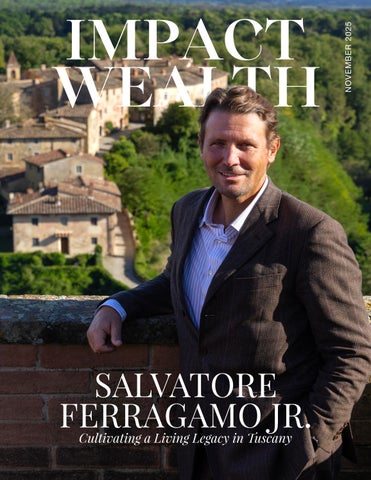

SALVATORE FERRAGAMO JR.

Cultivating a Living Legacy in Tuscany

92 Beyond the Horizon A Life of Legacy and Adventure in the World of Yachting By Steve Doyle

96 Navier Sets a New Benchmark in Marine Technology with Record-Breaking HybridElectric Vessel By Hillary Latos

98 COBA BANGKOK Chef Olivier Limousin Brings French-Mediterranean Elegance to the Heart of the City By Hillary Latos

HEALTH

&

WELLNESS

The Art of Restoration

Dr. Jeffrey Epstein Redefines Discreet Luxury in Hair Transformation

By Michael Glovaski

Joulebody and the $1 Trillion Wellness EconomyScaling Trust in Women’s Health

By

Hillary Latos

ESTATE

From Netflix to New York and Miami The SERHANT. Power broker redefining luxury for the modern era

By Hillary Latos

THOUGHT LEADERSHIP

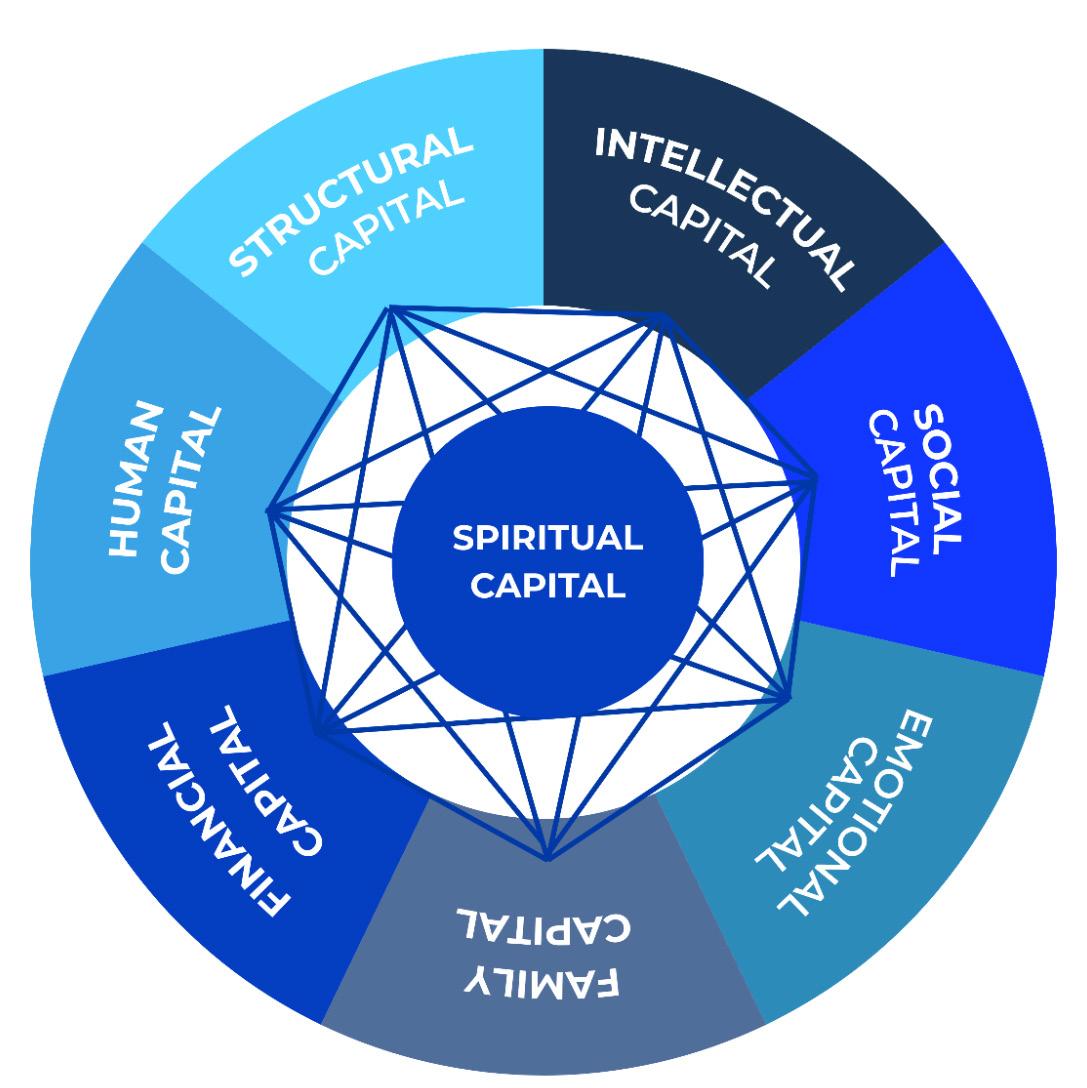

A New Phenomenon The Loss of the Sense of Transcendence in the new generation and the field of Family Businesses

By

Raul Serebrenik

Single Family Offices and UHNWI Investors The Rise of Smart Direct AI/Tech Investing

By Jason Ma

WHEN IT COMES TO A BUSINESS AIRCRAFT, YOU COULD BITE THE BULLET ON THE CAPITAL OUTLAY—OR YOU COULD KEEP IT IN THE FAMILY.

WITH GLOBAL JET CAPITAL, YOU GET:

• Decades of collective experience specifically in aircraft financing

• Expertise from thousands of completed aircraft transactions

• Our specialized asset expertise allows us to make complex deals happen that otherwise would not

• Customized financing solutions tailored to client needs

Connect with the Global Jet Capital team to explore how we can help you access private aircraft financing with ease.

Aimee Talbert Nardini Director of Marketing 561-212-1594 atalbertnardini@globaljetcapital.com

EDITOR’S NOTE

AI, Power Destinations & The New Global Playbook for the Ultra-Wealthy

This Fall issue of Impact Wealth explores a defining moment in modern luxury and global strategy—where artificial intelligence, mobility, and legacy intersect to reshape the way the world’s most influential families live, invest, and build dynasties.

From Florence to Dubai, from Art Basel to the metaverse, wealth is no longer defined solely by assets—but by access: access to proprietary technology, to generative AI platforms that accelerate creativity and deal flow, and to power destinations that are rapidly becoming global hubs for capital, culture, and influence.

In our cover feature, we spotlight Salvatore Ferragamo Jr., who is expanding the iconic Ferragamo legacy beyond fashion and into a new vertical of generational assets—fine Tuscan wine and hospitality through Il Borro. His vision signals a shift among global families: diversifying into experiential legacy investments that marry real estate, agriculture, culture, and sustainability.

This theme continues across our travel and investment portfolios. We journey to Milan Fashion Week Spring/Summer 2026, where heritage brands proved that identity and craftsmanship are not being replaced by AI—but rather reimagined through it. At New York Fashion Week, designers blended digital couture with physical collections, ushering in a new era where creativity is augmented by intelligence, not eclipsed by it.

We also explore the world’s new capital of wealth migration: Dubai. Once a desert port, today it stands as the fastest-growing jurisdiction for ultra-high-net-worth individuals and multi-family offices. In

this issue, we delve into why Dubai— with its tax infrastructure, geopolitical neutrality, AI-driven government, and global connectivity—is becoming the epicenter for wealth preservation in a rapidly shifting macro environment.

Our coverage of the Concordia Summit underscores another profound trend: the rising importance of AI in policy, humanitarian response, capital markets, and the future of work. AI is not just a tool; it is a geopolitical force that will determine global competitiveness for decades to come.

Rounding out our technology lens is our exclusive interview with Joaquín Cuenca Abela, CEO of Freepik, who is leading the charge in generative AI for content creation. As he reveals, those who control the platforms that power digital creativity will define the next great wealth wave— positioning AI not as a disruptor of human capital, but as an accelerant for visionaries.

And as always, travel remains our ultimate expression of luxury and expansion. From the exquisite Portrait Hotel in Milan, owned by the Ferragamo family, to the breathtaking culinary odyssey in Thailand with Coba, and our curated spotlight on the Leading Hotels of the World, we explore destinations that are not only breathtaking—but strategically important to the new global citizen.

This is the new landscape of impact and affluence. Not merely where you live—or even how you live—but the ecosystems you choose to be part of: AI ecosystems, sovereign ecosystems, hospitality ecosystems that build generational legacy.

Welcome to a new era of wealth where intelligence, mobility, and culture converge.

Hillary Latos Editor in Chief

Hillary Latos EDITOR IN CHIEF

Candice Beaumont MANAGING EDITOR

Emil Pavlov ART DIRECTOR

Charles Barnes, Daniel Perry CONTRIBUTING PHOTOGRAPHERS

Neal Berger, Janelle Brown, Cristina Carbo, Maria Gutierrez, Dorian May, Amy Poliakoff, Hannah Rose, David Seidman CONTRIBUTORS

Angela Gorman, Adam Weiss PUBLISHERS

Colin Thompson DIRECTOR OF SPONSORSHIP Impact Wealth Media LLC 222 Broadway, 18th Floor, New York, NY 212 542 3146

www.impactwealth.org info@impactwealth.org

WHY DUBAI IS THE NEW CAPITAL

for Global Family Offices and Ultra-High-Net-Worth Migration

In the evolving landscape of global wealth, one city has emerged as both a sanctuary and a springboard for the world’s most powerful families and investors: Dubai. Once known mainly for its luxury real estate and glittering skyline, the emirate has matured into a strategic hub for family offices, alternative investments, and intergenerational wealth management.

By Hillary Latos

As traditional markets in the West grapple with stagnating returns, mounting regulation, and geopolitical instability, ultra-high-net-worth individuals (UHNWIs) and family offices are increasingly turning to the United Arab Emirates (UAE)—and particularly the Dubai International Financial Centre (DIFC)—to establish their second residences, manage private capital, and access emerging-market growth.

The question is no longer “Why Dubai?” It is now “How quickly can we relocate there?”

The Strategic Magnetism of Dubai

Dubai’s rise as a global financial nucleus is not accidental—it is the product of vision, infrastructure, and a commitment to innovation. Situated at the crossroads of Europe, Asia, and Africa, the emirate offers a unique advantage: the transparency and governance of a developed market, combined with direct access to the explosive growth of emerging economies.

The latest DIFC report, The Future of Alternative Investments, notes that global alternative assets under management have tripled in the past decade, surpassing USD 20 trillion, and that Dubai now ranks among the top 15 financial centers worldwide.

From the outside, Dubai’s appeal might seem driven by lifestyle—tax-free income, yearround sunshine, and world-class amenities— but for UHNW investors, it is the structure beneath the skyline that matters most. The DIFC offers a common-law legal system, regulatory independence, and tax neutrality, placing it on par with London, Zurich, and Singapore as a premier financial jurisdiction.

The emirate’s pro-business policies, political stability, and legal transparency create an environment of trust—something increasingly scarce in a fragmented global economy.

The Family Office Migration

In recent years, Dubai has become the new gravitational center for family offices—the private investment vehicles that manage the wealth of ultraaffluent families across generations.

Under the DIFC Family Wealth Centre, families can establish a single or multifamily office in a matter of weeks, gaining access to a framework purpose-built for succession planning, asset protection, and cross-border investment. The ecosystem includes Special Purpose Vehicles (SPVs), holding companies, and soon, Variable Capital Companies—a new structure launching in

2025 that will provide even greater flexibility for fund managers and family offices to pool and allocate capital efficiently.

These structures provide robust legal frameworks, tax efficiency, and full ownership control, allowing families to centralize assets, diversify holdings, and manage global investments without bureaucratic drag.

The DIFC is now home to more than 440 wealth and asset management firms, including 85 hedge funds and 69 firms managing over USD 1 billion each—making it the largest concentration of alternative investment entities in the region.

For UHNW families seeking continuity and confidentiality, Dubai’s value proposition is clear: operate in a world-class jurisdiction while retaining global reach.

Economic and Regulatory Advantages

From an economic standpoint, Dubai offers unmatched efficiency. There is no corporate or personal income tax, no capital gains or inheritance tax, and no restrictions on foreign ownership or currency repatriation.

But beyond fiscal incentives lies something more fundamental—regulatory clarity and speed. While Europe’s financial hubs remain mired in bureaucracy and U.S. regulators tighten compliance, the Dubai Financial Services Authority (DFSA) provides a responsive, principlesbased framework that actively facilitates innovation, particularly in alternative finance, fintech, and sustainable investment.

In fact, the DIFC has become a model for public-private partnership in financial development, enabling private investors to deploy capital into high-growth sectors such as renewable energy, digital infrastructure, AI, and real estate.

Emerging Markets, Exponential Growth

According to the Future of Alternative Investments report, emerging markets are outpacing developed economies by 2–3% in annual GDP growth, driven by youthful demographics, rapid industrialization, and a “leapfrogging” of legacy systems.

Dubai’s unique position—bridging the Middle East, Africa, and South Asia (MEASA) region—makes it a gateway to more than three billion consumers across high-growth markets that are often inaccessible or overly fragmented for Western investors.

As a result, Dubai’s financial ecosystem attracts sovereign wealth funds, private equity firms, venture capitalists, and family offices looking to invest in innovation-driven sectors—from clean energy and digital assets to health tech and sustainable real estate.

“Emerging markets are a compelling frontier for alternative investments,” said Salmaan Jaffery, Chief Business Development Officer of the DIFC Authority. “Dubai has positioned itself as a strategic gateway for investors seeking to capitalize on the next era of growth.”

Private Credit, Real Estate, and Digital Innovation

The diversification imperative is clear: traditional equities and bonds are no longer delivering the stability they once did. That’s why UHNW investors are turning to alternative asset classes that combine yield, resilience, and inflation protection.

Private credit, one of the fastest-growing segments globally, now exceeds USD 2 trillion in assets. With global banks retrenching from risk, Dubai’s private credit market has filled the void, offering bespoke, sustainability-linked financing to enterprises across the region.

Real estate, long a hallmark of Dubai’s wealth story, continues to evolve beyond luxury villas and high-rises. Prime residential prices have stabilized after a 200% surge over four years, now forecast to rise nearly 10% annually, supported by population growth, limited supply, and urban development pipelines.

Yet the most dynamic opportunities may lie in AI-powered data centers, green infrastructure, and tokenized finance. Dubai’s government has embraced blockchain integration and cryptocurrency regulation, turning the emirate into a sandbox for financial innovation. Clear rules on stablecoins and digital assets have placed Dubai ahead of Western peers, inviting institutional capital and family offices seeking exposure to next-generation wealth creation.

The DIFC Advantage

At the core of Dubai’s appeal is the Dubai International Financial Centre (DIFC)—a 110-acre district that has become the beating heart of finance in the Middle East.

The newly launched DIFC Funds Centre embodies the city’s commitment to fostering innovation in asset management. Purposebuilt for hedge funds, private equity firms, and boutique investment houses, the Centre offers plug-and-play workspaces, regulatory clarity, and high-speed digital infrastructure— all designed to accelerate fund launches and scale operations with minimal friction.

This ecosystem extends far beyond office space. The DIFC fosters collaboration between global fund managers, fintech entrepreneurs, and sovereign wealth representatives, creating a living network effect that continuously drives capital efficiency.

By providing Special Purpose Vehicles (SPVs) and dedicated family office structures, DIFC enables investors to manage global portfolios from a secure and transparent platform— effectively merging Wall Street sophistication with Middle Eastern accessibility.

Comparative Edge: UAE vs. the World

When measured against traditional wealth jurisdictions like Switzerland or Singapore, Dubai’s strategic advantages are undeniable.

For family offices looking to expand beyond static asset preservation into active global investment, Dubai offers not only agility but alignment—with its government, infrastructure, and financial institutions all oriented toward wealth creation and capital mobility.

Vision from Dubai Chambers

Looking forward, the role of Dubai Chambers—which oversees business advocacy, investment promotion, and global trade engagement—will be pivotal in shaping the city’s next phase of wealth migration.

When asked about Dubai’s competitive edge, the CEO of Dubai Chambers emphasized the emirate’s multi-layered strategy: “Our aim is not only to attract wealth, but to cultivate ecosystems where that wealth fuels innovation, employment, and sustainable growth. The UAE’s family office framework and financial reforms are designed to create

Factor Dubai / UAE Switzerland Singapore

continuity across generations, ensuring Dubai remains a legacy hub for global families.”

Through partnerships with the DIFC, Dubai Chambers is aligning foreign direct investment (FDI) incentives with residency and citizenship programs, allowing investors to integrate lifestyle and business seamlessly—a dual proposition unmatched in most of the developed world.

Lifestyle and Legacy

For UHNW individuals, quality of life is inseparable from investment strategy. Dubai offers zero personal income tax, efficient visa programs, and world-class education and healthcare. The city’s cultural diversity and safety have made it the preferred home base for entrepreneurs, investors, and their families.

The Golden Visa program has further accelerated this migration, offering longterm residency to investors, entrepreneurs, and professionals in high-value sectors. Paired with second residence incentives and an expanding calendar of global art, finance, and sustainability events, Dubai has become both a playground and a powerhouse for global elites.

The New Paradigm of Wealth

Dubai’s evolution reflects a larger global trend: the rebalancing of financial power from the West to emerging markets. In this new order, the agility of governance, not the age of institutions, defines success.

The DIFC’s data tells the story: alternative assets are expanding, family offices are multiplying, and global capital is converging

here faster than anywhere else in the world. From private credit to tokenized real estate, Dubai is turning abstract investment theory into tangible opportunity.

As the Future of Alternative Investments report concludes, “DIFC offers both the governance and confidence of developed market hubs, and direct access to highgrowth emerging sectors and economies.”

Conclusion: The Future of Family Wealth Is in Dubai

In the post-globalization era, where geopolitical tensions, shifting regulations, and digital transformation redefine the financial landscape, Dubai has done something extraordinary—it has turned geography into strategy.

For UHNW families and institutional investors alike, the emirate offers a complete value proposition: fiscal freedom, global connectivity, innovation-led growth, and a secure foundation for legacy building.

In the words of His Excellency Arif Amiri, CEO of the DIFC Authority, “Thriving in a rapidly changing world demands an ecosystem that nurtures innovation, fosters collaboration, and connects talent and capital across borders.”

His Excellency Hadi Badri, CEO of the Dubai Economic Development Corporation (DEDC), the economic development arm of DET, summates: “Dubai’s progress reflects the strength of our ecosystem and the impact of long-term collaboration between government and business. Our success in attracting headquarters projects and investments reinforces Dubai’s role as a global hub for decision-making and growth. The diversity and quality of investments, especially in AI, FinTech and creative industries, show Dubai’s ability to anticipate global shifts and align with the sectors shaping the future economy. In the months ahead, we will continue building new partnerships, deepening existing ones and strengthening our innovation ecosystem to ensure Dubai remains the world’s leading destination for investors seeking growth and stability.”

For family offices seeking a place where innovation meets stability, Dubai is not just a destination—it is the future capital of global wealth.

INSIDE DUBAI’S WEALTH STRATEGY

A Conversation with H.E. Mohammed Ali Rashed Lootah, CEO and President of Dubai Chambers

By Hillary Latos

Global Positioning: How does Dubai position itself among global wealth hubs like Singapore and Zurich in attracting UHNW families and family offices?

Dubai has firmly established itself among the world’s leading wealth hubs. The city offers a rare blend of opportunity, stability, and lifestyle that appeals to ultra-highnet-worth families looking for a safe and dynamic base for their global operations.

According to Henley & Partners, the UAE is set to attract the world’s largest net inflow of millionaires in 2025, with around 9,800 new arrivals – equivalent to more than 26 every day. This remarkable momentum reflects growing confidence in Dubai’s role as a global wealth hub and one of the world’s fastest-growing destinations for private-wealth migration.

What truly sets the city apart is its strategic location linking Asia, Europe, and Africa, coupled with a business-friendly regulatory framework that allows 100% foreign ownership, no personal income tax, and highly competitive corporate tax rates. Add to this a sophisticated financial ecosystem, world-class infrastructure, and an exceptional quality of life, and it’s clear why so many family offices are choosing Dubai as their long-term home.

Economic Diversification: What specific incentives or policies are being developed to sustain Dubai’s leadership in finance, tech, and sustainability sectors?

Economic diversification is one of the main pillars of the Dubai Economic Agenda (D33) and the foundation of the city’s sustainable growth model. D33 sets an ambitious vision to double the size of Dubai’s economy and foreign trade by 2033, positioning the city as a global hub for innovation, investment, and enterprise.

Dubai’s approach focuses on building a balanced economy driven by finance, technology, and sustainability. In finance, Dubai continues to strengthen its position as a leading global center for capital, wealth management, and financial innovation. Dubai has been ranked among the world’s top four cities for FinTech in the latest Global Financial Centres Index (GFCI),

In technology, initiatives such as the Universal Blueprint for Artificial Intelligence and ongoing investment in digital infrastructure are accelerating transformation across every sector. These efforts are designed to advance the D33 goal of adding US$ 27 billion annually to Dubai’s economy through digital transformation projects.

Guided by initiatives including the Dubai Clean Energy Strategy 2050, Dubai is embedding sustainability and responsible growth at the core of policy and planning –from green investments and clean-energy transitions to circular-economy initiatives that promote long-term resilience.

Dubai’s investor-friendly environment, transparent regulation, and strategic location continue to attract leading businesses, entrepreneurs, and talent from around the world. Together, these factors reinforce Dubai’s position as a diversified, futurefocused economy – one that is agile, inclusive, and built to thrive in the decades ahead.

Family Office Growth: How has the influx of family offices reshaped the local investment ecosystem, and what new regulations support their expansion?

The influx of family offices has significantly reshaped Dubai’s investment ecosystem. Dubai is home to the highest concentration of private wealth in any Middle Eastern city. In 2024, assets under management in the Dubai International Financial Centre (DIFC) rose 58% year-on-year to exceed US$ 700 billion. Today, DIFC is home to over 470 asset and wealth management firms, including global names like St. James’s Place, Rothschild & Co, Ocorian, and Franklin Templeton.

Regulations such as the UAE Family Business Law and DIFC's Family Arrangements Regulations 2023 provide clarity and confidence for multi-generational wealth management. These frameworks support governance, succession planning, and risk management, making Dubai an ideal base for family offices looking to diversify and protect their assets in a stable environment.

Global Talent Magnet: With increasing global mobility of wealth, what measures are being taken to attract top-tier financial and legal talent to support the ecosystem?

Dubai is committed to being a global magnet for top-tier financial and legal talent. Programs such as the Golden Visa and digital nomad initiatives make it easier for skilled professionals to relocate and contribute to Dubai’s fast-growing financial ecosystem. Combined with a zero personal income tax regime and exceptional quality of life, these policies have made Dubai home to a workforce representing more than 200 nationalities.

This commitment to attracting global expertise is reflected in Dubai’s ranking as #1 worldwide for talent entry in the Kearney Global Cities Index 2024, reinforcing the city’s openness and competitiveness. To further strengthen its talent base, the DIFC Academy and Innovation Hub provide worldclass executive learning and legal-training programs, while strategic partnerships and global networking events connect leaders, investors, and advisors from around the world.

The UAE Ministry of Investment’s recent partnership with Microsoft to train 100,000 professionals in artificial intelligence demonstrates the nation’s dedication to building a future-ready workforce capable of supporting Dubai’s continued growth as a global center for finance and innovation.

Digital Transformation: How are blockchain, tokenisation, and digital asset frameworks shaping Dubai’s ambition to be a “Smart Financial Centre”?

Dubai’s ambition is powered by its proactive approach to digital transformation and innovation in financial services. The city’s strategy brings together advanced technologies, forward-looking regulation, and world-class talent to create a future-ready financial ecosystem.

Dubai is continuing to set benchmarks for financial innovation and was recently ranked among the top four cities globally for FinTech in the Global Financial Centers Index (GFCI). The city is also the only financial center in the MENA region recognized as a “global leader with broad and deep capabilities.”

Through initiatives like the Dubai Financial Services Authority’s Innovation Testing License and the Virtual Assets Regulatory Authority’s comprehensive digital assets framework, Dubai offers a secure and transparent environment for the development of emerging financial technologies. These encourage responsible experimentation while maintaining market integrity and investor protection. Supported by continued investment in AI, digital infrastructure, and talent development, Dubai is advancing toward its vision of a smart, connected, and globally competitive financial center at the forefront of digital finance.

Sustainability: What role does Dubai’s sustainability agenda (especially post-COP28) play in attracting impact-driven investors?

Sustainability is a defining pillar of Dubai’s long-term economic vision and a key

factor in attracting impact-driven investors. Following COP28, Dubai has accelerated its efforts to position sustainability at the core of policymaking, investment strategy, and private-sector engagement.

The DIFC Sustainable Finance Working Group continues to drive ESG integration across the financial sector, while initiatives under the Dubai Economic Agenda (D33) and the UAE Net Zero 2050 Strategy are creating new opportunities in renewable energy, green finance, and sustainable infrastructure. These frameworks give investors the confidence that Dubai’s growth is aligned with the global drive for sustainability.

At the same time, family offices and institutional investors based in Dubai are increasingly embedding ESG principles into their investment strategies, reflecting a clear shift toward purpose-driven capital and longterm value creation. Together, these efforts are reinforcing Dubai’s position as a regional leader in sustainable finance and a trusted destination for responsible investment.

Future

Outlook: Where do you envision Dubai’s financial ecosystem in the next decade, and how will

it evolve to accommodate trilliondollar family office inflows?

Over the coming decade, Dubai’s financial ecosystem is set for continued expansion, guided by clear policy direction and a strong foundation of regulatory, technological, and institutional strength. The city’s combination of robust legal frameworks, advanced infrastructure, and a culture of innovation will continue to attract global investors, family offices, and financial institutions seeking long-term stability and opportunity.

The Dubai Economic Agenda (D33) provides the roadmap for this growth, aiming to double the size of Dubai’s economy by 2033 and further integrate the emirate into global capital markets. Ongoing efforts to enhance financial regulation, digital infrastructure, and human capital are reinforcing Dubai’s role as a key gateway for international investment.

As financial markets continue to evolve, Dubai’s focus will remain on diversification, transparency, and responsible innovation, ensuring that its financial ecosystem grows in depth, sophistication, and global relevance in the years ahead.

THE POWER OF PRIVATE MARKETS

Joan Solotar on Blackstone’s Vision and the Future of Family Office Investing

From Wall Street equity analyst to global head of private wealth at Blackstone, Joan Solotar has carved out a singular vantage point in the world of alternative investments. In this conversation with Impact Wealth, she shares her career journey, the inner workings of Blackstone’s private wealth business, and why private markets are increasingly crucial for family offices navigating a shifting economic landscape.

By Candice Beaumont

Q&A with Joan Solotar, Global Head of Private Wealth Solutions, Blackstone

Impact Wealth: Joan, could you tell us a bit about your professional background and how you came to lead Blackstone’s private wealth business?

Joan Solotar: Absolutely. I began my career as an equity analyst covering financial institutions, initially at DLJ and then Credit Suisse. Later, I led equity research at Bank of America. Over those years, I worked on numerous IPOs for asset managers and investment banks— firms like Goldman Sachs, Dean Witter Discover, and DLJ, my former employer.

When Blackstone decided to go public, they hired me to help manage that process, develop shareholder relations, and lead strategic initiatives. At the time, around twothirds of Blackstone’s roughly $88 billion in assets under management came from U.S. pension funds. We were focused on expanding globally and growing our institutional investor base—but we also saw a major opportunity in serving private wealth investors.

About 14 years ago, we formally launched the private wealth business, and about a decade ago, I was asked to build it into what it is today: a global, market-leading business managing over $270 billion. Our mission has been clear—to bring institutional-quality alternative investments to private wealth investors in a way that prioritizes transparency, lower fees, and a far better client experience than they’d historically had access to.

Impact Wealth: What sets Blackstone apart in delivering alternative investments to private wealth clients?

Joan Solotar: The core idea was simple: take our institutional-quality funds and offer individuals a significantly improved experience. Historically, many alternative products aimed at individual investors came with high fees and were managed outside top-tier institutional processes. We focused on lowering fees, improving structures—for example, charging management fees on net asset value rather than on gross assets including leverage—and ensuring greater transparency. Beyond the products themselves, we’ve heavily invested

in education, investor services, and marketing support for advisors. The goal is an end-to-end experience, not merely selling a product.

A key differentiator is also the breadth of our platform. We’re not just private equity— we have leading franchises in private real estate, credit, infrastructure, and various sub-strategies. It allows us to offer private wealth investors highly diversified options.

Impact Wealth: Why should individual investors consider allocating to private markets?

Joan Solotar: Fundamentally, for the same reasons institutions do. Private markets— like private credit, private equity, real estate—have historically delivered higher returns with lower volatility than their public market equivalents. For example, private credit has outperformed public credit indices with less price fluctuation.

Private investments also provide meaningful diversification. The old 60/40 stock-bond portfolio isn’t always reliable anymore because correlations can spike in crises. Foundations,

endowments, and sophisticated investors with higher allocations to alternatives have significantly outperformed peers over time.

One reason private investments appear less volatile is how they’re valued. Unlike public markets, which can swing wildly day to day, private assets are marked to net asset value, so you’re not exposed to the same market noise. For instance, a building across the street doesn’t gain or lose 10% of its value overnight.

Impact Wealth: Beyond flagship private equity funds, how does Blackstone provide private market access to clients?

Joan Solotar: Investors have access to the entire Blackstone platform: private equity, credit, infrastructure, and real estate. We’ve created open-ended funds in each area, distributed through private banks, wirehouses, and financial advisors.

Most individuals don’t invest directly with us—it’s through their advisor

relationships. This approach allows us to scale our reach while ensuring advisors have the tools and education they need.

Impact Wealth: Where do you currently see the most compelling opportunities in private markets? Are there specific sectors or themes you’re especially excited about?

Joan Solotar: Each asset class—private equity, real estate, credit, infrastructure—has historically outperformed its benchmarks. But we’re extremely thematic in our investing. For example, in real estate, our open-ended fund has doubled the performance of the public REIT index. We’re heavily invested in sectors like rental housing, data centers, and logistics, while avoiding areas like offices and shopping malls that have struggled.

Technology trends like e-commerce, digitization, and AI drive many of our themes. We often focus on “picks and shovels” businesses supporting these trends—like data centers benefiting from AI rather than

Across

all our strategies,

the Blackstone mantra is “do not lose money.” We’re rigorous in underwriting and avoid purely speculative bets. We want investments that generate cash flow and that we can hold for the long term with confidence in their fundamentals.

betting on which specific AI company wins. In fact, we’re the largest owner of data centers in the U.S., serving hyperscale clients who pre-commit to the space before it’s even built.

Another example is franchise businesses, which require low capital and where Blackstone can add value through branding, marketing, and strategic growth.

The key is combining sector selection with the right assets and the ability to execute at scale. We leverage insights from our entire platform—including data science— to identify patterns and anticipate trends rather than merely reacting to the past.

Impact Wealth: Blackstone is known for innovative deal structuring, especially to manage downside risk. Could you share an example of how you’ve structured investments creatively to protect capital?

Joan Solotar: Absolutely. Much of that innovation sits within our Tactical Opportunities business, which can invest flexibly across the capital structure. One example is CoreWeave, an AI-focused company we backed early on. Our structure provided downside protection, similar to debt, while preserving upside through equity participation like warrants.

Another example is our direct lending business, where we provide senior secured loans—effectively at the top of the capital structure. Today, you can earn double-digit returns in that space without taking equity risk.

Across all our strategies, the Blackstone mantra is “do not lose money.” We’re rigorous in underwriting and avoid purely speculative bets. We want investments that generate cash flow and that we can hold for the long term with confidence in their fundamentals.

Impact Wealth: Many family offices worry about liquidity in private markets. How does Blackstone help clients balance illiquidity and risk?

Joan Solotar: That’s such a crucial distinction—liquidity and risk are different concepts. The first conversation any advisor should have with a client is determining how much illiquidity their portfolio can handle. In a perfect world, where you only optimize for return, yield, and diversification, a model might suggest allocating 50% to private markets. Realistically, many individuals can’t commit that much.

So allocations might range from 10% to 20%, depending on personal circumstances. Education is key, and we spend significant resources on advisor training—via Blackstone University, virtual sessions, in-person meetings—to ensure people understand liquidity constraints and the benefits of compounding in private markets.

Different asset classes serve different needs. Private equity might appeal to those seeking higher total return. Private credit often appeals to those seeking steady income. Real estate and infrastructure sit between those extremes, sometimes with tax benefits like depreciation.

Ultimately, it’s about aligning the portfolio with the client’s goals and risk tolerance.

Impact Wealth: With geopolitical tensions globally—conflicts, inflation, rising rates—how do these factors impact Blackstone’s investment approach?

Joan Solotar: While we’re mindful of geopolitical risks, we’re not trading public securities day-to-day. Blackstone has operated for 40 years through countless geopolitical shifts, wars, and regime changes.

Our thematic approach and longterm orientation mean we rarely pivot dramatically in response to news headlines. Of course, macro factors influence valuations, deal flow, and timing for exits or IPOs. For example, M&A activity slowed earlier this year due to rate uncertainty but seems to be picking up again.

We remain disciplined both in entry valuations and in exit strategies. The benefit of investing in illiquid assets is you’re not subject to daily fund flows or market swings. We focus on quality businesses and assets we’re willing to own for many years.

Impact Wealth: And finally, what proportion of Blackstone’s private wealth business comes from family offices and high-net-worth investors?

Joan Solotar: Of Blackstone’s $1.1 trillion in total assets under management, over $270 billion is dedicated to private wealth. I can’t publicly break down that $270 billion further into family office vs. other individual investors, but family offices are certainly a meaningful and growing part of our client base.

THREE INVESTMENT RISKS

Not Treated Equally

Investors should be aware of all investment risks when investing, but they are not. The one risk that seemingly gets 99% of attention from investors is risk to capital. Investors typically fret over volatility by equating high volatility with high risk. What they fail to recognize is that the most volatile assets lead to the highest returns over time.

By Robert Zuccaro, CFA

Clearly, stocks are regarded as being more volatile than bonds. However, risks associated with investing in the stock market dissipate over time. There have been three instances since WW II whereby stocks have lost 48% or more in bear markets. In every instance, the stock market has fully recouped these losses en route to going on and establishing new record highs.

It’s essential to adopt a long-term time horizon when investing in the stock market to minimize capital risk. Rolling 10-year returns for the S&P 500 through 2024 show a 221% cumulative return on average since 1971. Over 20-year periods, the average cumulative return jumps to 880%. Cumulative returns in both periods have far outpaced the corresponding rise in inflation as measured by the CPI, which has led to big gains in purchasing power.

Risk number two relates to lost opportunity costs. Looking at HFRI hedge fund data tells quite a story. Over 10 years ending 2024, the typical long bias equities hedge fund earned a cumulative return of 84% versus 245% for the S&P 500. Hence, the lost opportunity costs by not being fully invested in stocks were almost twice as great as money earned by long bias equities hedge funds.

Risk number three relates to loss of purchasing power, which is rarely considered by investors. Some major advisories have advocated maintaining a very heavy exposure in bonds throughout retirement. Specifically, these advisors key off the “the rule of 100” which is derived from subtracting one’s age from 100 to

arrive at one’s equity exposure. In the case of a 65-year-old, the portfolio mix would be 65% in bonds and 35% in stocks according to this methodology. In some cases, unduly conservative investors will hold a portfolio of 100% invested in bonds.

How did a 100% investment in long government bonds fare over the past 10 years? NYU Stern Business School’s research shows that an investment in 10-year government bonds returned 2.7% on a cumulative basis for 10-years ending 2024.

Meanwhile, the Consumer Price Index advanced at a 32% clip over the same period, which led to a significant decline in purchasing power for this bond portfolio. In summary, investors need to consider possible loss of opportunity costs and possible loss in purchasing power in addition to capital risk in formulating their investment strategy. History shows that ignoring opportunity and purchasing power risks can turn into financial penalties down the road.

Robert Zuccaro, CFA is the Founder & Chief Investment Officer at Golden Eagle Strategies. Robert has over four decades of experience in equity research and fund management, having led institutional portfolios through multiple market cycles. He’s been recognized by national financial publications for his work in quantitative investing.

Email:info@goldeneaglestrategies.com / phone: (561) 510-6606

AGNIESZKA PESTKA

Curates a New Season of Life with Salome Apartment

Art, Design, and Tranquility in the Heart of Manhattan

By Hillary Latos

Polish artist Agnieszka Pestka is entering a new phase of creative evolution. Known for her sculptural works and bold curatorial vision, Pestka is redefining what it means to live artfully. With Salome Apartment—her Chelsea residence and living gallery—she blends artistic expression with design, crafting a sanctuary where creativity and calm coexist.

“I want to keep evolving and getting better in every area of my work,” she says. “New York City is about moving forward and evolving as an artist. I want my art involved in everything—from the spaces I surround myself with to starting my own gallery.”

A Living Gallery in Chelsea

Nestled in the heart of Manhattan, Salome Apartment is both home and exhibition space. The artist has transformed the residence into a serene yet vibrant environment that reflects her ongoing dialogue between form and feeling.

“I think it’s my nature to always be growing and changing,” she adds. “It’s not something that happens overnight— it’s taken many strides to get here.”

The result is a deeply personal space shaped through collaboration with Polish designer Julia Bimer and realized by Voytek Orent Design. Together, they reimagined the apartment as a functional yet emotional canvas—an extension of Pestka’s artistic language.

Design as Expression

Part of a small co-op surrounded by private green spaces, the apartment exudes intimacy and quiet refinement. Restored original floors and Lumens lighting create a warm stage for contemporary forms. Every corner reflects deliberate choices that fuse comfort with design. In the living room, a white USM Modular cabinet anchors the space opposite a vibrant orange B&B Italia sofa. A green emerald marble coffee table from HD Buttercup stands like a sculpture, complemented by a black CB2 TV stand and a velvet Restoration Hardware sofa bed. The setting balances restraint and playfulness—an interplay of color, material, and light.

The walls showcase Pestka’s own work, including RTOIP, a metal bas-relief of ten zinc plates, and a delicate etching on rice paper titled She Comes to Me at Night (and Takes Me in Her Arms). The stainless-steel sculpture Tojad and glass pieces from her Hocus Pocus: Witchcraft and Magic Objects series add an ethereal dimension.

Personal Sanctuaries

In the bedroom, a custom-made bed sits beneath a striking pendant lamp that bathes the space in warm light. A CB2mirror, liquid metal-finished nightstand from Lulu and Georgia, and a minimalist Kryptonite wall cabinet lend a contemporary edge. Elegant glass doors open to a custom walk-in wardrobe—complete with cabinetry, shelving, and a small office nook overlooking an ivy-clad wall.

The bathroom continues the theme of sculptural simplicity. Architectural concrete walls, a hand-carved marble sink, and refined

fixtures create a private spa-like retreat. In the kitchen, marble countertops and liquid metal-finished cabinets meet premium appliances from Bertazzoni, Bosch, Forno, and Smeg, marrying performance with poise.

A New York Frame of Mind

Chelsea’s cinematic streetscape—brick townhouses, romantic architecture, and summer blooms—frames Pestka’s creative life. “It’s been an amazing journey,” she reflects. “I’m very happy.”

Pestka’s vision extends beyond New York. Her work has been shown at Art Basel Miami, in Key West, and across Poland. She is now preparing to launch her own gallery, PESTKA Gallery, at 669 NW 28th Street in Miami’s Allapattah district. The grand opening is scheduled for February 19, 2026.

Whether shaping a sculpture or curating her surroundings, Pestka continues to merge art and life into a single, luminous narrative.

307 West 20th Street, New York apestka.com

Salome Apartment

NINA YANKOWITZ

In the Out / Out the In

The Parrish Art Museum Celebrates Six Decades of Artistic Innovation and Vision.

By Candice Beaumont

This fall theParrish Art Museum in Water Mill, New York, unveiled Nina Yankowitz: In the Out / Out the In, a sweeping retrospective that captures six decades of fearless experimentation from one of the most dynamic voices in American contemporary art.

Organized by the Museum of Fine Arts in St. Petersburg, Florida, and now presented on the East End with generous support from the Helen Frankenthaler Foundation, Eric Firestone Gallery, Sherri and Darren Cohen, and other patrons, the exhibition unfolds across multiple galleries. It offers a rare opportunity to experience the full depth of Yankowitz’s groundbreaking career, from her radical pleated canvases of the 1960s to her immersive, collaborative installations that merge sound, sculpture, and technology.

“Nina Yankowitz has never stopped challenging the limits of artistic practice,” said Parrish Executive Director Mónica Ramírez-Montagut. “She brings painting, sculpture, sound, performance, and technology together in transformative

ways, and her work continues to enrich the artistic fabric of our community.”

From Canvas to Sound: The Early Years

Born in New Jersey in 1946, Nina Yankowitz has always embraced experimentation as a form of truth-seeking. After graduating from the School of Visual Arts in 1969, she quickly established herself in New York’s avant-garde circles, pushing the boundaries of painting through material innovation. Her early works on view at the Parrish—Oh Say Can You See – A Draped Sound Painting (1967–68), Goldie Lox (1968), and Ms. Majesty (1970–71)—use pleating machines, paint sprayers, and sewing techniques to reimagine canvas as a living surface.

These works do more than play with form; they question what painting can be. The folds and textures breathe with energy, the colors pulse with movement, and, in some cases, sound itself becomes part of the experience. Yankowitz’s artistic voice, shaped by the feminist movement and

her role as a founding member of the Heresies Collective, found freedom in bending the conventions of art itself.

Language, Perception, and the Human Experience

By the early 1970s, Yankowitz was already redefining the connection between perception and participation. Works such as Dilated Grain Reading: Scanning Reds and Blues (1973) and Lips Knees Neck Elbows Chest Rear (1974) exemplify her use of sound and color to trigger emotional and sensory awareness. These pieces, both on view at the Parrish, invite visitors to experience the intersection of sight and sound, body and consciousness.

Her Dilated Grain Readings series translates sensory experiences into painted form, while Lips Knees Neck Elbows Chest Rear encourages visitors to listen to their own bodies as instruments of perception. The result is both meditative and deeply human, a continuation of Yankowitz’s lifelong fascination with how art communicates without words.

“Working with Nina always feels like a creative journey,” said Parrish Chief Curator Corinne Erni. “Her work asks us not only to look, but to feel, listen, and participate. From her draped canvases to her interactive installations, she invites a level of engagement that stays with you long after you leave the gallery.”

Sculptural Transformations and Sound Architecture

As Yankowitz’s vision evolved through the 1980s and 1990s, she ventured into the sculptural and architectural. The monumental Hell’s Breath – A Vision of the Sounds of Falling (1982), reconstructed for the first time since its debut at MoMA PS1, stands as one of the exhibition’s focal points. The eight ceramic panels stretch across a gallery wall, immersing viewers in a visual rhythm that suggests both collapse and renewal.

Nearby, her Slant Series (1986) and Decorative Minimalism Cube (1991) showcase her playful approach to form and balance, while Cantilevered Sun (1997) extends this exploration of tension and levity. These works underscore Yankowitz’s ability to bridge the tactile and the conceptual, the material and the metaphysical.

Technology, Collaboration, and the Present Moment

The exhibition culminates in Closing Bell (2024–25), currently installed in the museum’s main gallery. This monumental new work brings together more than thirty artists, poets, and musicians in a collective reflection on climate change and migration. With sound, projection, and sculptural elements interwoven into a single immersive environment, Closing Bell positions Yankowitz not only as an artist but as a conductor of creative dialogue.

Also featured is Criss Crossing the Divine (2016), a digital projection work that invites viewers to navigate themes of spirituality and cultural exchange. Together, these installations illuminate her belief that art can be a catalyst for empathy and transformation in the face of global challenges.

The Artist and the East End

Since the 1970s, Yankowitz has been part of the creative fabric of the East End, first visiting with fellow artists such as Barbara Kruger, Joan Semmel, and Michelle Stuart before settling in Sag Harbor in the early 1990s. The natural soundscape of the region—the hum of insects, the call of birds—found its way into her early sound works and remains a quiet undertone throughout her practice.

“It is deeply meaningful to see my story told at the Parrish,” Yankowitz shared. “This museum has long been a place where the community and the arts come together. To have decades of my work presented here feels like both a homecoming and a celebration of the people and places that have inspired me.”

A Living Legacy

Nina Yankowitz: In the Out / Out the In not only traces a remarkable artistic journey but reaffirms her relevance to contemporary discourse. Her works are held in the collections of the Museum of Modern Art in New York, the Whitney Museum of American Art, the Art Institute of Chicago, and the Fine Arts Museums of San Francisco. In 2024, she was inducted into the New York Foundation for the Arts Hall of Fame, honoring a career defined by innovation and integrity.

At the Parrish, the retrospective offers an intimate and powerful view of an artist who has never ceased to explore, provoke, and inspire. Supported by institutions like the Helen Frankenthaler Foundation that share her spirit of experimentation, the exhibition stands as a testament to creative courage and the enduring pursuit of connection through art.

On view October 9, 2025 – February 22, 2026 Parrish Art Museum, Water Mill, NY

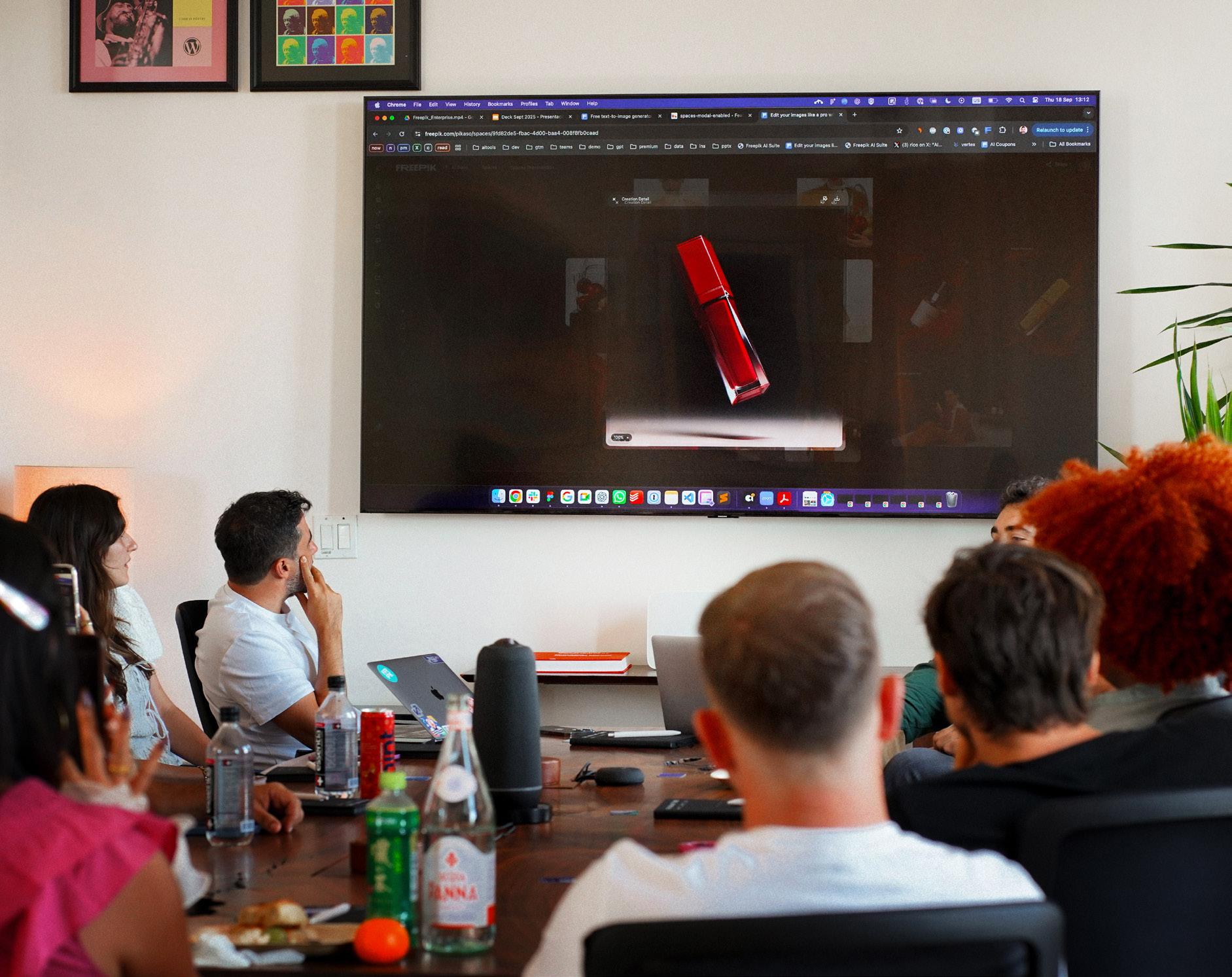

FREEPIK FOUNDER JOAQUÍN CUENCA

on How Generative AI Is Rewriting the Future of Creative Content

In a rapidly transforming digital economy, where imagery and storytelling drive brand identity, generative AI is not merely a tool—it is foundational to the next era of human creativity. Few companies embody this paradigm shift as powerfully as Freepik, the world’s leading platform for creative assets and AI-powered design. Under the direction of co-founder Joaquín Cuenca, Freepik has undergone a bold reinvention, evolving from a stock image repository into a next-generation AI studio poised to transform visual content creation across entertainment, marketing, publishing, and enterprise innovation.

By Hillary Latos

From Image Search Engine to AI Powerhouse

Cuenca, a serial entrepreneur whose early venture was acquired by Google and integrated into Google Earth and Google Maps, founded Freepik in 2010 out of frustration with the lack of high-quality image content on the internet. His original vision was to build a vertical search engine for free images. Today, that early idea has scaled into a global creative ecosystem— and over the past two years, Cuenca has completely repositioned Freepik as an AI-first platform, moving beyond content discovery into content generation.

“We are no longer just a marketplace,” he explains. “Freepik is now an all-in-one AI suite that empowers users to create professionalgrade images, videos, and design assets in minutes. The mission has evolved from supplying content to enabling creativity itself.”

Freepik now leads by traffic in the generative design category and was recently recognized by Andreessen Horowitz as one of the top AI suites globally.

AI Is Not Replacing Creators— It’s Multiplying Their Power

One of the core themes Cuenca emphasizes is that AI is a catalyst, not a competitor to human creativity.

“Creativity is defined by human originality,” he says. “AI is a tool—just as photography, Photoshop, or digital cameras were tools. What changes in every era is the speed and scale at which ideas can be executed. What remains constant is that the best ideas come from humans.”

According to Cuenca, the transition we’re witnessing is not from manual work to automated work, but from pixel manipulation to object understanding. AI now grasps creative intent. Designers no longer need to spend hours perfecting details; they can focus on vision.

One example is Freepik’s AI upscaler, which takes any image and enhances it to professional-grade quality— something previously only achievable through painstaking manual editing.

“AI is allowing people to do things that were previously impossible,” he notes. “Not faster—impossible.”

Where the Growth Is: Hollywood, Visual Effects & Enterprise Creativity

Cuenca points to visual effects and postproduction as one of the most explosive areas of growth. Major studios are already using Freepik’s AI tools to rapidly generate environments, textures, and visual iterations. Projects include Amazon’s House of David and a major Tom Hanks-led production.

“Visual effects used to require massive budgets and long lead times. Now directors can experiment in real time, expanding their vision rather than cutting it down,” says Cuenca. “Generative AI will not replace actors or storytelling—it will supercharge the visual imagination.”

Beyond entertainment, he sees enterprise content creation as a trilliondollar opportunity—from marketing departments to e-commerce brands and educational institutions needing constant visual output at scale.

WHERE CAPITAL IS FLOWING IN THE AI CREATIVE ECONOMY

A Trillion-Dollar Market in Motion

The global creative and content production industry is undergoing its first major structural shift since the rise of digital media. With AI now capable of generating high-quality imagery, video, and 3D assets, analysts project that AI-driven content creation will exceed $1.3 trillion in economic impact by 2032.

WHY

AI CREATIVE PLATFORMS

ARE ATTRACTIVE TO INVESTORS

Recurring Revenue Model: Subscription-based AI ecosystems like Freepik offer sticky, scalable monthly revenue with high retention.

Enterprise Expansion: Corporations are replacing traditional agencies with internal AI tools to accelerate production and cut costs by up to 70%.

Vertical Integration: Platforms that own both the AI technology and the content distribution layer are primed to dominate market share.

Explosive Market Adoption: Freepik has already converted the majority of its legacy subscribers into AI users—a rare and valuable indicator of product-market fit.

Competitive Edge: Why Freepik Is Winning the AI Race

Unlike platforms such as Canva, which focus on ease-of-use for mass audiences, Freepik is built for professionals and enterprises who demand creative precision and control.

“Canva serves a billion users with templatebased tools,” he explains. “Our users need the highest image quality, customizable models, and full creative command. We don’t believe in one-size-fits-all AI.”

Freepik also differentiates itself by offering multiple AI models within its platform, enabling expert users to choose specific generators based on output needs—image realism, cinematic lighting, illustration consistency, or AI video features. It's a modular, professional-grade platform built to scale with creator sophistication.

Ethics, Authenticity, and the Future of Human Expression

On the controversial topic of AI and copyright, Cuenca is pragmatic and forward-looking. He acknowledges the complexity of data licensing and stresses the importance of working only with reputable model providers who use legally sourced image collections. “If society completely shuts down the use of copyrighted materials for AI training, then we shut down progress itself,” he cautions. “The solution isn’t prohibition— it’s transparency, opt-in frameworks, and fair compensation for creators.”

Ultimately, his conviction is clear: human creativity remains irreplaceable.

“Everything that is of value in creativity comes from within the human mind,” he says. “AI is simply clearing the friction between the idea and the expression. The more powerful the tools become, the more important human taste and originality will be.”

The Legacy of Freepik: Democratizing Creative Greatness

Cuenca is not building Freepik to exit—it’s a long-term mission.

“I’ve had companies acquired before. This is different. My goal is for Freepik to be remembered as the platform that helped people create the best

work of their lives,” he says.

For today’s designers, filmmakers, entrepreneurs, and brands competing in an increasingly visual world, the message is clear: generative AI is not the end of creativity—it’s the beginning of a new golden age of artistic expression.

The creative economy is being redefined by AI. And Freepik—once a search engine for free images—is now at the forefront of this revolution, not just shaping how content is made, but expanding what is possible. In the age of AI, creativity is no longer limited by time, tools, or technique. It’s limited only by imagination.

THE NEW CREATIVE ECONOMY

Why Enterprises Are Turning to AI Suites Like Freepik

AI AS A FORCE MULTIPLIER FOR MARKETING

ROI

Generative AI is transforming how brands create, customize, and deploy content at scale. Rather than relying on expensive agency contracts or extended creative timelines, companies are now producing full campaigns—from concept to execution—in hours instead of weeks.

KEY ADVANTAGES FOR ENTERPRISES USING FREEPIK’S AI SUITE:

Hyper-Personalization at Scale: Tailored visuals for different demographics, languages, and A/B testing without additional cost.

Speed-to-Market Advantage: Generate ads, landing page assets, product imagery and videos in real time.

Brand Consistency with Customized Models: Enterprises can train AI on their own visual identity, ensuring every output aligns with brand guidelines.

Cost Efficiency: Reduces reliance on stock image licensing and external design teams.

The enterprise AI design market is projected to exceed $50 billion by 2030, with Freepik positioning itself as the preferred platform for scalable, professional-grade creative production— not just another visual template tool. WHERE JOAQUÍN CUENCA SEES THE BIGGEST AI OPPORTUNITIES

• Visual Effects & Film Production

• Enterprise Marketing & Branding

• AI-Generated Video & 3D Assets

• Personalized Creative Workflows

• Next-Generation Design Collaboration

MARKET INSIGHT FOR INVESTORS

Photography by Charles L. Barnes

SALVATORE FERRAGAMO JR. Cultivating a Living Legacy in Tuscany

By Angela Gorman

When Salvatore Ferragamo Jr. talks about Il Borro, the thousand-year-old Tuscan estate his family acquired three decades ago, he doesn’t describe it as a business first. “Il Borro is sometimes what we call an act of faith that repeats over time,” he says. “In the course of history, you find properties that people occupy, improve, and eventually restore. That’s what happened to us back in 1993.”

That was the year Ferragamo’s father, Ferruccio Ferragamo, purchased the medieval village from Duke Amedeo of Savoy-Aosta, a member of Italy’s royal family. The younger Ferragamo, grandson of the fashion house founder whose name he shares, was studying business in New York when the project began. “My father loved the countryside and saw incredible potential in the property,” he recalls. “He gathered the family together and said, ‘This will diversify our investments— but it must also stand on its own merit.’”

Today, Il Borro spans roughly 1,100 hectares of organic farmland in the Valdarno di Sopra region, framed by olive groves and vines that trace the foothills of Pratomagno. What began as a rural retreat is now a fully operational wine estate and hospitality

destination under the Relais & Châteaux banner, combining sustainable agriculture, fine dining, and restored architecture.

“The best way to describe Il Borro is really as a farm,” Ferragamo says. “We are certified organic farmers, we produce our own cheese, extra virgin olive oil, wine, honey, vegetables, eggs—you name it.”

The property’s scale and self-sufficiency are striking. Solar panels generate three times the energy the estate consumes. Water is drawn from natural wells. Even the restaurants follow a closed-loop philosophy, serving dishes sourced almost entirely from the estate’s land. “Every year we publish a sustainability statement,” Ferragamo adds. “It’s not just about organic farming, it’s about running responsibly and creating energy independence.”

Il Borro’s transformation has been gradual and deliberate, guided by a belief that Italian craftsmanship and rural heritage can coexist with modern luxury. Within the medieval village, artisans have returned to work—shoemakers, goldsmiths, and restorers—reviving trades that once defined

the region. The accommodations include restored villas, vineyard-view suites, and family residences such as Villa Mulino and Villa Casetta, each offering a blend of traditional architecture and understated modern design. “We wanted a Tuscan feel but more modern,” Ferragamo says. “Just like in fashion, attention to detail, materials, and design all matter.”

The parallel to the family’s legacy in fashion isn’t accidental. “If you think of Ferragamo and the apparel business, every six months we presented a new collection with incredible attention to quality and fit,” he explains. “That’s not far from what we do at Il Borro - selecting grapes, adjusting production to the vintage, and maintaining consistency without losing creativity.”

Ferragamo’s own path diverged from that of his twin brother, James Ferragamo, who remained in the core fashion business managing the brand’s leather goods division. Salvatore, instead, focused on hospitality and wine. “The wine growing came naturally,” he says. “We started by planting vineyards and olive trees, and slowly built the experience around them.” The flagship Il Borro Toscana—a Merlot,

Cabernet, and Syrah blend—is his favorite. “It would qualify as a Super Tuscan,” he says. “It’s quite well distributed in the U.S.” Other wines, including Petruna Anfora, are produced using traditional clay vessels, part of a wider move toward minimal-intervention winemaking. “There’s an incredible element of creativity, but also of technology,” he notes. “We use a gravity-fed winery and fiber-optic sorters to select individual berries. You never know what the season will bring, so patience and tenacity are essential.”

While Ferragamo speaks with precision about technology and production, the philosophy that underpins Il Borro’s wines runs much deeper. At Il Borro, winemaking is treated as both craft and calling. The estate’s philosophy holds that the uniqueness of wine comes from the absolute harmonization between the land and man, between nature and its being.

Each bottle captures not only the flavor of the vineyard but also the quiet devotion of those who nurture it. The flagship Il Borro Toscana, a blend of Merlot, Cabernet Sauvignon, and Syrah, perfectly encapsulates this harmony, its structure and elegance balanced by notes of ripe raspberry and red cherry that speak to the richness of the Valdarno soil and the meticulous care behind every harvest.

The Valdarno di Sopra region, where Il Borro’s vineyards take root, has long been regarded as one of Tuscany’s most treasured wine territories. Bordered by forests and olive groves, the area’s mineral-rich soils and temperate climate have supported vines since Renaissance times. Here, Ferragamo’s team pursues quality through harmony with the environment, eschewing excess intervention in favor of a deep respect for biodiversity and sustainability. The result

is a portfolio of wines that embody the authenticity of their terroir: balanced, expressive, and unmistakably Tuscan.

Despite its polish, Il Borro remains a working estate, one that Ferragamo calls both his home and his workplace. His three children, all studying in the United States, have spent summers working on the property. “One was a bar attendant making cocktails, another a waitress, and my son worked as a pool boy,” he says. “It’s a good way for them to make a little money, but it also teaches social skills and respect for hospitality.”

The family’s connection to the land extends beyond Il Borro. About twenty minutes away sits Viesca, another Ferragamo estate once owned by his grandmother, Wanda Ferragamo. Purchased by Salvatore and Wanda Ferragamo in 1950, Viesca served

The best way to describe Il Borro is really as a farm, We are certified organic farmers, we produce our own cheese, extra virgin olive oil, wine, honey, vegetables, eggs—you name it.

for decades as the family’s countryside residence. Ferruccio Ferragamo spent his youth there, harvesting grapes and collecting eggs, before leading the family’s next generation into the restoration of Il Borro.

“Viesca is maybe the more historic property,” Ferragamo says. “It was my grandparents’ house and my father grew up there. There’s a serenity there you rarely find in other places, it’s peaceful.”

Among the gardens stands Rosa Wanda, a rose bred in his grandmother’s honor.

“There’s an area of the estate with beautiful steps and this big rose dedicated to her. It reminds me of her very much,” he says.

Viesca’s charm is more private than Il Borro’s bustle. Guests can stay in its original Villa Viesca or in standalone villas scattered through the Florentine countryside. A dedicated minibus shuttles guests between the two estates. “It works really well,” Ferragamo says. “Il Borro guests can stop at Viesca for lunch, do a little shopping, and then come back.”

The success of both properties has given Ferragamo room to look outward. “The unique character of Il Borro and its exceptional art of hospitality have given Ferragamo the confidence to look outward. ‘In 2012, we

There’s an incredible element of creativity, but also of technology. We use a gravity-fed winery and fiberoptic sorters to select individual berries. You never know what the season will bring, so patience and tenacity are essential.

joined Relais & Châteaux, that was a defining moment for the estate,’ he says. ‘From there, we began expanding internationally.’”

” The brand now includes Il Borro Tuscan Bistro restaurants in Dubai, Crete, and other cities under development, all centered on the estate’s farm-to-table philosophy. “We want people to experience what a real extra virgin olive oil tastes like,” he adds. “That’s something we do pretty well here.”

Sustainability continues to shape Il Borro’s future. “In 2010 we started fitting the property with solar panels, and in 2015 we completed our conversion to organic farming,” he says. The estate now produces more renewable energy than it uses and aims to achieve Scope 3 carbon neutrality by offsetting emissions from third-party vendors. “We’re looking to expand our solar fields into an old quarry nearby which will help us complete the cycle,” he explains.

Ferragamo approaches progress with pragmatism rather than flourish. “You’re working with nature, so you have to accept imperfection. You make mistakes

and learn from them. If you have grit and consistency, the results come.”

Next, he’s focused on a newly acquired property: Pinino, in Montalcino, home of Brunello wines. “The estate was established in 1874,” he says. “We’re expanding our portfolio and paying attention to everything Pinino stands for.”

It’s a steady evolution that mirrors the Ferragamo way - continuous refinement rather than reinvention. “We’re also expanding the restaurant and hospitality side of the business, maybe through more license agreements around the world,” he says.

Asked to define la dolce vita, Ferragamo pauses. “La dolce vita is not easy to describe

because it’s a way of living,” he says. “I was schooled in America, and I love the energy there. But Italy is different, it’s about enjoying life, the culture of food and wine, the beauty of the landscape. In Tuscany you can go from the coast to the mountains in a day. It’s that slow pace of life that we offer here.”

For those considering a visit, he recommends autumn. “I love this time of year because we’re just finishing the wine harvest and starting the olive harvest,” he says. It’s a season that distills Il Borro’s spirit: the intersection of work, nature, and family life.

When asked to describe Il Borro in one word, Ferragamo doesn’t hesitate. “Authentic,” he says. Then, with a small smile, adds, “and real.”

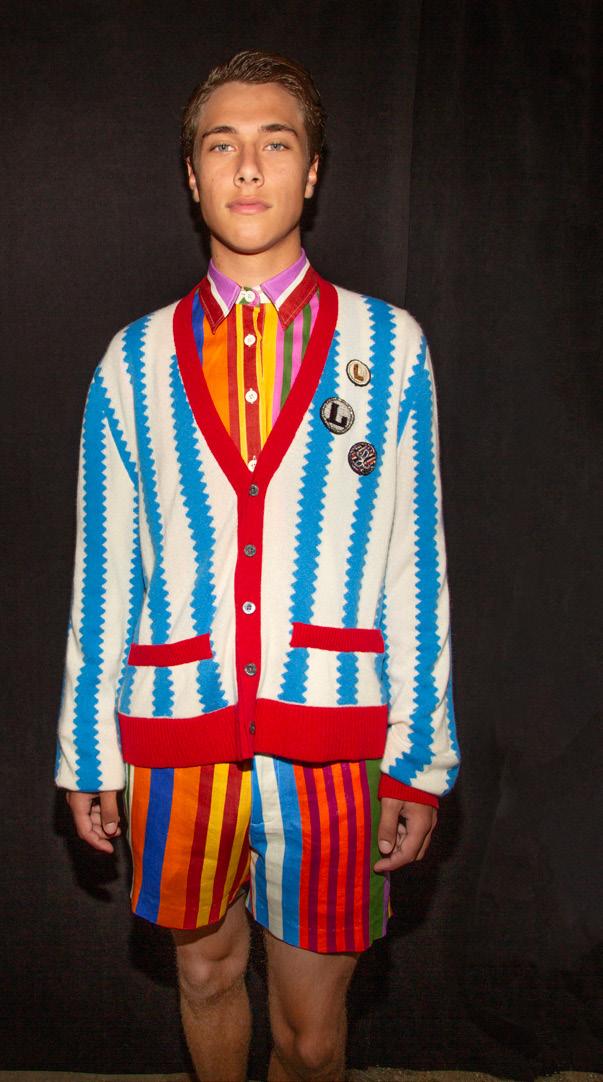

Pamella Roland

NEW YORK FASHION WEEK SPRING SUMMER

Photographed by Daniel Perry

CUCCULELLI SHAHEEN

BIBHU MOHAPATRA

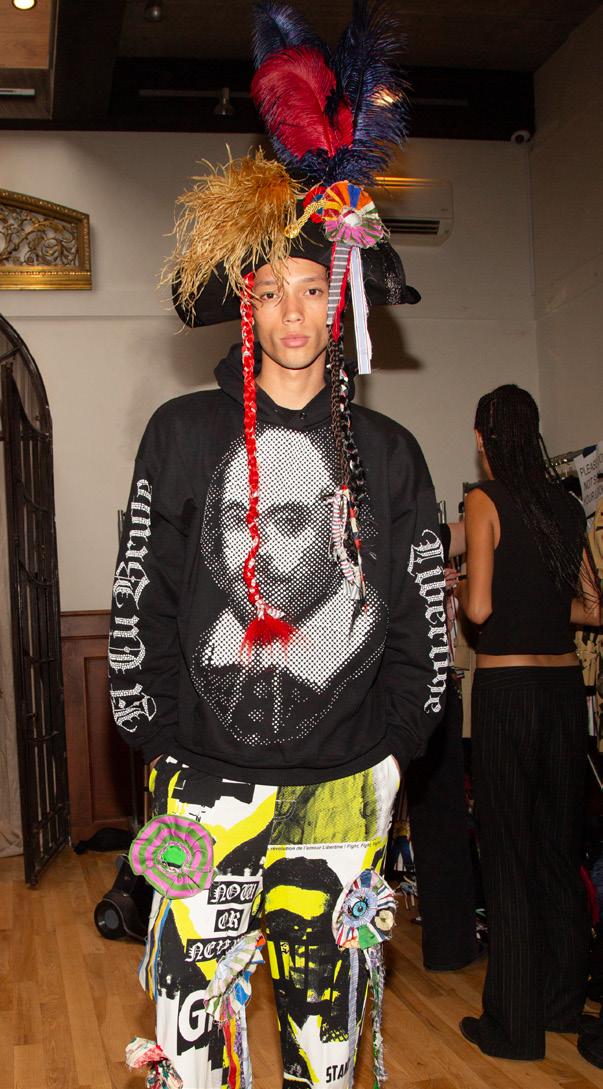

Pierre-Louis Mascia

MILAN FASHION WEEK SPRING SUMMER 2026

Shot by Charles Barnes

PIERRE-LOUIS MASCIA

PORTRAIT MILANO

Where Italian Heritage, Modern Design, and Sustainable Luxury

Converge

If Rome is the Eternal City, Milan is eternally chic — a metropolis where fashion, design, and innovation pulse through every cobblestone street. Among its many icons of style, none capture the essence of Milanese refinement quite like Portrait Milano, the Ferragamo family’s crown jewel and a proud member of the Leading Hotels of the World. This sophisticated urban retreat redefines what it means to live beautifully, marrying the legacy of Italian craftsmanship with contemporary sensibilities and a forward-thinking vision of sustainability.

By Hillary Latos

A Landmark Reimagined

Portrait Milano occupies one of Europe’s oldest seminaries, an architectural masterpiece reborn into a sanctuary of calm and cosmopolitan sophistication. Hidden behind the grand Baroque gateway on Corso Venezia, guests enter a tranquil inner world where history meets innovation. The transformation, led by renowned architect Michele Bönan, preserves the 16th-century heritage while infusing it with understated modern luxury — the result is a seamless dialogue between past and present.

At the heart of the property lies The Piazza del Quadrilatero, a spectacular 32,000-squarefoot courtyard that has quickly become one of Milan’s most vibrant meeting places. Once closed to the public, it now hums with life, framed by elegant colonnades that house exclusive boutiques, world-class dining, and the hotel’s own signature venues. It is Milan’s largest open-air square within the fashion district, a space that epitomizes both community and exclusivity — where global travelers, locals, and industry insiders intersect amid the rhythm of the city.

Recognition on the Global Stage

Since its debut, Portrait Milano has captured the attention of design aficionados and luxury travelers alike. In 2025, the hotel earned a prestigious place among The World’s 50 Best Hotels (51–100 list) — an acknowledgment that underscores its growing international acclaim and its unique positioning within Europe’s luxury landscape. The recognition celebrates Portrait Milano’s distinctive blend of artistry, hospitality, and vision — a triumph for the Lungarno Collection, the Ferragamo family’s hospitality group that continues to elevate Italian luxury worldwide.

A Commitment to Sustainable Excellence

Beyond beauty and comfort, Portrait Milano is setting new standards for ethical and environmental responsibility. In October 2024, it became the first hotel in Milan to achieve GSTC (Global Sustainable Tourism Council) certification through Dream&Charme. This certification is regarded as the highest global benchmark for sustainable hospitality, evaluating every dimension of a hotel’s operation — from energy

efficiency and resource management to community impact and guest well-being.

For discerning travelers and family offices with an interest in sustainable investment and responsible travel, this milestone signals a new era of eco-luxury in Milan. Portrait Milano’s sustainability initiatives include locally sourced materials, energy-saving technologies, reduced single-use plastics, and a strong partnership network supporting local artisans and food producers. The hotel’s approach extends beyond conservation — it’s a philosophy of longevity, harmony, and cultural preservation perfectly aligned with today’s values-driven luxury market.

Interiors that Whisper Elegance

Each of the 73 suites and rooms reflects Milan’s quiet confidence — refined, intelligent, and deeply personal. Michele Bönan’s design evokes the city’s mid-century aesthetic, blending dark woods, mirrored surfaces, and rich fabrics in shades of cardinal red and cream. The effect is both sensual and scholarly — a modern Milanese mansion that feels intimate and timeless.

Personal touches abound: curated art, rare design books, and historic photographs from the Ferragamo archives lend each room a sense of story and soul. The atmosphere feels less like a hotel and more like a beautifully appointed private residence, where impeccable service and attention to detail ensure that guests feel not merely welcomed, but known.

The Portrait Suite: Living Artfully

For those seeking the ultimate indulgence, the Portrait Suite offers a masterclass in contemporary Italian living. The spacious living room, lined with custom shelving and original artworks, opens onto a serene bedroom dressed in plush linens and warm lighting. Carrara-marble bathrooms feature floor-to-ceiling stonework, walk-in showers, and deep soaking tubs — the perfect retreat after a day of exploring Via Montenapoleone. Subtle mixology corners invite guests to craft the perfect Negroni or sip fine Italian amaro while overlooking the piazza below.

Dining as a Cultural Experience

Milan’s gastronomic scene is among Europe’s most exciting, and Portrait Milano stands at its center. The hotel’s 10_11 Bar • Giardino • Ristorante has quickly become a destination in itself — a lush, light-filled restaurant that flows effortlessly from morning espresso to latenight aperitivo. Overlooking both the square and a secluded garden, the space serves a sophisticated menu of modern Italian classics crafted with regional, seasonal ingredients. Guests can savor creamy risottos infused with saffron from Lombardy or delicate seafood dishes that nod to Italy’s Mediterranean coast.

For a more indulgent affair, Beefbar Milano, the Italian outpost of the celebrated Monaco-born brand, offers a sensory journey through the world’s finest cuts of meat and reimagined street food favorites. Here, carnivores and connoisseurs alike dine under soaring arches, surrounded by the quiet glamour that defines Portrait Milano’s aesthetic. It’s not simply dining — it’s

performance, ritual, and pleasure combined.

The Longevity Spa: Biohacking Meets Blue Zones

Wellness at Portrait Milano is not an afterthought but a guiding principle. The hotel’s Longevity Spa, one of the most innovative wellness centers in Milan, merges biohacking technology with holistic principles inspired by the world’s famed Blue Zones — regions known for exceptional longevity. Beneath vaulted stone ceilings reminiscent of an ancient cistern, guests find a heated pool, sauna, steam room, and sensory showers — a serene counterpoint to Milan’s urban energy.

The spa’s treatments are grounded in the pillars of cold therapy, detoxification, and aesthetic renewal, offering resultsdriven programs designed to optimize performance and vitality. A fully equipped gym complements the experience, with personalized fitness coaching and recovery-enhancing modalities that align with the contemporary pursuit of longevity — making it a favorite among executives and wellness-minded travelers.

A Cultural Hub and Design Destination

Beyond its physical beauty, Portrait Milano has become a cultural anchor for Milan’s creative community. The Piazza hosts rotating art installations, design pop-ups, and collaborations with local and international brands, transforming the space into an everevolving gallery of Italian style. Its proximity to the city’s most prestigious boutiques — including Ferragamo, Prada, and Bottega Veneta — makes it a natural nexus for Fashion Week events and global tastemakers.

The hotel also continues to attract a discerning clientele that includes artists, entrepreneurs, and leaders from the world of finance and fashion. For UHNW individuals and family offices exploring the European luxury landscape, Portrait Milano serves as both a model of thoughtful

investment in heritage assets and a case study in the value of cultural capital within real-estate-driven hospitality.

Hospitality as an Art Form

True to the Ferragamo legacy, the art of service at Portrait Milano is deeply personal. Guests are welcomed by name, and every stay is tailored to their preferences — from bespoke itineraries and private shopping experiences to art tours and culinary excursions curated by the hotel’s Lifestyle Team. This dedication to discretion and individuality elevates the guest experience beyond traditional five-star standards — a rare quality in an era of standardized luxury.

As part of the Lungarno Collection, which also includes the celebrated Portrait Roma and Portrait Firenze, Portrait Milano exemplifies the brand’s philosophy of