cullen started a business called Bella Tailors and deposited R800 000 into the bank account as a capital contribution.

2. Bought a building for R400 000. Make an electronic funds transfer.

3. Received R6 000 for services rendered.

4. Make a payment to the municipality for the deposit on water and electricity, R1 500.

5. Purchased consumable stores for R2 000, pay per EFT.

6. Paid wages, R13 000.

7. Pay Jacob’s Dealers for a safe purchased, R6 450.

8. Purchased a computer from Incredible Computers for R9 000 and pay per EFT.

9. The manager makes an electronic transfer of R4 000 for advertising.

10. Received R25 985 as current income.

11. Purchased office furniture from Eclipse Furniture, R11 700 and paid via EFT.

Activity Fin 2 (continued)

ASSETS = OWNER’S EQUITY + LIABILITIES

Activity Fin 2.1

Study the transactions in the previous activity and state whether they would be entered in the CRJ or the CPJ. Indicate the source document and which account is debited and credited.